Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment #1

x ANNUAL REPORT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2010

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________.

Commission file number 000-53480

CHINA WIND ENERGY INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

None

|

|

|

(State or Other Jurisdiction of Incorporation of Organization)

|

(I.R.S. Employer Identification No.)

|

|

|

No.2 Haibin Road, Binxi Developing Area

Heilongjiang Province, China

|

+86 451 56150071

|

|

|

(Address of principal executive offices) (ZIP Code)

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section12 (g) of the Act: Common Stock, $0.0001 par value

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registration has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that he registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No þ

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of Common Stock held by non-affiliates of the Registrant was $24,233,120 based on a $0.60 closing price for the Common Stock on January 27, 2010. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

Number of common shares outstanding at December 7, 2010: 51,902,250

TABLE OF CONTENTS

| 2 | |

| 2 | |

| 8 | |

| 8 | |

| 8 | |

| 8 | |

| 8 | |

| 9 | |

| 9 | |

| 10 | |

| 10 | |

| Item 7A. Qualitative and Qualitative Disclosures about Market Risk | 14 |

| 14 | |

| 15 | |

| 15 | |

| 16 | |

| 17 | |

| 17 | |

| 20 | |

| 22 | |

| 23 | |

| 24 | |

| 25 | |

| 25 | |

| 26 |

1

Forward-looking Statements

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable laws, including the securities laws of the United States, we do not intend to update any of the forward-looking statements so as to conform these statements to actual results.

As used in this annual report, the terms "we", "us", "our", “our company”, and "China Wind" mean China Wind Energy Inc. and all of our subsidiaries, unless otherwise indicated.

All dollar amounts refer to US dollars unless otherwise indicated.

Overview and Recent Business Developments

We were incorporated in Nevada on May 8, 2006. Prior to November 20, 2007 we were a shell company with nominal assets and operations. On November 20, 2007 we completed a reverse merger transaction with China Wind Energy Ltd., a Hong Kong company (“China Wind HK”). The closing of this reverse takeover transaction resulted in the acquisition of China Wind HK, and its wholly owned subsidiary XingYe Wind Energy Technology Limited (“XingYe”), becoming our wholly owned subsidiary. Xing Ye was in the business of providing management, consulting and administrative services to Harbin SQ Wind Power Ltd. (“Harbin SQ”), a manufacturer of wind turbines in China.

On December 5, 2007 we filed a certificate of change to effect a 5 for 1 forward split of our common stock. This forward split increased our issued common shares and authorized common stock, on a basis of five new common shares for every one existing common share and resulted in an increase from 7,377,450 issued and outstanding common shares to 36,887,250 issued and outstanding common shares. It also increased our authorized common stock from 80,000,000 to 400,000,000 shares.

On May 16, 2008 we entered into a share exchange agreement with Power Profit Technology Development Limited, a Hong Kong company (“Power Profit”), and Wan Yi Tse, the holder of 100% of the issued and outstanding share capital of Power Profit. The closing of this share exchange agreement on May 26, 2008 resulted in:

|

a)

|

the acquisition of 100% of the equity interests of Power Profit;

|

|

b)

|

the acquisition of 82.14% of the equity interests of Power Profit’s majority owned subsidiary, Harbin SQ

|

|

c)

|

Wan Yi Tse’s designees becoming the holders of 29% of all of our issued and outstanding common stock;

|

2

|

d)

|

Power Profit becoming our wholly owned subsidiary and Harbin SQ becoming our majority-owned subsidiary;

|

|

e)

|

the termination of an agreement for the provision of management, consulting and administrative services by XingYe, our subsidiary, to Harbin SQ; and

|

|

f)

|

the appointment of Shouquan Sun as our President, Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Secretary, Treasurer, and director to replace Jian Ren who resigned from all of his positions with us.

|

In the first half of 2010, we signed a ten-year wind turbine blade supply agreement with Xu Ji Wind Energy Technology Company (“Xu Ji”), a subsidiary to State Grid Corporation of China (“State Grid”). Pursuant to the terms of the agreement, we agreed to supply blades for wind turbines rated at 2.0 MW and above with a length of 45.3 meters. We are now developing and producing the required blade moulds to satisfy this order.

Description of Business

Harbin SQ, our majority-owned subsidiary, focuses primarily on the production of wind turbine blades and combine harvesters. Our primary product is a blade for wind turbine generators which allows for variable pitch and speed. Different from other blades of the 600KW and 750KW type produced in China, our blade products provide variable speed and pitch adjustments to achieve high efficiency. We have 5 individual patents on our wind turbine blades.

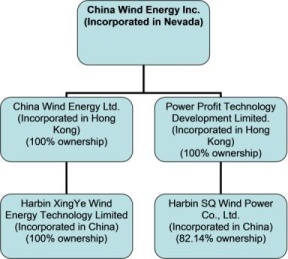

Organizational Structure

Our current organizational structure is summarized by the illustration below:

3

Sales of Blades

We have currently generated revenue only from the sale of combine harvesters which we were previously in the business of manufacturing. We anticipate that we will begin producing and selling our wind turbine product shortly and we anticipate that we will generate revenues from sales of our wind turbine blades to customers who install turbines and other equipment in wind farms.

Factors that may affect sales volumes for our wind turbine blades include:

| o |

world gross domestic product growth;

|

| o |

the availability of alternative sources of energy; and

|

| o |

the growth in demand for wind powered energy.

|

Factors that may affect the prices for our wind turbine blades include:

| o |

world economic environment;

|

| o |

industry operating rate, which is based on the supply and demand; and

|

| o |

relative strength of the Chinese currency.

|

The Market for Wind Turbine Blades

Wind energy is considered a “green” energy that does not pollute the environment, and is attractive to many countries in the world. China has a shortage of energy resources. The Chinese wind energy industry, while in its infancy, could grow to be an important source of energy production. On the eve of the 2005 Beijing International Renewable Energy Conference, a report released by the Chinese Renewable Energy Industries Association and sponsored by Greenpeace and the European Wind Energy Association showed that China could at least double its current wind production by 2020.

Wind energy is a rapidly growing market segment for the composites industry and is a fast growing energy sector. According to related research report, 38,310 MW of new wind generating capacity was installed in 2009, an increase of 31.6 percent compared to the previous year. One third of the new wind generating capacity is made in China. We are initially focusing on the domestic market in China, but will be looking to distribute our products throughout the world, with a focus on Europe.

Raw Materials

We source our raw materials from various metal smelting and electronics manufacturers in our local vicinity. Although we have not been subject to shortages of any of the components used in the fabrication of our wind turbines, we may be subject to cutbacks and price increases as we do not currently have any long term contracts with our supplies. In the event that prices do increase; we may not be able to pass these increases on to our customers.

