Attached files

| file | filename |

|---|---|

| 10-K - SBT BANCORP, INC. 10-K - SBT Bancorp, Inc. | a6658422.htm |

| EX-23 - EXHIBIT 23 - SBT Bancorp, Inc. | a6658422ex23.htm |

| EX-21 - EXHIBIT 21 - SBT Bancorp, Inc. | a6658422ex21.htm |

| EX-32.1 - EXHIBIT 32.1 - SBT Bancorp, Inc. | a6658422ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - SBT Bancorp, Inc. | a6658422ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - SBT Bancorp, Inc. | a6658422ex31_1.htm |

| EX-32.2 - EXHIBIT 32.2 - SBT Bancorp, Inc. | a6658422ex32_2.htm |

| EX-99.1 - EXHIBIT 99.1 - SBT Bancorp, Inc. | a6658422ex99_1.htm |

| EX-99.2 - EXHIBIT 99.2 - SBT Bancorp, Inc. | a6658422ex99_2.htm |

Exhibit 13

April 11, 2011

Dear Fellow Shareholders:

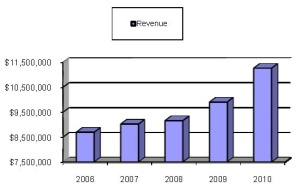

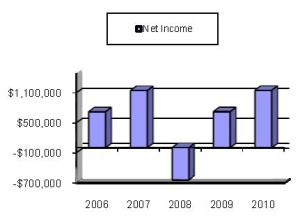

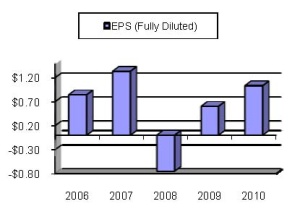

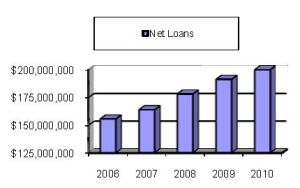

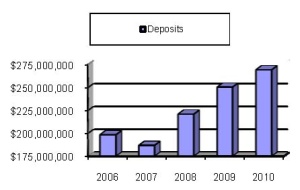

Simsbury Bank’s performance improved significantly in 2010. Net income increased 60% and fully diluted earnings per share increased 72%. Revenue grew strongly by 14% based on balance sheet and fee income growth. Total assets grew by 8% due to a similar increase in deposits as we welcomed new customers and an increase in business from existing customers. Net loans increased by 6% and gain on loans sold increased 284%.

We were pleased with the progress in expanding our capabilities to enhance our customers’ experience with us.

|

●

|

We invested in a stronger and deeper team of mortgage and consumer loan professionals who enabled us to expand our mortgage product offerings and improve our consumer loan systems and processes. Our mortgage team has built an infrastructure that will support our efforts to expand our loan origination activity throughout Central Connecticut.

|

|

●

|

We introduced new consumer deposit based products and services. Our Pinnacle Account, a relationship based offering of services and benefits, was well received by the market. We also introduced electronic delivery of deposit account statements and already over 25% of our online banking customers have selected e-statements as the way they prefer to receive their monthly statements. We made online banking enrollment much easier and found other ways to use technology to make our customers’ lives easier and our staff more productive and efficient.

|

|

●

|

We researched a variety of alternatives to streamline our small commercial loan process. We look forward to implementing some of these ideas for a more customer friendly loan underwriting, closing and monitoring process in 2011.

|

|

●

|

Finally, we focused on ensuring that our policies, processes and procedures are in strong shape for current and future business best practice and regulatory compliance standards. We feel confident that our commitment to a compliance culture and well controlled operating environment will support our growth in the future.

|

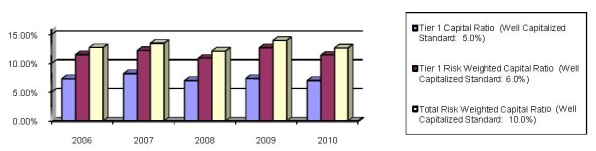

Simsbury Bank continues to benefit from its strong balance sheet. We have a relatively low-risk loan portfolio comprised of loans secured by conventionally underwritten residential mortgages and home equity loans (72%), commercial loans (26%), and consumer loans (2%). We have only modest exposure to the typically riskiest loan categories, construction and development loans and non-owner-occupied commercial real estate secured loans, which declined to approximately 8% from last year’s approximately 11% of total loans, well below many peer banks. Our deposit mix remains low cost and diversified with almost 34% demand deposits, 37% money market and savings deposits, and 29% certificates of deposit. Finally, our capital levels remain comfortably above levels qualifying the Bank as “well capitalized” from a regulatory perspective.

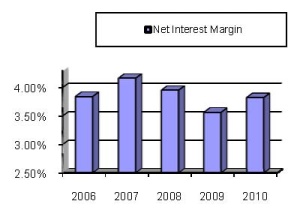

Earnings

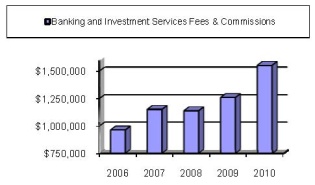

In 2010, Simsbury Bank’s total revenue increased 14% to $11.3 million from the prior year due to a 14% increase in net dividend and interest income to $10.2 million and a 17% increase in noninterest income to $1.8 million, partially offset by a 38% increase in loan loss provision to $0.76 million. Net interest and dividend revenue benefited from volume growth. Noninterest income benefited from a 6% increase in service charges and fees to $1.2 million and a 284% increase in loan sale gains to $0.2 million. As deposit growth of 8% exceeded our loan growth of 6%, our loan to deposit ratio decreased slightly to 76% at year-end 2010 from 78% at year-end 2009. Our close management of deposit costs and loan pricing resulted in an improvement in our net interest margin to 3.82% in 2010 from 3.56% in 2009.

|

|

|

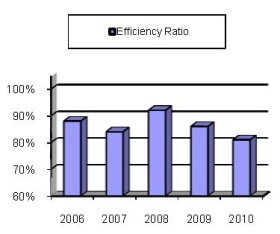

Thanks to the strong revenue growth and careful management of noninterest expenses, the Bank’s net income increased 60% to $1.1 million. Our efficiency ratio improved to 81% reflecting the benefits of our increased scale.

|

|

|

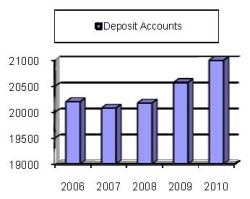

Loans and Deposits

As noted above, 2010 was another excellent year for loan and deposit growth. Mortgage and consumer loans increased by approximately 8% while commercial loans increased by approximately 2%. The Bank’s deposit mix remains favorable and relationship based. Deposit growth was led by checking deposits and money market deposits with each increasing by almost 16% and by savings deposits which increased 5%. These increases were partially offset by an approximately 9% decrease in time deposits. The number of deposit accounts increased by almost 3%.

|

|

|

Asset Quality

The Bank’s asset quality remains strong, both absolutely and compared to our competitors. Nonaccrual loans at year-end totaled $2.3 million, 27% lower than the prior year end. This resulted in the ratio of nonaccruals to total loans declining to 1.12% from 1.63%. Net charge offs increased to $640,000 (0.32% of average loans) as we moved aggressively to deal with problem loans. The Bank’s provision for loan losses totaled $755,000 compared to $547,000 in 2009. The allowance for loan and lease losses increased approximately 5% to $2.3 million, which continued to equal 1.14% of total loans and leases at year end.

- 2 -

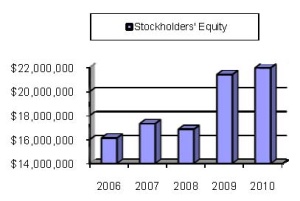

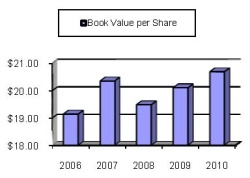

Shareholder’s Equity and Capital

Shareholder’s equity increased through our retained earnings in 2010. Book value per share also improved. The Company’s stock price remains well below historic multiples of book value, as does that of most of our peers.

|

|

|

We continue to manage our capital position to support revenue growth and remain comfortably “well capitalized” by regulatory standards.

|

In Recognition

Lincoln S. Young retired as SBT’s Chairman of the Board of Directors upon reaching the Board’s mandatory retirement age in November 2010. Linc was one of the Bank’s founders and served as a director since 1994. He also served as Secretary prior to becoming Chairman in 2002. Linc’s strong leadership reflected his extensive banking and business experience and deep commitment to community banking values. We will miss Linc’s steady hand, wisdom and guidance and wish him well.

The Board was pleased to elect another founding director, Robert J. Bogino, as Chairman upon Linc’s retirement. Bob served as Secretary from 2002 to 2004 when he was elected Vice Chairman. Bob’s entrepreneurial business experience, focus on shareholder value and commitment to ensuring that Simsbury Bank continues to fulfill its mission will ensure that SBT continues to enjoy strong leadership.

Reflecting on 2010 and Looking Forward

2010 was another year of progress for Simsbury Bank. We continued to develop our bankers’ advisory skills and introduced new products and services that resulted in broader and deeper customer relationships. We had a terrific year in mortgage and consumer lending while also putting in place the infrastructure necessary to expand that business in 2010 and beyond.

