Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - EXELON GENERATION CO LLC | dex991.htm |

| 8-K - FORM 8-K - EXELON GENERATION CO LLC | d8k.htm |

Exelon and

Constellation Energy Announce Merger April 28, 2011

Creating a Clean, Competitive Future

EXHIBIT 99.2 |

Cautionary

Statements Regarding Forward-Looking Information

1

Except for the historical information contained herein, certain of the matters discussed in this

communication constitute “forward-looking statements” within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private

Securities Litigation Reform Act of 1995. Words such as “may,” “will,”

“anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,” “believe,” “target,” “forecast,” and words and terms of

similar substance used in connection with any discussion of future plans, actions, or events identify

forward-looking statements. These forward-looking statements include, but are not

limited to, statements regarding benefits of the proposed merger, integration plans and

expected synergies, the expected timing of completion of the transaction, anticipated future

financial and operating performance and results, including estimates for growth. These statements

are based on the current expectations of management of Exelon Corporation (Exelon) and Constellation

Energy Group, Inc. (Constellation), as applicable. There are a number of risks and

uncertainties that could cause actual results to differ materially from the forward-looking

statements included in this communication. For example, (1) the companies may be unable to

obtain shareholder approvals required for the merger; (2) the companies may be unable to obtain

regulatory approvals required for the merger, or required regulatory approvals may delay the merger

or result in the imposition of conditions that could have a material adverse effect on the combined

company or cause the companies to abandon the merger; (3) conditions to the closing of the

merger may not be satisfied; (4) an unsolicited offer of another company to acquire assets or

capital stock of Exelon or Constellation could interfere with the merger; (5) problems may

arise in successfully integrating the businesses of the companies, which may result in the

combined company not operating as effectively and efficiently as expected; (6) the combined company may be

unable to achieve cost-cutting synergies or it may take longer than expected to achieve those

synergies; (7) the merger may involve unexpected costs, unexpected liabilities or unexpected

delays, or the effects of purchase accounting may be different from the companies’

expectations; (8) the credit ratings of the combined company or its subsidiaries may be

different from what the companies expect; (9) the businesses of the companies may suffer as a

result of uncertainty surrounding the merger; |

2

Cautionary Statements Regarding Forward-Looking

Information (Continued)

(10) the companies may not realize the values expected to be obtained for properties expected or

required to be divested; (11) the industry may be subject to future regulatory or legislative

actions that could adversely affect the companies; and (12) the companies may be adversely

affected by other economic, business, and/or competitive factors. Other unknown or

unpredictable factors could also have material adverse effects on future results, performance

or achievements of the combined company. Discussions of some of these other important factors and

assumptions are contained in Exelon’s and Constellation’s respective filings with the

Securities and Exchange Commission (SEC), and available at the SEC’s website at

www.sec.gov, including: (1) Exelon’s 2010 Annual Report on Form 10-K in (a) ITEM

1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition

and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 18;

(2) Exelon’s Quarterly Report on Form 10-Q for the quarterly period ended March

31, 2011 in (a) Part II, Other Information, ITEM 1A. Risk Factors, (b) Part 1, Financial

Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and

Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 12; and

(3) Constellation’s 2010 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b)

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 12. These risks,

as well as other risks associated with the proposed merger, will be more fully discussed in the

joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4

that Exelon will file with the SEC in connection with the proposed merger. In light of these

risks, uncertainties, assumptions and factors, the forward-looking events discussed in this

communication may not occur. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this communication. Neither

Exelon nor Constellation undertake any obligation to publicly release any revision to its

forward-looking statements to reflect events or circumstances after the date of this

communication. |

Additional

Information and Where to Find it 3

This communication does not constitute an offer to sell or the solicitation of an offer to buy any

securities, or a solicitation of any vote or approval, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. Exelon intends to

file with the SEC a registration statement on Form S-4 that will include a joint proxy

statement/prospectus and other relevant documents to be mailed by Exelon and Constellation to

their respective security holders in connection with the proposed merger of Exelon and

Constellation. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION about Exelon, Constellation and the proposed merger.

