Attached files

| file | filename |

|---|---|

| EX-21.1 - New Generation Biofuels Holdings, Inc | v218743_ex21-1.htm |

| EX-31.2 - New Generation Biofuels Holdings, Inc | v218743_ex31-2.htm |

| EX-32.2 - New Generation Biofuels Holdings, Inc | v218743_ex32-2.htm |

| EX-3.3 - New Generation Biofuels Holdings, Inc | v218743_ex3-3.htm |

| EX-32.1 - New Generation Biofuels Holdings, Inc | v218743_ex32-1.htm |

| EX-23.1 - New Generation Biofuels Holdings, Inc | v218743_ex23-1.htm |

| EX-31.1 - New Generation Biofuels Holdings, Inc | v218743_ex31-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission File No. 1-34022

NEW GENERATION BIOFUELS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

26-0067474

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification No.)

|

5850 Waterloo Road, Suite 140

Columbia, Maryland 21045

(Address of Principal Executive Offices, Including Zip Code)

(410) 480-8084

(Registrant’s Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

(Title of Each Class)

|

(Name of Exchange on Which Registered)

|

|

Common Stock, par value $0.001 per share

|

OTCQB

|

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

¨ Large accelerated filer ¨ Accelerated filer

¨ Non-accelerated filer x Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the Registrant’s Common Stock, par value $0.001 per share, held by nonaffiliates of the Registrant as of June 30, 2010, was $12,304,926.

As of March 14, 2011, the number of shares of the Registrant’s Common Stock, par value $0.001 per share, outstanding was 88,542,229.

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

1

|

|

Item 1A.

|

Risk Factors

|

14

|

|

Item 1B.

|

Unresolved Staff Comments

|

22

|

|

Item 2.

|

Properties

|

22

|

|

Item 3.

|

Legal Proceedings

|

22

|

|

Item 4.

|

Reserved

|

22

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

23

|

|

Item 6.

|

Selected Financial Data

|

24

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

24

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

32

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

32

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

32

|

|

Item 9A.(T)

|

Controls and Procedures

|

32

|

|

Item 9B.

|

Other Information

|

33

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

34

|

|

Item 11.

|

Executive Compensation

|

38

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

45

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

48

|

|

Item 14.

|

Principal Accounting Fees and Services

|

50

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

Signatures

|

52

|

|

|

Index to Exhibits

|

53

|

|

|

Certifications

|

||

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) that involve numerous assumptions, risks and uncertainties, many of which are beyond our control. Because our common stock is considered to be “penny stock” under the rules of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we may not rely on the safe harbor created by the PSLRA with respect to forward –looking statements. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those set forth under the heading “Risk Factors” beginning on page 14 and elsewhere in this report. Important factors that may cause actual results to differ from projections include without limitation:

|

|

·

|

our dependence on additional financing to continue as a going concern;

|

|

|

·

|

unexpected costs and operating deficits;

|

|

|

·

|

our lack of operating history;

|

|

|

·

|

our inability to generate revenues or profits from sales of our biofuel and to establish commercial scale production facilities;

|

|

|

·

|

the disproportionally higher cost of production relative to units sold;

|

|

|

·

|

our inability to enter into acceptable sublicensing agreements with respect to our technology or the inability of any sublicensee to successfully manufacture, market or sell biofuel utilizing our licensed technology;

|

|

|

·

|

market acceptance of our biofuel;

|

|

|

·

|

our inability to compete effectively in the renewable fuels market;

|

|

|

·

|

governmental regulation and oversight, including our ability to qualify our biofuel for certain tax credits and renewable portfolio standards;

|

|

|

·

|

our ability to protect our technology through intellectual property rights; and

|

|

|

·

|

adverse results of any material legal proceedings.

|

All statements, other than statements of historical facts, included in this report regarding our strategy, future operations, financial position, estimated revenue or losses, projected costs, prospects and plans and management objectives are forward-looking statements. When used in this report, the words “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “possible,” “plan,” “project,” “should,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. All forward-looking statements are based on information available at the time the statement was made. We undertake no obligation to update any forward-looking statements or other information contained in this report as a result of future events, new developments or otherwise. You should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, these plans, intentions or expectations may not be achieved.

As used in this report, the terms “Company,” “we,” “us” and “our” refer to New Generation Biofuels Holdings, Inc.

ITEM 1. BUSINESS

Our Business

We are a clean energy company deploying novel technologies to produce cleaner, renewable biofuels. We have rights to a portfolio of patented and patent pending technology to manufacture alternative biofuels from plant oils, animal fats and related oils, which we market as a new class of biofuel for power generation, commercial and industrial heating, and related uses. We believe that our proprietary biofuel can provide a lower cost, renewable alternative energy source with significantly lower emissions than traditional fuels. We began generating revenues in 2008. Resulting primarily from scarce operating capital we generated minimal revenues in 2009 and 2010 as we worked to identify and qualify lower cost feedstock alternatives.

1

We produce our biofuels using proprietary mixing technologies that we believe are simpler, cleaner, less expensive, and less energy intensive than the complex chemical reaction process used to produce traditional distillate fuels, biofuels such as ethnol and biodiesel and other fuels. We believe that these technological approaches, collectively “our technology,” enable us to produce biofuels that cost less and use less energy to manufacture and generate significantly lower emissions than our competitors. Our technology also gives us the flexibility to produce our biofuels from multiple feedstocks, which allows us to use non-edible raw materials in our production process, We believe that these factors will enable us to customize our product to specific customer requirements and react more quickly to trends in the biofuels market. We are also developing products utilizing existing waste streams, by-products and other oils that have low alternative use values. We believe that successfully developing biofuels from low alternative use value feedstocks will allow us to be profitable with or without government incentives and credits once we are producing fuels on a commercial scale.

During the year ended December 31, 2009, we commenced our principal business operations and exited the development stage. Prior to that from our inception, we were a development stage entity in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 915, “Development Stage Entities.”

We have incurred annual operating losses since inception and expect to incur substantial operating losses in the future in connection with the development of our products and technology. As of December 31, 2010, we had an accumulated deficit of $62.6 million. The operation and development of our business will require substantial additional capital by the end of April 2011 to fund our operations, fund payments due under our exclusive license agreement, the acquisition or development of manufacturing plants, research and development, and other initiatives including potentially the financing of future acquisitions.

