Attached files

| file | filename |

|---|---|

| 8-K - PRESENTATION OF THOMAS PROPERTIES GROUP, INC. DATED APRIL 2011 - THOMAS PROPERTIES GROUP INC | tpgi8k040511slidepresentat.htm |

Exhibit 99.1

PRESENTATION OF THOMAS PROPERTIES GROUP, INC.

DATED AS OF APRIL 2011

Thomas Properties Group, Inc.

April 2011

Forward Looking Statements

This presentation contains forward-looking statements that are not historical facts. These statements include management’s expectations with respect to future events and trends that may affect the Company’s business and results of operations, and are subject to risks and uncertainties. Actual results may differ from those expected in the forward-looking statements. You are advised to review the reports filed by Thomas Properties Group, Inc. with the Securities and Exchange Commission for additional information regarding some of the factors that may affect the Company’s business and results of operations.

Investment Highlights

Class A, Institutional Quality Office Portfolio

Seasoned Management Team with Superior Leasing Platform

Strong Partnerships with Leading Institutional Investors

Attractive Valuation

Internal and External Growth Opportunities

Significant Insider Ownership

Overview

Fully integrated institutional real estate platform, which owns, acquires, operates and selectively redevelops Class A office properties

Strong management team has extensive experience together across multiple economic cycles, and strong alignment of interest with shareholders

Own interests in and manage 24 operating properties with 12.6 million square feet, and provide asset management services on behalf of third parties for an additional four operating properties with 2.3 million square feet

Reliable investment management business includes programmatic joint ventures and funds with institutional partners

Highly regarded development team with expertise to take advantage of selective development and redevelopment opportunities

Class A Portfolio

Own interests in and manage properties in Los Angeles, Houston, Austin, Northern Virginia and Philadelphia

Current occupancy of 84%

In-place rents below current market provide NOI upside

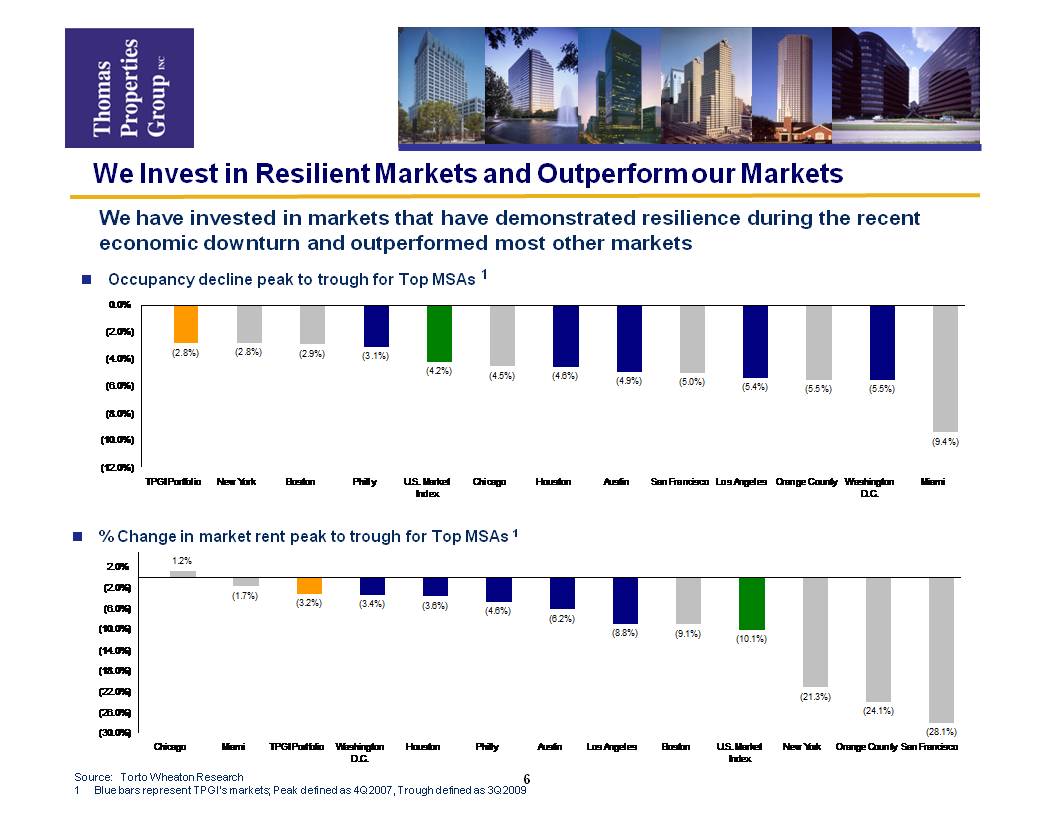

We Invest in Resilient Markets and Outperform our Markets

We have invested in markets that have demonstrated resilience during the recent economic downturn and outperformed most other markets

