Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF

1934

Date of Report (Date of earliest event reported): April 5,

2011

UNIONTOWN ENERGY INC.

(Exact

name of registrant as specified in its charter)

| Nevada | 000-52560 | 98-0441419 |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification |

| incorporation) | No.) |

314-837 W. Hastings Street, Vancouver, BC, V6C

3N6

(Address of principal executive offices)

604-642-6410

(Registrant’s telephone number, including

area

code)

________________________________________________

(Registrant’s

former name, address and telephone number)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing

obligation of the Registrant under any of the following provisions:

[

] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a

-12)

[ ] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d

-2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e

-4(c))

TABLE OF CONTENTS

1

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

| Item 3.02 | Unregistered Sales of Equity Securities. |

As used in this Current Report on Form 8-K, unless otherwise stated, all references to the “Company”, “we,” “our” and “us” refer to Uniontown Energy Inc.

Property Rights Acquisition

On March 17, 2011 we entered into a property acquisition agreement with AD Consult and Invest S.A. (the “Agreement”) to acquire an interest in the Musselshell Prospect: an oil and gas property covering approximately 7,000 acres in central Montana, for the following consideration:

-

Issuance of 10,000,000 restricted shares of our common stock; and

-

Grant of an option to acquire 1,000,000 shares of our preferred stock at $3.00 per share for a period of 5 years, with such preferred stock being designated as having 250:1 voting rights.

The interest in the Musselshell Prospect is be comprised of a 75% net revenue interest with AD Consult and Invest S.A holding a 25% net revenue interest and a 20% carried working interest in and to all drilling, completing, and other operations related to the development of the acreage.

On April 5, 2011 we entered into an amended property acquisition agreement with AD Consult, which replaced the March 17, 2011 agreement in its entirety. The only material change between the two agreements is that we will no longer be issuing an option to acquire preferred shares. The new consideration consists of the:

-

issuance of 10,000,000 restricted shares of our common stock; and

-

grant of an option to acquire 10,000,000 more shares of our common stock at $3.00 per share for a period of 5 years.

Description of Business

Forward-Looking

Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “may,”, “anticipates”, “believes”, “should”, “intends”, “estimates”, and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to raise additional capital to finance our activities; the effectiveness, profitability and marketability of our products; legal and regulatory risks associated with the share exchange; the future trading of our common stock; our ability to operate as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), or otherwise.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance on these forward-looking statements.

2

Overview

We are an exploration stage company with nominal revenues and a limited operating history. We were incorporated as “Lodge Bay Oil & Gas Corp.” in the State of Nevada on November 22, 2004. On April 9, 2008 we changed our name to Intelbahn Inc., and then again on December 27, 2010 we changed our name to Uniontown Energy Inc. We have gone through various capital structure changes with the last one being a three for one forward split of our issued, outstanding and authorized capital resulting in 214,500,000 shares of common stock issued and outstanding and 27,000,000,00 authorized. We maintain our business offices at 314 – 837 W. Hastings Street, Vancouver, British Columbia, and our telephone number is 604 642 6410. We have not been involved in any bankruptcy, receivership or similar proceeding.

Current Business

Our business plan is to acquire oil and gas properties for exploration, appraisal and development with the intent to bring the projects to feasibility at which time we will either contract out the operations or joint venture the project to qualified interested parties. Our main priority will be given to projects with near term cash flow potential, although consideration will be given to projects that may not be as advanced from a technical standpoint but demonstrate the potential for significant upside. On April 5, 2011 we acquired an interest in the Musselshell Prospect (further describer in the “Description of Property” section below).

We are currently preparing for the exploration of the Musselshell Prospect and seeking opportunities to acquire further prospective or producing oil and gas properties or other oil and gas resource related projects.

Market, Customers and Distribution Methods

As the U.S. economy expanded after World War II, the development of a vast interstate transmission system facilitated the widespread consumption of natural gas in homes and business establishments. The demand for natural gas rose sharply in the 1980s, when consumers and businesses began to find more uses for it. After years as a low-value commodity, natural gas ascended into the spotlight as demand for the fuel to fire power plants, heat homes and serve as chemical feedstock outstripped the petroleum industry's ability to tap new reserves. In the 1990s, the popularity of natural gas as an economic and environmentally benign fossil fuel made it the fuel of choice for power generation.

By the year 2000, the U.S. economy was thriving, fueled by cheap energy. To meet the growing need for electricity, U.S. utilities ordered 180,000 megawatts of gas-fired power plants to be installed by 2005. This was, by far, the largest amount of power generation capacity ever installed in such a short period. As a result, the U.S. electricity supply margins and its economy became dependent on natural gas availability and price. Today, most newly created electricity capacity is generated by natural gas, rather than oil, coal, water or nuclear. This has prompted the National Petroleum Council to predict that electricity generation will be responsible for 47% of the increase in natural gas consumption between 1998 and 2010.

3

The availability of a ready market and the prices obtained for produced oil and gas depends on many factors, including the extent of domestic production and imports of oil and gas, the proximity and capacity of natural gas pipelines and other transportation facilities, fluctuating demand for oil and gas, the marketing of competitive fuels, and the effects of governmental regulation of oil and gas production and sales. A ready domestic market for oil and gas exists because of the presence of pipelines to transport oil and gas. The existence of an international market exists depends upon the presence of international delivery systems and political and pricing factors.

If we are successful in producing oil and gas in the future, the target customers for our oil and gas are expected to be refiners, remarketers and third party intermediaries, who either have, or have access to, consumer delivery systems. We intend to sell our oil and gas under both short-term (less than one year) and long-term (one year or more) agreements at prices negotiated with third parties. Typically either the entire contract (in the case of short-term contracts) or the price provisions of the contract (in the case of long-term contracts) are renegotiated at intervals ranging in frequency from daily to annually.

We have not yet adopted any specific sales and marketing plans. However, as we purchase future properties, the need to hire marketing personnel will be addressed.

Competition

The oil and gas industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior oil and gas companies, independent producers and institutional and individual investors who are actively seeking to acquire oil and gas properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of oil and gas interests is intense with many oil and gas leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the oil and gas companies with which we compete for financing and for the acquisition of oil and gas properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring oil and gas interests of merit or on exploring or developing their oil and gas properties. This advantage could enable our competitors to acquire oil and gas properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further oil and gas interests or explore and develop our current or future oil and gas properties.

