Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - China Crescent Enterprises, Inc. | a6685955ex31_1.htm |

| EX-32 - EXHIBIT 32 - China Crescent Enterprises, Inc. | a6685955ex_32.htm |

| EX-31.2 - EXHIBIT 31.2 - China Crescent Enterprises, Inc. | a6685955ex31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 0-14306

CHINA CRESCENT ENTERPRISES, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

84-0928627

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

14860 Montfort Drive, Suite 210, Dallas, TX 75254

(Address of principal executive offices)

(214) 722-3040

(Registrant’s telephone number, including area code)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes o No þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes o No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer o

|

Accelerated Filer o

|

||

|

Non-Accelerated Filer o

|

Smaller Reporting Company þ

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

Aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant (assuming officers, directors and 10% stockholders are affiliates), based on the closing price of the Registrant’s common stock on June 30, 2010: $4,951,000

China Crescent Enterprises, Inc.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

|

3

|

|

|

6

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

14

|

|

|

14

|

|

|

15

|

|

|

18

|

|

|

19

|

|

|

19

|

|

|

19

|

|

|

20

|

|

|

20

|

|

|

21

|

|

|

22

|

|

|

23

|

|

|

23

|

|

|

24

|

|

|

25

|

|

|

F-1

|

ITEM 1. DESCRIPTION OF BUSINESS

History of the Business

Intercell International Corporation (“Intercell”) was incorporated under the laws of Nevada in May 2000. Until October 2003, Intercell had no operations. In October 2003, Intercell acquired 60% membership interest in Brunetti DEC, LLC, a Colorado limited liability company (“Brunetti”) for a cash contribution. In January 2004, Intercell acquired the remaining 40% of Brunetti for an additional cash contribution. In October 2004, the operations of Brunetti were discontinued and in March 2005, Brunetti filed a voluntary petition for relief in the United States Bankruptcy Court, District of Colorado under Chapter 7 of Title 7 of the U.S. Bankruptcy Code.

On March 16, 2005, Intercell filed a voluntary petition for relief in the United States Bankruptcy Court, District of Colorado under Chapter 11 of Title 11 of the U.S. Bankruptcy Code. On April 5, 2006, the United States Bankruptcy Court, District of Colorado dismissed the Chapter 11 proceedings.

In October 2006, Intercell executed an Agreement and Plan of Reorganization (the “Agreement”) with NewMarket China, Inc. (“NewMarket China”) a wholly-owned subsidiary of NewMarket Technology, Inc. (“NewMarket Technology”). The Agreement provided for Intercell to acquire from NewMarket Technology its subsidiary, NewMarket China, through the exchange of all of the issued and outstanding stock of NewMarket China, for two million (2,000,000) common shares of Intercell. As a result of the Agreement, NewMarket China became the wholly-owned subsidiary of Intercell.

In a separate agreement, NewMarket Technology agreed to purchase 250,000 shares of Series A Preferred Stock from Intercell for a $250,000 cash payment. The shares have a par value of $0.001 per share and a purchase price of $1.00 per share and bear no dividend. The shares are convertible into 60% of the issued and outstanding common stock of Intercell, any time after August 31, 2007. The shares have a voting right equal to 60% of the issued and outstanding common stock of Intercell.

As part of the reorganization and acquisition of Intercell, on January 31, 2007, we changed the name of the company to NewMarket China, Inc. (the “Company”) and changed its trading symbol to “NMCH”. Additionally, we changed the Company’s fiscal year end from September 30th to December 31st. In June 2008, we changed the Company’s name to China Crescent Enterprises, Inc. , subsequently changing its trading symbol to “CCTR”.

As a result of the acquisition of NewMarket China and the change in control of Intercell, several changes were made to our management. In October 2006, John Verges was appointed as Chief Executive Officer (“CEO”) and Philip J. Rauch was appointed as Chief Financial Officer (“CFO”). Additionally, the existing directors of the Company resigned and Mr. Rauch was appointed to the Board of Directors along with Philip Verges and Bruce Noller, the CEO and Director of Operations of NewMarket Technology, respectively.

Mr. Noller resigned from the Board on March 3, 2008 and was replaced by Mr. Paul Danner. Mr. John Verges resigned as Chief Executive Officer of the Company on June 2, 2008 and Mr. Danner was appointed as Chief Executive Officer of the Company effective July 1, 2008.

In April 2009, we issued 750 shares of Series B Convertible Preferred Stock, $.001 par value, to The Huali Group in connection with the acquisition by our Clipper Technology, Ltd. subsidiary, of an additional 25% interest in Clipper-Huali, Ltd., bringing our total ownership in Clipper-Huali, Ltd. to 76%.

In November 2009, we entered into an Equity Reorganization Agreement with NewMarket Technology under which NewMarket Technology exchanged its 250,000 shares of Series A Preferred Stock for the issuance of 10,000 shares of Series C Convertible Preferred Stock and 5,000 shares of Series D Preferred Stock.

In December 2009, we acquired 100% of Shenzhen Nubao Technology Co., Ltd. (“Nubao”), an original design manufacturer (“ODM”) of wireless products, from China Radio Technology Co., Ltd. in exchange for a $300,000 note. Additionally, in December 2009 we acquired 100% of Dalian Aoyuan Electronic Technology Services Co., Ltd. (“DAETS”), a systems integration company, from Aoyuan Electronic Company, Ltd., in exchange for a $200,000 note.

3

Mr. Danner resigned as CEO and a Director of the Company on January 31, 2010, and Dr. James Jiang was appointed CEO of the Company effective February 1, 2010.

In March 2010, we executed a non-binding letter of intent (the “Fonix LOI”) under which CLPTEC, our wholly-owned subsidiary based in Shanghai, China, would acquire 100% of Shanghai Gaozhi Software Systems, Ltd. (“Gaozhi”), a telecommunications software developer, from Fonix Corporation (“Fonix”) in exchange for the issuance of a newly authorized series of preferred stock, the terms and conditions of which were subject to negotiation. The transaction was subject to the parties successfully entering into a definitive agreement which we originally projected would occur in the third quarter of 2010.