4

Competition

The table below contains a description of our principal competitors in mainland China.

|

No

|

Enterprises

|

Form

|

Shareholders

|

Location

|

Date of Establishment

|

Output and Scale

|

|

1

|

LM Fiber Reinforced Plastics

(Tianjin) Ltd

|

Foreign Capital

|

Denmark LM Co.

|

Wuqing Development, Tientsin

|

August 2001

|

600 Sets per year

|

|

2

|

LM Urumchi Blade Works

|

Joint Venture using Chinese and foreign investment

|

Denmark LM Co. and Sinkiang Jinfeng Stock-joint Co.

|

Urumchi

|

Started production in August 2007

|

Supply products for Sinkiang Jinfeng joint venture.

|

|

3

|

Denmark VESTAS Wind Energy Electricity Equipment Limited

|

Foreign Capital

|

Denmark VESTAS Limited

|

West District in Tientsin Development

|

May 2005

|

1.5MW 200 sets of blades per year

|

|

4

|

SUZLON Resource Limited (Tientsin)

|

Foreign Capital

|

India SUZLON

|

HuaYuan Technology Development, Tientsin Development

|

2006

|

300-500 sets of blades per year

|

|

5

|

Tientsin Dongqi Wind Energy Blade Engineering Co.

|

Joint-stock

|

Orient Electric Group

|

Chemic Industry Garden in Tientsin Development

|

August 2006

|

Invested 279,000,000 RMB in first period, 1.5MW600 per year

|

|

6

|

Baoding China Air Huiteng Wind Power Equipment Limited

|

Joint-Venture using Chinese and Foreign Investment

|

NORDEX German Co.

|

Baoding New High-technology Development

|

August 2005

|

1.3MW Blades and provide to customers of Nordex in China

|

Competitive Advantages and Strategy

We believe that our unique technology, price points, relationships, infrastructure, proven quality control standards, and reputation represent substantial competitive advantages. We are currently able to maintain lower costs of manufacturing than competitors based in the United States and Europe. Furthermore, our competitive advantage in China is protected by our significant knowledge of government regulations, business practices, strong relationships, and patent protection.

We have been developing and plan to implement the following strategies to aide in the growth of our business:

|

1.

|

Management and Innovation Strategies

|

We have implemented a scientific approach to blade manufacture which relies on innovation. We also have a rigorous quality control program in place.

|

2.

|

Broaden Development Strategies

|

We have improved the reputation of our products by developing and implementing a marketing plan which will allow us to increase the value of our brand.

|

3.

|

Optimize Work Environment

|

We have implemented standardized safety procedures for our employees. Together with our quality control program, we hope this will result in high quality products for our customers.

|

4.

|

Cost Strategies

|

We plan to implement cost control measures in order to be more competitive in our domestic markets.

|

5.

|

Grow Capacity

|

We anticipate growing demand and have prepared to increase our production capacity in our current facility as well considered offsite manufacturing possibilities.

|

6.

|

Widen Sales Channels

|

We are actively seeking distribution contracts and increased sales through international channels.

5

Intellectual Property

We have received five patents in the wind energy industry from the China Patent and Trademark Office:

|

1.

|

ZL200620021590.7 - This patent relates to a belt drive accelerator which is fitted to wind power electricity equipment. This patent was obtained in 2006 and expires in 2016. The belt drive accelerator is especially important to us because it speeds up the blades in a dynamotor. This patent lowers the cost and increases the useful life of our blades.

|

|

2.

|

ZL200520020555.9 - This patent relates to a frame structure tower for wind energy equipment. The patent was obtained in 2005 and expires in 2015.

|

|

3.

|

ZL200220020019.9 - This patent relates to an integer-stand wind energy dynamotor. This patent was obtained in 2002 and expires in 2012.

|

|

4.

|

ZL200220020018.4 - This patent relates to a super-high-binding and auto-rising tower crane for the wind energy dynamotor. This patent was obtained in 2002 and expires in 2012.

|

|

5.

|

ZL200520020020.1 - This patent relates to equipment for motional wind energy blade production. This patent was obtained in 2005 and expires in 2015.

|

Products

In 2010, the price of blades of below 1.5 MW wind turbine went down; providing low profit margin. Therefore, we suspended the preparations for the production of blades of such specifications in 2010.

In the first half of 2010, we signed a ten-year blade supply agreement with Xu Ji Pursuant to the terms of the agreement, we agreed to supply blades for wind turbines rated at 2.0 MW and above with a length of 45.3 meters. We are now developing and producing the required blade moulds to satisfy this order. We expect to supply 100 sets of blades to Xu Ji in the second half of 2011.

In 2010, we began research and production of an intelligent blade monitor system. The service life of turbine blade is twenty years. Exposed to wind, frog, rain, the damage to them is inevitable. At present, the damage to blades can only be found when it causes the shutdown of turbines. We believe that our intelligent blade monitor system will aid in monitoring blade damage, dynamic balancing, ice covering, turbine and gear case temperature and turbine tower column inclination. Our targeted customers are turbine blade producers, wind turbine generator producers and wind field operators. We anticipate that the products will enter the market in November or December 2010 with commercial levels of production in March of 2011 .

In 2010 we also we engaged in the upgrading of combine harvesters. We have been manufacturing combine harvesters for over ten years. In the light of market demand, our backpack type harvesters will be upgraded to self-walking harvesters, which can harvest soybeans, wheat, rice and maize. They are now in small-scale trial production stage. We expect to produce 100 sets in 2011.

Customers

For the year ended July 31, 2010, we generated revenues of $194,069. These revenues resulted from the sales of combine harvesters as our wind turbine products are not yet ready for sale. We plan to distribute our products to various customers including private companies as well as government-backed entities. As of December 6, 2010 we have not sold any of our wind turbines or related products.

A significant percentage of our revenues for the year ended July 31, 2010 came from a small number of customers and we anticipate this will continue as we begin to produce and sell our wind turbine products due to the cost and nature of the product.

In light of the blade market change in 2010, we made those who are in need of blades of 2.0 MW and above turbines as our main targeted customers.

Customers

For the year ended July 31, 2010, we generated revenues of $194,069. These revenues resulted from the sales of combine harvesters as our wind turbine products are not yet ready for sale. We plan to distribute our products to various customers including private companies as well as government-backed entities. As of December 6, 2010 we have not sold any of our wind turbines or related products.

A significant percentage of our revenues for the year ended July 31, 2010 came from a small number of customers and we anticipate this will continue as we begin to produce and sell our wind turbine products due to the cost and nature of the product.

In light of the blade market change in 2010, we made those who are in need of blades of 2.0 MW and above turbines as our main targeted customers.

6

Employees

As of December 7, 2010 we had 400 employees. All employed full time, one of which is Shouquan Sun, our President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and director. Mr. Sun provides us with services in the areas of management, administration and business development. We also engage consultants in the areas of business development consulting, legal and accounting.

Government Regulations

We are subject to environmental regulation by both the Chinese central government and by provincial or local government agencies in China. Since our inception we have been in compliance with all applicable regulations.

