Attached files

| file | filename |

|---|---|

| EX-31.1 - HUIHENG MEDICAL, INC. | v217619_ex31-1.htm |

| EX-32.2 - HUIHENG MEDICAL, INC. | v217619_ex32-2.htm |

| EX-32.1 - HUIHENG MEDICAL, INC. | v217619_ex32-1.htm |

| EX-31.2 - HUIHENG MEDICAL, INC. | v217619_ex31-2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2010

|

|

|

¨

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

Commission File Number: 333-132056

HUIHENG MEDICAL INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

20-4078899

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

|

|

Huiheng Building, Gaoxin 7 Street South

|

||

|

Keyuannan Road, Nanshan District, Shenzhen Guangdong, P.R. China 518057

|

||

|

(Address of principal executive offices)

|

||

86-755-25331366

(Registrant’s Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Act:

None

Securities registered under Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

x Yes ¨ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

¨Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of March 15, 2011 was approximately $2,052,573 based upon the closing price of $0.90 per shares as quoted for such date on the Over-the-Counter Bulletin Board maintained by the Financial Industry Regulatory Authority (“FINRA”). Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates of the Company. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 29, 2011, there were 14,030,637 shares of the registrant’s $0.001 par value common stock issued and outstanding.

TABLE OF CONTENTS

|

|

Page

|

|||

|

PART I

|

||||

|

ITEM 1.

|

BUSINESS

|

3 | ||

|

ITEM 1A.

|

RISK FACTORS

|

10 | ||

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

23 | ||

|

ITEM 2.

|

PROPERTIES

|

23 | ||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

23 | ||

|

ITEM 4

|

(REMOVED AND RESERVED)

|

|||

|

PART II

|

||||

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

23 | ||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

25 | ||

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

25 | ||

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

38 | ||

|

ITEM 8.

|

FINANCIAL STATEMENTS

|

38 | ||

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

38 | ||

|

ITEM 9A.

|

CONTROLS AND PROCEDURES | 38 | ||

|

ITEM 9B.

|

OTHER INFORMATION | 39 | ||

|

PART III

|

||||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

39 | ||

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

41 | ||

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

43 | ||

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

44 | ||

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

45 | ||

|

PART IV

|

||||

|

ITEM 15.

|

EXHIBITS

|

45 | ||

|

SIGNATURES

|

47 |

2

PART I

Item 1. Business.

In this Annual Report on Form 10-K, references to “dollars” and “$” are to United States dollars and, unless the context otherwise requires, references to “we,” “us” and “our” refer to Huiheng Medical, Inc. and its consolidated subsidiaries.

This Annual Report contains certain forward-looking statements. When used in this Annual Report, statements which are not historical in nature, including the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend” “may,” “project,” “plan” or “continue,” and similar expressions are intended to identify forward-looking statements. They also include statements containing anticipated business developments, a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this Annual Report are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to them. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. These forward-looking statements are based on our current plans and expectations and are subject to a number of uncertainties and risks that could significantly affect current plans and expectations and our future financial condition and results.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this filing might not occur. We qualify any and all of our forward-looking statements entirely by these cautionary factors. As a consequence, current plans, anticipated actions and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein.

Overview of Our Business

We design and sell precision radiotherapy equipment used for the treatment of cancerous tumors in the People’s Republic of China (“PRC” or “China”). Our products include a patented line of gamma treatment systems (“GTS”) that accurately deliver well-defined conforming doses of radiation to the target tissue and a multileaf collimator (“MLC”) used in conjunction with a linear accelerator for radiation therapy applications. We currently have 42 patents issued in the PRC, 3 patents issued in the U.S., one patent issued in the European Union, 1 patent in Sweden, and additional patent applications pending.

We are dependent on a certain number of distributors consisting of hospital equipment financing companies who purchase our equipment and, in turn, sell our products to hospitals and clinics as end users. In addition to providing precision radiotherapy equipment, we offer comprehensive post-sale services for our products as well as products manufactured by others. These services include radioactive cobalt source replacement and disposal, medical expert training, clinical trial analysis, patient tumor treatment analysis, software upgrades and patient care consulting.

Our total revenues decreased from $9.38 million in 2009 to $8.64 million in 2010. Our net income decreased from $3.64 million in 2009 to $2.18 million in 2010. The decrease in revenues and corresponding net income was primarily the result of different products and a decrease in the unit price of products sold during 2010 as compared to the prior year.

Our operating subsidiaries in the PRC were founded in 2001 by Mr. Hui Xiaobing, our Chairman and a pioneer in the GTS industry in the PRC. Mr. Hui served as president and Chairman of Shenzhen OUR Technology, Co., Ltd., the first PRC company to develop a gamma treatment system. Mr. Hui is also the former CEO of Everbright Securities, a major Chinese financial institution.

The majority of our product sales in the PRC are made to Shenzhen Jiancheng Investment Co, Ltd. (“Jiancheng”) who sell our products to hospital and clinics. During the fiscal years ended December 31, 2010 and 2009, Jiancheng accounted for 67% and 71% of our total revenues, respectively.

3

Our Products

We currently have developed five products: the Super Gamma System (“SGS”), the Body Gamma Treatment System (“BGTS”), OPEN Stereotactic Gamma-ray Radiotherapy System, the Head Gamma Treatment System (“HGTS”), and a multileaf collimator device (“MLC”) used in conjunction with a linear accelerator (“LINAC”). On February 8, 2010, we filed an application with the PRC State Food and Drug Administration (“SFDA”) seeking approval of a LINAC product manufactured by us. Although we have been informed that the LINAC unit is in the final stage of SFDA approval, we do not have an anticipated timeframe for receiving such approval. Upon receipt of regulatory approval and available funding for research and development, our intent is to market and sell the LINAC product initially only in the PRC. In addition, the MLC has been approved by SFDA for sale and we launched the sale of the MLC in 2011 targeting primarily the PRC market. As to our advanced magnetic resonance imaging (“MRI”) and industrial LINAC products, we have temporarily suspended the development of these two projects due to the changing of market conditions and our lack of funding available for these projects. We anticipate that our future research and development efforts will focus on developing our advanced MRI device and an industrial LINAC unit used for, among other things, preserving food through irradiation. We will pursue these projects pending availability of funding for future research and development.

Recently, we have taken steps to expand our product offering by acquiring Portola Medical, Inc., a Delaware company whose primary asset consists of its rights to develop, manufacture and sell an adjustable Multi-Catheter Source Applicator under the ClearPath trademark which is intended to provide brachytherapy when a physician chooses to deliver intracavitary radiation to the surgical margins following lumpectomy of breast cancer. We plan to market and sell this product in the United States and in Asia. This product is still in its initial phase and there have been no sales of this product.

