Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - MIKOJO Inc | mikojo10kaex312_4142011.htm |

| EX-31.1 - EXHIBIT 31.1 - MIKOJO Inc | mikojo10kaex311_4142011.htm |

| EX-32.1 - EXHIBIT 32.1 - MIKOJO Inc | mikojo10kaex321_4142011.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

[x] Annual Report Pursuant to Section 13 or 15(D) of the Securities Exchange Act of 1934

for the fiscal year ended June 30, 2010

Transition Report Under Section 13 or 15(D) of the Securities Exchange Act of 1934

for the transition period from _______________ to _______________

Commission File Number: 000-53185

MIKOJO INCORPORATED

(Exact name of small Business Issuer as specified in its charter)

|

Delaware

|

95-3797580

|

|

(State or other jurisdiction of incorporation or

|

(IRS Employer Identification No.)

|

|

organization)

|

|

|

1840 Gateway Drive, Suite 200

|

|

|

Foster City, CA

|

94404

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Issuer's telephone number, including area code: (650) 283-2653

n/a

Former address if changed since last report

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001 per share

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ] Yes No [ ]

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

Accelerated Filer

|

Non-Accelerated Filer

(Do not check if a smaller reporting company)

|

Smaller Reporting Company

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X ] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $15,966,736

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 28,061,200 shares of common stock par value $0.0001 as of April 14, 2011.

DOCUMENTS INCORPORATED BY REFERENCE:

None

TABLE OF CONTENTS

|

PART I

|

||||

|

ITEM 1.

|

BUSINESS

|

3 | ||

|

ITEM 1A.

|

RISK FACTORS

|

5 | ||

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

19 | ||

|

ITEM 2.

|

PROPERTIES

|

19 | ||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

19 | ||

|

ITEM 4.

|

(REMOVED AND RESERVED)

|

19 | ||

|

PART II

|

||||

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

19 | ||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

21 | ||

|

ITEM 7.

|

MANAGEMENT’S CONDITION AND RESULTS OF OPERATION DISCUSSION AND ANALYSIS OF FINANCIAL

|

21 | ||

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

27 | ||

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

27 | ||

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

45 | ||

|

ITEM 9A

|

CONTROLS AND PROCEDURES

|

45 | ||

|

ITEM 9B.

|

OTHER INFORMATION

|

45 | ||

|

PART III

|

||||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

45 | ||

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

47 | ||

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

48 | ||

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

49 | ||

|

ITEM 14

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

51 | ||

|

PART IV

|

||||

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

52 | ||

|

SIGNATURES

|

54 |

- 2 -

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Report”), including ”Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future events and the future results of Mikojo Incorporated and its consolidated subsidiaries (the “Company”) that are based on management’s current expectations, estimates, projections and assumptions about the Company’s business. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “sees,” “estimates” and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, including, but not limited to, those discussed in the “Risk Factors” section in Item 1A, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and elsewhere in this Report as well as those discussed from time to time in the Company’s other Securities and Exchange Commission filings and reports. In addition, such statements could be affected by general industry and market conditions. Such forward-looking statements speak only as of the date of this Report or, in the case of any document incorporated by reference, the date of that document, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this Report. If we update or correct one or more forward-looking statements, investors and others should not conclude that we will make additional updates or corrections with respect to other forward-looking statements.

When used in this report, the terms “Mikojo,” “Company,” “we,” “our,” and “us” refer to Mikojo Incorporated.

PART I

|

ITEM 1.

|

BUSINESS.

|

Business of Mikojo.

Mikojo Pty. Ltd., an Australian corporation (“Mikojo (Aust)”), was founded in 2007. In 2008, Mikojo (Australia) launched a federated Internet search engine and has entered into a Search Distribution Agreement (“SDA”) with InfoSpace Europe Limited (“InfoSpace”) wherein InfoSpace has agreed to permit Mikojo (Aust) to incorporate certain search content and services into Mikojo (Aust)’s website. InfoSpace is a distributor of Google web content and has certain proprietary metasearch technology that combines the top results from the leading search engines (such as Google and YaHoo). Pursuant to the terms of the SDA, Mikojo (Aust) utilizes this search technology on its Mikojo.com website and has a revenue sharing agreement with respect to advertising revenues which are developed through its website. InfoSpace has established long-term advertising distribution contracts with various companies, including Google, Inc. and also has strategic advertising partnerships with MicroSoft, Yahoo, LookSmart and others.

On March 17, 2009, Mikojo (Aust) contributed all of its assets, including but not limited to its rights under the SDA, to Mikojo in exchange for the issuance of 12,000,000 newly issued common shares of Mikojo. Thereafter, Mikojo began generating cash flows pursuant to the terms of the SDA. Essentially, by indirectly acting as a distributor of advertising links originated by Google, Mikojo is compensated by InfoSpace based on the revenues it receives from Google calculated based on an “clicks” on such advertising generated through the Mikojo website. Mikojo then, in turn, may provide the click to other third party search engines (for example, YaHoo), for which it woulod also receive credit toward the generation of additional revenues.

Mikojo’s only current customer is InfoSpace, which client relationship is governed by the SDA. The SDA has a three-year term expiring on March 1, 2012 and is exclusive for that period. Mikojo has negotiated certain similar agreements with YaHoo, Inc., Looksmart, Ltd. and others., however, due to the aforementioned exclusivity agreement with InfoSpace, such other agreements will be utilized only if the agreement with InfoSpace is terminated.

- 3 -

LOBIS, Inc., a Delaware corporation (“LOBIS”), was formed in 2008 for the purpose of acquiring certain assets and patented technology from Computing Services Support Solutions, Inc. (“C3S”). Pursuant to the terms of an Asset and Patent Purchase Agreement (“LOBIS APA”) with C3S, LOBIS agreed to acquire C3S’ TriggerWare™ Server and Software (which is covered by US Patent No. 6,629,106 B1), subject to the terms and conditions of that agreement. A more detailed description of the TriggerWare™ software is in Management’s Discussion and Analysis or Plan of Operation, below. On March 17, 2009, LOBIS contributed all of its assets and Mikojo assumed all of LOBIS’ liabilities, including LOBIS’ rights and responsibilities under the LOBIS APA in exchange for the issuance of 12,000,000 newly issued common shares of Mikojo. Ownership of the patent for the TriggerWare™ technology remains vested in C3S until certain additional payments are made to C3S pursuant to the terms of the LOBIS APA.

