Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION PURSUANT TO SECTION 906 OF SARBANES OXLEY ACT OF 2002 - Ceetop Inc. | f10k2010ex32i_chinaceetop.htm |

| EX-31.1 - CERTIFICATION PURSUANT TO SECTION 302 OF SARBANES OXLEY ACT OF 2002 - Ceetop Inc. | f10k2010ex31i_chinaceetop.htm |

| EX-31.2 - CERTIFICATION PURSUANT TO SECTION 302 OF SARBANES OXLEY ACT OF 2002 - Ceetop Inc. | f10k2010ex31ii_chinaceetop.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

Or

o TRANSITION REPORT PURSUANT TO SECTION 13 OF 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

CHINA CEETOP.COM, INC.

(Exact name of registrant as specified in charter)

|

OREGON

|

98-0408707

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

A2803, Lianhe Guangchang, 5022 Binhe Dadao, Futian District, Shenzhen, China

|

518026

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code: (888) 257-4193

|

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the above Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 of 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding twelve months (or for such shorter time that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if smaller reporting company)

|

|||

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act: Yes x No ¨

The aggregate market value of the registrant’s voting common stock held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing price reported for March 31, 2011 on the OTC Bulletin Board, was US $44,045,463.

As of April 12, 2011, the Company had outstanding 29,363,642shares of its common stock, par value $0.001.

TABLE OF CONTENTS

|

ITEM NUMBER AND CAPTION

|

PAGE

|

||

|

PART I

|

|||

|

ITEM 1.

|

Business.

|

4

|

|

|

ITEM 1A.

|

Risk Factors.

|

6

|

|

|

ITEM 1B.

|

Unresolved Staff Comments.

|

6

|

|

|

ITEM 2.

|

Properties.

|

6

|

|

|

ITEM 3.

|

Legal Proceedings.

|

6

|

|

|

ITEM 4.

|

[Removed and Reserved].

|

6

|

|

|

PART II

|

|||

|

ITEM 5.

|

Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity.

|

7

|

|

|

ITEM 6.

|

Selected Financial Data.

|

7

|

|

|

ITEM 7.

|

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations.

|

8

|

|

|

ITEM 7A.

|

Quantitative And Qualitative Disclosures About Market Risk.

|

12

|

|

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

13

|

|

|

Balance Sheets – December 31, 2010 and December 31, 2009

|

|||

|

Statements Of Operations – Years Ended December 31, 2010 and 2009 and the period from inception (February 18, 2003) through December 31, 2010

|

|||

|

Statement Of Changes In Stockholders’ Deficit – Years Ended December 31, 2010 and 2009 and the period from inception (February 18, 2003) through December 31, 2010

|

|||

|

Statements Of Cash Flows – Years Ended December 31, 2010 And 2009 and the period from inception (February 18, 2003) through December 31, 2010

|

|||

|

ITEM 9.

|

Changes In And Disagreements With Accountants On Accounting And Financial Disclosure.

|

14

|

|

|

ITEM 9A(T).

|

Controls And Procedures.

|

14

|

|

|

ITEM 9B.

|

Other Information.

|

15

|

|

|

PART III

|

|||

|

ITEM 10.

|

Directors, Executive Officers And Corporate Governance.

|

16

|

|

|

ITEM 11.

|

Executive Compensation.

|

18

|

|

|

ITEM 12.

|

Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters.

|

19

|

|

|

ITEM 13.

|

Certain Relationships And Related Transactions, and Director Independence.

|

19

|

|

|

ITEM 14.

|

Principal Accountant Fees And Services.

|

19

|

|

|

PART IV

|

|||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules.

|

20

|

|

|

SIGNATURES

|

20

|

||

3

ITEM 1. BUSINESS

Business

Prior to September 1, 2010, Oregon Gold, Inc. held a number of mining prospects in Oregon. These mines had not been operational since 2004. However, during 2010, the Company evaluated its development plans for the Company’s claims and decided to change the Company’s focus. The Company did not renew the mining claims held in Oregon as of September 1, 2010 and forfeited the claims held in Josephine County, Oregon. No mining operations had taken place during 2009 or 2010.

As disclosed in a Form 8K filed with the SEC, in June 2010, the Company entered into a letter of intent with Surry Holdings Limited (Surry), to conduct a share exchange with Surry. As of December 31, 2010, the Company has not closed the transaction contemplated by the letter of intent, and is conducting due diligence on Surry while it continues its operations.

The independent auditors of Oregon Gold have qualified their opinion as to our ability to continue as a going concern. We currently do not have capital to implement our business plan and must obtain funding. If we do not receive funding, we will have to discontinue our business plan. To fund our operations, we intend to seek either debt or equity capital or both, or the possibility of a merger with a business with ongoing profitable operations.

Oregon Gold has no commitments for funding from unrelated parties or any other agreements that will provide working capital. We cannot give any assurance that Oregon Gold will locate any funding or enter into any agreements that will provide the required operating capital, especially in light of the current global economic crises.

As of August 27, 2009, Yinfang Yang acquired control of Oregon Gold by purchasing approximately 79.2% of the issued and outstanding shares of common stock of Oregon Gold directly from Pacific Gold Corporation. Ms. Yang is currently the sole director, as well as the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) of Oregon Gold.

Oregon Gold, Inc.

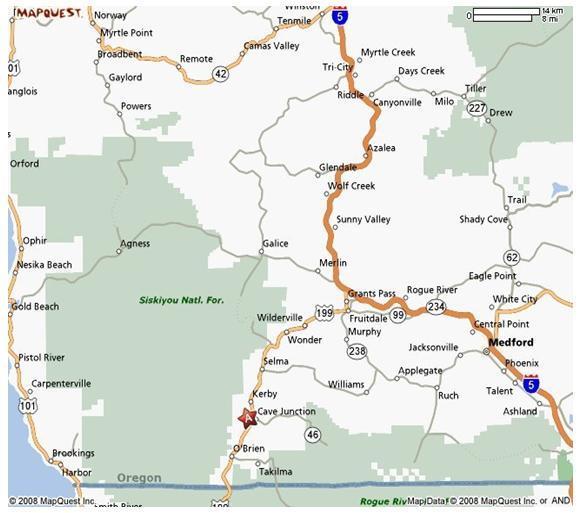

Prior to September 1, 2010, Oregon Gold held a number of prospects in the Siskiyou National Forest, in Josephine County, Oregon. These prospects covered approximately 280 acres of placer deposits in one area and another 37 acres in a second, almost contiguous area. The property was accessible from a gravel road that connected with a local paved road. Maintenance of the gravel road was moderate. In some places a stream must be forded for access. Generally, there was ample water from the perennial stream bordering the prospects available for exploratory and later implementation of the business plan. Water use was subject to meeting permitting requirements. Power was available through generators brought to and operated onsite.

