Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - DOUBLE CROWN RESOURCES INC. | denarii_ex321.htm |

| EX-31.1 - CERTIFICATION - DOUBLE CROWN RESOURCES INC. | denarii_ex311.htm |

| EX-31.2 - CERTIFICATION - DOUBLE CROWN RESOURCES INC. | denarii_ex312.htm |

| EX-23.1 - CONSENT LETTER - DOUBLE CROWN RESOURCES INC. | denarii_ex231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission file number 000-53389

DENARII RESOURCES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 98-0491567 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

711 S. Carson Street, Ste 4.

Carson City, NV 89701

(Address of Principal Executive Offices & Zip Code)

(949)-335-5159

(Telephone Number)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

|

Accelerated filer o

|

|

Non-accelerated filer o

(Do not check if a smaller reporting company)

|

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business of the registrant’s most recently completed second fiscal quarter: June 30, 2010 $2,992,815.

ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS

N/A

Check whether the issuer has filed all documents and reports required to be filed by Section 12, 13 and 15(d) of the Securities Exchange Act of 1934 after the distribution of securities under a plan confirmed by a court. Yes o No o

APPLICABLE ONLY TO CORPORATE REGISTRANTS

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date.

Class Outstanding as of April 10, 2011 Common Stock, $0.001 75,599,999 shares

DOCUMENTS INCORPORATED BY REFERENCE

If the following documents are incorporated by reference, briefly describe them and identify the part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (i) any annual report to security holders; (ii) any proxy or information statement; and (iii) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933 (the "Securities Act"). The listed documents should be clearly described for identification purposes (e.g. annual reports to security holders for fiscal year ended December 24, 1990).

N/A

Transitional Small Business Disclosure Format (Check one): Yes o No x

2

DENARII RESOURCES, INC.

Part I

Statements made in this Form 10-K that are not historical or current facts are "forward-looking statements" made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 (the "Act") and Section 21E of the Securities Exchange Act of 1934. These statements often can be identified by the use of terms such as "may," "will," "expect," "believe," "anticipate," "estimate," "approximate" or "continue," or the negative thereof. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management's best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Available Information

Denarii Resources Inc. files annual, quarterly, current reports, proxy statements, and other information with the Securities and Exchange Commission (the “Commission”). You may read and copy documents referred to in this Annual Report on Form 10-K that have been filed with the Commission at the Commission’s Public Reference Room, 450 Fifth Street, N.W., Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. You can also obtain copies of our Commission filings by going to the Commission’s website at http://www.sec.gov

PART I

BUSINESS DEVELOPMENT

Denarii Resources Inc. was incorporated under the laws of the State of Nevada on March 23, 2006 and has been engaged in the business of exploration of mineral properties worldwide since its inception. After the effective date of our registration statement filed with the Securities and Exchange Commission on June 16, 2006, we commenced trading on the Over-the-Counter Bulletin Board under the symbol “DNRR”.

Please note that throughout this Annual Report, and unless otherwise noted, the words "we," "our," "us," the "Company," or "Denarii Resources," refers to Denarii Resources Inc.

Our transfer agent is Island Stock Transfer Inc.,

CURRENT BUSINESS OPERATIONS

We are an exploration stage company that was organized to enter into the mineral industry. We intend to locate, explore, acquire and develop mineral properties worldwide.

MINERAL PROPERTIES

McNab Molybdenum Property

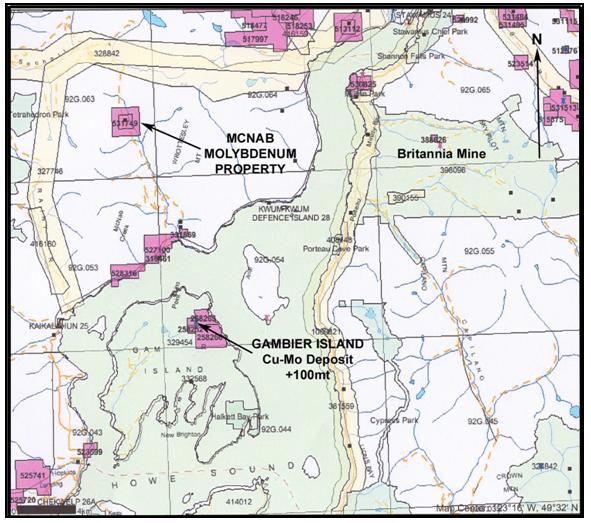

We have a mineral property, known as the McNab Molybdenum Property (the “McNab Property”). The McNab Property is comprised of one mineral claim containing 1 cell claim units totaling 251.11 hectares;

BC Tenure # Work Due Date Units Total Area (Hectares)

831929 12 251.11

Location and Tenure

The McNab Property is located near the headwaters of McNab Creek, approximately 40 km northwest of Vancouver, BC. Access to the property is presently via water or helicopter. The McNab Property consists of 251.11 hectares of mineral title, valid until August 20, 2010. The property is held in the name of Stan Ford on behalf of the company pending completion of the company’s application for a British Columbia Miners License. The McNab Property can be reached directly from Vancouver 40 km via helicopter. Alternatively, water transportation or float plane can be used to reach the logging camp at tidewater, and then by road 10 km to the McNab Property. Arrangements can be made to rent a truck from the logging company to allow road access to the property.

Previous work consisted of geological mapping, rock sampling, and a geochemical soil survey. The McNab property has similar geological characteristics to the nearby +100 MT Gambier Island porphyry Cu-Mo deposit. The McNab Property covers a zone of porphyry-style molybdenum and copper mineralization outcropping along the main logging road. A roadcut located approximately 10 km from tidewater exposes a mineralized zone over 150 metres in width. Molybdenite, chalcopyrite, bornite and pyrite occur in quartz veins and as disseminations within quartz diorite and granodiorite porphyritic intrusives. Several copper and molybdenum soil anomalies have been delineated adjacent to the known mineralized area.

Geology

Molybdenum mineralization in granitic rock was discovered in 1977 during the building of a logging road up the McNab Creek Valley. There is no previous record of molybdenum discoveries in the valley, with the sole exception of Howe Copper Mine, located beyond the headwaters of McNab Creek on Mount Donaldson. The nearest similar mineral deposit of the porphyry Mo-Cu type is the +100 mt Gambier Island Cu-Mo deposit located about 15 km to the southeast.

