Attached files

| file | filename |

|---|---|

| 8-K - CAPITAL ONE FINANCIAL CORPORATION 8-K 4-21-2011 - CAPITAL ONE FINANCIAL CORP | form8k.htm |

| EX-99.2 - EXHIBIT 99.2 - CAPITAL ONE FINANCIAL CORP | ex99_2.htm |

| EX-99.1 - EXHIBIT 99.1 - CAPITAL ONE FINANCIAL CORP | ex99_1.htm |

First Quarter 2011 Results

April 21, 2011

Exhibit 99.3

2

April 21, 2011

Forward-looking statements

Please note that the following materials containing information regarding Capital One’s financial performance speak only as of the particular date or dates

indicated in these materials. Capital One does not undertake any obligation to update or revise any of the information contained herein whether as a result

of new information, future events or otherwise.

indicated in these materials. Capital One does not undertake any obligation to update or revise any of the information contained herein whether as a result

of new information, future events or otherwise.

Certain statements in this presentation and other oral and written statements made by Capital One from time to time are forward-looking statements,

including those that discuss, among other things, strategies, goals, outlook or other non-historical matters; projections, revenues, income, returns,

accruals for claims in litigation and for other claims against Capital One, earnings per share or other financial measures for Capital One; future financial

and operating results; Capital One’s plans, objectives, expectations and intentions; and the assumptions that underlie these matters. To the extent that

any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities

Litigation Reform Act of 1995. Numerous factors could cause Capital One’s actual results to differ materially from those described in such forward-looking

statements, including, among other things: general economic and business conditions in the U.S., the U.K., Canada, or Capital One’s local markets,

including conditions affecting employment levels, interest rates, consumer income and confidence, spending and savings that may affect consumer

bankruptcies, defaults, charge-offs and deposit activity; an increase or decrease in credit losses (including increases due to a worsening of general

economic conditions in the credit environment); financial, legal, regulatory, tax or accounting changes or actions, including the impact of the Dodd-Frank

Wall Street Reform and Consumer Protection Act and the regulations promulgated thereunder; developments, changes or actions relating to any litigation

matter involving Capital One; increases or decreases in interest rates; Capital One’s ability to access the capital markets at attractive rates and terms to

capitalize and fund its operations and future growth; the success of Capital One’s marketing efforts in attracting and retaining customers; increases or

decreases in Capital One’s aggregate loan balances or the number of customers and the growth rate and composition thereof, including increases or

decreases resulting from factors such as shifting product mix, amount of actual marketing expenses Capital One incurs and attrition of loan balances; the

level of future repurchase or indemnification requests Capital One may receive, the actual future performance of mortgage loans relating to such requests,

the success rates of claimants against Capital One, any developments in litigation and the actual recoveries Capital One may make on any collateral

relating to claims against Capital One; the amount and rate of deposit growth; changes in the reputation of or expectations regarding the financial

services industry or Capital One with respect to practices, products or financial condition; any significant disruption in Capital One’s operations or

technology platform; Capital One’s ability to maintain a compliance infrastructure suitable for its size and complexity; Capital One’s ability to control costs;

the amount of, and rate of growth in, Capital One’s expenses as its business develops or changes or as it expands into new market areas; Capital One’s

ability to execute on its strategic and operational plans; any significant disruption of, or loss of public confidence in, the United States Mail service affecting

Capital One’s response rates and consumer payments; Capital One’s ability to recruit and retain experienced personnel to assist in the management and

operations of new products and services; changes in the labor and employment markets; the risk that cost savings and any other synergies from Capital

One’s acquisitions may not be fully realized or may take longer to realize than expected; disruptions from Capital One’s acquisitions negatively impacting

Capital One’s ability to maintain relationships with customers, employees or suppliers; fraud or misconduct by Capital One’s customers, employees or

business partners; competition from providers of products and services that compete with Capital One’s businesses; and other risk factors listed from time

to time in reports that Capital One files with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the Annual Report on

Form 10-K for the year ended December 31, 2010. You should carefully consider the factors discussed above in evaluating these forward-looking

statements. All information in these slides is based on the consolidated results of Capital One Financial Corporation, unless otherwise noted. A

reconciliation of any non-GAAP financial measures included in this presentation can be found in Capital One’s most recent Form 8-K filed April 21, 2011,

available on Capital One’s website at www.capitalone.com under “Investors.”