Investors and security holders will be able to obtain these materials (when they are available) and

other documents filed with the SEC free of charge at the SEC's website, www.sec.gov. In

addition, a copy of the joint proxy statement/prospectus (when it becomes available) may be

obtained free of charge from Exelon Corporation, Investor Relations, 10 South Dearborn Street,

P.O. Box 805398, Chicago, Illinois 60680-5398, or from Constellation Energy Group, Inc.,

Investor Relations, 100 Constellation Way, Suite 600C, Baltimore, MD 21202. Investors and security

holders may also read and copy any reports, statements and other information filed by Exelon, or

Constellation, with the SEC, at the SEC public reference room at 100 F Street, N.E.,

Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the

SEC’s website for further information on its public reference room.

Participants in the Merger Solicitation Exelon, Constellation, and their respective directors, executive officers and certain other members of

management and employees may be deemed to be participants in the solicitation of proxies in

respect of the proposed transaction. Information regarding Exelon’s directors and

executive officers is available in its proxy statement filed with the SEC by Exelon on March

24, 2011 in connection with its 2011 annual meeting of shareholders, and information regarding

Constellation’s directors and executive officers is available in its proxy statement filed with

the SEC by Constellation on April 15, 2011 in connection with its 2011 annual meeting of

shareholders. Other information regarding the participants in the proxy solicitation and a

description of their direct and indirect interests, by security holdings or otherwise, will be

contained in the joint proxy statement/prospectus and other relevant materials to be filed with the

SEC when they become available.

|

Agenda

Transaction Overview and

Exelon Strategic Rationale

John Rowe

Exelon Chairman and CEO

Constellation Strategic Rationale

and Execution Timeline

Mayo Shattuck

Constellation Chairman,

President and CEO

Combined Company Profile

and Financial Summary

Chris Crane

Exelon President and COO

Q&A Session

4 |

Exelon’s

Consistent View on M&A •

“When we look, we look first at the financial returns; second at how we can do it

consistent with maintaining our investment grade rating; third, whether it diversifies

our own risks; and we're just very bloody careful, like we have been for a very long

time.”

–

Exelon Third Quarter 2010 Earnings Conference call

•

“We remain very value-driven. We always look. We stay oriented toward cleaner

fleets, rather than less clean fleets. But we believe that this is an industry where you

need consolidation, but to make it make sense for investors, it has to be earnings

accretive in relatively early time periods, and it has to be consistent with our need to

maintain investment grade credit ratings.”

–

Exelon Second Quarter 2010 Earnings

Conference call

•

“We place a very high value on who we are and what we have. And we don't want to

give up too much of our upside…just to buy us a little more safety over the next year

or two. So with us, it's all about numbers.”

–

John Rowe, June 2010 Bernstein

Strategic Decisions Conference

5 |

Creating Value

Through a Strategic Merger •

Delivers financial benefits to both sets of shareholders

•

Increases scale and scope of the business across the value chain

•

Matches the industry’s premier clean merchant generating fleet with the

leading retail and wholesale customer platform

•

Diversifies the generation portfolio

•

Continued upside to power market recovery

•

Maintains a strong regulated earnings profile with large urban utilities

Combining Exelon’s generation fleet and Constellation’s customer-facing

businesses creates a strong platform for growth and delivers benefits to

investors and customers

6 |

•

$7 billion

•

$11

billion

•

11,430 (Total)

•

1,921(Nuclear)

•

1.2 mil. (MD)

•

0.7 mil. (MD)

•

38 states & D.C.

(5)

•

~106 TWh/yr

•

15% Generation

•

50% Utility

•

35% NewEnergy

Combination Will Result in Enhanced Scale,

Scope, Flexibility and Financial Strength

(1) Market Value as of 4/27/11. Enterprise Value represents Market Value plus

Net Debt as of 3/31/11 for Exelon and 12/31/10 for Constellation.

(2) Data as of 12/31/10. Constellation data includes 2,950 MW for Boston

Generation assets and excludes 550 MW for Quail Run. (3) Net of market

mitigation assumed to be 2,648 MW. (4) Represents

2011

booked

electric

sales.