The McNab Property is underlain by the various phases of the Cenozoic-Mesozoic Coast Plutonic Complex and a small pendant of Lower Cretaceous Gambier Group metavolcanic and metasedimentary rocks. The intrusive rocks vary from quartz diorite with diorite inclusions, to granodiorite. Mineralization consists of pyrite, chalcopyrite, molybdenite, and minor bornite occurring in the quartz diorite near its projected contact with granodiorite. The sulphides occur either on fracture plane surfaces or are associated with quartz veining. Minor sericite, epidote and chlorite are evident. Gambier Group rocks mask the eastward continuation of the mineralization.

The property and mineralization were described by S.S Tan, P. Eng. in a July 5, 1977 report as “Mineralization in the main showing is exposed for a north-south distance of 450 feet along the west bank of a road cut. Molybdenite with lesser chalcopyrite and pyrite occurs as streaks, patches and disseminations in closely spaced quartz veinlets and stringers within the quartz diorite porphyry host rock. A pyrite halo limits this stockwork Mo-Cu mineralization to the north and south. The McNab Property is favorable for the occurrence of the larger-tonnage low-grade Mo-Cu porphyry type deposit. The proximity to tidewater and the occurrence of Mo-Cu porphyry type showing makes this an attractive exploration target for the search of such economic mineral deposits.”

The only recorded exploration work on theMcNab Property occurred between 1977 and 1980, following discovery in 1977. Silverado Mines Ltd., a public listed company, funded this work. A geochemical soil survey done in 1979 is the most recent exploration work in the area. In a 1980 assessment report pertaining to a 370-sample geochemical soil survey of the area, J.W. Murton, P. Eng. describes two strong molybdenum and coincident copper soil anomalies, which were discovered peripheral to the showings. Additional surveys and rock trenching were recommended but no further geological work has been recorded.

Summary Report of Geologist

The McNab Property is the subject to a Summary Report dated April 2006 prepared by Greg Thomson, B.Sc., P. Geo. and James Laird, Laird Explorations Ltd. The Report was prepared in compliance with National Instrument 43-101 and Form 43-101F1.

Mr. Thomson certified that the information contained in the report was based upon a review of previous reports and geological studies related to the property area and personal experience with local geology gained while employed as a consulting geologist in Southwest British Columbia.

Proposed Work Program

A proposed work program includes construction of a control grid, geological mapping and rock sampling of surface showings, a soil and silt geochemical sampling program, IP geophysical survey, and rock trenching. Based on a compilation of these results, a diamond drill program will be designed to explore and define the potential resources.

Phase 1

Reconnaissance geological mapping, prospecting and

rock sampling, helicopter transportation.

Phase 2

Detailed geological mapping and rock sampling, grid construction, soil and silt geochemical survey, IP survey, establish drill and trenching targets.

Phase 3

1000 metres of diamond drilling including geological supervision, assays, report and other ancillary costs.

Our business plan is to proceed with the exploration of our molybdenum property to determine whether there is any potential for molybdenum on the property that comprises our mineral claims. We have decided to proceed with the three phases of a staged exploration program recommended by the geological report. We anticipate that these phases of the recommended geological exploration program will cost approximately $25,000.00, $100,000 and $175,000 respectively. We had $0 in cash reserves as of the period ended December 31, 2010. The lack of cash has kept us from conducting any exploration work on the property. We will commence Phase 1 of the exploration program once we receive funding. Phase 2 and 3 will commence after completion of the Phase 1 program. As such, we anticipate that we will incur the following expenses over the next twelve months:

>> $25,000.00 in connection with the completion of Phase 1 of our recommended geological work program;

>> $100,000.00 in connection with the completion of Phase 2 of our recommended geological work program;

>> $175,000 for Phase 3 of our recommended geological work program; and

>> $10,000 for operating expenses, including professional legal and accounting expenses associated with compliance with the periodic reporting requirements after we become a reporting issuer under the Securities Exchange Act of 1934.

If we determine not to proceed with further exploration of our mineral claims due to a determination that the results of our initial geological program do not warrant further exploration or due to an inability to finance further exploration, we plan to pursue the acquisition of an interest in other mineral claims. We anticipate that any future acquisition would involve the acquisition of an option to earn an interest in a mineral claim as we anticipate that we would not have sufficient cash to purchase a mineral claim of sufficient merit to warrant exploration. This means that we might offer shares of our stock to obtain an option on a property. Once we obtain an option, we would then pursue finding the funds necessary to explore the mineral claim by one or more of the following means: engaging in an offering of our stock; engaging in borrowing; or locating a joint venture partner or partners.

Lucky Thirteen Placer Property

Effective on June 3, 2010 (the “Effective Date”), we entered into a corporate acquisition agreement (the “Acquisition Agreement”) with Touchstone Precious Metals Inc. and Touchstone Ventures Ltd. (“Touchstone”). Touchstone had represented to us that it had an agreement (the “Touchstone Agreement”) with Peter Osha (“Osha”) to purchase the Lucky Thirteen Placer mineral claims located near Hope, British Columbia, Canada (the “Mineral Claims”). Touchstone had further represented to us that in accordance with the terms and provisions of the Touchstone Agreement, Touchstone will have the right to earn a 100% interest in the Mineral Claims subject only to royalty interests based upon payment by Touchstone of an aggregate amount of $1,500,000 on scheduled payments commencing May 15, 2010 as follows: (i) $50,000 upon completion of the work program (the “Work Program Effective Date”); (ii) $50,000 within six months of the Work Program Effective Date; (iii) $100,000 within twelve months of the Work Program Effective Date; (iv) $100,000 within eighteen months of the Work Program Effective Date; (v) $150,000 within twenty-four months of the Work Program Effective Date; (vi) $150,000 within thirty months of the Work Program Effective Date; (vii) $200,000 within thirty-six months of the Work Program Effective Date; (viii) $200,000 within forty-two months of the Work Program Effective Date; (ix) $250,000 within forty-eight months pf the Work Program Effective Date; and (x) $250,000 within fifty-four months of the Work Program Effective Date.

