Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file No. 333-136559

EXOPACK HOLDING CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware |

76-0678893 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

3070 Southport Road, Spartanburg, SC |

29302 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (864) 596-7140

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨ (Not yet applicable to registrant)

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates is zero. The registrant is a privately held corporation.

As of March 30, 2011, one share of the registrant’s common stock was outstanding.

EXOPACK HOLDING CORP.

TABLE OF CONTENTS

FORM 10-K

PART I

|

|

|

|

|

|

|

Page

|

|

Item 1 |

Business |

1 |

|

Item 1A |

Risk Factors |

13 |

|

Item 1B |

Unresolved Staff Comments |

20 |

|

Item 2 |

Properties |

20 |

|

Item 3 |

Legal Proceedings |

20 |

|

| ||

|

PART II | ||

|

|

|

|

|

Item 5 |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

21 |

|

Item 6 |

Selected Financial Data |

21 |

|

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

|

Item 7A |

Quantitative and Qualitative Disclosures about Market Risk |

35 |

|

Item 8 |

Financial Statements and Supplementary Data |

35 |

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

35 |

|

Item 9A |

Controls and Procedures |

35 |

|

Item 9B |

Other Information |

36 |

|

|

|

|

|

|

|

|

|

| ||

|

PART III | ||

|

|

|

|

|

Item 10 |

Directors, Executive Officers and Corporate Governance |

36 |

|

Item 11 |

Executive Compensation |

38 |

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

50 |

|

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

50 |

|

Item 14 |

Principal Accountant Fees and Services |

51 |

|

| ||

|

PART IV | ||

|

|

|

|

|

Item 15 |

Exhibits and Financial Statement Schedules |

F-1 |

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K of Exopack Holding Corp. (the “Company”) for the fiscal year ended December 31, 2010, including the “Management’s Discussion and Analysis of Financial Condition and Results of Operation” section in Item 7 of this annual report, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. These forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include but are not limited to the following: intense competition in the flexible packaging markets; the price and availability of polyethylene resin and paper and our ability to pass those prices on to our customers; global economic factors including risks associated with a recession and our customers’ access to credit; our customers’ inability to satisfy their obligations to us; financial difficulties experienced by our vendors, suppliers and other business partners; increases in our pension costs resulting from equity market fluctuations; increases in energy prices; our ability to adapt to technological advances in the packaging industry; our ability to protect our proprietary technology from infringement; environmental costs and liabilities; our ability to obtain funding, if needed, in light of the deterioration of the capital and credit markets; risks relating to our international operations; problems in our labor relations; a loss of transportation providers or increases in fuel prices; equipment failures; the control of our Company by an affiliate of Sun Capital Partners, Inc.; our ability to comply with Section 404 of the Sarbanes-Oxley Act; a loss of key individuals involved in our Company; changes in interest rates; our substantial indebtedness and our ability to incur additional indebtedness; our ability to generate cash to service our indebtedness; restrictions in the indenture governing our outstanding notes; our ability to successfully complete, integrate, transition the business and realize expected cost savings for acquisitions; and various factors that we cannot control.

You can identify these and other forward-looking statements by the use of words such as “may,” “will,” “could,” “would,” “should,” “expects,” “plans,” “anticipates,” “estimates,” “intends,” “potential,” “projected,” “continue,” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements.

These statements are based on current expectations and assumptions regarding future events and business performance and involve known and unknown risks, uncertainties and other factors that may cause industry trends or our actual results, level of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these statements. These factors include those set forth in the following discussion and within “Part I. Item 1A. Risk Factors” of this annual report and elsewhere within this annual report.

Although we believe that expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We do not assume and will not assume any obligation to update any of the forward-looking statements after the date of this annual report to conform these statements to actual results or changes in our expectations, except as required by law. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this annual report. You should carefully review the risk factors described in other documents that we file from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

ii

PART I

ITEM 1. BUSINESS

This annual report contains certain information about our Company. You should read the annual report carefully, including Item 1A entitled “Risk Factors” and our consolidated financial statements, included as Item 8, together with the accompanying notes. Except as otherwise indicated, references to “we,” “our,” “us,” and “our Company” refer to Exopack Holding Corp. and our subsidiaries.

Our Company

We are a provider of flexible packaging, film products, and specialty substrates based in North America and Europe. We design, manufacture and supply plastic and paper based flexible packaging, film products and precision coated substrates to approximately 1,200 customers in a variety of industries, including the food, medical, pet food, chemicals, beverages, personal care and hygiene, lawn and garden and building materials industries, among others. We have 19 manufacturing facilities in the United States, Canada and the United Kingdom. We provide packaging and films products for many of the world’s most well-known brands. Our primary strategy is to use a technologically advanced manufacturing platform coupled with excellent customer service in order to help our customers distinguish their brands and improve product shelf life.

The many products that we produce can be divided into four separate segments: (i) pet food and specialty packaging, (ii) consumer food and specialty packaging, (iii) performance packaging and (iv) coated products. Typically, customers decide whether to use paper or plastic packaging on the basis of end-use application, presentation considerations and the demands of particular filling processes. Such decisions may also be influenced by the relative importance of package size, sealability, shelf-appeal, durability, functionality and printability. Our pet food and specialty packaging segment produces products used in applications such as pet food, lawn and garden, charcoal, and popcorn packaging. The consumer food and specialty packaging segment produces products used in applications such as fresh meat, natural cheese and dairy products, beverage, frozen foods, confectionary, breakfast foods, personal care and unprinted films. The performance packaging segment produces products used in applications such as building materials, chemicals, agricultural products and food ingredient packaging. The coated products segment produces precision coated films, foils, fabrics and other substrates for imaging, electronics, medical and optical technologies.

Our History

Transactions Relating to Our Formation

A predecessor company with our same name was formed as a Delaware corporation on July 27, 2001 for the purpose of acquiring substantially all of the assets and assuming certain liabilities of the flexible packaging division of International Paper Company. This acquisition was completed on August 7, 2001. On September 30, 2003, the predecessor company, Exopack Holding Corp., purchased all of the assets and assumed certain liabilities of Plassein International of Thomasville, Inc. and Plassein International of Newmarket, Inc.

Cello-Foil Products, Inc. (“Cello-Foil”) was founded in 1949 as a privately-held, family-owned company headquartered in Battle Creek, Michigan. Cello-Foil began as a printing company and, through the years, developed expertise in flexible packaging manufacturing, laminating and printing. In 1990, Cello-Foil expanded its production capacity and built a second plant in Albany, Georgia. Cello-Foil’s relationship with our Company is discussed below.

The Packaging Group (“TPG”) was founded in Canada in 1990. Between 1990 and 2003, TPG grew through the acquisition of several companies in the flexible packaging industry, including PackageMasters and Plicon Canada (subsequently renamed Condor Co-Extrusions), Barrier Packaging, Inc., Golden State Equipment and Alcoa U.S. In 2005, after experiencing financial difficulties, TPG was placed under receivership in Canada. TPG’s relationship with our Company is discussed below.

