Attached files

Creating the Premier

Food & Specialty Beverage

Packaging Company

Exhibit 99.1 |

FORWARD LOOKING STATEMENT

1

I

SILGAN HOLDINGS INC.

Information provided and statements contained in this document that are not purely

historical are forward-looking statements within the meaning of

Section

27A

of

the

Securities

Act

of

1933,

Section

21E

of

the

Securities

Exchange

Act

of

1934

and

the

Private

Securities

Litigation

Reform

Act of 1995. Such forward-looking statements only speak as of the date of this

document, and Silgan and Graham assume no obligation to update the

information included in this document. Such forward-looking statements include information concerning Silgan’s or Graham’s

possible

or

assumed

future

results

of

operations.

These

statements

often

include

words

such

as

“approximately,”

“believe,”

“expect,”

“anticipate,”

“intend,”

“plan,”

“estimate”

or

similar

expressions

and

may

include,

but

are

not

limited

to,

statements

about

the

benefits

of

the

proposed merger between Silgan and Graham, including future financial and operating

results, the combined company’s plans, objectives, expectations and

intentions and other statements that are not historical fact. These forward-looking statements are not historical facts, and are

based on current expectations, estimates and projections about Silgan’s and

Graham’s industry, management’s beliefs and certain assumptions

made by management, many of which, by their nature, are inherently uncertain and

beyond Silgan’s and Graham’s control. Accordingly, readers are

cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties

and assumptions that are difficult to predict, including, without limitation, the

expected closing date of the transaction; the possibility that the

expected

synergies

and

value

creation

from

the

proposed

merger

will

not

be

realized,

or

will

not

be

realized

within

the

expected

time

period;

the

risk that the businesses will not be integrated successfully; disruption from the

merger making it more difficult to maintain business and operational

relationships; the risk that unexpected costs will be incurred; changes in economic conditions, political conditions, trade protection

measures, licensing requirements and tax matters in the foreign countries in which

Silgan and Graham do business; the possibility that the merger

does

not

close,

including,

but

not

limited

to,

due

to

the

failure

to

satisfy

the

closing

conditions;

the

risk

that

a

regulatory

approval

may

be

obtained subject to conditions; the risk that financing for the transaction may not

be available on favorable terms; and Silgan’s and Graham’s ability

to accurately predict future market conditions. Additional factors that could cause results to differ materially from those described in the

forward-looking statements can be found in Silgan’s 2010 Annual Report on

Form 10-K, Graham’s 2010 Annual Report on Form 10-K and each

company’s other filings with the SEC available at the SEC’s website

(http://www.sec.gov). Although Silgan and Graham believe that the

expectations reflected in such forward-looking statements are reasonable as of

the date made, expectations may prove to have been materially

different

from

the

results

expressed

or

implied

by

such

forward-looking

statements.

Unless

otherwise

required

by

law,

Silgan

and

Graham

also

disclaim any obligation to update their view of any such risks or uncertainties or

to announce publicly the result of any revisions to the forward- looking

statements made in this document. |

FORWARD LOOKING STATEMENT

2

I

SILGAN HOLDINGS INC.

Additional Information and Where to Find It:

The

proposed

merger

transaction

involving

Silgan

and

Graham

will

be

submitted

to

the

respective

stockholders

of

Silgan

and

Graham for their consideration. In connection with the proposed merger, Silgan will

prepare a registration statement on Form S-4 that will include a joint

proxy statement/prospectus for the stockholders of Silgan and Graham to be filed with the Securities and

Exchange Commission (the “SEC”), and each will mail the joint proxy

statement/prospectus to their respective stockholders and file

other

documents

regarding

the

proposed

transaction

with

the

SEC

as

well.

Silgan

and

Graham

urge

investors

and

stockholders to read the joint proxy statement/prospectus when it becomes available,

as well as other documents filed with

the

SEC,

because

they

will

contain

important

information.

Investors

and

security

holders

will

be

able

to

receive

the

registration

statement

containing

the

proxy

statement/prospectus

and

other

documents

free

of

charge

at

the

SEC’s

web

site,

http://www.sec.gov,

from

Silgan

at

4

Landmark

Square,

Suite

400,

Stamford,

CT

06901,

or

from

Graham

at

2401

Pleasant

Valley

Road, York, PA 17402.

Participants in Solicitation:

Silgan, Graham and their respective directors and executive officers and other

members of management and employees may be deemed to be participants in the

solicitation of proxies from the respective stockholders of Silgan and Graham in favor of the

merger. Information regarding the persons who may, under the rules of the SEC, be

deemed participants in the solicitation of the respective stockholders of

Silgan and Graham in connection with the proposed merger will be set forth in the joint proxy

statement/prospectus

when

it

is

filed

with

the

SEC.

