Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Crownbutte Wind Power, Inc. | ex32-1.htm |

| EX-31.1 - CERTIFICATION - Crownbutte Wind Power, Inc. | ex31-1.htm |

| EX-10.20 - PROMISSORY NOTE - Crownbutte Wind Power, Inc. | ex10-20.htm |

| EX-10.21 - PROMISSORY NOTE - Crownbutte Wind Power, Inc. | ex10-21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: December 31, 2010

or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _______________ to _______________

Commission file number: 333-156467

|

Crownbutte Wind Power, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

20-0844584

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer Identification No.)

|

|

111 5th Avenue NE, Mandan, ND

|

58554

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (701) 667-2073

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No þ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See the definitions of the “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Accelerated Filer o

|

|

|

Non-Accelerated Filer o (Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

State issuer's revenues for its most recent fiscal year. $0

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Approximately $4,896,121, as of June 30, 2010

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

State the number of shares outstanding of each of the issuer's classes of equity stock, as of the latest practicable date.

37,044,138 common shares issued and outstanding as April 13, 2011

2

TABLE OF CONTENTS

|

Item Number and Caption

|

Page

|

||

|

Forward-Looking Statements

|

|||

|

PART I

|

|||

|

1.

|

Business

|

5 | |

|

2.

|

Properties

|

28 | |

|

3.

|

Legal Proceedings

|

30 | |

|

4.

|

(Removed and Reserved)

|

31 | |

|

PART II

|

|||

|

5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

31 | |

|

6.

|

Selected Financial Data

|

33 | |

|

7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

33 | |

|

8.

|

Financial Statements and Supplemental Data

|

36 | |

|

9.

|

Changes in and Disagreements with Accountants on Accounting, and Financial Disclosure

|

54 | |

|

9A.[T]

|

Controls and Procedures

|

54 | |

|

9B.

|

Other Information

|

55 | |

|

PART III

|

|||

|

10.

|

Directors, Executive Officers, and Corporate Governance

|

55 | |

|

11.

|

Executive Compensation

|

58 | |

|

12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

61 | |

|

13.

|

Certain Relationships and Related Transactions

|

62 | |

|

14.

|

Principal Accountant Fees and Services

|

63 | |

|

PART IV

|

|||

| 15. | Exhibits, Financial Statement Schedules | 64 | |

| Signatures | 67 | ||

3

FORWARD-LOOKING STATEMENTS

Various statements in this Annual Report, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects, revenues, income and capital spending. We generally identify forward-looking statements with the words “believe,” “intend,” “expect,” “seek,” “may,” “should,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project” or their negatives, and other similar expressions. These statements are likely to address our growth strategy, financial results and exploration and development programs, among other things.

Forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those that we expected. The forward-looking statements contained in this Annual Report are largely based on our expectations, which reflect many estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors and it is impossible for us to anticipate all factors that could affect our actual results. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this Annual Report are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to the factors described in the “Risk Factors” section and elsewhere in this Annual Report. All forward-looking statements are based upon information available to us on the date of this Annual Report. We undertake no obligation to update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law.

In this Annual Report, unless the context requires otherwise, references to the “Company,” “Crownbutte,” “we,” “our” and “us” refer to Crownbutte Wind Power, Inc., a publicly traded Nevada corporation formerly known as ProMana Solutions, Inc., together with its subsidiaries, including Crownbutte Wind Power, Inc., a North Dakota corporation (“Crownbutte ND”).

4

PART I

Overview of Our Business

Crownbutte ND was founded in 1999 by former Chief Executive Officer, Timothy H. Simons, with the goal of addressing the requirements of regional utility companies to satisfy increasing renewable energy demands. We develop wind parks from green field to operation, which we have sold to regional utilities. One park developed by us was purchased directly by Basin Electric Power Cooperative (2.6 megawatts (MW) near Chamberlain, South Dakota). We also developed a 20 MW, expandable to 50 MW, project in Baker, MT, which was sold at late brownfield stage to Montana-Dakota Utilities. It was since expanded to 30 MW and is now called the Diamond Willow Wind Farm. In addition to these two operating parks, we have completed various consulting activities with regional utilities and international energy companies. Our ultimate goal is to develop, own and operate merchant wind parks in the 20 to 60 MW capacity range. Currently, we have 12 projects totaling approximately 638 MW (0 MW currently in operation) of prospective capacity in various phases of development primarily in North Dakota, South Dakota and Montana, with a total of over 40,000 acres under lease option. See “Properties.” Our project management team is also exploring other opportunities in this region.

Our principal executive offices are located at 111 5th Avenue NE, Mandan, ND 58554, and our telephone number is (701) 667-2073. Our website address is www.crownbutte.com .

We were incorporated in the State of Nevada on March 9, 2004, under the name ProMana Solutions, Inc. As ProMana Solutions, our business was to provide web-based, fully integrated solutions for managing payroll, benefits, human resource management and business processing outsourcing to small and medium sized businesses. Following the merger described below, we are no longer in that web services business.

On July 2, 2008, we amended our Articles of Incorporation to change our name to Crownbutte Wind Power, Inc.

Crownbutte ND was formed as a North Dakota limited liability company on May 11, 1999. On May 19, 2008, Crownbutte ND was converted to a North Dakota corporation.

On July 2, 2008, a special purpose acquisition subsidiary formed by us merged with and into Crownbutte ND, with Crownbutte ND surviving the merger, thereby becoming our wholly-owned subsidiary. Following the merger, we continued Crownbutte ND’s business operations. In connection with the merger, we changed our name to Crownbutte Wind Power, Inc. Upon the closing of the merger, the holders of all of the issued and outstanding shares of Crownbutte ND surrendered all of their shares and received shares of our common stock on a one-to-one basis. Also on the closing date, holders of issued and outstanding warrants to purchase shares of Crownbutte common stock received new warrants to purchase shares of our common stock, also on a one-to-one basis.

Pursuant to the merger, we ceased operating as a provider of web-based, fully integrated solutions for managing payroll, benefits, human resource management and business processing outsourcing, and acquired the business of Crownbutte ND to develop wind parks from green field to operation and has continued Crownbutte ND’s business operations as a publicly-traded company.

At the closing of the merger, each share of Crownbutte ND’s common stock outstanding was converted into one share of our Common Stock. As a result, an aggregate of 18,100,000 shares of our Common Stock were issued to the holders of Crownbutte ND’s common stock. In addition, warrants to purchase an aggregate of 10,600,000 shares of Crownbutte ND’s outstanding at the time of the merger became warrants to purchase an equivalent number of shares of our Common Stock.

5

The merger agreement contains a provision for a post-closing adjustment to the number of shares of our Common Stock issued to the former Crownbutte ND stockholders, in an amount up to 2,000,000 shares of our Common Stock, to be issued on a pro rata basis for any breach of the Merger Agreement by us, discovered during the one-year period following the closing. In order to secure the indemnification obligations of Crownbutte ND under the merger agreement, 5% of the shares of our Common Stock to which the former Crownbutte ND stockholders were entitled in exchange for their shares of Crownbutte ND in connection with the Merger were held in escrow for a period of one year.

The merger agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties will be subject to customary indemnification provisions.

