Attached files

| file | filename |

|---|---|

| EX-32 - MINT LEASING INC | ex32.htm |

| EX-10.7 - MINT LEASING INC | ex10-7.htm |

| 10-K - MINT LEASING INC | mintleasing10k123110.htm |

| EX-31 - MINT LEASING INC | ex31.htm |

Exhibit 10.8

THIRD RENEWAL EXTENSION AND MODIFICATION AGREEMENT

|

THE STATE OF TEXAS

|

§

|

|

|

§ KNOW ALL MEN BY THESE PRESENTS:

|

|

|

| COUNTY OF HARRIS |

§

|

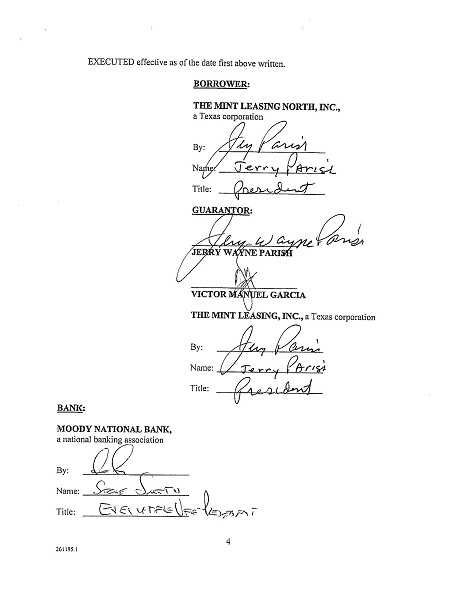

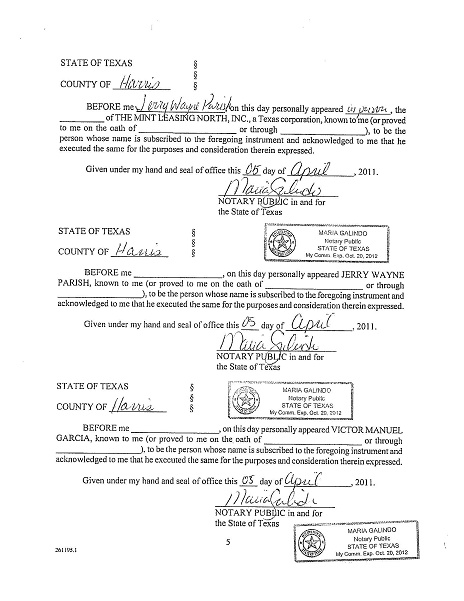

This Third Renewal, Extension and Modification Agreement ("Agreement") is executed effective as of the 28th day of February, 2011 ("Effective Date"), by and between THE MINT LEASING NORTH, INC., a Texas corporation (herein referred to as "Borrower"): JERRY WAYNE PARISH, VICTOR MANUEL GARCIA and THE MINT LEASING, INC., a Texas corporation (individually and collectively, "Guarantor""), and MOODY NATIONAL BANK, a national banking association (herein referred to as "Bank") to evidence their agreement as follows:

WITNESSETH:

WHEREAS, Bank is the legal and equitable owner and holder of that certain Revolving Line of Credit Promissory Note dated on or about July 24,2009 in the original principal amount of TEN MILLION AND NO/100 DOLLARS ($10,000,000.00) or so much thereof as may be advanced from time to time, made by Borrower payable to the order of Bank (herein referred to as the "Note"), which Note evidences that certain revolving line of credit loan made by Lender to Borrower in the original principal amount of up to $10,000,000.00 or so much thereof as may be advanced from time to lime ("Original Loan"), secured in part by that certain Collateral Assignment and Security Agreement dated July 24,2009; and

WHEREAS, each of Guarantor executed certain guaranty agreements dated as of the date of the Note, guaranteeing the obligations of Borrower under the Note and all other obligations of Borrower under any and all of the documents and instruments securing, evidencing and relating to the Loan (all such documents and instruments, including those executed in connection with the First Renewal, as defined below, collectively, the "Loan Documents"): and

WHEREAS, in connection with the Note, Borrower, Guarantor and Bank also entered into that certain Loan Agreement dated as of the date of the Note ("Loan Agreement") in which the use of funds advanced and to be advanced under the Note was stipulated; and

WHEREAS, effective December 31, 2009, Bank, Borrower and Guarantor executed that certain Renewal, Extension and Modification Agreement for the Loan (the "First Renewal"), which renewed and extended the maturity of the Loan until February 28,2010, and modified certain other terms of the Loan Documents, including, without limitation, the Note and the Loan Agreement: and

WHEREAS, effective February 28, 2010, Bank. Borrower and Guarantor executed that certain Second Renewal, Extension and Modification Agreement for the Loan (the "Second Renewal"), which renewed and extended the maturity of the Loan until February 28, 2011 and removed the revolving line of credit aspect of the Original Loan, and, additionally, modified certain other terms of certain of the Loan Documents, including, without limitation, the Note and the Loan Agreement; and

WHEREAS, Borrower and Guarantor have requested a further renewal of the Loan and an extension of the Scheduled Maturity Date (as defined herein), and to further modify certain other terms of the Loan Documents as provided for herein; and

WHEREAS, Bank is agreeable to the foregoing, subject to and in accordance with all of the terms and conditions of this Agreement.

NOW, THEREFORE, for and in consideration of the premises and of the mutual covenants and agreements herein contained, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

(1) As of the Effective Date, the outstanding principal balance due and payable under the Note is $2,202,637.56. Any and all unpaid accrued interest has been paid current to the Effective Date.

(2) As of the Effective Date, the Note is hereby renewed, extended and modified as follows:

(a) The "Scheduled Maturity Date" shall be March 1, 2012, upon which date any and all unpaid principal and all unpaid, accrued interest shall be due and payable in full.

(b) The "Basic Rate" shall mean a fixed six and 75/100ths percent (6.75%).

(c) Payments of principal and accrued interest on the Loan indebtedness are payable in monthly installments of FORTY-FIVE THOUSAND SIXTY AND NO/100 DOLLARS ($45,060.00) each, the first installment to become due and payable on April ], 2011 and one of said installments to become due and payable on the same day of each and every succeeding calendar month thereafter until the Scheduled Maturity Date. As said installments are paid, they are to be applied first to the payment of interest accrued on the entire amount of said indebtedness unpaid at the time of said payment, and the balance, if any, shall be applied to the payment of principal.

Maker understands that the monthly installments of interest and principal referred to above are based upon a hypothetical amortization period proposed by Maker and agreed to by Noteholder; that such installments will not amortize fully the principal balance of the indebtedness evidenced by the Note by the Scheduled Maturity Date; that the final installment will be a "balloon" payment; and that Noteholder has no obligation to refinance such "balloon" payment.

(3) All rights, remedies, titles, liens, security interests and equities evidenced by the Note or any of the remaining Loan Documents are hereby acknowledged by all parties hereto to be valid and subsisting, and are hereby recognized to be continued in full force and effect.

(4) It is agreed and acknowledged by the parties hereto that Bank's requirements in exchange for the consents and modifications as herein contained are reasonable in all respects.