Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AUXILIUM PHARMACEUTICALS INC | d8k.htm |

1

April 2011

(NASDAQ: AUXL)

Exhibit 99.1 |

2

Safe Harbor Statement

We will make various remarks during this presentation that constitute “forward-looking

statements” for purposes of the safe harbor provisions under The Private Securities

Litigation Reform Act of 1995, including statements regarding: the pricing, time to market, size of market, growth potential and therapeutic benefits of the

Company’s products and product candidates, including those for the treatment of Peyronie’s

disease and Frozen Shoulder syndrome; the size and development of the Dupuytren’s market

in the U.S., the EU and the rest of the world; the potential for XIAFLEX to become the standard of care for Dupuytren’s contracture; the

potential for XIAFLEX to be used in multiple indications and the success of efforts to advance any

such new indications; the effect of the identified leading indicators on the success of the

XIAFLEX launch and future net revenues; the ability to obtain reimbursement in the U.S. for XIAFLEX for the treatment of

Dupuytren’s; the timing and potential effect on sales of new reimbursement codes for XIAFLEX and

the effect of the reimbursement process on the success of the XIAFLEX launch; physicians and

sites that are moving from test drive to increasing usage; the generation of cash through licensing of XIAFLEX in other territories

and for new indications; the timing and likelihood of success of launch of XIAPEX for the treatment of

Dupuytren’s contracture in the European Union and of the development of XIAFLEX for the

treatment of Dupuytren’s contracture and Peyronie’s disease in Japan; additional Phase IV clinical trials for XIAFLEX; peer to

peer dialogue programs for U.S. physicians and our U.S. patient education campaign; future Testim

market share, prescriptions and sales growth and factors that may drive such growth; size and

growth potential of the testosterone replacement therapy market and the gel segment thereof and factors that may drive such

growth; the likelihood of generic competition in the testosterone replacement therapy gel market;

competitive developments affecting the Company’s products and product candidates,

including generic competition in the testosterone replacement therapy market; the scope, timing, methodology, endpoints, safety, execution

and results of the phase III studies for XIAFLEX for the treatment of Peyronie’s disease; the

size of the Peyronie’s market and any increase in treatment for Peyronie’s; business

development efforts and opportunities to build out the Company’s pipeline; the Company’s development and operational goals and strategic

priorities for 2011, including building out its pipeline in specialty therapeutic areas; the ability

to fund future operations; the opportunities and strategies to build shareholder value; the

status, timing, potential counterclaims and appeals, potential outcomes, resulting consequence and costs of, and effects on our business

from, the litigation with BioSpecifics Technologies Corp.; the Company’s expected financial

performance during 2011 and financial milestones that it may achieve for 2011, including 2011

XIAFLEX U.S. net revenues and Pfizer royalty and contract revenues; and the likelihood or timing of the Company becoming profitable

rapidly growing, profitable and sustainable biopharmaceutical company. All remarks other than

statements of historical facts made during this presentation, including but not limited to,

statements regarding future expectations, plans and prospects for the Company, statements regarding forward-looking financial

information and other statements containing the words “believe,” “may,”

“could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” and

similar expressions, as they relate to the Company, constitute forward-looking statements.

Actual results may differ materially from those reflected in these forward-looking

statements due to various factors, including general financial, economic, regulatory and political conditions affecting the biotechnology and

pharmaceutical industries and those discussed in Auxilium's Annual Report on Form 10-K for the

year ended December 31, 2010 under the heading “Risk Factors, which is on file with the

Securities and Exchange Commission (the “SEC”) and may be accessed electronically by means of the SEC’s home page on the Internet

at http://www.sec.gov or by means of the Company’s home page on the Internet at

http://www.auxilium.com under the heading “For Investors - SEC Filings.”

There may be additional risks that the Company does not presently know or that the Company currently

believes are immaterial which could also cause actual results to differ from those contained in

the forward-looking statements. Given these risks and uncertainties, any or all of these forward-looking statements may

prove to be incorrect. Therefore, you should not rely on any such factors or forward-looking

statements. In addition, forward-looking statements provide the Company’s

expectations, plans or forecasts of future events and views as of the date of this presentation. The Company anticipates that subsequent events and

developments will cause the Company’s assessments to change. However, while the Company may

elect to update these forward-looking statements at some point in the future, the Company

specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the

Company’s assessments as of any date subsequent to the date of this presentation. |

3

Our Vision Is to Become a Rapidly Growing,

Profitable and Sustainable Biopharmaceutical

Company

Maximize Value of

Testim and XIAFLEX

Deliver on

Current Pipeline

Build Out

Pipeline in

Specialty

Therapeutic

Areas |

4

XIAFLEX and Testim Are Global Product

Opportunities

U.S.