Occupancy decline peak to trough for Top MSAs 1

% Change in market rent peak to trough for Top MSAs 1

Source: Torto Wheaton Research

1 Blue bars represent TPGI’s markets; Peak defined as 4Q2007, Trough defined as 3Q2009

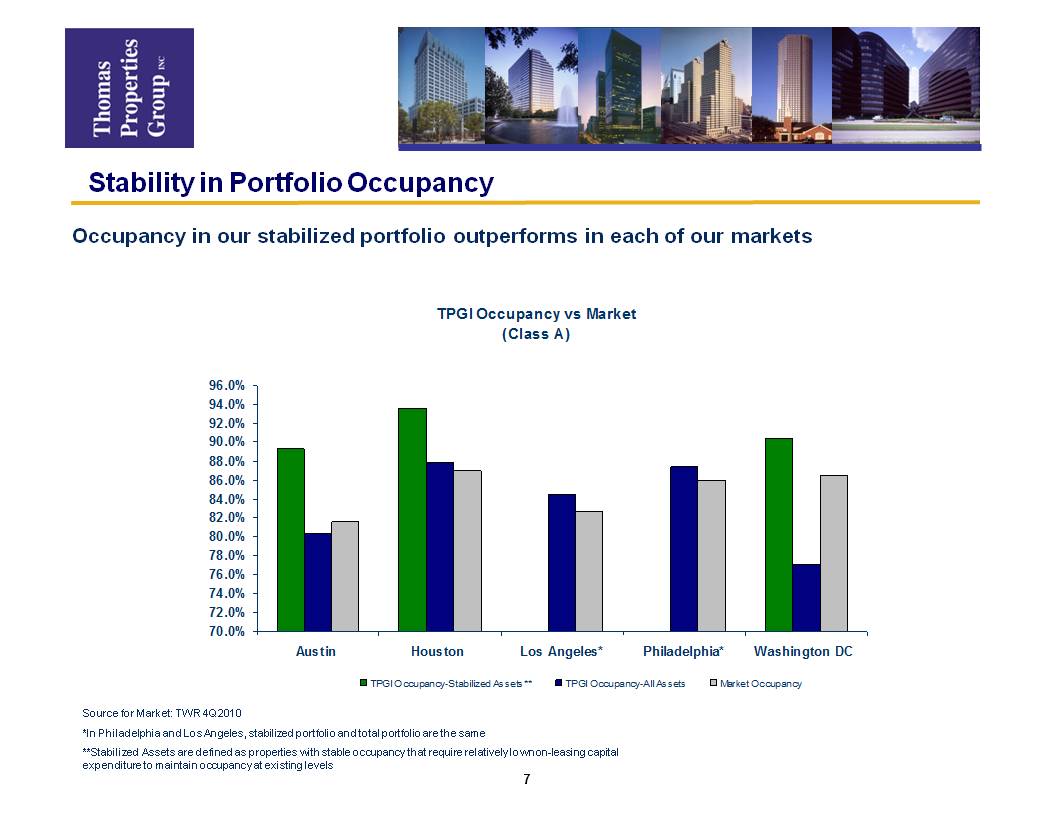

Stability in Portfolio Occupancy

Occupancy in our stabilized portfolio outperforms in each of our markets

Source for Market: TWR 4Q2010

*In Philadelphia and Los Angeles, stabilized portfolio and total portfolio are the same

**Stabilized Assets are defined as properties with stable occupancy that require relatively low non-leasing capital expenditure to maintain occupancy at existing levels

