Attached files

| file | filename |

|---|---|

| 8-K - Castle Brands Inc | v219262_8k.htm |

Investor Presentation –April 2011

Safe Harbor Statement MATTERS DISCUSSED IN THIS PRESENTATION CONTAIN FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. THESE STATEMENTS, WHICH INVOLVE RISKS AND UNCERTAINTIES, RELATE TO THE DISCUSSION OF OUR BUSINESS STRATEGIES AND OUR EXPECTATIONS CONCERNING FUTURE OPERATIONS, MARGINS, PROFITABILITY, LIQUIDITY AND CAPITAL RESOURCES AND TO ANALYSES AND OTHER INFORMATION THAT ARE BASED ON FORECASTS OF FUTURE RESULTS AND ESTIMATES OF AMOUNTS NOT YET DETERMINABLE. WHEN USED IN THIS PRESENTATION, THE WORDS "ANTICIPATE," "BELIEVE," "ESTIMATE," "MAY," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS IDENTIFY SUCH FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE MADE BASED ON EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS AFFECTING US AND ARE SUBJECT TO RISKS, UNCERTAINTIES, ASSUMPTIONS AND OTHER FACTORS RELATING TO OUR OPERATIONS AND BUSINESS ENVIRONMENTS, ALL OF WHICH ARE DIFFICULT TO PREDICT AND MANY OF WHICH ARE BEYOND OUR CONTROL, THAT COULD CAUSE OUR ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS TO DIFFER MATERIALLY FROM THOSE CONTEMPLATED, EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO, OUR HISTORY OF LOSSES AND EXPECTATION OF FURTHER LOSSES, THE ADEQUACY OF OUR CASH RESOURCES AND OUR ABILITY TO RAISE ADDITIONAL CAPITAL, OUR ABILITY TO EXPAND OUR OPERATIONS IN BOTH NEW AND EXISTING MARKETS, OUR ABILITY TO DEVELOP OR ACQUIRE NEW BRANDS, OUR RELATIONSHIPS WITH DISTRIBUTORS, THE SUCCESS OF OUR MARKETING ACTIVITIES, THE EFFECT OF COMPETITION IN OUR INDUSTRY AND ECONOMIC AND POLITICAL CONDITIONS GENERALLY, INCLUDING THE CURRENT RECESSIONARY ECONOMIC ENVIRONMENT AND CONCURRENT MARKET INSTABILITY, AND OTHER FACTORS

DETAILED IN PERIODIC REPORTS FILED BY CASTLE BRANDS WITH THE SECURITIES AND EXCHANGE COMMISSION.

Company Overview Company Evolution Refinanced and Restructured in 2008 Key Objectives Investment Highlights

Company Overview Castle Brands Inc. (“Castle” or the “Company”) engages in the development, importation, marketing and sale of premium spirits and wines. §The Company’s mission is to develop and grow its current portfolio of premium brands and to complement these brands through a combination of acquisitions, agency relationships and new product development. –Since its inception, Castle Brands has invested $100+ million to acquire and grow its portfolio, build strong U.S. and international routes to market and establish its distribution platform. –Listed on the NYSE AMEX since 2006 (NYSE AMEX:ROX); headquartered in New York, NY. –Fiscal year ended March 31, 2011 estimated revenue is forecast to be $31.8 million. Products are categorized into 6 categories: Rum, Liqueurs, Whiskey, Vodka, Fine Wine and Other. §The Company’s revenue contribution from these categories in calendar year 2010 were as follows: –Rum 34% / Liqueurs 25% / Whiskey 18% / Vodka 14% / Fine Wines 5% / Other 4%. The Company distributes its spirits and wines in the U.S., Europe and Latin America. §International segment contributed 13% of the Company’s sales in calendar year 2010. §Castle intends to expand its business operations in Asia and Eastern Europe.