The merger was treated as a recapitalization of the Company for financial accounting purposes. Crownbutte ND is considered the acquirer for accounting purposes, and our historical financial statements before the merger have been replaced with the historical financial statements of Crownbutte ND before the merger in all subsequent filings with the Securities and Exchange Commission.

The parties have taken all actions necessary to ensure that the merger is treated as a tax-free exchange under Section 368(a) of the Internal Revenue Code of 1986, as amended.

Contemporaneously with the merger, the then-existing assets and liabilities of the Company were transferred to Pro Mana Technologies, Inc., a New Jersey corporation, which at that time was a wholly-owned subsidiary of the Company. Contemporaneously with the merger, we transferred all of the outstanding capital stock of Pro Mana Technologies to certain pre-merger shareholders of the Company in exchange for the surrender and cancellation of an aggregate of 144,702 shares of our common stock and warrants to purchase 19,062 shares of our common stock held by those stockholders and certain covenants and indemnities. We no longer own Pro Mana Technologies.

On July 31, 2008, we effected a reverse stock split, as a result of which each 65.723 shares of our common stock (including those issued in connection with the merger) then issued and outstanding were converted into one share of our common stock. Unless otherwise stated herein or the context clearly indicates otherwise, all share and per share numbers in this Annual Report relating to our common stock have been adjusted to give effect to the reverse stock split.

General Philosophy

We have developed what we believe is a unique process for bringing viable wind parks to market. While most developers have focused on large projects of 100 MW or more, we have found a niche in the 20-60 MW range. Our focus will be to bring these smaller parks from concept to operation. The project sites currently in development by us are located directly on some of the most ideal wind regimes in the country, with net capacity factors of up to forty-six percent (46%). These above-average net capacity factors have a significant impact on the amount of electricity that can be generated and therefore on future revenues.

Net capacity factor is one element used in measuring the productivity of a wind turbine, wind energy project or any other power production facility. It compares the turbine’s production over a given period of time with the amount of power the turbine could have produced if it had run at full capacity for the same amount of time.

|

Amount of power produced over time (usually measured annually)

|

|

|

Net Capacity Factor =

|

|

|

Power that would have been produced if turbine operated at full capacity 100% of the time over the same period of time

|

Net capacity factors are calculated using the following inputs:

6

|

1)

|

The power curve for the specific turbine that is being used at a given project site. This comes from the turbine manufacturer and varies between turbine types.

|

|

2)

|

The wind velocity distribution (Weibull Distribution) at the site of a given project. This comes from a statistical analysis of the meteorological data gathered from our proprietary meteorological towers erected at the site over the course of several years and confirmed with existing meteorological information from very long term weather stations and airport and other meteorological towers near the site.

|

|

3)

|

A mathematical model of the wind shear which allows us to extrapolate the wind speed data gathered from our meteorological towers at three different heights up to the specific hub-height of the wind turbine generator.

|

|

4)

|

Estimates of a number of known losses that are incurred during wind turbine operations. In particular, these are:

|

|

|

Topographic efficiency

|

|

|

|

Electrical efficiencies

|

|

|

Availability

|

|

|

|

Array losses

|

|

|

Icing and blade degradation

|

|

|

|

Substation maintenance

|

|

|

Utility downtime

|

|

|

|

Power curve turbulence variation

|

|

|

Sector management

|

We utilize proprietary computer software which incorporates each of these inputs for a given project site and returns the net capacity factor as its output.

This capacity factor is then verified against the net capacity factor calculated by an independent Certified Consulting Meteorologist (CCM) who is contracted for each project so that the net capacity factors are certified as correct and thus can be used in our interconnection requests and financing negotiations.

When our results differ from those of the Certified Consulting Meteorologist, it is due to different estimates in the above list of inputs. For example, the CCM may use a different Hellman exponent in the wind shear model than we do, or they may use different estimates of the loss factors. In these cases, the CCM net capacity factor is assumed to be correct, and we adjust our input assumptions to conform with those of the CCM.

Our net capacity factor projections are subject to change and are not intended to predict the wind at any specific time over the turbine’s 20-year useful life. Even if our predictions of a wind energy project’s net capacity factor become validated over time, the energy projects may experience hours, days, months, and even years that are below our wind resource projections.

Our focus on smaller projects allows us to install parks where developers of larger projects would be at a disadvantage, because smaller projects more easily fit into the current transmission grid, which decreases the costs of upgrading downstream components. While small projects are the focus of our strategy, we have not ruled out the possibility of larger projects.

Our business model focuses on the development of merchant parks. We do not plan to enter into power purchase agreements (PPAs) unless they are offered on favorable terms. Currently in the upper Midwest, with the exception of Minnesota, power purchase agreements tend to be difficult to obtain. When power purchase agreements are available, they tend to be at a price per kilowatt hour (kWh) that is less than the market price of electricity. Merchant parks sell electricity on the open market. Based on spot prices for electricity over the past five years, our merchant parks would have received on average $0.042 per kWh. Selling power on the open market increases the risk of the projects. However, based on U.S. Department of Energy forecasts and our own analysis, we believe that over the next decade the market price of electricity will continue to increase and that this merchant model will allow us to capture that upside potential.

7

In the past, we have been developing and then selling wind parks, in some cases remaining as a consultant for the party that purchased the park. We plan to continue to sell developments as a part of our ongoing business, but we intend to shift the focus of our business towards ownership and operation of merchant wind parks that we develop. We believe that this will allow us to grow our balance sheet and increase cash flow.

We intend to develop sites from “green field” (or blank slate) at a rate of approximately two to three additions to our pipeline per year, with each site likely to reach operation in approximately three years.

The first wind park that we plan to build, own and operate is a 20 MW project called Gascoyne I located south of Dickinson, North Dakota. As stated elsewhere in this Annual Report and the accompanying notes to audited consolidated financial statements, financing efforts for the Gascoyne I park are ongoing. Our goal is to have approximately 20 MW of owned operating capacity by the end 2011, subject to financing, and we target the construction and commissioning of approximately 40 MW of owned operating capacity annually thereafter. We do not currently and do not plan to act as an operator of wind parks we do not own.

To successfully develop, build and own wind parks, and to acquire other developments or make business acquisitions, we will need to raise additional capital.

We anticipate that we will need to arrange turbine supply loans to finance approximately 60 to 90% of the cost of a project’s turbines. After we have developed a wind energy project that we intend to own to the point where we are prepared to commence construction, we will need to raise construction financing to retire turbine indebtedness and to pay construction costs. Construction loans are generally secured by the project’s assets and our equity interests in the project companies. In certain instances we may enter into a construction loan for a single project, while in other instances we may be able to finance multiple projects through a single credit facility. We will also use equity capital contributions (our own and potentially from other investors as described above) to fund a portion of each project’s construction costs.

It is important to note that we do not plan to enter into PPAs, unless they are offered at a favorable rate. Instead, we will be selling our electricity on the open market. This is a deviation from the standard business model of wind parks, where a PPA is entered into to guarantee a price for a period of time. In our geographic areas, utilities generally have not been interested in PPA agreements, except at unattractive rates. We believe we will benefit from the sale of electricity in the merchant model because of the higher average price relative to what would be offered by a utility.