We anticipate that significant change in the regulatory environment will continue as the provisions of the Dodd-Frank Act of 2010 are implemented. We strongly believe that our policymakers’ continuing focus on writing regulations appropriate for large banks then forcing small banks to comply with them only serves to undermine the benefits to the American economy of having many banks of all sizes. Unnecessary regulatory burdens on banks with simple business models like Simsbury Bank serve only to diminish choices for consumers and businesses. We will continue to advocate for an appropriate regulatory posture. And we will take all steps necessary to ensure that we comply with whatever regulatory requirements come our way.

- 3 -

Simsbury Bank has a bright future. Our board of directors, management and team members are united in our commitment to providing outstanding, personal service to our customers, being open for lending in good economic times and bad, and contributing to a healthy economy and quality of life for many years to come.

We will work hard to make 2011 another year of forward progress in helping our customers achieve their life goals, providing our shareholders with a competitive return, ensuring that our employees enjoy fulfilling jobs, and improving our communities’ quality of life.

Sincerely,

| /s/ Martin J. Geitz | /s/ Robert J. Bogino |

| Martin J. Geitz | Robert J. Bogino |

| President & Chief Executive Officer | Chairman of the Board of Directors |

- 4 -

Lincoln S. Young

Board Member 1994 to 2010

Chairman of the Board 2002 to 2010

The Board of Directors wishes to express its deep gratitude to Mr. Young for his dedicated service to Simsbury Bank. Mr. Young retired as Chairman of the Board in November 2010, having served in that capacity since 2002 and as a board member since 1994.

Mr. Young brought his long career in banking and business ownership to his roles with Simsbury Bank. His leadership during the capital raising period, early formation and ongoing operation of our institution has been critical to our success. His guiding principles through this time were to always maintain the highest standards of financial strength and to focus on the strong and steady expansion of Simsbury Bank in its marketplace and to its customer base, while ensuring an exceptional level of personalized customer service.

During Mr. Young’s service to Simsbury Bank, this institution successfully raised capital during a recession, opened to the public for banking business, conducted a very successful second stock offering and expanded its marketplace geographically as well as in the products and services available to our customers. The continued development of relationships with individuals, businesses and the community has provided families, businesses and not-for-profit organizations the financial resources to maintain and improve the quality of life and commerce in our community.

The directors, officers, employees, shareholders, customers and the communities we serve are grateful for and better because of Mr. Young’s dedication to Simsbury Bank. In honor of his service, the Board has elected Mr. Young as Director Emeritus and we look forward to his continued association with Simsbury Bank.

Thank you, Linc, for your vision of what Simsbury Bank could be and for generously committing

your talents in leading the way to its fulfillment.

- 5 -

Selected Financial and Other Data

|

At 12/31/10

|

At 12/31/09

|

At 12/31/08

|

||||||||||

|

Balance Sheet Data:

|

||||||||||||

|

Total assets

|

$ | 295,566,591 | $ | 273,738,573 | $ | 240,756,468 | ||||||

|

Loans, net

|

202,792,477 | 191,303,519 | 178,073,758 | |||||||||

|

Investment securities

|

46,948,797 | 50,642,016 | 33,628,012 | |||||||||

|

Federal funds sold, money market mutual

funds, and other interest-earning

deposits

|

23,707,092 | 8,876,984 | 7,550,417 | |||||||||

|

Deposits

|

269,279,026 | 250,445,682 | 220,879,117 | |||||||||

|

Stockholders’ equity

|

21,967,361 | 21,411,578 | 16,846,649 | |||||||||

|

For the Year

Ended 12/31/10

|

For the Year

Ended 12/31/09

|

For the Year

Ended 12/31/08

|

||||||||||

|

Statement of Income Data:

|

||||||||||||

|

Total interest and dividend income

|

$ | 12,054,857 | $ | 11,791,863 | $ | 11,064,810 | ||||||

|

Total interest expense

|

1,813,528 | 2,823,394 | 3,042,570 | |||||||||

|

Net interest and dividend income

|

10,241,329 | 8,968,469 | 8,022,240 | |||||||||

|

Provision for loan losses

|

755,000 | 547,000 | 450,000 | |||||||||

|

Net interest and dividend income after

provision for loan losses

|

9,486,329 | 8,421,469 | 7,572,240 | |||||||||

|

Gain on loans sold, net

|

226,580 | 58,928 | - | |||||||||

|

Write-down of available-for-sale

Securities

|

- | - | (1,755,600 | ) | ||||||||

|

Other noninterest income

|

1,776,981 | 1,522,020 | 1,601,042 | |||||||||

|

Noninterest expense

|

9,754,507 | 8,997,485 | 8,830,965 | |||||||||

|

Income tax expense (benefit)

|

362,094 | 227,713 | (768,459 | ) | ||||||||

|

Net income (loss)

|

1,146,709 | 718,291 | (644,824 | ) | ||||||||

|

Earnings (loss) per common share

|

$ | 1.03 | $ | 0.60 | $ | (0.75 | ) | |||||

|

Earnings (loss) per common share,

assuming dilution

|

$ | 1.03 | $ | 0.60 | $ | (0.75 | ) | |||||

|

Other Data:

|

||||||||||||

|

Net interest spread

|

3.66 | % | 3.32 | % | 3.56 | % | ||||||

|

Net interest margin

|

3.82 | % | 3.56 | % | 3.95 | % | ||||||

|

Return on average assets

|

0.42 | % | 0.27 | % | (0.30 | )% | ||||||

|

Return on average stockholders’ equity

|

5.16 | % | 3.49 | % | (3.71 | )% | ||||||

|

Dividend payout ratio

|

46.7 | % | 59.6 | % | n/a | |||||||

|

Average stockholders’ equity to

average assets

|

7.67 | % | 7.63 | % | 8.02 | % | ||||||

- 6 -

Management's Discussion and Analysis of

Financial Conditions and Results of Operations

Forward-Looking Statements

When used in this Annual Report or any press release, public announcement or filing, the words “intends,” “expects,” “plans,” “estimates,” “projects,” “believes,” “anticipates” and similar expressions are intended to identify forward-looking statements. The Company (defined below) has made and may continue to make various forward-looking statements with respect to earnings, credit quality and other financial and business matters for periods subsequent to December 31, 2010. All statements, other than statements of historical facts, are forward-looking statements. The Company cautions that these forward-looking statements are not guarantees of future performance and are subject to numerous assumptions, risks and uncertainties, and that statements relating to subsequent periods are subject to greater uncertainty because of the increased likelihood of changes in underlying factors and assumptions. Actual results could differ materially from forward-looking statements. In addition to those factors previously disclosed by the Company or the Bank (defined below) and those factors identified elsewhere herein, the following factors could cause actual results to differ materially from such forward-looking statements: competitive pressures on loan and deposit product pricing; other actions of competitors; changes in economic conditions; the extent and timing of actions of the Federal Reserve Board; customer deposit disintermediation; changes in customers' acceptance of the Bank's products and services; and the extent and timing of legislative and regulatory actions and reforms.

Please do not rely unduly on any forward-looking statement, as such statements speak only as of the date made and the Company undertakes no obligation to revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances.

General

This discussion is designed to assist you in better understanding the Company’s financial condition, results of operations, liquidity and capital resources and any significant changes and trends related thereto. This discussion should be read in conjunction with our financial statements.

SBT Bancorp, Inc. (the “Company”) is the holding company for The Simsbury Bank & Trust Company, Inc. (the “Bank”). The Company was incorporated in the State of Connecticut on February 17, 2006. The Company became the Bank’s sole shareholder pursuant to a reorganization that occurred on March 2, 2006. The Company’s only business is its investment in the Bank, which is a community-oriented financial institution providing a variety of banking and investment services.

The Bank was incorporated on April 28, 1992 and commenced operations as a Connecticut chartered bank on March 31, 1995. The Bank's deposit accounts are insured under the Federal Deposit Insurance Act, up to the maximum applicable limits thereof. The Bank is not a member of the Federal Reserve System. The Bank's main office and its corporate offices are located in the town of Simsbury, Connecticut. The Bank has branch offices in the towns of Granby, Avon, and Bloomfield, Connecticut. The Bank also maintains a business office in Canton, Connecticut. The Bank's customer base consists primarily of individual consumers and small businesses in north central Connecticut. The Bank has in excess of 21,150 deposit accounts.

The Bank offers a full range of commercial banking services to residents and businesses in its primary and secondary markets through a wide variety of mortgage programs, home equity lines and loans, FDIC-insured checking, savings, IRA accounts, and 401K rollover, as well as safe deposit and other customary non-deposit banking services. As of December 31, 2010, approximately 71% of the Bank's loans were secured by residential property located in Connecticut.

- 7 -

The Bank has two ATMs at its main office and at the Bloomfield branch, and one ATM at each of its other branch/business office locations. The ATMs generate activity fees based upon utilization by other banks' customers. The Bank offers investment products to customers through SBT Investment Services, Inc., a wholly-owned subsidiary of the Bank, and through its affiliation with the securities broker/dealer LPL Financial Services Corporation.