Our Strategies

Our goal is to gain greater market share for our GTS products by pursuing the following strategies:

|

|

·

|

continuing to offer high quality, competitively priced products and services;

|

|

|

·

|

broadening our product offering and improving our existing technologies;

|

|

|

·

|

expanding our sales and distribution force in the PRC;

|

|

|

·

|

exploring opportunities to develop international markets including the United States, South America, Eastern Europe and Southeast Asia; and

|

|

|

·

|

expanding our product portfolio through relationships with foreign medical equipment technology leaders.

|

Our Strengths

We believe, based solely on management’s knowledge of our industry, that we are a leader in the GTS market in the PRC. We consider our core competitive strengths to be:

|

|

·

|

experienced leadership;

|

|

|

·

|

strong customer relationships and networks;

|

|

|

·

|

proprietary technology with patent protection;

|

|

|

·

|

high quality product line;

|

|

|

·

|

strong gross margins and pricing flexibility;

|

|

|

·

|

consistent, high quality post-sale customer service and support;

|

|

|

·

|

experienced research and development team; and

|

|

|

·

|

strong R&D partnerships with Beijing University, China Science & Technology University and Public Healthcare Institute of Jilin University.

|

4

Our Industry

The market for medical equipment and supplies in the PRC is segmented into geographical regions. Hospitals with greater spending power tend to be located in large towns and cities in the eastern part of the PRC, where rapid economic growth has taken place during the last two decades and where the population tends to have higher income. Medical equipment and supplies distribution is a very specialized and localized business sector in the PRC. Distributors of medical equipment and supplies operate in the PRC within relatively small and geographically dispersed markets, each based in a wealthy eastern city to cover the surrounding areas, with few distributors willing or able to cover the entire country. Most distributors focus on the PRC’s eastern cities, where the bulk of purchasing power is concentrated, while the western part of the PRC has very limited coverage. The fact that different areas of the PRC have their own medical and insurance practices, purchasing policies and regulatory issues further increases the complexity of medical equipment and supplies distribution in the PRC.

Some of the key factors contributing to the growth of the medical equipment market in the country include the PRC’s aging population, the popularization of private hospitals and clinics and the growing demand for high-quality medical equipment and efficient healthcare services. Additionally, initiatives by the government, such as reforms in the national healthcare system, are also fueling growth in the industry.

The PRC Radiotherapy Market

The Ministry of Health identified cancer as the leading cause of death in the PRC for the past years. Further, the presence of both cancer related illnesses and deaths is expected to increase in the future due to certain environmental factors, such as air and water pollution, associated with the PRC’s rapid industrial expansion. As a result, effective treatment of cancer is a high priority for the PRC healthcare system.

Radiotherapy is used in approximately 50% of all cancer treatments worldwide. Based on information most recently available to us, it is estimated that the United States has 13 radiotherapy units per million people. The World Health Organization has previously recommended 6 radiotherapy units per million people for “developed” countries. The PRC remains well below the recommended threshold. In 2007, there was less than one radiotherapy unit per million people in the PRC.

The PRC radiotherapy industry has the following characteristics:

|

|

·

|

consolidation of the market as small suppliers find it difficult to compete;

|

|

|

·

|

high degree of government regulation with respect to unit pricing and approval process;

|

|

|

·

|

large discrepancy between the need for and access to radiation oncology systems; and

|

|

|

·

|

high barriers to entry due to both high technology requirements and established relationships.

|

Trends in the radiotherapy market in the PRC include:

|

|

·

|

increasing ability of the PRC medical community to detect cancer at treatable stages;

|

|

|

·

|

increasing acceptance of the use of Western style medicine and treatment approaches;

|

|

|

·

|

emerging middle class with increased financial ability to pay for medical procedures and improved cancer care; and

|

|

|

·

|

government indications to increase permissible spending on medical equipment procurement.

|

Our Corporate History

We were incorporated as a limited liability company in November 2002 under the name of Pinewood Imports, Ltd. and converted into a corporation under the laws of the State of Nevada on August 29, 2005. The Company was originally engaged in the business of importing molding and door component products, such as framing materials, made from pine wood from Brazil for resale and distribution. On September 6, 2006, we change our name to Mill Basin Technologies, Ltd. and became an inactive company that was in pursuit of merger opportunities or business operations.

5

On May 15, 2007, we entered into a Share Exchange Agreement to acquire all of the outstanding shares of Allied Moral Holdings Limited, a company with limited liability incorporated in the British Virgin Islands on July 26, 2006, with operating subsidiaries in the PRC. Allied Moral Holdings Limited became our wholly owned subsidiary and we changed our name to Huiheng Medical, Inc. At the time we acquired Allied Moral Holdings Limited, it, through its operating subsidiaries in the PRC, designed, developed and manufactured, and provided sales and services in connection with, radiation therapy medical equipment used for the treatment of cancer.

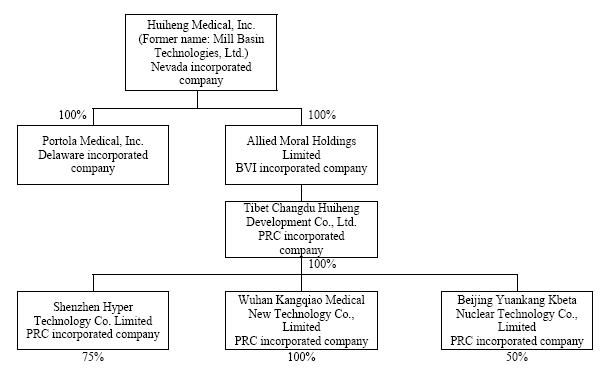

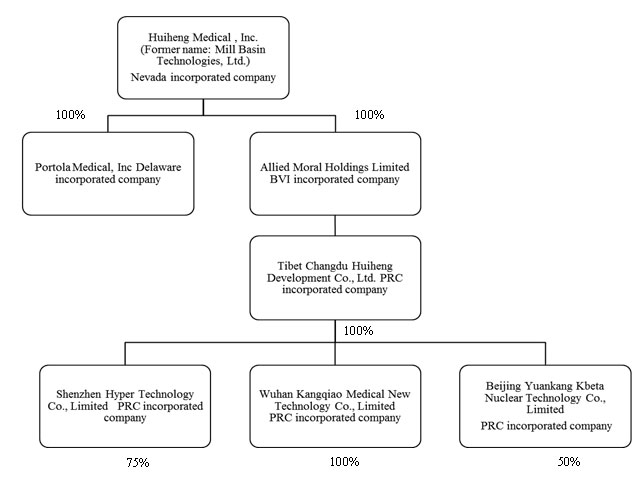

We operate as a Nevada holding company and we conduct all of our business through our operating subsidiaries as described in the chart below. As described above, we own 100% of the equity interest of Allied Moral Holdings, Ltd. (“Allied Moral”), a British Virgin Islands company that, in turn, owns 100% of the equity interest of Tibet Changdu Huiheng Development Company, Ltd., a Tibetan holding company (“Changdu Huiheng”) that, in turn, directly owns 100%, 75% and 50%, respectively, of our operating subsidiaries Wuhan Kangqiao Medical New Technology Company, Ltd., a PRC company (“Wuhan Kangqiao”), Shenzhen Hyper Technology Company, Ltd., a PRC company (“Shenzhen Hyper”), and Beijing Yuankang Kbeta Nuclear Technology Co., Ltd., a PRC company (“Beijing Kbeta”).