Our growth strategy is focused on developing parks from green field to operation. Our project management team is constantly exploring new opportunities in the North Dakota, South Dakota and Montana area that appear to be optimal sites. For our business strategy to work, new locations with excellent potential must continually be found and developed. In addition to green field developments, we are constantly analyzing the late stage developments of other wind developers. If a project appears to be feasible, we will pursue the purchase of the park. The value of a wind project and the expected level of returns are a function of the electricity that can be produced and its expected sales value over the lifetime of a wind farm. As the probability of a viable project reaching operation increases the market value also increases for that project. Key parts of the development stage, such as acceptable wind data, an interconnection agreement and a power off take solution, add the most value to the development process.

Each project has a value as it progresses, and projects can be sold at any stage of development. In our experience, prices for projects under development can range from $10,000 a MW for an early development stage project to $75,000 a MW for a project ready to begin construction. Developers looking to sell development stage projects will usually receive a higher price per MW for the sale of an entire pipeline of projects.

8

We are proceeding with development of our project portfolio. These projects are in various stages of development with the most advanced project ready to begin construction. We have focused on siting projects to fit the existing transmission grid so that our projects will not be subject to major upgrade costs or delayed because the need for additional transmission lines. As a result of our “size to fit” emphasis we have a number of small to mid size projects spaced out across North Dakota, South Dakota and Montana. Another key aspect of the Crownbutte development process is our emphasis on obtaining land control and wind data prior to starting the interconnection studies. Completing this work prior to the interconnection studies increases the probability that a project will be successful if an interconnection agreement is secured.

Development carries significant risk. In total, the process of site development can take up to five years and cost $200,000 to $300,000. Every step in the development process must be met precisely to prevent project failure. As the project completes each step in the development process the risk of the project decreases.

Our development strategy has several phases, and each phase adds value as a site is developed. The development phase involves all the preparation for park installation, up to but not including construction. The steps of wind park development, construction and operation are listed below:

|

1.

|

Identify the transmission capacity suitable for a specific-sized park within the large but widely scattered transmission system. By starting with the available transmission capacity we decrease the risk of adverse transmission system upgrade costs.

|

|

2.

|

Conduct topographical studies to determine the most promising locations by using the available meteorological data. We use this information to determine the anticipated energy production and associated project economics.

|

|

3.

|

Configure an initial park array to determine the parameters of the park with regard to transmission capability.

|

|

4.

|

Procure the necessary land lease options under the park’s footprint.

|

|

5.

|

Install site-specific meteorological instrumentation, which is always necessary to obtain site specific meteorological data. In some cases a meteorological tower is already on site, and historic data is therefore available. In most cases we will erect a meteorological tower for meteorological observation.

|

|

6.

|

Accumulate sufficient meteorological data.

|

|

7.

|

Select turbine type based on performance factors, availability and financeability.

|

|

8.

|

Prepare a wind report.. Once sufficient meteorological data has been accumulated we will retain a certified consulting meteorologist to prepare a financeable wind report by a certified consulting meteorologist, which validates that the wind regime will support the project cash flow model.

|

|

9.

|

Apply for local, state and federal permitting and transmission queue position. The permitting requirements for a project depend to a large extent on the location of the project. However, there are normally permitting considerations for zoning laws, wildlife protection, historical sites and use of air space.

|

|

10.

|

Secure interconnect agreements with utility and systems operator. Upon completion of the necessary system studies that follow an interconnection application we will know the upgrades necessary to tie into the transmission grid. Upon signing of an interconnection agreement we will be allowed to use the transmission grid to sell or wheel electricity.

|

|

11.

|

Prepare site design. Prior to construction, we will prepare the site design, which includes the geotechnical studies for the foundations.

|

|

12.

|

Execute turbine supply agreement. The turbine supply agreement dictates the relationship between the developer and a turbine manufacturer. It includes the turbine delivery time lines and the warranties on the turbines the manufacturer will provide.

|

9

|

13.

|

Retain construction subcontractors for each piece of the construction . These include high voltage work, crane use, access road construction, pouring of foundations, and all other necessary steps to complete the park.

|

|

14.

|

Prepare final site designs , including design of the high voltage systems, service roads, junction boxes, etc.

|

|

15.

|

Finalize project financing. Prior to construction the necessary arrangements for both construction financing and financing for the operational project must be secured. The financing normally includes some mix of developer equity, production tax credit (PTC), equity, and debt.

|

|

16.

|

Order long lead-time items such as the main step-up transformer and substation steel.

|

|

17.

|

Construction . Subcontractors will undertake all construction activities with oversight by us and the turbine manufacturer’s engineers. Construction on a 20 MW park generally takes 6-12 months. The majority of costs in developing a park are recognized during the construction phase.

|

|

18.

|

Turbine Commissioning. Once the turbines are erected, they will be tested for performance in line within the manufacturer’s specification. It the tests show the turbine is operation properly is will be commissioned and begin commercial operation.

|

|

19.

|

Operation & Maintenance . We will manage the operation of the project upon its commercial operation.

|

Our current pipeline of projects includes 12 projects totaling 638 MW (0 MW currently in operation) of potential capacity.

Buyers of Wind Parks

The mix of potential buyers changes as the size of wind projects increases. Different players in the market place only become interested when capital requirements for a project reach a certain level. Larger players need size to justify the time and expense required to construct or acquire projects. Smaller projects in the single to high teens of total megawatt output are usually owned by several different types of parties for specific reasons. Municipalities will purchase two to ten MW to generate some of their electricity needs from a renewable energy source. Utilities can also own small projects, usually as a result of a state mandate which requires the utility to generate a percentage of their electricity from renewable energy. In other cases a municipality may have a mandate to support community wind projects.

The midsize projects have the largest spectrum of potential buyers. These projects can range from 20 to 200 MW in size. Midsize projects benefit from economies of scale, and the projects become economically viable without the assistance of state mandates. Midsize projects are also more likely to fit into the existing transmission grid. As the projects get larger, the likelihood of needing substantial system upgrades increases. Midsize projects have a number of possible investors, ranging from utilities to financial institutions. Utilities generally prefer the midsize projects because they provide the generation necessary to address renewable energy portfolio standards, without buying more generation than is required. Financial institutions are attracted to the midsize projects because they are the right size for an efficient capital campaign. The projects are big enough that raising capital is worth their time and expense, but also the projects are small enough that an institution will not be over-exposed to the risks of one project. When a company is looking to create a portfolio of renewable energy assets, the midsize projects are most ideally suited to allow for diversification across geographic area, transmission systems and technology. According to the American Wind Energy Association, the average utility-scale wind project size in America is 60 MW. We are focusing on projects in the 20 to 60 MW range.

10

Wind Turbine and Construction Materials Supply

The growth of our business is dependent on the availability of turbines and turbine financing. Wind energy projects require delivery and assembly of turbines. Supply and logistical issues are of the utmost importance when developing a wind park. Over the past couple of years, demand for turbines has softened due to the 2008 financial market crisis. The industry is beginning to turn around and the rate of construction of projects has increased since the implementation of the U.S. Treasury Department renewable energy grant program as part of the American Recovery and Reinvestment Act of 2009. We have been contacted by various developers who have excess turbines at discounted prices and are evaluating the feasibility of purchasing some of these turbines with limited or no warranty. We have seen some evidence of softening turbine prices and shorter delivery lead times as the financial market turmoil during the autumn of 2008 has slowed the installation of new wind capacity. We expect that the turbines we require for our project development schedule will be available on a timely basis provided that we are able obtain turbine financing. We may work with several turbine suppliers to meet our turbine needs.