Occupancy Performance Relative to Peers

TPGI Change in Portfolio Occupancy vs Peers

January 1, 2009 - December 31, 2010

January 1, 2009 - December 31, 2010

Source: Companies’ Supplemental Financial Data

Superior Leasing Spreads

TPGI vs. Office Peers

2010 GAAP Leasing Spreads

Source: Companies’ Supplemental Financial Data

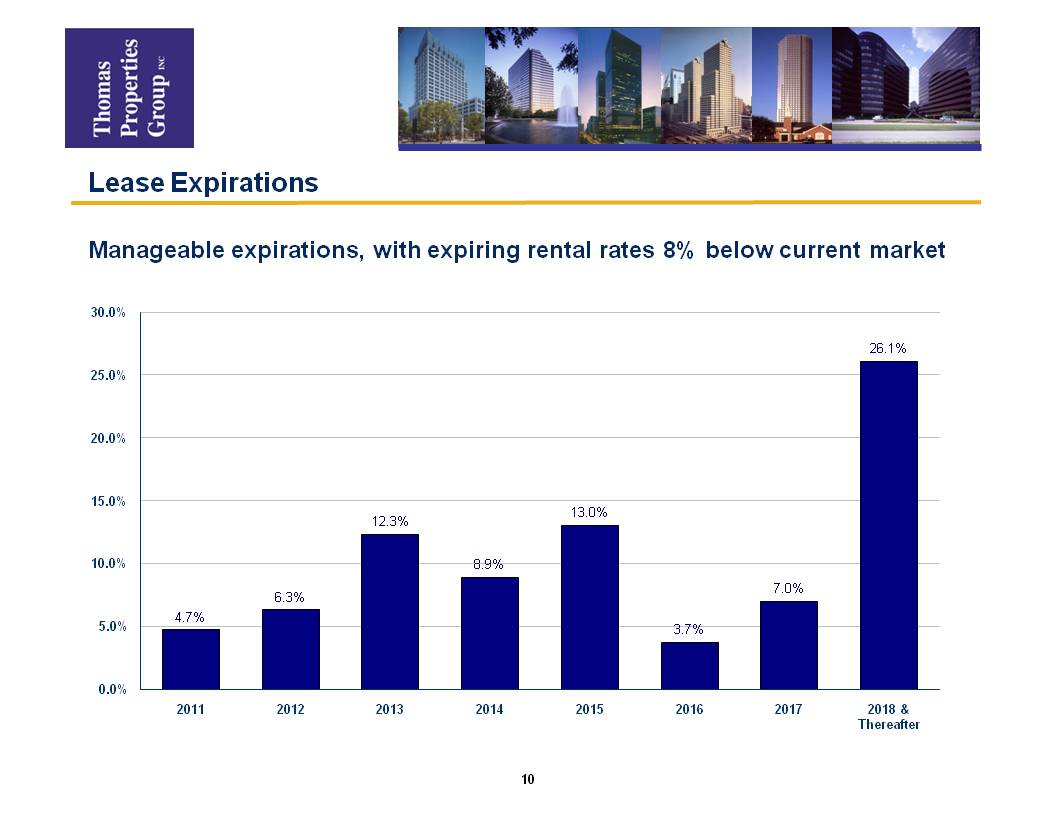

Lease Expirations

Manageable expirations, with expiring rental rates 8% below current market

Strong NOI Growth

TPGI vs. Office Peers

2010 Same Property NOI Growth

Cash Basis

GAAP Basis

*Excludes Two Commerce Square, eliminating the impact of Conrail lease expiration in 2008 and 2009

Source: Companies’ Supplemental Financial Data

Successful Refinancing Activities

We have focused on reducing the leverage on our balance sheet and taking advantage of opportunities to repay debt at a discount. Since January 2008, we have:

Reduced our pro rata share of property level debt by $260 mm (35% reduction)

Together with our partners, retired $454 mm of debt, at an average 29% discount from par value

Refinanced $911 million of joint venture debt with average maturities of 8.8 years at an average interest rate of 5.1%

Raised over $300 million of additional equity capital from our joint venture partner, California State Teachers’ Retirement System (CalSTRS) primarily for investment in our existing portfolio

Ranked as CalSTRS top “core” manager for past five years

Ranked in the top 25% in “specialty” portfolio

Our unrestricted cash balance at December 31, 2010 was $42.3 mm

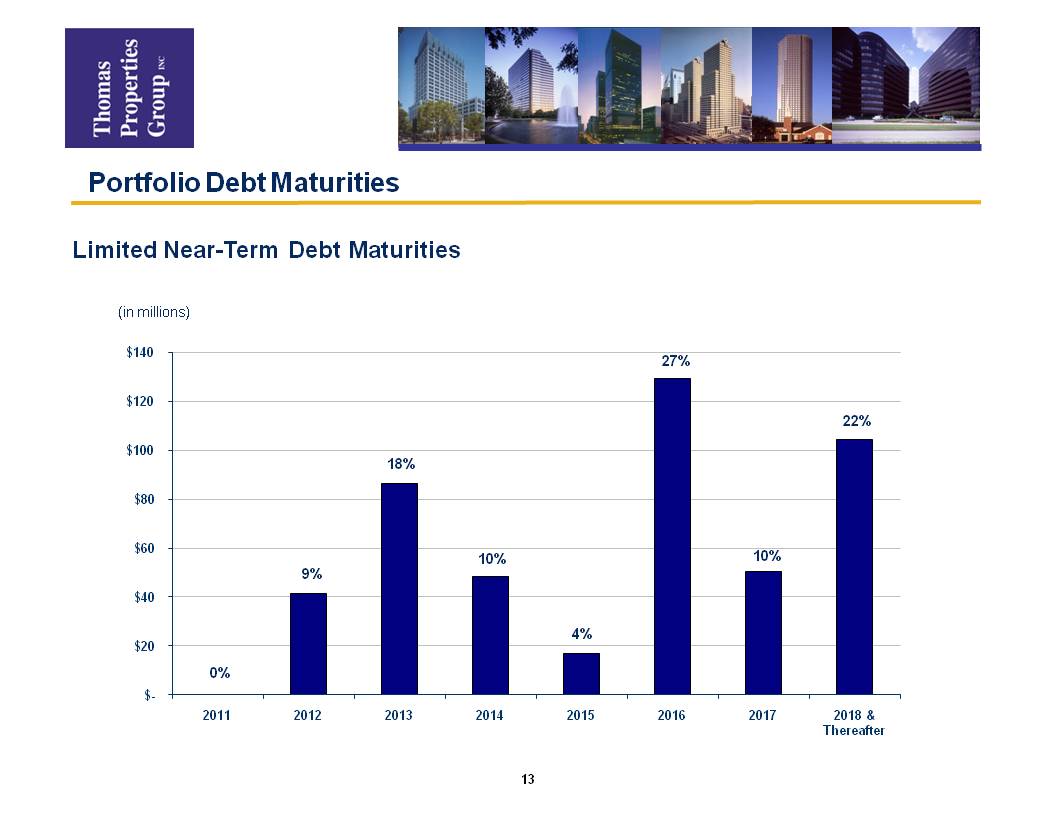

Portfolio Debt Maturities

Limited Near-Term Debt Maturities

(in millions)