Mikojo’s mission is to bring together the Internet distribution contracts owned by Mikojo (Aust) and the rights related to the TriggerWare™ technology owned by LOBIS to develop and provide the best possible search engine user experience on the Internet by revolutionizing Internet search and decision-making and providing users with a simple interface to retrieve decision-enabling, semantics-based information in real-time.

Background of Transaction.

Mikojo Incorporated, a Delaware corporation (“Mikojo”) was formed on February 20, 2009 to enter into asset contribution transactions with Mikojo (Aust) and LOBIS. On March 2, 2009, Mikojo issued 2,000,000 shares of its common stock par value $0.0001 to its founder, Accelerated Venture Partners, LLC for a total consideration of $200.00. Pursuant to the terms of a Contribution to Controlled Corporation Agreement between Mikojo and Mikojo (Aust) and LOBIS and separate Common Stock Purchase Agreements between Mikojo and Mikojo (Aust) and LOBIS, respectively (all agreements dated as of March 17, 2009), Mikojo (Aust) and LOBIS agreed to contribute all of their assets to Mikojo Incorporated and Mikojo Incorporated agreed to assume all liabilities of Mikojo (Aust) and LOBIS as consideration for the purchase of an aggregate of 24,000,000 common shares of Mikojo (each party received 12,000,000 common shares), with a stated face value of $0.0001 per share. These shares were then distributed to the shareholders of Mikojo (Aust) and LOBIS, respectively, on a pro-rata basis. The principal asset contributed by Mikojo (Aust) was its SDA with InfoSpace, Inc. The principal asset contributed by LOBIS was its rights pursuant to the LOBIS APA (principally its rights relative to the TriggerWare™ Server and Software). Subsequently, Mikojo engaged Clifton Gunderson LLP, an independent valuation firm, to perform a valuation engagement and provide conclusions of value and a detailed report to assist Mikojo’s management in the determination of the fair value of the assets being contributed by Mikojo (Aust) into Mikojo pursuant to Statement of Financial Accounting Standards No. 141(R), Business Combinations, (“SFAS 141(R)”), and Statement of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets (“SFAS 142”) as of March 17, 2009. Mikojo did not cause an independent analysis to be performed with respect to the assets contributed by LOBIS.

Thereafter, pursuant to the terms of the Merger Agreement, on July 20, 2009 Merger Sub merged with and into Mikojo, with Mikojo remaining as the surviving corporation with the stockholders of Mikojo exchanging all of their stock in Mikojo for a total of 26,000,000 shares of common stock of LG. Immediately prior to the Merger, certain existing shareholders of LG tendered a total of 29,360,500 shares of LG’s common stock to the Company for cancellation, leaving 1,530,600 issued and outstanding LG common shares including 1,000,000 shares of Common Stock which were escrowed pursuant to the promissory notes issued by the Company. As a result, following the Merger, LG had 27,530,600 shares of its common stock issued and outstanding, of which 98% were held by the former shareholders of Mikojo.

- 4 -

On September 11, 2009, LG completed a merger with and into its wholly-owned subsidiary, Mikojo Incorporated, a Delaware corporation , which resulted in (a) a change of domicile of the Company from the State of Colorado to the State of Delaware; (b) a change of the name of the Company from LG Holding Corporation to Mikojo Incorporated; (c) the right of each holder of the Company’s common shares to receive one (1) share of Mikojo Incorporated common stock, par value $0.0001 per share, for each one (1) share of the common stock of LG Holding Corporation, par value $0.001 per share, owned by the holder as of the effective time of the Merger; (d) the persons presently serving as the Company’s executive officers and directors serving in their same respective positions with Mikojo; and (e) the adoption of Mikojo’s Certificate of Incorporation under the laws of the State of Delaware, pursuant to which our authorized capital stock is 100,000,000 shares, consisting of 100,000,000 shares of common stock, par value $0.0001 per share and no preferred stock and the adoption of new Bylaws under the laws of the State of Delaware.

In connection with the Merger, Mikojo agreed to pay certain prior shareholders of LG an aggregate of $400,000 for expenses incurred in connection with the merger transaction and cancellation of certain previously outstanding LG shares as detailed above. In this connection, Mikojo paid a non-refundable fee of $25,000 with the balance due of $375,000 to be paid to such shareholders within 90 days of the closing of the merger and evidenced by a promissory note or notes in favor of such shareholders. Should the $375,000 payment not be made within 120 days of the merger closing, Mikojo agreed to pay a $100,000 penalty increasing the amount due to $475,000. Furthermore if the payment (including penalty) is not paid within 150 days of the merger closing, the noteholder(s) have an option to convert the note(s) pro rata into an aggregate of 1,000,000 shares of the surviving Company’s common stock.

Immediately following the closing of the Merger, the Company entered into an Acquisition Agreement with Allan Reeh, a shareholder of the Company (“Purchaser”), whereby the Company agreed to transfer 100% of its interest in its wholly-owned subsidiary, No Worries Managed Network Services, Inc. (“Sub”) and certain rights owned by the Company (“Rights”) to Purchaser in exchange for Purchaser’s assumption of all liabilities and responsibilities with respect to the Sub and the Rights. The transfer of the assets was subject to the completion of the Merger. Included in the assets transferred were all cash and cash equivalents, prepaid expenses, fixed assets and accounts receivable related to the Sub and the Rights and the Purchaser assumed all accounts payable and any other liabilities related to the Sub and the Rights. Included in the Rights transferred were the right to use the name “LG Holding Corporation” and “No Worries Managed Network Services, Inc.” together with all client agreements, both written and oral.

Ultimately, it is Mikojo’s plan to develop the commercialization of its TriggerWare software as a pioneering semantics-based search software vehicle, while continuing to generate cash flow from Internet advertising, as further described herein. The Company did not have any meaningful operations in its fiscal year ended June 30, 2010 due to a lack of funding.

Employees

As of September 30, 2010, we have no full- or part-time employees and rely upon our officers and directors and certain outsiders to provide services to the Company on a consultive basis.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a number of risks. You should carefully read and consider the following risks as well as the other information contained in this prospectus, including the financial statements and the notes to those financial statements, before making an investment decision. The realization of any of the risks described below could have a material adverse affect on our business, financial condition, results of operations, cash flows and/or future prospects. The trading price of our common stock could decline due to any of these risks, and you could lose part or all of your investment. The order of these risk factors does not reflect their relative importance or likelihood of occurrence.