In addition, spare parts for wind turbines and key pieces of electrical equipment will need to be available for the turbines we have in operation. When we purchase our turbines, we also enter into warranty agreements with the manufacturer. Along with turbines and electrical equipment, other construction materials, such as gravel, cement, and rebar are necessary for the construction of roads and foundations. The combination of all these issues makes it essential for us to maintain working relationships with all of our suppliers.

Industry Overview

Renewable energy is produced using resources that are naturally replenished, such as wind, sunlight, geothermal heat, tides and biofuels. Technologies that produce energy from these renewable sources (other than biofuels) are often referred to as “clean” or “green” as they produce few, if any, pollutants that negatively impact the environment. Comparatively, fossil fuels such as coal, natural gas and oil are exhaustible and release greenhouse gases such as carbon dioxide or other pollutants into the atmosphere during energy production. As a result of increased environmental awareness, the deployment of renewable energy technologies has grown rapidly during the past several years. According to the Energy Information Administration, 37% of new U.S. power generation capacity in 2007 consisted of renewable technologies, compared with only 2% in 2003. This increase is expected to continue, with the American Council on Renewable Energy forecasting renewable energy capacity to grow by a compounded annual growth rate between 9% and 11% through 2025, yielding a potential 550,000-700,000 MW of additional renewable capacity. At this rate, the United States could supply 25% of its electrical energy requirements with renewable energy by 2025.

According to the U.S. Department of State, wind energy is the fastest-growing renewable energy generation technology worldwide due to its cost efficiency, technological maturity and the wide availability of wind resources. We believe that it has the greatest potential among all renewable energy technologies for further growth in the United States. Although the United States has hydroelectric and geothermal resources, many potential hydroelectric sites have already been developed and geothermal production is confined by geographical limitations to only certain areas of the United States. In contrast, according to the American Wind Energy Association, or AWEA, the available untapped wind resources across the United States remain vast. Additionally, other renewable energy technologies, such as solar power, are currently less economically attractive than wind energy, and others, such as biofuels, emit particulates which have a greater negative impact on the environment than wind energy.

Growth in U.S. Wind Energy

We believe that the growth in U.S. wind energy will continue due to a number of key factors, including:

|

●

|

Increases in electricity demand coupled with the rising cost of fossil fuels used for conventional energy generation resulting in increases in electricity prices;

|

|

|

●

|

Heightened environmental concerns, creating legislative and popular support to reduce carbon dioxide and other greenhouse gases;

|

|

●

|

Regulatory mandates, such as state renewable portfolio standard programs, as well as federal tax incentives including production tax credits and accelerated tax depreciation;

|

|

|

●

|

Improvements in wind energy technology;

|

11

|

●

|

Increasing obstacles for the construction of conventional fuel plants; and

|

|

|

●

|

Abundant wind resources in attractive energy markets within the United States.

|

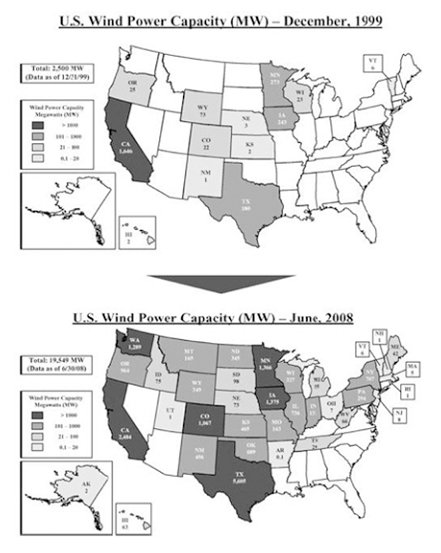

From its beginnings in California, wind energy in the United States has expanded steadily to 36 of the 50 states. As depicted on the maps below, the total installed capacity of U.S. wind parks increased by over 680% from 2,500 MW to over 19,500 MW between December 1999 and June 2008.

Source for December, 1999: U.S. Department of Energy.

Source for June, 2008: American Wind Energy Association.

12

According to the American Wind Energy (AWEA) 2009 Annual Wind Report, installed U.S. wind capacity increased by 8,545 MW (50.8%) in 2008 and by 5,249 MW (45.3%) in 2007. Despite this growth, wind energy generation still only represented just 1.26% of U.S. electricity supply in 2008, and we believe that the prospects for further growth are very favorable. Additionally, in May 2008, the U.S. Department of Energy published a feasibility report discussing the potential for wind power to provide up to 20% of U.S. electricity needs by 2030, which would require over 300,000 MW of cumulative installed wind capacity to meet this target.

Increases in Electricity Demand Coupled with the Rising Cost of Fossil Fuels Used for Conventional Energy Result in Increases in Electricity Prices

The demand for electricity has historically exhibited steady growth and has increased by a cumulative amount of 23% or 728 billion kWh from 1995 through 2007. According to the Energy Information Administration, electricity demand in the United States is forecasted to continue to grow at a steady long-term rate with a cumulative increase from 2007 through 2030 of 32%. Most of this demand has historically been supplied by coal- or natural gas-fired power plants, which accounted for 49% and 21%, respectively, of U.S. electrical power generation in 2007. In New York, New England, Texas and California, natural gas accounts for a significant portion of the electricity production, and this high usage, combined with the increased presence of natural gas-fired power plants, has made it the fuel that determines the price of power in these markets.

Price of Crude Oil and Natural Gas

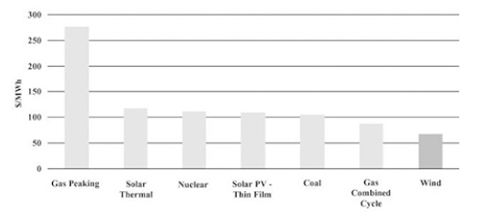

Comparative Cost of Electric Power Generation

Source: National Association of Regulatory Utility Commissioners. For each generation source, cost is calculated by taking the mid-point of the range described in the report by Lazard — “Levelized Cost of Energy Analysis — Version 2.0,” June 2008

13

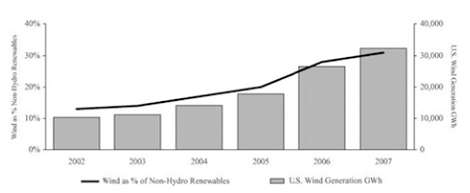

United States Wind Generation Growth

Source: Energy Information Administration

Non-hydro renewables consist of wind, solar, geothermal and biomass.

Wind energy also offers an attractive method of managing commodity price risk while maintaining strict environmental standards, as it provides a stable, affordable hedge against the risk of increases in the price of coal, natural gas and other fuels over time. Increasing the use of wind energy also has the implied benefit of lowering overall demand for natural gas, particularly during winter peak demand.

We believe that concern over the recent volatility in fuel prices in the United States, coupled with the country’s significant dependence on fossil fuels, has been and will continue to be a factor in the political and social movement towards greater use of clean energy.