Exelon

load

includes

ComEd

swap.

(5) Competitive and wholesale business also active in Alberta and Ontario,

Canada. (6) Exelon

EBITDA

estimates

per

equity

research.

Constellation

EBITDA

estimates

per

company

guidance.

Market Value and

Enterprise

Value

(1)

Pro forma

Standalone

Owned

Generation

(in MW)

(2)

Regulated

Utilities

Competitive

Retail &

Wholesale

(4)

Business

Mix

(6)

•

$27 billion

•

$41 billion

•

25,619 (Total)

•

17,047(Nuclear)

Electric customers

•

5.4 mil. (IL, PA)

Gas customers

•

0.5 mil. (PA)

•

4 states

•

~59

TWh/yr

2012E EBITDA

•

51% Generation

•

49% Utilities

•

$34 billion

•

$52 billion

•

38 states & D.C.

(5)

•

~165

TWh energy sales

•

Expect >50% pro forma EBITDA

from competitive business

•

34,401 (Total)

(3)

•

18,968 (Nuclear)

•

6.6 million electric & gas customers

in IL, PA and MD

7 |

Transaction

Overview •

100%

stock

–

0.930

shares

of

EXC

for

each

share

of

CEG

•

Upfront

transaction

premium

of

18.1%

(1)

•

$2.10 per share Exelon dividend maintained

•

Expect to close in early 1Q 2012

•

Exelon and Constellation shareholder approvals in 3Q 2011

•

Regulatory approvals including FERC, DOJ, MD, NY, TX

•

Executive Chairman: Mayo Shattuck

•

President and CEO: Chris Crane

•

Board of Directors: 16 total (12 from Exelon, 4 from Constellation)

•

Exelon Corporation

•

78% Exelon shareholders

•

22% Constellation shareholders

•

Corporate headquarters: Chicago, IL

•

Constellation headquarters: Baltimore, MD

•

No change to utilities’

headquarters

•

Significant employee presence maintained in IL, PA and MD

Company Name

Consideration

Pro Forma

Ownership

Headquarters

Governance

Approvals &

Timing

(1) Based on the 30-day average Exelon and Constellation closing stock

prices as of April 27, 2011. 8 |

Exelon

Transaction Rationale •

Increases

geographic

diversity

of

generation,

load

and

customers

in

competitive

markets

This transaction meets all of our M&A criteria and can be executed

Shared

Commitment to

Competitive

Markets

Enhances

Scalable Growth

Platform

Creates

Shareholder

Value

•

Expands a valuable channel to market our generation

•

Enhances margins in the competitive portfolio

•

Diversifies portfolio across the value chain

•

EPS break-even in 2012 and accretive by +5% in 2013

•

Maintains strong credit profile and financial discipline

•

Maintains earnings upside to future environmental regulations and power market

recovery

•

Adds stability to earnings and cash flow

9

•

Adds mix of clean generation to the portfolio

Clean

Generation Fleet |

Constellation

Transaction Rationale •

Upfront

premium

of

18.1%

(1)

•

Dividend accretion of 103% post-closing

•

Enhances upside to power market recovery and synergies

The transaction creates financial and strategic value that is consistent with

Constellation’s existing strategy

Creates

Shareholder

Value

•

Creates balance sheet capacity to pursue growth opportunities

throughout the competitive portfolio

•

Reduces cost of capital

Balance Sheet

Strength

Complementary

Portfolios

•

Advances

strategy of matching load with physical generation in key

competitive markets

•

Lowers collateral costs of competitive businesses

10

(1) Based on the 30-day average Exelon and Constellation closing stock

prices as of April 27, 2011. |

This

Combination Is Good for Maryland •

Maintains employee presence and platform for growth in Maryland

–

Exelon’s Power Team will be combined with Constellation’s wholesale and

retail business

under

the

Constellation

brand

and

will

be

headquartered

in

Baltimore

–

Constellation and Exelon’s renewable energy business headquartered in

Baltimore –

BGE maintains independent operations headquartered in Baltimore

–

No involuntary merger-related job reductions at BGE for two years after

close •

Supports Maryland’s economic development and clean energy infrastructure

–

$10 million to spur development of electric vehicle infrastructure

–

$4 million to support EmPower Maryland Energy Efficiency Act

–

25 MWs of renewable energy development in Maryland

–

Charitable contributions maintained for at least 10 years

•

Provides direct benefits to BGE customers

–

$5 million provided for Maryland’s

Electric Universal Service Program (EUSP)

–

Over $110 million to BGE residential customers from $100 one-time rate

credit We will bring direct benefits to the State of Maryland, the City

of Baltimore and

BGE customers. Total investment in excess of $250 million.