- 5 -

Risks Related to Our Business and Industry

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to continue as a going concern and our ability to obtain future financing

In their report dated November 22, 2010, our independent auditors stated that our financial statements for the period ended June 30, 2010 were prepared assuming that we would continue as a going concern. Our ability to continue as a going concern is an issue raised as a result of recurring losses from operations and cash flow deficiencies since our inception. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loans and grants from various financial institutions where possible.

The Company must raise Additional Capital to Carry Out its Business Plan

The Asset and Patent Purchase Agreement between LOBIS and C3S requires that the purchaser make certain payments in connection with the purchase of the patent relative to the TriggerWare™ software. The Company must raise additional capital to fund such payments, and if such payments are not funded, the rights to the TriggerWare™ software will revert to C3S. In addition, the Company will require additional capital resources in order to develop its metadata resources. Loss of the rights to the TriggerWare™ software or an inability to fund the development of metadata resources will significantly impair the Company’s business plan and could have a significant impact on the Company’s prospects for growth. There is no guarantee that the Company will be able to access additional capital at rates and on terms which are attractive to the Company, if at all.

We are highly dependent on our ability to finance and place advertising on the Web

Most of the Company’s revenue to date has been derived from payments by Infospace, Google and YaHoo for our generation of “clicks” on such advertising. There is a direct relationship between the quantity of advertising we place and the generation of “clicks”. Without funding for such advertising, our revenues for generation of “clicks” could be adversely affected which would directly affect our operating results.

We have an exclusive relationship with InfoSspace and Google , upon whom we rely very heavily.

At the present time, we are virtually entirely dependent on InfoSpace (and indirectly, Google) for our revenues. InfoSpace and Google are faced with significant competition from several companies such as Microsoft and YaHoo, which may have a greater ability to attract and retain users than InfoSpace and Google. If Microsoft or Yahoo is successful in providing similar or better web search results or more relevant advertisements, or in leveraging their platforms or products to make their web search or advertising services easier to access, InfoSpace and Google could experience a significant decline in user traffic and revenues. Any such decline could negatively affect our revenues. In addition, the Company’s relationship with InfoSpace is exclusive, which prevents us from utilizing any other sources of content distribution. We are therefore dependent on the ability of InfoSpace to maintain its business and operations on a positive basis and for InfoSpace to maintain its relationship with Google. There are terms and conditions in the SDA pursuant to which InfoSpace could terminate its relationship with the Company and such relationship is terminable by either party at the end of the initial three-year term or at the end of any renewal term upon thirty days written notice.

- 6 -

We face significant competition.

We face formidable competition in every aspect of our business, and particularly from other companies that seek to connect people with information on the web and provide them with relevant advertising. Most of our competitors have longer operating histories and more established relationships with customers and end users. They can use their experience and resources against us in a variety of competitive ways, including by making acquisitions, investing more aggressively in research and development and competing more aggressively for advertisers and web sites.

We face competition across all geographic markets from other Internet companies, including web search providers, Internet access providers, Internet advertising companies, destination web sites, and local information providers, and from traditional media companies.

We face competition from other web search providers, including start-ups as well as developed companies that are enhancing or developing search technologies. We compete with Internet advertising companies, particularly in the areas of pay-for-performance and keyword-targeted Internet advertising. Also, we may compete with companies that sell products and services online because these companies, like us, are trying to attract users to their web sites to search for information about products and services.

In certain markets outside the U.S., other web search, advertising services, and Internet companies have greater brand recognition than InfoSpace, Google or Mikojo, and more users, and more search traffic than we have. Even in countries where we have a significant user following, we may not be as successful in generating revenue due to slower market development, our inability to provide attractive local advertising services or other factors.

In addition to Internet companies, Internet advertising companies face competition from companies that offer traditional media advertising opportunities. Most large advertisers have fixed advertising budgets, a small portion of which is allocated to Internet advertising. We expect that large advertisers will continue to focus most of their advertising efforts on traditional media. If we fail to convince these companies to spend a portion of their advertising budgets with us, or if our existing advertisers reduce the amount they spend on our programs, our operating results would be harmed.

Emergence of Unanticipated Competition from Startups.

It is conceivable that one of several new start-up companies has technology comparable to Mikojo which could pose a threat to the company. Such company(ies) may be better funded and closer to product roll-out than Mikojo.

A “Major Player” may enter the Semantic Search Market.

Google or another “major player” in the search engine field might enter the semantic search engine market at some point, which would be a significant threat to Mikojo. Such company(ies) is likely to have resources to create metadata much more rapidly than Mikojo. If such were to occur, it would be more difficult for Mikojo to create branding around TriggerWare™ and relational queries as the basis for search.

Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our operating results may fluctuate as a result of a number of factors, many outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly, year-to-date, and annual expenses as a percentage of our revenues may differ significantly from our historical or projected rates. Our operating results in future quarters may fall below expectations. Each of the following factors may affect our operating results:

- 7 -

|

●

|

Our ability to continue to attract users to our web sites and satisfy existing users on our web sites.

|

|

●

|

Our ability to monetize (or generate revenue from) traffic on our web.

|

|

●

|

The amount and timing of operating costs and capital expenditures related to the maintenance and expansion of our businesses, operations, and infrastructure.

|

|

●

|

Our focus on long-term goals over short-term results.

|

|

●

|

The results of our investments in risky projects.

|

|

●

|

Our ability to keep our web sites operational at a reasonable cost and without service interruptions.

|

Because our business is changing and evolving, our historical operating results may not be useful to you in predicting our future operating results. In addition, advertising spending has historically been cyclical in nature, reflecting overall economic conditions as well as budgeting and buying patterns.

If we do not continue to innovate and provide products and services that are useful to users, we may not remain competitive, and our revenues and operating results could suffer.

Our success depends on providing products and services that make using the Internet a more useful and enjoyable experience for our users. Our competitors are constantly developing innovations in web search, online advertising and web based products and services. As a result, we must continue to invest significant resources in research and development in order to enhance our web search technology and our existing products and services and introduce new products and services that people can easily and effectively use. If we are unable to provide quality products and services, then our users may become dissatisfied and move to a competitor’s products and services. In addition, these new products and services may present new and difficult technology challenges, and we may be subject to claims if users of these offerings experience service disruptions or failures or other quality issues. Our operating results would also suffer if our innovations are not responsive to the needs of our users and advertisers and are not appropriately timed with market opportunities or are not effectively brought to market. As search technology continues to develop, our competitors may be able to offer search results that are, or that are seen to be, substantially similar to or better than ours. This may force us to compete in different ways and expend significant resources in order to remain competitive.

