Attached files

| file | filename |

|---|---|

| 8-K - SOMERSET HILLS BANCORP | c65411_8k.htm |

Ex 99.1

Annual Meeting of Stockholders

April 27, 2011

Forward-Looking Statements

2

This investor presentation contains certain forward-looking statements which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar expressions. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and the subsidiaries include, but are not limited to, those set forth in the Company’s Form 10-k under the caption “Risk Factors” and changes in interest rates, general economic conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area and accounting principles and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake -- and specifically disclaims any obligation -- to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Company Profile

3

Commercial banking franchise in Northern NJ; founded in 1998

A relationship-based lender located in one of the Nation’s wealthiest regions

$329 million in assets at year-end 2010

Strong capital; tangible common equity ratio 12.0%

Sound asset quality; greater than 99.9% of all loans are performing

First quarter 2011 blended cost of deposits was 55 basis points

Record earnings in 2010, marking the 9th consecutive year of profitability

85% of deposits core; 25% noninterest-bearing demand

NASDAQ listed--Ticker: SOMH

Branch Network

4

Phil.

Valuable New Jersey Franchise

5

Superior asset quality

We rank #1 out of 28 in asset quality versus NJ Banks (see note)

Rank based on SOMH nonperforming asset ratio of 0.08% versus NJ average of 2.88%

Exceptional deposit mix

We rank #2 out of 28 in deposit mix

Rank based on SOMH core (non-CD) deposits percentage of 85% versus NJ average of 64%

Wealthy operating area

We rank #2 out of 28 in HH Income

Rank based on weighted avg. median HH Income in SOMH trade area of $99,000

versus NJ Bank Avg. of

$76,000 (National Avg. is $55,000)

Scarcity Value - very few banking franchises in the Nation possess all three of these attributes

Note: Rankings based on publicly traded commercial banks headquartered in New Jersey with total assets greater than $170 MM. All data obtained from SNL Financial as of December 31, 2010. Nonperforming asset ratio calculated as nonaccrual loans plus OREO divided by Total Assets.

Balance Sheet Trends

($ thousands, quarterly avg.)

6

Total Assets

Core

Deposits

Loans

Net Income Trend

($ thousands)

7

Strong Earnings Momentum

Profitability Ratios (Annual)

8

Profitability Ratios (1st

Quarter)

9

2010Q1

Net Interest Margin Trend

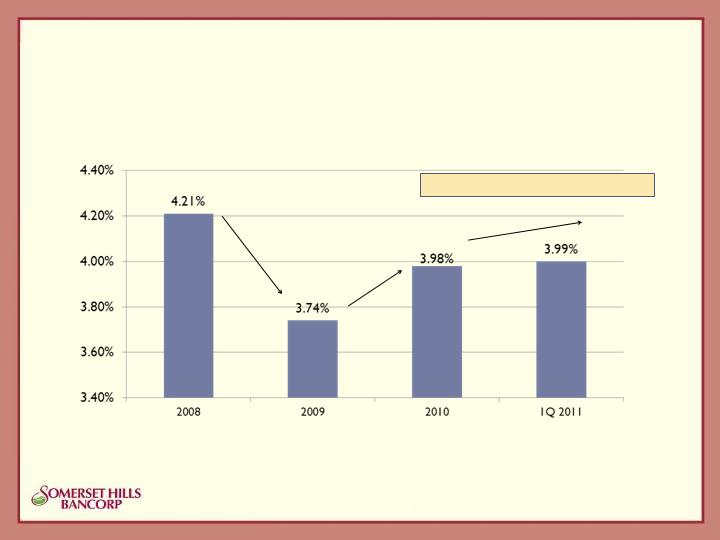

10

Reflects strategy to

increase liquidity

Unwinding of

strategy

Loan growth

Working our way back to 4.00%+

11

Operating Efficiency

($ millions)

Always determined to do

more with less

Capital Strength

12

An additional $4+

million of capital

is held at holding

company.

All regulatory capital ratios are more

than 500 bps in excess of well-

capitalized levels.

Credit Quality

13

Source: SNL Financial. Commercial banks between $100mm and $1billion in total assets. SNL’s definition of

nonperforming assets includes troubled

debt restructurings.

Somerset Hills Bank

Somerset Hills has significantly

less problem assets

Asset Quality-How Do We Do It?

14

Credit Culture

Conservative Strict Underwriting standards (Low LTV, Recourse, etc.)