11 |

Transaction

Timetable 2Q 2011

3Q 2011

4Q 2011

1Q 2012

Merger

Announcement

Make Regulatory

Filings

Mail Proxy

Materials

Exelon and

Constellation

Shareholder

Meetings

Secure Regulatory Approvals (including FERC, DOJ, Maryland, NRC,

New York and Texas)

Transaction Close

Divestiture

Process

12 |

Combined

Company Profile |

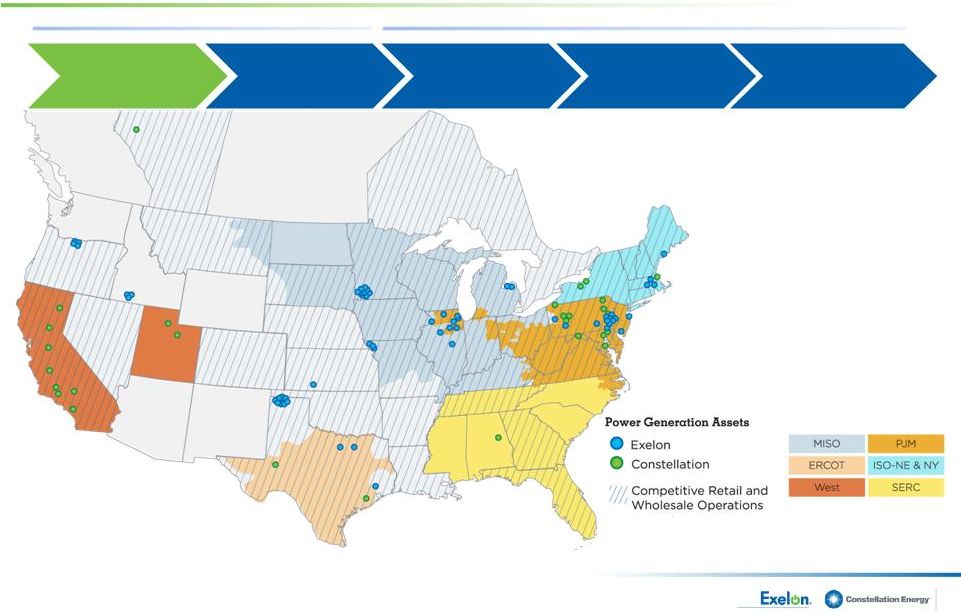

Scale, Scope

and Flexibility Across the Value Chain Upstream

Downstream

Reserves (gas)

266 bcf

Owned Generating

Capacity

34 GWs

(1)

Electric

Transmission

7,350 miles

Electric & Gas Dist.

6.6 million customers

Retail &

Wholesale Volumes

(2)

(Electric & Gas)

~165 TWh, 405 bcf

13

Note: Data as of 12/31/10 unless stated otherwise.

(1) Generation

capacity

net

of

market

mitigation

assumed

to

be

2,648

MW

consisting

of

Brandon

Shores

(1,273

MW),

H.A.

Wagner

(976

MW)

and

CP Crane (399 MW).

(2) Electric

load

includes

all

booked

2011E

competitive

retail

sales,

wholesale

sales,

and

sales

to

load

serving

entities

including

ComEd

swap.

