Attached files

| file | filename |

|---|---|

| EX-32.2 - Vyteris Holdings (Nevada), Inc. | v218510_ex32-2.htm |

| EX-31.1 - Vyteris Holdings (Nevada), Inc. | v218510_ex31-1.htm |

| EX-32.1 - Vyteris Holdings (Nevada), Inc. | v218510_ex32-1.htm |

| EX-31.2 - Vyteris Holdings (Nevada), Inc. | v218510_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-32741

Vyteris, Inc.

(Exact Name of Registrant as Specified in Charter)

|

NEVADA

|

84-1394211

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer

|

|

|

Of Incorporation or Organization)

|

Identification No.)

|

|

13-01 Pollitt Drive

|

||

|

Fair Lawn, New Jersey

|

07410

|

|

|

(Address of Principal Executive Office)

|

(Zip Code)

|

(201) 703-2299

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common stock, par value $0.015 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Check whether the issuer (1) filed all reports to be filed by Section 13 or 15(d) of the Exchange Act during the past twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shel1 company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

State issuer’s revenues for its most recent fiscal year. $117,792

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of a specified date within the past 60 days. (See definition of affiliate in Rule 12b-2 of the Exchange Act.) The aggregate market value of voting and non-voting common equity held by non-affiliates as of June 30, 2010, based upon the price at which such common equity was sold, was approximately $5,666,889. The number of shares outstanding of the registrant’s Common Stock, as of March 31, 2011, was 69,175,223 shares.

Documents Incorporated by Reference

Portions of the Definitive Proxy Statement for the 2011 Annual Meeting of Stockholders are incorporated by reference in Part III hereof.

VYTERIS , INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2010

TABLE OF CONTENTS

|

Form 10-K

Item Number:

|

Page

No.

|

|||

|

PART I

|

||||

|

Cautionary Statement Regarding Forward-Looking Statements

|

3 | |||

|

Item 1.

|

Business

|

4 | ||

|

Item 1A.

|

Risk Factors

|

15 | ||

|

Item 1B.

|

Unresolved Staff Comments

|

|||

|

Item 2.

|

Properties

|

27 | ||

|

Item 3.

|

Legal Proceedings

|

27 | ||

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

27 | ||

|

PART II

|

||||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

28 | ||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

29 | ||

|

Item 8.

|

Financial Statements and Supplementary Data

|

41 | ||

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

73 | ||

|

Item 9A.

|

Controls and Procedures

|

73 | ||

|

Item 9B.

|

Other Information

|

74 | ||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

74 | ||

|

Item 11.

|

Executive Compensation

|

74 | ||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

74 | ||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

75 | ||

|

Item 14.

|

Principal Accounting Fees and Services

|

75 | ||

|

PART IV

|

||||

|

Item 15.

|

Exhibits

|

75 | ||

|

Signatures

|

79 |

Vyteris® and LidoSite® are our trademarks. All other trademarks or servicemarks referred to in this Annual Report on Form 10-K are the property of their respective owners.

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in or incorporated by reference in this report, in press releases, written statements or other documents filed with or furnished to the Securities and Exchange Commission, or in our communications and discussions through webcasts, phone calls, conference calls and other presentations and meetings, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “future” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions.

Reference is made to forward-looking statements, including, but not limited to, those regarding:

|

|

·

|

the anticipated amount, mix and timing of future product sales, revenues from services provided for our Contract Research Organization (“CRO”), business, royalty revenues or obligations, milestone payments, expenses, liabilities, charges, contractual obligations, cash expenditures, share-based compensation, currency hedges, ax benefits and effective tax rate, and amortization of intangible assets;

|

|

|

·

|

our ability to integrate our CRO business with our drug delivery business in a cost and operationally efficient manner;

|

|

|

·

|

growth trends for our CRO business and any products developed with our drug delivery technology;

|

|

|

·

|

the incidence, timing, outcome and impact of litigation, proceedings related to patents and other intellectual property rights, tax audits and assessments and other legal proceedings;

|

|

|

·

|

the timing and impact of accounting standards;

|

|

|

·

|

the design, costs, development and timing of, and therapeutic area and indications targeted by, programs in our technology pipeline;

|

|

|

·

|

the timing and outcome of regulatory filings and communications with regulatory authorities;

|

|

|

·

|

the impact of the global macroeconomic environment and the deterioration of the credit and economic conditions internationally;

|

|

|

·

|

our ability to finance our operations and business initiatives and obtain funding for such activities;

|

|

|

·

|

our reliance on third-parties for certain aspects of our business;

|

|

|

·

|

the structure, strategy, financial and operational impact, and timing of our framework for growth; and

|

|

|

·

|

the drivers for growing our business, including our plans to pursue external business development and research opportunities, and the impact of competition.

|

Any such forward-looking statements are not guarantees of future performance and actual results, developments and business decisions may differ materially from those envisaged by such forward-looking statements. These forward-looking statements speak only as of the date of the report, press release, statement, document, webcast, or oral discussion in which they were made. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” (refer to Part I, Item 1A).

3

PART I

|

ITEM 1.

|

BUSINESS

|

Introduction

Vyteris, Inc. (the terms “Vyteris”, “we”, “our”, “us” and the “Company” refer to each of Vyteris, Inc. incorporated in the State of Nevada, its subsidiary, Vyteris, Inc. (incorporated in the State of Delaware), its subsidiary, MediSync BioServices, Inc. (“MediSync”) (incorporated in the State of Delaware) and the consolidated company) has developed and produced the first FDA-approved, electronically controlled transdermal drug delivery system that transports drugs through the skin comfortably, without needles. We believe that this platform technology can be used to administer a wide variety of therapeutics either directly into the skin or into the bloodstream.

On April 6, 2011, we completed a merger (the “Merger”) pursuant to which MediSync BioServices, Inc. became our wholly owned subsidiary. On April 1, 2011, the Company executed the Agreement and Plan of Merger with MediSync BioServices, Inc. and on April 6, 2011, the Company, and MediSync consummated the Merger by filing a Certificate of merger with the Secretary of State of the State of Delaware. MediSync’s business plan contemplates the acquisition and operation of contract research organizations (“CROs”) and related businesses. MediSync acquired one CRO in 2009, and is currently negotiating with several other acquisition targets. As a result of the Merger, we will operate in two business segments: a CRO business and a drug delivery technology business.