We also compete with other junior oil and gas companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior oil and gas companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their oil and gas properties or the price of the investment opportunity. In addition, we compete with both junior and senior oil and gas companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, oil and gas exploration supplies and drill rigs.

In the face of competition, we may not be successful in acquiring, exploring or developing profitable oil and gas properties or interests, and we cannot give any assurance that suitable oil and gas properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the oil and gas industry by:

-

keeping our costs low;

-

relying on the strength of our management’s contacts; and

-

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

4

Intellectual Property

We have not filed for any protection of our trademark, and we do not have any other intellectual property.

Research and Development

We did not incur any research and development expenses during the period from November 22, 2004 (inception) to our fiscal year ended October 31, 2010.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. After the effectiveness of this Registration Statement we will begin filing Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company’s operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

Our current and future operations and exploration activities are or will be subject to various laws and regulations in the United States and Canada, the countries in which we conduct or plan to conduct our activities. These laws and regulations govern the protection of the environment, conservation, prospecting, development, energy production, taxes, labor standards, occupational health and safety, toxic substances, chemical products and materials, waste management and other matters relating to the oil and gas industry. Permits, registrations or other authorizations may also be required to maintain our operations and to carry out our future oil and gas exploration and production activities, and these permits, registrations or authorizations will be subject to revocation, modification and renewal.

Governmental authorities have the power to enforce compliance with lease conditions, regulatory requirements and the provisions of required permits, registrations or other authorizations, and violators may be subject to civil and criminal penalties including fines, injunctions, or both. The failure to obtain or maintain a required permit may also result in the imposition of civil and criminal penalties, and third parties may have the right to sue to enforce compliance.

We expect to be able to comply with all applicable laws and regulations and do not believe that such compliance will have a material adverse effect on our competitive position. We have obtained and intend to obtain all environmental permits, licenses and approvals required by all applicable regulatory agencies to maintain our current oil and gas operations and to carry out our future exploration activities. We are not aware of any material violations of environmental permits, licenses or approvals issued with respect to our operations, and we believe that the operators of the properties in which we have an interest comply with all applicable laws and regulations. We intend to continue complying with all environmental laws and regulations, and at this time we do not anticipate incurring any material capital expenditures to do so.

5

Compliance with environmental requirements, including financial assurance requirements and the costs associated with the cleanup of any spill, could have a material adverse effect on our capital expenditures, earnings or competitive position. Our failure to comply with any laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of injunctive relief, or both. Legislation affecting the oil and gas industry is subject to constant review, and the regulatory burden frequently increases. Changes in any of the laws and regulations could have a material adverse effect on our business, and in view of the many uncertainties surrounding current and future laws and regulations, including their applicability to our operations, we cannot predict their overall effect on our business.

U.S. Regulations

Our operations are or will be subject to various types of regulation at the federal, state and local levels in the United States. Such regulation covers permits required for drilling wells; bonding requirements for drilling or operating wells; the implementation of spill prevention plans; submissions and permits relating to the presence, use and release of certain materials incidental to oil and gas operations; the location of wells; the method of drilling and casing wells; the use, transportation, storage and disposal of fluids and materials used in connection with drilling and production activities; surface usage and the restoration of properties upon which wells have been drilled; the plugging and abandoning of wells; and the transportation of oil and gas.

Our operations are or will also be subject to various conservation matters, including the regulation of the size of drilling and spacing units or proration units, the number of wells which may be drilled in a unit, and the unitization or pooling of oil and gas properties. In this regard, some states allow forced pooling or the integration of tracts to facilitate exploration while other states rely on the voluntary pooling of lands and leases, which may make it more difficult to develop oil and gas properties. In addition, state conservation laws establish maximum rates of production from oil and gas wells, generally limit the venting or flaring of gas and impose certain requirements regarding the ratable purchase of produced oil and gas. The effect of these regulations is to limit the amounts of oil and gas we may be able to produce from our wells and to limit the number of wells or the locations at which we may be able to drill.

Oil and natural gas exploration and production activities on federal lands are subject to the National Environmental Policy Act (NEPA). The NEPA requires federal agencies, including the Department of the Interior, to evaluate major agency actions that have the potential to significantly impact the environment. In the course of such evaluations, an agency will typically prepare an environmental assessment on the potential direct, indirect and cumulative impacts of a proposed project and, if necessary, will prepare a more detailed environmental impact statement that may be made available for public review and comment. This process has the potential to delay or limit the development of oil and natural gas projects.

The Resource Conservation and Recovery Act (RCRA) and comparable state laws regulate the generation, transportation, treatment, storage, disposal and cleanup of “hazardous wastes” as well as the disposal of non-hazardous wastes. Under the auspices of the U.S. Environmental Protection Agency, or EPA, individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements. While drilling fluids, produced waters, and many other wastes associated with the exploration, development, and production of crude oil, natural gas, or geothermal energy constitute “solid wastes”, which are regulated under the less stringent non-hazardous waste provisions, there is no assurance that the EPA or individual states will not in the future adopt more stringent and costly requirements for the handling of non-hazardous wastes or categorize some non-hazardous wastes as hazardous.

6

The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), also known as “Superfund”, and analogous state laws, impose joint and several liability, without regard to fault or legality of conduct, on persons who are considered to be responsible for the release of a “hazardous substance” into the environment. These persons include the owner or operator of the site where the release occurred and any company that disposed or arranged for the disposal of the hazardous substance at the site. Under CERCLA, such persons may be liable for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances into the environment.

The Water Pollution Control Act, also known as the Clean Water Act, and analogous state laws, impose restrictions and strict controls on the discharge of pollutants, including produced waters and other oil and natural gas wastes, into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or the relevant state. The Clean Water Act also prohibits the discharge of dredge and fill material into regulated waters, including wetlands, unless authorized by a permit issued by the U.S. Army Corps of Engineers. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations.

The Clean Air Act and associated state laws and regulations regulate emissions of various air pollutants through the issuance of permits and the imposition of other requirements. In addition, the EPA has developed, and continues to develop, stringent regulations governing emissions of toxic air pollutants at specified sources. In order to construct production facilities, we may be required to obtain permits before work can begin. These regulations may increase the costs of compliance for such facilities, and federal and state regulatory agencies may impose administrative, civil and criminal penalties for non-compliance.

