Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2011

Commission file number 001-32337

DREAMWORKS ANIMATION SKG, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 68-0589190 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification no.) |

1000 Flower Street

Glendale, California 91201

(Address of principal executive offices) (Zip code)

(818) 695-5000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock: As of April 15, 2011, there were 72,664,193 shares of Class A common stock and 10,838,731 shares of Class B common stock of the registrant outstanding.

Table of Contents

| Page | ||||||

| PART I. | ||||||

| Item 1. |

Financial Statements—DreamWorks Animation SKG, Inc. (unaudited) |

2 | ||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

13 | ||||

| Item 3. |

20 | |||||

| Item 4. |

21 | |||||

| PART II. | ||||||

| Item 1. |

21 | |||||

| Item 1A. |

21 | |||||

| Item 2. |

22 | |||||

| Item 5. |

22 | |||||

| Item 6. |

23 | |||||

| 24 | ||||||

| 25 | ||||||

Unless the context otherwise requires, the terms “DreamWorks Animation,” the “Company,” “we,” “us” and “our” refer to DreamWorks Animation SKG, Inc., its consolidated subsidiaries, predecessors in interest, and the subsidiaries and assets and liabilities contributed to it by the entity then known as DreamWorks L.L.C. (“Old DreamWorks Studios”) on October 27, 2004 in connection with our separation from Old DreamWorks Studios, including Pacific Data Images, Inc. and its subsidiary, Pacific Data Images, LLC.

1

Table of Contents

| Item | 1. Financial Statements |

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| March 31, 2011 |

December 31, 2010 |

|||||||

| (in thousands, except par value and share amounts) |

||||||||

| Assets |

||||||||

| Cash and cash equivalents |

$ | 86,108 | $ | 163,819 | ||||

| Trade accounts receivable, net of allowance for doubtful accounts |

28,345 | 40,136 | ||||||

| Income taxes receivable |

4,446 | 310 | ||||||

| Receivable from Paramount, net of allowance for doubtful accounts |

236,106 | 242,629 | ||||||

| Film and other inventory costs, net |

839,842 | 772,668 | ||||||

| Prepaid expenses |

29,535 | 21,795 | ||||||

| Other assets |

9,832 | 9,889 | ||||||

| Property, plant and equipment, net of accumulated depreciation and amortization |

172,116 | 174,803 | ||||||

| Deferred taxes, net |

287,500 | 295,602 | ||||||

| Goodwill |

34,216 | 34,216 | ||||||

| Total assets |

$ | 1,728,046 | $ | 1,755,867 | ||||

| Liabilities and Equity |

||||||||

| Liabilities: |

||||||||

| Accounts payable |

$ | 5,183 | $ | 3,515 | ||||

| Accrued liabilities |

101,454 | 143,098 | ||||||

| Payable to former stockholder |

297,100 | 329,590 | ||||||

| Deferred revenue and other advances |

70,873 | 20,793 | ||||||

| Total liabilities |

474,610 | 496,996 | ||||||

| Commitments and contingencies |

||||||||

| Stockholders’ equity: |

||||||||

| Class A common stock, par value $.01 per share, 350,000,000 shares authorized, 97,453,929 and 97,436,947 shares issued, as of March 31, 2011 and December 31, 2010, respectively |

975 | 975 | ||||||

| Class B common stock, par value $.01 per share, 150,000,000 shares authorized, 10,838,731 shares issued and outstanding, as of March 31, 2011 and December 31, 2010, respectively |

108 | 108 | ||||||

| Additional paid-in capital |

990,400 | 979,177 | ||||||

| Retained earnings |

975,729 | 966,935 | ||||||

| Less: Class A Treasury common stock, at cost, 24,789,801 and 23,834,081 shares, as of March 31, 2011 and December 31, 2010, respectively |

(713,776 | ) | (688,324 | ) | ||||

| Total stockholders’ equity |

1,253,436 | 1,258,871 | ||||||

| Total liabilities and stockholders’ equity |

$ | 1,728,046 | $ | 1,755,867 | ||||

See accompanying notes.

2

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| (in thousands, except per share amounts) |

||||||||

| Revenues |

$ | 108,037 | $ | 162,143 | ||||

| Costs of revenues |

72,027 | 106,183 | ||||||

| Gross profit |

36,010 | 55,960 | ||||||

| Product development |

168 | 185 | ||||||

| Selling, general and administrative expenses |

30,129 | 23,510 | ||||||

| Operating income |

5,713 | 32,265 | ||||||

| Interest income, net |

216 | 59 | ||||||

| Other income, net |

2,000 | 2,093 | ||||||

| Decrease (increase) in income tax benefit payable to former stockholder |

4,589 | (8,188 | ) | |||||

| Income before income taxes |

12,518 | 26,229 | ||||||

| Provision for income taxes |

3,724 | 4,560 | ||||||

| Net income |

$ | 8,794 | $ | 21,669 | ||||

| Basic net income per share |

$ | 0.10 | $ | 0.25 | ||||

| Diluted net income per share |

$ | 0.10 | $ | 0.24 | ||||

| Shares used in computing net income per share |

||||||||

| Basic |

84,138 | 86,838 | ||||||

| Diluted |

85,157 | 88,709 | ||||||

See accompanying notes.

3

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| (in thousands) | ||||||||

| Operating activities |

||||||||

| Net income |

$ | 8,794 | $ | 21,669 | ||||

| Adjustments to reconcile net income to net cash used in operating activities: |

||||||||

| Amortization and write-off of film and other inventory costs |

54,911 | 96,875 | ||||||

| Stock-based compensation expense |

7,021 | 6,674 | ||||||

| Depreciation and amortization |

726 | 629 | ||||||

| Revenue earned against deferred revenue and other advances |

(3,128 | ) | (29,898 | ) | ||||

| Deferred taxes, net |

8,102 | (538 | ) | |||||

| Changes in operating assets and liabilities: |

||||||||

| Trade accounts receivable |

11,791 | (11,472 | ) | |||||

| Receivable from Paramount |

6,523 | 36,773 | ||||||

| Film and other inventory costs |

(111,901 | ) | (116,670 | ) | ||||

| Prepaid expenses and other assets |

(8,470 | ) | (8,963 | ) | ||||

| Accounts payable and accrued liabilities |

(39,876 | ) | (10,597 | ) | ||||

| Payable to former stockholder |

(32,490 | ) | (13,511 | ) | ||||

| Income taxes payable/receivable, net |

(4,136 | ) | 4,345 | |||||

| Deferred revenue and other advances |

57,941 | 19,889 | ||||||

| Net cash used in operating activities |

(44,192 | ) | (4,795 | ) | ||||

| Investing activities |

||||||||

| Purchases of property, plant and equipment |

(8,075 | ) | (13,928 | ) | ||||

| Net cash used in investing activities |

(8,075 | ) | (13,928 | ) | ||||

| Financing activities |

||||||||

| Receipts from exercise of stock options |

7 | 7,964 | ||||||

| Excess tax benefits from employee equity awards |

— | 171 | ||||||

| Purchase of treasury stock |

(25,451 | ) | (2,270 | ) | ||||

| Net cash (used in) provided by financing activities |

(25,444 | ) | 5,865 | |||||

| Decrease in cash and cash equivalents |

(77,711 | ) | (12,858 | ) | ||||

| Cash and cash equivalents at beginning of period |

163,819 | 231,245 | ||||||

| Cash and cash equivalents at end of period |

$ | 86,108 | $ | 218,387 | ||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash paid during the period for income taxes, net |