Between July and October of 2005, Sun Capital Partners, Inc. (“Sun Capital”), through an affiliate, sponsored a series of transactions involving Cello-Foil, TPG and Exopack, LLC (“Exopack”) that resulted in the ultimate formation of our Company. Specifically, Cello-Foil Holding Corp., an affiliate of Sun Capital, acquired Cello-Foil and certain assets of TPG on July 14, 2005 and September 7, 2005, respectively. On October 13, 2005, in accordance with the terms of a merger agreement entered into on October 5, 2005, an affiliate of Sun Capital acquired Exopack, which became our wholly-owned subsidiary. Concurrently with our acquisition of Exopack, Cello-Foil Holding Corp. became our wholly-owned subsidiary, and we refinanced the then outstanding indebtedness of Exopack, Cello-Foil and TPG. We refer to our acquisitions of Exopack, Cello-Foil and TPG as the “Consolidation.” The net cost of the Consolidation and related transactions, including the refinancing of Exopack, Cello-Foil and TPG debt and the payment of related fees, commissions and expenses, was $312.6 million, net of cash acquired.

1

2007 Acquisitions

During 2007, we completed two acquisitions, as described below and referred to in this annual report as the “2007 Acquisitions.” On August 6, 2007, we acquired 100% of the membership interests of Intelicoat Technologies Image Products Matthews, LLC and 100% of the outstanding shares of its affiliate, Intelicoat Technologies EF Holdco, Ltd. (collectively, the “Electronic and Engineered Films Business,” or “EEF”), and also acquired certain assets and assumed certain liabilities of other EEF entities (the “EEF Acquisition”). We financed the EEF Acquisition primarily through borrowings under our senior revolving credit facility (referred to in this annual report as our “Senior Credit Facility” and further described in Note 4 to our consolidated financial statements included elsewhere in this annual report). EEF, through its parent companies prior to the EEF Acquisition, was previously controlled by an affiliate of Sun Capital.

We subsequently renamed the acquired EEF business Exopack Advanced Coatings (“EAC”). EAC is engaged in researching, developing, manufacturing, distributing, marketing, and selling precision coated films and specialty substrates for imaging, electronics, medical and optical technologies. EAC conducts its operations from our locations in the state of North Carolina and in North Wales, United Kingdom.

On November 28, 2007, we acquired certain assets and assumed certain liabilities of DuPont Liquid Packaging System’s performance films business segment (“Liqui-Box”), including its Whitby, Ontario, Canada operating facility (the “EPF Acquisition”). There was no material relationship between our Company and Liqui-Box prior to the commencement of matters relating to the EPF Acquisition.

We subsequently renamed the acquired Liqui-Box business Exopack Performance Films (“EPF”). EPF is engaged in researching, developing, manufacturing, distributing, marketing, and selling value-added films used primarily in the food and industrial markets.

2010 Acquisition

On July 13, 2010, we completed the acquisition of certain assets and liabilities of a packaging business previously operated by Bemis Company, Inc. The acquired business, which is referred to in this report as Exopack Meat, Cheese and Specialty (“EMCS”) involves the manufacture and sale of certain packaging products primarily in the United States and Canada, including flexible-packaging rollstock used for chunk, sliced and shredded natural cheeses packaged for retail sale and flexible-packaging shrink bags used for fresh meat. EMCS is included within our consumer food and specialty packaging segment (see Note 11 to our consolidated financial statements included elsewhere in this annual report). The acquisition of EMCS provided us with a leading market position in the flexible packaging market for meat and cheese and expanded our technology base and product offerings in the consumer food and specialty packaging segment.

Our Corporate Structure

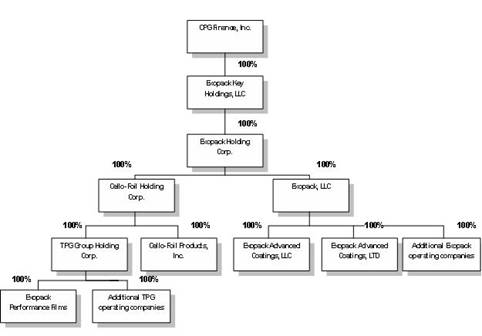

CPG Finance, Inc. is a subsidiary of an affiliate of Sun Capital. Exopack Key Holdings, LLC is a wholly-owned subsidiary of CPG Finance, Inc., and is the parent company of Exopack Holding Corp. Exopack Holding Corp. is a holding company that conducts substantially all of its operations through Exopack, LLC, Cello-Foil Holding Corp. and their respective subsidiaries. The current ownership structure of our parent companies and subsidiaries is set forth in the diagram below.

2

Sun Capital

We and our parent companies are controlled by an affiliate of Sun Capital. Sun Capital is a private investment firm focused on leveraged buyouts, equity, debt and other investments in market-leading companies that can benefit from Sun Capital’s in-house operating professionals and experience. Affiliates of Sun Capital have invested in and managed more than 250 companies worldwide with consolidated annual sales in excess of $40.0 billion since Sun Capital’s inception in 1995. Sun Capital has offices in Boca Raton, Los Angeles and New York and affiliates with offices in Frankfurt, London, Luxembourg, Paris, Shanghai and Shenzhen, China, focused on identifying opportunities that will provide operating synergies for Sun Capital’s affiliated portfolio companies.

Our Strategy

We have developed a business strategy targeted at increasing future revenue, earnings and cash flow performance. The key components of this strategy are:

Leveraging Our Customer Relationships. We enjoy long-standing relationships with many of our customers. One of our top priorities has been to integrate our product offerings into our customers’ operations by providing high quality, cost-effective products that are tailored to our customers’ specific needs. We seek to offer enhanced service and support, anticipating customer needs and providing value-added solutions to customer problems. We have undertaken joint product development efforts with many of our customers, allowing us to manage our research and development expenditures and increase incentives for customers to remain loyal to us over the long term.

The Consolidation and subsequent acquisitions have provided us with additional opportunities to cross-sell our products to our customer base. We offer our diverse array of paper and plastic packaging products, including multi-wall bags, printed and laminated roll stock, stand-up pouches and coated films, in the following end markets, among others:

• Food

• Medical

• Pet Food

• Personal Care and Hygiene

• Chemicals

• Beverages

• Cheese and Dairy

• Fresh Meat

• Lawn & Garden Products

• Building Materials

• Electronics

3

Efficiently Managing Our Raw Material Supply. We have multiple supply sources for paper, plastics and films and have maintained the majority of those relationships for over a decade. As one of the largest flexible packaging converters in the United States, we believe we are often able to use our increased size to secure volume pricing from our suppliers and expand our procurement reach.

We are currently focusing on efficiently managing the costs of raw materials, packaging and freight. To further these objectives, we are working to develop highly efficient procurement functions and innovative approaches to raw materials sourcing, including global sourcing arrangements. We continue to leverage purchasing across our organization and standardize the use of raw materials across facilities.

