Attached files

| file | filename |

|---|---|

| 8-K - Black Tusk Minerals Inc. | blacktusk8k_040411.htm |

EXHIBIT 99.1

|

43-101 Technical Report–Black Tusk Project–February 2011 |

GEOLOGICAL EVALUATION

OF THE

HUANZA PROPERTY

centred at

11 deg 27'31"S 76 deg 27'31"N

and located

75 km northeast of Lima Peru

for

BLACK TUSK MINERALS INC.

by

GLEN MACDONALD, P.GEO.

February, 2011

|

43-101 Technical Report–Black Tusk Project–February 2011 |

TABLE OF CONTENTS

|

1.0

|

SUMMARY

|

1

|

|

2.0

|

INTRODUCTION AND TERMS OF REFERENCES

|

2

|

|

3.2 Site Visit

|

3

|

|

|

3.0

|

RELIANCE ON OTHER EXPERTS

|

3

|

|

4.0

|

PROPERTY DESCRIPTION AND LOCATION

|

4

|

|

4.1 General Background

|

4

|

|

|

4.2 Location and Access

|

4

|

|

|

4.3 Mineral Rights

|

5

|

|

|

4.4 Potential Environmental Liabilities

|

7

|

|

|

5.0

|

ACCESSABILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE

|

|

|

AND PHYSIOGRAPHY

|

8

|

|

|

5.1 Accessibility

|

8

|

|

|

5.2 Climate and Physiography

|

8

|

|

|

5.3 Local Resources and Infrastructure

|

8

|

|

|

6.0

|

HISTORY

|

10

|

|

7.0

|

GEOLOGICAL SETTING

|

11

|

|

7.1 Regional Geology

|

11

|

|

|

7.2 Local Geology

|

12

|

|

|

Introduction

|

12

|

|

|

Geology

|

12

|

|

|

Structure

|

13

|

|

|

Mineralization

|

13

|

|

|

Alteration

|

13

|

|

|

7.3 Project Geology

|

14

|

|

|

8.0

|

DEPOSIT TYPES

|

15

|

|

8.1 Deposit Type - Typical of Huanza District

|

15

|

|

|

8.2 Potential Deposit Types

|

15

|

|

|

9.0

|

MINERALIZATION AND TARGET AREAS

|

17

|

|

10.0

|

EXPLORATION

|

18

|

|

11.0

|

DRILLING

|

19

|

|

12.0

|

SAMPLE METHOD AND APPROACH

|

20

|

|

13.0

|

SAMPLE PREPARATION ANALYSIS AND SECURITY

|

21

|

|

14.0

|

DATA VERIFICATION

|

22

|

|

15.0

|

ADJACENT PROPERTIES

|

23

|

|

15.1 Finlandia Mine

|

23

|

|

|

15.3 El Condor Pasa Mine

|

24

|

|

|

15.4 Regionally Significant Operations

|

25

|

|

|

16.0

|

OTHER RELEVANT DATA AND INFORMATION

|

27

|

|

17.0

|

INTERPRETATION AND CONCLUSIONS

|

28

|

|

19.0

|

REFERENCES

|

31

|

|

20.0

|

DATE AND SIGNATURE PAGE

|

32

|

|

43-101 Technical Report–Black Tusk Project–February 2011 |

LIST OF FIGURES

|

Figure 4.2

|

LOCATION OF THE BLACK TUSK PROJECT

|

5

|

|

Figure 7.1

|

Regional Geology (DATA Sourced USGS Website) with Central

|

|

|

Polymetallic Belt and Project Location

|

11

|

|

|

Figure 7.2

|

Local Geology Modified from Petersen and Diaz (1972)

|

|

|

Coordinates: UTM-PSAD '56-Zone 18S

|

12

|

|

|

Figure 15.1

|

Black Tusk Project in Relation to Adjacent Properties

|

|

|

Coordinates: UTM-PSAD '56-Zone 18S

|

23

|

LIST OF TABLES

|

Table 4.3

|

Black Tusk Project - Claim Details

|

6

|

|

Table 15.2

|

Metal Production Between 1968 and 1973, Finlandia Vein

|

24

|

|

Table 15.4

|

Proven and Probable Reserves at Morococha as of 31st December 2006

|

26

|

|

43-101 Technical Report–Black Tusk Project–February 2011 |

1.0 SUMMARY

Black Tusk Minerals Inc. (“Black Tusk”) holds the Huanza property centred at 11 deg 27'31"S 76027'31"W on map sheets 24K/24J. The property is comprised of 19 claims totalling 8066.51 hectares and lies 75 km northeast of Lima, Peru. The property lies between 4000 and 4800 meters in the Andes Mountains, and is accessible by paved and gravel roads.

The Black Tusk property is underlain by a series of volcanic and interbedded sedimentary rock units intruded by granitic stocks. The stratified rocks have undergone intense deformation and alteration and contain structurally-controlled vein systems. Similar veins have been mined on the adjoining property until prematurely closed in 1991 by guerrilla insurgencies.

