Attached files

EXHIBIT 13

Front Row: William F. Overacre, A. Patricia Merryman, John P. Erb (Chairman),

James E. Burton, IV (Vice Chairman), Michael E. Watson

Back Row: C. Bryan Stott, A. Willard Arthur, Thomas F. Hall, Robert H. Gilliam, Jr.,

John L. Waller, R. B. Hancock, Jr., Carroll E. Shelton

B O A R D O F D I R E C TO R S

| A. Willard Arthur | A. Patricia Merryman | |

| Retired; Former Chairman & Secretary | Vice President | |

| Marvin V. Templeton & Sons, Inc. | Sonny Merryman, Inc. | |

| James E. Burton, IV – Vice Chairman | William F. Overacre | |

| President | Retired; Former Associate Broker | |

| Templeton Paving, LLC | RE/MAX 1st Olympic, REALTORS | |

| John P. Erb – Chairman | Carroll E. Shelton | |

| Assistant Superintendent | Senior Vice President & Chief Credit Officer | |

| Campbell County Schools | First National Bank | |

| Vice President | ||

| Robert H. Gilliam, Jr. | Pinnacle Bankshares Corporation | |

| Chief Executive Officer | ||

| First National Bank | C. Bryan Stott | |

| President & Chief Executive Officer | Vice President & Branch Manager | |

| Pinnacle Bankshares Corporation | Stifel Nicolaus | |

| R. B. Hancock, Jr. | John L. Waller | |

| Retired; Former President & Owner | Owner & Operator | |

| R.B.H., Inc. | Waller Farms, Inc. | |

| Thomas F. Hall | Michael E. Watson | |

| President | Controller/Treasurer | |

| George E. Jones & Sons, Inc. | Flippin, Bruce & Porter, Inc. | |

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

Table of Contents

| Page | ||||

| Office Locations |

2 | |||

| Officers and Managers |

3 | |||

| President’s Letter |

4 | |||

| Selected Consolidated Financial Information |

6 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

7 | |||

| Consolidated Balance Sheets |

26 | |||

| Consolidated Statements of Income |

27 | |||

| Consolidated Statements of Changes in Stockholders’ Equity and Comprehensive Income |

28 | |||

| Consolidated Statements of Cash Flows |

29 | |||

| Notes to Consolidated Financial Statements |

31 | |||

| Management’s Report on Internal Control over Financial Reporting |

61 | |||

| Report of Independent Registered Public Accounting Firm |

62 | |||

| Shareholder Information |

63 | |||

| Tribute to Robert H. Gilliam, Jr. |

IBC | |||

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

First National Bank Office Locations

ALTAVISTA

MAIN OFFICE

622 Broad Street

Altavista, Virginia 24517

Telephone: (434) 369-3000

VISTA OFFICE

1301 N. Main Street

Altavista, Virginia 24517

Telephone: (434) 369-3001

LYNCHBURG

AIRPORT OFFICE

14580 Wards Road

Lynchburg, Virginia 24502

Telephone: (434) 237-3788

TIMBERLAKE OFFICE

20865 Timberlake Road

Lynchburg, Virginia 24502

Telephone: (434) 237-7936

OLD FOREST ROAD OFFICE

3309 Old Forest Road

Lynchburg, Virginia 24501

Telephone: (434) 385-4432

FOREST

FOREST OFFICE

14417 Forest Road

Forest, Virginia 24551

Telephone: (434) 534-0451

AMHERST

AMHERST OFFICE

130 South Main Street

Amherst, Virginia 24521

Telephone: (434) 946-7814

RUSTBURG

RUSTBURG OFFICE

1033 Village Highway

Rustburg, Virginia 24588

Telephone: (434) 332-1742

SMITH MOUNTAIN LAKE

LOAN PRODUCTION OFFICE

74 Scruggs Road, Suite 102

Moneta, Virginia 24121

Telephone: (540) 719-0193

2

PINNACLE BANKSHARES CORPORATION AND SUBSIDIARY

| Officers of Pinnacle Bankshares Corporation | ||

| Robert H. Gilliam, Jr. |

President & Chief Executive Officer | |

| Aubrey H. Hall, III |

Executive Vice President | |

| Carroll E. Shelton |

Vice President | |

| Bryan M. Lemley |

Secretary, Treasurer & Chief Financial Officer | |

| Officers and Managers of First National Bank |

||

| Robert H. Gilliam, Jr. |

Chief Executive Officer & Trust Officer | |

| Aubrey H. Hall, III |

President & Chief Operating Officer | |

| Carroll E. Shelton |

Senior Vice President & Chief Credit Officer | |

| Bryan M. Lemley |

Senior Vice President, Cashier & Chief Financial Officer | |

| Lucy H. Johnson |

Senior Vice President & Chief Information Officer | |

| William J. Sydnor, II |

Senior Vice President & Branch Administration Officer | |

| Judith A. Clements |

Senior Vice President & Director of Human Resources | |

| Thomas R. Burnett, Jr. |

Senior Vice President & Chief Lending Officer | |

| Pamela R. Adams |

Vice President & Loan Operations Manager | |

| James M. Minear |

Vice President & Commercial Officer | |

| Shawn D. Stone |

Vice President & Commercial Officer | |

| Tracie A. Robinson |

Vice President & Mortgage Production Manager | |

| Bianca K. Allison |

Vice President & Mortgage Loan Officer | |

| Tony J. Bowling |

Vice President & Network Administrator | |

| Cecilia L. Doyle |

Vice President & Senior Credit Analyst | |

| John E. Tucker |

Vice President & Investment Consultant | |

| Vivian S. Brown |

Vice President & Retail Sales and Service Manager | |

| Daniel R. Wheeler |

Vice President & Branch Manager (Airport) | |

| Marian E. Marshall |

Assistant Vice President & Branch Manager (Forest) | |

| Nancy J. Holt |

Assistant Vice President & Branch Manager (Main) | |

| Janet H. Whitehead |

Assistant Vice President & Branch Manager (Timberlake) | |

| M. Amanda Ramsey |

Assistant Vice President & Branch Manager (Amherst) | |

| Charlene A. Thompson |

Assistant Vice President & Branch Manager (Rustburg) | |

| Andria C. Smith |

Assistant Vice President & Branch Manager (Vista) | |

| Courtney M. Woody |

Assistant Vice President & Branch Manager (Old Forest Road) | |

| Christine A. Hunt |

Assistant Vice President & Internal Auditor | |

| Vicki G. Greer |

Assistant Vice President & Financial Analyst | |

| Albert N. Fariss |

Assistant Vice President & Facilities/Purchasing Manager and Security Officer | |

| Tarry R. Pribble |

Assistant Vice President & Collection and Recovery Manager | |

| Lisa M. Landrum |

Assistant Vice President & Dealer Finance Loan Officer | |

| Anita M. Jones |

Loan Production Officer | |

| Melissa L. Collins |

Mortgage Loan Officer | |

| Dianna C. Hamlett |

Compliance Officer & Bank Secrecy Act Officer | |

| Lauren R. Michael |

Training Officer | |

| J. Wayne Drumheller |

Collection Officer | |

| Barbara H. Caldwell |

Assistant Branch Manager (Main) | |

| Arin L. Brown |

Retail Business Development Officer (Main) | |

| April A. Morris |

Retail Business Development Officer (Main) | |

| Doris N. Trent |

Retail Business Development Officer (Vista) | |

| Sherry D. Johnson |

Retail Business Development Officer (Forest) | |

| Melissa T. Campbell |

Retail Business Development Officer (Airport) | |

| Romonda F. Davis |

E-Commerce Sales Officer | |

| Cathy C. Simms |

Assistant Portfolio Manager | |

| Cynthia I. Gibson |

Bookkeeping Manager | |

3

TO OUR SHAREHOLDERS, CUSTOMERS AND FRIENDS:

Progress was achieved by your Company on a number of fronts in 2010, not the least of which was in financial performance.

Net income for 2010 increased 96% over net income for 2009 to $687,000. The gain in net income was primarily fueled by an increase in net interest income of $772,000, as our net interest margin grew from 3.23% in 2009 to 3.37% in 2010. Noninterest income was essentially unchanged on a year-over-year basis, while noninterest expense registered a slight decline of 1% from 2009 to 2010.

Asset quality continues to be a concern as nonperforming loans stood at $7,843,000 as of December 31, 2010. The provision for loan losses charged against earnings in 2010 was $1,878,000, $348,000 more than in 2009. Obviously this level of loss provision adversely impacts net income. Our allowance for loan losses was $4,037,000 at year-end 2010, 8% higher than at year-end 2009, and amounted to 1.50% of total loans outstanding. We continue to employ an aggressive stance in dealing with credit quality issues, but expect to be challenged in addressing problem loans throughout much of 2011.