We may be subject to the requirements of the Occupational Safety and Health Act (OSHA) and comparable state statutes. The OSHA hazard communication standard, the EPA community right-to-know regulations under Title III of CERCLA, and similar state statutes require that we organize and/or disclose information about hazardous materials used or produced in our operations.

Canadian Regulations

As our business plan may involve operations and exploration activities in Canada, we may have to comply with Canadian laws and regulations related to the oil and gas industry. Canada has regulatory provisions concerning permits for the drilling of wells, the spacing of wells, the prevention of oil and natural gas waste, allowable rates of production and other matters. The amount of oil and natural gas produced is subject to control by regulatory agencies in each province that regulates allowable rates of production.

In addition to the foregoing, our future Canadian operations may be affected from time to time by political developments in Canada and by federal, provincial and local laws and regulations, such as restrictions on production and export, oil and natural gas allocation and rationing, price controls, tax increases, the expropriation of property, the modification or cancellation of contract rights and environmental protection controls.

7

The Canada Oil and Gas Operations Act permits the creation of regulations concerning the design, safety, construction, installation, inspection, testing, monitoring, operation, maintenance and repair of installations used in the exploration, development and production of oil and gas. The Act prohibits anyone from carrying on any work or activity related to the exploration for or the production of oil or gas unless they first obtain a license or authorization issued by the National Energy Board. As part of the application process, a plan must be submitted that shows that Canadians are being employed and that Canadian goods and services are being used. The National Energy Board may require that certain conditions be fulfilled, for example, that a company obtain appropriate insurance and that environmental studies be carried out.

The Oil and Gas Spills and Debris Liability Regulations govern the limits of liability for spills, authorized discharges and debris emanating or originating from work or activity related to the exploration or production of oil and gas.

The Canada Oil and Gas Drilling Regulations govern the exploration, drilling and conservation of oil and gas and specify measures to ensure the safety of these operations. These regulations stipulate that no person may drill a well without the authorization and approval of the Chief Conservation Officer.

The Registration of Storage Tank Systems for Petroleum Products and Allied Petroleum Products on Federal Lands or Aboriginal Lands Regulations require the registration of specified storage tank systems located on federal lands or aboriginal lands with the appropriate federal department responsible for administering the land. The Department of Environment has access to the consolidated storage tank system records in each appropriate federal department, and any unregistered storage tank systems are prohibited from engaging in fuel delivery.

Other Laws and Regulations

The Kyoto Protocol to the United Nations Framework Convention on Climate Change became effective in February 2005. Under the Protocol, participating nations are required to implement programs to reduce emissions of certain gases, generally referred to as greenhouse gases, which are suspected of contributing to global warming. Methane, a primary component of natural gas, and carbon dioxide, a byproduct of the burning of oil and natural gas, are examples of greenhouse gases regulated by the Protocol. Although the United States is not participating in the Protocol, the current session of Congress is considering climate change legislation, with multiple bills having already been introduced that propose to restrict greenhouse gas emissions. Also, several states have already adopted regulatory initiatives or legislation to reduce emissions of greenhouse gases. For example, California recently adopted the California Global Warming Solutions Act of 2006, which requires the California Air Resources Board to achieve a 25% reduction in emissions of greenhouse gases from sources in California by 2020. Additionally, in the April 2, 2007 decision of the U.S. Supreme Court in Massachusetts, et al. v. EPA, the Court held that the Clean Air Act provides the EPA with the authority to regulate emissions of carbon dioxide and other greenhouse gases from mobile sources. The Court determined that the EPA had failed to provide an adequate statutory basis for its refusal to regulate greenhouse gases from such sources, reversing the decision of the U.S. Circuit Court of Appeals for the District of Columbia. The Court remanded the case to the Circuit Court for further proceedings consistent with the ruling, which will presumably require the EPA to determine whether greenhouse gases from mobile sources endanger public health or welfare. The passage of climate control legislation by Congress or a determination by the EPA that public health or welfare is endangered by the emission of carbon dioxide from mobile sources may result in the federal regulation of carbon dioxide emissions and other greenhouse gases.

8

We believe that we are currently in compliance with the statutory and regulatory provisions governing our operations. We hold or will hold all necessary permits and other authorizations to the extent required by our current or future properties or interest and their associated operations. However, we may do business and own properties in a number of different geographic areas and may therefore be subject to the jurisdiction of a large number of different authorities at different levels of government. We plan to comply with all statutory and regulatory provisions governing our current and future operations; however, such regulations may significantly increase our costs of compliance, and regulatory authorities may also impose administrative, civil and criminal penalties for non-compliance. At this time, it is not possible to accurately estimate how laws or regulations may impact our future business. We also cannot give any assurance that we will be able to comply with future changes in any statutes or regulations.

We own or may own interests in properties that have been used for oil and gas exploration in the past. Although industry-standard operating and waste disposal practices may have been used, hazardous substances, wastes, or petroleum hydrocarbons may have been released on or under the properties, or on or under other locations, including off-site locations, where such substances have been taken for disposal. In addition, some of these properties may have been or may be operated by third parties or by previous owners or operators whose treatment and disposal of hazardous substances, wastes, or hydrocarbons was not under our control. These properties and the substances disposed or released thereon may be subject to CERCLA, RCRA and analogous state laws. Under such laws, we could be required to remove previously disposed substances and wastes, remediate contaminated property or perform remedial plugging or pit closure operations to prevent any future contamination.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of April 5, 2011 we have no employees other than our management who devote only a limited amount of time to our business.

Description of Property

Our principal office is located at 314 – 837 West Hastings Street, Vancouver, BC V6C 3N6. We neither rent nor own any properties. We utilize the office space and equipment of our management at no cost. We believe that this space is sufficient to meet our present needs and do not anticipate any difficulty in securing alternative or additional space, as needed.

Musselshell Prospect

On April 5, 2011 we entered into an amended property acquisition agreement with AD Consult, which replaced an original property acquisition agreement entered into on March 17, 2011in its entirety. The only material change between the two agreements is that we will no longer be issuing an option to acquire preferred shares. The new consideration consists of the:

-

issuance of 10,000,000 restricted shares of our common stock; and

- grant of an option to acquire 10,000,000 more shares of our common stock at $3.00 per share for a period of 5 years.

9

The interest in the Musselshell Prospect is be comprised of a 75% net revenue interest with AD Consult and Invest S.A holding a 25% net revenue interest and a 20% carried working interest in and to all drilling, completing, and other operations related to the development of the acreage.

