Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d8k.htm |

The PNC Financial

Services Group, Inc. Annual Meeting of Shareholders

April 26, 2011

Exhibit 99.1 |

James E.

Rohr Chairman and Chief Executive Officer |

3

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This presentation includes “snapshot” information about PNC used by way of

illustration. It is not intended as a full business or financial review and should be

viewed in the context of all of the information made available by PNC in its SEC

filings. The presentation also contains forward-looking statements regarding

our outlook or expectations for earnings, revenues, expenses, capital levels, liquidity

levels, asset quality and/or other matters regarding or affecting PNC and its future

business and operations. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over

time.

The forward-looking statements in this presentation are qualified by the

factors affecting forward-looking statements identified in the more detailed

Cautionary Statement included in the Appendix, which is included in the version of the

presentation materials posted on our corporate website at

www.pnc.com/investorevents. We provide greater detail regarding some of these factors in

our 2010 Form 10-K, including in the Risk Factors and Risk Management sections of

that report, and in our subsequent SEC filings (accessible on the SEC’s website at www.sec.gov and on or through our corporate

website at www.pnc.com/secfilings). We have included web addresses here and elsewhere in

this presentation as inactive textual references only. Information on these

websites is not part of this presentation.

Future events or circumstances may change our outlook or expectations and may also affect the

nature of the assumptions, risks and uncertainties to which our forward-looking

statements are subject. The forward-looking statements in this presentation speak only as of the date of this presentation. We do not

assume any duty and do not undertake to update those statements. In our

presentations, we sometimes refer to adjusted results to help illustrate the impact of certain types of items, such as our third quarter 2010 gain

related to the sale of PNC Global Investment Servicing Inc. (“GIS”), the

acceleration of accretion of the remaining issuance discount on our TARP preferred

stock in connection with the first quarter 2010 redemption of such stock, our fourth quarter

2009 gain related to BlackRock’s acquisition of Barclays Global Investors (the

“BLK/BGI gain”), our fourth quarter 2008 conforming provision for credit losses for National City, and integration costs in the 2010 and 2009

periods. This information supplements our results as reported in accordance with GAAP

and should not be viewed in isolation from, or a substitute for, our GAAP

results. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as

they evaluate the impact of these respective items on our results for the periods presented

due to the extent to which the items are not indicative of our ongoing operations. We

may also provide information on pretax pre-provision earnings (total revenue less noninterest expense), as we believe that pretax

pre-provision earnings, a non-GAAP measure, is useful as a tool to help evaluate the

ability to provide for credit costs through operations. Where applicable, we

provide GAAP reconciliations for such additional information.

In certain discussions, we may also provide information on yields and margins for all

interest-earning assets calculated using net interest income on a

taxable-equivalent basis by increasing the interest income earned on tax-exempt assets

to make it fully equivalent to interest income earned on taxable investments. We

believe this adjustment may be useful when comparing yields and margins for all earning assets. We may also use annualized, proforma,

estimated or third party numbers for illustrative or comparative purposes only. These

may not reflect actual results.

This presentation may also include discussion of other non-GAAP financial measures, which,

to the extent not so qualified therein or in the Appendix, is qualified by GAAP

reconciliation information available on our corporate website at www.pnc.com under “About PNC–Investor Relations.” |

4

Overview

PNC delivered an exceptional year in a challenging

environment

PNC’s business model is designed to deliver

strong results and long-term value for our

constituencies

PNC’s first quarter results highlight our

momentum

PNC is well positioned to capture future growth

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company. |

5

Delivered Exceptional 2010 Performance

Grew our businesses and delivered record net income of

$3.4 billion in 2010

Transitioned to a higher quality balance sheet

Improved our capital ratios to record levels

Implemented the PNC sales and service model and

successfully grew clients across our businesses

Exceeded our original acquisition-related cost savings target

Actively managed our risk positions toward a moderate

profile

PNC Is Positioned to Deliver Even Greater Shareholder Value.