Under the terms of the Touchstone Agreement, Touchstone was also going to be the operator of the Mineral Claims. At such time that net profits are realized from production of the Mineral Claims, Osha would be entitled to a return royalty to be paid as a percentage on any and all production to be based on the average settlement price for gold as determined by the London Bullion Metals Association $500/oz – 5.0% return royalty, $750/ox – 7.5% return royalty (the “Return Royalty”). Once Osha had received the aggregate payment of $1,500,000, Osha’s interest would automatically convert to a 3% net smelter royalty interest (the “Net Smelter Royalty”). For a period of no longer than one year after payment of the $1,500,000, the Net Smelter Royalty could be reduced to 1% in exchange for a $1,000,000 payment for each 1% of the Net Smelter Royalty total 2% leaving Osha with a 1% Net Smelter Royalty.

In accordance with the terms and provisions of the Acquisition Agreement, we were to acquire an eighty percent (80%) interest in Touchstone (the “Touchstone Interest”) represented by acquisition by us of shares of common stock of Touchstone. We would earn our Touchstone Interest as we funded an approved work program of approximately $400,000, which funds were to be monitored and disbursed by a committee represented by three persons (the “Committee”).

In further accordance with the terms and provisions of the Acquisition Agreement, we had thirty days from the Effective Date to fund $75,000 of the work program and sixty days from the Effective Date to place the balance of the $400,000 into the escrow account of Touchstone. Upon completion of the work program, Osha was to transfer the Mineral Claims to Touchstone and we would have earned twenty-five percent (25%) of the Touchstone Interest. Upon receipt by Touchstone of a British Columbia mining permit within twelve months from the Effective Date, we would subsequently have earned fifty percent (50%) of the Touchstone Interest. Once the Mineral Claims are in production, we would have earned a full eighty percent (80%) of the Touchstone Interest.

As of the date of this Annual Report and upon completion of its due diligence, we determined that it is in our best interests and those of our shareholders to rescind the Acquisition Agreement and to not further the acquisition of the Touchstone Interest.

Latapiat Purchase Agreement

Effective on September 25, 2009 (the “Effective Date”), we entered into an agreement for purchase (the “Purchase Agreement”) with Maria Ines Moraga Latapiat (“Latapiat”). In accordance with the terms and provisions of the Purchase Agreement, we were to have acquired from Latapiat two coal concessions which Latapiat owned the rights to located in Lota Bay, Chile, approximately 300 miles south of Santiago, Chile (the “Concessions”). We were to further issue 10,000,000 shares of its common stock to Latapiat.

After several months of researching the acquisition of the Concessions, as of approximately October 29, 2010, we have been unable to receive the adequate financial and technical information needed to make an informed decision as to whether to proceed with the acquisition of the Concessions. Latapiat was unable to provide the required documentation as a result of the loss of such information and documentation resulting from the earth quake in Chile on February 27, 2010. Therefore, after considerable due diligence, we have determined that it is in our best interests and those of our shareholders to rescind the Purchase Agreement and to not further the acquisition of the Concessions. As of the date of this Annual Report, the 10,000,000 shares of our common stock have not been issued to Latapiat.

PROPOSED FUTURE BUSINESS OPERATIONS

Our current strategy is to complete further acquisition of other mineral property opportunities which fall within the criteria of providing a geological basis for development of mining initiatives that can provide near term revenue potential and production cash flows to create expanding reserves. We anticipate that our ongoing efforts, subject to adequate funding being available, will continue to be focused on successfully concluding negotiations for additional interests in mineral properties. We plan to build a strategic base of producing mineral properties.

Our ability to continue to complete planned exploration activities and expand acquisitions and explore mining opportunities is dependent on adequate capital resources being available and further sources of debt and equity being obtained.

DEVELOPMENT OF MINERAL PROPERTIES

The requirement to raise further funding for mineral exploration and development beyond that obtained for the next six month period may be dependent on the outcome of geological and engineering testing occurring over this interval on potential properties. If future results provide the basis to continue development and geological studies indicate high probabilities of sufficient mineral production quantities, we will attempt to raise capital to further our programs, build production infrastructure, and raise additional capital for further acquisitions. This includes the following activity:

|

·

|

Target further leases for exploration potential and obtain further funding to acquire new development targets.

|

|

·

|

Review all available information and studies.

|

|

·

|

Digitize all available factual information.

|

|

·

|

Completion of a NI 43-101 Compliant Report with a qualified geologist familiar with mineralization in the respective area.

|

|

·

|

Determine feasibility and amenability of extracting the minerals.

|

|

·

|

Create investor communications materials, corporate identity.

|

|

·

|

Raise funding for mineral development.

|

COMPETITION

We operate in a highly competitive industry, competing with other mining and exploration companies, and institutional and individual investors, which are actively seeking metal and mineral based exploration properties throughout the world together with the equipment, labour and materials required to exploit such properties. Many of our competitors have financial resources, staff and facilities substantially greater than ours. The principal area of competition is encountered in the financial ability to cost effectively acquire prime metal and minerals exploration prospects and then exploit such prospects. Competition for the acquisition of metal and minerals exploration properties is intense, with many properties available in a competitive bidding process in which we may lack technological information or expertise available to other bidders. Therefore, we may not be successful in acquiring and developing profitable properties in the face of this competition. No assurance can be given that a sufficient number of suitable metal and minerals exploration properties will be available for acquisition and development.

MINERALS EXPLORATION REGULATION

Our minerals exploration activities are, or will be, subject to extensive foreign laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Minerals exploration is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations may impose substantial costs on us and will subject us to significant potential liabilities. Changes in these regulations could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our business operations.

Exploration and production activities are subject to certain environmental regulations which may prevent or delay the commencement or continuance of our operations. In general, our exploration and production activities are subject to certain foreign regulations, and may be subject to foreign or federal, state and local laws and regulations, relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Compliance with these laws and regulations does not appear to have a future material effect on our operations or financial condition to date. Specifically, we may be subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. However, such laws and regulations, whether foreign or local, are frequently changed and we are unable to predict the ultimate cost of compliance. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in the industry and our current operations have not expanded to a point where either compliance or cost of compliance with environmental regulation is a significant issue for us. Costs have not been incurred to date with respect to compliance with environmental laws but such costs may be expected to increase with an increase in scale and scope of exploration.