$ | 455 | $ | 563 | ||||

| Cash paid during the period for interest, net of amounts capitalized |

$ | 120 | $ | 149 | ||||

See accompanying notes.

4

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

1. Business and Basis of Presentation

Business

The businesses and activities of the DreamWorks Animation SKG, Inc. (“DreamWorks Animation” or the “Company”) primarily include the development, production and exploitation of animated films and its characters in the worldwide theatrical, home entertainment, television, merchandising and licensing and other markets (such as the creation of television specials/series and live performances based on the characters). The Company’s films are distributed on a worldwide basis, except for in the merchandising and licensing markets, by Paramount Pictures Corporation, a subsidiary of Viacom Inc. (“Viacom”), and its affiliates (collectively, “Paramount”) pursuant to a distribution agreement and a fulfillment services agreement (collectively, the “Paramount Agreements”). The Company generally retains all other rights to exploit its films, including commercial tie-in and promotional rights with respect to each film, as well as merchandising, interactive, literary publishing, music publishing and soundtrack rights, live performance and television production rights.

Basis of Presentation and Use of Estimates

The consolidated financial statements of the Company present the financial position, results of operations and cash flows of DreamWorks Animation and its wholly owned subsidiaries. All significant intercompany accounts and transactions have been eliminated. The accompanying unaudited financial data as of March 31, 2011 and for the three months ended March 31, 2011 and 2010 has been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) and in accordance with United States generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, certain information and footnote disclosures normally included in comprehensive financial statements have been condensed or omitted pursuant to such rules and regulations. The consolidated balance sheet as of December 31, 2010 was derived from the audited financial statements at that date, but does not include all the information and footnotes required by GAAP. These financial statements should be read in conjunction with the consolidated financial statements and related notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010 (the “2010 Form 10-K”).

The accompanying unaudited consolidated financial statements reflect all adjustments, consisting of only normal recurring items, which in the opinion of management, are necessary for a fair statement for the periods shown. The results of operations for such periods are not necessarily indicative of the results expected for the full year, or for any future period, as fluctuations can occur based upon the timing of our films’ theatrical and home entertainment releases, and television special broadcasts.

The preparation of financial statements in conformity with United States GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes, including estimates of ultimate revenues and ultimate costs of film, television product and live performances, estimates of product sales that will be returned and the amount of receivables that ultimately will be collected, the potential outcome of future tax consequences of events that have been recognized in the Company’s financial statements, loss contingencies, and estimates used in the determination of the fair value of equity awards for stock-based compensation or their probability of vesting. Actual results could differ from those estimates. To the extent that there are material differences between these estimates and actual results, the Company’s financial condition or results of operations will be affected. Estimates are based on past experience and other assumptions that management believes are reasonable under the circumstances, and management evaluates these estimates on an ongoing basis.

5

Table of Contents

2. Financial Instruments

The fair value of cash and cash equivalents, accounts receivable, accounts payable and advances approximates carrying value due to the short-term maturity of such instruments. The Company has short-term money market investments which are classified as cash and cash equivalents on the balance sheet. The fair value of these investments at March 31, 2011 and December 31, 2010 was measured based on quoted prices in active markets.

3. Film and Other Inventory Costs

Film, television, live performance and other inventory costs consist of the following (in thousands):

| March 31, 2011 |

December 31, 2010 |

|||||||

| In release, net of amortization(1) |

$ | 342,832 | $ | 384,863 | ||||

| In production |

460,874 | 355,678 | ||||||

| In development |

36,136 | 32,127 | ||||||

| Total film, television, live performance and other inventory costs, net |

$ | 839,842 | $ | 772,668 | ||||

| (1) | Includes $15.1 million and $13.6 million of live performance costs at March 31, 2011 and December 31, 2010, respectively. |

The Company anticipates that 49% and 87% of the above “in release” film costs as of March 31, 2011 will be amortized over the next 12 months and three years, respectively.

4. Accrued Liabilities

Accrued liabilities consist of the following (in thousands):

| March 31, 2011 |

December 31, 2010 |

|||||||

| Employee compensation |

$ | 33,590 | $ | 63,931 | ||||

| Participations and residuals |

44,554 | 46,746 | ||||||

| Deferred rent |

2,166 | 2,550 | ||||||

| Other accrued liabilities |

21,144 | 29,871 | ||||||

| Total accrued liabilities |

$ | 101,454 | $ | 143,098 | ||||

As of March 31, 2011, the Company estimates that over the next 12 months it will pay approximately $30.0 million of its accrued participation and residual costs.

6

Table of Contents

5. Deferred Revenue and Other Advances

The following is a summary of deferred revenue and other advances included in the consolidated balance sheets as of March 31, 2011 and December 31, 2010 and the related amounts earned and either recorded as revenue in the consolidated statements of income or recorded as an offset to other costs (as described below) for the three-month periods ended March 31, 2011 and 2010 (in thousands):

| Amounts Earned | ||||||||||||||||

| March 31, 2011 |

December 31, 2010 |

Three Months Ended March 31, |

||||||||||||||

| 2011 | 2010 | |||||||||||||||

| Home Box Office Inc. Advance(1) |

$ | 45,000 | $ | — | $ | — | $ | 13,333 | ||||||||

| Licensing Advances |

12,955 | 12,967 | 12 | 9,028 | ||||||||||||

| Deferred Revenue |

6,685 | 3,795 | 338 | 1,707 | ||||||||||||

| Strategic Alliance/Development Advances(2) |

416 | 1,667 | 6,551 | 2,993 | ||||||||||||

| Other Advances |

5,817 | 2,364 | 960 | 4,321 | ||||||||||||

| Total deferred revenue and other advances |

$ | 70,873 | $ | 20,793 | ||||||||||||

| (1) | The Company remains a participant of an exclusive multi-picture domestic pay television license agreement originally entered into between Old DreamWorks Studios and Home Box Office, Inc. (“HBO”), pursuant to which the Company receives advances against license fees payable for future film product. The agreement is currently expected to extend through 2014. The advance recorded as of March 31, 2011 relates to the Company’s 2010 films that are expected to be made available to HBO during 2011. |

| (2) | During the three months ended March 31, 2011 and 2010, of the total amounts earned against the “Strategic Alliance/Development Advances,” $4.6 million and $1.5 million, respectively, were capitalized as an offset to property, plant and equipment. |