Continuing to Focus on Enhancing Our Product Mix Through State-of-the-Art Technology. Our production facilities have allowed us to improve our production flexibility and dependability. We use high-performance machinery and a broad range of state-of-the-art technologies. Recent investments include printing presses that can print up to ten colors, high efficiency pasted valve machines, co-extruded blown film extruders, heat sealable paper bag line and stand-up re-sealable pouch machines. We believe that a key factor that differentiates our services from those of our competitors is the state-of-the-art graphics and technical capabilities of our Customer Resource Center, located at our Spartanburg, South Carolina headquarters. In addition, to enhance the convenience that we strive to provide to our customers, we have continued to add features such as handles and advanced package re-closure systems.

We view our array of facilities and ongoing commitment to state-of-the-art technology as key drivers in our ability to provide an exceptional combination of service, performance and value. Strategically, we plan to grow our revenue base by providing customized packaging solutions and benefiting from an overall trend toward flexible, rather than rigid, packaging.

Realizing Operational Efficiencies and Synergies. We strive to cultivate safe, efficient manufacturing by focusing on quality and operational practices. Our efficiency initiatives include establishing common operating and reporting procedures, streamlining production, optimizing asset utilization, rationalizing product mix and making strategic capital expenditures.

Our Strengths

We believe we have the following competitive strengths:

Established Relationships with Blue Chip Customers. We maintain strong relationships with a diverse base of customers in a wide array of businesses. We have approximately 1,200 customers, and even with recent market consolidations, most of our customers individually represent less than 5% of our net sales. No customer exceeded 10% of our net sales for 2010.

Cost Savings Opportunities. Part of our strategy consists of combining the functions shared by our acquired businesses and extracting synergies. We believe that we can achieve cost savings by in-sourcing manufacturing of certain films and other materials, improving procurement (through increased purchasing volume and efficiencies of scale in freight), and eliminating operational redundancies (through reducing headcount, restructuring certain facilities and consolidating information technology programs). For example, in 2008, we moved the EAC business operations conducted at Intelicoat’s South Hadley, Massachusetts facility to the EAC facility we acquired in Matthews, North Carolina. Similarly, we integrated the Whitby, Canada plant we purchased from DuPont into the Exopack business. The integration of the Whitby facility allowed us to produce certain films that we previously purchased from outside vendors. We also now process certain print jobs that were outsourced by the EPF business.

Position within the Industry. According to the Flexible Packaging Association (“FPA”), the size of the domestic flexible packaging industry was estimated to be approximately $25.5 billion in annual sales in 2010, of which “value-added” products accounted for an estimated $19.7 billion in sales. The “value-added” segment does not include retail shopping bags, consumer storage bags and wraps, or trash bags.

The flexible packaging market is fragmented, with an estimated 407 manufacturers operating in North America. A significant number of these manufacturers are relatively small, with the average converter generating annual sales of approximately $60.0 million to $65.0 million in 2009, according to the FPA. We believe that as a result of customer consolidation certain sectors and customers are underserved by smaller manufacturers. We believe our Company can take advantage of this market opportunity.

We believe there are several key drivers in the industry, including: the growing importance of convenience, functionality and shelf-appeal; technological developments; a trend toward flexible rather than rigid packaging; globalization; raw material cost volatility; the impact of sustainable packaging; and pressures to consolidate. We believe we are well-positioned to compete and expand our business due to our broad product mix, substrate expertise, customer service, award winning printing technology, global presence and technologically advanced manufacturing capabilities. Our global presence and capabilities are supported by Global Packaging Linx (“GPL”).

4

GPL is a strategic initiative we developed to leverage relationships with global packaging manufacturers. We believe GPL is a unique initiative in our industry. The goal of GPL is to procure flexible packaging solutions from a select network of global packaging manufacturers when it provides value to our customers or potential customers. We aim to take advantage of GPL while maintaining Exopack's standards for quality, service, and innovation. Through GPL, we believe we will be able to further identify and develop opportunities within our multinational customer base that will allow us to provide value through our own mix of domestic converted packaging solutions, as well as through offshore packaging technologies provided by our global alliance partners.

As part of the GPL initiative, Exopack signed a joint venture agreement with Lebanon-based packaging manufacturer INDEVCO Group (“INDEVCO”) to manufacture co-extruded polyethylene film in the Middle East under the name CEDEX Plastics Flexible Packaging (“CEDEX”). The joint venture represents the strengthening of a long-term relationship between Exopack and INDEVCO to support global customers. During 2010, the joint venture brought the first cost-effective films from the Middle East to customers in North America. We intend to expand our relationship with INDEVCO to take advantage of the new polymer manufacturing capacity coming on line in the Middle East, which is primarily due to the increased economic advantage of ethylene production in this region of the world. The CEDEX film is distributed by Exopack as part of the Company’s family of film products.

Highly Experienced Management Team. We have an experienced management team with an average of more than 20 years of industry experience. Our Chairman and Chief Executive Officer, Jack E. Knott, has over 30 years of experience in the packaging industry, during which he served as Chief Executive Officer of Pliant Corporation, Chairman of the FPA, President and Chief Operating Officer of Huntsman Packaging Corporation (the predecessor to Pliant Corporation) and President of Rexene Products (a petrochemical and polymer manufacturer). We also benefit from highly-motivated and experienced managers in key functional areas, including sales and marketing, operations, procurement and accounting and finance. Each of our key business unit managers has significant experience in the packaging and related industries.

Ability to Pass Through Raw Material Price Increases Within a Short Period of Time. Although most of our customers have contracts that prevent us from passing through raw material price increases immediately, historically, we have been able to pass through raw material price increases to our customers within a relatively short period of time, maintaining a relatively stable spread between selling price and raw material purchase price. More than 75% of our sales volume generated is under agreements that typically allow us to pass through raw material price increases/decreases every 30 to 90 days to customers that purchase plastic based packaging products and every 90 to 180 days to customers that purchase paper based packaging products. The remainder of our business is transactional, which permits us to pass through price increases/decreases to customers on an order-by-order basis.

Diversified Raw Material Supplier Base. We have relationships with multiple vendors in our pet food and specialty, consumer food and specialty, performance and coated products segments. We currently purchase our raw materials from more than 10 paper suppliers, more than 12 plastics suppliers, and more than 15 suppliers to our coated products segment. We are generally able to switch suppliers without sacrificing quality. We do not believe we are dependent on any single supplier to operate efficiently and profitably.

Diverse Mix of Paper Packaging, Plastic Packaging and Coated Products. We offer a diverse array of plastic packaging, paper packaging, films and coated products. We believe that we are well-positioned to meet customer needs in these three principal sectors. We believe we offer a high quality and diversified product line. Typically, our flexible packaging products are customized to fit particular customer specifications. We believe the multi-wall construction capabilities of our paper packaging segment are among the best in the industry. Our paper packaging products include a wide range of weights, run volumes and end-use applications, such as pinch bags, two- and three-ply pasted valve bags, sewn-open-mouth bags, self-opening sacks and specialty bags, among other products. Our plastic packaging and films products consist of a variety of film structures, printing, EB treatments and a number of converting styles. Our plastic packaging and films products include barrier films, high-clarity printed shrink films, shipping sacks, quad seal bags, stand-up pouches and laminated roll stock with a wide variety of printing options. Our coated products consist of a variety of laminations, coatings and other treatments. Our coated products include optical films, microfilm, medical products, conductive films and foils, ink jet receptive products and phototool products.