Our near-term business strategy involves the following:

|

|

·

|

Direct Sales. We are seeking to develop a revenue stream from direct sales of our biofuels produced at our Baltimore production facility. We plan to refine existing products and introduce new products into our existing customer base to generate field test data related to emissions and market acceptance. Our longer term strategy includes construction of an additional state-of-the-art production or plants.

|

|

|

·

|

Technology Licensing. As a second potential revenue stream, our business plan contemplates leveraging our technology to collect royalties by sublicensing our proprietary technology where it is more efficient for manufacturers to produce our biofuel at their own plants rather than requiring production at our facilities. We are in the process of exploring various technology licensing relationships.

|

|

|

·

|

Government Tax Credits. We are also pursuing our eligibility and qualification for tax credits and other government incentives to strengthen the competitive position of our biofuels and to otherwise attempt to take advantage of the U.S. government’s encouragement of “green” technologies.

|

|

|

·

|

Strategic Partners. We are seeking arrangements with strategic partners who would both provide funding and support our efforts to develop our production capacity, advance our technology, and attract customers.

|

|

|

·

|

Research and Development. With the appropriate funding we intend to continue to develop our technology and extend it to additional fuels with additional applications.

|

Recent Developments during the Fourth Quarter of 2010 and Early 2011

Significant recent developments include the following:

|

|

·

|

On February 1, 2011, we completed a private placement of six month secured convertible notes and warrants to four investors, which generated $1,000,000 in gross proceeds and $950,000, in net proceeds, after deducting placement agent’s fees. Net proceeds were used to satisfy past due obligations, retire a portion of our existing debt and to fund operations. We will need additional capital by end of April 2011.

|

|

|

·

|

On December 9, 2010, we notified The NASDAQ Stock Market that we were withdrawing our appeal of the delisting notice from the NASDAQ Listing Qualifications Panel. We began listing our common stock on the OTCQB effective with the opening of trading on Monday, December 13, 2010.

|

|

|

·

|

On November 1, 2010, we completed a private placement of six month secured convertible notes and warrants to three investors, which generated $375,000 in gross proceeds.

|

2

|

|

·

|

On October 4, 2010, we completed a registered direct offering of our common stock and warrants, which generated $600,000 in gross proceeds and approximately $550,000 in net proceeds, after deducting placement agent’s fees.

|

Our Growth Strategy

We plan to:

|

|

·

|

Continue pursuing sales to large customers through validation of biofuel performance. We are continuing to work with potential customers regarding sales of our biofuels. The sales cycle is lengthy, but we continue to emphasize the fuel characteristics and emissions data regarding our biofuels. To meet the potential demands of customers and prospective customers, we anticipate that we will need to develop additional production capacity.

|

|

|

·

|

Pursue technology licensing and sublicensing opportunities. We plan to pursue a second potential revenue stream by collecting royalties through sublicensing our proprietary technology. In March 2009, we entered into an addendum to our license agreement to provide for a cross-license with PTJ Bioenergy Holdings (“PTJ”) for all improvements by us to our proprietary emulsion technology. The royalty payable by PTJ to us for the cross-licensed technology will equal 5% of PTJ’s revenues outside of our territory, which under the license agreement includes North America, Central America and the Caribbean. Additionally, independent of our emulsion technology, we have developed new intellectual property around solutions, a second mixing approach. Although this technology is in earlier stages of development, we believe it is available for global licensing. Our solution approach is initially aimed at utilizing waste products and low alternative use feedstocks.

|

|

|

·

|

Market our biofuels to commercial and industrial process and space heating customers. These customers primarily consist of state-owned facilities and privately-owned corporate manufacturing facilities. A majority of states have passed mandates to utilize renewable energy, which mandates continue to increase annually. Privately owned corporate manufacturers are also beginning to concentrate on their responsibilities as global corporate citizens and are proactively seeking to lower their greenhouse gas emissions. We are marketing our biofuel as a fuel alternative to both of these types of consumers, including through existing distributors.

|

|

|

·

|

Expand product lines to develop new applications. Since many of the advantages of our biofuels come from their versatility and ability to be customized for different applications, we intend to continue our research and development efforts to develop additional applications for commercial use. We also plan to customize our products to customer specifications and continue to expand our product line to serve new market segments, such as blending our biofuel with # 6 Oil and co-firing in coal burning generators.

|

|

|

·

|

Pursue favorable tax and regulatory policies for our biofuels. On the federal level, we successfully partnered with other renewable biofuels providers to support the renewal of the 50 cent per gallon “alternative fuel tax credit” which was extended through December 31, 2011. We have also been working with federal policymakers in an effort to qualify our fuel for the $1 per gallon tax credit as “renewable diesel.” In addition, on both the federal and state level, we are working to qualify our biofuels as a fuel that receives credit for state renewable energy portfolio standards that require the use of renewable energy sources and/or to qualify for federal and state biofuel mandates and incentives, such as the Renewable Fuel Standard 2 program run by EPA.

|

|

|

·

|

Market our biofuels to power plants that are constrained by emissions restrictions and eligible for renewable energy credits. We are marketing our biofuel as a low capital expenditure solution that would enable customers to meet requirements to use renewable energy sources and increase the productivity and extend the useful life of coal and oil power plants.

|

The Biofuels Industry and Market Trends

Biofuels and Feedstocks

Biofuels can be defined generally as solid, liquid or gas fuels produced from renewable, recently living biological resources, such as plant biomass. In contrast, fossil fuels are derived from non-renewable biological material formed from the decayed remains of prehistoric plants and animals. Biofuels are perceived to have a number of potential benefits including the ability to reduce greenhouse gas emissions and environmental pollution, promote energy independence through the growth of domestic energy sources, increase rural development, and establish a sustainable, renewable future energy supply.

3

“First generation biofuels,” such as corn-based ethanol or biodiesel, use conventional technologies to produce fuel from crops high in simple sugars, such as sugar cane or sugar beets, or high in starch, such as corn or maize, or from crops containing high amounts of vegetable oil, such as soybeans or palm oil, or from animal fats. For example, ethanol production involves fermenting sugars or starches to produce ethyl alcohol, while biodiesel is produced through a chemical reaction called transesterification to generate a methyl ester fuel, while yielding glycerin as a by-product. The growth of first generation biofuels has been criticized because of perceptions that their feedstocks may divert food from human use and contribute to price increases and food shortages, particularly in lesser-developed countries.

“Second generation” or “advanced” biofuels use newer technologies to produce fuel from food crops, non-food plants and waste vegetable oil sources. Often cellulosic-derived fuels are considered second generation. We call our biofuels “New Generation Biofuels” because they can be produced using our less complex, proprietary blending technology to derive fuels from both food crops like the oil from soybeans and non-food sources such as recycled vegetable oil.

We have been developing “next generation” biofuels. As our technology and processes evolve, our objective is to incorporate non-food based oils that are of less demand and therefore carry a lower acquisition cost. Our flexible technology allows use of feedstocks that are not always amenable to other technologies and therefore have lower value alternative uses. The sources of these feedstock oils are in some instances, a by-product or waste stream from other technologies such as alternative fuel or waste reduction. Our flexible technology also allows for easier opportunities to not only improve environmental profiles but to also address physical property challenges other fuels will have difficulties meeting (e.g. low temperature flow, lubricity and flash points.

Market Size and Growth

The Energy Information Administration (“EIA”) has projected that the use of alternative fuels, such as ethanol and biodiesel will increase substantially as a result of the higher prices projected for traditional fuels and the support for alternative fuels provided in recently enacted federal and state legislation. According to a recent report, direct economic output from the advanced biofuels industry, including capital investment, research and development, technology royalties, processing operations, feedstock production and biofuels distribution, is estimated to rise to $5.5 billion in 2012, $17.4 billion in 2016 and $37 billion by 2022.