Company Evolution 2003 2004 2005 2006 2007. 2008. 2009.2010 Castle Brands Inc. was formed Acquired the Roaring Water Bay Spirits Group Limited, owner of Boru Vodka, Clontarf Irish Whisky, and Brady’s Irish Cream Liquor Began aggressively building sales team Exclusive U.S. marketing agreement signed with I.L.A.R. (Pallini Limoncello) Acquired 60% of the shares of Gosling-Castle Partners, Inc. , which holds the worldwide rights to the Gosling’s rums and related products Completed Initial Public Offering (IPO) Acquired McLain & Kyne, Ltd. producer of Jefferson’s Bourbons Castle Brands entered into an agreement with Autentica Tequilera to launch a new brand of organic tequila, Tierras Refinanced and restructured Betts & Scholl wine acquired Added to portfolio de Fussigny Cognac & Hasse’s Pie Liqueurs

Refinanced & Restructured in 2008In October 2008, the Company was refinanced and restructured to strengthen its balance sheet and substantially reduce costs going forward. §The Company completed a $15 million private placement of Series A Preferred stock (which converted to common stock) with certain investors, including Vector Group Ltd. (NYSE:VGR) and Dr. Phillip Frost (Chairman of Teva Pharmaceuticals Ltd. (NASDAQ:TEVA), Chairman and CEO of OPKO Health, Inc. (NYSE AMEX:OPK), Founder, Chairman and CEO, Ivax Pharmaceuticals (acquired by Teva in 2006), Co-Founder of Key Pharmaceuticals and former Co-Vice Chairman of the Board of Governors of the American Stock Exchange. –Many of the investors have continued to show support for the Company by extending credit to the Company and acquiring additional equity in the Company. –Substantially all of the Company’s $19 million in then outstanding debt was converted to common stock. §In conjunction with the restructuring, Castle also made changes to strengthen its management team and Board of Directors. –Management team has significantly reduced both “Sales and Marketing” and “General and Administrative” expenses. –Cuts have not jeopardized one of the Company‘s core assets –the ability to offer nationwide distribution of its brands. –Gross Margin has been improved by increased focus on the Company’s more profitable markets and brands.

Key Objectives Since 2008, Adjusted EBITDA has improved significantly. (millions of USD) FY 2008 FY 2009 FY 2010 FY 2011E Adjusted EBITDA(1) (2) $ (16.9) $ (11.3) $ (5.0) $ (4.0)(3)(4) Loss from operations $ (29.5) $ (20.5) $ (5.8) $ (5.3) (1)Fiscal year numbers are for the 12 months ended March 31. (2)Earnings before interest, taxes, depreciation and amortization, or EBITDA, adjusted for allowances for doubtful accounts and obsolete inventory, non-cash compensation expense and severance charges is a key metric the Company uses in evaluating our financial performance. EBITDA is considered a non-GAAP financial measure as defined by Regulation G promulgated by the SEC under the Securities Act of 1933, as amended. The Company considers EBITDA, as adjusted, important in evaluating its performance on a consistent basis across various periods. Due to the significance of non-cash and non-recurring items, EBITDA, as adjusted, enables the Company’s Board of Directors and management to monitor and evaluate the business on a consistent basis. The Company uses EBITDA, as adjusted, as a primary measure, among others, to analyze and evaluate financial and strategic planning decisions regardingfuture operating investments and allocation of capital resources. The Company believes that EBITDA, as adjusted, eliminates items that are not indicative of our core operating performance, such as severance expense, or do not involve a cash outlay, such as stock-related compensation. EBITDA, as adjusted, should be considered in addition to, rather than as a substitute for, income from operations, net income and cash flows from operating activities. The following is a reconciliation of loss from operations to Adjusted EBITDA: Year ending March 31, FY 2008 FY 2009 FY 2010 FY 2011E(3) Loss from operations $ (29,524,075) $ (20,524,075) $ (5,789,643) $(5,329,104) Add: Depreciation and amortization 1,029,579 1,307,536 924,946 981,404 Goodwill impairment 8,750,000 4,845,287 -- Allowance for doubtful accounts 199,484 378,851 316,365 (8,165) Allowance for obsolete inventory 1,541,579 (360,133) (657,599) (24,589) Stock-based compensation expense 1,072,010 1,653,619 160,347 180,454 Severance charges -1,400,000 -200,000 Adjusted EBITDA $ (16,931,423) $ (11,298,915) $ (5,045,584) $ (4,000,000) (3) FY2011 is unaudited. (4) Loss in FY2011 includes an estimated $700K loss associated with the new wine business. Castle now has a clear path to profitability. §Continue increasing revenues and gross margins from core brands (Estimate $1.3 million increase in FY2012, current year). §Further cost reductions (Estimate $1.0 million reduction in FY2012, current year, including $500,000 from wine business, and additional cost savings from international operations and reduced consulting fees). §Increase earnings from potential new agency relationships (Estimate $150,000 in FY2012, current year). §Expect positive Adjusted EBITDA at revenue of approximately $41.4 million. Castle Brands believes that the prospect of profitability will promote "tipping point”. §Ability to attract new brands §Use stock or debt for new acquisitions §Improved stock valuation §Ability to strengthen marketing team §Access to traditional 3rdparty working capital financing

Investment Highlights Solid platform for growth and value creation. §Multi-brand company competing in several of the most attractive sectors in premium distilled spirits and wine. §Full distribution platform enabling nationwide sales. §International capability enabling worldwide distribution. §Proven track record of brand growth. §Additional growth prospects through expansion in Asian and Eastern European markets. §Strong potential for developing a break-outbrand success -can substantially increase the value of the Company. §Professional management team able to leverage resources and maximize performance.

