Attached files

| file | filename |

|---|---|

| 8-K - MARTIN MIDSTREAM PARTNERS L.P. | form8-k.htm |

Exhibit 99

High Yield

Conference

May 2011

Martin Midstream Partners, LP

Presentation to

Forward-Looking Statements

Statements included that are not historical facts (including any statements concerning plans and objectives

of management for future operations or economic performance, or assumptions or forecasts related

thereto), are forward-looking statements. These statements can be identified by the use of forward-

looking terminology including “forecast,” “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,”

“continue,” or other similar words. These statements discuss future expectations, contain projections of

results of operations or of financial condition or state other “forward-looking” information. We and our

representatives may from time to time make other oral or written statements that are also forward-looking

statements.

of management for future operations or economic performance, or assumptions or forecasts related

thereto), are forward-looking statements. These statements can be identified by the use of forward-

looking terminology including “forecast,” “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,”

“continue,” or other similar words. These statements discuss future expectations, contain projections of

results of operations or of financial condition or state other “forward-looking” information. We and our

representatives may from time to time make other oral or written statements that are also forward-looking

statements.

These forward-looking statements are based upon management’s current plans, expectations, estimates,

assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and

uncertainties. We caution that forward-looking statements are not guarantees and that actual results could

differ materially from those expressed or implied in the forward-looking statements.

assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and

uncertainties. We caution that forward-looking statements are not guarantees and that actual results could

differ materially from those expressed or implied in the forward-looking statements.

Because these forward-looking statements involve risks and uncertainties, actual results could differ

materially from those expressed or implied by these forward-looking statements for a number of important

reasons. A discussion of these factors, including risks and uncertainties, is set forth in Martin Midstream’s

annual and quarterly reports filed from time to time with the Securities and Exchange Commission. Martin

Midstream expressly disclaims any intention or obligation to revise or update any forward-looking

statements whether as a result of new information, future events, or otherwise.

materially from those expressed or implied by these forward-looking statements for a number of important

reasons. A discussion of these factors, including risks and uncertainties, is set forth in Martin Midstream’s

annual and quarterly reports filed from time to time with the Securities and Exchange Commission. Martin

Midstream expressly disclaims any intention or obligation to revise or update any forward-looking

statements whether as a result of new information, future events, or otherwise.

2

Management Team

3

• Ruben Martin

Chief Executive Officer, General Partner

– Has served as Chief Executive Officer and a member of the Board of Directors since June 2002

– President of Martin Resource Management Corporation (“MRMC” or the “Parent”) since 1981 and

joined MRMC in 1974

joined MRMC in 1974

• Bob Bondurant

Executive Vice President and Chief Financial Officer, General Partner

– Joined MRMC in 1983 as Controller and became CFO and a member of the Board of Directors in 1990

– Previously served in the audit department at Peat Marwick, Mitchell and Co.

• Wes Martin

Vice President of Business Development, General Partner

– Joined MRMC in 2005

– Previously served as an analyst in Energy Investment Banking at Raymond James

• Joe McCreery

Vice President of Finance and Head of Investor Relations, General Partner

– Joined MRMC in 2009

– Previously served as a Director in the Corporate Energy Department of SunTrust Robinson

Humphrey specializing in midstream/MLP finance

Humphrey specializing in midstream/MLP finance

Partnership Overview

Terminalling and Storage

Started in early 1990s

Natural Gas Services

Started in 1950s

32%

Marine Transportation

Started in 1980s

22%

Sulfur Services

Started in 1960s

22%

Differentiated by Diversity

5

24%

NASDAQ: MMLP

Unit price: $39.08

Market Cap: $800 million

Distribution / Yield: $3.04 / 7.8%

(as of April 12, 2011 close)

2010 EBITDA of $102.7

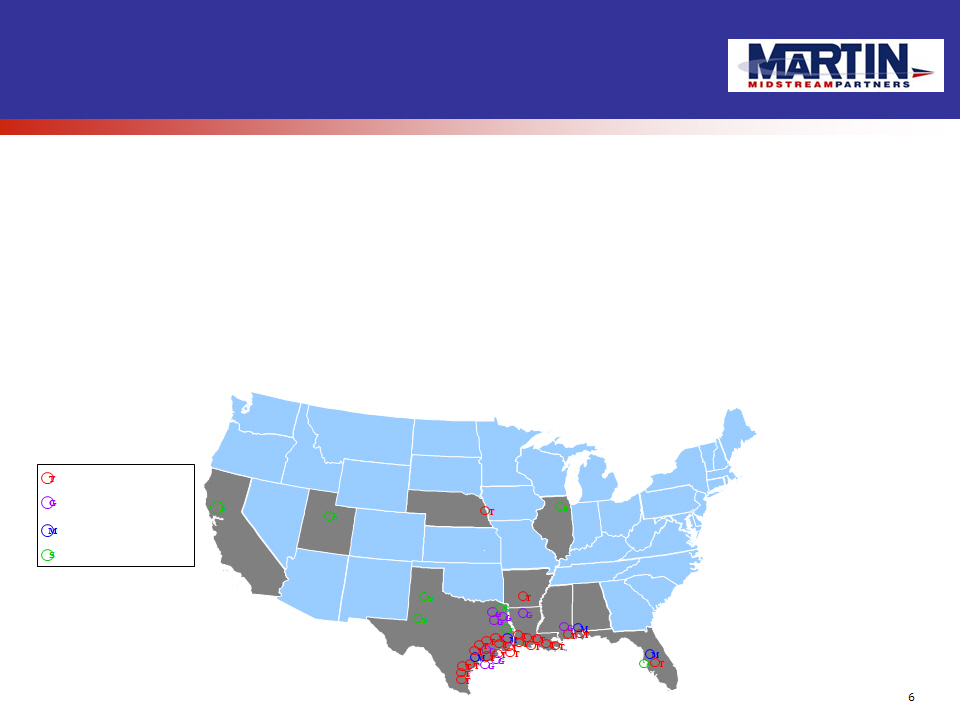

• Strategic operations across ~50 locations in 10 states, primarily in the Gulf Coast Region of the U.S., provide

cost-efficient operations in areas of high customer activity

cost-efficient operations in areas of high customer activity

– Shore bases acr0ss the Gulf Coast

– Favorable proximity to major refining regions

of the U.S.

of the U.S.