Heightened Environmental Concerns, Creating Legislative and Popular Support to Reduce Carbon Dioxide and Other Greenhouse Gases

The growing concern over global warming caused by greenhouse gas emissions has also contributed to the growth in the wind energy industry. According to the Intergovernmental Panel on Climate Change Fourth Assessment Report, experts have noted that eleven of the last twelve years (1995-2006) rank among the warmest years since 1850. Additionally, the global average sea level has risen at an average rate of 1.8 millimeters per year since 1961 and at 3.1 millimeters per year since 1993, due to the melting of glaciers, ice caps and polar ice sheets, coupled with thermal expansion of the oceans. The importance of reducing greenhouse gases has been recognized by the international community, as demonstrated by the signing and ratification of the Kyoto Protocol, which requires reductions in greenhouse gases by the 177 (as of March 2008) signatory nations. While the United States did not ratify the Kyoto Protocol, state-level initiatives have been undertaken to reduce greenhouse gas emissions. California was the first state to pass global warming legislation, and ten states on the east coast have signed the Regional Greenhouse Gas Initiative, which proposes to require a 10% reduction in power plant carbon dioxide emissions by 2019.

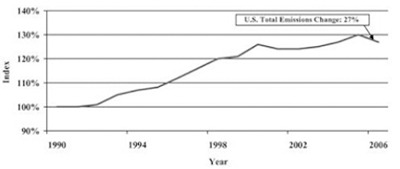

Substituting wind energy for traditional fossil fuel-fired generation would help reduce CO2 emissions due to the environmentally-friendly attributes of wind energy. According to the Energy Information Administration, the United States had the highest CO2 emissions of all countries in the world in 2005, contributing approximately 20% of the world’s CO2 emissions. Since 1990, CO2 emissions from the United States’ electric power industry have increased by a cumulative amount of 27%, from 1.9 billion metric tons to 2.5 billion metric tons.

14

Indexed Electric Power Industry CO 2 Emissions: 1990–2006

Source: Energy Information Administration

1990: 100% = 1.9 Billion Metric Tons of CO2

Environmental legislation and regulations provide additional incentives for the development of wind energy by increasing the marginal cost of energy generated through fossil-fuel technologies. Such legislation and regulations have been designed to, for example, reduce ozone concentrations, particulate emissions, haze and mercury emissions and can require conventional energy generators to make significant expenditures, implement pollution control measures or purchase emissions credits to meet compliance requirements. These measures have increased fossil fuel-fired generators’ capital and operating costs and put upward pressure on the market price of energy. Because wind energy producers are price takers in energy markets, these legislative measures effectively serve to make the return on wind energy more attractive relative to other sources of generation.

We believe there is significant support in the United States to enact legislation that will attempt to reduce the amount of carbon produced by electrical generators. Although the ultimate form of legislation is still being debated, the two most likely alternatives are (i) a direct emissions tax or (ii) a cap-and-trade regime. We believe either of these alternatives would likely result in higher overall power prices, as the marginal cost of electricity in the United States is generally set by carbon intensive generation assets which burn fossil fuels such as oil, natural gas and coal. As a non-carbon emitter and a market price taker, we are positioned to benefit from these higher power prices.

Regulatory Mandates, Such as State Renewable Portfolio Standard Programs, as Well as Federal Tax Incentives Including Production Tax Credits and Accelerated Tax Depreciation

Growth in the U.S. wind energy market has also been driven by state and federal legislation designed to encourage the development and deployment of renewable energy technologies. This support includes:

|

●

|

Renewable Portfolio Standards. In response to the push for cleaner power generation and more secure energy supplies, many states have enacted renewable portfolio standard programs. These programs either require electric utilities and other retail energy suppliers to produce or acquire a certain percentage of their annual electricity consumption from renewable power generation resources, or, as the case in New York, designate an entity to administer the central procurement of renewable energy certificates for the state. Wind energy producers generate renewable energy certificates due to the environmentally beneficial attributes associated with their production of electricity.

|

The number of states with renewable portfolio standard programs has doubled in the last six years and as of August 2008, 32 states and the District of Columbia had adopted some form of renewable portfolio standard program. The District of Columbia and 26 of the 32 states have mandatory renewable portfolio standard requirements and combined, these 26 states represent over 50% of total U.S. electrical load. A number of states, including Arizona, California, Colorado, Massachusetts, Nevada, New Jersey, New Mexico and Texas have been so successful in meeting their original renewable portfolio standard targets that they have revised their programs to include higher targets. Among the states in which we currently have projects, Texas and Montana have renewable portfolio standards. Other states such as Missouri, North Dakota, South Dakota, Utah, Vermont and Virginia have adopted state goals, which set targets, not requirements, for certain percentages of total energy to be generated from renewable resources. The states that have adopted renewable portfolio standard programs or set state goals, as well as the related requirements or targets, are set forth in the following map.

15

U.S. Renewable Portfolio Standard Programs and Goals for Renewable Energy Generation

Source: Database of State Incentives for Renewables & Efficiency, August 2008.

|

1.

|

RE – Renewable Energy.

|

|

|

2.

|

IOUs – Investor-Owned Utilities.

|

|

3.

|

Xcel – Xcel Energy, an electric and gas company that operates in the Midwest.

|

|

|

4.

|

Class I Renewables – Electricity derived from solar, wind, wave or tidal action, geothermal, landfill gas, anaerobic digestion, fuel cells using renewable fuels, and certain other forms of sustainable biomass.

|

|

5.

|

Co-op – Customer-owned electric utility that distributes electricity to its members.

|

|

|

6.

|

Munis – Municipalities.

|

|

●

|

Almost every state that has implemented a renewable portfolio standard program will need considerable additional renewable energy capacity to meet its renewable portfolio standard requirements. Much of Emerging Energy Research’s forecasted 50,000 MW of installed wind capacity by 2015 will be driven by current and proposed renewable portfolio standard targets, along with additional demand from states without renewable standards.

|

|

●

|

Renewable Energy Certificates (“RECs”). A renewable energy certificate is a stand-alone tradable instrument representing the attributes associated with one MWh of energy produced from a renewable energy source. These attributes typically include reduced air and water pollution, reduced greenhouse gas emissions and increased use of domestic energy sources. Many states use renewable energy certificates to track and verify compliance with their renewable portfolio standard programs. Retail energy suppliers can meet the requirements by purchasing renewable energy certificates from renewable energy generators, in addition to producing or acquiring the electricity from renewable sources. Under many renewable portfolio standard programs, energy providers that fail to meet renewable portfolio standard requirements are assessed a penalty for the shortfall, usually known as an alternative compliance payment. Because renewable energy certificates can be purchased to satisfy the renewable portfolio standard requirements and avoid an alternative compliance payment, the amount of the alternative compliance payment effectively sets a cap on renewable energy certificate prices. In situations where renewable energy certificate supply is short, renewable energy certificate prices approach the alternative compliance payment, which in several states is in the $50-$59/MWh range. As a result, renewable energy certificate prices can rival the price of energy and renewable energy certificates can represent a significant additional revenue stream for wind energy generators.

|

16

|

●

|

Production Tax Credits. The production tax credit provides wind energy generators with a credit against federal income taxes, annually adjusted for inflation, for a duration of ten years from the date that the wind turbine is placed into service. In 2008, the production tax credit was $20.78/MWh. Wind energy generators with insufficient taxable income to benefit from the production tax credit may take advantage of a variety of investment structures to monetize the tax benefits.

