Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT UNDER THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2010

Commission File No. 333-167964

CHINA SHOUGUAN MINING CORPORATION

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

27-2513824

(IRS Employer Identification No.)

6009 Yitian Road

New World Center Rm. 3207

Futian District, Shenzhen

People’s Republic of China

Telephone 0086-755-82520008

Facsimile 0086-755-82520156

(Address and telephone number of registrant’s principal executive offices)

__________________________

Law Office of Michael M. Kessler, P.C.

4900 Paloma Avenue

Carmichael, CA 95608

Telephone (916) 248-3666

Facsimile (916) 517-1449

(Name, address and telephone number of agent for service)

__________________________

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Issuer's revenues for the year ended were $6,452,491.

As of December 31, 2010, there were 100,000,000 shares of our common stock issued and outstanding. Our common stock is not currently listed and trading on any exchange. The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the $0.0001 par value price per share paid for the shares is approximately $5,918.

DOCUMENTS INCORPORATED BY REFERENCE

Some exhibits required to be filed hereunder, are incorporated herein by reference to our original Form S-1 Registration Statement, filed under CIK No 0001493893 on July 1, 2010, and in amendments filed thereafter, on the SEC website at www.sec.gov.

TABLE OF CONTENTS

|

PART I

|

|||

|

ITEM 1.

|

Business

|

1 | |

|

ITEM 1A.

|

Risk Factors

|

7 | |

|

ITEM 1B.

|

Unresolved Staff Comments

|

14 | |

|

ITEM 2.

|

Properties

|

14 | |

|

ITEM 3.

|

Legal Proceedings

|

14 | |

|

ITEM 4.

|

(Removed and Reserved)

|

14 | |

|

PART II

|

|||

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

15 | |

|

ITEM 6.

|

Selected Financial Data

|

15 | |

|

ITEM 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

15 | |

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

26 | |

|

ITEM 8.

|

Financial Statements

|

28 | |

|

ITEM 9.

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

28 | |

|

ITEM 9A(T).

|

Controls and Procedures

|

28 | |

|

ITEM 9B.

|

Other Information

|

29 | |

|

PART III

|

|||

|

ITEM 10.

|

Directors and Executive Officers and Corporate Governance

|

29 | |

|

ITEM 11.

|

Executive Compensation

|

31 | |

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

34 | |

|

ITEM 13.

|

Certain Relationships and Related Transactions and Director Independence

|

35 | |

|

ITEM 14.

|

Principal Accountant Fees and Services

|

35 | |

|

PART IV

|

|||

|

ITEM 15

|

Exhibits, Financial Statement Schedules

|

36 | |

|

SIGNATURES

|

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These statements relate to future events or our future financial performance. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue," the negative of such terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any otherperson assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no duty to update any of the forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

Readers are also urged to carefully review and consider the various disclosures made by us which attempt to advise interested parties of the factors which affect our business, including without limitation the disclosures made in PART I. ITEM 1A:. Risk Factors and PART II. ITEM 6 "Management's Discussion and Analysis or Plan of Operation" included herein.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports that we file with the U.S. Securities and Exchange Commission (SEC) are available at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

PART I.

Item 1. Business

Overview

China ShouGuan Mining Corporation (“ShouGuan”, “we” and the “Company”) was incorporated in the State of Nevada on May 4, 2010. We are a holding company that conducts business operations in Shandong Province in the People’s Republic of China (PRC). On June 23, 2010, we entered into a stock exchange transaction with the shareholders of Bei Sheng Limited (“BSL”), whereby we issued 100,000,000 shares of common stock in exchange for 100% of the ownership interest in BSL, for the purpose of re-domiciling BSL as a Nevada corporation in the United States. These shares were issued as restricted securities under SEC Rule 144. As a result of the share exchange transaction, BSL became our wholly-owned operating subsidiary in the PRC. Unless otherwise indicated, all references to the Company throughout this annual report include the operations of BSL and its subsidiaries and variable interest entities (“VIEs”).

We were founded by a number of business professionals and experts in China who specialize in mining technologies, mining resources management and financial and strategic management. Our primary focus is on acquiring existing gold mine in Shandong province of the PRC. These potential targets are mostly run with low productivity because of inadequate funds and primitive technologies. We plan to re-engineer and redevelop these gold mines through the transfer of advanced exploration and mining technologies, capital injection and effective management.

Our business model includes sourcing of early stage gold mines with good profit potential, conducting feasibility studies to identify suitable projects, leasing the suitable mining sites and facilities and managing the mining operations on these selected sites, with the goal of acquiring the mine if the operations prove to be satisfactory based on the review criteria set by our experienced management. In addition, we also provide consulting services in areas related to mine exploration and analysis to our clients on a project-by-project basis.

Revenues are derived from the sales of gold concentrates, the principal raw material used in gold smelting operation to produce gold. All mining operations are outsourced to Jinhai Mine Underground Engineering Ltd., an independent third-party subcontractor, and we only take possession of the gold concentrates when they are sold to smelters. At that time, the selling prices are determined from two factors, the amount of gold in the gold concentrates and the price of gold on the date of sale. The amount of gold in the gold concentrates is determined and agreed upon between the Company and the smelters and then the selling price is determined according to the official gold price at the time of sale as indicated by the Shanghai Gold Exchange (http://www.sge.sh), an entity governed by the PRC Government). On the consulting side, revenues are derived on a project-by-project basis and payment is collected as we complete our service as outlined in the scope of each individual project.

We target to grow proactively through continual sourcing of existing gold mines in the PRC and managing them. These projects will be executed by BSL and its VIEs. Cunli Ji Gold Mine was the first project commenced in May 2009. To ensure all mines are legally and properly operated, all target gold mines are required to have full sets of government-approved licenses before effecting commencement of any business operations.