We currently generate our revenue almost entirely from advertising, and the reduction in spending by or loss of advertisers could seriously harm our business.

Advertisers will reduce their advertising expenditures if they perceive that such expenditures do not generate sales leads, and ultimately customers, or if their advertising content is not delivered in an appropriate and effective manner. In addition, expenditures by advertisers tend to be cyclical, reflecting overall economic conditions and budgeting and buying patterns.

The effects of the recent global economic crisis may impact our business, operating results, or financial condition.

The recent global economic crisis has caused disruptions and extreme volatility in global financial markets and increased rates of default and bankruptcy, and has impacted levels of consumer spending. These macroeconomic developments could negatively affect our business, operating results, or financial condition in a number of ways. For example, current or potential advertisers may delay or decrease spending. In addition, if consumer spending continues to decrease, this may result in fewer clicks on advertisers’ ads displayed on our web sites. Finally, if the banking system or the financial markets continue to deteriorate or remain volatile, our investments may be impacted and the values and liquidity of our investments could be adversely affected.

- 8 -

Our business and operations are experiencing rapid growth. If we fail to effectively manage our growth, our business and operating results could be harmed.

We have experienced and expect to continue to experience rapid growth in our operations, which has placed, and will continue to place, significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, the quality of our products and services could suffer, which could negatively affect our operating results. Our expansion and growth in international markets heightens these risks as a result of the particular challenges of supporting a rapidly growing business in an environment of multiple languages, cultures, customs, legal systems, alternative dispute systems, regulatory systems and commercial infrastructures. To effectively manage this growth, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. These systems enhancements and improvements will require significant capital expenditures and management resources. Failure to implement these improvements could hurt our ability to manage our growth and our financial position.

Metadata Retrieval and Acquisition Risks

The biggest barrier to the success of the Company’s TriggerWare™ technology is that there is currently no relational metadata that exists on the Internet. Mikojo must ensure that a critical mass of metadata is created for enough of the Internet to ensure that users will be able to gain value from the search services that TriggerWare™ affords. The Company must create the metadata bases very rapidly and will be utilizing the services of an off-shore organization for such work. Such organizations may be unreliable and may not produce the desired results. The Company must also maintain the accuracy of the metadata as data sources change.

Metadata Retrieval and AcquisitionTechnical Risks

In order to function in a viable manner, TriggerWare™ needs to scale up to potentially hundreds of thousands of simultaneous users. This will require establishment of server infrastructure so that there can be several instances of the TriggerWare™ server handling requests from the different segments of the user community. While this approach will work with TriggerWare™ as it does with other servers, the ultimate validation of TriggerWare™ in this kind of production mode is yet to be fully tested.

Market Risks

The Company will face numerous risks relating to market acceptance of its products and services:

|

|

●

|

Users may refuse to be provide search queries: Engines in the marketplace take it for granted that users will simply refuse to provide search input beyond typing in a few keywords. Today, there are no search engines that do semantics-based search and the Company’s products and services have not been test-marketed.

|

|

|

●

|

Data providers may prevent use of their data: Since Mikojo separates metadata from data, it is able to use metadata to interpret the data in various URLs. It is conceivable that if Mikojo is successful on a large scale, data providers could notice that their data is being used in high-volume situations. Mikojo recognizes that it will need to negotiate advertising and revenue-sharing agreements with data providing entities to continue to operate as the engine that brings semantics to Internet search. There are no guarantees that this can be accomplished

|

|

|

●

|

A much larger Company may emerge as a competitor before Mikojo fully launches its technology and therefore time is of the essence in rolling out our technology.

|

- 9 -

Acquisitions could result in operating difficulties, dilution and other harmful consequences.

We do not have a great deal of experience acquiring companies. We expect to evaluate and enter into discussions regarding a wide array of potential strategic transactions. These transactions could be material to our financial condition and results of operations. The process of integrating an acquired company, business or technology has created, and will continue to create unforeseen operating difficulties and expenditures. The areas where we face risks include:

|

●

|

Implementation or remediation of controls, procedures and policies at the acquired company.

|

|

●

|

Diversion of management time and focus from operating our business to acquisition integration challenges.

|

|

●

|

Coordination of product, engineering and sales and marketing functions.

|

|

●

|

Transition of operations, users and customers onto our existing platforms.

|

|

●

|

Cultural challenges associated with integrating employees from the acquired company into our organization.

|

|

●

|

Retention of employees from the businesses we acquire.

|

|

●

|

Integration of the acquired company’s accounting, management information, human resource and other administrative systems.

|

|

●

|

Liability for activities of the acquired company before the acquisition, including patent and trademark infringement claims, violations of laws, commercial disputes, tax liabilities and other known and unknown liabilities.

|

|

●

|

Litigation or other claims in connection with the acquired company, including claims from terminated employees, customers, former stockholders, or other third parties.

|

|

●

|

In the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political and regulatory risks associated with specific countries.

|

|

●

|

Failure to successfully further develop the acquired technology.

|

Our failure to address these risks or other problems encountered in connection with our past or future acquisitions and strategic investments could cause us to fail to realize the anticipated benefits of such acquisitions or investments, incur unanticipated liabilities and harm our business generally.

Future acquisitions or dispositions could also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities or amortization expenses, or write-offs of goodwill, any of which could harm our financial condition. Also, the anticipated benefit of many of our acquisitions may not materialize

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products, services and brand.

Our intellectual property rights are important assets for us. Various events outside of our control pose a threat to our intellectual property rights as well as to our products and services. For example, effective intellectual property protection may not be available in every country in which our products and services are distributed or made available through the Internet. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time consuming. Any increase in the unauthorized use of our intellectual property could make it more expensive to do business and harm our operating results.

- 10 -

Although we seek to obtain patent protection for our innovations, it is possible we may not be able to protect some of these innovations. In addition, given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important. Furthermore, there is always the possibility, despite our efforts, that the scope of the protection gained will be insufficient or that an issued patent may be deemed invalid or unenforceable. We could also face risks associated with our trademarks.