The Musselshell Prospect is made up of the Heath and Amsden formations. The Heath formation is an upper Mississippian shallow marine/estuarian sequence of highly organic shales, calcareous shales, and argillaceous limestone. The Heath limestones contain both vuggy and fracture porosity. Historical production from the Heath formation occurs in the Devil’s Basin and Devil’s Pocket fields. Production occurs along tight anticlinal noses where the argillaceous limestones are fractured. Unfortunately, the porosities and permeabilities of the Heath matrix and fractures is poorly known. The Amsden formation is a Pennsylvanian-aged limestone and dolostone sequence that was deposited in a shallow sea. In the study area, the Amsden underlies a regional Jurassic unconformity which eroded all of the post-Pennsylvanian strata. The Jurassic Piper limestone and shale commonly sits directly above the Amsden Formation. The Amsden Formation varies in reservoir quality between fair to poor and is often most productive in zones of fracturing along the crest of anticlines.

10

The Musselshell Prospect was originally a Tyler sand oil prospect with potential for development of the Heath Shale. Central Montana production is confined to the area just north of Roundup and near Musselshell, Montana. An east-west structural trend known as the Montana trough has been an active lineament system since the Paleozoic. During the Paleozoic the trough was part of the Williston Basin with source material coming from the west.

Erosion of the Mississippian exposed the Heath shale within the trough. Deposition of the Tyler channel sands occurred atop the Heath. With time the Heath matured to become the source rock for the Tyler oil fields in the area as well as the likely source for other production. Block faulting and lineaments fractured the Heath allowing migration of oil into the overlying sands. Where the channel sands are absent the oil is still present.

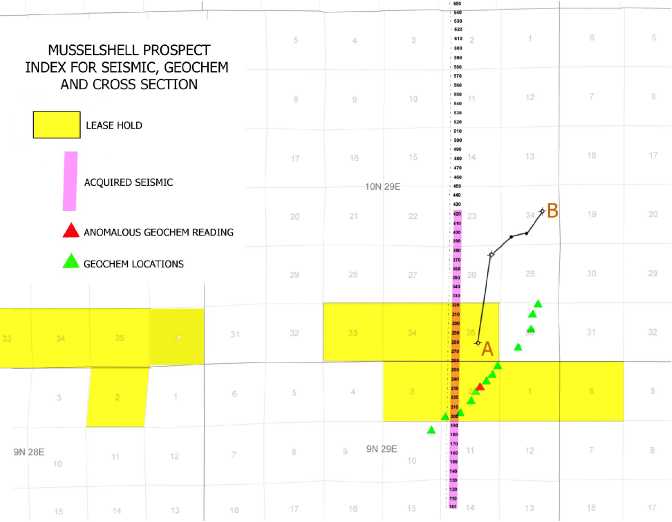

The photo attached below displays the structural feature making up the Musselshell prospect. The East and West structures are pressed against the large lineament known as the south flank of the Montana Trough. Stress in this area assures fracturing of the Heath shale.

Oil and Gas Acreage

The following table sets forth the undeveloped acreage, by area, which we have rights to as of April 5, 2011. Undeveloped acres are acres on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and gas, regardless of whether or not such acreage contains proved reserves. Gross acres are the total number of acres in which we have a working interest. Net acreage is obtained by multiplying gross acreage by our working interest percentage in the properties. The table does not include acreage in which we have a contractual right to acquire or to earn through drilling projects, or any other acreage for which we have not yet received leasehold assignments.

11

| Total | Undeveloped Acres | |

| Gross | Net | |

| 8347.54 | 7077.76 | |

Financial Information

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the financial statements of Uniontown Energy Inc., including the notes thereto, appearing elsewhere in this report. The discussion of results, causes and trends should not be construed to imply any conclusion that these results or trends will necessarily continue into the future. All references to currency in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section are to U.S. dollars, unless otherwise noted.

Results of Operations

Years Ended October 31,

2010 and 2009

Our operating results for the years ended October 31, 2010 and 2009 are summarized as follows:

| Year Ended | ||||||

| October 31 | ||||||

| 2010 | 2009 | |||||

| Revenue | $ | $ | ||||

| Operating Expenses | $ | 128,080 | $ | 112,247 | ||

| Net Loss | $ | (128,080 | ) | $ | (112,247 | ) |

Revenue

We have not earned any revenues since our inception and we do not anticipate earning revenues in the near future.

Expenses

Our expenses for the year ended October 31, 2010 and October 31, 2009 are outlined in the table below:

| Year Ended | ||||||

| October | 31 | |||||

| 2010 | 2009 | |||||

| Amortization | $ | 897 | $ | 1,994 | ||

| Consulting fees | $ | 6,000 | $ | Nil | ||

| Foreign exchange (gain) loss | $ | 30,466 | $ | 55,581 | ||

| Interest and bank charges | $ | 11,912 | $ | 6,804 | ||

| Office and general | $ | 16,160 | $ | 7,899 | ||

| Professional fees | $ | 40,783 | $ | 36,123 | ||

| Management fees | $ | 21,862 | $ | 3,846 | ||

12

The increase in general and administrative expenses for the year ended October 31, 2010, compared to the same period in fiscal 2009, was mainly due to foreign exchange loss.

Three months ended January 31, 2011 compared to three months ended January 31, 2010.

| Three months | Three months | |||||

| ended | ended | |||||

| January 31, 2011 | January 31, 2010 | |||||

| Revenue | $ | Nil | $ | Nil | ||

| Operating | $ | 36,778 | $ | 29,564 | ||

| Expenses | ||||||

| Net Income (Loss) | $ | (36,778 | ) | $ | (29,564 | ) |

Expenses

Our operating expenses for the three month periods ended January 31, 2011 and January 31, 2010 are outlined in the table below:

| Three | Three | |||||

| months | months | |||||

| ended | ended | |||||

| January 31, | January 31, | |||||

| 2011 | 2010 | |||||

| Amortization | $ | 102 | $ | 226 | ||

| Consulting fees | $ | 6,000 | $ | Nil | ||

| Foreign exchange loss | $ | 7,789 | $ | 5,495 | ||

| Impairment of oil and gas | $ | Nil | $ | Nil | ||

| property | ||||||

| Interest and bank charges | $ | 3,803 | $ | 3,176 | ||

| Office and general | $ | 11,086 | $ | 7,130 | ||

| Professional fees | $ | 7,500 | $ | 13,537 | ||

| Management fees | $ | 498 | $ | Nil | ||

| Net Loss | $ | 36,778 | $ | 29,564 |

Operating expenses for the three months ended January 31, 2011 increased by 24.4% as compared to the comparative period in January 31, 2010 primarily as a result of an increase in consulting fees and office and general expenses.