On December 28, 2010, our initial public offering document, registered with the SEC on Form S-1, became effective. We are currently attempting to sell a total of 1,000,000 shares of our common stock at a price of $0.50 per share to raise a total of $500,000. As of the date of the filing of this annual report, we had not yet sold any shares. We have not engaged the services of an underwriter, but rather, our officers and directors are attempting to sell the shares to friends, business associates and family members. The offering is being conducted on an all-or-none basis, which means we have to sell all of the shares before we can use any of the funds, which will be held in a separate bank account until the offering is sold out or closed. There is no assurance we will be able to sell any or all of the shares. If we are successful in selling all of the shares being offered, the proceeds will be used to acquire other properties and to generally grow our business. We do not intend to use any funds from the sale of the shares in our initial public offering in our current business operations. For more detailed information regarding the shares being offered and the use of the proceeds, please see our final Form S-1/A registration statement, filed on the SEC website on December 14, 2010 and is incorporated herein by this reference.

Corporate History and Structure

China ShouGuan Mining Corporation was incorporated in the State of Nevada on May 4, 2010. On May 27, 2010, Harry Orfanos, our original director and incorporator in the State of Nevada, resigned as our President and Chief Executive Officer and the Board of Directors appointed Mr. Feize Zhang to serve as our President,Treasurer, Chief Executive Officer and Director, Mr. Ming Cheung as Secretary, Chief Financial Officer and Director and Mr.Jingfeng Lv as Chief Technical Officer.

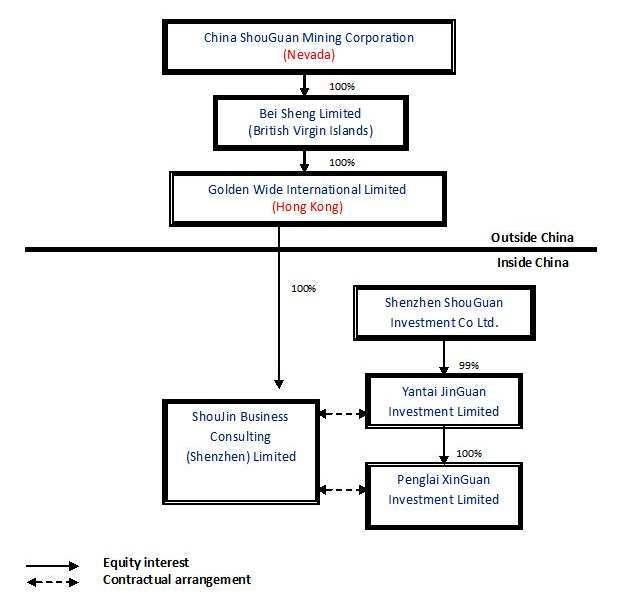

On June 23, 2010, we entered into a stock exchange transaction with the shareholders of Bei Sheng Limited (“BSL”), whereby we issued 100,000,000 shares of common stock in exchange for 100% of the ownership interest in BSL, for the purpose of re-domiciling BSL as a Nevada corporation in the United States. These shares were issued as restricted securities under SEC Rule 144. As a result of the merger, BSL became our wholly-owned operating subsidiary in the PRC.BSL was incorporated in the British Virgin Islands on December 17, 2009 as a limited liability company for the purpose of holding 100% equity interest in Golden Wide International Limited (“GWIL”).

GWIL was incorporated in the Hong Kong Special Administrative Region (“Hong Kong”) on June 18, 2009 as a limited liability company. GWIL formed Shoujin Business Consulting (Shenzhen) Limited (“SBCL”) as a wholly foreign-owned enterprise under the laws of the PRC on April 23, 2010. SBCL is principally engaged in the business of providing consulting services in the PRC.

Shenzhen Shouguan Investment Co., Ltd (“SSIC”) is an investment holding company established in Shenzhen, on December 1, 2008. It is 70% owned by Mr. Feize Zhang, our Chairman and CEO, 20% owned by Mr. Jingfeng Lv, our Chief Technical Officer, and 10% owned by Mr. Jianxi Yang, a director of Yantai JinGuan Investment Limited, SSIC’s subsidiary.

1

Yantai JinGuan Investment Limited (“JinGuan”) was incorporated in Yantai, the PRC and is a subsidiary held 99% by SSIC.

Penglai XinGuan Investment Limited (“XinGuan”) was incorporated in Penglai, the PRC and is the wholly-owned subsidiary of JinGuan. XinGuan houses our licenses and operations in Penglai, the PRC.

The following diagram illustrates our current corporate structure:

To satisfy the investment restrictions in the PRC mining business, the Company, through SBCL entered into and consummated certain contractual arrangements with SSIC, JinGuan and XinGuan. As a result of these contractual arrangements, which obligates SBCL to absorb the risk of loss from the activities of SSIC, JinGuan and XinGuan ,and enables SBCL to receive all of its expected residual returns, we account for SSIC, JinGuan and XinGuan ,and their subsidiaries, as a variable interest entity (“VIE”) under U.S. GAAP and we consolidate their results in our consolidated financial statements.

Since the Company, BSL, GWIL, SBCL and its VIE arrangement as SSIC were under common control with the same ultimate beneficial owners, who are officers and directors of the Company, the re-domiciling transaction and VIE arrangement was accounted for as a transfer of entities under common control and all disclosures referencing business operations of our VIEs were made throughout this report as if the share exchange transaction had become effective as of the beginning of the first period presented, even though the Company was not yet incorporated in Nevada. As such, the Company, BSL and its subsidiaries and VIEs are hereinafter collectively referred to as the Company and all are consolidated in our financial statements.

Prior to acquisition of the Company shares, Mr. Zhang, Mr. Cheung and Mr. Lv were not affiliates of the Company. They were also not an affiliate of any of the Company’s shareholders.

2

Contractual Arrangements

Gold mining is a highly restricted industry in China. As such, it is extremely difficult for PRC gold mining companies to obtain government approval on having foreign ownership. Accordingly, BSL's PRC subsidiary, SBCL, which is considered foreign-invested, is currently ineligible to directly own the required exploration and mining licenses in China. Our exploration and mining business is currently provided through contractual arrangements with BSL and its VIEs in China, which are currently SSIC and its subsidiaries, JinGuan and XinGuan.