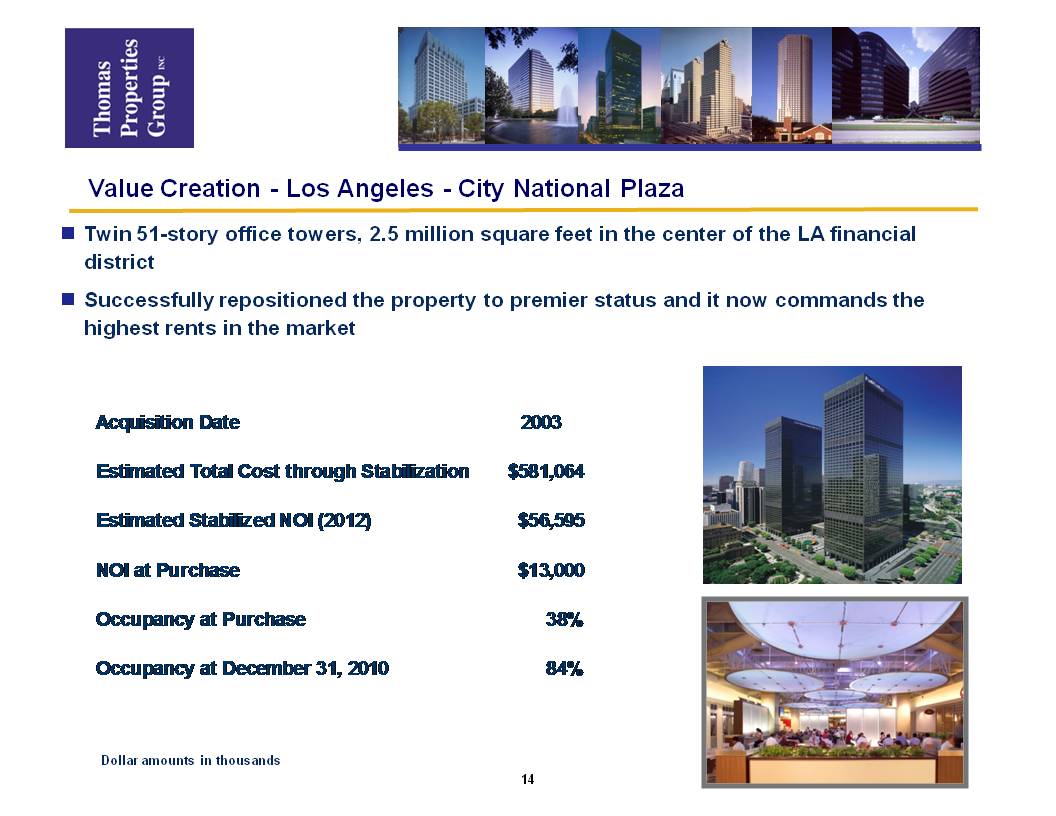

Value Creation - Los Angeles - City National Plaza

Twin 51-story office towers, 2.5 million square feet in the center of the LA financial district

Successfully repositioned the property to premier status and it now commands the highest rents in the market