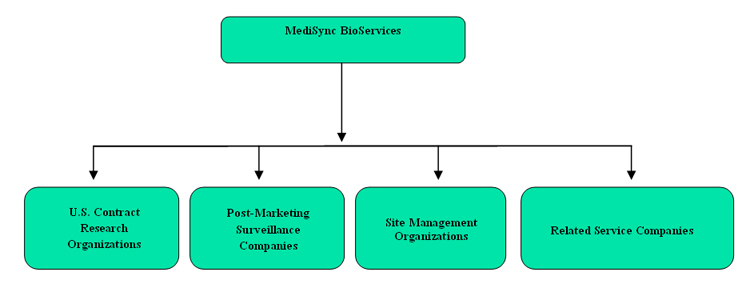

MediSync was formed in 2006 for the purpose of acquiring and consolidating CROs and related businesses, including but not limited to (i) SMOs, which sub-contract clinical trial-related responsibilities from CROs and pharmaceutical/biotechnology companies, (ii) post marketing surveillance companies, which monitor pharmaceutical drugs or devices after release into the market and (iii) clinical, regulatory and litigation consulting companies. We believe that MediSync’s current and future operations serve a growing demand for outsourced clinical research and related services in the pharmaceutical and biomedical industries. We further believe that each CRO and related business that MediSync acquires (each, an “Acquired Business”) may benefit from (a) potential cost savings and efficiencies proposed by the consolidation model, (b) the sharing of, and collaboration on, clinical research studies among the Acquired Businesses, (c) new services offered by other Acquired Businesses, and (d) synergistic efficiencies caused by MediSync’s consolidation with the existing Vyteris infrastructure.

The CRO Industry

CROs provide a wide range of pharmaceutical research and device-development services to the pharmaceutical, biotechnology, and medical device industries, including, but not limited to, product development and formulation, clinical trial management, and data management services to conform to Food and Drug Administration (FDA) regulations. The CRO industry revenue was predicted to approach $20 billion in 2010, or approximately one-third of research and development spending for the pharmaceutical and biotechnology sectors.1 Several analyst reports and studies have demonstrated a growing trend in pharmaceutical and biotechnology companies’ reliance on the outsourcing of clinical research and related services to CROs and similar organizations. For example, in mid-2009, it was estimated that approximately 25% of all biopharmaceutical drug development was being outsourced, representing a CRO market greater than $22 billion.2 Some industry analysts anticipate that the rate of outsourcing to CROs will accelerate, approaching 40% over the next several years.3

In addition, approximately $125 billion of revenue from patent-protected drugs may no longer be available in the next few years, due to recent and upcoming patent expirations.4 As a result, pressure on pharmaceutical companies to revive drug development pipelines has intensified.5 We believe that this pressure will lead to new drug development opportunities for CROs and related businesses.

1 CRO Market, www.acrohealth.org/cro-market1.html, as of March 6, 2011.

2 J.P. Morgan, CRO Report, July 16, 2009.

3 Goldman Sachs, Americas: Healthcare Services: Pharmaceutical Services, October 20, 2009.

4 Washington Drug Letter, FDA News, Vol. 42 No. 42, October 25, 2010.

5 J.P. Morgan, CRO Report, July 16, 2009.

4

Acquisition Strategy

We anticipate that MediSync’s Acquired Businesses will consist of companies that play an integral role in assisting pharmaceutical and biotechnology companies with the development of, and strategies relating to, drugs, biologics and medical devices. With respect to MediSync’s acquisition targets, we intend to focus on privately owned and operated companies that are profitable (after making certain pro-forma acquisition adjustments), have at least five years of operating history, and have built a good reputation through working with numerous well-known pharmaceutical and/or biotechnology customers. We plan to build value (i) through programs designed to drive incremental new revenues, (ii) by benefiting from economies of scale, proactive business development and marketing initiatives, centralized management and information systems, and “brand name” identification, and (iii) by broadening the scope of services offered by each of the Acquired Businesses.

With respect to the Acquired Businesses, we plan to strategically:

|

|

·

|

contribute expansion capital as appropriate and available;

|

|

|

·

|

increase operational efficiencies;

|

|

|

·

|

leverage the unique specialties and areas of expertise of each Acquired Business;

|

|

|

·

|

create new revenue streams through new service offerings;

|

|

|

·

|

leverage cost savings through economies of scale;

|

|

|

·

|

operate throughout the U.S. and subsequently embark upon a global expansion; and

|

|

|

·

|

carefully monitor the synergies among the Acquired Businesses to effectively nurture organic growth of their businesses.

|

We intend to cause each Acquired Business to maintain its own identity and specialty skills while at the same time benefiting from operating efficiencies and lower overhead costs. Because we plan to target small- to mid-size companies, we believe that a consolidation of resources of such companies could significantly contribute to the expansion of operations, resulting in increased revenues. We believe that our acquisition of carefully selected companies with complementary attributes and expertise will contribute to an inherent synergy, thereby allowing the Acquired Businesses to source, and collaborate on, clinical research studies among one another. Through this cross pollenization, MediSync can expand its operations by offering a larger range of services provided by each of its unique Acquired Businesses to potential customers.

We anticipate MediSync’s organizational structure to be as follows:

5

MediSync is pursuing acquisition targets with respect to its pipeline, which we intend to pursue for closing by the end of the first quarter of 2012. These include the following:

|

|

·

|

Potential extension of agreement with scientific consulting firm across a variety of business applications to industry and counsel in (i) assisting clients with the navigation of clinical and regulatory requirements, and (ii) supporting clients in defending their products in a variety of legal actions. Transaction terms include a total purchase price up to $7.3 million consisting of (i) $4.3 million in cash; (ii) $1.0 million in purchase money promissory note; (iii) 3.75 million shares of Company common stock valued at $0.8 million; and (iv) earn outs of up to $1.2 million over three years.

|

|

|

·

|

Signed letter of intent with a service management organization specializing in trials requiring a controlled environment. Transaction terms include a total purchase price of $10.0 million consisting of (i) $8.0 million in cash; and (ii) $0.6 million in Vyteris common stock, along with a $1.2 million earn out. Due diligence, as well as an audit of the targets financial statements, is underway.

|

|

|

·

|

Negotiations underway with a CRO with a 50 bed research unit. Transaction terms anticipated to include a total purchase price of $12.5 million, with $10.0 million in cash and $1.0 million in equity, with a $1.5 million three-year earn out.

|

|

|

·

|

Negotiations underway with an international CRO. Transaction terms anticipated to include a total purchase price of $7.5 million, with $1.0 million in cash and $4.0 million in equity, with $2.5 million in a combination of purchase money notes and/or earn outs.

|

|

|

·

|

Negotiations underway with a research company which specializes in post-marketing surveillance. Transaction terms anticipated to include a total purchase price of $7.5 million, with $4.0 million in cash, $1.8 million in earn out and $0.9 million in each of a purchase money note and equity.

|

There can be no assurances whether any or all of the above described acquisitions will be consummated or if financing can be secured for any acquisition, and if so, on what terms.

Our Drug Delivery Business

Technology

Our drug delivery business is technology driven. Our active transdermal drug delivery technology is based upon a process known as electrotransport, or more specifically iontophoresis, which is the ability to transport drugs, including peptides, through the skin by applying a low-level electrical current. Our active patch patented technology works by applying a charge to the drug-holding reservoir of the patch. This process differs significantly from passive transdermal drug delivery which relies on the slow, steady diffusion of drugs through the skin. A significantly greater number of drugs can be delivered through active transdermal delivery than is possible with passive transdermal delivery. Our technology can also be used in conjunction with complementary technologies to further enhance the ability to deliver drugs transdermally.