Wuhan Kangqiao focuses on research and development and production management of the Head Gamma Treatment System and Body Gamma Treatment System. Shenzhen Hyper focuses on research and development and production management of the Super Gamma System and our multileaf collimator product that is used in conjunction with a linear accelerator for cancer treatment. Beijing Kbeta focuses on installation and replacement of the Cobalt 60 radioactive sources used in our gamma treatment systems products. The remaining equity interests in Shenzhen Hyper and Beijing Kbeta are owned by unrelated, unaffiliated parties.

6

As described previously, Portola Medical, Inc.’s primary asset consists of its rights to develop, manufacture and sell an adjustable Multi-Catheter Source Applicator which is intended to provide brachytherapy when a physician chooses to deliver intracavitary radiation to the surgical margins following lumpectomy of breast cancer. We plan to market and sell this product in the United States and in Asia. Our development and marketing plan is in its initial phases.

Government Regulation

The sale and marketing of our products are subject to regulation in the PRC and in most other countries where we intend to conduct business. For a significant number of our products, we need to obtain and renew licenses and registrations with SFDA and its equivalent in other markets.

In the event we begin to market and sell the Multi-Catheter Source Applicator owned by Portola Medical, Inc. in the United States, we will need to ensure compliance with various federal and state laws.

Regulation

Our products are subject to regulatory controls governing medical devices. Our SGS, BGTS and GTS products are authorized by the SFDA which is the regulatory institution for medical devices in the PRC. As a developer of medical equipment, we are subject to regulation and oversight by different levels of the SFDA. We are also subject to other government laws and regulations which are applicable to developers in general. SFDA requirements include obtaining production permits, compliance with clinical testing standards, development practices, quality standards, applicable industry and adverse reporting, and advertising and packing standards. In addition, the installation of our products require the approval by the Ministry of Health and local provincial government.

On April 1, 2000, SFDA formulated a set of regulations for the medical device market - “Regulations for the Supervision and Administration of Medical Devices” - which included general provisions, administration of medical devices, administration of production, distribution and use of medical devices, supervision of medical devices, penalties, and supplementary provisions. Recent regulatory changes in the PRC include improvements in the supervision and efficiency of medical devices testing, introduction of a new pricing policy for medical devices, and introduction of a new regulation - “Provisions on Daily Supervision and Administration of Medical Devices Manufacturing Enterprises,” by SFDA in 2006. In addition, among other recently issued regulations, “Measure for the Examination of Medical Apparatus Advertisements” came into effect on May 20, 2009. Also on May 20, 2009, the “Standard for the Examination of Medical Apparatus Advertisements” came into effect.

Classification of medical devices

In China, medical devices are classified into three different categories, Class I, Class II and Class III, depending on the degree of risk associated with each medical device and the extent of control needed to ensure safety and effectiveness. Classification of a medical device is important because the class to which a medical device is assigned determines, among other things, whether a developer needs to obtain a production permit and the level of regulatory authority involved in obtaining such permit. Classification of a device also determines the types of registration required and the level of regulatory authority involved in effecting the registration.

Class I devices are those with low risk to the human body and are subject to “general controls.” Class I devices are regulated by the local food and drug administration of the city where the manufacturer is located. Class II devices are those with medium risk to the human body and are subject to “special controls.” Class II devices require product certification, usually through a quality system assessment, and are regulated by the food and drug administration of the province where the manufacturer is located. Class III devices are those with high risk to the human body, such as life-sustaining, life-supporting or implantable devices, and are regulated by the SFDA under the strictest regulatory control.

Our products are classified as Class III devices, and are therefore subject to all regulatory controls governing Class III medical devices.

Production permit for medical devices

A developer must obtain a production permit from the provincial food and drug administration before commencing the development of Class II or Class III medical devices. A production permit, once obtained, is valid for four years and is renewable upon expiration. To renew a production permit, a developer must submit to the provincial food and drug administration an application to renew the permit, along with required information six months before the expiration date of the permit. In September 2007. we applied for a renewal of our production permit, which was promptly renewed in December 2007.

7

Registration requirements of medical devices

In accordance with the “Administration Measures Regarding Medical Device Registration” implemented on August 9, 2004, before a medical device can be developed for commercial distribution, a developer must obtain medical device registration by establishing, to the satisfaction of respective levels of the food and drug administration, the safety and effectiveness of the medical device. In addition, in order to conduct a clinical trial on a Class II or Class III medical device, the SFDA requires developers to apply and to obtain in advance a favorable inspection result for the device from a third party inspection center approved by the SFDA. The application to the inspection center must be supported by required data, such as animal and laboratory testing results, as well as certain pre-clinical and clinical trial data. If approved, the medical device registration is valid for four years.

The SFDA occasionally changes its policies, adopts additional regulations, revises existing regulations or tightens enforcement, each of which could block or delay the approval process for a medical device.

All of the products that we currently sell, including the OPEN Stereotactic Gamma-ray Radiotherapy System, Stereotactic Gamma-ray Whole Body Therapeutic System (SGS-1), Multi-leaf Collimator, TOP Stereotactic Gamma-ray Radiotherapy System, Whole Body Sterotactic Gamma System (SGS-1+), Head Gamma Treatment System (HGTS) and Body Gamma Treatment System (BGTS) have obtained SFDA approval. The Medical Linear Accelerator (LINAC) we currently sell is manufactured by Shinwa. We filed an application with the SFDA seeking approval of a LINAC product manufactured by the Company. In February 2011, the SFDA approved our LINAC product and we intend to begin selling the LINAC product.

Continuing SFDA regulations

We are subject to continuing regulation by the SFDA. In the event of significant modification to an approved medical device, its labeling or its manufacturing process, a new pre-market approval or pre-market approval supplement may be required. Our GTS products are subject to, among others, the following regulations:

|

|

·

|

SFDA’s quality system regulations, which require developers to create, implement and follow certain design, testing, control, documentation and other quality assurance procedures;

|

|

|

·

|

medical device reporting regulations, which require that developers report to the SFDA certain types of adverse reactions and other events involving their products; and

|

|

|

·

|

SFDA’s general prohibition against promoting products for unapproved uses.

|

Class II and III devices may also be subject to special controls applicable to them, such as supply purchase information, performance standards, quality inspection procedures and product testing, which may not be required for Class I devices. We believe we are in compliance with the applicable SFDA guidelines, but we could be required to change our compliance activities or be subject to other special controls if the SFDA changes or modifies its existing regulations or adopts new requirements.

