Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE OF 1934

For the fiscal year ended December 31, 2010

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE OF 1934

For the transition period from _____ to _____

Commission file number: 001-32581

LOTUS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Nevada | 20-0507918 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

No. 16 Cheng Zhuang Road, Feng Tai District, Beijing, People's Republic of China | 100071 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: | 86 (10) 63899868 |

Securities registered under Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

None | Not applicable |

Securities registered under Section 12(g) of the Act:

Common stock, $0.001 Par Value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [√]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [√]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [√] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

Large accelerated filer | [ ] | Accelerated filer | [ ] |

Non-accelerated filer (Do not check if smaller reporting company) | [ ] | Smaller reporting company | [√] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [√]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: $24,964,911 on June 30, 2010.

As of March 28, 2011, the registrant had 27,747,131 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

ii

LOTUS PHARMACEUTICALS, INC.

FORM 10-K

TABLE OF CONTENTS

|

| Page No. |

Part I | ||

Item 1. | Business. | 4 |

Item 1A. | Risk Factors. | 16 |

Item 1B. | Unresolved Staff Comments. | 28 |

Item 2. | Properties. | 28 |

Item 3. | Legal Proceedings. | 28 |

Item 4. | [Removed and Reserved.] | 28 |

Part II | ||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 29 |

Item 6. | Selected Financial Data. | 30 |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operation. | 30 |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 40 |

Item 8. | Financial Statements and Supplementary Data. | 40 |

Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. | 41 |

Item 9A.(T) | Controls and Procedures. | 41 |

Item 9B. | Other Information. | 43 |

Part III | ||

Item 10. | Directors, Executive Officers and Corporate Governance. | 43 |

Item 11. | Executive Compensation. | 47 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 49 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 50 |

Item 14. | Principal Accountant Fees and Services. | 50 |

Part IV | ||

Item 15. | Exhibits, Financial Statement Schedules. | 51 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, global competition, and other factors as relate to our doing business within the People's Republic of China. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in "Item 1A. - Risk Factors" Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

2

OTHER PERTINENT INFORMATION

We maintain a web site at www.lotuspharma.com. Information on this website is not a part of this annual report.

All share and per share information in this report gives effect to the 2:1 reverse stock split of our common stock which was effective on December 31, 2010.

INDEX OF CERTAIN DEFINED TERMS USED IN THIS REPORT

Unless specifically set forth to the contrary, when used in this report the terms:

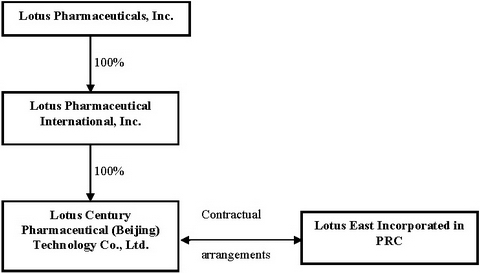

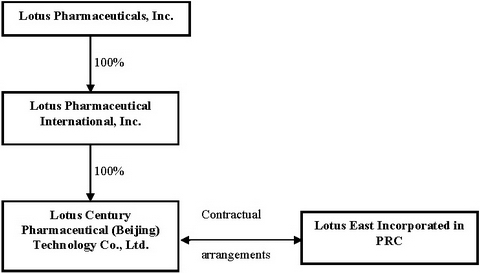

• "Lotus," "we," "us," "our," the "Company," and similar terms refer to Lotus Pharmaceuticals, Inc., a Nevada corporation formerly known as S.E. Asia Trading Company, Inc., and its subsidiary,

• "Lotus International" refers to Lotus Pharmaceutical International, Inc., a Nevada corporation and a subsidiary of Lotus,

• "Lotus Century" refers to Lotus Century Pharmaceutical (Beijing) Technology co., Ltd., a wholly foreign-owned enterprise (WFOE) Chinese company which is a subsidiary of Lotus,

• "Liang Fang" refers to Beijing Liang Fang Pharmaceutical Co., Ltd., a Chinese limited liability company formed on June 21, 2000,

• “En Ze Jia Shi” refers to Beijing En Ze Jia Shi Pharmaceutical Co., Ltd., a Chinese limited liability company formed on September 17, 1999 and an affiliate of Liang Fang,

• "Lotus East" collectively refers to Liang Fang and En Ze Jia Shi,

• "Consulting Services Agreements" refers to the Consulting Services Agreements dated September 20, 2006 between Lotus and Lotus East.