Market Opportunity

We believe there are a significant number of pharmaceutical drugs with substantial annual sales for which the patent is due to expire by 2012. Based on our analysis, there are currently a significant number of these and other FDA-approved drugs that may be relatively easily formulated for transdermal delivery and thus made eligible for new patent protection.

6

Business Model

Business Strategy and Initiatives

Our commercialization strategy is to develop near-term and future market opportunities utilizing FDA-approved and marketed drugs (primarily peptides and small molecule drugs) with our proprietary delivery technology. By targeting compounds that may qualify for accelerated development and regulatory pathways such as those implemented under Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act, we strive to develop and commercialize products that can reach the market faster and at a reduced cost as compared to the traditional development and regulatory approval processes for new drugs. Additionally, we are exploring various strategies to derive revenue from our FDA approved LidoSite product, and our phase II infertility and phase I migraine projects. These strategies include sale or licensing of these products to third parties and pursuit of partnership opportunities with other companies in the pharmaceutical and biotechnology industries.

Technology initiatives are also under way to expand our drug delivery capabilities so that we are able to utilize our technology for a wider variety of pharmaceutical applications. We are looking to improve our existing patch and controller technology, as well as to implement innovative product manufacturing methods to reduce materials costs. We have been actively pursuing opportunities that combine our technology with complementary technologies such as ultrasound, chemical enhancers, in order to further increase transdermal drug penetration that may lead to successful delivery of higher molecular weight drugs. We are not currently manufacturing any products and if we are able to move toward commercial viability of products we will look for alternative production strategies, which may include outsourcing.

Market Opportunity

We have identified key areas of market opportunity in the areas of therapeutic peptides and small molecules which we intend to pursue:

|

|

·

|

Women’s health, such as infertility,

|

|

|

·

|

Migraine treatment,

|

|

|

·

|

Pain management, and

|

|

|

·

|

Metabolic diseases, such as diabetes and osteoporosis.

|

Our focus on these core market areas represents our belief in their relatively near-term commercialization and revenue-generating potential.

Female Infertility Treatment

One of our development opportunities is in the peptide delivery market. Pursuant to the termination provisions of our former Development Agreement with Ferring Pharmaceuticals, Inc. (“Ferring”), we believe we now own the rights for the development of an innovative product to treat female infertility using our smart patch technology. The product under development is designed to mimic the female body's natural rhythms of hormonal secretions, a characteristic important in the delivery of therapeutics for the treatment of infertility. To be effective, many patients currently need to undergo multiple injection-based protocols for ovulation inducement, sometimes as many as eight daily injections for up to three weeks. Our product would make it possible to administer the peptide without needles in a painless, convenient and cost-effective manner.

Migraine Treatment

Another key area where we are seeking to apply our smart patch technology is the treatment of migraines. This may be a highly attractive market segment, estimated at over $3 billion per year (“Migraine Market: Trexima Approval Delays Benefits Generic Triptan”, RedOrbit NEWS, published March 29, 2007), where major market leaders face imminent patent expirations. The treatment of migraine requires rapid onset of medication. A class of compounds known as “triptans” is currently considered an effective treatment. We believe a significant market opportunity exists to improve the efficacy of triptan therapy for migraines by changing the method by which triptans are administered. Taken orally, triptans often fail to deliver sufficient quantities of medication in the short time frame required to optimally treat migraine onset. Further, they often fail to prevent the second episode, known as recurrence, which many migraine patients suffer within 12 to 18 hours after a first attack.

7

Our active patch technology can be pre-programmed for rapid delivery — as little as 15 minutes to achieve therapeutic levels — followed by a sustained maintenance dose that may prevent headache recurrence. If our smart patch is applied in this area, this customizable drug delivery could offer advantages in the treatment of migraine, and could improve patient satisfaction and patient compliance. We believe that this could be a unique and significantly improved therapy and that it could be a potentially effective way to significantly improve treating and preventing recurring migraine headaches.

Pain Management

Another key area of potential partnership with pharmaceutical companies is in pain management, specifically, the non-steroidal anti-inflammatory drug (“NSAID”) sector, which falls in line with our strategy of pursuing high probability, low risk opportunities leading to better patient care. Some of the well-known NSAIDs that are or have been on the market are Vioxx, Celebrex, Naproxen and Daypro.

NSAIDs have made a dramatic contribution to pain management, but their extensive use has also documented a problematic safety profile, due to gastrointestinal (“GI”) side effects associated with extended use or over dosing of the drugs. In the United States alone, more than 107,000 hospitalizations are attributed to NSAID use, and more than 16,000 deaths a year are attributed to NSAID use (“Horizon Therapeutics Announces Two Pivotal HZT-501 Phase 3 Trials Meet Primary Endpoints,” Horizon Therapeutics, Inc., December 2, 2008).

Our active delivery system bypasses the gastrointestinal tract, minimizing the GI side effects associated with oral NSAIDs, and circumvents a major disadvantage of these commonly used medications. We believe that if our smart patch technology is applied to NSAIDs, the controlled drug delivery profile from our active patch could also curtail overdosing of the drugs.

Metabolic Diseases

We are also exploring the possible opportunities to use our technology to combat certain metabolic diseases, such as diabetes and osteoporosis.

Diabetes

Diabetes mellitus is a common metabolic disease. It is characterized by a lack of insulin secretion and/or increased cellular resistance to insulin, resulting in hyperglycemia and other metabolic disturbances. People with diabetes suffer from increased morbidity and premature mortality related to cardiovascular, microvascular and neuropathic complications. The delivery of peptides (insulin or GLP-1) through the skin drugs may be accomplished by iontophoresis alone or by a combination of physical or chemical enhancement technologies with iontophoresis to result in delivery of these therapies.

Osteoporosis

Osteoporosis is a metabolic skeletal disorder wherein bone strength decreases and risk of bone fracture increases. Bone strength is maintained by a continual process of bone resorption and bone regeneration. Osteoporosis results when bone resorption occurs at a faster rate than bone regeneration. We believe iontophoresis can be used to transdermally deliver calcium-regulating hormones such as salmon calcitonin and parathyroid hormone (1-34). Such delivery could be useful for chronic treatment of post-menopausal osteoporosis and other clinical indications as a superior alternative to injection.

Technology

Overview of Electrotransport, or Active Transdermal Drug Delivery

Our active transdermal drug delivery technology (also referred to as our smart patch technology) is based on a process known as electrotransport, or more specifically, iontophoresis, a process that transports drugs through the skin by applying a low-level electrical current. Our patented technology works by applying a charge to the drug-holding reservoir of the patch. A positive charge is applied to a reservoir where a positively charged drug molecule is held. Because like-charges repel, the drug molecules are forced out of the reservoir and into the skin (the same process can occur when a negative charge is applied to a reservoir containing a negatively charged drug molecule).