BSL's VIEs sell gold concentrates directly to our customers, which are typically the refinery plants in China. We have been and are expected to continue to be dependent on our VIEs to operate our exploration and mining business. SBCL has entered into contractual arrangements with our VIEs, which enable us to:

|

-

|

exercise effective control over the VIEs;

|

|

-

|

receive substantially all of the economic benefits from the VIEs; and

|

| - |

have an exclusive option to purchase all of the equity interests in the VIEs.

|

SBCL entered into a series of agreements (“VIE agreements”) amongst SSIC, JinGuan and XinGuan and the individual owners of SSIC, JinGuan and XinGuan and details of the VIE agreements are as follows:

|

1.

|

Exclusive Technical Service and Business Consulting Agreement, signed on May 15, 2010 - SBCL has the exclusive right to provide to SSIC, JinGuan and XinGuan, consulting services, including operational management, human resources management, research and development of the technologies related to the operations of SSIC, JinGuan and XinGuan. SSIC, JinGuan and XinGuan pay to SBCL annually consulting service fees in an amount equal to all of their revenue for such year. These agreements run for a 10-year term and are subject to automatic renewal for an additional 10 year term provided that no objection is made by both parties on the renewal.

|

|

2.

|

Exclusive Option Agreement - SBCL has the option to purchase all of the assets and ownership of SSIC, JinGuan and XinGuan at any time.

|

|

3.

|

Equity Pledge Agreement, signed on May 15, 2010 - SSIC, JinGuan and XinGuan agree to pledge their legal interests to SBCL as a security for the obligations under the Exclusive Technical Service and Business Consulting Agreement.

|

|

4.

|

Proxy Agreement - SSIC, JinGuan and XinGuan irrevocably grant and entrust SBCL the right to exercise its voting and other stockholder rights.

|

|

5.

|

Operating Agreement, signed on May 15, 2010 - SBCL agrees to participate in the operations of SSIC, JinGuan and XinGuan in different aspects.

|

With the above agreements, SBCL demonstrates its ability to control SSIC, JinGuan and XinGuan as the primary beneficiaries and the operating results of the VIEs were included in the consolidated financial statements.

XinGuan commenced operations on our first mining project, the Cunli Ji Gold Mine, in May 2009. XinGuan holds the operating right to Cunli Ji Gold Mine ("CJ Mine") with all regulatory and government operating licenses in China.

On May 4, 2009, the Company, through BSL and its VIE, XinGuan, entered into a Master Agreement, an Operating Lease Agreement and an Acquisition Agreement with Penglai City Gold Mining Holding Co. Limited (PCGM), an unrelated third party which is the legal owner and holds the PRC State license to the CunliJi Mine. The Master Agreement sets out the general terms of the Operating Lease Agreement and the Acquisition Agreement. Pursuant to the terms of the Operating Lease Agreement, XinGuan agrees to pay a monthly rent of $14,641 (RMB 100,000) for the right to lease and manage the gold mine for a term of 20 months, with a rental deposit of $2,925,174 (RMB 20 million). Pursuant to the terms of the Acquisition Agreement, XinGuan agrees to acquire the gold mine for a purchase consideration of $5,089,803 if the following conditions are satisfied upon the expiration of the Operating Lease Agreement: 1) average daily ore production from the CunliJi Mine has reached production of 80 tons of ore or more for the year 2010, and 2) the CunliJi mine has obtained ISO (or equivalent) certification on or before January 3, 2011. Upon successful closing of the acquisition, the rental deposit would become part of the purchase consideration. If the mining operations do not meet the above production levels, the rental deposit will be refunded in full to XinGuan.

3

On September 1, 2009, XinGuan entered into a Construction Project Agreement with Jinhai Mine Underground Engineering Ltd. ("Jinhai"), an unrelated third party, to carry out the underground mining and ancillary work at the CJ Mine. Jinhai will conduct all underground mining activities and construction work in accordance with the design and work drawings provided by XinGuan on a monthly basis and will be required to meet all regulatory and safety standards specified by XinGuan and the PRC for underground mining operations in the Shandong Province. The Agreement was effective on September 1, 2009 and was valid for one year. Through mutual consent by both parties, this Agreement was renewed on August 28, 2010 for an additional year until August 28, 2011, with the contracted prices and all other terms unchanged. No relationship exists between Jinhai, the subcontractor we rely on for all of our mining operations in the PRC, and Penglai City Gold Mining Holding Co. Limited, the legal owner and holder of the PRC State license to the CunliJi Mine; they are unrelated parties. On September 30, 2010, XinGuan and Jinhai mutually agreed to terminate the renewed agreement unconditionally effective from November 1, 2010. On October 1, 2010, XinGuan entered into another Construction Project Agreement with Wenzhou Mine Engineering Construction Group Co. Ltd. (“WMEC”), an unrelated third party, to carry out the underground mining and ancillary work at the CJ Mine. WMEC will conduct all underground mining activities and construction work in accordance with the design and work drawings provided by XinGuan on a monthly basis and will be required to meet all regulatory and safety standards specified by XinGuan and the PRC for underground mining operations in the Shandong Province. The Agreement was effective on October 1, 2010 and was valid for one year.

On June 18, 2010, XinGuan paid an additional amount of $1,309,679 to PCGM as an additional rental deposit on the same terms as the original agreement. The additional deposit would become part of the purchase consideration upon successful closing of the acquisition or will be refunded in full if the mining operations do not meet the production levels set forth in the agreement.