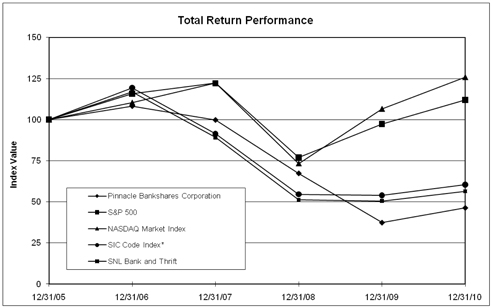

Although returns for 2010 continue to be fractions of pre-2008 returns, 2010 net income represents a positive step in the right direction and we are encouraged about prospects for a continuation of this trend in upcoming years.

The balance sheet reflects an increase in total assets of $4,903,000 in 2010, ending the year at $337,113,000. Total deposits grew $4,835,000 for the year. Net loans declined $874,000, less than 1%, in 2010, to $265,030,000, while securities owned increased $6,361,000 to $26,517,000 at December 31, 2010. Stockholders’ equity ended 2010 at $26,482,000, a $631,000 increase over 2009. Average equity to average assets was 7.88% for 2010, compared with 7.69% for 2009.

A $0.05 per share cash dividend was paid in November, 2010, fulfilling the goal of reinstatement of some level of dividend payment in 2010. This was the first cash dividend since $0.10 per share was paid in February 2009. Improvement in the level of cash dividend payments will continue to be a high priority of your board and management, evaluated in the context of the critical importance of capital preservation.

Another front in which progress was achieved in 2010 was in the corporate governance arena. The President and Chief Executive Officer for a number of years has served as acting Chairman of the Board, inasmuch as the Board had chosen not to formally elect a chairman. In 2010, the Board of Directors added an independence element to its leadership structure by electing outside directors John P. Erb and James E. Burton, IV as Chairman of the Board and Vice Chairman of the Board, respectively. Both Mr. Erb and Mr. Burton have filled these rolls in an admirable fashion.

Changes also occurred in the composition of the Board in 2010. James P. Kent, Jr. retired from the Board after having completed 30 years of dedicated service. His wise counsel to the Board during his tenure is much appreciated. Two new directors were elected to the Board in 2010 in the persons of A. Patricia Merryman and C. Bryan Stott. Both new directors have brought valuable attributes to the Board and have made immediate contributions.

4

Another area where I would recognize progress is that of management succession and transition. Succession and transition began in late 2010 when I informed our Board of my intention to retire in a mid-year 2011 timeframe and continues on through this date. In early 2011 our Board identified Aubrey H. (Todd) Hall, III as my successor, appointed him to the Board of First National Bank and elected him President of the Bank. Todd has been nominated for election to the Board of Directors of Pinnacle Bankshares at the 2011 Annual Meeting of Shareholders. He is slated to become Chief Executive Officer of First National Bank and President and Chief Executive Officer of Pinnacle Bankshares Corporation upon my retirement, targeted for July 1, 2011.

Todd is a Campbell County native and lifelong resident. He has worked in the banking industry since graduating from Lynchburg College in May, 1992, and has been with First National Bank since March, 2003. The Company is fortunate to have a highly qualified successor within the existing ranks of senior management. Todd is a skilled banker and will serve this Company well in the top leadership role. I am pleased to report that transition is proceeding smoothly.

The development of a new five year Strategic Plan is another example of progress in 2010. The Plan will serve as a guide to managing the Company to a higher level of performance in future years and will be a living, breathing document that can be amended to reflect changes in the economy and banking environment. The Strategic Plan is an important element in management transition as well.

Your patience with us in these challenging times is much appreciated as we work hard to lead your Company through and out of the effects of the deep and prolonged economic downturn that began in late 2007. Our rich heritage and history of strength and stability have served us well during this period. Progress is slow and gradual, but there is clear evidence of progress nonetheless and we firmly believe that momentum has developed in a positive direction.

We look forward to sharing more of the Pinnacle Bankshares story at our Annual Meeting of Shareholders to be held at 11:30 a.m., Tuesday, April 12, 2011 in the Fellowship Hall of Altavista Presbyterian Church, 707 Broad Street, Altavista, Virginia. We hope you will be able to join us for this occasion.

Thank you for the distinct privilege of allowing me to have served as your President and Chief Executive Officer.

|

| Robert H. Gilliam, Jr. |

| President and Chief Executive Officer |

February 18, 2011

5

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

Selected Consolidated Financial Information

(In thousands, except ratios, share and per share data)

| Years ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Net interest income |

$ | 10,776 | 10,004 | 10,209 | 10,181 | 9,192 | ||||||||||||||

| Provision for loan losses |

1,878 | 1,530 | 2,881 | 462 | 339 | |||||||||||||||

| Noninterest income |

3,134 | 3,148 | 2,896 | 2,632 | 2,500 | |||||||||||||||

| Noninterest expenses |

11,037 | 11,171 | 9,846 | 8,524 | 7,825 | |||||||||||||||

| Income tax expense |

308 | 100 | 72 | 1,227 | 1,116 | |||||||||||||||

| Net income |

687 | 351 | 306 | 2,600 | 2,412 | |||||||||||||||

| Per Share Data: |

||||||||||||||||||||

| Basic net income |

$ | 0.46 | 0.24 | 0.21 | 1.76 | 1.65 | ||||||||||||||

| Diluted net income |

0.46 | 0.24 | 0.21 | 1.75 | 1.64 | |||||||||||||||

| Cash dividends |

0.05 | 0.10 | 0.60 | 0.60 | 0.55 | |||||||||||||||

| Book value |

17.71 | 17.41 | 16.78 | 17.95 | 16.66 | |||||||||||||||

| Weighted-Average Shares Outstanding: |

||||||||||||||||||||

| Basic |

1,492,137 | 1,485,089 | 1,485,089 | 1,479,689 | 1,459,007 | |||||||||||||||

| Diluted |

1,492,137 | 1,485,089 | 1,488,213 | 1,489,377 | 1,471,806 | |||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Assets |

$ | 337,113 | 332,210 | 321,243 | 279,913 | 256,421 | ||||||||||||||

| Loans, net |

265,030 | 265,904 | 279,199 | 232,752 | 207,861 | |||||||||||||||

| Securities |

26,517 | 20,156 | 13,931 | 19,635 | 24,866 | |||||||||||||||

| Cash and cash equivalents |

32,533 | 32,060 | 15,926 | 18,344 | 14,586 | |||||||||||||||

| Deposits |

306,954 | 302,119 | 287,233 | 251,866 | 230,817 | |||||||||||||||

| Stockholders’ equity |

26,482 | 25,851 | 24,919 | 26,816 | 24,492 | |||||||||||||||

| Performance Ratios: |

||||||||||||||||||||

| Return on average assets |

0.21 | % | 0.11 | % | 0.10 | % | 0.97 | % | 1.00 | % | ||||||||||

| Return on average equity |

2.62 | % | 1.40 | % | 1.14 | % | 10.17 | % | 10.10 | % | ||||||||||

| Dividend payout |

10.92 | % | 41.88 | % | 291.50 | % | 34.12 | % | 33.25 | % | ||||||||||

| Asset Quality Ratios: |

||||||||||||||||||||

| Allowance for loan losses to total loans, net of unearned income and fees |

1.50 | % | 1.38 | % | 1.40 | % | 0.73 | % | 0.84 | % | ||||||||||

| Net charge-offs to average loans, net of unearned income and fees |

0.59 | % | 0.65 | % | 0.24 | % | 0.23 | % | 0.04 | % | ||||||||||

| Capital Ratios: |

||||||||||||||||||||

| Leverage |

7.74 | % | 8.04 | % | 8.28 | % | 9.54 | % | 9.80 | % | ||||||||||

| Risk-based: |

||||||||||||||||||||

| Tier 1 capital |

9.36 | % | 9.50 | % | 9.20 | % | 10.55 | % | 9.92 | % | ||||||||||

| Total capital |

10.61 | % | 10.75 | % | 10.45 | % | 11.24 | % | 10.64 | % | ||||||||||

| Average equity to average assets |

7.88 | % | 7.69 | % | 9.14 | % | 9.45 | % | 9.91 | % | ||||||||||

6

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

(in thousands, except ratios, share and per share data)

Cautionary Statement Regarding Forward-Looking Statements

The following discussion is qualified in its entirety by the more detailed information and the consolidated financial statements and accompanying notes appearing elsewhere in this Annual Report. In addition to the historical information contained herein, this Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of management, are generally identifiable by use of words such as “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “may,” “will” or similar expressions. These forward-looking statements may include, but are not limited to, statements relating to anticipated future financial performance, funding sources including cash generated by banking operations, loan portfolio composition, trends in asset quality and strategies to address nonperforming assets and nonaccrual loans, adequacy of the allowance for loan losses and future provisions for loan losses, securities portfolio composition and future performance, interest rate environments, deposit insurance assessments, and strategic business initiatives.

