Attached files

| file | filename |

|---|---|

| 10-K - BODY OF FORM 10-K - UNION BANKSHARES INC | unb12311010k.htm |

| EX-32.2 - EXHIBIT 32.2 - UNION BANKSHARES INC | unb123110ex322.htm |

| EX-31.1 - EXHIBIT 31.1 - UNION BANKSHARES INC | unb123110ex311.htm |

| EX-31.2 - EXHIBIT 31.2 - UNION BANKSHARES INC | unb123110ex312.htm |

| EX-32.1 - EXHIBIT 32.1 - UNION BANKSHARES INC | unb123110ex321.htm |

Exhibit 13.1

| ||||

SELECTED FINANCIAL DATA

At or For The Years Ended December 31 | |||||||||||||||

2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

Balance Sheet Data | |||||||||||||||

Total assets | $ | 454,085 | $ | 447,522 | $ | 440,104 | $ | 393,264 | $ | 381,193 | |||||

Investment securities | 24,280 | 24,649 | 27,834 | 33,822 | 23,683 | ||||||||||

Loans, net of unearned income | 382,071 | 358,167 | 353,310 | 318,194 | 317,452 | ||||||||||

Allowance for loan losses | (3,755 | ) | (3,493 | ) | (3,556 | ) | (3,378 | ) | (3,338 | ) | |||||

Deposits | 376,660 | 368,827 | 364,370 | 323,961 | 319,822 | ||||||||||

Borrowed funds | 28,986 | 30,993 | 27,416 | 20,328 | 14,596 | ||||||||||

Stockholders' equity (1) | 41,725 | 41,180 | 39,150 | 42,074 | 41,923 | ||||||||||

Income Statement Data | |||||||||||||||

Total interest income | $ | 22,907 | $ | 23,217 | $ | 24,721 | $ | 26,273 | $ | 25,197 | |||||

Total interest expense | (4,117 | ) | (5,294 | ) | (7,177 | ) | (8,228 | ) | (6,821 | ) | |||||

Net interest and dividend income | 18,790 | 17,923 | 17,544 | 18,045 | 18,376 | ||||||||||

Provision for loan losses | (520 | ) | (400 | ) | (335 | ) | (265 | ) | (180 | ) | |||||

Noninterest income | 5,934 | 5,521 | 4,329 | 4,249 | 4,058 | ||||||||||

Noninterest expenses | (16,915 | ) | (16,397 | ) | (15,412 | ) | (14,409 | ) | (13,814 | ) | |||||

Income before provision for income taxes | 7,289 | 6,647 | 6,126 | 7,620 | 8,440 | ||||||||||

Provision for income taxes | (1,702 | ) | (1,420 | ) | (1,020 | ) | (1,965 | ) | (2,185 | ) | |||||

Net income | $ | 5,587 | $ | 5,227 | $ | 5,106 | $ | 5,655 | $ | 6,255 | |||||

Per Common Share Data | |||||||||||||||

Net income (2) | $ | 1.25 | $ | 1.17 | $ | 1.14 | $ | 1.25 | $ | 1.38 | |||||

Cash dividends paid | 1.00 | 1.00 | 1.12 | 1.12 | 1.06 | ||||||||||

Book value (1) | 9.36 | 9.23 | 8.75 | 9.34 | 9.25 | ||||||||||

Weighted average number of shares outstanding | 4,458,193 | 4,466,760 | 4,488,888 | 4,521,380 | 4,539,641 | ||||||||||

Number of shares outstanding | 4,455,704 | 4,461,208 | 4,474,598 | 4,502,969 | 4,531,977 | ||||||||||

(1) | Stockholders' equity includes unrealized gains or losses, net of applicable income taxes, on investment securities classified as “available-for-sale” and the unfunded liability for pension benefits, net of taxes for the defined benefit pension plan. |

(2) | Computed using the weighted average number of shares outstanding for the period. |

LETTER TO SHAREHOLDERS

Dear Shareholder, | March 28, 2011 |

We are pleased to present our 2010 annual report which contains much information, not only about your Company's financial performance but also highlights other activities, services and products we offer or participate in. Although the past year continued to be a difficult one for some financial institutions, after reading our report we believe you will agree we had a strong year in a number of areas.

Of particular significance to 2010's results were lending related activities. Interest rates remained at historically low levels, contributing to the continued refinancing of residential mortgages. Over $71 million in residential loans were originated and $51 million were sold into the secondary mortgage market, with the vast majority servicing retained, generating $1 million in premium income.

It is the Bank's procedure to retain servicing on sold loans in so far as it is possible. Our portfolio of sold and serviced loans now exceeds $166 million, placing us in the top 5% of banks in our peer group. Service fees generated by these sold loans generated $549,000 in revenue during the year and will provide a continuing stream of fees in the years to come.

In mid 2010, Congress passed the Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). This legislation makes sweeping changes in the banking industry, consumer protection, and implements price controls on certain banking fees. Although community banks are exempted from some of these new rules, you can be assured the costs of regulatory compliance will increase for all financial institutions while revenue sources are being reduced. We need to remain proactive with regulatory compliance as we believe, over time banks which manage regulatory risk well will have additional opportunities for growth in the future, while those who are unable to comply will find it more difficult to operate under the increased regulatory burden.

This past November we announced that David Silverman, Senior Vice President and Senior Loan Officer of Union Bank, had been selected the successor to Ken Gibbons. In accordance with the management succession plan adopted by the Board last July, Mr. Silverman was voted by the Board as President of both companies effective April 1, 2011, and CEO in May 2012. Mr. Gibbons will become Board Chair upon the retirement of current Board Chair, Richard C. Sargent, at the annual meeting of shareholders in May 2011, and will remain as CEO during the management transition year of May 2011 to May 2012. Mr. Silverman was elected a director of Union Bank on November 17, 2010, and it is also expected that Mr. Silverman will stand for election to the Company's Board of Directors at the 2011 annual meeting. The transition process has begun and we are all looking forward to the changes it will bring.

We were saddened in September when long-time Director Franklin G. Hovey II passed away unexpectedly. Franklin had been a Director of the Company or a subsidiary since 1981 and was Board Secretary. Frank's insight, humor and directness were of great value to the Company and his fellow Board members.

Earlier this month we announced the purchase of three branch offices in New Hampshire from Northway Bank, which we expect will add approximately $80 million in deposits and $33 million in performing loans. With the changes happening on the regulatory front, the economy making positive advances and our expansion in New Hampshire, we believe 2011 will be a year of solid growth. The continued support and dedication of our shareholders, customers and staff will ensure continued success.

Sincerely,

|  | |

Richard C. Sargent | Kenneth D. Gibbons | |

Chairman | President & CEO |

Union Bankshares, Inc. 2010 Annual Report 1

SHAREHOLDER ASSISTANCE & INVESTOR INFORMATION

If you need assistance with a change in registration of certificates, combining your certificates into one, reporting

lost certificates, non-receipt or loss of dividend checks, assistance regarding direct deposit of dividends,

information about the Company, or to receive copies of financial reports, please contact either:

JoAnn A. Tallman, Assistant Secretary | Registrar & Transfer Company | |

Union Bankshares, Inc. | Attn: Stock Transfer Department | |

P.O. Box 667 | 10 Commerce Drive | |

Morrisville, VT 05661-0667 | Cranford, NJ 07016 | |

Phone: 802-888-6600 | Phone: 1-800-368-5948 | |

Fax: 802-888-4921 | Fax: 1-908-497-2318 | |

Email: ubexec@unionbankvt.com | E-mail: info@rtco.com |

NASDAQ Stock Market Ticker Symbol: UNB

Corporate Name: Union Bankshares, Inc.

To view additional information about the Company or to receive alerts when public filings are posted, please view the Investor Relations page at www.unionbankvt.com.

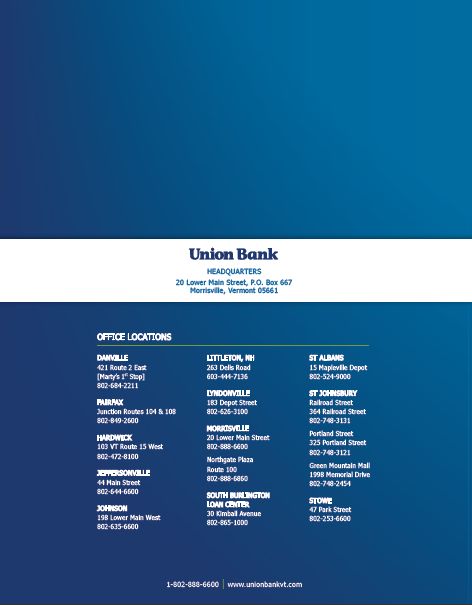

Union Bankshares, Inc., operates as a one bank holding company for Union Bank, which provides commercial, municipal, trust and retail banking services in northern Vermont and northwestern New Hampshire. As of December 31, 2010, the company operated 13 community banking locations in Lamoille, Caledonia and Franklin counties of Vermont; one in the town of Littleton, (Grafton County), New Hampshire; and one loan center in South Burlington, (Chittenden County), Vermont; as well as 30 ATMs throughout northern Vermont and northwestern New Hampshire. Union Bank was founded in 1891 in Morrisville, Vermont, where the Bank’s and its holding company’s headquarters are located.

