Attached files

| file | filename |

|---|---|

| 8-K - NORTHERN OIL AND GAS, INC 8-K 3-28-2011 - NORTHERN OIL & GAS, INC. | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - NORTHERN OIL & GAS, INC. | ex99_1.htm |

Exhibit 99.2

Northern Oil and Gas, Inc.

Howard Weil 2011

Northern Oil and Gas, Inc. (NYSE/AMEX: NOG)

2

Forward Looking Statements

Statements made by representatives of Northern Oil and Gas, Inc. (“Northern” or the “Company”) during

the course of this presentation that are not historical facts are forward-looking statements. These

statements are based on certain assumptions and expectations made by the Company which reflect

management’s experience, estimates and perception of historical trends, current conditions, anticipated

future developments and other factors believed to be appropriate. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are beyond the control of the Company,

which may cause actual results to differ materially from those implied or anticipated in the forward-looking

statements. These include risks relating to the global financial crisis, our ability to obtain additional

capital needed to implement our business plan, minimal operating history, loss of key personnel, lack of

business diversification, reliance on strategic, third-party relationships, ability to obtain rights to explore

and develop oil and gas reserves, financial performance and results, our indebtedness under our credit

facility, prices and demand for gas, oil and natural gas liquids, our ability to replace reserves and

efficiently develop our current reserves, our ability to make acquisitions on economically acceptable

terms, and other important factors that could cause actual results to differ materially from those

anticipated or implied in the forward-looking statements. Northern undertakes no obligation to publicly

update any forward-looking statements, whether as a result of new information or future events.

the course of this presentation that are not historical facts are forward-looking statements. These

statements are based on certain assumptions and expectations made by the Company which reflect

management’s experience, estimates and perception of historical trends, current conditions, anticipated

future developments and other factors believed to be appropriate. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are beyond the control of the Company,

which may cause actual results to differ materially from those implied or anticipated in the forward-looking

statements. These include risks relating to the global financial crisis, our ability to obtain additional

capital needed to implement our business plan, minimal operating history, loss of key personnel, lack of

business diversification, reliance on strategic, third-party relationships, ability to obtain rights to explore

and develop oil and gas reserves, financial performance and results, our indebtedness under our credit

facility, prices and demand for gas, oil and natural gas liquids, our ability to replace reserves and

efficiently develop our current reserves, our ability to make acquisitions on economically acceptable

terms, and other important factors that could cause actual results to differ materially from those

anticipated or implied in the forward-looking statements. Northern undertakes no obligation to publicly

update any forward-looking statements, whether as a result of new information or future events.