|

The production tax credit was originally enacted in 1992 for wind parks placed into service after December 31, 1993 and before July 1, 1999. The production tax credit subsequently has been extended five times, but has been allowed to lapse three times (for periods of three, six and nine months) prior to retroactive extension. Currently, the production tax credit is scheduled to expire on December 31, 2012, unless an extension or renewal is enacted into law.

|

●

|

Accelerated Tax Depreciation. Tax depreciation is a non-cash expense meant to approximate the loss of an asset’s value over time and is generally the portion of an investment in an asset that can be deducted from taxable income in any given tax period. Current federal income tax law requires taxpayers to depreciate most tangible personal property placed in service after 1986 using the modified accelerated cost recovery system under which taxpayers are entitled to use the 200% or 150% declining balance method depending on the class of property, rather than the straight line method. In addition, under the modified accelerated cost recovery system, a significant portion of wind park assets is deemed to have depreciable life of five years which is substantially shorter than the 15 to 20 year depreciable lives of many non-renewable power supply assets. This shorter depreciable life and the accelerated depreciation method results in a significantly accelerated realization of tax depreciation for wind parks compared to other types of power projects. Wind energy generators with insufficient taxable income to benefit from this accelerated depreciation often monetize the accelerated depreciation, along with the production tax credits, through forming a limited liability company with third parties.

|

Improvements in Wind Energy Technology

Wind turbine technology has improved considerably in recent years with significant increases in capacity and efficiency. Multiple types and sizes of turbines are now available to suit a wide range of wind resource characteristics and landscapes. Modern wind turbines are capable of generating electricity for 20 to 30 years.

There have been two major trends in the development of wind turbines in recent years:

|

●

|

According to the Danish Wind Industry Association and the U.S. Department of Energy, individual turbine capacity has increased dramatically over the last 25 years, with 30 kW machines that operated in 1980 giving way to the 1.5 MW machines that are standard today; and

|

|

●

|

Wind park performance has improved significantly, according to the U.S. Department of Energy, as turbines installed in 2004 through 2006 averaged a 33%-35% net capacity factor (the ratio of the actual output over a period of time and the output if the wind park had operated at full capacity over that time period) as compared to the 22% net capacity factor realized by turbines installed prior to 1998.

|

Additionally, as wind energy technology has continued to improve, according to AWEA, the capital cost of wind energy generation has fallen by approximately 80% over the past 20 years.

17

Increasing Obstacles for the Construction of Conventional Fuel Plants

In addition to the impediments presented by the extensive and growing environmental legislation, new power plants that use conventional fuels, such as coal and nuclear technologies, face a difficult, lengthy and expensive permitting process. Furthermore, increasing opposition from public environmental groups towards coal-fired power plants, coupled with rising construction costs, contributed to the cancellation of many planned coal plants in 2007. According to Resource Media, a public relations firm representing environmental groups in the western United States, the construction of 31 coal-fired plants totaling 24,250 MW was canceled or delayed in 2007. As a result, despite increasing gross margins, only about 2,000 MW of net new capacity from coal and nuclear plants was brought online between 2003 and 2006. Additionally, in October 2007, the Kansas Department of Health and Environment became the first government agency in the United States to cite carbon dioxide emissions as the reason for rejecting an air permit for a proposed coal-fired electricity generating plant, saying that the greenhouse gas threatens public health and the environment. Traditional energy developers and utilities are likely to face similar permitting and restricted supply issues in the future. As a result, alternative energy sources such as wind will need to be developed to meet increasing electricity demand and will be able to capitalize on the resulting higher energy prices.

Abundant Wind Resources in Attractive Energy Markets within the United States

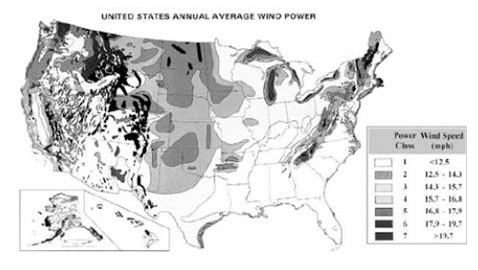

The potential for future growth in the U.S. wind energy market is supported by the large land area available for turbine installations and the availability of significant wind resources. According to AWEA, annual average wind speeds of 11 miles per hour or greater are required for grid-connected wind parks. As shown in the map below, a large portion of the United States exhibits wind speeds sufficient for wind park development.

Source: United States Department of Energy—National Renewable Energy Laboratory.

A chart describing the potential for wind power in billions of kWh is included below. Note that according to this source, North Dakota offers the best wind resource in the United States. The wind is exceptional in the Great Plains (and North Dakota especially), the actual installed capacity is minimal. Assuming a net capacity factor of 35%, current North Dakota wind parks only generate a small fraction of the state’s potential output. In fact, even with the projects planned for construction in the next year, less than 1% of potential will be realized.

18

THE TOP TWENTY STATES

for Wind Energy Potential

as measured by annual energy potential in the billions of kWh, factoring in environmental and land use exclusions for wind class of 3 and higher.

|

B kWh/Yr

|

B kWh/Yr

|

|||||||||

|

1.

|

North Dakota

|

1,210

|

11.

|

Colorado

|

481

|

|||||

|

2.

|

Texas

|

1,190

|

12.

|

New Mexico

|

435

|

|||||

|

3.

|

Kansas

|

1,070

|

13.

|

Idaho

|

73

|

|||||

|

4.

|

South Dakota

|

1,030

|

14.

|

Michigan

|

65

|

|||||

|

5.

|

Montana

|

1,020

|

15.

|

New York

|

62

|

|||||

|

6.

|

Nebraska

|

868

|

16.

|

Illinois

|

61

|

|||||

|

7.

|

Wyoming

|

747

|

17.

|

California

|

59

|

|||||

|

8.

|

Oklahoma

|

725

|

18.

|

Wisconsin

|

58

|

|||||

|

9.

|

Minnesota

|

657

|

19.

|

Maine

|

56

|

|||||

|

10.

|

|

Iowa

|

|

551

|

|

20.

|

|

Missouri

|

|

52

|

Source: An Assessment of the Available Windy Land Area and Wind Energy Potential in the Contiguous United States, Pacific Northwest Laboratory, August 1991. PNL-7789

Wind Energy Fundamentals

The term “wind energy” refers to the process used to generate electricity through wind turbines. The turbines convert wind’s kinetic energy into electrical power by capturing it with a three blade rotor mounted on a nacelle that houses a gearbox and generator. When the wind blows, the combination of the lift and drag of the air pressure on the blades spins the blades and rotor, which turns a shaft through the gearbox and generator to create electricity.

Wind turbines are typically grouped together in what are often referred to as “wind parks.” Electricity from each wind turbine travels down a cable inside its tower to a collection point in the wind park and is then transmitted to a substation for voltage step-up and delivery into the electric utility transmission network, or “grid.” Today’s wind turbines can efficiently generate electricity when the wind speed is between 11 and 55 miles per hour.