Government initiatives are expected to contribute to this growth. For example, the Energy Independence and Security Act of 2007 increased the minimum production of renewable fuels target to 36 billion gallons in 2022. Currently, the US produces only 12 billion gallons of biofuels. According to a 2008 study performed in connection with the legislation, the economic impact of increasing renewable fuels production to 36 billion gallons between 2008 and 2022 would include:

|

|

·

|

adding more than $1.7 trillion to the U.S. gross domestic product;

|

|

|

·

|

generating an additional $436 billion of household income;

|

|

|

·

|

supporting the creation of as many as 1.1 million new jobs; and

|

|

|

·

|

generating $209 billion in new federal tax receipts.

|

At the end of 2010, Congress reinstated biofuel tax incentives retroactively for 2010 and through 2011. The Obama Administration and many members of Congress support biofuel incentives. As a result, we are hopeful that such tax incentives will be continued; however, it cannot be guaranteed that they will be renewed in the same form or at all in the future.

Trends in the Biofuels Market

We believe that our biofuels can benefit from favorable market trends that are converging to drive growth across the renewable fuels industry, including:

Global energy supply and demand. Despite past drops in oil prices due to the global economic recession, we believe that, over the long term, there will be a sustained period of high demand for energy, especially for conventional sources such as petroleum-based fuels. We believe that this demand will continue to pressure oil supplies worldwide and has led to a heightened interest in developing domestic, alternative, renewable energy sources. Moreover, global unrest, particularly the civil unrest in the Middle East and the ongoing crisis in Japan, has put further uncertainty on petroleum prices.

4

Short-term energy security risks. Increased trade may carry a risk of heightened short-term energy insecurity for all consuming countries, as geographic supply diversity is reduced and reliance grows on vulnerable supply routes, such as the Middle East. We believe that in developing domestic renewable energy sources, the United States-and potentially other countries and regions as well- will be less vulnerable to overseas markets and the vulnerability associated with those supply routes.

Environmental and sustainability concerns. Concerns have risen over the growth in greenhouse gas emissions and their potential negative impact on the global environment and climate change. Compared to fossil fuels, renewable biofuels are generally considered to have lower carbon footprints. because the carbon dioxide released by burning the fuel is offset by the carbon dioxide absorbed by new plant growth

Government incentives and mandates for renewable fuels. In the pursuit of climate change initiatives and energy independence, federal and state governments are increasingly emphasizing the use of renewable fuels. The revised renewable fuel standard calls for an increase in mandatory biofuel used that are approved by the Environmental Protection Agency under the Renewable Fuel Standards 2 program. In addition to renewable biofuels mandates as of January 2011, a majority of states plus the District of Columbia have enacted renewable portfolio standards (“RPS”), which require electric power producers to use renewable sources to generate electricity. Many RPS requirements are graduated and are ramping up in the very near future. We also believe that these government policies will generate market opportunities for our biofuel.

Food versus fuel debate. We believe that the “food vs. fuel debate,” which has resulted in growing concerns over diversion of food supplies to fuel production, is pressuring first generation biofuel producers to explore alternative, non-edible feedstocks to produce their fuels . The United Nations noted in a 2007 report on sustainable bioenergy that “as second generation technologies . . . become commercially available, this will lessen the possible negative effects on land and resource competition on food availability.” We believe that there will be a transition period for second and future generations of biofuels before non-edible feedstocks are widely available in sufficient commercial quantities. There may also be a transition period before these technologies become more commercially viable. We also believe that the ability to use various feedstocks (both edible and non-edible) and waste products will provide an advantage to certain biofuels during this transition period and beyond.

Our Market Opportunity

We believe a significant market opportunity exists for our biofuel in three target market segments that consume an aggregate of approximately 5 billion gallons of fuel per year: commercial, industrial and electric power markets in the U.S. Of this 5.0 billion gallon amount, the industrial and commercial sectors consume approximately 2.7 billion gallons of fuel oil annually. Much of this energy is used in boilers to generate steam and hot water. These boilers consume about 40 percent of all energy consumed in the commercial and industrial sectors. Our initial focus within these sectors has been working with customers in the Central Atlantic and Midwest regions of the US. These regions comprise a large boiler and combustion turbine markets, which use distillate fuel, heavy fuel oil or coal co-firing as an energy source.

Commercial Market

The commercial market is defined as service-providing facilities and equipment of non-manufacturing businesses. Examples include government facilities, schools, institutional living quarters, and private and public service organizations,

Common uses of energy associated with this sector include space heating, water heating, air conditioning, lighting, refrigerating, cooking and running a wide variety of other equipment.

Industrial Market

The industrial market is defined as all facilities and equipment used for producing, processing, or assembling goods. Examples include manufacturing and mining.

Overall energy use in this sector is largely for process heat, cooling and powering machinery, with lesser amounts used for facility heating, air conditioning and lighting.

Electric Power Market

The electric power market is defined as facilities that produce electricity for sale and combined heat and power (“CHP”) plants whose primary business is to sell electricity or electricity and heat, to the public.

5

NGBF’s emphasis in this market is aimed at CHPs, which are peak power units that are oil fired, and as a form of liquid biomass that can be co-fired with coal to help meet EPA emission reductions and state RPS requirements.

Our Products

Current Products

Currently we have commercialized two product families based on renewable plant and animal oil and fat feedstocks.

Both are emulsified renewable fuels aimed at replacing diesel or distillate fuels in boiler and coal co-firing applications, with the capability to fulfill needs in additional applications. Trademarked as ClassicTM (“Classic”) and Ultra High FlashTM (“Ultra HF”), both product families offer:

|

|

·

|

Renewable biofuels designation

|

|

|

·

|

Significantly reduce emissions vs. petroleum based fuels

|

|

|

o

|

Essentially eliminates sulfur oxide (“SOx”) emissions

|

|

|

o

|

>40% reductions in nitrus oxide (“NOx”) emissions

|

|

|

·

|

Improved carbon footprints

|

|

|

·

|

Excellent atomization and ignition properties

|

|

|

·

|

Low pour point for improved handling in colder conditions

|

|

|

·

|

Good fuel stability

|

|

|

·

|

Enhanced fuel lubricity

|

Classic has a very low pour point of -49 degrees Fahrenheit.

Ultra HF was developed based on customer and market needs for a fuel that met local storage and handling requirements. Ultra HF offers the benefits of Classic, with two major differences:

|

|

·

|

A significantly higher flash point (above 210 °F)

|

|

|

·

|

A higher energy content (> 100,000 Btu/gal)

|

Technology Development

As our technology and processes evolves our objective is to incorporate non-food based oils that are of less demand and therefore carry a lower acquisition cost. Our flexible technology allows for the use of feedstocks that are not always amenable to other technologies and therefore have lower value alternative uses. The sources of these feedstock oils are in some instances, a by-product or waste stream from other technologies such as alternative fuel or waste reduction.

