Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Great Lakes Dredge & Dock CORP | d8k.htm |

Great Lakes

Dredge & Dock BB&T C&I Conference

Growing Through Opportunities

April 7, 2011

Exhibit 99.1 |

Safe

Harbor This presentation includes “forward-looking”

statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, the Private

Securities Litigation Reform Act of 1995 or in releases made by the SEC, all as may be

amended from time to time. Such statements include declarations regarding the

intent, belief, or current expectation of the Company and its management. The

Company cautions that any such forward-looking statements are not guarantees of

future performance, and involve a number of risks, assumptions

and uncertainties that could cause actual results of the Company

and its subsidiaries, or industry

results, to differ materially from those expressed or implied by

any forward-looking statements

contained herein, including, but not limited to, as a result of the factors, risks and

uncertainties described in other securities filings of the Company made with the SEC,

such as the Company’s most recent Report on Form 10-K. You should not

place undue reliance upon these forward- looking statements.

Forward-looking statements provided herein are made only as of the date hereof or

as a specified date herein and the Company does not have or undertake any obligation to

update or revise them, unless required by law.

2

April 2011

Growing Through Opportunities |

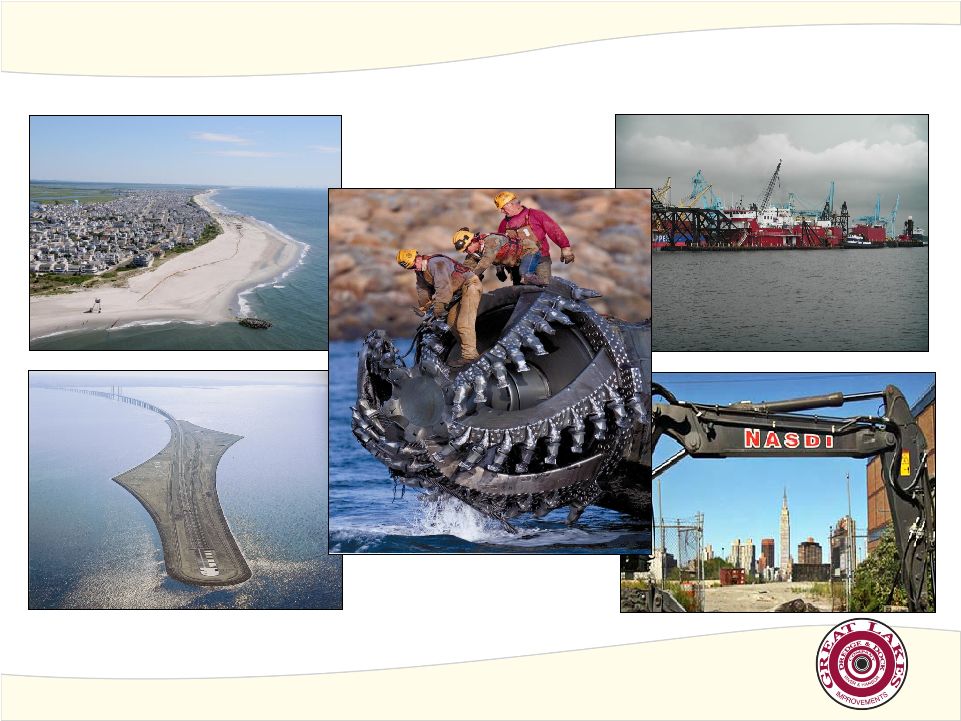

Who is Great

Lakes Dredge & Dock Corporation? 3

Avalon & Sea Isle Beach Nourishment

Oresund Bridge –

International land reclamation

Jacksonville, FL Harbor Deepening

Hunters Point Waterfront Park

Dredge Florida Cutterhead

Growing Through Opportunities

April 2011 |

Great Lakes

Highlights •

Significant growth since 2006

•

Revenue -

three-year CAGR of 10.0%

•

EBITDA -

three-year CAGR of 21.4%

•

Significant investment in PP&E of $140M since 2006

•

Purchased four dredging vessels in 2007 as well as built a piece

of

ancillary equipment

•

Upgraded dredge Ohio into world-class cutter suction dredge

•

Decreased Net Debt / EBITDA from 6.4x at 12/31/05 to 1.3x at

12/31/10

•

Over $48M in cash on hand at year-end –

increase in 2011 as result

of refinancing of notes

•

Over $145M of availability on revolving credit facility

4

Growing Through Opportunities

April 2011 |

Management

Team 5

Board member since December 2006

Former Managing Director and Co-head of Corporate Finance for Navigant Consulting,

Inc Former partner at KPMG, LLP and past National Partner in charge of Corporate

Finance at KPMG

Jonathan Berger

Chief Executive

Officer and Director

Board member since December 2006

Significant institutional knowledge as Senior Vice President, CFO and Treasurer of Great

Lakes from 1991 to 1999

Private real estate investor and independent consultant since April 1999

Bruce Biemeck

President and Chief

Financial Officer,

Director

Growing Through Opportunities

April 2011

David Simonelli

President of Dredging

Operations

Served as Chief Site Manager from 2007 to February 2009 and Senior Vice President from

February 2009 to April 2010

Joined Great Lakes in 1978 as a Project Engineer, and has served

the Company in various

roles since that time

Member of the Hydrographic Society, the Western Dredging Association and the American

Society of Civil Engineers |

Acquisition of

L.W. Matteson On December 31, 2010, Great Lakes acquired the assets of L.W.