4

Oregon Gold owned the Defiance Mine and additional claims in Josephine County, Oregon. The company operated the Defiance Mine during the summer and fall of 2004. Mining activity concluded for the winter at the end of November 2004. The Company had planned to initiate a new mining plan of operations on its claims in Josephine County, if adequate funding could have been obtained. As funds were not available and the Company decided to pursue an alternate business plan, the claims held by Oregon Gold, Inc were not renewed as of September 1, 2010.

Regulation

The exploration and development of a mining prospect is subject to regulation by a number of federal and state government authorities. These include the United States Environmental Protection Agency and the Bureau of Land Management as well as the various state environmental protection agencies. The regulations address many environmental issues relating to air, soil, and water contamination and apply to many mining related activities including exploration, mine construction, mineral extraction, ore milling, water use, waste disposal, and use of toxic substances. In addition, we are subject to regulations relating to labor standards, occupational health and safety, mine safety, general land use, export of minerals, and taxation. Many of the regulations require permits or licenses to be obtained and the filing of Notices of Intent and Plans of Operations, the absence of which or inability to obtain will adversely affect the ability for us to conduct our exploration, development and operation activities. The failure to comply with the regulations and terms of permits and licenses may result in fines or other penalties or in revocation of a permit or license or loss of a prospect.

For a mining claim to be maintained, the Company must comply with the annual staking and patent maintenance requirements of the State of Oregon and the United States Bureau of Land Management. We must also comply with the filing requirements of our proposed exploration and development, including Notices of Intent and Plans of Operations. In connection with our exploration and assessment activities, we have pursued necessary permits where exemptions have not been available although, to date, most of these activities have been done under various exemptions.

Competition

Under our mining operations, we expected to compete with many mining and exploration companies in identifying and acquiring claims with gold mineralization. We believed that most of our competitors have greater resources than the Company. We also expected to compete for qualified geological and environmental experts to assist us in our exploration of mining prospects, as well as any other consultants, employees and equipment that we may require in order to conduct our operations. We could not give any assurances that we would be able to compete without adequate financial resources.

5

Employees

As of April 12, 2011, the Company has 181 employees. Current corporate structure is managed by the board members, Mr. Weiliang Liu and Juqun Zhao. Weiliang Liu is company’s Chairman of the Board, Chief Executive Officer, President and Secretary; Juqun Zhao is company’s Chief Financial Officer and Treasurer.

Executive Offices

The corporate address in China is A2803, Lianhe Guangchang, 5022 Binhe Dadao, Futian District, Shenzhen, China. Our telephone number in China is 86-755-3336-6628

ITEM 1A. RISK FACTORS.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Smaller reporting companies are not required to provide disclosure pursuant to this Item.

ITEM 2. PROPERTIES.

All mining claims owned or leased by Oregon Gold were federal mining claims under the jurisdiction of the Bureau of Land Management and/or the United States Forest Service. The claims are valid for one year and require a renewal prior to September 1st of each year. The Company did not renew the claims as of September 1, 2010, thereby forfeiting the claims.

Through August 31, 2010, Oregon Gold held 14 placer claims covering approximately 280 acres in Josephine County, Oregon. Included in these claims were the Defiance Mine, a fully permitted, previously operational mine located in southwestern Oregon. The Defiance Mine was approximately 37.5 acres in size. The Company held a 5% net smelter royalty payable only on the 37.5 acres covered by the Defiance Mine.

ITEM 3. LEGAL PROCEEDINGS.

ITEM 4. [REMOVED AND RESERVED].

6

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

Market Information

Our common stock did not begin trading on the Over-the-Counter Bulletin Board (“OTCBB”) until March 17, 2009. As of December 31, 2010, the Company traded under the symbol “ORGG,” Effective January 31, 2011 the symbol for the Company on the Over the Counter Bulletin Board was changed to “CTOP.”

Our common shares are designated as “penny stock”. The SEC has adopted rules (Rules 15g-2 through l5g-6 of the Exchange Act), which regulate broker-dealer practices in connection with transactions in “penny stocks.” Penny stocks generally are any non-NASDAQ equity securities with a price of less than $5.00, subject to certain exceptions. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer’s account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that is subject to the penny stock rules. Since our common shares are subject to the penny stock rules, persons holding or receiving such shares may find it more difficult to sell their shares. The market liquidity for the shares could be severely and adversely affected by limiting the ability of broker-dealers to sell the shares and the ability of shareholders to sell their stock in any secondary market.

The trading volume in our common stock has been and is extremely limited. The limited nature of the trading market can create the potential for significant changes in the trading price for our common stock as a result of relatively minor changes in the supply and demand for common stock and perhaps without regard to our business activities.

The market price of our common stock may be subject to significant fluctuations in response to numerous factors, including: variations in our annual or quarterly financial results or those of our competitors; conditions in the economy in general; announcements of key developments by competitors; loss of key personnel; unfavorable publicity affecting our industry or us; adverse legal events affecting us; and sales of our common stock by existing stockholders.

Dividends

We have not paid any dividends to date. We can give no assurance that our proposed operations will result in sufficient revenues to enable profitable operations or to generate positive cash flow. For the foreseeable future, we anticipate that we will use any funds available to finance the growth of our operations and that we will not pay cash dividends to stockholders. The payment of dividends, if any, in the future is within the discretion of the Board of Directors and will depend on our earnings, capital requirements, restrictions imposed by lenders and financial condition, and other relevant factors.

As of the date of this Annual Report, we have not authorized any equity compensation plan, nor has our Board of Directors authorized the reservation or issuance of any securities under any equity compensation plan.

Holders

As of April 12, 2011 we have 217 shareholders of record of our common stock.

Recent Sales Of Unregistered Securities

|

ITEM 6. SELECTED FINANCIAL DATA.

|

7

|

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

Forward Looking Statements

From time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Such forward-looking statements may be included in, but not limited to, press releases, oral statements made with the approval of an authorized executive officer or in various filings made by us with the Securities and Exchange Commission. Words or phrases "will likely result", "are expected to", "will continue", "is anticipated", "estimate", "project or projected", or similar expressions are intended to identify "forward-looking statements". Such statements are qualified in their entirety by reference to and are accompanied by the above discussion of certain important factors that could cause actual results to differ materially from such forward-looking statements.

Management is currently unaware of any trends or conditions other than those mentioned in this discussion and analysis that could have a material adverse effect on the Company's financial position, future results of operations, or liquidity. However, investors should also be aware of factors that could have a negative impact on the Company's prospects and the consistency of progress in the areas of revenue generation, liquidity, and generation of capital resources. These include: (i) variations in revenue, (ii) possible inability to attract investors for its equity securities or otherwise raise adequate funds from any source should the Company seek to do so, (iii) increased governmental regulation, (iv) increased competition, (v) unfavorable outcomes to litigation involving the Company or to which the Company may become a party in the future and (vi) a very competitive and rapidly changing operating environment.