Canada

EU

Japan

Open

ROW

Open

Open

Territory

XIAFLEX

Testim |

5

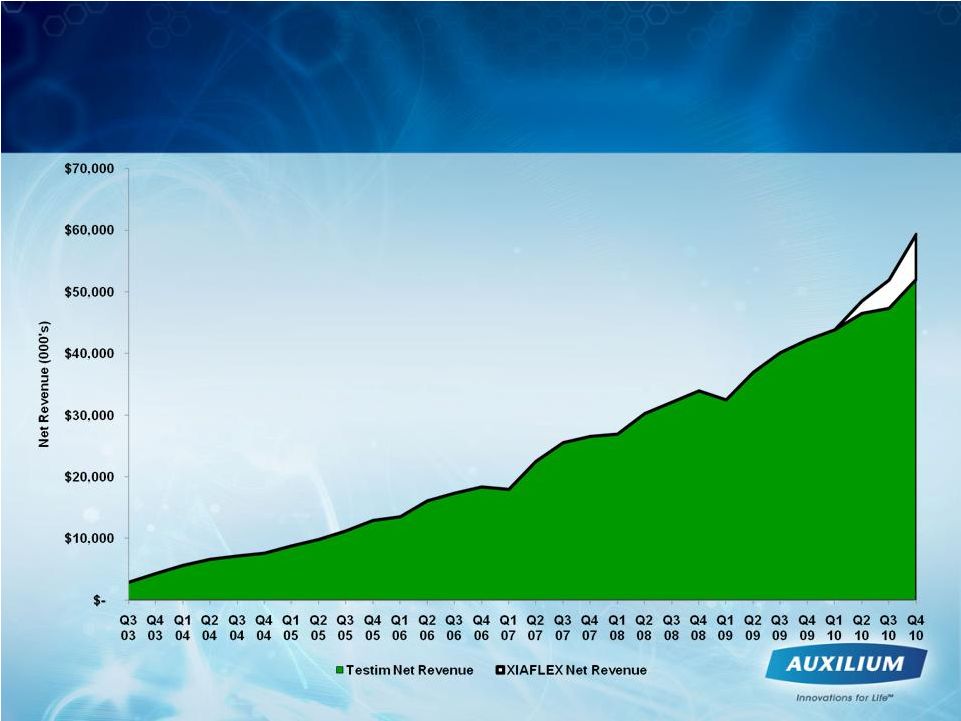

Auxilium Has a 6 Year Net Revenue CAGR

of 40.2%

4Q10 XIAFLEX Net

Revenues $8.4M

(including $7.3M in U.S.

revenues)