We are also subject to inspection and market surveillance by the SFDA to determine compliance with regulatory requirements. If the SFDA decides to enforce its regulations and rules, the agency can institute a wide variety of enforcement actions, such as:

|

|

·

|

fines, injunctions and civil penalties;

|

|

|

·

|

recall or seizure of our products;

|

|

|

·

|

the imposition of operating restrictions, partial suspension or complete shutdown of production; and

|

|

|

·

|

criminal prosecution.

|

Regulatory requirements for developing international markets

We believe that the regulatory requirements of some international markets we are targeting will be satisfied at least in part by the regulatory approvals granted by the SFDA. We believe that compliance with regulatory requirements in the international markets that we are targeting in the near term will ultimately be the responsibility of the local distributor, especially in markets where regulators will rely on the SFDA approval process. We have not fully evaluated the regulatory requirements of these markets and our ability to comply with the requirements of a jurisdiction will be a factor in our expansion plans. These requirements may include: the need for additional clinical trials; compliance with labeling, advertising and promotion restrictions; manufacturing and quality control obligations; and post-market reporting and record keeping obligations.

8

Customers

China

We sell our products through distributors who primarily consist of third party hospital equipment financing companies and who purchase our equipment and services directly, and resell such equipment and services to hospitals and clinics. Thus, even though these distributors are the purchasers of our equipment, the end users of our products and services are hospitals and clinics that treat various types of tumors. Further, although these distributors are contractually obligated to pay us for the equipment and services, their ability to pay us is dependent upon their receipt of the payments from hospitals and clinics who utilize the equipment and services.

In addition, before our equipment can be installed, the hospital or clinic must obtain approval from both the Ministry of Health and local provincial government, which approval process may range from three to twenty-four months. Because of the approval process, the receipt of payment under a particular purchase agreement may be delayed until the equipment is installed and the hospital or and clinic starts using such equipment for treatment since the third party hospital financing company is unable to make payment to us until it receives payment from the hospital or clinic. We are exploring different ways to resolve this delay in payment as it creates long accounts receivable collection cycle and puts a strain on our cash flow.

Currently, we have a limited number of distributors in the PRC (with two distributors accounting for approximately 90% of our sales for the year ending December 31, 2010) While we are expanding our own sales and marketing capabilities and developing an internal distribution network to facilitate direct sales, we will still need to cooperate with these distributors who provide lease financing to the end users consisting of hospitals and clinics.

Outside China

In an effort to expand our customer base outside of China, we have entered into distribution agreements with companies located in India, Argentina, Ukraine, Chile, Russia, Hungary, South Korea and Peru. These agreements were entered into from September 2005 through October 2007. Based on our experience with our distributor in India (where obtaining regulatory approval took more than two years from the execution of the agreement in January 2006), we expect that it will take at least two years from commencement of a distribution agreement before sales commence in those countries, and substantially longer if the applicable regulatory authorities require clinical trials or additional data beyond what was required to obtain SFDA approval. In addition, we understand that in several countries the local distributors have delayed filing for regulatory approval until they have reasonable assurance that there is a hospital or treatment center in the country that wants to acquire the equipment and there is a feasible source of financing. In general, regulatory approval delays concerning client facility preparation needed to install our products can often delay the sale and installation of our products. In certain instances, such as in Peru, the distributor has obtained regulatory approval, but shipment of our products has been delayed as a result of delays in completion of the treatment center where our products will be installed.

Materials and Components

Our manufacturing activities are outsourced and performed by others. We obtain components for our products and assembly services from a network of third party suppliers located in Shenzhen, Beijing, Wuhan and Chengdu, which are considered some of the industrialized areas of China. We obtain our Cobalt 60 sources from Beijing Shuangyuan Isotope Co. Ltd. and Chengdu Zhonghe Isotope Co. Ltd.; electrical cabinets from Wuhan Shankuo Mechanical & Electrical Equipment Co. Ltd; main engines from Jiangsu Duoling Numerical Control Machine Tool Co. Ltd and Chengdu Aviation Plastic Modeling Co. Ltd; and positioning beds from Shenzhen Tianda High-Tech Material Co. Ltd. Although we work closely with these organizations, component shortages may occur from time to time. We do not have long-term agreements with our suppliers. Instead, we obtain these products and services on a purchase order basis. Because of the knowledge of our suppliers concerning our requirements, we would have some difficulties, in the short run, replacing a supplier.

Our major assembly processes are “dry,” meaning that they do not involve significant quantities of solvents, plating solutions or other types of materials that lead to the generation of large amounts of hazardous wastes, process wastewater discharges or air pollutant emissions. Our GTS devices use radioactive isotopes, and the proper handling of this material, both prior to installation and after removing it from a device for replacement, which must occur periodically, is initially our responsibility. However, under current Chinese law and the arrangements that we have with our waste handler, the responsibility and liability for management of that waste transfers to the waste handler with the waste itself.

9

We periodically review the performance of our suppliers and manufacturers, which includes an evaluation of any quality issues and corrective actions.

Intellectual Property

We have been issued 42 patents in China covering radiotherapy devices, switching devices, and various other aspects of the Gamma Treatment System. We have also been issued three patents in the United States, one patent in the European Union and one patent in Sweden. These foreign patents expire between 2020 and 2027. We intend to patent our new inventions both in China and internationally and have filed a total of approximately 15 patent applications in the PRC, U.S. and EU.

In addition, pursuant to our acquisition of Portola Medical, Inc. in June of 2010, we acquired one additional U.S. patent and eight pending U.S. patent applications (“Portola Patents”). The Portola Patents relate to an adjustable Multi-Catheter Source Applicator which is intended to provide brachytherapy when a physician chooses to deliver intracavitary radiation to the surgical margins following lumpectomy of breast cancer.

Our patents cover the intellectual property we use in our products. We do not license patent rights from others for our products. Management is not aware of any current or previous infringement of the existing patents. If any infringement occurs, our management intends to vigorously prosecute actions to halt the infringement and recover damages if the value of the patent is judged at the time to be sufficient to justify that effort.

Employees

As of December 31, 2010, we had 79 employees, of which 79 were full-time employees and 0 were part-time employees. Of such employees, 45 were in research and development, 9 were in sales and customer support, and 25 were in finance and administration. We consider our relations with our employees to be strong.