The risks identified here are not all inclusive. New risk factors emerge from time to time and it is not possible for management to predict all of such risk factors, nor can it assess the impact of all such risk factors on the Company's business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results.

The financial information set forth in the following discussion should be read with the financial statements of Oregon Gold included elsewhere herein.

Financial Condition and Changes in Financial Condition

Overall Operating Results:

The Company had no revenues from the sale of gold for the years ended December 31, 2010 or 2009.

The Company had $140,848 in general and administrative expenses during 2010. Of this expense, $15,295 was for accounting expenses, $84,000 for legal expenses, and $41,553 for other consulting and administrative expenses. During 2009, the Company had $53,035 in general and administrative expenses. Of this expense, $21,634 was for accounting expenses, $12,734 for legal expenses, and $18,667 for other consulting and administrative expenses.

In the second quarter of 2009, the Company exchanged the $500,000 note to its former parent company, offering the note as a convertible note at a conversion price of $0.05 per share. As the fair market value at the date of issuance exceeded the effective conversion price, the Company recorded a beneficial conversion feature, which is amortized to non-cash interest expense over the life of the note (one year) using the straight line method.

On August 27, 2009 the $500,000 note to our former parent company was evenly assigned to four new parties at a face value of $125,000 per note. The notes matured on April 15, 2010 and the unamortized discount was fully realized. The initial beneficial conversion feature recorded in the second quarter of 2009 was $400,000 and amortization for the years ended December 31, 2010 and 2009 was $115,068 and $284,932.

On April 30, 2010, $490,000 of the outstanding notes was converted into shares of common stock at $0.05 each, as specified in the note agreement. The Company issued a total of 9,800,000 additional shares, as a result of the conversion. Ms. Yang, the Company’s sole officer and director, received 2,500,000 of these additional shares of common stock, giving her a total share count of 10,502,389.

8

On September 1, 2010, the Company forfeited its mining claims, resulting in a complete write-off of the Company’s mining claims and associated accumulated depletion. This transaction resulted in a loss from disposition of assets of $224,901.

Liquidity and Capital Resources:

Since inception to December 31, 2010, we have funded our operations with advances from our former parent company (Pacific Gold Corporation), settlement from a lawsuit and advances from the Company’s new owner, At December 31, 2010, we had unsecured notes payable, accounts payable, and accrued expenses from these fundings totaling $196,044.

As of December 31, 2010, the Company held no assets, as the mining interests were forfeited as of September, 2010. Our total liabilities were $196,044 which primarily consisted of notes payable of $10,907, accounts payable and accrued expenses of $185,137. We had an accumulated deficit of $1,156,330. Oregon Gold had negative working capital of $196,044 at December 31, 2010.

Our independent auditors, in their report on the financial statements, have indicated that the Company has experienced recurring losses from operations and may not have enough cash and working capital to fund its operations beyond the very near term, which raises substantial doubt about our ability to continue as a going concern. Management has made a similar note in the financial statements. As indicated herein, we have need of capital for the implementation of our business plan, and we will need additional capital for continuing our operations. We do not have sufficient revenues to pay our expenses of operations. Unless the Company is able to raise working capital, it is likely that the Company either will have to cease operations or substantially change its methods of operations or change its business plan.

Significant Accounting Policies

Cash and Cash Equivalents

For purposes of the statement of cash flows, Oregon Gold considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. The Company has no cash in excess of FDIC federally insured limits and no cash equivalents as of December 31, 2010 and 2009.

Revenue Recognition

Oregon Gold recognizes revenue from the sale of gold when persuasive evidence of an arrangement exists, services have been rendered, the sales price is fixed or determinable, and collection is reasonably assured, which is determined when it places a sale order of gold from its inventory on hand with the refinery. For the years ended December 31, 2010 and 2009, there was no revenue.

Accounts Receivable/Bad Debt

The allowance for doubtful accounts is maintained at a level sufficient to provide for estimated credit losses based on evaluating known and inherent risks in the receivables portfolio. Management evaluates various factors including expected losses and economic conditions to predict the estimated realization on outstanding receivables. As of December 31, 2010 and 2009, there was no allowance for bad debts.

Property and Equipment

Property and equipment are valued at cost. Additions are capitalized and maintenance and repairs are charged to expense as incurred. Gains and losses on dispositions of equipment are reflected in operations. Depreciation is provided using the straight-line method over the estimated useful lives of the assets.

9

Impairment of Long-Lived Assets

Oregon Gold reviews the carrying value of its long-lived assets annually or whenever events or changes in circumstances indicate that the historical cost-carrying value of an asset may no longer be appropriate. Oregon Gold assesses recoverability of the carrying value of the asset by estimating the undiscounted future net cash flows, which depend on estimates of metals to be recovered from proven and probable ore reserves, and also identified resources beyond proven and probable reserves, future production costs and future metals prices over the estimated remaining mine life. If undiscounted cash flows are less than the carrying value of a property, an impairment loss is recognized based upon the estimated expected future net cash flows from the property discounted at an interest rate commensurate with the risk involved. If the future net cash flows are less than the carrying value of the asset, an impairment loss is recorded equal to the difference between the asset’s carrying value and fair value.

All mine-related costs, other than acquisition costs, are expensed prior to the establishment of proven or probable reserves. Reserves designated as proven and probable are supported by a final feasibility study, indicating that the reserves have had the requisite geologic, technical and economic work performed and are legally extractable at the time of reserve determination. Once proven or probable reserves are established, all development and other site-specific costs are capitalized.

Capitalized development costs and production facilities are depleted using the units-of-production method based on the estimated gold which can be recovered from the ore reserves processed. There has been no change to the estimate of proven and probable reserves. Lease development costs for non-producing properties are amortized over their remaining lease term if limited. Maintenance and repairs are charged to expense as incurred.

The fair value of an asset retirement obligation is recognized in the period in which it is incurred if a reasonable estimate of fair value can be made. The present value of the estimated asset retirement costs is capitalized as part of the carrying amount of the long-lived asset. For Oregon Gold, asset retirement obligations primarily relate to the abandonment of ore-producing property and facilities. There are currently no obligations.

Income Taxes

The Company follows the asset and liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that included the enactment date. A valuation allowance is recorded to reduce the carrying amounts of deferred tax assets unless management believes it is more likely than not that such assets will be realized.

Basic and Diluted Income / (Loss) Per Share

The basic net loss per common share is computed by dividing the net loss by the weighted average number of common shares outstanding. Diluted net loss per common share is computed by dividing the net loss adjusted on an "as if converted" basis, by the weighted average number of common shares outstanding plus potential dilutive securities.

As of December 31, 2010 and 2009, the Company had a note payable for $10,000 and $500,000, respectively, convertible into shares of common stock at $0.05 per share. As the conversion price was higher than the market price, there was no dilutive effect as of December 31, 2010 or 2009.