The Bank earned net income of $1,146,709 for the year ended December 31, 2010, compared to $718,291 for the year ended December 31, 2009, an increase of 60%. Net income available to common shareholders after preferred dividends was $889,709, or $1.03 per diluted share, for the year ended December 31, 2010, compared to $552,369, or $0.60 per diluted share, for the year ended December 31, 2009, an increase in diluted earnings per share of 72%. Key items for the year ended December 31, 2010 compared to the year ended December 31, 2009 included the following: Earnings per share increased by 72%; total revenues increased by 14%; core deposits increased by 14%; total loans outstanding increased by 6%; taxable equivalent net interest margin increased by 26 basis points to 3.82%, from 3.56%; total non-accrual loans and loans 30 days or more days past due decreased to 1.39% from 1.80% of loans outstanding; allowance for loan losses ended the 2010 year at 1.14% of total loans outstanding; and capital ratios remained well above regulatory standards for a “well capitalized” bank.

Results of Operations for the Years Ended December 31, 2010, 2009, and 2008

Net Interest Income and Net Interest Margin

The Bank’s earnings depend largely upon the difference between the income received from its loan portfolio and investment securities and the interest paid on its liabilities, mainly interest paid on deposits. This difference is “net interest income.” The net interest income, when expressed as a percentage of average total interest-earning assets, is referred to as the net interest margin. The Bank’s net interest income is affected by the change in the level and the mix of interest-earning assets and interest-bearing liabilities, referred to as volume changes. The Bank’s net interest margin is also affected by changes in yields earned on assets and rates paid on liabilities, referred to as rate changes. Interest rates charged on the Bank’s loans are affected principally by the demand for such loans, the supply of money available for lending purposes and competitive factors. These factors are in turn affected by general economic conditions and other factors beyond the Bank’s control, such as federal economic policies, the general supply of money in the economy, legislative tax policies, governmental budgetary matters, and the actions of the Federal Reserve.

Net interest and dividend income after provision for loan losses totaled $9,486,329 in 2010, which is an increase of $1,064,860, or 12.6%, from 2009. Earning assets have grown from $256 million on December 31, 2009 to $273 million at December 31, 2010. The Bank’s net interest spread and net interest margin increased to 3.66% and 3.82%, respectively, during 2010 as compared to 3.32% and 3.56%, respectively, during 2009. This was primarily due to the historically low level of interest rates prevalent for much of the year.

The following table presents the average amounts outstanding for the major categories of the Bank’s interest-earning assets and interest-bearing liabilities and the average interest rates earned or paid thereon for the years ended December 31, 2010, 2009 and 2008.

- 8 -

|

NET INTEREST INCOME

|

||||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

For the Year Ended 12/31/10

|

||||||||||||

|

Average

Balance

|

(1)

Interest

|

Yield

|

||||||||||

|

Federal funds sold and overnight deposits

|

$ | 14,192 | $ | 32 | 0.23 | % | ||||||

|

Investments (1)

|

57,342 | 1,974 | 3.44 | |||||||||

|

Mortgage loans

|

106,578 | 5,500 | 5.16 | |||||||||

|

Commercial loans

|

49,904 | 2,714 | 5.44 | |||||||||

|

Consumer loans

|

45,177 | 2,038 | 4.51 | |||||||||

|

Term federal funds sold

|

- | - | - | |||||||||

|

Total loans

|

201,659 | 10,252 | 5.08 | % | ||||||||

|

Total interest-earning assets

|

$ | 273,193 | $ | 12,258 | 4.49 | % | ||||||

|

NOW deposits

|

$ | 35,729 | $ | 40 | 0.11 | % | ||||||

|

Savings deposits

|

103,179 | 585 | 0.57 | |||||||||

|

Time deposits

|

76,286 | 1,149 | 1.51 | |||||||||

|

Total interest-bearing deposits

|

215,194 | 1,774 | 0.82 | |||||||||

|

Securities sold under agreements to

repurchase

|

3,434 | 40 | 1.16 | |||||||||

|

Federal Home Loan Bank advances

|

51 | - | - | |||||||||

|

Total interest-bearing liabilities

|

$ | 218,679 | $ | 1,814 | 0.83 | % | ||||||

|

Net interest income

|

$ | 10,444 | ||||||||||

|

Net interest spread

|

3.66 | % | ||||||||||

|

Net interest margin

|

3.82 | % | ||||||||||

|

For the Year Ended 12/31/09

|

||||||||||||

|

Average

Balance

|

(1)

Interest

|

Yield

|

||||||||||

|

Federal funds sold and overnight deposits

|

$ | 14,829 | $ | 25 | 0.17 | % | ||||||

|

Investments (1)

|

57,629 | 2,106 | 3.65 | |||||||||

|

Mortgage loans

|

100,650 | 5,444 | 5.41 | |||||||||

|

Commercial loans

|

49,657 | 2,759 | 5.56 | |||||||||

|

Consumer loans

|

33,507 | 1,615 | 4.82 | |||||||||

|

Term federal funds sold

|

227 | 3 | 1.32 | |||||||||

|

Total loans

|

184,041 | 9,821 | 5.34 | |||||||||

|

Total interest-earning assets

|

$ | 256,499 | $ | 11,952 | 4.66 | % | ||||||

|

NOW deposits

|

$ | 32,670 | $ | 37 | 0.11 | % | ||||||

|

Savings deposits

|

86,423 | 656 | 0.76 | |||||||||

|

Time deposits

|

90,322 | 2,115 | 2.34 | |||||||||

|

Total interest-bearing deposits

|

209,415 | 2,808 | 1.34 | |||||||||

|

Securities sold under agreements to

repurchase

|

980 | 8 | 0.82 | |||||||||

|

Federal Home Loan Bank advances

|

227 | 7 | 3.08 | |||||||||

|

Total interest-bearing liabilities

|

$ | 210,622 | $ | 2,823 | 1.34 | % | ||||||

|

Net interest income

|

$ | 9,129 | ||||||||||

|

Net interest spread

|

3.32 | % | ||||||||||

|

Net interest margin

|

3.56 | % | ||||||||||

- 9 -

|

NET INTEREST INCOME

|

||||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

For the Year Ended 12/31/08

|

||||||||||||

|

Average

Balance

|

(1)

Interest

|

Yield

|

||||||||||

|

Federal funds sold and overnight deposits

|

$ | 3,812 | $ | 201 | 5.27 | % | ||||||

|

Investments (1)

|

33,092 | 1,597 | 4.83 | |||||||||

|

Mortgage loans

|

78,901 | 4,343 | 5.50 | |||||||||

|

Commercial loans

|

38,528 | 2,747 | 7.13 | |||||||||

|

Consumer loans

|

39,864 | 2,566 | 6.44 | |||||||||

|

Term federal funds sold

|

33 | 1 | 3.03 | |||||||||

|

Total loans

|

157,326 | 9,657 | 6.14 | |||||||||

|

Total interest-earning assets

|

$ | 194,230 | 11,455 | 5.90 | ||||||||

|

NOW deposits

|

$ | 27,764 | $ | 51 | 0.18 | % | ||||||

|

Savings deposits

|

57,754 | 546 | 0.95 | |||||||||

|

Time deposits

|

65,016 | 2,758 | 4.24 | |||||||||

|

Total interest-bearing deposits

|

150,534 | 3,355 | 2.23 | |||||||||

|

Securities sold under agreements to

repurchase

|

1,529 | 37 | 2.42 | |||||||||

|

Federal Home Loan Bank advances

|

1,632 | 85 | 5.21 | |||||||||

|

Total interest-bearing liabilities

|

$ | 153,695 | $ | 3,477 | 2.26 | % | ||||||

|

Net interest income

|

$ | 7,978 | ||||||||||

|

Net interest spread

|

3.64 | % | ||||||||||

|

Net interest margin

|

4.11 | % | ||||||||||

|

(1)

|

On a fully taxable equivalent basis based on a tax rate of 34%. Interest income on investments includes a fully taxable equivalent adjustment of $203,000 in 2010, $161,000 in 2009, and $143,000 in 2008.

|

The following table sets forth the effects of changing rates and volumes on our net interest income. The rate column shows the effects attributable to changes in rate (changes in rate multiplied by prior volume). The volume column shows the effects attributable to changes in volume (changes in volume multiplied by prior rate). The net column represents the sum of the rate column and the volume column. For purposes of this table, changes attributable to changes in both rate and volume that cannot be segregated have been allocated proportionally based on the changes due to rate and the changes due to volume.