Although we believe our plans, intentions and expectations reflected in these forward-looking statements are reasonable, we can give no assurance that these plans, intentions, or expectations will be achieved. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain, and actual results, performance or achievements could differ materially from those contemplated. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in: interest rates; declining collateral values, especially in the real estate market; general economic conditions, including continued deterioration in general business and economic conditions and in the financial markets; deterioration in the value of securities held in our investment securities portfolio; the legislative/regulatory climate, including the impact of any policies or programs implemented pursuant to the Emergency Economic Stabilization Act of 2008 (the EESA), the American Recovery and Reinvestment Act of 2009 (the ARRA), the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) or other laws; monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System; the quality or composition of the loan and/or investment portfolios; demand for loan products; deposit flows; competition; demand for financial services in our market area; and accounting principles, policies and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements contained herein. We base our forward-looking statements on management’s beliefs and assumptions based on information available as of the date of this report. You should not place undue reliance on such statements, because the assumptions, beliefs, expectations and projections about future events on which they are based may, and often do, differ materially from actual results. We undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

In addition, we have experienced increases in loan losses during the current economic climate. Continued difficulties in significant portions of the global financial markets, particularly if it worsens, could further impact our performance, both directly by affecting our revenues and the value of our assets and liabilities, and indirectly by affecting our counterparties and the economy generally. Dramatic declines in the residential and commercial real estate markets in recent years have resulted in significant write-downs of asset values by financial institutions in the United States. Concerns about the stability of the U.S. financial markets generally have reduced the availability of funding to certain financial institutions, leading to a tightening of credit and reduction of business activity. There can be no assurance that the EESA, the ARRA, the Dodd-Frank Act or other actions taken by the Federal government will stabilize the U.S. financial system or alleviate the industry or economic factors that may adversely affect our business. In addition, our business and financial performance could be impacted as the financial industry restructures in the current environment, both by changes in the creditworthiness and performance of our counterparties and by changes in the competitive and regulatory landscape.

7

Company Overview

Pinnacle Bankshares Corporation, a Virginia corporation (Bankshares), was organized in 1997 and is registered as a bank holding company under the Bank Holding Company Act of 1956, as amended. Bankshares is headquartered in Altavista, Virginia. Bankshares conducts all of its business activities through the branch offices of its wholly owned subsidiary bank, First National Bank (the Bank). Bankshares exists primarily for the purpose of holding the stock of its subsidiary, the Bank, and of such other subsidiaries as it may acquire or establish.

First National Bank currently maintains a total of nine offices to serve its customers. The Main Office and Vista Branch are located in the Town of Altavista, the Airport Branch and Timberlake Branch in Campbell County, the Old Forest Road Branch in the City of Lynchburg, the Forest Branch in Bedford County, the Amherst Branch in the Town of Amherst, the Rustburg Branch in the Town of Rustburg and a Loan Production Office in Franklin County at Smith Mountain Lake. The Bank also maintains an administrative and training facility in the Wyndhurst section of the City of Lynchburg.

A total of one-hundred seven full and part-time staff members serve the Bank’s customers.

With an emphasis on personal service, the Bank today offers a broad range of commercial and retail banking products and services including checking, savings and time deposits, individual retirement accounts, merchant bankcard processing, residential and commercial mortgages, home equity loans, consumer installment loans, agricultural loans, investment loans, small business loans, commercial lines of credit and letters of credit. The Bank also offers a full range of investment, insurance and annuity products through its association with Infinex Investments, Inc. and Banker’s Insurance, LLC. The Bank has two wholly-owned subsidiaries: FNB Property Corp., which holds title to Bank premises real estate; and First Properties, Inc., which holds title to other real estate owned from foreclosures.

The following discussion supplements and provides information about the major components of the results of operations and financial condition, liquidity and capital resources of Bankshares and its subsidiary (collectively the Company). This discussion and analysis should be read in conjunction with the Company’s consolidated financial statements and accompanying notes.

Executive Summary

The Company serves a trade area known better as Region 2000 consisting primarily of Campbell County, northern Pittsylvania County, eastern Bedford County, northern Franklin County, Amherst County and the city of Lynchburg from nine facilities located within the area. In February 2009, the Company opened the Rustburg facility located on Village Highway in the Rustburg Marketplace Shopping Center. This opening further increases our presence in Campbell County. The Company operates in a well-diversified industrial economic region that does not depend upon one or a few types of commerce.

The Company earns revenues on the interest margin between the interest it charges on loans it extends to customers and interest received on the Company’s securities portfolio net of the interest it pays on deposits to customers. The Company also earns revenues on service charges on deposit and loan products, gains on securities that are called or sold, fees from origination of mortgages, and other noninterest income items including but not limited to overdraft fees, commissions from investment, insurance and annuity sales, safe deposit box rentals, and automated teller machine surcharges. In 2010, an increase in net income was realized due to an increase in net interest margin and a decrease in noninterest expense. The Company’s revenue generating activities and related expenses are outlined in the consolidated statements of income and consolidated statements of changes in stockholders’ equity and comprehensive income and accompanying notes and in “Results of Operations” below.

The Company generates cash through its operating, investing and financing activities. The generation of cash flows is outlined more fully in the consolidated statements of cash flows and accompanying notes and in “Liquidity and Asset/Liability Management” below.

8

The Company’s balance sheet experienced a slight decline in its loan portfolio and growth in its deposit portfolio in 2010. The overall growth of the Company is outlined in the consolidated balance sheets and accompanying notes and the “Investment Portfolio,” “Loan Portfolio,” “Bank Premises and Equipment,” “Deposits” and “Capital Resources” discussions below.

The Company expects minimal loan portfolio growth in 2011, as we continue to monitor our capital ratios. The Company will look to continue growth in our branches, especially our newer Amherst and Rustburg locations, as we continue to build relationships with businesses and individuals within each market. While growing, the Company continues to leverage efficiencies from our reporting and imaging systems. The Company is also making our customers’ lives more convenient by offering innovative products and services and providing many channels to bank with us including Internet banking, Internet bill pay, telephone banking, mobile banking, remote deposit capture, debit and credit cards and real-time ATMs. The Company will continue to identify and install convenient products and services in 2011 with the goal to better enhance the customer’s experience with the Company.

Overview of 2010 and 2009

Total assets at December 31, 2010 were $337,113, up 1.48% from $332,210 at December 31, 2009. The principal components of the Company’s assets at the end of the year were $32,533 in cash and cash equivalents, $26,517 in securities and $265,030 in net loans. During the year ended December 31, 2010, gross loans decreased 0.22% or $590. The Company’s lending activities are a principal source of income. Loans decreased in 2010 as the Company experienced lower demand for credit and employed tighter credit standards.

Total liabilities at December 31, 2010 were $310,631, up 1.39% from $306,359 at December 31, 2009, with the increase reflective of an increase in total deposits of $4,835 or 1.60%. Noninterest-bearing demand deposits decreased $1,092 or 3.38% and represented 10.16% of total deposits at December 31, 2010, compared to 10.68% at December 31, 2009. Savings and NOW accounts increased $14,499 or 14.02% and represented 38.42% of total deposits at December 31, 2010, compared to 34.24% at December 31, 2009. Time deposits decreased $8,572 or 5.15% at December 31, 2010 and represented 51.42% of total deposits at December 31, 2010, compared to 55.08% at December 31, 2009. The Company’s deposits are provided by individuals and businesses located within the communities served. The Company had no brokered deposits as of December 31, 2010 and December 31, 2009.

Total stockholders’ equity at December 31, 2010 was $26,482, including $21,918 in retained earnings. At December 31, 2009, stockholders’ equity totaled $25,851, including $21,306 in retained earnings. The increase in stockholders’ equity resulted mainly from the Company’s retained earnings of $612 during 2010.