Environmental Remediation Liability

The Company has not begun mining its claims held. Until such time as mining activities commence, the Company believes that it has adequately mitigated any liability that could be incurred by the Company to reclaim lands disturbed in its mining process.

Fair Value of Financial Instruments

Accounting principles generally accepted in the United States of America require disclosing the fair value of financial instruments to the extent practicable for financial instruments, which are recognized or unrecognized in the balance sheet. The fair value of the financial instruments disclosed herein is not necessarily representative of the amount that could be realized or settled, nor does the fair value amount consider the tax consequences of realization or settlement. In assessing the fair value of these financial instruments, the Company uses a variety of methods and assumptions, which were based on estimates of market conditions and risks existing at that time. For certain instruments, including cash, accounts payable, accrued liabilities and convertible notes payable, it was estimated that the carrying amount approximated fair value for the majority of these instruments because of their short maturity.

10

Share Based Compensation

Stock-based awards to non-employees are accounted for using the fair value method.

The Company adopted provisions which requires that we measure and recognize compensation expense at an amount equal to the fair value of share-based payments granted under compensation arrangements.

The Company has adopted the “modified prospective” method, which results in no restatement of prior period amounts. This method would apply to all awards granted or modified after the date of adoption. In addition, compensation expense must be recognized for any unvested stock option awards outstanding as of the date of adoption on a straight-line basis over the remaining vesting period. The Company will calculate the fair value of options using a Black-Scholes option pricing model. The Company does not currently have any outstanding options subject to future vesting therefore no charge is required for the period ended December 31, 2010. Our method also requires the benefits of tax deductions in excess of recognized compensation expense to be reported in the Statement of Cash Flows as a financing cash inflow rather than an operating cash inflow. In addition, our method required a modification to the Company’s calculation of the dilutive effect of stock option awards on earnings per share. For companies that adopt the “modified prospective” method, disclosure of pro forma information for periods prior to adoption must continue to be made.

Development Stage Policy

The Company has not earned revenue from planned principal operations since inception (February 18, 2003). Accordingly, the Company's activities have been accounted for as those of a "Development Stage Enterprise" as set forth by current authoritative account literature. Among the disclosures required by current accounting literature are that the Company's financial statements be identified as those of a development stage company, and that the statements of operations, stockholders' equity and cash flows disclose activity since the date of the Company's inception.

Recently Adopted and Recently Enacted Accounting Pronouncements

In April 2009, the FASB issued ASC 805-10, "Accounting for Assets Acquired and Liabilities assumed in a Business Combination That Arise from Contingencies—an amendment of FASB Statement No. 141 (Revised December 2007), Business Combinations". ASC 805-10 addresses application issues raised by preparers, auditors and members of the legal profession on initial recognition and measurement, subsequent measurement and accounting and disclosure of assets and liabilities arising from contingencies in a business combination. ASC 805-10 is effective for assets or liabilities arising from contingencies in business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. ASC 805-10 will have an impact on our accounting for any future acquisitions and its consolidated financial statements.

In May 2009, the FASB issued, which is included in ASC Topic 855, Subsequent Events. ASC Topic 855 established principles and requirements for evaluating and reporting subsequent events and distinguishes which subsequent events should be recognized in the financial statements versus which subsequent events should be disclosed in the financial statements. ASC Topic 855 also requires disclosure of the date through which subsequent events are evaluated by management. ASC Topic 855 was effective for interim periods ending after June 15, 2009 and applies prospectively. Because ASC Topic 855 impacts the disclosure requirements, and not the accounting treatment for subsequent events, the adoption of ASC Topic 855 did not impact our consolidated results of operations or financial condition. See Note 10 for disclosures regarding our subsequent events.

11

Effective July 1, 2009, we adopted the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 105-10, Generally Accepted Accounting Principles—Overall ("ASC 105-10"). ASC 105-10 establishes the FASB Accounting Standards Codification (the "Codification") as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with U.S. GAAP. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative U.S. GAAP for SEC registrants. All guidance contained in the Codification carries an equal level of authority. The Codification superseded all existing non-SEC accounting and reporting standards. All other non-grandfathered, non-SEC accounting literature not included in the Codification is non-authoritative. The FASB will not issue new standards in the form of Statements, FASB Staff Positions or Emerging Issues Task Force Abstracts. Instead, it will issue Accounting Standards Updates ("ASUs"). The FASB will not consider ASUs as authoritative in their own right. ASUs will serve only to update the Codification, provide background information about the guidance and provide the bases for conclusions on the change(s) in the Codification. References made to FASB guidance throughout these consolidated financials have been updated for the Codification.

In August 2009, the FASB issued ASU No. 2009-05, Measuring Liabilities at Fair Value, which provides additional guidance on how companies should measure liabilities at fair value under ASC 820. The ASU clarifies that the quoted price for an identical liability should be used. However, if such information is not available, an entity may use the quoted price of an identical liability when traded as an asset, quoted prices for similar liabilities or similar liabilities traded as assets, or another valuation technique (such as the market or income approach). The ASU also indicates that the fair value of a liability is not adjusted to reflect the impact of contractual restrictions that prevent its transfer and indicates circumstances in which quoted prices for an identical liability or quoted price for an identical liability traded as an asset may be considered level 1 fair value measurements. This ASU is effective October 1, 2009. We are currently evaluating the impact of this standard, but would not expect it to have a material impact on our consolidated results of operations or financial condition.

In October 2009, the FASB issued an amendment to the accounting standards related to the accounting for revenue in arrangements with multiple deliverables including how the arrangement consideration is allocated among delivered and undelivered items of the arrangement. Among the amendments, this standard eliminated the use of the residual method for allocating arrangement considerations and requires an entity to allocate the overall consideration to each deliverable based on an estimated selling price of each individual deliverable in the arrangement in the absence of having vendor-specific objective evidence or other third party evidence of fair value of the undelivered items. This standard also provides further guidance on how to determine a separate unit of accounting in a multiple-deliverable revenue arrangement and expands the disclosure requirements about the judgments made in applying the estimated selling price method and how those judgments affect the timing or amount of revenue recognition. This standard, for which the Company is currently assessing the impact, will become effective for the Company on January 1, 2011.

In October 2009, the FASB issued an amendment to the accounting standards related to certain revenue arrangements that include software elements. This standard clarifies the existing accounting guidance such that tangible products that contain both software and non-software components that function together to deliver the product’s essential functionality, shall be excluded from the scope of the software revenue recognition accounting standards. Accordingly, sales of these products may fall within the scope of other revenue recognition standards or may now be within the scope of this standard and may require an allocation of the arrangement consideration for each element of the arrangement. This standard, for which the Company is currently assessing the impact, will become effective for the Company on January 1, 2011.

Off Balance Sheet Arrangements

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Smaller reporting companies are not required to provide disclosure pursuant to this Item.

12

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

CHINA CEETOP.COM, INC.