- 10 -

|

Year Ended December 31, 2010

Compared to

Year Ended December 31, 2009

|

Year Ended December 31, 2009

Compared to

Year Ended December 31, 2008

|

|||||||||||||||||||||||

|

Increase (Decrease)

Due to

|

Increase (Decrease)

Due to

|

|||||||||||||||||||||||

|

Volume

|

Rate

|

Net

|

Volume

|

Rate

|

Net

|

|||||||||||||||||||

|

(In thousands)

|

||||||||||||||||||||||||

|

Interest and dividend income:

|

||||||||||||||||||||||||

|

Federal funds sold and overnight

|

||||||||||||||||||||||||

|

deposits

|

$ | (1 | ) | $ | 9 | $ | 8 | $ | 175 | $ | (294 | ) | $ | (119 | ) | |||||||||

|

Investments

|

(10 | ) | (122 | ) | (132 | ) | 1,090 | (235 | ) | 855 | ||||||||||||||

|

Loans

|

785 | (354 | ) | 431 | 396 | (387 | ) | 9 | ||||||||||||||||

|

Total interest-earning assets

|

774 | (467 | ) | 307 | 1,661 | (916 | ) | 745 | ||||||||||||||||

|

Interest expense:

|

||||||||||||||||||||||||

|

NOW deposits

|

3 | - | 3 | 5 | (13 | ) | (8 | ) | ||||||||||||||||

|

Savings deposits

|

233 | (304 | ) | (71 | ) | (1,765 | ) | 1,704 | (61 | ) | ||||||||||||||

|

Time deposits

|

(293 | ) | (673 | ) | (966 | ) | (536 | ) | 437 | (99 | ) | |||||||||||||

|

Total interest-bearing deposits

|

(57 | ) | (977 | ) | (1,034 | ) | (2,296 | ) | 2,128 | (168 | ) | |||||||||||||

|

Securities sold under agreements to

|

||||||||||||||||||||||||

|

repurchase

|

27 | 5 | 32 | (17 | ) | (23 | ) | (40 | ) | |||||||||||||||

|

FHLB advances

|

(2 | ) | (4 | ) | (6 | ) | (11 | ) | 1 | (10 | ) | |||||||||||||

|

Total interest-bearing liabilities

|

(32 | ) | (976 | ) | (1,008 | ) | (2,324 | ) | 2,106 | (218 | ) | |||||||||||||

|

Net change in interest income

|

$ | 806 | $ | 509 | $ | 1,315 | $ | 3,985 | $ | (3,022 | ) | $ | 963 | |||||||||||

Provision for Loan Losses

Provisions for loan losses are charged to earnings to bring the total allowance for loan losses to a level deemed appropriate by the Bank’s management (“Management”) based on such factors as historical experience, the volume and type of lending conducted by the Bank, the amount of non-performing loans, regulatory policies, generally accepted accounting principles, general economic conditions, and other factors related to the collectability of loans in the Bank’s portfolio.

Each month the Bank reviews the allowance for loan losses and makes additional provisions to the allowance, as needed. For the year ended December 31, 2010, the allowance increased $114,386, net of charge-offs and recoveries. The total allowance for loan losses at December 31, 2010 was $2,325,687 or 1.14% of outstanding loans. This compares with a total allowance for loan losses of $2,211,301 at year-end 2009, which represented 1.14% of outstanding loans. With the exclusion of loans to financial institutions (term federal funds sold), this ratio was 1.14% at year-end 2010 and 2009. During 2010, the Bank charged off eight loans for a total of $646,761 compared to 2009 when it charged off fifteen loans for a total of $358,097. The Bank recovered five loans for $6,147 in 2010 and five loans for $5,253 in 2009. Management believes the allowance for loan losses is adequate.

Noninterest Income and Noninterest Expense

The following table sets forth the various components of the Bank’s noninterest income (charges) and noninterest expense for the years ended December 31, 2010, 2009, and 2008.

- 11 -

|

NONINTEREST INCOME (CHARGES)

|

|

For Year

Ended

12/31/10

|

% of Income

excluding Write-down

|

For Year

Ended

12/31/09

|

% of Income

excluding Write-down

|

For Year

Ended

12/31/08

|

% of Income

excluding Write-down

|

|||||||||||||||||||

|

Service charges on

deposit accounts

|

$ | 523,770 | 29.5 | % | $ | 544,054 | 35.7 | % | $ | 479,210 | 29.9 | % | ||||||||||||

|

Safe deposit fees

|

80,230 | 4.5 | 80,968 | 5.3 | 74,039 | 4.6 | ||||||||||||||||||

|

Business manager income

|

116,338 | 6.5 | 109,425 | 7.2 | 129,232 | 8.1 | ||||||||||||||||||

|

Gain on loans sold, net

|

226,580 | 12.8 | 58,928 | 3.9 | - | - | ||||||||||||||||||

|

SBT Investment Services, Inc

|

114,046 | 6.4 | 100,910 | 6.6 | 82,295 | 5.2 | ||||||||||||||||||

|

Other income

|

716,017 | 40.3 | 627,735 | 41.3 | 836,266 | 52.2 | ||||||||||||||||||

|

Noninterest income

excludes write-down

|

1,776,981 | 100.0 | % | 1,522,020 | 100.0 | % | 1,601,042 | 100.0 | % | |||||||||||||||

|

Write-down of securities available- for-sale

|

- | - | (1,755,600 | ) | ||||||||||||||||||||

|

Total noninterest income (charges)

|

$ | 1,776,981 | $ | 1,522,020 | $ | (154,558 | ) | |||||||||||||||||

|

NONINTEREST EXPENSE

|

|

For Year

Ended

12/31/10

|

% of

Total

|

For Year

Ended

12/31/09

|

% of

Total

|

For Year

Ended

12/31/08

|

% of

Total

|

|||||||||||||||||||

|

Salaries and employee benefits

|

$ | 4,818,836 | 49.4 | % | $ | 4,165,247 | 46.3 | % | $ | 4,284,603 | 48.5 | % | ||||||||||||

|

Occupancy expense

|

1,133,024 | 11.6 | 1,128,436 | 12.5 | 1,287,076 | 14.5 | ||||||||||||||||||

|

Equipment expense

|

287,414 | 2.9 | 349,935 | 3.7 | 411,703 | 4.7 | ||||||||||||||||||

|

Impairment of operating lease

|

- | - | - | - | 298,657 | 3.4 | ||||||||||||||||||

|

Professional fees

|

722,772 | 7.4 | 513,000 | 5.7 | 407,597 | 4.6 | ||||||||||||||||||

|

Advertising and promotions

|

407,944 | 4.2 | 398,365 | 4.4 | 384,404 | 4.4 | ||||||||||||||||||

|

Forms and supplies

|

146,103 | 1.5 | 185,882 | 2.1 | 152,212 | 1.7 | ||||||||||||||||||

|

Insurance

|

471,606 | 4.8 | 575,120 | 6.4 | 200,750 | 2.3 | ||||||||||||||||||

|

Loan expenses

|

199,443 | 2.0 | 94,742 | 1.1 | 68,393 | 0.8 | ||||||||||||||||||

|

Postage

|

97,779 | 1.0 | 103,912 | 1.2 | 151,522 | 1.7 | ||||||||||||||||||

|

Other expenses

|

1,469,586 | 15.2 | 1,482,846 | 16.6 | 1,184,048 | 13.4 | ||||||||||||||||||

|

Total

|

$ | 9,754,507 | 100.0 | % | $ | 8,997,485 | 100.0 | % | $ | 8,830,965 | 100.0 | % | ||||||||||||

Noninterest income for the twelve months ended December 31, 2010 increased by approximately $255,000 to $1,776,981 from $1,522,020 for the twelve months ended December 31, 2009. This increase was due primarily to an increase of approximately $168,000 in gains on loans sold. For the twelve months ended December 31, 2009, noninterest income decreased by approximately $79,000, excluding the write-down of securities available for sale, when compared to the twelve months ended December 31, 2008. The 2009 decrease in noninterest income was due primarily to a decrease of approximately $247,000 in cash surrender value of bank owned life insurance (“BOLI”) and BOLI death benefit income, which was partially offset by an increase in service charges on deposit accounts. Total noninterest income (charges) was a loss in 2008 due to the write-down of securities available-for-sale. Management deemed the value of Fannie Mae and Freddie Mac preferred stock holdings to be other-than-temporarily impaired.

At December 31, 2010, the Bank had 21,174 deposit accounts, an increase of 658 accounts or 3.2% over the number of accounts at year-end 2009 and approximately 1,000 accounts more than at year-end 2008. SBT Investment Services, Inc.’s revenues increased by approximately $13,000 in 2010 compared to 2009.

Noninterest expense for the year ended December 31, 2010 was approximately $9,755,000, an increase of approximately $758,000 or 8% over 2009. Noninterest expense for the year ended December 31, 2009 was approximately $8,997,000, which represents an increase of 2% over noninterest expense for 2008. The increase in 2010 was primarily related to an approximately $654,000 increase in salary and benefits and an approximately $210,000 increase in professional fees as the Bank made preparations for future growth.

- 12 -

Salaries and employee benefits comprised 49% of total noninterest expense during 2010, as compared to 46% in 2009. Occupancy expense and equipment expense, at approximately 14% in 2010 and 16% in 2009, continue to be the other major categories of noninterest expense.