The Company had net income of $687 for the year ended December 31, 2010, compared to net income of $351 for the year ended December 31, 2009, an increase of 95.73%. The Company’s net income increased primarily due to an increase in net interest income which was largely due to improvements to the Company’s net interest margin, and a decrease in noninterest expense, partially offset by an increase in provision for loan losses. Management expects continued improvement in net income, although whether the Company can continue to grow net income could be adversely affected by numerous factors including factors related to the Company’s asset quality. We expect continued improvement in our net interest margin in 2011. We expect minimal increases in noninterest expense and noninterest income in 2011.

Profitability as measured by the Company’s return on average assets (ROA) was 0.21% in 2010, compared to 0.11% in 2009. Return on average equity (ROE), was 2.62% for 2010, compared to 1.40% for 2009.

Overview of 2009 and 2008

Total assets at December 31, 2009 were $332,210, up 3.41% from $321,243 at December 31, 2008. The principal components of the Company’s assets at the end of the year were $32,060 in cash and cash equivalents, $20,156 in securities and $265,904 in net loans. During the year ended December 31, 2009, gross loans decreased 4.80% or $13,608. The Company’s lending activities are a principal source of income. Loans decreased in 2009 as the Company experienced lower demand for credit and employed tighter credit standards. Total liabilities at

9

December 31, 2009 were $306,359, up 3.39% from $296,324 at December 31, 2008, with the increase reflective of an increase in total deposits of $14,886 or 5.18%. Noninterest-bearing demand deposits increased $4,545 or 16.39% and represented 10.68% of total deposits at December 31, 2009, compared to 9.65% at December 31, 2008. Savings and NOW accounts increased $15,613 or 17.78% and represented 34.24% of total deposits at December 31, 2009, compared to 30.58% at December 31, 2008. Time deposits decreased $5,272 or 3.07% at December 31, 2009 and represented 55.08% of total deposits at December 31, 2009, compared to 59.77% at December 31, 2008. The Company’s deposits are provided by individuals and businesses located within the communities served. The Company had no brokered deposits as of December 31, 2009 and December 31, 2008.

Total stockholders’ equity at December 31, 2009 was $25,851, including $21,306 in retained earnings. At December 31, 2008, stockholders’ equity totaled $24,919, including $21,102 in retained earnings. The increase in stockholders’ equity resulted mainly from an after tax after tax unrealized gain of $660 incurred by the Company’s retirement plan. This unrealized gain is recognized in accumulated other comprehensive net loss.

The Company had net income of $351 for the year ended December 31, 2009, compared to net income of $306 for the year ended December 31, 2008, an increase of 14.71%. The Company’s net income increased primarily due to a decrease in provision for loan loss expense of $1,351 in 2009 compared to 2008. This was partially offset by a decrease in net interest income due to lower margins and lower loan volume. It was also partially offset by an increase in noninterest expense due to the effect of the overall growth of the company on personnel expenses and fixed assets. Profitability as measured by the Company’s ROA was 0.11% in 2009, compared to 0.10% in 2008. Return on average equity (ROE), was 1.40% for 2009, compared to 1.14% for 2008.

Results of Operations

Net Interest Income. Net interest income represents the principal source of earnings for the Company. Net interest income is the amount by which interest and fees generated from loans, securities and other interest-earning assets exceed the interest expense associated with funding those assets. Changes in the amounts and mix of interest-earning assets and interest-bearing liabilities, as well as their respective yields and rates, have a significant impact on the level of net interest income. Changes in the interest rate environment and the Company’s cost of funds also affect net interest income.

The net interest spread increased to 3.07% for the year ended December 31, 2010 from 2.85% for the year ended December 31, 2009. Net interest income was $10,776 ($10,842 on a tax-equivalent basis) for the year ended December 31, 2010, compared to $10,004 ($10,097 on a tax-equivalent basis) for the year ended December 31, 2009, and is attributable to interest income from loans, federal funds sold and securities exceeding the cost associated with interest paid on deposits and other borrowings. In 2010, our deposits repriced at lower rates more rapidly than did our loans in the declining rate environment, causing our interest rate spread to increase. The Bank’s cost of rate on interest-bearing liabilities in 2010 was sixty basis points lower compared to 2009. The Bank’s yield on interest-earning assets for the year ended December 31, 2010 was thirty-eight basis points lower than the year ended December 31, 2009 due to higher yielding assets being replaced by lower yielding assets in 2010 and repricing of existing assets in the declining rate environment.

The net interest spread decreased to 2.85% for the year ended December 31, 2009 from 3.11% for the year ended December 31, 2008. Net interest income was $10,004 ($10,097 on a tax-equivalent basis) for the year ended December 31, 2009, compared to $10,209 ($10,325 on a tax-equivalent basis) for the year ended December 31, 2008, and is attributable to interest income from loans, federal funds sold and securities exceeding the cost associated with interest paid on deposits and other borrowings. In 2009, our loans repriced at lower rates more rapidly than did our deposits in the declining rate environment, causing our interest rate spread to decrease. The Bank’s yield on interest-earning assets for the year ended December 31, 2009 was ninety-four basis points lower than the year ended December 31, 2008 due to higher yielding assets being replaced by lower yielding assets in 2009 and repricing of existing assets. The Bank’s cost of funds rate on interest-bearing liabilities in 2009 was sixty-eight basis points lower compared to 2008.

In an effort to stimulate economic activity, the Federal Reserve has pushed interest rates to exceptionally low levels, causing the Company’s interest-earning assets and interest-bearing liabilities to reprice downward. The Company’s net interest margins declined from 2008 to 2009 as interest-earning assets repriced faster than

10

interest-bearing liabilities, but net interest margins expanded from 2009 to 2010 as our interest-bearing liabilities repriced faster than our interest-earning assets. The Company’s improved net interest margin in 2010 was due in part to deposit pricing strategies. The Company attempts to conserve net interest margin by product pricing strategies, such as attracting deposits with longer maturities when rates are relatively low and attracting deposits with shorter maturities when rates are relatively high, all depending on our funding needs. Many economic forecasts of interest rates predict that interest rates will continue to remain at historically low levels for much of 2011 with a slight increase in rates towards the end of 2011. The Company expects its net interest margin to improve slightly in 2011 as we expect interest-bearing liabilities to reprice slightly faster than interest-earning assets. While there is no guarantee of how rates may change in 2011, the Company will price products that are competitive in the market, allow for growth and strive to maintain the net interest margin as much as possible. The Company also continues to seek new sources of noninterest income to combat the effects of volatility in the interest rate environment.

The following table presents the major categories of interest-earning assets, interest-bearing liabilities and stockholders’ equity with corresponding average balances, related interest income or interest expense and resulting yield and rates for the periods indicated.

ANALYSIS OF NET INTEREST INCOME

| Years ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||||||

| Assets | Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

|||||||||||||||||||||||||||

| Interest-earning assets: |

||||||||||||||||||||||||||||||||||||

| Loans (2)(3) |

$ | 264,604 | 15,835 | 5.98 | % | 274,710 | 16,622 | 6.05 | % | 263,924 | 17,615 | 6.67 | % | |||||||||||||||||||||||

| Investment securities: |

||||||||||||||||||||||||||||||||||||

| Taxable |

20,456 | 587 | 2.87 | % | 11,351 | 470 | 4.14 | % | 13,041 | 622 | 4.77 | % | ||||||||||||||||||||||||

| Tax-exempt (4) |

3,063 | 167 | 5.45 | % | 4,046 | 273 | 6.75 | % | 4,910 | 324 | 6.60 | % | ||||||||||||||||||||||||

| Interest-earning deposits |

31,912 | 84 | 0.26 | % | 16,907 | 33 | 0.20 | % | 261 | 6 | 2.30 | % | ||||||||||||||||||||||||

| Federal funds sold |

1,261 | 4 | 0.32 | % | 5,564 | 11 | 0.20 | % | 4,689 | 104 | 2.22 | % | ||||||||||||||||||||||||

| Total interest-earning assets |

321,296 | 16,677 | 5.19 | % | 312,578 | 17,409 | 5.57 | % | 286,825 | 18,671 | 6.51 | % | ||||||||||||||||||||||||

| Other assets: |

||||||||||||||||||||||||||||||||||||

| Allowance for loan losses |

(3,774 | ) | (3,766 | ) | (1,912 | ) | ||||||||||||||||||||||||||||||

| Cash and due from banks |

2,419 | 2,123 | 5,171 | |||||||||||||||||||||||||||||||||

| Other assets, net |

14,058 | 13,749 | 8,618 | |||||||||||||||||||||||||||||||||

| Total assets |

$ | 333,999 | 324,684 | 298,702 | ||||||||||||||||||||||||||||||||

| Years ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ equity |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