(FORMERLY KNOWN AS OREGON GOLD, INC.)

FINANCIAL STATEMENTS

DECEMBER 31, 2010

TABLE OF CONTENTS

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|

Balance Sheets

|

F-2

|

|

Statements of Income

|

F-3

|

|

Statements of Cash Flows

|

F-4

|

|

Statements of Stockholders’ Equity

|

F-5

|

|

Notes to Financial Statements

|

F-6 - F-15

|

13

Report of Independent Registered Public Accounting Firm

Board of Directors and Stockholders of

China Ceetop.com, Inc.

We have audited the accompanying balance sheet of China Ceetop.com, Inc. as of December 31, 2010, and the related statements of income, stockholders’ equity and cash flows for the year ended December 31, 2010. China Ceetop.com, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that out audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of China Ceetop.com, Inc. as of December 31, 2010, and the results of its operations and its cash flows of the year ended December 31, 2010 in conformity with accounting principles generally accepted in the United States of America.

Clement C. W. Chan & Co.

Certified Public Accountants

3/F., & 5/F., Heng Shan Centre, 145 Queen’s Road East, Wanchai, Hong Kong

12 April, 2011

|

CHINA CEETOP.COM, INC.

(A DEVELOPMENT STAGE COMPANY)

|

||||||||||||

|

BALANCE SHEETS

|

||||||||||||

|

Note

|

December 31,

|

December 31,

|

||||||||||

|

2010

|

2009

|

|||||||||||

|

ASSETS

|

||||||||||||

|

Current Assets

|

||||||||||||

|

Accounts receivable

|

$ | - | $ | 58 | ||||||||

|

Total Current Assets

|

- | 58 | ||||||||||

|

Non-Current Assets

|

||||||||||||

|

Intangible assets, net

|

3 | - | 224,901 | |||||||||

|

Total Assets

|

$ | - | $ | 224,959 | ||||||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||||||

|

Current and Total Liabilities

|

||||||||||||

|

Accounts payable

|

$ | 11,000 | $ | 11,000 | ||||||||

|

Accounts payable - related party

|

5 | 174,137 | 33,346 | |||||||||

|

Notes payable (including convertible notes)

|

10,907 | 385,839 | ||||||||||

|

Total Current and Total Liabilities

|

196,044 | 430,185 | ||||||||||

|

Stockholders' Equity

|

||||||||||||

|

Common stock, USD $0.001 par value, 100,000,000 shares authorized, 19,900,100 and

10,100,100 shares issued and outstanding as of December 31, 2010 and

December 31, 2009 respectively

|

5,6,8 | 19,900 | 10,100 | |||||||||

|

Additional paid-in capital

|

6 | 940,386 | 446,320 | |||||||||

|

Accumulated deficit

|

(1,156,330 | ) | (661,646 | ) | ||||||||

|

Stockholders' Equity

|

(196,044 | ) | (205,226 | ) | ||||||||

|

Total Liabilities and Stockholders' Equity

|

$ | - | $ | 224,959 | ||||||||

The accompanying notes are an integral part of these financial statements.

|

CHINA CEETOP.COM, INC.

|

|

(A DEVELOPMENT STAGE COMPANY)

|

|

STATEMENTS OF INCOME

|

|

FOR THE YEARS ENDED DECEMBER 31, 2010 AND 2009

|

|

AND THE PERIOD FROM INCEPTION (FEBRUARY 18, 2003) THROUGH DECEMBER 31, 2010

|

|

From inception

|

||||||||||||

|

February 18, 2003 Through

|

||||||||||||

|

2010

|

2009

|

December 31, 2010

|

||||||||||

|

Revenue

|

$ | - | $ | - | $ | 61,562 | ||||||

|

Production costs

|

- | - | (104,996 | ) | ||||||||

|

Depreciation and depletion

|

- | - | (11,614 | ) | ||||||||

|

Total production costs

|

$ | - | $ | - | $ | (116,610 | ) | |||||

|

Operating expenses :

|

||||||||||||

|

Mineral rights expense

|

- | - | (32,485 | ) | ||||||||

|

General and administrative

|

(140,848 | ) | (53,035 | ) | (465,393 | ) | ||||||

|

Impairment

|

(224,901 | ) | - | (224,901 | ) | |||||||

|

Loss on sale of assets

|

- | - | (902 | ) | ||||||||

|

Total operating expenses

|

$ | (365,749 | ) | $ | (53,035 | ) | $ | (723,681 | ) | |||

|

(Loss) from operations

|

$ | (365,749 | ) | $ | (53,035 | ) | $ | (723,681 | ) | |||

|

Other income and expense

|

||||||||||||

|

Other income

|

- | - | 50,400 | |||||||||

|

Interest expense

|

(128,935 | ) | (299,066 | ) | (428,001 | ) | ||||||

|

Total other expense

|

(128,935 | ) | (299,066 | ) | (377,601 | ) | ||||||

|

Net Loss

|

$ | (494,684 | ) | $ | (352,101 | ) | $ | (1,156,330 | ) | |||

|

Weighted average common shares outstanding

|

||||||||||||

|

Basic

|

16,678,182 | 10,039,004 | ||||||||||

|

Diluted

|

20,100,100 | N/A | ||||||||||

|

Net (loss) per common share

|

||||||||||||

|

Basic

|

$ | (0.030 | ) | $ | (0.04 | ) | ||||||

|

Diluted

|

$ | N/A | $ | N/A | ||||||||

Note : As the effect of the convertible instrument is anti-dilutive, diluted net loss per common share is not disclosed.

The accompanying notes are an integral part of these financial statements.

|

CHINA CEETOP.COM, INC.

|

||||||||||||

|

(A DEVELOPMENT STAGE COMPANY)

|

||||||||||||

|

STATEMENTS OF CASH FLOWS

|

||||||||||||

|

FOR THE YEAR ENDED DECEMBER 31, 2010 AND 2009

|

||||||||||||

|

AND THE PERIOD FROM INCEPTION (FEBRUARY 18, 2003) TO DECEMBER 31, 2010

|

||||||||||||

|

From

|

||||||||||||

|

Inception

|

||||||||||||

| February 18, 2003 | ||||||||||||

|

Through

|

||||||||||||

|

December

|

||||||||||||

|

2010

|

2009

|

31, 2010 | ||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Net loss

|

$ | (494,684 | ) | $ | (352,101 | ) | $ | (1,156,330 | ) | |||

|

Adjustments to reconcile net loss to net cash

|

||||||||||||

|

provided by/(used in) operating activities:

|

||||||||||||

|

Amortization of discount on note payable

|

115,068 | 284,932 | 400,000 | |||||||||

|

Impairment

|

224,901 | - | 224,901 | |||||||||

|

Common stock issued for services

|

- | 5,700 | 15,700 | |||||||||

|

Depreciation and depletion

|

- | - | 294 | |||||||||

|

Imputed interest

|

13,866 | 13,808 | 27,674 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Accounts receivable