Matteson L.W. Matteson is a leading inland dredging and marine construction

contractor –

Serves four primary markets in the U.S. including: Inland Levee and

Construction, Inland Maintenance Dredging, Environmental and Habitat

Restoration, and Inland Lake Dredging

The purchase price was $45 million, with $37.5 million paid at closing and a note

payable to the seller of $7.5 million (approximate EBITDA multiple of 3.0x)

L.W. Matteson has experienced strong growth and provides Great Lakes with a

platform to enter new markets

6

Growing Through Opportunities

April 2011 |

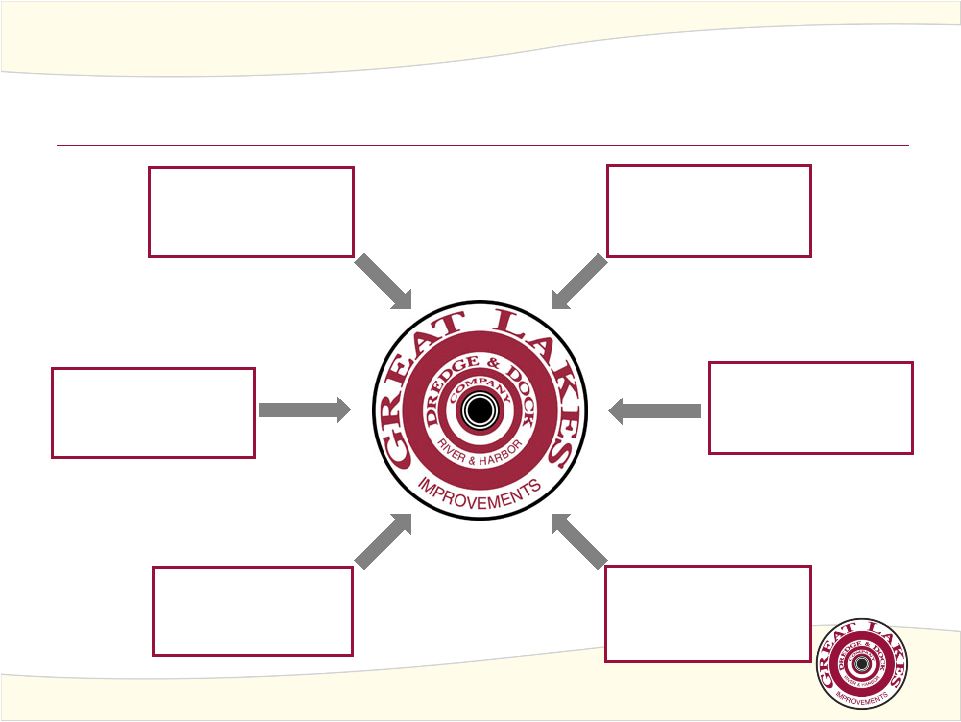

Strategy

•

New Strategy (in formulation stage)

•

Must develop a risk-based growth strategy

which takes advantage of our many strengths

•

Complex engineering

•

Maritime construction knowledge

•

Project management

•

Extensive and versatile fleet

•

Strong balance sheet

•

Areas to explore

•

Domestic dredging markets in which we

do not participate

•

International dredging

•

Environmental services

•

Other maritime and Jones Act related

business

•

Aggregate mining and sales

•

Specialty construction

•

Historical Strategy (through Private Equity ownership)