Minerals exploration operations are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our business operations. Minerals exploration operations are subject to foreign, federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Minerals exploration operations are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, state, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. As of the date of this Annual Report, we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

RESEARCH AND DEVELOPMENT ACTIVITIES

No research and development expenditures have been incurred, either on our account or sponsored by customers, during the past three years.

EMPLOYEES

We do not employ any persons on a full-time or on a part-time basis. Dr. Stewart Jackson is our President and Chief Executive Officer/Chief Financial Officer. This individual is primarily responsible for all our day-to-day operations. Other services are provided by outsourcing, consultant, and special purpose contracts.

CONSULTANTS

Consulting Agreements

Effective October 1, 2010 and November 1, 2010, we entered into certain consulting agreements with certain consultants as described below:

|

·

|

Six-month consulting agreement dated October 1, 2010 (the “LV Media Group Consulting Agreement”) between the Company and LV Media Group LLC (“LV Media Group), pursuant to which LV Media Group will provide certain consulting services to the Company including, but not limited to, news releases, corporate positioning, corporate website, e-newsletter strategy, and corporate information circular; (ii) LV Media Group shall be entitled to monthly compensation in the amount of $5,000.00 representing aggregate compensation of $30,000.00; and (iii) the Company shall issue to LV Media an aggregate of 3,000,000 shares of its restricted common stock at $0.01 per share as payment for the aggregate amount of $30,000.00 due and owing;

|

|

·

|

Eight-month consulting agreement dated October 1, 2010 (the “Murphy Consulting Agreement”) between the Company and Paul Murphy (“Murphy”), pursuant to which Murphy will provide certain consulting services to the Company including, but not limited to, contact with precious metal assets for acquisition in North America; (ii) Murphy shall be entitled to monthly compensation of $10,000.00 representing aggregate compensation of $80,000.00; and (iii) the Company shall issue to Murphy an aggregate of 4,000,000 shares of its restricted common stock at $0.02 per share as payment for the aggregate amount of $80,000.00 due and owing;

|

|

·

|

Twelve-month consulting agreement dated November 1, 2010 (the “Serrano Consulting Agreement”) between the Company and Ariel Serrano (“Serrano”), pursuant to which Serrano will provide certain consulting services to the Company including, but not limited to, contact with precious metal assets for acquisition in North American; (ii) Serrano shall be entitled to monthly compensation of $3,333.33 representing aggregate compensation of $40,000.00; and (iii) the Company shall issue to Serrano an aggregate of 2,000,000 shares of its restricted common stock at $0.02 per share as payment for the aggregate amount of $40,000.00 due and owing;

|

|

·

|

Five-year consulting agreement dated October 1, 2010 (the “Jackson Consulting Agreement”) between the Company and Dr. Stewart Jackson (“Jackson”), pursuant to which Jackson, as the chief executive officer and a member of the Board of Directors, will provide certain consulting services to the Company including, but not limited to, contact with precious metal assets for acquisition in North America; (ii) Jackson shall be entitled to monthly compensation of $2,000.00 representing aggregate compensation of $120,000.00; and (iii) the compensation may be paid by cash or issuance of shares of common stock priced at the ten-day average each month;

|

|

·

|

Twelve-month consulting agreement dated October 1, 2010 (the “Figueiredo Consulting Agreement”) between the Company and David Figueiredo (“Figueiredo”), pursuant to which Figueiredo will provide certain consulting services to the Company including, but not limited to, news releases, corporate positioning, corporate website, e-newsletter strategy, and corporate information circular; (ii) Figueiredo shall be entitled to an initial retainer of $20,000.00; (iii) Figueiredo shall be further entitled to monthly compensation of $4,000.00; and (iv) the Company shall issue to Figueiredo an aggregate of 666,666 shares of its restricted common stock at $0.03 per share as payment for the initial retainer of $20,000.00;

|

|

·

|

Twelve-month consulting agreement dated October 1, 2010 (the “Claus Consulting Agreement”) between the Company and Steve Claus (“Claus”), pursuant to which Claus will provide certain consulting services to the Company including, but not limited to, news releases, corporate positioning, corporate website, e-newsletter strategy, and corporate information circular; (ii) Clause shall be entitled to an initial retainer of $10,000.00; (iii) Claus shall be further entitled to monthly compensation of $2,000.00; and (iv) the Company shall issue to Claus an aggregate of 333,333 shares of its restricted common stock at $0.03 per share as payment for the initial retainer of $10,000.00;

|

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are all of the material risks that we are currently aware of that are facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

We are an exploration stage company and we expect to incur operating losses for the foreseeable future.

We were incorporated on March 23, 2006 and to date have recently been involved in the organizational activities, and acquisition of our claims. We have no way to evaluate the likelihood that our business will be successful. We have not earned any revenues as of the date of this annual report. Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration and development of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur significant losses into the foreseeable future. We recognize that if production of minerals from the claims is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We have yet to earn revenue and our ability to sustain our operations is dependent on our ability to raise additional financing to complete the final phase of our exploration program if warranted. As a result, our accountant believes there is substantial doubt about our ability to continue as a going concern.

We have accrued net losses of $1,084,113 for the period from inception (March 23, 2006) to December 31, 2010, and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral claims. These factors raise substantial doubt that we will be able to continue as a going concern. Seale and Beers CPAs, our independent auditor, has expressed substantial doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, we will not be able to complete our business plan. As a result we may have to liquidate our business and you may lose your investment. You should consider our auditor's comments when determining if an investment in our company is suitable.

We may be unable to obtain additional capital that we may require to implement our business plan. This would restrict our ability to grow.

The proceeds from our private offerings completed during fiscal year ended December 31, 2010 provide us with a limited amount of working capital and is not sufficient to fund our proposed operations. We will require additional capital to continue to operate our business and our proposed operations. We may be unable to obtain additional capital as and when required. Generally during prior fiscal years, a related party paid expenses on our behalf.

Future acquisitions and future development, production and marketing activities, as well as our administrative requirements (such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses) will require a substantial amount of additional capital and cash flow.

