Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - iPayment, Inc. | dex991.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 21, 2011

IPAYMENT, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or Other Jurisdiction of Incorporation)

000-50280

(Commission File Number)

62-1847043

(I.R.S. Employer Identification Number)

40 Burton Hills Boulevard, Suite 415

Nashville, TN 37215

(Address and zip code of principal executive offices)

(615) 665-1858

(Registrant’s telephone number, including area code)

N/A

(Name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

On April 21, 2011, iPayment, Inc. (the “Company”) announced that the Company plans to offer $375 million in aggregate principal amount of Senior Notes due 2018 (the “Notes”). The Company also announced today that its direct parent, iPayment Holdings, Inc. (“Holdings”), plans to offer 150,000 units (the “Units”), consisting of $150 million in aggregate principal amount of Senior Notes due 2018 and 150,000 warrants to purchase common stock of Holdings. The Notes and the Units are being offered only to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”) and to non-U.S. persons outside of the United States in compliance with Regulation S of the Securities Act. The Notes and the Units have not been registered under the Securities Act, any other federal securities laws or the securities laws of any state, and until so registered, the Notes and the Units may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws. This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities.

In connection with the offering of the Notes, the Company disclosed certain information in an offering memorandum to prospective investors, including the information set forth below. Not all of the information contained in the offering memorandum appears below. Accordingly, certain sections referred to in cross references and certain definitions do not appear below.

Unless otherwise indicated, the terms the “Company,” “we,” “us” and “our” refer to iPayment, Inc. and its subsidiaries, unless the context requires otherwise.

2

Offering memorandum summary

Our company

We are a leading provider of credit and debit card payment processing services to small merchants across the United States. Our payment processing services enable small merchants to accept credit cards from Visa, MasterCard, American Express, Discover and Diners Club as well as other forms of electronic payments, including debit cards, checks, gift cards and loyalty programs. The majority of our charge volume is derived from Visa and MasterCard transactions. During December 2010, we generated revenue from approximately 172,000 small merchants located across the United States. Of these merchants, approximately 133,000 were active merchants that had each processed at least one Visa or MasterCard transaction in that month. In 2010, the small merchants we serve generated an average charge volume of approximately $170,000 and had an average transaction value of approximately $67. We processed over 339 million transactions in 2010, representing approximately $22.7 billion of charge volume. For the year ended December 31, 2010, we generated net revenues of $319 million, net income of $22.8 million, Pro Forma Adjusted EBITDA of $136 million and free cash flow of $58 million, which is calculated as cash from operating activities minus dividends minus capital expenditures.

Market focus and sales

We believe that small merchants are an attractive customer base that value and demand the payment processing services we provide. In the United States, the small merchant segment is the largest segment of our industry based on number of locations and we believe it is also the segment with the highest average amount of revenue generated by payment processors per transaction. We also believe that the competitive environment for card processing in the small merchant segment is more favorable than in the large merchant segment for a number of reasons, including:

| • | Specific segment needs. We believe that small merchants are difficult to serve profitably by other processors that do not have the knowledge, experience and scale that we have to effectively evaluate and manage the payment processing needs and risks unique to small merchants. We believe it can be difficult for payment processors that typically serve larger national or regional merchants to provide customized payment processing services, customer service and risk management services for small merchants on a cost-effective basis. The methods used to efficiently market to and secure small merchant customers differ from those utilized for larger national or regional merchants. Small merchants are typically more fragmented, local businesses and are therefore more difficult to identify by larger payment processors, which are more accustomed to serving national or regional merchants. |

| • | Higher transaction fees. Small merchants typically pay higher average transaction fees than large merchants, because they are more difficult to identify and service and their businesses are more likely to fail than larger merchants. They also do not individually generate sufficient charge volume to command significant volume discounts from larger processors. |

| • | Efficient gathering mechanism. In order to identify small merchants, we market and sell our services primarily through a large network of independent sales groups (“ISGs”). We estimate that this non-employee, external sales force is comprised of approximately 3,500 independent sales groups and agents located throughout the United States. ISGs allow us to access a large |

3

| and experienced sales force with a local presence and enable us to gain new small merchants over a broad geographic area without incurring incremental overhead costs. ISGs typically market and sell our services to merchants under our brand name and directly approach merchants to enroll them in our services. Many of our ISGs have contractual obligations that require them to submit to us either all or a minimum number of new merchant applications. To drive growth in new sales channels, we are also increasing our efforts to market and sell our services through our direct sales channel. Our direct sales channel represented approximately 11.2% of our new merchant activations in 2010, an increase of approximately 10% since 2009, not including the results of Central Payment Co, LLC, which was sold during the fourth quarter of 2009. |

Services and economics

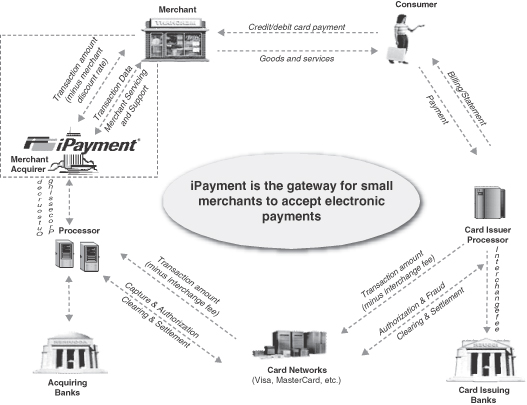

We enable small merchants to accept credit and debit cards by providing a range of services, which include transaction processing, risk management, fraud detection, merchant assistance and support and chargeback services in connection with disputes with cardholders. For these services, we charge our merchants a discount fee (the “Merchant Discount”), which is based primarily on a percentage of the dollar amount of each transaction we process. The Merchant Discount may vary based on several other factors, including the type of merchant, the type of card used and whether the transaction process is a swipe transaction or a card-not-present transaction (i.e., over the Internet or by mail, fax or telephone). For example, the Merchant Discount we typically receive for a credit card transaction is approximately 3.0% of the dollar amount of the transaction. In 2010, we derived 91% of our revenues from the Merchant Discount that we charge for each transaction, which we believe has contributed to a stable, recurring revenue base.

A transaction is initiated when a consumer purchases a product or service at a merchant using his or her card. At the point of transaction, the consumer’s credit card information is submitted to our processing vendor (to which we pay a processing fee), which then communicates with the card-issuing bank through the proper association network (such as Visa or MasterCard) to authorize the transaction. After authorization, we instruct our processing vendor to route funds from the card-issuing bank to our sponsoring bank. Our sponsoring bank, to which we pay a sponsoring fee and which sponsors us for membership in the Visa, MasterCard or other card association, settles the transaction with the merchant. We also pay interchange fees and assessment fees to the card-issuing bank and the credit card association, respectively, which are typically passed through in the Merchant Discount we charge our merchants. We believe this structure allows us to maintain an efficient operating structure and enables us to expand our operations without significantly increasing our fixed costs or capital expenditures.