Philosophy of “careful growth” since inception in 1998

Owner-occupied collateral - focusing on professionals (e.g., lawyers, accountants,

doctors)

Economic Strength of Operating Area

Our borrowers tend to have greater financial cushion than those in other regions

Better positioned, although not immune, to withstand economic downturn

We are NOT in the following businesses:

Indirect auto, credit cards, leasing, and SBA lending

Focus on Loan Monitoring and Collection

We continuously monitor borrower financial condition

Have always been aggressive collectors in all business cycles

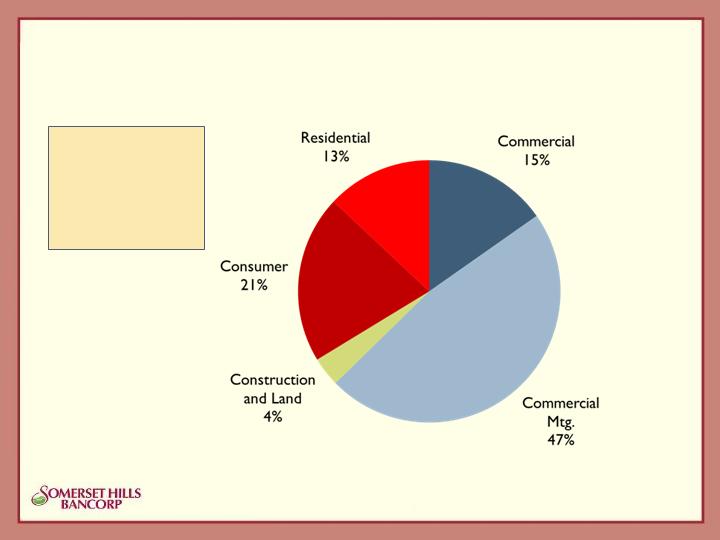

Loan Mix at Year-end 2010

15

Total Loan

Portfolio =

$207.1 million

Well-diversified

by Loan Type

Commercial Mortgage Portfolio

(information as of December 31, 2010)

16

Portfolio totals $98.2 million

We’ve never had a loss in this portfolio

100% of portfolio is secured by NJ properties

Diversified with $659,000 average exposure per loan

Average LTV at origination was 57%

Approximately 56% of portfolio is owner-occupied by local businesses

More than 90% of portfolio carries personal guarantees

Commercial Loan Portfolio

(information as of December 31, 2010)

17

Portfolio totals $31.6 million

No nonperforming loans

Average loan size of less than $200,000 reflecting a diverse local customer

base, with strong cross sell and referral opportunities

Virtually all commercial loans supported by personal guarantees and by

collateral including:

First- and second-liens on residential and/or commercial properties

Liquid assets, such as marketable securities

Other business assets including equipment, inventory and trade receivables

18

$42.9 million outstanding (98% Home Equity)

Historical charge-offs in home equity portfolio = ZERO

No nonaccrual loans

100% in State of NJ

Self-originated, individually underwritten in-house

We do not use automated underwriting models

Majority originated with a CLTV of 50% to 65%; maximum of 80%

85% of portfolio represented by home equity lines of credit, which are additionally

underwritten on a cash flow basis

Consumer Loan Portfolio

(information as of December 31, 2010)

Residential Mortgage Lending

(information as of December 31, 2010)

19

Residential portfolio totals $26.9 million

Primarily “accommodation” jumbos to local high net worth individuals

Avg. LTV of portfolio at origination is less than 50%

No nonaccrual or loans past-due 30 days or more

We have never had a loss in this portfolio

Sullivan Financial Services, Inc. (wholly-owned subsidiary)

Residential Mortgages sold on a flow basis, servicing released (i.e., fee-based model)

Efficient and scalable platform

Managed by mortgage banking veterans

Very low fixed cost of operations

Contributed 11% to consolidated net income in 2010.

Investment Portfolio at Year-end 2010

20

We have never taken an OTTI charge, largely due

to our

conservative investment philosophy

We avoid reaching for yield and stick to high

quality investments

Approximately 75% of the portfolio is guaranteed

by U.S. Gov’t/Agencies

The fair market value of our municipal securities

portfolio exceeds book value. It is a highly

granular portfolio comprised of 36 investments

(avg. $257,000) in regional municipalities.

Our corporate securities portfolio is relatively

small. All investments are rated A or higher.

The tax-equivalent yield is 4.37%, which is the

4th highest in NJ. The weighted

average re-

pricing interval is 4.4 years.

Liquidity

21

As a financial institution and, in particular, a community bank, we pay close

attention to liquidity management.