Average balance(1) |

Interest income/ expense |

Rate earned/ paid |

|||||||||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||||||||||||||

| Savings and NOW |

$ | 113,100 | 1,271 | 1.12 | % | 97,233 | 1,264 | 1.30 | % | 79,298 | 1,170 | 1.48 | % | |||||||||||||||||||||||

| Time |

162,489 | 4,564 | 2.81 | % | 171,293 | 6,044 | 3.53 | % | 160,613 | 7,055 | 4.39 | % | ||||||||||||||||||||||||

| Other borrowings |

— | — | — | 740 | 4 | 0.54 | % | 5,150 | 110 | 2.14 | % | |||||||||||||||||||||||||

| Federal funds purchased |

— | — | — | — | — | — | 408 | 11 | 2.70 | % | ||||||||||||||||||||||||||

| 275,589 | 5,835 | 2.12 | % | 269,266 | 7,312 | 2.72 | % | 245,469 | 8,346 | 3.40 | % | |||||||||||||||||||||||||

| Noninterest-bearing liabilities: |

||||||||||||||||||||||||||||||||||||

| Demand deposits |

27,884 | 25,883 | 25,169 | |||||||||||||||||||||||||||||||||

| Other liabilities |

4,376 | 4,580 | 774 | |||||||||||||||||||||||||||||||||

| 307,849 | 299,729 | 271,412 | ||||||||||||||||||||||||||||||||||

| Stockholders’ equity |

26,150 | 24,955 | 27,290 | |||||||||||||||||||||||||||||||||

| $ | 333,999 | 324,684 | 298,702 | |||||||||||||||||||||||||||||||||

| Net interest income |

10,842 | 10,097 | 10,325 | |||||||||||||||||||||||||||||||||

| Net interest margin (5) |

3.37 | % | 3.23 | % | 3.60 | % | ||||||||||||||||||||||||||||||

| Net interest spread (6) |

3.07 | % | 2.85 | % | 3.11 | % | ||||||||||||||||||||||||||||||

11

| (1) | Averages are daily averages. |

| (2) | Loan interest income includes accretion of loan fees of $30 in 2010, amortization of loan fees of $67 in 2009 and amortization of loan fees of $24 in 2008. |

| (3) | For the purpose of these computations, non-accrual loans are included in average loans. |

| (4) | Tax-exempt income from investment securities is presented on a tax-equivalent basis assuming a 34% U.S. Federal tax rate for 2010, 2009 and 2008. |

| (5) | The net interest margin is calculated by dividing net interest income by average total interest-earning assets. |

| (6) | The net interest spread is calculated by subtracting the interest rate paid on interest-bearing liabilities from the interest rate earned on interest-earning assets. |

As discussed above, the Company’s net interest income is affected by the change in the amounts and mix of interest-earning assets and interest-bearing liabilities, referred to as “volume change,” as well as by changes in yields earned on interest-earning assets and rates paid on deposits and other borrowed funds, referred to as “rate change.”. The following table presents, for the periods indicated, a summary of changes in interest income and interest expense for the major categories of interest-earning assets and interest-bearing liabilities and the amounts of change attributable to variations in volumes and rates.

RATE/VOLUME ANALYSIS

| Years ended December 31, | ||||||||||||||||||||||||

| 2010 compared to 2009 Increase (decrease) |

2009 compared to 2008 Increase (decrease) |

|||||||||||||||||||||||

| Volume | Rate | Net | Volume | Rate | Net | |||||||||||||||||||

| Interest earned on interest-earning assets: |

||||||||||||||||||||||||

| Loans (1) |

$ | (606 | ) | (181 | ) | (787 | ) | 772 | (1,765 | ) | (993 | ) | ||||||||||||

| Investment securities: |

||||||||||||||||||||||||

| Taxable |

190 | (73 | ) | 117 | (75 | ) | (77 | ) | (152 | ) | ||||||||||||||

| Tax-exempt (2) |

(59 | ) | (47 | ) | (106 | ) | (58 | ) | 7 | (51 | ) | |||||||||||||

| Interest-earning deposits |

39 | 4 | 43 | 27 | — | 27 | ||||||||||||||||||

| Federal funds sold |

(31 | ) | 24 | (7 | ) | 24 | (117 | ) | (93 | ) | ||||||||||||||

| Total interest earned on interest-earning assets |

(467 | ) | (273 | ) | (740 | ) | 690 | (1,952 | ) | (1,262 | ) | |||||||||||||

| Interest paid on interest-bearing liabilities: |

||||||||||||||||||||||||

| Savings and NOW |

41 | (34 | ) | 7 | 198 | (104 | ) | 94 | ||||||||||||||||

| Time |

(298 | ) | (1,182 | ) | (1,480 | ) | 516 | (1,527 | ) | (1,011 | ) | |||||||||||||

| Federal funds purchased |

— | — | (11 | ) | — | (11 | ) | |||||||||||||||||

| Other borrowings |

(2 | ) | (2 | ) | (4 | ) | (57 | ) | (49 | ) | (106 | ) | ||||||||||||

| Total interest paid on interest-bearing liabilities |

(259 | ) | (1,218 | ) | (1,477 | ) | 646 | (1,680 | ) | (1,034 | ) | |||||||||||||

| Change in net interest income |

$ | (208 | ) | 945 | 737 | 44 | (272 | ) | (228 | ) | ||||||||||||||

| (1) | Non-accrual loans are included in the average loan totals used in the calculation of this table. |

| (2) | Tax-exempt income from investment securities is presented on a tax equivalent basis assuming a 34% U.S. Federal tax rate. |

Provision for Loan Losses. The provision for loan losses is based upon the Company’s evaluation of the quality of the loan portfolio, total outstanding and committed loans, the Company’s previous loan loss experience and current and anticipated economic conditions. The amount of the provision for loan losses is a charge against earnings. Actual loan losses are charges against the allowance for loan losses.

The Company’s allowance for loan losses is maintained at a level deemed adequate to provide for known and inherent losses in the loan portfolio. No assurance can be given that unforeseen adverse economic conditions or other circumstances will not result in increased provisions in the future, or that the allowance for loan losses will be adequate for actual losses. Additionally, regulatory examiners may require the Company to recognize additions to the allowance based upon their judgment about information available to them at the time of their examinations.

The provisions for loan losses for the years ended December 31, 2010, 2009 and 2008 were $1,878, $1,530 and $2,881, respectively. The provision for loan losses increased substantially in 2008 from prior periods as management recognized weaknesses in the loan portfolio due to declining economic conditions, declining collateral values and an increased risk of some customer’s ability to service their of loans due to job losses. While the provision for loan losses decreased 46.89% from 2008 to 2009, the provision for loan losses increased 22.75%

12

from 2009 to 2010 due to continuing pressures on asset quality in 2010. The Company saw an increase in its nonperforming loans to total loans from 1.49% on December 31, 2009 to 2.91% on December 31, 2010. Total nonperforming loans were $7,843 as of December 31, 2010 and $4,017 as of December 31, 2009. The Company expects to continue to see weaknesses in its loan portfolio in 2011 and is working to minimize its losses from non-accrual and past due loans. See “Allowance for Loan Losses” for further discussions.

Noninterest Income. Total noninterest income for the year ended December 31, 2010 decreased $14 or 0.44% to $3,134 from $3,148 in 2009. The Company’s principal source of noninterest income is service charges and fees on deposit accounts, particularly transaction accounts, fees on sales of mortgage loans, and commissions and fees from investment, insurance, annuity and other bank products. The slight decrease in 2010 is primarily attributable to the following factors. Service charges on deposit accounts decreased $18 for the year ended December 31, 2010 compared to 2009 as nonsufficient funds charges decreased due to new regulations and opt-in requirements. Commissions and fees increased $54 for the year ended December 31, 2010, compared to 2009 and were mainly derived from investment sales. Mortgage loan fees increased $24 for the year ended December 31, 2010, compared to 2009. Service charges on loan accounts decreased by $36 due to lower loan volume in 2010 compared with 2009.

Total noninterest income for the year ended December 31, 2009 increased $252 or 8.70% to $3,148 from $2,896 in 2008. The Company’s principal source of noninterest income is service charges and fees particularly transaction accounts, mortgage loan fees, and commissions and fees from investment, insurance, annuity and other bank products. The increase in 2009 is primarily attributable to an increase in the volume of mortgage loan sales. Mortgage loan fees increased $286 for the year ended December 31, 2009, compared to 2008.