The area of the Black Tusk claim has been a resurgence of exploration activity in recent years with significant mining operators now underway nearby and major exploration programs taking place.

The Huanza property has the potential to host base and precious metal mineralization in structurally-controlled veins and shears, and also manto or skarn and porphyry style occurrences. No modern exploration has been conducted on the claims now controlled by Black Tusk, and a staged exploration program to include satellite imagery study; airborne geophysical surveying; ground prospecting, mapping and sampling at a budget of $225,000 is recommended by the author. The author visited the subject claims accompanied by Mr. Robert Krause, a Black Tusk geologist, on August 12, 2009.

- 1 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

2.0 INTRODUCTION AND TERMS OF REFERENCE

The author has been asked to prepare a N1 43-101 report at the request of Robert Krause, a Black Tusk geologist. The writer was asked to review available data on the Huanza Property and to make recommendations for further exploration, if warranted. The writer reviewed all Company and publicly available information on the property, and has summarized it in this report.

The writer was retained to complete this report in compliance with National Instrument 43-101 of the Canadian Securities Administrators ("N1 43-101") and the guidelines in Form 43-101F1. The author is a "qualified person" within the meaning of National Instrument 43-101 ("N1 43-101").

This report is based on information collected by the writer during a site visit performed in August 2009, with additional information provided by Black Tusk. Other information was obtained from sources within the public domain. The writer has no reason to doubt the reliability of the information provided by Black Tusk.

This technical report is based on the following sources of information:

|

|

·

|

Inspection of the Huanza project area.

|

|

|

·

|

Review of geological and historical data provided by Black Tusk.

|

|

|

·

|

Claims Information: Information concerning the location, shape and status of the mining claims comprising the property has been provided to the Author by Black Tusk's legal counsel (Snra Greta Castillo) in Lima, Peru.

|

The technical report was assembled in Vancouver, Canada during the month of February, 2011.

This information includes previous NI 43-101 compliant documents from surrounding projects. These reports have been cited herein and include the following:

|

|

·

|

Technical Report on the Pre-Feasibility of the Coricancha project, April 2007, for Gold Hawk Resources Limited.

|

|

|

·

|

Independent Technical Report on the Silveria project, June 2008, for Journey Resources Corp.

|

|

|

·

|

Technical Report on the Morochoca project, December 2007, for Pan American Silver Corp.

|

- 2 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

|

|

·

|

Technical Report on the Nueva Condor property, May 1997, for Oroperu Resources Inc.

|

This report was compiled to accompany an application by Black Tusk for listing of the Company's shares for trading on the Canadian National Stock Exchange (CNSX).

2.1 Site Visit

In accordance with the N1 43-101 guidelines, Mr. Glen Macdonald visited the property on August 12, 2009. Mr. Macdonald was accompanied by Mr. Robert Krause, a Black Tusk geologist and Mr. Gavin Roy, president of the Company. During the visit, Mr. Macdonald reviewed aspects of previous work in the region and on the property itself and explored possibilities for future exploration programs. This visit allowed Mr. Macdonald to observe and confirm the reported geology, and structural controls for potential mineralization on the Huanza Property, and evaluate the possible exploration targets.

Mr. Macdonald was given full access to all relevant data and conducted interviews of those persons involved with previous exploration on Huanza Property.

3.0 RELIANCE ON OTHER EXPERTS

This report has been prepared by Glen Macdonald for Black Tusk Minerals Inc. The information, opinions and conclusions contained herein are based on:

|

|

·

|

Information available to the author at the time of preparation of this report;

|

|

|

·

|

Assumptions, conditions, and qualifications as set forth in this report; and

|

|

|

·

|

Data, reports and other information supplied by Black Tusk and other third party sources.

|

For the purpose of the report the author has relied on ownership information provided by legal counsel for Black Tusk and therefore has not researched property title or mineral rights for the property and expresses no legal opinion as to the ownership status of the property.

- 3 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

4.0 PROPERTY DESCRIPTION AND LOCATION

4.1 General Background

Black Tusk is a Vancouver based exploration company engaged in the acquisition, exploration and development of late stage projects in North, Central and South America. Black Tusk is based in Vancouver, British Columbia.

The Black Tusk Project (the “Project”) consists of 19 contiguous claims (Figure 4.3, Table 4.3), located in the Huanza District, Huarochiri province, Department of Lima, Peru. Black Tusk is the sole proprietor of the nineteen claims comprising the Project.

4.2 Location and Access

The Black Tusk Project in made up of 19 mineral claims located in the Administrative District of Huanza, Province of Huarochiri, Department of Lima. The Project is situated approximately 75 kilometres northeast of Peru’s capital city, Lima, in the western cordillera of the central high Andes. It is centred on latitude 11°27’31” south and longitude 76°27’31” west (Figure 4.2). The Project area is split between map sheets; 24K Matucana and 24J Chosica.