The following contractual agreements were entered into with unrelated third parties with regard to the operation of the CJ Mine:

|

1.

|

Master Agreement signed on May 4, 2009 between XinGuan and Penglai City Gold Mining Holding Co. Ltd. - Sets out the general terms of the Operating Lease Agreement and the Acquisition Agreement.

|

|

2.

|

Operating Lease Agreement signed on May 4, 2009 between XinGuan and Penglai City Gold Mining Holdings Co. Ltd. - XinGuan agreed to pay a monthly rent for the right to lease and manage the CJ Mine for a term of 20 months.

|

|

3.

|

Acquisition Agreement signed on May 4, 2009 between XinGuan and Penglai City Gold Mining Holding Co. Ltd. - XinGuan has the option to purchase the CJ Mine on or before January 3, 2011 if certain production and licensing conditions are met.

|

|

4.

|

Construction Project Agreement, renewed and new agreement signed on same terms and conditions for an additional one year period on August 28, 2010 between XinGuan and Jinhai Mine Underground Engineering Limited

|

|

5.

|

Gold Concentrate Processing Agreement, signed on July 1, 2009 between XinGuan and Shandong Humon Smelting Co., Ltd.

|

Current Mining Property and Location

Cunli Ji Gold Mine (“CJ Mine”)

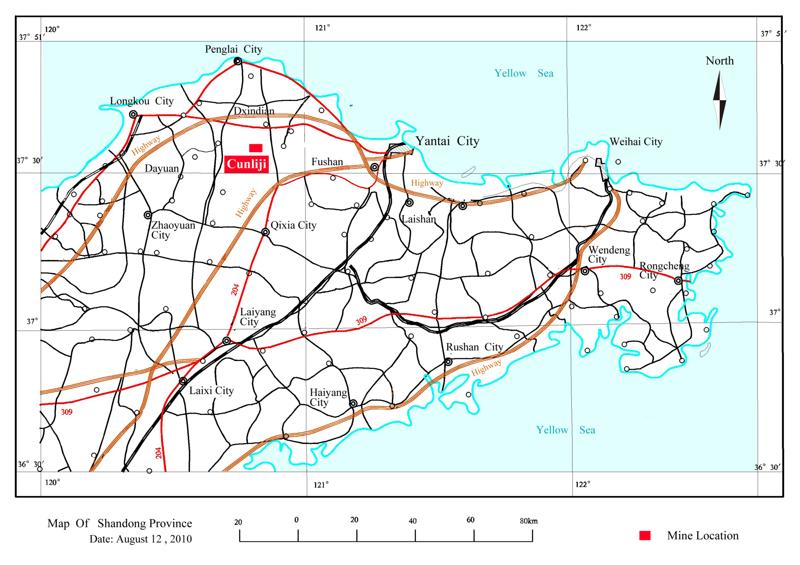

The Cunli Ji Gold Mine is located in Shandong is a coastal province of eastern PRC. Shandong is located on the eastern edge of the North China Plain (see map below). From the economic aspect, Shandong is one of the wealthiest provinces in China, with its economic development focuses on large enterprises with well-known brand names. Shandong ranks first among the provinces in the production of precious metals such as gold and diamonds. It is also the biggest industrial producer and one of the top manufacturing provinces in China. Shandong has also benefited from South Korean and Japanese investment, due to its geographical proximity to those countries. In 2008, the nominal GDP and GDP per capital for Shandong were RMB3.11 trillion (US$446 billion) and RMB33,083 (US$4,749) respectively, ranking second and seventh accordingly in the country. Penglai City is a port, a town and an administrative subdivision of Yantai, which Yantai is a prefecture-level city in Shandong province. Yantai is the largest fishing seaport in Shandong and a robust economic center today.

4

Mining Areas:

CJ Mine consists of three mining and exploration areas namely, Cunliji Mining Area (”Cunliji”), Jiyingshan Exploration Area (”Jiyingshan”) and Chenjiagou Exploration Area (”Chenjiagou”). The Cunliji Mining Area has an exploration right and a mining right while both Jiyingshang and Chenjiagou each has an exploration right. Geographically, Jiyingshan locates in the middle of the whole site; Chenjiagou on west to northwestern side; and Cunliji on the southeast side.

Location and Access:

The CJ Mine is an underground mine located in Cunliji Town, Penglai, Shandong Province in the PRC covering a site area of 0.425 sq. km. The geological coordinate of the mine is EL120°50′15″ ~ EL120°50′49″ and NL37°33′31″ ~ NL37°32′12″. The CJ Mine consists of three mining areas, 1) Cunliji Mining Area (“Cunliji”), 2) Jiyingshan Exploration Area (“Jiyingshan”) and 3) Chenjiagou Exploration Area (“Chenjiagou”). Jiyingshan locates roughly in the middle of the CJ Mine, Chenjiagou on the west–northwest region and Cunliji on the southeast region. The whole site is 35 km to the south of Penglai City, Shandong Province and 5 km to the east of Cunliji Town. It is under administrative division of Cunliji Town, Penglai City. There is 30 km from the west of the CJ Mine to Longkou Port and 60 km from the east of the CJ Mine to Yantai Port. The CJ Mine is easily accessible by interlinked highways including the Mou-Huang Highway (running from Mouping to Huang County) and the Peng-Qing Highway (running from Penglai to Qingdao). Access to the underground workings at the CJ Mine is via a ramp from the surface and connecting numerous levels.

5

Identifying Information of the CJ Mine:

Mining license No.: 3700000720179

Gold Mining Ratification: Gold - State Approval (2008) No.17

Exploration license No.: 3700000710963

Safety production license: (Shandong Approval) FM Safety (2008) 06-0104

Safety production license: (Shandong Approval) FM Safety (2008) 06-0187

Exploration Rights:

Exploration license No.: T37120080102000548

Exploration license No.: T37120080602009999

Area of the CJ Mine:

Cunliji Mining Area: 106.255 acres

Chenjiagou Exploration Area: 3995.69 acres

Jiyingshan Exploration Area: 437.90 acres

Work Completed and Present Conditions:

I) Cunliji Mining Area - The mine area consists of two parts, one is mining area from the elevation 0m to 100m, the other is prospecting area under 0m. Currently only the 4 ore bodies are mined.

II) Jiyingshan Exploration Area - The area is divided into 3 parts that are Jiyingshan, Dacuijia and Shangwangjia. Currently exploration just has been done in the ore lode of No.21 and No. 22 estimated resources in northern Jiyingshan occurrence, with thick and continuous ore bodies. The geological condition of the ore lode of No.23 is the completely same with that of 21 and 22, while its resources estimation has not been done for without engineering control.

III) Chenjiagou Exploration Area - It is the one with the lowest work degree among the mining areas of the CJ Mine. From the current geological work, several alteration zones have been found by geological mapping with light mountain project and exploration engineering. Several profiles have been done in the middle of the area by using the IP ladder from which a better potential has been found with a fine seeing- mine effect.