|

58 | - | - | |||||||||

|

Accounts payable

|

- | (4,975 | ) | 11,000 | ||||||||

|

Accounts payable - related party

|

140,791 | 44,346 | 174,137 | |||||||||

|

Net cash used in operating activities

|

- | (8,290 | ) | (302,624 | ) | |||||||

| - | - | |||||||||||

|

CASH FLOW FROM INVESTING ACTIVITIES

|

||||||||||||

|

Purchases and development of property and equipment

|

- | - | (225,195 | ) | ||||||||

|

Net cash used in investing activities

|

- | - | (225,195 | ) | ||||||||

|

CASH FLOW FROM FINANCING ACTIVITES

|

||||||||||||

|

Payments on stockholder notes payable

|

- | - | (33,030 | ) | ||||||||

|

Proceeds from stockholder notes

|

- | 8,288 | 560,849 | |||||||||

|

Net cash provided by financing activities

|

- | 8,288 | 527,819 | |||||||||

|

Net Decrease in cash and cash equivalents

|

- | (2 | ) | - | ||||||||

|

Cash and cash equivalents, beginning balance

|

- | 2 | - | |||||||||

|

Cash and cash equivalents, ending balance

|

$ | - | $ | - | $ | - | ||||||

|

NON CASH TRANSACTIONS :

|

||||||||||||

|

Initial beneficial conversion measurement

|

$ | 490,000 | $ | 400,000 | $ | 400,000 | ||||||

|

Extinguishment of debt - related party

|

$ | - | $ | 26,912 | $ | 26,912 | ||||||

The accompanying notes are an integral part of these financial statements.

|

CHINA CEETOP.COM, INC.

(A DEVELOPMENT STAGE COMPANY)

FOR THE PERIOD FROM INCEPTION (FEBRUARY 18, 2003) THROUGH DECEMBER 31, 2010

|

|

Common

Stock

|

||||||||||||||||||||

|

Stock

|

Additional

Paid-in

|

(Accumulated

|

Total

Stockholders

|

|||||||||||||||||

|

outstanding

|

Amount

|

Capital

|

Deficit)

|

Equity

|

||||||||||||||||

|

Inception February 18, 2003

|

$ | 100 | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

(Loss) for the period

|

- | - | - | (83,823 | ) | (83,823 | ) | |||||||||||||

|

Balance December 31, 2003

|

100 | - | - | - | (83,823 | ) | ||||||||||||||

|

(Loss) for the year ended December 31, 2004

|

- | - | - | (26,874 | ) | (26,874 | ) | |||||||||||||

|

Balance December 31, 2004

|

100 | - | - | (110,697 | ) | (110,697 | ) | |||||||||||||

|

Issuance on Merger with Grants Pass Gold

|

100 | - | - | - | - | |||||||||||||||

|

(Loss) for the year ended December 31, 2005

|

- | - | - | (159,789 | ) | (159,789 | ) | |||||||||||||

|

Balance December 31, 2005

|

200 | - | - | (270,486 | ) | (270,486 | ) | |||||||||||||

|

(Loss) for the year ended December 31, 2006

|

- | - | - | (40,317 | ) | (40,317 | ) | |||||||||||||

|

Balance December 31, 2006

|

200 | - | - | (310,803 | ) | (310,803 | ) | |||||||||||||

|

(Loss) for the year ended December 31, 2007

|

- | - | - | (11,687 | ) | (11,687 | ) | |||||||||||||

|

Balance December 31, 2007

|

200 | - | - | (322,490 | ) | (322,490 | ) | |||||||||||||

|

Issuance of common shares for related party

|

||||||||||||||||||||

|

debt forgiveness

|

9,999,900 | 10,000 | - | - | 10,000 | |||||||||||||||

|

Income for the year ended December 31, 2008

|

- | - | - | 12,945 | 12,945 | |||||||||||||||

|

Balance December 31, 2008

|

10,000,000 | 10,000 | - | (309,545 | ) | (299,545 | ) | |||||||||||||

|

Convertible note payable conversion

|

- | - | 400,000 | - | 400,000 | |||||||||||||||

|

Note payable - related party contributed to capital

|

- | - | 26,912 | - | 26,912 | |||||||||||||||

|

Imputed interest

|

- | - | 13,808 | - | 13,808 | |||||||||||||||

|

Shares issued for services

|

100,000 | 100 | 5,600 | - | 5,700 | |||||||||||||||

|

(Loss) for the year ended December 31, 2009

|

- | - | - | (352,101 | ) | (352,101 | ) | |||||||||||||

|

Balance December 31, 2009

|

10,100,100 | 10,100 | 446,320 | (661,646 | ) | (205,226 | ) | |||||||||||||

|

Conversion of convertible note payable

|

9,800,000 | 9,800 | 480,200 | - | 490,000 | |||||||||||||||

|

Imputed interest

|

- | - | 13,866 | - | 13,866 | |||||||||||||||

|

(Loss) for the year ended December 31, 2010

|

- | - | - | (494,684 | ) | (494,684 | ) | |||||||||||||

|

Balance December 31, 2010

|

$ | 19,900,100 | $ | 19,900 | $ | 940,386 | $ | (1,156,330 | ) | $ | (196,044 | ) | ||||||||

The accompanying notes are an integral part of these financial statements

CHINA CEETOP.COM, INC.

(FORMERLY KNOWN AS OREGON GOLD, INC.)

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2010

Note 1 – ORGANIZATION

China Ceetop.com, Inc. (formerly known as Oregon Gold, Inc.) (“the “Company” or “China Ceetop”) was incorporated in Oregon on February 18, 2003 under the name of GL Gold Inc. On June 6, 2003 the Company filed an amendment with the State of Oregon changing its name to Oregon Gold, Inc. On January 7, 2011 Oregon Gold Inc. changed its name to China Ceetop.com, Inc.

The original principal activities of the Company were engaged in the identification, acquisition, exploration and development of mining prospects believed to have gold mineralization. The main objective is to explore, identify and develop commercially viable mineralization on prospects over which the Company has rights that could produce revenues. These types of prospects may also contain mineralization of metals often found with gold which also may be worth processing. Exploration and development for commercially viable mineralization of any metal includes a high degree of risk which careful evaluation, experience and factual knowledge may not eliminate, and therefore, we may never produce any significant revenues. The Company ceased business during the year.

These financial statements present the Company on a historical basis.

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company adopted the new accounting guidance (“Codification”) on July 1, 2009. For the year ended December 31, 2010, all reference for periods subsequent to July 1, 2009 are based on the codification.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

CHINA CEETOP.COM, INC.

(FORMERLY KNOWN AS OREGON GOLD, INC.)

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2010

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought. There were no contingencies of this type as of December 31, 2010 and 2009.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed. There were no contingencies of this type as of December 31, 2010 and 2009.

