Attached files

| file | filename |

|---|---|

| EX-31.2 - RULE 13(A)-14(A)/15D-14(A) CERTIFICATION - SAFEWAY INC | dex312.htm |

| EX-31.1 - RULE 13(A)-14(A)/15D-14(A) CERTIFICATION - SAFEWAY INC | dex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

X ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 1, 2011

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-00041

SAFEWAY INC.

(Exact name of registrant as specified in its charter)

| Delaware | 94-3019135 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 5918 Stoneridge Mall Road | ||

| Pleasanton, California | 94588-3229 | |

| (Address of principal executive offices) | (Zip Code) | |

| Registrant’s telephone number, including area code: |

(925) 467-3000 | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.01 par value per share | New York Stock Exchange | |

| 7.45% Senior Debentures due 2027 | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

(Title of class)

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes X No .

(Cover continued on following page)

SAFEWAY INC. AND SUBSIDIARIES

(Cover continued from previous page)

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No X.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No .

Indicate by check mark whether the registrant has electronically submitted and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes X No .

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K X.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer X |

Accelerated filer |

Non-accelerated filer | ||

| Smaller reporting company |

||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No X.

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 19, 2010 was approximately $7.9 billion.

As of February 23, 2011, there were outstanding approximately 368.2 million shares of the registrant’s common stock.

DOCUMENTS INCORPORATED BY REFERENCE

The following document is incorporated by reference to the extent specified herein:

| Document Description |

10-K Part | |

| Portions of the definitive proxy statement for use in connection with the Annual Meeting of Stockholders (to be held May 19, 2011) to be filed within 120 days after the end of the fiscal year ended January 1, 2011 |

III |

SAFEWAY INC. AND SUBSIDIARIES

EXPLANATORY NOTE:

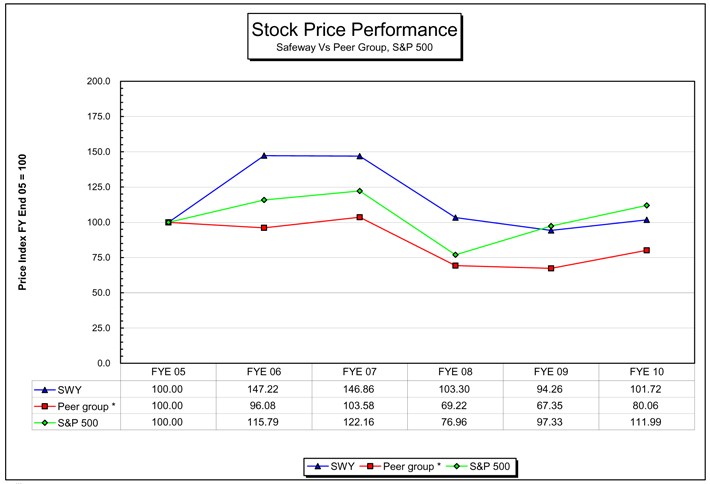

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K of Safeway Inc. (“Safeway” or the “Company”) for the fiscal year ended January 1, 2011 (the “2010 Form 10-K”) filed with the United States Securities and Exchange Commission on February 28, 2011. The purpose of the Amendment is to correct the cumulative total return of the Standard & Poor’s 500 in the Stock Performance Graph found in Part II, Item 5 of the 2010 Form 10-K. The Amendment makes no other changes to the 2010 Form 10-K.

Safeway hereby amends and replaces Part II, Item 5 of the 2010 Form 10-K in its entirety. In addition, pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, the Amendment includes new certifications of our principal executive officer and principal financial officer on Exhibits 31.1 and 31.2, each as of the filing date of the Amendment.

The Amendment does not reflect subsequent events occurring after the original filing date of the 2010 Form 10-K or modify or update in any way disclosures made in the 2010 Form 10-K, except as described above.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s common stock, $0.01 par value, is listed on the New York Stock Exchange. Information on dividends declared per common share is set forth in Part II, Item 7 of this report. The following table presents quarterly high and low sales prices for the Company’s common stock.

| Fiscal Year 2010: | Low | High | ||||||

| Quarter 4 (16 weeks) |

$ | 19.89 | $ | 24.00 | ||||

| Quarter 3 (12 weeks) |

18.73 | 21.91 | ||||||

| Quarter 2 (12 weeks) |

20.53 | 27.04 | ||||||

| Quarter 1 (12 weeks) |

20.91 | 25.41 | ||||||

| Fiscal Year 2009: | ||||||||

| Quarter 4 (16 weeks) |

$ | 19.15 | $ | 23.63 | ||||

| Quarter 3 (12 weeks) |

17.87 | 21.15 | ||||||

| Quarter 2 (12 weeks) |

18.98 | 21.73 | ||||||

| Quarter 1 (12 weeks) |

17.19 | 24.25 | ||||||

There were 14,595 stockholders of record as of February 23, 2011; however, approximately 99% of the Company’s outstanding stock is held in “street name” by depositories or nominees on behalf of beneficial holders. The closing price per share of common stock, as reported on the New York Stock Exchange Composite Tape, was $22.05 at the close of business on February 23, 2011.