Equipment, Infrastructure and Other Facilities of the CJ Mine:

Mining equipment of the CJ Mine mainly includes exploration machinery, ore mining machinery and mineral processing machinery. The machinery includes drillers, belt conveyor, lift trucks, mining crusher, grinding mill, revolving screens, sand washer, etc. Site infrastructure includes roads, water supply system, electric supply system, warehouses, living quarters, dining facilities and an administration building.

Current State of Exploration

As of the date of this report, the CJ Mine property is without known reserves. For the fiscal year 2010, total mining production of the Cunliji Mine Area was approximately 36,579 tons of gold ore, or a monthly average of 3,480 tons, with an average gold grade of 4.54 grams per ton. Total ore processed and gold concentrate sold in 2010 were 1,591 tons and 100 kg, respectively. Metallurgical recovery rate of the Cunliji Mine Area to date in 2010 was approximately 90%. Both the Jiyingshan Exploration Area and the Chenjiagou Exploration Area are exploratory in nature. First stage geochemical surveys have been completed. We have no detailed plan to survey these properties at this time.

Our Proposed Business Strategy

Currently, most privately-owned gold mines in China are poorly managed and operated and are usually mined to a depth of about 300 - 500 meters, far beyond a valid exploration analysis of about 200~300 meters. Mining activities are generally done without any systematic planning and/or analysis. This often leads to high waste of mining inputs and results in inefficient operations with low productivity. We intend to re-engineer and redevelop our mining targets through the transfer of advanced exploration and mining technologies to identify the geological features and locations of the ore bodies, as well as the formation trends of associated mineral veins. We feel that the proposed business strategies of our experienced management team will provide a better solution to mine the ore bodies in a more efficient and productive way. Our mining solutions include mining data collection and analysis, identification of ore locations and running trends of veins, design of exploration and mining plans, on-site mine construction planning, formulation and customization of mining methodologies, introduction of modern exploration and mining technologies to increase productivity, supervision of subcontracting staff and provision of technical supports in relation to production management, mine ventilation, water discharge, system upgrade, quality assurance, safety control, etc. Our current mining operations subcontractor is only responsible for the actual underground mining works like digging tunnels, underground transportation and mine extraction, and does not participate in any works related to mine planning, data analysis, site identification and operational management.

6

Future potential mining projects

We target to grow proactively through continual sourcing of existing gold mines in the PRC and managing them. Before investing in a potential mining project, we intend to go through a series of procedures for preliminary assessment in order to determine the amount of minerals, if any, and therefore whether the subject property should be acquired, based on the economic viability of extracting the potential minerals and profitably processing them. To do so, we intend to engage geotechnical professionals to conduct such assessments and analyses.

Item 1A. Risk Factors

The following risk factors should be considered carefully in addition to the other information in this annual report.

RISKS ASSOCIATED WITH OUR COMPANY:

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Messrs. Feize Zhang, our principal executive officer, Ming Cheung, our principal financial officer and JingFeng Lv, our chief technical officer, have extensive contacts and experience in the gold exploration and natural resource industry in China and we are dependent upon their abilities and services to develop and market our business. They are responsible for overseeing all of our day-to-day business operations in the PRC of our operating company, BSL, and its subsidiaries and VIEs, including the mining operations and negotiations for the sales of any gold concentrates extracted. We may not be able to retain these executive officers/managers for any given period of time. The loss of their services could have a material adverse effect upon our business operations, financial condition and results of operations. In addition, we must attract, recruit and retain a sizeable workforce of technically competent employees in the PRC to run our mining operations. Our ability to effectively implement our proposed business strategies and expand our operations will depend upon the successful recruitment and retention of additional highly skilled and experienced management and other key personnel in the PRC. If we cannot maintain highly experienced and skilled management teams, our business could fail and you could lose any investment you make in our shares.

Since our business consists of managing gold mining projects, the drop in the price of gold would negatively impact our asset values, cash flows, potential revenues and profits.

We plan to pursue opportunities in properties with gold mineralized material or reserves with exploration potential. The price that we pay to lease these properties will be influenced, in large part, by the price of gold at the time of the leasing agreements. Our potential future revenues are expected to be derived from the production and sale of gold from these properties, or from the sale of some of these properties. The value of any gold reserves or other mineralized materials, and the value of any potential mineral production will vary in direct proportion to changes in those mineral prices. The price of gold has fluctuated widely as a result of numerous factors beyond our control. The effect of these factors on the price of gold and other minerals, and therefore the economic viability of any of our projects, cannot accurately be predicted. Any drop in the price of gold and other minerals we may produce would negatively affect our asset values, cash flows and potential revenues and profits.

Estimates of mineral reserves and of mineralized material are inherently forward-looking statements, subject to error, which could force us to curtail or cease our business operations.

Estimates of mineral reserves and of mineralized materials are inherently forward-looking statements subject to error. Unforeseen events and uncontrollable factors can have significant adverse impacts on the estimates. Actual conditions inherently differ from estimates. The unforeseen adverse events and uncontrollable factors may include: geologic uncertainties including inherent sample variability, metal price fluctuations, fuel price increases, variations in mining and processing parameters, and adverse changes in environmental or mining laws and regulations. The timing and effects of variances from estimated values cannot be predicted.

|

·

|

Geologic Uncertainty and Inherent Variability: Estimated reserves and additional mineralized materials are generally derived from appropriately spaced drilling to provide a high degree of assurance in the continuity of the mineralization, however, there is generally variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There are also unknown geologic details that are not always identified or correctly appreciated at the current level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining operations. Acceptance of these uncertainties is part of any mining operation.

|

||

|

·

|

Metal Price Variability: The prices for gold, silver, copper and other precious metals fluctuate in response to many factors beyond anyone's ability to predict. The prices used in making the reserve estimates are disclosed and differ from daily prices quoted in the news media. The percentage change in the price of a metal cannot be directly related to the estimated reserve quantities, which are affected by a number of additional factors. For example, a ten percent (10%) change in price may have little impact on the estimated reserve quantities and affect only the resultant positive cash flow, or it may result in a significant change in the amount of reserves. Because mining occurs over a number of years, it may be prudent to continue mining for some period during which cash flows are temporarily negative for a variety of reasons, including a belief that the low price is temporary and/or the greater expense would be incurred in closing a property permanently.