You

can

find

information

about

Silgan’s

executive

officers

and

directors

in

its

definitive proxy statement for its 2010 annual meeting of stockholders, which was

filed with the SEC on April 29, 2010. You can find more information about

Graham’s executive officers and directors in its definitive proxy statement for its 2010 annual meeting

of

stockholders,

which

was

filed

with

the

SEC

on

April

30,

2010.

You

can

obtain

free

copies

of

these

documents

from

Silgan

and

Graham using the contact information above. |

AGENDA

3

I

SILGAN HOLDINGS INC.

About Silgan

Strategic Rationale

Financial Impact

Next Steps / Q & A

Compelling Combination to Create World’s Premier Food and

Specialty Beverage Packaging Company |

4

I

SILGAN HOLDINGS INC.

SILGAN SNAPSHOT

2010 Sales by Business

$3.4 Billion Total Sales

____________________

Note: Silgan figures pro forma for full year of IPEC and Vogel &

Noot acquisitions. Focused portfolio of industry leading

consumer packaging franchises

Largest manufacturer of metal food

containers in North America

Leading positions in closures and plastic

containers

Long-term customer contracts and

near site / on site locations

83 manufacturing facilities

~9,000 employees and operations in 19

countries

Closures

Metal

Plastic

17%

64%

19% |

OUR

FRANCHISE FOCUS 5

I

SILGAN HOLDINGS INC.

Leading

Market

Positions

Best Value

(quality, price, service)

Leading Technology

and Manufacturing

Support

Long-term

Customer

Relationships

High Return

on Capital

Employed

Sustainable Competitive Advantage |

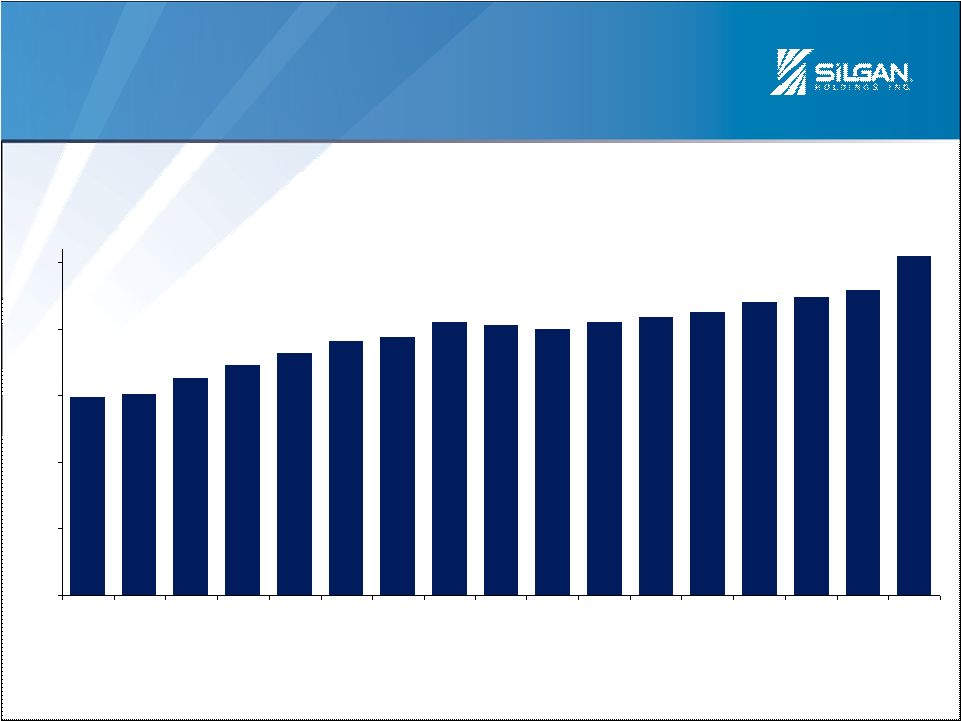

HISTORICAL RETURNS

6

I

SILGAN HOLDINGS INC.

$1,878

$1,941

$1,988

$2,312

$2,421

$2,495

$2,668

$2,923

$3,121

$3,067

$3,072

$250

$750

$1,250

$1,750

$2,250

$2,750

$3,250

$3,750

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

AVERAGE ROCE = 18%

____________________

Notes: ROCE calculated as Operating Profit divided by Total

Year-end Debt and Equity Sales

from

2000

-

2003

reflect

the

adoption

of

EITF

No.

00-10.

ROCE

from

2000

–

2009

is

adjusted

to

reflect

the

retrospective

inventory

accounting

change

from

LIFO

to

FIFO

for

Plastics.

