Attached files

| file | filename |

|---|---|

| EX-32.2 - SECTION 906 CFO CERTIFICATION - FNDS3000 Corp | dex322.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - FNDS3000 Corp | dex311.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - FNDS3000 Corp | dex321.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - FNDS3000 Corp | dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended February 28, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT |

For the transition period from to

Commission File Number: 333-138512

FNDS3000 CORP

(Exact name of registrant as specified in its charter)

| DELAWARE | 51-0571588 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

4651 Salisbury Road Suite 533, Jacksonville, Florida 32256

(Address of principal executive offices) (Zip Code)

904-273-2702

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of April 14, 2011, the Company had outstanding 82,573,661 shares of its common stock, par value $0.001.

Table of Contents

FNDS3000 CORP AND SUBSIDIARIES

FORM 10-Q

For the Quarterly Period Ended February 28, 2011

| PART I |

Financial Information | 3 | ||||

| Item 1. |

Financial Statements | 3 | ||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 22 | ||||

| Item 3. |

Quantitative and Qualitative Disclosures about Market Risk | 38 | ||||

| Item 4. |

Controls and Procedures | 38 | ||||

| PART II |

Other Information | 39 | ||||

| Item 1. |

Legal Proceedings | 39 | ||||

| Item 1A. |

Risk Factors | 39 | ||||

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds | 39 | ||||

| Item 3. |

Defaults Upon Senior Securities | 39 | ||||

| Item 5. |

Other Information | 39 | ||||

| Item 6. |

Exhibits | 40 | ||||

| 41 | ||||||

Table of Contents

PART 1 - FINANCIAL INFORMATION

| Item 1. | Financial Statements |

FNDS3000 CORP AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| February 28, 2011 | August 31, 2010 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash |

$ | 289,392 | $ | 332,399 | ||||

| Accounts receivable, net |

17,220 | 32,512 | ||||||

| Prepaid expenses and other current assets |

123,997 | 126,252 | ||||||

| Total current assets |

430,609 | 491,163 | ||||||

| Deposits |

34,916 | 29,701 | ||||||

| Restricted cash |

92,053 | 35,022 | ||||||

| Property and equipment, net |

91,944 | 77,004 | ||||||

| Software license, net |

1,118,467 | 1,236,199 | ||||||

| Total assets |

$ | 1,767,989 | $ | 1,869,089 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 363,694 | $ | 164,032 | ||||

| Accrued payroll and benefits |

79,676 | 95,975 | ||||||

| Other accrued liabilities |

27,454 | 26,149 | ||||||

| Due to related parties |

98,445 | 203,902 | ||||||

| Total current liabilities |

569,269 | 490,058 | ||||||

| Total liabilities |

569,269 | 490,058 | ||||||

| Commitments and contingencies |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock; $0.001 par value; 5,000,000 shares authorized; no shares issued and outstanding |

— | — | ||||||

| Common stock; $0.001 par value; 150,000,000 shares authorized; 78,796,683 issued and outstanding, February 28, 2011; 68,959,019 issued and outstanding, August 31, 2010; |

78,797 | 68,959 | ||||||

| Additional paid-in capital |

19,443,705 | 17,789,805 | ||||||

| Accumulated deficit |

(18,323,782 | ) | (16,479,733 | ) | ||||

| Total stockholders’ equity |

1,198,720 | 1,379,031 | ||||||

| Total liabilities and stockholders’ equity |

$ | 1,767,989 | $ | 1,869,089 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Table of Contents

FNDS3000 CORP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| For the Three Months Ended February 28, | For the Six Months Ended February 28, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

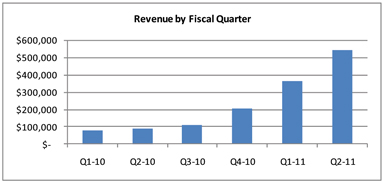

| Revenue, net |

$ | 545,951 | $ | 89,414 | $ | 910,630 | $ | 167,109 | ||||||||

| Cost of revenue |

341,729 | 46,894 | 569,131 | 82,870 | ||||||||||||

| Gross margin |

204,222 | 42,520 | 341,499 | 84,239 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Processing, technical and financial expense |

384,438 | 196,404 | 764,174 | 365,164 | ||||||||||||

| Salaries and benefits expense |

382,278 | 455,970 | 739,357 | 914,179 | ||||||||||||

| Travel expense |

28,576 | 62,512 | 100,995 | 156,165 | ||||||||||||

| Professional and consultant expense |

53,460 | 145,442 | 289,463 | 349,180 | ||||||||||||

| Depreciation and amortization expense |

72,171 | 68,885 | 143,314 | 139,722 | ||||||||||||

| Other selling, general and administrative expense |

88,006 | 88,407 | 153,067 | 154,337 | ||||||||||||

| Total operating expense from operations |

1,008,929 | 1,017,620 | 2,190,370 | 2,078,747 | ||||||||||||

| Loss from operations |

(804,707 | ) | (975,100 | ) | (1,848,871 | ) | (1,994,508 | ) | ||||||||

| Other income (expense): |

||||||||||||||||

| Interest and other income |

6,733 | 2,978 | 8,512 | 3,930 | ||||||||||||

| Non-cash interest income/(expense) |

6,400 | (150,000 | ) | — | (216,945 | ) | ||||||||||

| Interest and other expense |

(299 | ) | (366 | ) | (395 | ) | (603 | ) | ||||||||

| Gain/(loss) from foreign currency remeasurment |

4,110 | 16,487 | (1,228 | ) | (11,104 | ) | ||||||||||

| Loss from asset disposal |

(2,067 | ) | — | (2,067 | ) | — | ||||||||||

| Total other income (expense) from operations |

14,877 | (130,901 | ) | 4,822 | (224,722 | ) | ||||||||||

| Loss from operations before income taxes |

(789,830 | ) | (1,106,001 | ) | (1,844,049 | ) | (2,219,230 | ) | ||||||||

| Provision for income taxes |

— | — | — | — | ||||||||||||

| Loss from operations |

(789,830 | ) | (1,106,001 | ) | (1,844,049 | ) | (2,219,230 | ) | ||||||||

| Stock price indemnity |

— | — | — | (26,431 | ) | |||||||||||

| Loss from discontinued operations |

— | — | — | (26,431 | ) | |||||||||||

| Net loss |

$ | (789,830 | ) | $ | (1,106,001 | ) | $ | (1,844,049 | ) | $ | (2,245,661 | ) | ||||

| Net loss per common share: |

||||||||||||||||

| Basic and diluted loss per share: |

||||||||||||||||

| Loss from continuing operations |

$ | (0.01 | ) | $ | (0.02 | ) | $ | (0.02 | ) | $ | (0.05 | ) | ||||

| Loss from discontinued operations |

(0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | ||||||||

| Net loss |

$ | (0.01 | ) | $ | (0.02 | ) | $ | (0.02 | ) | $ | (0.05 | ) | ||||

| Weighted average common shares: |

||||||||||||||||

| Basic and diluted |

76,148,269 | 47,314,185 | 73,922,893 | 47,314,185 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Table of Contents

FNDS3000 CORP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| For the Six Months Ended February 28, | ||||||||

| 2011 | 2010 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||

| Net loss |

$ | (1,844,049 | ) | $ | (2,245,661 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation and amortization |

143,314 | 139,722 | ||||||

| Contributed services |

45,000 | — | ||||||

| Equity-based compensation |

184,231 | 213,850 | ||||||

| Loss on asset disposal |

2,067 | — | ||||||

| Accretion of non-cash beneficial conversion feature on convertible note payable - related party |