Currently, approximately 10% of the balance sheet ($30-$35 million) is held

at the Federal Reserve in an overnight position

We have substantial amounts of collateral, both securities and loans, held at

the FHLB and the Federal Reserve

At year-end 2010, we had $93.9 million additional borrowing capacity at the FHLB

At year-end 2010, we had $9.7 million additional borrowing capacity at the Federal

Reserve Discount Window.

We have an additional aggregate $13 million of unsecured Fed Funds

borrowing capacity from several large banks.

Positioned for Rising Interest Rates

22

We maintain a relatively large volume of overnight holdings

We have avoided reaching for yield in our securities portfolio

The duration of our loan portfolio is approximately 2 years

Our residential exposure (both securities and loans) remains low–approx. 17% of total assets

Approx. 50% of our loan portfolio re-prices in one year while only 20% re-prices in more

than 5 years.

Our strong capital and core deposit levels bode well for rising rates

33% of our earning assets are funded by capital and noninterest-bearing demand

The average ratio of NJ commercial banks is 20% (We rank #1)

These funds bear no interest cost to bank in any rate environment

54% of earning assets are funded by interest-bearing transaction deposits

We retain pricing control (subject to market conditions), but typically reprice at a much slower

pace than the general level of interest rates.

Note: #1 Rank based on publicly traded NJ banks with assets greater than $170 million. Data sourced from SNL Financial as of year-

end 2010.

Deposit Funding

23

Our business model relies almost exclusively on core and other local deposits

Core deposit (i.e., non-time) balances comprised 85% of total deposits, best in NJ

Relationship-driven commercial non-interest bearing demand accounts

Paramount account, an attractive interest-bearing checking account for retail customers and

not-for-profits

Escrow Ease trust accounts, servicing close to 100 Northern NJ law firms

Time deposits are raised through local branch marketing efforts only.

We do not accept brokered deposits

We rarely advertise

Average core deposits grew by 9.7% in 2010 from 2009, driven principally from:

Favorable economic conditions

Superior customer service

Strength and soundness of our bank, which we believe is well-known in our operating area

24

Deposit Mix Trends

($ thousands, annual averages)

Core Deposits have increased by 14.3% over the past two years.

Expense Control

25

($ thousands)

Increase/(Decrease)

2010

2009

Amount

Pct.

Occupancy

$ 1,664.9

$ 1,881.6

$ (216.7)

-11.5%

Printing, Stat & Supplies

133.2

186.0

(52.9)

-28.4%

Legal Fees

38.4

85.9

(47.5)

-55.3%

Correspondent Bank Fees

58.6

94.0

(35.4)

-37.6%

Audits and Exams

261.1

286.3

(25.2)

-8.8%

Telephone

68.9

92.7

(23.8)

-25.7%

Total Reductions

2,225.1

2,626.4

(401.4)

-15.3%

All Other Expenses

7,414.9

7,482.6

(67.6)

-0.9%

Total Operating Expense

$ 9,640.0

$ 10,109.0

$ (469.0)

-4.6%

Continued success in reducing overhead, with a focus on the following

areas:

More efficient use of office space and equipment

Reduced branch lease expense upon renewal

Reduced use of outside consultants and advisors

Negotiating better terms with vendors (and changing vendors, if necessary)

Technology

26

As a community bank, we generally do not implement cutting-edge

technology; however, we have the capability to deploy cost-effective

technology, whenever advantageous

We recently enhanced our debit card fraud detection systems.

We are the first community bank to implement Trusteer’s Rapport identity

protection product

Remote deposit capture for our commercial customers

Expands our geographic reach and provides immediate cost savings

Mobile “Text” Banking

The fastest growing delivery channel

Recently implemented first stage functionality with strong initial customer adoption.

27

Yesterday, we declared a quarterly cash dividend of 6 cents per share

Represents a dividend yield of 2.7% (assuming $8.75 share price)

We were one of just a handful of banks nationwide that raised its cash

dividend in 2010.

Our financial strength and performance bode well for potentially higher cash

dividends and additional stock dividends in future periods.

Dividends

28

We have a unique and valuable community banking franchise

We operate in one of the wealthiest regions in the Nation

Our asset quality metrics are among the best

We have a superior deposit mix

We are strongly capitalized

We are positioned well for a higher rate environment

Our staff is highly experienced

Each of our key executives, and a majority of our staff, has significant industry experience at both

large and community-based banks

We are patient and disciplined

Our track record speaks for itself

We will not force growth, but will rather maintain our strict underwriting standards

Shareholder value focused

We will be opportunistic regarding acquisition and merger of equals opportunities

We recognize that our franchise is valuable to larger banks in region

Summary