4

The following table provides an example of a typical transaction, including amounts paid to the card-issuing bank, the Visa, MasterCard or other card association, the processing vendor, the sponsoring bank and us. This example also presents some of our other costs of services, which typically include payments to ISGs in the form of residuals, merchant losses and various other expenses.

| Purchase amount |

$ | 100.00 | ||

| Less: cash to merchant |

(97.00 | ) | ||

| iPayment gross revenue (Merchant Discount) |

$ | 3.00 | ||

| Less: interchange fee |

(1.75 | ) | ||

| Less: network dues and assessments and bank processing fees |

(0.21 | ) | ||

| iPayment net settlement |

$ | 1.04 | ||

| Less: other transaction costs |

(0.61 | ) | ||

| iPayment processing margin |

$ | 0.43 | ||

Diversified merchant base

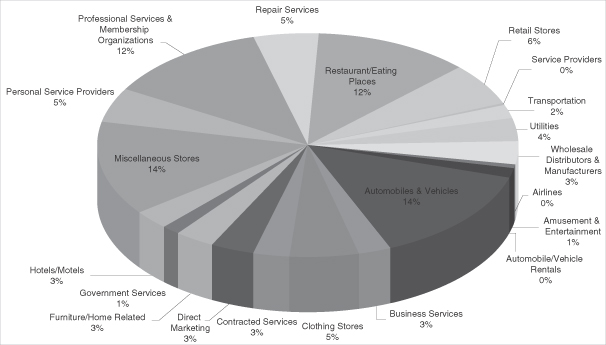

We serve a large portfolio of approximately 133,000 active small merchants that are engaged in a wide variety of businesses and industries. We believe this diversity contributes to a stable revenue base. No single merchant accounted for more than 1% of our aggregate charge volume for 2010. Because of our limited customer concentration, variation in charge volume from any one merchant or industry has a limited effect on our total charge volume and financial results. The following chart shows the primary categories of the merchants we serve based on 2010 charge volume:

5

We define a merchant as “active” if the merchant processes at least one Visa or MasterCard transaction in a given calendar month. In 2010, the small merchants we serve had an average charge volume of approximately $170,000 per year and an average transaction value of approximately $67. Small merchants, such as those served by our Company, have historically paid higher fees per transaction than larger merchants because they are difficult to identify and service, and their businesses are more likely to fail than larger merchants.

Merchant attrition is expected in the payment processing industry in the ordinary course of business; however, we believe the low average transaction volume of the merchants we serve makes them less likely to change providers because of the inconvenience associated with a transfer. During 2010, we experienced monthly volume attrition ranging from 1.0% to 2.0% of our total annual charge volume on our merchant portfolios. The primary cause of attrition among our small business customers is business failure.

Our industry

Significant market opportunity

The use of card-based forms of payment, such as credit and debit cards, by consumers in the United States has increased steadily over the past ten years and is projected by The Nilson Report to continue to increase through at least 2015. The growth is a result of wider merchant acceptance, growth in consumer spending, increased consumer use of bankcards and advances in payment processing and telecommunications technology. According to The Nilson Report, in 2009, merchant locations in the United States generated approximately $3.5 trillion of total purchases using card-based systems compared to approximately $2.7 trillion in 2005, and are expected to grow to approximately $5.9 trillion by 2015, representing a compound annual growth rate of approximately 8.1% from 2005 to 2015. As credit and debit card usage increases, we believe that businesses, both large and small, will need to increasingly accept card-based payment to remain competitive.

6

Key participants comprise an efficient value chain

The payment processing industry is made up of a number of key participants, including retail merchants, merchant acquirers (like iPayment), processing vendors, sponsor banks, card issuing banks and card network associations. The various players work together at different points of the value chain with the goal of ensuring seamless processing of transactions, reliable transmission of data, effective risk management and customer service. The diagram below illustrates the payment service providers’ value chain.

Strong profitability and growth of the small merchant segment

We focus on the small merchant segment, which we believe generates a disproportionate amount of the U.S. payment processing industry’s net revenue. We also believe the small merchant segment will experience strong growth. According to the U.S. Census Bureau, there were approximately 27.1 million total business locations in the United States in 2007, compared to only 8.7 million business locations that The Nilson Report estimates accepted Visa and MasterCard credit cards in 2010. While many business locations may never accept credit and debit cards, we believe that most large locations currently accept electronic payments and, therefore, the most significant opportunity for new market penetration will be in the small merchant market as well as new industry verticals.

7

We believe the benefits of card-based payment methods will continue to make the services we provide increasingly appealing to a growing segment of the small merchant market. We also believe these merchants have experienced increasing pressure to accept card-based payment methods to remain competitive and meet consumer expectations. Furthermore, card associations continually seek to develop and implement programs to expand card usage and acceptance. As a result, we believe small merchants, including those in industries such as taxis, quick-serve restaurants and service industries (such as electricians and landscapers) that have historically only accepted cash and checks as payment, will increasingly choose to accept credit and debit cards, which we believe is a more efficient means of payment for merchandise and services.

Our competitive strengths

Leading market position in the small merchant segment

We are a leading provider of card-based payment processing services focused on serving small merchants across the United States. We believe our focus, experience and scale have enabled us to provide payment processing services to small merchants on a cost-effective basis. We also provide specialized customer service and comprehensive risk management to small merchants that many larger and smaller processors cannot provide as efficiently and effectively. For example, small merchants often require a high level of customized customer service, and we have designed our customer support functions to offer high quality, personalized services in a scalable and cost-effective manner. In addition, small merchants’ credit must be carefully underwritten, requiring an individual application process and risk assessment, which our platform can provide quickly and effectively.

Strong and differentiated strategic partnerships

Our position as an industry leader in the U.S. small merchant market is built upon our strong and differentiated relationships with our partners.

| • | Processing vendors. We have a longstanding relationship with First Data Merchant Services Corporation (“FDMS”), our primary processing vendor. We believe we are one of the largest merchant services customers of FDMS, and, as such, we believe we are an important channel for FDMS to participate in providing payment processing services to small merchants. In addition to FDMS, we have relationships with other processing vendors, such as TSYS Processing Services, LLC and Global Payments Direct, Inc. |

| • | Independent sales groups. We have been successful in maintaining and growing the number of ISGs in our network and increasing the number of merchant applications that they submit to us. We believe the strong relationships we typically enjoy with our ISGs are a result of: |

| (i) | the recurring revenue stream we share with an ISG for as long as the merchant it sourced remains a customer of ours; |

| (ii) | the rapid and consistent review and acceptance of merchant applications we provide; |

| (iii) | the reliability and stability of the technology and service support we give to an ISG; and |

| (iv) | the compelling offerings we develop for an ISG to market to prospective merchants. |

8

| • | Sponsoring banks. We have a longstanding relationship with Wells Fargo, our primary sponsoring bank. We provide value to Wells Fargo and other sponsoring banks by paying them a sponsoring fee for each transaction we process. |

Efficient business model and highly scalable platform

We believe we have an efficient business model and operating structure that enables us to generate strong free cash flow from our recurring revenue base. We operate a highly scalable and efficient merchant acquiring platform that includes a combination of (1) leading technology, (2) a full range of services that we develop and conduct in-house (such as our customer service and risk management operations) where we believe we can add the most value based on our experience and expertise and (3) strategically outsourced services for our most commoditized, capital-intensive processing services (such as transaction authorization, clearing and funds settlement services) with contract pricing terms that become more favorable to us as the charge volume generated by our merchant base increases.