Revenue

We have not had any revenues from operations since inception (November 22, 2004). We do not anticipate that we will earn any revenues from operations unless and until we acquire and operate a profitable business. This might never happen and we can offer no assurance that even if we acquire a business that we will ever be profitable.

13

Liquidity and Capital Resources

As of October 31, 2010

| Working Capital | |||||||||

| At | At | Percentage | |||||||

| October | October | Increase/Decre | |||||||

| 31, 2010 | 31, 2009 | ase | |||||||

| Current Assets | $ | 2,899 | $ | 1,002 | 189% | ||||

| Current Liabilities | $ | 265,855 | $ | 250,271 | 6% | ||||

| Working Capital | $ | (262,956 | ) | $ | (249,269 | ) | 5% |

| Cash Flows | ||||||

| At | At October | |||||

| October | 31, 2009 | |||||

| 31, 2010 | ||||||

| Net cash used in operations | $ | (86,752 | ) | $ | (84,509 | ) |

| Net cash used in investing activities | $ | Nil | $ | Nil | ||

| Net cash provided by financing activities | $ | 88,398 | $ | 84,668 | ||

| Increase In Cash During The Period | $ | 1,646 | $ | 159 |

We had cash in the amount of $2,648 as of October 31, 2010 as compared to $1,002 as of October 31, 2009. We had a working capital deficit of $262,956 as of October 31, 2010 compared to working capital deficit of $249,269 as of October 31, 2009.

As of January 31, 2011

Working Capital

| Percentage | |||||||||

| As at | As at | Increase/ | |||||||

| January 31, 2011 | October 31, 2010 | (Decrease) | |||||||

| Current Assets | $ | 157 | $ | 2,899 | (95)% | ||||

| Current Liabilities | $ | 291,832 | $ | 265,855 | 9.7% | ||||

| Working Capital | $ | (291,675 | ) | $ | (262,956 | ) | 10.9% |

Cash Flows

| Three months | Three months | |||||

| Ended | Ended | |||||

| January 31, | January 31, | |||||

| 2011 | 2010 | |||||

| Net cash used in operations | $ | (2,491 | ) | $ | (18,545 | ) |

| Net cash used in investing activities | $ | Nil | Nil | |||

| Net cash provided by financing activities | $ | Nil | 20,000 | |||

| Increase (decrease) in cash | $ | (2,491 | ) | $ | 1,455 |

Our net cash used by operating activities for the three months ended January 31, 2011 was $2,491 compared with $18,545 for the three months ended January 31, 2010. Our management believes that we will need additional funding in order to meet our operating expenses.

14

We estimate that our expenses over the next 12 months (beginning April 2011) will be approximately $3,150,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

| Estimated | Estimated | |

| Description | Completion Date | Expenses |

| ($) | ||

| Legal and accounting fees | 12 months | 150,000 |

| Exploration Expenses | 12 months | 1,500,000 |

| Management and operating costs | 12 months | 150,000 |

| Salaries and consulting fees | 12 months | 200,000 |

| Property acquisitions | 12 months | 1,000,000 |

| General and administrative expenses | 12 months | 150,000 |

| Total | 3,150,000 |

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement or debt financings. However, there is no assurance that any such financing will be available or if available, on terms that will be acceptable to us. We may not raise sufficient funds to fully carry out our business plan.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete listing of these policies is included in Note 2 of the notes to our financial statements for the years ended October 31, 2010 and 2009. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

15

Use of estimates and assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that is believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are readily apparent from other sources. The actual results experienced by the Company may differ materially from the Company’s estimates. To the extent there are material differences, future results may be affected. Estimates used in preparing theses financial statements include the carrying value of the equipment and deferred income tax amounts, rates and timing of the reversal of income tax differences.

Loss per common share

Basic earnings per share includes no dilution and is computed by dividing income available to common stockholders by the weighted average number of common shares outstanding for the period. Dilutive earnings per share reflect the potential dilution of securities that could share in the earnings of the Company. Because the Company does not have any potentially dilutive securities the diluted loss per share is equal to the basic loss per share.

Foreign Currency Translation

Foreign denominated monetary assets and liabilities are translated to their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Expenses are translated at average rates of exchange during the period. Related translation adjustments are reported as a separate component of stockholders’ equity, whereas gains or losses resulting from foreign currency transactions are included in results of operations.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the ownership, as of April 5, 2011, of our common stock by each of our directors, by all of our executive officers and directors as a group and by each person known to us who is the beneficial owner of more than 5% of any class of our securities. As of April 5, 2011, there were 224,500,000 shares of our common stock issued and outstanding. All persons named have sole or shared voting and investment control with respect to the shares, except as otherwise noted. The number of shares described below includes shares which the beneficial owner described has the right to acquire within 60 days of the date of this Form 8-K.

Title of Class |

Name and Address of Beneficial Owner |

Amount and

Nature of Beneficial Ownership |

Percent of

Class (1) |

| Common Stock |

Darren Stevenson (2) c/o 314-837 W. Hastings Street, Vancouver, BC, V6C 3N6 |

0 | 0% |

16

| Common Stock |

Terry Fields (3) c/o 314-837 W. Hastings Street, Vancouver, BC, V6C 3N6 |

0 | 0% |

| Common Stock |

Al Radford (4) c/o 314-837 W. Hastings Street, Vancouver, BC, V6C 3N6 |

0 |

0% |

| All Officers and Directors as a Group | 0 | 0% | |

| Common Stock |

AD

Consult and Invest S.A. St. Peterstrasse 1, CH-8022 Zurich, Switzerland |

20,000,000 (5) | 8.5%(5) |

| Common Stock |

Christine Kilbourn c/o 314-837 W. Hastings Street, Vancouver, BC, V6C 3N6 |

12,000,000 | 5.3% |

| Common Stock |

Brandon Truaxe c/o 314-837 W. Hastings Street, Vancouver, BC, V6C 3N6 |

19,500,000 | 8.7% |

| (1) |

Based on 224,500,000 issued and outstanding shares of our common stock as of April 5, 2011. |

| (2) |

Darren Stevenson is our President, Chief Executive Officer and director. |

| (3) |

Terry Fields is our Chief Financial Officer, Secretary, Treasurer and director. |

| (4) |

Al Radford is our director. |

| (5) |

Consists of 10,000,000 shares of our common stock and an option to acquire 10,000,000 additional shares of our common stock at $3 per share for a period of 5 years. The percentage of AD Consult holdings of was calculated assuming that the option to acquire the common shares was exercised. |

Changes in Control

As of April 5, 2011 we had no pension plans or compensatory plans or other arrangements which provide compensation in the event of termination of employment or a change in our control.