Access to the Project area from Lima is via the Carterra Central Highway to the towns of Chosica 70 (kilometres) or San Mateo (100 kilometres) then continuing via unpaved road, a further 50 kilometres from Chosica or San Mateo, traversing mountainous terrain. Driving time from Lima is approximately 5 hours. The Project area ranges from 4000 to 4800m above sea level.

- 4 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

Figure 4.2 Location of the Black Tusk Project

4.3 Mineral Rights

At the time of writing, the Black Tusk Project covered an area of 8066.51 hectares (19 claims) of mineral rights. The corner coordinates for the claims boundaries are registered with the Instituto Geológico Minero y Metalúrgico (INGAMMET) Avenida Las Artes Sur 220, San Borja, Lima.

- 5 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

|

N°

|

Concession Name

|

Code

|

Status

|

Public Registry

|

|

01

|

Altococha Mine

|

0101292-07

|

Resolution No 3423 INGEMMET/PCD/PM

|

12125438

|

|

02

|

Altococha Mine 1

|

0101324-07

|

Resolution N°002242-2007-INACC/J

|

12089171

|

|

03

|

Altococha Mine 2

|

0101325-07

|

Resolution N° 002666-2007-INGEMMET/PCD/PM

|

12134767

|

|

04

|

Altococha Mine 3

|

0101326-07

|

Resolution N°000071-2007-INGEMMET/PCD/PM

|

12089882

|

|

05

|

Altococha Mine 4

|

0101327-07

|

Resolution N° 002099-2007-INACC/J

|

12089359

|

|

06

|

Altococha Mine 5

|

0101328-07

|

Resolution N° 000310-2007-INGEMMET/PCD/PM

|

12189875

|

|

07

|

Altococha Mine 7

|

0101598-07

|

Resolution N° 002425-2007-INACC/J

|

12089522

|

|

08

|

Altococha Mine 8

|

0101597-07

|

Resolution N° 002458-2007-INACC/J

|

12089420

|

|

09

|

Altococha Mine 9

|

0101664-07

|

Resolution N° 002100-2007-INACC/J

|

12089424

|

|

10

|

Altococha Mine 10

|

0101665-07

|

Resolution N° 002579-2007-INGEMMET/PCD/PM

|

12135392

|

|

11

|

Altococha Mine 11

|

0101666-07

|

Resolution N° 000402-2007-INGEMMET/PCD/PM

|

12089535

|

|

12

|

Altococha Mine 12

|

0101667-07

|

Resolution N° 001448-2007-INGEMMET/PCD/PM

|

12089549

|

|

13

|

Altococha Mine 14

|

0104158-07

|

Resolution N° 004169-2008-INGEMMET/PCD/PM

|

12359543

|

|

14

|

Altococha Mine 15

|

0106330-07

|

Resolution N° 001890-2008-INGEMMET/PCD/PM

|

12359721

|

|

15

|

Altococha Mine 16

|

0106329-07

|

Resolution N° 001705-2008-INGEMMET/PCD/PM

|

12359751

|

|

16

|

Black Tusk 1

|

0102020-09

|

Resolution No 4919-2009- INGEMMET/PCD/PM

|

12477466

|

|

17

|

Black Tusk 2

|

0102019-09

|

Resolution No 0209-2010- INGEMMET/PCD/PM

|

12477470

|

|

18

|

Black Tusk 3

|

0102018-09

|

Resolution No 0367-2010- INGEMMET/PCD/PM

|

12477475

|

|

19

|

Black Tusk 4

|

0102021-09

|

Resolution No 0045-2010- INGEMMET/PCD/PM

|

12477483

|

Table 4.3 Black Tusk Project - claim details.

According to the General Mining Law of Peru:

“Validity Fees” are payable annually at a cost of US$ 3.00 per hectare and must be paid by the 30th of June. Should payment of Validity Fees not be made for two consecutive years, mining pediments or concessions will be cancelled.

After pediments or concessions are held by a party for 6 years annual fees change according to the following framework;

- 6 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

“Holders of mining concessions are obliged to achieve a minimum production equivalent to US$100.00 per hectare per year, within six years following the year in which the respective mining concession title is granted. If this minimum production is not reached, as of the first semester of the 7th year after the concession title has been granted, the holder of the concession should pay a US$ 6.00 penalty per hectare per year. If such minimum production is not obtained until the end of the 11th year after obtaining the concession title, the penalty to be paid as of the 12th year increases to US$ 20.00 per hectare per year.”

Black Tusk has also reached an agreement with the local Huanza community granting access and surface rights to the Project.

4.4 Potential Environmental Liabilities

According to General Mining Law, the onus to clean up areas of contamination is with the company that created the contamination, unless the liability is sold to a third party in which case the owner is responsible for clean up costs. There are no current environmental issues that will potentially affect Black Tusk.