Acquisition Date 2003

Estimated Total Cost through Stabilization $581,064

Estimated Stabilized NOI (2012) $56,595

NOI at Purchase $13,000

Occupancy at Purchase 38%

Occupancy at December 31, 2010 84%

Dollar amounts in thousands

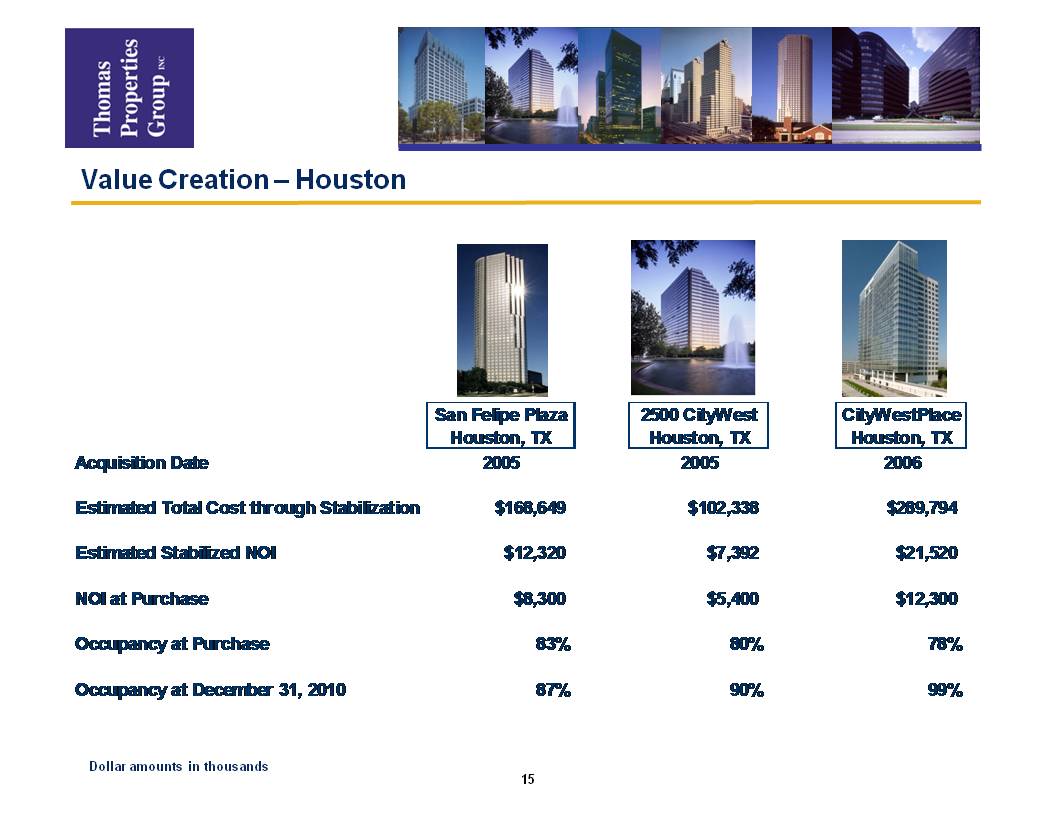

Value Creation – Houston

San Felipe Plaza Houston, TX

Acquisition Date 2005

Estimated Total Cost through Stabilization $168,649

Estimated Stabilized NOI $12,320

NOI at Purchase $8,300

Occupancy at Purchase 83%

Occupancy at December 31, 2010 87%

2500 CityWest Houston, TX

Acquisition Date 2005

Estimated Total Cost through Stabilization $102,338

Estimated Stabilized NOI $7,392

NOI at Purchase $5,400

Occupancy at Purchase 80%

Occupancy at December 31, 2010 90%

CityWestPlace Houston, TX

Acquisition Date 2006

Estimated Total Cost through Stabilization $289,794

Estimated Stabilized NOI $21,520

NOI at Purchase $12,300

Occupancy at Purchase 78%

Occupancy at December 31, 2010 99%

Dollar amounts in thousands

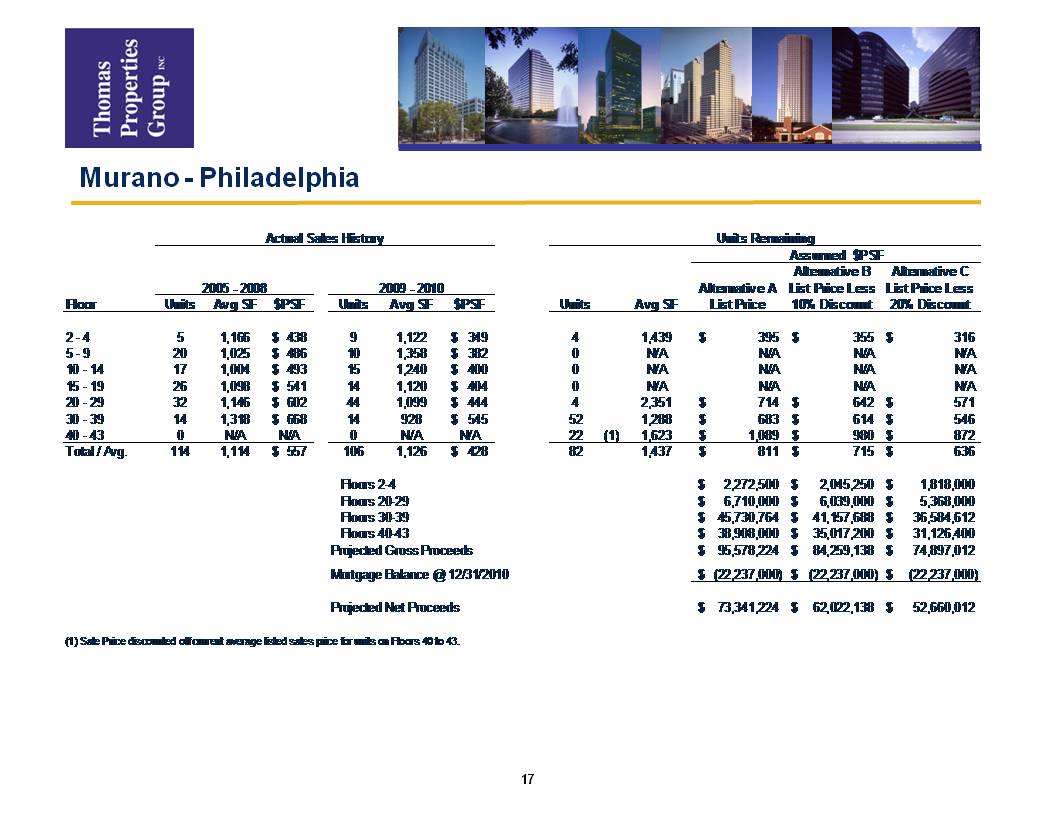

Murano - Philadelphia.

302-unit luxury condominium tower in downtown Philadelphia

Through December 31, 2010, have sold 220 units (73%), with completion of sales expected over the next 24 months

Loan balance of $214 per square foot, just 26% of the list price of $811 per square foot for the remaining 82 units

Remaining units are the most desirable in the building due to both location and size

Our ownership interest in net sales proceeds is approximately 90%. Using conservative pricing estimates, this represents approximately $30-50 million of net proceeds

Murano - Philadelphia

Actual Sales History Units

Years 2005 - 2008, Floors 2 - 4, units 5, avg sf 1,166, $PSF $438; Floors 5 - 9, units 20, avg sf 1,025, $PSF $486; Floors 10 - 14, units 17, avg sf 1,004, $PSF $493; Floors 15 - 19, units 26, avg sf 1,098, $PSF $541; Floors 20 - 29, units 32, avg sf 1,146, $PSF $602; Floors 30 - 39, units14, avg sf 1,318, $PSF $668; Floors 40 - 43, units 0, avg sf N/A, $PSF N/A; Total/Avg. 114 units; Avg SF 1,114; SPSF $557

Years 2009 - 2010, Floors 2 - 4, units 9, avg sf 1,122, $PSF $349; Floors 5 - 9, units 10, avg sf 1,358, $PSF $382; Floors 10 - 14, units 15, avg sf 1,240, $PSF $400; Floors 15 - 19, units 14, avg sf 1,120, $PSF $404; Floors 20 - 29, units 44, avg sf 1,099, $PSF $444; Floors 30 - 39, units 14, avg sf 928, $PSF $545; Floors 40 - 43, units 0, avg sf N/A, $PSF N/A;Total/Avg. 106 units; Avg SF 1,126; SPSF $428