Our efficient and scalable platform has resulted in declining per unit costs of processing and has allowed us to expand and scale our operations without significantly increasing our fixed costs. From 2008 to 2010, our consolidated processing costs declined by 31.5% from approximately $0.10 per transaction to approximately $0.07 per transaction, while our average EBITDA per employee increased 40.7% from $280,000 to $393,000. Over the same period, our average EBITDA margin increased by approximately 3.2% to 18.3% in 2010. At the same time, we have increased the number of merchants we serve with limited direct investment in sales infrastructure, overhead (such as advertising) and management through our ISG network, having averaged capital expenditures of approximately $2.2 million per year from 2007 to 2010. We typically enjoy low working capital requirements because we do not carry significant inventories and we collect fees from our merchants on a monthly basis prior to making disbursements for our costs of providing services.

Robust risk management

We believe our knowledge and experience in dealing with attempted fraud, including our management’s experience with higher risk market segments, has resulted in our development and implementation of effective risk management and fraud prevention systems and procedures. Effective risk management helps us minimize merchant losses for our and our merchant customers’ mutual benefit. Our risk management procedures also help protect us from fraud perpetrated by merchants. As of December 31, 2010, we had a staff of 33 employees dedicated to risk management operations, which encompasses underwriting new accounts, monitoring and investigating merchant account activity for suspicious transactions or trends and avoiding or recovering losses. Charges incurred by us for merchant losses were $3.5 million, or 0.5% of revenues in 2010, and were $4.9 million, or 0.7% of revenues in 2009. In 2010, merchant losses were approximately 1.5 basis points of our total charge volume. In 2010, the average merchant loss we incurred was approximately $2,000.

Strong, committed management team

Our senior management team has extensive expertise in the payment processing industry and has significant experience in developing and implementing merchant acquiring services for the small

9

merchant sector. Carl Grimstad is a co-founder of our Company and has been our President since our foundation in 2001. Mark Monaco, our Chief Financial Officer, has over 20 years of financial services experience, including serving as the Chairman of Retriever Payment Systems, another U.S. merchant acquirer.

Our business strategy

Our goal is to enhance our position as a leading provider of card-based payment processing services to small merchants in the United States while continuing to improve our efficiency and profitability. In order to achieve this objective, we plan to execute the following strategy:

Expand our relationships with independent sales groups

We believe our ISGs will continue to be a significant driver of growth for our business. We seek to increase the number of ISG relationships we have and increase the volume of merchant referrals from ISGs. We believe that our industry experience, combined with our ability to evaluate and manage the risks related to providing payment processing services to small merchants, allow us to accept a high rate of merchant applications. We believe this ability, combined with the compelling services that we provide for ISGs to market to prospective merchants and our reliable and stable ISG support, position us well to continue to increase the number of our ISG relationships and the number of new applications our existing ISGs refer to us.

Increase our direct sales efforts

We have increased the percentage of new merchant activations sourced from our direct sales channel from 10.2% in 2009 to 11.2% in 2010. We plan to continue to increase our direct sales efforts by increasing the size of our direct sales force and by entering into new channels and strategic relationships with marketing companies and other business service providers, which we believe will contribute to profitable growth. We compensate our direct sales channels largely through sales commissions that are paid upon activation of each merchant sourced by the sales person. However, unlike our ISGs, our direct sales force typically does not share in the revenue streams we generate from our merchants.

Maximize retention and diversify existing merchant base

We seek to maintain a stable merchant base by providing our merchants with a consistently high level of service and support. In doing so, we believe that we will continue to build merchant loyalty and maximize merchant retention. We also intend to further enhance the relationships we have with our customers by offering them additional value added products and services that they are purchasing for their business from other suppliers.

Increase operating leverage and maximize free cash flow

We will continue to maintain a strong focus on producing further operating leverage improvements in our business by striving to create and realize new operating efficiencies, driving down marginal expenses and maintaining our low cost structure. We intend to make these improvements by continuing to (1) develop and maintain in-house leading technology and services that provide differentiated capabilities and a high level of service for the small merchant

10

market, (2) strategically outsource commoditized processing and sponsorship services and use our growing scale to extract increasingly favorable contract pricing terms from our vendors, (3) utilize our non-employee sales force to expand our footprint and reach, while minimizing overhead and (4) maintain capital discipline in the use of our free cash flow.

Selectively pursue strategic acquisitions

When appropriate, we plan to selectively pursue acquisitions of portfolios of merchant accounts and other merchant acquirers to increase our business and leverage our operating efficiencies. The fragmented small merchant market provides substantial opportunity for future growth and we intend to use a disciplined investment process with rigorous analysis of return on investment, financial impact, sales benefits and portfolio quality when evaluating our acquisitions. We have significant experience acquiring providers of payment processing services as well as portfolios of merchant accounts. Since December 2003, we have expanded our card-based payment processing services through the acquisition of five businesses, four significant portfolios and several smaller portfolios of merchant accounts. We have enhanced revenues and improved operating efficiencies of the merchant accounts we have acquired by improving the services, support and benefits we offer to the ISGs that serve those accounts. In addition, we have increased the operating efficiencies of many of the businesses we have acquired by conducting profitability analyses of acquired merchant accounts to maximize revenues, reducing duplicative functions and introducing new products and services.

The related transactions

We are offering $375 million aggregate principal amount of our notes and intend to concurrently enter into our new senior secured credit facilities, which will include $375 million of term loans and availability of up to $75 million of revolving loans with the ability to request an increase of $25 million in the amount of revolving loans. See “Description of notes” and “Description of other indebtedness.”

We intend to use the net proceeds from this offering, together with borrowings under our new senior secured credit facilities, to:

| • | permanently repay all of the outstanding indebtedness under our existing senior secured credit facilities; |

| • | redeem and satisfy and discharge all of our existing senior subordinated notes; and |

| • | make a distribution to our indirect parent, iPayment Investors, L.P. (“Investors”), in an amount sufficient to enable Investors, together with the net proceeds of the Parent Financing described below, to (i) redeem and satisfy and discharge all of its outstanding 115/8%/123/4% Senior Notes due 2014 (the “existing PIK toggle notes”) and (ii) subject to the satisfaction (or, if applicable, waiver) of the conditions set forth in the Redemption Agreement described below, to redeem all of the equity interests in Investors and its general partner, iPayment GP, LLC (“GP”), held by our Chairman and Chief Executive Officer, Mr. Gregory Daily, and by entities controlled by him or in trust for the benefit of his family members (collectively, the “Daily Interests”), including payment of related fees and expenses. There can be no assurance that the Equity Redemption will occur and if the Equity Redemption is not consummated for any reason, the net proceeds from this offering allocated for the Equity Redemption will instead be used for general corporate purposes. See “—Recent developments” and “Use of proceeds.” |

11

In this offering memorandum, we refer to the entry into our new senior secured credit facilities and the offer and sale of the notes, including the application of the net proceeds of the notes and borrowings under our new senior secured credit facilities as described above, as the “Transactions.”