No permits are required for exploration work although an affidavit must be signed. An Environmental Impact Assessment (EIA) must be completed prior to any drilling. No EIA has yet been undertaken, although preliminary discussions in this regard have been initiated.

- 7 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

5.0 ACCESSABILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

5.1 Accessibility

From Lima the Project area is accessed via the Carretera Central Highway, a major supply route for numerous industries, exiting at the town of Chosica (1 hour). From Chosica a further 4 hour drive over a gravel surfaced road leads to the property. A network of tracks within the Project area grants access via four wheel drive vehicle to numerous parts of the Project area. Alternative access to the Project area can be gained by exiting the Carretera Central Highway north of the town of San Mateo.

5.2 Climate and Physiography

The climate in the Project area is typical of the Peruvian Andes with both wet and dry seasons. December to March is the wet season, during which electrical storm activity can develop with hail, rain and occasionally snow above 5000 metres. Individual rainfall events can be severe, with >2.5 centimetres falling in an hour, and such events have led to the temporary closure of the Carretera Central Highway between Chosica and San Mateo. Dense fog is common during the rainy season and temperatures rarely reach above 15° C. The dry season is from April to November, during which temperatures can fall below 0° C and may exceed 25° C. Rainfall is very rare in the dry season.

The Project area ranges between 4000 m - 4800 m altitude. Unpaved roads leading to the Project area peak at around 5000 m altitude. Mountain slopes vary and range between 30° to near vertical with local relief exceeding 1500 meters. Vegetation is sparse to non-existent at higher elevation; valley bottoms and lower elevations may host short grasses and moss, small bushes survive close to drainages. Subsistence farming is variably developed in the valleys and alpacas, llamas and goats are herded at higher elevations.

5.3 Local Resources and Infrastructure

The western cordillera has a long history of mining and exploration. Experienced Peruvian labour and equipment can be found in many towns including Chosica and San Mateo; the more local (10 kilometres) mountain village of Huanza is also likely to have a ready work force.

The Village of Huanza is supplied with hydroelectricity and is the closest electrical supply to the Project area. Electricity pylons, that once carried electricity to the adjoining Finlandia mine and mill, stand within the Project concessions. Power cables, however, have been removed.

Water flows year-round in mountain streams.

- 8 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

A broad valley floor crossing the Project area has suitable characteristics to provide for processing facilities and tailings disposal.

The unpaved roads between the Carterra Central Highway and Project area cross an operating freight rail road between Lima and La Oroya. The nearest airport to the Black Tusk Project is Lima International Airport (100 kilometres). A few derelict buildings stand within the concession boundaries; ownership of these buildings is not known.

As an international mining centre Peru (and Lima in-particular) has a good supply of world-class mining and exploration related services including; drilling companies, ISO accredited assay laboratories, surveying companies, specialist tool and equipment suppliers.

- 9 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

6.0 HISTORY

Gold mining in the Lima region of Peru dates back to the early colonial days, when the Spaniards are reported to have mined polymetallic veins located in the Huanza area.

More recent exploration and mining at Huanza started in the mid 1950s by El Grupo Huampar (Huampar) which mined the El Condor Pasa and Finlandia veins from 1956 to 1991. These operations adjoin the Black Tusk claims and at the time of operation included the area of the Black Tusk property. Similar geological structures were noted by these operators to occur on the claims now held by Black Tusk, but no definitive exploration results are available for work carried out at that time. Mining ceased due to a terrorist event which destroyed a major power plant, hence stopping part of the power supply to the city of Lima and also to the Huampar Mine. During that period some 2.5 million tonnes of ore was mined at an average grade of 1.6 g/t Au, 5.4 oz/ton Ag, 3.8% Pb and 5.0% Zn, and more than 82,000 m of underground development was carried out on 6 levels spaced 50 m apart and numerous raises at 70 m intervals. At the time of the mine closure Huampar reported that remaining underground reserves contained some 700,000 tonnes of similar grade material (Roscoe Postle, 1997). The results are reported here as historical record and are not N1 43-101 compliant.

No records of the previous work within the Black Tusk Project area are available, but a short exploratory drive, shallow pits and trenches are visible onsite. A recent snowfall precluded sampling of material in the workings by the author.

Well established mining and exploration laws have encouraged investment in Peru’s mining and exploration industry from overseas. Black Tusk took ownership of the Black Tusk property in 2008.

- 10 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

7.0 GEOLOGICAL SETTING

7.1 Regional Geology

The Black Tusk Project is situated within the central polymetallic belt, part of the Western Cordillera, central Peru, (Figure 7.1). Precambrian basement of the Western Cordillera is overlain by lower to middle tertiary volcanics and sediments; and intruded by upper Jurassic to Lower Cretaceous intrusions of varying compositions.