Castle Brands Portfolio

Castle Brands Portfolio Boru Vodka Gosling’s RumTravis Hasse’s Pie Liqueurs Knappogue Castle Irish Whiskey Tierras TequilaPallini Limoncello A. De Fussigny Cognac Brady’s Irish Cream Liqueur Clontarf Irish WhiskeyCeltic Honey Liqueur Jefferson’s Bourbons Betts & Scholl Wine

Castle Premium Brands –(Gosling’s) Gosling’s is a flagship brand at Castle Brands and has the potential to become a “break-out” brand. §Premium rum brand with a 200-year history, imported from Bermuda. –Well positioned to grow in rum category. –Castle controls 60% interest in Gosling-Castle Partners, Inc., a global export venture between Castle Brands and the Gosling family. –Global sales rights for 15 years, with automatic extensions upon achieving certain sales targets. §Gosling’s Black Seal owns a delicious proprietary cocktail: trademarked Dark ‘n Stormy®known as “Bermuda’s national drink.” §The Dark ‘n Stormy®Drink (Gosling’s Rum, Ginger Beer and lime) is starting to sell well all around the country. –Gosling’s has grown from 78,000 cases in FY08 to an estimated 110,000 cases in FY2011 -an increase of 40% over 3 years. –Stormy Ginger Beer was launched 20 months ago and sold over 100,000 cases in FY2011; Castle anticipates launching a premixed Dark ‘n Stormy®in a can this summer to further establish the drink. §Forecast 17,000 cases of growth FY 2012, current year, which represents $400,000 of incremental gross margin on Gosling’s rum alone. 78,26688,585 95,033 109,1000 20,000 40,000 60,00080,000 100,000120,000 140,000 2008 2009 20102011E Source: Company’s internal data

Castle Premium Brands –(Jefferson’s Bourbon) Jefferson’s Bourbons are quickly becoming a success story in the “small batch” segment of the bourbon category. §Castle Brands enjoys 100% ownership of the brand. §Brand competes in the fast-growing super premium, small-batch bourbon category with three grades of bourbon: –Jefferson’s / Jefferson’s Reserve / Jefferson’s Presidential Select. §Jefferson’s Presidential Select 18 year old bourbon was launched in FY2010. –It received an exceptional 96 rating in the Malt Advocate. –It has successfully been used as a halo brand for the line and earns $500 per case margin. §Jefferson’s has grown from a tiny brand selling 3,000 cases in FY2008 to an estimated 9,200 cases in FY2011, last year, an increase of 250%. §Selling personalized barrels of Jefferson’s bourbon has dramatically improved individual store sales and accelerated the brand’s growth. –The barrel program has been extended to encompass Jefferson’s Presidential Select. §In FY2012, current year, Castle Brands intends to launch a limited edition Jefferson’s Rye whisky at a $5 premium per bottle more than the standard product. §Jefferson’s is showing the potential to be an umbrella brand that can support line extensions at higher prices than the standard product. 3,722 5,202 7,452 9,1660 2,0004,000 6,000 8,000 10,00012,000 2008 20092010 2011E Source: Company’s internal data

Castle Premium Brands Pallini Limoncello §Largest selling super premium Limoncello sold in the U.S. –Produced by ILAR SpA, manufacturers of Romana Sambuca. §Two other flavor extensions: –Pallini Peachcello, made with white peaches. –Pallini Raspicello, made from a combination of raspberries. §Castle Brands has 6-year, exclusive U.S. distribution rights for Pallini Limoncello and its related brand extensions, with automatic extensions upon achieving certain purchase targets. Knappogue Castle Irish Whiskey §12 year old single malt Irish whiskey. –Winner of multiple awards. §Recently repackaged to align with the graphics and product language of single malt scotch. §Castle Brands enjoys 100% ownership of the brand. Clontarf Irish Whiskey §Blended Irish whiskey, triple-distilled and aged in bourbon barrels. –Steady increase of sales over the past three years. §Undergoing redesign to create a more premium package and give it a unique identity centered around the battle of Clontarf in 1014. §Castle Brands enjoys 100% ownership of the brand.