– Coast-to-coast integrated sulfur infrastructure,

including access to export markets from

Stockton, CA and Beaumont, TX and storage

at main domestic pricing point in Tampa, FL

including access to export markets from

Stockton, CA and Beaumont, TX and storage

at main domestic pricing point in Tampa, FL

Attractive Operating Footprint

Terminalling and Storage

Natural Gas Services

Marine Transportation

Sulfur Services

T

G

M

S

S

S

S

S

S

S

S

G

G

G

G

G

G

G

T

T

T

T

T

T

M

M

M

T

T

T

T

T

T

T

T

T

T

T

T

T

T

T

T

– Lubricant distributors and marketers

– Marine service terminals providing broad

geographic coverage and distribution

capabilities

geographic coverage and distribution

capabilities

– Natural gas assets strategically located in

Haynesville Shale, featuring only full

fractionation capabilities within ~ 200 miles

Haynesville Shale, featuring only full

fractionation capabilities within ~ 200 miles

T

T

• Crosstex - In January 2010, Waskom JV (with CenterPoint) acquired the East Texas natural gas and processing assets of Crosstex for $40

million ($20 million for Martin’s 50% share) with 60 miles of natural gas gathering pipelines, 2 compressor stations and 3 natural gas processing

refrigeration plants

million ($20 million for Martin’s 50% share) with 60 miles of natural gas gathering pipelines, 2 compressor stations and 3 natural gas processing

refrigeration plants

• Terminalling Facilities & Marine Asset Drop-down - In August 2010, acquired 2 marine terminals, 1 in Mississippi and 1 in Alabama, from MRMC

for $11.7 million. In December 2010, acquired a 60,000 bbl barge from MRMC for $17 million

for $11.7 million. In December 2010, acquired a 60,000 bbl barge from MRMC for $17 million

• Velocity Midstream - In November 2010, Prism acquired the East Texas natural gas gathering assets of Velocity Midstream for $25 million with

20 miles of natural gas gathering pipelines and various equipment

20 miles of natural gas gathering pipelines and various equipment

• Terminalling Facilities Drop-down - In January 2011, acquired 13 marine and 1 inland terminalling facilities located across the Louisiana Gulf

Coast from MRMC for $36.5 million

Coast from MRMC for $36.5 million

7

2010 2011

$20MM Acquisition of

Gas Gathering Assets

from Crosstex

from Crosstex

Acquisitions + Equity - A Pattern Repeated

Public Equity

Offering: $50.6MM

Offering: $50.6MM

$36.5MM Drop-down

of Shore-based Marine

Terminal Assets

Terminal Assets

Public Equity

Offering: $70.7MM

Offering: $70.7MM

Public Equity

Offering: $28.1MM (1)

Offering: $28.1MM (1)

$28.7MM Drop-downs

of Shore-based

Terminals and Marine

Assets

Terminals and Marine

Assets

$25MM Acquisition of

Gas Gathering Assets

from Velocity Midstream

from Velocity Midstream

(1) - August 2010 offering proceeds used solely to redeem MRMC owned MMLP units

Modest sized acquisitions of familiar assets with conservative financing mix

High Yield Offering:

$200.0MM

$200.0MM

8

• MRMC developed the infrastructure and brand

reputation for the Partnership’s business segments over

the past 50 years

reputation for the Partnership’s business segments over

the past 50 years

• MRMC directs the Partnership’s business operations

through its control of the GP

through its control of the GP

• The Partnership has commercial arrangements (as

customer and supplier) with MRMC that enhance its

ability to efficiently serve its third party customers

customer and supplier) with MRMC that enhance its

ability to efficiently serve its third party customers

• MRMC has invested ~$150 million in the Partnership over

the last 9 years (including drop-down support)

the last 9 years (including drop-down support)

• Strong, independent governance with four outside GP

directors plus Ruben Martin

directors plus Ruben Martin

Wholly-owned Subsidiaries

MRMC Affiliates

Non-Affiliates

Martin Resource

Management

Corporation

Martin Midstream

Partners L.P.

Partners L.P.

66.4%

LP Interest

2%

GP Interest

Martin

Resources`

LLC

Resources`

LLC

100%

Martin

Midstream

GP LLC

Midstream

GP LLC

100%

Public

Unitholders

6.6 million LP

Units

31.6% LP

Interest

MRMC is fully committed to the success of the Partnership

Strong General Partner Support

Private Company:

28.5% Owned by

Management /

ESOP*

Management /

ESOP*

*Excludes shares owned by Ruben Martin

9

• Integrated and complementary business segments uniquely position Martin and are a key driver of long-term

customer relationships

customer relationships

– Aligned with customers to address logistical and transportation issues and/or achieve operational synergies

through strategic alliances and partnerships

through strategic alliances and partnerships

• Breadth, scale and brand recognition developed over several decades make Martin a premier supplier

• Customers include some of the largest, most profitable businesses in the energy industry

– Major oil and gas companies, independent refiners, large chemical companies, fertilizer manufacturers

– Unique assets and capabilities and outstanding customer service (particularly for hard-to-handle products)

provide high barriers to entry and consistent contract renewals

provide high barriers to entry and consistent contract renewals

• Relationships with several of the majors span more than 10 years, with additional services added in recent years

Marquee Customer Base

High Quality, Stable Customer Base

Business Segment Overviews

Terminalling & Storage

Terminalling & Storage:

Asset Overview

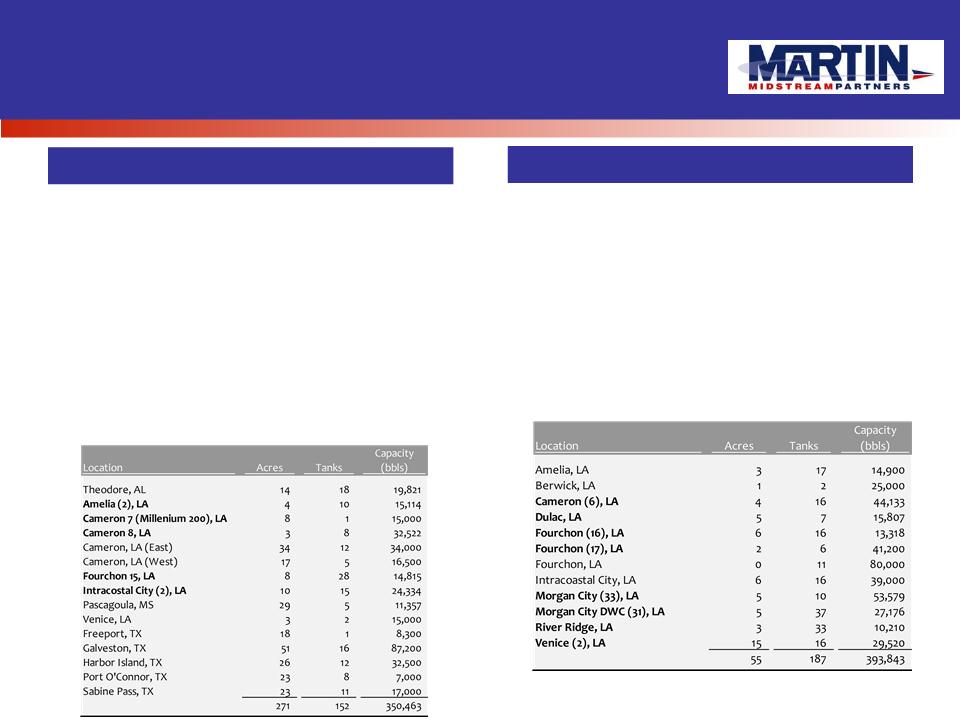

• Partnership’s largest segment by cash flow

• Stable fee-based contracts

• Business driven by 3 types of terminals

– Full Service Marine Terminals

– Fuel and Lubricant Marine Terminals

– Specialty Petroleum Terminals

Marine Terminals

• One of the largest operators of marine service terminals in the Gulf

Coast region

Coast region

– 27 terminals with ~750,000 barrels of storage capacity

– Primarily fee-based contracts with ancillary products and services

Specialty Terminals

• Allow for the processing of crude oil into finished products, the

blending and storage of lubricants and asphalt storage

blending and storage of lubricants and asphalt storage

• Revenue driven by minimum fee contracts and take-or-pay agreements

– 12 terminals with ~ 2.6 million barrels of storage capacity

12

Shore-based Terminalling Asset

Drop-down Acquisitions

• In August 2010, acquisition of two shore-based marine terminals in Mississippi and Alabama from MRMC for $11.7 million

– Theodore, AL terminal has approximately 20,000 barrels of storage capacity and Pascagoula, MS terminal has

approximately 12,000 barrels of storage capacity

approximately 12,000 barrels of storage capacity

– Additional annual throughput of ~20 to 22 million gallons of diesel and other fuels and ~150,000 gallons of lubricants

– Long-term, fee-based cash flow with minimum throughput volume commitments guaranteed by MRMC

– Combined incremental cash flow of ~$1.7 million annually

13

• In January 2011, MRMC purchased all membership interests in L&L Holdings, LLC;

simultaneously, MMLP acquired various terminalling facilities located across the

Louisiana Gulf Coast from MRMC for $36.5 million

simultaneously, MMLP acquired various terminalling facilities located across the

Louisiana Gulf Coast from MRMC for $36.5 million

– 13 marine terminals located across the Louisiana Gulf Coast with approximately

340,000 barrels of storage capacity and 1 inland terminal in Lake Charles, LA

with approximately 9,000 barrels of storage capacity

340,000 barrels of storage capacity and 1 inland terminal in Lake Charles, LA

with approximately 9,000 barrels of storage capacity

– Additional annual throughput of ~120 million gallons of diesel and other fuels

and ~5 million gallons of lubricants

and ~5 million gallons of lubricants

– Acquisition eliminated one of the lowest margin fuel suppliers in the Gulf Coast

region

region

– Synergies exist across the Martin system with fuel purchasing, marine

equipment optimization, terminal consolidation and workforce reduction

equipment optimization, terminal consolidation and workforce reduction

– Long-term, fee-based cash flow with minimum throughput volume

commitments guaranteed by MRMC

commitments guaranteed by MRMC

– Incremental cash flow of ~$5.0 million annually

Terminalling & Storage:

Significantly Expanded Marine Terminal Assets

• Shore bases offering services including logistical

support, lubricant distribution and marketing and fuel

oil storage and handling

support, lubricant distribution and marketing and fuel

oil storage and handling

– Generate additional revenue by providing shore

bases to support customer operating activities

related to offshore exploration

bases to support customer operating activities

related to offshore exploration

• 15 terminals providing ~350,500 barrels of aggregate

capacity

capacity

• Customers primarily include oil and gas exploration

and production companies and oilfield service

companies

and production companies and oilfield service

companies

14

• Terminals dedicated to providing storage,

handling, distribution and marketing services for

lubricants and fuel oil

handling, distribution and marketing services for

lubricants and fuel oil

• Provide support primarily to MRMC

• 12 terminals providing ~394,000 barrels of

aggregate capacity

aggregate capacity

Full Service Terminals

Fuel & Lubricant Terminals

Recently acquired terminals from L&L in bold

Our Proven Performer - Specialty Terminals

• Highest margin business (40 - 50%) given unique products and lack of

competition equipped to provide specialty services

competition equipped to provide specialty services

– Requisite equipment and experience necessary to handle difficult

materials (e.g. molten sulfur, sulfuric acid, ammonia)

materials (e.g. molten sulfur, sulfuric acid, ammonia)