Gas

load

includes

all

booked

and

forecasted

2011E

competitive

retail

sales. |

Exelon

Constellation

MISO (TWh)

PJM (TWh)

South

(1)

(TWh)

ISO-NE & NY ISO

(2)

(TWh)

West (TWh)

Load

Generation

Exelon

Constellation

Exelon

Constellation

Exelon

Constellation

Exelon

Constellation

Load

Generation

Generation

Load

Load

Generation

Load

Generation

6.3

9.1

101.5

179.1

27.8

23.2

27.1

13.9

2.4

0.8

Portfolio Matches Generation with Load in

Key Competitive Markets

The combination establishes an industry-leading platform with regional

diversification of the generation fleet

(1)

Represents load and generation in ERCOT, SERC and SPP.

(2)

Constellation load includes ~0.7TWh of load served in Ontario

Note: Data for Exelon and Constellation represents expected generation and load for 2011 as of

12/31/10. Exelon load includes ComEd

Swap, load sold through affiliates, fixed and indexed load sales and load sold through POLR auctions.

Constellation load includes load sold through affiliates, fixed and indexed load sales and load

sold through POLR auctions. 14

2.4

0.4

0.4

4.8

27.1

9.1

31.8

42.8

147.3

58.7

5.8

0.5

9.1

23.2

27.8 |

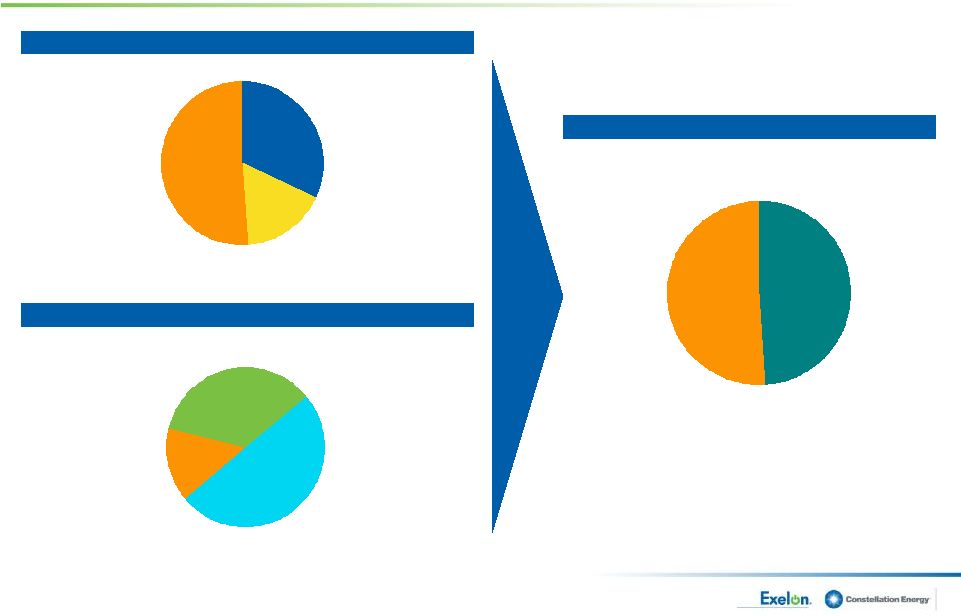

A Clean

Generation Profile Creates Long-Term Value in Competitive Markets

(1) Net of market mitigation assumed to be 2,648 MW.

(2)

Constellation generation includes Boston Generation acquisition (2,950 MW of natural gas) and excludes

Quail Run (~550 MW of natural gas). Constellation nuclear reflects 50.01% interest in

Constellation Energy Nuclear Group LLC. Exelon Standalone

Total Generation: 25,619 MW

Constellation Standalone

(2)

Total Generation: 11,430 MW

Pro forma Company (Net of Mitigation)

(1)

Total Generation: 34,401 MW

15

Combined company remains the premier low-cost generator

Coal

24%

Nuclear

17%

Gas

52%

Wind/Solar/Other

2%

Hydro

3%

Oil

3%

Coal

6%

Oil

8%

Gas

11%

Hydro

6%

Wind/Solar/Other

3%

Nuclear

67%

Nuclear

55%

Coal

6%

Oil

7%

Gas

24%

Hydro

6%

Wind/Solar/

Other

2% |

Expertise in

Operating Regulated Utilities in Large Metropolitan Areas

•

3.8 million electric customers

•

Service Territory: 11,300 square miles

•

Peak Load

(1)