•

Ride the cyclical wave of domestic dredging, pay down debt and opportunistically

take advantage of international markets

7

Growing Through Opportunities

April 2011 |

Significant

Opportunities to Grow U.S. Port Deepening

Post Panama Canal

Deepening

Harbor Maintenance

Trust Fund

Environmental

Services/Dredging

Gulf Coast Restoration

International

Levee Repairs

8

Growing Through Opportunities

April 2011 |

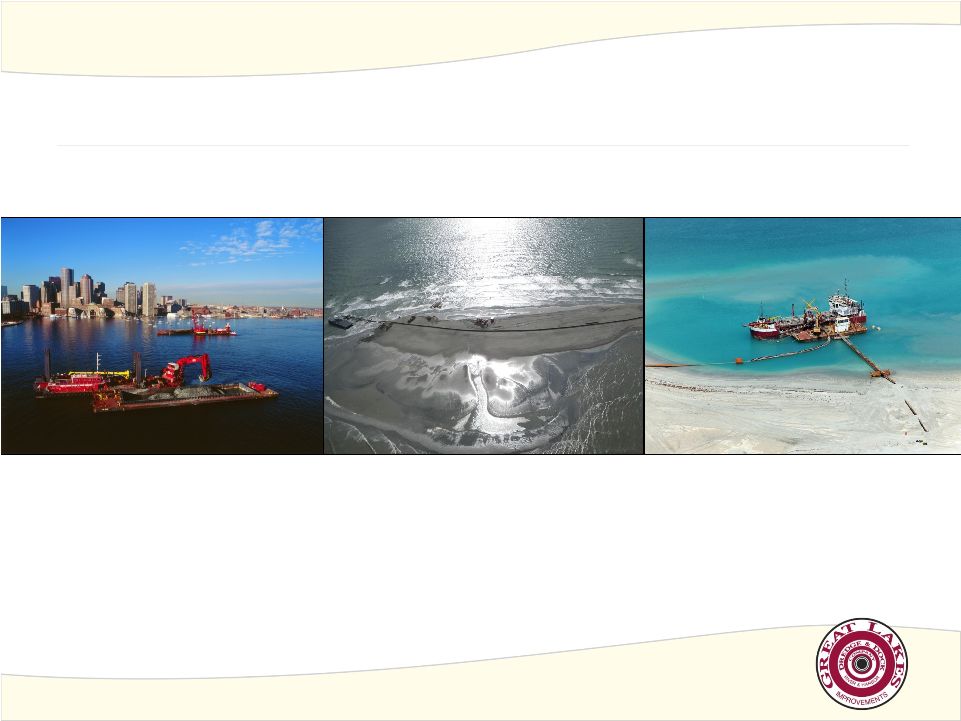

Dredging

Innovative Civil Engineering Solutions Since 1890

9

Growing Through Opportunities

April 2011 |

Domestic

Dredging Market 10

Growing Through Opportunities

April 2011 |

Foreign

Dredging Market 11

Growing Through Opportunities

April 2011 |

Dredging

Overview Deepening ports, land reclamation, and

excavation of underwater trenches

Maintenance

Maintaining depth of shipping channels

•

Army Corps of Engineers (Largest)

•

Port authorities

•

State and local governments

•

Foreign governments

•

Prime contractors on turn-key projects

•

Private entities (e.g., oil companies, utilities)

Customers

Beach Nourishment

Creating and rebuilding beaches

Capital

12

Growing Through Opportunities

April 2011 |

Large and

Flexible Fleet in U.S and International Markets Types of Dredges

Hydraulic

•

20 Vessels: 16 U.S., 4 Middle East

(19 U.S. flagged)

•

Including the only two large electric

cutterhead dredges available in the

U.S. for environmentally sensitive

regions requiring lower emissions

Hopper

•

10 Vessels: 4 U.S., 5 Middle

East, 1 Brazil (4

U.S. flagged) •

Highly mobile, able to operate in

rough waters

•

Little interference with other

ship traffic

Mechanical

•

5 Vessels: All U.S (All U.S. flagged)

•

Operates one of two environmentally

friendly electric clamshell dredges in

the U.S.

•

Maneuverability in tight areas such

as docks and terminals

Estimate fleet replacement cost in excess of $1.5 billion in current market

25

Material

Transportation

Barges

and

Over

160

Other

Specialized

Support

Vessels

Dredge Texas at Boca Raton

Dredge Liberty Island at Melbourne

Beach

Dredge GL 55 at Upper Chesapeake

13

Growing Through Opportunities

April 2011 |

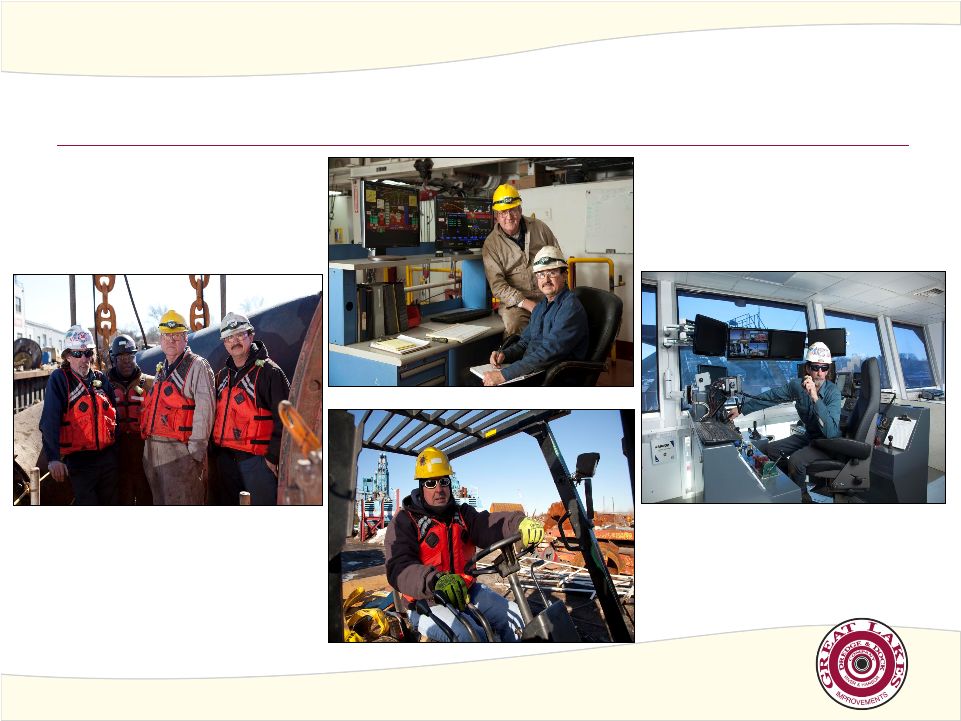

Our

Intellectual Property and Human Capital are a Competitive Advantage 14

Growing Through Opportunities

April 2011 |

Industry

and Company Overview 15

Growing Through Opportunities

April 2011 |

Attractive

Catalysts in the Dredging Market •

Maintenance Dredging

•

Harbor Maintenance Trust Fund legislation passage could add $500M to the

Company’s bid market

•

Panama Canal expansion leads to U.S. port deepening

•

Coastal Restoration throughout Gulf Area

•

Levee repair/replacement throughout U.S.