Proprietary Brands, Products and Processes. We believe we have established a reputation for developing innovative products, improving the shelf-appeal of our customers’ products and enhancing product performance. For example, we have developed our RAVE™ brand of plastic-laminated and converted plastic bags with easy to open and reclose features for the pet food and lawn and garden markets, specialty packaging for feminine care products, eXpress pv®two-ply cement bags for our cement and packaged concrete customers and paper bags with reclosable zippers for popular pet food brands. The acquisition of the EMCS facilities has added recognizable brands such as Clearshield® , Maraflex® , and Halo™ for the meat and cheese market segments. We also hold numerous patents, have other patent applications pending, and possess a number of proprietary constructions, compositions and manufacturing processes. In addition to our expertise in developing innovative products, our in-house graphics center has earned several industry awards for print quality and innovation.

5

Industry Overview

General. The flexible packaging and coating industry manufactures a broad range of consumer and industrial packaging for use in diverse end markets. Multi-layer flexible polymer/paper structures and barrier laminates are used for food, medical, agricultural and personal care products, as well as other consumer and industrial uses, and are used in a variety of products that generally include plastic film, paper or a combination of the two.

Plastic films, which account for the largest share of market demand in the industry, have been increasingly popular in recent years and offer strong barrier performance, re-closeability and outstanding print characteristics. Plastic has been used to reduce packaging weight when switching from rigid packaging applications. Paper products are versatile and support vibrant graphics and color schemes, while simultaneously offering durability and freshness retention as necessary. Moreover, paper products are increasingly appealing to consumers who place emphasis on environmental concerns and value the ability to use renewable resources and the option to recycle such products.

According to the FPA, the domestic flexible packaging market accounted for an estimated $25.5 billion in sales in 2010, the annual growth rates for the industry are projected to be approximately 3%. The flexible packaging industry is highly fragmented, as demonstrated by the estimated 407 flexible packaging manufacturers in North America.

End Markets. With its versatility, favorable cost profile and considerable shelf-appeal compared to traditional packaging configurations, flexible packaging has made, and continues to make, inroads in a wide variety of consumer and industrial markets. The focus on sustainable packaging also favors the reduced packaging material weight of flexible packaging. According to the 2009 FPA report, approximately 85% of end market applications for domestic flexible packaging are consumer and institution oriented, while approximately 8% of the overall flexible packaging market stems from industrial uses for flexible packaging, particularly in the agricultural, building and chemical industries. Retail and institutional food and beverage markets account for approximately 56% of all flexible packaging applications. In addition, medical and pharmaceutical markets account for approximately 7% of flexible packaging applications. Various other applications, such as personal care products and retail and institutional non-food products, account for approximately 29% of the flexible packaging industry.

Industry Forecast. Growth in the flexible packaging industry is expected to be driven by a number of trends, including:

• increasing importance of convenience, portability, functionality and shelf-appeal;

• technological developments leading to enhancements in packaging product performance capabilities;

• ongoing industry conversion from rigid to flexible packaging;

• impact of sustainable packaging; and

• globalization.

We believe that larger producers are particularly well situated to take advantage of the current industry trends given their ability to reliably service larger, national customers by offering large-scale production capacity, enhanced product development capabilities, broad product offerings and competitive pricing. Additionally, larger producers have relatively greater purchasing leverage than smaller producers and have greater access to resources necessary to pursue substantial acquisition strategies. We believe that our Consolidation in 2005 and acquisitions in 2007 and 2010 provide us with the potential to benefit from such size-related advantages.

Competition

The business of supplying flexible packaging products is extremely competitive, and we face competition from companies that sell similar and substitute packaging products. We compete principally with a limited number of manufacturers of flexible packaging products who offer a broad range of products and maintain production and marketing facilities domestically and internationally. Our major domestic competition includes Bemis Company, Inc., Sealed Air, Inc., Printpack, Inc., Hood Packaging Group, Graphic Packaging Corp., Sonoco Products Company and Coating Excellence International. Our international competitors include Nordenia International AG, Peel Plastic Products Ltd., Mondi Group, Bischof and Klein and UFlex.

Segments

Our business is divided into four primary product segments: pet food and specialty packaging, consumer food and specialty packaging, performance packaging and coated products. The overall product capabilities and production capacity of these segments allow us to serve as a full-service packaging provider to our customers.

Pet Food and Specialty Segment. This market segment includes packaging products we sell to producers of products such as pet food, lawn and garden, charcoal, microwave popcorn and pet care products. We offer a wide range of packaging styles, graphics, special features and coatings that help our customers maximize product appeal to their target markets. We offer our customers custom-engineered paper for graphics and proprietary coatings for additional barrier protection, depending on each customer’s particular safety requirements and convenience concerns. In addition, our plastic offering supports both high fidelity graphics for large format packaging as well as barrier materials for more sensitive product needs. We continue to invest in state-of-the-art converting equipment to provide the most desirable packaging formats with consumer features such as slider zipper reclosures.

6

Consumer Food and Specialty Segment. The consumer food and specialty segment includes packaging and films products we sell to producers of fresh bone-in and boneless meats, natural chunk, sliced and shredded cheese, breakfast foods, frozen foods, beverages, coffee, candy, paper towels and tissue, healthcare products and other consumer goods. We offer a wide range of packaging styles, graphics, special features and coatings to suit particular customer needs and maximize product shelf-appeal.

Performance Packaging Segment. For this segment, the primary performance of the package is to protect and transport goods in a safe, reliable and cost effective manner and graphics are relied upon primarily to communicate product use. We produce industrial-strength paper packaging products used by the agricultural, building products, food ingredient, diary and processed minerals industries, among others. Our plastic products are additionally used to package resin pellets, chemicals, salt, building materials and agricultural products, among others. Many of these end-use sectors are also marketing products into big box retailers where product crossover occurs from industrial customers to retail consumers. Our amplified printing capabilities can improve the package appeal for products sold through this channel.

Coated Products Segment. Our coated products segment includes coated products we sell to the medical, electronic, optical, security, conductives and printing markets. Typical end uses for coated products include white boards, LCD screens, digital printing, electrical cars and breathable wound care applications. We offer branded products, proprietary products developed under partnerships and OEM labeled products.

See Note 11 to our consolidated financial statements included elsewhere in this annual report for additional information regarding our segments.

Products

We produce a wide variety of value-added, flexible, paper-based and plastic-based packaging and film products, including multi-wall bags, heavy duty shipping sacks and multi-layer laminated products.