Concurrently with this offering, iPayment Holdings, Inc. (“Holdings”), our direct parent, is offering units (the “Parent Financing”) consisting of $150 million aggregate principal amount of %/ % Senior Notes due 2018 (“Holdings’ new notes”) and warrants to purchase an aggregate of shares of Holdings’ common stock (representing approximately % of Holdings’ outstanding common stock). A portion of the net proceeds of the Parent Financing will be deposited into an escrow account upon the closing thereof, to be used for the Equity Redemption and to pay related fees and expenses. If the conditions to the consummation of the Equity Redemption are not satisfied, an aggregate principal amount of Holdings’ new notes equal to the proceeds so deposited will be mandatorily redeemed and the associated warrants will be cancelled. See “—Recent developments.”

Nothing in this offering memorandum should be construed as an offer to sell, or a solicitation of an offer to buy, the securities that are being offered in the Parent Financing.

The consummation of this offering is conditioned upon our entry into our new senior secured credit facilities but is not conditioned upon the consummation of the Parent Financing or the Equity Redemption.

Recent developments

On April 12, 2011, Investors and GP entered into a redemption agreement (the “Redemption Agreement”) with (i) Mr. Daily, (ii) the trustee appointed in Mr. Daily’s personal bankruptcy case under Chapter 11 of the United States Bankruptcy Code (the “Daily Bankruptcy Trustee”) and (iii) the trusts for the benefit of, and other entities controlled by, members of Mr. Daily’s family that hold equity interests in Investors (together with Mr. Daily and the Daily Bankruptcy Trustee, on behalf of the Daily bankruptcy estate, the “Daily Parties”).

Pursuant to the Redemption Agreement, Investors and GP have agreed to redeem from the Daily Parties, and the Daily Parties have agreed to transfer and surrender to Investors and GP, as applicable, all of the equity interests of the Daily Parties in Investors and GP, representing approximately 65.8% of the outstanding equity of Investors, for an aggregate price of $118.5 million (the “Equity Redemption”). The interests to be redeemed pursuant to the Redemption Agreement constitute all of the direct and indirect equity interests of the Daily Parties in the Company.

Upon the closing of the Equity Redemption, Mr. Daily will resign as a director and officer, as applicable, of GP, Investors and each of Investors’ subsidiaries, including as our Chairman and Chief Executive Officer. The Redemption Agreement includes covenants on the part of Mr. Daily not to compete with the Company and its affiliates for one year, and not to solicit employees, independent sales agents and independent sales organizations and merchants of the Company and its affiliates for three years, in each case from the closing date of the Equity Redemption.

The closing of the Equity Redemption is also subject to the satisfaction (or, if applicable, waiver) of the following conditions: (i) the approval of the United States Bankruptcy Court for the Middle

12

District of Tennessee (the “Bankruptcy Court”), (ii) the receipt by Investors and its subsidiaries of financing sufficient to fund the Equity Redemption, and such refinancings of their existing indebtedness (or waivers or amendments thereof) as are necessary to permit the Equity Redemption, in each case on terms reasonably satisfactory to Investors, (iii) the execution by Investors and certain of its affiliates of mutual general releases of claims, in form and substance reasonably acceptable to Investors and GP, with each of the Daily Parties and certain other parties with an interest in Mr. Daily’s bankruptcy estate and (iv) other customary closing conditions.

A hearing of the Bankruptcy Court on whether to approve the Equity Redemption is scheduled for April 27, 2011 and a decision by the Bankruptcy Court is expected on or about that date. There can be no assurance that the Bankruptcy Court will approve the Equity Redemption, that the other conditions to the Equity Redemption will be satisfied or that the Equity Redemption will occur.

The Redemption Agreement may be terminated by GP or the Daily Bankruptcy Trustee if the Equity Redemption has not occurred on or before June 30, 2011.

If the Equity Redemption is consummated, Carl Grimstad, our President, and parties related to him will control 100% of the equity interests and voting power of Investors and will have the power to elect all of the members of our board of directors. It is anticipated that Mr. Grimstad will become our Chairman and Chief Executive Officer and that the boards of directors of the Company and Holdings will consist of Mr. Grimstad, Mark Monaco, our Chief Financial Officer, and three independent directors to be determined after the consummation of the Equity Redemption.

In addition, Investors intends to adopt, or cause Holdings to adopt, a management equity program pursuant to which members of management would be issued equity interests, options or similar rights representing, in the aggregate, up to 20% of the outstanding equity of the issuer thereof on a fully-diluted basis. If the Equity Redemption is consummated, Investors intends to effect a merger of itself into Holdings, with Holdings being the surviving corporation in such merger.

13

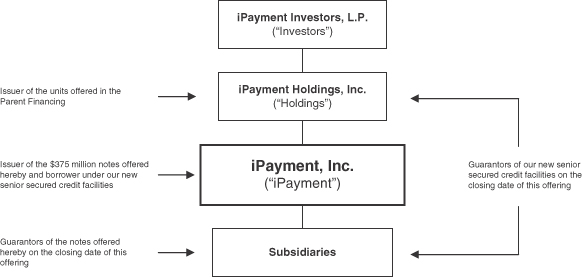

Corporate structure

The following chart summarizes our and our direct and indirect parents’ organizational structure and principal indebtedness immediately following the consummation of the Transactions and the Parent Financing. This chart is provided for illustrative purposes only. Each subsidiary is wholly-owned by its parent.

Corporate information

iPayment, Inc., or “iPayment,” is a Delaware corporation. Our principal executive offices are located at 40 Burton Hills Boulevard, Suite 415, Nashville, Tennessee. Our telephone number at that address is (615) 665-1858, and we maintain a website at www.ipaymentinc.com. The information contained on, or accessible through, our website is provided for informational purposes only and is not incorporated by reference in this offering memorandum.

iPayment was originally incorporated as iPayment Holdings, Inc., or “Holdings,” in Tennessee and was reincorporated in Delaware under the name iPayment, Inc. On May 10, 2006, iPayment completed a merger transaction pursuant to which it emerged as the surviving corporation and a wholly-owned subsidiary of Holdings.

On the closing date of this offering, all of iPayment’s subsidiaries will be restricted subsidiaries and guarantors of the notes under the indenture governing the notes. Under certain circumstances, the indenture will permit us to designate certain of our subsidiaries as unrestricted subsidiaries, which subsidiaries will not be subject to the covenants in the indenture and will not guarantee the notes. See “Description of notes—Certain covenants—Guarantees.”

14

Summary historical consolidated financial and

operating data

The following table presents our summary historical consolidated financial and operating data as of and for the periods indicated. The summary historical consolidated financial data as of December 31, 2009 and 2010 and for each of the three years in the period ended December 31, 2010 have been derived from our audited consolidated financial statements and related notes thereto, which are included elsewhere in this offering memorandum. Charge volume for all periods indicated below has not been derived from our audited consolidated financial statements. The summary as adjusted financial data as of and for the year ended December 31, 2010 give effect to the Transactions described under “Offering memorandum summary—The related transactions” as if such Transactions had occurred on December 31, 2010. Such as adjusted financial data are based on assumptions and are presented for illustrative and informational purposes only and do not purport to represent what our actual financial position would have been had such transactions been completed on such date.

The summary historical consolidated financial and operating data should be read in conjunction with “Use of proceeds,” “Management’s discussion and analysis of financial condition and results of operations,” “Capitalization,” “Selected consolidated historical financial information and other data,” and our audited consolidated financial statements and related notes thereto included elsewhere in this offering memorandum. The results of operations for the historical periods included in the following table are not necessarily indicative of the results to be expected for future periods. In addition, see “Risk factors” for a discussion of risk factors that could impact our future financial condition and results of operations.