Bayou Dupont, LA

Coastal Restoration

Dredge California and GL 55 at Pass a Loutre

Coastal Restoration

16

Growing Through Opportunities

April 2011 |

(in

millions) Three Year Average

FY 2009

FY 2010

Bid Market Size

$325

$310

$356*

GLDD Revenue

$219

$203

$301

Domestic Dredging Industry Demand Drivers

Capital

•

U.S. ports 5'–10' shallower vs. foreign ports

•

Domestic port development required to

support larger, deeper draft ships

•

Long-term funding for wetland and coastal marshes

•

Other port development

Berm construction off Louisiana coast

17

Growing Through Opportunities

April 2011

*Note:

The

2010

bid

market

excludes

dredging

work

related

to

the

construction

of

sand

berms

off

the

coast

of

Louisiana |

(in

millions) Three Year Average

FY 2009

FY 2010

Bid Market Size

$127

$183

$ 76

GLDD Revenue

$

77

$

62

$106

Domestic Dredging Industry Demand Drivers

Beach Nourishment

•

Storm activity/natural erosion

•

Growing population in coastal communities

•

22 of the 25 most densely populated U.S. counties are

coastal

•

Importance of beach assets to recreation and local tourism

industry

•

Anticipate robust market opportunities in next 12 months

Melbourne Beach

18

Growing Through Opportunities

April 2011 |

(in

millions) Three Year Average

FY 2009

FY 2010

Bid Market Size

$478

$645

$444

GLDD Revenue

$130

$175

$119

Domestic Dredging Industry Demand Drivers

Maintenance

•

Corps of Engineers’