Union Bank promotes personal service and banking expertise within the communities it serves, with a focus on small- to middle-market businesses, local municipalities, non-profits, retail and trust customers. To leverage its local expertise, Union Bank continues to enhance its niche capabilities and focuses on expanding to additional neighboring communities.

Union Bankshares, through Union Bank, is committed to the communities it serves, and encourages employee participation in community events and charitable services. The Company views small businesses as foundations for thriving local economies; these businesses provide jobs, attract other businesses and create wealth.

Currently, Union Bank employs 160 people, many of whom are leaders in community organizations throughout the Bank’s service area.

• Union Bankshares’ growing asset base of over $454 million provides the financial strength to successfully serve its constituents

• The Company reported a Return on Average Equity of 12.33% or greater and a Return on Average Assets of 1.21% or greater for each of the last five years

• Union Bank has scored an "Outstanding" rating on ALL its CRA (Community Reinvestment Act) examinations since 1995

• Union Bank has been an SBA "Preferred Lender" since 1987

Union Bankshares, Inc. 2010 Annual Report 2

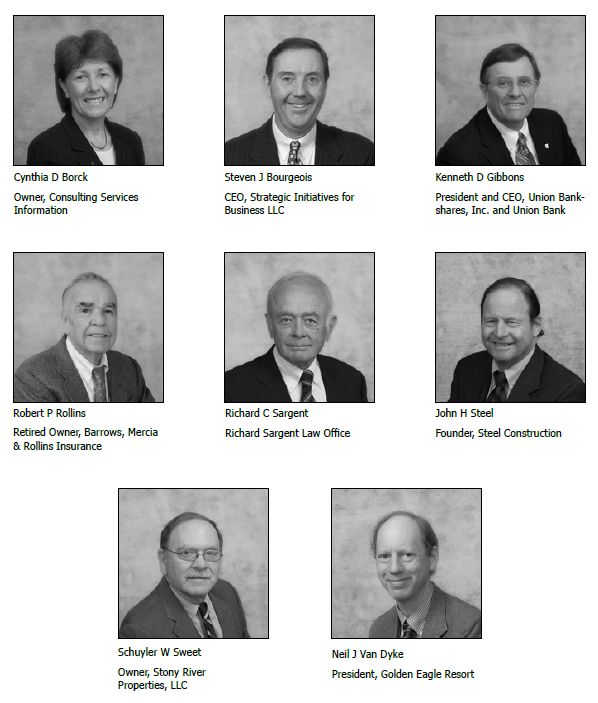

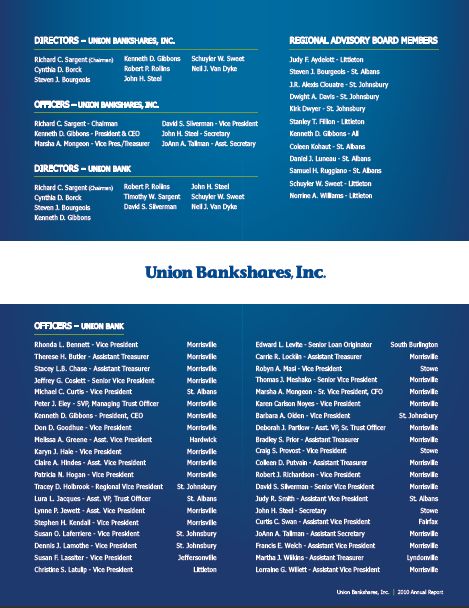

DIRECTORS

Union Bankshares, Inc. 2010 Annual Report 3

TAKING STOCK OF MILESTONES

Union Bankshares, Inc. (UNB), the holding Company for Union Bank, continues to grow in strength despite the economic conditions that are hampering the Nation. The rallying cry to “buy local” is resonating with consumers and a positive effect on businesses in small towns, including Union Bank. People are responding to the concept of putting their money to work for the local economy not only with their purchasing power but with their deposits as well. Turning these deposits around and using them to invest in our communities is a hallmark of our success.

Our dividend history, peer group standings, CRA ratings and infrastructure enhancements combine to form our solid foundation of strength. It is important to pause for a moment and take stock of these milestones.

Shareholder Value

Growing financial return for our shareholders over time is an important part of our mission. Total dividends paid per share for each of 2010 and 2009 was $1.00.

Our goal is to make prudent improvements to our infrastructure and systems that add efficiencies and increase our profitability. You will read further on about the addition of a Loan Center in South Burlington, Vermont; a name-change for the Trust Department and about the new web portal. We believe investing in changes like these will benefit our bottom line and continue to strengthen the performance of our stock.

We continue to provide above-average long-term returns while keeping current returns strong. Even though our financial performance has been good by most standards, we are not satisfied with the status quo. As we move forward, we will persistently look for areas in which we can grow, improve and become more efficient.

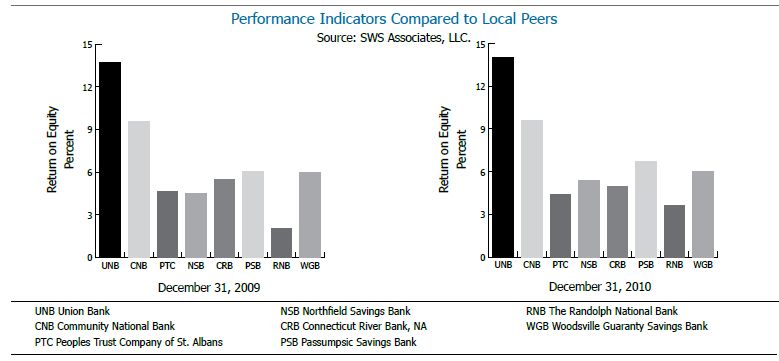

Peer Group Performance

Union Bank has consistently performed ahead of our peer group. The 2010 numbers again bear out our enviable position of financially outperforming our peers. See charts below.

The last few years have been difficult ones for the financial services industry. We believe that our strategy of holding firm to our core values while at the same time embracing technology has proven that a community bank can thrive and prosper even through difficult economic times.

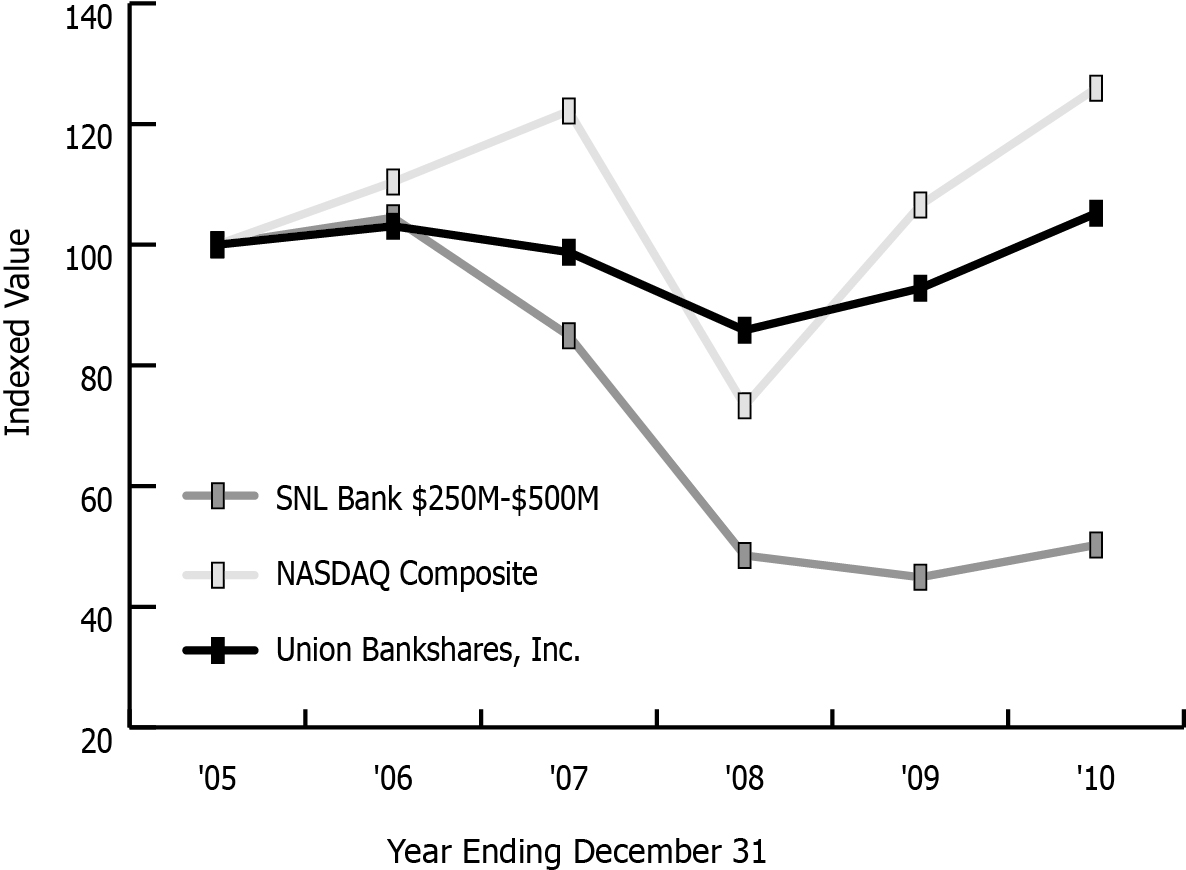

Total Return Performance Source: SNL Financial LC

Union Bankshares, Inc. 2010 Annual Report 4

Expansion into Chittenden County

With the opening of our South Burlington Loan Center in September, the Bank has entered the largest marketplace in Vermont: Chittenden County. The new Loan Center currently specializes in residential lending and offers a variety of personal lending options, including both fixed and adjustable rate mortgages; portfolio, construction, renovation or addition loans; energy efficiency loans; and loans for land purchases.