8

This process differs significantly from passive transdermal drug delivery, which relies on the slow, steady diffusion of drugs through the skin. Passive drug delivery patches have a limited number of applications including: smoking cessation, birth control, hormone replacement therapy, angina and motion sickness.

By contrast, using iontophoresis, certain drugs can be delivered through the skin and deeper into the bloodstream faster and in larger quantities than by passive transdermal patches. Because of the application of an external form of energy (electrical energy in the form of a charge), this mode of delivery is also called “active transdermal delivery”. Initial research indicates that a significantly greater number of drugs can be delivered through active transdermal delivery than through passive transdermal delivery. Based on our analysis, we estimate that there are currently in excess of 180 FDA-approved drugs that can be delivered through our active transdermal delivery platform.

Furthermore, because the drug is only delivered when current is being administered, our delivery system is precise, controllable and electronically programmable, thereby enabling active transdermal delivery technology to duplicate the steady or periodic delivery patterns of intravenous infusion. By controlling the intensity and duration of the charge applied, the smart patch controls whether the drug delivery is topical, or whether the delivery is systemic, in which case the drug molecules are pushed deeper into the skin, where they enter the body’s circulatory system directly. The technology also aids speed of absorption.

Our Approach to Iontophoresis

We have developed a proprietary technology encompassing a series of significant improvements to drug formulation and commercial manufacturing. We used this technology with our first FDA-approved product, LidoSite, and are currently using this technology to deliver peptides and small molecules in a research and development setting. Many of our innovations center on the way we approach designing and formulating electronically controlled drug delivery patches. Our patches are pre-filled with the proper dosage of drug during the manufacturing process. They are designed to be disposable after a single application and are discreet in appearance. Further, we designed our patches so that they can be quickly and cost-effectively mass-produced using automated manufacturing processes.

To complement our patch design, we approached the design of electronic controllers with the goal of being small, wearable, easy to operate and programmable to handle simple, as well as complex, drug delivery profiles. The dose controller contains a miniature battery and circuitry, controlling delivery rate, and is capable of recording information on the amount and time of drug delivered. We believe the controllability and programmability offered by our technology are distinct competitive advantages that will enable our products to deliver more consistent and predictable results for a broad range of existing and new drugs.

Clinical Studies

Infertility/Peptide Application

We assisted Ferring in completing a Phase I clinical trial demonstrating that our patented smart patch transdermal technology successfully delivered a peptide molecule in humans (multiple pulse) without the use of needles (noninvasively) in therapeutic levels aimed at the treatment of female infertility. The study results showed that therapeutic levels of the peptide in humans are achievable without the use of injections or infusion pumps. The clinical trial was conducted in the U.S. with 30 patients under an investigational new drug application. Specific technical data will undergo peer review for future disclosure.

In the Phase I clinical trial, a pulse profile controlled the transdermal delivery of the peptide from patches loaded with different concentrations of the peptide. The amounts of peptide delivered using the patch were comparable or higher than with subcutaneous (subQ) injection. The study used different formulations within our patch that were compared with subQ delivery of the peptide.

9

Ferring also conducted a Phase II clinical trial of the infertility product. The Phase II trial was a multi-center clinical trial conducted at approximately 35 centers throughout the U.S. and enrolled approximately 350 female patients between the ages of 18 and 38 years with anovulatory / oligoovulatory infertility. In this clinical trial, the safety, tolerability, and effectiveness of our transdermal delivery system was evaluated. We are currently reviewing the results of this trial to determine what degree of success was achieved based on the goals of the trial; whether an additional Phase II trial may be needed; and the feasibility of moving on to Phase III trials. We anticipate that any such additional trials would be conducted by a strategic partner pursuant to a development and marketing agreement.

LidoSite

We received FDA approval for the sale of our LidoSite product in the United States in 2004. Our LidoSite product is currently dormant, and there are no plans to engage in further development, marketing or licensing of this product.

Competition

Any existing or future products which we may develop will likely compete with both conventional drug delivery methods and advanced drug delivery methods.

Conventional Drug Delivery Methods

Traditionally, the pharmaceutical industry has relied on oral delivery and injection as the primary methods of administering drugs:

|

|

·

|

Conventional Oral Method. Conventional, oral drug dosage forms, such as pills and capsules, are the most common types of drug delivery. Oral drug delivery methods are easy to administer, but their efficacy can be limited because drugs must first pass through the digestive system and liver before being absorbed into the bloodstream. Therefore, orally delivered drug dosages must be large to overcome the degradation that occurs in the gastrointestinal tract and liver. As a result, conventional oral dosage forms often produce higher initial drug levels than are required to achieve the desired therapeutic effects, thereby increasing the risk of side effects, some of which can be serious. Also, it is difficult to maintain therapeutically optimal drug levels using oral drug delivery methods. Further, oral drug delivery methods can require patients to follow inconvenient dosing routines, which may diminish patient compliance with self-medication schedules.

|

|

|

·

|

Injection Methods. Injectable drug dosage forms generally provide rapid onset of therapeutic action and offer many of the same advantages as conventional oral drug dosage methods. Injectable drug delivery methods use needles, raising the possibility of needle-stick injuries, as well as the risk of infection to the caregiver and the patient. The use of needles also increases patient anxiety due to the pain of injection.

|

Advanced Drug Delivery Technologies

The limitations of conventional forms of drug delivery have driven demand for advanced drug delivery alternatives that are safer, more effective and more convenient. Advanced drug delivery technologies have improved oral and injection methods as well as offering new means of administering drugs, such as through the skin and the respiratory system. Advanced drug delivery technologies include sustained release pills and injectables, passive transdermal patches and infusion pumps, as well as pulmonary, nasal, intravaginal and opththalmic methods. In some cases, these technologies offer better control over the release of drugs into the bloodstream, thereby improving therapeutic efficacy and reducing side effects and risks. In other cases, advanced drug delivery technologies make therapies easier to administer and support more complex therapeutic regimens. Innovative drug delivery technologies can offer many advantages over traditional methods, including ease of use and administration, greater control of drug concentration in the blood, improved safety and efficacy, improved patient compliance, expanded indications for certain therapies, and totally new therapies using drugs that cannot be delivered otherwise.