Unaudited Pro Forma Adjusted EBITDA is provided for illustrative purposes only and does not represent what the actual Adjusted EBITDA would have been had the adjustments occurred on December 31, 2010, nor does it purport to represent Adjusted EBITDA for any future period or our financial position at any future date.

| Year ended December 31, | ||||||||||||

| ($ in thousands, unless otherwise indicated) |

2008 | 2009 | 2010 | |||||||||

| Statement of Operations Data: |

||||||||||||

| Revenues |

$ | 794,825 | $ | 717,928 | $ | 699,174 | ||||||

| Operating expenses |

||||||||||||

| Interchange |

450,570 | 397,530 | 380,577 | |||||||||

| Other cost of services |

240,880 | 228,253 | 216,873 | |||||||||

| Selling, general and administrative |

20,941 | 20,348 | 13,827 | |||||||||

| Total operating expenses |

712,391 | 646,131 | 611,277 | |||||||||

| Income from operations |

82,434 | 71,797 | 87,897 | |||||||||

| Other expenses |

||||||||||||

| Interest expense, net |

(56,289 | ) | (46,488 | ) | (45,662 | ) | ||||||

| Other |

(750 | ) | (1,245 | ) | (1,058 | ) | ||||||

| Total other expense |

(57,039 | ) | (47,733 | ) | (46,720 | ) | ||||||

| Income before income taxes |

25,395 | 24,064 | 41,177 | |||||||||

| Income tax provision |

10,105 | 8,736 | 18,349 | |||||||||

| Net income |

15,290 | 15,328 | 22,828 | |||||||||

| Less: Net income attributable to noncontrolling interests |

(987 | ) | (3,588 | ) | — | |||||||

15

| Year ended December 31, | ||||||||||||

| ($ in thousands, unless otherwise indicated) |

2008 | 2009 | 2010 | |||||||||

| Net income attributable to iPayment, Inc. |

$ | 14,303 | $ | 11,740 | $ | 22,828 | ||||||

| Financial and Other Data: |

||||||||||||

| Charge volume (in millions) (unaudited)(1) |

$ | 26,783 | $ | 23,526 | $ | 22,653 | ||||||

| Capital expenditures |

2,374 | 2,304 | 2,904 | |||||||||

| Ratio of earnings to fixed charges(2) |

1.41x | 1.44x | 1.90x | |||||||||

| EBITDA(3) |

119,725 | 116,380 | 128,060 | |||||||||

| Adjusted EBITDA(4) |

121,231 | 118,777 | 136,051 | |||||||||

| Year ended December 31, | ||||||||||||||||

| ($ in thousands) |

2008 | 2009 | 2010 | As Adjusted 2010(5) (unaudited) |

||||||||||||

| Balance Sheet Data (as of period end): |

||||||||||||||||

| Cash and cash equivalents |

3,589 | 2 | 1 | |||||||||||||

| Working capital (deficit) |

(10,591 | ) | (6,601 | ) | (9,732 | ) | ||||||||||

| Total assets |

768,864 | 745,366 | 735,629 | |||||||||||||

| Total long-term debt including current portion |

687,326 | 651,519 | 624,967 | |||||||||||||

| Stockholders’ equity |

26,605 | 43,138 | 72,441 | |||||||||||||

| Pro

Forma 2010 (unaudited) |

||||

| Pro Forma Financial Data:(5) |

||||

| Adjusted cash interest expense |

||||

| Ratio of adjusted total debt to Adjusted EBITDA(4) |

||||

| Ratio of Adjusted EBITDA to adjusted cash interest expense(4) |

||||

| Ratio of Adjusted EBITDA minus capital expenditures to adjusted cash interest expense(4) |

||||

| (1) | Represents the total dollar volume of all Visa and MasterCard transactions processed by our merchants. This data is provided to us by our third-party processing vendors and is not independently verified by us. |

| (2) | For purposes of computing the ratio of earnings to fixed charges, fixed charges consist of interest expense on long-term debt and capital leases, amortization of deferred financing costs and that portion of rental expense deemed to be representative of interest. Earnings consist of income (loss) before income taxes and minority interest, plus fixed charges and minority interest in pre-tax losses of subsidiaries that have not incurred fixed charges. |

| (3) | EBITDA is defined as net income (loss) before (i) depreciation and amortization, (ii) interest expense and (iii) provision for income taxes (benefit). The reconciliation of net income (loss) under GAAP to EBITDA is as follows: |

| Year ended December 31, | ||||||||||||

| ($ in thousands) |

2008 | 2009 | 2010 | |||||||||

| Net income |

$ | 15,290 | $ | 15,328 | $ | 22,828 | ||||||

| Depreciation and amortization |

38,041 | 45,828 | 41,221 | |||||||||

| Interest expense, net |

56,289 | 46,488 | 45,662 | |||||||||

| Income tax provision |

10,105 | 8,736 | 18,349 | |||||||||

| EBITDA |

$ | 119,725 | $ | 116,380 | $ | 128,060 | ||||||

We have provided this non-GAAP financial measure because we believe that it provides potential purchasers of the notes with useful information in assessing our operating performance and also serves as an indicator of our ability to service or incur indebtedness, make capital expenditures and finance working capital requirements. EBITDA is not a measure of financial performance under GAAP and should not be considered in isolation or as an alternative to cash flow from operating activities or as an alternative to net income as indicators of operating performance or any other measures of performance derived in accordance with GAAP. See “Non-GAAP financial measures.” Other companies in our industry may calculate EBITDA differently than we do and EBITDA as presented in this offering memorandum may not be comparable with similarly titled measures of other companies.

16

| (4) | Adjusted EBITDA represents EBITDA adjusted for the impact of certain non-recurring legal expenses, regarding certain strategic alternatives and related matters, including the potential sale of the Daily Interests. Pro Forma Adjusted EBITDA represents Adjusted EBITDA after giving effect to the annualized impact of certain acquisitions consummated in the fourth quarter of 2010. The reconciliation of EBITDA to Adjusted EBITDA and Pro Forma Adjusted EBITDA is as follows: |

| Year ended December 31, | ||||||||||||

| ($ in thousands) |

2008 | 2009 | 2010 | |||||||||

| EBITDA |

$ | 119,725 | $ | 116,380 | $ | 128,060 | ||||||

| Non-recurring legal expenses |

1,658 | |||||||||||

| Adjusted EBITDA |

$ | 119,725 | $ | 116,380 | $ | 129,718 | ||||||

| Acquisitions(a) |

1,506 | 2,397 | 6,333 | |||||||||

| Pro Forma Adjusted EBITDA |

$ | 121,231 | $ | 118,777 | $ | 136,051 | ||||||

| (a) | Represents the financial impact of our acquisitions during a specified year as if such acquisitions had occurred on January 1 of such year. |

We have provided these non-GAAP financial measures because we believe that they provide potential purchasers of the notes with useful information in assessing our operating performance and as an indicator of our ability to service or incur indebtedness, make capital expenditures and finance working capital requirements. Adjusted EBITDA and Pro Forma Adjusted EBITDA are not a measure of financial performance under GAAP and should not be considered in isolation or as an alternative to cash flow from operating activities or as an alternative to net income as indicators of operating performance or any other measures of performance derived in accordance with GAAP. See “Non-GAAP financial measures.” Other companies in our industry may calculate Adjusted EBITDA and Pro Forma Adjusted EBITDA differently than we do and Adjusted EBITDA and Pro Forma Adjusted EBITDA as presented in this offering memorandum may not be comparable with similarly titled measures of other companies.

| (5) | As adjusted financial data give effect to the Transactions described under “Offering memorandum summary—The related transactions” as if such Transactions had occurred on December 31, 2010. |

17

Risk Factors

Our business could be adversely affected by a deteriorating economic environment that causes our merchants to experience adverse business conditions, as they may generate fewer transactions for us to process or may become insolvent, thereby increasing our exposure to chargeback liabilities.