Union Bank's history is built upon traditional values, and we continue to maintain those values in our approach to community and customer service at the Loan Center. We believe the Loan Center's Team-with its overall experience, knowledge and leadership-will provide a reliable resource for residential lending in Chittenden County.

Edward L. Levite is the Loan Center Manager and Senior Loan Originator. Ed's primary responsibilities are to originate residential loans, manage day-to-day office activities and establish Union Bank as the preferred residential mortgage lender in Chittenden County. Ed comes to Union with extensive lending experience, most recently as vice president of a multi-location residential mortgage operation. He also brings extensive loan office management experience and a strong history of building relationships with referral sources and vendors.

The Center has three Senior Mortgage Loan Originators: Brenda Farrell, Stephen M. Laquerre and our most recent addition, Sue Ryan. These three are primarily responsible for working with borrowers as they apply for residential and up-to-four-family home loans, from taking in a loan application through the disbursal of funds.

Completing the team is Jessica Eastman, Senior Mortgage Specialist/Underwriter. Jessica provides support to the loan originators, underwrites and closes mortgage loans. She has worked as a senior mortgage specialist, underwriter, direct endorsement underwriter, processor and loan closer for the past eight years in the Chittenden County area.

The Loan Center staff brings a wealth of experience in both Federal Housing Administration (FHA) and Veterans Administration (VA) lending. Union Bank has been approved to offer these loans across our entire footprint. We are currently working with our loan officers and loan assistants providing the necessary training for taking in and underwriting these loans. Soon we will offer all our customers the greater flexibility in refinancing and purchasing that the FHA loans bring. We are proud to bring eligible veterans throughout northern Vermont and New Hampshire very favorable financing terms with the addition of the VA loans.

Having these loans in our product line is one more way we are acting on our commitment to helping people in our communities buy homes.

Welcome to the Asset Management Group

Although the Trust Department is changing its name to Union Bank Asset Management Group to better reflect the array of services offered, it is still comprised of the same highly skilled staff members who are well versed in the legal and financial responsibilities associated with their fiduciary roles. Peter Eley, Managing Trust Officer, and Deb Partlow, Senior Trust Officer, work out of the Morrisville office, though any day could find them working with clients throughout northern Vermont and New Hampshire. Lura Jacques, Trust Officer, works out of our St. Albans office and takes care of clients in the surrounding neighborhoods. Local and accessible, our Asset Management advisors provide our communities with the best possible investment management and trust services.

The strength of these advisors is in the depth of the relationship they build with their clients. A relationship that is backed by their expertise and coupled with the confidence we have in our partner Granite Investment Advisors. Granite is an independent, employee owned investment advisory firm that manages our clients' equity and balanced investment portfolios. Founded in 1983, Granite Investment Advisors had 300+ clients and $527 million in assets under management on December 31, 2010.

The Asset Management Group's philosophy is to preserve, and ultimately grow, the purchasing power of assets under their management. The team provides prompt, personal service with professionalism by bringing quiet, rational discussions to bear. The portfolios are individually tailored with no employment of “common or proprietary funds.” The decision to purchase or sell individual securities is driven by the needs of the portfolio.

We will continue providing individualized services to our clients and making Asset Management available to people throughout northern Vermont and northwestern New Hampshire. We have purposefully kept our initial investment-level low in order to serve what we feel is a large and worthwhile demographic throughout our region, who are interested in protecting their wealth, an unbiased approach to investment selection, personal trusts, retirement strategies, estate services as well as commercial services.

Union Bankshares, Inc. 2010 Annual Report 5

CORE VALUES

A business' choice of core values and its resolve to live by those same values form its character and reputation. Core values are the underpinnings of our relationships-how we conduct business, how we interact with each other as a team, our customers and our shareholders. What the past few years have more than proven within the financial industry is that those values are the guidepost for professional judgments and choices, and variance causes serious repercussions.

At Union Bank we believe that our commitment to traditional values has saved us from much of the pain many larger financial institutions have felt and are still feeling. Though the mistakes of others have tarnished the industry's reputation, our values have served as a solid guide for decision-making and kept us strong. We want to take a moment to address what we see are our three core values-integrity, social responsibility and customer relationships-and how they have proven essential to our character and stability.

Integrity

Integrity is essential to a community bank; it is the basis for trust. Without it, it is difficult to imagine anyone entrusting us with one of their most precious resources-their money-be they customer or shareholder. Union Bank believes that our consistent and vigilant commitment to integrity has shaped and strengthened our reputation and continually earns us more business. We strive to practice integrity and excellence during every interaction with both current and future clients. That is the foundation of our reputation for honesty, fairness and expertise.

Integrity is essential to effectiveness internally as well. Union Bank associates are committed to practicing integrity throughout daily interactions and activities. Our average employee tenure (10 years) illustrates a work environment that only comes with trust. Integrity is integral to maintaining the responsible and committed leadership and effective management team we are fortunate to have. Integrity allows people to communicate fairly, learn from each other and form a highly functioning team bent for success.

Practicing integrity is how we earn the trust of our stakeholders and is essential to our long-term success. You can count on a person of integrity to do what they think is right. Everyone wants people of integrity on their team, and we want our customers and our shareholders to know that a commitment to honesty and integrity is basic to how Union Bank defines itself.

Social Responsibility

Corporate social responsibility isn't just one thing; it is comprised of a variety of actions and decisions that reflect a commitment to making a difference. A business that accepts responsibility is also perceived as being reliable, dependable and its employees are willing to be accountable for who they are and what they do. In short, they care and are recognized as an integral part of the community.

Healthy, thriving community economies and infrastructure are essential to our business and our own success. Union Bank believes that being a local bank means setting the bar for good corporate citizenship. The Bank as a business works in partnership with many community organizations by

Union Bank believes that being a local bank necessarily means commitment to being a good corporate citizen. The Bank as a business works in partnership with many community organizations annually.

Union Bankshares, Inc. 2010 Annual Report 6

contributing cash, services and in-kind goods. Our employees give countless hours of their expertise and time.

We also promote public interest by encouraging community growth and development. Our recognition as Outstanding for our Community Reinvestment for the past 15 years underscores this.

Reinvesting in Our Communities

The Community Reinvestment Act (CRA) of 1977 encourages banks to help meet their local communities' credit needs, and evaluates banks community development lending.

We are one of the few Vermont banks to have received an 'Outstanding' CRA rating for the past 15 years, and that is a testament to our Company's investment in the successes of the communities we serve.

Union Bank also works to support our environment. We encourage customers and staff to use "green" practices-such as Online Banking, E Statements and virtua!-which help us all use fewer natural resources in our homes and in our businesses. We also encourage and fund energy improvements with our lending program, Greenlend™.

Strong Customer Relationships

Since we started operations in 1891, our customers' financial needs have been and still are a top priority. Strong, loyal, customer relationships are the cornerstone of our success. Long-lasting relationships with satisfied customers mean return customers and referrals, and a growth-oriented future for the Bank.

Our strategy is simple: we offer quality products and excellent customer service. Our customers come to us because they have trust in us and they believe in our expertise. We work hard to keep our products in tune with the needs of our customers, listening to what they need. What better way is there to show the value that we place on our relationships?