Planned Product Offering

We are currently in the development stages of a pyrolysis oil based renewable biofuel. Our objective for this product is to provide equivalent performance benefits as Classic and Ultra HF, but with additional significant benefits:

|

|

·

|

A much lower raw material feedstock cost

|

|

|

·

|

Is defined as a cellulosic biomass based fuel, which has current incentive advantages.

|

Key Advantages of our Biofuels

Our technology centers on the use of precise mixing approaches to blend renewable oils with water to create renewable biofuels. These precise mixing approaches, emulsions and solutions, represent our patent pending technologies.

Our technological approach is to be able to combine chemicals that normally do not mix (i.e., oil and water) coupled with various additives, such as surfactants in the case of emulsions, to create a stable homogeneous mixture.

The incorporation of water in our fuel formulations provides significant emission reduction benefits by lowering the temperatures at the point of combustion to minimize the formation of pollutants such as NOx. Water also assists in the atomization of our biofuels, which results in more complete combustion, improving fuel efficiency and decreasing the likelihood of pollutants being formed.

In addition to the benefits related to burning described above, our technology offers us significant manufacturing and raw material cost benefits and our mixing processes are not as complex as most other biofuel and petroleum refining technologies.

Process complexity usually adds costs in the following areas:

6

|

|

·

|

Capital costs for manufacturing equipment

|

|

|

·

|

Operating costs for process heating and cooling

|

|

|

·

|

Operating costs for catalysts and/or solvents

|

|

|

·

|

Yield losses from chemical reactions or molecular transformations

|

|

|

·

|

Production of waste streams as a result of yield losses

|

For example, ethanol production requires fermentation and distillation processes. Biodiesel processes involve relatively complex chemical reactions. Other processes may also utilize hazardous chemicals and they can create byproducts (e.g. glycerin) that must be handled and disposed of properly.These activities can all add costs.

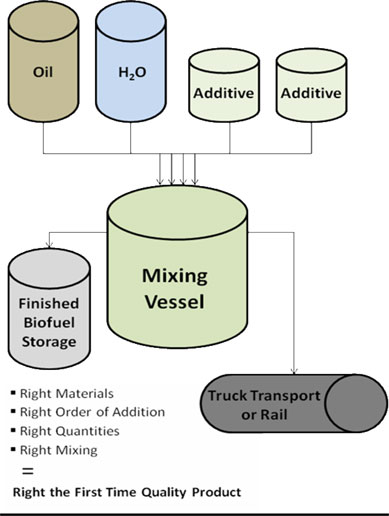

Our mixing technologies are based on a combination of the correct raw materials and proper mixing techniques. It requires precision and accuracy utilizing the correct raw materials added at the correct time and in the correct quantities. Our mixing technologies do not require complex chemical reactions, catalysts, or enzymatic processes, and it does not produce any appreciable waste steams or products.

We utilize low energy pumps and motors, relatively standard storage and handling metallurgy, simple mixing capability and appropriate measuring and metering capability. As a result, our manufacturing process has a relatively low carbon footprint as compared to other more complex manufacturing technologies.

Our manufacturing technology is also environmentally friendly. Many of our materials are biodegradable. The emissions from our processes are very low. This generally means the permitting process for our technology is also less time consuming and costly as compared to more complex technologies.

Typical NGBF Biofuel Production Process Flow

7

Research and Development

We have established a research and development group, headed by our Chief Technology Officer, Dr. Andrea Festuccia, which is based in Rome, Italy. Our research and development objectives are aimed at positioning the Company to capitalize on the demand for renewable, emissions reducing fuels, together with the potential upsides associated with regulatory mandates and potential emission based trading markets. Utilizing input from test burns and existing customers, Dr. Festuccia has worked to optimize our product and improve its performance to meet customer specifications. Improvements and modifications in the last year have included successfully expanding the number of feedstocks we can use to produce our biofuels with our emulsion technology. Also, in 2010, we filed a provisional patent for pyrolysis oil as a feedstock and a provisional patent for a glycerin solution. In February 2011, we filed another provisional patent for a solution using pyrolysis oils.

Feedstocks

Our feedstock strategy is aimed at identifying cost effective and technically viable feedstocks that allows our formulations to be environmentally and performance advantaged, and to potentially be profitable without government incentives.

Feedstocks drive our costs, performance, and ultimately profitability. There are many lessons learned from other biofuel technologies in connection with feedstocks, particularly with respect to corn based ethanol and commodity oil/fat based biodiesel, whose profitability has been negatively impacted by their limited feedstock options.

Background and Our Path Forward

We believe we have key advantages in the marketplace to support our growth in respect to raw materials:

|

|

·

|

We have flexibility in the feedstocks we can utilize. Our processes provide latitude in the raw materials we can combine. As a result, we can procure raw materials from a wide range of supply sources based on local and global supply and demand opportunities which allows us to optimize economics and performance. Other biofuels typically are produced using a chemical reaction process that hinders their flexibility in the types of feedstocks that can be utilized.

|

|

|

·

|

Our formulations use various percentages of the raw material components. This is different than other biofuel technologies that can be highly dependent on just one or two raw materials. As a result, we are able to mitigate supply challenges by not being focused on a single raw material but multiple materials to spread the burden of supply needs.

|

|

|

·

|

We focus on less traditional biofuel feedstock sources. As a result, we have been able to develop strong relationships with our feedstock suppliers - many with global reach - and will continue to foster and grow these relationships as well as partner with new supply sources as they become strategic in supporting our business plans and customer needs.

|

|

|

·

|

Our process does not generate yield losses based on chemical processing, so all of the feedstock we purchase becomes incorporated into our fuel products.

|

Our strategic feedstock objectives are focused toward driving costs down in the total formulation of our biofuels. Key drivers include:

|

|

·

|

Developing and maintain feedstock flexibility:

|

|

|

o

|

Be capable of using a wide range of feedstocks; and

|

|

|

o

|

Develop non-traditional feedstock options to take advantage of lower alternative values of the raw material.

|

|

|

·

|

Minimize our supply chain expenses:

|

|

|

o

|

Including a range of activities from evaluating feedstocks on a delivered cost basis to consideration of where to locate manufacturing facilities.

|

|

|

·

|

Identify opportunistic purchase situations:

|

|

|

o

|

Take advantage of short term supply and demand and pricing imbalances in the feedstock markets

|

8

Current Feedstock Initiatives:

|

|

·

|

Continued funding and resourcing our R&D efforts in seeking, screening, evaluating, formulating, and application testing lower cost feedstocks:

|

|

|

o

|

Place primary focus on pyrolysis oil;

|

|

|

o

|

Economics, efficacy, energy content, and environmental performance are key screening and evaluation parameters; and

|

|

|

o

|

Develop and support feedstock flexibility to mitigate shifting raw material costs.

|

|

|

·

|

Identify additional transactional and strategic partnerships for feedstocks:

|

|

|

o

|

Supply sources including non-traditional organizations;

|

|

|

o

|

Research institutions; and

|

|

|

o

|

Financing supply agreements.

|

|

|

·

|

Utilization and optimization of current supply sources to establish testing programs to generate profitable sales.

|

|

|

·

|

Extend current relationships and include new technology partners to seek low cost feedstock alternatives.

|

|

|

·

|

Continue partnering with key additive suppliers to advance and accelerate feedstock evaluations and appropriate additive packages for stability and performance criteria.

|

|

|

·

|

Progress registration processes, and the associated supporting engineering and laboratory work, for governmental approvals in key areas such as the EPA Renewable Fuel Standard 2 program.

|

Production Facilities

NGBF currently operates a Phase 1 pilot plant located in Baltimore, MD. This facility was completed in February 2009, and is permitted to produce 3.6 million gallons of fuel per year. The plant has been used to produce Classic and Ultra HF biofuels for initial customer test burns and acceptance programs. While this facility can be and may be expanded in the future, we recognize that additional modifications are required to allow for more consistent fuel production to meet the demand of our current customers. In particular, additional raw material storage, plant winterization and certain plant upgrades are needed to handle the storage and processing requirements of pyrolysis oil. We also recognize that locating a plant in another geographic region may be more efficient for feedstock acquisition and end user sales.