Our manufacturing processes generate noise, wastewater, gaseous and other industrial wastes, and we use, generate and discharge toxic, volatile and otherwise hazardous chemicals and wastes in our operations. As a result, we are required to comply with all national and local regulations regarding protection of the environment. Our operations are subject to regulations promulgated by China’s Environmental Protection Administration, as well as local pollution regulations. We are also subject to periodic monitoring by local environmental protection authorities in Harbin. We believe that our manufacturing facilities and equipment are in substantial compliance with all applicable environmental regulations. Based on the requirements of present law, additional measures to maintain compliance are not expected to materially affect our capital expenditures, competitive position, financial position or results of operations.

The Chinese government has expressed concern about pollution and other environmental hazards. Although we believe that we comply with current national and local government regulations, if it is determined that we are in violation of these regulations, we can be subject to financial penalties as well as the loss of our business license, in which event we would be unable to continue in business. Further, if the national or local government adopts more stringent regulations, we may incur significant costs in complying with such regulations. If we fail to comply with present or future environmental regulations, we may be required to pay substantial fines, suspend production or cease operations. Any failure by us to control the use of, or to restrict adequately the discharge of, hazardous substances could subject us to potentially significant monetary damages and fines or suspensions of our business operations.

Regulations Governing Electrical Equipment

Our products are subject to regulations that pertain to electrical equipment, which may materially adversely affect our business. These regulations influence the design, components or operation of our products. New regulations and changes to current regulations are always possible and, in some jurisdictions, regulations may be introduced with little or no time to bring related products into compliance with these regulations. Our failure to comply with these regulations may restrict our ability to sell our products in China. In addition, these regulations may increase our cost of supplying the products by forcing us to redesign existing products or to use more expensive designs or components. In these cases, we may experience unexpected disruptions in our ability to supply customers with products, or we may incur unexpected costs or operational complexities to bring products into compliance. This could have an adverse effect on our revenues, gross profit margins and results of operations and increase the volatility of our financial results.

Business License

We, and all of our subsidiaries, have been issued business licenses with the appropriate municipal and provincial governments which specifically authorize the companies to operate their respective businesses. All of these business licenses, which are subject to annual review by the issuing agencies, are current as of the date of this report.

Beneficial Regulations

In 2010, we have been qualified as a scientific and technological enterprise by our provincial government. This provides us with a preferential income tax levied at a reduced tax rate of 15%.

In its current 5-Year Plan (covering 2006-2011) and in the National Science Mid to Long-Term Development Plan (2006-2020), the Chinese government identified wind power as a viable “green” energy technology that will reduce emissions while increasing the energy supply.

Reports to Security Holders

We intend to furnish our shareholders annual reports containing financial statements audited by our independent auditors and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

7

As a “smaller reporting company”, we are not required to provide the information required by this Item.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Our principal executive offices are located at 2 Haibin Road, Binxi Development, Harbin, Heilongjiang Province, China, where we carry out the management of our manufacturing factory. We own this property through our majority owned subsidiary: Harbin SQ. The property consists of a factory of 63,638 square meters (approximately 208,787 square feet) and an office building of 20,000 square meters (approximately 65,616 square feet). Harbin SQ carries out the manufacturing of our wind turbine blades at this location.

Our majority owned subsidiary, Harbin SQ, was named as a defendant in a lawsuit in which the plaintiffs alleged that illegal transfers and misleading promotion of Harbin SQ’s shares to the public occurred through securities brokers. The plaintiffs, 51 current stockholders representing 1,018,000 outstanding shares, acquired Harbin SQ’s shares through securities brokers from Harbin SQ’s initial stockholders and sought monetary damages from Harbin SQ, including the costs of acquiring the shares, expenses and imputed interest.

In September 2008 the claims of the plaintiffs were refuted in a judgment of the Court of Bin County, Heilongjiang Province. On May 25, 2009, 48 individual plaintiffs appealed the decision to a higher court. All appeals have been rejected by the courts and we do not anticipate any further liability from these proceedings.

We know of no other material, active or pending legal proceedings against us, our subsidiaries or our property, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholders are an adverse party or have a material interest adverse to us.

Market Information

There is a limited public market for our common shares. Our common shares are quoted for trading on the OTC Bulletin Board under the symbol “CWEY”. The market for our stock is highly volatile. We cannot assure you that there will be a market in the future for our common stock. OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers in stocks. OTC Bulletin Board stocks are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Our common shares became eligible for quotation on the OTC Bulletin Board on August 2, 2007, but no trades were made until September 11, 2007.

The following table shows the high and low prices of our common shares on the OTC Bulletin Board. The following quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions:

|

Period

|

High

|

Low

|

|

May 1, 2010 – July 31, 2010

|

$0.55

|

$0.0722

|

|

February 1, 2010 – April 30, 2010

|

$0.55

|

$0.051

|

|

November 1, 2009 – January 31, 2010

|

$0.99

|

$0.20

|

|

August 1, 2009 – October 31, 2009

|

$1.08

|

$0.05

|

|

May 1, 2009 – July 31, 2009

|

$0.91

|

$0.51

|

|

February 1, 2009 – April 30, 2009

|

$0.91

|

$0.52

|

|

November 1, 2008 – January 31, 2009

|

$0.55

|

$0.41

|

|

August 1, 2008 – October 31, 2008

|

$1.30

|

$0.51

|

|

May 1, 2008 – July 31, 2008

|

$1.60

|

$0.90

|

We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future.

Holders

As of December 7, 2010, there were 3,360 holders of record of our common stock.

Dividends

Holders of our common stock are entitled to dividends if declared by the Board of Directors out of funds legally available therefore. As of December 7, 2010 no cash dividends have been declared.

We do not intend to issue any cash or stock dividends in the near future. We intend to retain earnings, if any, to finance the development and expansion of our business. Our future dividend policy will be subject to the discretion of the Board of Directors and will be contingent upon future earnings, if any, our financial condition, capital requirements, general business conditions and other factors.

Equity Compensation Plans

As of December 7, 2010, we did not have any equity compensation plans.

9

Recent Sales of Unregistered Securities

We have not made any previously unreported sales from August 1, 2008 to July 31, 2010.

Recent Purchases of Equity Securities by us and our Affiliated Purchases

We have not repurchased any of our common stock and have no publicly announced repurchase plans or programs as of December 7, 2010.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

We are a development stage company with limited operations and revenues from our business operations. Our auditors have issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional financing to fund our operations. Our only source of cash at this time is investments by others in our company.

Forward-Looking Statements

This report contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including, "could" "may", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" and the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this Prospectus.

Liquidity and Capital Resources

At July 31, 2010 and 2009 we had cash of $257,620 and $65,233 respectively.