Financial Condition at Years Ended December 31, 2010, 2009 and 2008

The following table sets forth the average balances of each principal category of our assets, liabilities and capital accounts for the years ended December 31, 2010, 2009 and 2008.

|

Distribution of Assets, Liabilities and Stockholders’ Equity

|

|||||||||||||||||||

|

(Dollars in thousands)

|

|

For the Year Ended

12/31/10

|

For the Year Ended

12/31/09

|

For the Year Ended

12/31/08

|

||||||||||||||||||||||

|

Average

Balance

|

Percent of

Total

Assets

|

Average

Balance

|

Percent of

Total

Assets

|

Average

Balance

|

Percent of

Total

Assets

|

|||||||||||||||||||

|

Assets

|

||||||||||||||||||||||||

|

Cash and due from banks

|

$ | 8,221 | 2.8 | % | $ | 7,280 | 2.7 | % | $ | 7,682 | 3.6 | % | ||||||||||||

|

Investment securities

|

58,211 | 20.1 | 57,881 | 21.4 | 22,873 | 10.5 | ||||||||||||||||||

|

Federal funds sold and overnight

deposits

|

14,086 | 4.9 | 14,829 | 5.5 | 9,717 | 4.5 | ||||||||||||||||||

|

Loans, net

|

199,358 | 68.8 | 181,929 | 67.5 | 171,723 | 79.1 | ||||||||||||||||||

|

Premises and equipment

|

643 | 0.2 | 787 | 0.3 | 1,072 | 0.5 | ||||||||||||||||||

|

Accrued interest and other assets

|

9,081 | 3.2 | 6,909 | 2.6 | 3,960 | 1.8 | ||||||||||||||||||

|

Total assets

|

$ | 289,600 | 100.0 | % | $ | 269,615 | 100.0 | % | $ | 217,027 | 100.0 | % | ||||||||||||

|

Liabilities and Stockholders' Equity

|

||||||||||||||||||||||||

|

Deposits

|

||||||||||||||||||||||||

|

Demand and NOW deposits

|

$ | 83,348 | 28.8 | % | $ | 70,154 | 26.0 | % | $ | 64,953 | 29.9 | % | ||||||||||||

|

Savings deposits

|

103,179 | 35.6 | 86,423 | 32.1 | 65,706 | 30.3 | ||||||||||||||||||

|

Time deposits

|

76,286 | 26.4 | 90,322 | 33.5 | 65,755 | 30.3 | ||||||||||||||||||

|

Total deposits

|

262,813 | 90.8 | 246,899 | 91.6 | 196,414 | 90.5 | ||||||||||||||||||

|

Accrued interest and other liabilities

|

4,576 | 1.6 | 2,146 | 0.8 | 3,210 | 1.5 | ||||||||||||||||||

|

Total liabilities

|

267,389 | 92.4 | 249,045 | 92.4 | 199,624 | 92.0 | ||||||||||||||||||

|

Stockholders’ equity:

|

||||||||||||||||||||||||

|

Preferred stock

|

4,049 | 1.4 | 3,079 | 1.1 | - | - | ||||||||||||||||||

|

Common stock

|

9,380 | 3.2 | 9,353 | 3.5 | 9,177 | 4.2 | ||||||||||||||||||

|

Retained earnings and other

comprehensive income

|

8,782 | 3.0 | 8,138 | 3.0 | 8,226 | 3.8 | ||||||||||||||||||

|

Total stockholders’ equity

|

22,211 | 7.6 | 20,570 | 7.6 | 17,403 | 8.0 | ||||||||||||||||||

|

Total liabilities and

stockholders’ equity

|

$ | 289,600 | 100.0 | % | $ | 269,615 | 100.0 | % | $ | 217,027 | 100.0 | % | ||||||||||||

Investment Portfolio

In order to maintain a reserve of readily marketable assets to meet the Bank’s liquidity and loan requirements, the Bank purchases United States Treasury securities and other investments. Sales of “federal funds” (short-term loans to other banks) are regularly utilized. Placement of funds in certificates of deposit with other financial institutions may be made as alternative investments pending utilization of funds for loans or other purposes.

Securities may be pledged to meet security requirements imposed as a condition for receipt of deposits of public funds and repurchase agreements. At December 31, 2010, the Bank had forty-five securities with a carrying value totaling $16,587,463 pledged for such purposes.

As of December 31, 2010, the Bank’s investment portfolio consisted of U.S. government and agency securities and preferred stocks, mortgage-backed securities, corporate bonds, municipal securities, and money market mutual funds. The Bank’s policy is to stagger the maturities of its investments to meet overall liquidity requirements of the Bank.

- 13 -

The following table summarizes the amounts and distribution of the Bank’s investment securities held as of December 31, 2010, 2009, and 2008.

|

INVESTMENT PORTFOLIO

|

|||||||

|

(Dollars in thousands)

|

|

December 31, 2010

|

||||||||||||

|

Amortized Cost

|

Fair

Value

|

Yield

|

||||||||||

|

AVAILABLE-FOR-SALE SECURITIES

|

||||||||||||

|

U.S. government and agency securities

|

||||||||||||

|

Due after one to five years

|

$ | 10,750 | $ | 10,791 | 1.77 | % | ||||||

|

Total U.S. government and agency securities

|

10,750 | 10,791 | 1.77 | |||||||||

|

State and municipal securities

|

||||||||||||

|

Due within one year

|

497 | 497 | 0.85 | |||||||||

|

Due after one to five years

|

499 | 507 | 5.10 | |||||||||

|

Due after five to ten years

|

3,426 | 3,486 | 3.57 | |||||||||

|

Due after ten to fifteen years

|

5,294 | 5,203 | 3.90 | |||||||||

|

Due beyond fifteen years

|

1,891 | 1,873 | 4.10 | |||||||||

|

Total state and municipal securities

|

11,607 | 11,566 | 3.76 | |||||||||

|

Corporate debt securities

|

||||||||||||

|

Due after one to five years

|

1,003 | 1,022 | 3.65 | |||||||||

|

Total corporate debt securities

|

1,003 | 1,022 | 3.65 | |||||||||

|

Mortgage-backed securities

|

||||||||||||

|

WARM* within one year

|

3 | 3 | 5.65 | |||||||||

|

WARM* after one to five years

|

838 | 861 | 3.68 | |||||||||

|

WARM* after five to ten years

|

5,060 | 5,192 | 3.63 | |||||||||

|

WARM* after ten to fifteen years

|

7,944 | 8,042 | 3.12 | |||||||||

|

WARM* beyond fifteen years

|

7,181 | 7,209 | 3.80 | |||||||||

|

Total mortgage-backed securities

|

21,026 | 21,307 | 3.50 | |||||||||

|

SBA loan pool

|

||||||||||||

|

Due after one to five years

|

194 | 203 | 4.63 | |||||||||

|

Due after five to ten years

|

1,265 | 1,365 | 5.14 | |||||||||

|

Total SBA loan pool

|

1,459 | 1,568 | 5.07 | |||||||||

|

Preferred stocks

|

17 | 35 | 0.00 | |||||||||

|

Total available-for-sale securities

|

$ | 45,862 | $ | 46,289 | 3.46 | % | ||||||

|

* - Weighted-Average Remaining Maturity

|

||||||||||||

|

INVESTMENT PORTFOLIO

|

|

(Dollars in thousands)

|

|

December 31, 2009

|

||||||||||||

|

Amortized

Cost

|

Fair

Value

|

Yield

|

||||||||||

|

AVAILABLE-FOR-SALE SECURITIES

|

||||||||||||

|

U.S. Government and Agency securities

|

||||||||||||

|

Due after one to five years

|

$ | 15,723 | $ | 15,767 | 2.44 | % | ||||||

|

Total U.S. Government and Agency securities

|

15,723 | 15,767 | 2.44 | |||||||||

|

State and municipal securities

|

||||||||||||

|

Due after one to five years

|

1,493 | 1,537 | 5.39 | |||||||||

|

Due after five to ten years

|

1,847 | 1,883 | 5.41 | |||||||||

|

Due after ten to fifteen years

|

3,920 | 3,918 | 3.88 | |||||||||

|

Due beyond fifteen years

|

2,717 | 2,764 | 4.18 | |||||||||

|

Total state and municipal securities

|

9,977 | 10,102 | 4.10 | |||||||||

|

Corporate debt securities

|

||||||||||||

|

Due after one to five years

|

509 | 536 | 5.00 | |||||||||

|

Total corporate debt securities

|

509 | 536 | 5.00 | |||||||||

|

Mortgage -backed securities

|

||||||||||||

|

WARM* within one year

|

110 | 111 | 3.60 | |||||||||

|

WARM* after one to five years

|

1,497 | 1,528 | 3.73 | |||||||||

|

WARM* after five to ten years

|

4,165 | 4,279 | 4.07 | |||||||||

|

WARM* after ten to fifteen years

|

8,047 | 8,090 | 3.95 | |||||||||

|

WARM* beyond fifteen years

|

7,953 | 7,834 | 4.14 | |||||||||

|

Total mortgage-backed securities

|

21,772 | 21,842 | 4.03 | |||||||||

|

SBA loan pool

|

|||||||||||||

|

Due after one to five years

|

195 | 202 | 4.63 | ||||||||||

|

Due after five to ten years

|

1,445 | 1,505 | 5.18 | ||||||||||

|

Total SBA loan pool

|

1,640 | 1,707 | 5.11 | ||||||||||

|

Preferred stocks

|

17 | 57 | - | ||||||||||

|

Total available-for-sale securities

|

$ | 49,638 | $ | 50,011 | 3.58 | % | |||||||

- 14 -

|

INVESTMENT PORTFOLIO

|

|

(Dollars in thousands)