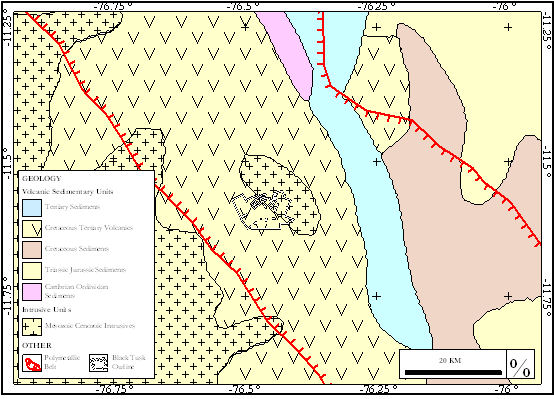

Figure 7.1 Regional geology (data sourced USGS website) with Central Polymetallic Belt and Project Location.

West to east subduction of the Nazca tectonic plate beneath South American has introduced pervasive folding and faulting throughout the Western Cordillera.

The geology of Huanza district in particular, is dominated by tertiary volcanic sequences; bedded andesitic lavas and tuffs, of varying colours and textures as well as basalts. Dykes and metal bearing veins are associated with intrusions and faulting.

- 11 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

7.2 Local Geology

Introduction

Map sheets 24K Matacuna and 24J Chosica cover the geology of the Black Tusk Project at 1:50,000 scale and show volcanics intruded by intrusives and areas of quaternary cover. Petersen and Diaz (1972) mapped part of the geology (Figure 7.2) of the Huanza district in greater detail as great variability of the volcanics hindered straight correlation with the volcanics of the surrounding areas. Their detailed mapping recorded subunits within the volcanic sequence as well as hydrothermal alteration and structures.

Figure 7.2 – Local geology modified from Petersen and Diaz (1972). Coordinates: UTM-PSAD ’56-Zone 18S.

Geology

Andesitic units dominate the volcanic sequence and are interdigitated with lesser amounts of dacite. These units range from tuffs to massive lava flows and vary in colour, texture and thickness. Minor siliceous and fossiliferous calcareous sediments are recorded stratigraphically below these sequences.

- 12 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

Basaltic units are more abundant to the west of the north-south trending Yau-Yau fault; east of this fault a narrow band of basalts divide lesser from more altered andesitic units.

The units described above have been intruded by later intrusions of varying compositions.

Structure

North-south trending, north plunging folds are common and two principle fault systems dominate the Huanza district; one trending east-northeast, the other north south. The former comprising vertical faults and tensional fractures that are the exclusive loci of mineralisation (metal bearing veins) and dyke emplacement (Kamilli and Ohmotto, 1977).

The Lourdes Fault (Figure 7.2), is a major north-northeast near vertical structure with synistral displacement. Near vertical tensional fractures propagate from this structure at shallow angles (20-40), and a number of dykes and metal bearing veins are hosted within these fractures.

Mineralisation

Polymetallic sulphide bearing veins are a typically contained in east-northeast tensional openings, within strongly altered andesitic units. Vein development along this trend varies, pinching and swelling, introduces barren gaps and areas of thickening, individual veins range between zero and 2.5 meters in width. Veins may contain copper or lead-zinc rich +/- silver and gold mineralization.

Kamilli and Ohmotto (1977) described a general zoning of metal content within the veins mapped by Petersen and Diaz; centred on the Cobre Vein (Figure 7.2) mineralisation is copper rich, moving away from this vein, in both directions, along the east northeast trend veins become more lead-zinc and eventual silver rich.

Alteration

Mafic minerals within volcanic units are variably altered; hydrothermal alteration is strongest in the east often resulting in mafic minerals being unidentifiable. Tuffs, being more permeable exhibit a greater degree of alteration than do flows, intrusives are less altered then the surrounding volcanics. In general, with greater proximity to mineralised veins alteration grades from propylitic (epidote, calcite, sericite, chlorite) to argillic (quartz, sericite), although immediately adjacent to veins, alteration may not be noticeably different to that of the country rock (Petersen and Diaz, 1972).

- 13 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

7.3 Project Geology

A large part of the Project area is covered by the mapping of Petersen and Diaz (1972) (Figure 7.2). Variably altered andesitic units are the dominant rock type in the Project area. Lesser altered andesites to the west of the Project area are separated from more altered andesites in the east by basalts. Intrusions are mapped within all units.

Folding is pervasive within the volcanic units and in general is hinged around a north south axis. Faulting is dominated by major north to south and northeast to southwest fault sets. Smaller splay style fault off-set systems are also present.

The author confirmed the presence of the various units.

- 14 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

8.0 DEPOSIT TYPE

8.1 Deposit Type - Typical of Huanza District

Petersen and Diaz (1972) describe mineralisation in the Huanza area as shallow epithermal vein type with inferred formation temperatures between 240 and 270 C. Textures within the Finlandia vein described by Petersen and Diaz (1972) are indicative of both near surface (boiling textures associated with gold-silver bonanza zones) and mineralisation at greater depths (coarse clotted nature of quartz and lead and zinc sulphides), suggesting telescoping epithermal systems.