6. Financing Arrangements

Revolving Credit Facility. The Company has a $125.0 million revolving credit facility with a number of banks which terminates in June 2013. There was no debt outstanding for the respective periods. The revolving credit facility requires the Company to maintain a specified leverage ratio and, subject to specific exceptions, prohibits the Company from taking certain actions without the lenders’ consent, such as granting liens or entering into any merger or other significant transaction. The revolving credit facility also prohibits the Company from paying dividends on its capital stock if, after giving pro forma effect to such dividend, an event of default would occur or exist under the revolving credit facility. The Company is required to pay a commitment fee on undrawn amounts at an annual rate of 0.375%. Interest on borrowed amounts is determined by reference to i) either the lending banks’ base rate plus 0.50% per annum or ii) LIBOR plus 1.50% per annum. Interest costs incurred as a result of the commitment fee was $0.1 million for each of the three-month periods ended March 31, 2011 and 2010.

As of March 31, 2011, the Company was in compliance with all applicable financial debt covenants.

7

Table of Contents

7. Income Taxes

Set forth below is a reconciliation of the components that caused the Company’s provision for income taxes (including the income statement line item “Decrease (increase) in income tax benefit payable to former stockholder”) to differ from amounts computed by applying the U.S. Federal statutory rate of 35% for the three months ended March 31, 2011 and 2010.

| Three Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| Provision for income taxes (combined with decrease/increase in income tax benefit payable to former stockholder)(1) |

||||||||

| U.S. Federal statutory rate |

35.0 | % | 35.0 | % | ||||

| U.S. state taxes, net of Federal benefit |

3.0 | % | 1.4 | |||||

| Export sales exclusion/manufacturer’s deduction |

(57.1 | )% | (2.3 | ) | ||||

| Revaluation of deferred tax assets, net |

9.6 | % | 3.0 | |||||

| Other |

(1.4 | )% | (0.1 | ) | ||||

| Total provision for income taxes (combined with decrease/increase in income tax benefit payable to former stockholder)(1)(2) |

(10.9 | )% | 37.0 | % | ||||

| Less: decrease/increase in income tax benefit payable to former stockholder(1) |

||||||||

| U.S. state taxes, net of Federal benefit |

38.4 | % | (1.1 | ) | ||||

| Export sales exclusion/manufacturer’s deduction |

20.5 | % | 1.3 | |||||

| Revaluation of deferred tax assets, net |

— | (22.3 | ) | |||||

| Other |

(1.0 | )% | (1.6 | ) | ||||

| Total decrease/increase in income tax benefit payable to former stockholder(1) |

57.9 | % | (23.7 | )% | ||||

| Total provision for income taxes |

47.0 | % | 13.3 | % | ||||

| (1) | As a result of a partial increase in the tax basis of our tangible and intangible assets attributable to transactions entered into by affiliates controlled by a former significant stockholder at the time of the Company’s 2004 initial public offering, the Company may pay reduced tax amounts to the extent it generates sufficient taxable income in the future. The Company is obligated to remit to an affiliate of the former significant stockholder 85% of any cash savings in U.S. Federal income tax, California franchise tax and certain other related tax benefits. Refer to the Company’s 2010 Form 10-K for a more detailed description. |

| (2) | For the three months ended March 31, 2011, includes an aggregate benefit of $4.3 million related to the Company’s determination during the current period of its ability to claim certain tax deductions related to prior years. For the three months ended March 31, 2010, includes an adjustment primarily related to deferred tax assets (net of valuation allowance) of approximately $2.1 million associated with prior year taxes. |

8

Table of Contents

The Company’s California Franchise tax returns for the years ended December 31, 2004 through 2007 are currently under examination by the Franchise Tax Board (“FTB”). The Internal Revenue Service (“IRS”) had previously concluded its audits of the Company’s federal income tax return for the periods through December 31, 2006. The Company’s federal income tax returns for the tax years ended December 31, 2007 and 2008 are currently under examination by the IRS. All tax years since the Company’s separation from Old DreamWorks Studios remain open to audit by all state and local taxing jurisdictions.

8. Stockholders’ Equity

Class A Common Stock

Stock Repurchase Program. In July 2010, the Company’s Board of Directors authorized a stock repurchase program pursuant to which the Company may repurchase up to an aggregate of $150 million of its outstanding stock. During the three months ended March 31, 2011, the Company repurchased 0.9 million shares of its outstanding Class A Common Stock for $25.0 million under this program. During the month of March 2010, the Company repurchased 0.7 million shares of its outstanding Class A Common Stock for $27.6 million under the Company’s then existing stock repurchase program, which did not settle until subsequent to March 31, 2010.

Class B Common Stock

In March 2010, 580,730 shares of the Company’s Class B common stock were converted into an equal amount of shares of the Company’s Class A common stock at the request of David Geffen, a significant stockholder, who owned such shares. Mr. Geffen, in turn, donated these shares to a charitable foundation that was established by him. These transactions had no impact on the total amount of the Company’s shares outstanding.

9. Equity-Based Compensation

The Company recognizes compensation costs for equity awards granted to its employees based on their grant-date fair value. Most of the Company’s equity awards contain vesting conditions dependent upon the completion of specified service periods or achievement of established sets of performance criteria. Compensation cost for service-based equity awards is recognized ratably over the vesting period. Compensation cost for certain performance-based awards is adjusted to reflect the estimated probability of vesting. In the fourth quarter of 2010, the Company granted performance-based awards where the value of the award upon vesting will vary depending on the level of performance ultimately achieved. The Company recognizes compensation cost for these awards based on the level of performance expected to be achieved. The Company will recognize the impact of any change in estimate in the period of the change.

Generally, equity awards are forfeited by employees who terminate prior to vesting. However, certain employment contracts for certain named executive officers provide for the acceleration of vesting in the event of a change in control or specified termination events. In addition, the Company has granted equity awards of stock appreciation rights and restricted shares subject to market-based conditions. Compensation costs related to awards with a market-based condition will be recognized regardless of whether the market condition is satisfied, provided that the requisite service has been provided. The Company currently satisfies exercises of stock options and stock appreciation rights, the vesting of restricted stock and the delivery of shares upon the vesting of restricted stock units with the issuance of new shares.