PNC Is Positioned to Deliver Even Greater Shareholder Value. |

6

0

25

50

75

100

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

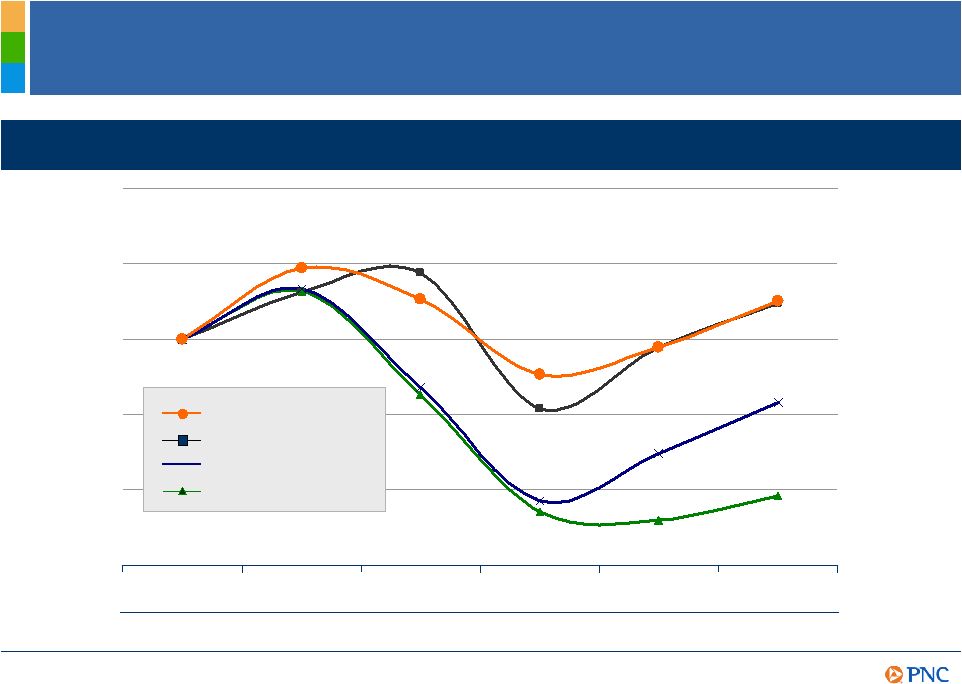

Recognizing Changing Customer Preferences

Customers have more choices and want more control

US banking transactions by channel (billions)

Mobile

Online

ATM

Call center

Branch

Source: Tower Group, McKinsey & Co.

Growth in electronic

channels continues to

reduce consumer

check payments

In 2002, checks

accounted for 48% of

non-cash transactions

By 2012, checks are

expected to account

for only 17% of

non-cash transactions

Forecast

Actual |

7

Footprint covering nearly 1/3 of the U.S.

population

Retail

Corporate & Institutional

A leader in serving middle-market

customers and government entities

One of the largest bank-held asset

managers in the U.S.

Asset Management

Residential Mortgage

National distribution capabilities

PNC’s Powerful Franchise

Dec. 31, 2010

U.S. Rank

Deposits

$183B

6

Assets

$264B

6

Branches

2,470

5

ATMs

6,673

5

Record 2010 net income of $3.4B

(1)

Rankings

source:

SNL

DataSource;

Banks

headquartered

in

U.S.

Assets

rank

excludes

Morgan

Stanley

and

Goldman

Sachs.

CO

TX

KS

OK

BlackRock

A leader in investment management, risk

management and advisory services worldwide

th

th

th

th

1 |

8

Our Business Model is Delivering Strong Results and

Long-Term Value

A successful business model

Delivering value for our stakeholders

Core funded, disciplined deposit

pricing

Returning to a moderate risk profile

Leveraging customer relationships,

strong brand to grow high quality,

diverse revenue streams

Focus on creating positive operating

leverage, invest in innovation

Remaining disciplined with capital

Execute

SHAREHOLDERS

Return

Operating

leverage

Capital utilization

CUSTOMERS

Engagement

Brand equity

Customer growth

Market share

EMPLOYEES

Engagement

Talent

management

Diversity

COMMUNITIES

Community-based

spending

Grow Up Great

Green initiatives |

9

Delivering Long–Term Value for Our Shareholders

$25

$50

$75

$100

$125

$150

2005

2006

2007

2008

2009

2010

December 31

PNC

S&P 500 Index

Peer

Group

¹

S&P 500 Banks

X

Comparison of cumulative 5-year total return

(1) Peer group represents BBT, BAC, COF, CMA, FITB, JPM, KEY, MTB, PNC, RF, STI, USB and