2010 not pro forma for Vogel & Noot and IPEC acquisitions.

|

FRANCHISE LANDSCAPE

Metal

Containers

Metal

Containers

Plastic

Containers

Plastic

Containers

Closures

Closures

Food

Specialty

Beverage

Personal

Care

Personal

Care

7

I

SILGAN HOLDINGS INC.

____________________

Note: Size of circle indicative of North American market size.

|

Food and

Specialty

Beverage

Household

Personal Care

/ Specialty

Automotive

Lubricants

11%

6%

18%

65%

8

I

SILGAN HOLDINGS INC.

GRAHAM PACKAGING SNAPSHOT

2010 Sales by Business Unit

$2.8 Billion Total Sales

____________________

Note: Graham Packaging figures pro forma full year

for Liquid Container acquisition. Leading global supplier of innovative

plastic containers for branded consumer products

Approximately 90% of sales in product

categories with leading market position

97 manufacturing facilities, of which ~1/3 of

plants are on-site with customers

8,200 employees

Operations in 15 countries |

9

I

SILGAN HOLDINGS INC.

SUPERIOR TECHNOLOGY WITH A LONG

HISTORY OF INNOVATION

~ 80% of Products Utilize

Proprietary Technology

Process Technology

Product Innovation

High-Speed Extrusion Blow Molding

Wheels

High-Speed PET Bottle Production

Multi-Layer Barrier Production

Light-Weighting Technologies

Hot-Fill Processing Capabilities

Post Consumer Recycling

World-Class Design Center

SlingShot™

ThermaSet™

G-Lite®

Multi-Layer Barrier

SurBond™, SurShot®

MonoSorb®

Over 1,000 Issued or Pending

Patents |

HISTORICAL STABILITY THROUGH

RESIN VOLATILITY

10

I

SILGAN HOLDINGS INC.

$505

$479

$474

$470

$463

$459

$455

$450

$453

$444

$432

$423

$413

$401

$399

$455

$441

$250

$300

$350

$400

$450

$500

Q4 06

Q1 07

Q2 07

Q3 07

Q4 07

Q1 08

Q2 08

Q3 08

Q4 08

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

____________________

Notes: Dollars in millions.

Graham Packaging 2010 financials not pro forma for Liquid Container

acquisition. Graham Packaging LTM Adjusted EBITDA

|

AGENDA

11

I

SILGAN HOLDINGS INC.

About Silgan

Strategic Rationale

Financial Impact

Next Steps / Q & A

Compelling Combination to Create World’s Premier Food and

Specialty Beverage Packaging Company |

12

I

SILGAN HOLDINGS INC.

STRATEGIC RATIONALE

Creates Leading Food and Specialty Beverage Packaging Market Position

•

#1 market positions across franchises

•

High barriers to entry

•

Stable end markets

Common Business Fundamentals to Silgan

•

End market focus

•

Entrenched customer partnerships

•

Raw material passthroughs

•

Focus on FCF, return on capital and operational excellence

Compelling Synergy Opportunities with Low Integration Risk

Accretive to Cash Flow, Earnings and Growth

Positions Shareholders to Realize Attractive Levered Equity Returns

|

13

I

SILGAN HOLDINGS INC.

COMPLEMENTARY

CONSUMER PACKAGING FRANCHISES

____________________

Note: Dollars in millions.

(1) Silgan figures pro forma full year for IPEC and Vogel & Noot

acquisitions. (2) Graham Packaging figures pro forma full year

for Liquid Container acquisition; Liquid Container assumed to be 80% food & beverage.

Plastic

100%

=

By

Franchise

+

$3,437

$2,803

$6,240

By End

Market

(1)

Silgan

Pro forma

Graham Packaging

(2)