Directors and Executive Officers

Directors and Officers

Our Articles state that our authorized number of directors shall be not less than one and shall be set by resolution of our Board of Directors. Our Board of Directors has fixed the number of directors at three, and we currently have three directors.

Our current director and officer is:

| Name | Age | Position |

| Darren Stevenson | 39 | President, Chief Executive Officer and Director |

| Terry Fields | 68 | Chief Financial Officer, Principal Accounting Officer Secretary, Treasurer, and Director. |

| Al Radford | 63 | Director |

17

Our Directors will serve in that capacity until our next annual shareholder meeting or until their successors are elected and qualified. Officers hold their positions at the will of our Board of Directors. There are no arrangements, agreements or understandings between non-management security holders and management under which non-management security holders may directly or indirectly participate in or influence the management of our affairs.

Darren Stevenson, President, Chief Executive Officer Director

Darren R Stevenson is a senior oil and gas executive with experience in technology, corporate turnarounds and mergers and acquisitions. He brings to UnionTown Energy the leadership and practical skills required to achieve growth in the oil and gas business. Previously, from April 2007 to May 2010, he was a founding shareholder, director and officer of Voyageur Oil and Gas Corp., a private Canadian exploration stage company based in Calgary, Alberta where he was served as the CEO leading the effort to raise over $20 million in funding for its exploration activities in North Africa (Tunisia). He also recruited proven senior explorationists to manage the upcoming $50 million drilling campaign in the highly prospective Southern Tunisian exploration permit. From January 2006 to March 2011, he was the president and director of Sunset Pacific Petroleum (formerly, Bighorn Petroleum Ltd.) where he was responsible for leading a team of professionals to develop new growth prospects in the oil and gas sector. In 2006, the company made a gas discovery in Northeastern BC, with Encana Corporation as the operator. The Company has since changed its name to Sunset Pacific Petroleum (TSX.V:SPK) and is pursuing other non oil and gas business opportunities. In addition, from April 2006 to October 2007, he served as the CEO of Blacksands Petroleum Inc. (OTCBB.BSPE) based in Calgary, Alberta, where we was responsible for the start-up of this exploration company that formed a partnership with the Buffalo River Dene Nation through its subsidiary, Access Energy. Prior to this, Mr. Stevenson spent four years in The Hague and Amsterdam with Royal Dutch Shell PLC's consultancy business, Shell Global Solutions. Serving as a business development director, he led a team in technology and commercial business development in support of Shell's business pursuits in Europe, the Middle East and Russia. Mr. Stevenson studied Chemical Engineering at the University of British Columbia, and over the past 17 years has worked in engineering and commercial capacities for companies such as Syncrude Canada (1997-1998), Shell Canada (1994) and the University of British Columbia Industry Liaison Office (1997-2000). He also has more than 17 years' experience spearheading successful business ventures throughout the global market place, and has raised in excess of $35 million for three (3) oil and gas exploration companies he founded. We appointed Mr. Stevenson as our officer and director due to his experience in the oil and gas industry.

Terry Fields, Chief Financial Officer, Principal Accounting Officer Secretary, Treasurer and Director

Mr. Fields' business career spans more than 40 years in both the public and private sectors. After graduating from the University of California in Los Angeles (UCLA) and having received his Bachelor of Science Degree in 1965, he attended Loyola University School of Law in Los Angeles where he was Student Body President, earning the prestigious Loyola University School of Law Alumni Award and the American Bar Association Silver Key Award for Excellence.

He obtained his Doctorate of Law Degree (J.D.) in 1968 and was admitted to the California State Bar in 1969. He engaged in trial law for fifteen years, subsequently specializing in Business and Corporate Law with an emphasis on finance, both domestic and international.

18

Mr. Fields has been involved in the oil and gas sector throughout his career. He is currently President and majority shareholder of Spirit Holding Inc., a private company, holding a 35% interest in twenty-five wells on +1,000 acres in central Texas. Mr. Fields is a consultant and equity owner of Gibraltar Energy Group LLC, which holds large oil and gas interests in Michigan and Kentucky. For the past 25 years, Terry has provided legal counsel to the President of United Energy Corp. (UNRG.OB) which is involved in all phases of the oil industry domestic and internationally. Mr. Fields holds an equity position in United Energy Corp as well. Mr. Fields’ experience in the oil and gas industry and his vast experience in administration of public companies are the reasons we appointed him to our board of directors. We appointed Mr. Fields as our director and officer due to his legal background and business experience.

Al Radford, Director

Since July 2010, Al Radford has been the chief executive officer, president and director of Formation Fluid Management Inc. From 2000 to July 2010, Mr. Radford co-founded and served as president and chief executive officer at Produced Water Solutions, Inc., a diversified oilfield service company located in Red Deer, Alberta. During that period, he also was a sales manager at Terroco Industries, a diversified oilfield service company in Red Deer, Alberta. From 1998 to 2000, Mr. Radford owned and operated a forestry exporting company based out of Rocky Mountain House, Alberta.

From 1995 to 1998, he was a management consultant and provided various consulting services for Stewart Enterprises in Rocky Mountain House, Alberta. From 1992 to 1995, Mr. Radford, owned and operated a management consultant business where is consulted a variety of business which included oilfield service and logging companies as well as a number of marketing firms.

Between 1967 to 1982, he held various management consulting positions with a number of companies and owned and operated several automotive, industrial, and oilfield supply businesses across Alberta, Canada which included Northern Metallic in Rocky Mountain House, Alberta, Quality Parts Radford’s Auto Supply in Morinville, Alberta and Radford’s Auto Supply in Bonnyville, Alberta.

Mr. Radford currently resides in Sylvan Lake, Alberta, Canada. We appointed Mr. Radford as director due to his business experience is oil and gas companies.