Units Remaining Assumed $PSF

Alternative A

Floors 2 - 4, Units 4, Avg SF 1,439, List Price $395; Floors 5 - 9,Units 0, Avg SF N/A, List Price N/A; Floors 10 - 14, Units 0, Avg SF N/A, List Price N/A; Floors 15 - 19, Units 0, Avg SF N/A, List Price N/A; Floors 20 - 29, units 4, avg sf 2,351, $PSF $714; Floors 30 - 39, units 52, avg sf 1,288, $PSF $683; Floors 40 - 43, units 22 (1), avg sf 1,623, $PSF $1,089;

Alternative B List Price Less 10% Discount

Floors 2 - 4, Units 4, Avg SF 1,439, Price $355; Floors 5 - 9,Units 0, Avg SF N/A, Price N/A; Floors 10 - 14, Units 0, Avg SF N/A, Price N/A; Floors 15 - 19, Units 0, Avg SF N/A, Price N/A; Floors 20 - 29, units 4, avg sf 2,351, $PSF $642; Floors 30 - 39, units 52, avg sf 1,288, $PSF $614; Floors 40 - 43, units 22 (1), avg sf 1,623, $PSF $980;

Alternative C List Price Less 20% Discount

Floors 2 - 4, Units 4, Avg SF 1,439, Price $316; Floors 5 - 9,Units 0, Avg SF N/A, Price N/A; Floors 10 - 14, Units 0, Avg SF N/A, Price N/A; Floors 15 - 19, Units 0, Avg SF N/A, Price N/A; Floors 20 - 29, units 4, avg sf 2,351, $PSF $571; Floors 30 - 39, units 52, avg sf 1,288, $PSF $546; Floors 40 - 43, units 22 (1), avg sf 1,623, $PSF $872;

Total/Avg. 82 units; Avg SF 1,437; Alternative A Average List Price SPSF $811;Alternative B Average List Price less 10% discount SPSF $715;Alternative C Average List Price less 20% discount SPSF $636;

Projected Gross Proceeds

Alternative A

Floors 2 - 4, Gross Proceeds $2,272,500; Floors 20 - 29, Gross Proceeds $6,710,000; Floors 30 - 39, Gross Proceeds$45,730,764; Floors 40 - 43, Gross Proceeds$38,908,000; Total Projected Gross Proceeds $95,578,224; Mortgage Balance @ 12/31/2010 ($22,237,000); Projected Net Proceeds $73,341,224

Alternative B

Floors 2 - 4, Gross Proceeds $2,045,250; Floors 20 - 29, Gross Proceeds $6,039,000; Floors 30 - 39, Gross Proceeds$41,157,688; Floors 40 - 43, Gross Proceeds$35,017,200; Total Projected Gross Proceeds $84,259,138; Mortgage Balance @ 12/31/2010 ($22,237,000); Projected Net Proceeds $62,022,138

Alternative C

Floors 2 - 4, Gross Proceeds $1,818,000; Floors 20 - 29, Gross Proceeds $5,368,000; Floors 30 - 39, Gross Proceeds$36,584,612; Floors 40 - 43, Gross Proceeds$31,126,400; Total Projected Gross Proceeds $74,897,012; Mortgage Balance @ 12/31/2010 ($22,237,000); Projected Net Proceeds $52,660,012

(1) Sale Price discounted off current average listed sales price for units on Floors 40 to 43.

Strategic Plan

TPGI has recently completed an extensive strategic review utilizing both internal and external resources and has adopted a new strategic plan that capitalizes on its strengths

TPGI’s goal is to expand its asset base by acquiring wholly-owned assets

TPGI intends to focus on maximizing the portfolio’s recurring cash flow and NOI growth

Strategic Plan - Highlights

Selectively sell non-core assets that have achieved their maximum value

Redeploy sales proceeds in institutional quality assets in high barrier to entry markets to generate superior recurring cash flow and NOI growth

Continue to create value by repositioning value-add properties

Continue capital relationships with institutional investors to acquire and control trophy quality office properties, with a long term goal of increasing ownership interests

Continue to reduce leverage on our portfolio with a target of 50% LTV

Reduce the size of our development portfolio to approximately 10% of net asset value