|

|

December 31, 2008

|

||||||||||||

|

Amortized

Cost

|

Fair

Value

|

Yield

|

||||||||||

|

AVAILABLE-FOR-SALE SECURITIES

|

||||||||||||

|

U.S. Government and Agency securities

|

||||||||||||

|

Due within one year

|

$ | 500 | $ | 503 | 4.91 | % | ||||||

|

Due after one to five years

|

5,272 | 5,351 | 3.25 | |||||||||

|

Total U.S. Government and Agency securities

|

5,772 | 5,854 | 3.40 | |||||||||

|

State and municipal securities

|

||||||||||||

|

Due after one to five years

|

1,493 | 1,546 | 5.39 | |||||||||

|

Due after five to ten years

|

231 | 237 | 5.41 | |||||||||

|

Due after ten to fifteen years

|

1,851 | 1,822 | 3.92 | |||||||||

|

Due beyond fifteen years

|

2,373 | 2,249 | 4.12 | |||||||||

|

Total state and municipal securities

|

5,948 | 5,854 | 4.43 | |||||||||

|

Corporate debt securities

|

||||||||||||

|

Due within one year

|

2,159 | 2,176 | 6.00 | |||||||||

|

Due after one to five years

|

512 | 514 | 5.00 | |||||||||

|

Total corporate debt securities

|

2,671 | 2,690 | 5.78 | |||||||||

|

Mortgage -backed securities

|

||||||||||||

|

WARM* within one year

|

234 | 234 | 3.72 | |||||||||

|

WARM* after one to five years

|

2,216 | 2,236 | 3.88 | |||||||||

|

WARM* after five to ten years

|

3,472 | 3,469 | 4.55 | |||||||||

|

WARM* after ten to fifteen years

|

4,219 | 4,231 | 4.77 | |||||||||

|

WARM* beyond fifteen years

|

6,658 | 6,533 | 5.22 | |||||||||

|

Total mortgage-backed securities

|

16,799 | 16,703 | 4.77 | |||||||||

|

SBA loan pool

|

||||||||||||

|

Due within one year

|

17 | 18 | 8.80 | |||||||||

|

Due after one to five years

|

230 | 231 | 4.63 | |||||||||

|

Due after five to ten years

|

- | - | - | |||||||||

|

Due after ten to fifteen years

|

1,583 | 1,630 | 5.11 | |||||||||

|

Total SBA loan pool

|

1,830 | 1,879 | 5.09 | |||||||||

|

Preferred stocks

|

17 | 17 | - | |||||||||

|

Total available-for-sale securities

|

$ | 33,037 | $ | 32,997 | 4.64 | % | ||||||

|

* - Weighted-Average Remaining Maturity

|

||||||||||||

- 15 -

Loan Portfolio

General

The following table presents the Bank’s loan portfolio as of December 31, 2010, 2009, 2008, 2007, and 2006.

|

LOAN PORTFOLIO

|

|

(Dollars in thousands)

|

|

December 31, 2010

|

December 31, 2009

|

December 31, 2008

|

||||||||||||||||||||||

|

Balance

|

% Total

Loans

|

Balance

|

% Total

Loans

|

Balance

|

% Total

Loans

|

|||||||||||||||||||

|

Commercial, financial and agricultural *

|

$ | 13,568 | 6.6 | % | $ | 12,901 | 6.7 | % | $ | 15,742 | 8.7 | % | ||||||||||||

|

Real estate – construction and land development

|

4,987 | 2.4 | 6,745 | 3.5 | 8,871 | 4.9 | ||||||||||||||||||

|

Real estate – residential

|

148,396 | 72.5 | 138,409 | 71.6 | 126,042 | 70.1 | ||||||||||||||||||

|

Real estate – commercial

|

31,294 | 15.3 | 28,721 | 14.9 | 22,962 | 12.8 | ||||||||||||||||||

|

Municipal

|

2,034 | 1.0 | 2,015 | 1.0 | 2,082 | 1.2 | ||||||||||||||||||

|

Consumer

|

4,512 | 2.2 | 4,474 | 2.3 | 4,125 | 2.3 | ||||||||||||||||||

|

Total loans

|

204,791 | 100.0 | % | 193,265 | 100.0 | % | 179,824 | 100.0 | % | |||||||||||||||

|

Allowance for loan losses

|

(2,326 | ) | (2,211 | ) | (2,017 | ) | ||||||||||||||||||

|

Deferred costs, net

|

327 | 250 | 267 | |||||||||||||||||||||

|

Net loans

|

$ | 202,792 | $ | 191,304 | $ | 178,074 | ||||||||||||||||||

|

* - Includes term federal funds sold of $0 at 12/31/2010, $0 at 12/31/2009 and $2,000,000 at 12/31/2008.

|

||||||||||||||||||||||||

|

December 31, 2007

|

December 31, 2006

|

|||||||||||||||

|

Balance

|

% Total

Loans

|

Balance

|

% Total

Loans

|

|||||||||||||

|

Commercial, financial and agricultural *

|

$ | 16,585 | 10.0 | % | $ | 10,947 | 7.0 | % | ||||||||

|

Real estate – construction and land development

|

10,756 | 6.5 | 11,113 | 7.1 | ||||||||||||

|

Real estate – residential

|

113,629 | 68.7 | 106,375 | 67.7 | ||||||||||||

|

Real estate – commercial

|

15,135 | 9.1 | 15,974 | 10.2 | ||||||||||||

|

Municipal

|

1,916 | 1.2 | 987 | 0.6 | ||||||||||||

|

Consumer

|

7,427 | 4.5 | 11,582 | 7.4 | ||||||||||||

|

Total loans

|

165,448 | 100.0 | % | 156,978 | 100.0 | % | ||||||||||

|

Allowance for loan losses

|

(1,925 | ) | (1,698 | ) | ||||||||||||

|

Deferred costs, net

|

242 | 233 | ||||||||||||||

|

Net loans

|

$ | 163,765 | $ | 155,513 | ||||||||||||

|

* - Includes term federal funds sold of $3,000,000 at 12/31/2007 and $0 at 12/31/2006.

|

||||||||||||||||

The Bank’s commercial loans are made for the purpose of providing working capital, financing the purchase of equipment, or for other business purposes. Such loans include loans with maturities ranging from thirty days to two years and “term loans,” which are loans with maturities normally ranging from one to ten years. Short-term business loans are generally intended to finance current transactions and typically provide for periodic principal payments, with interest payable monthly. Term loans normally provide for fixed or floating interest rates, with monthly payments of both principal and interest.

The Bank’s construction loans are primarily interim loans made to finance the construction of commercial and single-family residential property. These loans are typically short-term. The Bank generally pre-qualifies construction loan borrowers for permanent “take-out” financing as a condition to making the construction loan. The Bank occasionally will make loans for speculative housing construction or for acquisition and development of raw land.

- 16 -

The Bank’s other real estate loans consist primarily of loans made based on the borrower’s cash flow and which are secured by deeds of trust on commercial and residential property to provide another source of repayment in the event of default. It is the Bank’s policy to restrict real estate loans without credit enhancement to no more than 80% of the lower of the appraised value or the purchase price of the property depending on the type of property and its utilization. The Bank offers both fixed and floating rate loans. Maturities on such loans typically range from five to thirty years. However, Small Business Administration (SBA) and certain other real estate loans easily sold in the secondary market are made for longer maturities. The Bank has been designated an approved SBA lender. The Bank’s SBA loans are categorized as commercial or real estate depending on the underlying collateral. Also, the Bank has been approved as an originator of loans that can be sold to the Federal Home Loan Mortgage Corporation.

During the year ended December 31, 2010, there were 71 loans sold with a total principal balance of $14,706,700 resulting in a total gain for the Bank of $226,600. During the year ended December 31, 2009, there were 21 loans sold with a total principal balance of $4,718,800 resulting in a total gain for the Bank of approximately $59,000. During 2008 there were no loans sold. During the year ended December 31, 2007, the Bank sold one loan with total principal balance of approximately $268,000 resulting in a total net loss of $414 for the Bank. During the year ended December 31, 2006, the Bank sold four loans with total principal balances of approximately $598,000 resulting in a total net gain of $3,977 for the Bank.

Consumer loans are made for the purpose of financing automobiles, various types of consumer goods, and other personal purposes. Consumer loans generally provide for the monthly payment of principal and interest. Most of the Bank’s consumer loans are secured by the personal property being purchased.

With certain exceptions, the Bank is permitted under applicable law to make related extensions of credit to any one borrowing entity up to 15% of the Bank’s capital and reserves. An additional 10% is permitted under applicable law if the credit is fully secured by qualified collateral. The Bank sells participations in its loans when necessary to stay within lending limits. As of December 31, 2010, these lending limits for the Bank were $3,606,713 and $6,011,188, respectively.

Loan Concentrations

The Bank does not have any significant concentrations in its loan portfolio by industry or group of industries. As of December 31, 2010, approximately 71% of the Bank’s loans were secured by residential property located in Connecticut. As of December 31, 2009, approximately 78% of the Bank’s loans were secured by such property.