— | 166,667 | ||||||

| Bad debt allowance |

12,460 | 28,215 | ||||||

| Reserve for chargebacks/fraud |

9,768 | — | ||||||

| Non-cash interest expense |

— | 50,278 | ||||||

| Stock price indemnity expense |

— | 26,431 | ||||||

| Change in operating assets and liabilities: |

||||||||

| Accounts receivable |

2,832 | (52,082 | ) | |||||

| Prepaid expenses and other assets |

2,255 | (43,624 | ) | |||||

| Deposits |

(5,215 | ) | 578 | |||||

| Restricted cash |

(57,031 | ) | (442 | ) | ||||

| Accounts payable and other accrued liabilities |

191,200 | 66,117 | ||||||

| Accrued payroll and benefits |

(16,299 | ) | 22,429 | |||||

| Stock price indemnity liability |

— | (137,860 | ) | |||||

| Due to related parties |

(126,758 | ) | (66,869 | ) | ||||

| Net cash used in operating activities |

(1,456,225 | ) | (1,832,251 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES |

||||||||

| Purchase of property and equipment |

(42,590 | ) | (1,886 | ) | ||||

| Net cash used in investing activities |

(42,590 | ) | (1,886 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES |

||||||||

| Proceeds from private placements |

1,500,000 | 1,800,000 | ||||||

| Offering costs |

(44,192 | ) | (42,882 | ) | ||||

| Net cash provided by financing activities |

1,455,808 | 1,757,118 | ||||||

| Net decrease in cash |

(43,007 | ) | (77,019 | ) | ||||

| Cash at beginning of year, net of restricted cash |

332,399 | 371,644 | ||||||

| CASH AT END OF PERIOD, net of restricted cash |

$ | 289,392 | $ | 294,625 | ||||

| SUPPLEMENTAL CASH FLOW DISCLOSURE |

||||||||

| Cash paid for interest |

$ | 395 | $ | 603 | ||||

| Cash paid for income taxes |

$ | — | $ | — | ||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH FINANCING ACTIVITIES |

||||||||

| Consulting services provided as additional consideration for shares issued |

$ | — | $ | 250,000 | ||||

| Beneficial conversion feature on convertible note payable - related party |

$ | — | $ | 166,667 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Table of Contents

FNDS3000 CORP AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 – Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of FNDS3000 Corp (the “Company,” FNDS3000,” “we,” “our,” “its” or “us”) and subsidiaries have been prepared in accordance with United States generally accepted accounting principles (“GAAP”) for interim financial statements. Therefore, they include all of the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements. These unaudited condensed consolidated financial statements should be read in conjunction with the Form 10-K for the year ended August 31, 2010 of FNDS3000 Corp which was filed with the Securities and Exchange Commission on November 29, 2010.

These interim condensed consolidated financial statements of FNDS3000 Corp and its subsidiaries present the audited consolidated balance sheet as of August 31, 2010, the unaudited condensed consolidated balance sheet as of February 28, 2011 and the unaudited condensed consolidated statements of operations for the three and six months ended February 28, 2011 and 2010 and statements of cash flows for the six months ended February 28, 2011 and 2010. In the opinion of management, all adjustments necessary to present fairly the financial position as of February 28, 2011 and the results of operations and cash flows presented herein have been included in the condensed consolidated financial statements. Interim results are not necessarily indicative of results of operations for the full year.

All references to fiscal periods apply to our fiscal quarters, which end on the last day of the months of November, February, May and August, with August 31 being our fiscal year end.

The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Note 2 – Going Concern

Our financial statements are prepared in accordance with United States generally accepted accounting principles applicable to a going concern, which contemplate the realization of assets and liquidation of liabilities in the normal course of business. As of February 28, 2011, our working capital deficit was approximately $138,700. As we have incurred approximately $18.3 million in losses since our inception, our ability to continue as a going concern must be considered in light of the problems, expenses and complications frequently encountered by entrance into established markets and the competitive environment in which we operate.

Since inception, our operations have primarily been funded through privately placed equity financings, and we will continue to seek additional funding through private or public equity and debt financings. However, due to the current economic environment and the Company’s current financial condition, there can be no assurance that our plans will materialize and/or that we will be successful in funding our estimated cash shortfalls through additional debt or equity capital. Additionally, we expect, but cannot provide assurance that operating revenue from the sales of our products and other related revenue will continue to increase.

These factors, among others, indicate that there is doubt about our ability to continue as a going concern for a reasonable length of time. These consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty nor do they include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

6

Table of Contents

Note 3 – Formation, Background and Operations of the Company

Corporate History

FNDS3000 Corp was formed to take advantage of the dynamic growth occurring in the global prepaid card market. Our focus is on pursuing compelling, high growth business opportunities specifically in developing international prepaid markets. We established our base of operations in Johannesburg, South Africa, which will ultimately serve to support an anticipated global customer base concentrated in Africa, the Middle East and Southern Europe.

FNDS3000 Corp was incorporated on January 24, 2006 in the State of Delaware and is headquartered in Jacksonville, Florida. Our fiscal year end is August 31. On March 28, 2008, we changed the Company’s name to FNDS3000 Corp from FundsTech Corp.

In 2008, FNDS3000 became the first non-South African company to receive MasterCard certification in that country, which was a fundamental objective for advancing our business plan. During December 2008 and January 2009, a change of executive management occurred and Sherington Holdings, LLC (“Sherington”) became a major investor.

In May 2009, we sold the Atlas subsidiary, which was purchased in July of 2008.

In the summer of 2009, we completed the Pilot Test Phase of our processing platform in South Africa, during which time we implemented further product enhancements, together with comprehensive customer service operations and advanced our fraud prevention protocols. Our comprehensive test phases demonstrated stability and validated the processes and systems that are required to handle the higher volume of prepaid cards to be processed during the Production Rollout, which was scheduled to commence in late December 2009. During these phases, we tested, developed and enhanced our systems, processes, infrastructure and the operational team. This process included extensive internal testing and validation. Subsequently, we had our South African processing procedures and electronic funds transfer system reviewed and validated by our Sponsor Bank, and by the staff of a top international auditing firm.

During the latter part of 2009, one of our key distributors, Australis, encountered internal difficulties. These difficulties continued to increase through February 28, 2010 and ultimately, in March 2010, the Company and Australis agreed to terminate the agreement between the companies. Thereafter, we entered into direct contractual relationships with the former customers of Australis and we intend to continue to develop this sales avenue.

After integrating a mobile banking solution into our processing platform in the fall of 2009, we concluded the Market Test Phase of our processing platform and commenced Production Rollout of our prepaid payroll programs to businesses in South Africa on schedule in late December 2009.

Early on in our Production Rollout phase, our distributors and corporate clients encountered logistical and procedural delays in distributing cards to cardholders. We found the process significantly slower than expected, which adversely influenced the speed and rate of card activation. As a result, the Company refocused staff on supporting and assisting distributors and corporate clients in meeting this challenge. Operating metrics and emerging trends are indicating that we have begun to achieve growing market acceptance.

During the months of December 2009 through May 2010, we further developed our plans and programs for micro financing, which we believe offers particular attractions in high-volume potential repeat business without the challenges of distribution, as the cardholder is present at the time funds are loaded to a card.

In July 2010, the decision was made to appoint Robert Klein, a Sherington consultant who had been working with the Company since October 2009, as President and Chief Executive Officer–South Africa to lead the day-to-day operations of FNDS3000 South Africa in order to further strengthen our South Africa operations team as well as our marketing and contract management expertise, thus positioning us for our next critical growth phase.