Castle Premium Brands Boru Vodka §Produced in Ireland; high quality product that compares well with other premium vodkas. –Resides in the mid-premium sector of category, the largest, most dynamic and most competitive sector. §Three flavor extensions, including: –Boru Citrus / Boru Orange / Boru Crazzberry (a cranberry/raspberry fusion). §Castle Brands enjoys 100% ownership of the brand. Brady’s Irish Cream Liqueur §High quality Irish cream, made in small batches using Irish whiskey, fresh cream and natural flavors. –Package redesign positions it to compete well with Bailey’s, the category leader. §Recently introduced Brady’s Chocolate Mint Irish Cream. §Sales have grown at a double digit rate. §Castle Brands enjoys 100% ownership of the brand. Travis Hasse’s Original Pie Liqueurs §Competes in the lower proof “shooter” category, a dynamic and large sub-category of liqueurs. –Due to its appealing and unique taste, Hasse’s performs extremely well in consumer tastings -the primary tool being used to establish the brand. –Based on examples of several other similar products (Peachtree Schnapps) there is a strong possibility the brand can grow quickly. §In 2010, Castle formed DP Castle Partners, LLC to manage the global marketing and distribution for the brands. –Castle currently owns 20% of DP Castle Partners, LLC, but can increase its stake in the entity based on performance.

Castle Premium Brands A. De Fussigny Cognac §High-quality, beautifully packaged cognacs designed to compete with Remy Martin and other “grandes marques” of cognac. §Both a compelling story (the only cognac distilled, aged and bottled in Cognac) and an impactful packaging will enable Fussigny to make inroads into the premium cognac business. §Castle Brands recently took on US distribution rights to the brand. Celtic Crossing/Celtic Honey §Irish honey liqueur made with Irish whiskey. §In the process of redesign to provide a sleeker, more contemporary look. –Product will be re-launched as Celtic Honey to take advantage of the growing honey liqueur sub category. §Castle Brands enjoys 100% ownership of Celtic Honey. Tierras Tequila §Premium, top shelf, USDA certified organic tequila. –Small, steady sales §Available in several types: –Blanco / Reposado / Añejo §Castle Brands is the exclusive U.S. importer and marketer of Tierras. –Can earn 25% of equity in the brand based on volume. Wine Portfolio §Portfolio consists of Betts & Scholl, CC: and Casanuovo delle Cerbaie. §Betts & Scholl is a line of boutique, high quality wines each rated over 90 points by the Wine Spectator. –Current line consists of Hermitage Rouge, Hermitage Blanc, Australian Shiraz and two Australian Grenaches. §CC: is a new line of premium American wines consisting of Napa Valley Cabernet Sauvignon and Monterey Chardonnay. §Cerbaie is a high quality Brunello di Montalcino. §Castle enjoys 100% ownership of the Betts & Scholl and CC: brands.

Management Team Sales Force Sales Capability

Management Team Castle Brands is led by a proven team with many years of operational and financial experience. §Mark Andrews –Chairman and Founder –Founded American Exploration Company, a natural resources company in 1980. He served as its Chairman and CEO, taking the Company public and selling it Louis Dreyfus Natural Gas Corp. (LDNGC) in 1997. He also served as a Director at LGNDC. –Former Director of IVAX Corp. (from its founding) until its sale to Teva Pharmaceutical Industries Limited (NASDAQ:TEVA). –Life Trustee of New York Presbyterian Hospital in New York City. –Received a Bachelor of Arts from Harvard College and MBA from Harvard Business School. §Richard Lampen –President and Chief Executive Officer –President and CEO of Ladenburg Thalmann Financial Services Inc (NYSE AMEX:LTS). –Executive VP, Vector Group Ltd. (NYSE: VGR), holding company with business interests in consumer goods and real estate. –Former Managing Director and Senior Member, Leveraged Finance Group, Salomon Brothers Inc. –Former Partner & Co-Chairman of Corporate Department, Steel Hector & Davis, a law firm with headquarters in Miami, FL. –Received a Bachelor of Arts from the Johns Hopkins University and a JD from Columbia Law School. §John Glover –Chief Operating Officer –Over 30 years experience in marketing, commercial and general management in the spirits industry. –Former Senior VP Commercial Management of Remy Cointreau USA, where he was responsible for business development and analysis, strategic planning, marketing services and sales strategy. –Served in various roles in marketing and commercial management with International Distillers and Vintners before it merged with United Distillers and Vintners, a subsidiary of Diageo plc (LSE:DGE). Served as Marketing Director of Smirnoff Vodkas duringits rebranding. –Holds both Undergraduate and MBA degrees from Dartmouth College. §Alfred Small –Chief Financial Officer –Over 10 years experience in finance, operations and compliance in the spirits industry. –Senior Accountant at Grodsky Caporrino & Kaufman, practicing in consumer goods, wholesale distribution, and technology . –Bachelor of Science from the State University of New York and a Certified Public Accountant.