Mineralisation in Huanza district is hosted in quartz-calcite-epidote altered andesitic lavas and tuffs within zones of northeast faulting and associated east-northeast shearing.

Within these structures polymetallic quartz-sulphide veins dip steeply and pinch and swell along strike and down dip, individual veins can strike for over 2 kilometres and mineralisation can extend in excess of 480 meters down dip. Veins are typically lead-zinc dominant but can be enriched in copper, silver or gold.

8.2 Potential Deposit Types

Previous mineral discoveries surrounding the Project area are all of the epithermal style and are structure controlled. Volcanic terrains and orogenic belts can host numerous other deposit styles including:

Volcanic Hosted Massive Sulphide (VHMS) – Stratabound massive sulphide deposits which can contain economic quantities of Cu, Pb, Zn, Au and Ag. Deposited in sub marine environments and associated with volcanic sequences.

Skarn – Structure or strata-controlled replacement deposits found in close association with intrusions and more porous lithologies (volcanic tuffs and sediments). Skarn deposits are often mined for Fe, Cu and Au.

Porphyry – found below and are often the source of fluid, heat and metals for many epithermal districts. Can contain economic amounts of Cu, Mo, Au. Associated with epithermal districts and large scale hydrothermal alteration.

Mantos – Stratabound and stratigraphically controlled sulphide deposits are often mined for Cu. Found in sediments with close association to intrusions.

- 15 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

Mineral deposits being mined currently at the Pan American Silver Morococha mine, some 25 kilometres north of the Black Tusk Project, occur in all of these mineralization styles, hosted in similar rock units. Porphyry-style mineral occurrences are presently being drill-tested by Barrick on the north side of the Black Tusk claims.

- 16 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

9.0 MINERALISATION AND TARGET AREAS

Due to recent snowfall, targets at the Black Tusk Project were not open to review. Limited earlier work by Grupo Huampar (1960's) suggests that while operating their adjoining mines they considered structures on the mine claims may continue to the property now held by Black Tusk, and that other similar geological environments occur on these present claims. Huampar were only targeting epithermal vein deposits and therefore would not have explored for other deposit types.

- 17 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

10.0 EXPLORATION

No exploration work has yet been conducted by Black Tusk. Earlier exploration was undertaken in the 1960's by Huampar in conjunction with their mine operations, but no records of this activity remain.

- 18 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

11.0 DRILLING

No drilling has taken place on the Black Tusk property.

- 19 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

12.0 SAMPLE METHOD AND APPROACH

No samples were collected.

- 20 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

13.0 SAMPLE PREPARATION ANALYSIS AND SECURITY

No samples were collected.

- 21 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

14.0 DATA VERIFICATION

No samples were collected by the author, and historic results from the 1960's are not available.

- 22 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

15.0 ADJACENT PROPERTIES

15.1 Introduction

Historically, numerous polymetallic veins have been mined in Huanza District. A brief description for two of the larger veins; one within a east-northeast shear known to host several veins; the other associated with a northeast trending structure, immediately adjacent the Black Tusk claims (Figure 15.1) is presented below. Both properties were operated by Grupo Huampar and closed in 1991 due to activities by the Shining Path terrorist group, halting power supply to the operations. The author has not independently verified the information contained in section 15.2 or 15.3 which has been compiled from publicly released data and is not necessarily indicative of mineralisation in the Black Tusk Project.

Figure 15.1: Black Tusk Project in relation to adjacent properties. Coordinates: UTM-PSAD ’56-Zone 18S.

15.2 Finlandia Mine

The following information was authored by R.J. Kamilli and H. Ohmoto and published in the Journal of Economic Geology under the title of “Paragenesis, Zoning, Fluid Inclusion, and Isotopic Studies of the Finlandia Vein, Huanza Distrcit, Central Peru; and dated 1977.

Several polymetallic (Pb-Zn-Cu-Ag-Au) quartz-sulphide veins are hosted in andesitic volcanics (predominantly lavas) of tertiary age. Mineralisation is focused within a zone of sub-vertical east-northeast trending shear that strikes over 5 kilometres.

- 23 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

The Finlandia vein is principally galena (Pb) and sphalerite (Zn) bearing, although texturally distinct “bonanza” zones of gold-silver mineralisation occur and are vertically confined to a 130 meter interval.

Close to the Finlandia vein propylitic (epidote-calcite-sericite-chlorite) alteration gives way to argillic (quartz-sericite) alteration.

The Finlandia vein varies in thickness along strike and down dip between zero and 2.5 meters, averaging 1 meter wide. The vein was mined over 1.5 kilometres strike and 480 meters down-dip without ever reaching a lower limit of mineralisation.