: 23,613 MW

•

2011

Rate

Base

(2)

:

$9.3

billion

•

1.6 million electric customers

•

0.5 million gas customers

•

Service Territory: 2,100 square miles

•

Peak

Load

(1)

:

8,932

MW

•

2011

Rate

Base

(2)

:

$5.0

billion

•

1.2 million electric customers

•

0.7 million gas customers

•

Service Territory: 2,300 square miles

•

Peak

Load

(1)

:

7,198

MW

•

2011 Rate Base

(2)

: $3.9 billion

(1)

Peak load represents all-time peak load.

(2)

Estimated rate base as of end of year.

16 |

Financial

Summary |

Transaction

Economics Are Attractive for Both Companies

•

EPS break-even in 2012 and accretive by +5% in 2013

•

Free cash flow accretive beginning in 2012

•

Run-rate synergies of ~$260 million

–

Total costs to achieve of ~$500 million

–

Synergies primarily from corporate consolidation and power

marketing platform integration

•

Lower consolidated liquidity requirements, resulting in cost savings

•

Investment-grade ratings and credit metrics

17 |

Balanced

EBITDA Contribution from Competitive and Regulated Businesses

2012E Exelon Standalone

2012E Constellation Standalone

Source: Exelon EBITDA estimates per equity research. Constellation EBITDA estimates per

company guidance. Pro forma EBITDA contribution reflects EBITDA before asset divestitures.

2012E Pro forma Company

Competitive Businesses

51%

Regulated Utilities

49%

18

Generation

15%

BGE

50%

NewEnergy

35%

Exelon Generation

51%

PECO

17%

ComEd

32% |

Summary

Highlights 19

•

Delivers immediate financial benefits to both sets of shareholders

•

Increases scale and scope of the business across the value chain

•

Matches the industry’s premier clean merchant generating fleet with the

leading retail and wholesale customer platform

•

Diversifies the generation portfolio

•

Continued upside to commodity price recovery

•

Maintains a strong regulated earnings profile with large urban utilities

|

Q&A |

Appendix |

Benefits to

Constellation Shareholders •

Upfront premium and pro forma ownership in a large growing company

•

Dividend uplift based on current Exelon dividend

The dividend remains a core part of the company’s value return

proposition Note:

Ongoing

dividends

are

subject

to

quarterly

declarations

by

the

Board

of

Directors.

Per Share

EXC Current Annual dividend

$2.10

Transaction Exchange Ratio

0.930

= Implied CEG Exchange Ratio-Adjusted Dividend

$1.95

Current CEG Annual Dividend

$0.96

Dividend Uplift to CEG Shareholders

103%

20 |

225

400

520

119

20

20

550

550

867

825

552

260

415

516

1,340

550

500

800

702

600

550

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2012

2013

2014

2015

2016

2017

2018

2019

2020

(in $M)

Constellation Regulated

Constellation Unregulated

Exelon Regulated

Exelon Unregulated

Ample Liquidity and Manageable

Debt Maturities

Sources of Liquidity

Debt

Maturity

Profile

(2012-2020)

(2)

•

Exelon & Constellation (excluding utilities)

currently have $10.3 billion of liquidity

•

Additional $2.2 billion of utility liquidity

•

Matching retail load and generation

reduces liquidity requirements for

combined company

•

$6.3B -

$7.3 billion

(1)

of liquidity provides

ample cushion

Pro

Forma

21

(in $B)

(1)

Based on preliminary analysis.

(2)

Debt

maturity

schedule

as

of

12/31/10,

except

for

make

whole

of

Constellation

Energy

2012

notes

in

January,

2011.

$6.1

$6.3 - $7.3

$3 - $4

$4.2

Existing liquidity

(ex-utilities)

Reduction in

existing liquidity

Pro forma liquidity

Exelon

Constellation

(1)

~75% of 2012 –

2016 debt

maturities consist of

regulated utility debt

Pro forma |

Debt Structure

at Closing BGE

•

BGE will exist as a separate subsidiary under Exelon with its current

structure

•

BGE will continue as an SEC registrant and will continue to issue debt

Constellation Energy Group, Inc.