We also seek to maintain certain intellectual property as trade secrets. The secrecy could be compromised by outside parties, or by our employees, which would cause us to lose the competitive advantage resulting from these trade secrets.

We are, and may in the future be, subject to intellectual property rights claims, which are costly to defend, could require us to pay damages and could limit our ability to use certain technologies in the future.

Companies in the Internet, technology and media industries own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. As we have grown, the intellectual property rights claims against us have increased. Our products, services and technologies may not be able to withstand any third-party claims and regardless of the merits of the claim, intellectual property claims are often time-consuming and expensive to litigate or settle. In addition, to the extent claims against us are successful, we may have to pay substantial monetary damages or discontinue any of our services or practices that are found to be in violation of another party’s rights.

Privacy concerns relating to our technology could damage our reputation and deter current and potential users from using our products and services.

From time to time, concerns have been expressed about whether our products and services compromise the privacy of users and others. Concerns about our practices with regard to the collection, use, disclosure or security of personal information or other privacy-related matters, even if unfounded, could damage our reputation and operating results. While we strive to comply with all applicable data protection laws and regulations, as well as our own posted privacy policies, any failure or perceived failure to comply may result in proceedings or actions against us by government entities or others, which could potentially have an adverse effect on our business.

In addition, as nearly all of our products and services are web based, the amount of data we store for our users on our servers (including personal information) has been increasing. Any systems failure or compromise of our security that results in the release of our users’ data could seriously limit the adoption of our products and services as well as harm our reputation and brand and, therefore, our business. We may also need to expend significant resources to protect against security breaches. The risk that these types of events could seriously harm our business is likely to increase as we expand the number of web based products and services we offer as well as increase the number of countries where we operate.

A variety of new and existing U.S. and foreign laws could subject us to claims or otherwise harm our business.

We are subject to a variety of laws in the U.S. and abroad that are costly to comply with, can result in negative publicity and diversion of management time and effort, and can subject us to claims or other remedies. Many of these laws were adopted prior to the advent of the Internet and related technologies and, as a result, do not contemplate or address the unique issues of the Internet and related technologies. The laws that do reference the Internet are being interpreted by the courts, but their applicability and scope remain uncertain. For example, the laws relating to the liability of providers of online services are currently unsettled both within the U.S. and abroad. Claims have been threatened and filed under both U.S. and foreign law for defamation, libel, slander, invasion of privacy and other tort claims, unlawful activity, copyright and trademark infringement, or other theories based on the nature and content of the materials searched and the ads posted by our users, our products and services, or content generated by our users.

- 11 -

In addition, the Digital Millennium Copyright Act has provisions that limit, but do not necessarily eliminate, our liability for listing or linking to third-party web sites that include materials that infringe copyrights or other rights, so long as we comply with the statutory requirements of this act. The Child Online Protection Act and the Children’s Online Privacy Protection Act restrict the distribution of materials considered harmful to children and impose additional restrictions on the ability of online services to collect information from minors. In the area of data protection, many states have passed laws requiring notification to users when there is a security breach for personal data, such as California’s Information Practices Act. We face similar risks and costs as our products and services are offered in international markets and may be subject to additional regulations.

We are subject to increased regulatory scrutiny that may negatively impact our business.

The growth of our Company and our expansion into a variety of new fields implicate a variety of new regulatory issues and may subject us to increased regulatory scrutiny, particularly in the U.S. and Europe. Moreover, our competitors have employed and will likely continue to employ significant resources to shape the legal and regulatory regimes in countries where we have significant operations. Legislators and regulators may make legal and regulatory changes, or interpret and apply existing laws, in ways that make our products and services less useful to our users, require us to incur substantial costs, or change our business practices. These changes or increased costs could negatively impact our business.

More individuals are using non-PC devices to access the Internet. If users of these devices do not widely adopt versions of our web search technology, products or operating systems developed for these devices, our business could be adversely affected.

The number of people who access the Internet through devices other than personal computers, including mobile telephones, personal digital assistants (PDAs), smart phones and handheld computers and video game consoles, as well as television set-top devices, has increased dramatically in the past few years. The lower resolution, functionality and memory associated with alternative devices make the use of our products and services through such devices more difficult and the versions of our products and services developed for these devices may not be compelling to users, manufacturers or distributors of alternative devices. Each manufacturer or distributor may establish unique technical standards for its devices, and our products and services may not work or be viewable on these devices as a result. As we have limited experience to date in operating versions of our products and services developed or optimized for users of alternative devices, and as new devices and new platforms are continually being released, it is difficult to predict the problems we may encounter in developing versions of our products and services for use on these alternative devices and we may need to devote significant resources to the creation, support and maintenance of such devices. If we are unable to attract and retain a substantial number of alternative device manufacturers, distributors and users to our products and services or if we are slow to develop products and technologies that are more compatible with non-PC communications devices, we will fail to capture a significant share of an increasingly important portion of the market for online services, which could adversely affect our business.

- 12 -

Our business may be adversely affected by malicious applications that interfere with, or exploit security flaws in, our products and services.

Our business may be adversely affected by malicious applications that make changes to our users’ computers and interfere with the use of our products and services. These applications have in the past attempted, and may in the future attempt, to change our users’ Internet experience, including hijacking queries to our service, altering or replacing search results we provide, or otherwise interfering with our ability to connect with our users. The interference often occurs without disclosure to or consent from users, resulting in a negative experience that users may associate with our products and services. These applications may be difficult or impossible to uninstall or disable, may reinstall themselves and may circumvent other applications’ efforts to block or remove them. In addition, we offer a number of products and services that our users download to their computers or that they rely on to store information and transmit information to others over the Internet. These products and services are subject to attack by viruses, worms and other malicious software programs, which could jeopardize the security of information stored in a user’s computer or in our computer systems and networks. The ability to reach users and provide them with a superior experience is critical to our success. If our efforts to combat these malicious applications are unsuccessful, or if our products and services have actual or perceived vulnerabilities, our reputation may be harmed and our user traffic could decline, which would damage our business.

Proprietary document formats may limit the effectiveness of our search technology by preventing our technology from accessing the content of documents in such formats, which could limit the effectiveness of our products and services.