• Large barriers to entry drive key industry relationships and multi-year

(typically 3 - 5 years), minimum fee contracts with consistent renewals

(typically 3 - 5 years), minimum fee contracts with consistent renewals

• Customers are primarily large oil refining and natural gas processing

companies

companies

• Segment includes Cross Refinery assets and associated long-term tolling

agreement

agreement

• 12 terminals with ~2.6 million barrels of storage capacity

15

Specialty Petroleum Terminals

Recently acquired terminal from L&L in bold

Business Overview:

• 7,500 bpd naphthenic lube refinery in Smackover, AR

• Approximately 10% of total U.S. market share in specialized refining capacity

• Profitability drivers include:

– Refinery efficiency (utilization / lube yield maximization)

– Crude feedstock costs and availability

– Alternative lubricant prices (paraffinic vs. naphthenic)

– Industrial demand (utility maintenance, metalworking, etc.)

– Environmental regulation (driving switch to naphthenic lubes for tire industry)

• Naphthenic crude yields of ~65% for lubes, 20% for distillates and 12% for asphalt flux

• Cross contributes $10 - 12 million of EBITDA before $1 - 2 million of annual maintenance

CapEx

CapEx

• The Partnership has entered into a long-term, fee based agreement with MRMC,

securing stable cash flow

securing stable cash flow

• 12-year Tolling Agreement

• Fees generated via formulaic “Aggregate Quarterly Tolling Fee”

• Minimum tolling fee requires MRMC to make minimum volume purchases

• Includes additional volume and commodity price surcharges, ensuring baseline

profitability

profitability

16

Terminalling & Storage:

Cross Refinery Asset Detail

Note: Martin 10-K filings reflect Cross assets assuming 2009 full year ownership given “common control” accounting standards.

Terminalling & Storage:

Continued Performance

Adjusted EBITDA

Revenue

17

• Business Outlook

– Our largest and fastest growing segment

producing nearly 100% fee-based cash flows

producing nearly 100% fee-based cash flows

– Expanded shore base market penetration

through recent L&L acquisition

through recent L&L acquisition

– Continued strength in specialty terminalling

businesses including Cross. Naphthenic lube

demand remains strong

businesses including Cross. Naphthenic lube

demand remains strong

– Increasing revenue across each of the terminal

assets

assets

1 Reflects Revenue pro forma for Cross acquisition

Natural Gas Services

Natural Gas Services:

Snapshot

19

• Samson (% of Liquids)

• CenterPoint Energy Gas Transmission (Fee)

• Devon Energy (% of Proceeds)

• GMX Resources (Fee)

• Shelby Operating (% of Proceeds)

• Talco Midstream (% of Proceeds)

• Prism’s key assets include:

– 706 miles of gathering and transmission

pipelines

pipelines

§ Woodlawn - ~142 miles of gathering pipe,

~33 miles of transport pipe

~33 miles of transport pipe

– Solid processing capabilities

§ Waskom - 285 MMcf/d natural gas

processing plant

processing plant

§ Woodlawn - 30 MMcf/d processing plant

– Over 2.1 million barrels of combined NGL

storage capacity

storage capacity

– 200 mile NGL pipeline from Longview, TX to

Beaumont, TX

Beaumont, TX

• Fractionator at Waskom provides key competitive

advantage

advantage

– Only gas plant in East Texas that has full

fractionation capability (14,500 bpd)

fractionation capability (14,500 bpd)

Breakdown of 2010 EBITDA Contribution

Velocity Midstream Acquisition

• In November 2010, Prism acquired certain East Texas natural gas

gathering assets from Velocity Midstream for $25 million, the

“Darko Acquisition”

gathering assets from Velocity Midstream for $25 million, the

“Darko Acquisition”

Gas Gathering Assets

• Approximately 20 miles of natural gas gathering pipelines that are

connected to Harrison County Gas Gathering System acquired from

Crosstex in January 2010

connected to Harrison County Gas Gathering System acquired from

Crosstex in January 2010

• Provides opportunity to direct gas to Prism / Waskom assets

• Life of lease dedication from Berry Petroleum ensures long-term

competitive position

competitive position

• Extends Prism's footprint in East Texas with potential to extend

system further

system further

• Incremental cash flow of ~$3.0 million annually

20

Natural Gas Services: Integrated Solutions

with Attractive Contract Mix

• The Natural Gas Services segment provides an integrated distribution channel for gas producers

– Gathering and processing facilities collect the wet gas and separate liquids under fee-based, percent of proceeds or

percent of liquids pricing arrangements

percent of liquids pricing arrangements

– Pipelines and trucks distribute extracted or purchased NGLs for a fixed margin based on Mt. Belvieu indexed pricing

– Large storage capacity allows Martin to re-sell NGLs during higher-priced winter seasons, locking in margins via

hedging

hedging

– Wholesale propane business sells NGLs to propane retailers for a fixed-fee margin based on Mt. Belvieu indexed

pricing or through pre-bought and pre-sold arrangements (based on the same index)

pricing or through pre-bought and pre-sold arrangements (based on the same index)

– Wholesale distribution of NGLs provides smoothing effect to natural gas processing for MMLP

• Competitive Advantages

– Martin’s NGL business has 50+ years of performance and name recognition

– Long-term fee contracts, pricing arrangements and effective hedging (45% of commodity price risk for 2011) create

relative cash flow stability

relative cash flow stability

– Limited geographic alternatives (Waskom / Arcadia) and a large number of customers lower competitive pressures