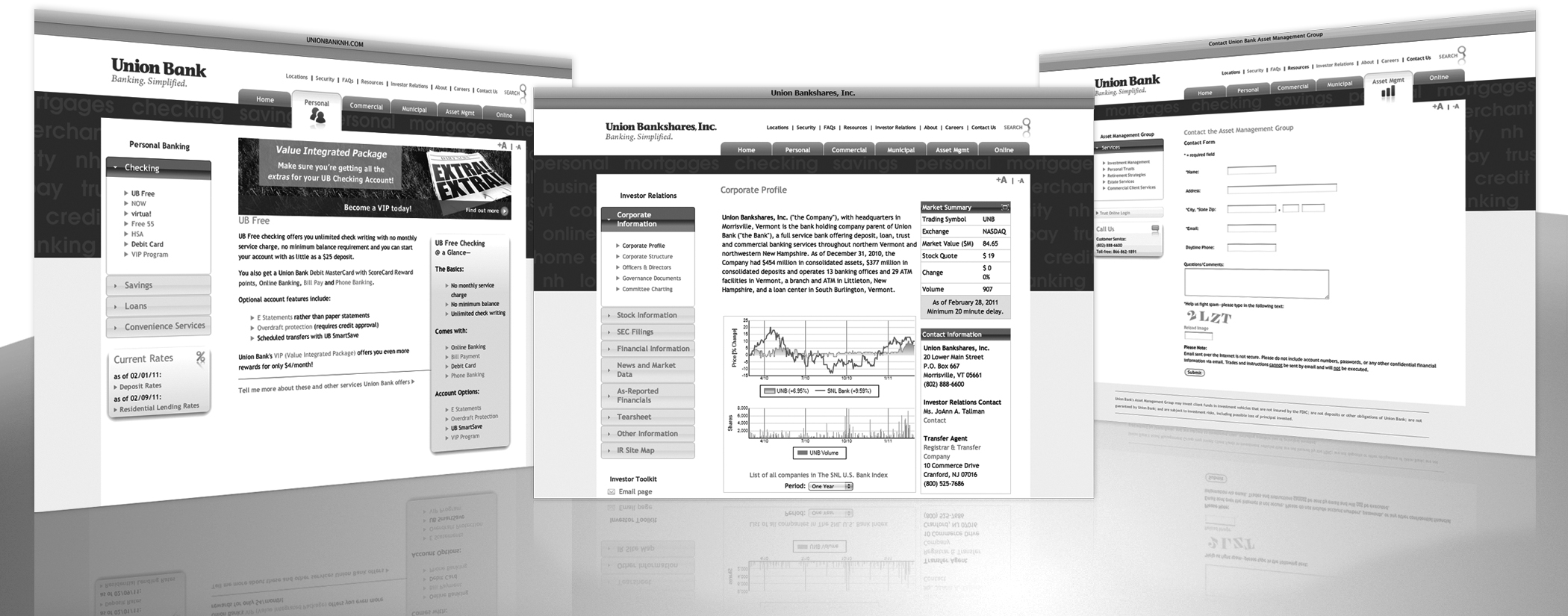

We also know that our relationships are not limited to our customers' experiences within the branch. Our commitment to revisiting our website this year was made in recognition of the increased emphasis on electronic banking capabilities. For many customers today, trust starts with the first encounter, which is often online. Whether it is in the branch or on the website, we work to make every interaction with our customers as simple and clear as possible.

We believe our new website is a solid step forward to establishing our credibility as a tech-savvy bank that strives to be straight forward and easy to access. We endeavor to offer real value through information, products and services.

We are a bank that actually lends. At the end of 2010, our loan portfolio totaled $382 million, and we were servicing an additional $166 million in sold residential loans. We offer a full array of residential loans, including secondary market mortgages, FHA and VA loans.

Union Bankshares, Inc. 2010 Annual Report 7

SIGNIFICANT DECISIONS AFFECTING 2011 & BEYOND

Changes in Leadership

On November 3, 2010 both the Boards of the Company and the Bank unanimously selected David S. Silverman, Senior Vice President of the Bank and Vice President of the Company, as successor to President and Chief Executive Officer Kenneth D. Gibbons. The Bankshares Board also appointed Mr. Silverman as a director of the Bank as of November 17, 2010.

In accordance with the management succession plan adopted by the Board last July, Mr. Silverman will become President of both companies on April 1, 2011, and CEO in May 2012. Mr. Gibons will become Board Chair upon the retirement of the current Board Chair, Richard C. Sargent, at the annual meeting of shareholders May 18, 2011, and will remain as CEO during the management transition year of May 2011 to May 2012. Mr. Silverman will stand for election to the Company's Board of Directors at the 2011 annual meeting.

Mr. Silverman began employment with Union Bank in 1986, and over the years has progressed through various departments and positions to his current Bank positions of Senior Vice President (1994), Senior Commercial Lender (1999) and Senior Loan Officer (2008). He has also served as the Bank's Marketing Officer for many years. He has been Vice President of the Company since 2008.

Mr. Silverman moved with his family from Huntington, NY, to Essex, VT, in 1969, where he attended the Essex school system through high school graduation. Mr. Silverman holds a BA in Business Management from Johnson State College.

Mr. Silverman is very active within the community, currently serving as Board Chair of Copley Professional Services Group d/b/a Community Health Services of Lamoille Valley, a non-profit primary health care organization. He has also held the positions of Treasurer and Executive Committee Member of the Stowe Area Association, Member of the Morristown/ Morrisville Development Review Board, Commissioner of the Town of Hardwick Electric Department and served on the Board of Directors of Lamoille County Mental Health. He has also volunteered as an Umpire for the Little League and Babe Ruth Baseball in Lamoille County for several years.

Both the Boards and Senior Management are confident that Mr. Silverman's strong leadership qualities, skills and insights will help to ensure continuity and a smooth transaction.

Website Improvements

In today's world of finance, a bank's website functions as an electronic branch for customers and shareholders. Not only does it serve to introduce a bank to new customers, it is a critical interaction point for current customers and a location for conducting banking business. We are pleased to have recently launched our much improved Union Bank website.

Especially noteworthy is the introduction of Investors Relations pages. Here you will find corporate and stock information, SEC filings, financials, corporate news and market data, and other relevant financial information. We encourage you to visit the site at www.unionbankvt.com.

The web makes execution of banking tasks and access to our services easier for customers. Growing ever more dependent of electronic banking, our customers visited the Online Banking area of the site 15,500 times in the first week of launch. This way of conducting secure transactions brings a tremendous amount of efficiency to the Bank.

The new site is a better reflection of the Union Bank way of doing business. Simple, clear navigation complements essential information, creating a useful and practical banking tool.

Union Bankshares, Inc. 2010 Annual Report 8

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM REPORT

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders

Union Bankshares, Inc. and Subsidiary

We have audited the accompanying consolidated balance sheets of Union Bankshares, Inc. and Subsidiary (the Company) as of December 31, 2010 and 2009, and the related consolidated statements of income, changes in stockholders’ equity, and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Union Bankshares, Inc. and Subsidiary as of December 31, 2010 and 2009, and the consolidated results of their operations and their consolidated cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Portland, Maine

March 28, 2011

Vermont Registration No. 92-0000278

Union Bankshares, Inc. 2010 Annual Report 9

UNION BANKSHARES, INC. AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

December 31, 2010 and 2009

2010 | 2009 | |||||

ASSETS | ||||||

Cash and due from banks | $5,447,386 | $ | 4,941,612 | |||

Federal funds sold and overnight deposits | 8,844,889 | 17,190,525 | ||||

Cash and cash equivalents | 14,292,275 | 22,132,137 | ||||

Interest bearing deposits in banks | 14,041,101 | 22,974,800 | ||||

Investment securities available-for-sale | 23,779,845 | 24,648,589 | ||||

Investment securities held-to-maturity (fair value was $502,205 at December 31, 2010) | 500,000 | — | ||||

Loans held for sale | 5,610,436 | 9,262,352 | ||||

Loans | 376,271,910 | 348,827,116 | ||||

Allowance for loan losses | (3,754,618 | ) | (3,492,783 | ) | ||

Net deferred loan costs | 188,305 | 77,508 | ||||

Net loans | 372,705,597 | 345,411,841 | ||||

Accrued interest receivable | 1,560,322 | 1,634,095 | ||||

Premises and equipment, net | 7,842,281 | 7,613,319 | ||||

Other assets | 13,753,554 | 13,844,963 | ||||

Total assets | $ | 454,085,411 | $ | 447,522,096 | ||

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||

LIABILITIES | ||||||

Deposits | ||||||

Noninterest bearing | $ | 64,526,154 | $ | 60,128,845 | ||

Interest bearing | 312,134,328 | 308,698,292 | ||||

Total deposits | 376,660,482 | 368,827,137 | ||||

Borrowed funds | 28,985,907 | 30,992,604 | ||||

Liability for defined benefit pension plan | 3,541,612 | 3,048,318 | ||||

Accrued interest and other liabilities | 3,172,736 | 3,474,427 | ||||

Total liabilities | 412,360,737 | 406,342,486 | ||||

COMMITMENTS AND CONTINGENCIES (Notes 8, 14, 15, 16, 17 and 20) | ||||||

STOCKHOLDERS' EQUITY | ||||||

Common stock, $2.00 par value; 7,500,000 shares authorized; 4,921,786 shares issued at December 31, 2010 and 2009 | 9,843,572 | 9,843,572 | ||||

Additional-paid-in capital | 244,363 | 219,331 | ||||

Retained earnings | 37,622,575 | 36,494,110 | ||||

Treasury stock at cost; 466,082 and 460,578 shares at December 31, 2010 and 2009, respectively | (3,822,838 | ) | (3,724,326 | ) | ||

Accumulated other comprehensive loss | (2,162,998 | ) | (1,653,077 | ) | ||

Total stockholders' equity | 41,724,674 | 41,179,610 | ||||

Total liabilities and stockholders' equity | $ | 454,085,411 | $ | 447,522,096 | ||

See accompanying notes to consolidated financial statements.