Corporate Information

Our principal executive office is located at: Huiheng Building, Gaoxin 7 Street South, Keyuannan Road, Nanshan District, Shenzhen Guangdong, P.R. China 518057. Our telephone number at that address is 86-755-25331366. Our website address is www.huihengmedical.com. The information on our website is not a part of this Annual Report.

Item 1A. Risk Factors.

Risks Related to our Business

We extend credit to our customers and often do not collect outstanding receivables on a timely basis. Our inability to collect such receivables has had an adverse effect on our immediate and long-term liquidity.

The contracts covering the sale of our equipment provide for the distributor to make a deposit at the time that the order is placed and to make progress payments at various stages of the manufacturing, shipping, installing and testing process, typically with the final 10% payment due 12 months after the customer accepts the product as meeting the specifications. However, in the PRC we have rarely collected payments under those stated terms and our distributors have historically made most of their payments following the installation of our equipment ranging from 12 to 24 months. The payment by our distributors to us for the purchase of our equipment is dependent upon our distributor’s client’s, consisting of hospitals and clinics, ability to pay. Our two largest distributor, who are third party equipment financing companies, had aggregate outstanding accounts receivable balance of $19.75 million and $14.1 million as of December 31, 2010 and 2009, respectively. Of these amounts approximately 58.8% and 58.9% of the accounts receivable as of December 31, 2010 and 2009 were older than 365 days. Accordingly, we have reclassified that portion of accounts receivable that is older than 365 days as a long-term asset. The delay in receipt of customer payments places pressure on our working capital requirements. Although legal action may be available to collect on our accounts receivable, the duration and outcome of litigation is inherently uncertain, particularly in the PRC, where the civil justice system continues to evolve. If we are unable to collect on these accounts, this will adversely affect our liquidity and profitability.

10

Adverse trends in the medical equipment industry, such as an overall decline in sales or a shift away from the therapies that our products support, may reduce our revenues and profitability.

Our business depends on the continued growth of the radiotherapy equipment industry in the PRC. We operate in an industry characterized by technological change, short product life cycles and margin pressures. It is possible that innovations in the treatment of tumors or improvements in radiotherapy equipment developed by others will make our products uncompetitive, reducing our revenues and profits.

We do not have long-term purchase commitments from our customers and we have to rely on obtaining orders from new customers for our products.

Our medical equipment is generally sold one unit at a time through a limited number of hospital equipment financing companies to a particular hospital or clinic, and they generally do not reorder our products. As a result, the continued growth of our business involves making sales to an increasing number of new hospitals and clinics each year. The failure to find and sell to a significant number of new end users each year would limit our revenues and profits.

We also make significant decisions related to production schedules, component procurement commitments, facility requirements, personnel needs and other resource requirements, based upon our estimates of future sales. Because many of our costs and operating expenses are fixed, a reduction in customer demand would reduce our gross margins and operating results. Additionally, from time to time, we may purchase quantities of supplies and materials greater than the amount that is required to fulfill our customer orders in an attempt to secure more favorable pricing, delivery or credit terms. These purchases could expose us to losses from cancellation costs, inventory carrying costs or inventory obsolescence if the expected demand does not materialize, and hence, adversely affect our business and operating results.

The majority of our products sold in the PRC are made to one entity.

The majority of our product sales in the PRC are made to Jiancheng. During the years ended December 31, 2010 and 2009, sales to Jiancheng accounted for 66.84% and 71.27%, respectively, of our total revenues. Any reduction in sales to Jiancheng will negatively impact our results of operations and could harm our business.

The Installation of our Radiotherapy Equipment in Hospitals by our Customers is Subject to Prior Approval by the Chinese Government.

In China, before our radiotherapy equipment may be installed, each hospital or clinic must obtain approval from the Ministry of Health and the local provincial government. The obligation to obtain approval from the Ministry of Health and the local provincial government is the responsibility of our customer, who is usually a third party hospital equipment financing company and distributes our equipment. As part of the application process, however, we will assist in responding to technical questions raised from time to time . Questions raised during the process can include ensuring that equipment has been approved by the SFDA, that the equipment meets the specifications stated and that the equipment has been properly installed. Because there is no standard application and approval procedure, the processing time for obtaining approval from the local provincial government will vary from province to province. Based on the Company’s prior experience, and depending on the priority of and interest of the local provincial government, obtaining the Ministry of Health and local provincial government approval by our customers has taken from 3 to 24 months. As a result, our ability to sell, install and recognize revenue for sales of our radiotherapy equipment through our customers is largely dependent on the customer’s and hospital’s ability to obtain approval by the Ministry of Health and the local provincial government.

We need additional capital, and we may be unable to obtain such capital in a timely manner or on acceptable terms, or at all.

In order to grow, remain competitive, develop new products and expand distribution, we require additional capital. Our ability to obtain additional capital will be subject to a variety of uncertainties, including:

|

|

·

|

our future financial condition, results of operations and cash flows;

|

|

|

·

|

general market conditions for capital raising activities by medical equipment and related companies;

|

|

|

·

|

investor demand for new offerings by issuers with small market capitalizations; and

|

|

|

·

|

economic, political and other conditions in China and elsewhere.

|

11

As a result of such uncertainties, we may be unable to obtain additional capital in a timely manner, or on acceptable terms or at all. Furthermore, the terms and amount of any additional capital raised through issuances of equity securities may result in significant stockholder dilution.

The price and the sales of our products may be adversely affected by reductions in treatment fees by the Chinese government.

Treatment fees for our radiotherapy systems are subject to prices set by provincial governments in China, and these prices can be adjusted downward or upward from time to time. If the treatment fees for our products are reduced by the government, some customers may be discouraged from buying our products, which would reduce our sales. We may need to decrease the price of our products to provide our customers with acceptable financial returns on their purchases. Our business or results of operations may be adversely affected by a reduction in treatment fees for our products in the future.

Failure to optimize our sourcing activities and cost structure could materially increase our expenses, causing a decline in our margins and profitability.

We strive to utilize our parts suppliers and manufacturing services in an efficient manner. The efficiency of our operations depends in part on our success in accurately forecasting demand for our products and planning component parts and outsourced manufacturing services for new products that we intend to produce. Failure to optimize our sourcing activities and cost structure could materially and adversely affect our business and operating results.

Moreover, our cost structure is subject to fluctuations from inflationary pressures. Recently, China has experienced dramatic growth in its economy. Future instances of similar growth may lead to pressure on wages and salaries that may exceed increases in productivity. In addition, these pressures may be exacerbated by exchange rate movements.

Our business is subject to intense competition, which may reduce demand for our products and materially and adversely affect our business, financial condition, results of operations and prospects.