Sales Force Castle Brands has a strong sales force, with considerable sales experience. Collectively, sales team with their prior companies sold over 2 million cases annually.Kelley Spillane –Senior VP of U.S. Sales §Former VP of Sales, and was appointed to Executive VP of U.S. Sales in December 2003. §Served as Director of National Accounts at Carillon Importers Limited, a subsidiary of Diageo plc (LSE:DGE), and was promoted to director of special accounts, focusing on expanding sales in national accounts. §Ron Schaum –Sales Manager Mid Atlantic –20 years of experience; prior companies Charmer / Sunbelt, Allied Domeq. §Lee Royer –Sales Manager New England –36 years of experience; prior company Allied Domecq. §Michael Fleming –Sales Manager Midwest –21 years of experience; prior company Union Beverage Co. §John Milstead –Sales Manager West Coast –31 years of experience; prior companies Bacardi / White Rock. §Bill Boykin –Sales Manager Southeast –31 years of experience; prior company Seagram’s. §Colin Wells –Sales Manager Mountain / North West –11 years of experience; prior company Freshies.

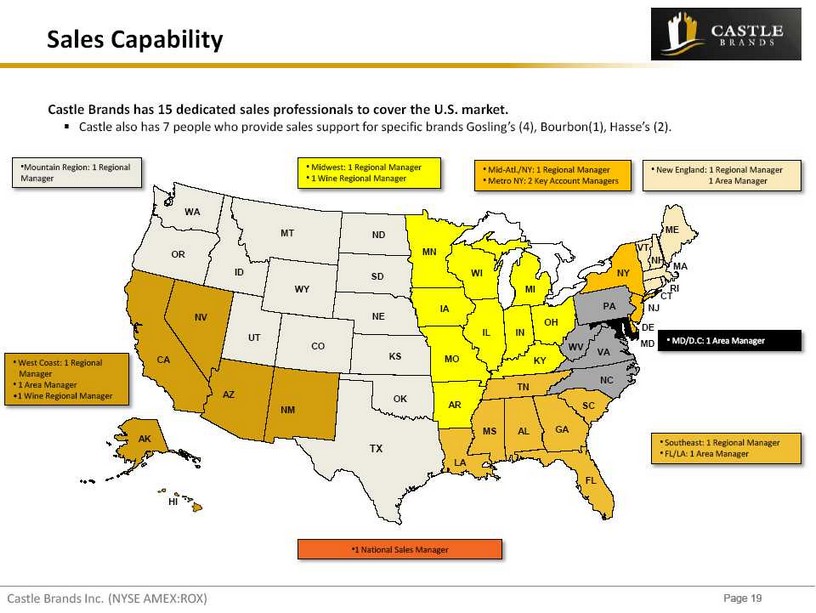

Sales Capability MT WY ID WA OR NV UT CA AZ ND SD NE CO NM TX OK KS AR LA MO IA MN WI IL IN KY TN MS AL GA FL SC NC VA WV OH MI NY PA MD DE NJ CT RI MA ME VT NH HI •New England: 1 Regional Manager1 Area Manager •Mid-Atl./NY: 1 Regional Manager •Metro NY: 2 Key Account Managers •Southeast: 1 Regional Manager •FL/LA: 1 Area Manager •West Coast: 1 Regional Manager •1 Area Manager •1 Wine Regional Manager •Midwest: 1 Regional Manager •1 Wine Regional Manager •Mountain Region: 1 Regional Manager •1 National Sales Manager Castle Brands has 15 dedicated sales professionals to cover the U.S. market. §Castle also has 7 people who provide sales support for specific brands Gosling’s (4), Bourbon(1), Hasse’s (2).