Simultaneous with the execution of the Fonix LOI, we planned to enter into a one-year management agreement with Fonix under which CLPTEC would assist in the management of Gaozhi until the execution of a definitive agreement between the parties for the acquisition of Gaozhi by CLPTEC. In August 2010 it became apparent the parties would be unable to negotiate a mutually satisfactory definitive agreement regarding the intended transaction, therefore all aforementioned relationships between CLPTEC and Fonix were subsequently terminated.

Business of China Crescent Enterprises, Inc.

Our headquarters is located in Dallas, Texas but our primary operations are currently in The People’s Republic of China (“China” or “PRC”). To date, the majority of our revenue has been derived from the resale of information technology products, as well as providing certain technology-related services within mainland China. Through a recent acquisition the Company has expanded into the original design manufacturing (ODM) market. An ODM designs and manufactures products which are specified and eventually branded by another firm for sale. Such ODM companies allow the brand firm to produce (either as a supplement or solely) without having to engage in the organization or running of a factory. ODM's typically handle production for multiple clients, often providing a large portion of overall production. A primary attribute of this business model is that the ODM owns and/or designs in-house the products that are branded by the buying firm which is in contrast to a contract manufacturer (CM). This business model is often employed in international trade, where a local ODM is used to produce goods for a foreign company which benefits from some advantage in the transaction, such as low labor inputs, transport links or proximity to markets. ODM manufacturing may also be utilized when local ownership laws prohibit direct ownership of assets by foreigners, allowing a local firm to produce for a brand company for either the domestic market or export.

Beyond the recent inclusion of our ODM business, the Company also continues to explore the possibility of establishing worldwide business relationships with customers that may involve:

|

-

|

Outsourcing of software development in China

|

|

|

-

|

Expansion within the Chinese marketplace

|

|

|

-

|

Localization of products and/or services

|

|

|

-

|

Identification of complimentary products in China

|

|

|

-

|

Export of products manufactured in China

|

We provide these products and services through our subsidiaries and partnerships, as discussed below.

Clipper Technology, Ltd. (“CLPTEC”). CLPTEC, a Wholly Owned Foreign Entity (W.O.F.E.) registered in Shanghai, China, is our main operating subsidiary. Chinese companies must be registered in the specific market they intend to operate in. CLPTEC’s corporate charter in China allows the Company to provide consulting, development, implementation, and maintenance of technology systems which include both software and hardware peripherals for computing, communication, and data exchanges related to general business applications as well as the specialty fields of medical, security, military and homeland defense applications. CLPTEC may also engage in the prototype development of security systems as well as original equipment manufacturing (“OEM”) sourcing for production of hardware related to the above business activities.

4

Clipper Huali Co., Ltd. (“Clipper Huali”). Clipper Huali was originally formed as a collaborative business venture between CLPTEC and a consortium of Chinese technology firms called The Huali Group, Ltd. (“Huali”). Such ventures in China are required to be registered companies. In 2006, CLPTEC and Huali formalized our business relationship with the formation of Clipper Huali. Clipper Huali is registered in the City of Ningbo, China, located just south of Shanghai on the opposite side of the Hangzhou Bay. By virtue of its registration as an independent firm, Clipper Huali is a now a majority-owned subsidiary of CLPTEC and was initially owned 51% by CLPTEC and 49% by Huali. Clipper Huali is a value-added reseller of IT products including notebook and desktop computers, printers, servers and networking equipment from a number of global brand partners including Dell, HP, IBM, Cisco, Sony, Epson, Canon and Sanyo. The company is also an authorized reseller of operating systems, database, middleware and application software from Microsoft, Red Hat, Oracle, Sybase, IBM, BEA, Veritas and others. In March 2009, CLPTEC acquired an additional 25% interest in Clipper Huali from Huali in exchange for the issuance of 750 shares of Series B Convertible Preferred Stock of the Company, bringing CLPTEC’s total ownership in Clipper Huali to 76% and reducing Huali’s ownership interest to 24%.

Gaozhi Science and Technology Development, Ltd. (“Gaozhi”). In 2006, CLPTEC formed a strategic partnership with Gaozhi to develop and distribute high technology products and services. Our primary office in mainland China is located in the same building as Gaozhi. Gaozhi is a well established technology company in Shanghai, China. Gaozhi operates in many high technology markets including the manufacture of mobile communication vehicles, low-energy intelligent lighting products, satellite data communications, telecommunications software, and IP television. We have partnered with Gaozhi to develop foreign sales for several of Gaozhi’s products and services.

Dalian Aoyuan Electronic Technology Services Co., Ltd. (“DAETS”). DAETS is a wholly-owned subsidiary that was acquired by CLPTEC in December 2009 from Aoyuan Electronic Company, Ltd., located in Dalian, China. Established in March 1995, Aoyuan is one of the top 500 computer hardware suppliers in China and is listed as one of the “Top 100 Northeast Regional Computer Suppliers” by First Chinese Computer Vendors. In 2004, Aoyuan was awarded “Best IT Distributor of Northeast China” and received ISO9001 certification by SGS in the United Kingdom. Aoyuan’s staff operate several business segments, including computer software and hardware sales, system integration, IT consulting services, IT product promotion and IT retail sales.

Shenzhen Nubao Technology Co. Ltd. (“Nubao”). Nubao is a wholly-owned subsidiary acquired by CLPTEC in December 2009 from China Radio Technology Co., Ltd., an original design manufacturer located in Shenzhen, China. Nubao designs and manufactures a wide range of custom wireless products specified by customers worldwide, with the company’s primary product focus on wireless communication terminals (GSM, GSM/GPRS modules, GPS modules, GPS trackers, and personal navigation devices). The core research and development staff of Nubao averages more than five years of professional experience, and provides customers with industrial design (ID), mechanical design (MD), hardware design (HW), software design (SW), manufacturing, test and evaluation (T&E), and quality assurance (QA) services covering the full range of wireless communication solutions for intelligent terminals.