On September 29, 2010, shareholders of the Company holding a majority of the issued and outstanding shares of common stock of the Company voted to reduce the size of our Board of Directors to five and therefore removed, without cause, David Fann, John Hancock, Don Headlund, Ernst Schoenbaechler and John Watson from their positions as directors.

7

Table of Contents

On September 30, 2010, several changes occurred to the composition of our executive management. The Board removed John Hancock, President and CEO, and John Watson, Executive Vice President, from their positions as executive officers of the Company and David Fann resigned from his position as Corporate Secretary. In conjunction with these changes, the Board appointed Raymond Goldsmith as President and CEO, Riva Smith as Corporate Secretary and Derek Mitchell as a director of the Company. Mr. Mitchell has served as Director of Business Affairs of International Sports Multimedia, Ltd. (“ISM”) since January 2009. Raymond Goldsmith, our CEO and Chairman, is the founder, Chairman and CEO of ISM. Since 1998, Ms. Smith has served as Executive Assistant to Mr. Goldsmith in his capacity as Chairman and CEO of ISM.

On October 23, 2010, Victoria Vaksman resigned her position as Executive Vice President, EMEA (Europe, Middle East and Africa).

On November 23, 2010, the Board of Directors amended the Bylaws to provide that the annual meeting may be set by the Board of Directors at its discretion. At the December 15, 2010 annual shareholders meeting, the majority of shareholders voted to further reduce the size of the Board to four members.

We have experienced delays associated with card distribution and activation. These delays, having extended the period during which funds must be expended without having significant revenue, led to the need for additional financing. As of February 28, 2011, approximately $12.3 million from sales of our common stock and warrants, along with convertible notes for $1.5 million have provided the required financing.

Because we cannot anticipate when significant revenue will be generated, and our monthly cash needs range between approximately $200,000 and $250,000, we will need to raise additional funds to continue to execute our business plan, respond to competitive pressures and to react to unanticipated requirements or expenses.

During the six months ended February 28, 2011, through sales of our common stock, we raised $1 million in October 2010 and another $500,000 in January 2011. We estimate that we will require an additional $1 million to $1.25 million to carry out our business plan for the remaining six months of fiscal 2011 from March 1 through August 31, 2011. These funds will provide us with necessary working capital to support our South Africa business operations while we work toward achieving positive cash flow, as well as to finance planned growth initiatives in that market to support our anticipated growth. We will require additional funds to provide for strategic expansion of our business into other targeted developing prepaid markets.

We plan to raise any such additional capital primarily through the private placement of our equity securities. The issuance of additional equity securities could result in a significant dilution in the equity interests of our current stockholders. However, there is no assurance that we will be able to obtain further funds required for our continued operations or that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will not be able to meet our other obligations as they become due and we will be forced to scale down or perhaps even cease our operations.

Note 4 – Summary of Significant Accounting Policies

Basis of Presentation/Going Concern

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, which contemplate continuation of the Company as a going concern.

Since inception, our losses total approximately $18.3 million and our working capital deficit as of February 28, 2011 is approximately $138,700. These conditions raise doubt as to our ability to continue as a going concern. These consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty nor do they include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern. The accompanying unaudited condensed consolidated financial statements have been prepared on the accrual basis of accounting in accordance with GAAP.

8

Table of Contents

Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of FNDS3000 Corp and our wholly owned subsidiaries: FndsTech Corp. SA. (Pty) Ltd., Atlas Merchant Services, LLC (includes activity through the sale date of May 14, 2009), and Transaction Data Management, Inc., which is inactive. Significant inter-company accounts and transactions are eliminated in consolidation.

Reclassifications

Certain items in the February 28, 2010 condensed consolidated financial statements have been reclassified to conform to the February 28, 2011 presentation. Of particular note, for improved comparison of card- and transaction-related cost to revenue, certain non-transactional costs are now presented as “Processing, Technical and Financial Expense” and are included in Operating Expense rather than as Cost of Revenue. Due to this reclassification, the gross margin for the three months ended February 28, 2010 was $42,520 rather than a loss of $58,544, an increase of $101,064. For the six months ended February 28, 2010 gross margin was $84,239 rather than a loss of $88,184, an increase of $172,423.

Additionally, as the amount of restricted cash on deposit with our sponsor bank has increased from $35,022 as of August 31, 2010 to $92,053 as of February 28, 2011, restricted cash is now presented separately as a long-term asset. Therefore, the balance sheet as of August 31, 2010 has been revised to present $35,022 as Restricted Cash.

These reclassifications did not affect our consolidated net loss for any period.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. The reported amounts of revenue and expenses during the reporting period may be affected by the estimates and assumptions we are required to make. In particular, depreciation, amortization and the valuation of stock option grants are significant estimates. Estimates that are critical to the accompanying financial statements arise from our belief that we will secure an adequate amount of cash to continue as a going concern, that our allowance for doubtful accounts is adequate to cover potential losses and that all long-lived assets are recoverable.

The markets for our products are characterized by intense competition, rapid technological development, evolving standards, short product life cycles and price competition, all of which could influence the future realization of our assets. Estimates and assumptions are reviewed periodically and the effects of revisions are reflected in the period that they are determined to be necessary. It is at least reasonably possible that our estimates could change in the near term with respect to these matters.

Financial Instruments

The Company’s financial instruments consist of cash, accounts receivable and accounts payable. These financial instruments are stated at their respective carrying values, which approximate their fair values.

Cash and Cash Equivalents

We consider all highly liquid investments with an original maturity of three months or less to be cash equivalents. Resticted cash on deposit with our sponsor bank is considered to be a long-term asset.

Concentration of Credit Risk

Financial instruments that potentially subject us to concentrations of credit risk consist principally of temporary cash investments and trade accounts receivable. We maintain cash balances at two national financial institutions in Jacksonville, Florida. Accounts at these institutions are secured by the Federal Deposit Insurance Corporation up to $250,000. At times, balances may exceed federally insured limits.

We also maintain cash balances at two financial institutions in Bryanston, South Africa.

9

Table of Contents

We have not experienced any losses in such accounts we believe that we are not exposed to any significant credit risk with respect to cash and cash equivalents.

Revenue Recognition and Deferred Revenue

Revenue consists primarily of fees generated through the electronic processing of payment transactions and related services, and are recognized as revenue in the period the transactions are processed or when the related services are performed.

Our revenue is derived from the following:

| • | Initiation fees from sales of our prepaid cards. |

| • | Transaction fees from the use and loading of funds for the prepaid cards. |

| • | Maintenance fees for continued activation. |

| • | Financial float fees, which arise from the balance of funds available prior to the use of the funds. |

Revenue derived from electronic processing of the prepaid card transactions are recognized immediately as revenue and are reported gross of amounts paid to sponsor banks as well as interchange and assessments paid to credit card associations such as MasterCard. Our receivables arise from the initial sale of the plastic card and the security tokens, which are invoiced with net 30-day terms.

Our revenue recognition policy for fees and services arising from our products is that we recognize revenue when, (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) our price to the buyer is fixed or determinable; and (4) collectability of the receivables is reasonably assured. More specifically, issuance fee revenue for our prepaid cards is recognized when shipped, transaction fee revenue is recognized when the transaction occurs and posts, and maintenance and financial float fee revenue are recognized when the products are used. Consulting fees are recognized as services are performed and per contractual terms with the customer. Costs of revenue, including the cost of printing the cards, are recorded at the time revenue is recognized.