We believe that challenging economic conditions have caused some of the merchants we serve to experience difficulty in supporting their current operations and implementing their business plans, and any deterioration in economic conditions has the potential to negatively impact consumer confidence and consumer spending. If these merchants make fewer sales of their products and services, we will have fewer transactions to process, resulting in lower revenues.

In addition, in the current difficult economic environment, the merchants we serve could be subject to a higher rate of business failure which could adversely affect us financially. We bear credit risk for chargebacks related to billing disputes between credit or debit card holders and bankrupt merchants. If a merchant seeks relief under bankruptcy laws or is otherwise unable or unwilling to pay, we may be liable for the full transaction amount of a chargeback.

18

If the Equity Redemption is not consummated for any reason, we and our directors, officers and affiliates could continue to be involved in disputes relating to, or arising out of, the pending litigation and bankruptcy of our Chief Executive Officer, Mr. Daily, which could have a material adverse effect on our business, financial condition and results of operations.

In May 2009, a jury in the Superior Court of the State of California handed down a verdict in the amount of $350 million against Mr. Daily, our Chief Executive Officer, in connection with litigation (the “Daily Litigation”) over Mr. Daily’s beneficial ownership in us. In response to the verdict, Mr. Daily filed for personal bankruptcy protection under Chapter 11 of the United States Bankruptcy Code in Nashville, Tennessee (the “Daily Bankruptcy Case”). On April 8, 2010, the Bankruptcy Court ordered the appointment of the Daily Bankruptcy Trustee to administer the estate of Mr. Daily. The Daily Litigation was brought against Mr. Daily individually and not in his capacity as an officer or director of the Company, Investors or Holdings, and we were not named as a party in the Daily Bankruptcy Case.

On April 12, 2011 Investors and GP, entered into the Redemption Agreement with the Daily Parties. The Equity Redemption is subject to (i) the approval of the Bankruptcy Court, (ii) the receipt by Investors and its subsidiaries of financing sufficient to fund the Equity Redemption, and such refinancings of their existing indebtedness (or waivers or amendments thereof) as are necessary to permit the Equity Redemption, in each case on terms reasonably satisfactory to Investors, (iii) the execution by Investors and certain of its affiliates of mutual general releases of claims, in form and substance reasonably acceptable to Investors and GP, with each of the Daily Parties and certain other parties with an interest in Mr. Daily’s bankruptcy estate, and (iv) other customary closing conditions. A hearing of the Bankruptcy Court on whether to approve the Equity Redemption is scheduled for April 27, 2011 and a decision by the Bankruptcy Court is expected on or about that date.

If the Equity Redemption is not approved by the Bankruptcy Court or the Equity Redemption is not consummated for any reason, the Daily Litigation and Daily Bankruptcy Case will continue. As a result, we, our directors and officers and our respective affiliates may continue to be involved in disputes relating to, or arising out of, the Daily Litigation and Daily Bankruptcy Case. If this were to occur, we may continue to incur expenses, our management team may be subject to continued distractions, and potential claims may be made against us or our officers, any of which could have a material adverse effect on our business, financial condition and results of operations. In addition, if the Equity Redemption does not occur, the governance changes in connection with the Equity Redemption, as described in “Offering memorandum summary—Recent developments” and “Principal shareholders and related party transactions,” would not take effect.

19

Use of proceeds

We intend to use the proceeds from this offering, together with borrowings under our new senior secured credit facilities, to: (i) permanently repay all of the outstanding indebtedness under our existing senior secured credit facilities; (ii) redeem and satisfy and discharge all of our existing senior subordinated notes; (iii) make a distribution to Investors in an amount sufficient to enable Investors, together with the net proceeds of the Parent Financing, to redeem and satisfy and discharge all of its existing PIK toggle notes and to redeem all of the Daily Interests pursuant to the Equity Redemption and to pay related fees and expenses and (iv) pay fees and expenses related to this offering.

The anticipated sources and uses of funds in connection with this offering and borrowings under our new senior secured credit facilities are set forth below. The amounts reflected below are based upon an assumed closing date of May 3, 2011 and certain assumptions and estimates we have made regarding the Transactions and the Parent Financing. Actual amounts may vary and will depend on the amount of proceeds, if any, received by Holdings in the Parent Financing and the actual closing date of this offering. See “Offering memorandum summary—The related transactions.”

| Sources of funds |

Uses of funds |

|||||||||

| (in millions) | ||||||||||

| Notes offered hereby |

$ | 375.0 | Repayment of our existing senior secured credit facilities(2)(3) |

$ | 410.7 | |||||

| New senior secured credit facilities(1) |

386.6 | Redemption of our existing senior subordinated notes(4) |

203.3 | |||||||

| Distribution to Investors(5)(6)(7) |

116.3 | |||||||||

| Estimated fees and expenses of this offering(8) |

31.3 | |||||||||

| Total sources |

$ | 761.6 | Total uses |

$ | 761.6 | |||||

| (1) | Concurrently with the closing of this offering, we intend to enter into our new senior secured credit facilities, which we anticipate will provide for $375 million of term loans and availability of up to $75 million of revolving loans. We anticipate borrowing approximately $12 million under the revolving portion of our new senior secured credit facilities on the closing date of this offering. See “Description of other indebtedness.” |

| (2) | Our existing senior secured credit facilities consist of a term loan facility and a revolving credit facility. Based on our assumptions and estimates, repayment amount consists of the repayment of the entire aggregate principal amount outstanding under the term loan facility. |

| (3) | Borrowings under the term loan facility bear interest at a rate of LIBOR plus a margin of 2% to 2.25% and borrowings under the revolving credit facility bear interest at a rate of prime plus a margin of 0.50% to 1.25% or at a rate of LIBOR plus a margin of 1.50% to 2.25% depending on our ratio of consolidated debt to EBITDA (as defined therein). The term loan facility and the revolving credit facility mature on May 10, 2013 and May 10, 2012, respectively. |

| (4) | Includes accrued and unpaid interest of $8.8 million through May 3, 2011, but does not include any accrued and unpaid interest for the 30 day redemption period after closing. |

| (5) | Distribution to fund, together with the net proceeds of the Parent Financing, the redemption and satisfaction and discharge of the existing PIK toggle notes and the Equity Redemption. If the Equity Redemption is not consummated, or if there are funds remaining from the offering after the redemption and other uses specified above, any funds in excess of the amount required to fund the redemption of the existing PIK toggle notes will instead be used for general corporate purposes. See “Offering memorandum summary—The related transactions” and “Offering memorandum summary—Recent developments.” |

| (6) | Assuming a closing date of May 3, 2011, we estimate the aggregate outstanding principal amount of the existing PIK toggle notes to be $136 million, including $5 million of accrued and unpaid interest through May 3, 2011 but excluding such interest for the 30-day redemption period thereafter. |

| (7) | The aggregate price of the Equity Redemption is $118.5 million, excluding related fees and expenses of approximately $7.5 million. The amount of proceeds allocated to the Equity Redemption will depend upon the amount of proceeds raised in the Parent Financing. See “Offering memorandum summary—Recent developments” and “Principal shareholders and related party transactions.” |

| (8) | Includes the estimated legal, accounting and other fees and expenses associated with this offering, including the initial purchasers’ discounts and fees. |