including those that discuss, among other things, strategies, goals, outlook or other non-historical matters; projections, revenues, income, returns,

accruals for claims in litigation and for other claims against Capital One, earnings per share or other financial measures for Capital One; future financial

and operating results; Capital One’s plans, objectives, expectations and intentions; and the assumptions that underlie these matters. To the extent that

any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities

Litigation Reform Act of 1995. Numerous factors could cause Capital One’s actual results to differ materially from those described in such forward-looking

statements, including, among other things: general economic and business conditions in the U.S., the U.K., Canada, or Capital One’s local markets,

including conditions affecting employment levels, interest rates, consumer income and confidence, spending and savings that may affect consumer

bankruptcies, defaults, charge-offs and deposit activity; an increase or decrease in credit losses (including increases due to a worsening of general

economic conditions in the credit environment); financial, legal, regulatory, tax or accounting changes or actions, including the impact of the Dodd-Frank

Wall Street Reform and Consumer Protection Act and the regulations promulgated thereunder; developments, changes or actions relating to any litigation

matter involving Capital One; increases or decreases in interest rates; Capital One’s ability to access the capital markets at attractive rates and terms to

capitalize and fund its operations and future growth; the success of Capital One’s marketing efforts in attracting and retaining customers; increases or

decreases in Capital One’s aggregate loan balances or the number of customers and the growth rate and composition thereof, including increases or

decreases resulting from factors such as shifting product mix, amount of actual marketing expenses Capital One incurs and attrition of loan balances; the

level of future repurchase or indemnification requests Capital One may receive, the actual future performance of mortgage loans relating to such requests,

the success rates of claimants against Capital One, any developments in litigation and the actual recoveries Capital One may make on any collateral

relating to claims against Capital One; the amount and rate of deposit growth; changes in the reputation of or expectations regarding the financial

services industry or Capital One with respect to practices, products or financial condition; any significant disruption in Capital One’s operations or

technology platform; Capital One’s ability to maintain a compliance infrastructure suitable for its size and complexity; Capital One’s ability to control costs;

the amount of, and rate of growth in, Capital One’s expenses as its business develops or changes or as it expands into new market areas; Capital One’s

ability to execute on its strategic and operational plans; any significant disruption of, or loss of public confidence in, the United States Mail service affecting

Capital One’s response rates and consumer payments; Capital One’s ability to recruit and retain experienced personnel to assist in the management and

operations of new products and services; changes in the labor and employment markets; the risk that cost savings and any other synergies from Capital

One’s acquisitions may not be fully realized or may take longer to realize than expected; disruptions from Capital One’s acquisitions negatively impacting

Capital One’s ability to maintain relationships with customers, employees or suppliers; fraud or misconduct by Capital One’s customers, employees or

business partners; competition from providers of products and services that compete with Capital One’s businesses; and other risk factors listed from time

to time in reports that Capital One files with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the Annual Report on

Form 10-K for the year ended December 31, 2010. You should carefully consider the factors discussed above in evaluating these forward-looking

statements. All information in these slides is based on the consolidated results of Capital One Financial Corporation, unless otherwise noted. A

reconciliation of any non-GAAP financial measures included in this presentation can be found in Capital One’s most recent Form 8-K filed April 21, 2011,

available on Capital One’s website at www.capitalone.com under “Investors.”

3

April 21, 2011

Net Interest Income

Non-Interest Income

Revenue

Marketing Expense

Operating Expense

Pre-Provision Earnings (before tax)

Net Charge-offs

Other

Allowance Build (Release)

Provision Expense

Discontinued Operations, net of tax

Total Company (after tax)

EPS

Tax Expense

Pretax Income

$MM

Operating Earnings (after tax)

First quarter 2011 earnings were $2.21 per share, up 45% from the prior

quarter

quarter

Non-Interest Expense

3,140

942

4,082

276

1,886

2,162

1,920

1,145

(50)

(561)

534

1,016

1,032

(16)

$2.21

1,386

354

Q111

3,023

939

3,962

308

1,783

2,091

1,871

1,394

(8)

(547)

839

697

701

(4)