Balanced Franchise Portfolio Supporting

Common

Food & Beverage Markets

Closures

Metal

Plastic

54%

35%

11%

Closures

Metal

Plastic

17%

64%

19%

77%

Food and Beverage

Other

+

=

PF Food &

Beverage

1.6x SLGN

Standalone |

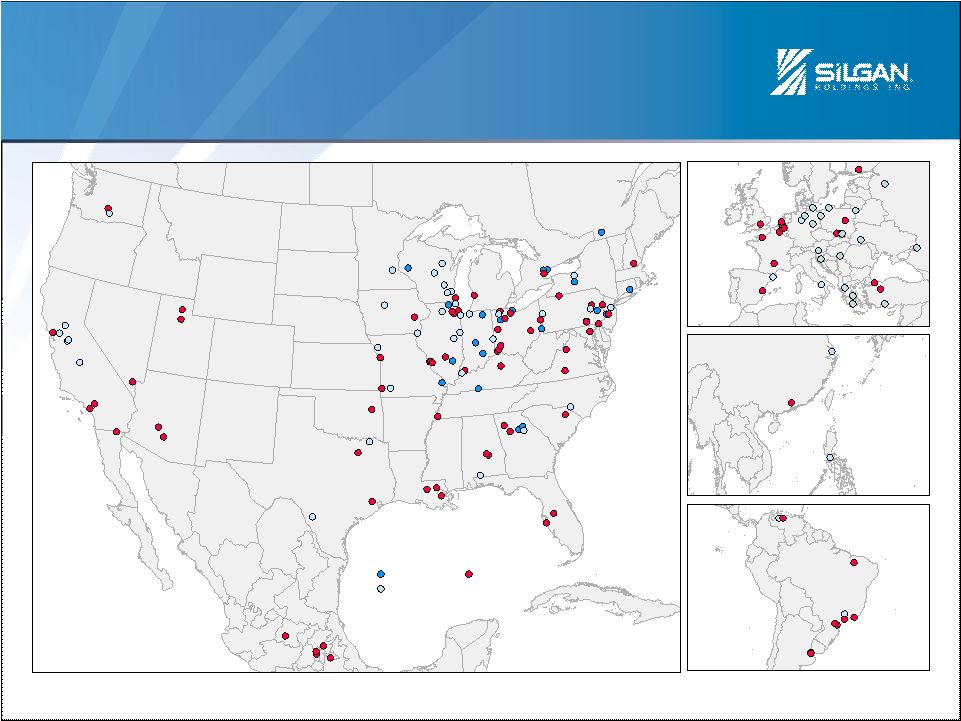

BROAD GLOBAL

FOOTPRINT:

180 OPERATING FACILITIES

14

I

SILGAN HOLDINGS INC.

58

Silgan

Plants

73

Graham

Plants

21

14

1

2

9

Silgan (Cans, Closures)

Silgan Plastics

Graham

2 |

15

I

SILGAN HOLDINGS INC.

COMBINED WORLD CLASS CONSUMER

PACKAGING CUSTOMER BASE

Silgan / Graham

Common Heritage

On Site / Near Site

Manufacturing

Long-term Strategic

Partnerships

Raw Material

Passthroughs

BP Lubricants

Complementary Customer Base Across Multiple Products |

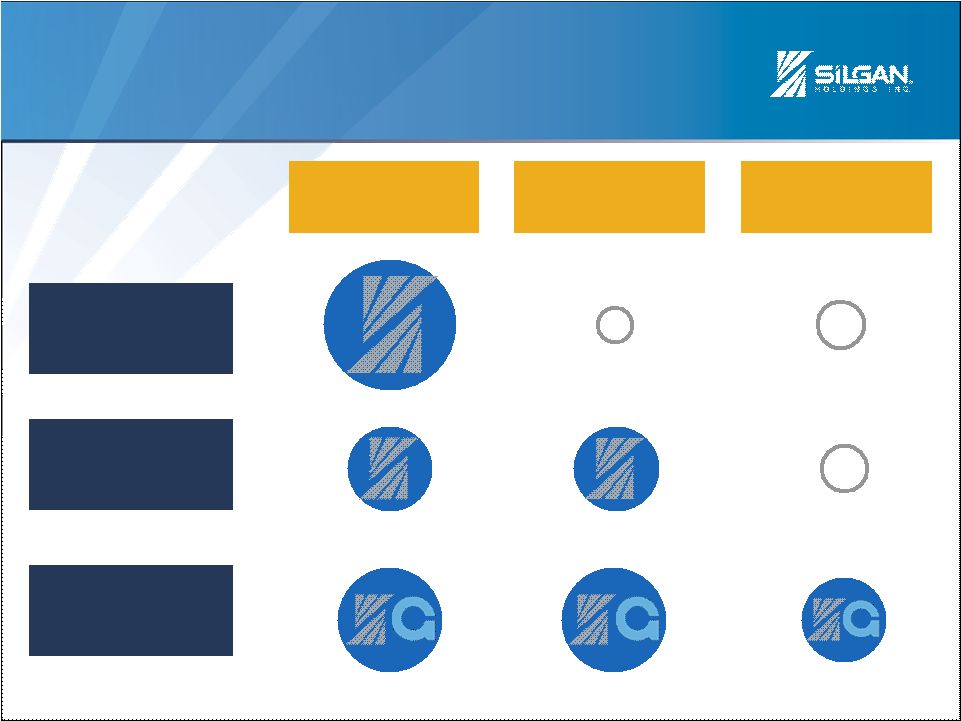

FRANCHISES ALIGNED TO MARKETS

Metal

Containers

Plastic

Containers

Closures

Food

Specialty

Beverage

Personal

Care

16

I

SILGAN HOLDINGS INC.