Our key paper-based packaging products include:

Pinch Bags. Pinch bags offer presentation and functionality advantages for consumer applications that require packaging which lies flat or stands upright and is sift resistant. Typically, pinch bags are used by manufacturers and distributors of light products, such as sugar, flour, pet food, livestock feed and smaller lawn and garden products. Due to their multi-layer constructions, this style of bag is also used for chemical products where specific barriers are required. Pinch bags are left unsealed at one end after production and offer convenient filling and sealing features for our customers and end users. Pinch bags typically are formed using multiple layers of paper, film and other barrier materials to include laminated film-to-paper composites.

Pasted Valve Bags. Pasted valve bags, constructed of heavy-gauge, multi-wall paper, are most often used in industrial and construction markets. Pasted valve products are extremely durable and strong enough to hold significant weights and volume for such products as cement, clay, chemicals and sand. In general, pasted valve products lay flat for storage and are easily stackable in mass quantities. The attached valve is designed to work with specific filling equipment. We produce a two-ply line of pasted valve products, which provide what we believe to be efficient, superior performance. We also offer UN/DOT testing, which is required for all packaging used to carry hazardous materials.

Self-Opening Sacks. Self-opening sacks, most commonly used for smaller consumer applications, utilize a variety of multi-wall construction combinations to suit performance requirements. Paper and plastic layers are often combined to provide outstanding barrier performance for content containment, as well as moisture or oxygen resistance. Moreover, self-opening sacks are easily re-closable by the end consumer and are particularly convenient for smaller pet food, charcoal, animal litter, coffee, sugar and flour packaging products.

Sewn-Open-Mouth Bags. Sewn-open-mouth bags provide packaging solutions for livestock feed, seed and flour applications. Sewn bags are preferred in many applications because of the ease with which they can be opened. Sewn closed at one end, the bags are filled with content by the customer and sewn shut with heavy-gauge filament. Sewn-open-mouth bags are constructed to lie flat and are designed to carry heavy loads. We provide a wide variety of printing and combined substrate choices for sewn-open-mouth bags. In addition to multi-wall, kraft and film, we use woven polypropylene in the construction to enhance the strength of the bag.

Multi-Wall and Specialty Bags. We manufacture technically complex specialty bags capable of providing protection against oil, grease, chemicals and moisture. These bags are used to package pet food, microwave popcorn and charcoal, among other products.

Market Print. Market print is primarily used for building insulation backing, or as wrap for roofing shingles. Constructed from one-ply, unbleached kraft paper, market print is often printed with one or two colors on one side and delivered to customers on large rolls.

7

Our key plastic-based packaging and films products include:

Shipping Sacks. Our shipping sacks are used for difficult packaging applications, such as insulation, salt, plastic, resin, sand, gravel, soil, seed and other industrial, chemical and agricultural materials and products. Typically constructed of heavy-gauge plastic, our shipping sacks are extruded in a tube and heat or adhesive-sealed, thereby creating a weld designed to withstand harsh industrial environments.

Rollstock. We manufacture a variety of tubular and single-wound sheet rollstock products tailored to individual customer preferences. Extruded film is available in several varieties, including mono-layer, co-extrusion or laminated film, and can be delivered plain or with printing. Rollstock is often utilized for resin, food, beverage and lawn and garden wraps.

Flexible Overwrap Packaging. Overwrap packaging consists of specially co-extruded film with high-performance characteristics. Such products are used for tissue products, such as toilet paper, bundle packs of bar soap and pharmaceutical products. We can accommodate orders for thin gauge extensible films, as thin as .5 millimeters and with as many as 10 colors.

Multi-Layer Laminations. Multi-layer lamination products provide complex, customized flexible packaging structures to personal care, food, dairy and pet food producers. These products offer strength, machinability, above-average barrier protection and shelf life characteristics, and can be made easy open and/or tamper evident.

Printed Shrink Film. Shrink films are used in the personal care, beverage, cereal, convenience foods and canned goods markets, offering product protection and clear graphics at relatively low prices.

Dartek ® Nylon Cast Films. Cast films can be used as thermoforming films that require high barrier and excellent optics properties and are also used in pouches and bags.

Sclairfilm®. Sclair sealant films consist of mono and coex blown polyethylene-based products designed for laminations to other materials. These films feature toughness and durability, barrier properties, superior tensile and puncture strength and excellent sealability.

Stand-Up Pouches. Pouches provide an alternative to traditional rigid packaging, providing increased versatility and convenience. Pouches also feature a large surface area which allows for more eye-catching graphics. Additionally, the relatively thin, light nature of flexible pouches facilitates product storage and reduces shipping costs. Our stand-up pouches are suited for a wide range of applications and can be customized to a variety of specifications.

Edge Seam. Edge seam bags are primarily used by seed, fertilizer and chemical manufacturers due to their laminated construction and ability to provide eye catching graphics. These bags are made from rollstock and are gusseted and sealed on one side. Our management believes that our additional features for edge seam bags (such as handles, 10-color printability and custom-engineered constructions and laminations) distinguish our edge seam bags from those of our competitors.

Quad Style Bags and Pouches. Quad style bags are much like an edge seam bag with all four edges sealed to give a box like appearance to the filled bag. These bags lend themselves to high fidelity graphics, consumer convenience features and allow for a wide range of substrate choices. This is often the plastic version of the paper pinch-style bag.

Shrink Vacuum Bags and/or Tubestock. Used primarily in fresh meat products, a packaging film produced from plastic resins is extruded via a tubular process. The film is cooled and then reheated and stretched at a temperature near its melting point. The film is made to shrink around a product to be packaged by the customer through the application of a thermal treatment. Alternatively, a layer of an oxygen barrier material can be included to manufacture a barrier shrink film product. This film is then further converted through printing and sold as either tubestock or further fabricated into a finished bag form.

Our key coated products include:

Coated/Laminated Substrates: Precise manufacturing methods and conditions are required for the process of applying complex coatings to these products, which include a variety of films and foils.

Breathable Polyurethane Films and Foams: These products are used in professional wound dressings, often incorporating anti-microbial silver properties.

Coated Polyester Film: These products consist of hard-coats, which are used in window-safety film, anti-graffiti material and scratch resistant high gloss furniture foil.

Coated and Laminate Flexible Materials: Used in the electronics market, we manufacture substrates used in the printed circuit, batteries and advanced fuel cells segment.

8

Specialty Coatings: We are able to use our extensive expertise to develop and produce high precision coatings for a wide variety of critical applications.

Operations and Manufacturing

We maintain an expansive array of packaging machinery at our various facilities, which collectively produced approximately 240 million pounds of paper packaging and approximately 190 million pounds of plastic packaging and films for the year ended December 31, 2010. Our machinery includes numerous presses, tubers, bottomers, sewing lines, self-opening square bottom and two-ply pasted valve bag machines, multiple extrusion lines, flexo and roto presses, pouch machines, coating machines and laminators. This wide variety of machinery and specialized equipment enables us to increase our product offerings and maintain a high degree of flexibility in meeting customer demands.