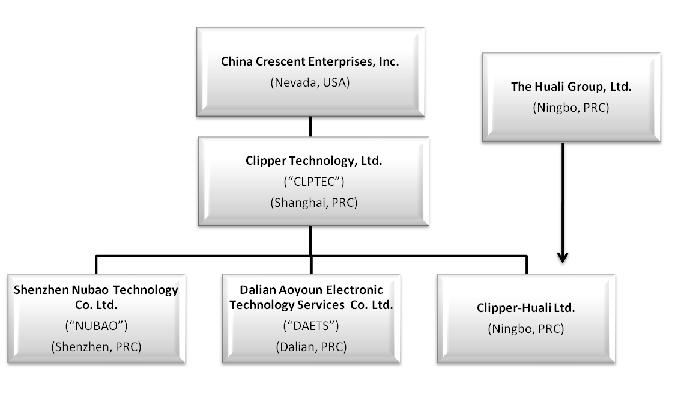

The following chart reflects our current organizational structure as of the date of this report:

5

Employees

As of December 31, 2010, we had approximately 315 employees, of which 223 employees work for Clipper-Huali, 45 employees work for Nubao, 42 employees work for DAETS and three employees work for CLPTEC. Our employees are not represented by a labor union or subject to any collective bargaining agreement that may stem from such unions. Our Chinese subsidiaries are subject to Chinese labor laws that give labor a comparatively minor level of group power. We believe our relations with our employees are satisfactory and do not present any undue organizational risk.

ITEM 1A. RISK FACTORS

This Annual Report contains forward-looking statements that involve risks and uncertainties that could cause our actual results to differ materially from those discussed in this Annual Report. These risks and uncertainties include the following:

Risks Related to Our Company

While we have been profitable over the last four years, we cannot be certain that we will not incur monthly and/or quarterly operating losses from time to time in the future.

We cannot be certain that we can sustain or increase profitability on a quarterly or annual basis in the future. If we are unable to remain profitable, our liquidity could be materially harmed.

Given our operating history, it will be difficult to predict our future results. You should consider the uncertainties that we may encounter as a technology company in a rapidly evolving market. These uncertainties include:

|

-

|

Market acceptance of our products or services

|

|

|

-

|

Consumer demand for, and acceptance of, our products, services and follow-on products

|

|

|

-

|

Our ability to create user-friendly applications

|

|

|

-

|

Our unproven and evolving business model

|

We will need to achieve greater revenues, better margins, and/or reduce operating expenses in order to maintain profitability. There can be no assurance that we will be successful in increasing revenues, generating acceptable margins and reducing operating expenses. We may have to seek additional outside sources of capital for our business. There can be no assurance that we will be able to obtain such capital on favorable terms and conditions or at all. If this occurs the market price of our common stock could suffer.

6

Our quarterly and annual sales and financial results have varied significantly in the past, and we expect to experience fluctuations in the future, which means that period-to-period comparisons are not necessarily meaningful or indicative of future performance. These fluctuations may be attributed to several factors, including the introduction of new products by competitors, pricing pressures, the timing of the completion and/or the cancellation of projects, the evolving and unpredictable nature of the markets in which our products and services are sold and economic conditions in general or in certain geographic areas in which our customers do business. Furthermore, we may be unable to control spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, we cannot give any assurances that sales and net income, if any, in any particular quarter will not be lower than sales and net income, if any, in a preceding or comparable quarter or quarters. In addition, sales and net income, if any, in any particular quarter are not likely to be indicative of the results of operations for any other quarter or for the full year. The trading prices of our securities may fluctuate significantly in response to variations in our quarterly or annual results of operations.

We may not be able to sustain or accelerate growth, or sustain or accelerate recurring revenue from our business.

Rapid technological change could render our products and services obsolete.

The IT services industry is characterized by rapid technological innovation, sudden changes in user and customer requirements and preferences, frequent new product and service introductions and the emergence of new industry standards and practices. Each of these characteristics could render our services, products, intellectual property and systems obsolete. The rapid evolution of our market requires that we continually improve the performance, features and reliability of our products and services, particularly in response to competitive offerings. Our success also will depend, in part, on our ability:

|

-

|

To develop or license new products, services and technologies that address the varied needs of our customers and prospective customers

|

|

|

-

|

To respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis

|

If we are unable, for technical, financial, legal or other reasons, to adapt in a timely manner to changing market conditions or user preferences, we could lose customers, which would cause a decrease in our revenue.

From time to time, we evaluate the various components of our portfolio of businesses and may, as a result, decide to acquire or divest businesses or enter into joint ventures or strategic alliances. These acquisitions, divestitures, joint ventures and alliances affect our costs, revenues, profitability and financial position. We may also consider the acquisition of specific assets or businesses that fall outside our traditional lines of business if we deem such properties sufficiently attractive. If we fail to manage the risks associated with acquisitions, divestitures, joint ventures or other alliances, our business, financial condition, and results of operations could be materially and adversely affected.

Divestitures have inherent risks, including possible delays in closing transactions (including potential difficulties in obtaining regulatory approvals), the risk of lower-than-expected sales proceeds for the divested business, unexpected costs associated with the separation of the business to be sold, and potential post-closing claims for indemnification. In addition, adverse economic or market conditions may result in fewer potential bidders and unsuccessful sales efforts. Expected cost savings, which are offset by revenue losses from divested businesses, may also be difficult to achieve or maximize due to our fixed cost structure.

Acquisitions also involve risks, including difficulties in integrating acquired operations, diversions of management resources, debt incurred in financing these acquisitions (including the related possible reduction in our credit ratings and increase in our cost of borrowing), differing levels of management and internal control effectiveness at the acquired entities and other unanticipated problems and liabilities. Competition for certain types of acquisitions is significant. Even if successfully negotiated, closed and integrated, certain acquisitions or investments may prove not to advance our business strategy and may fall short of expected return on investment targets.