|

||

|

·

|

Fuel Price Variability: The cost of fuel can be a major variable in the cost of mining; one that is not necessarily included in the contract mining prices obtained from mining contractors but is passed on to the overall cost of operation. Future fuel prices and their impact are difficult to predict, but could force us to curtail or cease our business operations.

|

|

·

|

Variations in Mining and Processing Parameters: The parameters used in estimating mining and processing efficiency are based on testing and experience with previous operations at the properties or on operations at similar properties. Various unforeseen conditions can occur that may materially affect the estimates. In particular, past operations indicate that care must be taken to ensure that proper ore grade control is employed and that proper steps are taken to ensure that the leaching operations are executed as planned. Unforeseen difficulties may occur in our current or future operations which would force us to curtail or cease our business operations.

|

|

·

|

Changes in Environmental and Mining Laws and Regulations: Our reserve estimates contain cost estimates based on compliance with current laws and regulations in the PRC. While there are no currently known proposed changes in these laws or regulations, significant changes have affected past operations of mining companies in China and if additional changes do occur in the future, we may or may not be able to comply with them and continue our operations.

|

We may not be able to successfully compete with other mineral exploration and mining companies.

We compete with other mineral exploration and mining companies or individuals, including large, well established mining companies with substantial capabilities and financial resources in the PRC, to research and acquire rights to mineral properties containing gold and other minerals. There is a limited supply of desirable mineral lands available for claim staking, lease or other acquisition in the PRC. We don't know if we will be able to successfully acquire any prospective mineral properties against competitors with substantially greater financial resources than we have. If we cannot successfully acquire other mining properties to manage and explore and generally expand our business operations, our results of operations, financial condition and future revenues could be reduced and you could suffer a loss of any investment you make in our shares.

We are subject to the many risks of doing business internationally, including but not limited to the difficulty of enforcing liabilities in foreign jurisdictions.

We are a Nevada corporation and, as such, are subject to the jurisdiction of the State of Nevada and the United States courts for purposes of any lawsuit, action or proceeding by investors. An investor would have the ability to effect service of process in any action against the Company within the United States. In addition, we are registered as a foreign corporation doing business in Shandong Province, PRC, and as such, are subject to the local laws of Shandong Province governing an investors’ ability to bring actions in foreign courts and enforce liabilities against a foreign private issuer, or any person, based on U.S. federal securities laws. Generally, a final and conclusive judgment obtained by investors in U.S. courts would be recognized and enforceable against us in the Shandong Province courts having jurisdiction without re-examination of the merits of the case.

Investors may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based upon U.S. laws, including the federal securities laws or other foreign laws against us or our management.

All of our current operations are conducted in the PRC and all of our directors and officers are nationals and residents of China. All or substantially all of the assets of these persons are located outside the United States and in the PRC. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon these persons. In addition, uncertainty exists as to whether the courts of China would recognize or enforce judgments of U.S. courts obtained against us or such officers and/or directors predicated

7

upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in China against us or such persons predicated upon the securities laws of the United States or any state thereof.

All of our assets are located in China and all of our revenues are derived from our operations in China. As a result, any changes in the political climate and/or economic policies of the PRC government could have a significant impact upon our current and proposed future business operations in the PRC and our results of operations and financial condition.

Our business operations may be adversely affected by the current and future political and economic environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the Communist Party of China. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since the late1970s. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to successfully operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization; however, if the PRC significantly alters any of its current policies, with or without notice, it could have a substantial adverse effect on our results of operations and financial condition and could result in a total loss of any investment you make in our shares.

We are employing a VIE structure, which could materially adversely affect our business operations if current regulations change in the PRC regarding VIE’s.

In order to comply with PRC regulatory requirements, we operate our businesses operations through companies in the PRC with which we have contractual relationships, but in which we do not have controlling ownership. We cannot be sure that the PRC government will continue to view our operating arrangements to be in compliance with PRC regulations if any new laws regarding operating businesses in the PRC through VIEs may be adopted in the future. If we are determined not to be in compliance, the PRC government could levy fines, revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business.

In addition, our Exclusive Option Agreement with SSIC, JinGuan and XinGuan and its shareholders gives our Chinese subsidiary, SBCL, the option to purchase all or part of the equity interests in them. The option may not be exercised by SBCL if the exercise would violate any applicable laws and regulations in China or cause any license or permit held by, and necessary for the operation of SSIC, JinGuan and XinGuan, to be cancelled or invalidated. Under the laws of China, if a foreign entity, through a foreign investment company that it invests in, acquires a domestic related company, China’s regulations regarding mergers and acquisitions may technically apply to the transaction. If these regulations apply, an examination and approval of the transaction by China’s Ministry of Commerce (“MOFCOM”), or its local counterparts would be required. In addition, an appraisal of the equity interest or the assets to be acquired would also be mandatory. Since the scope of business activities (mining operations and consulting services), as defined in the business license of SBCL, does not involve the MOFCOM approval and monitoring, we do not believe at this time that an approval or an appraisal is required for SBCL to exercise its option to acquire SSIC, JinGuan and XinGuan. In light of the different views on this issue, however, it is possible that the central MOFCOM office in Beijing will issue a standardized opinion imposing the approval and appraisal requirement. If we are not able to purchase the equity of SSIC, JinGuan and XinGuan, then we will lose a substantial portion of our ability to control SSIC, JinGuan and XinGuan and our ability to ensure that SSIC, JinGuan and XinGuan will act in our interests. Our business in the PRC could be materially adversely affected if there are any changes to current regulations in the PRC which would affect our business operations and current business agreements with our PRC operating company and its subsidiaries and VIEs, resulting in a loss of any investment you make in our shares.

Our principal stockholder, who is also an officer and director of our Company, has conflicts of interest which may not always be resolved favorably to our Company and its stockholders.