WFC. |

10

Significant 1Q11 Achievements

1Q11 financial

summary

Net income

Diluted EPS from

net income

Return on

average assets

$832 million

$1.57

1.29%

Delivered strong financial results through the execution of our business model

Record capital levels

-

Increased quarterly common stock dividend 250% to $0.35 per share for

2Q11

-

Confirmed 25 million share repurchase program; plan to repurchase up to

$500 million

in

2011

¹

Businesses continued to grow clients, deepen relationships and launch new

products

Continued to maintain a high quality balance sheet, poised to support client

growth

Actively managed our risk positions toward a moderate profile

1Q11 highlights

(1) Subject to market and general economic conditions, economic and regulatory capital

conditions, alternative uses of capital, regulatory and contractual limitations, and

potential impact on credit ratings. |

11

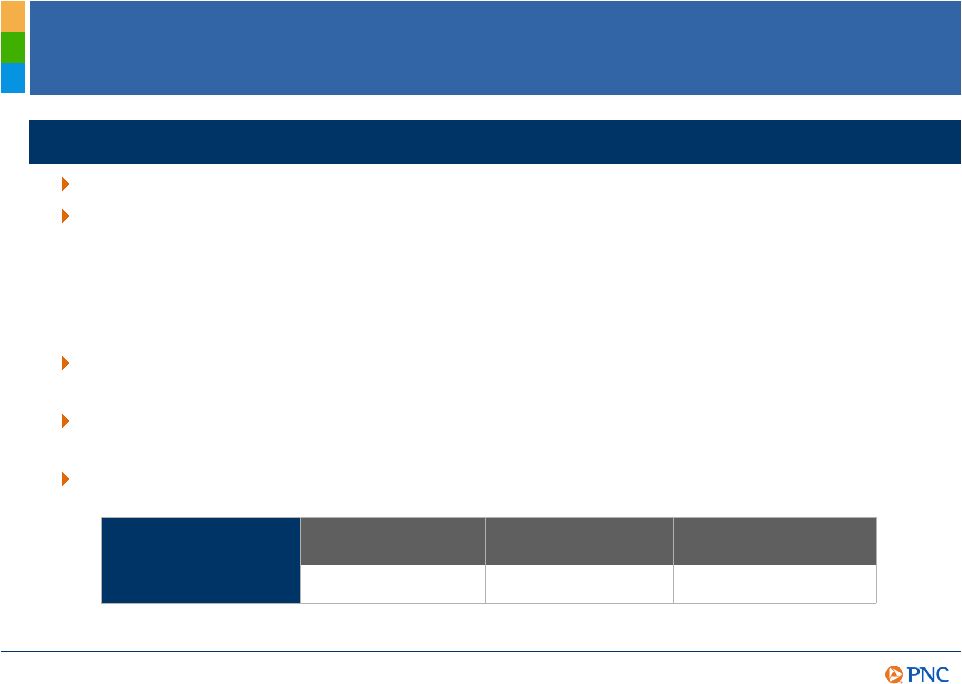

PNC’s Growth Opportunities

Time

Disciplined

expense

management

Growth

through

execution

Growth

through

lending

Growth

through

innovation

Growth

through

market share

Credit quality

improvement

Capital

management

Higher

interest rates |

12

Cautionary Statement Regarding Forward-Looking

Information

Appendix

This presentation includes “snapshot” information about PNC used by way of

illustration and is not intended as a full business or financial review. It should

not be viewed in isolation but rather in the context of all of the information made available by PNC in its SEC filings.