We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, the capital we have received to date may not be sufficient to fund our operations going forward without obtaining additional capital financing.

Any additional capital raised through the sale of equity may dilute your ownership percentage. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

Our ability to obtain needed financing may be impaired by such factors as the capital markets (both generally and in the resource industry in particular), our status as a new enterprise without a demonstrated operating history, the location of our mineral properties and the price of minerals on the commodities markets (which will impact the amount of asset-based financing available to us) or the retention or loss of key management. Further, if mineral prices on the commodities markets decrease, then our revenues will likely decrease, and such decreased revenues may increase our requirements for capital. If the amount of capital we are able to raise from financing activities is not sufficient to satisfy our capital needs, we may be required to cease our operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Our exploration activities on our mineral properties may not be commercially successful, which could lead us to abandon our plans to develop the property and our investments in exploration.

Our long-term success depends on our ability to establish commercially recoverable quantities of ore on our mineral properties that can then be developed into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of mineral exploration is determined in part by the following factors:

· identification of potential mineralization based on superficial analysis;

· availability of government-granted exploration permits;

· the quality of management and geological and technical expertise; and

· the capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop processes to extract minerals, and to develop the mining and processing facilities and infrastructure at any chosen site. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate09-8 widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if it is unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the trading price of our common stock and impair our ability to raise future financing. We cannot provide any assurance to investors that we will discover or acquire any mineralized material in sufficient quantities on any of our properties to justify commercial operations. Further, we will not be able to recover the funds that we spend on exploration if we are not able to establish commercially recoverable quantities of precious metals or minerals on our properties.

Because of the unique difficulties and uncertainties inherent in mineral ventures, we face a high risk of business failure.

You should be aware of the difficulties normally encountered by mineral companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration and development of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. If the results of our development program do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims. Our ability to acquire additional claims will be dependent upon our possessing adequate capital resources when needed. If no funding is available, we may be forced to abandon our operations.

Because of the inherent dangers involved in mineral extracting, there is a risk that we may incur liability or damages as we conduct our business.

The extracting of minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no insurance to cover against these hazards. The payment of such liabilities may result in our inability to complete our planned program and/or obtain additional financing to fund our program.

Future participation in an increased number of minerals exploration prospects will require substantial capital expenditures.

The uncertainty and factors described throughout this section may impede our ability to economically discover, acquire, develop and/or exploit mineral prospects. As a result, we may not be able to achieve or sustain profitability or positive cash flows from operating activities in the future.

The financial statements for the fiscal year ended December 31, 2010 and December 31, 2009 have been prepared “assuming that we will continue as a going concern,” which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business. Our ability to continue as a going concern is dependent on raising additional capital to fund our operations and ultimately on generating future profitable operations. There can be no assurance that we will be able to raise sufficient additional capital or eventually have positive cash flow from operations to address all of our cash flow needs. If we are not able to find alternative sources of cash or generate positive cash flow from operations, our business and shareholders will be materially and adversely affected. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation – Going Concern.”

The mineral exploration and mining industry is highly competitive and there is no assurance that we will be successful in acquiring the leases.

The mineral exploration and mining industry is intensely competitive, and we compete with other companies that have greater resources. Many of these companies not only explore for and produce certain minerals, but also market certain minerals and other products on a regional, national or worldwide basis. These companies may be able to pay more for productive mineral properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may have a greater ability to continue exploration activities during periods of low mineral market prices. Our larger competitors may be able to absorb the burden of present and future foreign, federal, state, local and other laws and regulations more easily than we can, which would adversely affect our competitive position. Our ability to acquire additional properties and to discover productive prospects in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, because we have fewer financial and human resources than many companies in our industry, we may be at a disadvantage in bidding for exploratory prospects and producing mineral properties.

The marketability of natural resources will be affected by numerous factors beyond our control which may result in us not receiving an adequate return on invested capital to be profitable or viable.

The marketability of natural resources which may be acquired or discovered by us will be affected by numerous factors beyond our control. These factors include macroeconomic factors, market fluctuations in commodity pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of certain minerals and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

As we undertake development of our claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our program.

There are several governmental regulations that materially restrict our mineral extraction program. We will be subject to the laws of the Province of British Columbia as we carry out our program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the area in order to comply with these laws. The cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

|

(a)

|

Water discharge will have to meet drinking water standards;

|

|

|

(b)

|

Dust generation will have to be minimal or otherwise re-mediated;

|

|

|

(c)

|

Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation;

|

|

|

(d)

|

An assessment of all material to be left on the surface will need to be environmentally benign;

|

|

|

(e)

|

Ground water will have to be monitored for any potential contaminants;

|

|

|

(f)

|

The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be remediated; and

|

|

|

(g)

|

There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species.

|

There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. If remediation costs exceed our cash reserves we may be unable to complete our exploration program and have to abandon our operations.

If access to our mineral properties is restricted by inclement weather, we may be delayed in any future mining efforts.

It is possible that adverse weather could cause accessibility to our properties difficult and this would delay in our timetables.

Based on consumer demand, the growth and demand for any ore we may recover from our claims may be slowed, resulting in reduced revenues to the company.

Our success will be dependent on the growth of demand for ores. If consumer demand slows our revenues may be significantly affected. This could limit our ability to generate revenues and our financial condition and operating results may be harmed.

We may be unable to retain key employees or consultants or recruit additional qualified personnel.

Our extremely limited personnel means that we would be required to spend significant sums of money to locate and train new employees in the event any of our employees resign or terminate their employment with us for any reason. Due to our limited operating history and financial resources, we are entirely dependent on the continued service of Dr. Stewart Jackson as our President/Chief Executive Officer/Chief Financial Officer and a director. Further, we do not have key man life insurance on any of these individuals. We may not have the financial resources to hire a replacement if any of our officers were to die. The loss of service of any of these employees could therefore significantly and adversely affect our operations.

Our officers and directors may be subject to conflicts of interest.

Our officers and directors serve only part time and are subject to conflicts of interest. Each of our executive officers and directors serves only on a part time basis. Each devotes part of his working time to other business endeavors, including consulting relationships with other corporate entities, and has responsibilities to these other entities. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, our officers and directors may be subject to conflicts of interest.