$1.52

1,032

331

2

Q410

2

4%

0%

3%

10%

(6)%

(3)%

3%

18%

525%

3%

36%

46%

47%

(300)%

34%

(7)%

45%

% Change

Highlights

• Interest income increase driven by

margin expansion

margin expansion

• Non-interest expense increased

modestly as one-time operating

costs were partially offset by

seasonally lower marketing costs

modestly as one-time operating

costs were partially offset by

seasonally lower marketing costs

• Improvement in credit led to lower

charge-offs and continued

allowance release

charge-offs and continued

allowance release

• Tax rate decrease driven by IRS

settlements in the quarter

settlements in the quarter

4

April 21, 2011

Margins increased in the quarter

Q1 Margin Expansion

• Higher asset yields

• Improving credit trends and outlook

• Modest improvement in cost of funds

Drivers of Future Margin Trends

• Competitive dynamics

• Asset mix

• Credit trends

Margins as % of Managed Assets

Revenue Margin

Net Interest Margin

5

April 21, 2011

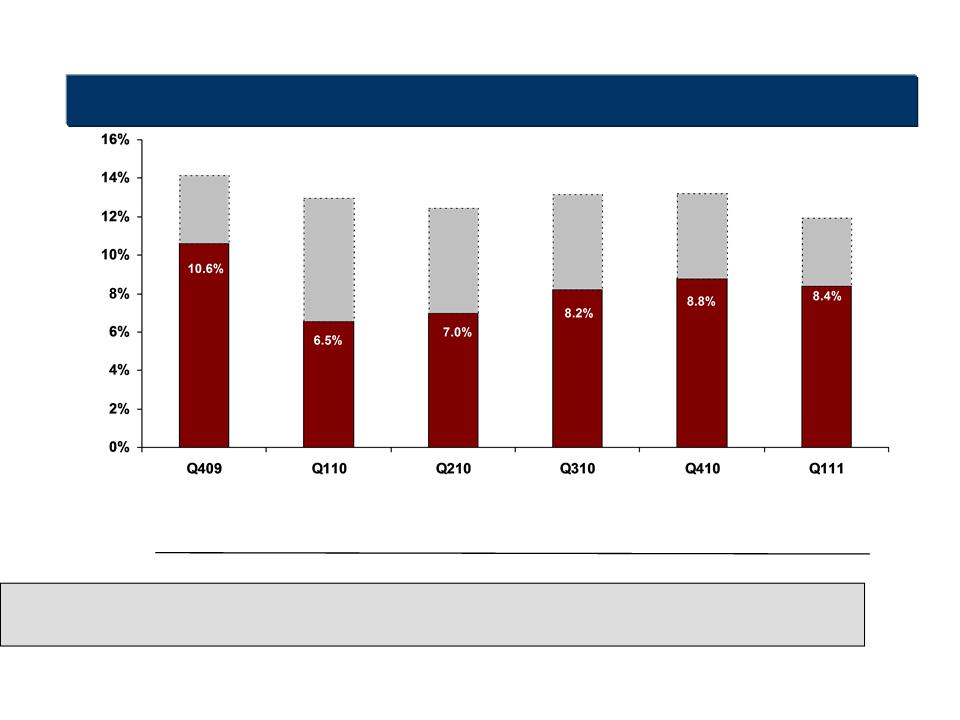

Our capacity to generate capital remains strong

Tier 1 Common Equity + Allowance Ratio to Risk-Weighted Assets

Allowance

Tier 1 Common

14.2%

13.0%

12.5%

13.2%

13.2%

1

1 Tier 1 common equity ratio is a non-GAAP measure calculated based on Tier 1 common equity divided by risk-

weighted assets. See "Exhibit 99.2—Table 12: Reconciliation of Non-GAAP Measures and Calculation of Regulatory

Capital Measures" for the calculation of this ratio.

weighted assets. See "Exhibit 99.2—Table 12: Reconciliation of Non-GAAP Measures and Calculation of Regulatory

Capital Measures" for the calculation of this ratio.

Disallowed DTA

RWA

EOP Loans

(0)

(2.2)

(2.0)

(1.3)

(1.1)

116

120

124

125

127

137

130

127

126

126

(1.4)

142

124

12.0%

Tier 1 Common excluding

disallowed DTA

disallowed DTA

($B)

12.3

10.1

10.7

11.5

12.3

13.4

Tier 1 Common

12.3

7.9

8.7

10.2

11.2

12.0

6

April 21, 2011

Loan balances declined modestly, reflecting expected seasonal trends

Liability Highlights

Asset Highlights

Total Cost

of Funds 1.76% 1.69% 1.64% 1.50% 1.41%

of Funds 1.76% 1.69% 1.64% 1.50% 1.41%

End of Period Assets

Domestic Card

Commercial

Int’l Card

Consumer

$B

Other

Cash & Cash

Equivalents

Securities

• End of period loans declined ~$1.9 billion

– Run-off portfolios down ~$1.0 billion

– Decline excluding run-off ~$800 million

• Average loans declined ~$400 million

• Cost of funds decreased to 1.41%

• Continued shift in funding to lower priced deposits

• Loan to deposit ratio of 0.99

7

April 21, 2011

Credit improvement in our consumer businesses continues to run

ahead of broader economic indicators

ahead of broader economic indicators

Domestic Credit Card ($51.9B*)