Loss contingencies considered to be remote by management are generally not disclosed unless they involve guarantees, in which case the guarantee would be disclosed.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand and cash in time deposits, certificates of deposit and all highly liquid debt instruments with original maturities of three months or less.

Accounts Receivable

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. Reserves are recorded based on the Company’s historical collation history. Allowances for doubtful accounts as of December 31, 2010 and 2009 were both Nil.

CHINA CEETOP.COM, INC.

(FORMERLY KNOWN AS OREGON GOLD, INC.)

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2010

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Impairment of Long-Lived Assets

The Company reviews the carrying value of its long-lived assets annually or whenever events or changes in circumstances indicate that the historical cost-carrying values of an asset may no longer be appropriate. The Company assesses recoverability of the carrying value of the asset by estimating the undiscounted future net cash flows, which depend on estimates of metals to be recovered from proven and probable ore reserves, and also identified resources beyond proven and probable reserves, future production costs and future metals prices over the estimated remaining mine life. If undiscounted cash flows are less than the carrying value of a property, an impairment loss is recognized based upon the estimated expected future net cash flows from the property discounted at an interest rate commensurate with the risk involved. If the future net cash flows are less than the carrying value of the assets, an impairment loss is recorded equal to the difference between the asset’s carrying value and fair value.

All mine-related costs, other than acquisition costs, are expensed prior to the establishment of proven or probable reserves. Reserves designated as proven and probable are supported by a final feasibility study, indicating that the reserves have had the requisite geologic, technical and economic work performed and are legally extractable at the time of reserve determination. Once proven or probable reserves are established, all development and other site-specific costs are capitalized.

Capitalized development costs and production facilities are depletion using the units-of-production method based on the estimated gold which can be recovered from the ore reserves processed. There has been no change to the estimate of proven and probable reserves. Lease development costs for non-producing properties are amortized over their remaining lease term if limited. Maintenance and repairs are charged to expense as incurred.

The fair value of an asset retirement obligation is recognized in the period in which it is incurred if a reasonable estimated of fair value can be made. The present value of the estimated asset retirement costs is capitalized as part of the carrying amount of the long-lived asset. For China Ceetop.com, Inc., asset retirement obligations primarily relate to the abandonment of ore-producing property and facilities. There are currently no obligations.

Fair Value of Financial Instruments

The Financial Instrument Topic of the Codification requires that the Company disclose estimated fair values of financial instruments. The carrying amounts reported in the balance sheets for current assets and current liabilities qualifying as financial instruments are a reasonable estimate of fair value. The carrying amount of long-term bank loans are considered to be representative of their fair values.

Revenue Recognition

The Company’s revenue recognition policies are in compliance with SEC Staff Accounting bulletin (“SAB”) 104 (codified in FASB ASC Topic 605). Sales revenue is recognized at the completion of delivery to customers when a formal arrangement exists, the price is fixed or determinable, no other significant obligations of the Company exist and collectability is reasonably assured at the date of completion of delivery. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as unearned revenue.

CHINA CEETOP.COM, INC.

(FORMERLY KNOWN AS OREGON GOLD, INC.)

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2010

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Income Taxes

The Company utilizes the accounting standards (“SFAS”) No. 109, “Accounting for Income Taxes,” codified in Financial Accounting Standard Board Accounting Standards Codification (“ASC”) Topic 740 which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, (“FIN 48”), codified in FASB ASC Topic 740. When tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of income. The adoption of FIN 48 did not have a material impact on the Company’s financial statements. At December 31, 2010 and December 31, 2009, the Company did not take any uncertain positions that would necessitate recording a tax related liability.

Basic and Diluted Earnings per Share

Earnings per share are calculated in accordance with FASB ASC Topic 260, “Earnings per Share”. Basic earnings per share is based upon the weighted average number of common shares outstanding. Diluted earnings per share is based on the assumption that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

CHINA CEETOP.COM, INC.

(FORMERLY KNOWN AS OREGON GOLD, INC.)

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2010

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk are cash, accounts receivable and other receivables arising from its normal business activities. The Company did not have any assets as of December 31, 2010 and ceased business during the year. As such, there was no credit risk as of December 31, 2010.

Recent Accounting Pronouncements

In October 2009, the FASB issued, Multiple-Deliverable Revenue Arrangements—a consensus of the FASB Emerging Issues Task Force, that provides amendments to the criteria for separating consideration in multiple-deliverable arrangements. As a result of these amendments, multiple-deliverable revenue arrangements will be separated in more circumstances than under existing U.S. GAAP. The ASU does this by establishing a selling price hierarchy for determining the selling price of a deliverable. The selling price used for each deliverable will be based on vendor-specific objective evidence if available, third-party evidence if vendor-specific objective evidence is not available, or estimated selling price if neither vendor-specific objective evidence nor third-party evidence is available. A vendor will be required to determine its best estimate of selling price in a manner that is consistent with that used to determine the price to sell the deliverable on a standalone basis. This ASU also eliminates the residual method of allocation and will require that arrangement consideration be allocated at the inception of the arrangement to all deliverables using the relative selling price method, which allocates any discount in the overall arrangement proportionally to each deliverable based on its relative selling price. Expanded disclosures of qualitative and quantitative information regarding application of the multiple-deliverable revenue arrangement guidance are also required under the ASU. The ASU does not apply to arrangements for which industry specific allocation and measurement guidance exists, such as long-term construction contracts and software transactions. This is effective beginning January 1, 2011. The adoption of this topic does not have a material effect on the Company’s financial statements.

In October 2009, the FASB issued, Certain Revenue Arrangements That Include Software Elements—a consensus of the FASB Emerging Issues Task Force, that reduces the types of transactions that fall within the current scope of software revenue recognition guidance. Existing software revenue recognition guidance requires that its provisions be applied to an entire arrangement when the sale of any products or services containing or utilizing software when the software is considered more than incidental to the product or service. As a result of the amendments, many tangible products and services that rely on software will be accounted for under the multiple-element arrangements revenue recognition guidance rather than under the software revenue recognition guidance. Under the amendments, the following components would be excluded from the scope of software revenue recognition guidance: the tangible element of the product, software products bundled with tangible products where the software components and non-software components function together to deliver the product’s essential functionality, and undelivered components that relate to software that is essential to the tangible product’s functionality. The ASU also provides guidance on how to allocate transaction consideration when an arrangement contains both deliverables within the scope of software revenue guidance (software deliverables) and deliverables not within the scope of that guidance (non-software deliverables). This amendment is effective beginning January 1, 2011. The adoption of this topic does not have a material effect on the Company’s financial statements.

CHINA CEETOP.COM, INC.

(FORMERLY KNOWN AS OREGON GOLD, INC.)