We may be unable to obtain additional capital if needed to grow our business, which would adversely impact our business. If we raise additional financing, shareholders may suffer significant dilution.

7

We anticipate that our current cash and cash flow from operations will be sufficient to satisfy our working capital and ordinary course capital expenditure needs over the next 12 months. However, if our revenues do not continue to cover our expenses, we will need to seek additional investment from our parent company or a third party to finance our growth plans as we have done in the past. We cannot be certain that financing from our parent company or third parties will be available on acceptable terms to us or at all. Our future capital requirements will depend upon several factors, including the rate of market acceptance of our products and services, our ability to expand our customer base and our level of expenditures for sales and marketing. If our capital requirements vary materially from those currently planned, we may require additional financing sooner than anticipated. If we cannot raise funds on acceptable terms, we may not be able to develop our products and services, take advantage of future opportunities or respond to competitive pressures or unanticipated requirements, any of which could have a material adverse effect on our ability to grow our business. Furthermore, if we issue equity securities, shareholders will experience dilution of their ownership percentage, and the new equity securities may have rights, preferences or privileges senior to those of our common stock.

Certain direct market competitors have significantly greater financial, technical, marketing and other resources than we do and may be able to respond more quickly to new or emerging technologies and changes in customer requirements. Additional competition could result in price reductions, reduced margins and loss of market. We cannot guarantee that we will be able to compete successfully against future competitors or that future competitive pressures will not materially and adversely affect our business, financial condition and results of operations.

Our success depends in large part on the continued service of our management and other key personnel and our ability to continue to attract, motivate and retain highly qualified employees. If one or more of our key employees leaves the Company, we will have to find a replacement with the combination of skills and attributes necessary to execute our strategy. Because competition from other technology companies for skilled employees is intense, and the process of finding qualified individuals can be lengthy and expensive, we believe that the loss of key personnel could negatively affect our business, financial condition and results of operations.

The ongoing worldwide credit crisis and turmoil in the global financial system may have an adverse impact on our business and our financial condition, and we may face challenges if conditions in the financial markets do not improve. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise capital, which could have an impact on our flexibility to react to changing economic and business conditions. In addition, current economic conditions also impact levels of government and consumer spending, which have recently deteriorated significantly and may remain depressed for the foreseeable future. It is uncertain how long the global crisis in the financial services and credit markets will continue and how much of an impact it will have on the global economy in general or the Chinese economy in particular.

A prolonged economic downturn could reduce our customer base and demand for our products. Our success significantly depends upon the growth of demand of our products from a growing customer base. If demand for our products and services do not grow, or if prevailing economic conditions locally, nationally or internationally are unfavorable, our business may not succeed. A prolonged economic downturn would likely contribute to the deterioration of the demand for our products and services, which in turn would hurt our business. A prolonged economic downturn could, therefore, result in reduced revenue, reduced gross margin or losses that could materially and adversely affect our business.

In August 2006, six Chinese regulatory agencies promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective in September 2006 (the “M&A Rule”). According to the M&A Rule, a “Round-trip Investment” is defined as having taken place when a Chinese business that is owned by Chinese individual(s) is sold to a non-Chinese entity that is established or controlled, directly or indirectly, by those same Chinese individual(s). Under the M&A Rules, any Round-trip Investment must be approved by China’s Ministry of Commerce (“MOFCOM”), and any indirect arrangement or series of arrangements which achieves the same end result without the approval of MOFCOM is a violation of Chinese law. The M&A Rule establishes additional procedures and requirements that could make some acquisitions of Chinese companies by foreign investors more time-consuming and complex, including requirements in some instances that the MOFCOM be notified in advance of any change-of-control transaction and/or require approval of the MOFCOM when a foreign investor takes control of a Chinese domestic enterprise. In the future, we may grow our business in part by acquiring complementary businesses. The M&A Rule also requires MOFCOM anti-trust review of any change-of-control transactions involving certain types of foreign acquirers. Complying with the requirements of the M&A Rule to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the MOFCOM, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

8

Risks Related to Doing Business in China

Recently, U.S. public companies that have substantially all of their operations in China, particularly companies like ours that have completed so-called reverse merger transactions, have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the United States Securities and Exchange Commission (“SEC”). Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of such scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed China-based companies has sharply decreased in value and, in some cases, has become virtually worthless. Furthermore, many of these companies are conducting internal and external investigations into such allegations and in the interim are subject to trading halts, SEC investigative and enforcement actions and shareholder lawsuits. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on our company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our company. Such a development would be costly and time consuming and would distract our management from growing our company. If such allegations are not proven to be groundless, our company and business operations will be severely harmed and your investment in our stock could be rendered worthless.

Changes in Chinese laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under its current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If we undertake new business ventures that are unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties associated with these ventures may seek ways to terminate the transactions, or may hinder or prevent us from accessing important information regarding the financial and business operations of these acquired companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination, all of which we have no control over. Any rights we may have to specific performance, or to seek an injunction under Chinese law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

Substantially all of our revenues have been generated by operating companies that report to our Chinese subsidiary, CLPTEC. However, Chinese regulations restrict the ability of CLPTEC to make dividends and other payments to its parent company. Chinese legal restrictions permit payments of dividends by CLPTEC only out of its accumulated after-tax profits, if any, determined in accordance with Chinese accounting standards and regulations. Any limitations on the ability of CLPTEC to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we cannot assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

9

China has only recently permitted provincial and local economic autonomy and private economic activities, and, as a result, we are dependent on our relationship with the local government in the province in which we operate our business. Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