20

Capitalization

The following table sets forth our cash and cash equivalents and capitalization as of December 31, 2010:

| • | on an actual basis; and |

| • | on an as adjusted basis to give effect to the Transactions described under “Offering memorandum summary—The related transactions,” as if such Transactions had occurred on such date. |

This table should be read in conjunction with “Use of proceeds,” “Management’s discussion and analysis of financial conditions and results of operations,” “Selected consolidated historical financial information and other data,” “Description of other indebtedness,” our audited consolidated financial statements and related notes thereto, and other information included elsewhere in this offering memorandum.

| As of December 31, 2010 | ||||||||

| (in thousands) |

Actual | As adjusted | ||||||

| Cash and cash equivalents |

$ | 1 | $ | |||||

| Long-term debt, including current portion: |

||||||||

| Existing senior secured credit facilities |

$ | 431,638 | $ | — | ||||

| Existing senior subordinated notes |

193,329 | — | ||||||

| Notes offered hereby |

— | |||||||

| New senior secured credit facilities(1) |

— | |||||||

| Total long-term debt, including current portion |

$ | 624,967 | $ | |||||

| Total stockholders’ equity |

72,441 | |||||||

| Total capitalization |

$ | 697,408 | $ | |||||

| (1) | Concurrently with the closing of this offering, we intend to enter into our new senior secured credit facilities, which we anticipate will provide for $375 million of term loans and availability of up to $75 million of revolving loans. We anticipate borrowing approximately $12 million under the revolving portion of our new senior secured credit facilities on the closing date of this offering. See “Description of other indebtedness.” |

21

Description of other indebtedness

We summarize below the principal terms of the agreements that will govern our new senior secured credit facilities. As the final terms of our new senior secured credit facilities have not been agreed upon, the final terms may differ from those set forth herein and any such differences may be significant. In addition, in connection with the syndication of our new senior secured credit facilities, the pricing and structure of our new senior credit facilities may be changed by the administrative agent, in consultation with us, subject to certain limitations. This summary is not a complete description of all of the terms of the agreements. Defined terms used herein and not defined will have the meanings ascribed thereto in the credit agreement governing our new senior secured credit facilities (the “credit agreement“).

New senior secured credit facilities

Summary. Our new senior secured credit facilities provides for the following:

| • | a six-year, up to $375.0 million Term Facility the proceeds of which will (i) repay certain of our existing debt; (ii) finance in part the Transactions, including the payment of fees and expenses incurred in connection therewith and (iii) for working capital; and |

| • | a five-year, up to $75.0 million Revolving Facility, which includes a Swingline Loan facility and is available from time to time until the fifth anniversary of the Closing Date. |

Incremental facility. Our credit agreement gives us the ability to request an increase in the amount of the Revolving Facility in an aggregate amount of up to $25.0 million.

Prepayments and amortization. Subject to customary and other exceptions, our new senior secured credit facilities shall be prepaid with: (i) 100% of the net cash proceeds of asset sales and dispositions by us and our subsidiaries; (ii) 100% of the net cash proceeds of issuances of certain debt obligations by us and our subsidiaries; and (iii) 50% of annual Excess Cash Flow subject to reduction to 25% at a leverage ratio below 4.00:1.00 and to 0% at a leverage ratio below 3.00:1.00. Each such prepayment shall be applied to our new senior secured credit facilities in the following manner: first, to any scheduled principal installments due within the following twelve months in direct order of maturity and, thereafter, ratably to all remaining principal repayment installments of the Term Facility and, second, to the outstanding under the Revolving Facility, but without reduction of the commitments thereunder.

Voluntary prepayments are permitted, in whole or in part, subject to minimum prepayment or reduction requirements; provided that voluntary prepayments of certain loans on a date other than the last day of the relevant interest period are subject to the payment of customary breakage costs, if any. Each such prepayment of the Term Facility shall be applied to reduce scheduled principal repayments as directed by us.

The unutilized portion of any commitment under our new senior secured credit facilities may be reduced or terminated by us at any time without penalty subject to minimum reduction requirements.

The credit agreement requires us to make quarterly amortization payments equal to 0.25% of the initial aggregate Term Borrowings to be payable at the end of each quarter prior to maturity and 94.5% of the initial aggregate Term Borrowings to be payable at maturity.

22

Interest rates and fees. The interest rates under our new senior secured credit facilities (other than in respect to Swingline Loans) are calculated, at our option, at either BBA LIBOR or the alternate base rate, which is the highest of the JPMorgan Chase Bank, N.A. prime rate, the Federal Funds rate plus 0.50%, BBA one-month LIBOR plus 1%, or, in respect of the Term Facility, 2.50%, plus, in each case, the Applicable Margin which differs for the Term Facility and the Revolving Facility. Overdue principal, interest, fees and other amounts shall bear interest at a rate that is 2.0% above the rate then borne by such borrowing. A commitment fee equal to 0.625% on the unused portion of our new senior secured credit facilities will accrue and will be payable until we deliver financial statements for the first full fiscal quarter following the Closing Date, and thereafter, a percentage per annum determined in accordance with a pricing grid set forth in the credit agreement.

Outstanding Letter of Credit fees will be equal to the Applicable Margin from time to time on Revolving Facility Eurodollar Rate advances on a per annum basis and will be payable quarterly in arrears and shared proportionately by the lenders under the Revolving Facility. In addition, a customary fronting fee will be payable to the fronting bank for its own account quarterly in arrears.

Guarantees. The obligations under the credit agreement are guaranteed by us, and each of our existing and future direct and indirect material domestic subsidiaries. The obligations under the credit agreement are also guaranteed by iPayment Holdings, Inc., our immediate parent.

Security. The loans are secured by a first-priority perfected security interest in substantially all of our assets and the assets of our guarantor affiliates, in each case now owned or later acquired, including a pledge of all equity interests and notes owned by us and our guarantor affiliates, including each of our present and future subsidiaries, provided that only 65% of the voting equity interests of our and our domestic subsidiaries’ “first-tier” non-U.S. subsidiaries are required to be pledged in respect of the obligations under the credit agreement. The loans are also secured by all proceeds and products of the property and assets described above.