Since November 27, 2006 (inception) to July 31, 2010, our accumulated deficit was $13,853,487. We are dependent on the funds raised through our equity or debt financing, investing activities, and revenue generated through the sales of our products to fund our operations. The ability of our Company to continue as a going concern is dependent upon our ability to successfully accomplish our business plans and eventually secure other sources of financing and attain profitable operations. We anticipate that we will incur substantial losses over the next year and our ability to generate any revenues in the next 12 months continues to be uncertain.

As of July 31, 2010 we had total assets of $12,553,642 compared to $22,002,466 as of July 31, 2009. The decrease in total assets was due to goodwill impairment charge upon our annual goodwill impairment test. Our total assets as of July 31, 2010 were primarily made up of property, equipment and intangible assets. Our total liabilities increased from $4,365,158 as of July 31, 2009 to $6,156,213 as of July 31, 2010 due to an increase in short term loans.

We used net cash of $2,125,918 in operating activities for the year ended July 31, 2010 as compared to $1,642,454 for the year ended July 31, 2009 and $4,192,679 from inception to July 31, 2010. The decrease in cash used in operating activities for the year ended is mainly attributed to decrease in accounts receivable.

We used net cash of $860,697 in investing activities for the year ended July 31, 2010 including $319,896 in purchase of property, offset by $288,675 in collection of loans made to related parties, $891,908 in proceeds from sale of land use right. This compares to $303,599 used in investing activities for the year ended July 31, 2009 including $799,738 in purchases of property and equipment and $398,558 in cash paid for construction, offset by $723,541 collection of loans made to related parties.

10

We received net cash of $1,455,906 from financing activities for the year ended July 31, 2010, including $4,382,386 from short term loans, offset by 2,926,480 repayments of short term loans. We received net cash of $1,934,109 from financing activities for the year ended July 31, 2009, including $19,614 as proceeds from related party loans and $2,462,936 from other short term loans. We also repaid $548,441 towards short term loans during the year ended July 31, 2009.

Our cash position increased by $192,387 during the year ended July 31, 2010 compared to a decrease of $15,115 during the year ended July 31, 2009.

During the year ended July 31, 2010 we secured short term loans from an institutions and individuals to meet our ongoing cash requirements. Below is a table of these loans at July 31, 2010 and 2009.

|

2010

|

2009

|

|||||||

|

Bank loan 2010

|

$ | 2,217,000 | $ | - | ||||

|

Bank loan 2009

|

- | 1,465,700 | ||||||

|

Loans from individuals

|

677,160 | 645,805 | ||||||

|

Short term loan

|

$ | 2,894,160 | $ | 2,111,505 | ||||

Not all of the loans from individuals are interest-bearing. For interest bearing loans, the interest rate is ranging from 14% to 40% per annum. Interest expenses for short term loans were $648,436 for the year ended July 31, 2010 and $239,141 for the year ended July 31, 2009.

Our subsidiary, Harbin SQ provided a loan to Shouquan. Sun, our President, prior to us acquiring it. No monies have been loaned to Mr. Sun since our acquisition of Harbin SQ. As of July 31, 2010, Mr. Sun and the company under his control owed us $8,890 compared to $297,097 as of July 31, 2009. From April 30, 2008 to July 31, 2010, Mr. Sun has repaid a total of $1,271,147 on the loans. We hope to have the remaining funds settled with Mr. Sun in the near future.

We expect that our total expenses will increase over the next year as we increase our business operations through Harbin SQ, our majority owned subsidiary. We have not been able to reach the break-even point since our inception and have had to rely on outside capital resources. Over the next 12 months, we plan to begin manufacturing and selling of our wind turbines. However, we do not anticipate that we will generate sufficient revenues to fund our proposed operations.

Our approximate monthly cash requirement during the year ended July 31, 2010 was $49,065 compared to $51,031 during the year ended July 31, 2009. We expect to require approximately $2,374,323 in financing to fund our business operations over the next 12 months (beginning November 2010), as follows:

11

|

Description

|

Estimated

expenses

|

|||

|

Research and development of wind turbines

|

$ | 538,460 | ||

|

Marketing

|

104,130 | |||

|

Salaries

|

565,432 | |||

|

Equipment maintenance

|

20,288 | |||

|

Development of distribution chain

|

140,413 | |||

|

Utilities

|

200,600 | |||

|

Professional Fees

|

220,000 | |||

|

General and administrative expenses

|

585,000 | |||

|

Total

|

$ | 2,374,323 | ||

At present, our cash requirements for the next 12 months outweigh the funds available to maintain or develop our operations. Of the $2,374,323 that we require for the next 12 months, we had $257,620 in cash as of July 31, 2010. In order to improve our liquidity, we intend to apply for short term mortgage loan from bank. If we are unable to achieve the necessary additional financing, then we plan to reduce the amounts that we spend on our business activities and administrative expenses in order to be within the amount of capital resources that are available

Results of Operations

Revenues

Since our inception to July 31, 2010 we have generated gross revenues of $424,760 from the sale of combine harvesters manufactured by us. We generated $194,069 during the year ended July 31, 2010 and $82,308 during the year ended July 31, 2009. Our cost of goods sold was $887,682 for the year ended July 31, 2010 and $631,507 for the year ended July 31, 2009. .

Expenses

For the year ended July 31, 2010, we have total operating expenses of $10,142,669, including $39,311 in selling expenses, $1,992,398 in general and administrative and $8,110,960 of goodwill impairment loss. By comparison, for the year ended July 31, 2009, we have total operating expenses of $4,334,680, including $101,351 in selling expenses, $2,581,395 in general and administrative and $1,651,934 in loss on disposal of assets. For the period from inception to July 31, 2010 our total operating expenses were $14,924,118.

Net Loss

Since our inception on November 27, 2006 to July 31, 2010, we incurred a net loss of $16,808,386. For the year ended July 31, 2010, we incurred net loss of $ 11,413,008 compared to $4,961,009 for the year ended July 31, 2009. Our net loss per share was $0.18 for the year ended July 31, 2010 and $0.08 for the year ended July 31, 2009.

Our net loss for the year ended July 31, 2010 was the result of limited revenue of $194,069 counted against $887,682 in cost of goods sold, $39,311 in selling expenses, $1,992,398 in general and administrative expenses and $8,110,960 of goodwill impairment loss. Comparatively, during the year ended July 1, 2009 we generated revenue of $82,308 counted against $631,507 in cost of goods sold, $101,351 in selling expenses, $2,581,395 in general and administrative expenses and $1,651,934 in loss on disposal of assets.

12

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenue and operating results has not been significant.

Critical Accounting Policies

Our financial statements are impacted by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete summary of these policies is included in note 3 of the notes to our financial statements. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Impairment of Long-Lived Assets

Long-lived assets, including property, plant and equipment, identifiable intangible assets and capitalized software costs are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the long-lived asset may not be recoverable. The carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. If it is determined that an impairment loss has occurred, the loss is measured as the amount by which the carrying amount of the long-lived asset exceeds its fair value.