Our Future Manufacturing Asset Requirements

We believe our capital costs are competitive and a potential differentiator for our business going foward. In general, we are able to design, engineer, and construct a plant supporting our manufacturing processes for $0.25-$0.50 per gallon of annual production capacity. The range incorporates anticipated structural, infrastructure, and civil needs a potential site may face. In general, the more appropriate infrastructure that already exists, the lower the costs of constructing a plant would be. We believe that one advantage of our manufacturing process is that it is easily scalable. With no major reactors or process heating/cooling requirements, scale up consists primarily of storage tanks, pumps, meters and mixing kettles. We anticipate that our designs will us to use relatively small site footprints. For example, we believe that we can set up a 25 million gallon facility, excluding logistics, in 30,000 square feet depending upon configurations of the site. Although each individual site requires its own engineering to assure the processes are optimized and meet permitting and license to operate parameters, which are sometimes unpredictable and could cause significant delays, we believe that our fundamental plant design and low capital cost significantly differentiate our technologies from other alternative fuel production processes.

Competition

The markets for our biofuels are highly competitive. We compete with petroleum-based fuels, with other biofuels such as biodiesel or ethanol, and with other forms of alternative energy such as wind and solar.

Currently, the cost of producing most alternative fuels forces many manufacturers to operate at a significant competitive disadvantage compared to petroleum-based fuels. Producers of alternative fuels generally depend upon government support, including tax credits mandates to use specified minimum amounts of renewable fuels, upon the willingness of customers to pay a premium for renewable non-petroleum fuels, and upon access to low cost feedstock alternatives. Our ability to compete with petroleum-based fuels depends significantly on our ability to qualify for the various tax credits and other government incentives such as the Renewable Fuel Standard 2 (“RFS2”) program.

9

Also relevant to our ability to compete with petroleum-based fuels is the cost of adapting equipment to use alternative fuels. Since the vast majority of fuels currently consumed are petroleum-based, most consumers have equipment designed for consumption of such petroleum-based fuels, and alternative fuel suppliers often experience a second cost disadvantage – the expense of adapting the equipment to accommodate alternative fuels. We believe the ability of our biofuels to serve as a direct fuel replacement for distillate or residual fuel oils that requires no significant plant modifications improves our ability to compete with both petroleum-based fuels and other biofuels.

Within the alternative fuels market, the manufacture, marketing and sale of biofuels and other alternative fuels is highly competitive and highly fragmented. Such competition could be intense and could drive up the costs of feedstocks, plant construction, attracting and retaining qualified engineers, chemists and other key employees, as well as other operating expenses. Additionally, new companies are constantly entering the market.

We believe our ability to compete successfully in the biofuel production industry will depend on several factors, including the following:

|

|

·

|

advantages of our production process, including cost and efficiency factors;

|

|

|

·

|

fuel performance characteristics, including the ability of our biofuels to be used as a complete fuel replacement for distillate or residual fuel oils and our ability to customize our products to meet a customer’s requirements;

|

|

|

·

|

feedstock flexibility, particularly the ability to avoid using edible feedstocks in our production process;

|

|

|

·

|

overall demand for biofuels as a result of governmental incentives and legislation; and

|

|

|

·

|

continued technological innovation.

|

Tax Credits and Other Government Support

Since our fuel and other alternative and renewable fuels generally cost more to produce per unit of energy than petroleum-based fuels or coal, we and other producers of alternative fuels are dependent upon government support to make our fuels cost competitive in comparison to fossil fuels. This support generally takes the form of tax credits, payments or other incentives or mandates.

Fifty cent per gallon “alternative fuel” tax credit. The 50 cent per gallon credit applicable to our fuel, when mixed with diesel, kerosene or other taxable fuel and sold at the retail level, expired on December 31, 2009, along with biodiesel and other alternative fuel tax credits. In December 2010, Congress extended the alternative fuel credit, retroactive to January 1, 2010, through December 31, 2011.

One dollar per gallon tax credit for biodiesel and “renewable diesel.” We are not currently eligible for the $1 per gallon federal tax credit currently afforded to biodiesel and “renewable diesel.” We have been engaged in an effort to convince the United States Congress to amend the tax code definitions to make our biofuels eligible for the same tax credit provided to biodiesel.In addition, the biodiesel tax credit (and renewable diesel) expired on December 31, 2009. In December 2010 Congress extended the $1 per gallon tax credit, retroactive to January 1, 2010, through December 31, 2011.

Intellectual Property

We acquired the rights to our proprietary emulsion technology (the “Technology”) through an exclusive license agreement with the inventor of the technology, Ferdinando Petrucci, in March 2006. Under the license agreement, we have been granted a perpetual, exclusive license to make, use and exploit certain chemical additives for use in making biofuel and related know-how. Our exclusive license extends to North America, Central America and the Caribbean, and we have a right of first offer for any other territories worldwide (other than Italy and Paraguay, which are reserved to the inventor). As of March 25, 2011, our license agreement has remaining payments of $1.0 million per year during each of the next four years, the next payment of $1.0 million was originally due on March 20, 2011. The parties agreed to extend the payment due date until May 21, 2011.

10

In addition to the rights acquired under our exclusive license agreement, we have also acquired non-exclusive rights to our Technology pursuant to an assignment of rights to the Technology by Andrea Festuccia, a co-owner of the Technology and an officer of the Company. Pursuant to the assignment from Mr. Festuccia of the Technology, we have non-exclusive rights to exploit the Technology on a worldwide basis. The license agreement provides us with exclusive rights to exploit the technology solely in North America, Central America, and the Carribean.

In April 2006, we filed a provisional U.S. patent application on behalf of the inventor for the emulsion technology covered by our license. In April 2007, we filed a patent application under the Patent Cooperation Treaty which claimed the benefit of the provisional U.S. application and in September 2008, we filed national applications in the U.S. and certain foreign countries. Between 2006 and 2009, our R&D efforts significantly improved the initial emulsion formulation which resulted in the filing of amendments to the original provisional patent for two new renewable biofuels. In addition to being renewable, these biofuels significantly lower NOx, SOx and carbon emissions in relation to traditional petroleum diesel and can be produced from a wide variety of non-food feedstocks. We have continued to develop new feedstocks for the emulsion technology including a 2010 filing of a provisional patent for pyrolysis oil as a feedstock. Also in 2010 we filed a provisional patent for a glycerin solution. In February 2011 we filed another provisional patent for a solution using pyrolysis oils. We believe the patents we have filed for the glycerin and pyrolysis oil based biofuels, that are solutions instead of emulsions, are available to us for global production, sales and licensing and are not covered by our emulsion technology license agreement..