A large amount of information on the Internet is provided in proprietary document formats such as Microsoft Word. The providers of the software application used to create these documents could engineer the document format to prevent or interfere with our ability to access the document contents with our search technology. This would mean that the document contents would not be included in our search results even if the contents were directly relevant to a search. The software providers may also seek to require us to pay them royalties in exchange for giving us the ability to search documents in their format. If the software provider also competes with us in the search business, they may give their search technology a preferential ability to search documents in their proprietary format. Any of these results could harm our brand and our operating results.

New technologies could block our ads, which would harm our business.

Technologies have been developed that can block the display of our ads. Most of our revenues are derived from fees paid to us by advertisers in connection with the display of ads on web pages. As a result, ad-blocking technology could adversely affect our operating results.

Index spammers could harm the integrity of our web search results, which could damage our reputation and cause our users to be dissatisfied with our products and services.

There is an ongoing and increasing effort by “index spammers” to develop ways to manipulate our web search results. For example, because our web search technology ranks a web page’s relevance based in part on the importance of the web sites that link to it, people have attempted to link a group of web sites together to manipulate web search results. We take this problem very seriously because providing relevant information to users is critical to our success. If our efforts to combat these and other types of index spamming are unsuccessful, our reputation for delivering relevant information could be diminished. This could result in a decline in user traffic, which would damage our business.

- 13 -

If we were to lose the services of key members of our management team, we may not be able to execute our business strategy.

Our future success depends in a large part upon the continued service of key members of our senior management team, who are critical to the overall management of the Company as well as the development of our technology, our culture and our strategic direction. The loss of any of our management or key personnel could seriously harm our business.

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel, hire qualified personnel, we may not be able to grow effectively.

Our performance largely depends on the talents and efforts of highly skilled individuals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Competition in our industry for qualified employees is intense, and certain of our competitors have directly targeted our employees. In addition, our compensation arrangements, such as our equity award programs, may not always be successful in attracting new employees and retaining and motivating our existing employees. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees.

We have a short operating history and a relatively new business model in an emerging and rapidly evolving market. This makes it difficult to evaluate our future prospects and may increase the risk that we will not continue to be successful.

Our predecessor in interest, Mikojo (Aust) first derived revenue from our business in 2008, and we have only a short operating history with our business model. As a result, we have only a short operating history to aid in assessing our future prospects. Also, we derive nearly all of our revenues from online advertising, which is an immature industry that has undergone rapid and dramatic changes in its short history. We will encounter risks and difficulties as a company operating in a new and rapidly evolving market. We may not be able to successfully address these risks and difficulties, which could materially harm our business and operating results.

We may have difficulty scaling and adapting our existing architecture to accommodate increased traffic and technology advances or changing business requirements, which could lead to the loss of users and advertisers, and cause us to incur expenses to make architectural changes.

To be successful, our network infrastructure has to perform well and be reliable. The greater the user traffic and the greater the complexity of our products and services, the more computing power we will need. If we do not expand successfully, or if we experience inefficiencies and operational failures, the quality of our products and services and our users’ experience could decline. This could damage our reputation and lead us to lose current and potential users and advertisers. Cost increases, loss of traffic or failure to accommodate new technologies or changing business requirements could harm our operating results and financial condition.

- 14 -

We rely on bandwidth providers, data centers and others in providing products and services to our users, and any failure or interruption in the services and products provided by these third parties could damage our reputation and harm our ability to operate our business.

We rely on vendors, including data center and bandwidth providers in providing products and services to our users. Any disruption in the network access or colocation services provided by these providers or any failure of these providers to handle current or higher volumes of use could significantly harm our business. Any financial or other difficulties our providers face may have negative effects on our business. We exercise little control over these vendors, which increases our vulnerability to problems with the services they provide. We license technology and related databases to facilitate aspects of our data center and connectivity operations including Internet traffic management services. We expect to experience interruptions and delays in service and availability for such elements. Any errors, failures, interruptions or delays in connection with these technologies and information services could harm our relationship with users, adversely affect our business and expose us to liabilities.

Our business depends on continued and unimpeded access to the Internet by us and our users. Internet access providers may be able to block, degrade or charge for access to certain of our products and services, which could lead to additional expenses and the loss of users and advertisers.

Our products and services depend on the ability of our users to access the Internet, and certain of our products require significant bandwidth to work effectively. Currently, this access is provided by companies that have significant and increasing market power in the broadband and Internet access marketplace, including incumbent telephone companies, cable companies and mobile communications companies. Some of these providers have stated that they may take measures that could degrade, disrupt or increase the cost of user access to certain of our products by restricting or prohibiting the use of their infrastructure to support or facilitate our offerings, or by charging increased fees to us or our users to provide our offerings. These activities may be permitted in the U.S. after recent regulatory changes, including recent decisions by the U.S. Supreme Court and Federal Communications Commission. While interference with access to our popular products and services seems unlikely, such carrier interference could result in a loss of existing users and advertisers and increased costs, and could impair our ability to attract new users and advertisers, thereby harming our revenue and growth.

Interruption or failure of our information technology and communications systems could hurt our ability to effectively provide our products and services, which could damage our reputation and harm our operating results.

The availability of our products and services depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could result in interruptions in our service, which could reduce our revenues and profits, and damage our brand. Our systems are vulnerable to damage or interruption from earthquakes, terrorist attacks, floods, fires, power loss, telecommunications failures, computer viruses, computer denial of service attacks or other attempts to harm our systems. Some of our data centers are located in areas with a high risk of major earthquakes. Our data centers are also subject to break-ins, sabotage and intentional acts of vandalism, and potential disruptions if the operators of these facilities have financial difficulties. Some of our systems are not fully redundant, and our disaster recovery planning cannot account for all eventualities. The occurrence of a natural disaster, a decision to close a facility we are using without adequate notice for financial reasons or other unanticipated problems at our data centers could result in lengthy interruptions in our service.

- 15 -

Our business depends on increasing use of the Internet by users searching for information, advertisers marketing products and services and web sites seeking to earn revenue to support their web content. If the Internet infrastructure does not grow and is not maintained to support these activities, our business will be harmed.

Our success will depend on the continued growth and maintenance of the Internet infrastructure. This includes maintenance of a reliable network backbone with the necessary speed, data capacity and security for providing reliable Internet services. Internet infrastructure may be unable to support the demands placed on it if the number of Internet users continues to increase, or if existing or future Internet users access the Internet more often or increase their bandwidth requirements. In addition, viruses, worms and similar programs may harm the performance of the Internet. The Internet has experienced a variety of outages and other delays as a result of damage to portions of its infrastructure, and could face outages and delays in the future. These outages and delays could reduce the level of Internet usage as well as our ability to provide our solutions.