The medical equipment market is highly competitive, and we expect the level of competition to remain at its current level or intensify. We face direct competition in China and will do so in other markets should we expand internationally. This competition is across all product lines and at all price points. Our competitors also vary significantly according to business segment. For domestic sales, our competitors include publicly-traded and privately-held multinational companies, as well as domestic Chinese companies. To date, our international sales have been very limited (zero international sales in 2009 and zero sales in 2010) and while we are planning to engage in additional international sales in Latin American and Eastern Europe in the near future, there is no guarantee that we will meet with success. Our competitors are primarily publicly-traded and privately-held multinational companies. We also face competition in international sales from companies that have local operations in the markets in which we sell our products.

Some of our larger competitors, especially the multinational companies, have, among them:

|

|

·

|

greater financial and other resources;

|

|

|

·

|

a larger variety of products that have received regulatory approvals;

|

|

|

·

|

more extensive research and development and technical capabilities;

|

|

|

·

|

patent portfolios that may present an obstacle to our conduct of business;

|

|

|

·

|

greater knowledge of local market conditions where we seek to increase our international sales;

|

|

|

·

|

stronger brand recognition; and

|

|

|

·

|

larger sales and distribution networks.

|

As a result, we may be unable to offer products similar to, or more desirable than, those offered by our competitors, and/or market our products as effectively as our competitors or otherwise respond successfully to competitive pressures. In addition, our competitors may be able to offer discounts on competing products as part of a “bundle” of non-competing products, systems and services that they sell to our customers, and we may not be able to match those discounts while remaining profitable. Furthermore, our competitors may develop technologies and products that are more effective than ours or that render our products obsolete or uncompetitive. In addition, the timing of the introduction of competing products into the market could affect the market acceptance and market share of our products. Our failure to compete successfully could materially and adversely affect our business, financial condition, results of operation and prospects.

12

Moreover, some of our internationally-based competitors have established or are in the process of establishing production and research and development facilities in China, while others have entered into cooperative business arrangements with Chinese manufacturers. If we are unable to develop competitive products, obtain regulatory approval or clearance and supply sufficient quantities to the market as quickly and effectively as our competitors, market acceptance of our products may be limited, which could result in decreased sales. In addition, we may not be able to maintain our outsourced manufacturing cost advantage.

In addition, we believe that corrupt practices in the medical equipment industry in China still occur, although it is difficult to quantify. To increase sales, certain manufacturers or distributors of medical equipment may pay kickbacks or provide other benefits to hospital personnel who make procurement decisions. Our company policy prohibits these practices. As a result, as competition intensifies in the medical equipment industry in China, we may lose sales, customers or contracts to competitors who engage in these practices, and there may be no remedy we can pursue to prevent this.

We may fail to effectively develop and commercialize new products, which would materially and adversely affect our business, financial condition, results of operations and prospects.

Our success depends on our ability to anticipate technology development trends and to identify, develop and commercialize in a timely and cost-effective manner new and advanced products that our customers demand. Moreover, it may take an extended period of time for our new products to gain market acceptance, if at all. Furthermore, as the life cycle for a product matures, the average selling price generally decreases. Although we have previously offset the effect of declining average sales prices through increased sales volumes and reductions in outsourced manufacturing costs, we may be unable to continue to do so. Lastly, during a product’s life cycle, problems may arise regarding regulatory, intellectual property, product liability or other issues which may affect its continued commercial viability.

Whether we will be successful in developing and commercializing new products will depend on our ability to:

|

|

·

|

obtain regulatory clearances or approvals in a timely and cost efficient manner;

|

|

|

·

|

optimize our procurement processes to control costs;

|

|

|

·

|

manufacture and deliver quality products in a timely manner;

|

|

|

·

|

increase customer awareness and acceptance of our new products;

|

|

|

·

|

compete effectively with other medical equipment companies;

|

|

|

·

|

price our products competitively; and

|

|

|

·

|

effectively integrate customer feedback into our research and development planning.

|

If we fail to obtain or maintain applicable regulatory clearances or approvals for our products, or if such clearances or approvals are delayed, we will be unable to distribute our products in a timely manner, or at all, which could significantly disrupt our business and materially and adversely affect our sales and profitability.

The sale and marketing of our products are subject to regulation in the PRC and in most other countries where we intend to conduct business. For a significant portion of our products, we need to obtain and renew licenses and registrations with the SFDA and its equivalent in other markets. The processes for obtaining regulatory clearances or approvals can be lengthy and expensive, and the results are unpredictable. All of the products that we currently sell, including the OPEN Stereotactic Gamma-ray Radiotherapy System, Stereotactic Gamma-ray Whole Body Therapeutic System (SGS-1), Multi-leaf Collimator, TOP Stereotactic Gamma-ray Radiotherapy System, and Whole Body Sterotactic Gamma System (SGS-1+) have obtained SFDA approval. The Medical Linear Accelerator (LINAC) we currently sell is manufactured by Shinwa. As of February 8, 2010, we filed an application with SFDA seeking approval of a LINAC product manufactured by the Company which was approved in February 2011. We intend to sell our LINAC soon. In addition, relevant regulatory authorities may introduce additional requirements or procedures that could have the effect of delaying or prolonging the approval for our existing or new products. For example, in 2007 the SFDA introduced a new safety standard to its approval process for new medical equipment which we believe has increased the typical time period required to obtain approval by approximately three months. If we are unable to obtain approvals needed to market existing or new products, or obtain such approvals in a timely fashion, our business would be significantly disrupted, and our sales and profitability could be materially and adversely affected.

In particular, as we enter foreign markets, we lack the experience and familiarity with both the regulators and the regulatory systems, which could make the process more difficult, more costly, more time consuming and less likely to succeed.

13

Failure to manage our growth could strain our management, operational and other resources, which could materially and adversely affect our business and prospects.

Our growth strategy includes building our brand, increasing market penetration of our existing products, developing new products, increasing our targeting of hospitals in the PRC, and expanding internationally. Pursuing these strategies has resulted in, and will continue to result in, substantial demands on management resources.

In addition, the management of our growth will require, among other things:

|

|

·

|

enhancement of our research and development capabilities;

|

|

|

·

|

stringent cost controls;

|

|

|

·

|

adequate working capital and financial resources;

|

|

|

·

|

strengthening of financial and management controls and information technology systems;

|

|

|

·

|

increased marketing, sales and sales support activities; and

|

|

|

·

|

hiring and training of new personnel.

|

If we are not able to manage our growth successfully, our business and prospects would be materially and adversely affected.

If we are unable to effectively and efficiently improve and maintain our controls and procedures, there could be a material adverse effect on our operations or financial results.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Sarbanes-Oxley Act of 2002 (“SOX”). These requirements may place a strain on our systems and resources, especially as we grow into other markets and develop our own manufacturing capabilities. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition. SOX requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. We are currently reviewing and further documenting our internal control procedures. We expect to devote significant resources to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting.