10

The following is an overview of advanced drug delivery technologies and other alternative methods that could be direct or indirect competitors of our potential future products:

|

|

·

|

Sustained release oral dosage forms are designed to release the active ingredients of the drug into the body at either a predetermined point in time or at a predetermined rate over an extended period of time, generally do not work fast and may be partially destroyed by the liver and stomach before they get into the blood stream.

|

|

|

·

|

Passive transdermal patches allow absorption of drugs through the skin and generally provide a convenient method of administering drugs at a steady rate over an extended period of time, but onset of action may take hours after application, and absorption of the drug may continue for hours after the patch is removed, which can increase side effects. Additionally, because human skin is an effective barrier, most drug formulations will not passively permeate the skin in therapeutic quantities.

|

|

|

·

|

Sustained release injectable preparations allow conventional injectable drugs to be incorporated into a biodegradable material that is then injected and absorbed slowly into the surrounding tissue. These preparations reduce the frequency of injections by creating a small “depot” of the drug beneath the skin that is slowly absorbed by the body, thus increasing the interval between injections. They can turn a conventional once-a-day injection into a once weekly or even longer regimen.

|

|

|

·

|

Continuous infusion pumps are small implantable or externally-worn battery-powered pumps that introduce drugs directly into the body, using a needle or catheter inserted into tissue just below the skin or directly into the blood stream or spinal space. They use conventional drugs, and provide rapid onset of action as well as sustained or programmed delivery of medication. These are costly, complex electromechanical devices reserved mostly for treatment of chronic conditions such as the delivery of insulin for certain diabetes patients and for chronic intractable pain management for the treatment of certain forms of spasticity.

|

|

|

·

|

Pulmonary, nasal and transmucosal methods are designed to provide fast action or to deliver drugs that are destroyed by the gastro-intestinal tract. Variations in a user's respiratory tract, often brought on by everyday occurrences such as a cold, infection or even changes in climate, can markedly affect the amount of drug inhaled from each spray.

|

|

|

·

|

Jet injection drug delivery technology uses stored mechanical energy from either a spring or compressed gas cylinder to ballistically deliver a liquid or powder through the skin without a needle. Liquid jet injection has been used for many years with minimal success. A new technology allows the administration of small amounts of drugs in dry powder form through the skin using a specially engineered device, which propels the drug using a high-powered jet of helium gas. The gas accelerates the dry drug particles, enabling penetration of the skin.

|

Competition for our drug delivery products may come from any of the above technologies or new, yet-to-be-developed technologies.

Current and Potential Iontophoresis Competition

NuPathe Inc. is a privately-held specialty pharmaceutical company specializing in the development of therapeutic products based on iontophoresis for neurological and psychiatric diseases. NuPathe’s lead compound, Zelix™, combines sumatriptan with NuPathe’s proprietary Iontophoretic System. NuPathe completed its pivotal Phase III study and is believed to be planning an NDA filing in 2011.

Dharma Therapeutics, Inc. is a subsidiary of Transcu Group Limited. Dharma is an early stage drug delivery company based in Seattle, Washington which develops transdermal delivery systems with a focus on iontophoretic transdermal drug delivery technology. Dharma is currently developing products in the areas related to pain, inflammation, and nausea. Recently, Dharma completed Phase II clinical trials for its Lidocaine iontophoresis patch drug delivery system.

11

EyeGate Pharma is a specialty pharmaceutical company centered in ophthalmics and focused on developing and commercializing its EyeGate® II Delivery System and formulation technologies to deliver therapeutics to the eye. Eyegate uses iontophoresis technology to deliver drugs to both the anterior and posterior tissues of the eye. EyeGate Pharma’s initial focus is on treating inflammatory conditions like uveitis, which is responsible for an estimated 10 to 15 percent of all cases of blindness in the Unites States. The company recently completed a Phase II study of its lead product candidate, EGP-437, for the treatment of anterior uveitis, a proprietary formulation of a well-studied corticosteroid, for treating severe uveitis and dry eye.

Alza Corporation, formerly a Johnson & Johnson subsidiary, with its E-TRANS® system, is the only other company known to have developed pre-filled iontophoresis technology. Alza has chosen a very different application, delivery of an opiate-based product for systemic pain management, for its first product. Alza received approval of its IONSYSTM NDA in the summer of 2006 from the FDA. This approval further validates the potential value and utility of iontophoretic drug delivery, making this class of technology more attractive to the pharmaceutical and health-care industries. The Alza system was developed to treat pain associated with major surgery and cannot be used as a dermal anesthetic. We also believe that because Alza has incorporated the electronics into each patch, the added complexity of the product necessitates product development cycles for new applications that are significantly longer than those required by our system.

Travanti Pharma, Inc., formerly Birch Point Medical, Inc., a development stage company, developed a single use iontophoretic system called IontoPatch™, aimed at the physical therapy market. We believe that the IontoPatch product is not FDA-approved for any specific therapeutic indication and is not pre-filled with medication.

Becton Dickinson is engaged in developing alternative drug delivery technologies, and we may compete in the future with alternative technologies developed or acquired by Becton Dickinson. Becton Dickinson has developed drug delivery technology employing “micro-needles,” tiny needles that deliver compounds into the first few hundred microns of the skin. This technology, which has not yet been commercialized, may compete directly with our current technology.

Patents, Intellectual Property and Proprietary Technology

We protect our technological and marketing position in advanced transdermal drug delivery technology by filing U.S. patent applications and, where appropriate, corresponding foreign patent applications. Our success will depend in part upon our ability to protect our proprietary technology from infringement, misappropriation, duplication and discovery. Our policy is to apply for patent protection for inventions and improvements deemed important to the success of our business. We have a portfolio of approximately 50 U.S. patents and 70 foreign patents. We have approached the design and development of our active transdermal drug delivery systems with the objective of maximizing overall delivery system efficiency while addressing commercial requirements for reproducibility, formulation stability, safety, convenience and cost. To achieve this goal, our delivery systems integrate proprietary and patented technology with commercially available, off-the-shelf components.

Iontophoresis, as a way of delivering drugs, has been well known for many years. Our patent portfolio consists of innovations that advance basic iontophoresis technology through:

|

|

·

|

enabling more efficient electrode designs;

|

|

|

·

|

drug formulations that enhance iontophoresis;

|

|

|

·

|

specific transdermal patch features allowing convenient use and low manufacturing cost;

|

|

|

·

|

electronic circuitry and program algorithms improving the safety and control of medication delivery; and

|

|

|

·

|

ability to deliver specific classes of molecules not previously possible.

|

12

The issuance of a patent is not conclusive as to its validity or as to the enforceable scope of the claims of the patent. The patent positions of pharmaceutical, biotechnology and drug delivery companies, including our company, are uncertain and involve complex legal and factual issues. Accordingly, we cannot assure investors that our patents will prevent other companies from developing similar products or products which produce benefits substantially the same as our products, or that other companies will not be issued patents that may prevent the sale of our products or require us to pay significant licensing fees in order to market our products. If our patent applications are not approved or, even if approved, if such patents are circumvented or not upheld in a court of law, our ability to competitively exploit our patented products and technologies may be significantly reduced. Additionally, the coverage claimed in a patent application can be significantly reduced before the patent is issued. As a consequence, we do not know whether any of our patent applications will be granted with broad coverage or whether the claims that eventually issue or that relate to our current patents will be circumvented. Since patent applications in the United States can be maintained in secrecy until patents issue, and since publication of discoveries in scientific or patent literature often lag behind actual discoveries, we cannot be certain that we were the first inventor of inventions covered by our issued patents or pending patent applications or that we were the first to file patent applications or such inventions. Moreover, we may have to participate in interference proceedings declared by the United States Patent and Trademark Office to determine priority of invention, which could result in substantial cost to us, even if the eventual outcome is favorable. An adverse outcome could subject us to significant liabilities to third parties, require disputed rights to be licensed from or to third parties or require us to cease using the technology in dispute.