Covenants. Our new senior secured credit facilities documentation contains certain customary covenants that, subject to significant exceptions, restrict our and our subsidiaries’ ability to, among other things (i) declare dividends or redeem or repurchase equity interests by us or our subsidiaries; (ii) prepay, redeem or purchase certain debt; (iii) incur liens and engage in sale-leaseback transactions; (iv) make loans and investments; (v) incur additional indebtedness; (vi) amend or modify specified debt and other material agreements; (vii) engage in mergers, acquisitions and asset sales; (viii) change accounting policies; (ix) become a general partner; (x) enter into speculative transactions; (xi) transact with affiliates; and (xii) engage in businesses that are not related to our existing business. In addition, under our credit agreement, we will be required to comply with specified financial ratios and tests, including a minimum Consolidated Interest Coverage Ratio and a maximum Senior Secured Leverage Ratio.

In determining compliance with the above financial covenant requirements, Consolidated EBITDA, Consolidated Funded Indebtedness and Consolidated Interest Charges will be calculated in accordance with the defined terms in the credit agreement for our new senior secured credit facilities. These definitions are expected to include a number of adjustments that will make them different from the terms EBITDA, consolidated debt and interest expense as they are commonly used. While Consolidated EBITDA is expected to include a number of adjustments similar to those used in calculating Adjusted EBITDA, it may differ from Adjusted EBITDA, and will differ from Consolidated Cash Flow as defined in the indenture for the notes.

23

In addition, our new senior secured credit facilities documentation contains certain customary affirmative covenants, including requirements for financials reports and other notices from us.

Events of default. Events of default, which are subject to grace periods and exceptions, as set forth in the credit agreement include, but are not limited to: (i) our failure to pay principal or interest when due; (ii) any representation or warranty proving to have been materially incorrect; (iii) covenant defaults; (iv) judgment defaults; (v) customary ERISA defaults; (vi) invalidity of loan documents or impairment of collateral; (vii) events of bankruptcy; and (viii) a change of control.

24

Principal shareholders and related party transactions

Principal shareholders

On May 10, 2006, Holdings acquired all of our issued and outstanding common stock. Holdings is a wholly-owned subsidiary of Investors. The general partner of Investors is iPayment GP, LLC, which we refer to as “GP.” Under the limited partnership agreement of Investors, GP is granted full authority to act on behalf of Investors and the limited partners of Investors may not participate in the management of Investors or vote for the election, removal or replacement of GP. The board of directors of GP is comprised of Gregory Daily and Carl Grimstad and any action by the board requires the vote of both directors. As a result, Messrs. Daily and Grimstad may be deemed to share beneficial ownership of all of our outstanding shares. Messrs. Daily and Grimstad disclaim beneficial ownership of such shares except to the extent of their respective pecuniary interests therein. Mr. Daily’s indirect percentage interest in us is 65.8% (including all of the Daily Interests) and Mr. Grimstad’s indirect percentage interest in us is 34.2% (including shares held by members of Mr. Grimstad’s family and related entities). None of our other executive officers beneficially own any of our shares, but may be issued equity interests or similar rights in Holdings or Investors if the Equity Redemption occurs.

If the Equity Redemption is consummated, Mr. Daily will resign as a director and officer, as applicable, of GP, Investors and each of Investors’ subsidiaries, including as our Chairman and Chief Executive Officer, and will no longer be affiliated with the Company. Further, Mr. Grimstad, our President, and parties related to him will control 100% of the equity interests and voting power of Investors and will have the power to elect all of the members of our board of directors. It is anticipated that Mr. Grimstad will become our Chairman and Chief Executive Officer and that the boards of directors of the Company and Holdings will consist of Mr. Grimstad, Mark Monaco, our Chief Financial Officer, and three independent directors to be determined after the consummation of the Equity Redemption.

See “Offering memorandum summary—Recent developments” for further information.

Related party transactions

In the ordinary course of business, our Company from time to time engages in transactions with other corporations or financial institutions whose officers or directors are also directors or officers of the Company. Transactions with such corporations and financial institutions are conducted on an arm’s-length basis and may not come to the attention of the directors or officers of the Company or of the other corporations or financial institutions involved. The board of directors of the Company does not consider that any such transactions would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and the board of directors of the Company is not currently aware of any related party transactions other than those set forth below.

During 2008, our shareholders repurchased $14.2 million of our existing senior subordinated notes. These repurchases caused us to recognize cancellation of debt income for tax purposes for the year ended December 31, 2008, which resulted in an increase to both our tax expense and our deferred tax assets of $1.3 million. The deferred tax asset will be realized as an income tax benefit over the remaining life of our existing senior subordinated notes. During 2009, we made adjustments that decreased the cancellation of debt income, which reduced income tax expense and deferred taxes by $0.6 million.

25

In 2010, iPayment and the financial services firm Perella Weinberg Partners LP (“Perella Weinberg”) entered into an engagement letter providing for Perella Weinberg to act as our financial advisor in connection with a potential change of control or similar transaction involving the Company. In March 2010, Adearo Holdings, LLC (“Adearo”), an entity majority owned and controlled by Mark Monaco, entered into a consulting agreement with Perella Weinberg. Mr. Monaco became Chief Financial Officer of the Company in October 2010. If the Equity Redemption is consummated, we will pay to Perella Weinberg a transaction fee pursuant to such engagement letter and, upon the payment by us of such fee to Perella Weinberg, Adearo will be entitled pursuant to the consulting agreement described above to receive from Perella Weinberg a payment of approximately $0.75 million to $1.12 million. See “Use of proceeds.”

26

| Item 8.01. | Other Events. |

On April 21, 2011, iPayment, Inc. (the “Company”) announced that the Company plans to offer $375 million in aggregate principal amount of Senior Notes due 2018 (the “Notes”). The Company also announced today that its parent, iPayment Holdings, Inc. (“Holdings”), plans to offer 150,000 units (the “Units”), consisting of $150,000,000 in aggregate principal amount of Senior Notes due 2018 and 150,000 warrants to purchase common stock of Holdings.

The net proceeds from the offering of the Notes and the Units, together with borrowings under the Company’s proposed new senior secured credit facilities, will be used to (i) permanently repay all of the outstanding indebtedness under the Company’s existing senior secured credit facilities; (ii) redeem and satisfy and discharge all of the Company’s existing senior subordinated notes; and (iii) make a distribution to the Company’s indirect parent, iPayment Investors, L.P. (“Investors”) in an amount sufficient to enable it to redeem and satisfy and discharge all of its existing PIK toggle notes and, subject to the satisfaction of certain conditions, to redeem all of the equity interests in Investors and its general partner held by the Company’s Chairman and Chief Executive Officer and by entities controlled by him or in trust for the benefit of his family members.

The Notes and Units are being offered only to qualified institutional buyers under Rule 144A of the Securities Act and to non-U.S. persons outside of the United States in compliance with Regulation S of the

27

Securities Act. The Notes and Units have not been registered under the Securities Act, any other federal securities laws, or the securities laws of any state, and until so registered, the Notes and Units may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws. This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities.

A copy of our press release announcing the offering of the Notes and Units is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits |

| 99.1 | Press Release of iPayment, Inc., dated April 21, 2011 (filed herewith). |

28

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| IPAYMENT, INC. | ||||

| By: | /s/ Mark C. Monaco | |||

| Name: | Mark C. Monaco | |||

| Title: | Chief Financial Officer | |||

Dated: April 21, 2011

29