Goodwill and Other Intangible Assets

Goodwill is not subject to amortization but is tested for impairment on an annual basis (or more frequently if impairment indicators arise). Impairment losses are calculated at the reporting unit level, and represent the excess of the carrying value of reporting unit goodwill over its implied fair value. The implied fair value of goodwill is determined by a two-step process. The first compares the fair value of the reporting unit (measured as the present value of expected future cash flows) to its carrying amount. If the fair value of the reporting unit is less than its carrying amount, a second step is performed. In this step, the fair value of the reporting unit is allocated to its assets and liabilities to determine the implied fair value of goodwill, which is used to measure the impairment loss.

The Company’s evaluation of goodwill completed during the year ended July 31, 2010 resulted in $8,110,960 impairment loss.

Our intangible assets comprised of land use rights and are being amortized on a straight-line basis over their estimated useful life which is 40 years. None of our acquired intangible assets have indefinite lives. Land use rights are related to the land the Company occupies in Heilongjiang Province, PRC.

13

Property and Equipment

Property and equipment are initially recorded at cost. Gains or losses on disposals are reflected as gain or loss in the period of disposal. The cost of improvements that extend the life of plant and equipment are capitalized. These capitalized costs may include structural improvements, equipment and fixtures. All ordinary repairs and maintenance costs are expensed as incurred.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets:

|

Buildings

|

20 years

|

|

Machinery and equipment

|

14 years

|

|

Transportation equipment

|

12 years

|

|

Office equipment

|

10 years

|

As a “smaller reporting company”, we are not required to provide the information required by this Item.

CHINA WIND ENERGY INC. AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

INDEX

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

F-1

|

|

CONSOLIDATED BALANCE SHEETS

|

F-2

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

F-3

|

|

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

|

F-4

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

F-5

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

F-6

|

14

REPORT OF INDEPENDENT REGISTER PUBLIC ACCOUNTING FIRM

Board of Directors

China Wind Energy Inc. and Subsidiaries

(A development stage company)

We have audited the accompanying consolidated balance sheets of China Wind Energy Inc. and subsidiaries (a development stage company) as of July 31, 2010 and 2009 and the related consolidated statements of operations, changes in stockholders’ equity and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required at this time, to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of China Wind Energy Inc. and subsidiaries at July 31, 2010 and 2009 and the consolidated results of its operations and its cash flows for the years then ended, and for the period from November 27, 2006 (date of inception) to July 31, 2010 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered losses from operations and has a working capital deficit. These factors raise substantial doubt about its ability to continue as a going concern. Management’s plans concerning this matter are also described in Note 2. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey, LLP

MaloneBailey, LLP

www.malone-bailey.com

Houston, Texas

December 6, 2010

(April 26, 2011 as to the effects of correcting the 2010 financial statements described in Note 19)

F-1

China Wind Energy Inc. And Subsidiaries

(A Development Stage Company)

Consolidated Balance Sheets

|

July 31,

|

July 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 257,620 | $ | 65,233 | ||||

|

Accounts receivable, net

|

1,092 | 891,776 | ||||||

|

Inventories, net

|

639,740 | 648,043 | ||||||

|

Prepaid expenses

|

58,767 | 125,899 | ||||||

|

Total current assets

|

957,219 | 1,730,951 | ||||||

|

Prepayment and deposit

|

7,966 | 10,945 | ||||||

|

Due from related parties

|

10,691 | 298,884 | ||||||

|

Property and equipment, net

|

9,628,603 | 9,214,594 | ||||||

|

Construction in progress

|

156,503 | 797,016 | ||||||

|

Goodwill

|

- | 8,110,960 | ||||||

|

Intangible assets, net

|

1,792,660 | 1,839,116 | ||||||

|

Total Assets

|

$ | 12,553,642 | $ | 22,002,466 | ||||

|

Liabilities & Stockholders' Equity

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 2,386,509 | $ | 2,177,545 | ||||

|

Short term loans

|

2,894,160 | 2,111,505 | ||||||

|

Due to related parties

|

875,544 | 76,108 | ||||||

|

Total current liabilities

|

6,156,213 | 4,365,158 | ||||||

|

Stockholders' Equity

|

||||||||

|

Common stock; 400,000,000 shares authorized; 0.0001 par value; 51,902,250 shares issued and outstanding, respectively

|

5,191 | 5,191 | ||||||

|

Additional paid-in capital

|

20,335,701 | 20,335,701 | ||||||

|

Accumulated other comprehensive income

|

190,715 | 50,301 | ||||||

|

Accumulated deficit during development stage

|

(13,853,487 | ) | (4,478,842 | ) | ||||

|

Total China Wind Energy Inc. stockholders' equity

|

6,678,120 | 15,912,351 | ||||||

|

Non-controlling interest

|

(280,691 | ) | 1,724,957 | |||||

|

Total Stockholders' Equity

|

6,397,429 | 17,637,308 | ||||||

|

Total Liabilities & Stockholders' Equity

|

$ | 12,553,642 | $ | 22,002,466 | ||||

The accompanying notes are an integral part of these financial statements

F-2

China Wind Energy Inc. And Subsidiaries

(A Development Stage Company)

Consolidated Statement of Operations

|

Nov.27, 2006

|

||||||||||||

|

Year Ended

|

Year Ended

|

(Inception) to

|

||||||||||

|

July 31,

2010

|

July 31,

2009

|

July 31,

2010

|

||||||||||

|

Revenue

|

$ | 194,069 | $ | 82,308 | $ | 424,760 | ||||||

|

Cost of goods sold

|

(887,682 | ) | (631,507 | ) | (1,646,627 | ) | ||||||

|

Gross loss

|

(693,613 | ) | (549,199 | ) | (1,221,867 | ) | ||||||

|

Operating Expenses

|

||||||||||||

|

Selling expenses

|

39,311 | 101,351 | 144,447 | |||||||||

|

General and administrative

|

1,992,398 | 2,581,395 | 5,016,777 | |||||||||

|

Loss on goodwill impairment

|

8,110,960 | - | 8,110,960 | |||||||||

|

Loss on disposal of assets

|

- | 1,651,934 | 1,651,934 | |||||||||

|

Total operating expenses

|

10,142,669 | 4,334,680 | 14,924,118 | |||||||||

|

Loss from operations

|

(10,836,282 | ) | (4,883,879 | ) | (16,145,985 | ) | ||||||

|

Other income (expenses)

|

||||||||||||

|

Interest income

|

255 | 806 | 1,255 | |||||||||

|

Interest expenses

|

(648,435 | ) | (239,141 | ) | (896,315 | ) | ||||||

|

Government subsidy income

|

71,454 | 161,205 | 232,659 | |||||||||

|

Total other (expenses)

|

(576,726 | ) | (77,130 | ) | (662,401 | ) | ||||||

|

Loss before income taxes

|

(11,413,008 | ) | (4,961,009 | ) | (16,808,386 | ) | ||||||

|

Income taxes

|

- | - | - | |||||||||

|

Net loss

|

(11,413,008 | ) | (4,961,009 | ) | (16,808,386 | ) | ||||||

|

Less: net loss attributable to the non-controlling interest

|

2,038,363 | 883,791 | 2,954,899 | |||||||||

|

Net loss attributable to China Wind Energy Inc.