• "Operating Agreements" refers to the Operating Agreements dated September 20, 2006 between Lotus, Lotus East and the stockholders of Lotus East,

• "Equity Pledge Agreements" refers to the Equity Pledge Agreements dated September 20, 2006 between Lotus, Lotus East and the stockholders of Lotus East,

• "Option Agreements" refers to the Option Agreements dated September 20, 2006 between Lotus, Lotus East and the stockholders of Lotus East,

• "Proxy Agreements" refers to the Proxy Agreements dated September 20, 2006 between Lotus, Lotus East and the stockholders of Lotus East,

• "Contractual Arrangements" collectively refers to the Consulting Services Agreements, Operating Agreements, Equity Pledge Agreements, Option Agreements and the Proxy Agreements,

• "China" or the "PRC" refers to the People's Republic of China,

• “SFDA” refers to The State Food and Drug Administration,

• "RMB" refers to the renminbi which is the currency of mainland PRC of which the yuan is the principal currency,

• "2009" generally refers to the fiscal year ended December 31, 2009;

• "2010" generally refers to the fiscal year ended December 31, 2010; and

• "2011" generally refers to the fiscal year ended December 31, 2011.

3

PART I

ITEM 1. BUSINESS.

Overview

Lotus Pharmaceuticals, Inc. is a holding company incorporated in Nevada with its principal place of business in the People’s Republic of China (the “PRC”). We operate, control and beneficially own the pharmaceutical business of Lotus East. Lotus East develops, manufactures, markets and sells pharmaceutical products in the PRC. Lotus East produces crude medicine and drugs in forms of tablets, capsules, granules, eye-drops, and freeze-dried powder injection. Lotus East has established markets for several drugs that are self-branded or self-patented, including (i) Maixin - valsartan capsules for the treatment of hypertension, (ii) Muxin – eye drops for the treatment of glaucoma and (iii) Yipubishan - octreotide Acetate Injection solution for the treatment of gastric ulcers. Lotus East’s drug development is focused on the treatment of cerebro-cardiovascular disease, asthma, and diabetes. Lotus East has a nationwide sales network to directly and indirectly sell to hospitals, clinics and drugs stores in approximately 30 provinces in China. Additionally, through its 10 retail pharmacy locations in Beijing, China, Lotus East sells western and traditional Chinese medications and medical treatment equipment.

On December 15, 2010, we received notification that our certificate of change was accepted by the Secretary of State of Nevada. Pursuant to the certificate of change, we effected a two-for-one reverse split of our common stock. Pursuant to Section 72.209 of the Nevada Revised Statutes, no shareholder approval or amendment to our articles of incorporation was required for the certificate of change. On December 31, 2010, the reverse stock split was effectuated. Following the reverse stock split, the total number of shares of our common stock outstanding was reduced from 53,399,407 shares to approximately 26,700,000 shares and the maximum number of shares of common stock that the Company is authorized to issue was also reduced from 200,000,000 to 100,000,000. Our financial statements have been retroactively adjusted to reflect the reverse split. Additionally, all share representations are on a post-split basis hereinafter.

Corporate Structure

To be in compliance with China’s regulations on foreign ownership in the pharmaceutical industry, we operate our business in China through the Contractual Arrangements with Lotus East. The contractual relationship among the above companies as follows:

Notwithstanding that Lotus, Liang Fang and En Ze Jia Shi are separate legal entities and the legal obligations of the parties are governed by the Contractual Arrangements, there is commonality of control between Lotus and Lotus East as set forth in the following table:

4

Name | Executive Officer/Director of Lotus | Principal Stockholder of Lotus | Stockholder of Liang Fang | Stockholder of En Ze Jia Shi |

Dr. Zhongyi Liu | √ | √ | √ | √ |

Mrs. Zhenghong Song 1 |

| √ | √ | √ |

Wenli Xian |

|

| √ |

|

(1) Mrs. Zhenghong Song is the spouse of Dr. Zhongyi Liu.

Our principal executive offices are located at No. 16 Cheng Zhuang Road, Feng Tai District, Beijing, PRC 100071 and our telephone number is 86-10-63899868. Our fiscal year end is December 31.