Accounts Receivable and Allowance for Doubtful Accounts

Our accounts receivable arise from the sale of cards and security tokens and for application and set-up fees. Accounts receivable are determined to be past due if payment is not made in accordance with the terms of our contracts and receivables are written off when they are determined to be uncollectible. Ongoing credit evaluations are performed for all of our customers.

We evaluate the allowance for doubtful accounts on a regular basis for adequacy. The level of the allowance account and related bad debts are based upon our review of the collectability of our receivables in light of historical experience, adverse situations that may affect our customers’ ability to repay, estimated value of any underlying collateral and prevailing economic conditions. We use the direct write-off method for accounts receivable that are determined to be uncollectable and believe there is no material difference in this method from the allowance method. This evaluation is inherently subjective, as it requires estimates that are susceptible to significant revision as more information becomes available.

We do not have an allowance for bad debt as of February 28, 2011.

Reserves for Uncollectible Overdrawn Accounts, Chargebacks and Fraudulent Transactions

Cardholder accounts may become overdrawn if service fees or other charges exceed the available funds in a cardholder’s account; merchants may issue chargebacks or fraudulent transactions may occur. Due to this exposure, we maintain reserves to offset these risks. Additionally, we have established a cash reserve, which is a component of restricted cash.

As of February 28, 2011, we have reserved $12,460 for overdrawn accounts and $9,768 for potential chargebacks and the risk of fraudulent activity.

10

Table of Contents

Property and Equipment

Equipment and improvements are stated at cost less accumulated depreciation and amortization. Depreciation and amortization of equipment and improvements are provided over the estimated useful lives of the assets, or the related lease terms if shorter, by the straight-line method. Useful lives range as follows:

| Category |

Useful Lives | |

| Computers and networks | 3 years | |

| Machinery and equipment | 5-7 years | |

| Furniture and fixtures | 5-7 years | |

| Office equipment | 3-10 years | |

| Leasehold improvements | Lesser of lease term or useful life of asset |

Major additions will be capitalized, while minor additions, maintenance and repairs, which do not extend the useful life of an asset, will be expensed as incurred. Upon disposition, the cost and related accumulated depreciation are removed from the accounts and the resulting gain or loss is reflected in current operations.

Long-Lived Assets and Impairment

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of a long-lived asset may not be recoverable. The Company periodically evaluates whether events and circumstances have occurred that may warrant revision of the estimated useful lives of its long-lived assets or whether the remaining balance of long-lived assets should be evaluated for possible impairment.

Intangible assets that are determined to have definite lives are amortized over their useful lives and are measured for impairment only when events or circumstances indicate the carrying value may be impaired. Intangible assets with indefinite lives are not amortized but instead are measured for impairment at least annually in our fourth fiscal quarter, or when events indicate that impairment exists.

We have a capitalized intangible asset, which is the software license from World Processing, Ltd., the parent company of Global Cash Card (“GCC”), and associated fees relative to its modification to meet our needs. In recognition of the right to receive future cash flows related to transactions of the asset, we are amortizing this value over seven years, as it is anticipated that the software would continue to evolve with our needs.

We review intangibles at least annually for impairment as events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. If the carrying amounts of the assets exceed their respective fair values, additional impairment tests are performed to measure the amount of the impairment loss, if any. If an asset is deemed impaired, the impairment loss is recognized in current earnings. No impairment loss was recognized for the GCC software license for the years ended August 31, 2010 and 2009.

Purchased and Developed Software

We account for software development costs which consist of costs to develop software programs to be used solely to meet the Company’s internal needs in accordance with Statement of Position (“SOP”) No. 98-1, Accounting for Costs of Computer Software Developed or Obtained for Internal Use. Costs incurred during the application development stage for software programs to be used solely to meet our internal needs are capitalized. Capitalized software costs are included in the value of our intangibles, net and are amortized over the estimated useful life of the software.

Purchases of “off-the-shelf” software may be capitalized depending on the value. If capitalized, the costs are amortized over the expected economic life, generally three years.

Net Earnings or (Loss) Per Share

Basic net earnings or loss per share is computed by dividing the net earnings or loss available to common stockholders for the period by the weighted average number of common shares outstanding during the period. Diluted net earnings/(loss) per share is computed by dividing the net earnings or loss for the period by the number of common and common equivalent shares outstanding during the period.

11

Table of Contents

Basic net loss per common share has been computed based upon the weighted average number of shares of common stock outstanding during the periods. All potential diluted shares have been excluded from the calculation of diluted earnings/(loss) per share for the three and six months ended February 28, 2011 and 2010 as the effect of conversion is anti-dilutive.

Equity-Based Compensation

The Company has equity-based compensation plans, which are designed to retain directors, executives and selected employees and consultants and to reward them for making major contributions to the success of the Company.

SEC Staff Accounting Bulletin No. 110, “Share Based Payment,” allows companies to continue to use the simplified method to estimate the expected term of stock options under certain circumstances. The simplified method for estimating the expected life uses the mid-point between the vesting term and the contractual term of the stock option. The Company has analyzed the circumstances in which the simplified method is allowed and has determined that utilizing the simplified method for stock options granted is appropriate.

Fair value of the stock options is estimated using a Black-Scholes option pricing formula. The variables used in the option pricing formula for each grant are determined at the time of grant as follows: (1) volatility is based on the weekly closing price of the Company’s stock over a look-back period of time that approximates the expected option life; (2) risk-free interest rates are based on the yield of U.S. Treasury Strips as published in the Wall Street Journal or provided by a third-party on the date of the grant for the expected option life; and (3) expected option life represents the period of time the options are expected to be outstanding. Periodically the factors influencing the expected life of option grants are reviewed and may be modified.

Equity instruments issued for services are based on the fair value of the consideration received or the fair value of the equity instruments, whichever is more reliably measurable. Prior to February 2009, the quoted market price was a basis for the fair value of the common stock. Beginning in February 2009, significant amounts of common stock were issued in exchange for cash, the value of which was used to determine the fair value of the shares issued for services at or near the time of these issuances for cash. However, as per the terms of the October 2010 Commitment Agreement between the Company and Sherington, sales of our common stock for the final three tranches of this agreement, which are scheduled to close between January 2011 and July 2011, will be valued at the lesser of (a) USD $0.175 or (b) the average trading price of the Stock for the 10 trading days prior to the closing date of the applicable tranche closing. In January 2011, the sale price was $0.154 per share and in March 2011, the sale price was $0.139 per share.

Determining the appropriate fair value model and calculating the fair value of share-based payment awards requires the input of highly subjective assumptions, including the expected life of the share-based payment awards and stock price volatility. The assumptions used in calculating the fair value of share-based payment awards represent management’s best estimates, but these estimates involve inherent uncertainties and the application of management judgment. As a result, if factors change and we use different assumptions, our stock-based compensation expense could be materially different in the future. In addition, we are required to estimate the expected forfeiture rate and only recognize expense for those shares expected to vest. If our actual forfeiture rate is materially different from our estimate, the stock-based compensation expense could be significantly different from what we have recognized in the current period.

Derivative Financial Instruments

We have adopted certain disclosure requirements under FASB Accounting Standards Codification (“ASC”) 815, “Derivatives and Hedging” which requires that objectives for using derivative financial instruments be disclosed in terms of the underlying risk and accounting designation. Additionally, ASC 815 requires that the fair value of derivative financial instruments and their gains and losses be presented in tabular format in order to present a more complete picture of the effects of using derivative financial instruments. ASC 815 establishes accounting and reporting standards for derivative instruments, including certain derivative instruments embedded in other contracts, (collectively referred to as derivatives) and for hedging activities. It requires that an entity recognize all derivatives as either assets or liabilities in the statement of financial position and measure those instruments at fair value. If certain conditions are met, a derivative may be specifically designated as (a) a hedge of the exposure to changes in the fair value of a recognized asset or liability or an unrecognized firm commitment, (b) a hedge of the exposure to variable cash flows of a forecasted transaction, or (c) a hedge of the foreign currency exposure of a net investment in a foreign operation, an unrecognized firm commitment, an available-for-sale security, or a foreign-currency-denominated forecasted transaction.