Changes in China's political or economic situation could harm us and our operating results. Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

|

●

|

Level of government involvement in the economy

|

|

|

●

|

Control of foreign exchange

|

|

|

●

|

Methods of allocating resources

|

|

|

●

|

Balance of payments position

|

|

|

●

|

International trade restrictions

|

|

|

●

|

International conflict

|

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy, and weak corporate governance and lack of a flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of OECD member countries.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2%. These factors have led the Chinese government to adopt various corrective measures which they implement at will, designed to restrict the availability of credit or regulate growth and contain inflation. While inflation has been more moderate since 1995, high inflation in the future may cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

China historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, computer and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in China. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

Uncertainties with respect to the Chinese legal system could limit the legal protections available to you and us. We conduct substantially all of our business through our subsidiaries in China. Our subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The Chinese legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the Chinese legal system continues to evolve rapidly, the interpretations of many laws, regulations, and rules are not always uniform, and enforcement of these laws, regulations, and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. As a result, it may be difficult for investors to effect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

10

Risks Related to Currency Exchange Between the Chinese Renminbi and United States Dollars

Our reporting currency is the U.S. dollar while our operations in China use their local currency as their functional currencies. Substantially all of our revenue and expenses are in Chinese Renminbi (“RMB”). We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the RMB depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of RMB to the U.S. dollar had generally been stable and the RMB had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of Chinese RMB to the U.S. dollar. Under the new policy, Chinese RMB may fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy resulted in substantial appreciation of the RMB against the U.S. dollar between July 21, 2005 and December 31, 2010.

It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of RMB against the U.S. dollar. We can offer no assurance that RMB will be stable against the U.S. dollar or any other foreign currency.

The income statements appearing elsewhere herein are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions will result in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions will result in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of CLPTEC and our subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we may have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. The availability and effectiveness of any hedging transaction may be limited and we may not be able to successfully hedge our exchange rate risks.

Although Chinese governmental policies were introduced in 1996 to allow the convertibility of RMB into foreign currency for current account items, conversion of RMB into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange, or SAFE, which is under the authority of the People’s Bank of China. However, these approvals do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or that Chinese regulatory authority will not impose greater restrictions on the convertibility of RMB in the future. Because a significant amount of our future revenue may be in the form of RMB, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in RMB to fund potential business activities outside of China, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial condition and results of operations.

Risks Related to Our Industry

In addition to the current global financial crises, deterioration of the IT services industry could lead to further reductions in capital spending budgets by our customers, which could further adversely affect our revenues, gross margins and income.

Our revenues and gross margins will depend significantly on the overall demand for IT products and services. Reduced capital spending budgets by our customers caused by the ongoing industry downturn have led to continued soft demand for our products and services, which has resulted in, and may continue to result in, decreased revenues, earnings levels or growth rates. The global economy in general, and the technology market in particular, has weakened and market conditions continue to be challenging. As a result, individuals and companies are delaying or reducing expenditures. We have observed effects of the global economic downturn in many areas of our business. In addition, the technology industry has experienced significant consolidation, and this trend is expected to continue. It is possible that we and one or more of our competitors each supply products to the companies that have merged or will merge. This consolidation could result in further delays in purchasing decisions by merged companies or in us playing a decreased role in the supply of products to the merged companies. Further delays or reductions in spending could have a material adverse effect on demand for our products and services and, consequently, our results of operations, prospects and stock price.

11

Risks Related to Our Capital Stock

The public market for our common stock may be volatile and you could lose all or part of your investment.

In the recent past, stocks, specifically those traded on the over-the counter (“OTC”) markets, generally have experienced high levels of volatility. Our common stock is traded on the OTC market under the symbol “CCTR” and is not eligible for trading on any national or regional securities exchange or the Nasdaq National Market. A more active trading market for our common stock may never develop, or if such a market develops, it may not be sustained.

The market price of our common stock has been and is likely to continue to be significantly affected by various factors, including those described in this “Risk Factors” section, many of which are beyond our control and may not be related to our operating performance. These fluctuations could cause you to lose all or part of your investment in our common stock as you may be unable to sell your shares at or above the price you paid. Factors that could cause fluctuations in the trading price or our stock include but are not limited to:

|

-

|

Price and volume fluctuations in the overall stock market from time to time

|

|

|

-

|

Significant volatility in the market prices and trading volume of technology stocks

|

|

|

-

|

Actual or anticipated fluctuations in our quarterly or annual operating results

|

|

|

-

|

Actual or anticipated changes in the expectations of investors or the recommendations of any securities analysts who follow our stock

|

|

|

-

|

The public’s reaction to our press releases, other public announcements and filings

|

|

|

-

|

Litigation involving the Company, our industry or both or investigations by regulators into our operations or those of our competitors

|

|

|

-

|

New laws or regulations or new interpretations of existing laws or regulations applicable to our business or operations

|

|

|

-

|

Changes in accounting standards policies, guidelines, interpretations or principles

|

|

|

-

|

Discontinued operations, layoffs or corporate actions

|

|

|

-

|

General economic conditions or industry conditions or trends

|

|

|

-

|

Limited market making activity and research coverage

|

In the past, many companies that have experienced volatility in the market price of their stock have become subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in substantial costs and divert our management’s attention from other business concerns, which could seriously harm our business.

The SEC has adopted regulations which generally define a “penny stock” to be an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. The market price of our common stock is less than $5.00 per share and therefore is a “penny stock” and is subject to the “penny stock” rules of the SEC. The trading market in our securities is limited which makes transactions in our stock cumbersome and may reduce the value of an investment in our common stock. Brokers and dealers effecting transactions in “penny stock” must disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect your ability to sell shares.

12

Our stock is controlled by a single majority shareholder for the foreseeable future who as a result, will be able to control our overall direction. This majority shareholder could conceivably control the outcome of matters requiring stockholder approval and could be able to elect all of our directors. Such control, which may have the effect of delaying, deferring or preventing a change of control, significantly diminishes control and influence which existing and future stockholders may have in our Company.

Shareholder interest in our Company may be substantially diluted as a result of the sale of additional securities to fund our plan of operation.

Our preferred stock has certain preferences over our common stock with regard to liquidation, dividends and election of directors.