– Strategically located Waskom Processing Plant remains the only full fractionation facility in East Texas production

area

area

– Existing infrastructure prime for expansion to provide full midstream services for both rich and lean gas

– Joint venture strategy with strong partner allows Martin to fully capitalize upon growth opportunities

21

Locked-in, higher

Natural Gas Services - Integrated Solutions

Wet Gas

Liquids

separated under

fee-based POP or

POL pricing

arrangements

separated under

fee-based POP or

POL pricing

arrangements

Third party purchasers

(Pipelines, trucks)

Martin storage facilities

Third party purchasers

NGLs

Martin wholesale

propane business

propane business

MTI. Belvieu

Propane retailers

615 miles of

gathering and

transmission

pipelines

gathering and

transmission

pipelines

200 miles NGL

pipeline

pipeline

285 MMcf/d

natural gas

processing plant

with 14,500 bbld

fractionation

capacity

natural gas

processing plant

with 14,500 bbld

fractionation

capacity

> 2.1MM bbl NGL

storage facilities

storage facilities

Third party suppliers

indexed pricing

priced winter sales

MTI. Belvieu

indexed pricing

22

Natural Gas Liquids

Value Chain

23

NATURAL GAS

GATHERING PIPELINES

GATHERING PIPELINES

Mixed NGLS

To fractionators for separation into

NGL purity products

NGL purity products

NGL PIPELINE

NGL STORAGE

Dry Natural Gas

(principally methane with ethane)

(principally methane with ethane)

NATURAL GAS

PIPELINES

PIPELINES

NATURAL GAS

STORAGE

STORAGE

Power Generation

Industrial Fuel

Residential Fuel

Petrochemicals

Petrochemicals and

Industrial/Residential Fuel

Industrial/Residential Fuel

Gasoline Additives and

Petrochemicals

Petrochemicals

Gasoline Additives and

Petrochemicals

Petrochemicals

Motor Gasoline

NGL Fractionation

ETHANE

PROPANE

ISOBUTANE

MIXED BUTANES

NORMAL BUTANE

NATURAL GASOLINE

WASKOM PROCESSING

PLANT

PLANT

END USERS:

EAST TEXAS PRODUCTION

COTTON VALLEY AND

HAYNESVILLE SHALE

Natural Gas Services:

Growth in 2010 = Increased Performance

24

• Business Outlook

– Multi-year dedicated acreage contracts (up to

life of reserves) provide access to Cotton Valley

and Haynesville gas

life of reserves) provide access to Cotton Valley

and Haynesville gas

– Cold winter season and signs of improving

economy support a stronger outlook for 2011

economy support a stronger outlook for 2011

– Waskom processing plant capacity expansion

will bring capacity from current 285 MMcf/d

level to 320 MMcf/d

will bring capacity from current 285 MMcf/d

level to 320 MMcf/d

– Waskom rail rack project will give expanded

market access for liquids - beyond regional

petrochem buyers

market access for liquids - beyond regional

petrochem buyers

Adjusted EBITDA

Revenue

1 Reflects EBITDA pro forma for Crosstex acquisitions

Volume

Sulfur Services

Sulfur Services:

Snapshot

• Engaged in the gathering of molten sulfur (270o F) from refiners and natural gas processing plants

• Integrated suite of specialized assets designed to gather, transport, store and process sulfur

• In addition to fees generated from gathering and storing, Martin is strategically structured to generate

revenue via multiple avenues

revenue via multiple avenues

– Sulfuric Acid Production

– Fertilizer Manufacturing

– Prilling - transformation of molten sulfur to sulfur pellets

• Invested in the essential assets and expertise to handle the unique requirements for transportation and

storage of molten sulfur

storage of molten sulfur

– 1 offshore tow, 1 inland tow, 165 railcars and several trucks owned and operated by MRMC

• Key assets

– 3 sulfur prillers (2 in Texas, 1 in California) with a combined

prilling capacity of 5,000 tons per day

– 6 sulfur-based fertilizer production plants

– 1 sulfuric acid plant

– 1 emulsified sulfur blending plant

26

Sulfur Services:

Intermodal Logistics

27

Refinery

Gas

Fertilizer

Production

Production

Industrial Uses

International

Demand

Demand

Beaumont, TX

Stockton, CA

Tampa, FL

Truck, Barge, Rail

Truck, Barge, Rail

Prilling

* Martin takes on

pricing at this point

Molten Form

China, Brazil,

Morocco

* Martin can take physical

delivery at this point

delivery at this point

($ Fee)

($ Fee)

($ Fee)

• Martin is able to capture fees at five points along the integrated system, which the Partnership

has developed over 30 years

has developed over 30 years

($ Fee)

Beaumont,

TX

TX

(Neches and

Stanolind)

Stanolind)

($ Fee)

($ Fee)

MMLP purchases

sulfur

sulfur

Source: Partnership

Full Service Logistical Provider

& Consistent Fertilizer Results

Molten Sulfur Overview

• Sales contracts typically last 1 to 5 years

• Contracts priced as a margin over a published market indicator

– Both sales and purchase prices are tied to a market published index (products/commodities are simultaneously purchased

and sold)

and sold)

• Prilling capability provides logistical services on a reservation fee basis; customers pay cost plus if prilling capacity is used

• Cash flow generation for 2010 equally split among traditional sulfur services, including prilling and our fertilizer production

Fertilizer Overview

• Dedicated offtake from MMLP owned sulfuric acid production facility

• Produces 4 primary sulfur and sulfur-based niche fertilizer products

– Plant nutrient sulfur products - agricultural ground sulfur products produced in Odessa, TX and Seneca, IL

– Ammonium sulfate products - includes nitrogen-phosphorus-potassium products and custom grades of lawn and garden

fertilizer produced in Plainview, TX and Salt Lake City, UT

fertilizer produced in Plainview, TX and Salt Lake City, UT

– Industrial sulfur - produced in Texarkana, TX for paper manufacturing processes, rubber manufacturing, etc.