goal is to reach 95% of U.S. port operating

capacity

•

Natural sedimentation and volatile weather

•

New capital projects increase need for ongoing maintenance

•

57% of 2009 domestic bid market was maintenance work

Dredge 54 at NYCT Berth

19

Growing Through Opportunities

April 2011 |

(in

millions) Three Year Average

FY 2009

FY 2010

GLDD Revenue

$130

$134

$

83

Great Lakes is Well Positioned to Compete Globally

International

•

International projects tend to be larger/ longer duration vs. domestic

projects

•

Middle East has been a strong market historically, and is expected to

provide good opportunities in the future

•

Upgrade of the dredge Ohio completed at the end of 2010. Will allow us

to meet future demand anticipated in Middle East

•

Deepening project in Brazil began in September

•

Strong market ahead in Brazil

Reem

Island at Port of Natal, Brazil

20

Growing Through Opportunities

April 2011 |

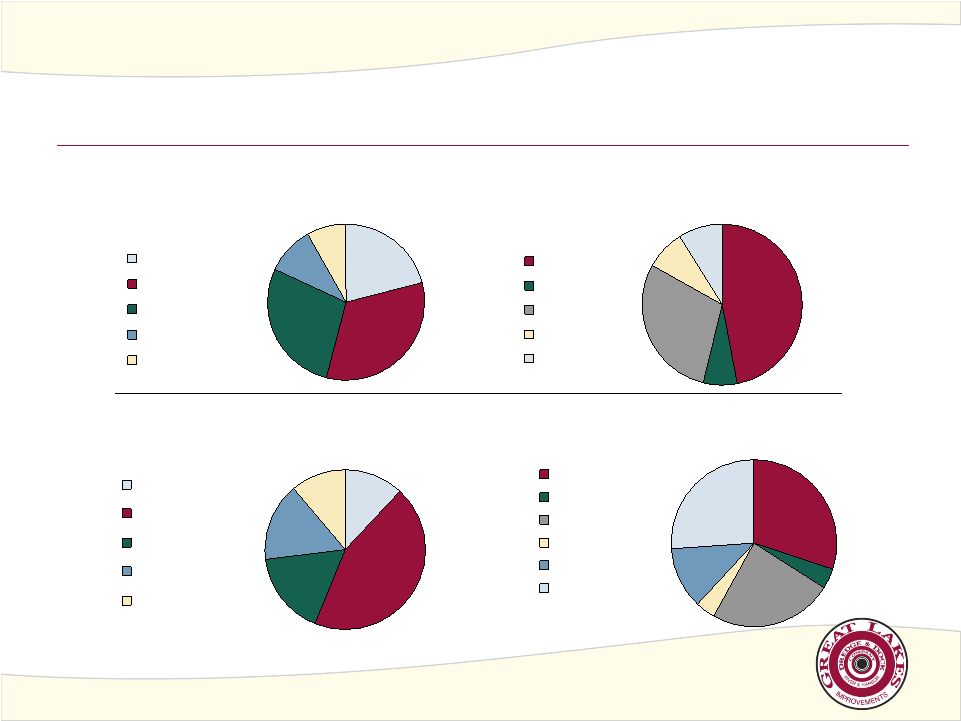

Largest

Provider of Dredging 28%

10%

8%

21%

33%

Foreign

Capital

Maintenance

Beach

Demolition

2009 REVENUE BY WORK TYPE

$622 million

8%

9%

47%

7%

29%

Great Lakes

Norfolk

Weeks

Manson

Other

2009 DOMESTIC DREDGING BID MARKET

SHARE

Domestic Bid Market: $1,137 million

44%

17%

16%

11%

12%

Foreign

Capital

Maintenance

Beach

Demolition

2010 REVENUE BY WORK TYPE

$687 million

12%

4%

24%

4%

30%

26%

Great Lakes

Norfolk

Weeks

Manson

Don Jon

Other

2010 DOMESTIC DREDGING BID MARKET

SHARE

Domestic Bid Market: $875 million

21

Growing Through Opportunities

April 2011 |

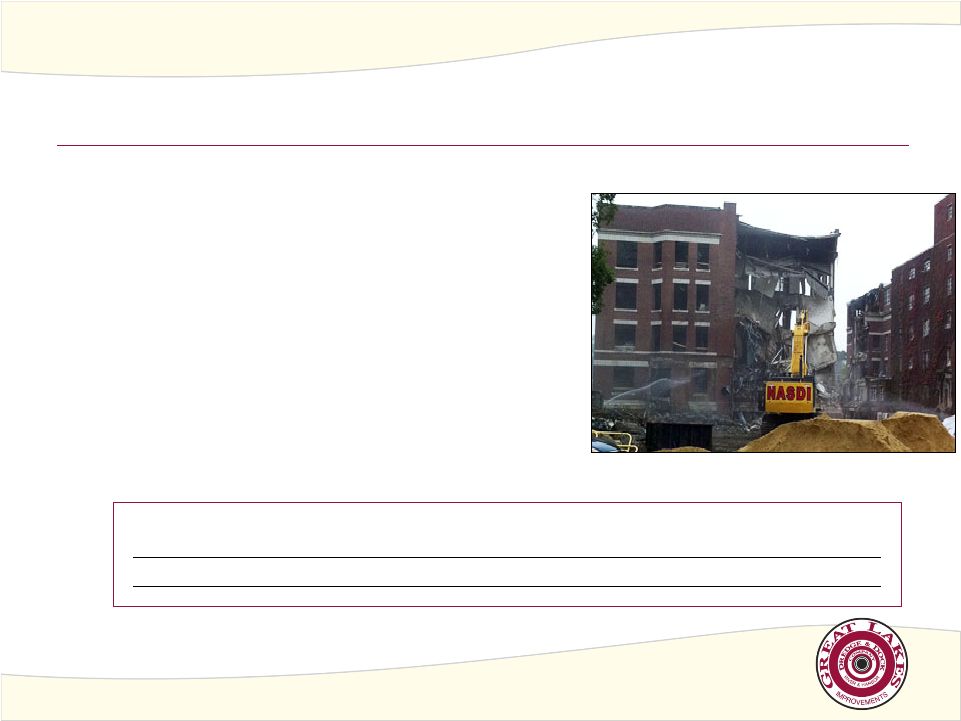

(in

millions) Three Year Average

FY 2009

FY 2010

Demolition Revenue

$

76

$

48

$

78

Demolition Services -

The Preferred Demolition Contractor in New England

NASDI and Yankee Environmental Services

•

Major U.S. provider of commercial and industrial demolition services;