We also make statements in this presentation, and we may from time to time make other

statements, regarding our outlook or expectations for earnings, revenues, expenses,

capital levels, liquidity levels, asset quality and/or other matters regarding or affecting PNC and its future

business and operations that are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act. Forward- looking statements are

typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,

“will,” “should,” “project,” “goal” and other similar

words and expressions. Forward-looking statements are subject to numerous assumptions,

risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date they are made. We do not assume any

duty and do not undertake to update our forward-looking statements. Actual

results or future events could differ, possibly materially, from those that we anticipated in our forward-

looking statements, and future results could differ materially from our historical

performance. Our forward-looking statements are subject to the following principal risks and

uncertainties. We provide greater detail regarding some of these factors in our

2010 Form 10-K, including in the Risk Factors and Risk Management sections of that report, and in our subsequent SEC

filings. Our forward-looking statements may also be subject to other risks and

uncertainties, including those that we may discuss elsewhere in this presentation or in

our filings with the SEC, accessible on the SEC’s website at www.sec.gov and on or through our corporate website at

www.pnc.com/secfilings. We have included these web addresses as inactive textual

references only. Information on these websites is not part of this document.

•Our businesses and financial results are affected by business and economic conditions,

both generally and specifically in the principal markets in which we operate. In

particular, our businesses and financial results may be impacted by:

o

Changes in interest rates and valuations in the debt, equity and other financial markets.

o

Disruptions in the liquidity and other functioning of financial markets, including such

disruptions in the markets for real estate and other assets commonly securing financial

products. o

Actions by the Federal Reserve and other government agencies, including those that impact

money supply and market interest rates. o

Changes in our customers’, suppliers’ and other counterparties’ performance in

general and their creditworthiness in particular. o

A slowing or failure of the moderate economic recovery that began in mid-2009 and

continued throughout 2010 and into 2011. o

Continued effects of the aftermath of recessionary conditions and the uneven spread of the

positive impacts of the recovery on the economy in general and our customers in

particular, including adverse impact on loan utilization rates as well as delinquencies, defaults

and customer ability to meet credit obligations.

o

Changes in levels of unemployment.

o

Changes in customer preferences and behavior, whether as a result of changing business and

economic conditions, climate-related physical changes or legislative and regulatory

initiatives, or other factors. •Turbulence in significant portions of the US and

global financial markets could impact our performance, both directly by affecting our

revenues and the value of our assets and liabilities and indirectly by affecting our

counterparties and the economy generally. |

13

Cautionary Statement Regarding Forward-Looking

Information (continued)

•We will be impacted by the

extensive

reforms

provided

for

in

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act

(“Dodd-Frank

Act”)

and ongoing reforms impacting the financial institutions industry generally. Further, as

much of the Dodd-Frank Act will require the adoption of implementing regulations by

a number of different regulatory bodies, the precise nature, extent and timing of many of these reforms and the impact

on us is still uncertain.

•Financial

industry

restructuring

in

the

current

environment

could

also

impact

our

business

and

financial

performance

as

a

result

of

changes

in

the

creditworthiness and performance of our counterparties and by changes in the competitive and

regulatory landscape. •Our results depend on our ability to manage current elevated

levels of impaired assets. •Given current economic and financial market conditions,

our forward-looking financial statements are subject to the risk that these conditions will be

substantially different than we are currently expecting. These statements are based on our

current view that the moderate economic recovery that began in mid-2009 and

continued throughout 2010 will transition into a self-sustaining economic expansion in 2011 pushing the unemployment rate

lower amidst continued low interest rates.

•Legal and regulatory developments could have an impact on our ability to operate our

businesses or our financial condition or results of operations or our competitive

position or reputation. Reputational impacts, in turn, could affect matters such as business generation and retention, our ability to

attract and retain management, liquidity, and funding. These legal and regulatory

developments could include: o

Changes resulting from legislative and regulatory responses to the current economic and

financial industry environment. o

Other legislative and regulatory reforms, including broad-based restructuring of financial

industry regulation (such as that under the Dodd-Frank Act) as well as changes to

laws and regulations involving tax, pension, bankruptcy, consumer protection, and other aspects of the financial

institution industry.

o

Unfavorable resolution of legal proceedings or other claims and regulatory and other

governmental investigations or other inquiries. In addition to matters relating

to PNC’s business and activities, such matters may also include proceedings, claims, investigations, or inquiries relating to

pre-acquisition

business

and

activities

of

acquired

companies,

such

as

National

City.