Nevada law and our articles of incorporation may protect our directors from certain types of lawsuits.

Nevada law provides that our officers and directors will not be liable to us or our stockholders for monetary damages for all but certain types of conduct as officers and directors. Our Bylaws permit us broad indemnification powers to all persons against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our officers and directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our officers and directors against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

Risks Related to Our Common Stock

Sales of a substantial number of shares of our common stock into the public market by certain stockholders may result in significant downward pressure on the price of our common stock and could affect your ability to realize the current trading price of our common stock.

Sales of a substantial number of shares of our common stock in the public market by certain stockholders could cause a reduction in the market price of our common stock.

As of the date of this Annual Report, we have 75,599,999 shares of common stock issued and outstanding. As of the date of this Annual Report, there are 29,577,499 outstanding shares of our common stock that are restricted securities as that term is defined in Rule 144 under the Securities Act. Although the Securities Act and Rule 144 place certain prohibitions on the sale of restricted securities, restricted securities may be sold into the public market under certain conditions.

Any significant downward pressure on the price of our common stock as the selling stockholders sell their shares of our common stock could encourage short sales by the selling stockholders or others. Any such short sales could place further downward pressure on the price of our common stock.

The trading price of our common stock on the OTC Bulletin Board has been and may continue to fluctuate significantly and stockholders may have difficulty reselling their shares.

Our common stock commenced trading on approximately February 28, 2009 on the OTC Bulletin Board and the trading price has fluctuated. In addition to volatility associated with Bulletin Board securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock: (i) disappointing results from our discovery or development efforts; (ii) failure to meet our revenue or profit goals or operating budget; (iii) decline in demand for our common stock; (iv) downward revisions in securities analysts’ estimates or changes in general market conditions; (v) technological innovations by competitors or in competing technologies; (vi) lack of funding generated for operations; (vii) investor perception of our industry or our prospects; and (viii) general economic trends.

In addition, stock markets have experienced price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common stock. As a result, investors may be unable to sell their shares at a fair price and you may lose all or part of your investment.

Additional issuances of equity securities may result in dilution to our existing stockholders.

Our Articles of Incorporation authorize the issuance of 100,000,000 shares of common stock. The Board of Directors has the authority to issue additional shares of our capital stock to provide additional financing in the future and the issuance of any such shares may result in a reduction of the book value or market price of the outstanding shares of our common stock. If we do issue any such additional shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other stockholders. As a result of such dilution, if you acquire shares of our common stock, your proportionate ownership interest and voting power could be decreased. Further, any such issuances could result in a change of control.

Our common stock is classified as a “penny stock” under SEC rules which limits the market for our common stock.

Because our stock is not traded on a stock exchange or on the NASDAQ National Market or the NASDAQ Small Cap Market, and because the market price of the common stock has fluctuated and may trade at times at less than $5 per share, the common stock may be classified as a “penny stock.” SEC Rule 15g-9 under the Exchange Act imposes additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as an “established customer” or an “accredited investor.” This includes the requirement that a broker-dealer must make a determination that investments in penny stocks are suitable for the customer and must make special disclosures to the customers concerning the risk of penny stocks. Many broker-dealers decline to participate in penny stock transactions because of the extra requirements imposed on penny stock transactions. Application of the penny stock rules to our common stock reduces the market liquidity of our shares, which in turn affects the ability of holders of our common stock to resell the shares they purchase, and they may not be able to resell at prices at or above the prices they paid.

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise additional capital for our operations. Since our operations to date have been principally financed through the sale of equity securities, a decline in the price of our common stock could have an adverse effect upon our liquidity and our continued operations. A reduction in our ability to raise equity capital in the future would have a material adverse effect upon our business plan and operations, including our ability to continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

Certain of our directors and officers are outside the United States with the result that it may be difficult for investors to enforce within the United States any judgments obtained against certain of our directors or officers.

Certain of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to effect service of process on our directors or officers, or enforce within the United States or Canada any judgments obtained against us or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under U.S. federal securities laws against them. In addition, investors may not be able to commence an action in a Canadian court predicated upon the civil liability provisions of the securities laws of the United States.

We currently do not own any physical property or own any real property. Our principal executive office is located at 711 S. Carson Street, Ste 4.,Carson City, NV 89701.

Management is not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Annual Report, no director, officer or affiliate is (i) a party adverse to us in any legal proceeding, or (ii) has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET FOR COMMON EQUITY

Shares of our common stock commenced trading on the OTC Bulletin Board under the symbol “DNRR:OB” in October 2008. The market for our common stock is limited, and can be volatile. The following table sets forth the high and low bid prices relating to our common stock on a quarterly basis for the periods indicated as quoted by the NASDAQ stock market. These quotations reflect inter-dealer prices without retail mark-up, mark-down, or commissions, and may not reflect actual transactions.

|

Quarter Ended

|

High Bid

|

Low Bid

|

||||||

|

December 31, 2008

|

$ | 0.0250 | $ | 0.0083 | ||||

|

March 31, 2009

|

$ | 0.35 | $ | 0.10 | ||||

|

June 30, 2009

|

$ | 0.76 | $ | 0.50 | ||||

|

September 30, 2009

|

$ | 0.65 | $ | 0.2500 | ||||

|

December 31, 2009

|

$ | 0.18 | $ | 0.05 | ||||

|

March 31, 2010

|

$ | 0.038 | $ | 0.024 | ||||

|

June 30, 2010

|

$ | 0.035 | $ | 0.033 | ||||

|

September 30, 2010

|

$ | 0.023 | $ | 0.022 | ||||

|

December 31, 2010

|

$ | 0.025 | $ | 0.022 |

All amounts have been adjusted for stock splits.

As of April 10, 2011, we had 199 shareholders of record, which does not include shareholders whose shares are held in street or nominee names.