Net Charge-off Rate

Home Loan ($12.0B*)

International Credit Card ($8.7B*)

Net Charge-off Rate

30+ Day Delinquency Rate

Net Charge-off Rate

30+ Day Performing

Delinquency Rate

Delinquency Rate

Net Charge-off Rate

30+ Day Performing

Delinquency Rate

Delinquency Rate

* Average assets for Q1

8

April 21, 2011

Commercial Banking credit metrics have stabilized and improved

modestly over the last four quarters

modestly over the last four quarters

Total Commercial Banking ($29.8B*)

Nonperforming

Asset Rate

Asset Rate

Commercial & Multi-Family Real Estate ($13.3B*)

Nonperforming

Asset Rate

Asset Rate

Charge-off

Rate

Rate

Total Commercial Lending

Excluding Small Ticket CRE ($28.0B*)

Excluding Small Ticket CRE ($28.0B*)

Nonperforming

Asset Rate

Asset Rate

Charge-off

Rate

Rate

Nonperforming

Asset Rate

Asset Rate

Charge-off

Rate

Rate

* Average assets for Q1

9

April 21, 2011

Capital One is well positioned to deliver and sustain attractive returns and

generate capital

generate capital

Local Banking

Commercial

Banking

Banking

Strong and Resilient Balance Sheet

Retail

Banking

• Access to Assets

• Strong ROAs

• Leading Brand Scale

• Low Risk Commercial Assets

• Core Deposit Funding

• Banking Relationships

Card

Auto

National Scale

Brand

Moderate growth

Strong returns

Strong capital generation

10

April 21, 2011

Appendix

11

April 21, 2011

Strong credit continues to drive Domestic Card profits

• Revenue margin increased 56 bps from

Q4 driven by favorable credit trends and a

modest increase in fee revenue

Q4 driven by favorable credit trends and a

modest increase in fee revenue

• Non-interest expenses increased due to

higher legal expenses in Q1 partially offset

by seasonally lower marketing expenses

higher legal expenses in Q1 partially offset

by seasonally lower marketing expenses

• Credit improvement continued

–Lower provision from declining

charge-offs

charge-offs

– Delinquency rate improved 50 bps

from Q4

from Q4

• Ending loans declined by $3.3B driven by

seasonal decreases and closed end loan

run-off

seasonal decreases and closed end loan

run-off

• Purchase volume declined by $2.0B due to

seasonal patterns

seasonal patterns

• Purchase volume increased 14%

from Q1 2010

from Q1 2010

Net interest income

Non-interest income

Total revenue

Provision for loan and lease losses

Non-interest expenses

Income before taxes

Income taxes

Net income

Selected Metrics

Period end loans held for investment

Average loans held for investment

Loans held for investment yield

Revenue margin

Net charge-off rate

30+ day delinquency rate

Purchase volume

Earnings

(in millions)

Q1 2010

Q1 2011

Highlights

583

230

990

2,234

1,014

360

654

14.65%

17.22%

3.59%

1,651

6.20%

618

1,096

809

2,483

578

206

372

56,228

58,108

14.78%

17.09%

5.30%

21,988

1,865

10.48%

Q4 2010

594

505

935

2,215

775

276

499

53,849

53,189

13.57%

16.66%

4.09%

26,985

1,621

7.28%

50,570

51,889

25,024

Domestic Card

12

April 21, 2011

International Card performance was driven primarily by the inclusion of HBC

HBC Acquisition Drove the Following

• $1.2B higher loans and an associated

increase in revenue compared to Q4

increase in revenue compared to Q4

• Inclusion of the HBC business drove non-

interest expense higher by approximately

$30MM for the quarter

interest expense higher by approximately

$30MM for the quarter

• Higher provision expense was due

primarily to a one-time ALLL build for HBC

of $105MM

primarily to a one-time ALLL build for HBC

of $105MM

Net interest income

Non-interest income

Total revenue

Provision for loan and lease losses

Non-interest expenses

Income before taxes

Net income (loss)