12

Table of Contents

In October 2010, we entered into a release agreement with a consultant in which we agreed to issue at various future dates $100,000 of our common stock. The first of four $25,000 tranches was issued in January 2011 at a price of $0.175 as per the agreement. The terms of this agreement stipulate that the number of shares to be issued for the remaining $75,000 will be determined based upon a per share price of (i) the lesser of $0.175 or (ii) the average trading price of the stock for the 10 trading days prior to the issuance date.

The second tranche was issued February 1, 2011 at $0.154.

As of February 28, 2011, the Company owes $50,000 in shares to the consultant. As the average trading price of the stock for the 10 trading days prior to February 28, 2011 was less than the maximum price of $0.175, the $6,400 non-cash interest expense for the discounted stock price recognized at November 30, 2010 was reversed. See “Consulting Agreements” in Note 13 – Commitments and Obligations for additional information.

Foreign Currency Transactions, Translation and Remeasurement

The financial position and results of operations of the FNDS3000 South Africa operations are measured using the parent’s currency, the U.S. dollar, as the functional currency; however, the original books and records are maintained in the South African Rand. Therefore, exchange rate gains and losses are considered to be “transaction” gains and losses.

Transaction gains and losses are a result of the effect of exchange rate changes on transactions denominated in currencies other than the functional currency. Gains and losses on those foreign currency transactions are generally included in determining net income/(loss) for the period in which exchange rates change unless the transaction hedges a foreign currency commitment or a net investment in a foreign entity. Inter-company transactions of a long-term investment nature are considered part of a parent’s net investment and hence do not give rise to gains or losses. Assets and liabilities of these operations are translated at the exchange rate in effect at the end of the reporting period.

Statement of operations accounts, with the exception of amortized assets or liabilities, are translated at the average exchange rate during the year.

Fluctuations from the beginning to the end of any given reporting period result in the remeasurement of our foreign currency-denominated cash, receivables and payables, and generate currency transaction gains or losses that impact our non-operating income and expense levels in the respective period are reported in other income/(expense), net, in our condensed consolidated financial statements.

Income Taxes

We account for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements. Under this method, deferred tax assets and liabilities are determined based on the differences between the financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date.

We record net deferred tax assets to the extent we believe these assets will more likely than not be realized. In making such determination, all available positive and negative evidence will be considered, including future reversals of existing taxable temporary differences, projected future taxable income, tax planning strategies and recent financial operations. A valuation allowance is established against deferred tax assets that do not meet the criteria for recognition. In the event the we determine that it would be able to realize deferred income tax assets in the future in excess of their net recorded amount, we would make an adjustment to the valuation allowance which would reduce the provision for income taxes.

13

Table of Contents

We follow the accounting guidance which provides that a tax benefit from an uncertain tax position may be recognized when it is more likely than not that the position will be sustained upon examination, including resolutions of any related appeals or litigation processes, based on the technical merits. Income tax positions must meet a more-likely-than-not recognition threshold at the effective date to be recognized initially and in subsequent periods. Also included is guidance on measurement, de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition.

For the period from January 24, 2006 (inception) to February 28, 2011, we have incurred net operating losses. However, no benefit for income taxes has been recorded due to the uncertainty of the realization of this deferred tax asset. As of February 28, 2011, we have in excess of $12 million of federal and state net operating losses (“NOL”) allocated to continuing operations available as a carry-forward for the calculation of income tax. The net operating loss carry forward, if not utilized, will begin to expire in 2024. The difference between our net loss of $18.3 million and the NOL of $12 million relates to business expenses that are either not deductible for tax purposes or are deductible over differing fiscal and tax years.

For financial reporting purposes based upon continuing operations, we have incurred a loss in each fiscal quarter since inception.

Note 5 – Recent Pronouncements

In December 2010, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2010-28, When to Perform Step 2 of the Goodwill Impairment Test for Reporting Units with Zero or Negative Carrying Amounts (Topic 350)—Intangibles—Goodwill and Other (ASU 2010-28). ASU 2010-28 amends the criteria for performing Step 2 of the goodwill impairment test for reporting units with zero or negative carrying amounts and requires performing Step 2 if qualitative factors indicate that it is more likely than not that a goodwill impairment exists. Any impairment to be recorded upon adoption will be recognized as an adjustment to our beginning retained earnings. We are currently evaluating the impact of the pending adoption of ASU 2010-28 on our consolidated financial statements.

In August 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) No. 2010-22 regarding “Accounting for Various Topics – Technical Corrections to SEC Paragraphs.” This ASU amends various SEC paragraphs based on external comments received and the issuance of FASB’s Staff Accounting Bulletin (“SAB”) 112, which amends or rescinds portions of certain SAB topics.

In August 2010, the FASB issued ASU No. 2010-21 regarding “Accounting for Technical Amendments to Various SEC Rules and Schedules.” This ASU amends various SEC paragraphs pursuant to the issuance of Release No. 33-9026: “Technical Amendments to Rules, Forms, Schedules and Codification of Financial Reporting Policies,” which amends various SEC paragraphs based on external comments received and the issuance of SAB 112, which amends or rescinds portions of certain SAB topics.

In April 2010, the FASB issued ASU No. 2010-18 regarding improving comparability by eliminating diversity in practice about the treatment of modifications of loans accounted for within pools under Subtopic 310-30–Receivable–Loans and Debt Securities Acquired with Deteriorated Credit Quality (“Subtopic 310-30”). Furthermore, the amendments clarify guidance about maintaining the integrity of a pool as the unit of accounting for acquired loans with credit deterioration. Loans accounted for individually under Subtopic 310-30 continue to be subject to the troubled debt restructuring accounting provisions within Subtopic 310-40, “Receivables—Troubled Debt Restructurings by Creditors.” The amendments in this update are effective for modifications of loans accounted for within pools under Subtopic 310-30 occurring in the first interim or annual fiscal period ending on or after July 15, 2010. The amendments are to be applied prospectively. Early adoption is permitted. We are currently evaluating the impact of this ASU; however, we do not expect the adoption of this ASU to have a material impact on our consolidated financial statements.

In April 2010, the FASB issued ASU No. 2010-13 regarding the classification of an employee share-based payment award with an exercise price denominated in the currency of a market in which the underlying equity security trades. FASB Accounting Standards Codification™ Topic 718, “Compensation—Stock Compensation,” provides guidance on the classification of a share-based payment award as either equity or a liability. A share-based payment award that contains a condition that is not a market, performance or service condition is required to be classified as a liability. Under Topic 718, awards of equity share options granted to an employee of an entity’s foreign operation that provide a fixed exercise price denominated in (1) the foreign operation’s functional currency or (2) the currency in which the employee’s pay is denominated should not be considered to contain a condition that is not a market, performance, or service condition. However, GAAP does not specify whether a share-based payment award with an exercise price denominated in the currency of a market in which the underlying equity security trades has a market, performance or service condition. Diversity in practice has developed on the interpretation of whether such an award should be classified as a liability when the exercise price is not denominated in either the foreign operation’s functional currency or the currency in which the employee’s pay is denominated. This update provides amendments to Topic 718 to clarify that an employee share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity securities trades should not be considered to contain a condition that is not a market, performance, or service condition. Therefore, an entity would not classify such an award as a liability if it otherwise qualifies as equity. We are currently evaluating the impact of this ASU; however, we do not expect the adoption of this ASU to have a material impact on our consolidated financial statements.