Also, patents may or may not provide competitive advantages for their respective products or they may be challenged or circumvented by competitors, in which case our ability to commercially exploit these products may be diminished.

From time to time, we may need to obtain licenses to patents and other proprietary rights held by third parties in order to develop, manufacture and market our products. If we are unable to timely obtain these licenses on commercially reasonable terms, our ability to commercially exploit such products may be inhibited or prevented. Additionally, we cannot be assured that any of our products or technology will be patentable or that any future patents we obtain will give us an exclusive position in the subject matter claimed by those patents. Furthermore, we cannot be assured that our pending patent applications will result in issued patents, that patent protection will be secured for any particular technology, or that our issued patents will be valid, enforceable and provide us with meaningful protection.

Although we have entered into invention assignment agreements with our employees and with certain advisors, if those employees or advisors develop inventions or processes independently which may relate to products or technology under development by us, disputes may arise about the ownership of those inventions or processes. Time-consuming and costly litigation could be necessary to enforce and determine the scope of our rights.

We also rely on trade secrets and proprietary know-how that we seek to protect, in part, through confidentiality agreements with our strategic partners, customers, suppliers, employees and consultants. It is possible that these agreements will be breached or will not be enforceable in every instance, and that we will not have adequate remedies for any such breach. It is also possible that our trade secrets will otherwise become known or independently developed by competitors.

Suppliers

Some of our principal suppliers of components, and other of our suppliers, are single-source. Although we have not experienced significant production delays attributable to supply changes, we believe that, for the electrode subcomponent and hydrogel in particular, alternative sources of supply would be difficult to develop over a short period of time. Because we do not have supply agreements and direct control over our third-party suppliers, interruptions or delays in the products and services provided by these third parties may be difficult to remedy in a timely fashion. In addition, if such suppliers are unable or unwilling to deliver the necessary parts or products or if we are unable to make full payments to these suppliers on a current basis, we may be unable to redesign or adapt our technology to work without such parts or find alternative suppliers or manufacturers. In such events, we could experience interruptions, delays, increased costs, or quality control problems.

Research and Development

We spent approximately 8,916 hours engaged in R&D in 2010. Most R&D was internally generated and not attributable to any customers.

13

Governmental Regulation

Under the United States Food, Drug and Cosmetic Act, "new drugs" must obtain clearance from the Food and Drug Administration, or FDA before they can be marketed lawfully in the United States. Applications for marketing clearance must be based on extensive clinical and other testing, the cost of which is very substantial. Approvals – sometimes including pricing approvals — are required from health regulatory authorities in foreign countries before marketing of pharmaceutical products may commence in those countries. Requirements for approval may differ from country to country, and can involve additional testing. There can be substantial delays in obtaining required clearances from both the FDA and foreign regulatory authorities after applications are filed. Even after clearances are obtained, further delays may be encountered before the products become commercially available in countries requiring pricing approvals.

Product development generally involves the following steps which are required by the regulatory process:

|

|

·

|

preclinical development, during which initial laboratory development and in vitro and in vivo testing takes place;

|

|

|

·

|

submission to the FDA of an investigational new drug application (IND) for the commencement of clinical studies;

|

|

|

·

|

adequate and well-controlled human clinical trials — Phase I, II and III studies —to establish the safety and efficacy of the product;

|

|

|

·

|

submission of an NDA to the FDA requesting clearance to market the product and comparable filings to regulatory agencies outside the United States if the product is to be marketed outside of the United States; and

|

|

|

·

|

clearance from the FDA — and foreign regulatory authorities, if applicable — must be obtained before the product can be marketed.

|

Medical devices are subject to comparable regulatory requirements.

Each of these steps can take several years and can cost tens of millions of dollars. Failure to obtain, or delays in obtaining, regulatory clearance to market new products, as well as other regulatory actions and recalls, could adversely affect our financial results.

The packaging, labeling and advertising of pharmaceutical products are also subject to government regulation. The FDA recommends preclearing advertising materials prior to the launch of a product, and the launch materials for products receiving an accelerated FDA clearance must be precleared by the FDA. With an accelerated FDA clearance, all labeling and advertising must be submitted to the FDA 30 days prior to use, unless the FDA determines otherwise. In addition, the FDA may require that additional clinical studies - Phase IV studies - be completed after it grants clearance to market a product.

Our research and development, manufacturing and distribution operations involve the use of hazardous substances and are regulated under international, federal, state and local laws governing health and safety and the environment. We believe that our operations comply in all material respects with applicable environmental laws and worker health and safety laws; however, the risk of environmental liabilities cannot be eliminated and we cannot be assured that the application of environmental and health and safety laws to us will not require us to incur significant expenditures.

Employees

At December 31, 2010, Vyteris had a staff of 15 employees, of which 2 are part-time employees and 13 are full-time employees. Of those 15 employees, 3 are in process development, 2 in regulatory, quality and analytical services, 3 in research and development and 7 in administration and management. None of our employees are represented by a labor union or covered by a collective bargaining agreement, nor have we experienced any work stoppage.

14

Investor Information

Our Internet website address is www.vyteris.com. The information on our website is not a part of this annual report. We make available, free of charge on our website, by clicking on the “SEC filings” link on our home page, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after electronically filing such material with, or furnishing it to, the Securities and Exchange Commission (the “ SEC”).

|

ITEM 1A.

|

RISK FACTORS

|

You should carefully consider the risks described below together with all of the other information included in this report, as well as all other information included in all other filings, incorporated herein by reference, when evaluating us and our business. If any of the following risks actually occurs, our business, financial condition, and results of operations could suffer. In that case, the price of our common stock could decline and our stockholders may lose all or part of their investment. The risks set forth below are not the only ones facing our Company. Additional risks and uncertainties may exist that could also adversely affect our business, operations and prospects. If any of the following risks actually materialize, our business, financial condition, prospects and/or operations could suffer. No inference should be drawn as to the magnitude of any particular risk from its position in

the list of risk factors.

RISKS RELATED TO OUR BUSINESS

General Business Risks

We continue to experience a severe, continuing cash shortage and without sufficient additional financing we may not be able to execute our MediSync business strategy and may be required to cease operations, and this demonstrates uncertainty as to our ability to continue as a going concern.