Product conformance is continually monitored and maintained by our supervisors and our key equipment and critical operations are administered by trained, experienced operators. Investments in equipment are driven by industry trends, developing technologies, customer needs and cost containment.

Due to the high degree of specialization at each of our facilities and the fact that our production is often customer-driven, we primarily distribute our products directly to our customers. We ship all of our products based on agreements with individual customers, typically using third-party shipping sources to deliver our products. Given our diverse customer base our business does not typically experience significant seasonal variation.

We produce our paper packaging, plastic packaging and films and coated products through three distinct but similar manufacturing processes. In some cases we may cross between manufacturing platforms to produce composite products which contain both paper and film technologies. Each of the business unit market segments controls or has access to the following manufacturing platforms.

Paper Packaging. The manufacture of paper packaging involves several processes, including printing, tubing and bottoming.

• Printing. Flat form paper products are printed using either rotogravure or flexographic print methods. The rotogravure method consists of pressing etched steel plates against flat form paper, using a rotary press to transfer the prints or graphics from the steel plates to the paper. During this process, the desired image is etched onto a steel cylinder creating small recesses, known as cells, which carry ink. The etched surface of the rotating cylinder is then dipped into an ink pan which fills the cells with ink. Surplus ink is wiped off the cylinder surface, leaving ink only in the cells. A second rotating cylinder then presses paper onto the cylinder, and the ink is transferred onto the paper. The flexographic print method is similar to the rotogravure method described above but utilizes flexible plates that are drawn through a roller to apply ink and graphics to paper. Once printed, the paper then undergoes tubing and bottoming processes.

• Tubing. Printed paper is converted to tube form by rolling and seaming the paper along one side. Tubing is critical to the production process, as many value-added features are added to the product at this stage, including the combination of multiple film layers, barriers and laminations. Film layers help provide tubed paper packaging with graphics and specific end-use features. The tubing process is finalized when the seamed paper is cut by machine into individual bags.

• Bottoming. Bottoming of the paper packaging completes the manufacturing process. At this stage, a paper tube is sealed at one end with heat or pressure-applied adhesives. Sewn-open mouth bags are customarily sealed with heavy-gauge filament that is sewn through the packaging.

Plastic Packaging and Films. The manufacture of plastic packaging and films also involves several processes, including extrusion, printing, slitting and pouching.

• Extrusion. Extrusion results in the creation of plastic film, the basis of flexible plastic packaging products. Appropriate machinery and technical knowledge are required to create a consistently high quality product. To begin, plastic resins with various properties are blended with additives to create a specified performance compound, the nature of which is primarily dependent on end-market use and customer preference. Blended resin compounds are then shaped under heat and pressure to create a thin plastic film. Many manufacturing dynamics, including the combination of resin and extrusion methods, produce variations in color, clarity, tensile strength, toughness, thickness, shrinkability, surface friction, transparency, sealability and permeability. Extruded plastic film can be used in a wide range of applications. We do not, however, extrude all of our plastic films, such as polyethylene terephalate (“PET”) and oriented polypropylene (“OPP”) films. Extruded product may result in sheet or tubular form.

• Printing. Extruded plastic film can be printed. Exopack utilizes either a rotogravure or flexographic printing process, similar to the ones used to print paper packaging.

• Lamination. In many circumstances, a product needs the protection of more than a single plastic film. In these instances, additional layers are bonded to the plastic film, with the added layers consisting of materials, such as oriented polyester, a polyethylene based sealant or OPP. These materials are stiffer, harder to tear and heat sealable. The film layers are brought together by applying an adhesive or by extruding a layer of molten polyethylene to bind two film layers into one. The lamination process allows us to meet the protection requirements for a variety of different end uses.

9

• Slitting. Finished plastic film can be placed in razor and shear-cut slitting machines that tailor the film to sizes and widths specified by the customer. Several of our machines are able to store key machine settings for specific products, which results in a high level of consistency and manufacturing efficiency.

• Pouch/bag converting. Printed and/or laminated films can be converted into a variety of styles with re-closable features, handles or other required package elements.

Coated Products. The manufacture of coated products also involves several processes, including coating and lamination.

• Coating. Extruded plastic film, foil, and paper can be coated using slot die, direct gravure, reverse gravure and proprietary coating methods, using liquid crystal, exotic filled ceramics and polyamides. Energy cured coatings can be used over printed products for gloss, print protection or surface dynamic control.

In order to optimize these processes and increase efficiencies, we share production-related best practices among our facilities and closely monitor numerous quality control and production analysis metrics. As a result of such practices, we believe that we have considerably improved our efficiency and quality. Other efficiency and productivity initiatives are underway in order to optimize processes and productive capacity, including:

• establishing company-wide a systematic management process in each segment and plant;

• further streamlining production to focus each facility’s core equipment and manufacturing strengths;

• optimizing asset utilization at each plant; and

• strategically making capital expenditures to enhance efficiencies.

Management believes that these initiatives should enable us to improve our overall efficiency and enhance profitability.

Materials

We use polyethylene resin and barrier films, paper, inks, adhesives and chemicals, including coated and un-coated woven polypropylene, polyester and nylon films in the manufacture of our products. We purchase our raw materials from a variety of suppliers and do not depend on any one supplier for our raw material needs. We also purchase finished goods through our GPL relationships.

We negotiate pricing and contract terms with each supplier. We attempt to purchase raw materials with the best possible terms and pricing, and we believe that we have good relationships with each of our suppliers, several of which have supplied raw materials to us for decades.

We are currently focusing on increasing the efficiency of our raw materials procurement process. To this end, we are working to develop highly efficient procurement methods and have adopted innovative approaches to raw materials sourcing, such as developing additional global and internal sourcing arrangements. In addition, we have programs in place to leverage raw materials procurement and standardize raw material usage across our Company.

Technology and Research and Development

Our technology development is primarily focused on providing paper, plastic and coatings expertise to suit our customers’ development requirements.

We are able to use our broad product offerings and state-of-the-art technology to transfer technological innovations from one market to another. For example, our expertise in producing zippered stand-up pouches for the food industry has helped us to develop and commercialize a patented re-closeable feature on multi-wall bags for pet food. We have also successfully developed our RAVETM composite line of premade bags. Through unique substrate combinations these robust bags offer less damage to the retailer and lower overall cost for the packaged goods company.

Many of our customers work with our technical representatives to deliver more competitive products. We have enhanced our relationships with such customers by providing the technical service required to support the commercialization of new products and by helping such customers improve operational efficiency and quality throughout the life cycle of their products. In order to ensure product quality and consistency for their own customers, our customers typically do not change suppliers often, as supplier changes can be risky, expensive and time-consuming.

During the latter part of 2010, Exopack centralized its research and development team in a new research and development center in Menasha, Wisconsin to capitalize on the core competencies of the more than 50 engineers and scientists currently working within our various business units. The focus of this research and development team is to develop and bring to market the latest cutting-edge flexible packaging products. In addition to the Menasha research and development center, we maintain research and development specialists and product testing laboratories at our corporate headquarters in Spartanburg, South Carolina as well as within our Matthews, North Carolina and Wrexham, North Wales, United Kingdom facilities.