At the height of production 200 metric tons of ore where mined daily. Total production between 1968 and 1973 is reported as;

|

Commodity

|

Ounces

|

Dry Metric Tonnes

|

|

Lead

|

-

|

18,992

|

|

Zinc

|

-

|

31,737

|

|

Copper

|

-

|

912

|

|

Gold

|

37,298

|

-

|

|

Silver

|

1,694,207

|

-

|

Table 15.2: Metal production between 1968 and 1973, Finlandia Vein.

15.3 El Condor Pasa Mine

The following information is a summary of information compiled by Roscoe Postle Associates at the request of Oroperu Resources Inc. the original report was released on the 30th of May 1997 and titled “Report on Three Exploration Properties in Central and Northern Peru – For Oroperu Resources Inc.”.

El Condor Pasa mine is situated 6 km south of the shear zone that hosts the Finlandia vein and others (section 15.2).

Silicified intermediate volcanics with close proximity to a monzonite intrusion hosts 6 separate and well as coalescing polymetallic (Pb-Zn-Cu-Ag-Au) quartz-sulphide veins within a shear.

- 24 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

The mineralised shear is described as northeast trending, moderately southeast dipping and has been traced along strike for over 2 km. Ore shoots generally plunge sub-vertically and are less continuous than those described at Finlandia.

Propylitic (epidote and pyrite) wall-rock alteration within the volcanics is well developed and is strongest with proximity to veining.

Veins are typically 85% quartz, 5% calcite, with 20% sulphide; galena (Pb) and sphalerite (Zn) occur in almost equal quantities; gold occurs both as free disseminations and within sulphide. Individual veins range between 1 meter and 1.25 meters in width and can strike for up to 1 kilometre.

15.4 Regionally Significant Operations

Numerous other mines and exploration projects are located within 40 kilometres of the Black Tusk Project and the central polymetallic belt; these include:

The Coricancha mine: located approximately 30 kilometres southwest of the Black Tusk Project. Mineralisation is described as low-sulphidation multiphase veins of pyrite, galena, chalcopyrite and arsenopyrite bearing quartz carbonate hosted in steeply dipping structures within the Rimac volcanic sequence. The main Coricancha vein has been mined over 3900 metres strike and vertically over 840 metres and is known to extend vertically over 1400 metres. According to publicly released information estimated mineral reserves include 458 434 tonnes of proven and probable material combined averaging: 4.8 g/t Au, 170.74 g/t Ag, 2.16 % Pb and 2.86 % Zn.

The Toromocho open-pit: situated approximately 40 kilometres east of the Black Tusk Project. Mesozoic limestone and volcanic flows have been intruded and hydrothermally altered by rocks of tertiary age. Copper, molybdenum, zinc, lead and silver occurs in various forms including; veins breccias, replacement bodies and disseminated porphyry style bodies. According to the Chinalco website (www.chinalco.com) Toromocho contains an estimated reserve of copper mineralisation in excess of 7.3 million tonnes and an additional estimated resource of 12 million tonnes.

The Morococha mine: is operated by Pan American Silver and is situated approximately 25 kilometres northeast of the Black Tusk Project. Mining in the area has been continuous since the 1800’s. Mineralisation styles include skarns, mantos and “epi-mesothermal” silver and base metal veins. Sphalerite, galena and chalcopyrite are the typical ore bearing minerals across all deposit

- 25 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

sub-types with gangue minerals generally quartz, calcite, barite and rhodochrosite. Table 15.4 highlights publicly released information for proven and probable reserves at Morococha as of 31st December 2006;

|

Reserves

|

Dry Metric Tonnes

|

Ag g/mt

|

Ag Cont. (oz)

|

Cu %

|

Pb %

|

Zn %

|

|

Proven

|

4 073 423

|

155

|

20 300 280

|

0.36

|

1.49

|

3.84

|

|

Probable

|

2 304 141

|

157

|

11 649 101

|

0.41

|

1.83

|

4.16

|

|

Total

|

6 377 564

|

156

|

31 949 381

|

0.38

|

1.61

|

3.96

|

Table 15.4: Proven and Probable reserves at Morococha as of 31st December 2006.

- 26 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

16.0 OTHER RELEVANT DATA AND INFORMATION

Nil

- 27 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

17.0 INTERPARTATION AND CONCLUSIONS

The Black Tusk Huanza property is located in an historical and current base and precious metal mining area of the Peruvian Andes. The claims cover a series of volcanic and sedimentary rocks intruded by granitic stocks of varying composition. Mineralization at adjoining and nearby properties is hosted in structurally-controlled veins and shears, mantos and skarns, and porphyritic intrusives.

The volcanic rocks underlying the Black Tusk claims have undergone extensive structural deformation and contain extensive structural deformation and contain numerous fracture and shear zones, some of which contain quartz veins. No assays are reported from the historic claim holders, Grupo Huampar, who operated the adjoining mines from 1956-1991. These mines were prematurely closed due to guerrilla activity in 1991.