Until patent protection is granted, we must rely on trade secret protection, which requires reasonable steps to preserve secrecy. Therefore, we require that our personnel, contractors and sublicensees not disclose the trade secrets and confidential information pertaining to the technology. In addition, trade secret protection does not provide any barrier to a third party “reverse engineering” fuel made with the technology, to the extent that the technology is readily ascertainable by proper means. Neither the patent, if it issues, nor trade secret protection will preclude third parties from asserting that the technology, or the products we or our sub-licensees commercialize using the technology, infringes upon their proprietary rights.

Government Regulations

Environmental Regulations. Our business is subject to significant environmental risks and hazards and we are subject to environmental regulation implemented or imposed by a variety of international conventions as well as federal, state, provincial, and municipal laws and regulations. Environmental laws restrict and prohibit spills, discharges and emissions of various substances produced in association with biofuel manufacturing operations. Environmental laws also require that manufacturing plants are operated, maintained and decommissioned in such a way that satisfies applicable regulatory authorities. Environmental permitting of biofuel manufacturing facilities varies with the characteristics of individual plants and by each governmental authority. Our biofuels are manufactured using a process that is believed to yield little, if any wastes, emissions or discharges.

Compliance with environmental laws can require significant expenditures and a violation may result in the imposition of fines and penalties, some of which may be material to our business. Environmental legislation both domestically and internationally is evolving in a manner we expect may result in stricter standards and enforcement, larger fines and liability, as well as potentially increased capital expenditures and operating costs. Compliance with environmental laws may cause us to limit our production, significantly increase the costs of our operations and activities, or otherwise adversely affect our financial condition, results of operations, and/or prospects.

Clean Air Act. We intend to market our biofuels as a new class of biofuel for power generation, commercial and industrial heating, and marine use. In order to be legally marketable as a fuel for on-road motor applications, our biofuel must be registered with the EPA and comply with the EPA’s rigorous emissions, durability, and health effects regulations promulgated to implement Section 211 of the Clean Air Act. Under these regulations, a company registering a fuel must conduct extensive testing on a variety of in-use motor vehicle engines.

Section 211 of the Clean Air Act generally does not apply to using our biofuel in a stationary source, such as utility power generation applications or institutional/commercial heating fuel, or in certain marine applications. There may, however, be federal or state requirements applicable to emissions from individual furnaces, boilers, and similar equipment. As a practical matter, market acceptance of our biofuel may be limited until we can demonstrate that (i) our biofuels are comparable to conventional fuels from an energy content and emissions perspective as well as handling and storage perspectives, and (ii) that our biofuels are compatible with existing heating systems or power generation systems and other combustion systems. To date, we have only demonstrated the foregoing in commercially available systems on a very limited basis

11

Company History

We are a Florida corporation that was initially organized as Wireless Holdings, Inc. in June 2003. Our Delaware subsidiary, New Generation Biofuels, Inc, formerly H2Diesel, Inc. (“H2Diesel”), was formed in February 2006, to acquire the exclusive license to commercialize the proprietary technology used to produce our biofuels. H2Diesel became a subsidiary of public company Wireless Holdings, Inc. through a reverse merger transaction in October 2006. In November 2006, we renamed Wireless Holdings, Inc. to H2Diesel Holdings, Inc., and in March 2008, we renamed H2Diesel Holdings, Inc. to New Generation Biofuels Holdings, Inc. Since December 2010, our common stock has been listed on the OTC Markets Group Inc., inter-dealer electronic quotation and trading system which operates the OTCQB, under the ticker symbol “NGBF.”

Employees

We have eight full time employees and one part time employee. We expect to increase the number of employees as we implement our business objectives and expand our management team. None of our employees are represented by a labor union or covered by a collective bargaining agreement. We believe that our relations with our employees are good.

12

Executive Officers

|

Name

|

Age

|

Position

|

||

|

David H. Goebel, Jr.

|

51

|

Interim Principal Executive and Chief Operating Officer

|

||

|

Dane R. Saglio

|

53

|

Chief Financial Officer

|

||

|

Andrea Festuccia

|

39

|

Chief Technology Officer

|

The following is a description of the business experience of each of our executive officers:

David H. Goebel, Jr., Interim Principal Executive Officer and Chief Operating Officer

Mr. Goebel has served as our Chief Operating Officer since July 2009 and became our Interim Principal Executive Officer as of March 14, 2011. Mr. Goebel previously served as our Vice President of Global Sourcing and Supply Chain since September 2007 and previously worked at MeadWestvaco, a packaging solutions and products company, as the acting Vice President of Supply Chain/Director of Customer Service. He was responsible for redesigning the corporate order-to-cash processes, strategizing organizational and process changes in capacity planning, demand forecasting, inventory management/ operations, logistics/distribution, and customer service. Additionally, for nearly 20 years, Mr. Goebel worked at ExxonMobil and its predecessor, Mobil Corporation, in many different leadership capacities including manufacturing, engineering, supply chain, operations, marketing, and sales. Mr. Goebel holds a bachelor of science degree in microbiology from University of Minnesota along with graduate studies at both the University of Texas at Dallas and Northeastern University.

Dane R. Saglio, Chief Financial Officer

Mr. Saglio has served as our Chief Financial Officer since March 2010. Mr. Saglio possesses experience ranging from early-stage entrepreneurial enterprises through mature public companies across multiple technology based industries. Prior to joining Mr. Saglio was a consultant in the biotechnology sector focusing on emerging private companies. From 2003 -2008 Mr. Saglio served as Chief Financial Officer at EntreMed, Inc., a publicly traded clinical-stage biopharmaceutical firm. Previously Mr. Saglio held financial management positions with Public Communications Associates, a private telecommunications company, Bresler & Reiner, Inc and Sterling Software, two publicly traded companies focused on real estate development and management and information management, respectively.