____________________

Note: Size of circle indicative of North American market size.

|

AGENDA

17

I

SILGAN HOLDINGS INC.

About Silgan

Strategic Rationale

Financial Impact

Next Steps / Q & A

Compelling Combination to Create World’s Premier Food and

Specialty Beverage Packaging Company |

TRANSACTION SUMMARY

18

I

SILGAN HOLDINGS INC.

Silgan has agreed to acquire Graham Packaging to form the world’s leading

food and specialty beverage packaging company

0.402 Silgan shares + $4.75 in cash for total consideration of $19.56/ share

Total Enterprise Value of $4.1 billion

•

7.0x 2011E EBITDA

•

6.5x 2011E EBITDA (with $50 million synergies)

Pro forma Net Debt / Adjusted EBITDA of 3.9x, with expected rapid

deleveraging from robust free cash flow

Voting agreements executed with:

•

Silgan co-founders who beneficially own 29% of Silgan shares

•

Blackstone and the Graham Family who collectively own 65% of Graham

Packaging shares

Expected closing in Q3 |

19

I

SILGAN HOLDINGS INC.

DEBT FINANCING SUMMARY

Transaction structured to maintain Ba2 / BB credit profile

Fully committed debt financing of $4.0 billion

Assuming $500 million of Graham bonds

$245 million change of control payment under Graham income

tax receivable agreements

•

NPV of tax benefits received exceeds upfront payment

|

20

I

SILGAN HOLDINGS INC.

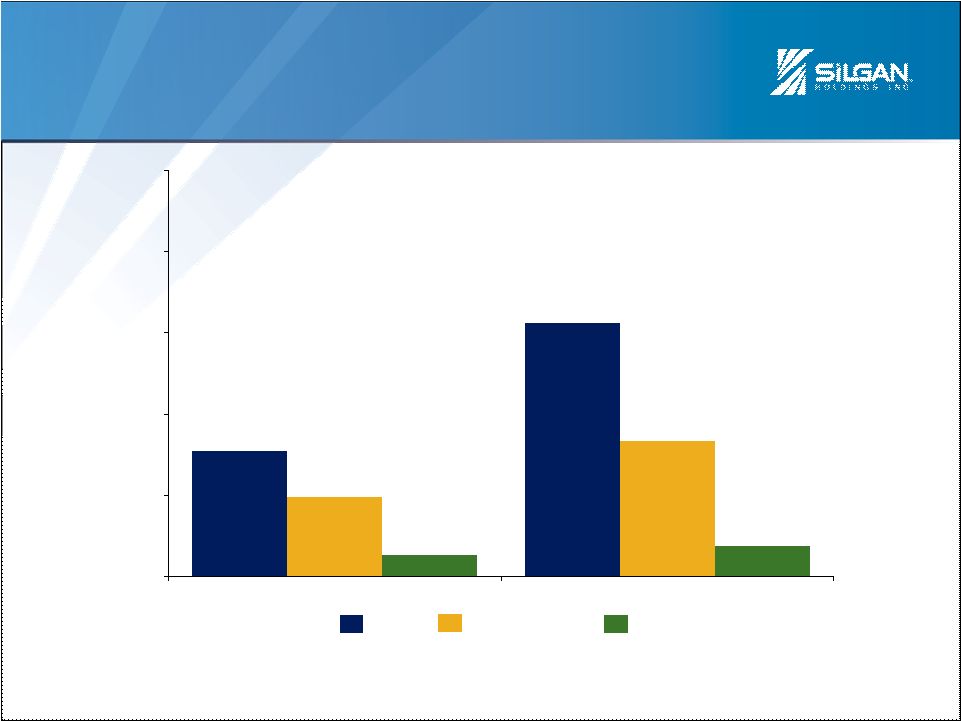

SYNERGY OPPORTUNITIES

Compelling Synergy Opportunities with Low Integration Risk

SG&A –

$18 million

•

Corporate / Administration

•

Sales

•

R&D / Technology

Procurement –

$15 million

Operational

/

Best

Practices

–

$17

million

$10

$30

$50

$0

$10

$20

$30

$40

$50

$60

Year 1

Year 2

Full

Run-Rate

Estimated Annual Impact

($mm) |

21

I

SILGAN HOLDINGS INC.