Long term goal to convert to REIT status

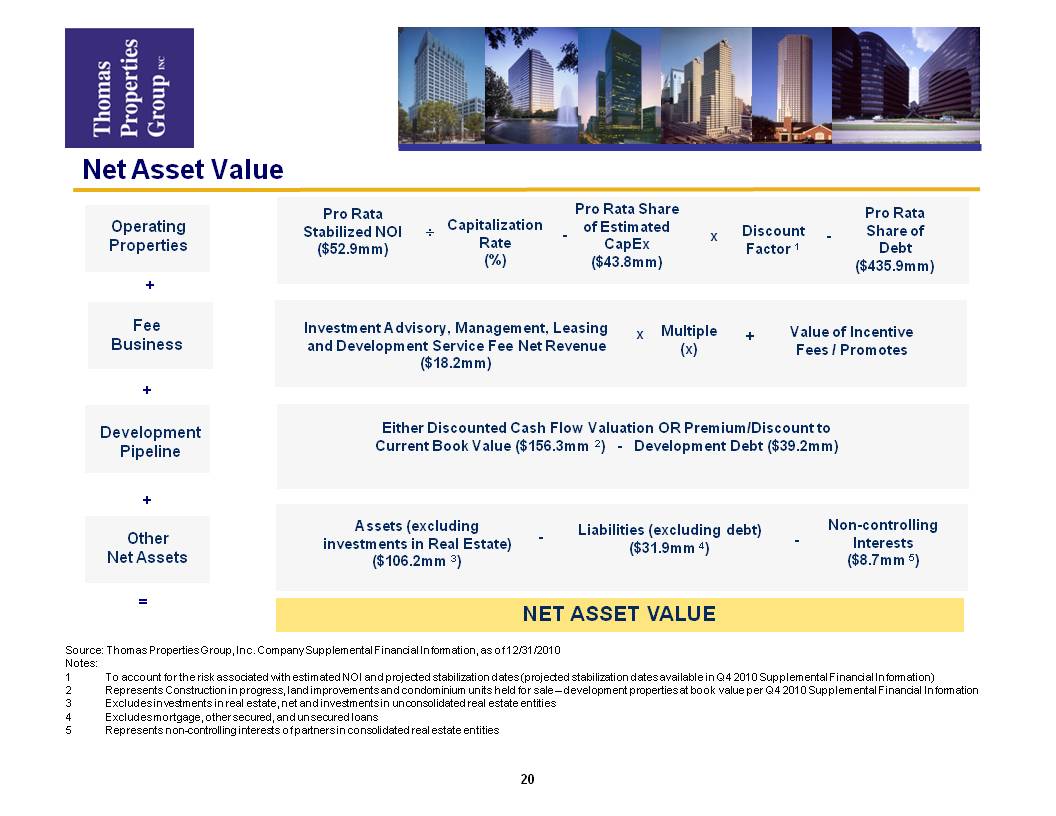

Net Asset Value

Operating Properties Pro Rata Stabilized NOI ($52.9mm) Capitalization Rate (%) Pro Rata Share of Estimated CapEx ($43.8mm) Discount Factor 1 Pro Rata Share of Debt ($435.9mm)

Fee Business Investment Advisory, Management, Leasing and Development Service Fee Net Revenue ($18.2mm) Multiple (x) Value of Incentive Fees / Promotes

Development Pipeline Either Discounted Cash Flow Valuation OR Premium/Discount to Current Book Value ($156.3mm 2) - Development Debt ($39.2mm)

Other Net Assets Assets (excluding investments in Real Estate) ($106.2mm 3) Liabilities (excluding debt) ($31.9mm 4) Non-controlling Interests ($8.7mm 5)

NET ASSET VALUE

Source: Thomas Properties Group, Inc. Company Supplemental Financial Information, as of 12/31/2010

Notes:

1 To account for the risk associated with estimated NOI and projected stabilization dates (projected stabilization dates available in Q4 2010 Supplemental Financial Information)

2 Represents Construction in progress, land improvements and condominium units held for sale – development properties at book value per Q4 2010 Supplemental Financial Information

3 Excludes investments in real estate, net and investments in unconsolidated real estate entities

4 Excludes mortgage, other secured, and unsecured loans

5 Represents non-controlling interests of partners in consolidated real estate entities

Net Asset Value – Investor Model

TPGI intends to publish an Excel-based calculator on our website to assist investors with the calculation of the net asset value of the company. This calculator, which will be updated quarterly, will allow investors to input the following variables:

Cap rates to be applied to estimated stabilized operating property NOI

Predevelopment property valuations

Multiple to be applied to net fee revenue

Summary

Experienced management team with Class A institutional quality office portfolio

Reduced loan balances and extended debt maturities

New strategic plan includes:

Expansion of our office portfolio with an increased focus on acquiring wholly-owned assets in California and the western United States

Disposition of selected assets and redeployment of the proceeds to acquire new assets

Continuing to create value by repositioning properties to maximize recurring cash flow