We may have exposure to greater than anticipated tax liabilities.

Our future income taxes could be adversely affected by earnings being lower than anticipated in jurisdictions where we have lower statutory tax rates and higher than anticipated in jurisdictions where we have higher statutory tax rates, by changes in the valuation of our deferred tax assets and liabilities, as a result of gains on our foreign exchange hedging program, or changes in tax laws, regulations, accounting principles or interpretations thereof. Our determination of our tax liability is always subject to review by applicable tax authorities. Any adverse outcome of such a review could have a negative effect on our operating results and financial condition. In addition, the determination of our worldwide provision for income taxes and other tax liabilities requires significant judgment, and there are many transactions and calculations where the ultimate tax determination is uncertain. Although we believe our estimates are reasonable, the ultimate tax outcome may differ from the amounts recorded in our financial statements and may materially affect our financial results in the period or periods for which such determination is made.

Risks Related to Ownership of Our Common Stock

The price of our common stock may be extremely volatile.

In some future periods, our results of operations may be below the expectations of public market investors, which could negatively affect the market price of our common stock. Furthermore, the stock market in general has experienced extreme price and volume fluctuations in recent years. We believe that, in the future, the market price of our common stock could fluctuate widely due to variations in our performance and operating results or because of any of the following factors:

|

●

|

announcements of new services, products, technological innovations, acquisitions or strategic relationships by us or our competitors;

|

|

●

|

trends or conditions in the software, business process outsourcing and Internet markets;

|

|

●

|

changes in market valuations of our competitors; and

|

|

●

|

general political, economic and market conditions.

|

In addition, the market prices of securities of software and technology companies, including our own, have been volatile and have experienced fluctuations that have often been unrelated or disproportionate to a specific company's operating performance. As a result, investors may not be able to sell shares of our common stock at or above the price at which an investor purchase paid. In the past, following periods of volatility in the market price of a company's securities, securities class action litigation has often been instituted against that Company. If any securities litigation is initiated against us, we could incur substantial costs and our management's attention could be diverted from our business.

- 16 -

Quarterly and annual operating results may fluctuate, which could cause our stock price to be volatile.

Our quarterly and annual operating results may fluctuate significantly in the future due to a variety of factors that could affect our revenues or our expenses in any particular period. You should not rely on our results of operations during any particular period as an indication of our results for any other period. Factors that may adversely affect our periodic results may include the loss of a significant account or accounts.

Our operating expenses are based in part on our expectations of our future revenues and are partially fixed in the short term. We may be unable to adjust spending quickly enough to offset any unexpected revenue shortfall.

The significant concentration of ownership of our common stock will limit an investor's ability to influence corporate actions.

The concentration of ownership of our common stock may limit an investor's ability to influence our corporate actions and have the effect of delaying or deterring a change in control of our Company, could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of our Company, and may affect the market price of our common stock. Certain major stockholders, if they act together, are able to substantially influence all matters requiring stockholder approval, including the election of all directors and approval of significant corporate transactions and amendments to our certificate of incorporation. These stockholders may use their ownership position to approve or take actions that are adverse to interests of other investors or prevent the taking of actions that are inconsistent with their respective interests.

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We have offered and sold our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information provided by investors themselves.

If any prior offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

The availability of a large number of authorized but unissued shares of common stock may, upon their issuance, lead to dilution of existing stockholders.

We are authorized to issue 100,000,000 shares of common stock, $0.0001 par value per share, of which, as of September 30, 2010, 28,061,200 shares of common stock were issued and outstanding and 71,938,800 remain unissued. These shares may be issued by our board of directors without further stockholder approval. The issuance of large numbers of shares, possibly at below market prices, is likely to result in substantial dilution to the interests of other stockholders. In addition, issuances of large numbers of shares may adversely affect the market price of our common stock.

- 17 -

Further, our Certificate of Incorporation authorizes 1,000,000 shares of preferred stock, $0.01 par value per share. The board of directors is authorized to provide for the issuance of these unissued shares of preferred stock in one or more series, and to fix the number of shares and to determine the rights, preferences and privileges thereof. Accordingly, the board of directors may issue preferred stock which convert into large numbers of shares of common stock and consequently lead to further dilution of other shareholders.

We do not intend to pay cash dividends in the foreseeable future.

We currently intend to retain all future earnings for use in the operation and expansion of our business. We do not intend to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

There is currently a very limited market for our securities and there can be no assurance that anymore liquid market will ever develop.

There is currently only a very limited trading market for our common stock and there is currently only one market maker quoting our stock on the OTCBB. There can be no assurance as to whether additional market makers will quote our stock or that an orderly market will develop, (if ever) in our common stock. As a result, we expect that the price at which our stock trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of us and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock. Owing to the anticipated low price of the securities, many brokerage firms may not be willing to effect transactions in the securities. See “Broker-dealers may be discouraged from effecting transactions in our common stock because they are considered a penny stock and are subject to the penny stock rules.”

Our common stock is subject to the Penny Stock Regulations.

Our common stock and will likely be subject to the SEC's “penny stock” rules to the extent that the price remains less than $5.00. Those rules, which require delivery of a schedule explaining the penny stock market and the associated risks before any sale, may further limit your ability to sell your shares.

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our common stock, when and if a trading market develops, may fall within the definition of penny stock and subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the `penny stock` rules may restrict the ability of broker-dealers to sell our common stock and may affect the ability of investors to sell their common stock in the secondary market.

- 18 -

Our common stock is illiquid and subject to price volatility unrelated to our operations.

The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock. Sales of substantial amounts of common stock, or the perception that such sales could occur, and the existence of convertible securities to purchase shares of common stock at prices that may be below the then current market price of the common stock, could adversely affect the market price of our common stock and could impair our ability to raise capital through the sale of our equity securities.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES.

Our executive offices are located at 1840 Gateway Drive, Suite 200, Foster City, CA 94404 which we utilize on a rent-free basis pursuant to a verbal understanding with Accelerated Venture Partners, LLC, one of our shareholders.

ITEM 3. LEGAL PROCEEDINGS

As of June 30, 2010, the Company was not a party to any pending or threatened legal proceedings.