Noninterest Expense. Total noninterest expense for the year ended December 31, 2010 decreased $134 or 1.20% to $11,037 from $11,171 in 2009. The decrease in noninterest expense is primarily attributable to a $120 decrease in FDIC premiums and a $96 decrease in salaries and employee benefits due to lower retirement cost. The Company anticipates future increases in deposit insurance assessment rates as the FDIC attempts to replenish its resolution fund.

Total noninterest expense for the year ended December 31, 2009 increased $1,325 or 13.46% to $11,171 from $9,846 in 2008. The increase in noninterest expense is attributable a $544 increase in FDIC premiums, and increase in commissions paid on mortgage loan and investment sales and an increase in fixed asset costs due to the growth of the Company. A $135 increase in the cost of foreclosures led to an increase in other expenses.

Income Tax Expense. Applicable income taxes on 2010 earnings amounted to $308, resulting in an effective tax rate of 30.95% compared to $100, or 22.17% in 2009. The effective tax rate for 2010 is a function of the higher net income earned in 2010 than in 2009 and the effects of interest earned on tax-exempt securities.

Applicable income taxes on 2009 earnings amounted to $100, resulting in an effective tax rate of 22.17% compared to $72, or 19.05% in 2008. The effective tax rate for 2009 is a function of the higher net income earned and the effects of interest earned on tax-exempt securities.

Liquidity and Asset/Liability Management

Effective asset/liability management includes maintaining adequate liquidity and minimizing the impact of future interest rate changes on net interest income. The responsibility for monitoring the Company’s liquidity and the sensitivity of its interest-earning assets and interest-bearing liabilities lies with the Investment Committee of the Bank which meets at least quarterly to review liquidity and the adequacy of funding sources.

Cash Flows. The Company derives cash flows from its operating, investing and financing activities. Cash flows of the Company are primarily used to fund loans and purchase securities and are provided by the deposits and borrowings of the Company.

The Company’s operating activities for the year ended December 31, 2010 resulted in net cash provided from operating activities of $3,683 compared to net cash provided from operating activities of $766 in 2009, an increase of $2,917. This increase is primarily attributable to cash received from noninterest income of $5,022,

13

which is $3,774 higher than 2009. The increase in net cash provided from operating activities is also due to cash received from net interest income of $10,862, which is $1,108 higher than in 2009. Partially offsetting this was cash paid for income taxes totaling $1,283 in 2010 compared to cash received of $353 in 2009. Also offsetting these increases was cash paid for non-interest expense of $10,965, which was $376 higher than 2009. Management expects continued increases in the Company’s cash provided by operating activities through deposit pricing strategies and continued focus on improving the efficiency of the Company’s operations.

The Company’s cash flows from investing activities for the year ended December 31, 2010 resulted in net cash used of $7,993, compared to net cash provided of $4,629 in 2009. The increase is primarily attributable to an $8,740 increase in cash used to purchase securities as the Company increased its securities portfolio by 31.56% from 2009. The Company also saw a small net increase in loans made to customers of $1,400 in 2010. The Company experienced more maturities and calls from available-for sale securities and less paydowns, maturities and sales of available-for-sale mortgage-backed securities in 2010. The Company expects a lower volume of paydowns in available-for-sale mortgage-backed securities in 2011 due to fewer mortgage-backed securities in the investment portfolio.

Net cash provided by financing activities for the year ended December 31, 2010 was $4,783, compared to net cash provided by financing activities of $10,739 in 2009. The decrease in net cash provided is primarily attributable to an accelerated decrease in time deposits from 2009 to 2010 as compared to the change from 2008 to 2009. The Company also experienced smaller net increases in demand, savings and NOW deposits from 2009 to 2010 as compared to the change from 2008 to 2009.

The Company’s operating activities for the year ended December 31, 2009 resulted in net cash the provided from operating activities of $766 compared to net cash provided from operating activities of $2,968 in 2008. The decrease is primarily attributable to the cash paid for noninterest expenses of $10,589. This was $902 higher than 2008 due to higher personnel expenses, fixed asset costs and FDIC insurance premiums in 2009. Offsetting this was cash received for income taxes totaled $353 in 2009 compared to cash paid of $1,087 in 2008. Also offsetting this was cash received from net interest income of $9,754, which was $555 lower than the net interest received in 2008 as a result of a decrease in loan volume and interest received. Cash received from noninterest income in 2009 was $2,675 lower than the noninterest income amount received in 2008.

The Company’s cash flows from investing activities for the year ended December 31, 2009 resulted in net cash provided of $4,629, compared to net cash used in investing activities of $45,864 in 2008. The increase is primarily attributable to an $11,080 decrease in cash used to make loans to customers as the Company decreased its gross loans by 4.80% from 2008 to 2009 as compared to a 20.76% increase from 2007 to 2008. The Company experienced more paydowns, maturities and sales of available-for-sale mortgage-backed securities in 2009.

Net cash provided by financing activities for the year ended December 31, 2009 was $10,739, compared to net cash provided by financing activities of $40,478 in 2008. The decrease in net cash provided is primarily attributable to an accelerated decrease in time deposits from 2008 to 2009 as compared to the change from 2007 to 2008. The Company also repaid a note payable to the Federal Home Loan Bank. The Company had success in attracting demand, savings and NOW deposits in 2009.

Liquidity. Liquidity measures the ability of the Company to meet its maturing obligations and existing commitments, to withstand fluctuations in deposit levels, to fund its operations, and to provide for customers’ credit needs. Liquidity represents an institution’s ability to meet present and future financial obligations through either the sale or maturity of existing assets or the acquisition of additional funds from alternative funding sources.

The Company’s liquidity is provided by cash and due from banks, federal funds sold, investments available-for-sale, managing investment maturities, interest-earning deposits in other financial institutions and loan repayments. The Company’s ratio of liquid assets to deposits and short-term borrowings was 16.96% as of December 31, 2010 as compared to 16.37% as of December 31, 2009. The Company sells excess funds as overnight federal funds sold to provide an immediate source of liquidity. Federal funds sold at December 31, 2010 was $0 as compared to $2,008 at December 31, 2009. The decrease in federal funds sold in 2010 was primarily related to retaining excess funds in our Federal Reserve account which began paying interest in 2009.

14

Cash and due from banks of $32,533, which includes funds in our Federal Reserve account, as of December 31, 2010 was $2,481 higher when compared to December 31, 2009 as more funds were moved to our Federal Reserve account. The Company expects to deploy some of this cash into securities in 2011. We also expect loans to increase slightly in 2011.

The level of deposits may fluctuate significantly due to seasonal business cycles of depository customers. Levels of deposits are also affected by convenience of branch locations and ATMs to the customer, the rates offered on interest-bearing deposits and the attractiveness of noninterest-bearing deposit offerings compared with the competition. Similarly, the level of demand for loans may vary significantly and at any given time may increase or decrease substantially. However, unlike the level of deposits, management has more direct control over lending activities and maintains the level of those activities according to the amounts of available funds. Loan demand may be affected by the overall health of the local economy, loan rates compared with the competition and other loan features offered by the Company.

As a result of the Company’s management of liquid assets and its ability to generate liquidity through alternative funding sources, management believes that the Company maintains overall liquidity that is sufficient to satisfy its depositors’ requirements and to meet customers’ credit needs. Additional sources of liquidity available to the Company include its capacity to borrow funds through correspondent banks and the Federal Home Loan Bank. The total amount available for borrowing to the Company for liquidity purposes was $65,650 on December 31, 2010.

The Company obtains sources of funds through growth in deposits, scheduled payments and prepayments from the loan and investment portfolios and retained earnings growth, and may purchase or borrow funds from the Federal Home Loan Bank or through the Federal Reserve’s discount window. The Company also has sources of liquidity through three correspondent banking relationships. The Company uses its funds to fund loan and investment growth. Excess funds are sold daily to other institutions. The Company also has a $5,000 holding company line of credit with a correspondent bank for bank capital purposes with an outstanding balance of $2,000 on December 31, 2010 and December 31, 2009.