DIVIDEND POLICY

No dividends have ever been declared by the Board of Directors on our common stock. Our losses do not currently indicate the ability to pay any cash dividends, and we do not have the intention of paying cash dividends on our common stock in the foreseeable future.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER COMPENSATION PLANS

We do not have an equity compensation plan. Therefore the table set forth below presents information as of the date of this Annual Report:

|

Plan Category

|

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

(a)

|

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights

(b)

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding column (a)

|

|||||||||

|

Equity Compensation Plans Approved by Security Holders

|

n/a | |||||||||||

|

Equity Compensation Plans Not Approved by Security Holders Warrants

|

||||||||||||

|

Total

|

1,700,000 | |||||||||||

Common Stock Purchase Warrants

As of the date of this Annual Report, there are an aggregate of 1,700,000 common stock purchase warrants issued and outstanding (the “Warrants”). The 1,700,000 Warrants to purchase shares of common stock and the shares of common stock underlying the Warrants were issued in a private placement by us during fiscal year 2010 at an exercise price of $0.02 per share exercisable for a period of two years from the date of share issuance, which expiration date is April 14, 2012. .

As of the date of this Annual Report, no Warrants have been exercised.

RECENT SALES OF UNREGISTERED SECURITIES

As of the date of this Annual Report and during fiscal year ended December 31, 2010, to provide capital, we sold stock in private placement offerings, issued stock in exchange for our debts or pursuant to contractual agreements as set forth below.

2010 PRIVATE PLACEMENTS

During fiscal year ended December 31, 2010, we completed two private placement offerings. Effective on April 14, 2010, we completed a certain private placement offering (the “First Private Placement Offering”) with certain United States residents. In accordance with the terms and provisions of the First Private Placement, we authorized the issuance to certain investors an aggregate of 1,700,000 units at a per unit price of $0.0147 for aggregate proceeds of $25,000. Each Unit was comprised of one share of restricted common stock and one non-transferrable Warrant. Each Warrant is exercisable at $0.02 per share for a period of two years.

Effective on May 26, 2010, we completed a certain private placement offering (the “Second Private Placement”) with a certain non-United States resident. In accordance with the terms and provisions of the Second Private Placement, we authorized the issuance to certain investors an aggregate of 2,000,000 shares of common stock at a per share price of $0.02 for aggregate proceeds of $40,000.

The Units under the First Private Placement Offering and the shares under the Second Private Placement Offering were sold to non-United States residents in reliance on Regulation S promulgated under the United States Securities Act of 1933, as amended (the “Securities Act”). The First Private Placement Offering and the Second Private Placement Offering have not been registered under the Securities Act or under any state securities laws and may not be offered or sold without registration with the United States Securities and Exchange Commission or an applicable exemption from the registration requirements. The investors executed subscription agreements and acknowledged that the securities to be issued have not been registered under the Securities Act, that they understood the economic risk of an investment in the securities, and that they had the opportunity to ask questions of and receive answers from our management concerning any and all matters related to acquisition of the securities.

CONSULTANT SERVICES

During fiscal year ended December 31, 2010, we issued 1,000,000 and authorized the issuance of an aggregate of 9,999,999 shares of our restricted common stock for services as follows:

Effective February 9, 2010, we issued 1,000,000 shares for services rendered to one of our consultants. The shares were issued at $0.14 per share.

Effective October 1, 2010 and November 1, 2010, we entered into the various consulting agreements. Therefore, our Board of Directors authorized the issuance of an aggregate of 9,999,999 shares of our restricted common stock to the consultants at either a per share price of $0.01 per share of $0.03 per share as follows:

|

·

|

Authorized issuance of 3,000,000 shares of restricted common stock to LV Media effective as of October 1, 2010.

|

|

·

|

Authorized issuance of 4,000,000 shares of restricted common stock to Murphy effective as of October 1, 2010.

|

|

·

|

Authorized issuance of 2,000,000 shares of restricted common stock to Serrano effective as of November 1, 2010.

|

|

·

|

Authorized issuance of 333,333 shares of restricted common stock to Claus effective as of October 1, 2010 as compensation for the retainer.

|

|

·

|

Authorized issuance of 666,666 shares of restricted common stock to Figueiredo effective as of October 1, 2010 as compensation for the retainer.

|

The aggregate of 9,999,999 shares of common stock were authorized to be issued and 1,000,000 shares were issued to either United States residents or non-United States residents in reliance on Section 4(2) or Regulation S promulgated under the United States Securities Act of 1933, as amended (the “Securities Act”). The shares of common stock have not been registered under the Securities Act or under any state securities laws and may not be offered or sold without registration with the United States Securities and Exchange Commission or an applicable exemption from the registration requirements. The consultants acknowledged that the securities to be issued have not been registered under the Securities Act, that they understood the economic risk of an investment in the securities, and that they had the opportunity to ask questions of and receive answers from the Company’s management concerning any and all matters related to acquisition of the securities.

The following selected financial information is qualified by reference to, and should be read in conjunction with our financial statements and the notes thereto, and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” contained elsewhere herein. The selected income statement data for fiscal years ended December 31, 2010 and 2009 and the selected balance sheet data as of December 31, 2010 and 2009 are derived from our audited financial statements which are included elsewhere herein.

|

Fiscal Years Ended December 31

2010 and 2009

|

For the Period from October 19, 2004 (inception) to December 31, 2010

|

|||||||||||

|

STATEMENT OF OPERATIONS DATA

|

||||||||||||

|

Revenue

|

-0- | -0- | -0- | |||||||||

|

Operating Expenses

|

||||||||||||

|

Mineral Claims written off

|

$ | - | $ | -0- 0 | $ | 10,000 | ||||||

|

Mineral Claims Expenses

|

595 | 595 | ||||||||||

|

Professional Fees

|

388,905 | 59,440 | 734,448 | |||||||||

|

Office- General Expenses

|

17,875 | 16,007 | 24,886 | |||||||||

|

Office – General Expenses – Related Party

|

152,784 | 111,293 | 274,469 | |||||||||

|

Total Operating Expenses

|

$ | 560,159 | $ | 186,740 | $ | 1,044,398 | ||||||

|

Net Loss From Operations

|

$ | (560,159 | ) | $ | (186,740 | ) | $ | (1,044,398 | ) | |||

|

Other Expenses

|

||||||||||||

|

Financing cost- Related Party

|

$ | (39,715 | ) | - | $ | (39,715 | ||||||

|

Net Loss Before Income Taxes

|

$ | (599,874 | ) | $ | (186,740 | ) - | $ | (1,084,113 | ) | |||

|

BALANCE SHEET DATA

|

||||||||||||

|

Total Assets

|

$ | - - | $ | -0- | ||||||||

|

Total Liabilities

|

470,264 | 209,439 | ||||||||||

|

Stockholders Equity/Deficit

|

(470,264 | ) | (209,439 | ) | ||||||||

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The summarized financial data set forth in the table above is derived from and should be read in conjunction with our audited financial statements for the period from inception (October 19, 2004) to fiscal year ended December 31, 2010, including the notes to those financial statements which are included in this Annual Report. The following discussion should be read in conjunction with our audited financial statements and the related notes that appear elsewhere in this Annual Report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this Annual Report, particularly in the section entitled "Risk Factors". Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