There have been no transactions between the Company, Mr. Stevenson, Mr. Fields and Mr. Radford since the Company’s last fiscal year which would be required to be reported herein. There are no family relationships among our directors or executive officers.

Other Directorships

Other than as disclosed above, during the last 5 years, none of our directors held any other directorships in any company with a class of securities registered pursuant to section 12 of the Exchange Act or subject to the requirements of section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

Board of Directors and Director Nominees

Since our Board of Directors does not include a majority of independent directors, the decisions of the Board regarding director nominees are made by persons who have an interest in the outcome of the determination. The Board will consider candidates for directors proposed by security holders, although no formal procedures for submitting candidates have been adopted. Unless otherwise determined, at any time not less than 90 days prior to the next annual Board meeting at which a slate of director nominees is adopted, the Board will accept written submissions from proposed nominees that include the name, address and telephone number of the proposed nominee; a brief statement of the nominee’s qualifications to serve as a director; and a statement as to why the security holder submitting the proposed nominee believes that the nomination would be in the best interests of our security holders. If the proposed nominee is not the same person as the security holder submitting the name of the nominee, a letter from the nominee agreeing to the submission of his or her name for consideration should be provided at the time of submission. The letter should be accompanied by a résumé supporting the nominee's qualifications to serve on the Board, as well as a list of references.

19

The Board identifies director nominees through a combination of referrals from different people, including management, existing Board members and security holders. Once a candidate has been identified, the Board reviews the individual's experience and background and may discuss the proposed nominee with the source of the recommendation. If the Board believes it to be appropriate, Board members may meet with the proposed nominee before making a final determination whether to include the proposed nominee as a member of the slate of director nominees submitted to security holders for election to the Board.

Conflicts of Interest

Our directors are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities that are engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to the corporation if:

-

the corporation could financially undertake the opportunity;

-

the opportunity is within the corporation’s line of business; and

-

it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation.

We have adopted a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent.

Significant Employees

Other than as described above, we do not expect any other individuals to make a significant contribution to our business.

Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has, during the past ten years:

-

been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences);

-

had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

20

-

been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

-

been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

-

been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

-

been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Except as set forth in our discussion below in “Certain Relationships and Related Transactions, and Director Independence – Transactions with Related Persons,” none of our directors, director nominees or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Audit Committee and Charter

Our board of directors has determined that it does not have a member of its audit committee that qualifies as an "audit committee financial expert" as defined in Item 407(d)(5)(ii) of Regulation S-K, and is "independent" as the term is used in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934, as amended.

We believe that the members of our board of directors are collectively capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. We believe that retaining an independent director who would qualify as an "audit committee financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the early stages of our development and the fact that we have not generated any material revenues to date. In addition, we currently do not have nominating, compensation or audit committees or committees performing similar functions nor do we have a written nominating, compensation or audit committee charter. Our board of directors does not believe that it is necessary to have such committees because it believes the functions of such committees can be adequately performed by our board of directors.

21

Code of Ethics

Effective December 31, 2008, our company's board of directors adopted a Code of Business Conduct and Ethics that applies to, among other persons, members of our board of directors, our company's officers including our president, chief executive officer and chief financial officer, employees, consultants and advisors. As adopted, our Code of Business Conduct and Ethics sets forth written standards that are designed to deter wrongdoing and to promote:

| 1. |

honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; | |

| 2. |

full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with, or submit to, the Securities and Exchange Commission and in other public communications made by us; | |

| 3. |

compliance with applicable governmental laws, rules and regulations; | |

| 4. |

the prompt internal reporting of violations of the Code of Business Conduct and Ethics to an appropriate person or persons identified in the Code of Business Conduct and Ethics; and | |

| 5. |

accountability for adherence to the Code of Business Conduct and Ethics. |

Our Code of Business Conduct and Ethics requires, among other things, that all of our company's Senior Officers commit to timely, accurate and consistent disclosure of information; that they maintain confidential information; and that they act with honesty and integrity.

In addition, our Code of Business Conduct and Ethics emphasizes that all employees, and particularly Senior Officers, have a responsibility for maintaining financial integrity within our company, consistent with generally accepted accounting principles, and federal and state securities laws. Any Senior Officer who becomes aware of any incidents involving financial or accounting manipulation or other irregularities, whether by witnessing the incident or being told of it, must report it to our company. Any failure to report such inappropriate or irregular conduct of others is to be treated as a severe disciplinary matter. It is against our company policy to retaliate against any individual who reports in good faith the violation or potential violation of our company's Code of Business Conduct and Ethics by another.

Our Code of Business Conduct and Ethics was filed with the Securities and Exchange Commission as Exhibit 14.1 to our annual report for the year ended October 31, 2010. We will provide a copy of the Code of Business Conduct and Ethics to any person without charge, upon request. Requests can be sent to: Uniontown Energy Inc., Suite 314 –837 West Hastings Street, Vancouver, British Columbia V6C 3N6.

22

Executive Compensation

The particulars of the compensation paid to the following persons:

-

our principal executive officer;

-

each of our two most highly compensated executive officers who were serving as executive officers at the end of the years ended October 31, 2010 and 2009; and

-

up to two additional individuals for whom disclosure would have been provided under (b) but for the fact that the individual was not serving as our executive officer at the end of the years ended October 31, 2010 and 2009,

who we will collectively refer to as the named executive officers of our company, are set out in the following summary compensation table, except that no disclosure is provided for any named executive officer, other than our principal executive officers, whose total compensation did not exceed $100,000 for the respective fiscal year:

| SUMMARY COMPENSATION TABLE | |||||||||

Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensati on Earnings ($) |

All Other Compensation ($) |

Total ($) |

| Terry Fields(1) President, Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer |

2010 2009 |

Nil N/A |

Nil N/A |

Nil N/A |

Nil N/A |

Nil N/A |

Nil N/A |

Nil N/A |

Nil N/A |

| Christine Kilbourn(2) Former President, Treasurer and Director |

2010 2009 |

8,000 3,846 |

Nil Nil |

Nil Nil |

Nil Nil |

Nil Nil |

Nil Nil |

Nil Nil |

8,000 3,846 |

| Mauro Baessato(3) Former Secretary |

2010 2009 |

13,862 Nil |

Nil Nil |

Nil Nil |

Nil Nil |

Nil Nil |

Nil Nil |

Nil Nil |

13,862 Nil |

| (1) |

Mr. Fields was appointed President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and as a director on October 28, 2010. |

| (2) | Ms. Kilbourn was elected director on February 1, 2008 and appointed president, secretary and treasurer on April 1, 2008. Ms. Kilbourn resigned as secretary on May 27, 2008 and as president, treasurer and director on October 12, 2010. |

|

| (3) | Mr. Baessato was appointed secretary of our company on May 27, 2008 and resigned as secretary on October 12, 2010. |

23

There are no compensatory plans or arrangements with respect to our executive officers resulting from their resignation, retirement or other termination of employment or from a change of control.