Union Bankshares, Inc. 2010 Annual Report 10

UNION BANKSHARES, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF INCOME

Years Ended December 31, 2010 and 2009

2010 | 2009 | |||||

Interest income | ||||||

Interest and fees on loans | $ | 21,462,581 | $ | 21,558,734 | ||

Interest on debt securities: | ||||||

Taxable | 709,770 | 842,906 | ||||

Tax exempt | 297,975 | 302,560 | ||||

Dividends | 3,845 | 3,162 | ||||

Interest on federal funds sold and overnight deposits | 21,848 | 24,951 | ||||

Interest on interest bearing deposits in banks | 411,216 | 484,274 | ||||

Total interest income | 22,907,235 | 23,216,587 | ||||

Interest expense | ||||||

Interest on deposits | 2,977,065 | 4,117,568 | ||||

Interest on short-term borrowed funds | 17,814 | 693 | ||||

Interest on long-term debt | 1,122,367 | 1,175,949 | ||||

Total interest expense | 4,117,246 | 5,294,210 | ||||

Net interest income | 18,789,989 | 17,922,377 | ||||

Provision for loan losses | 520,000 | 400,000 | ||||

Net interest income after provision for loan losses | 18,269,989 | 17,522,377 | ||||

Noninterest income | ||||||

Trust income | 481,301 | 379,042 | ||||

Service fees | 4,027,893 | 3,600,094 | ||||

Net gains on sales of investment securities available-for-sale | 97,956 | 257,546 | ||||

Net gains on sales of loans held for sale | 1,029,720 | 969,541 | ||||

Other income | 297,380 | 315,084 | ||||

Total noninterest income | 5,934,250 | 5,521,307 | ||||

Noninterest expenses | ||||||

Salaries and wages | 6,558,759 | 6,097,064 | ||||

Pension and other employee benefits | 2,828,401 | 2,923,803 | ||||

Occupancy expense, net | 937,040 | 956,966 | ||||

Equipment expense | 1,056,687 | 1,109,626 | ||||

ATM and debit card expense | 446,689 | 251,569 | ||||

Vermont franchise tax | 414,263 | 396,549 | ||||

FDIC insurance assessment | 498,612 | 684,085 | ||||

Expenses of other real estate owned, net | 241,481 | 280,954 | ||||

Fees paid to sell loans in secondary market | 293,654 | 272,467 | ||||

Equity in losses of limited partnerships | 425,970 | 425,970 | ||||

Other expenses | 3,213,189 | 2,998,120 | ||||

Total noninterest expenses | 16,914,745 | 16,397,173 | ||||

Income before provision for income taxes | 7,289,494 | 6,646,511 | ||||

Provision for income taxes | 1,702,707 | 1,419,943 | ||||

Net income | $ | 5,586,787 | $ | 5,226,568 | ||

Earnings per common share | $ | 1.25 | $ | 1.17 | ||

Dividends per common share | $ | 1.00 | $ | 1.00 | ||

See accompanying notes to consolidated financial statements.

Union Bankshares, Inc. 2010 Annual Report 11

UNION BANKSHARES, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

Years Ended December 31, 2010 and 2009

Common Stock | |||||||||||||||||||||

Shares, net of treasury | Amount | Additional paid-in capital | Retained earnings | Treasury stock | Accumulated other comprehensive loss | Total stockholders' equity | |||||||||||||||

Balances, December 31, 2008 | 4,474,598 | $ | 9,843,572 | $ | 207,683 | $ | 35,868,916 | $ | (3,500,504 | ) | $ | (3,269,584 | ) | $ | 39,150,083 | ||||||

Comprehensive income: | |||||||||||||||||||||

Net income | — | — | — | 5,226,568 | — | — | 5,226,568 | ||||||||||||||

Other comprehensive income, net of tax: | |||||||||||||||||||||

Change in net unrealized loss on investment securities available-for-sale, net of reclassification adjustment and tax effects | — | — | — | — | — | 447,285 | 447,285 | ||||||||||||||

Change in net unrealized loss on unfunded defined benefit pension plan liability, net of reclassification adjustment and tax effects | — | — | — | — | — | 1,169,222 | 1,169,222 | ||||||||||||||

Total other comprehensive income | 1,616,507 | ||||||||||||||||||||

Total comprehensive income | 6,843,075 | ||||||||||||||||||||

Cash dividends declared | — | — | — | (4,601,374 | ) | — | — | (4,601,374 | ) | ||||||||||||

Stock based compensation expense | — | — | 11,648 | — | — | — | 11,648 | ||||||||||||||

Purchase of treasury stock | (13,390 | ) | — | — | — | (223,822 | ) | — | (223,822 | ) | |||||||||||

Balances, December 31, 2009 | 4,461,208 | 9,843,572 | 219,331 | 36,494,110 | (3,724,326 | ) | (1,653,077 | ) | 41,179,610 | ||||||||||||

Comprehensive income: | |||||||||||||||||||||

Net income | — | — | — | 5,586,787 | — | — | 5,586,787 | ||||||||||||||

Other comprehensive loss, net of tax: | |||||||||||||||||||||

Change in net unrealized gain on investment securities available-for-sale, net of reclassification adjustment and tax effects | — | — | — | — | — | (184,345 | ) | (184,345 | ) | ||||||||||||

Change in net unrealized loss on unfunded defined benefit pension plan liability, net of reclassification adjustment and tax effects | — | — | — | — | — | (325,576 | ) | (325,576 | ) | ||||||||||||

Total other comprehensive loss | (509,921 | ) | |||||||||||||||||||

Total comprehensive income | 5,076,866 | ||||||||||||||||||||

Cash dividends declared | — | — | — | (4,458,322 | ) | — | — | (4,458,322 | ) | ||||||||||||

Stock based compensation expense | — | — | 25,032 | — | — | — | 25,032 | ||||||||||||||

Purchase of treasury stock | (5,504 | ) | — | — | — | (98,512 | ) | — | (98,512 | ) | |||||||||||

Balances, December 31, 2010 | 4,455,704 | $ | 9,843,572 | $ | 244,363 | $ | 37,622,575 | $ | (3,822,838 | ) | $ | (2,162,998 | ) | $ | 41,724,674 | ||||||

See accompanying notes to consolidated financial statements.

Union Bankshares, Inc. 2010 Annual Report 12

UNION BANKSHARES, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

j

Years Ended December 31, 2010 and 2009

2010 | 2009 | |||||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

Net income | $ | 5,586,787 | $ | 5,226,568 | ||

Adjustments to reconcile net income to net cash provided by (used in) operating activities: | ||||||

Depreciation | 660,381 | 713,659 | ||||

Provision for loan losses | 520,000 | 400,000 | ||||

Deferred income tax benefit | (95,737 | ) | (11,415 | ) | ||

Net amortization of investment securities | 25,144 | 6,359 | ||||

Net gains on sales of investment securities available-for-sale | (97,956 | ) | (257,546 | ) | ||

Equity in losses of limited partnerships | 425,970 | 425,970 | ||||

Stock based compensation expense | 25,032 | 11,648 | ||||

Net gains on sales of loans held for sale | (1,029,720 | ) | (969,541 | ) | ||

Net losses on disposals of premises and equipment | 6,347 | 31,041 | ||||

Net (gains) losses on sales of other real estate owned | (37,760 | ) | 9,928 | |||

Write-down of impaired assets | 8,652 | 93,075 | ||||

Net increase in unearned loan costs | (110,797 | ) | (183,983 | ) | ||

Proceeds from sales of loans held for sale | 53,692,584 | 61,400,565 | ||||

Origination of loans held for sale | (49,010,948 | ) | (66,514,974 | ) | ||

Decrease in accrued interest receivable | 73,773 | 304,468 | ||||

Amortization (prepayment) of FDIC insurance assessment | 447,684 | (1,803,863 | ) | |||

Decrease (increase) in other assets | 289,896 | (1,063,133 | ) | |||

Contribution to defined benefit pension plan | (1,250,000 | ) | (2,106,963 | ) | ||

Increase in other liabilities | 1,127,726 | 1,427,306 | ||||

Net cash provided by (used in) operating activities | 11,257,058 | (2,860,831 | ) | |||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

Interest bearing deposits in banks | ||||||

Proceeds from maturities and redemptions | 18,543,000 | 17,170,000 | ||||

Purchases | (9,609,301 | ) | (25,355,627 | ) | ||

Investment securities available-for-sale | ||||||

Proceeds from sales | 1,097,654 | 4,499,013 | ||||

Proceeds from maturities, calls and paydowns | 11,744,969 | 6,091,699 | ||||

Purchases | (12,180,377 | ) | (6,476,025 | ) | ||

Investment securities held-to-maturity | ||||||

Proceeds from maturities, calls and paydowns | 1,500,000 | — | ||||

Purchases | (2,000,000 | ) | — | |||

Net (increase) decrease in loans | (28,894,859 | ) | 305,889 | |||

Recoveries of loans charged off | 57,484 | 59,873 | ||||

Investments in limited partnerships | (179,420 | ) | (193,620 | ) | ||

Purchase of premises and equipment | (895,690 | ) | (897,326 | ) | ||

Proceeds from sales of other real estate owned | 421,876 | 228,848 | ||||

Proceeds from sales of repossessed property | 27,930 | 21,981 | ||||

Net cash used in investing activities | (20,366,734 | ) | (4,545,295 | ) | ||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

Advances of long-term debt | 2,977,500 | — | ||||

Repayment of long-term debt | (1,544,197 | ) | (1,863,658 | ) | ||

Net (decrease) increase in short-term borrowings outstanding | (3,440,000 | ) | 5,440,000 | |||

Net increase (decrease) in noninterest bearing deposits | 4,397,309 | (1,185,814 | ) | |||

Net increase in interest bearing deposits | 3,436,036 | 5,643,223 | ||||

Purchase of treasury stock | (98,512 | ) | (223,822 | ) | ||

Dividends paid | (4,458,322 | ) | (4,601,374 | ) | ||

Net cash provided by financing activities | 1,269,814 | 3,208,555 | ||||

Net decrease in cash and cash equivalents | (7,839,862 | ) | (4,197,571 | ) | ||

CASH AND CASH EQUIVALENTS: | ||||||

Beginning of year | 22,132,137 | 26,329,708 | ||||

End of year | $ | 14,292,275 | $ | 22,132,137 | ||

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | ||||||

Interest paid | $ | 4,284,578 | $ | 5,526,446 | ||

Income taxes paid | $ | 1,605,000 | $ | 1,245,000 | ||

SUPPLEMENTAL SCHEDULE OF NONCASH INVESTING AND FINANCING ACTIVITIES | ||||||

Other real estate acquired in settlement of loans | $ | 1,483,931 | $ | 1,093,229 | ||

Other assets acquired in settlement of loans | $ | 26,335 | $ | 21,500 | ||

Loans originated to finance the sale of other real estate owned | $ | 375,850 | $ | 533,157 | ||

See accompanying notes to consolidated financial statements.