Andrea Festuccia, PhD, Chief Technology Officer

Dr. Festuccia has served as Chief Technology Officer since April 2006. Currently, Dr. Festuccia is Partner, Technical Director and member of the Board of Directors of IGEAM S.r.l. (since February 2009), a private Italian company with about 100 employees engaged in consulting environmental and safety problems where he has worked since June 1999. Prior to his current position with IGEAM S.r.l., Dr. Festuccia was the Director of the B.U. “Environment and Territory” at IGEAM S.r.l. Dr. Festuccia was Adjunct Professor of General and Inorganic Chemistry with the University of “La Tuscia” of Viterbo from 1999 to 2000. Dr. Festuccia was a former Technical Director and member of the Board of Directors of 3TI Progetti Italia (from July 2004 to January 2009). Dr. Festuccia is currently an external consultant with the University “La Sapienza” of Rome, a position that he has held since 2001. He also worked as an external expert for the Minister of Foreign Affairs of Italy-Farnesina from 2002-2004 and as Technical Director of Ecosystems S.r.l. from 2002 to present. He is the Chairman of the Board of Directors of OPT SENSOR, a private Italian company dealing with R&D for electronic equipments to measure chemical/physical parameters, a spin-off company of University “La Sapienza” of Rome. He is also the CEO of BART-Biotechnology and Recovery Technologies, a small private Italian company engaged in biotechnology. In October 1996, he received a degree in chemical engineering and subsequently, in 2007, his doctor of philosophy degree in chemical engineering from the University of Rome - “La Sapienza”.

13

Other Information

News and information about New Generation Biofuels is available on and/or may be accessed through our website, www.newgenerationbiofuels.com. In addition to news and other information about our company, we have provided access through this site to our filings with the Securities and Exchange Commission as soon as reasonably practicable after we file or furnish them electronically. We are not including the information on our website as a part of, or incorporating it by reference into, our Form 10-K.

We have also provided access on our website to our Code of Business Conduct and Ethics, the charters of our Audit, Compensation and Nominating Committees and our Whistleblower Policy. Copies of these documents are available to any shareholder upon written request made to our corporate secretary at our corporate headquarters at 5850 Waterloo Road, Suite 140, Columbia, Maryland 21045, Attn: Corporate Secretary. In addition, we intend to disclose on our website any changes to or waivers for executive officers from our Code of Business Conduct and Ethics.

ITEM 1A. RISK FACTORS

Our business faces many risks. If any of the events or circumstances described in the following risks actually occur, our business, financial condition or results of operations could suffer, and the trading price of our common stock could decline. Some of the risks described below may apply to more than just the subsection in which we grouped them for the purpose of this presentation. You should consider all of the following risks, together with all of the other information in this Annual Report on Form 10-K, before deciding to invest in our securities.

Risks Related to Our Business

Our existing financial resources will only provide financing through the end of April 2011, and we will need to raise additional capital to continue our business, which could be particularly challenging in the near term under current financial market conditions.

The report of our independent registered public accounting firm for the year ended December 31, 2010 contains an explanatory footnote which states that we have incurred negative cash flows from operations since inception and are dependent upon future financing and, based on our operating plan and existing working capital deficit, this raises substantial doubt about our ability to continue as a going concern. Based on our current estimates, we anticipate that our existing financial resources will be adequate to permit us to continue to conduct our business through mid April 2011, and we will need to control costs and raise additional capital to continue our business beyond April 2011. Accordingly, we will need to complete a financing by end of April of 2011. As of December 31, 2010, we have incurred a net loss of $11.6 million and negative cash flows from operating activities of $4.6 million. As of December 31, 2010, we had approximately $0.2 million of available cash and approximately $1.6 million of accounts payable and accrued expenses. In February 2011, we closed a private placement of senior secured convertible notes for total gross proceeds of $1.0 million. In addition, under the license agreement with the inventor of our proprietary technology, we are required to pay $1.0 million per year over the next four years, with the next $1 million originally due in March 2011has now been extended to May 21, 2011. We cannot ensure that additional funding will be available or, if available, that it can be obtained on terms and conditions we will deem acceptable. Any additional funding derived from the sale of equity securities is likely to result in significant dilution to our existing shareholders and may require shareholder approval, which cannot be assured. If we are unable to raise additional capital, we will not be able to continue our business.

We are an early stage company with a limited operating history, which makes us a speculative investment.

We are an early stage company that is commercializing our exclusive rights to proprietary technology to manufacture biofuel. Since then, we have been engaged in organizational activities, including developing our business plan, hiring key management, optimizing product performance, developing our production facility, raising capital, conducting test burns with potential customers, entering into initial sales contracts, delivering initial fuel orders to customers and exploring sublicensing opportunities. We recorded our first sales in the fourth quarter of 2008. We currently have eight employees. During the year ended December 31, 2009, we commenced our principal business operations and have exited the development stage. Prior to that from our inception, we were a development stage entity. Accordingly, we have limited relevant operating history upon which you can evaluate our performance and prospects. You should consider our prospects in light of the inherent risks, expenses and difficulties encountered by companies in the early stage of development, particularly companies in new and evolving markets such as the renewable fuels industry. Such risks include technology risks, capital requirements, lack of market acceptance of our products, failure to establish business relationships, competitive disadvantages against larger and more established companies and regulatory matters.

14

We have a history of losses, deficits and negative operating cash flows and will likely continue to incur losses for the foreseeable future which may impede our ability to achieve our business objectives.

We expect to incur operating losses and continued negative cash flows for the foreseeable future as we invest in sales and marketing, research and development and production facilities to achieve our business objectives. We may not achieve or sustain profitability on a quarterly or annual basis in the future. To be profitable, we will have to significantly increase our revenues and reduce our costs. Future revenues and profits, if any, will depend upon various factors such as those discussed here, many of which are beyond our control. If we are unable to increase our revenues, reduce costs or achieve profitability, we may have to reduce or terminate our operations.

Sufficient customer acceptance for our biofuel may never develop or may take longer to develop than we anticipate, and as a result, our revenues and profits, if any, may be insufficient to fund our operations.

Sufficient markets may never develop for our biofuel, may develop more slowly than we anticipate or may develop with economics that are not favorable for us. The development of sufficient markets for our biofuel at favorable pricing may be affected by cost competitiveness of our biofuel, customer reluctance to try a new product and emergence of more competitive products. Because we only recently began manufacturing our biofuel, potential customers may be skeptical about product stability, supply availability, quality control and our financial viability, which may prevent them from purchasing our biofuel or entering into long-term supply agreements with us. We cannot estimate or predict whether a market for our biofuel will develop, whether sufficient demand for our biofuel will materialize at favorable prices, or whether satisfactory profit margins will be achieved. If such pricing levels are not achieved or sustained, or if our technologies and business approach to our markets do not achieve or sustain broad acceptance, our business, operating results and financial condition will be materially and adversely impacted.

Our ability to produce and distribute our biofuel on a commercially sustainable basis is unproven, and until we can prove our technology, we likely will not be able to generate or sustain sufficient revenues to continue operating our business.

While producing biofuel from vegetable oils or animal fats is not a new technology, the technologies we are pursuing for our biofuel production have never been utilized on a commercially sustainable basis. Our biofuel, while intended as a new class of biofuel for power generation, commercial and industrial heating and marine use, may never achieve technical or commercial viability. All of the tests and sales that we have conducted to date with respect to our technology have been performed in a limited scale environment, and the same or similar results may not be obtainable at competitive costs on a large-scale commercial basis.

We have conducted multiple test burns of our biofuel products with potential customers. However, others may need to replicate these tests before our biofuel becomes commercially acceptable. We have never utilized our technology under the conditions or in the volumes that will be required for us to be profitable and cannot predict all of the difficulties that may arise. Our technology may require further research, development, regulatory approvals, environmental permits, design and testing prior to commercialization. Accordingly, our technology and our biofuel may not perform successfully on a commercial basis and may never generate any profits.