10

In addition, we formed a long term innovation team to search for new technologies that can be translated into packaging or coating products. This team is charged with finding technology platforms that have the potential to be commercialized in a 3-5 year time horizon.

For additional information related to our research and development costs, please see Note 2 to our consolidated financial statements included elsewhere in this annual report.

Sales and Marketing

Overview. Our overall sales and marketing strategy is to deliver levels of quality, consistency, innovation, reliability and customer service that are competitive in the industry and to leverage our resources to position us as a trusted partner and leading solutions provider in value-added market segments. In addition to the ability to provide innovative and customized products to customers regardless of whether they require paper or plastic configurations, our critical differentiators include strong technical resources, customer service and support capabilities, broad geographic reach and large-scale production resources. We believe that our full service, “one-stop” resources enable us to provide industry-leading services and products to a wide range of customers, including national blue chip companies and smaller, regional accounts.

We strive to maintain close relationships with our customers, collaborating on technological advancements and demand planning. Our sales representatives are trained to focus on specific product categories, while maintaining a general familiarity with all of our products in order to take advantage of cross-selling opportunities. As a result, we believe that our sales personnel have developed a deep understanding of our product lines, in addition to the specific operations and needs of the individual customers that each representative services. We believe that this expertise enables us to cultivate new business, develop highly-effective partnering initiatives with key customers, meet or exceed customer needs and expectations as to product quality and innovation, and differentiate our products from those of our competitors.

Sales Organization. Approximately 65 sales personnel are organized around our business segments. Within each segment, sales representatives are divided between regional and national accounts. Regional representatives target smaller accounts, while national representatives focus on customers requiring service from multiple facilities. Typically, we maintain a single sales personnel and customer service contact with each customer, which we believe facilitates clear communication and fosters close personal relationships.

In addition to a base salary, our sales personnel have an incentive plan according to the profitability of the products they sell or to the amount of cash their sales generate. Accordingly, our sales representatives have an incentive to sell high-value products. We devote significant resources on an ongoing basis to product and sales technique training programs, which inform sales representatives about each of our products, their functionality, potential applications and value-added selling techniques. We believe that these efforts have resulted in a highly knowledgeable and motivated sales force, capable of specifically addressing a broad range of customer requirements.

Marketing Initiatives. We actively seek to identify and pursue developing opportunities with customers, leveraging our technical expertise to meet customer needs, regardless of segment or packaging configuration. We believe these efforts enhance our ability to pursue cross-selling opportunities with existing and potential customers. Market and product-focused professionals have reinforced our business with our major customers by developing expertise and enhancing recognition of Exopack products and services. In addition, there has been a renewed focus on branded products to enhance customer experience. We believe that brands such as Maraflex® , Clearshield® , Halo™ , AquaCrystal®, eXpress plv®, Sclairfilm®, Dartek®, StratFX™, Reflex®, RAVETM, Duratool®, InspireTM, and ShurSealTM have become trusted names in our product portfolio.

Customer Service

We believe our commitment to customer service and support is reflected in our long-term customer relationships and new customer retention. Customer service is critical to our ability to differentiate our Company from our competition and reinforce our market position. Accordingly, we maintain a strong focus on our customers by emphasizing an attentive approach to customer needs and by providing value-added services that complement products designed and printed to customer specifications.

Our approach to service emphasizes four primary objectives:

• delivering quality products on-time;

11

• responding to customer questions, concerns and problems, and closely collaborating with customers to promptly address any such questions, concerns or problems;

• customizing and designing innovative products that conform to our customers’ exact specifications; and

• using specialized manufacturing and information technology to provide customers with rapid processing and service alternatives.

In addition, we actively promote our broad network of production facilities in order to attract and maintain customers that require production from multiple locations.

Customers and Order Backlog

We have a diversified customer base of more than 1,200 customers. Our customers range in size from Fortune 100 companies to smaller regional businesses, and come from a variety of industries, including food, chemical, medical, pet food, building materials, beverages, electronics, lawn and garden and personal care and hygiene products.

Sales arrangements with our customers vary by customer and product supplied, and may include purchase order arrangements or long-term agreements and contracts. Contractual terms typically stipulate product prices, potential raw material price increase/decrease pass-through, on-hand inventory or production availability and payment and freight terms. Contractual terms range in length from one-time sales to three or more years and typically contain cost pass-through provisions.

The time between receipt of orders and shipment generally averages between four to six weeks. As a result, backlog is not significant.

For information regarding a summary of our significant accounting policies for revenue recognition, please see Note 2 to our consolidated financial statements included elsewhere in this annual report.

Employees

At December 31, 2010, we had 2,435 employees, of which 501 were covered by five separate collective bargaining agreements. In our Battle Creek, Michigan facility, 127 employees, including production and maintenance employees, quality control inspectors and drivers, are covered by a collective bargaining agreement that was recently negotiated to replace a collective bargaining agreement that expired on February 1, 2011. The new Battle Creek collective bargaining agreement expires on February 4, 2016. In our Tomah, Wisconsin facility, 110 employees are covered by a collective bargaining agreement that expires on February 28, 2012. In our Matthews, North Carolina facility, 69 employees are covered by a collective bargaining agreement that expires on June 27, 2012. In our Menasha, Wisconsin facility, 195 employees are covered by two separate collective bargaining agreements; the Graphics Communications Workers are covered by a collective bargaining agreement that expires on June 30, 2013 and the United Steelworkers are covered by a collective bargaining agreement that expires on February 28, 2012.

Patents and Trademarks

We have proprietary rights to a number of trademarks important to our business, including, but not limited to, Exopack®, eXpress plv® , Sclairfilm®, Dartek® , Maraflex® , ClearShield® , Halo® , AquaCrystal®and Shur Seal®. We also hold approximately 96 U.S. and foreign patents relating to our products, manufacturing processes and equipment and numerous patent applications are currently pending in the United States and certain foreign jurisdictions.

Regulatory Matters

Our business is subject to numerous federal, state, local and foreign laws and regulations relating to the protection of human health and the environment. These domestic environmental laws and regulations include the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act and the Comprehensive Environmental Response, Compensation and Liability Act and relate to such things as the storage, release and remediation of hazardous substances. In addition, we are subject to similar state laws.

Exopack’s North Wales facility is subject to European Union and U.K. legislation covering similar areas of human health and environmental protection. These include the Clean Air Act 1993, the Pollution Prevention and Control (England and Wales) regulations 2000, the Water Resources Act 1991, the Water Protection Zone (River Dee Catchment) Regulations 1999, the Environmental Protection Duty of Care Regulations 1991, the Hazardous Waste Regulations 2005, the Producer Responsibility Obligations (Packaging Waste) Regulations 2005 and the Landfill Regulations 2002.