Union Bankshares, Inc. 2010 Annual Report 13

UNION BANKSHARES, INC. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Significant Accounting Policies

Basis of financial statement presentation

The accounting and reporting policies of Union Bankshares, Inc. and Subsidiary (the “Company”) are in conformity with U. S. generally accepted accounting principles (“GAAP”) and general practices within the banking industry. The following is a description of the more significant policies.

The consolidated financial statements include the accounts of Union Bankshares, Inc., and its wholly owned subsidiary, Union Bank (“Union”) headquartered in Morrisville, Vermont. All significant intercompany transactions and balances have been eliminated. The Company utilizes the accrual method of accounting for financial reporting purposes.

The Company meets the qualification requirements under Securities and Exchange Commission (“SEC”) rules for smaller reporting companies and, pursuant to such rules, has elected to present audited statements of income, cash flows and changes in stockholders' equity for each of the most recent two fiscal years.

Certain amounts in the 2009 financial statements have been reclassified to conform to the current year presentation.

Nature of operations

The Company provides a variety of financial services to individuals, municipalities, commercial and nonprofit customers through its branches, ATMs, telebanking and internet banking systems in northern Vermont and northwestern New Hampshire. This market area encompasses primarily retail consumers, small businesses, municipalities, agricultural producers and the tourism industry. The Company's primary deposit products are checking, savings, money market accounts, certificates of deposit and individual retirement accounts and its primary lending products are commercial, real estate, municipal and consumer loans.

Concentration of risk

The Company's operations are affected by various risk factors, including interest rate risk, credit risk, and risk from geographic concentration of its deposit taking and lending activities. Management attempts to manage interest rate risk through various asset/liability management techniques designed to match maturities/repricing of assets and liabilities. Loan policies and administration are designed to provide assurance that loans will only be granted to creditworthy borrowers, although credit losses are expected to occur because of subjective factors and factors beyond the control of the Company. Although national economic conditions have been volatile during the last twenty seven months, local economic conditions have been somewhat more stable. The Company has a diversified loan portfolio with a substantial portion of the Company's loans secured by real estate and/or partially guaranteed by a U. S. Government agency. Most of its lending activities are conducted within the northern Vermont and northwestern New Hampshire market area where it is located. As a result, the Company and its borrowers may be especially vulnerable to the consequences of changes in the local economy and real estate market conditions. Notes 5 and 6 discuss the types of lending in which the Company engages.

Use of estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates. Material estimates that are particularly susceptible to significant change in the near term and involve inherent uncertainties relate to the determination of the allowance for losses on loans, the valuation of real estate acquired in connection with foreclosures or in satisfaction of loans, deferred tax assets, judgments regarding valuation and impairment of investment securities and other assets and pension plan accounting. These estimates involve a significant degree of complexity and subjectivity and the amount of the change that is reasonably possible, should any of these estimates prove inaccurate, cannot be estimated.

Union Bankshares, Inc. 2010 Annual Report 14

Presentation of cash flows

For purposes of presentation in the consolidated statements of cash flows, Cash and cash equivalents includes cash on hand, amounts due from banks (including cash items in process of clearing), Federal funds sold (generally purchased and sold for one day periods) and overnight deposits.

Trust operations

Assets held by the Trust & Asset Management Division of Union in a fiduciary or agency capacity, other than trust cash on deposit with Union, are not included in these consolidated financial statements because they are not assets of Union or the Company.

Fair value measurements

The Company utilizes the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures, as guidance for accounting for assets and liabilities carried at fair value. This standard defines fair value as the price that would be received, without adjustment for transaction costs, to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value is a market based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. The guidance in FASB ASC Topic 820 establishes a three-level fair value hierarchy, which prioritizes the inputs used in measuring fair value. A financial instrument's level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement.

The three levels of the fair value hierarchy are:

• | Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities; |

• | Level 2 - Quoted prices for similar assets or liabilities in active markets, quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; |

• | Level 3 - Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity). |

Investment securities

Investment securities purchased and held primarily for resale in the near future are classified as trading securities and are reported at fair value with unrealized gains and losses included in earnings. Debt securities the Company has the positive intent and ability to hold to maturity are classified as held-to-maturity and reported at amortized cost. Debt and equity securities not classified as either held-to-maturity or trading are classified as available-for-sale. Investments classified as available-for-sale are reported at fair value.

Accretion of discounts and amortization of premiums arising at acquisition on investment securities are included in income using the effective interest method over the life of the securities to maturity or call date. Unrealized gains and losses on investment securities available-for-sale are excluded from earnings and reported in Accumulated other comprehensive income (loss), net of tax and reclassification adjustment, as a separate component of stockholders' equity. The specific identification method is used to determine realized gains and losses on sales of available-for-sale or trading securities.

An unrealized loss is generally deemed to be other-than-temporary and a credit loss on a debt security is deemed to exist if the present value of the expected future cash flows is less than the amortized cost basis of the security. The credit loss component of an other-than-temporary write down is reflected in earnings as realized losses in other income. The remaining portion of the impairment loss is recognized in other comprehensive income, provided the Company does not intend to sell the underlying debt security and it is “more likely than not” that the Company will not have to sell the debt security prior to recovery.

Union Bankshares, Inc. 2010 Annual Report 15

Management considers the following factors in determining whether an other-than-temporary impairment exists and the period over which the debt security is expected to recover:

• | The length of time, and extent to which, the fair value has been less than the amortized cost; |

• | Adverse conditions specifically related to the security, issuer, industry, or geographic area; |

• | The historical and implied volatility of the fair value of the security; |

• | The payment structure of the debt security and the likelihood of the issuer being able to make payments that may increase in the future; |

• | Failure of the issuer of the security to make scheduled interest or principal payments; |

• | Any changes to the rating of the security by a rating agency; and |

• | Recoveries or additional declines in fair value subsequent to the balance sheet date. |

Loans held for sale

Loans originated and intended for sale in the secondary market are carried at the lower of cost or estimated fair value in the aggregate. Loans transferred from held for sale to portfolio are transferred at the lower of cost or fair value in the aggregate. Sales are normally made without recourse. Gains and losses on the disposition of loans held for sale are determined on the specific identification basis. Net unrealized losses are recognized through a valuation allowance by charges to income.

Loans

Loans receivable that management has the intent and ability to hold for the foreseeable future or until maturity or payoff are reported at their unpaid principal balances, adjusted for any charge-offs, the allowance for loan losses, and any deferred fees or costs on originated loans and unamortized premiums or discounts on purchased loans.

Loan interest income is accrued daily on outstanding balances. The accrual of interest is discontinued when a loan is specifically determined to be impaired and/or management believes, after considering collection efforts and other factors, that the borrowers' financial condition is such that collection of interest is doubtful. Normally, any unpaid interest previously accrued on those loans is reversed against interest income. A loan may be restored to accrual status when its financial status has significantly improved and there is no principal or interest past due. A loan may also be restored to accrual status if the borrower makes six consecutive monthly payments or the lump sum equivalent. Income on nonaccrual loans is generally not recognized unless a loan is placed back in accrual status or after all principal has been collected. Interest income generally is not recognized on impaired loans unless the likelihood of further loss is remote. Interest payments received on such loans are generally applied as a reduction of the loan principal balance. Delinquency status is determined based on contractual terms.

Loan origination, commitment fees and direct loan origination costs are deferred and amortized as an adjustment of the related loan's yield using methods that approximate the interest method. The Company generally amortizes these amounts over the contractual life of the related loans.

Allowance for loan losses

The allowance for loan losses is established for estimated losses in the loan portfolio through a provision for loan losses charged to earnings. Loan losses are charged against the allowance when management believes the loan balance is uncollectible or in accordance with federal guidelines. Subsequent recoveries, if any, are credited to the allowance.