Contractual Obligations

The Company has entered into certain contractual obligations including long-term debt and operating leases. The table does not include deposit liabilities entered into in the ordinary course of banking. Operating Leases include leases of our Amherst, Timberlake and Wyndhurst facilities. Also included are contractual leases for offsite ATMs and postage machinery. The following table summarizes the Company’s contractual obligations as of December 31, 2010.

| Pinnacle Bankshares Corporation Line of Credit |

2011 | $ | 2,000 | |||||

| Operating Leases |

||||||||

| Year | Payments | |||||||

| 2011 | $ | 199 | ||||||

| 2012 | 185 | |||||||

| 2013 | 141 | |||||||

| 2014 | 141 | |||||||

| 2015 | 141 | |||||||

| After 2015 | 2,010 | |||||||

| Total | $ | 2,817 | ||||||

15

Interest Rates

While no single measure can completely identify the impact of changes in interest rates on net interest income, one gauge of interest rate sensitivity is to measure, over a variety of time periods, the differences in the amounts of the Company’s rate-sensitive assets and rate-sensitive liabilities. These differences or “gaps” provide an indication of the extent to which net interest income may be affected by future changes in interest rates. A “positive gap” exists when rate-sensitive assets exceed rate-sensitive liabilities and indicates that a greater volume of assets than liabilities will reprice during a given period. This mismatch may enhance earnings in a rising interest rate environment and may inhibit earnings in a declining interest rate environment. Conversely, when rate-sensitive liabilities exceed rate-sensitive assets, referred to as a “negative gap,” it indicates that a greater volume of liabilities than assets will reprice during the period. In this case, a rising interest rate environment may inhibit earnings and a declining interest rate environment may enhance earnings. The cumulative one-year gap as of December 31, 2010 was $44,860, representing 13.31% of total assets. This positive gap falls within the parameters set by the Company.

The following table illustrates the Company’s interest rate sensitivity gap position at December 31, 2010.

| 1 year | 1-3 years | 3-5 years | 5-15 years | |||||||||||||

| ASSET/(LIABILITY): |

||||||||||||||||

| Cumulative interest rate sensitivity gap |

$ | 44,860 | 28,022 | 17,827 | 38,284 | |||||||||||

As of December 31, 2010, the Company was asset-sensitive in all periods up to 15 years. The foregoing table does not necessarily indicate the impact of general interest rate movements on the Company’s net interest yield, because the repricing of various categories of assets and liabilities is discretionary and is subject to competition and other pressures. As a result, various assets and liabilities indicated as repricing within the same period may reprice at different times and at different rate levels. Management attempts to mitigate the impact of changing interest rates in several ways, one of which is to manage its interest rate-sensitivity gap. In addition to managing its asset/liability position, the Company has taken steps to mitigate the impact of changing interest rates by generating noninterest income through service charges, and offering products that are not interest rate-sensitive.

Effects of Inflation

The effect of changing prices on financial institutions is typically different from other industries as the Company’s assets and liabilities are monetary in nature. Interest rates are significantly impacted by inflation, but neither the timing nor the magnitude of the changes is directly related to price level indices. Impacts of inflation on interest rates, loan demand and deposits are not reflected in the consolidated financial statements.

Investment Portfolio

The Company’s investment portfolio is used primarily for investment income and secondarily for liquidity purposes. The Company invests funds not used for capital expenditures or lending purposes in securities of the U.S. Government and its agencies, mortgage-backed securities, taxable and tax-exempt municipal bonds, corporate securities or certificates of deposit. Obligations of the U.S. Government and its agencies include treasury notes and callable or noncallable agency bonds. The mortgage-backed securities include mortgage-backed security pools that are diverse as to interest rates. The Company has not invested in derivatives.

Investment securities available-for-sale as of December 31, 2010 totaled $22,048, an increase of $2,943 or 15.40% from $19,105 as of December 31, 2009. Investment securities held-to-maturity increased to $4,469 as of December 31, 2010 from $1,051 as of December 31, 2009, an increase of $3,418 or 325.21%. Securities increased in 2010 as funds from loan payoffs, security maturities, calls and pay downs were used to buy additional bonds and kept as cash due to low loan demand in 2010. Held-to-maturity securities increased in 2010 as the Company purchased taxable and tax-exempt bonds in 2010 which are normally classified as held-to-maturity.

The following table presents the composition of the Company’s investment portfolios as of the dates indicated.

16

| 2010 | December 31, 2009 |

2008 | ||||||||||||||||||||||

| Available-for-Sale | Amortized cost |

Fair value |

Amortized cost |

Fair value |

Amortized cost |

Fair value |

||||||||||||||||||

| U.S. Treasury securities and obligations of U.S. Government corporations and agencies |

$ | 17,247 | 17,196 | 11,532 | 11,580 | 2,031 | 2,040 | |||||||||||||||||

| Obligations of states and political subdivisions |

3,381 | 3,471 | 4,728 | 4,839 | 4,891 | 4,973 | ||||||||||||||||||

| Corporate securities |

— | — | 1,000 | 1,003 | 999 | 974 | ||||||||||||||||||

| Mortgage-backed securities – government |

1,211 | 1,271 | 1,514 | 1,573 | 3,339 | 3,389 | ||||||||||||||||||

| Other securities |

110 | 110 | 110 | 110 | 50 | 50 | ||||||||||||||||||

| Total available-for-sale |

$ | 21,949 | 22,048 | 18,884 | 19,105 | 11,310 | 11,426 | |||||||||||||||||

| 2010 | December 31, 2009 |

2008 | ||||||||||||||||||||||

| Held-to-Maturity | Amortized cost |

Fair value |

Amortized cost |

Fair value |

Amortized cost |

Fair value |

||||||||||||||||||

| Obligations of states and political subdivisions |

$ | 4,469 | 4,400 | 1,051 | 1,078 | 2,505 | 2,575 | |||||||||||||||||

| Total held-to-maturity |

$ | 4,469 | 4,400 | 1,051 | 1,078 | 2,505 | 2,575 | |||||||||||||||||

The following table presents the maturity distribution based on fair values and amortized costs of the investment portfolios as of the dates indicated.

INVESTMENT PORTFOLIO – MATURITY DISTRIBUTION

| December 31, 2010 | ||||||||||||

| Available-for-Sale | Amortized Cost |

Fair Value |

Yield | |||||||||

| U.S. Treasury securities and obligations of U.S. |

||||||||||||

| Government corporations: |

||||||||||||

| Within one year |

$ | 30 | 31 | 6.00 | % | |||||||

| After one but within five years |

14,391 | 14,446 | 3.14 | % | ||||||||

| After five years through ten years |

2,825 | 2,718 | 2.91 | % | ||||||||

| Obligations of states and political subdivisions (1): |

||||||||||||

| Within one year |

1,252 | 1,275 | 4.27 | % | ||||||||

| After one but within five years |

1,438 | 1,496 | 6.52 | % | ||||||||

| After five years through ten years |

205 | 205 | 7.00 | % | ||||||||

| After ten years |

487 | 495 | 5.17 | % | ||||||||

| Mortgage-backed securities – government |

1,211 | 1,272 | 3.59 | % | ||||||||

| Other securities (2) |

110 | 110 | — | |||||||||

| Total available-for-sale |

$ | 21,949 | 22,048 | |||||||||

| Held-to-Maturity |

||||||||||||

| Obligations of states and political subdivisions (1): |

||||||||||||

| After one but within five years |

2,836 | 2,852 | 3.69 | % | ||||||||

| After five years through ten years |

1,633 | 1,548 | 4.12 | % | ||||||||

| Total held-to-maturity |

$ | 4,469 | 4,400 | |||||||||

| (1) | Obligations of states and political subdivisions include yields of tax-exempt securities presented on a tax-equivalent basis assuming a 34% U.S. Federal tax rate. |

| (2) | Equity securities are assumed to have a life greater than ten years. |

Loan Portfolio

The Company’s net loans were $265,030 as of December 31, 2010, a decrease of $874 or 0.33% from $265,904 as of December 31, 2009. This decrease resulted primarily from decreased volume of real estate loan originations during 2010. The Company’s ratio of net loans to total deposits was 86.34% as of December 31, 2010 compared to 88.01% as of December 31, 2009.

17

Typically, the Company maintains a ratio of loans to deposits of between 80% and 100%. The loan portfolio primarily consists of commercial, real estate (including real estate term loans, construction loans and other loans secured by real estate), and loans to individuals for household, family and other consumer expenditures. However, the Company adjusts its mix of lending and the terms of its loan programs according to market conditions and other factors. The Company’s loans are typically made to businesses and individuals located within the Company’s market area, most of whom have account relationships with the Bank. There is no concentration of loans exceeding 10% of total loans that is not disclosed in the categories presented below. The Company has not made any loans to any foreign entities including governments, banks, businesses or individuals. Commercial and construction loans in the Company’s portfolio are primarily variable rate loans and have little interest rate risk.