14

Table of Contents

In February 2010, the FASB issued ASU No. 2010-09 regarding subsequent events and amendments to certain recognition and disclosure requirements. Under this ASU, a public company that is a SEC filer, as defined, is not required to disclose the date through which subsequent events have been evaluated. This ASU is effective upon the issuance of this ASU. The adoption of this ASU did not have a material impact on our consolidated financial statements.

In January 2010, the FASB issued ASU 2010-6, which amends existing disclosure requirements about fair value measurements by adding required disclosures about items transferring into and out of levels 1 and 2 in the fair value hierarchy; adding separate disclosures about purchase, sales, issuances, and settlements relative to level 3 measurements; and clarifying, among other things, the existing fair value disclosures about the level of disaggregation. ASU 2010-6 is effective for fiscal years beginning after December 15, 2009. The adoption of this ASU has not had an impact on our consolidated financial statements.

In September 2009, the FASB issued ASU No. 2009-12 – Fair Value Measurements and Disclosures (Topic 820) – Investments in Certain Entities That Calculate Net Asset Value per Share (or its equivalent). This ASU permits use of a practical expedient, with appropriate disclosures, when measuring the fair value of an alternative investment that does not have a readily determinable fair value. ASU No. 2009-12 is effective for interim and annual fiscal periods ending after December 15, 2009, with early application permitted. Since the Company does not currently have any such investments, it does not anticipate any impact on its financial statements upon adoption.

Note 6 – Accounts Receivable, net

We have accounts receivable from distributors and customers for application and set up fees and for sales of security tokens, blank cards and other miscellaneous transactions. During the six months ended February 28, 2011, we have written off $1,451 of these receivables.

As of February 28, 2011, there is no allowance for our accounts receivable.

As cardholder accounts may become overdrawn if service fees or other charges exceed the available funds in a cardholder’s account; merchants may issue chargebacks or fraudulent transactions may occur, we have reserved $12,460 for overdrawn cards, which is presented as a reduction to accounts receivable and as a charge to bad debt expense.

Note 7 – Property and Equipment

Property and equipment consisted of the following at February 28, 2011 and August 31, 2010:

| February 28, 2011 | August 31, 2010 | |||||||

| Category |

||||||||

| Computer equipment |

$ | 88,287 | $ | 88,159 | ||||

| Software |

58,336 | 57,834 | ||||||

| Furniture |

11,882 | 9,211 | ||||||

| Other equipment |

4,117 | 4,117 | ||||||

| Leasehold improvement |

16,680 | 16,680 | ||||||

| Vehicle |

38,584 | — | ||||||

| 217,886 | 176,001 | |||||||

| Less accumulated depreciation |

(125,942 | ) | (98,997 | ) | ||||

| Fixed assets, net |

$ | 91,944 | $ | 77,004 | ||||

15

Table of Contents

During the three months ended February 28, 2011 and 2010, we recognized depreciation expense of $13,305 and $10,054, respectively.

During the six months ended February 28, 2011 and 2010, we recognized depreciation expense of $25,582 and $21,992, respectively.

Note 8 – Intangible Asset

The Company has the following intangible asset as of February 28, 2011:

| Intangible Asset | Estimated Useful Lives (Years) |

Cost | Accumulated Amortization |

Net Value | ||||||||||||||||||||||||

| Software license |

7 | $ | 1,648,263 | $ | 529,796 | $ | 1,118,467 | |||||||||||||||||||||

As we began generating revenue in December 2008, we also began amortizing the license over its expected life of seven years. Estimated amortization expense for the license for the next five years is as follows:

| Year Ending August 31, |

Amount | |||

| 2011 |

$ | 235,464 | ||

| 2012 |

235,464 | |||

| 2013 |

235,464 | |||

| 2014 |

235,464 | |||

| 2015 |

58,879 | |||

The Company’s intangible asset as of August 31, 2010 was as follows:

| Intangible Asset | Estimated Useful Lives (Years) |

Cost | Accumulated Amortization |

Net Value | ||||||||||||||||||||||||

| Software license |

7 | $ | 1,648,263 | $ | 412,064 | $ | 1,236,199 | |||||||||||||||||||||

During the three months ended February 28, 2011 and 2010, we recognized amortization expense of $58,866 and $58,831, respectively.

During the six months ended February 28, 2011 and 2010, we recognized amortization expense of $117,732 and $117,730, respectively.

Note 9 – Deposits

We have various deposits of approximately $34,916 held by third parties for security deposits on our offices and certain utilities. As these deposits are not due to be returned to us within the next twelve months, they are presented as a long-term asset.

Note 10 – Restricted Cash

Pursuant to agreements with Mercantile Bank Ltd., our sponsor bank, we maintain a deposit of restricted cash on account. This amount is expected to increase as our volume increases. Additionally, we maintain a reserve of restricted cash for potential chargebacks, overdrawn account balances and other adjustments. The restricted cash is reflected in non-current assets on the condensed consolidated balance sheets. Restricted cash was $92,053 at February 28, 2011 and $35,022 at August 31, 2010.

16

Table of Contents

Note 11 – Significant Revenue Concentrations

Currently, the Company has a significant concentration of revenue attributable to one client, Adcorp.

For the six months ended February 28, 2011, revenue from Adcorp represents approximately 67.0% of our revenue. No other customer accounted for more than 8% of revenue.

For the six months ended February 28, 2010, the customers of three distributors were responsible for approximately $129,000, or 77.2%, of total revenue: ProCard’s revenue was approximately $63,000, or 37.7% of total revenue; Australis’ revenue was approximately $46,000, or 27.5% of total revenue; and revenue from Exchange 4 Free was approximately $20,000, or 12.0% of total revenue.

Note 12 – Related Party Transactions

In October 2010 and January 2011 we sold shares of our common stock and warrants to purchase shares of our common stock to Sherington Holdings, LLC. Raymond Goldsmith, our Chairman and Chief Executive Officer, is the sole member of Sherington Holdings, LLC.

Details of the sales are more fully described in Note 14 – Equity Transactions.

Other Expenses

As of February 28, 2011, we owe approximately $98,000 to related parties. We have accrued approximately $41,000 for travel and other miscellaneous expenses we incurred and owe to Sherington. We also accrued approximately $7,000 for reimbursement of travel expenses incurred by an employee and a director.

Additionally, we have accrued for a $50,000 equity-based payment as a result of a settlement agreement with a former consultant.

As of August 31, 2010, we owe approximately $204,000 to related parties. We had accrued approximately $110,000 for consulting fees payable to Mike Dodak and David Fann, $42,000 for travel, legal and other miscellaneous expenses we incurred, and owe to Sherington, $16,000 payable to a director and $36,000 payable to employees for unreimbursed travel and miscellaneous expenses.

Note 13 – Commitments and Obligations

Consulting Services

As a condition to the October 2008 Sherington Agreement closing, Michael Dodak, the former CEO, and David Fann, the former President, agreed that their employment agreements would be converted to Consulting Agreements effective December 5, 2008 for Mr. Dodak and February 1, 2009 for Mr. Fann. Each agreement was for a monthly fee of $10,000. However, in conjunction with other cost-cutting measures initiated by the Company during the last fiscal year, September 1, 2009 through August 31, 2010, and to contribute toward improving cash flow, Mr. Dodak and Mr. Fann agreed to defer a portion of their fees through September 30, 2010.