As of December 31, 2010, our cash and cash equivalents amounted to $0.4 million. Our revenue in 2010 was de minimis, and we have been dependent upon proceeds from various fundraising activities to fund our operations. As of December 31, 2010, our current liabilities exceeded our current assets by approximately $14.4 million, and we have approximately $1.9 million in outstanding accounts payable which are over 60 days past due. If we do not continue to raise capital until we generate sufficient cash flow from operations to cover this working capital deficit, we may be required to discontinue or further substantially modify our business, as well as not being able to finance the acquisitions that are the core of our MediSync business strategy. We cannot be certain that additional financing will be available to us on favorable terms when required, if at all. The failure to raise needed funds could have a material adverse effect on our business, financial condition, operating results and prospects. Additionally, we face claims and litigation from our vendors and other parties to which we owe money, and we do not have sufficient funds to pay such payables and/or to defend litigation which may arise from nonpayment. These factors raise substantial doubt about our ability to continue as a going concern. The report of the independent registered public accounting firm relating to the audit of our consolidated financial statements for the year ended December 31, 2010 contains an explanatory paragraph expressing uncertainty regarding our ability to continue as a going concern because of our operating losses and our need for additional capital. Such explanatory paragraph could make it more difficult for us to raise additional capital and may materially and adversely affect the terms of any future financing that we may obtain.

As of April 11, 2011, we have commitments from our Board of Directors and other insiders to fund at least $0.1 million no later than April 21, 2011 ("Initial Bridge Funding"). This Initial Bridge Funding is insufficient to fund our operations for more than three weeks, and during that time, we will not pay for any nonessential services, including salaries for our management team, and we will continue to incur payables, as well as be unable to pay other payables which are already in arrears.

We are currently in negotiations with an investment banking firm with respect its acting as a selling agent for a longer term bridge financing of up to $2.0 million, to be comprised of convertible notes and warrants. Our objective is to launch this bridge financing before April 30, 2011.

Additionally, the Company engaged two other investment bankers in the first quarter of 2011 to assist in raising equity capital needed to complete its business plan. While no specific dollar amounts or terms have been agreed to as yet, our discussions with these firms relate to their raising approximately $10.0 to $15.0 million, to fund CRO’s acquisitions, and for working capital and general corporate purposes.

Even if we are successful in raising the bridge capital set forth above, no inference can be made that this is an indication of potential success in raising equity capital needed to complete its business plan The bridge capital is intended as short term, interim finances, and without successful completion of the larger financing by our investment bankers, management will, more likely than not, be required to substantially curtail, if not cease, operations, which will result in a material adverse effect on the financial position and results of operations of the Company. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

We have never been profitable, we may never be profitable, and, if we become profitable, we may be unable to sustain profitability.

From November 2000 through December 31, 2010, we incurred net losses in excess of $224.9 million, as we have been engaged primarily in clinical testing and development activities. In 2011, we will also be required to fund the activities of our MediSync business until or unless we acquire businesses with sufficient cash flow to fund those operations. We have never been profitable, we may never be profitable, and, if we become profitable, we may be unable to sustain profitability. We expect to continue to incur significant losses for the foreseeable future and will endeavor to finance our operations through sales of securities and incurrence of indebtedness, of which there can be no assurance.

15

We may be unable to hire and retain the key management necessary to develop and grow our business.

We rely on the continued service of our senior management, our chief technical staff, and other key employees as well as the hiring of new qualified employees. Due to the Merger, we have recently embarked on a business plan which includes acquisition of various CRO businesses which rely heavily upon the continued services of their incumbent management. In the pharmaceutical and biotechnology industries, there is substantial and continuous competition for highly skilled business, product development, technical and other personnel. Given the concern over our long-term financial strength and current general economic conditions, we may not be successful in recruiting new personnel and retaining and motivating existing personnel, which could lead to increased turnover and reduce our ability to meet the needs of our current and future customers. If we are unable to retain qualified personnel, we could face disruptions to operations, loss of key information, expertise or know-how, and unanticipated additional recruitment and training costs. If employee turnover increases, our ability to execute our strategy would be negatively affected.

As a small company with limited financial resources, we have not proven that we will be capable to meet the many challenges that we face, including successfully bringing product to market.

You should consider the risks and uncertainties that a company with limited financial resources, such as Vyteris, faces in the rapidly evolving markets for CROs and for drug delivery technologies, especially given the challenges of general economic conditions, which have materially limited the ability of small companies to raise capital and generate revenues. In particular, you should consider that we have not proven that we will be able to:

|

|

·

|

raise significant additional capital in the public or private markets;

|

|

|

·

|

be able to acquire CROs on favorable terms and pricing;

|

|

|

·

|

obtain the regulatory approvals necessary to commence selling drug delivery systems that we may develop in the future;

|

|

|

·

|

manufacture products in a manner that enables us to be profitable or meets regulatory, strategic partner or customer requirements;

|

|

|

·

|

attract, retain and manage a qualified, diverse staff of engineers and scientists;

|

|

|

·

|

develop the relationships with strategic partners and key vendors that are necessary to our ability to exploit the processes and technologies that we develop;

|

|

|

·

|

effectively manage our operations;

|

|

|

·

|

develop new products and drug delivery processes and new applications for our drug delivery technology; and

|

|

|

·

|

respond effectively to competitive pressures.

|

If we cannot accomplish all or even some of these goals, our business is not likely to succeed.

Current economic conditions may adversely affect our ability to continue operations.

Current economic conditions may cause a decline in business and consumer spending and capital market performance, which could adversely affect our business and financial performance. Our ability to raise funds, upon which we are fully dependent to continue operations, may be adversely affected by current and future economic conditions, such as a reduction in the availability of credit, financial market volatility, lessened liquidity in the capital markets, lessened availability of investment funds in the capital markets and recession.

Risks from the CRO business as well as the nature of our drug delivery business may result in our being subject to liability claims by employees, customers and third parties, and we may not be able to obtain adequate insurance to cover these risks.

The nature of our business may result in our being subject to liability claims by employees, customers and third parties, including breach of contract claims, worker compensation claims and personal injury suits. Our liability insurance, but such insurance may not be adequate to cover claims asserted against us. In addition, we may be unable to maintain or purchase such insurance in the future. Any of these events could have a material adverse affect on our financial condition.

16

Our integration of the traditional Vyteris drug delivery business with our new MediSync CRO business poses integrational as well as operational risks.

As a result of the Merger, we will evolve from a business plan originally based on product development to a business plan which includes the acquisition and operation of a CRO business with a robust acquisition strategy.The integration and then operation of the combined businesses poses several unique risks.

|

|

·

|

Due to the Merger, we will be required to combine many aspects of two businesses, including accounting, information systems and other functions. We have limited experience in combining business operations of this nature, and there can be no assurance that we will be successful in our efforts, or as to what the cost of the combination will be. If we are unable to combine operations in a timely or cost effective manner, we may incur additional costs to combine and/or be required to obtain additional experienced personnel with the costs associated therewith.

|

|

|

·

|

We will be required to integrate new personnel and businesses, which have traditionally operated as distinct businesses, into Vyteris. The cost and time of integrating these businesses could have a material adverse impact on our cash flow and our ability to effectively manage our business given our limited staffing resources.

|

|

|

·

|

Once integrated, we will be required to manage operations at various locations across the U.S. rather than from one location in New Jersey, as was the case with our drug delivery business. We have limited experience in and resources with respect to operating a multi site business and we may be unsuccessful in managing our expanding sites without incrementally increased cost, including the need to hire qualified operations personnel, including a chief operations manager.

|

|

|

·

|

In order to manage our increased business operations, we will be required to increase our administrative and IT personnel and functions. We have limited resources with which to so increase our administrative capacities which could have a material adverse impact in our ability to effectively administer our combined businesses without incurrence of additional costs, above the anticipated budgeted costs.

|

Risks Related to our CRO Business

The outsourcing trend in the preclinical and clinical stages of drug discovery and development may decrease.