9

Table of Contents

The impact of stock options (including stock appreciation rights) and restricted stock awards on net income (excluding amounts capitalized) for the three-month periods ended March 31, 2011 and 2010 was as follows (in thousands):

| Three Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| Total equity-based compensation |

$ | 7,021 | $ | 6,674 | ||||

| Tax impact(1) |

765 | (2,469 | ) | |||||

| Reduction in net income, net of tax |

$ | 7,786 | $ | 4,205 | ||||

| (1) | Tax impact is determined at the Company’s combined effective tax rate, which includes the income statement line item “Increase in income tax benefit payable to former stockholder” (see Note 7). |

Stock-based compensation cost capitalized as a part of film costs was $4.2 million and $3.0 million for the three-month periods ended March 31, 2011 and 2010, respectively.

The following tables set forth the number and weighted average grant-date fair value of equity awards granted during the three-month periods ended March 31, 2011 and 2010:

| Three Months Ended March 31, |

||||||||

| Number Granted |

Weighted Average Grant-Date Fair Value |

|||||||

| (in thousands) | ||||||||

| 2011 |

||||||||

| Stock appreciation rights |

35 | $ | 10.61 | |||||

| Restricted stock and restricted stock units |

44 | $ | 28.40 | |||||

| 2010 |

||||||||

| Stock appreciation rights |

14 | $ | 17.62 | |||||

| Restricted stock and restricted stock units |

51 | $ | 43.46 | |||||

As of March 31, 2011, the total compensation cost related to unvested equity awards granted to employees (excluding equity awards with performance objectives not probable of achievement) but not yet recognized was approximately $85.7 million and will be amortized on a straight-line basis over a weighted average period of 1.7 years.

10. Concentrations of Credit Risk

A substantial portion of the Company’s revenue is derived directly from Paramount. Paramount represented 78.3% and 58.5% of the Company’s total revenue for the three-month periods ended March 31, 2011 and 2010, respectively.

11. Related Party Transactions

The Company has entered into an aircraft sublease (the “Sublease”) agreement with an entity controlled by Jeffrey Katzenberg, the Company’s Chief Executive Officer and a significant stockholder, for use of an aircraft that such entity leases from the aircraft owner, a company jointly owned indirectly by Mr. Katzenberg and Mr. Spielberg (who is also a stockholder in the Company). Under the Sublease, the Company pays all the aircraft operating expenses on Mr. Katzenberg’s Company-related flights. In addition, in the event that Mr. Katzenberg uses the aircraft for Company-related travel more than 36 hours in any calendar year, the Company pays the

10

Table of Contents

subleasing entity a specified hourly rate for those hours. During the three months ended March 31, 2011, the Company incurred $0.2 million related to the sublease. The Company did not incur significant costs during the three months ended March 31, 2010.

From time to time, the Company uses a private airplane that is owned by David Geffen, a former director and one of the Company’s controlling stockholders, for Company business. The Company’s use of this aircraft is pursuant to a customary charter arrangement, under which the Company generally pays an hourly rate as well as certain additional flight-related charges, such as crew expenses, catering and landing fees. During the three months ended March 31, 2011, the Company incurred approximately $0.1 million for use of this plane. The Company did not incur significant costs during the three months ended March 31, 2010.

Consulting Agreement with David Geffen

The Company has entered into a consulting agreement with David Geffen, pursuant to which Mr. Geffen provides consulting services to the Company with respect to the Company’s operations, overall direction, projects and strategic matters. Mr. Geffen receives $2.0 million annually for these services and is entitled to be reimbursed for reasonable travel and other expenses in the performance of his duties. The term of the agreement expires in July 2013, although either party may terminate the agreement sooner upon notice to the other party. During the three months ended March 31, 2011, the Company incurred $0.5 million related to this agreement. As of March 31, 2011, the Company has also recorded a prepaid asset of $0.5 million related to this agreement.

12. Commitments and Contingencies

Legal Proceedings. From time to time, the Company is involved in legal proceedings arising in the ordinary course of its business, typically intellectual property litigation and infringement claims related to the Company’s feature films, which could cause the Company to incur significant expenses or prevent the Company from releasing a film. The Company also has been the subject of patent and copyright claims relating to technology and ideas that it may use or feature in connection with the production, marketing or exploitation of the Company’s feature films, which may affect the Company’s ability to continue to do so. While the resolution of these matters cannot be predicted with certainty, the Company does not believe, based on current knowledge, that any existing legal proceedings or claims are likely to have a material adverse effect on its financial position, results of operations or liquidity.

11

Table of Contents

13. Net Income Per Share

The following table sets forth the computation of basic and diluted net income per share (in thousands, except per share amounts):

| Three Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| Numerator: |

||||||||

| Net income |

$ | 8,794 | $ | 21,669 | ||||

| Denominator: |

||||||||

| Weighted average common shares and denominator for basic calculation: |

||||||||

| Weighted average common shares outstanding |

84,267 | 87,271 | ||||||

| Less: Unvested restricted stock |

(129 | ) | (433 | ) | ||||

| Denominator for basic calculation |

84,138 | 86,838 | ||||||

| Weighted average effects of dilutive equity-based compensation awards: |

||||||||

| Employee stock options and stock appreciation rights |

128 | 963 | ||||||

| Restricted stock awards |

891 | 908 | ||||||

| Denominator for diluted calculation |

85,157 | 88,709 | ||||||

| Net income per share—basic |

$ | 0.10 | $ | 0.25 | ||||

| Net income per share—diluted |

$ | 0.10 | $ | 0.24 | ||||

The following table sets forth (in thousands) the weighted average number of options to purchase shares of common stock, stock appreciation rights, restricted stock awards and equity awards subject to performance or market conditions which were not included in the calculation of diluted per share amounts because the effects would be anti-dilutive.

| Three Months Ended March 31, |

||||||||

| 2011 | 2010 | |||||||

| Options to purchase shares of common stock and restricted stock awards |

2,370 | — | ||||||

| Stock appreciation rights |

4,829 | 972 | ||||||

| Total |

7,199 | 972 | ||||||

For the three months ended March 31, 2011, 1.6 million shares of equity awards (which is comprised of 0.8 million restricted stock awards and 0.8 million stock appreciation rights) that are contingently issuable were not included in the calculation of diluted shares as the required market and/or performance conditions had not been met as of March 31, 2011. For the three months ended March 31, 2010, 2.8 million shares of equity awards (which is comprised of 1.2 million restricted stock awards and 1.6 million stock appreciation rights) that are contingently issuable were not included in the calculation of diluted shares as the required market and/or performance conditions had not been met as of March 31, 2010.