During September 2010, the Company paid a total of $8,500 toward the deferred amount. In early November 2010, the Company entered into settlement agreements with both Mr. Dodak and Mr. Fann. The agreements stipulated an immediate payment of $30,000 to each, with a remaining value of $100,000 due to both to be paid in common stock of the Company. The Company recognized $200,000 of equity-based consulting expense and reduced the related combined liability reflected on its balance sheet of $301,000 to $200,000.

In November 2010, both consultants were issued cash payments of $30,000.

In December 2010, pursuant to the agreement, Mr. Fann was issued 571,429 shares of stock valued at $100,000.

Mr. Dodak agreed to the receipt of the $100,000 of stock in four tranches of $25,000. Per the terms of the agreement, the first tranche is to be issued based upon a stock price of $0.175 and the number of shares to be issued to settle the three remaining $25,000 tranches is to be calculated based on the lesser of $0.175 or the average trading price of the Company’s shares of common stock for the ten trading days prior to the date of the issuance.

17

Table of Contents

The first tranche of 142,857 shares, valued at $0.175 was issued January 4, 2011 and the second tranche of 162,338 shares, valued at $0.154 was issued February 1, 2011.

The third tranche of $25,000 is scheduled for issuance between April 1, 2011 and May 16, 2011 and the final tranche scheduled to be issued between July 1, 2011 and August 15, 2011. However, the actual issuances will coincide with the closing of the remaining two tranches agreed to in the Sherington Commitment Agreement.

As the quantity of shares to be issued for the remaining $50,000 of Mr. Dodak’s settlement is dependent upon the trading price at the time of issuance, at the end of each fiscal quarter, we will review the 10-day average trading price of the stock to determine if a non-cash premium or discount must be recognized. On November 30, 2010, the average trading price of the stock for the 10 trading days prior was $0.19. The $75,000 payable to Mr. Dodak at that time was multiplied by $0.015 (the difference between $0.19 and $0.175), which was recognized as a non-cash discount of $6,400.

As of February 28, 2011, the average trading price of the stock for the 10 trading days prior was less than the maximum price of $0.175. Having previously recognized $6,400 of non-cash discount expense, we reversed this expense in its entirety.

Leases

We have the following lease arrangements:

| • | We paid a deposit of $5,770 and signed a lease agreement for its Jacksonville Florida office on an 18-month basis starting August 1, 2009 and continuing through December 31, 2010. We renewed the lease as of February 1, 2011 for one year. For the six months ended February 28, 2011, we recognized $13,790 for lease and lease-related expense for the corporate office. |

| • | Our South Africa operations paid a deposit of approximately $17,500 and signed a five-year lease agreement starting April 1, 2009 and continuing through March 31, 2014. The current monthly lease amount (adjusted for utilities) is approximately $4,000, subject to the foreign exchange rate. We recognized $33,132 for lease and utilities expense during the six months ended February 28, 2011. |

| • | Our South Africa operations also entered into a three-year lease, effective October 2008, for its dedicated data hosting solution, which is located in a fully secured data center. The monthly cost of the lease is approximately $11,750, subject to the foreign exchange rate. For the six months ended February 28, 2011, we recognized $79,811 for lease expense for the hosting facilities. |

| • | Our South Africa operations also entered into a one-year lease, effective October 1, 2010 for a rental house for Robert Klein during his stay in South Africa. The monthly cost of the lease is approximately $5,300, subject to the foreign exchange rate. For the six months ended February 28, 2011, we recognized $25,267 for lease expense for the house. |

Our approximate remaining lease obligations under the current leases are as follows:

| Fiscal 2011 |

$ | 165,000 | ||

| Fiscal 2012 |

186,000 | |||

| Fiscal 2013 |

100,000 | |||

| Fiscal 2014 |

52,000 | |||

| Total |

$ | 503,000 | ||

Royalties

As part of the GCC Software License Agreement (the “License”) with World Processing, Ltd., royalties are to be paid at varying rates as various threshold quantities of transactions are achieved. These thresholds are to be considered in the aggregate with respect to all financial transactions that utilize the GCC software and will not be deemed an annual threshold or a threshold calculated on a per location basis. Accordingly, once royalties of $20,000 have been paid on the first million financial transactions, the Company will pay royalties of $60,000 for the next four million financial transactions; $50,000 for the next five million financial transactions; $200,000 for the next forty million transactions; and $2,500 for each million transactions thereafter. For the six months ended February 28, 2011, the Company accrued approximately $11,300 for royalty expense. Since inception, the total royalty expense incurred is approximately $15,500.

18

Table of Contents

Employment Agreements

On July 14, 2010, the Company and Joseph McGuire, its Chief Accounting Officer, entered into a revised employment agreement for a one-year term with a salary of $120,250.

If Mr. McGuire’s employment with the Company is terminated by the Company without cause at any time prior July 17, 2011, Mr. McGuire shall receive from the Company severance pay in an amount equal to the greater of (i) his then-current base compensation in effect at the time of such termination through either September 30, 2011 or (ii) twelve months from the date of notice, all unpaid benefits such as accrued vacation and all outstanding expenses and any declared but unpaid annual bonus. If Mr. McGuire’s employment with the Company is terminated by the Company by virtue of the expiration of the McGuire Agreement on July 17, 2011, Mr. McGuire shall be entitled to continue to receive from the Company the balance of his salary still owed to him in accordance with the Company’s general payroll practices as well as any declared but unpaid annual bonus

On August 30, 2010, the Company and Robert Klein entered into a Contract of Employment whereby Mr. Klein agreed to serve as the Chief Executive Officer, South Africa commencing September 1, 2010 through December 31, 2011. The Company agreed to pay Mr. Klein an annual salary of $200,000 as well as to provide Mr. Klein with standard benefits.

Note 14 – Equity Transactions

Sales of Unregistered Common Stock

October 2010 Financing with Sherington - On October 19, 2010, to obtain funding for the development of the business, the Company entered into a private placement subscription agreement (the “Sherington October 2010 Subscription Agreement”) with Sherington Holdings, LLC pursuant to which Sherington purchased 5,638,890 shares of common stock (the “Sherington October 2010 Shares”) at a purchase price of $0.175 per share and a warrant to purchase 5,638,890 shares of common stock (the “Sherington October 2010 Warrant”) for aggregate gross proceeds of $986,806.

The Sherington October 2010 Warrant is exercisable for a period of two years from the date of issuance (the “Exercise Period”) at an initial exercise price of $0.175 per share. The exercise price of the Sherington October 2010 Warrant is subject to full ratchet and anti-dilution adjustment for subsequent lower price issuances by the Company, as well as customary adjustments provisions for stock splits, stock dividends, recapitalizations, etc.

Further, the Company issued to Sherington a Fifth Amended and Restated Warrant (the “Fifth Warrant”), amending the number of shares that Sherington is entitled to from 12,412,427 shares to 9,254,360 shares and recognizing an increased fully diluted interest in the Company from 49.98% to 55.21%. The Fifth Warrant provides that Sherington is entitled to purchase from the Company an aggregate of 9,254,360 shares of common stock of the Company at a price equal to $0.175 per share through December 31, 2013. Notwithstanding the foregoing, the Fifth Warrant shall only be exercisable so that Sherington may maintain its fully-diluted percentage interest in the Company of 55.21% and is only exercisable by Sherington if and when there has occurred a full or partial exercise of any derivative securities of the Company outstanding as of July 1, 2009 (but excluding the securities held by Sherington), the 4,000,000 warrants issued to Bank Julius Baer & Co. Ltd. and the 1,000,000 warrants issued to Mr. Besuchet. The exercise price of the Fifth Warrant is subject to full ratchet and anti-dilution adjustment for subsequent lower price issuances by the Company, as well as customary adjustments, provisions for stock splits, stock dividends, recapitalizations, etc.