The allowance for loan losses is maintained at a level believed by management to be appropriate to absorb probable credit losses inherent in the loan portfolio as of the balance sheet date. The amount of the allowance is based on management's periodic evaluation of the collectability of the loan portfolio, including the nature, volume and risk characteristics of the portfolio, credit concentrations, trends in historical loss experience, estimated value of any underlying collateral, specific impaired loans and economic conditions. While management uses available information to recognize losses on loans, future additions to the allowance for loan losses may be necessary based on changes in economic conditions or other relevant factors.

Union Bankshares, Inc. 2010 Annual Report 16

In addition, various regulatory agencies, as an integral part of their examination process, regularly review the Company's allowance for loan losses. Such agencies may require the Company to recognize additions to the allowance for loan losses based on their judgments about information available to them at the time of their examination, which may not be currently available to management.

The allowance consists of specific, general and unallocated components. The specific component relates to the loans that are classified as either monitor, substandard or special mention. For such loans, the level of allowance allocable to those loans is determined through estimating probable loss for each individual credit based on its specific risk attributes. Loans are also evaluated for impairment and may be classified as impaired when management believes it is probable that the Company will not collect all the contractual interest and principal payments as scheduled in the loan agreement. Impaired loans may also include troubled loans that are restructured. A troubled debt restructuring occurs when the Company, for economic or legal reasons related to the borrower's financial difficulties, grants a concession to the borrower that would otherwise not be granted. Troubled debt restructurings may include the transfer of assets to the Company in partial satisfaction of a troubled loan, a modification of a loan's terms, or a combination of the two. Large groups of smaller balance homogeneous loans are collectively evaluated for impairment. Accordingly, the Company does not separately identify individual consumer, residential or small balance commercial loans for

impairment evaluation, unless such loans are subject to a restructuring agreement or have been identified as impaired as part of a larger customer relationship. A specific reserve amount is allocated to the allowance for individual loans that have been classified as impaired on the basis of the fair value of the collateral for collateral dependent loans, an observable market price, or the present value of anticipated future cash flows. The general component represents the level of allowance allocable to each loan portfolio category with similar risk characteristics and is determined based on historical loss experience, adjusted for qualitative factors. Qualitative factors considered include underwriting, economic and market conditions, portfolio composition, collateral values, delinquencies, lender experience and legal issues. An unallocated component is maintained to cover uncertainties that could affect management's estimate of probable losses. The unallocated component of the allowance reflects the margin of imprecision inherent in the underlying assumptions used in the methodologies for estimating specific and general losses in the portfolio.

All evaluations are inherently subjective as they require estimates that are susceptible to significant revision as more information becomes available or as changes occur in economic conditions or other relevant factors.

Other real estate owned

Real estate properties acquired through or in lieu of loan foreclosure are to be sold and are initially recorded at the estimated fair value at the date of acquisition establishing a new carrying basis. Thereafter, valuations are periodically performed by management, and the real estate is carried in Other assets at the lower of carrying amount or fair value, less estimated cost to sell. Revenue and expenses from operations and changes in valuation are included in Expenses of other real estate owned, net.

Premises and equipment

Premises and equipment are stated at cost, less accumulated depreciation. Depreciation is computed principally by the straight line method over the estimated useful lives of the assets. The cost of assets sold or otherwise disposed of and the related accumulated depreciation are eliminated from the accounts and the resulting gains or losses are reflected in the statement of income. Maintenance and repairs are charged to current expense as incurred and the costs of major renewals and betterments are capitalized. Construction in progress is stated at cost, which includes the cost of construction and other direct costs attributable to the construction. No provision for depreciation is made on construction in progress until such time as the relevant assets are completed and put into use.

Federal Home Loan Bank stock

As a member of the Federal Home Loan Bank (“FHLB”) of Boston, Union is required to invest in Class B common stock of the FHLB of Boston. The Class B common stock has a five year notice requirement for redemption and there is no guarantee of future redemption. Also, there is the possibility of future capital calls by the FHLB of Boston on member

Union Bankshares, Inc. 2010 Annual Report 17

banks to ensure compliance with its capital plan. FHLB of Boston stock is reported in Other assets at its par value of $1,922,000 at December 31, 2010 and 2009. The stock is nonmarketable, and is redeemable by the FHLB of Boston at par value.

Company-owned life insurance

Company-owned life insurance (“COLI”) represents life insurance on the lives of certain current or former directors or employees who have provided positive consent allowing the Company to be the beneficiary of such policies. The Company utilizes COLI as tax-efficient funding for the benefit obligations to its employees and directors, including obligations under one of the Company's nonqualified deferred compensation plans. See Note 14. The Company is the primary beneficiary of the insurance policies. Increases in the cash value of the policies, as well as any gain on insurance proceeds received, are recorded in Other income, and are not currently subject to income taxes. COLI is recorded at the cash value of the policies, less any applicable cash surrender charges of which there are currently none. The COLI is reflected as an Other asset in the accompanying consolidated balance sheets. The Company reviews the financial strength of the insurance carriers prior to the purchase of COLI to ensure minimum credit ratings of at least investment grade. The financial strength of the carriers is reviewed annually and COLI with any individual carrier is limited by Company policy to 10% of capital plus reserves.

Servicing assets

Servicing assets are recognized as separate assets when rights are acquired through purchase or sale of loans with servicing rights retained. Capitalized servicing rights are reported in Other assets and are amortized against Noninterest income in proportion to, and over the period of, the estimated future net servicing income of the underlying loans. The value of capitalized servicing rights represents the present value of the future servicing fees arising from the right to service loans that have been previously sold. Servicing assets are evaluated regularly for impairment based upon the fair value of the rights as compared to amortized cost. Impairment is determined by stratifying rights by predominant characteristics, such as interest rates and terms. Fair value of a stratum is determined using prices for similar assets with similar characteristics, when available, or based upon discounted cash flows using market-based assumptions.

Impairment is recognized through a valuation allowance for an individual stratum, to the extent that estimated fair value is less than the capitalized amount for the stratum.

Investments carried at equity

The Company has purchased various limited partnership interests in low income housing partnerships. These partnerships were established to acquire, own and rent residential housing for elderly, low or moderate income residents in northeastern and central Vermont. The investments are accounted for under a method approximating the equity method of accounting. These equity investments, which are included in Other assets, are recorded at cost and adjusted for the Company's proportionate share of the partnerships' undistributed earnings or losses.

Pension plans

Union maintains a noncontributory defined benefit pension plan covering all eligible employees who meet certain service requirements. The costs of this plan, based on actuarial computations of current and estimated future benefits for employees, are charged to Pension and other employee benefits as a current operating expense.

Union also has a contributory 401(k) pension plan covering all employees who meet certain service requirements. The plan is voluntary, and Union, through the discretionary matching component of the plan, contributed fifty cents for every dollar contributed by participants, up to six percent of each participant's salary in 2010 and 2009.

Advertising costs

The Company expenses advertising costs as incurred and they were immaterial in 2010 and 2009.

Union Bankshares, Inc. 2010 Annual Report 18

Earnings per common share

Earnings per common share are computed based on the weighted average number of shares of common stock outstanding during the period, retroactively adjusted for stock splits and stock dividends and reduced for shares held in treasury. The weighted average shares outstanding were 4,458,193 and 4,466,760 for the years ended December 31, 2010 and 2009, respectively. There are 15,000 stock options outstanding at December 31, 2010 and 11,500 outstanding at December 31, 2009 excluded from the computation of diluted earnings per share since inclusion of these stock options would be anti-dilutive.

Income taxes

The Company prepares its Federal income tax return on a consolidated basis. Federal income taxes are allocated to members of the consolidated group based on taxable income. The Company recognizes income taxes under the asset and liability method. This involves estimating the Company's actual current tax exposure as well as assessing temporary differences resulting from differing treatment of items, such as timing of the deduction of expenses, for tax and GAAP purposes. These differences result in deferred tax assets and liabilities, which are included in the Company's consolidated balance sheets as Other assets. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The Company must also assess the likelihood that any deferred tax assets will be recovered from future taxable income and to the extent that recovery is not likely, a valuation allowance must be established. Significant management judgment is required in determining the provision for income taxes and deferred tax assets and liabilities. Low income housing tax credits are recognized as a reduction of the Provision for income taxes in the year they are earned.

Off-balance-sheet financial instruments

In the ordinary course of business, the Company is a party to off-balance-sheet financial instruments consisting of commitments to originate credit, unused lines of credit including commitments under credit card arrangements, commitments to purchase investment securities, commitments to invest in low income housing partnerships, commercial letters of credit, standby letters of credit and risk-sharing commitments on certain sold loans. Such financial instruments are recorded in the financial statements when they become fixed and certain.

Comprehensive income (loss)

Accounting principles generally require that recognized revenue, expenses, gains, and losses be included in net income. Although certain changes in assets and liabilities, such as the after tax effect of unrealized gains and losses on investment securities available-for-sale that are not other-than-temporarily impaired and the unfunded liability for the defined benefit pension plan, are not included in the statement of income, the cumulative effect of such items, net of tax effect, is reported as a separate component of the equity section of the balance sheet as Accumulated other comprehensive income (loss). Such items, along with net income, are components of comprehensive income.