12

Table of Contents

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

This section and other parts of this Quarterly Report on Form 10-Q (the “Quarterly Report”) contain forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements. You should read the following discussion and analysis in conjunction with our unaudited consolidated financial statements and the related notes thereto contained elsewhere in this Quarterly Report, and our audited consolidated financial statements and related notes thereto, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the “Risk Factors” section included in our Annual Report on Form 10-K for the year ended December 31, 2010 (the “2010 Form 10-K”). We urge you to carefully review and consider the various disclosures made by us in this Quarterly Report and in our other reports filed with the Securities and Exchange Commission (the “SEC”), including our 2010 Form 10-K and Current Reports on Form 8-K, before deciding to purchase, hold or sell our common stock.

Our Business and Distribution and Servicing Arrangements

Our business is primarily devoted to developing, producing and exploiting animated feature films and its characters, as well as creating television specials/series and live performances based on such characters. Our films are distributed in the worldwide theatrical, home entertainment and television markets by Paramount Pictures Corporation, a subsidiary of Viacom Inc., and its affiliates (collectively, “Paramount”) pursuant to a distribution agreement and a fulfillment services agreement (collectively, the “Paramount Agreements”). We generally retain all other rights to exploit our films, including commercial tie-in and promotional rights with respect to each film, as well as merchandising, interactive, literary publishing, music publishing and soundtrack rights. Please see “Part I—Item 1—Business—Distribution and Servicing Arrangements” in our 2010 Form 10-K for a discussion of our distribution and servicing arrangements with Paramount.

Our Revenues and Costs

Our feature films are currently the source of a significant percentage of our revenues. We derive revenue from our distributor’s worldwide exploitation of our feature films in theaters and in markets such as home entertainment, pay and free broadcast television and other ancillary markets. Pursuant to the Paramount Agreements, prior to reporting any revenue for one of our feature films to us, Paramount is entitled to (i) retain a fee of 8.0% of gross revenue (without deduction for distribution and marketing costs and third-party distribution fees and sales agent fees), and (ii) recoup all of its permissible distribution and marketing costs with respect to the exploitation of our films on a film-by-film basis. As such, under the Paramount Agreements, each film’s total expenses and fees are offset against that film’s revenues on a worldwide basis across all markets, and Paramount reports no revenue to the Company until the first period in which an individual film’s cumulative worldwide gross revenues exceed its cumulative worldwide gross distribution fee and costs, which may be several quarters after a film’s initial theatrical release. Additionally, as the cumulative revenues and cumulative costs for each individual film are commingled between all markets and geographical territories and Paramount only reports additional revenue to the Company for a film in those reporting periods in which that film’s cumulative worldwide gross revenues continue to exceed its cumulative worldwide gross costs, the Company’s reported revenues in any period are often a result of gross revenues with respect to an individual film generated in one or several territories being offset by the gross costs of both related and unrelated territories for such film.

In addition, we generate royalty-based revenues from the licensing of our character and film elements to consumer product and home entertainment companies worldwide. We have also entered into business activities beyond our core feature film business, including the development, production and licensing of animated television specials/series and live performances. Revenue and cost activities related to live performances and

13

Table of Contents

certain television specials/series are not typically subject to the Paramount Agreements and, accordingly, we receive payment and record revenues directly from third parties.

Our primary operating expenses include:

| • | Costs of Revenues—Our costs of revenues primarily include the amortization of capitalized costs related to feature films and television specials/series (which consists of production, overhead and interest costs), participation and residual costs for our feature films and television specials/series and write-offs of amounts previously capitalized for titles not expected to be released or released titles not expected to recoup their capitalized costs. Generally, given the structure of our distribution arrangements with Paramount, our costs of revenues do not include distribution and marketing costs or third-party distribution and fulfillment services fees associated with our feature films. However, our television specials/series and live performances are typically not subject to the Paramount Agreements, and accordingly, we may directly incur distribution and marketing costs, which are classified as costs of revenues. In addition, costs of revenues also include direct costs for sales commissions to outside third parties for the licensing and merchandising of our characters and marketing and promotion costs. |

| • | Selling, General and Administrative Expenses—Our selling, general and administrative expenses consist primarily of employee compensation (including salaries, bonuses, stock-based compensation and employee benefits), rent, insurance and fees for professional services. |

For a detailed description of our revenues and operating expenses, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our Revenues and Costs” in our 2010 Form 10-K.

Our films are distributed in foreign countries and, in recent years, we have derived on average 49% of our feature film revenue from foreign countries. A significant amount of our transactions in foreign countries are conducted in the local currencies and, as a result, fluctuations in foreign currency exchange rates can affect our business, results of operations and cash flow. For a detailed discussion of our foreign currency risk, please see “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” of our 2010 Form 10-K.

Seasonality

The timing of revenue reporting and receipt of cash remittances to us from our distributor fluctuate based upon the timing of our films’ theatrical and home entertainment releases and the recoupment position of our distributor on a film-by-film basis, which varies depending upon a film’s overall performance. Furthermore, revenues related to our television specials/series fluctuate based upon the timing of their broadcast and the licensing of our character and film elements are influenced by seasonal consumer purchasing behavior. As a result, our annual or quarterly operating results for any period are not necessarily indicative of results to be expected for future periods.

14

Table of Contents

Results of Operations

Overview of Financial Results

The following table sets forth, for the periods presented, certain data from our unaudited consolidated statements of income. This information should be read in conjunction with our unaudited consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report.