Exploration work is warranted by Black Tusk to evaluate the potential of the Huanza property to host mineralization in styles now known to exist in the area in addition to structurally-controlled epithermal veins. No systematic modern exploration has taken place on the Black Tusk claims and a program is recommended to be undertaken.

- 28 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

18.0 RECOMMENDATIONS AND BUDGET

Black Tusk should focus initial exploration efforts on identifying mineralisation typical of the Huanza district. The following characteristics may be useful for determining areas of priority for exploration:

|

|

·

|

Metal bearing veins are typically hosted in altered volcanic units, widespread propylitic (chlorite, calcite, sericite, epidote) alteration grades into argillic (quartz-sericite) alteration with proximity to mineralisation.

|

|

|

·

|

Mineralisation in structurally controlled; northeast faulting and associated east-northeast tensional openings are the exclusive loci of mineralisation. Dykes also occupy this trend.

|

Field mapping should be undertaken throughout the Black Tusk Project area with the aim of;

|

|

·

|

Confirming the structures and areas of alteration previously mapped.

|

|

|

·

|

Identifying further structures and zones of alteration, particularly in areas not covered by previous mapping.

|

|

|

·

|

Sampling old workings.

|

A satellite imagery study is recommended for the area to initiate survey control. An airborne geophysical survey of areas selected from the satellite results is recommended. If this can be done in conjunction with other local explorers the costs can be lowered.

Areas proximal to east-northeast structures and zones of more intense alteration should be considered most prospective for the vein-type deposits typical of the Huanza district and are therefore priority areas.

Black Tusk should also consider the possibility of other (non-epithermal) mineral deposit types existing within their property when conducting exploration.

Widespread hydrothermal alteration within the Project area is an encouraging sign of a significant heat source and fluid movement, known metal bearing veins confirm metals were present within these fluids. VHMS, skarn, porphyry and manto deposits are often spatially associated with areas of hydrothermal alteration in epithermal districts and are all potential targets.

- 29 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

Stratabound deposit types such as VHMS, skarn and manto are dependent on suitable lithology (porous volcaniclastics and sediments) as opposed to structure for accommodation of mineral deposition. The apparent absence of structure therefore should not discount an area as being prospective.

BUDGET

|

Satellite Imagery

|

$ 25,000

|

|

Airborne geophysical survey (500 km @ $200/km)

|

100,000

|

|

Ground follow-up (geology, soil geochemistry, rock sampling)

|

100,000

|

|

$225,000

|

A drilling decision can be made following a review of results of the initial exploration work.

- 30 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

19.0 REFERENCES

Kamilli, R.J., and Ohmoto, H, 1977, Paragenesis, Zoning, Fluid Inclusion, and Isotopic Studies of the Finlandia Vein, Huanza Destrict, Central Peru: Economic Geology, Vol 72. p. 950-982.

Petersen, U., and Diaz, N., 1972, Geologia de la region minera Huanza, Huarochiri, Lima: Sociedad Geologica del Peru, Bol 42. p. 5-20.

Roscoe Postle Associates INC., 1997, Report on three exploration properties in central and northern Peru for Oroperu Resources Inc.

Rozelle, J.W., and Tschabrun, D.B., 2009, Technical Report on the Re-Start of the Corichanca Mine, Peru: Tetra Tech.

- 31 -

|

43-101 Technical Report–Black Tusk Project–February 2011 |

20.0 CERTIFICATES

I, Glen Macdonald, do hereby certify as follows:

That I am a consulting geologist, residing at 905 - 1600 M Beach Avenue, Vancouver, B.C.

This certificate applies to the report entitled "Geological Evaluation of the Huanza Property", dated February, 2011.

That I am a graduate of University of British Columbia, with a B.Sc. in Geology; and Bachelor of Arts 1971.

That I am a Practicing Member in good standing of the British Columbia Association of Professional Engineers, Geologists and Geophysicists (license 20464) and the Alberta Association of Professional Engineers, Geologists and Geophysicists (license 36214). That I have been practicing my profession continuously since 1974, and have been working since 1986 in gold, diamonds, uranium, precious and base metal exploration throughout Canada, parts of the United States.

That I am author of the report entitled, "Geological Evaluation of the Huanza Property", dated February, 2011.

I have visited the property on August 12, 2009.

That I have no direct or indirect interest in the property. I have no interest in any other properties of Black Tusk Minerals Inc. I own, directly or indirectly, nil securities of Black Tusk Minerals Inc.

I have read the definition of "qualified person" set out in National Instrument 43-101 ("N1 43-101) and certify that by reason of my education, affiliation with appropriate professional associations (as defined in N1 43-101) and past relevant work experience, I fulfil the requirements to be a "qualified person" for the purpose of N1 43-101.

As of the date of this certificate, to the best of my knowledge, information and belief, the technical report contains all scientific and technical information that is required to be disclosed to make this technical report not misleading.

That I have read National Instrument 43-101, Companion Policy 43-101CP, and form 43-101F, and that this report is in compliance therewith.

- 32 -