These

matters

may

result

in

monetary

judgments or

settlements or other remedies, including fines, penalties, restitution or alterations in our

business practices and in additional expenses and collateral costs.

o

The results of the regulatory examination and supervision process, including our failure to

satisfy the requirements of agreements with governmental agencies.

o

Changes in accounting policies and principles.

o

Changes

resulting

from

legislative

and

regulatory

initiatives

relating

to

climate

change

that

have

or

may

have

a

negative

impact

on

our

customers’

demand for or use of our products and services in general and their creditworthiness in

particular. o

Changes to regulations governing bank capital, including as a result of the Dodd-Frank Act

and of the Basel III initiatives. •Our business and operating results are affected

by our ability to identify and effectively manage risks inherent in our businesses, including, where

appropriate,

through

the

effective

use

of

third-party

insurance,

derivatives,

and

capital

management

techniques,

and

by

our

ability

to

meet

evolving

regulatory capital standards.

•The adequacy of our intellectual property protection, and the extent of any costs

associated with obtaining rights in intellectual property claimed by others, can impact

our business and operating results. •Our ability to anticipate and respond to

technological changes can have an impact on our ability to respond to customer needs and to meet

competitive demands.

•Our ability to implement

our

business

initiatives

and

strategies

could

affect

our

financial

performance

over

the

next

several

years.

•Competition can have an impact on customer acquisition, growth and retention, as well as

on our credit spreads and product pricing, which can affect market share, deposits and

revenues. Appendix |

14

Cautionary Statement Regarding Forward-Looking

Information (continued)

•Our business and operating results can also be affected by widespread disasters,

terrorist activities or international hostilities, either as a result of the impact on

the economy and capital and other financial markets generally or on us or on our customers, suppliers or other counterparties

specifically.

•Also, risks and uncertainties that could affect the results anticipated in

forward-looking statements or from historical performance relating to our equity

interest in BlackRock, Inc. are discussed in more detail in BlackRock’s filings with the SEC, including in the Risk Factors sections of

BlackRock’s reports. BlackRock’s SEC filings are accessible on the SEC’s

website and on or through BlackRock’s website at www.blackrock.com. This material

is referenced for informational purposes only and should not be deemed to constitute a part of this document.

We grow our business in part by acquiring from time to time other financial services

companies, financial services assets and related deposits. Acquisitions present

us with risks in addition to those presented by the nature of the business acquired. These include risks and uncertainties

related both to the acquisition transactions themselves and to the integration of the acquired

businesses into PNC after closing. Acquisitions may be substantially more expensive to

complete (including unanticipated costs incurred in connection with the integration of the

acquired company) and the anticipated benefits (including anticipated cost savings and

strategic gains) may be significantly harder or take longer to achieve than

expected. Acquisitions may involve our entry into new businesses or new geographic or other markets, and these situations also

present risks resulting from our inexperience in those new areas.

As a regulated financial institution, our pursuit of attractive acquisition opportunities

could be negatively impacted due to regulatory delays or other regulatory issues.

In addition, regulatory and/or legal issues relating to the pre-acquisition operations of an acquired business may cause

reputational harm to PNC following the acquisition and integration of the acquired business

into ours and may result in additional future costs or regulatory limitations arising

as a result of those issues. Any annualized, proforma, estimated, third party or

consensus numbers in this presentation are used for illustrative or comparative purposes only

and may not reflect actual results. Any consensus earnings estimates are calculated

based on the earnings projections made by analysts who cover that company. The

analysts’ opinions, estimates or forecasts (and therefore the consensus earnings

estimates) are theirs alone, are not those of PNC or its management, and may not

reflect PNC’s or other company’s actual or anticipated results. Appendix

|