|

(9,374,645 | ) | (4,077,218 | ) | (13,853,487 | ) | ||||||

|

Other comprehensive loss

|

||||||||||||

|

Foreign currency translation

|

( 173,129 | ) | ( 5,932 | ) | (223,430 | ) | ||||||

|

Total omprehensive loss

|

$ | (11,239,879 | ) | (4,955,077 | ) | $ | (16,584,956 | ) | ||||

|

Comprehensive loss attributable to the non- controlling interest

|

(2,005,649 | ) | (883.008 | ) | (280,691 | ) | ||||||

|

Comprehensive loss attributable to China Wind Energy Inc.

|

(9,234,230 | ) | (4,072,069 | ) | (16,304,265 | ) | ||||||

|

Net Loss Per Share, Basic and Diluted

|

(0.18 | ) | (0.08 | ) | ||||||||

|

Weighted Average Shares Outstanding, Basic and Diluted

|

51,902,250 | 51,902,250 | ||||||||||

The accompanying notes are an integral part of these financial statements

F-3

China Wind Energy Inc. And Subsidiaries

(A Development Stage Company)

Consolidated Statement of Changes in Stockholders' Equity

For the period from November 27, 2006 (Date of Inception) to July 31, 2010

|

Stock

|

||||||||||||||||||||||||||||||||

|

Common Stock

|

Subscriptions

|

Accumulated

|

Noncontrolling

|

Total

|

||||||||||||||||||||||||||||

|

Shares

|

Amount

|

APIC

|

Receivable

|

OCI

|

Deficit

|

Interest

|

Equity

|

|||||||||||||||||||||||||

|

Bal. at inception (11/27/06)

|

- | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||||||

|

Issuance of CS for cash

|

1 | 1 | 100,000 | (100,000 | ) | - | - | - | 1 | |||||||||||||||||||||||

|

Foreign Currency Translation

|

- | - | - | - | (120 | ) | - | - | (120 | ) | ||||||||||||||||||||||

|

Net Loss

|

- | - | - | - | - | (37,817 | ) | - | (37,817 | ) | ||||||||||||||||||||||

|

Bal. at 7/31/07

|

1 | $ | 1 | $ | 100,000 | $ | (100,000 | ) | $ | (120 | ) | $ | (37,817 | ) | $ | - | $ | (37,936 | ) | |||||||||||||

|

Proceeds from issuance of CS

|

- | - | - | 100,000 | - | - | - | 100,000 | ||||||||||||||||||||||||

|

Adjustment to number of shares of CS issued and O/S as a result of reverse merger takeover of CWE Ltd.

|

||||||||||||||||||||||||||||||||

|

Recapitalization related to reverse merger

|

36,887,249 | 3,688 | (3,688 | ) | - | - | - | - | - | |||||||||||||||||||||||

|

Net assets acquired in reverse merger

|

- | - | 3,041 | - | - | - | - | 3,041 | ||||||||||||||||||||||||

|

Issuance of CS for service

|

15,000 | 2 | 17,848 | - | - | - | - | 17,850 | ||||||||||||||||||||||||

|

Issuance of CS for acquisition

|

15,000,000 | 1,500 | 20,218,500 | - | - | - | - | 20,220,000 | ||||||||||||||||||||||||

|

Noncontrolling interest related to acquisition of controlling interest in Harbin SQ

|

- | - | - | - | - | 2,607,965 | 2,607,965 | |||||||||||||||||||||||||

|

Foreign Currency Translation

|

- | - | - | - | 44,489 | - | - | 44,489 | ||||||||||||||||||||||||

|

Net Loss

|

- | - | - | - | - | (363,807 | ) | - | (363,807 | ) | ||||||||||||||||||||||

|

Bal. at 7/31/08

|

51,902,250 | $ | 5,191 | $ | 20,335,701 | $ | - | $ | 44,369 | $ | (401,624 | ) | $ | 2,607,965 | $ | 22,591,602 | ||||||||||||||||

|

Foreign Currency Translation

|

- | - | - | - | 5,932 | - | 783 | 6,715 | ||||||||||||||||||||||||

|

Net Loss

|

- | - | - | - | - | (4,077,218 | ) | (883,791 | ) | (4,961,009 | ) | |||||||||||||||||||||

|

Bal. at 7/31/09

|

51,902,250 | $ | 5,191 | $ | 20,335,701 | $ | - | $ | 50,301 | $ | (4,478,842 | ) | $ | 1,724,957 | $ | 17,637,308 | ||||||||||||||||

|

Foreign Currency Translation

|

140,414 | 32,715 | 173,129 | |||||||||||||||||||||||||||||

|

Net Loss

|

(9,374,645 | ) | (2,038,363 | ) | (11,413,008 | ) | ||||||||||||||||||||||||||

| - | ||||||||||||||||||||||||||||||||

|

Bal. at 7/31/10

|

51,902,250 | $ | 5,191 | $ | 20,335,701 | $ | - | $ | 190,715 | $ | (13,853,487 | ) | $ | (280,691 | ) | $ | 6,397,429 | |||||||||||||||

The accompanying notes are an integral part of these financial statements

F-4

China Wind Energy Inc. And Subsidiaries

(A Development Stage Company)

Consolidated Statements of Cash Flows

|

Nov. 27, 2006

|

||||||||||||

|

Year Ended

|

Year Ended

|

(Inception)

|

||||||||||

|

July 31, 2010

|

July 31, 2009

|

to July 31, 2010

|

||||||||||

|

(Restated)(Note 19)

|

(Restated)(Note 19)

|

|||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Net loss

|

$ | (11,413,008 | ) | $ | (4,961,009 | ) | $ | (16,808,386 | ) | |||

|

Adjustments to reconcile net income to net cash

|

||||||||||||

|

used for operating activities:

|

||||||||||||

|

Depreciation

|

634,471 | 475,342 | 1,124,295 | |||||||||

|

Provision for inventory

|

668,317 | - | 564,051 | |||||||||

|

Amortization

|

41,419 | 48,334 | 141,072 | |||||||||

|

Loss on disposal of assets

|

- | 1,651,934 | 1,651,934 | |||||||||

|

Loss(Gain) on physical count of inventories

|

- | - | 26,831 | |||||||||

|

Loss on goodwill impairment

|

8,110,960 | - | 8,110,960 | |||||||||

|

Common stock issued for services

|

- | - | 17,850 | |||||||||

|

Changes in operating assets and liabilities

|

||||||||||||

|

Accounts receivable

|

19,614 | 19,188 | ||||||||||

|

Prepaid expenses

|

(961 | ) | 317,646 | 265,343 | ||||||||

|

Inventories

|

(526,502 | ) | (204,767 | ) | (558,680 | ) | ||||||

|

Advance to Suppliers

|

68,643 | - | 68,643 | |||||||||

|

Prepayment and deposit

|

3,821 | 738,204 | 561,571 | |||||||||

|

Accounts payable & accrued liabilities

|

286,922 | 272,248 | 622,648 | |||||||||

|

NET CASH USED IN OPERATING ACTIVITIES

|

(2,125,918 | ) | (1,642,454 | ) | (4,192,679 | ) | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||||||

|

Purchase of property and equipment

|

(319,896 | ) | (799,738 | ) | (1,593,670 | ) | ||||||

|

Cash paid for construction in progress

|

- | (398,558 | ) | (398,558 | ) | |||||||

|

Proceeds from sale of land use right

|

891,908 | 73,285 | 965,193 | |||||||||

|

Proceeds from sale of fixed assets

|

- | 99,278 | 99,278 | |||||||||

|

Cash paid to acquire intangibles

|

- | (1,407 | ) | (1,407 | ) | |||||||

|

Collection of loans made to related parties

|

288,675 | 723,541 | 1,282,176 | |||||||||

|

cash acquired on acquisition

|

- | - | 314,713 | |||||||||

|

CASH USED FOR INVESTING ACTIVITIES

|

860,697 | (303,599 | ) | 667,725 | ||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||||||

|

Proceeds from related party loans

|

- | 19,614 | 69,319 | |||||||||

|

Proceeds from short term loans

|

4,382,386 | 2,462,936 | 6,890,321 | |||||||||

|

Repayment of related party loans

|

- | - | - | |||||||||

|

Repayment of short term loans

|

(2,926,480 | ) | (548,441 | ) | (3,474,921 | ) | ||||||

|

Proceeds from issuance of common stock

|

- | - | 100,001 | |||||||||

|

CASH PROVIDED BY FINANCING ACTIVITIES

|

1,455,906 | 1,934,109 | 3,584,720 | |||||||||

|

Effect of exchange rate changes on cash

|

1,712 | (3,171 | ) | 197,854 | ||||||||

|

NET INCREASE (DECREASE) IN CASH

|

192,387 | (15,115 | ) | 257,620 | ||||||||

|

Cash and cash equivalents, beginning of period

|

65,233 | 80,348 | - | |||||||||

|

Cash and cash equivalents, end of period

|

$ | 257,620 | $ | 65,233 | $ | 257,620 | ||||||

|

Supplemental disclosure information

|

||||||||||||

|

Interest expense paid

|

$ | 447,657 | $ | 29,065 | ||||||||

|

Non-Cash Financing and Investing Activities:

|

||||||||||||

|

Increase of accounts receivable related to the sale of land use right

|

$ | - | $ | 882,351 | ||||||||

|

Increase of accounts payable related to accrual of PP&E additions

|

$ | - | $ | 1,549,467 | ||||||||

The accompanying notes are an integral part of these financial statements

F-5

China Wind Energy Inc. And Subsidiaries

Notes to Consolidated Financial Statements

1. ORGANIZATION AND BUSINESS BACKGROUND

The Company was incorporated in Nevada on May 8, 2006, under the name Pooch Pal Beverages Inc., and changed its name to K-Care Nutritional Products Inc. On November 29, 2007, the Company changed its name to China Wind Energy Inc.

On November 20, 2007, the former President of the Company entered into a Stock Purchase Agreement with Jian Ren, a resident and citizen of the Hong Kong SAR of the People’s Republic of China (the “Purchaser”), pursuant to which the Purchaser agreed to purchase 5,950,000 shares of the Company’s common stock, $0.0001 par value, from the former President of the Company for $50,000. These shares represented 81% of the issued and outstanding common stock of the Company. The Stock Purchase Agreement closed on November 27, 2007.

Also, on November 20, 2007, the Company entered into an Acquisition Agreement with the Purchaser, who is the owner of all of the share capital of China Wind Energy Limited, a corporation organized and existing under the laws of the Hong Kong SAR of the People’s Republic of China, pursuant to which the Purchaser agreed to transfer all of his share capital in China Wind Energy Limited to the Company for $1. Upon closing of the Acquisition agreement on November 27, 2007, China Wind Energy Limited became a wholly owned subsidiary of the Company. China Wind Energy Limited has one wholly owned subsidiary, Harbin XingYe Wind Energy Technology Limited (“XingYe”), a company established under the Law of the People’s Republic of China (“PRC”).

The Acquisition was accounted for as a reverse merger, since the Purchaser owned a majority of the outstanding shares of the Company’s common stock immediately following the Acquisition. China Wind Energy Limited is deemed to be the acquirer in the merger. Consequently, the assets and liabilities and the historical operations that are reflected in the financial statements prior to the Acquisition are those of China Wind Energy Limited and are recorded at the historical cost basis of China Wind Energy Limited, whereas, the consolidated financial statements after completion of the Acquisition will include the assets and liabilities of the Company and China Wind Energy Limited, the historical operations of China Wind Energy Limited, and the Company’s operations from the closing date of the Acquisition.

On May 16, 2008, the Company entered into a Share Exchange Agreement with Power Profit Technology Development Limited, a company incorporated under the laws of Hong Kong, People’s Republic of China (“Power Profit”), and Wan Yi Tse, the holder of 100% of the issued and outstanding registered share capital of Power Profit.

Pursuant to the share exchange agreement, on May 26, 2008, the Company completed the acquisition of 100% of the equity interests of Power Profit and 82.14% of the equity interests of its subsidiary, Harbin SQ Wind Power Co., Ltd. (formerly Harbin Sanye Wind Energy Technology Co., Ltd.) (“Harbin SQ”). Harbin SQ is a company incorporated under the laws of the People’s Republic of China, engaged in the business of harvesters and blades for wind generators. Together, Power Profit and Harbin SQ become the subsidiaries of the Company. Power Profit becomes the Company’s wholly owned subsidiary and Harbin SQ becomes the Company’s majority owned subsidiary.

The Company has not yet generated significant revenues from planned principal operations and is considered a development stage company.

F-6

2. GOING CONCERN

As reflected in the accompanying consolidated financial statements, the Company has accumulated deficits of $13,853,487 and $4,478,842 at July 31, 2010 and 2009, respectively that include losses of $11,413,008 and $4,961,009 for the years ended July 31, 2010 and 2009, respectively. The Company also had a working capital deficiency of $5,210,101 and $2,634,207 as of July 31, 2010 and 2009. These factors raise substantial doubt about the ability of the Company to continue as a going concern. The consolidated financial statements have been prepared on a going basis and do not include any adjustments that might result from outcome of this uncertainty.