Contemporaneously with the execution and delivery of the Sherington October 2010 Subscription Agreement, the Company and Sherington entered into Amendment No. 6 to the Registration Rights Agreement dated January 6, 2009 (the “Sixth Amendment”) whereby the Company expanded the definition of Shares (as defined in the Sixth Amendment) to include, among other things, the Sherington October 2010 Shares and the shares issuable upon the exercise of the Sherington October 2010 Warrant.

19

Table of Contents

Furthermore, with the execution and delivery of the Sherington October 2010 Subscription Agreement, the Company and Sherington entered into a Commitment Agreement (the “Commitment Agreement”) dated October 19, 2010. Pursuant to the Commitment Agreement, the Company agreed to sell and Sherington agreed to commit to purchase a prescribed pro rata portion of common stock of the Company in a private placement. The Company plans to offer shares of the Company’s common stock in four tranches, the first tranche (“Tranche 1”) closed on October 19, 2010 and three additional tranches to generate proceeds of $500,000 each are to close in January 2011, April 2011 and July 2011. In addition, in the event that the aggregate funds received from accepted subscriptions of any tranche is less than the applicable tranche cap, Sherington agreed to purchase shares in an aggregate principal amount equal to, and for an aggregate purchase price of, Sherington’s call amount, as defined in the Commitment Agreement.

October 2010 Financing with Accredited Investors – Also on October 19, 2010, the Company entered into a private placement subscription agreement (the “October 2010 Subscription Agreement”) with accredited investors (the “October 2010 Investors”) pursuant to which the October 2010 Investors purchased, in the aggregate, 75,396 shares (the “Purchased Shares”) of the Company’s common stock at a purchase price of $0.175 per share and a warrant, to purchase, in the aggregate, 75,396 shares of common stock (the “October 2010 Warrant”) for aggregate gross proceeds of $13,194. The October 2010 Investors included Raymond Goldsmith, our Chairman and Chief Executive Officer.

The October 2010 Warrant is exercisable for a period of two years from the date of issuance at an initial exercise price of $0.175 per share. The exercise price of the October 2010 Warrant is subject to full ratchet and anti-dilution adjustment for subsequent lower price issuances by the Company, as well as customary adjustments provisions for stock splits, stock dividends, recapitalizations, etc.

The securities were offered and sold to the investors in a private placement transaction made in reliance upon exemptions from registration pursuant to Section 4(2) under the Securities Act of 1933 and Rule 506 promulgated under Regulation D thereunder. The October 2010 Investors are accredited investors as defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933.

January 2011 Financing with Sherington – On January 24, 2011, to obtain funding for the development of the business, we sold to Sherington Holdings, LLC, at a $0.154 per share purchase price, 3,246,754 shares of common stock, $0.001 par value (the “Sherington January 2011 Shares”) and related common stock purchase warrants to acquire 3,246,754 shares of common stock (the “Sherington 2011 Warrants”) at an exercise price of $0.308 representing gross proceeds of $500,000 as more fully detailed below. This funding was provided pursuant to the Commitment Agreement dated October 19, 2010 whereby we agreed to sell and Sherington agreed to commit to purchase a prescribed pro rata portion of our common stock in a private placement. We expect to offer shares of our common stock in four tranches. The first tranche closed on October 19, 2010, the second tranche closed on January 24, 2011 and two additional tranches to generate proceeds of $500,000 each are to close in March and May 2011.

The Sherington January 2011 Warrant is exercisable for a period of two years from the date of issuance at an initial exercise price of $0.308 per share. The exercise price of the Sherington January 2011 Warrant is subject to full ratchet and anti-dilution adjustment for subsequent lower price issuances by the Company, as well as customary adjustments, provisions for stock splits, stock dividends, recapitalizations, etc.

The Company also issued to Sherington a Sixth Amended and Restated Warrant (the “Sixth Warrant”), amending the number of shares that Sherington is entitled to from 9,254,360 shares to 13,156,920 shares and also recognizing an increased interest in the Company from 55.21% to 57.42%. The Sixth Warrant provides that Sherington is entitled to purchase from the Company an aggregate of 13,156,920 shares of common stock of the Company at a price equal to $0.154 per share through December 31, 2013. Notwithstanding the foregoing, the Sixth Warrant shall only be exercisable so that Sherington may maintain its percentage interest in the Company of approximately 57.42% and is only exercisable by Sherington if and when there has occurred a full or partial exercise of any derivative securities of the Company outstanding as of July 1, 2009 (but excluding the securities held by Sherington), the 4,000,000 warrants issued to Bank Julius Baer & Co. Ltd. and the 1,000,000 warrants issued to Mr. Besuchet. The exercise price of the Sixth Warrant is subject to full ratchet and anti-dilution adjustment for subsequent lower price issuances by the Company, as well as customary adjustments, provisions for stock splits, stock dividends, recapitalizations, etc.

20

Table of Contents

The Company and Sherington also entered into Amendment No. 7 to the Registration Rights Agreement dated January 24, 2011 (the “Seventh Amendment”) whereby the definition of Shares (as defined in the Sixth Amendment) was expanded to include, among other things, the Sherington January 2011 Shares and the shares issuable upon the exercise of the Sherington January 2011 Warrant.

These securities were offered and sold to Sherington in a private placement transaction made in reliance upon exemptions from registration pursuant to Section 4(2) under the Securities Act of 1933 and Rule 506 promulgated under Regulation D thereunder. Sherington is an accredited investor as defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933.

Stock Options

During the three and six months ended February 28, 2011 we recognized approximately $6,600 and $12,900 of expense related to vested options. At February 28, 2011, the Company has 5,755,159 outstanding options as detailed below:

| Quantity |

% Vested | Exercise Price/Range | Expiration Date/Range | |||||||||

| 3,500,000 | 100 | % | $0.26 | June 2014 | ||||||||

| 550,000 | 100 | % | $0.20 | July 2015 | ||||||||

| 500,000 | 50 | % | $0.29 | July 2014 | ||||||||

| 500,000 | 67 | % | $0.39 | July 2013 | ||||||||

| 500,000 | 100 | % | $0.40 | October 2013 | ||||||||

| 90,000 | 33 | % | $0.40 | January 2014 | ||||||||

| 120,159 | 33 | % | $0.40 - $0.45 | September 2013 to January 2014 | ||||||||

| 45,000 | 33 | % | $0.745 | October 2013 | ||||||||

| 5,755,159 | ||||||||||||

Stock Warrants

As of February 28, 2011, the Company has 40,038,184 outstanding warrants and 13,156,920 potential anti-dilutive warrants.

| Quantity |

Exercise Price/Range | Expiration Date Range | ||||||

| 5,714,286 | $0.20 to $0.25 | December 2010 to July 2011 | ||||||

| 11,791,428 | $0.175 | October 2011 to November 2011 | ||||||

| 18,285,716 | $0.175 to $0.25 | April 2012 to Oct 2012 | ||||||

| 3,246,754 | $0.308 | January 2013 | ||||||

| 1,000,000 | $0.20 | June 2013 | ||||||

| 40,038,184 | Sub-total of outstanding warrants | |||||||

| 13,156,920 | $0.154 | Potential anti-dilutive Sherington warrant | ||||||

| 53,195,104 | Total outstanding and potential warrants | |||||||

Note 15 – Subsequent Events