The Contractual Arrangements are comprised of a series of agreements, including Consulting Services Agreements and Operating Agreements, through which we have the right to advise, consult, manage and operate Lotus East, and collect and own all of their respective net profits. Additionally, under Proxy Agreements, the stockholders of Lotus East have vested their voting control over Lotus East to us. In order to further reinforce our rights to control and operate Lotus East, these companies and their stockholders have granted us, under Option Agreements, the exclusive right and option to acquire all of their equity interests in Lotus East, alternatively, all of the assets of Lotus East. Further the Lotus East stockholders have pledged all of their rights, titles and interests in Lotus East to us under Equity Pledge Agreements.

Under PRC laws, each of Lotus Century, Liang Fang and En Ze Jia Shi is an independent legal person and none of them is exposed to liabilities incurred by the other party. Other than pursuant to the Contractual Arrangements, Lotus East does not transfer any other funds generated from their respective operations to us.

On September 6, 2006, we entered into the following Contractual Arrangements:

Consulting Services Agreements. Pursuant to the exclusive Consulting Services Agreements we have the exclusive right to provide to Lotus East general pharmaceutical business operations services as well as consulting services related to the technological research and development of pharmaceutical products as well as general business operation advice and strategic planning (the "Services"). Under these agreements, we own the intellectual property rights developed or discovered through research and development, in the course of providing the Services, or derived from the provision of the Services. Lotus East is to pay us a quarterly consulting service fees in RMB that is equal to Lotus East's net profits, as defined, for such quarter.

Operating Agreements. Pursuant to the Operating Agreements we provide guidance and instructions on Lotus East's daily operations, financial management and employment issues. The stockholders of Lotus East must designate the candidates recommended by us as their representatives on each of Lotus East's Board of Directors. We have the right to appoint senior executives of Lotus East. In addition, we agreed to guarantee Lotus East's performance under any agreements or arrangements relating to Lotus East's business arrangements with any third party. Lotus East, in return, agreed to pledge its accounts receivable and all of its assets to us. Moreover, Lotus East agreed that without our prior consent, Lotus East would not engage in any transaction that could materially affect the assets, liabilities, rights or operations of Lotus East, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of these agreements is 10 years from September 6, 2006 and may be extended only upon our written confirmation prior to the expiration of the these agreements, with the extended term to be mutually agreed upon by the parties.

Equity Pledge Agreements. Under the Equity Pledge Agreements, the stockholders of Lotus East pledged all of their equity interests in Lotus East to us to guarantee Lotus East's performance of its obligations under the Consulting Services Agreements. If Lotus East or Lotus East's stockholders breach its respective contractual obligations, we, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. Lotus East's stockholders also agreed that upon occurrence of any event of default, we will be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of Lotus East's stockholders to carry out the security provisions of the Equity Pledge Agreements and take any action and execute any instrument that we might deem necessary or advisable to accomplish the purposes of The Equity Pledge Agreements. The stockholders of Lotus East agreed not to dispose of the pledged equity interests or take any actions that would prejudice our interest. The Equity Pledge Agreements expire two years after Lotus East's obligations under the Consulting Services Agreements have been fulfilled.

5

Option Agreements. Under the Option Agreements, the stockholders of Lotus East irrevocably granted us or our designated person exclusive options to purchase, to the extent permitted under PRC law, all or part of the equity interests in Lotus East for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable PRC law. We, or our designated person, have sole discretion to decide when to exercise the option, whether in part or in full. The term of these agreements is 10 years from September 6, 2006 and may be extended prior to their expiration by written agreement of the parties.

Proxy Agreements. Pursuant to the Proxy Agreements, Lotus East's stockholders agreed to irrevocably grant a person to be designated by us with the right to exercise Lotus East's stockholders' voting rights and their other rights, including the attendance at and the voting of Lotus East's stockholders' shares at the stockholders' meetings (or by written consent in lieu of such meetings) in accordance with applicable laws and their Articles of Association, including but not limited to the rights to sell or transfer all or any of his equity interests of Lotus East, and appoint and vote for the directors and Chairman as the authorized representative of the stockholders of Lotus East. The term of these Proxy Agreements is 10 years from September 6, 2006 and may be extended prior to their expiration by written agreement of the parties.