primarily in New England

•

Purchased Yankee in 2009; able to offer removal of asbestos and

hazardous materials

•

Successfully gaining foothold in New York market over last year

•

Strong bonding capacity

•

Currently expanding into new domestic markets with contract awarded

in Louisiana

Massachusetts Mental Health Hospital

22

Growing Through Opportunities

April 2011 |

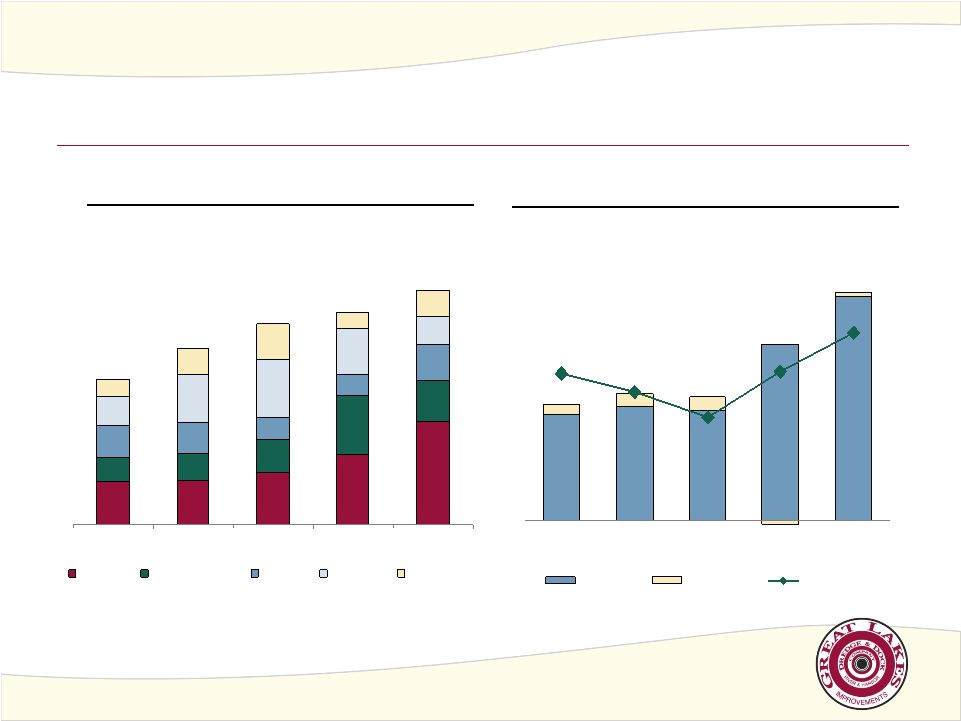

Financial

Highlights 23

Growing Through Opportunities

April 2011 |

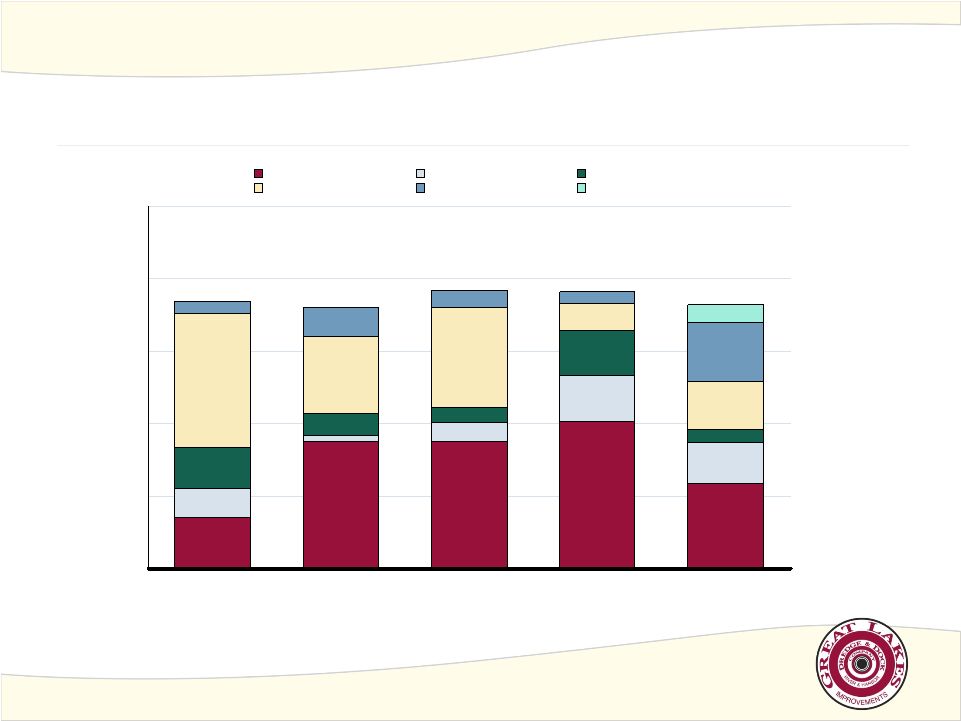

Financial

Performance 0

100

200

300

400

500

600

700

$800

2006

2007

2008

2009

2010

Capital

Maintenance

Beach

Foreign

Demolition

$52.6

$57.5

$55.9

$103.0

$77.6

9.5%

15.0%

12.5%

12.3%

11.1%

(20)

0

20

40

60

80

100

$120

2006

2007

2008

2009

2010

0.0%

4.0%

8.0%

12.0%

16.0%

20.0%

Dredging

Demolition

% EBITDA Margin

ANNUAL REVENUE

3 year CAGR = 10.0%

ANNUAL EBITDA

(a)

3 year CAGR =

21.4%

(a)

EBITDA represents net income (loss), adjusted for net interest expense, income

taxes, depreciation and amortization expense. Please see reconciliation of

Net Income to EBITDA at the end of this presentation.

Note: Great Lakes went public in December 2006

($ in millions)

$426.0

$515.8

$586.9

$622.2

$686.9

24

Growing Through Opportunities

April 2011 |

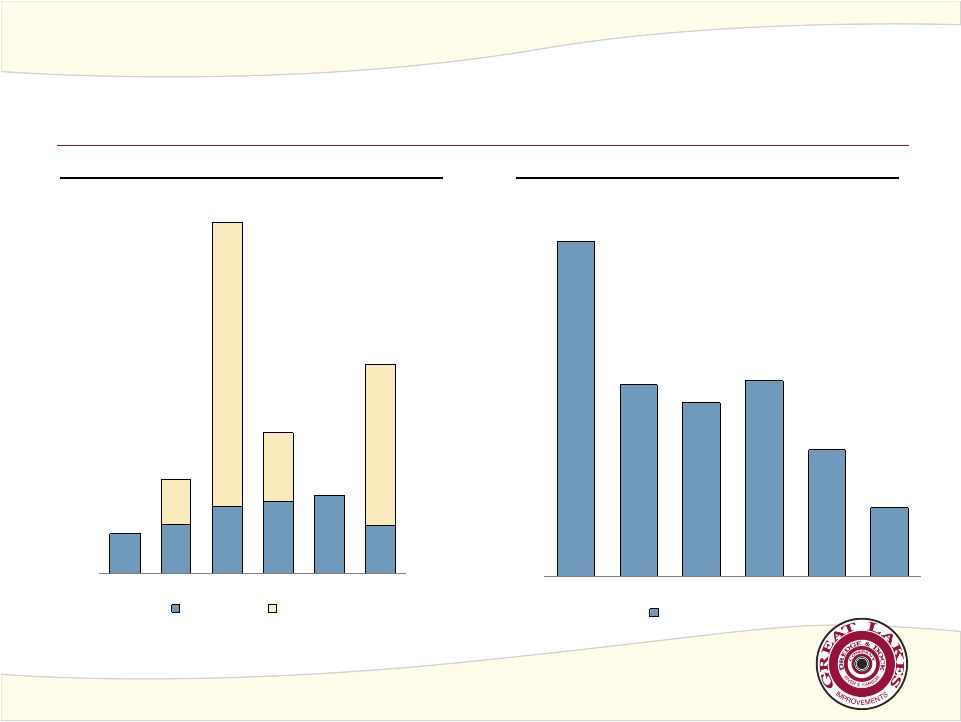

Improved

Financial Flexibility $25.7

$44.5

$111.0

(a)