At July 31, 2010, the Company has suffered losses from development stage activities to date. Although management is currently attempting to implement its business plan, and is seeking additional sources of equity or debt financing, there is no assurance these activities will be successful.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Basis of Presentation and Use of Estimates

The consolidated financial statements include the accounts of the Company and its majority-owned subsidiaries after the elimination of intercompany accounts and transactions. The Company’s fiscal year ends on July 31.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“US GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. While management believes that the estimates and assumptions used in the preparation of the financial statements are appropriate, actual results could differ from these estimates. The Company regularly evaluates estimates and assumptions related to obsolete inventory, useful life and recoverability of long lived assets, and goodwill. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

b. Principles of Consolidation

The accompanying consolidated financial statements of the Company include the accounts of its wholly and majority-owned subsidiaries. All material intercompany accounts and transactions have been eliminated.

c. Fair values of financial instruments

The carrying amount reported in the balance sheet for cash, accounts receivable, inventory, accounts payable and accrued expenses approximate fair value because of the immediate or short-term maturity of these financial instruments.

d. Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, demand deposits with banks and liquid investments with an original maturity of three months or less. Cash deposits with banks are held in financial institutions in China, which has no federally insured deposit protection. Accordingly, the Company has a concentration of credit risk related to these uninsured deposits.

e. Accounts Receivable

Accounts receivable are stated at the amount management expects to collect from outstanding balances. Management provides for probable uncollected amounts through a charge to earnings and a credit to an allowance for bad debts based on its assessment of the current status of individual accounts. Balances those are still outstanding after management has used reasonable collection efforts are written off through a charge to the allowance for bad debts and a credit to accounts receivable.

F-7

f. Inventories

Inventories are stated at the lower of cost, as determined on a weighted average basis, or market. Costs of inventories include purchase and related costs incurred in bringing the products to their present location and condition. Market value is determined by reference to selling prices after the balance sheet date or to management’s estimates based on prevailing market conditions. The management writes down the inventories to market value if market value is below cost. The management also regularly evaluates the composition of its inventories to identify slow-moving and obsolete inventories to determine if a valuation allowance is required.

g. Property and Equipment

Property and equipment are initially recorded at cost. Gains or losses on disposals are reflected as gain or loss in the period of disposal. The cost of improvements that extend the life of plant and equipment are capitalized. These capitalized costs may include structural improvements, equipment and fixtures. All ordinary repairs and maintenance costs are expensed as incurred.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets:

|

Buildings

|

20 years

|

|

Machinery and equipment

|

14 years

|

|

Transportation equipment

|

12 years

|

|

Office equipment

|

10 years

|

h. Construction in Progress

Construction in progress represents direct costs of construction or acquisition and design fees incurred. Capitalization of these costs ceases and the construction in progress is transferred to property and equipment when substantially all the activities necessary to prepare the assets for their intended use are completed.

i. Impairment of Long-Lived Assets

Long-lived assets, including property, plant and equipment, identifiable intangible assets and capitalized software costs are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the long-lived asset may not be recoverable. The carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. If it is determined that an impairment loss has occurred, the loss is measured as the amount by which the carrying amount of the long-lived asset exceeds its fair value.

j. Goodwill and Other Intangible Assets

Goodwill is not subject to amortization but is tested for impairment on an annual basis (or more frequently if impairment indicators arise). Impairment losses are calculated at the reporting unit level, and represent the excess of the carrying value of reporting unit goodwill over its implied fair value. The implied fair value of goodwill is determined by a two-step process. The first compares the fair value of the reporting unit (measured as the present value of expected future cash flows) to its carrying amount. If the fair value of the reporting unit is less than its carrying amount, a second step is performed. In this step, the fair value of the reporting unit is allocated to its assets and liabilities to determine the implied fair value of goodwill, which is used to measure the impairment loss.

The Company’s evaluation of goodwill completed during the year ended July 31, 2010 resulted in $8,110,960 impairment loss.

Our intangible assets consist primarily of land use right. intellectual property that has been internally developed or purchased. Intangible assets are amortized using the straight-line method over estimated useful lives. None of our acquired intangible assets have indefinite lives. Land use rights are related to the land the Company occupies in Heilongjiang Province, PRC.

F-8

k. Comprehensive income

ASC 220, “Reporting Comprehensive Income”, requires disclosure of all components of comprehensive income and loss on an annual and interim basis. Comprehensive income and loss is defined as the change in equity of a business enterprise during a period from transactions and other events and circumstances from non-owner sources. The Company’s other comprehensive income arose from the effect of foreign currency translation adjustments.

l. Revenue recognition

The Company generates revenues from the sales of harvesters. Sales are recognized when the following four revenue criteria are met: persuasive evidence of an arrangement exists, delivery has occurred, the selling price is fixed or determinable, and collectability is reasonably assured. Sales are presented net of value added tax (VAT). No return allowance is made as products returns are insignificant based on historical experience.

m. Research and development costs

Research and development costs are expensed to operations as incurred.

n. Income taxes

The Company accounts for income taxes in accordance with FASB ASC 740, "Income Taxes." FASB ASC 740 requires an asset and liability approach for financial accounting and reporting for income taxes and allows recognition and measurement of deferred tax assets based upon the likelihood of realization of tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future deductibility is uncertain.

o. Foreign exchange and currency translation

The Company’s functional currency is Chinese currency Renminbi (“RMB”) and its reporting currency is the U.S. dollar. Transactions denominated in foreign currencies are translated into U.S. dollar at exchange rate in effect on the date of the transactions. Exchange gains or losses on transactions are included in earnings.

The financial statements of the Company are translated into United States dollars in accordance with ASC 830, “Foreign Currency Matters”, using year-end rates of exchange for assets and liabilities, and average rates of exchange for the period for revenues, costs, and expenses and historical rates for the equity. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income.

At July 31, 2010 and 2009, the cumulative translation adjustment of $223,430 and $50,301 were classified as an item of accumulated other comprehensive income in the stockholders’ equity section of the balance sheet respectively. For the year ended July 31, 2010 and 2009, other comprehensive loss was $173,129 and $5,932, respectively.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the financial statements were as follows: As of July 31, 2010 and 2009, the Company used the period-end rates of exchange for assets and liabilities of $1 to RMB 6.765 and $1 to RMB 6.823 respectively. For the years ended July 31, 2010 and 2009, the Company used the period’s average rate of exchange to convert revenues, costs, and expenses of$1 to RMB 6.81338 and $1 to RMB 6.82361, respectively. The Company used historical rates for equity and goodwill.

F-9

p. Related parties

A party is considered to be related to the Company if the party directly or indirectly or through one or more intermediaries, controls, is controlled by, or is under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. A party which can significantly influence the management or operating policies of the transacting parties or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests is also a related party.

q. Net loss per share