On May 25, 2007, Lotus International’s wholly-owned foreign enterprise (WFOE) Lotus Century Pharmaceutical (Beijing) Technology Co., Ltd. (“Lotus Century”) was duly incorporated in Beijing, China. On August 20, 2007, an assignment agreement was signed between Lotus International and Lotus Century. Pursuant to the terms of the assignment agreement, Lotus Century was assigned all of Lotus International’s right, title and interest to control the management and voting and to be entitled to all of the profits and losses of Lotus East.

LOTUS EAST

Based in Beijing, China, Liang Fang is engaged in the production, trade and retailing of pharmaceuticals, focusing on the development of innovative medicines and investing in strategic growth to address various medical needs. Liang Fang owns and operates 10 drug stores throughout Beijing, China, that sell western and traditional Chinese medications and medical treatment equipment and generate revenues from the leasing of retail space to third party vendors at its retail stores. En Ze Jia Shi is the sole manufacturer for Liang Fang and maintains facilities for the production of medicines, patented Chinese medicine, as well as the research and production of other new medicines.

Lotus East's business is composed of two parts:

| · | manufacturing and distribution of pharmaceutical products, |

| · | retailing of western and traditional Chinese medications, and medical treatment equipment through retail locations and direct sales to other Over-the-Counter drug stores in Beijing |

MANUFACTURING AND DISTRIBUTION OF PHARMACEUTICAL PRODUCTS

Lotus East's production enterprise was located in the Chaoyang District of Beijing and covers a floor space of approximately 50,000 square feet until the end of November 2009 when Lotus decided to enhance its operations with a new production facility and office building so as to consolidate its previously separated operation units in Beijing. Lotus East intended to build a new complex building in 2009 and expected to finish the construction of the new building in the fourth quarter of 2011. Until completed, production is outsourced to Shuanghe Pharmaceutical Group which is located near Lotus East’s existing facility. The new facility is designed to be similar to the previous plant, with it containing liquid phase, gas phase, spectrum, and mass spectrum equipment and a variety of types of purification and distilling equipment, all of which can be used for production and research and development of biochemical medicines, Chinese traditional medicines, chemical compound medicines, antibiotics and other new medicines. As one of the first enterprises to be authenticated by the National China Good Manufacturing Practices (GMP), Lotus East believes it has an advanced automatic pharmacy product line which is GMP authenticated under certificate numbers C0849, C0850, D1645, and G3452. In June 2009, Lotus East received a Good Supply Practices (GSP) certificate from the Chinese State Food & Drug Administration (SFDA). Medicines produced by Lotus East include:

| · | crude medicine, |

| · | tablets, |

| · | capsules, |

| · | granules; |

| · | freeze-dried powder for injections and |

| · | eye drops. |

6

Different production control zones are used with separated air conditioning system according to different production and control needs. Production and sale of its self-branded drugs and wholesale distribution of third party manufactured pharmaceuticals is Lotus East's largest and most profitable business. Net revenues from our wholesale distribution account for approximately 70.7% and 79.4% of our total net revenues in fiscal 2010 and fiscal 2009, respectively.

Currently, Lotus East markets and sells its products only in PRC. Lotus East's currently manufactures four branded drugs, and own intellectual property right to one branded drug produced by a third party. All of which are listed in China’s national medical insurance catalog. The five branded drugs include:

Valsartan

In 2000, Lotus East obtained approval from the State Food and Drug Administration (SFDA) of China to sell Valsartan as a raw material and as a capsule (brand name: Maixin). Among its best selling products, Valsartan is a drug that treats hypertension or high blood pressure. This product is globally recognized as the ideal anti-high blood pressure medication by the medical industry due to its most stable and longest lasting therapeutic effects and limited side-effects.

High blood pressure adds to the workload of the heart and arteries. If it continues for a long time, the heart and arteries may not function properly. This can damage the blood vessels of the brain, heart, and kidneys, resulting in a stroke, heart failure, or kidney failure. High blood pressure may also increase the risk of heart attacks. These problems may be less likely to occur if blood pressure is controlled. Valsartan works by blocking a substance in the body that causes blood vessels to tighten. As a result, Valsartan relaxes blood vessels. This lowers blood pressure and increases the supply of blood and oxygen to the heart. Lotus East's goal is to make Valsartan a leading prescribed brand in its class of high blood pressure medications in the PRC.