Option Grants

As of the date of this report we had not granted any options or stock appreciation rights to our named executive officers or directors.

Management Agreements

We have not currently entered into any management agreements with any of our officers.

Compensation of Directors

Our directors did not receive any compensation for their services as directors from our inception to the date of this report. We have no formal plan for compensating our directors for their services in the future in their capacity as directors, although such directors are expected in the future to receive options to purchase shares of our common stock as awarded by our Board of Directors or by any compensation committee that may be established.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits to our directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the Board of Directors or a committee thereof.

Compensation Committee

We do not currently have a compensation committee of the Board of Directors or a committee performing similar functions. The Board of Directors as a whole participates in the consideration of executive officer and director compensation.

Certain Relationships and Related Transactions, and Director Independence

Except as disclosed herein, no director, executive officer, shareholder holding at least 5% of shares of our common stock, or any family member thereof, had any material interest, direct or indirect, in any transaction, or proposed transaction since the year ended October 31, 2010, in which the amount involved in the transaction exceeded or exceeds the lesser of $120,000 or one percent of the average of our total assets at the year end for the last three completed fiscal years.

24

Director Independence

We currently act with three directors, consisting of Terry Fields, Darren Stevenson and Al Radford. We have determined that only Al Radford would qualify as an “independent director” as defined in NASDAQ Marketplace Rule 4200(a)(15).

We do not have a standing audit, compensation or nominating committee, but our entire board of directors acts in such capacities. We believe that our members of our board of directors are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The board of directors of our company does not believe that it is necessary to have an audit committee because we believe that the functions of an audit committee can be adequately performed by the board of directors. In addition, we believe that retaining an independent director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given the early stages of our development.

Legal Proceedings

We are not aware of any material pending legal proceedings to which we are a party or of which our property is the subject. We also know of no proceedings to which any of our directors, officers or affiliates, or any registered or beneficial holders of more than 5% of any class of our securities, or any associate of any such director, officer, affiliate or security holder are an adverse party or have a material interest adverse to us.

Market Price of and Dividends on the Registrant’s Common

Equity and Related

Stockholder Matters

Market Information

Our common stock is not traded on any exchange. Our common stock is quoted on OTC Bulletin Board under the trading symbol “UTOG”. We cannot assure you that there will be a market in the future for our common stock.

OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a national or regional stock exchange.

The following table reflects the high and low bid information for our common stock obtained from Stockwatch and reflects inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

| OTC Bulletin Board | ||

| Quarter Ended(1) | High ($) | Low ($) |

| January 31, 2011 | 0.7667 | 0.2833 |

| October 30, 2010 | 0.29 | 0.0417 |

| July 31, 2010 | - | - |

| April 30, 2010 | - | - |

| January 31, 2010 | - | - |

| October 30, 2009 | 0.0417 | 0.0417 |

| (1) |

The first trade in our stock did not occur until October 30, 2009. |

25

Holders

As of the date of this report there were 32 holders of record of our common stock.

Dividends

To date, we have not paid dividends on shares of our common stock and we do not expect to declare or pay dividends on shares of our common stock in the foreseeable future. The payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by our Board of Directors.

Equity Compensation Plans

As of the date of this report we did not have any equity compensation plans.

26

Recent Sales of Unregistered Securities

Except for the issuance of the common shares to AD consult described elsewhere in this current report, there have been no sales of unregistered securities which have taken place during any of our last three fiscal years.

Since our inception we have made no purchases of our equity securities.

Description of Registrant’s Securities to be Registered

Our authorized capital stock consists of 27,000,000,000 shares of common stock, $0.001 par value and 20,000,000 shares of preferred stock, $0.001 par value.

Common Stock

As of the date of this report we had 224,500,000 shares of our common stock issued and outstanding.

Holders of our common stock have no preemptive rights to purchase additional shares of common stock or other subscription rights. Our common stock carries no conversion rights and is not subject to redemption or to any sinking fund provisions. All shares of our common stock are entitled to share equally in dividends from sources legally available, when, as and if declared by our Board of Directors, and upon our liquidation or dissolution, whether voluntary or involuntary, to share equally in our assets available for distribution to our security holders.

Our Board of Directors is authorized to issue additional shares of our common stock not to exceed the amount authorized by our Articles of Incorporation, on such terms and conditions and for such consideration as our Board may deem appropriate without further security holder action.

Voting Rights

Each holder of our common stock is entitled to one vote per share on all matters on which such stockholders are entitled to vote. Since the shares of our common stock do not have cumulative voting rights, the holders of more than 50% of the shares voting for the election of directors can elect all the directors if they choose to do so and, in such event, the holders of the remaining shares will not be able to elect any person to our Board of Directors.

Dividend Policy

Holders of our common stock are entitled to dividends if declared by our Board of Directors out of funds legally available for the payment of dividends. From our inception to April 5, 2011 we did not declare any dividends.

We do not intend to issue any cash dividends in the future. We intend to retain earnings, if any, to finance the development and expansion of our business. However, it is possible that our management may decide to declare a stock dividend in the future. Our future dividend policy will be subject to the discretion of our Board of Directors and will be contingent upon future earnings, if any, our financial condition, our capital requirements, general business conditions and other factors.

27

Preferred Stock

We are authorized to issue up to 20,000,000 shares of $0.001 par value preferred stock. We have no shares of preferred stock outstanding. Under our Articles of Incorporation, the Board of Directors has the power, without further action by the holders of the common stock, to determine the relative rights, preferences, privileges and restrictions of the preferred stock, and to issue the preferred stock in one or more series as determined by the Board of Directors. The designation of rights, preferences, privileges and restrictions could include preferences as to liquidation, redemption and conversion rights, voting rights, dividends or other preferences, any of which may be dilutive of the interest of the holders of the common stock.

Indemnification of Directors and Officers