Industry Overview –Global

Industry Overview –Global According to the Distilled Spirits Council, the spirits and wine industry continued to grow even in the 2008 recession. §The super-premium and above price segments are likely to see the highest increase in percentage terms, as consumers become more confident; price/mix will improve as consumers trade up within categories. §Consumers have returned to high-end/super-premium spirits; revenue in the super-premium category grew 11%. India, China and the U.S. are expected to be the three fastest-growing markets for spirits globally through 2015. §All spirit categories to show growth in India, with vodka predicted to show the highest percentage growth. §In China, Scotch will lead growth, up by 7.8% to reach 2.8 million cases in 2015. §In the United States, the vodka market alone is likely to gain over 12 million cases. 1.31.2011 0% 1% 2% 3% 4% 5% 6% 7% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 )Source: First Research. Beer, Wine, and Spirits Distributorships. 1.31.2011Source: First Research. Beer, Wine, and Spirits Distributorships.

Financials –Income Statement Financials –Public Comparables Financials –Capitalization Table

Financials –Income Statement Castle Brands is poised to have a strong fiscal 2012. §Company is projecting revenue growth from FY2011E ($31.9 million) to FY2012E ($38.1 million), an increase of 20%. §Company is projecting to have positive Adjusted EBITDA when revenues reach approximately $41.4 million. –Continue increasing revenues and gross margins from core brands (Estimate $1.3 million increase in FY2012, current year). –Further cost reductions (Estimate $1.0 million reduction in FY2012, current year, including $500,000 from wine business, and additional cost savings from international operations and reduced consulting fees). –Increase earnings from potential new agency relationships (Estimate $150,000 in FY2012, current year). (1)2010 numbers are for the trailing 12 months ended as of December 31, 2010. (2)Fiscal year numbers are for the 12 months ending March 31. (3)The following is a reconciliation of loss from operations to Adjusted EBITDA (See note 2 on slide 7 for an explanation of theCompany’s use of Adjusted EBITDA:Year ending March 31,FY 2010 FY 2011E FY 2012E Loss from operations $ (5,789,643) $ (5,329,104) $ (2,783,243)Add: Depreciation and amortization 924,946 981,404 944,788 Allowance for doubtful accounts 316,365 (8,165) 60,200Allowance for obsolete inventory (657,599) (24,589) -Stock-based compensation expense 160,347 180,454 210,000 Severance charges -200,000 -Adjusted EBITDA $ (5,045,584) $ (4,000,000) $ (1,568,255)

Financials -Public Comparables Castle Brands Inc.(NYSE AMEX:ROX) Castle Brands competes against significantly larger, multinational spirit and distribution companies. Castle Brands views this as a competitive edge as it allows the Company to enter into agency distribution agreements and acquire brands by being more responsive to individual brand owners, utilizing flexibility in transaction structures and providing partners the option to retain local production and ‘‘home’’ market sales. Public liquor companies trade at 3.8x EV/Revenues. Public small-cap beverage companies trade at 2.4x EV/Revenues. Financials –Capitalization TableThe Company has 107,202,145 shares of outstanding common stock as of April 19th, 2011.Castle Brands Inc.(NYSE AMEX:ROX) Page 25 OWNERSHIP TABLE(1) Holder Name % of Outstanding Officers & Directors Phillip Frost, M.D. (Director) 30.8% Dennis Scholl (Director) 3.3% Mark Andrews (Director & Chairman) 2.8% Glenn Halpryn (Director) 2.7% Richard Lampen (Director & CEO) 0.2% Other Officers & Directors 0.6% Total Officer and Directors 40.4% Greater than 5% Shareholders Vector Group Ltd. 10.7% I.L.A.R. S.p.A. (Pallini) 8.0% Lafferty Limited 6.0% Total Greater than 5% Shareholders 24.7% Public & Other 34.9%

CAPITALIZATION TABLE Description Number Common Shares Outstanding 107,202,145 Stock Options (Weighted Average Strike Price of $0.92)(2) 1,685,400 (1)Sources include the Company’s public filings with the SEC and filings by significant shareholders. (2)Source, Company’s internal data (April 15, 2010). Transaction Summary

Castle Brands Inc. 122 East 42ndStreet, Suite 4700 New York, NY 10168 Office: 646.356.0200 Toll Free: 800.882.8140 Fax: 646.356.0222 For any additional questions or comments please contact: info@castlebrandsinc.com