Lotus East holds current manufacturing rights to produce Valsartan. It estimates that there are currently 10 enterprises producing single regent dosage and fixed-dose combinations of Valsartan in China. The foreign pharmacy Novartis Pharma sells Valsartan under its brand name, Diovan. According to clinical verification, the two products, Maixin and Diovan, have the same clinical effects. Lotus East’s currently holds approximately 20% of the total China market share for Valsartan. Lotus East believes that it will maintain its current market share due to increased brand recognition and continued sales efforts. Even if the market does face fiercer competition in the future, Lotus East believes that its sales revenue from Valsartan can stay relatively stable because of:

| · | Good product quality; |

| · | Stable sales teams; |

| · | The existing customers; |

| · | Stable sales agents; |

| · | Gradual increase of customers at all levels (such as province, municipal and county-level hospitals); |

| · | Gradual increase of sales agents at all levels (such as province, municipal and county-level cities); |

| · | Good corporate image; and |

| · | The relative stability of China national policies. |

Brimonidine Tartrate Eye Drops

Brimonidine Tartrate is a drug used to constrict adrenaline receptors, an important step in treating glaucoma. Lotus East sells Brimonidine Tartrate eye drops under its brand name "Muxin". The drug was first put into market in the U.S. in 1998 and in August 2004, Lotus East received the rights to manufacture and release the drug in the Chinese market. A fast and long lasting therapeutic effect, very few side-effects, a very high exponent of cure and high endurement are prime features of the drug. It will produce no harmful effects of reducing blood pressure, resulting in calmness and so on, much like diazepam. The imported product of its kind is Alphagan and is produced by Allergan (Hangzhou) Pharmaceutical Co., Ltd. According to clinical experiments of People's Hospital of Peking University and Tianjin Eye Hospital, Muxin and imported Alphagan have exactly the same curative effect but the side-effects of Muxin are fewer than Alphagan. As a result, Lotus East believes that its product has a stronger competitive advantage.

Currently, Lotus East holds approximately 50% of the total China market share for Brimonidine Tartrate. Even if the market does face fiercer competition in the future, Lotus East believes that its sales revenue from Brimonidine Tartrate can stay relatively stable because of:

| · | Excellent product quality; |

| · | Stable sales teams; |

| · | The existing customers; |

7

| · | Stable sales agents; |

| · | Gradual increase of customers in the next few years, mainly from tertiary hospitals in Beijing and other provinces; |

| · | Gradual increase or change in provincial and municipal sales agents; |

| · | Good corporate image; and |

| · | The relative stability of China national policies. |

Levofloxacin Lactate for Injection

Levofloxacin is a popular anti-bacterial drug for the treatment of mild, moderate, and severe infections caused by susceptible trains of the designated microorganisms in the conditions such as acute maxillary sinusitis, acute bacterial exacerbation of chronic bronchitis, community-acquired pneumonia, complicated and uncomplicated skin and skin structure infections, complicated and uncomplicated urinary tract infections, and acute pyelonephritis. Lotus East received the rights to manufacture and release the drug in the Chinese market in 2005. Lotus East sells Levofloxacin Lactate for Injection under its brand name "Junxin". The imported product of its kind is manufactured by Japanese pharmaceutical company, Daiichi Pharmaceutical Co.. Our Levofloxacin Lactate for Injection is covered by the National Health Insurance Program, therefore, its sale price is controlled by Chinese government. In 2010, our manufacture facility was removed from service in order to construct our new building in Beijing. If we use third party manufacture service to produce Levofloxacin Lactate for Injection, the gross profit margin which we could get from the sale of the drug would be very low. So, we did not use any third party manufacture service to produce the drug during fiscal 2010. Lotus East management anticipate that Lotus East can continue to produce Levofloxacin at its own new factory in 2012 after construction of the new building is completed. Lotus East expects to sell Levofloxacin after 2011.