4Q10 Testim Net

Revenues $53.4M,

13.3% y/y growth |

6 |

7

•

Excessive collagen in fascia of hand

•

Nodules or pits are an early, active

presentation

•

Rope-like cords develop in the finger

and result in contractures

•

Quality of life and daily activities

affected

•

Surgery has been reserved for

advanced disease due to the nature of

the disease, unpredictable results,

complications, long recovery time and

recurrence/additional surgeries

Dupuytren’s Contracture Is Debilitating for Patients

and Surgery Has Been the Standard of Care

Immediately post-operative

Intra-operative open fasciectomy

Pictures courtesy

of Dr. Clayton Peimer

pre-operative open fasciectomy |

8

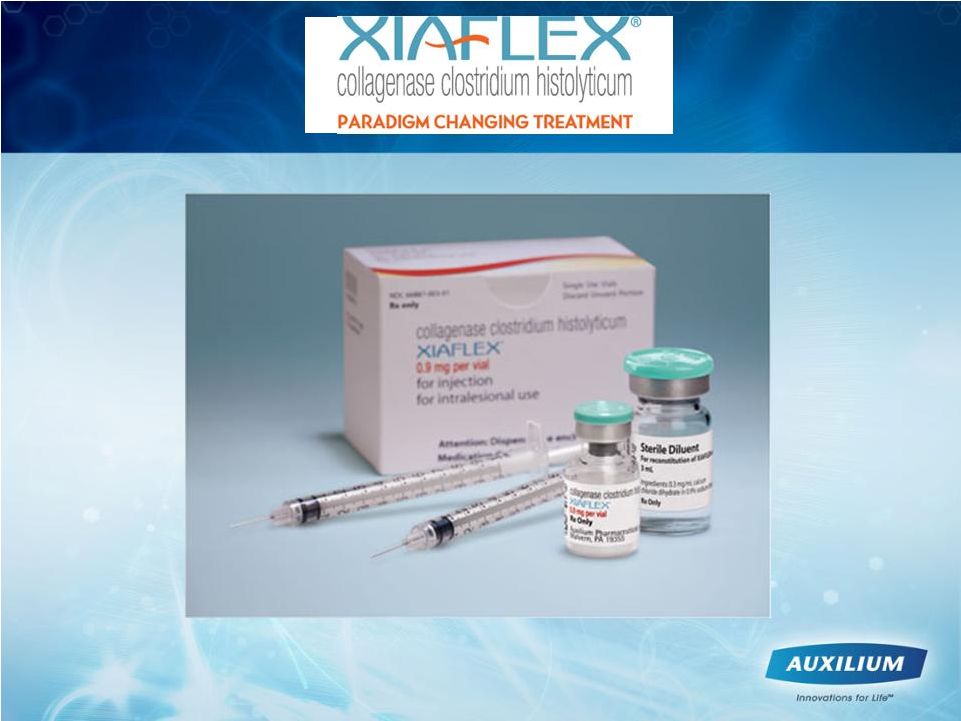

We Believe XIAFLEX Is a Paradigm

Changing Treatment

•

Simple, non-invasive injection of XIAFLEX

•

Established mechanism of action and selective for specific types of collagen

•

XIAFLEX’s post-approval profile is consistent with clinical trial

experience Pre XIAFLEX injection

30 days following XIAFLEX

injection |

9

Strategies for Establishing XIAFLEX as the

Standard of Care

•

Disseminate excellent clinical efficacy and safety data

•

Facilitate peer to peer dialogue

•

Educate patients and health care providers on a non-

invasive option

•

Smooth the reimbursement process

•

Activate a critical mass of experienced prescribers |

10

XIAFLEX Launch Strategy is Tailored to

Customer Needs

•

~ 6,000 target physicians

–

Hand surgeons, plastic surgeons, orthopedic

surgeons, general surgeons, rheumatologists

•

~ 100 field based personnel

–

Sales reps, sales managers, and reimbursement

specialists

•

Medical science liaisons

–

Key opinion leader and regional opinion leader

support |

11

We Believe the U.S. Dupuytren’s Opportunity Is

Significant

70,000 Surgical

2,3,4

Patients Annually

300,000 Diagnosed

Patients Annually

2,3,4

>1 Million Diagnosed

Patients

2,4

1.

Dupuytren’s

Disease

–

Tubiana,

LeClerq,

Hurst,

Badalamente,

Mackin

2.

SDI Claims Data Based Projections

3.

Medicare

Data

Based

Projections

(BESS

database

used,

Medicare

5%

database

also

used

to

validate

numbers)

4.

Auxilium

Research (Patient

Segmentation,

Forecast

Research,

WK/AMA

Databases)

Sources:

$350 Million

Market

Opportunity

$1 Billion

Annual Market

Opportunity

>$3 Billion Market

Opportunity |

12

Launch Update Through

March 2011 |

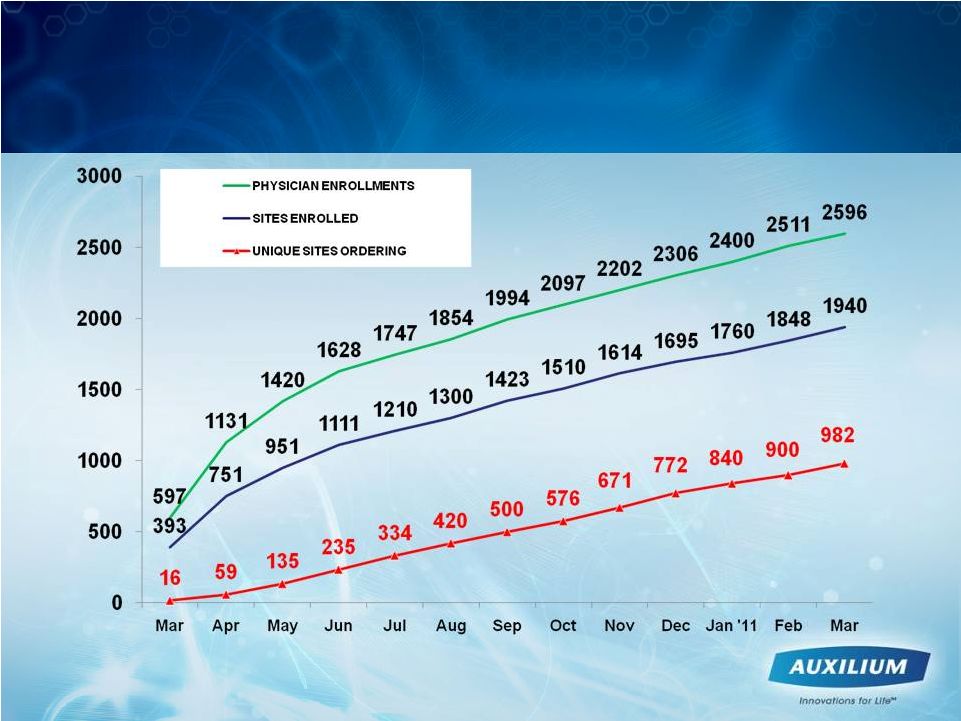

13

Leading Indicators Trending Positively

-

Enrollment & sites that have ordered XIAFLEX |

14

Quarterly XIAFLEX Unit Sales Growth

Increased Steadily in 2010

1Q10

2Q10

3Q10

4Q10

53

632

1464

2356

0

500

1000

1500

2000

2500 |

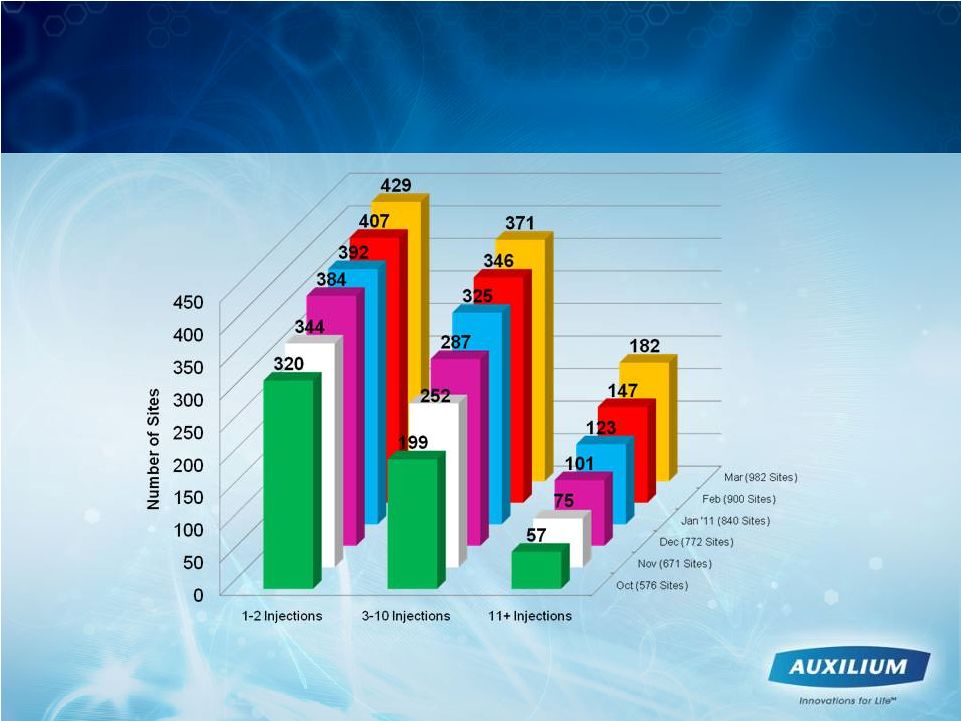

15

Some Sites Moving from Test Drive to

Increasing Usage

Injections per Site |

16

We Expect the Global Dupuytren’s Market to

Develop in 2011 and 2012

U.S.