Transfers of financial assets

Transfers of financial assets are accounted for as sales when control over the assets has been surrendered. Control over transferred assets is deemed to be surrendered when the assets have been isolated from the Company, the transferee obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets, and the Company does not maintain effective control over the transferred assets through an agreement to repurchase them before their maturity.

Stock option plan

The Company recognizes stock-based compensation expense based on the grant date estimated fair value of stock-based awards over the vesting period of the awards.

Union Bankshares, Inc. 2010 Annual Report 19

Recent accounting pronouncements

In June 2009, FASB issued two related accounting pronouncements changing the accounting principles and disclosure requirements related to securitizations and special-purpose entities. Specifically, these pronouncements eliminate the concept of a "qualifying special-purpose entity", change the requirements for derecognizing financial assets and change how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar) rights should be consolidated. These pronouncements also expand existing disclosure requirements to include more information about transfers of financial assets, including securitization transactions, and where companies have continuing exposure to the risks related to transferred financial assets. These pronouncements were effective as of the beginning of each reporting entity's first annual reporting period that began after November 15, 2009, for interim periods within that first annual reporting period and for interim and annual reporting periods thereafter. The recognition and measurement provisions regarding transfers of financial assets shall be applied to transfers that occur on or after the effective date. These new pronouncements became effective for the Company on January 1, 2010. The adoption of these pronouncements did not have a material effect on the Company's consolidated financial statements.

In January 2010, the FASB issued an Accounting Standards Update (ASU), Fair Value Measurements and Disclosures: Improving Disclosures about Fair Value Measurements, to amend the disclosure requirements and clarify existing requirements related to recurring and nonrecurring fair value measurements and employers' disclosures about postretirement benefit plan assets. The guidance requires new disclosures regarding transfers of assets and liabilities between Level 1 (quoted prices in active market for identical assets or liabilities) and Level 2 (significant other observable inputs) of the fair value measurement hierarchy, including the reasons and the timing of the transfers. Additionally, the guidance requires a rollforward of activities, separately reporting purchases, sales, issuance, and settlements, for assets and liabilities measured using significant unobservable inputs (Level 3 fair value measurements). The new disclosure requirements apply to interim and annual reporting periods beginning after December 15, 2009, except for the new rules regarding purchases, sales, issuances and settlements associated with Level 3 measurements which are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. Other than requiring additional disclosures, adoption of this accounting standard did not have a material effect on the Company's consolidated financial statements. See Notes 14 and 18.

In February 2010, the FASB issued an ASU, Subsequent Events: Amendments to Certain Recognition and Disclosure Requirements, related to events that occur after the balance sheet date but before financial statements are issued. This guidance amends existing standards to address potential conflicts with SEC guidance and refines the scope of the reissuance disclosure requirements to include revised financial statements only. Under this guidance, SEC filers are no longer required to disclose to the date through which subsequent events have been evaluated. The adoption of this update did not have a material effect on the Company's consolidated financial statements. See Note 23.

In July 2010, the FASB issued an ASU, Receivables- Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses, to provide additional information to assist financial statement users in assessing an entity's credit risk exposures and evaluating the adequacy of its allowance for credit losses. The disclosures are required on a disaggregated basis- portfolio segment and class of financing receivable. The new disclosures require an entity to provide credit quality indicators of financing receivables at the end of the reporting period by class, the aging of past due financing receivables at the end of the reporting period by class, the nature and extent of troubled debt restructurings that occurred during the period by class and their effect on the allowance for loan losses, the nature and extent of financing receivables modified as troubled debt restructurings within the previous twelve months that defaulted during the reporting period by class and their effect on the allowance for credit losses, and significant purchases and sales of financing receivables during the reporting period disaggregated by portfolio segment. The ASU also requires an entity to provide disclosures about its financing receivables on a disaggregated basis, including a roll forward schedule of allowance for credit losses for the reporting period on a portfolio segment basis, with the ending balance further disaggregated on the basis of the impairment method and the related recorded investment in financing receivables as well as the nonaccrual and impairment status of financing receivables by class. The new and amended disclosures for public entities as of the end of a reporting period were effective for interim and annual reporting periods ending on or after December 15, 2010. The disclosures about activity that occurs during a reporting period are effective for interim and annual reporting periods beginning on or after December 15, 2010. In January 2011, the FASB issued an ASU,

Union Bankshares, Inc. 2010 Annual Report 20

Deferral of the Effective Date of Disclosures about Troubled Debt Restructuring, for public-entity creditors to temporarily delay the effective date of the disclosures about troubled debt restructurings until the FASB completes its deliberations on what constitutes a troubled debt restructuring. The Company adopted the required portions of the accounting standard as of December 31, 2010 with no material impact on the Company's consolidated financial statements. See Notes 6 and 7 for additional disclosures required under this accounting standard.

Note 2. Restrictions on Cash and Due From Banks

The Company is required to maintain vault cash or noninterest bearing reserve balances with Federal Reserve Bank of Boston. Total reserve balances required at December 31, 2010 and 2009 were $360,000 and $307,000, respectively, which were both satisfied by vault cash.

The nature of the Company's business requires that it maintain amounts due from correspondent banks which, at times, may exceed federally insured limits. The balances in these accounts at December 31, were as follows:

2010 | 2009 | |||||

Noninterest bearing accounts | $ | 1,281,059 | $ | 826,625 | ||

Federal Reserve Bank of Boston | 9,677,784 | 18,039,925 | ||||

FHLB of Boston | 322,317 | 191,983 | ||||

No losses have been experienced in these accounts and the Company believes it is not exposed to any significant risk with respect to the accounts.

The Company was required to maintain contracted clearing balances of $1,000,000 at both December 31, 2010 and 2009, which are included in the Federal Reserve Bank of Boston balances above. Balances in excess of the contracted clearing amount at the Federal Reserve Bank of Boston and a portion of the funds at the FHLB of Boston are classified as overnight deposits as they earn interest.

Note 3. Interest Bearing Deposits in Banks

Interest bearing deposits in banks consist of certificates of deposit purchased from various financial institutions. Deposits at each institution are generally maintained at or below the Federal Deposit Insurance Corporation (“FDIC”) insurable limit of $250,000. Certificates are held with rates ranging from 0.40% to 5.50% and mature at various dates through 2015, with $6,543,000 scheduled to mature in 2011.

Union Bankshares, Inc. 2010 Annual Report 21

Note 4. Investment Securities

Investment securities as of the balance sheet dates consisted of the following:

December 31, 2010 | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||

Available-for-sale | ||||||||||||

Debt securities: | ||||||||||||

U.S. Government-sponsored enterprises | $ | 4,521,083 | $ | 459 | $ | (62,906 | ) | $ | 4,458,636 | |||

Mortgage-backed | 4,734,511 | 87,201 | (10,983 | ) | 4,810,729 | |||||||

State and political subdivisions | 9,372,801 | 174,792 | (154,694 | ) | 9,392,899 | |||||||

Corporate | 4,737,273 | 274,495 | (39,682 | ) | 4,972,086 | |||||||

Total debt securities | 23,365,668 | 536,947 | (268,265 | ) | 23,634,350 | |||||||

Marketable equity securities | 49,718 | 1,385 | (5,723 | ) | 45,380 | |||||||

Mutual funds | 100,115 | — | — | 100,115 | ||||||||

Total | $ | 23,515,501 | $ | 538,332 | $ | (273,988 | ) | $ | 23,779,845 | |||

Held-to-maturity | ||||||||||||

U.S. Government-sponsored enterprises | $ | 500,000 | $ | 2,205 | $ | — | $ | 502,205 | ||||

December 31, 2009 | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||

Available-for-sale | ||||||||||||

Debt securities: | ||||||||||||

U.S. Government-sponsored enterprises | $ | 4,498,813 | $ | 2,535 | $ | (47,570 | ) | $ | 4,453,778 | |||

Mortgage-backed | 4,750,024 | 112,023 | (2,346 | ) | 4,859,701 | |||||||

State and political subdivisions | 7,547,916 | 165,786 | (27,483 | ) | 7,686,219 | |||||||

Corporate | 7,176,437 | 349,200 | (2,500 | ) | 7,523,137 | |||||||

Total debt securities | 23,973,190 | 629,544 | (79,899 | ) | 24,522,835 | |||||||

Marketable equity securities | 49,717 | — | (5,991 | ) | 43,726 | |||||||

Mutual funds | 82,028 | — | — | 82,028 | ||||||||

Total | $ | 24,104,935 | $ | 629,544 | $ | (85,890 | ) | $ | 24,648,589 | |||

Investment securities with a carrying amount of $1,538,478 and $3,641,077 at December 31, 2010 and 2009, respectively, were pledged as collateral for public deposits and for other purposes as required or permitted by law.

Union Bankshares, Inc. 2010 Annual Report 22

Information pertaining to investment securities available-for-sale with gross unrealized losses as of the balance sheet date, aggregated by investment category and length of time that individual securities have been in a continuous loss position, follows:

Less Than 12 Months | Over 12 Months | Total | ||||||||||||||||

December 31, 2010 | Fair Value | Gross Unrealized Loss | Fair Value | Gross Unrealized Loss | Fair Value | Gross Unrealized Loss | ||||||||||||

Debt securities: | ||||||||||||||||||