Effective internal controls are necessary for us to provide reliable financial reports. If we cannot provide reliable financial reports, our business and operating results could be harmed. For year ended December 31, 2010, we noted that we needed improvement in our enterprise risk management system to address enterprise risk and internal policies over enterprise level controls. Because of these deficiencies in our controls and procedures, we have undertaken the following remedial measures: (1) we have hired an outside consultant to help us improve internal procedures; and (2) we are working with professional advisors to analyze, re-design and remediate key internal controls over financial reporting in order to standardize internal policies and procedures.

Any failure to implement and maintain the improvements in the controls over our financial reporting, or difficulties encountered in the implementation of these improvements in our controls, could cause us to fail to meet our reporting obligations. Any failure to improve our internal controls to address these identified deficiencies could also cause investors to lose confidence in our reported financial information, which could have a negative impact on the trading price of our stock.

Compliance with rules and regulations concerning corporate governance may be costly, which could harm our business.

We will continue to incur significant legal, accounting and other expenses to comply with regulatory requirements. SOX, together with rules implemented by the Securities and Exchange Commission (“SEC”), has required and will require us to make changes in our corporate governance, public disclosure and compliance practices. In addition, we have incurred significant costs and will continue to incur costs in connection with ensuring that we are in compliance with rules promulgated by the SEC regarding internal controls over financial reporting pursuant to Section 404 of SOX. Compliance with these rules and regulations has increased our legal and financial compliance costs, which have had, and may continue to have, an adverse effect on our profitability.

14

We generate a significant portion of our revenues from a small number of products, and a reduction in demand for any of these products could materially and adversely affect our financial condition and results of operations.

We derive a substantial percentage of our revenues from a small number of products. We currently have just five in our portfolio, and we only recently both launched the fifth product, the SGS-I+, and updated our Medical Linear Accelerator, in 2009. As a result, continued market acceptance and popularity of these products are critical to our success. A reduction in demand due to, among other factors, the introduction of competing products, the entry of new competitors, or customer dissatisfaction with the quality of our products, could materially and adversely affect our financial condition and results of operations.

If we experience a significant number of warranty claims, our costs could substantially increase and our reputation and brand could suffer.

We typically sell our products with warranty terms covering 12 months after purchase. Our product warranty requires us to repair all mechanical malfunctions and, if necessary, replace defective components. If we experience an increase in warranty claims or if our repair and replacement costs associated with warranty claims increase significantly, we may have to accrue a greater liability for potential warranty claims. Moreover, an increase in the frequency of warranty claims could substantially increase our costs and harm our reputation and brand. Our business, financial condition, results of operations and prospects may suffer materially if we experience a significant increase in warranty claims on our products.

Products we develop may contain design or manufacturing defects, which could result in reduced demand for our products and services and increased customer claims against us, causing us to sustain additional costs, loss of business reputation and legal liability.

Our products are highly complex and may at times contain design or manufacturing errors or failures. Any defects in the products we develop, whether caused by a design, manufacturing or component failure or error, may result in claims, delayed shipments to customers or reduced or cancelled customer orders. If these defects occur, we will incur additional costs, and if they occur in large quantity or frequently, we may sustain additional costs, loss of business reputation and legal liability.

Any product recall could have a material adverse effect on our business, results of operations and financial condition.

Complex medical equipment, such as our radiotherapy systems, can experience performance problems that require review and possible corrective action by the manufacturer. From time to time, we receive reports from users of our products relating to performance problems they have encountered. We expect that we will continue to receive customer reports regarding performance problems they encounter through the use of our products. Furthermore, component failures, manufacturing errors or design defects could result in an unsafe condition or injury to the patient. Any serious failures or defects could cause us to withdraw or recall products, which could result in significant costs such as repair and product replacement costs. We cannot assure investors that market withdrawals or product recalls will not occur in the future. The occurrence of such events could have a material adverse effect on our business, financial condition and results of operations. We are currently unable to insure against this type of liability in China.

We could become involved in intellectual property disputes, resulting in substantial costs and diversion of our management resources. Such disputes could materially and adversely affect our business by increasing our expenses and limiting the resources devoted to expansion of our business, even if we ultimately prevail.

We currently possess 42 patents issued in the PRC, three patents in the U.S., one patent in the European Union and one patent in Sweden. We also have a number of patents pending. If one of our patents is infringed upon by a third party, we may need to devote significant time and financial resources to attempt to halt the infringement. We may not be successful in defending the patents involved in such a dispute. Similarly, while we do not knowingly infringe on patents, copyrights or other intellectual property rights owned by other parties, we may be required to spend a significant amount of time and financial resources to resolve any infringement claims against us. We may not be successful in defending our position or negotiating an alternative remedy. Any litigation could result in substantial costs and diversion of our management resources and could reduce our revenues and profits and harm our financial condition.

We also rely on trade secrets, proprietary know-how and other non-patentable technology, which we seek to protect through non-disclosure agreements with employees. We cannot assure investors that these non-disclosure agreements will not be breached, that we will have adequate remedies for any breach, or that our trade secrets, proprietary know-how and other non-patentable technology will not otherwise become known to, or be independently developed by, our competitors.

15

Enforcement of PRC intellectual property-related laws has historically been deficient and ineffective, and is hampered by corruption and local protectionism. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries. Policing unauthorized use of proprietary technology is difficult and expensive, and we might need to resort to litigation to enforce or defend patents issued to us or to determine the enforceability, scope and validity of our proprietary rights or those of others. The experience and capabilities of PRC courts in handling intellectual property litigation varies, and outcomes are unpredictable. Further, such litigation may require significant expenditure of cash and management efforts and could harm our business, financial condition and results of operations. An adverse determination in any such litigation will impair our intellectual property rights and may harm our business, prospects and reputation.

We may develop new products that do not gain market acceptance, and the significant costs in designing and manufacturing such product solutions could hurt our profitability and operations.

We operate in an industry characterized by frequent technological advances, the introduction of new products and new design and manufacturing technologies. We expect to introduce two new products over the next several years. As a result, we are expending funds and committing resources to research and development activities, possibly requiring additional engineering and other technical personnel; purchasing new design, production, and test equipment; expanding our manufacturing capabilities and continually enhancing design processes and techniques. Delays in product approval by regulatory authorities could further increase our costs. We may invest in equipment employing new production techniques for existing products and new equipment in support of new technologies that fail to generate adequate returns on the investment due to insufficient productivity, functionality or market acceptance of the products for which the equipment may be used. We could, therefore, incur significant costs in design and manufacturing services for new products that do not result in sufficient revenue to make those investments profitable, or in any revenue at all.

Our limited operating history makes evaluating our business and prospects difficult.