•

XIAFLEX specific J-code J0775 effective Jan. 1

•

U.S. CPT code guidance expected for Jan. 2012

•

Additional phase IV clinical trials

•

Increasing peer to peer dialogue programs for U.S.

physicians

•

Targeted U.S. patient education campaign planned

ROW

•

Pfizer

launch

of

XIAPEX

®

in

EU

begins

in

2011

•

Asahi Kasei development of XIAFLEX in Japan |

Testim

®

1% Testosterone Gel

17

•

Indicated for testosterone replacement therapy in adult

males for hypogonadism

•

Launched in U.S. in 2003 and EU in 2006

•

>7 yrs of use with established safety and efficacy

•

Applied once daily at 5-10mg

>

~100M daily doses since launch

>

16 clinical studies involving approx. 1,800 patients

>

90% stay on starting dose of 5mg (one tube)

>

Simple application process |

18

Hypogonadism Is an Unmet Need and

Under-penetrated Market

•

39% of U.S. males over 45 yrs are

hypogonadal

1

>Less than 10% of affected population

receives treatment

•

Increasing physician and patient education

and awareness should result in increased

treatment

1

Mulligan

T.

et

al.

Int

J.

Clin

Pract

2006 |

19

Gels Continue to Drive Significant Growth in

TRT Marketplace

Source: IMS data

$35

$117

$198

$281

$334

$371

$439

$545

$685

$892

$1,149

$49

$59

$77

$118

$210

$302

$390

$451

$483

$554

$663

$810

$1,041

0

200

400

600

800

1,000

1,200

1,400

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

($ in millions)

Gel Segment Growth ($)

Feb

2011 L12M:

28.8%

$1,329

Gel

Patch

Oral

Injectables |

20

Testosterone Replacement Therapy Landscape

is Changing

•

New competition in 2011 should help

increase overall market

–

Axiron 2% solution

–

Fortesta 2% gel

–

Androgel 1.6% gel seeking approval

•

Expected further increase in physician and

patient education and awareness |

21

Delivering on Current Pipeline

PRODUCT

LATE RESEARCH

PRE-CLINICAL PHASE I PHASE II PHASE

III MARKET

TESTIM®

GEL

XIAFLEX®

XIAFLEX®

XIAFLEX®

Hypogonadism

Dupuytren’s contracture

Peyronie’s disease

Frozen Shoulder Syndrome |

22

1

Smith BH. Am J Clin Pathol. 1966;45:670-678.

2

Somers KD, Dawson DM. J Urol. 1997;157:311-315.

•

Scarring phenomenon affecting the

tunica albuginea

1

•

Plaques show excessive collagen deposition

2

•

Potential Symptoms

>

Pain with erection, penile curvature/

deviation, penile shortening, indentations,

and/or erectile dysfunction

>

May experience difficulty with sexual

intercourse, loss of self-esteem,

and depression

Peyronie’s disease Is a Devastating Disorder

with No Approved Therapies |

23

1

Bella A. Peyronie’s Disease J Sex Med 2007;4:1527–1538

2

Lue TF, et al. Summary of the recommendations on sexual dysfunctions in men. J Sex Med

2004;1:6–23. 3

Mulhall JP, et al. Subjective and objective analysis of the prevalence of Peyronie’s disease in a

population of men presenting for prostate cancer screening. J Urol 2004;171:2350–3.

4

Smith BH. Am J Clin Pathol. 1966;45:670-678.

5

Lindsay MB, J Urol.

1991;146:1007-1009.

6

Nyberg L, J Urol.128: 48, 1982

•

Prevalence of Peyronie’s disease is estimated to be approximately

5% in adult men

1,2,3

>

Actual prevalence may be higher, based on autopsies

4

•

Prevalence rate increases with age

>

The

average

age

of

disease

onset

is

53

years

5

•

High association with other diseases such as:

>

Diabetes, erectile dysfunction (ED), Dupuytren’s contracture,

plantar fascial contracture, tympanosclerosis, gout, and Paget’s

disease

6

We believe Peyronie’s Disease Is Under-

diagnosed and Under-treated |

24

Peyronie’s Disease Phase III Development

Program

Study

Type

~ #

Subjects

Sites

XIAFLEX:

Placebo

Duration

AUX-CC-803

Double-blind,

placebo controlled

300

~ 30 US

5 AUS

2:1

52 Wks

AUX-CC-804

Double-blind,

placebo controlled

300

~ 30 US

5 AUS

2:1

52 Wks

AUX-CC-802

Open Label

250

12 US

6 NZ

18 EU

N/A

36 Wks

AUX-CC-805

Pharmacokinetics

16

1 US

N/A

4 Wks

XIAFLEX 0.58 mg

Two injections per treatment cycle

24 to 72 hours between injections

Penile plaque modeling following each cycle

Up to 4 cycles at 6 week intervals

Co-primary endpoints of disease bother and penile curvature

|

25

We Believe Changes to the Phase IIb Trial Design

Should Increase the Chance of Success in Phase III

•

4 cycles of therapy in the phase III trial

•

All patients receive modeling in the phase III trial

•

All patients must have greater than 12 months of

disease since diagnosis to enter the phase III trial

Mean net improvements in phase IIb penile

curvature and bother domain for modeling

arm would have met statistical significance

using phase III co-primary endpoint

requirements |

26

Business Development Efforts Expected to

Focus on Building Out Pipeline

•

Leverage current infrastructure of Testim and

XIAFLEX field forces with marketed products

•

Seeking Phase II and later assets in Urology,

Endocrinology, Rheumatology, and Orthopedics

•

Niche products with specialty physician call

points also represent development opportunities |

27

BTC Litigation Update

•

On Feb. 15, 2011, AUXL filed a complaint against BioSpecifics Technologies

Corp.

(BTC)

alleging

that

BTC

has

breached

the

parties’

Amended

and

Restated

Development and License Agreement dated as of December 11, 2008 by its

commencement of clinical trials for the use of injectable collagenase to treat

canine

lipomas

without

the

prior

knowledge

and

approval

of

the

parties’

Joint

Development Committee (JDC).

•

AUXL is seeking preliminary and permanent injunctions ordering BTC to, among

other things:

•

suspend its canine lipoma clinical trial known as Chien-803 and

•

refrain from initiating any new clinical trials related to collagenase, both until

such time as

any

such

trial

has

been

reviewed

and

approved

by

the

parties’

JDC

pursuant

to

the

terms of the Agreement.

•

AUXL also seeking a declaratory judgment as to the rights and responsibilities of

the JDC under the Agreement

•

Suit filed in the Court of Common Pleas, Chester County, Pennsylvania

•

Court ordered that papers filed with the court were to be deemed

under seal and

not available to the public until further order |

28

2010 Financial Results ($ Millions)

Incr. (Decr.)

2010

2009

$

%

Total Revenues

$211.4

$164.0

$47.4

29%

Cost of Goods Sold *

$49.7

$37.1

$12.6

34%

Gross Profit

$161.7

$127.0

$34.7

27%

% of Revenues

76%

77%

R & D Expense *

$48.0

$51.4

($3.4)

-7%

S G & A Expense *

$164.7

$129.2

$35.5

27%

Net Loss

($51.2)

($53.5)

$2.2

4%

Earnings per share

($1.08)

($1.22)

$0.14

12%

* Stock Based Comp Expense

$17.81

$17.90

($0.1)

-1%

Cash & Cash

Equivalents

$128.20 |

29

2011 Guidance

Global Testim Revenues

$200 -

210 million

Xiaflex:

US Revenues

50 -

60 million

Ex US / Def Rev

5 -

7 million

Total Xiaflex

$55 -

67 million

Total Revenues

$255 -277 million

R & D Expense

$60 -

70 million

S G & A Expense

$170 -

180 million

Net Income (Loss)

$(35) -

(45) million

Stock Base Comp Expense

$15 -

20 million |

30

We Believe That Auxilium is Well-Positioned

for Long-Term Growth

•

Maximize XIAFLEX net revenues for Dupuytren’s

contracture in the U.S.;

•

Maximize global Testim revenues.

•

Support Pfizer in the launch of Xiapex for Dupuytren’s

contracture in the EU;

•

Complete Peyronie’s disease phase III double-blind

studies, with top-line results anticipated in 1H12; and,

•

Advance XIAFLEX new indication(s). |

31

Our Vision Is to Become a Rapidly Growing,

Profitable and Sustainable Biopharmaceutical

Company

Maximize Value of

Testim and XIAFLEX

Deliver on

Current Pipeline

Build Out

Pipeline in

Specialty

Therapeutic

Areas |