– Ammonium thiosulfate - a liquid nutrient sprayed directly on plants and manufactured in Beaumont, TX

• Low competition levels in primary areas of operation (Texas and the Midwest)

• Competitive Advantages

– Proximity of manufacturing plants to customer base

– Reduced freight costs and enhance ability to respond to customer requests

– Regional market dynamics captured through multiple production facilities

– Product offering provides optionality to maximize profits with shifts in demand/supply dynamics

28

Sulfur Services:

Performance

Adjusted EBITDA

Revenue

29

• Business Outlook

– Additional prilling capacity and new reservation fee

contracts added for 2011

contracts added for 2011

– Expected demand in 2011 fueled by emerging

markets, particularly as China continues to require

mass quantities

markets, particularly as China continues to require

mass quantities

– Consistent performance from fertilizer expected

with increased product offering for 2011 (from 2010

CapEx initiatives) and strong demand given current

high agricultural pricing

with increased product offering for 2011 (from 2010

CapEx initiatives) and strong demand given current

high agricultural pricing

– Full profit upside as sulfur inventory essentially

carried at no cost due to current stockpile

carried at no cost due to current stockpile

– Re-negotiated molten sulfur sales contract

eliminates commodity price exposure

eliminates commodity price exposure

Volume

Marine Transportation

Marine Transportation:

Asset Base Well Positioned

• Martin remains a “term market player” for inland transportation services

– Goal is to keep fleet 100% contracted on a long-term basis, as historically achieved

– Contract tenor has shortened, however, strengthening economy will improve contract structure and

pricing

pricing

• Inland utilization forecasted to be > 90% for 2011

– Pressure towards shorter-term contracting or spot pricing not expected to affect utilization levels

– Current spot rates not materially lower than term contract rates

31

• Fleet modernization provides competitive advantage for the Partnership

– Newer and safer equipment is more desirable for clients

– Cost efficiencies (lower maintenance CapEx enables higher profitability for inland fleet)

Marine Asset

Drop-down Acquisition

• In December 2010, acquisition of a 60,000 barrel

offshore barge from MRMC for $17 million

offshore barge from MRMC for $17 million

– The M6000, a 60,000 barrel barge carrying

clean product (diesel fuel) for MFS, servicing the

shore-based terminals owned by MMLP and

currently paired with the MMLP tug LaForce

clean product (diesel fuel) for MFS, servicing the

shore-based terminals owned by MMLP and

currently paired with the MMLP tug LaForce

– Vessel placed under fully-found charter to MFS

increasing cash flow by approximately $5,000

per day

increasing cash flow by approximately $5,000

per day

– Incremental cash flow of approximately $1.8

million annually

million annually

32

Marine Transportation:

Solid Performance

33

• Business Outlook

– Maintain high utilization rates, with a goal

of restoring longer term contracts

of restoring longer term contracts

– Rates have reached market bottom,

providing significant upside as demand

rebounds

providing significant upside as demand

rebounds

– Continued industry capacity reduction as

older fleets are retired

older fleets are retired

– Expected normalization from heightened

activity surrounding BP/Macondo tragedy

activity surrounding BP/Macondo tragedy

Adjusted EBITDA

Revenue

Financial Overview

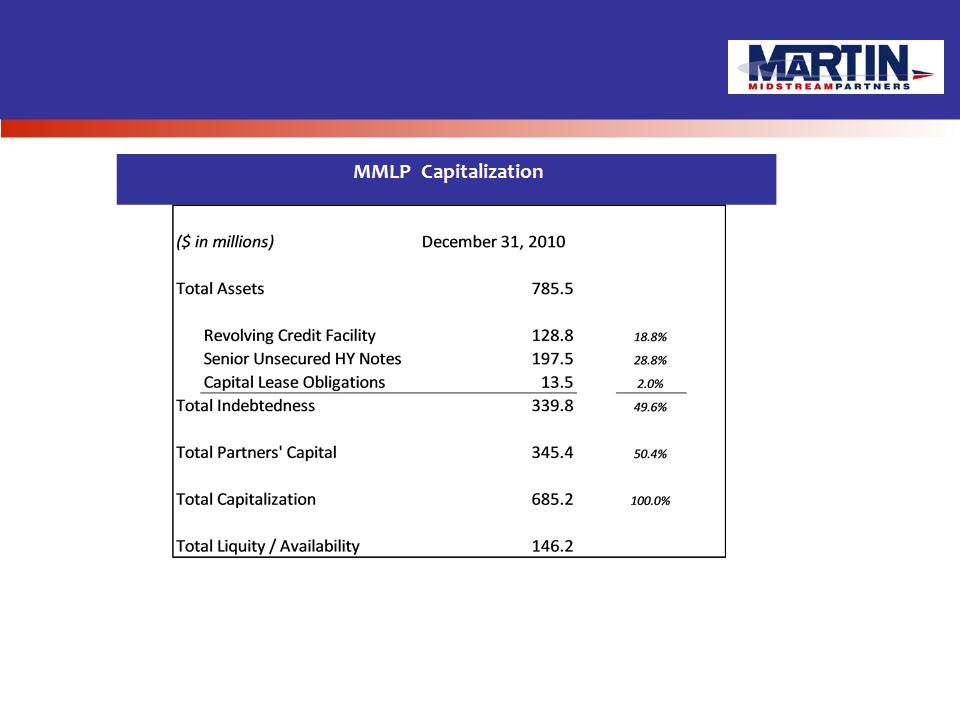

Current Capitalization

35

• MMLP issued $70.7 million in common equity units in February 2011

• MMLP is currently in the process of upsizing and extending its revolving credit facility from $275MM to