We operate our businesses in China through SSIC, JinGuan and XinGuan. Our chairman, CEO and principal

8

shareholder, Mr. Feize Zhang, owns 70% of the equity interest in SSIC. Conflicts of interests between his duties to us and to SSIC may arise. We cannot assure you that if and when conflicts of interest arise, he will act in the best interests of our Company, or that any conflict of interest will be resolved in our favor. These conflicts may result in management decisions that could negatively affect our operations and potentially result in the loss of opportunities.

We could be subject to tax consequences in the PRC that could negatively impact our business operations, revenues and results of operations.

Our arrangements with SSIC, JinGuan and XinGuan and its shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses. We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with SSIC, JinGuan and XinGuan and its shareholders were not entered into based on arm’s length negotiations. If the PRC tax authorities determine that any of our contractual arrangements in the PRC were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any, which could materially affect our financial condition and resulting revenues.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some that may compete with us, are not subject to these prohibitions, and therefore may have a competitive advantage over us. Our executive officers and employees have not been subject to the United States Foreign Corrupt Practices Act prior to 2010. We have no control over whether our employees or other agents will or will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material and adverse effect on our business.

The PRC’s legal system is a civil law system based on written statutes, in which system-decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and/or criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties that are unclear at this time. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We are considered a “foreign persons” or “foreign funded” enterprise under PRC laws, and as a result, we are required to comply with PRC laws and regulations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of any PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

|

·

|

levying fines;

|

|

·

|

revoking our business and other licenses;

|

|

·

|

requiring that we restructure our ownership or operations; and/or

|

|

·

|

requiring that we discontinue any portion or all of our business operations in the PRC.

|

9

Mining risks and insurance could negatively effect on our profitability.

The business of mining for gold and other metals is generally subject to a number of risks and hazards including environmental hazards, industrial accidents, labor disputes, unusual or unexpected geological conditions, pressures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods, blizzards and earthquakes. At the present time, we have in effect statutory required social insurance for all employees and mine workers and have obtained additional accidental insurance. There is currently no other insurance in place for the mining site and management and even if we were to purchase additional insurance, we can't be sure that such insurance would be available to us or that we could afford the premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. In addition, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to companies in the mining industry on acceptable terms. We might also become subject to liability for pollution or other hazards which we may not be insured against, or which we may elect not to insure against, because of premium costs or other reasons. Any losses from any of these events may cause us to incur significant costs that could have a material adverse effect upon our financial performance and results of operations, which could negatively impact any investment you make in our shares.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

PRC companies have historically not adopted a Western style of management and financial reporting concepts and practices, which includes strong corporate governance, internal controls and computer, financial and other control systems. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards for foreign subsidiaries. As a result, we may experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002. This could result in significant deficiencies or material weaknesses in our internal controls which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

Changes in interest rates could negatively impact our results of operations, stockholders’ equity (deficit) and fair value of net assets.

Our investment activities and credit guarantee activities expose us to interest rate and other market risks. Changes in interest rates, up or down, could adversely affect our net interest yield. Although the yield we earn on our assets and our funding costs tend to move in the same direction in response to changes in interest rates, either can rise or fall faster than the other, causing our net interest yield to expand or compress. For example, due to the timing of maturities or rate reset dates on variable-rate instruments, when interest rates rise, our funding costs may rise faster than the yield we earn on our assets. This rate change could cause our net interest yield to compress until the effect of the increase is fully reflected in asset yields. Changes in the slope of the yield curve could also reduce our net interest yield.

Interest rates can fluctuate for a number of reasons, including changes in the fiscal and monetary policies of the federal government and its agencies, such as the Federal Reserve. Federal Reserve policies directly and indirectly influence the yield on our interest-earning assets and the cost of our interest-bearing liabilities. The availability of derivative financial instruments (such as options and interest rate and foreign currency swaps) from acceptable counterparties of the types and in the quantities needed could also affect our ability to effectively manage the risks related to our investment funding. Our strategies and efforts to manage our exposures to these risks may not be effective in the future, which could negatively impact our results of operations and the price of our common stock.

10

RISKS RELATED TO DOING BUSINESS IN CHINA:

We conduct substantially all of our operations and generate all of our revenues in China. Accordingly, our business, financial condition, results of operations and future revenue prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

• the higher level of government involvement;

• the early stage of development of the market-oriented sector of the economy;

• the rapid growth rate;

• the higher level of control over foreign exchange; and

• the allocation of resources.

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in the economic conditions or government policies in China could have a material adverse effect on the overall economic growth and the level of security and surveillance investments and expenditures in China, which in turn could lead to a reduction in demand for our products and consequently have a material adverse effect on our business and prospects.

The PRC government exerts substantial influence over the manner in which we conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and any number of other unknown matters. The PRC central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or different interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China, or particular regions in China, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures. Any of these actions by the PRC government would severely and negatively impact our business operations and resulting revenues, which could result in a total loss of any investment you make in our shares.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

Most of our sales revenue and expenses are denominated in Renminbi. Under PRC law, the Renminbi is currently convertible under the "current account," which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, the PRC operating subsidiaries and VIEs of BSLmay purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC governmental authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in Renminbi, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in Renminbi to fund our business activities outside China that are denominated in foreign currencies.

11

Foreign exchange transactions by PRC operating subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if the PRC operating subsidiaries and/or VIEs of BSL borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries and/or VIEs by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or their respective local counterparts. These limitations could affect the PRC operating subsidiaries’ and/or VIEs’ ability to obtain foreign exchange through debt or equity financing, which could limit our business operations and impact our future revenues and financial condition.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into the operating PRC subsidiaries and/or VIEs of BSL, limit BSL's PRC subsidiaries’/VIEs’ ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, SAFE issued a public notice, the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, or the SAFE Notice, which requires PRC residents to register with the competent local SAFE branch before using onshore assets or equity interests held by them to establish offshore special purpose companies, or SPVs, for the purpose of overseas equity financing. Under the SAFE Notice, such PRC residents must also file amendments to their registration in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations. Moreover, if the SPVs were established and owned the onshore assets or equity interests before the implementation date of the SAFE Notice, a retroactive SAFE registration is required to have been completed before March 31, 2006. If any PRC resident stockholder of any SPV fails to make the required SAFE registration and amended registration, the PRC subsidiaries of that SPV may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV. Failure to comply with the SAFE registration and amendment requirements described above could also result in liability under PRC laws for evasion of applicable foreign exchange restrictions.