3

Presenter

Michael Reger

CEO, Chairman

4

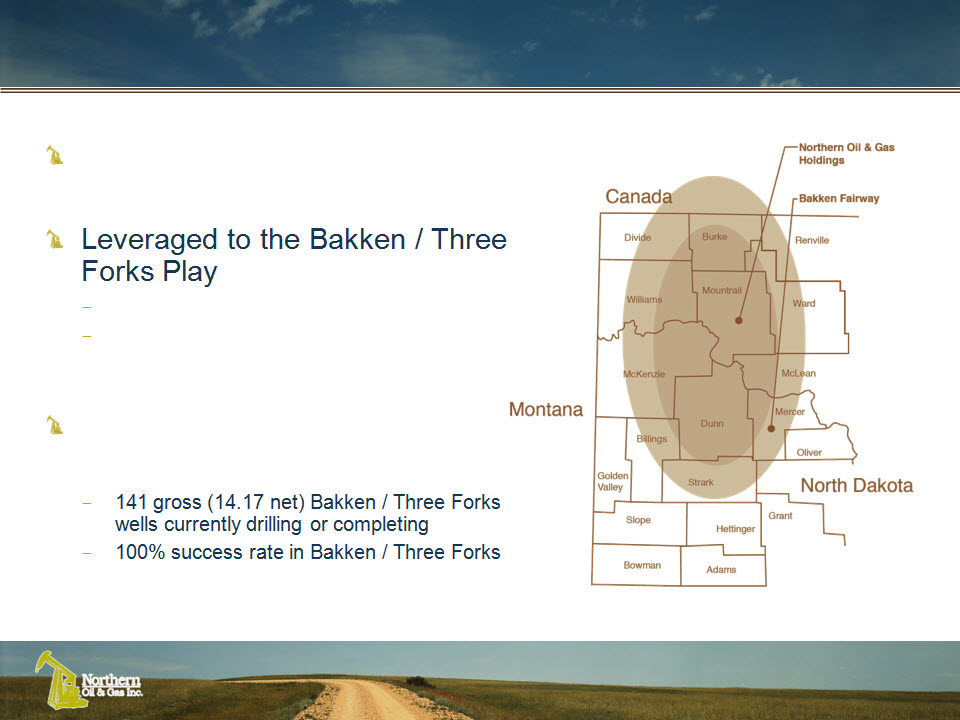

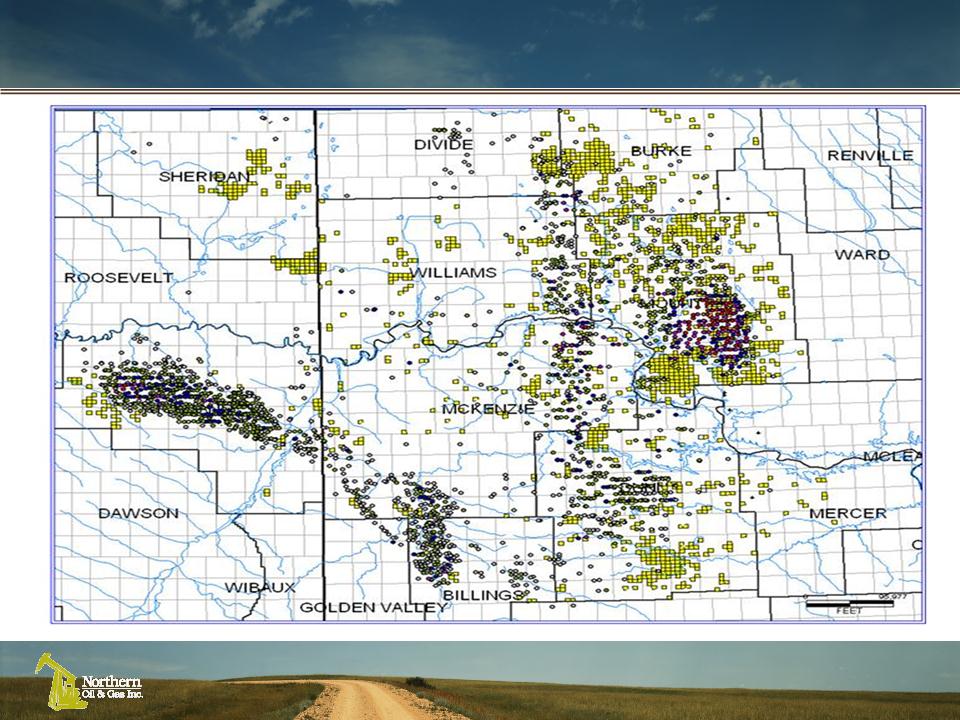

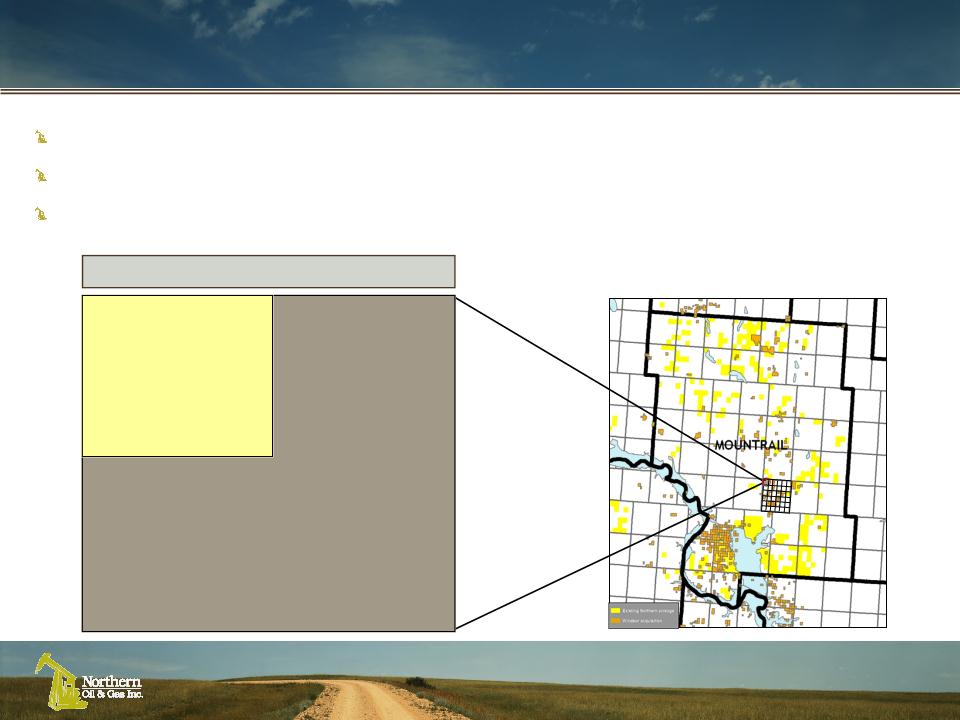

Williston Basin Bakken / Three Forks Focus

Strong Williston Basin Position

Bakken / Three Forks acreage

~151,300 net acres

Participated in 475+ Gross

Bakken / Three Forks wells

Bakken / Three Forks wells

NOG Core Bakken Leasehold: ~151,300 Net Acres

5

6

Key Operating Statistics

|

Q4 2010 Average Net Production (boe/d)

|

~3,700

|

|

Exit Rate (boe/d) (as of 12/31/10)

2011E Average Net Production (boe/d)

|

~5,200

~6,500 - ~7,100

|

|

Net Wells Spud 2010

|

~25.00

|

|

Net Wells Spud (FY 2011E)

3 Net Bakken Wells Available for Drilling:

3 Net Three Forks Wells Available for Drilling:

Total Williston Basin Drilling Exposure:

|

~40.00

1,280 acre spacing = 354 net wells

1,280acre spacing = 354 net wells

708 NET WELLS

|

7

Strategy - Keep It Simple

Maximize Bakken/Three Forks exposure as Non-Operator

Extensive leasehold in Mountrail County, ND

Substantial permitting activity on NOG’s acreage

Continue to partner with experienced operators

Acquire opportunistic acreage and production

First Quarter 2011 - Acquired ~11,100 net acre for ~$1,540 per acre

Maintain financial flexibility and strong balance sheet

December 2010 Capital Raise of $200 million

$125 million cash position

$100 million undrawn credit facility

No Debt

8

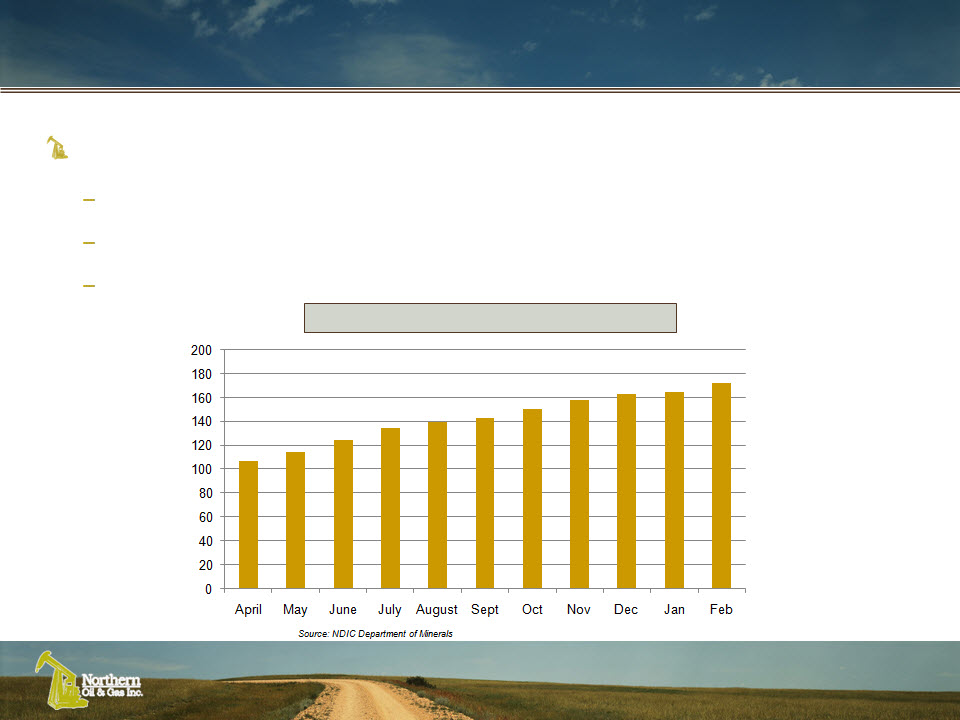

Bakken Shale Activity

Favorable developments in the Bakken

North Dakota rig count is at all-time highs: ~ 173 rigs

Three Forks productivity delineating rapidly throughout the field

Completion techniques evolving rapidly (super-fracs widely used)

North Dakota Average Monthly Rig Count

9

Record drilling activity has significantly intensified the pace of

development

development

NOG’s number of net wells drilling, awaiting completion, or

completing continues to grow:

completing continues to grow:

14.17 net wells as of March 28th, 2011

13.32 net wells as of February 25th, 2011

12.06 net wells as of November 29th, 2010

7.2 net wells as of August 9th, 2010

North Dakota - NOG is currently participating in 141 gross wells

drilling or completing (North Dakota rig count: ~ 173 rigs)

drilling or completing (North Dakota rig count: ~ 173 rigs)

Northern’s Bakken Activity

10

Strong Northern Results

25 net wells were spud in 2010

Drilling guidance increased to 40 net wells spud by YE 2011

Production increased 36% sequentially in Q4 2010

Production: 95% oil weighted

Oil Hedges in place through June 2012

Total Swaps: ~1,789,000 barrels @ ~$87

Feb-Dec 2011 Costless Collar: ~451,000 barrels @ $85/101.75

100% success rate in the Bakken/Three Forks play

11

Net wells spud:

40.00

Average production:

6,500 - 7,100 BOE per day

Average estimated well cost:

$6.3 million

Drilling capital plan:

$252 million

Acreage capital plan:

Remain opportunistic

2011 Guidance

12

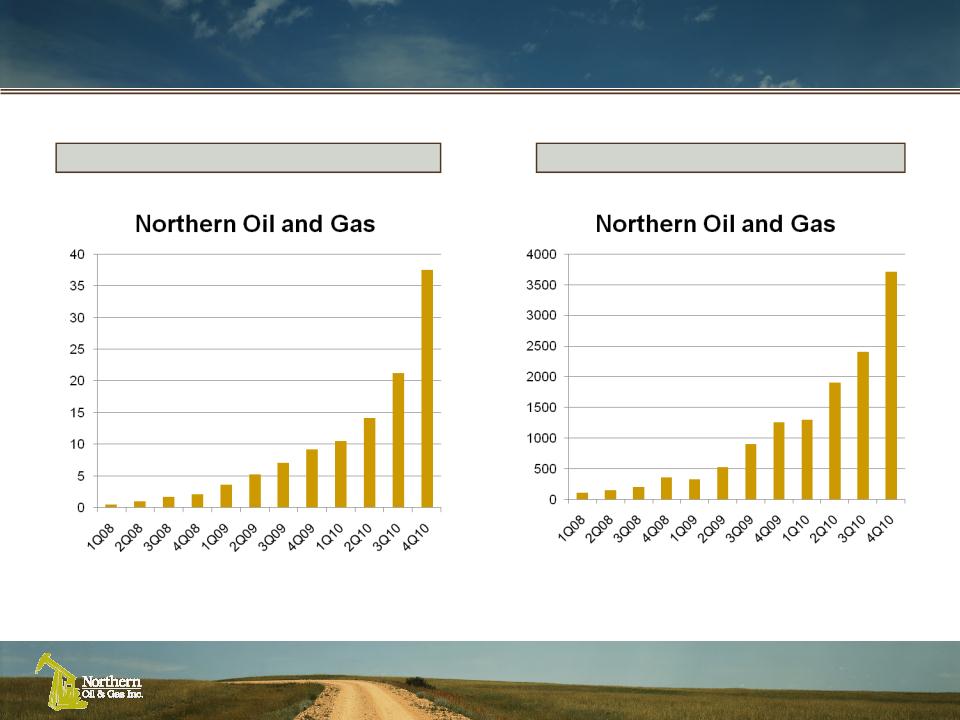

Northern’s Continued Execution

Cumulative Net Wells Producing & Spud

Average Quarterly Production (BOEPD)

Source: Company Filings

13

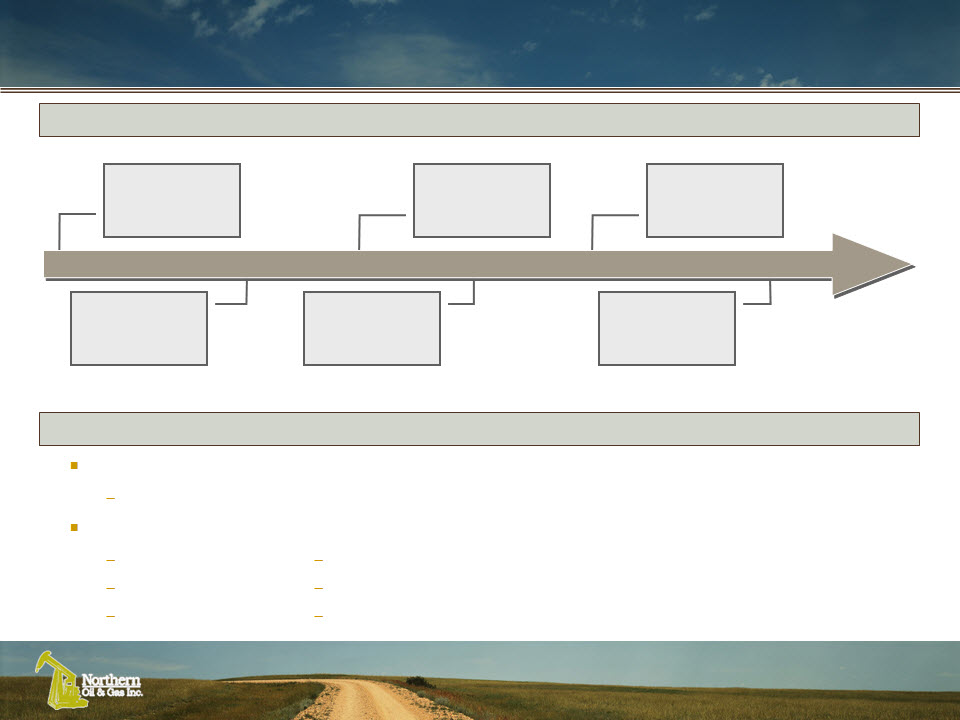

Non-Operator Model

Majority interest owner can permit a well on standard spacing without protest

Minority interest owners pooled into pro-rata share of well / drilling unit

Minority interest owner can permit well with support of other minority owners

Majority Interest (Operator)