$350MM- expected closing 4/15/2011

$350MM- expected closing 4/15/2011

36

Financial Strategy:

No Change in our Discipline

• Target Leverage:

• Distribution Policy:

• Risk Management:

• Growth Opportunities:

– 3.0x - 3.5x

– Conservative approach to LP distributions

– The Partnership and BoD will consider distribution increases once a

comfortable DCR has been achieved (target of 1.15x)

comfortable DCR has been achieved (target of 1.15x)

– Hedging policies in place regarding type, transactor and counter-party

thresholds for both interest rate and commodity activity

thresholds for both interest rate and commodity activity

– The Partnership maintains the following insurance coverage:

§ Full umbrella coverage of $100 million laying over several layers of

GL, workers’ comp and asset-specific liability lien

GL, workers’ comp and asset-specific liability lien

§ Marine carries $1 billion of pollution coverage and hull value liability

– Predominantly geared for organic growth in 2011. Approved expansion for

both the natural gas services & terminalling and storage segments

both the natural gas services & terminalling and storage segments

– Opportunistic acquisitions will continue to be financed using the

Partnership’s Revolver followed by deleveraging through follow-on equity

issuances to maintain target leverage

Partnership’s Revolver followed by deleveraging through follow-on equity

issuances to maintain target leverage

37

• Terminalling and Storage:

– Cornerstone of the Partnership’s stable, fee-based cash flows as the largest segment by cash flow contribution

– Strength in tenor (1 - 12 years), product and geographic diversity; specialized products in niche markets

allowing for minimum fee/minimum volume mechanisms

allowing for minimum fee/minimum volume mechanisms

• Natural Gas Services:

– Wholesale NGL distribution provides stable margin-based cash flow for Partnership

– Multi-year up to life of reserve contracts for dedicated gathering and processing volumes

– Waskom JV contract mix: 50% Percent of Liquids, 35% Fee, 15% Percent of Proceeds, <1% Keep Whole

• Sulfur Services:

– 1-5 year, fee-based “take or pay” prilling agreements with majors (ExxonMobil, Shell, ConocoPhillips, Valero,

Total); majors pay under a cost plus scenario if capacity is used

Total); majors pay under a cost plus scenario if capacity is used

– 1-2 year supply agreements with oil refiners and natural gas producers; products then sold to phosphate

producers and other industrial customers

producers and other industrial customers

– Largest molten sulfur sales contract renegotiated to a cost plus structure in January 2011, reducing commodity

exposure

exposure

– Manufacturing process of sulfur-based fertilizer provides stable margin-based cash flow for Partnership

• Marine Transportation:

– 100% fee-based, primarily term contracts, with temporarily increased spot market activity when rates are

unfavorable for term contract renewals

unfavorable for term contract renewals

– Hard-to-handle product infrastructure provides substantial barriers to entry, even for spot market business

Heavily Weighted Fee-Based Contract Mix

Note: “margin-based” contracts represent i) buy/sell contracts which are priced off of same benchmark simultaneously, and ii) effectively eliminate pricing risk

Active Commodity Risk Management

38

• Established hedging policy to manage commodity risk exposure

– Swaps for crude oil, natural gas, natural gasoline

– Careful monitoring of counterparty risk

• Hedging focused in the Natural Gas Services segment

– 45% of volumes hedged for 2011 and 20% for 2012

– A $1 change in natural gas pricing affects cash flow by $32,670 per month in 2011

– A $10 change in oil pricing affects cash flow by $57,670 per month in 2011

• Hedging policy supplements Martin’s predominately fee-based cash flows

– Approximately 63% of the Partnership’s 2011 projected EBITDA consists of fee-based or take-or-pay

mechanisms, given the specialized assets and unique capabilities

mechanisms, given the specialized assets and unique capabilities

2010 Adjusted EBITDA

39

• Multiple lines of business provide the opportunity to direct capital strategically to multiple segments

– Focus on highest value projects

• Cross Refinery growth opportunities with tire industry demand

– $50 million of investment over 2 years at 4x - 7x EBITDA multiple

– New vacuum tower to increase yield of high viscosity lubes

§ $17 million capital investment with increased EBITDA of $4.5 million annually

§ Anticipated completion Spring 2012

– New hydrogen plant (Pending Investment)

§ $14 million to vertically integrate part of business, allowing Martin to produce ultra-low sulfur diesel for direct

sale and could also nearly double Cross capacity to 13,500 bbl/d

sale and could also nearly double Cross capacity to 13,500 bbl/d

§ Not yet approved by MMLP BoD

– New high pressure hydrotreater (2,600 psi vs. current 1,300 psi) (Pending Investment)

§ $19 million to facilitate increased non-carcinogenic lube production for tires

§ Not yet approved by MMLP BoD

• Completion of marine transportation fleet modernization (approximately $6 million of remaining expenditures) with new

inland barges will achieve greater cost efficiencies and provide Martin with a competitive advantage

inland barges will achieve greater cost efficiencies and provide Martin with a competitive advantage

• Waskom plant capacity will be increased to 320 MMcf/d from current 285 MMcf/d by the end of 2011 and natural gas liquids

rail loading facility added to take advantage of increased Haynesville drilling activity (cost of $25.5 million total; $12.75 million

Prism’s share)

rail loading facility added to take advantage of increased Haynesville drilling activity (cost of $25.5 million total; $12.75 million

Prism’s share)

• Ability to double or triple capacity at sulfur prilling plants with minimal CapEx requirements