Our issued and outstanding preferred stock holds a preference in liquidation over our common stock. Certain classes of our outstanding preferred stock are subject to conversion into common stock upon the occurrence of certain enumerated events and contain provisions that may limit our ability to raise additional capital if needed. In addition, any such conversion will dilute our existing and future common stockholders.

Our ability to issue additional preferred stock or other convertible securities may adversely affect the rights of our common stockholders and may make takeovers more difficult, possibly preventing you from obtaining optimal share price.

Our Articles of Incorporation authorize the issuance of shares of "blank check" preferred stock, which would have the designations, rights and preferences as may be determined from time to time by the board of directors. Accordingly, the board of directors is empowered, without shareholder approval (but subject to applicable government regulatory restrictions), to issue additional preferred stock with dividend, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of the common stock. In the event of an issuance, the preferred stock could be used, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company. We have also historically used securities that are convertible into common stock as a currency to finance acquisitions and may continue to do so in the future.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. DESCRIPTION OF PROPERTY

Principal Executive Offices

Our principal executive offices are located at 14860 Montfort Drive, Suite 210, Dallas, Texas 75254. We moved to these offices during the fall of 2006. NewMarket Technology, Inc., our majority stockholder, leases the space.

CLPTEC’s offices are located at No. 123 Qinjiang Road, Shanghai, 200233, People’s Republic of China. The offices are leased from Gaozhi, a strategic partner, on a month-to-month basis. The annual rent expense for the year ended December 31, 2010 was approximately $7,000.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. (REMOVED AND RESERVED)

13

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

Market Information

Our common stock is presently traded on the over-the-counter market maintained by the OTC Markets Group, Inc. under the symbol “CCTR.” The following table summarizes the high and low prices for our common stock of each of the calendar quarters of 2010 and 2009:

|

2010

|

2009

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

First Quarter

|

0.023 | 0.011 | 0.375 | 0.115 | ||||||||||||

|

Second Quarter

|

0.03 | 0.0071 | 0.225 | 0.029 | ||||||||||||

|

Third Quarter

|

0.0085 | 0.0054 | 0.075 | 0.020 | ||||||||||||

|

Fourth Quarter

|

0.0069 | 0.0015 | 0.060 | 0.020 | ||||||||||||

Our common stock is subject to rules adopted by the SEC regulating broker dealer practices in connection with transactions in "penny stocks." Those disclosure rules applicable to "penny stocks" require a broker dealer, prior to a transaction in a "penny stock" not otherwise exempt from the rules, to deliver a standardized disclosure document prepared by the SEC. That disclosure document advises an investor that investment in "penny stocks" can be very risky and that the investor's salesperson or broker is not an impartial advisor, but rather paid to sell the shares. The disclosure contains further warnings for the investor to exercise caution in connection with an investment in "penny stocks," to independently investigate the security, as well as the salesperson the investor is working with and to understand the risky nature of an investment in this security. The broker dealer must also provide the customer with certain other information and must make a special written determination that the "penny stock" is a suitable investment for the purchaser, and receive the purchaser's written agreement to the transaction. Further, the rules require that, following the proposed transaction, the broker provide the customer with monthly account statements containing market information about the prices of the securities. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for our common stock. Many brokers may be unwilling to engage in transactions in our common stock because of the added disclosure requirements, thereby making it more difficult for stockholders to dispose of their shares.

Number of Shareholders

At December 31, 2010, there were 620 stockholders of record of our common stock. This number does not include an indeterminate number of shareholders whose shares are held by brokers in “street name.”

Issuer Purchases of Equity Securities

We have made no repurchases of our equity securities in the fiscal year ended December 31, 2010.

Dividend Policy

We have not declared any cash dividends on our common stock during our fiscal years ended on December 31, 2010 or 2009. Our Board of Directors has made no determination to date to declare cash dividends during the foreseeable future, but is not likely to do so. There are no restrictions on our ability to pay dividends.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

14

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

Forward-Looking Statements

Some statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include the words “may,” “estimate,” “intend,” “continue,” “believe,” “expect,” or “anticipate” and other similar words. These forward-looking statements generally relate to plans and objectives for future operations and are based upon management’s reasonable estimates of future results or trends. Although we believe that the plans and objectives reflected in or suggested by such forward-looking statements are reasonable, such plans or objectives may not be achieved. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including: (a) lack of demand for our products and services; (b) competitive products and pricing; (c) limited amount of resources devoted to advertising; (d) lack of demand for our products and services being purchased via the Internet; and (e) other factors that may negatively affect our operating results. Statements made herein are as of the date of the filing of this Form 10-K with the SEC and should not be relied upon as of any subsequent date. We expressly disclaim any obligation to update any information or forward-looking statements contained in this Form 10-K, except as may otherwise be required by applicable law.

Overview

We sell information technology products and services and provide systems integration services in mainland China through our wholly-owned foreign entity, Clipper Technology, Ltd. The majority of our sales are concentrated in and around the cities of Shanghai, Ningbo, Hangzhou, Dalian, and Shenzhen in China.

In December 2009, we acquired 100% of Shenzhen Nubao Technology Co., Ltd. (“Nubao”), an Original Design Manufacturer of wireless products, from China Radio Technology Co., Ltd. in exchange for a $300,000 note. Additionally, in December 2009 we acquired 100% of Dalian Aoyuan Electronic Technology Services Co., Ltd. (“DAETS”), a systems integration company, from Aoyuan Electronic Company, Ltd., in exchange for a $200,000 note.

In February 2010, Paul K. Danner resigned as President and Chief Executive Officer of the Company and Dr. James Jiang was appointed President and Chief Executive Officer of the Company.