DISCIPLINED FOCUS

EBITDA Growth

Cash Flow Generation

Focus on ROCE

Disciplined Long-Term

Acquisition Strategy

Capital Structure

Franchise

Building

Value

Creation |

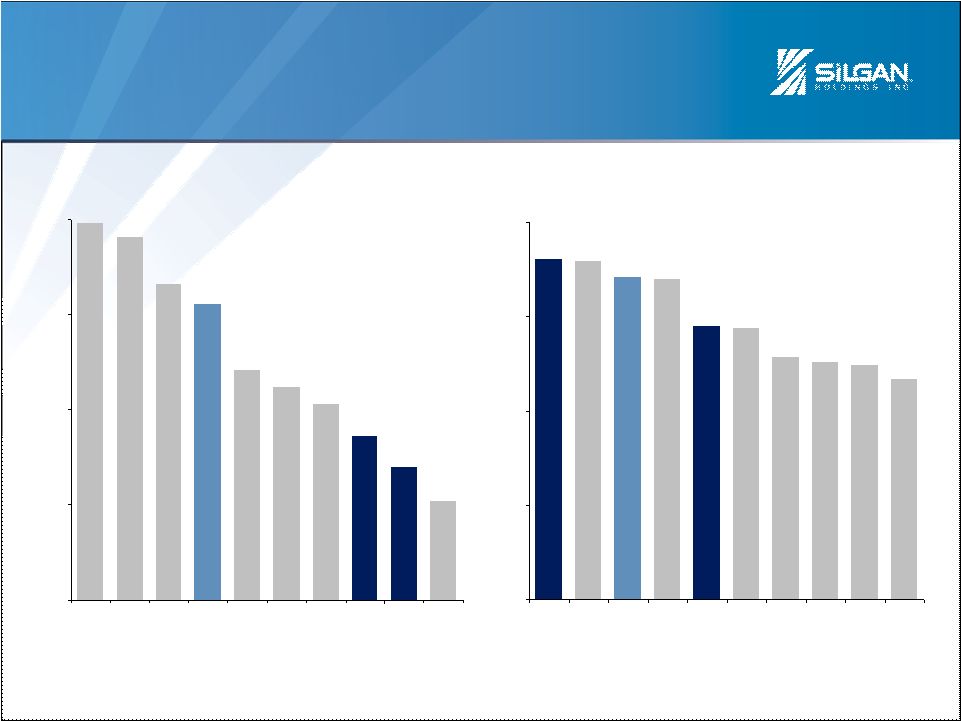

SUPERIOR RETURNS AND CASH FLOW

22

I

SILGAN HOLDINGS INC.

Adj. EBITDA –

Capex as % of Sales

(1)

ROCE

18.0%

20.1%

19.4%

16.4%

18.1%

16.7%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

2008

2009

2010

9.3%

11.4%

11.6%

11.9%

13.9%

14.4%

0.0%

5.0%

10.0%

15.0%

2008

2009

2010

____________________

Notes:

Return

on

Capital

Employed

(ROCE)

defined

as

EBIT

divided

by

the

sum

of

total

year-end

debt

and

equity;

Graham

Packaging

ROCE

based

on

Adjusted

EBIT.

2010 ROCE for Silgan not pro forma full year for IPEC and Vogel & Noot

acquisitions. (1)

2010

Silgan

pro

forma

full

year

for

IPEC

and

Vogel

&

Noot

acquisitions;

2010

Graham

Packaging

pro

forma

full

year

for

Liquid

Container

acquisition.

Silgan

Graham Packaging |

23

I

SILGAN HOLDINGS INC.

MULTIPLE DRIVERS OF FREE CASH FLOW

Operations

Proven Free Cash Flow of both Silgan and Graham

Packaging

Pro forma 2010 EBITDA of $1.1 billion (including $50

million of synergies)

Estimated 2011 combined Capex of ~$335 million

Low Cost of

Debt Capital

Pro forma total debt of ~$4.7 billion

Low-to-mid 5%’s expected weighted average cost of debt

Favorable

Tax

Attributes

Graham Packaging NOLs will offset taxable income by

~$175 million for first five years

~$60 million annual cash tax savings

Robust Free Cash Flow: ~$500mm ($5/share) in 1st Full Year

____________________

Note: Free cash flow defined as Operating Cash Flow less Capex on a pro

forma basis. |

4.1x

3.8x

3.4x

3.5x

2.5x

2.0x

2.8x

2.2x

1.8x

1.1x

1.7x

3.9x

0.0x

0.5x

1.0x

1.5x

2.0x

2.5x

3.0x

3.5x

4.0x

4.5x

$0.00

$15.00

$30.00

$45.00

24

I

SILGAN HOLDINGS INC.