We are an exploration stage company and have not generated any revenue to date. The above table sets forth selected financial information for the periods indicated. We have incurred recurring losses to date. Our financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation.

We expect we will require additional capital to meet our long term operating requirements. We expect to raise additional capital through, among other things, the sale of equity or debt securities.

RESULTS OF OPERATION

Fiscal Year Ended December 31, 2010 Compared to Fiscal Year Ended December 31, 2009.

Our net loss for fiscal year ended December 31, 2010 was ($599,874) compared to a net loss of ($186,740) during fiscal year ended December 31, 2009 (an increase of $413,134). During fiscal years ended December 31, 2010 and 2009, we did not generate any revenue.

During fiscal year ended December 31, 2010, we incurred operating expenses of approximately $599,874 compared to $186,740 incurred during fiscal year ended December 31, 2009 (an increase of $413,134). These general and administrative expenses incurred during fiscal year ended December 31, 2010 consisted of: (i) mineral claims of $595 (2009: $-0-); (ii) professional fees of $388,905 (2009: $59,440); (iii) office – general expenses of $17,875 (2009: $16,007); (iv) office – general expenses – related party of $152,784 (2009: $111,293);

General and administrative expenses incurred during fiscal year ended December 31, 2010 compared to fiscal year ended December 31, 2009 increased primarily due to an increase in professional fees related to the increase in the scope and scale of our exploratory mineral business operations. General and administrative expenses generally include corporate overhead, financial and administrative contracted services, marketing, and consulting costs.

Of the $599,874 incurred as general and administrative expenses during fiscal year ended December 31, 2010, we incurred consulting fees of $6,000 payable to our officers and directors.

Our net loss during fiscal year ended December 31, 2019 was ($599,874) or ($0.01) per share compared to a net loss of ($186,740) or ($0.06) per share during fiscal year ended December 31, 2009. The weighted average number of shares outstanding was 61,793,151 for fiscal year ended December 31, 2010 compared to 60,786,575 for fiscal year ended December 31, 2009.

LIQUIDITY AND CAPITAL RESOURCES

Fiscal Year Ended December 31, 2010

As at fiscal year ended December 31, 2010, our current assets were $0 and our current liabilities were $470,264, which resulted in a working capital deficit of $470,264. As at fiscal year ended December 31, 2010, current liabilities were comprised of: (i) $83,802 in accounts payable - other; and (ii) $248,080 in accounts payable – related parties, and (iii) $132,382 in Convertible Promissory Notes – related party, and (iv) $6,000 in Convertible debt – related party.

As at December 31, 2010, our total assets were $0.. The total assets in fiscal year ended December 31, 2009 was$0.

As at December 31, 2010, our total liabilities were $470,264 comprised entirely of current liabilities. The increase in liabilities during fiscal year ended December 31, 2010 from fiscal year ended December 31, 2009 was primarily due to the increase in accounts payable – related parties. .

Stockholders’ Deficit increased from ($209,439) for fiscal year ended December 31, 2009 to Stockholders’ Deficit of ($470,264) for fiscal year ended December 31, 2010.

Cash Flows from Operating Activities

We have not generated positive cash flows from operating activities. For fiscal year ended December 31, 2010, net cash flows used in operating activities was ($0), consisting primarily of a net loss of ($599,874). Net cash flows used in operating activities was changed by an increase of $64,735 in accounts payable, $140,000 in common stock issued for services, $94,334 in common stock issuable for service $39,715 in Beneficial Conversion Feature and $261,090 in expenses paid by related parties. For fiscal year ended December 31, 2009, net cash flows used in operating activities was ($0), consisting primarily of a net loss of ($186,740). Net cash flows used in operating activities was changed by an increase of $15,723 in accounts payable and $171,017 in expenses paid by related parties.

Cash Flows from Investing Activities

For fiscal years ended December 31, 2010 and December 31, 2009, there were no cash flows from investing activities.

Cash Flows from Financing Activities

We have financed our operations primarily from either advancements or the issuance of equity and debt instruments.

How can these be blank on financial statements?

We expect that working capital requirements will continue to be funded through a combination of our existing funds and further issuances of securities. Our working capital requirements are expected to increase in line with the growth of our business.

PLAN OF OPERATION AND FUNDING

Existing working capital, further advances and debt instruments, and anticipated cash flow are expected to be adequate to fund our operations over the next six months. We have no lines of credit or other bank financing arrangements. Generally, we have financed operations to date through the proceeds of the private placement of equity and debt instruments. In connection with our business plan, management anticipates additional increases in operating expenses and capital expenditures relating to: (i) oil and gas operating properties; (ii) possible drilling initiatives on current properties and future properties; and (iii) future property acquisitions. We intend to finance these expenses with further issuances of securities, and debt issuances. Thereafter, we expect we will need to raise additional capital and generate revenues to meet long-term operating requirements. Additional issuances of equity or convertible debt securities will result in dilution to our current shareholders. Further, such securities might have rights, preferences or privileges senior to our common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to take advantage of prospective new business endeavors or opportunities, which could significantly and materially restrict our business operations.

During fiscal year ended December 31, 2010, we completed the 2010 Private Placements for total gross proceeds of $ 65,000.

MATERIAL COMMITMENTS

During fiscal year ended December 31, 2010, we owed an aggregate of $386,462 to related parties.

Convertible Promissory Notes