Although the Company expects to continue to pay quarterly dividends on its common stock, the payment of future dividends is at the discretion of the Board of Directors and will depend upon the Company’s earnings, capital requirements, financial condition and other factors.

SAFEWAY INC. AND SUBSIDIARIES

Issuer Purchases of Equity Securities

| Fiscal period | Total number of shares purchased |

Average price paid per share (2) |

Total number of shares purchased as part of publicly announced plans or programs |

Approximate dollar value of shares that may yet be purchased under the plans or programs (in millions) (3 ) |

||||||||||||

| September 12, 2010 – October 9, 2010 |

– | – | – | $ | 825.5 | |||||||||||

| October 10, 2010 – November 6, 2010 |

4,120,000 | $ | 22.44 | 4,120,000 | 732.9 | |||||||||||

| November 7, 2010 – December 4, 2010 |

3,373,400 | 22.94 | 3,373,400 | 655.5 | ||||||||||||

| December 5, 2010 – January 1, 2011 |

10,998 | (1) | 21.80 | – | 1,655.5 | |||||||||||

| Total |

7,504,398 | $ | 22.66 | 7,493,400 | $ | 1,655.5 | ||||||||||

| (1) | Shares withheld, at the election of a certain holder of restricted stock, by the Company from the vested portion of restricted stock awards with a market value approximating the amount of the withholding taxes due from such restricted stockholder. |

| (2) | Average price per share excludes commissions. Average price per share excluding the restricted shares referred to in footnote 1 above was $22.67. |

| (3) | In December 2010, the Company’s Board of Directors increased the authorized level of the Company’s stock repurchase program from $6.0 billion to $7.0 billion. From the initiation of the repurchase program in 1999 through the end of fiscal 2010, the aggregate cost of shares of common stock repurchased by the Company, including commissions, was approximately $5.3 billion, leaving an authorized amount for repurchases of approximately $1.7 billion. The timing and volume of future repurchases will depend on several factors, including market conditions. The repurchase program has no expiration date but may be terminated by the Board of Directors. |

SAFEWAY INC. AND SUBSIDIARIES

Stock Performance Graph

The following graph compares the yearly percentage change in the Company’s cumulative total stockholder return on its common stock for the period from the end of its 2005 fiscal year to the end of its 2010 fiscal year to that of the Standard & Poor’s (“S&P”) 500 and a group of peer companies(*) in the retail grocery industry and assumes reinvestment of dividends. The stock price performance shown below is not necessarily indicative of future performance.

| (*) | The peer group consists of The Great Atlantic & Pacific Tea Company, Inc., The Kroger Co., SUPERVALU INC., Whole Foods Market, Inc. and Winn-Dixie Stores, Inc. Winn-Dixie Stores, Inc. started trading in November 2006, and their initial offering price is used as the FYE 05 value. |

The performance graph above is being furnished solely to accompany this amendment number 1 to the annual report on Form 10-K pursuant to Item 201(e) of Regulation S-K, and is not being filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is not to be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

SAFEWAY INC. AND SUBSIDIARIES

PART IV

| Item 15. | Exhibits and Financial Statement Schedules |

| (a) | The following documents are filed as a part of this report: |

| 3. | The following exhibits are filed as part of this report: |

| Exhibit 31.1 |

Rule 13(a)-14(a)/15d-14(a) Certification. | |

| Exhibit 31.2 |

Rule 13(a)-14(a)/15d-14(a) Certification. | |

SAFEWAY INC. AND SUBSIDIARIES

Signatures

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SAFEWAY INC. | ||||||||

| By |

/s/ Steven A. Burd |

Date: April 7, 2011 | ||||||

| Steven A. Burd |

||||||||

| Chairman, President and Chief Executive Officer (Principal Executive Officer) |

||||||||

SAFEWAY INC. AND SUBSIDIARIES

Exhibit Index

LIST OF EXHIBITS FILED WITH FORM 10-K/A (Amendment No. 1)

FOR THE YEAR ENDED JANUARY 1, 2011

| Exhibit 31.1 | Rule 13(a)-14(a)/15d-14(a) Certification. | |

| Exhibit 31.2 | Rule 13(a)-14(a)/15d-14(a) Certification. | |