ITEM 4. (REMOVED AND RESERVED)

PART II.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY; RELATED STOCKHOLDER MATTERS AND SMALL BUSINESS ISSUER PURCHASES OF EQUITY SECURITIES

Market Price

The Company became subject to Securities Exchange Act Reporting Requirements in September 2008. The symbol "MKJI" is assigned for our securities. There has never been any market for or trading in our stock. There can be no assurance that a highly-liquid market for our securities will ever develop.

- 19 -

Options and Warrants

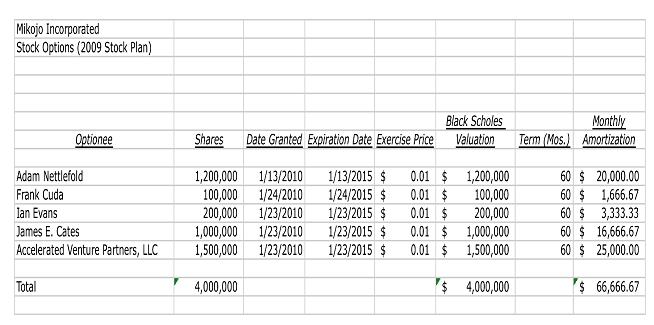

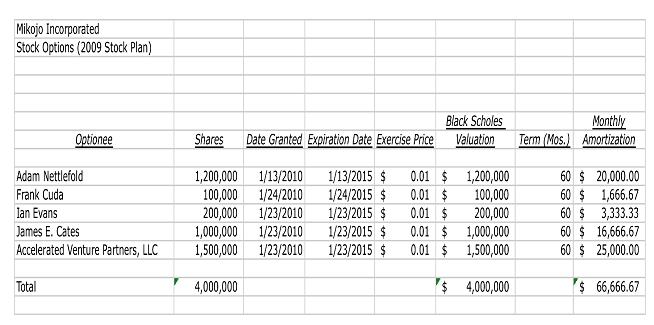

The Company has adopted the Mikojo Incorporated 2009 Stock Plan (“2009 Plan”) that includes both incentive stock options and nonqualified stock options to be granted to employees, officers, and consultants, independent contractors, directors and affiliates of the Company. The board of directors establishes the terms and conditions of all stock options grants, subject to the Plan and applicable provisions of the Internal Revenue Code. Incentive stock options must be granted at an exercise price not less than the fair market value of the common stock on the grant date. The options expire on the date determined by the board of directors.

The following table details grants to date under the 2009 Plan:

Equity Compensation Plan Information

|

Plan category

|

Number of securities to be issued

upon exercise of outstanding options,

warrants and rights

(a)

|

Weighted-average exercise

price of outstanding options,

warrants and rights

(b)

|

Number of securities remaining

available for future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(c)

|

|

Equity compensation plans approved by security holders

|

--

|

n/a

|

--

|

|

Equity compensation plans not approved by security holders

|

4,000,000

|

$0.01

|

209,180

|

|

Total

|

4,000,000

|

$0.01

|

209,180

|

None of the shares of our common stock are subject to outstanding warrants.

Status of Outstanding Common Stock

As of September 30, 2010, we had a total of 28,061,200 shares of our common stock outstanding. Of these shares, 20,077,832 are held by “affiliates” of the Company and the remaining shares are either registered or may be transferred subject to the requirements of Rule 144. We have not agreed to register any additional outstanding shares of our common stock under the Securities Act.

Holders

We have issued an aggregate of 28,061,200 shares of our common stock to approximately 60 record holders.

Dividends

We have not paid any dividends to date, and have no plans to do so in the immediate future.

Recent Sales of Unregistered Securities

None

- 20 -

Purchases of Equity Securities

The Company has never purchased nor does it own any equity securities of any other issuer.

ITEM 6. SELECTED FINANCIAL DATA

|

Year Ended

|

6/30/2010

|

6/30/2009

|

||||||

|

Revenues

|

$ | 750 | $ | 1,740,449 | ||||

|

Net Loss

|

(762,654 | ) | (87,875 | ) | ||||

|

Net loss per share

|

(0.03 | ) | (0.00 | ) | ||||

|

Weighted average no shares

|

28,115,930 | 26,000,000 | ||||||

|

Stockholders' deficit

|

1,987,611 | 1,192,928 | ||||||

|

Total assets

|

18,818 | 63,623 | ||||||

|

Total liabilites

|

$ | 2,006,429 | $ | 1,256,551 | ||||

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION ANDRESULTS OF OPERATION

The following discussion should be read in conjunction with our financial statements and the notes thereto.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND USE OF TERMS

This annual report contains forward-looking statements, which reflect our views with respect to future events and financial performance. These forward-looking statements are subject to certain uncertainties and other factors that could cause actual results to differ materially from such statements. These forward-looking statements are identified by, among other things, the words “anticipates”, “believes”, “estimates”, to expects”, “plans”, “projects”, “targets” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future. Except as otherwise indicated by the context, references in this report to:

- 21 -

Overview

Our Background and History

Business of Mikojo.

Mikojo Pty. Ltd., an Australian corporation (“Mikojo (Aust)”), was founded in 2007. In 2008, Mikojo (Australia) launched a federated Internet search engine and has entered into a Search Distribution Agreement (“SDA”) with InfoSpace Europe Limited (“InfoSpace”) wherein InfoSpace has agreed to permit Mikojo (Aust) to incorporate certain search content and services into Mikojo (Aust)’s website. InfoSpace is a distributor of Google web content and has certain proprietary metasearch technology that combines the top results from the leading search engines (such as Google and YaHoo). Pursuant to the terms of the SDA, Mikojo (Aust) utilizes this search technology on its Mikojo.com website and has a revenue sharing agreement with respect to advertising revenues which are developed through its website. InfoSpace has established long-term advertising distribution contracts with various companies, including Google, Inc. and also has strategic advertising partnerships with MicroSoft, Yahoo, LookSmart and others.

On March 17, 2009, Mikojo (Aust) contributed all of its assets, including but not limited to its rights under the SDA, to Mikojo. Thereafter, Mikojo began generating cash flows pursuant to the terms of the SDA. Essentially, by indirectly acting as a distributor of advertising links originated by Google, Mikojo is compensated by InfoSpace based on the revenues it receives from Google calculated based on an “clicks” on such advertising generated through the Mikojo website. Mikojo then, in turn, may provide the click to other third party search engines (for example, YaHoo), for which it would also receive credit toward the generation of additional revenues.