A key factor in the success of any wind park is the profile and predictability of the wind resources at the site. Extensive studies of historical weather and wind patterns have been performed across North America and many resources, in the forms of charts, graphs and maps, are available to wind energy developers. The most attractive wind park sites offer a combination of land accessibility, power transmission, proximity to construction resources and strong and dependable winds.

When wind energy developers identify promising sites, they perform detailed studies to provide greater certainty with respect to the long-term wind characteristics at the site and to identify the most effective turbine sitting strategy. The long-term annual output of a wind park is assessed through the use of on-site wind data, publicly available reference data and sophisticated software. Wind speeds are estimated in great detail for specific months, days or even hours, and are then correlated to turbine manufacturers’ specifications to identify the most efficient turbine for the site. Additional calculations and adjustments for turbine availability (which is principally affected by planned and unplanned maintenance events), wake effects (wind depletion caused by turbines sited upwind), blade soiling and icing and other factors are made to arrive at an estimate of net expected annual kilowatt hour electricity production at the site.

19

Sources of Revenue for Wind Generators

Wind energy generators primarily derive revenue from three sources:

|

|

Energy sales. Energy sales are derived from the sale of energy into a wholesale market or to a specific customer, such as a utility or power marketer;

|

|

|

Renewable energy certificate sales. In many states, conventional energy producers are required either to produce a certain percentage of their energy from renewable sources or to purchase renewable energy certificates from renewable energy producers. Renewable energy certificates represent the environmental attributes associated with electricity from renewable sources. Renewable energy certificates are a tradable instrument that can be sold separately from the electricity produced by a renewable generation source, thereby providing an additional revenue stream; and

|

|

|

Capacity sales. In some states, but not the states in which we are developing wind parks, payments are made to energy generators, including wind parks, as a market incentive to promote the development and continued operation of capacity sufficient to meet regional load and reserve requirements. Market systems have been established to ensure that generators receive these payments based on their availability to generate electricity. Payments are generally allocated to wind parks based on the previous year’s capacity for the super-peak hours during winter and summer qualifying periods.

|

Crownbutte’s Portfolio Management

We have been involved with all stages of the development process for wind energy projects. We believe this experience has given us knowledge to develop wind energy projects efficiently and effectively. We seek to develop well sited and well planned wind energy projects. Revenues generated in the past from the sale of brown-field and completed projects have been reinvested into our project portfolio by continuing to develop additional projects. Selling developed projects prior to construction provides returns for the capital invested in the development process. However, the sale is a onetime occurrence from the developer’s standpoint, and developing projects just to sell them is a relatively high risk business strategy.

Operating wind projects allows the project owner to receive revenues over the life of a project. We view ownership and operation of wind energy projects as the next step in our expansion strategy. We believe that operational projects will provide the Company with better risk adjusted returns on capital. Ownership may also give us upside potential if electricity prices continue to rise or if the value of an operational wind energy project increases. We anticipate that both of these values will continue to increase over the long term, as they have in the past several years.

The upside potential for ownership in wind energy projects is driven mainly by the price of electricity. A wind energy project receives payment for the power it generates in one of two ways: either through a power purchase agreement (PPA) or selling into an open market for electricity. The PPA is the most common method of power off-take for wind energy projects. The agreements are almost always with a utility and normally require the utility to buy all electricity a project may generate at a set rate. The agreements normally have a price increase every year and can run for up to 20 years. The PPA rates are usually below the market rate for electricity. The guaranteed price that a PPA offers reduces the risk of a project. Additionally projects with PPAs will usually be able to secure higher levels of debt financing and/or lower interest rates on the debt.

In many areas of the country another viable strategy for power off-take is to sell the electricity into a power spot market. Projects that sell electricity in this manner are referred to as “merchant” projects. There are several systems that provide real time and day-ahead spot markets for electricity such as Midwest ISO, PJM, ERCOT and Cal ISO. To decrease risk and increase financing options, some projects will sell into the spot markets but hedge their exposure with electricity futures contracts that trade on exchanges like the NYMEX.

20

Our portfolio of projects is located in the Midwest, and therefore our merchant projects would sell into the Midwest ISO’s spot market. We view selling power from our projects into the MISO market as a better off-take strategy than a PPA. This view is based on the fact that we believe the price of electricity will continue to rise and that a merchant project model will allow us to most effectively participate in upward price movement. The historically increasing costs are reflected in the year-over-year rise in the spot price on the MISO market. As the U.S. continues in recession, all prices in the economy, including the price of electricity, will experience downward pressure. To the extent that Crownbutte intends to use open market venues ( i.e. , the “merchant” markets) to sell power, variability of electricity prices are a risk to profitability in the short term. Over the long term, the demand for electricity is driven by the number of consumers, the numbers of electricity-powered devices employed and the efficiency of those devices.

We continue to identify new green-field sites to build our pipeline of projects. Upon successfully reaching commercial operation with a project, we will continually evaluate the most ideal mix of projects in the portfolio. In the event a buyer is identified and the sale of a project would, in our judgment, provide better returns than operation, the project may be sold off after it is in commercial operation. The sale of projects could be used to assist in the financing of additional projects that may provide higher returns for the Company.

Current Wind Development Projects

We are currently involved in the development of 12 separate wind projects having approximately 638 MW, or more (0 MW currently in operation), of total potential generating capacity. Pertinent information concerning each of the three (3) most advanced wind projects is summarized in greater detail below.

Gascoyne I Wind Park. The Gascoyne I Wind Park project site is an estimated 19.2 MW wind energy project located midway between the larger towns of Bowman and Hettinger, North Dakota, along the Adams and Bowman County line. This project is envisioned to would entail a total of 12 GE type 1.6MW turbines and is scheduled to begin construction in Fall, 2011, subject to project financing and other considerations.

Project Site and Wind Regime. As previously indicated, the Gascoyne I Wind Park project site is located between the towns of Bowman and Hettinger, North Dakota and covers 1,733 acres of contiguous land along a ridge line that has elevations averaging 3000 ft. ASL. The wind resource at the Gascoyne I site is one of the best in the United States with high mean wind speeds, low seasonal variations and low turbulence intensity. Site specific data has been recorded from two towers in the project area, with data beginning in November 2002. This data has been used to calculate the capacity factors based on GE 1.6 SLE turbine’s power curve, and have resulted in a projected approximate 50%+ net capacity factor after subtracting all loss components.

Electric Interconnection and Transmission. It is anticipated that the Gascoyne I Wind Park project will connect to a substation at the south end of the project site feeding into a 115 kV transmission line belonging to Montana-Dakota Utility Company, and which serviced a now closed lignite coal mine, still owned by Westmoreland Coal Company. The interconnection is facilitated by an Interconnection and Operating Agreement under an MISO (Midwest Independent System’s Operator) market.

Electricity Market. The Gacoyne I Wind Park project should be able to sell electricity into the wholesale market as established under PURPA (Public Utility Regulatory Policy Act) requiring system’s owners and system’s operators to create an OATT (open access transmission tariffs). The OATT was established in April 2005 within the MISO (Midwest Independent Systems Operator) footprint. MISO has published that the average wholesale price of electricity (called the LMP = Locational Marginal Price) within their system was at an all time low of $0.035 per KWH in 2010 because of the economic downturn. They have indicated that this price is recovering to an anticipated average of approximately $0.05 per KWH. A further advantage of selling electricity into the LMP is that the power producer maintains control of the Renewable Energy Credits (REC’s). REC’s can be sold even internationally. However, because of the lack of US regulation presently, REC’s have slightly more value than $0.01 per KWH. In areas where there are renewable portfolio standards (California) prices of up to $0.04 per KWH have been discussed. The Company anticipates a low per KW (Kilowatt Hour) combined price (LMP + REC) of $0.45 per KWH.