Exopack’s Canadian facilities are subject to Canadian legislation covering similar areas of human health and environmental protections. Our facilities are subject to one or more of the following regulations: the Canadian Environmental Protection Act (CEPA) which includes the National Pollutant Reporting Inventory regulation, the Kyoto Protocol, the Fisheries Act, the New Substance Notification Regulations, Transportation of Dangerous Goods, the Workplace Hazardous Materials Information System, the Ontario Environmental Protection Act, Ontario Air Regulations 419 & 127, Ontario Waste Regulation 347, “3Rs” Regulations, the Ontario Water Resources Act, municipal water by-laws and Municipal-Industrial Strategy for Abatement laws and the Ontario Regulation 63/95 for Effluent Monitoring and Effluent Limits - Organic Chemical Manufacturing Sector law.

12

These laws are constantly evolving, with a trend towards increasing stringency. The ultimate impact of complying with existing laws and regulations is not always clearly known or determinable, because certain implementing regulations for some of the laws described above have not yet been promulgated or in certain instances are undergoing revisions. These environmental laws and regulations could result in increased capital, operating and compliance costs.

Geographic Areas

For a discussion of our consolidated net sales and long-lived assets based on geographic area please see Note 11 to our consolidated financial statements included elsewhere in this annual report.

Available Information

We maintain an Internet website at http://www.exopack.com. The information on our website does not constitute a part of this annual report and the reference to our website is intended as an inactive textual reference only. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports are available free of charge through our website as soon as reasonably practicable after we file this material with the SEC. We will also provide electronic or paper copies of our SEC filings free of charge upon request.

ITEM 1A. RISK FACTORS

Our business operations and the implementation of our business strategy are subject to significant risks inherent in our business, including, without limitation, the risks and uncertainties described below. The occurrence of any one or more of the risks or uncertainties described below could have a material adverse effect on our consolidated financial condition, results of operations and cash flows and could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this annual report. While we believe we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our business, operations, industry, financial position and financial performance in the future. Because of the following risks and uncertainties, as well as other variables affecting our operating results, past financial performance should not be considered a reliable indicator of future performance and historical trends may not be consistent with results or trends in future periods. Our consolidated financial statements and the notes thereto and the other information contained in this annual report should be read in connection with the risk factors discussed below.

Intense competition in the flexible packaging markets may adversely affect our operating results.

The business of supplying flexible packaging products is extremely competitive. We face intense competition from many domestic and international competitors, some of which have extensive production facilities, well developed sales and marketing staffs and greater financial resources than we have. Competitive products are also available from a number of local manufacturers specializing in the production of a limited group of products, which they market nationally. This results in competition that is extremely price sensitive. We also compete on the basis of quality, service, timely delivery and differentiation of our products. This competition could result in additional pricing pressures, reduced sales and lower margins. An increase in competition could result in material selling price reductions or loss of market share, which would adversely affect our operating results and financial condition.

The profitability of our business depends on the price and availability of polyethylene resin and paper, two of our principal raw materials, and our ability to pass on polyethylene resin and paper price increases to customers.

The principal raw materials that we use in the production of our products are polyethylene resin and paper. Our ability to operate profitably depends, in large part, on the price and availability for these raw materials. The price for polyethylene resin fluctuates substantially as a result of changes in petroleum and natural gas prices, demand and the capacities of the companies that produce polyethylene resin to meet market needs. Prices for paper depend on the industry’s capacity utilization and the costs of raw materials.

Historically, we have been able to relatively quickly pass through to our customers substantially all increases and decreases in the cost of polyethylene resin and paper through contractual provisions in our long-term agreements and standard industry practice. If we are not able to promptly pass cost increases through in the future and there are substantial increases in polyethylene resin or paper prices, our operating margins could be affected adversely. Furthermore, natural disasters such as hurricanes, in addition to terrorist activity and governmental regulation of environmental emissions, or a substantial increase in oil or natural gas prices, may negatively impact the production or delivery capacity of our raw materials suppliers in the chemical and paper industries. This could result in increased raw material costs or supply shortages, which may have a negative impact on our profitability if we are unable to pass along the increased costs in our selling prices or, in the case of a shortage, secure raw materials from alternative sources.

13

Our business is affected by global economic factors including risks associated with a recession and our customers' access to credit.

Our financial results are substantially dependent upon the overall economic conditions globally and in the locations where we do business, including in the United States, the United Kingdom and Canada. A recession in any of these locations or globally—or public perceptions that result in declining economic conditions—could substantially decrease the demand for our products and adversely affect our business. Indeed, as a result of the economic downturn that commenced in late 2008 and continued into 2010, we have experienced decreased demand for some of our products. Moreover, many of our customers rely on access to credit to fund their operations. The inability of our customers to access credit facilities may adversely affect our business by reducing our sales, increasing our exposure to accounts receivable bad debts and reducing our profitability.

The recent negative worldwide economic conditions and market instability also make it increasingly difficult for us, our customers and our suppliers to forecast demand trends. A continued decline in demand could place further financial pressure on our results of operations. The timing and extent of any changes to currently prevailing market conditions is uncertain and supply and demand may be unbalanced at any time. As a consequence, we are unable to accurately predict the extent or duration of business cycles or their effect on our financial condition or results of operations, and can give no assurances as to the timing, extent or duration of the current or future business cycles.

We are subject to the risk of loss resulting from nonpayment or nonperformance by our customers.

As a result of the recent economic downturn and continued weak economic conditions, some of our customers may be unable to satisfy their obligations to us when they become due and may initiate bankruptcy proceedings. Our credit procedures and policies may not be adequate to eliminate customer credit risk. Our customers may experience financial difficulties, including bankruptcies, restructurings and liquidations. These and other financial problems that may be experienced by our customers, as well as potential financial weakness in our industry and in the economy generally may increase our risk in extending trade credit to customers. A significant adverse change in a customer relationship or in a customer's financial position could cause us to limit or discontinue business with that customer, require us to assume more credit risk relating to that customer's receivables or limit our ability to collect accounts receivable from that customer, all of which could have a material adverse effect on our business, results of operations, financial condition and liquidity.

Financial difficulties and related problems at our vendors, suppliers and other business partners could result in a disruption to our operations and have a material adverse effect on our business.

We rely on numerous vendors and suppliers and collaborations with other industry participants to provide us with polyethylene resin, paper, packaging materials and other raw materials, along with energy sources and, in certain cases, facilities, that we need to operate our business. We believe that certain of our business partners may be experiencing or may experience cash flow problems, which could be further aggravated by recessionary industry conditions. Due to the recent economic downturn and continued weak economic conditions, some of these companies may be forced to reduce their output, shut down their operations or file for bankruptcy protection. Financial difficulties or solvency problems at companies on which we rely could materially adversely affect their ability to provide us with the raw materials, energy sources or facilities that we need, which could disrupt our operations, including the production of certain of our products. In addition, it could be difficult to find replacements for certain of our business partners without incurring significant delays or cost increases.

Fluctuations in the equity market will likely adversely affect our pension plan assets and our future cash flows.