In March 2010, we executed a non-binding letter of intent (the “Fonix LOI”) under which CLPTEC, our wholly-owned subsidiary based in Shanghai, China, would acquire 100% of Shanghai Gaozhi Software Systems, Ltd. (“Gaozhi”), a telecommunications software developer, from Fonix Corporation (“Fonix”) in exchange for the issuance of a newly authorized series of preferred stock, the terms and conditions of which were subject to negotiation. The transaction was subject to the parties successfully entering into a definitive agreement which we originally projected would occur in the third quarter of 2010. Simultaneous with the execution of the Fonix LOI, we planned to enter into a one-year management agreement with Fonix under which CLPTEC would assist in the management of Gaozhi until the execution of a definitive agreement between the parties for the acquisition of Gaozhi by CLPTEC. In August 2010 it became apparent the parties would be unable to negotiate a mutually satisfactory definitive agreement regarding the intended transaction, therefore all aforementioned relationships between CLPTEC and Fonix were subsequently terminated.

Through our Nubao subsidiary, in February 2010 we entered into a non-binding letter of intent (“LOI”) with an undisclosed Japanese technology company to develop and potentially provide 10,000 custom Wi-Fi devices. In conjunction with the LOI, the Japanese firm placed a $1.6 million purchase order with Nubao for 100 sets of the device as part of a pilot program. Although the pilot program has been completed, the long-term status of project remains uncertain. In light of the earthquake, tsunami and associated events that have taken place in Japan in March 2011, the likelihood and timing of a follow on order is less certain.

Results of Operations

Fiscal Years Ended December 31, 2010 and 2009

15

Revenue increased 71% from $45,628,397 for the year ended December 31, 2009 to $78,187,546 for the year ended December 31, 2010. This increase is primarily attributable to revenue from our Nubao and DAETS subsidiaries which were acquired in the fourth quarter of 2009. Year-over-year systems integration sales from our Clipper-Huali subsidiary in the Ningbo and Shanghai regions was essentially even. Historically, we have reported a disproportionate percentage increase in revenue in the fourth quarter of our fiscal year compared to earlier quarters. This was the case again for the year ended December 31, 2010. However, the comparative increase in gross profit was approximately 17% less than the growth in revenue. This was attributable to (i) a lower gross margin associated with the fulfillment of a specific contract for our Nubao subsidiary, and; (ii) a government mandate in the fourth quarter of 2010 to accelerate the completion and billing on all government-related contracts which resulted in a higher percentage of lower margin, government-related revenue associated with our Clipper-Huali and DAETS subsidiaries. Cost of sales increased 72% from $41,578,424 for the year ended December 31, 2009 to $71,635,967 for the year ended December 31, 2010. This increase was primarily due to the corresponding increase in sales. Cost of sales as a percentage of sales was approximately 92% and 91% for the years ended December 31, 2010 and 2009, respectively.

General and administrative expenses for the year ended December 31, 2010 were $2,019,376 compared to $1,138,739 for the year ended December 31, 2009, an increase of 77%. The increase is primarily attributable to costs associated with our new Dalian and Shenzhen subsidiaries.

For the year ended December 31, 2010, we recognized net income of $4,201,431 after accounting for the non-controlling interest in a consolidated subsidiary, compared to net income of $2,182,620 for the year ended December 31, 2009, a 92% increase. The increase in net income is attributable to (i) an increase in overall sales as our gross margin remained approximately the same; and (ii) an increase in other income compared to the previous year. Comprehensive income for the year ended December 31, 2010 was $4,434,924 compared to comprehensive income of $2,101,432 for the year ended December 31, 2009, a 111% increase. Comprehensive income includes foreign currency translation adjustments and gains or losses on investment securities held.

Liquidity and Capital Resources

Cash Flow Activities

Our cash balance at December 31, 2010 decreased $1,827,649, from $3,977,382 as of December 31, 2009, to $2,149,733. The decrease was the result of cash used in investing activities of $3,300,000 and cash used in operating activities of $2,797,926 offset by cash provided by financing activities of $2,577,525 and the effect of exchange rates on cash of $1,692,752. Operating activities for the year ended December 31, 2010, exclusive of changes in operating assets and liabilities provided $4,225,035, as well as a decrease in inventory of $778,030 and an increase in accounts payable of $17,609, offset by an increase in accounts receivable of $6,490,133, an increase in deposits and other assets of $1,162,536 and a decrease in accrued expenses of $165,931.

Financing Activities

In recent years, we have funded our working capital requirements principally through borrowings under bank lines of credit, term loans, and issuances of common stock in exchange for debt. To the extent our operations are not sufficient to fund our capital requirements, we may enter into additional revolving loan agreements with a financial institution, or attempt to raise additional capital through the sale of additional common or preferred stock or through the issuance of additional debt. To the extent that we raise additional capital or settle existing liabilities through the sale or issuance of equity or convertible debt securities, the ownership interest of our existing stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of our stockholders. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring debt, making capital expenditures or declaring dividends. The current financing environment in the United States is exceptionally challenging and we can provide no assurances that we could raise capital either for operations or to finance an acquisition.

16

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires our management to make assumptions, estimates and judgments that affect the amounts reported in the financial statements, including the notes thereto, and related disclosures of commitments and contingencies, if any. We consider our critical accounting policies to be those that require the more significant judgments and estimates in the preparation of financial statements, including the following:

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, our wholly-owned subsidiaries CLPTEC, Nubao and DAETS and our majority-owned subsidiary Clipper Huali. All material intercompany accounts, transactions and profits have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

We follow paragraph 825-10-50-10 of the FASB Accounting Standards Codification (“ASC”) for disclosures about fair value of our financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification to measure the fair value of our financial instruments. Our financial instruments consist of cash and cash equivalents, trade receivables, prepaid expenses, payables and accrued expenses. The carrying amounts of the Company’s financial assets and liabilities approximate their fair values because of the short maturity of these instruments.

Accounts Receivable

Receivables were carried at their estimated collectible amounts. Accounts were periodically evaluated for collectability based on past credit history with customers and their current financial condition and were written off when deemed to be uncollectible. An allowance for doubtful accounts was recorded when management determined the collection was unlikely.