| Three Months Ended March 31, | ||||||||||||||||

| 2011 | 2010 | $ Change | % Change | |||||||||||||

| (in millions, except percentages and per share data) |

||||||||||||||||

| Revenues |

$ | 108.0 | $ | 162.1 | $ | (54.1 | ) | (33.4 | )% | |||||||

| Costs of revenues |

72.0 | 106.2 | (34.2 | ) | (32.2 | )% | ||||||||||

| Product development |

0.2 | 0.2 | — | — | % | |||||||||||

| Selling, general and administrative expenses |

30.1 | 23.5 | 6.6 | 28.1 | % | |||||||||||

| Operating income |

5.7 | 32.2 | (26.5 | ) | (82.3 | )% | ||||||||||

| Interest income, net |

0.2 | 0.1 | 0.1 | 100.0 | % | |||||||||||

| Other income, net |

2.0 | 2.1 | (0.1 | ) | (4.8 | )% | ||||||||||

| Decrease (increase) in income tax benefit payable to former stockholder |

4.6 | (8.2 | ) | 12.8 | 156.1 | % | ||||||||||

| Income before income taxes |

12.5 | 26.2 | (13.7 | ) | (52.3 | )% | ||||||||||

| Provision for income taxes |

3.7 | 4.5 | (0.8 | ) | (17.8 | )% | ||||||||||

| Net income |

$ | 8.8 | $ | 21.7 | $ | (12.9 | ) | (59.4 | )% | |||||||

| Diluted net income per share |

$ | 0.10 | $ | 0.24 | $ | (0.14 | ) | (58.3 | )% | |||||||

| Diluted shares used in computing diluted net income per share |

85.2 | 88.7 | (3.9 | )% | ||||||||||||

15

Table of Contents

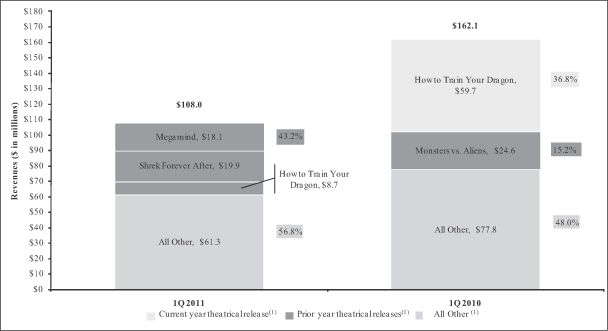

The following table sets forth (in millions), for the periods presented, our revenues by film. This information should be read in conjunction with our unaudited consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report.

| (1) | For each period shown, “Current year theatrical release” consists of revenues attributable to films released in the current year, “Prior year theatrical releases” consists of revenues attributable to films released during the immediately prior year, and “All Other” consists of revenues attributable to films released during all previous periods, including our library titles, as well as revenues from any other sources. |

Three Months Ended March 31, 2011 Compared to Three Months Ended March 31, 2010

Revenues. For the three months ended March 31, 2011, our revenue was $108.0 million, a decrease of $54.1 million, or 33.4%, as compared to $162.1 million for the three months ended March 31, 2010. The lack of a theatrical release in the first quarter of 2011 led to lower revenues in the first quarter of 2011 when compared to the same period of the prior year, which benefited from revenues resulting from our first quarter 2010 release, How to Train Your Dragon. Additionally, our revenues for the three months ended March 31, 2011 were negatively affected by the elimination (as of April 1, 2010) of the 30-day lag in reporting international home entertainment results. The change in reporting resulted in $26.1 million of lower revenues during the three months ended March 31, 2011 as our December 2010 home entertainment releases in international territories (which would have been recorded in January 2011 absent the change) were included in our 2010 results. The decrease in revenues between periods was partially offset by an increase of $22.1 million in revenues contributed by the “Prior year theatrical releases” category, which resulted from an increased number of titles that comprise this category in the current period when compared to the same period of the prior year. Lastly, our “All Other” category decreased $16.5 million, which was primarily attributable to television market revenues earned by our film library titles, which were lower in the first quarter of 2011 in comparison to the first quarter of 2010 as a result of the timing of revenue recognition.

Revenue for the quarter ended March 31, 2011 was comprised of amounts earned by a variety of films. For the quarter ended March 31, 2011, Megamind contributed $18.1 million primarily earned in the worldwide theatrical and domestic home entertainment markets, and Shrek Forever After and How to Train Your Dragon contributed $19.9 million and $8.7 million, respectively, primarily earned in the worldwide home entertainment

16

Table of Contents

markets. Lastly, our “All other” category, which is mainly comprised of our library titles, contributed $61.3 million which was largely driven by Kung Fu Panda and Madagascar: Escape 2 Africa, earned across several markets. For the quarter ended March 31, 2011, our “All other” category included $10.8 million of revenues attributable to our non-film initiatives.

Revenue for the quarter ended March 31, 2010 was primarily driven by How to Train Your Dragon (released in the first quarter of 2010), which contributed $59.7 million attributable primarily to licensing and merchandising activities. Monsters vs. Aliens contributed $24.6 million of revenues earned primarily in the domestic television market. Lastly, our library of titles contributed $77.8 million earned across several markets.

Costs of Revenues. Costs of revenues for the three months ended March 31, 2011 totaled $72.0 million, a decrease of $34.2 million, compared to $106.2 million for the three months ended March 31, 2010.

Cost of revenues, the primary component of which is film amortization costs, as a percentage of revenues was 66.7% for the three months ended March 31, 2011 and 65.5% for the three months ended March 31, 2010. Cost of revenues as a percentage of revenues decreased as a result of the stronger performance of titles that comprise the 2011 “Prior year theatrical release” category when compared to 2010’s “Prior year theatrical release” category. This was partially offset by an increase in costs of revenues as a result of operating and marketing costs associated with the ongoing production of our Shrek The Musical touring show, which debuted in July 2010.

Product Development. Product development costs totaled $0.2 million for each of the three-month periods ended March 31, 2011 and 2010. Product development costs primarily represent research and development costs that are incurred in connection with our online virtual world activities or that are not related to an individual film.

Selling, General and Administrative Expenses. Total selling, general and administrative expenses increased $6.6 million to $30.1 million (including $6.7 million of stock-based compensation expense) for the quarter ended March 31, 2011 from $23.5 million (including $6.1 million of stock-based compensation expense) for the quarter ended March 31, 2010. The increase in selling, general and administrative expenses was primarily attributable to $2.5 million of higher salaries and benefits (including incentive compensation), $1.3 in increased professional fees and $1.1 million related to bad debt expense. The remaining increase was attributable to other higher selling, general and administrative expenses, none of which were individually material.

Operating Income. Operating income for the three months ended March 31, 2011 was $5.7 million, a decrease of $26.5 million, compared to $32.2 million for the comparable period of 2010. The decrease in operating income between the periods was primarily because we did not release a film in the first quarter of 2011. Operating income was higher for the comparable quarter of the prior year as it benefited from revenue generated by our 2010 first quarter release, How to Train Your Dragon. In addition, higher selling, general and administrative expenses during the current quarter, when compared to the same quarter of the prior year, also contributed to the decrease.

Interest Income, Net. For the three months ended March 31, 2011, total interest income remained relatively consistent at $0.2 million, an increase of $0.1 million, from $0.1 million for the same period of 2010.

Other Income, Net. For the three months ended March 31, 2011 and 2010, total other income was $2.0 million and $2.1 million respectively. Other income in both years consisted primarily of income recognized in connection with preferred vendor arrangements with certain of our strategic alliance partners.