Appendix

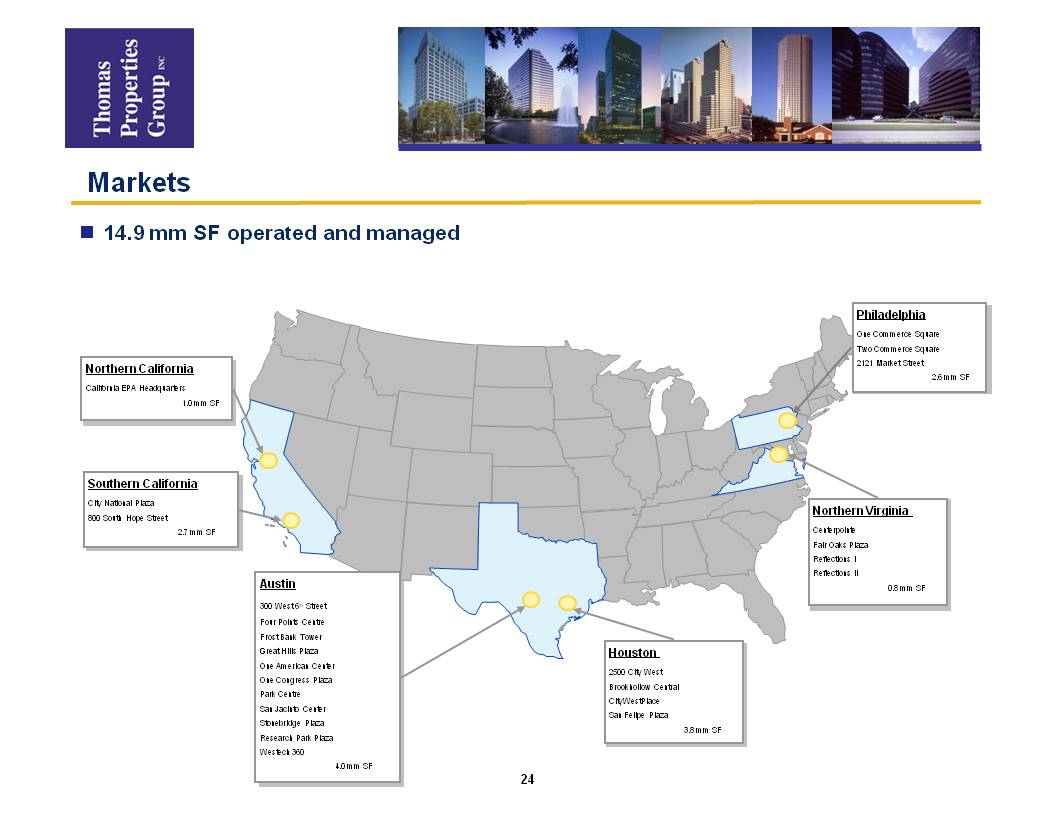

Markets

14.9 mm SF operated and managed

Northern California

California EPA Headquarters

1.0 mm SF

Southern California

City National Plaza

800 South Hope Street

2.7 mm SF

Austin

300 West 6th Street

Four Points Centre

Frost Bank Tower

Great Hills Plaza

One American Center

One Congress Plaza

Park Centre

San Jacinto Center

Stonebridge Plaza

Research Park Plaza

Westech 360

4.0 mm SF

Philadelphia

One Commerce Square

Two Commerce Square

2121 Market Street

2.6 mm SF

Northern Virginia

Centerpointe

Fair Oaks Plaza

Reflections I

Reflections II

0.8 mm SF

Houston

2500 City West

Brookhollow Central

CityWestPlace

San Felipe Plaza

3.8 mm SF

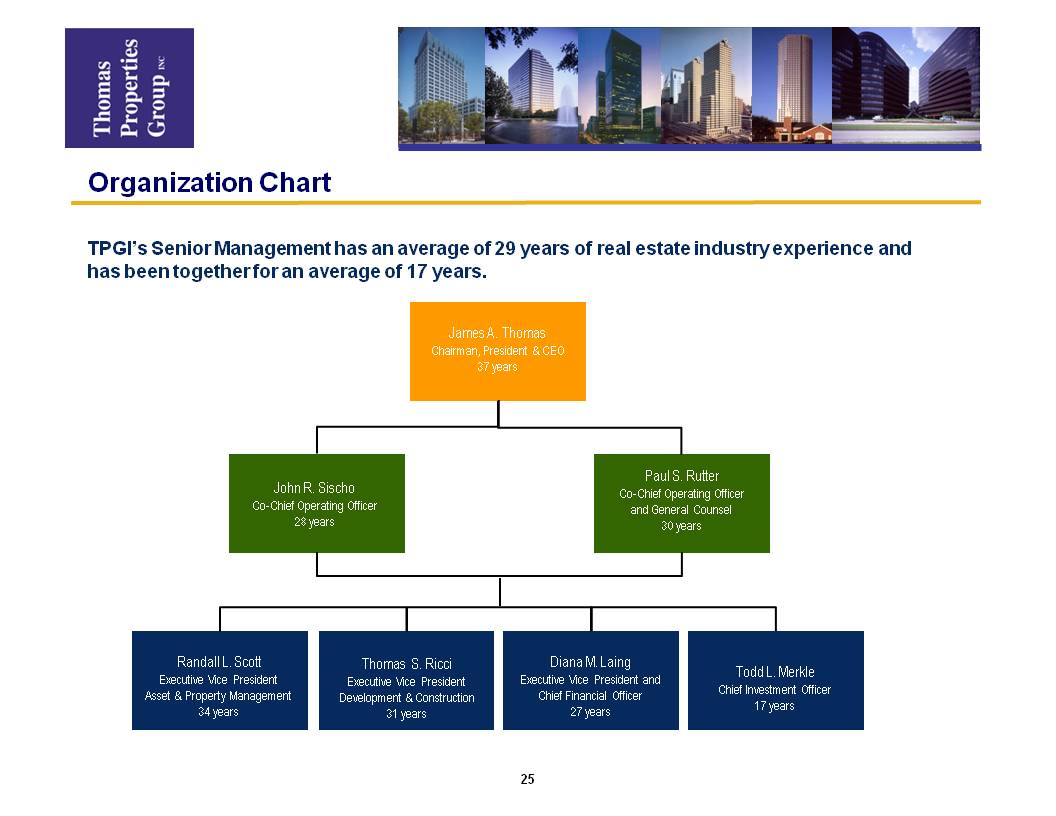

Organization Chart

TPGI’s Senior Management has an average of 29 years of real estate industry experience and has been together for an average of 17 years.

James A. Thomas

Chairman, President & CEO

37 years

John R. Sischo

Co-Chief Operating Officer

28 years

Paul S. Rutter

Co-Chief Operating Officer

and General Counsel

30 years

Randall L. Scott

Executive Vice President

Asset & Property Management

34 years

Thomas S. Ricci

Executive Vice President

Development & Construction

31 years

Diana M. Laing

Executive Vice President and

Chief Financial Officer

27 years

Todd L. Merkle

Chief Investment Officer

17 years