75% (480 acres)

Minority Interest

(Non-Operator)

25% (160 acres)

640 Acre Section (Drilling Unit)

14

14

Non-Operator Model Continued

Low cost producer

Pay only direct drilling, development and operating costs of wells

Not responsible for many other operator costs

G&G

R&D

Seismic

Illustrative Transaction Timeline (1)

Legal / accounting for production

Engineering

Large operator staff not required

Benefits

Complete well

North Dakota Industrial

Commission issues

permit to drill Bakken

well

Commission issues

permit to drill Bakken

well

Receive authority for

expenditure (“AFE”)

expenditure (“AFE”)

Elect to participate / not

participate in AFE

participate in AFE

Spud well / Make

payment to operator

based on AFE estimate

payment to operator

based on AFE estimate

Receive first payment

from operator 60 days

after completion

from operator 60 days

after completion

Day 0

Day 120

Day 90

Day 60

Day 30

Day 180

Transaction timeline can be shorter or longer depending primarily on factors affecting the successful drilling and completion of a well that are both within and beyond the operator’s control.

15

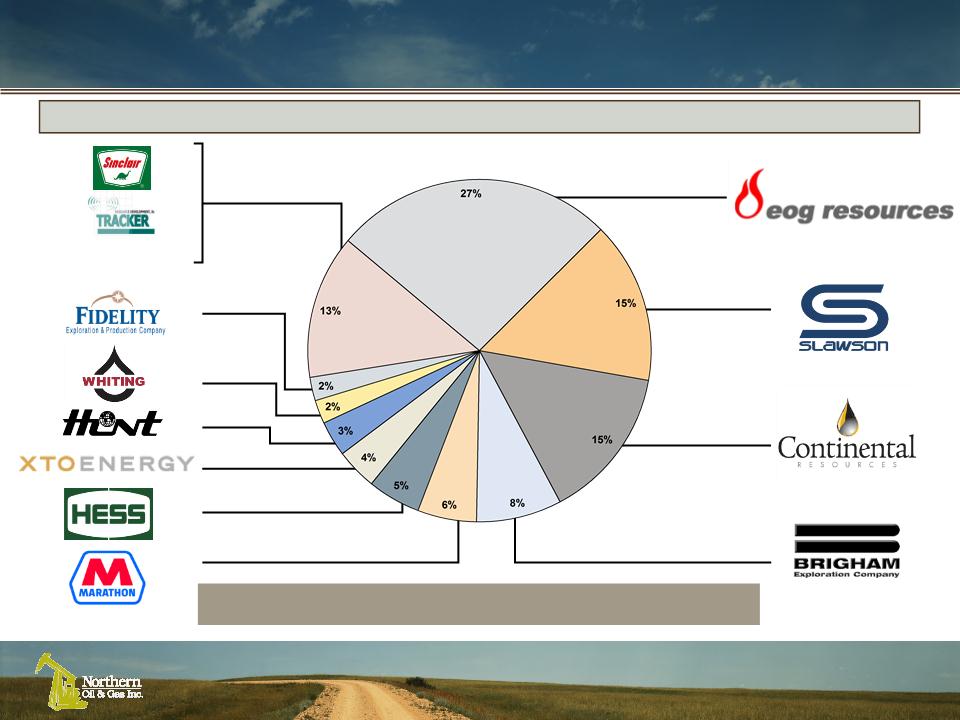

High-Quality Bakken Operators

OTHERS

Northern Operating Partners (% of Gross Wells)

Risk Diversification + Technology Transfer

16

Investment Highlights

Large Core Bakken / Three Forks Acreage Position With

Significant Drilling Inventory

Significant Drilling Inventory

Numerous Benefits Achieved Through Working With High-

Quality Operating Partners

Quality Operating Partners

Attractive Bakken / Three Forks Economics

Diversification Across Operators

Acreage Acquisition Advantage

Questions & Answers

Northern Oil and Gas, Inc. (NYSE/AMEX: NOG)