The Company had no option adjustable rate mortgages, subprime loans or loans with teaser rates and similar products as of December 31, 2010. Junior lien mortgages totaled of $26,209 as of December 31, 2010 with a specific allowance for loan loss calculation of $269. The Company had interest only loans totaling $13,025 as of December 31, 2010. Residential mortgage loans with a loan to collateral value ratio exceeding 100% were $2,793 as of December 31, 2010.

The following table presents the composition of the Company’s loan portfolio as of the dates indicated.

LOAN PORTFOLIO

| December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Real estate loans: |

||||||||||||||||||||

| Residential real estate |

$ | 111,369 | 116,259 | 117,806 | 75,579 | 68,540 | ||||||||||||||

| Commercial real estate |

87,216 | 81,219 | 86,915 | 92,102 | 72,797 | |||||||||||||||

| Loans to individuals for household, family and other consumer expenditures |

47,545 | 50,097 | 54,329 | 46,834 | 46,360 | |||||||||||||||

| Commercial and industrial loans |

22,794 | 21,589 | 23,820 | 19,909 | 21,694 | |||||||||||||||

| All other loans |

262 | 612 | 514 | 240 | 454 | |||||||||||||||

| Total loans, gross |

269,186 | 269,776 | 283,384 | 234,664 | 209,845 | |||||||||||||||

| Less unearned income and fees |

(119 | ) | (149 | ) | (216 | ) | (192 | ) | (214 | ) | ||||||||||

| Loans, net of unearned income and fees |

269,067 | 269,627 | 283,168 | 234,472 | 209,631 | |||||||||||||||

| Less allowance for loan losses |

(4,037 | ) | (3,723 | ) | (3,969 | ) | (1,720 | ) | (1,770 | ) | ||||||||||

| Loans, net |

$ | 265,030 | 265,904 | 279,199 | 232,752 | 207,861 | ||||||||||||||

Commercial Loans. Commercial and industrial loans accounted for 8.47% of the Company’s gross loan portfolio as of December 31, 2010 compared to 8.00% as of December 31, 2009. Such loans are generally made to provide operating lines of credit, to finance the purchase of inventory or equipment, and for other business purposes. Commercial loans are primarily made at rates that adjust with changes in the prevailing prime interest rate, are generally made for a maximum term of five years (unless they are term loans), and generally require interest payments to be made monthly. The creditworthiness of these borrowers is reviewed, analyzed and evaluated on a periodic basis. Most commercial loans are collateralized with business assets such as accounts receivable, inventory and equipment. Even with substantial collateralization such as all of the assets of the business and personal guarantees, commercial lending involves considerable risk of loss in the event of a business downturn or failure of the business.

Real Estate Loans. Real estate loans accounted for 73.77% of the Company’s gross loan portfolio as of December 31, 2010 compared to 73.20% as of December 31, 2009. The Company makes commercial real estate term loans that are typically secured by a first deed of trust.

As of December 31, 2010, 56.08% of the real estate loans were secured by 1-4 family residential properties. Of these 1-4 family residential property loans, 6.62% were construction loans, 33.91% were home equity lines of credit, 53.96% were closed end loans secured by a first deed of trust and 5.51% were closed end loans secured by a second deed of trust.

As of December 31, 2010, 43.92% of the real estate loans were secured by commercial real estate. Of the total commercial real estate loans as of December 31, 2010, 29.60% were acquisition and development loans, 8.44%

18

were secured by farmland, 43.69% were secured by owner occupied commercial real estate and 18.27% were secured by non-owner occupied commercial real estate typically 1st and 2nd deeds of trust.

Real estate lending involves risk elements when there is lack of timely payment and/or a decline in the value of the collateral. Both commercial and residential real estate values in the Company’s market declined slightly in 2010. The Company is still seeing evidence of some borrowers being strained in their ability to service loans. This has resulted in a higher number of loan impairments in 2010 and may result in future impairments in 2011. The Company continuously monitors the local real estate market for signs of weakness that could decrease collateral values.

Installment Loans. Installment loans are represented by loans to individuals for household, family and other consumer expenditures with typical collateral such as automobile titles. Installment loans accounted for 17.66% of the Company’s loan portfolio as of December 31, 2010 compared to 18.57% as of December 31, 2009.

Loan Maturity and Interest Rate Sensitivity. The following table presents loan portfolio information related to maturity distribution of commercial and industrial loans and real estate construction loans based on scheduled repayments at December 31, 2010.

| Due within one year |

Due one to five years |

Due after five years |

Total | |||||||||||||

| Commercial and industrial loans |

$ | 12,594 | 5,088 | 5,112 | 22,794 | |||||||||||

| Real estate – construction |

6,308 | 905 | 158 | 7,371 | ||||||||||||

The following table presents the interest rate sensitivity of commercial and industrial loans and real estate construction loans maturing after one year or longer as of December 31, 2010.

INTEREST RATE SENSITIVITY

| Fixed interest rates |

$ | 11,263 | ||

| Variable interest rates |

— | |||

| Total maturing after one year |

$ | 11,263 | ||

Restructured Loans. The Company had four restructured loans totaling $3,262 at December 31, 2010 and none at December 31, 2009.

Nonperforming Assets. Interest on loans is normally accrued from the date a disbursement is made and recognized as income as it is earned. Generally, the Company reviews any loan on which payment has not been made for 90 days for potential nonaccrual. The loan is examined and the collateral is reviewed to determine loss potential. If the loan is placed on nonaccrual status, any prior accrued interest that remains unpaid is reversed. Loans on nonaccrual status amounted to $7,073, $2,619 and $2,292 as of December 31, 2010, 2009 and 2008, respectively. Interest income that would have been earned on nonaccrual loans if they had been current in accordance with their original terms and the recorded interest that was included in income on these loans was not significant for 2010, 2009 or 2008. There were no commitments to lend additional funds to customers whose loans were on nonaccrual status at December 31, 2010. Five foreclosed properties totaling $474 were on hand as of December 31, 2010 compared to three properties totaling $461 as of December 31, 2009 and one property totaling $300 as of 2008.

The current recession which began in the second half of 2008 has led to an increase in the Company’s nonperforming assets over the last three years. Some commercial borrowers have struggled to service their loans due to the difficult business climate, lower revenues, tightening of credit markets and difficulties in moving their product. Some noncommercial borrowers have experienced job losses and other economic challenges, as well. Continued market weaknesses including increased unemployment levels in 2010 led to the increase in nonperforming assets in 2010 compared to 2009. We expect nonperforming assets to decrease slightly in 2011 as the economy recovers. The Company will continue to monitor the situation and take steps necessary to mitigate losses in its loan portfolio, such as increased early monitoring of its portfolio to identify “problem” credits and

19

continued counseling of customers to discuss options available to them. The following table presents information with respect to the Company’s nonperforming assets and nonaccruing loans 90 days or more past due by type as of the dates indicated.

NONPERFORMING ASSETS

| December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Nonaccrual loans |

$ | 7,073 | 2,619 | 2,292 | ||||||||

| Loans 90 days or more past due |

770 | 1,398 | 620 | |||||||||

| Foreclosed properties |

474 | 461 | 300 | |||||||||

| Total nonperforming assets |

$ | 8,317 | 4,478 | 3,212 | ||||||||

Nonperforming assets totaled $8,317 or 2.47% of total assets as of December 31, 2010, compared to $4,478 or 1.35% as of December 31, 2009 and $3,212 or 1.00% as of December 31, 2008. The following table presents the balance of accruing loans 90 days or more past due by type as of the dates indicated.

ACCRUING LOANS 90 DAYS OR MORE

PAST DUE BY TYPE

| December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Loans 90 days or more past due by type: |

||||||||||||

| Real estate loans |

$ | 732 | 1,283 | 546 | ||||||||

| Loans to individuals |

38 | 84 | 41 | |||||||||

| Commercial loans |

— | 31 | 33 | |||||||||

| Total accruing loans 90 days or more past due |

$ | 770 | 1,398 | 620 | ||||||||

Allowance for Loan Losses. The Company maintains an allowance for loan losses which it considers adequate to cover the risk of losses in the loan portfolio. The allowance is based upon management’s ongoing evaluation of the quality of the loan portfolio, total outstanding and committed loans, previous charges against the allowance and current and anticipated economic conditions. The allowance is also subject to regulatory examinations and determinations as to adequacy, which may take into account such factors as the methodology used to calculate the allowance. The Company’s management believes that as of December 31, 2010, 2009 and 2008, the allowance was adequate. The amount of the provision for loan losses is a charge against earnings. Actual loan losses are charged against the allowance for loan losses.