DISCIPLINED FINANCIAL APPROACH

20+ year history of delivering

strong levered equity returns to

shareholders

Consistent Silgan track record

of deleveraging post-acquisition

Financial policy and

commitment to dividend

unchanged

____________________

Notes: 2000-2010 Net Leverage defined as EBITDA divided by Net

Debt. (1) Pro forma for Vogel & Noot and Graham acquisitions

using adjusted EBITDA with $50mm in synergies assumed for Graham. Net Leverage

Ratio / Stock Price Performance

(1)

Price ($)

Net Leverage |

15.4%

31.2%

9.8%

16.6%

2.7%

3.8%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

5-Year

10-Year

Packaging Peers

SLGN

S&P 500

TRACK RECORD OF SUPERIOR LEVERED

EQUITY RETURNS

25

I

SILGAN HOLDINGS INC.

____________________

Notes:

Total

Shareholder

Return

includes

cumulative

share

price

returns

and

dividends

reinvested

through

April

1,

2011.

Packaging Peers include AptarGroup, Ball, Bemis, Crown, Owens-Illinois,

Sealed Air and Sonoco. Packaging

Peers’

total

shareholder

return

represents

the

average.

Total Shareholder Return CAGR |

TRANSFORMATIVE TO SILGAN’S FINANCIAL

PROFILE

26

I

SILGAN HOLDINGS INC.

2010 Revenue

2010 EBITDA -

Capex % of Sales

____________________

Notes:

Silgan 2010 figures pro forma full year for IPEC and Vogel & Noot

acquisitions. 2010 Silgan Adj. EBITDA includes adjustments per

reconciliation in Appendix. Graham

Packaging

2010

Revenue,

Adj.

EBITDA

and

Capex

figures

pro

forma

full

year

for

Liquid

Container

acquisition.

Pro

forma

Silgan

and

Graham

Packaging

Adj.

EBITDA

includes

$50mm

in

synergies.

$7,941

$7,630

$6,633

$6,240

$4,835

$4,490

$4,124

$3,437

$2,803

$2,077

$0

$2,000

$4,000

$6,000

$8,000

CCK

BLL

OI

PF

BMS

SEE

SON

SLGN

GRM

ATR

($mm)

14.4%

14.4%

13.7%

13.6%

11.6%

11.5%

10.3%

10.1%

9.9%

9.3%

0.0%

4.0%

8.0%

12.0%

16.0%

GRM

SEE

PF

ATR

SLGN

OI

BMS

BLL

SON

CCK |

ACQUISITION A PERFECT FIT WITH OUR

FRANCHISE CRITERIA…

27

I

SILGAN HOLDINGS INC.

Leading

Market

Positions

Best Value

(quality, price, service)

Leading Technology

and Manufacturing

Support

Long-term

Customer

Relationships

High Return

on Capital

Employed

Sustainable Competitive Advantage

WHITE CAP

METAL CONTAINERS

GRAHAM PACKAGING |

28

I

SILGAN HOLDINGS INC.

…AND OUR DISCIPLINED FOCUS

EBITDA Growth

Cash Flow Generation

Focus on ROCE

Disciplined Long-Term

Acquisition Strategy

Capital Structure

Franchise

Building

Value

Creation |

AGENDA

29

I

SILGAN HOLDINGS INC.

About Silgan

Strategic Rationale

Financial Impact

Next Steps / Q & A

Compelling Combination to Create World’s Premier Food and

Specialty Beverage Packaging Company |

NEXT STEPS / Q & A

30

I

SILGAN HOLDINGS INC.

Raise permanent debt financing

Shareholder votes at Silgan and Graham

Customary regulatory approvals

Expected closing Q3 |

31

I

SILGAN HOLDINGS INC.

APPENDIX

Non-GAAP Reconciliation |

32

I

SILGAN HOLDINGS INC.

EBITDA RECONCILIATION –

SILGAN

($ in millions)

Reconciliation

2010

2009

2008

Net Income

$144.6

$159.4

$125.0

Provision for income taxes

77.0

88.2

68.6

Interest and other debt expense

54.1

49.7

60.2

Loss on early extinguishment of debt

7.5

1.3

-

Income from Operations

$283.3

$298.6

$253.7

Depreciation & Amortization

142.9

145.3

144.0

EBITDA

$426.3

$443.9

$397.7

Rationalization charges

22.2

1.5

12.2

Stock option & RSU expenses

5.8

4.9

3.7

Venezuela Devaluation

3.2

-

-

Adjusted EBITDA

$457.5

$450.3

$413.6 |

33

I

SILGAN HOLDINGS INC.