21

Project Costs and Summary. The Gascoyne project became shovel ready during the period when the major problem within the wind industry was turbine availability. The price of turbines more than doubled within 5 years. However, currently the major setbacks for wind power development are transmission constraints, lack of Power Purchase Agreements (PPAs) and political/regulatory uncertainties.

At the peak of the turbine bottleneck, the installed costs of Gascoyne I was $42 million with a project financial package roughly 1/3 from a tax equity investor using the Production Tax Credit, 1.3 from a private equity investor who would remain long term for a majority of project ownership and 1/3 debt. Presently, in lieu of the Production Tax Credit (PTC), there is a Treasury Grant available which would cover 30% of the installed price. There would be a bridging loan required for the installation of the park. The bridging loan often comes from the BOP (Balance of Plant) contractor who constructs the park based on the engineered specifications and cost analysis from the developer, and whois then compensated from the Treasury Grant once the park is completed. The Company currently has two BOP contractors who have made verbal commitments to provide bridging loan, guarantee the install price and bond their performance at our proforma prices in exchange for a no-bid contract.

Because of the large amount of new turbines literally sitting in the grass without interconnect capability, the cost of Gascoyne is now projected to be approximately $32 million. With 1/3 going to BOP contractor from the Treasury Grant and the remaining funds from debt. The remaining $15 million covers the cost of the turbines, transformers, pad mount transformers, sub-station and HV (hgh voltage) work, sysem’s upgrades, asset assignment, SCADA (systems control and data acquisition) and dVAR (dynamic Volt/Amp regulation).

Project Economics. Confirmed through CCM (Certified Consulting Meterorologist) reports, 12 GE type 1.6 ME SLE turbines will produce nearly 80,500,000 kilowatt hours per year for total revenues of approximately $3.62 million. It is anticipated that the Operations, Maintenance, Park Management, as well as Power Dispatch and Scheduling, will cost $1 million per year. Based on the foregoing, it is anticipated that the Gascoyne I Wind Park project should be able to easily service debt over 15 years at 7.5% interest.

Elgin Wind Project. The Elgin project is a 19.5 MW wind energy project near Elgin, North Dakota and is scheduled to begin construction in Fall, 2011, subject to project financing and other considerations. The Company has structured the project utilizing any of a number of different wind turbines types depending on which provides the most favorable agreement in terms of price, options and delivery schedule.

The project currently includes meteorological data since June of 2002, full land control, and an interconnection queue position with the transmission system operator (MISO) in the final Facility Study. We anticipate completing a turbine supply agreement, power dispatch and scheduling services agreement with Montana-Dakota Utilities and permitting upon finalizing project financing.

Project Site and Wind Regime. The project site is located south of the town of Elgin, North Dakota and consists of 800 acres of contiguous land under lease along a Montana-Dakota Utilities 69 kV transmission line. The wind resource at the Elgin site is one of the best in the United States with high mean wind speeds, low seasonal variations and low turbulence intensity. Site specific data have been recorded from a meteorological towers in the project area since 2002 and have been used to calculate the capacity factors based on a GE 1.5 MW turbine power curve (used as a standard benchmark) and have resulted in a net capacity factor over 40%.

Meteorological towers on the site of the Elgin project are collecting wind speed, direction, and temperature data at three different heights continuously and averaging over 10 minute intervals. These data are then transmitted via the cellular network to a central server where the information is combined with the turbine power curve and the real time (LMP) market price of electricity allowing us to continuously calculate the profit that would be made by a turbine at that location. We have written software which automates this procedure and have analyzed the site since 2005.

22

Electrical Interconnection and Transmission The Elgin project will tap into a new substation on an existing MDU 69 kV transmission line at the site. The interconnection will be facilitated by an Interconnection and Operating Agreement (MISO project G981, Queue 39517-02) and this agreement includes access to MISO's LMP market which establishes the price for generated electricity sold into the grid. The sale of the electricity will be facilitated by an Electricity Dispatch and Scheduling Services Agreement signed between Montana-Dakota Utilities and the Company.

Electricity Market. Elgin is structured as a merchant wind energy project where the generated electricity will be sold into the Midwest ISO (MISO)LMP market via the Open Access Transmission Tariff (OATT) established in response to a Federal Energy Regulatory Commission (FERC) order. Thus, the Company does not require a Power Purchase Agreement (PPA) for the Elgin project.

Zoning and Permitting Permits have been received from the Public Service Commission. Permits from the North Dakota Game and Fish and the State Historical Society are not needed and the FAA permitting is completed with a determination of No Hazzard to air navigation. A building permit from the County Planning and Zoning Commission will be obtained before construction begins.

Cost Summary. The total cost of development for the Elgin park is estimated at $32 million with an expected construction time line spanning five to ten months from ground-breaking. After completion of the construction phase, Crownbutte will be responsible for the management and maintenance of the park with contracted assistance from the turbine supplier as a consequence of their turbine warranty.

Wibaux Wind Project. The Wibaux wind project is a 19.5 MW wind energy project near Wibaux, Montana, and is scheduled to begin construction in Fall, 2011, subject to project financing and other considerations. The Company has structured the project utilizing any of a number of different wind turbines types depending on which provides the most favorable agreement in terms of price, options and delivery schedule.

The project currently includes meteorological data since August of 2007, full land control, and a interconnection queue position with the transmission system operator (MISO) in the final Facility Study. We anticipate completing a turbine supply agreement, power dispatch and scheduling services agreement with Montana-Dakota Utilities and permitting upon finalizing project financing.

Project Site and Wind Regime. The project site is located northwest of the town of Wibaux, Montana and consists of 1190 acres of contiguous land under lease along a Montana-Dakota Utilities 57KV transmission line. The wind resource at the Wibaux site is one of the best in the United States with high mean wind speeds, low seasonal variations and low turbulence intensity. Site specific data have been recorded from a meteorological tower in the project area since 2007 and have been used to calculate the capacity factors based on GE 1.5 MW turbine power curves (used as a standard benchmark) and have resulted in a projected 43% net capacity factor.

Meteorological towers on the site of the park are collecting wind speed, direction, and temperature data at three different heights continuously and averaging over 10 minute intervals. These data are then transmitted via the cellular network to a central server where the information is combined with the turbine power curve and the real time (LMP) market price of electricity allowing us to continuously calculate the profit that would be made by a turbine at that location. We have written software which automates this procedure and have analyzed the site since 2007.

Electrical Interconnection and Transmission. The Wibaux project will tap into a new substation on an existing MDU 57 kV transmission line at the site. The interconnection will be facilitated by an Interconnection and Operating Agreement (MISO project G994, Queue 39538-02) and this agreement includes access to MISO's LMP market which establishes the price for generated electricity sold into the grid. The sale of the electricity will be facilitated by an Electricity Dispatch and Scheduling Services Agreement signed between Montana-Dakota Utilities and the Company.