Because of uncertainty over how the SAFE Notice will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, BSL's present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with the SAFE Notice by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by the SAFE Notice. We also have little control over either our present or prospective direct or indirect stockholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with the SAFE Notice, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit BSL's subsidiaries’/VIEs’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations which became effective on September 8, 2006.

On August 8, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission or CSRC, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, governs the approval process by which a PRC company may participate in an acquisition of assets or equity interests. Depending on the structure of the transaction, the new regulation will require the PRC parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, our ability to engage in business combination transactions has become significantly more complicated, time consuming and expensive, and we may not be able to negotiate a transaction that is acceptable to our stockholders or sufficiently protect their interests in a transaction.

12

The new regulation allows PRC government agencies to assess the economic terms of a business combination transaction. Parties to a business combination transaction may have to submit to the Ministry of Commerce and other relevant government agencies an appraisal report, an evaluation report and the acquisition agreement, all of which form part of the application for approval, depending on the structure of the transaction. The regulations also prohibit a transaction at an acquisition price obviously lower than the appraised value of the PRC business or assets and in certain transaction structures, require that consideration must be paid within defined periods, generally not in excess of a year. The regulation also limits our ability to negotiate various terms of the acquisition, including aspects of the initial consideration, contingent consideration, holdback provisions, indemnification provisions and provisions relating to the assumption and allocation of assets and liabilities. Transaction structures involving trusts, nominees and similar entities are prohibited. Therefore, such regulation may impede our ability to negotiate and complete a business combination transaction on financial terms that satisfy our investors and protect our stockholders’ economic interests.

In addition to the above risks, in many instances, we will seek to structure transactions in a manner that avoids the need to make applications or a series of applications with Chinese regulatory authorities under these new M&A regulations. If we fail to effectively structure an acquisition in a manner that avoids the need for such applications or if the Chinese government interprets the requirements of the new M&A regulations in a manner different from our understanding of such regulations, then acquisitions that we have effected may be unwound or subject to rescission. Also, if the Chinese government determines that our structure of any of our acquisitions does not comply with these new regulations, then we may also be subject to fines and penalties.

Under the New EIT Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China passed a new Enterprise Income Tax Law, or the New EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. Because the New EIT Law and its implementing rules are new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from BSL's PRC subsidiaries/VIEs currently qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. We are actively monitoring the possibility of “resident enterprise” treatment for the 2009 tax year and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible. If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against any U.S. taxes we may owe.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions and foreign exchange policies. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the revised policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Following the removal of the U.S. dollar peg, the RMB appreciated more than 20% against the U.S. dollar over the following three years. Since July 2008, however, the RMB has traded within a narrow range against the U.S. dollar. It is difficult to predict how long the current situation may last and when and how the RMB exchange rates may change going forward.

13

Our revenues and costs are mostly denominated in RMB, while a significant portion of our financial assets are denominated in U.S. dollars. At the Cayman Islands holding company level, we rely entirely on dividends and other fees paid to us by our subsidiaries and consolidated affiliated entities in China. Any significant revaluation of RMB may materially and adversely affect our cash flows, revenues, earnings and financial position. For example, an appreciation of RMB against the U.S. dollar would make any new RMB denominated investments or expenditure more costly to us, to the extent that we need to convert U.S. dollars into RMB for such purposes. An appreciation of RMB against the U.S. dollar would also result in foreign currency translation losses for financial reporting purposes when we translate our U.S. dollar denominated financial assets into RMB, as RMB is our reporting currency. Conversely, a significant depreciation of the RMB against the U.S. dollar may significantly reduce the U.S. dollar equivalent of our earnings, which in turn could adversely affect the price of our common stock.

We may be delayed by or unable to comply with government and environmental laws, rules and regulations related to our operations which could severely impact our business operations.

The mining industry is subject to extensive regulations by the PRC government. These regulations govern a wide range of areas, including, but not limited to, investments, exploration, production, mining rights, pricing, trading and investments. In addition, mining operations are subject to fees and taxes, as well as safety and environmental protection laws and regulations. Our proposed mineral exploration programs will be subject to all of these extensive laws, rules and regulations. Various governmental permits will be required prior to implementation of proposed exploration operations. We are not assured of receiving any such permits as and when needed for operations, or at all. There is also no guarantee that new environmental or safety standards more stringent than those presently in effect will not be enacted in the future, which could negatively affect our exploration programs. Also, the industry often finds itself in conflict with the interests of private environmental groups which can have an adverse effect on the mining industry. Our planned exploration program budgets for regulatory compliance, however, there is always a risk that new regulations could increase our time and costs of doing business and prevent us from carrying out our exploration programs. Please see the subsection entitled "Government and Industry Regulations" under the Description of Business section on page 28 for a more detailed description of the PRC rules and regulations our industry is subject to.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

We do not currently own any properties.

The Company’s headquarters is located in Futian District, Shenzhen, China. The address is Room 3207, New World Center, 6009 Yitian Road, Futian District, Shenzhen, China. The monthly rental for the office is US$3,480 with a contract lease period from March 1, 2009 to March 1, 2011.

The Company has a branch office in the City of YanTai, ShanDong, China with the address of Room 501-505, Lantian International Building, 59 Changjiang Road, Development District, Yantai, China. The rent is US$1,923 per month with a contract lease period from March 1, 2010 to February 28, 2011.

Item 3. Legal Proceedings

We are not aware of any legal proceedings to which we are a party or of which our property is the subject. None of our directors, officers, affiliates, any owner of record or beneficially of more than 5% of our voting securities, or any associate of any such director, officer, affiliate or security holder are (i) a party adverse to us in any legal proceedings, or (ii) have a material interest adverse to us in any legal proceedings. We are not aware of any other legal proceedings that have been threatened against us.

Item 4. (Removed and Reserved)

14

PART II.

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.