Shenzhen Hyper commenced operations in September 2001, and we installed our first SGS in that year and installed our first MLC in March 2007. Wuhan Kangqiao also commenced operations in September 2001, and we installed our first BGTS in 2003 and our first HGTS in 2004. As a result, we have a limited operating history which may not provide a meaningful basis for investors to evaluate our business, financial performance and prospects. We may not have sufficient experience to address the risks frequently encountered by early-stage companies, and as a result we may not be able to:

|

|

·

|

maintain profitability;

|

|

|

·

|

preserve what we believe (based solely on management’s knowledge of the industry) is our leading position in the GTS market in China;

|

|

|

·

|

acquire and retain customers;

|

|

|

·

|

attract, train, motivate and retain qualified personnel;

|

|

|

·

|

keep up with evolving industry standards and market developments;

|

|

|

·

|

increase the market awareness of our products;

|

|

|

·

|

respond to competitive market conditions;

|

|

|

·

|

maintain adequate control of our expenses;

|

|

|

·

|

manage our relationships with our suppliers and hospital equipment investors; or

|

|

|

·

|

protect our proprietary technologies.

|

If we are unsuccessful in addressing any of these risks, our business may be materially and adversely affected.

Our component and materials suppliers may fail to meet our needs and quality standards, causing us to experience outsourced manufacturing delays, which may harm our relationships with current or prospective customers and reduce sales.

We acquire the components of our equipment from third parties. This exposes us to supply risk and to price increases that we may not be able to pass on to our customers. There may be shortages of some of the materials and components that we use. If we are unable to obtain sufficient amounts of components or materials on a timely and cost effective basis, we may experience outsourced manufacturing delays, which could harm our relationships with current or prospective customers and reduce sales.

16

We are subject to product liability exposure and have no product liability insurance coverage.

As our main products are medical equipment used for the treatment of patients, we are exposed to potential product liability claims in the event that the use of our products causes or is alleged to have caused personal injuries or other adverse effects. A successful product liability claim against us could require us to pay substantial damages. Product liability claims, whether or not successful, are often costly and time-consuming to defend. Also, in the event that our products prove to be defective, we may be required to recall or redesign such products. As the insurance industry in China is still in an early stage of development, we do not have any product liability insurance. A product liability claim, with or without merit, could result in significant adverse publicity against us, and could have a material adverse effect on the marketability of our products and our reputation, which in turn, could have a material adverse effect on our business, financial condition and results of operations. In addition, we do not have any business interruption insurance coverage for our operations. Any business disruption or natural disaster could result in substantial costs and diversion of resources.

New product development in the medical equipment and supply industry is both costly and labor-intensive and has a very low rate of successful commercialization.

Our success will depend in part on our ability to enhance our existing products and technologies and to develop and acquire new products or technologies. The development process for medical technology is complex and uncertain, as well as time-consuming and costly. Product development requires the accurate assessment of technological and market trends as well as precise technological execution. We cannot assure investors that:

|

|

·

|

our product or technology development will be successfully completed;

|

|

|

·

|

necessary regulatory clearances or approvals will be granted by the SFDA or other regulatory bodies as required on a timely basis, or at all; or

|

|

|

·

|

any product or technology we develop can be commercialized or will achieve market acceptance.

|

Also, we may be unable to develop suitable products or technologies or to acquire such products or technologies on commercially reasonable terms. Failure to develop or acquire, obtain necessary regulatory clearances or approvals for, or successfully commercialize or market potential new products or technologies could have a material adverse effect on our financial condition and results of operations.

Potential strategic alliances may not achieve their objectives, which could lead to wasted effort or involvement in ventures that are not profitable and could harm our company’s reputation.

We are currently exploring strategic alliances intended to enhance or complement our technology, to provide additional know-how, components or supplies, and to introduce and distribute products and services utilizing our technology and know-how. Any strategic alliances entered into may not achieve their strategic objectives, and parties to our strategic alliances may not perform as contemplated. As a result, the alliances themselves may run at a loss, which would reduce our profitability, and if the products or customer service provided by such alliances were of inferior quality, our reputation in the marketplace could be harmed, affecting our existing and future customer relationships.

We may not be able to retain, recruit and train adequate management and production personnel. We rely heavily on those personnel to help develop and execute our business plans and strategies, and if we lose such personnel, it would reduce our ability to operate effectively.

Our success is dependent, to a large extent, on our ability to retain the services of our executive management, who have contributed to our growth and expansion to date. Our Chairman, Mr. Hui Xiaobing, has been, and will continue to be, instrumental to our success. In addition, the executive directors play an important role in our operations and the development of our new products. Accordingly, the loss of their services, without suitable replacements, will have an adverse effect on our business generally, operating results and future prospects.

In addition, our continued operations are dependent upon our ability to identify and recruit adequate management and production personnel in China. We require trained graduates of varying levels and experience and a flexible work force of semi-skilled operators. Many of our current employees come from the more remote regions of China as they are attracted by the wage differential and prospects afforded by Shenzhen, Beijing and our operations. With the economic growth currently being experienced in China, competition for qualified personnel will be substantial, and there can be no guarantee that a favorable employment climate will continue and that wage rates we must offer to attract qualified personnel will enable us to remain competitive. The inability to attract such personnel or the increased cost of doing so could reduce our competitive advantage relative to our competitors, reducing or eliminating our growth in revenues and profits.

17

Risks Related to our Activities in China

The Chinese legal system may have inherent uncertainties that could materially and adversely impact our ability to enforce the agreements governing our operations.

We are subject to oversight at the provincial and local levels of government in China. Our operations and prospects would be materially and adversely affected by the failure of the local government to honor our agreements or an adverse change in the laws governing them. In the event of a dispute, enforcement of these agreements could be difficult in China. China tends to issue legislation, which is followed by implementing regulations, interpretations and guidelines that can render immediate compliance difficult. Similarly, on occasion, conflicts arise between national legislation and implementation by the provinces that take time to reconcile. These factors can present difficulties in our ability to achieve compliance. Unlike the United States, China has a civil law system based on written statutes in which judicial decisions have limited precedential value. The Chinese government has enacted laws and regulations to deal with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, our experience in interpreting and enforcing our rights under these laws and regulations is limited, and our future ability to enforce commercial claims or to resolve commercial disputes in China is therefore unpredictable. These matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces and factors unrelated to the legal merits of a particular matter or dispute may influence their determination.

It will be extremely difficult to acquire jurisdiction and enforce liabilities against our officers, directors and assets based in China.

Substantially all of our assets are located outside of the United States and most of our officers and directors reside outside of the United States. As a result, it may not be possible for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under Federal securities laws of the United States. Moreover, we have been advised that the PRC does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement of criminal penalties of the Federal securities laws of the United States.

Our management may fail to meet the obligations under Chinese law that enable the distribution of profits earned in the PRC to entities outside of the PRC.