Loan Portfolio Maturities and Interest Rate Sensitivity

The following table summarizes the maturities and interest rate sensitivity of the Bank’s loan portfolio.

|

MATURITIES AND RATE SENSITIVITY OF LOANS

|

|

As of December 31, 2010

|

|

(In thousands)

|

|

One Year

or Less

|

Over One to

Five Years

|

Over

Five Years

|

Total

|

|||||||||||||

|

Commercial, financial and agricultural

|

$ | 5,656 | $ | 7,912 | $ | - | $ | 13,568 | ||||||||

|

Real estate - construction and land development

|

4,987 | - | - | 4,987 | ||||||||||||

|

Real estate – residential

|

41,528 | 63,515 | 43,353 | 148,396 | ||||||||||||

|

Real estate – commercial

|

26,379 | 2,393 | 2,522 | 31,294 | ||||||||||||

|

Municipal

|

2,035 | - | - | 2,035 | ||||||||||||

|

Consumer

|

1,868 | 2,644 | - | 4,512 | ||||||||||||

|

Total loans

|

$ | 82,453 | $ | 76,464 | $ | 45,875 | $ | 204,792 | ||||||||

|

Loans with fixed interest rates

|

$ | 23,748 | $ | 68,340 | $ | 44,877 | $ | 136,929 | ||||||||

|

Loans with variable interest rates

|

58,705 | 8,160 | 998 | 67,863 | ||||||||||||

|

Total loans

|

$ | 82,453 | $ | 76,464 | $ | 45,875 | $ | 204,792 | ||||||||

- 17 -

The following table sets forth the Bank’s loan commitments, standby letters of credit, and unadvanced portions of loans at December 31, 2010, 2009 and 2008.

|

LOAN COMMITMENTS AND STANDBY LETTERS OF CREDIT

|

|

(In thousands)

|

|

12/31/10

|

12/31/09

|

12/31/08

|

||||||||||

|

Commitments to originate loans

|

$ | 2,701 | $ | 1,498 | $ | 1,273 | ||||||

|

Standby letters of credit

|

233 | 337 | 337 | |||||||||

|

Unadvanced portion of loans:

|

||||||||||||

|

Construction

|

4,322 | 3,474 | 5,987 | |||||||||

|

Commercial lines of credit

|

7,858 | 7,744 | 9,479 | |||||||||

|

Consumer

|

735 | 701 | 715 | |||||||||

|

Home equity lines of credit

|

24,120 | 24,232 | 22,894 | |||||||||

|

Commercial real estate, land

|

- | - | - | |||||||||

|

Total

|

$ | 39,969 | $ | 37,986 | $ | 40,685 | ||||||

Non-Performing Assets

Interest on performing loans is accrued and taken into income daily. Loans over 90 days past due are deemed “non-performing” and are placed on a nonaccrual status, unless the loan is well collateralized and in the process of collection. Interest received on nonaccrual loans is credited to income only upon receipt and in certain circumstances may be applied to principal until the loan has been repaid in full, at which time the interest received is credited to income. The Bank had 19 nonaccrual loans with a balance of approximately $2,300,000 as of December 31, 2010, 21 nonaccrual loans with a balance of approximately $3,200,000 as of December 31, 2009, 12 nonaccrual loans with a balance of approximately $561,000 as of December 31, 2008, one nonaccrual loan with a balance of approximately $5,000 as of December 31, 2007 and one nonaccrual loan with a balance of approximately $78,000 as of December 31, 2006. Gross interest that would have been recorded if the nonaccrual loans had been current was approximately $136,000 for the year ended December 31, 2010, $77,000 for the year ended December 31, 2009 and $26,000 for the year ended December 31, 2008. For the years ended December 31, 2007 and 2006, respectively, the gross interest that would have been recorded if the nonaccrual loans had been current was immaterial. The amount of interest on nonaccrual loans included in net income was approximately $61,000 for the year ended December 31, 2010, approximately $18,000 for the year ended December 31, 2009 and approximately $19,000 for the year ended December 31, 2008. For the years ended December 31, 2007 and 2006, respectively, the amount of interest on nonaccrual loans included in net income was immaterial. As of December 31, 2010, the Bank had no loans more than 90 days past due and still accruing interest. As of December 31, 2009, the Bank had two loans with a balance of approximately $202,000 that were more than 90 days past due and still accruing interest. The Bank had four loans with a balance of approximately $90,000 as of December 31, 2008 and one loan with a balance of approximately $1,000 as of December 31, 2007 that were more than 90 days past due and still accruing interest. The Bank had no loans more than 90 days past due and still accruing interest as of year-end 2006.

When appropriate or necessary to protect the Bank’s interests, real estate taken as collateral on a loan may be taken by the Bank through foreclosure or a deed in lieu of foreclosure. Real property acquired in this manner by the Bank is referred to as “other real estate owned” (“OREO”), and is carried on the books of the Bank as an asset, at the lesser of the Bank’s recorded investment or the fair value less estimated costs to sell. As of December 31, 2010, there was $350,121 in OREO property held by the Bank. As of December 31, 2009, 2008, 2007 and 2006, there was no OREO held by the Bank.

A loan whose terms have been modified due to financial difficulties of a borrower is reported as a troubled debt restructure (“TDR”). All TDRs are placed on non-accrual status until the loan qualifies for return to accrual status. Loans qualify for return to accrual status once they have demonstrated performance with the restructured terms of the loan agreement for a minimum of six months. The Bank had three TDR loans at December 31, 2010 with a balance of approximately $408,000. The Bank had no TDR loans at December 31, 2009, 2008, 2007 and 2006.

The risk of nonpayment of loans is an inherent feature of the banking business. That risk varies with the type and purpose of the loan, the collateral which is utilized to secure payment, and ultimately, the credit worthiness of the borrower. In order to minimize this credit risk, the Bank requires that most loans be approved by at least two officers, one of whom must be an executive officer. Commercial loans greater than $500,000, as well as other loans in certain circumstances, must be approved by the Loan Committee of the Bank’s Board of Directors.

- 18 -

The Bank has an internal review process to verify credit quality and risk classifications. In addition, the Bank also maintains a program of annual review of certain new and renewed loans by an outside loan review consultant. Loans are graded from “pass” to “loss,” depending on credit quality, with “pass” representing loans that are fully satisfactory as additions to the Bank’s portfolio. These are loans which involve a degree of risk that is not unwarranted given the favorable aspects of the credit and which exhibit both primary and secondary sources of repayment. Classified loans identified in either review process are added to the Bank’s Internal Watchlist and an additional allowance for loan losses is established for such loans if appropriate. Additionally, the Bank is examined regularly by the Federal Deposit Insurance Corporation and the State of Connecticut Department of Banking at which time a further review of the loan portfolio is conducted.

There were fifty-two classified loans with a combined outstanding balance of $7,820,966 as of December 31, 2010, sixty-three classified loans with a combined outstanding balance of $9,382,436 as of December 31, 2009, forty-one classified loans with a combined outstanding balance of $ 5,944,355 as of December 31, 2008, twenty-four classified loans with a combined outstanding balance of $ 4,157,400 as of December 31, 2007 and eighteen classified loans with a combined outstanding balance of $2,168,600 as of December 31, 2006.

Allowance for Loan Losses

The Bank maintains an allowance for loan losses to provide for potential losses in the loan portfolio. Additions to the allowance are made by charges to operating expenses in the form of a provision for loan losses. All loans that are judged to be uncollectable are charged against the allowance while any recoveries are credited to the allowance. Management conducts a critical evaluation of the loan portfolio monthly. This evaluation includes an assessment of the following factors: the results of the Bank’s internal loan review, any external loan review, any regulatory examination, loan loss experience, estimated potential loss exposure on each credit, concentrations of credit, value of collateral, any known impairment in the borrower’s ability to repay, and present and prospective economic conditions.

The following table summarizes the Bank’s loan loss experience, transactions in the allowance for loan losses, and certain prominent ratios at or for the years ended December 31, 2010, 2009, 2008, 2007, and 2006.

|

At or For the Year

Ended 12/31/10

|

At or For the Year

Ended 12/31/09

|

|||||||

|

ALLOWANCE FOR LOAN LOSSES

|

||||||||

|

Balance at beginning of period

|

$ | 2,211 | $ | 2,017 | ||||

|

Charge-offs:

|

||||||||

|

Commercial, financial and agricultural

|

(627 | ) | (226 | ) | ||||

|

Installment loans to individuals

|

(20 | ) | (132 | ) | ||||

|

Total charge-offs

|

(647 | ) | (358 | ) | ||||

|

Recoveries:

|

||||||||

|

Commercial, financial and agricultural

|

1 | 3 | ||||||

|

Installment loans to individuals

|

6 | 2 | ||||||

|

Total recoveries

|

7 | 5 | ||||||

|

Net loans (charged-off) recovered

|

(640 | ) | (353 | ) | ||||

|

Provision for loan losses

|

755 | 547 | ||||||

|

Balance at end of period

|

$ | 2,326 | $ | 2,211 | ||||

|

BALANCES

|

||||||||

|

Average total loans

|

$ | 202,181 | $ | 184,089 | ||||

|

Total loans at end of period

|

204,792 | 193,265 | ||||||

|

RATIOS

|

||||||||

|

Allowance for loan losses to average loans

|

1.15 | % | 1.20 | % | ||||

|

Allowance for loan losses to loans at end of period

|

1.14 | 1.14 | ||||||

- 19 -

|

At or For the Year

Ended 12/31/08

|

At or For the Year

Ended 12/31/07

|

|||||||

|

ALLOWANCE FOR LOAN LOSSES

|

||||||||

|

Balance at beginning of period

|

$ | 1,924 | $ | 1,698 | ||||

|

Charge-offs:

|

||||||||

|

Commercial, financial and agricultural

|

(130 | ) | (3 | ) | ||||

|

Installment loans to individuals

|

(229 | ) | (21 | ) | ||||

|

Total charge-offs

|

(359 | ) | (24 | ) | ||||

|

Recoveries:

|

||||||||

|

Commercial, financial and agricultural

|

2 | - | ||||||

|

Installment loans to individuals

|

- | - | ||||||

|

Total recoveries

|

2 | - | ||||||

|

Net loans (charged-off) recovered

|

(357 | ) | (24 | ) | ||||

|

Provision for loan losses

|

450 | 250 | ||||||

|

Balance at end of period

|

$ | 2,017 | $ | 1,924 | ||||

|

BALANCES

|

||||||||

|

Average total loans

|

$ | 173,168 | $ | 157,326 | ||||

|

Total loans at end of period

|

179,824 | 165,448 | ||||||

|

RATIOS

|

||||||||

|

Allowance for loan losses to average loans

|

1.17 | % | 1.22 | % | ||||

|

Allowance for loan losses to loans at end of period

|

1.12 | 1.16 | ||||||

|

At or For the Year

Ended 12/31/06

|

||||

|

ALLOWANCE FOR LOAN LOSSES

|

||||

|

Balance at beginning of period

|

||||

|

Total charge-offs (installment loans to individuals)

|

$ | 1,720 | ||

|

Total recoveries (installment loans to individuals)

|

(22 | ) | ||

|

Net loans (charged-off) recovered

|

- | |||

|

Provision for loan losses

|

(22 | ) | ||

|

Balance at end of period

|

- | |||

| $ | 1,698 | |||

|

BALANCES

|

||||

|

Average total loans

|

||||

|

Total loans at end of period

|

$ | 151,822 | ||

| 156,978 | ||||

|

RATIOS

|

||||

|

RATIOS

|

||||

|

Allowance for loan losses to average loans

|

1.12 | % | ||

|

Allowance for loan losses to loans at end of period

|

1.08 | |||

The following table summarizes the allocation of the allowance for loan losses by loan type and the percent of loans in each category compared to total loans at December 31, 2010, 2009, 2008, 2007 and 2006.

|

ALLOCATION OF ALLOWANCE FOR LOAN LOSSES

|

|||||||||||||||||

|

(Dollars in thousands)

|

|||||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

December 31, 2008

|

||||||||||||||||||||||

|

Allocation of Allowance

|

% of

Loans by Category

|

Allocation of Allowance

|

% of

Loans by

Category

|

Allocation of Allowance

|

% of

Loans by

Category

|

|||||||||||||||||||

|

Real estate - residential

|

$ | 1,198 | 72.5 | % | $ | 1,229 | 71.6 | % | $ | 639 | 70.1 | % | ||||||||||||

|

Real estate - commercial

|

465 | 15.3 | 450 | 14.9 | 823 | 12.8 | ||||||||||||||||||

|

Real estate – construction and land

development

|

68 | 2.4 | 106 | 3.5 | 77 | 4.9 | ||||||||||||||||||

|

Commercial, financial and agricultural

|

377 | 6.6 | 341 | 6.7 | 345 | 8.8 | ||||||||||||||||||

|

Municipal

|

34 | 1.0 | 38 | 1.0 | 33 | 1.2 | ||||||||||||||||||

|

Consumer

|

91 | 2.2 | 47 | 2.3 | 100 | 2.2 | ||||||||||||||||||

|

Unallocated

|

93 | - | - | - | - | - | ||||||||||||||||||

|

Total

|

$ | 2,326 | 100.0 | % | $ | 2,211 | 100.0 | % | $ | 2,017 | 100.0 | % | ||||||||||||

- 20 -

|

December 31, 2007

|

December 31, 2006

|

|||||||||||||||

|

Allocation of Allowance

|

% of

Loans by

Category

|

Allocation of Allowance

|

% of

Loans by

Category

|

|||||||||||||

|

Real estate - residential

|

$ | 563 | 68.7 | % | $ | 464 | 67.7 | % | ||||||||

|

Real estate - commercial

|

316 | 9.1 | 465 | 10.2 | ||||||||||||

|

Real estate – construction and land

development

|

464 | 6.5 | 212 | 7.1 | ||||||||||||

|

Commercial, financial and agricultural

|

363 | 10.0 | 331 | 7.0 | ||||||||||||

|

Municipal

|

31 | 1.2 | 9 | 0.6 | ||||||||||||

|

Consumer

|

188 | 4.5 | 217 | 7.4 | ||||||||||||

|

Total

|

$ | 1,925 | 100.0 | % | $ | 1,698 | 100.0 | % | ||||||||

Deposits

Deposits are the Bank’s primary source of funds. At December 31, 2010, the Bank had a deposit mix of 34% checking, 37% savings, and 29% certificates of deposit. Twenty-one percent of the total deposits of $269.3 million were noninterest bearing at December 31, 2010. At December 31, 2009, the Bank had a deposit mix of 32% checking, 35% savings, and 33% certificates of deposit. Seventeen percent of the total deposits of $250.4 million were noninterest bearing at December 31, 2009. At December 31, 2010, $35.6 million of the Bank’s deposits were from public sources and at December 31, 2009, $28.7 million of the Bank’s deposits were from public sources. The Bank’s net interest income is enhanced by its percentage of noninterest bearing deposits.

The Bank’s deposits are obtained from a cross-section of the communities it serves. No material portion of the Bank’s deposits has been obtained from or is dependent upon any one person or industry. The Bank’s business is not seasonal in nature. The Bank accepts deposits in excess of $100,000 from customers. Those deposits are priced to remain competitive. Through the Certificate of Deposit Accounts Registry Service (CDARS) program, the Bank has brokered deposits of $7,700,879 as of December 31, 2010, and $5,344,781 as of December 31, 2009.

The Bank is not dependent upon funds from sources outside the United States and has not made loans to any foreign entities.

The following table summarizes the distribution of average deposits and the average annualized rates paid for the years ended December 31, 2010, 2009 and 2008.

|

AVERAGE DEPOSITS

|

||||||||||||||

|

(Dollars in thousands)

|

|

For the Year Ended

December 31, 2010

|

For the Year Ended

December 31, 2009

|

For the Year Ended

December 31, 2008

|

||||||||||||||||||||||

|

Average

Balance

|

Average

Rate

|

Average

Balance

|

Average

Rate

|

Average

Balance

|

Average

Rate

|

|||||||||||||||||||

|

Demand deposits

|

$ | 47,618 | 0.00 | % | $ | 37,484 | 0.00 | % | $ | 34,963 | 0.00 | % | ||||||||||||

|

NOW deposits

|

35,729 | 0.11 | 32,670 | 0.11 | 29,990 | 0.15 | ||||||||||||||||||

|

Savings deposits

|

103,179 | 0.57 | 86,423 | 0.76 | 65,706 | 1.09 | ||||||||||||||||||

|

Time deposits

|

76,286 | 1.51 | 90,323 | 2.34 | 65,755 | 3.37 | ||||||||||||||||||

|

Total average deposits

|

$ | 262,812 | 0.68 | % | $ | 246,900 | 1.14 | % | $ | 196,414 | 1.51 | % | ||||||||||||

- 21 -

The following table indicates the maturity schedule for the Bank’s time deposits of $100,000 or more as of December 31, 2010, 2009 and 2008.

|

SCHEDULED MATURITY OF TIME DEPOSITS OF $100,000 OR MORE

|

||||||||||||

|

(Dollars in thousands)

|

|

December 31, 2010

|

December 31, 2009

|

December 31, 2008

|

||||||||||||||||||||||

|

Balance

|

% of

Total

|

Balance

|

% of

Total

|

Balance

|

% of

Total

|

|||||||||||||||||||

|

Three months or less

|

$ | 12,126 | 37.6 | % | $ | 14,342 | 41.4 | % | $ | 21,148 | 62.6 | % | ||||||||||||

|

Over three through six months

|

6,166 | 19.1 | 6,984 | 20.1 | 5,180 | 15.4 | ||||||||||||||||||

|

Over six through twelve months

|

3,277 | 10.2 | 5,983 | 17.2 | 3,923 | 11.6 | ||||||||||||||||||

|

Over twelve months

|

10,673 | 33.1 | 7,369 | 21.3 | 3,503 | 10.4 | ||||||||||||||||||

|

Total Time Deposits

|

$ | 32,242 | 100.0 | % | $ | 34,678 | 100.0 | % | $ | 33,754 | 100.0 | % | ||||||||||||

Liquidity and Asset-Liability Management

Liquidity management for banks requires that funds always be available to pay anticipated deposit withdrawals and maturing financial obligations promptly and fully in accordance with their terms. The balance of the funds required is generally provided by payments on loans, sale of loans, liquidation of assets, and the acquisition of additional deposit liabilities.