•

Constellation (excluding BGE) will be a wholly-owned subsidiary of Exelon

Generation

•

Constellation will remain a separate SEC registrant

•

All future debt for Exelon Generation and Constellation is expected to be

issued at Exelon Generation

22 |

16%

34%

41%

9%

RTO

EMAAC

MAAC

SWMAAC

8%

15%

15%

63%

EMAAC

MAAC

RTO

SWMAAC

42%

7%

51%

RTO

MAAC

EMAAC

Increased Regional Diversity in PJM:

Capacity

Eligible

for

2014/15

RPM

Auction

(1)

2014/15

RPM

auction

results

will

be

announced

on

May

13

th

,

2011

Pro forma Company

(2)

4,390 MW

2,535 MW

9,230 MW

11,345 MW

Exelon Standalone

Constellation Standalone

(1)

All generation values are approximate and not inclusive of wholesale transactions; all capacity values

are in installed capacity terms (summer ratings) located in the areas and adjusted for

mid-year PPA roll-offs. (2)

Net of market mitigation assumed to be 2,648 MW.

8,700 MW

10,300 MW

1,500 MW

1,035 MW

4,390 MW

23

1,045 MW

530 MW |

Combining

Constellation’s leading competitive businesses and Exelon’s clean

generation… Captures value across a range

of market conditions

Directly links consumers of

electricity and generation

assets

Spreads credit risk across

more parties

Adds asset optimization

opportunities

Generation

Load

Optimizes cost structure by

reducing

3

rd

party

transactions

Reduces working capital

requirements and liquidity

needs

…Creates a platform for future growth and optimization of earnings and

cash flows

24 |

(1)

Source: KEMA report as of February 2011.

A Leader in the U.S. Commercial and

Industrial Retailer Landscape

Opportunities for Continued Growth

•

Increased customer shopping creates

opportunities for capturing market share

•

Vehicle to offer value-added products and

innovative customer solutions

•

Constellation remains the top supplier in

the C&I market

•

Exelon Energy has become a top 10

supplier in the C&I market

Top 15 Non-Residential Retailers based on

Estimated Annualized Sales (TWh)

(1)

25

0

20

40

60

80

100

120

2009

2010

2011E

Exelon

Constellation

Electric Volumes

MWh-Millions |

7.3

2.0

6.7

6.7

1.9

1.9

Distribution

Transmission

(1)

Data as of 12/31/10. Peak load represents all-time peak load, which occurred on

August 3, 2006. (2)

ComEd does not plan to move forward with these Smart Grid/Meter investments unless

appropriate cost recovery mechanisms are in place. (3)

Includes transmission growth projects.

(4)

Rate base as of end of year.

Commonwealth Edison Company

2009

2010

2011E

$8.6

$8.6

$9.3

$950

$1,025

$950

$1,050

Service Territory

Capital Expenditure Plan (in $M)

Regulatory Update

(2)

(3)

Key Data

(1)

Total # of Customers: 3.8M

Area: 11,300 square miles

Peak Load: 23,613 MW

26

Distribution Rate Case

•

ALJ Proposed Order of $152M vs. ComEd request of $343M

•

Final ICC decision expected by 5/31/11

•

IL House Bill 14 (Formula Rate legislation) under review

Transmission Rate Case

•

Rate adjustments filed annually with FERC under formula rate

•

Next scheduled rate adjustment in June 2011

Rate

Base

Growth

(4)

(in

$B)

2011E

2012E

2013E

2010

650

625

675

700

100

100

50

50

325

225

275

200

Base CapEx

Smart Grid/Meter

New Business |

475

325

50

50

50

75

375

325

50

25

75

50

Base CapEx

Smart Grid/Meter

New Business

Rate

Base

Growth

(4)

(in

$B)

PECO Energy Company

2009

2010

2011E

$550

$450

$425

$500

$5.6

$4.9

$5.0

Service Territory

Capital Expenditure Plan (in $M)

(1)

Data as of 12/31/10. Peak load represents all-time peak load, which occurred on

August 3, 2006. (2)

Rate base as of end of year.