$29.8

$12.7

$66.0

(b)

0.0

20.0

40.0

60.0

80.0

100.0

$120.0

2005

2006

2007

2008

2009

2010

Maintenance

Growth

6.4x

3.6x

3.3x

3.7x

2.4x

1.3x

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0x

2005

2006

2007

2008

2009

2010

Net Debt / EBITDA

(a)

Growth capital expenditures during the year of 2007 includes the purchase of four

vessels. (b)

Includes $14.6m related to the upgrade of the dredge Ohio and $36m related to

Matteson acquisition CAPEX

LEVERAGE

($ in millions)

25

Growing Through Opportunities

April 2011 |

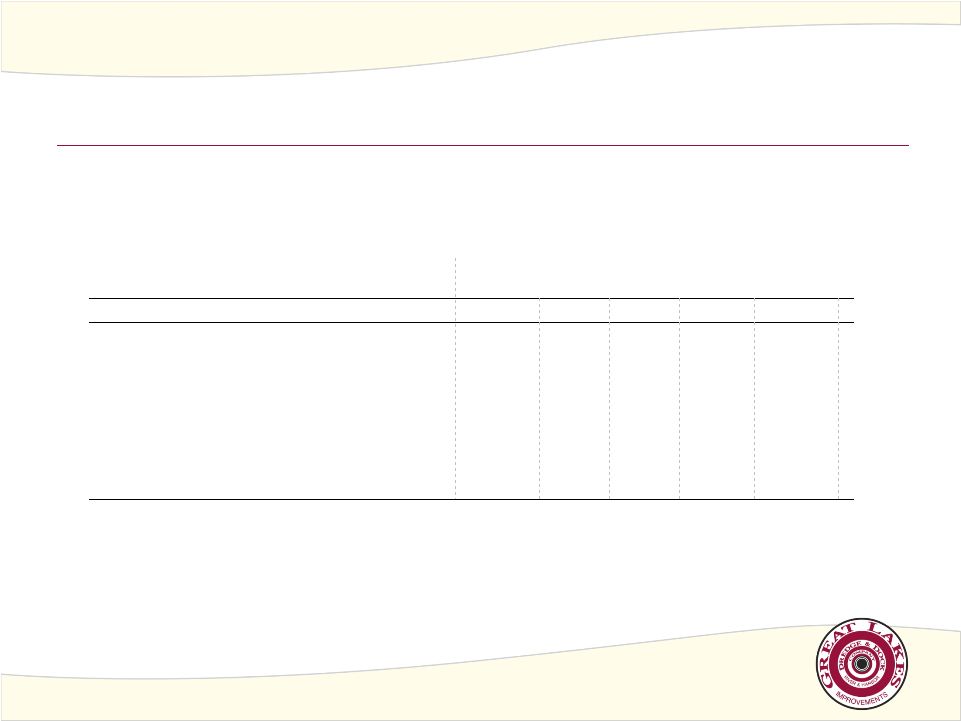

0

100

200

300

400

500

12/31/2006

12/31/2007

12/31/2008

12/31/2009

12/31/2010

Capital

Maintenance

Beach

Foreign

Demolition

Rivers & Lakes

$

Backlog

BY SEGMENT

$364

$382

$385 (a)

$360

$369

(a)

Foreign

backlog

at

December

31,

2008

has

been

adjusted

for

the

portion

of

the

Diyar

contract

that

became

an

option

pending

award

in

the

first

quarter

of

2009

($ in millions)

26

Growing Through Opportunities

April 2011 |

Investment

Highlights •

Attractive near and long-term catalysts in U.S dredging market

•

Harbor Maintenance Trust Fund secures funding for long-term maintenance demand

•

Other sources of dredging demand include coastal restoration, port deepening and port

development and levee repair/replacement

•

Strong financial performance and improved financial flexibility

•

Revenue –

3 year CAGR 10%, EBITDA –

3 year CAGR 21.4%

•

EBITDA growth from $45.1 million in 2005 to $103.0 million in 2010

•

Decreased Net Debt / EBITDA from 6.4x in 2005 to 1.3x in 2010

•

International Presence

•

Only U.S. dredger with significant foreign presence

•

Flexible fleet enables repositioning of vessels as necessary

•

Demonstrated record of successful project completion never having failed to complete a

project •

Expanding demolition business

•

Opportunistic acquirer of dredging assets

27

Growing Through Opportunities

April 2011 |

Appendix

28

Growing Through Opportunities

April 2011 |

Reconciliation of Net Income to EBITDA

$103.0

34.3

20.6

13.5

$34.6

2010

$52.6

25.1

1.0

24.3

$2.2

2006

$57.5

26.5

6.4

17.5

$7.1

2007

$77.6

33.0

11.0

16.1

$17.5

2009

$55.9

30.1

3.8

17.0

$5.0

2008

Depreciation and Amortization

($ in millions)