Property and Equipment

Property and equipment are recorded at cost, less accumulated depreciation. Depreciation is provided for using straight-line methods over the estimated useful lives of the respective assets, usually three to seven years.

Stock-Based Compensation

We recognize the cost of stock-based compensation plans and awards in operations on a straight-line basis over the vesting period (if any) of the awards. We measure and recognize compensation expense for all stock-based payment awards made to employees and directors. The compensation expense for our stock-based payments is based on an estimated fair value at the time of the grant. We estimate the fair value of stock based payment awards on the date of the grant using an option pricing model. These option pricing models involve a number of assumptions, including the expected lives of stock options, the volatility of the market price of our common stock and interest rates. We are using the Black-Scholes option pricing model. Stock based compensation expense recognized during the period is based on the value of the portion of stock-based payment awards that are ultimately expected to vest. Changes in our assumptions can materially affect the estimate of the fair value of stock-based payments and the related amount recognized in our consolidated financial statements.

17

Valuation of Long-Lived Assets

We periodically evaluate long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. If the estimated future cash flows (undiscounted and without interest charges) from the use of an asset were less than the carrying value, a write-down would be recorded to reduce the related asset to its estimated fair value. We do not believe that there has been any impairment to long-lived assets as of December 31, 2010.

Statement of Cash Flows

In accordance with ASC 230-10, Statement of Cash Flows, cash flows from our operations are based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Translation Adjustment

The Chinese Renminbi ("RMB"), the national currency of the China, is the primary currency of the economic environment in which our operations are conducted. We use the United States dollar ("U.S. dollars") for financial reporting purposes.

In accordance with ASC 830-10, Foreign Currency Matters, our results of operations and cash flows are translated at the average exchange rates during the period, assets and liabilities are translated at the exchange rates at the balance sheet dates, and equity is translated at the historical exchange rates. As a result, amounts related to assets and liabilities reported on the consolidated statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets.

Comprehensive Income

Comprehensive income includes accumulated foreign currency translation gains and losses and any accumulated gains or losses attributable to securities held for investment purposes. We have reported the components of comprehensive income on our statements of stockholders’ equity.

Effects of Inflation

Inflation and changing prices have not had a material effect on our business and we do not expect that inflation or changing prices will materially affect our business in the foreseeable future. However, our management will closely monitor the price change and continually maintain effective cost control in operations

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements as defined in Regulation S-K Item 303(a)(4).

Recent Accounting Pronouncements

(See “Recently Issued Accounting Pronouncements” in Note 2 of Notes to the Consolidated Financial Statements.)

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Exchange Rate Risk

While our reporting currency is the U.S. dollar, the majority of our consolidated revenues and consolidated costs and expenses are denominated in foreign currency, specifically the Chinese RMB. The majority of our assets are denominated in RMB. As a result, we are exposed to foreign exchange risk as our revenues and results of operations may be affected by fluctuations in the exchange rate between U.S. dollars and the Chinese currencies. If the Chinese currency depreciates against the U.S. dollar, the value of a portion of our revenues, earnings and assets as expressed in our U.S. dollar financial statements will decline. We have not entered into any hedging transactions in an effort to reduce our exposure to foreign exchange risk.

18

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The full text of our audited consolidated financial statements as of December 31, 2010 and 2009 begins on page F-1 of this annual report.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISLCOSURE

|

None.

ITEM 9A. CONTROLS AND PROCEDURES

Management’s Report on Internal Control Over Financial Reporting

(a) Evaluation of Disclosure Controls and Procedures

Management of the Company with the participation of the Chief Executive Officer and Chief Financial Officer, conducted an evaluation of the effectiveness of the Company’s disclosure controls and procedures (as such term is defined in Rule 13a-15(e) and Rule 15d-15(e) under the Securities Exchange Act of 1934) pursuant to Rile 13a-15 under the Exchange Act. The Company’s disclosure controls and procedures are designed to ensure that information required to be disclosed by the Company in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported on a timely basis and that such information is communicated to management, including the Chief Executive Officer, Chief Financial Officer and the Company’s Board of Directors, to allow timely decisions regarding required disclosure.

Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective as of December 31, 2010.

(b) Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reposting and the assessment of the effectiveness of internal control over financial reporting. As defined by the SEC, internal control over financial reporting is a process designed by, or under the supervision of our principal executive officer and principal financial officer and implemented by our Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of our financial statements in accordance with U.S. generally accepted accounting principles.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

It should be noted that the Company’s management, including the Chief Executive Officer and Chief Financial Officer, do not expect that the Company’s internal controls will necessarily prevent all errors or fraud. A control system, no matter how well conceived or operated, can only provide reasonable, not absolute, assurance that the objectives of the control system are met, Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs.

As of December 31, 2010, we conducted an evaluation of the effectiveness of our internal controls over financial reporting based on criteria established in “Internal Control-Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission, or the COSO Framework. Management’s assessment included an evaluation of the design of our internal control over financial reporting and testing of the operational effectiveness of those controls.

A material weakness is defined within the Public Company Accounting Oversight Board’s Auditing Standard No. 5 as a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. Based upon this assessment, management concluded that our internal control over financial reporting was effective as of December 31, 2010.

19

This annual report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. The Company’s internal controls over financial reporting was not subject to attestation by the Company’s independent registered public accounting firm pursuant to temporary rules of the SEC that permit the Company to provide only management’s report in this annual report.

(c) Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during the last fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

None.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table sets forth information with respect to the sole executive officers and directors of the Company as of March 31, 2011:

|

Name and Age

|

Position

|

Date of Appointment

|

|

James Jiang, PhD (57)

|

President & Chief Executive Officer

|

February 1, 2010

|

|

Paul K. Danner (53)

|

President & Chief Executive Officer, Director

|

July 1, 2008 to February 1, 2010

|

|

Philip J. Rauch (50)

|

Chief Financial Officer, Director

|

October 18, 2006

|

|

Philip Verges (45)

|

Chairman

|

October 18, 2006