Key Data

(1)

Total # of Customers:

1.6M (Electric); 0.5M (Gas)

Area: 2,100 square miles

Peak Load: 8,932 MW

27

2011E

2012E

2013E

2010

Regulatory Update

Electric Distribution Rate Case

•

Rate case filed on 3/31/10

–

Original request of $316M; ROE request of 11.75%

–

Final revenue increase of $225M per Dec. 2010 settlement

Gas Delivery Rate Case

•

Rate case filed on 3/31/10

–

Original request of $44M; ROE request of 11.75%

–

Final revenue increase of $20M per Dec. 2010 settlement

3.0

3.2

3.3

1.1

1.1

1.1

0.6

0.6

0.6

0.9

Electric Distribution

Electric Transmission

CTC

Gas |

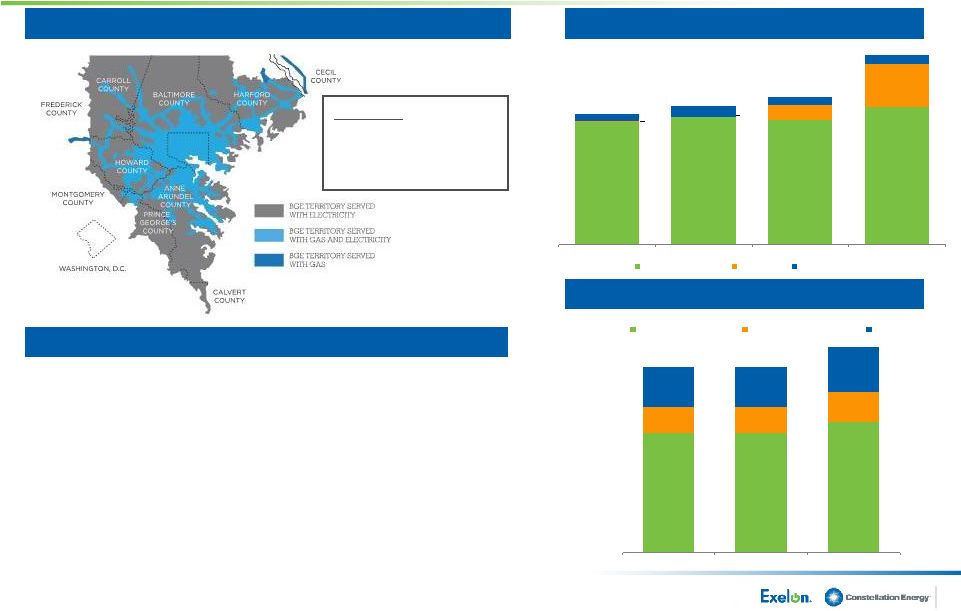

2.4

2.4

2.6

0.5

0.5

0.6

0.8

0.8

0.9

Electric Distribution

Electric Transmission

Gas

570

562

584

628

196

2

4

70

47

35

39

44

Base CapEx

AMI

New Business

BGE

Service Territory

Capital Expenditure Plan (in $M)

$601

$633

$678

$868

2010

2011E

2009

$3.7

$3.8

$3.9

Key Data

(1)

Total # of Customers:

1.2M (Electric); 0.7M (Gas)

Area: 2,300 square miles

Peak Load: 7,198 MW

(1)

Data as of 12/31/10. Peak load represents all-time peak load, which occurred on

August 3, 2006. (2)

Amounts shown net of DOE grant dollars.

(3)

Rate base as of end of year.

28

2011E

2012E

2013E

2010

Regulatory Update

Electric Distribution Rate Case

•

Rate case filed on 5/7/10

–

Original request of $47M; ROE range request of 10.65% to 12.65%

–

Final revenue increase of $31M with an ROE of 9.86%

Gas Delivery Rate Case

•

Rate case filed on 5/7/10

–

Original request of $30M; ROE range request of 10.65% to 12.65%

–

Final revenue increase of $10M with an ROE of 9.56%

Rate

Base

Growth

(3)

(in

$B)

(2) |