Decrease (Increase) in Income Tax Benefit Payable to Former Stockholder. As a result of a partial increase in the tax basis of our tangible and intangible assets attributable to transactions entered into by affiliates controlled by a former stockholder at the time of our 2004 initial public offering (“Tax Basis Increase”), we may pay reduced tax amounts to the extent we generate sufficient taxable income in the future. As discussed in “Critical Accounting Policies and Estimates—Provision for Income Taxes” of our 2010 Form 10-K, we are obligated to remit to such affiliates 85% of any cash savings in U.S. Federal income tax, California franchise tax

17

Table of Contents

and certain other related tax benefits, subject to repayment if it is determined that these savings should not have been available to us.

For the quarter ended March 31, 2011, our payable to former stockholder decreased as a result of our determination during the current period of our ability to claim certain tax deductions related to prior years. Accordingly, we recorded $4.6 million as a decrease in income tax benefit payable to former stockholder in our income statement. For the quarter ended March 31, 2010, we recorded $9.6 million in net tax benefits associated with the Tax Basis Increase as a reduction in the provision for income taxes and recorded an expense of $8.2 million, representing 85% of these recognized benefits, as an increase in income tax benefit payable to former stockholder.

Provision for Income Taxes. For the three months ended March 31, 2011 and 2010, we recorded a provision for income taxes of $3.7 million and $4.6 million, respectively, or an effective tax rate of 47.0% and 13.3%, respectively. However, when our provision for income taxes is combined with the amounts associated with the Decrease (Increase) in Income Tax Benefit Payable to Former Stockholder (see above), the combined effective tax rates for the three months ended March 31, 2011 and March 31, 2010 were (10.9)% and 37.0%, respectively. The decrease in the combined effective tax rate between periods is related to an adjustment we recorded in the first quarter of 2011, which resulted from our determination in the first quarter of 2011 of our ability to claim certain tax deductions related to prior periods.

Our effective tax rate for 2011 was lower than the 35% statutory federal rate because of our assessment in the first quarter of 2011 of our ability to claim certain tax deductions related to prior periods. Our effective tax rate for 2010 was lower than the 35% statutory federal rate because of a decrease in our valuation allowance, primarily resulting from the increase in the net tax benefits recognized from the Tax Basis Increase.

Net Income. Net income for the three months ended March 31, 2011 was $8.8 million, or $0.10 per diluted share, as compared to net income of $21.7 million, or $0.24 net income per diluted share, in the corresponding period in 2010.

Financing Arrangements

There were no material changes during the three months ended March 31, 2011 to the financing arrangements specified in the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our 2010 Form 10-K.

As of March 31, 2011, we were in compliance with all applicable financial debt covenants.

For a more detailed description of our various financing arrangements, please see Note 6 to the unaudited consolidated financial statements contained in Part I, Item 1 of this Quarterly Report and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of our 2010 Form 10-K.

Liquidity and Capital Resources

Current Financial Condition

Our primary operating capital needs are to fund the production and development costs of our films and non-film initiatives, including television specials/series and live performances, make participation and residual payments, and fund selling, general and administrative costs and capital expenditures. Our operating activities for the three months ended March 31, 2011, as well as our cash on hand, were adequate to meet our operating cash needs. For the next 12 months, we expect that cash on hand, cash from operations (including anticipated cash collections during the second half of 2011) and funds available under our revolving credit facility will be sufficient to satisfy our anticipated cash needs for working capital and capital expenditures.

18

Table of Contents

As of March 31, 2011, we had cash and cash equivalents totaling $86.1 million. Our cash and cash equivalents consist of cash on deposit and short-term money market investments, principally commercial paper and commercial paper mutual funds, that are rated AAA and with maturities of three months or less when purchased. Our cash and cash equivalents balance at March 31, 2011 decreased by $77.7 million from that of $163.8 million at December 31, 2010. Components of this change in cash for the three months ended March 31, 2011, as well as for the three months ended March 31, 2010, are provided below in more detail.

Operating Activities

Net cash used in operating activities for the three months ended March 31, 2011 and 2010 was as follows (in thousands):

| 2011 | 2010 | |||||||

| Net cash used in operating activities |

$ | (44,192 | ) | $ | (4,795 | ) | ||

During the three months ended March 31, 2011, our main source of cash from operating activities was attributable to collections of revenues from Paramount related to Megamind’s domestic television and worldwide theatrical revenues, Shrek Forever After and How to Train Your Dragon’s domestic television and worldwide home entertainment revenues, Shrek the Third’s worldwide television and home entertainment revenues, Bee Movie’s worldwide television revenues and, to a lesser extent, the collection of worldwide television and home entertainment revenues from our other films. Net cash used in operating activities for the first three months of 2011 was primarily attributable to $38.2 million paid related to annual incentive compensation payments, as well as $27.9 million paid to an affiliate of a former stockholder related to tax benefits realized in 2011 from the Tax Basis Increase. The cash from operating activities was also partially offset by production spending for our films, television specials/series and live performances, as well as participation and residual payments. Our net cash used in operating activities during the three months ended March 31, 2011 was greater than the same period of the prior year largely as a result of an increase in annual incentive compensation payments and payments to an affiliate of a former stockholder. Additionally, when comparing the current period to the same period of the prior year, operating cash flows for the three months ended March 31, 2010 benefited from higher amounts collected from revenue-generating commercial tie-in arrangements.

Net cash provided by operating activities for the first three months of 2010 was primarily attributable to collections of revenues from Paramount related to Monsters vs. Aliens’ worldwide home entertainment and domestic television revenues, Kung Fu Panda’s worldwide home entertainment and television revenues, Madagascar: Escape 2 Africa’s worldwide home entertainment and domestic television revenues and, to a lesser extent, the collection of worldwide television and home entertainment revenues from our other films. Net cash used in operating activities for the first three months of 2010 was primarily attributable to $23.5 million paid related to annual incentive compensation payments, as well as $21.7 million paid to an affiliate of a former stockholder related to tax benefits realized in 2010 from the Tax Basis Increase. The cash from operating activities was also partially offset by film production spending and participation and residual payments.

Investing Activities

Net cash used in investing activities for the three months ended March 31, 2011 and 2010 was as follows (in thousands):

| 2011 | 2010 | |||||||

| Net cash used in investing activities |

$ | (8,075 | ) | $ | (13,928 | ) | ||

Net cash used in investing activities for the three months ended March 31, 2011 and 2010 was primarily related to the investment in property, plant and equipment.

19

Table of Contents

Financing Activities

Net cash (used in) provided by financing activities for the three months ended March 31, 2011 and 2010 was as follows (in thousands):

| 2011 | 2010 | |||||||

| Net cash (used in) provided by financing activities |

$ | (25,444 | ) | $ | 5,865 | |||

Net cash used in financing activities for the three-month period ended March 31, 2011 was primarily comprised of repurchases of our Class A common stock. Net cash provided by financing activities for the three-month period ended March 31, 2010 was primarily due to proceeds received upon employee exercise of stock options.