• Overall EBITDA multiple of ~5x for all organic growth projects

Attractive Growth Opportunities

Across Business Segments

40

Closing Key Investment Considerations

à Four fully integrated and complementary business units spanning the midstream

value chain

value chain

Proven

Management

Management

à Demonstrated maintenance of conservative leverage profile through follow-on

equity offerings

equity offerings

Focus on EBITDA growth with base of stable, fee-based cash flows (some featuring

minimum fee/take-or-pay) and carefully managed commodity exposure

minimum fee/take-or-pay) and carefully managed commodity exposure

Stable base of leading industry players, largely under multi-year contracts with

consistent renewals

consistent renewals

Strong historical and continued support through several decades of infrastructure

and reputation development, drop-down and equity contributions

and reputation development, drop-down and equity contributions

à Experienced management team with independent GP directors

High Quality, Stable

Customer Base

Customer Base

Strong General

Partner Support

Partner Support

Fully Integrated

Service Provider

Service Provider

Strong Credit

Profile

Profile

Solid Growth

Diversified Business

Mix

Mix

à

Strategically located assets to provide cost-efficient operations in areas of high

customer activity

customer activity

Attractive

Operating Footprint

Operating Footprint

Diverse products and services, with specialized equipment and assets to process,

transport and store hard-to-handle products

transport and store hard-to-handle products

à

à

à

à

Question & Answer

Non-GAAP Reconciliation

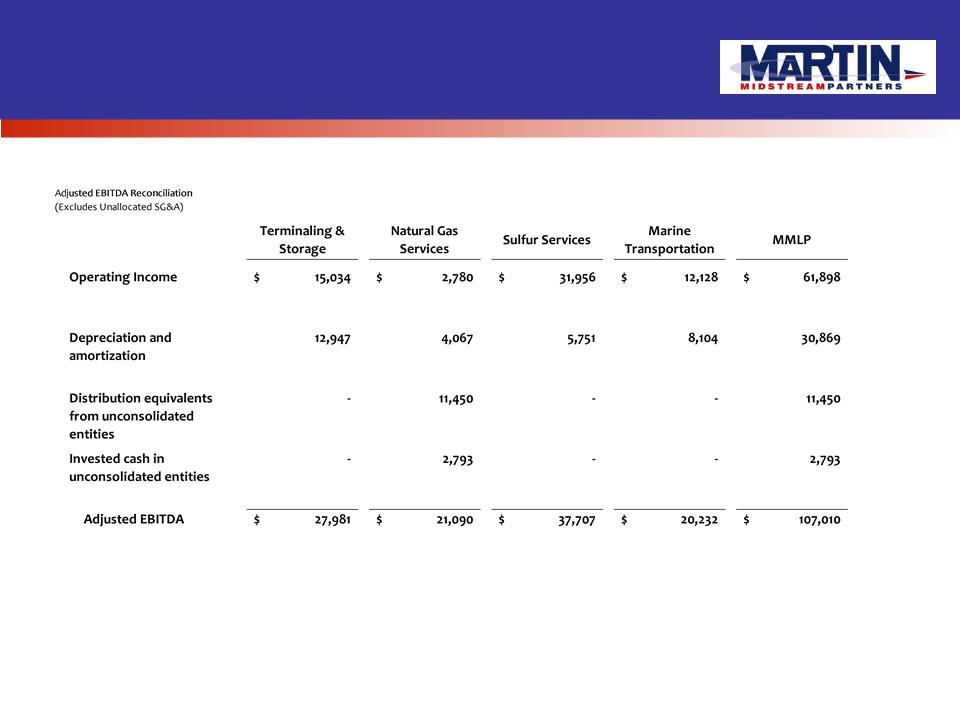

Adjusted EBITDA Reconciliation - 2010

43

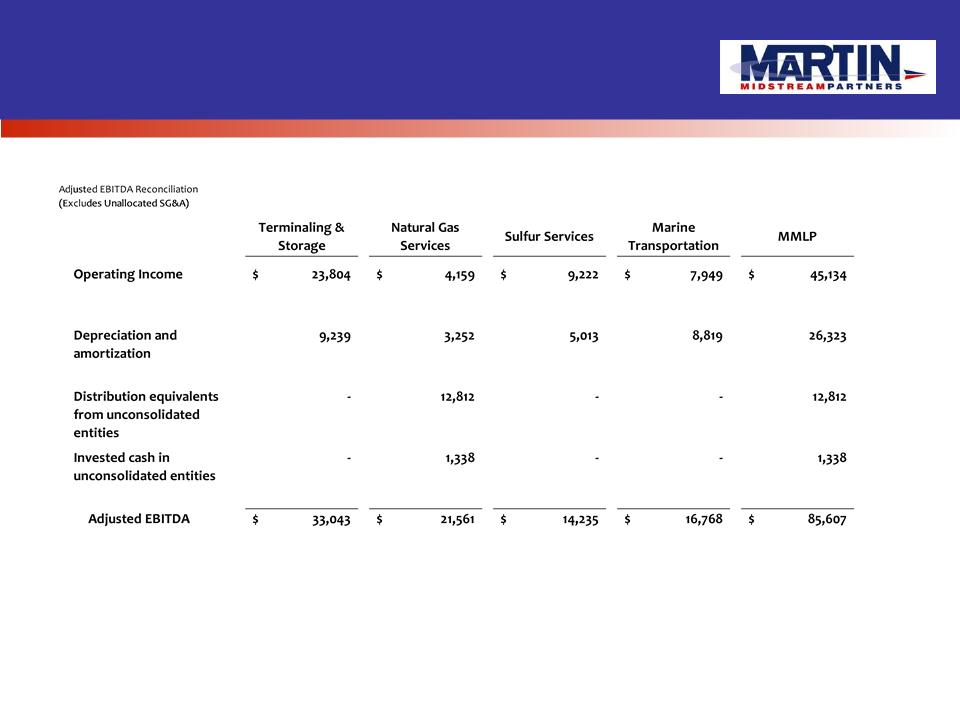

Adjusted EBITDA Reconciliation - 2009

44

Adjusted EBITDA Reconciliation - 2008

45

Adjusted EBITDA Reconciliation - 2007

46

High Yield

Conference

May 2011

Martin Midstream Partners, LP

Presentation to