Selected Metrics

Period end loans held for investment

Average loans held for investment

Loans held for investment yield

Revenue margin

Net charge-off rate

30+ day delinquency rate

Purchase volume

Earnings

(in million)

Income taxes (benefit)

Q1 2010

Q1 2011

International Card

91

220

188

381

(27)

(16)

(11)

16.65%

17.52%

5.55%

290

5.74%

100

79

105

348

164

47

117

7,578

7,814

15.66%

17.81%

6.39%

1,936

248

8.83%

Q4 2010

78

84

121

327

122

35

87

7,522

7,419

16.82%

17.63%

5.75%

2,394

249

6.68%

8,735

8,697

2,773

Highlights

13

April 21, 2011

Commercial Banking net income was higher in Q1 due to lower provision

expenses

expenses

• Revenue and average loans remained

relatively stable compared to Q4

relatively stable compared to Q4

• Non-interest expenses decreased due in

part to lower legal and foreclosure

expenses

part to lower legal and foreclosure

expenses

• Provision expenses decreased $49MM

from Q4 due to a decline in charge-offs

from lower loss severities

from Q4 due to a decline in charge-offs

from lower loss severities

• Deposits increased by $1.6B from Q4

mainly driven by growth in Money Market /

Savings accounts and DDA

mainly driven by growth in Money Market /

Savings accounts and DDA

Net interest income

Non-interest income

Total revenue

Provision for loan and lease losses

Non-interest expenses

Income (loss) before taxes

Net income (loss)

Selected Metrics

Period end loans held for investment

Average loans held for investment

Loans held for investment yield

Period end deposits

Average deposits

Deposit interest expense rate

Core deposit intangible amortization

Net charge-off rate

Earnings

Nonperforming loans as a % of

loans HFI

loans HFI

Nonperforming asset rate

(in millions)

Income taxes (benefit)

Q1 2010

Q1 2011

Highlights

Commercial Banking

71

(15)

177

392

230

82

148

4.80%

24,244

0.79%

321

0.55%

1.95%

1.84%

42

238

192

354

(76)

(27)

(49)

29,612

29,723

5.03%

21,605

21,859

14

1.37%

312

0.72%

2.64%

2.48%

Q4 2010

49

34

207

385

144

51

93

29,742

29,617

5.13%

22,630

22,808

13

1.43%

336

0.61%

1.80%

1.66%

11

24,138

29,793

30,017

14

April 21, 2011

Consumer Banking net income increased by $95MM in Q1 from Q4

• Revenue increased by $23MM from Q4

driven by higher margins in Auto

driven by higher margins in Auto

• Non-interest expenses decreased by

$30MM due primarily to lower marketing

costs

$30MM due primarily to lower marketing

costs

• Provision expenses decreased by nearly

50% from Q4 due to better credit

performance in auto, mortgage and retail

banking

50% from Q4 due to better credit

performance in auto, mortgage and retail

banking

• Ending loans decreased slightly from Q4

with an increase in auto loans offset by

continued home loan run-off

with an increase in auto loans offset by

continued home loan run-off

• Period end deposits were higher by $3.4B

in Q1 driven by increases in Money

Market/Savings accounts

in Q1 driven by increases in Money

Market/Savings accounts

Net interest income

Non-interest income

Total revenue

Provision for loan and lease losses

Non-interest expenses

Income before taxes

Net income

Selected Metrics

Period end loans held for investment

Average loans held for investment

Loans held for investment yield

Auto loan originations

Period end deposits

Average deposits

Deposit interest expense rate

Core deposit intangible amortization

Earnings

Nonperforming loans as a % of

loans HFI

loans HFI

Nonperforming asset rate

Net charge-off rate

30+ day performing delinquency rate

Period end loans serviced for others

(in millions)

Income taxes

3.42%

1,169

1,212

Q1 2010

Q1 2011

Highlights

Consumer Banking

186

95

740

334

119

215

9.60%

86,355

1.06%

983

83,884

2.00%

1.84%

1.57%

316

50

688

474

169

305

36,383

38,245

8.96%

1,343

76,883

896

75,115

1.62%

3.90%

26,778

1.27%

38

2.03%

1.76%

4.28%

1,146

Q4 2010

196

189

770

187

67

120

34,383

34,751

9.20%

2,217

82,959

1.13%

34

950

81,834

2.17%

1.97%

1.98%

20,689

34,306

34,236

2,571

35

19,956