We likely will not be able to generate significant revenues until we can successfully validate our product performance with customers and operate our manufacturing facility on a commercial scale.

To date, we have generated a small amount of revenues on sales of limited quantities of our biofuel. Revenue generation could be impacted by any of the following:

|

|

·

|

delays in demonstrating the technological advantages or commercial viability of our proposed products;

|

|

|

·

|

problems with our commercial scale production plant, including delays in upgrading the plant, technical staffing, permitting or other operational issues;

|

|

|

·

|

inability to interest early adopter customers in our products; and

|

|

|

·

|

inability to obtain cost effective supplies of vegetable oil and feedstocks.

|

15

Any planned manufacturing plants may not achieve projected capacity or efficiency, and we may not be able to sell our biofuel generated at these plants at prices that will cover our costs. Potential customers may require lengthy or complex trials or long sampling periods before committing to significant orders for our products.

We granted a security interest in all of our assets in connection with our recent financing in February 2011, and certain terms of such financing may cause dilution to our current shareholders.

Pursuant to the terms of a Subscription Agreement dated February 1, 2011, we entered into a Security Agreement dated February 1, 2011, to secure obligations of the Company under Secured Convertible Promissory Notes dated February 1, 2011 (“February 2011 Notes”). If we default under the February 2011 Notes, the holders will be entitled to foreclose on our assets pursuant to the Security Agreement. We do have the option of issuing shares of common stock of the Company instead of making cash payments; however, any additional issuances of common stock of the Company will dilute the current shareholders’ holdings. After such time as we have repaid 51% of the original outstanding principal of February 2011 Notes, whether in cash payments or conversion into common stock, we will no longer be subject to the Security Agreement.

The current credit and financial market conditions may exacerbate certain risks affecting our business.

Due to the continued disruption in the financial markets arising from the global recession in 2008 and the slow pace of economic recovery, many of our potential customers are unable to access capital necessary to accommodate the use of our biofuel. Many are operating under austerity budgets that limit their ability to invest in infrastructure necessary to use alternative fuels and that make it significantly more difficult to take risks with new fuel sources. As a result, we may experience increased difficulties in convincing customers to adopt our biofuel as a viable alternative at this time.

We may not be able to generate revenues from sublicensing our technology.

Our exclusive perpetual license allows us to sublicense our proprietary technology in North America, Central America and the Caribbean, and our business plan includes, as a second potential revenue stream, the collection of royalties through sublicensing our proprietary technology. We likely will need to continue proving the viability of our technology before we can obtain any additional sublicense agreements, and we cannot assure you that we will be able to do so. Companies to which we grant sublicenses may not be able to produce, market and sell enough biofuel to pay us royalty fees or they may default on the payment of royalties. We may not be able to achieve profitable operations from collecting royalties from the sublicensing of our proprietary technology.

The strategic relationships upon which we may rely are subject to change.

Our ability to successfully test our technology, to develop and operate manufacturing plants and to identify and enter into commercial arrangements with customers or sublicensees will depend on developing and maintaining close working relationships with industry participants. These relationships will need to change and evolve over time, as we enter different phases of development. Our strategic relationships most often are not yet reflected in definitive agreements, or the agreements we have do not cover all aspects of the relationship. Our success in this area also will depend on our ability to select and evaluate new strategic relationships and to consummate transactions. Our inability to identify suitable companies or enter into and maintain strategic relationships may impair our ability to grow. The terms of relationships with strategic partners may require us to incur expenses or undertake activities we would not otherwise be inclined to incur or undertake in order to maintain these relationships. Moreover, reliance upon strategic partners to manufacture and sell our biofuel subjects us to additional risks, including a limited ability to control the quality of such fuel and the failure of such partners to perform in accordance with the terms of agreements that they may enter into with us. Arrangements we enter into with such partners may compete with any biofuel that we may manufacture at our own plants and therefore may limit our organic growth.

Our biofuel and other alternative sources are at significant disadvantage to petroleum fuels.

Our biofuel and other alternative fuels like biodiesel compete with petroleum-based fuels. Currently, the cost of producing most alternative fuels forces manufacturers to operate at a significant competitive disadvantage compared to petroleum-based fuels. Producers of alternative fuels generally depend upon government support, including tax credits and various incentives and mandates to purchase alternative fuels, and upon the willingness of customers to pay a premium for cleaner burning, renewable non-petroleum fuels.

16

We may be unable to compete successfully in the highly competitive alternative fuels market.

Within the alternative fuels market, the manufacture, marketing and sale of biofuels (such as biodiesel) and other alternative fuels is highly competitive. Such competition could be intense and could drive up the costs of feedstock, plant construction, attracting and retaining qualified engineers, chemists and other key employees, as well as other operating expenses. Additionally, new companies are constantly entering the market. This growth and fragmentation could negatively impact us or our sublicensees’ ability to obtain additional capital from investors. Larger companies which have been engaged in this business for substantially longer periods of time may have access to greater financial and other resources. These companies may have greater success in recruiting and retaining qualified employees and in fuel manufacturing and marketing, which may give them a competitive advantage.

We may never develop the scale economies necessary to optimize our cost structure and enable us to produce and sell our biofuels for a profit.

Our current business model depends, in part, on developing sufficiently large sales volumes and production capacity to be able to realize economies of scale and minimize raw materials, sourcing, logistics and transportation costs. If we are unable to generate sufficient economies of scale in our operations, we may be unable to obtain volume discounts on raw materials and transportation or cut marginal production costs to the level necessary to profitably price our biofuel.

The tax credits for which we are eligible will expire on December 31, 2011. Failure to extend or renew these or similar tax credits could make our biofuels less competitive.

The 50 cent per gallon credit applicable to our fuel, when mixed with diesel, kerosene or other taxable fuel and sold at the retail level, will expire on December 31, 2011, along with biodiesel and other alternative fuel tax credits. We depend in part on the availability of tax credits to incentivize customers to purchase our fuels. Our ability to produce revenues from our biofuels may be impacted significantly if such credits are not extended or renewed past December 31, 2011.

If our biofuels do not qualify for government mandated or incentivized renewable energy credits or renewable portfolio standards or biofuel mandates, our potential customers may be less likely to pay a premium for our biofuels, which could negatively impact our ability to generate revenues.

More than thirty states have enacted renewable energy credits (“RECs”) or renewable portfolio standards (“RPS”), and several other states have created biofuel mandates, tax credits and other incentives for the use of renewable fuels. Our business model depends in part, on our biofuels qualifying for RECs, RPS requirements or biofuel mandates and that our customers will pay a premium for our biofuels in order to receive tax credits or comply with the government mandates. If we do not receive this premium because our biofuel does not qualify our customers for the credits or incentives, we may be unable to generate sufficient revenues or profits which could have a negative effect on our business, results of operations and financial condition.

We may never fully realize the value of our technology license agreement, which presently is the principal asset reflected on our balance sheet.