Net Income Attributable to Great Lakes Dredge &

Dock Corporation

Interest Expense

Income Tax Expense

EBITDA

29

Growing Through Opportunities

April 2011 |

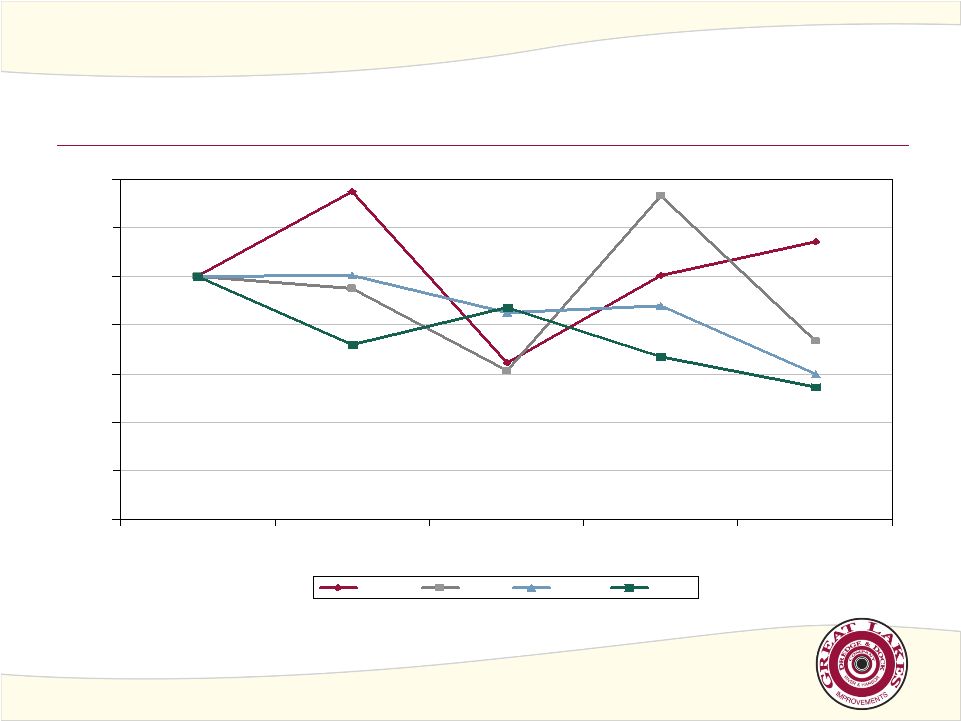

0

20

40

60

80

100

120

140

12/31/2006

12/31/2007

12/31/2008

12/31/2009

12/31/2010

GLDD

ORN

STRL

GVA

Stock Performance

Initial Investment $100

*Note: ORN, STRL, and GVA were selected as GLDD’s

three closest peers

30

Growing Through Opportunities

April 2011 |

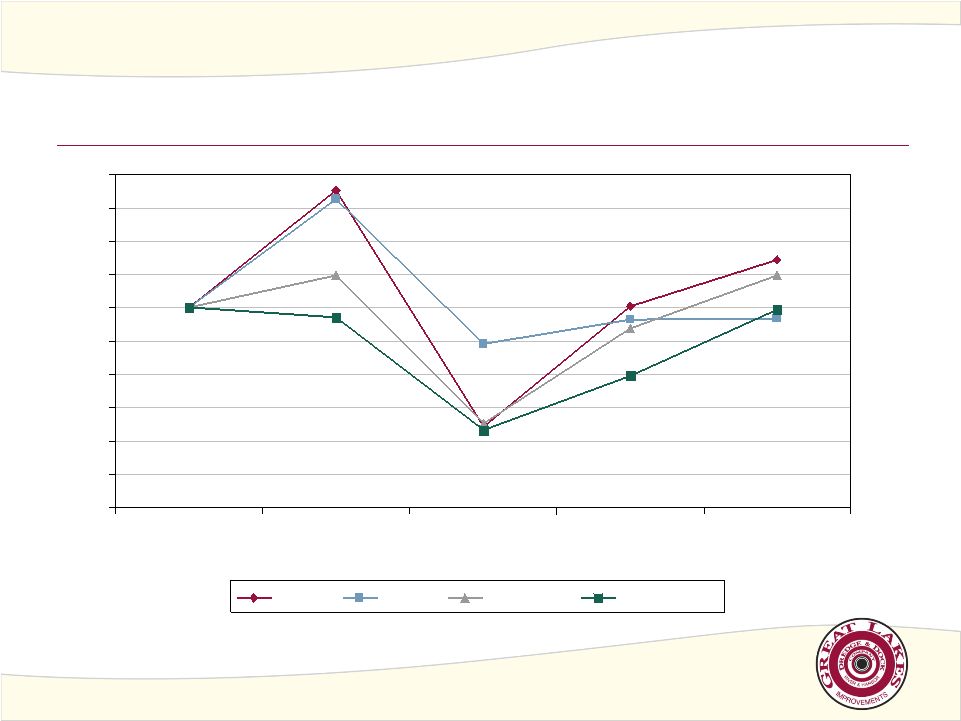

Stock

Performance Initial Investment $100

40

50

60

70

80

90

100

110

120

130

140

12/31/2006

12/31/2007

12/31/2008

12/31/2009

12/31/2010

GLDD

Peers

NASDAQ

Russel 2K

31

Growing Through Opportunities

April 2011 |