Industry analysts have identified a trend among pharmaceutical and biotechnology companies of outsourcing drug development, research and clinical trial management, thereby enabling such companies to focus on their core competencies. While industry analysts expect the outsourcing trend to continue for the immediate future, a decrease in preclinical and/or clinical outsourcing activity could adversely affect MediSync’s prospects, financial condition and results of operations. Furthermore, MediSync’s future customer contracts will likely be terminable on little or no notice. Termination of a large contract or multiple contracts could adversely affect MediSync’s sales and revenue.

Pharmaceutical and biotechnology companies may reduce their research and development budgets.

MediSync’s customers mainly consist of pharmaceutical and biotechnology companies. MediSync’s ability to maintain and grow its customer base is dependent in large part upon the ability and willingness of the pharmaceutical and biotechnology industries to continue to expend financial resources on research and development and to outsource the services MediSync will provide. Fluctuations in the research and development budgets of these organizations could have a significant effect on the demand for MediSync’s services and/or the fees MediSync can charge for services provided. Research and development budgets fluctuate due to changes in available resources, mergers of pharmaceutical and biotechnology companies, spending priorities and institutional budgetary policies. MediSync’s business could be adversely affected by any significant decrease in research and development expenditures by pharmaceutical and biotechnology companies, as well as by academic institutions, government laboratories, or private foundations.

17

Customers may experience a reduction or loss of government funding.

MediSync’s customer base may include academic institutions and research laboratories whose funding is partially dependent on both the level and timing of funding from government sources, such as the U.S. National Institutes of Health (NIH) and similar domestic and international agencies. Government funding of research and development is inherently unpredictable. MediSync’s sales may be adversely affected if its customers delay purchases of services as a result of uncertainties surrounding the approval of government budget proposals.

Government regulation of the pharmaceutical or biotechnological industries could change substantially.

MediSync operates in a heavily regulated industry. To effectively manage and operate its business, MediSync will be impacted by, and need to respond to changes in, applicable regulations and requirements governing its operations. These regulations include those relating to licensure, conduct of operations and accreditation. The future course of federal, state and local regulations or legislation cannot be predicted. Failure of MediSync to monitor and respond to changes in such requirements could cause MediSync to incur criminal or civil penalties and expend substantial resources responding to an investigation or other enforcement action under these laws or regulations. In addition, some changes in regulations, such as an increase in regulatory requirements that MediSync may have difficulty satisfying or that make MediSync’s services less competitive, could eliminate or substantially reduce the demand for MediSync’s future services.

Recently, the U.S. Congress and state legislatures have considered and enacted various types of health care reform intended to control growing health care costs. MediSync is unable to predict what legislative proposals will be adopted in the future, if any. Implementation of health care reform legislation that place additional cost pressure on drug development and research could adversely affect research and development expenditures by pharmaceutical and biotechnology companies, which could in turn decrease the business opportunities available to MediSync. Furthermore, if health insurers were to change their practices with respect to reimbursements for pharmaceutical products, MediSync’s customers may spend less on outsourcing, or reduce their growth in spending on research and development.

Failure to comply with applicable regulations and related guidance could harm MediSync’s reputation and operating results.

Any failure on the part of MediSync to comply with applicable regulations could result in the termination of ongoing research or the disqualification of data for submission to regulatory authorities. This could harm MediSync’s reputation, prospects for future work and operating results. For example, the issuance of a notice of observations or a warning from the Food and Drug Administration based on a finding of a material violation by MediSync of good clinical practice, good laboratory practice or good manufacturing practice requirements could materially and adversely affect MediSync.

The CRO industry is highly competitive.

The CRO industry is highly competitive. MediSync competes for business not only with other companies in the industry, but also with internal discovery and development departments within larger biotech and pharmaceutical companies, each of which may have greater resources than MediSync. MediSync also competes with universities and teaching hospitals. MediSync competes based on a variety of factors, including:

|

|

·

|

reputation for on-time quality performance;

|

|

|

·

|

reputation for regulatory compliance;

|

|

|

·

|

expertise and experience in specific areas;

|

|

|

·

|

scope and breadth of service offerings;

|

|

|

·

|

broad geographic availability;

|

|

|

·

|

price/value;

|

|

|

·

|

technological expertise and efficient development processes;

|

|

|

·

|

quality of services and facilities;

|

|

|

·

|

financial stability;

|

|

|

·

|

size;

|

|

|

·

|

ability to acquire, process, analyze and report data in an effective manner; and

|

|

|

·

|

ability to manage clinical trials both domestically and internationally.

|

18

If MediSync does not compete successfully, its business will suffer. Increased competition might lead to price and other concessions that might adversely affect MediSync’s operating results and could lead to significant losses. The CRO industry has continued to see a trend towards consolidation. If this trend continues, it is likely to produce more competition among the larger companies and CROs generally, with respect to both clients and acquisition candidates. In addition, private equity firms may determine that there are opportunities in acquiring companies that we would like to acquire, thus further increasing possible competition and affecting acquisition prices. These competitive pressures may adversely affect MediSync’s growth and financial results.

Contract research services create a risk of liability.

By competing in the CRO industry, MediSync faces a range of potential liabilities, including:

|

|

·

|

errors or omissions in the reporting of study detail that may lead to inaccurate reports, which may potentially advance studies absent the necessary support or inhibit studies from proceeding to the next level of testing;

|

|

|

·

|

litigation risk, including potential litigation resulting from MediSync’s errors or omissions, or from MediSync’s association with clinical studies that are directly or indirectly related to death, illness, personal injury or other negative side effects to clinical study participants or other persons;

|

|

|

·

|

risks associated with possible failure of MediSync to properly care for customers’ property, such as research models and samples, study compounds, records, work in progress, or goods and materials in transit, while in MediSync’s possession; and

|

|

|

·

|

errors and omissions during a trial that may undermine the usefulness of a trial or data from the trial.

|

MediSync will attempt to mitigate these risks through a variety of control procedures and methods. Nonetheless, it is impossible to completely eradicate such risks. Contractual indemnifications may not adequately protect MediSync against any such liabilities. MediSync could be materially and adversely affected if it were required to pay damages or bear the costs of defending any claim which is not covered by a contractual indemnification provision or insurance.

Actions or inspections by regulatory authorities may cause clients not to award future contracts to MediSync or to cancel existing contracts, which may have a material and adverse effect on MediSync’s results of operations.