Contractual Obligations

There have been no material changes during the period covered by this Quarterly Report, outside of the ordinary course of business, to the contractual obligations specified in the table of contractual obligations included in the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our 2010 Form 10-K.

As of March 31, 2011 we had non-cancelable talent commitments totaling approximately $27.8 million that are payable over the next five years.

Critical Accounting Policies and Estimates

Our significant accounting policies are outlined in Note 2 to the audited consolidated financial statements contained in our 2010 Form 10-K. We prepare our consolidated financial statements in accordance with United States generally accepted accounting principles (“GAAP”). In doing so, we have to make estimates and assumptions that affect our reported amounts of assets, liabilities, revenues and expenses, as well as related disclosure of contingent assets and liabilities including estimates of ultimate revenues and costs of film and television product, estimates of product sales that will be returned, the potential outcome of future tax consequences of events that have been recognized in our financial statements and estimates used in the determination of the fair value of stock options and other equity awards for the determination of stock-based compensation. In some cases, changes in the accounting estimates are reasonably likely to occur from period to period. Accordingly, actual results could differ materially from our estimates. To the extent that there are material differences between these estimates and actual results, our financial condition or results of operations will be affected. We base our estimates on past experience and other assumptions that we believe are reasonable under the circumstances, and we evaluate these estimates on an ongoing basis.

An accounting policy is deemed to be critical if it requires an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time the estimate is made, if different estimates reasonably could have been used, or if changes in the estimate that are reasonably likely to occur could materially impact the financial statements. Management believes there have been no material changes during the three months ended March 31, 2011 to the items that we disclosed as our critical accounting policies and estimates in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2010.

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk |

Market and Exchange Rate Risk

For quantitative and qualitative disclosures about our interest rate, foreign currency, and credit risks, please see “Part II—Item 7A—Quantitative and Qualitative Disclosures About Market Risk,” of our 2010 Form 10-K. Exposure to our interest rate, foreign currency and credit risks have not changed materially since December 31, 2010.

20

Table of Contents

| Item 4. | Controls and Procedures |

(a) Evaluation of disclosure controls and procedures.

Our management, with the participation of our chief executive officer and chief financial officer, evaluated the effectiveness of our disclosure controls and procedures pursuant to Rule 13a-15 under the Securities Exchange Act of 1934, as amended, as of the end of the period covered by this Quarterly Report. In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Based on that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were effective as of the end of the first quarter to provide reasonable assurance that information we are required to disclose in reports that we file or submit under the Securities Exchange Act of 1934, as amended, is accurately recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure.

(b) Changes in internal controls over financial reporting.

There were no changes in our internal control over financial reporting that occurred during the period covered by this Quarterly Report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| Item 1. | Legal Proceedings |

See discussion of Legal Proceedings in Note 12 to the unaudited consolidated financial statements contained in Part I, Item 1 of this Quarterly Report.

| Item 1A. | Risk Factors |

Information concerning certain risks and uncertainties appears in “Part I—Item 1A—Risk Factors” of the Company’s 2010 Form 10-K. You should carefully consider these risks and uncertainties before making an investment decision with respect to shares of our Class A common stock. Such risks and uncertainties could materially adversely affect our business, financial condition or operating results.

During the period covered by this Quarterly Report, there have been no material changes from the risk factors previously disclosed in the Company’s 2010 Form 10-K or filings subsequently made with the SEC.

21

Table of Contents

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

The following table shows Company repurchases of its Class A common stock for the three months ended March 31, 2011.

| Total Number of Shares Purchased(1) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plan or Program(2) |

Maximum Number (or Approximate Dollar Value) of Shares That May Yet Be Purchased Under the Plan or Program(2) |

|||||||||||||

| January 1–January 31, 2011 |

— | $ | — | — | $ | 150,000,000 | ||||||||||

| February 1–February 28, 2011 |

— | $ | — | — | $ | 150,000,000 | ||||||||||

| March 1–March 31, 2011 |

938,645 | $ | 26.63 | 938,645 | $ | 125,000,000 | ||||||||||

| Total |

938,645 | $ | 26.63 | 938,645 | ||||||||||||

| (1) | Does not include shares forfeited to the Company upon the expiration or cancellation of unvested restricted stock awards. |

| (2) | In July 2010, the Company’s Board of Directors terminated the then-existing stock repurchase program and authorized a new stock repurchase program pursuant to which the Company may repurchase up to an aggregate of $150 million of its outstanding stock. |

Item 3 is not applicable and has been omitted.

| Item 5. | Other Information |

None.

22

Table of Contents

| Item 6. | Exhibits |

| Exhibit 31.1 | Certification of Chief Executive Officer Pursuant to Exchange Act Rule 13a-14(a) or 15d-14(a), as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| Exhibit 31.2 | Certification of Chief Financial Officer Pursuant to Exchange Act Rule 13a-14(a) or 15d-14(a), as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| Exhibit 32.1 | Certifications of Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| Exhibit 101 | The following financial information from the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2011 formatted in eXtensible Business Reporting Language: (i) Unaudited Consolidated Statements of Operations for the three months ended March 31, 2011 and 2010; (ii) Unaudited Consolidated Balance Sheets at March 31, 2011 and December 31, 2010; (iii) Unaudited Consolidated Statements of Cash Flows for the three months ended March 31, 2011 and 2010; and (iv) Notes to the Unaudited Consolidated Financial Statements (tagged as blocks of text). | |

23

Table of Contents

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| DREAMWORKS ANIMATION SKG, INC. | ||||||

| Date: April 26, 2011 | By: | /S/ LEWIS W. COLEMAN | ||||

| Name: | Lewis W. Coleman | |||||

| Title: | President and Chief Financial Officer | |||||

| (Principal Financial Officer and Duly Authorized Officer) | ||||||

24

Table of Contents

| Exhibit |

Description | |

| Exhibit 31.1 | Certification of Chief Executive Officer Pursuant to Exchange Act Rule 13a-14(a) or 15d-14(a), as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| Exhibit 31.2 | Certification of Chief Financial Officer Pursuant to Exchange Act Rule 13a-14(a) or 15d-14(a), as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| Exhibit 32.1 | Certifications of Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| Exhibit 101 | The following financial information from the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2011 formatted in eXtensible Business Reporting Language: (i) Unaudited Consolidated Statements of Operations for the three months ended March 31, 2011 and 2010; (ii) Unaudited Consolidated Balance Sheets at March 31, 2011 and December 31, 2010; (iii) Unaudited Consolidated Statements of Cash Flows for the three months ended March 31, 2011 and 2010; and (iv) Notes to the Unaudited Consolidated Financial Statements (tagged as blocks of text). | |

25