NET LEVERAGE RECONCILIATION –

SILGAN

($ in millions)

Reconciliation

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

Total Debt

$904.7

$799.4

$884.9

$992.5

$955.6

$700.4

$841.7

$1,002.6

$956.8

$944.8

$1,031.5

Less: Cash

175.2

305.8

163.0

95.9

16.7

20.5

35.4

12.1

58.3

18.0

20.1

Net Debt

$729.4

$493.7

$721.9

$896.6

$938.9

$679.9

$806.3

$990.5

$898.5

$926.8

$1,011.4

Net Income

$144.6

$159.4

$125.0

$126.8

$100.5

$90.3

$87.7

$42.9

$54.0

$40.7

$31.2

Equity Loss in Affiliates

-

-

-

-

-

-

-

0.3

2.6

4.1

4.6

Provision for income taxes

77.0

88.2

68.6

73.0

48.9

62.7

60.7

28.2

36.9

29.5

23.1

Gain on assets contributed to Affiliate

-

-

-

-

-

-

-

-

-

(4.9)

-

Interest and other debt expense

54.1

49.7

60.2

66.0

59.2

49.4

55.6

78.9

73.8

81.2

91.2

Loss on early extinguishment of debt

7.5

1.3

-

-

0.2

11.2

1.6

19.2

1.0

-

6.9

Income from Operations

$283.3

$298.6

$253.7

$265.8

$208.8

$213.6

$205.6

$169.4

$168.3

$150.6

$157.0

Depreciation & Amortization

142.9

145.3

144.0

138.0

126.2

121.2

118.5

111.3

95.7

95.5

89.0

EBITDA

$426.3

$443.9

$397.7

$403.8

$335.0

$334.8

$324.1

$280.7

$264.0

$246.1

$246.0

Net Leverage Ratio

1.7x

1.1x

1.8x

2.2x

2.8x

2.0x

2.5x

3.5x

3.4x

3.8x

4.1x

____________________

Note: Net Income from 2000-2009 is adjusted to reflect the

retrospective inventory accounting change from LIFO to FIFO for Plastics. |

34

I

SILGAN HOLDINGS INC.

EBITDA RECONCILIATION –

GRAHAM

PACKAGING

($ in millions)

____________________

(1)Represents

the

net

loss

on

disposal

of

fixed

assets,

stock-based

compensation

expense

and

equity

income

from

unconsolidated

subsidiaries.

(2)Represents

annual

fees

paid

to

Blackstone

Management

Partners

III

L.L.C.,

through

the

date

of

the

IPO,

and

a

limited

partner

of

Holdings

pursuant

to

the

Fifth

Amended

and

Restated

Limited

Partnership

Agreement,

the

Monitoring Agreement and the Sixth Amended and Restated Limited Partnership

Agreement. (3)Represents

costs

related

to

the

termination

of

the

Monitoring

Agreement,

IPO

bonus

payments

and

other

IPO-related

costs.

(4)Represents costs related to the acquisition and integration of the

Liquid Entities, China Roots and other entities. (5)Represents costs

related to a settlement to OnTech, plant closures, employee severance and other costs.

(6)Represents administrative expenses incurred by Blackstone.

Reconciliation

2010

2009

2008

2007

2006

Net Income

$61.8

$14.3

($57.9)

($207.4)

($121.1)

Loss from discontinued operations

-

9.5

10.5

3.7

1.1

Income tax (benefit) provision

(50.7)

27.0

13.0

20.3

27.5

Interest Income

(0.7)

(1.1)

(0.8)

(0.9)

(0.6)

Interest Expense

185.6

176.9

180.0

210.4

207.4

Income from Operations

$196.0

$226.5

$144.8

$26.1

$114.3

Depreciation & Amortization

171.1

158.6

175.5

201.7

204.6

EBITDA

$367.1

$385.1

$320.3

$227.8

$318.9

Asset impairment charges

9.6

41.8

96.1

157.7

25.9

Increase in income tax receivable obligations

5.0

-

-

-

-

Other non-cash charges

(1)

4.9

7.3

9.3

19.4

14.3

Fees related to monitoring agreements

(2)

1.5

5.0

5.0

5.0

5.0

Net loss on debt extinguishment

31.1

8.7

-

-

-

Write-off of amounts in accumulated other

comprehensive income related to interest rate swaps

7.0

-

-

-

-

Contract termination fee and IPO-related expenses

(3)

39.6

0.2

-

-

-

Acquisition and integration expenses

(4)

20.3

-

-

-

-

Venezuelan hyper-inflationary accounting

2.3

-

-

-

-

Reorganization and other costs

(5)

16.0

14.2

22.0

22.0

34.6

Other administrative expenses

(6)

-

0.1

0.1

0.1

-

Adjusted EBITDA

$504.4

$462.5

$452.8

$432.0

$398.7

Depreciation & Amortization

171.1

158.6

175.5

201.7

204.6

Adjusted EBIT

$333.3

$303.9

$277.3

$230.3

$194.1 |

Creating the Premier

Food & Specialty Beverage

Packaging Company |