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2010

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Recent Accounting Pronouncements (Continued)

On February 25, 2010, the FASB issued Accounting Standards Update (“ASU”) 2010-09 Subsequent Events Topic 855, “Amendments to Certain Recognition and Disclosure Requirements,” effective immediately. The amendments in the ASU remove the requirement for an SEC filer to disclose a date through which subsequent events have been evaluated in both issued and revised financial statements. Revised financial statements include financial statements revised as a result of either correction of an error or retrospective application of US GAAP. The FASB believes these amendments remove potential conflicts with the SEC’s literature. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

On March 5, 2010, the FASB issued ASU No. 2010-11 Derivatives and Hedging Topic 815, “Scope Exception Related to Embedded Credit Derivatives.” This ASU clarifies the guidance within the derivative literature that exempts certain credit related features from analysis as potential embedded derivatives requiring separate accounting. The ASU specifies that an embedded credit derivative feature related to the transfer of credit risk that is only in the form of subordination of one financial instrument to another is not subject to bifurcation from a host contract under ASC 815-15-25, Derivatives and Hedging – Embedded Derivatives – Recognition. All other embedded credit derivative features should be analyzed to determine whether their economic characteristics and risks are “clearly and closely related” to the economic characteristics and risks of the host contract and whether bifurcation is required. The ASU is effective for the Company on July 1, 2010. Early adoption is permitted. The adoption of this ASU did not have any impact on the Company’s consolidated financial statements.

In April 2010, the FASB codified the consensus reached in Emerging Issues Task Force Issue No. 08-09, “Milestone Method of Revenue Recognition.” FASB ASU No. 2010-17 provides guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research and development transactions. FASB ASU No. 2010-17 is effective for fiscal years beginning on or after June 15, 2010, and is effective on a prospective basis for milestones achieved after the adoption date. The Company does not expect this ASU will have a material impact on its financial position or results of operations when it adopts this update on January 1, 2011.

Recently Issued Accounting Pronouncements Not Yet Adopted

As of December 31, 2010, there are no recently issued accounting standards not yet adopted that would have a material effect on the Company’s financial statements.

Note 3 – INTANGIBLE ASSETS

Through September 1, 2010, the sole asset of the Company were its mining claims. These claims are depleted on a units-of-production basis as gold is produced from the claims. The Company did not renew its mining claims as of September 1, 2010 and forfeited all claims, due to a clerical filing error by the Company. As there was no mining activity during 2010, the claims experienced no depletion for the period ended September 30, 2010. The forfeiture of these claims resulted in an impairment expenses to the Company of the total value of the assets, less accumulated depreciation, of $224,901 in the Statement of Income of the Company for the year ended December 31, 2010. There was no such expense in 2009.

CHINA CEETOP.COM, INC.

(FORMERLY KNOWN AS OREGON GOLD, INC.)

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2010

Note 4 - INCOME TAXES

The Company did not generate any revenue and profit during the year, no provision for income tax is made as of December 31, 2010.

The Company believes that given its operational status, it is remote that the Company will pay federal income taxes in the future. The Company also does not have any material uncertain income tax positions. There was no income tax provision for the year ended December 31, 2010 or 2009. We have a tax loss carry forward of $379,616 and $61,469 which will expire in fiscal years 2029 and 2028, respectively.

|

December 31, 2010

|

December 31, 2009

|

|||||||

|

Current Deferred Tax Asset

|

$ | - | $ | - | ||||

|

Current Year Net Loss

|

(494,684 | ) | (352,101 | ) | ||||

|

Add backs :

|

||||||||

|

Amortization discount

|

115,068 | 284,932 | ||||||

|

Shares for services

|

- | 5,700 | ||||||

|

Current Year Loss, Net of Adjustments

|

(379,616 | ) | (61,469 | ) | ||||

|

Tax Rate

|

35 | % | 35 | % | ||||

|

Expected Income tax benefit

|

(132,866 | ) | (21,514 | ) | ||||

|

Valuation Allowances

|

132,866 | 21,514 | ||||||

|

Total

|

$ | - | $ | - | ||||

Note 5 - ACCOUNTS PAYABLE/RELATED PARTY TRANSACTIONS

As of August 27, 2009, Yinfang Yang acquired control of the Company by purchasing approximately 79.2% of the issued and outstanding shares of common stock of the Company directly from Pacific Gold Corporation (“Pacific Gold,” the foregoing transaction is hereinafter referred to as the “Transaction”). This accounted for all of the Pacific Gold shares of common stock of the Company.

Immediately prior to the closing of the Transaction, Mitchell Geisler served as the sole member of the Board of Directors. Immediately following the closing of the Transaction (1) Yinfang Yang was appointed as a member to the Board of Directors, (2) Mitchell Geisler tendered resignation from the Board of Directors, and (2) the parties agreed to appoint Yinfang Yang, to the Board of Directors.

Additionally, within the purchase agreement, Pacific Gold agreed to extinguish its short term note of $26,912, resulting in additional paid in capital to the Company, as it was a related party transaction.

The Company has included on its financial statements $11,000 due to its previous parent company (Pacific Gold) management as of September 30, 2010 and December 31, 2009, but believes all amounts owed to former Pacific Gold management were expressly released in the purchase transaction. Therefore, the Company disputes the validity of the $11,000 reflected at September 30, 2010 and December 31, 2009.

Commencing August 27, 2009, the Company’s new majority shareholder, Ms. Yang, has advanced funds to the Company to fund operations. The advanced funds total $174,137 and $33,346 at December 31, 2010 and December 31, 2009, respectively, it is unsecured, interest free and is repayable on demand.

Note 6 - NOTES PAYABLE / CONVERTIBLE NOTES PAYABLE / RELATED PARTY TRANSACTIONS

The Company had a note with a face value of $500,000 owed to its (former) parent company as of December 31, 2008. The maturity date of the note was April 15, 2010 and interest being imputed on balance at 8% per year. Originally, the amount due was one note payable to the (former) parent company bearing no interest. In the second quarter of 2009, the Company amended the note agreement to offer the note as a convertible note at a conversion price of $0.05 per share, which was reviewed under current guidance. Because the fair market value at the date of issuance exceeded the effective conversion price, the Company recorded a beneficial conversion feature, which is amortized to non-cash interest expense over the life of the note (one year) using the straight line method. The initial beneficial conversion feature recorded in the second quarter of 2009 was $400,000 and amortization for the years ended December 31,

2010 and 2009 was $115,068 and $284,932 respectively.

On August 27, 2009 the $500,000 note to our former parent company was evenly assigned to four new parties at a face value of $125,000 per note. The notes matured on April 15, 2010 and the unamortized discount was fully realized. On April 30, 2010, $490,000 of the outstanding notes was converted into shares of common stock at $0.05 each, as specified in the note agreement. The Company issued a total of 9,800,000 additional shares, as a result of the conversion. Ms. Yang, the Company’s sole officer and director, received 2,500,000 of these additional shares of Common Stock, giving her a total share count of 10,502,389.