Nicergoline for Injection

Nicergoline for Injection is an alpha-receptor blockage nerve system blood-brain medicine with a curative effect. On the cerebral level, it prompts a lowering of vascular resistance, an increase in arterial flow and stimulates the use of oxygen and glucose. Nicergoline also improves blood circulation in the lungs and limbs and has been shown to inhibit blood platelet aggregation. It is used to treat senile dementia, migraines of vascular origin, transient ischemia, platelet hyper-aggregability and macular degeneration. Lotus East received the rights to manufacture this product in 2006 and released the drug in the Chinese market in 2007. Lotus East sells Nicergoline for Injection under its brand name "Ni Mai Jiao Lin". The sale price of our Nicergoline for Injection is controlled by Chinese government since it is covered by the National Health Insurance Program. In 2010, our manufacture facility was removed from service in order to construct our new building in Beijing. If we use third party manufacture service to produce Nicergoline for Injection, the gross profit margin which we could get from the sale of the drug would be very low. Therefore, we did not use any third party manufacture service to produce the drug during fiscal 2010. Lotus East management anticipate that Lotus East can continue to produce Nicergoline at its own new factory in 2012 after construction of the new building is completed. Lotus East expects to sell Nicergoline after 2011.

Yipubishan -Octreotide Acetate Injection Solution

In December 2008, Lotus East entered into an intellectual rights transfer contract with Beijing Yipuan Bio-Medical Technology Co., Ltd. to acquire the drug Yipubishan, a highly effective and stable octreotide acetate injection solution, according to a clinical research report issued by Beijing Union Medical College Hospital Center for Clinical Pharmacology, used to treat the symptoms of gastric ulcers and hemorrhages of the upper digestive tract since 2004. Lotus East paid RMB 54 million (approximately $8 million) for the intellectual property rights of Yipubishan. Yipuan has a manufacturing agreement with Beijing Si Huan pharmaceutical Co., Ltd. to manufacture Yipubishan. Si Huan continues to manufacture Yipubishan for Lotus East after Lotus East purchased the intellectual property rights of Yipubishan. Even if the market does face fiercer competition in the future, Lotus East believes that its sales revenue from Yipubishan can stay relatively stable because of:

| · | Good product quality; |

| · | Stable sales team; |

| · | The existing customers; |

| · | Stable sales agents; |

| · | Gradual increase of customers in third tier cities and small towns or county-level cities; |

| · | Gradual increase of sales agents in third tier cities and small towns or county-level cities; |

| · | Good corporate image; and |

| · | The relative stability of China national policies. |

8

In fiscal 2010 and fiscal 2009, net revenues from wholesale distribution of the above five principal products (Valsartan, Brimonidine Tartrate Eye Drops, Levofloxacin Lactate for Injection, Nicergoline for Injection and Yipubishan – Octreotide Acetate Injection Solution) were approximately 38.0% and 53.8% of our total net revenues, respectively.

Lotus East also acts as a wholesale distributor to distribute various pharmaceutical products manufactured by third party manufacturers. Currently, the third party manufactured products distributed through Lotus East’s wholesale distribution channel are summarized below:

Product Name |

| Indication |

| Type of Distribution Rights |

Recombinant Human Erythropoietin Injection (EPO) |

|

|

| Exclusive Distribution Rights |

Recombinant Human Interleukin-2 Injection |

|

|

| Exclusive Distribution Rights |

Potassium Aspartate and Magnesium Aspartate for Injection |

|

|

| Non-exclusive Distribution Rights |

Omeprazole enteric-coated capsules |

|

|

| Non-exclusive Distribution Rights |

Recombinant Human Granulocyte Stimulating Factor Injection |

| Cancer |

| Exclusive Distribution Rights |

Cervus and Cucumis Polypeptide Injection |

| Rheumatism |

| Non-exclusive Distribution Rights |

Deproteinized Calfblood Extractives Injection |

| Nerves |

| Non-exclusive Distribution Rights |

Cefotaxime Sodium For Injection |

|

|

| Non-exclusive Distribution Rights |

Qingkailing Paotengpian |

| Respiratory |

| Non-exclusive Distribution Rights |

NINGXIN YISHEN Oral Liquid |

| Immune System |

| Non-exclusive Distribution Rights |

Cold Capsules |

|

|

| Non-exclusive Distribution Rights |

Small Adjustable Film |

| Joint Disease |

| Non-exclusive Distribution Rights |

Prostate Capsules |

| Prostate |

| Non-exclusive Distribution Rights |

LGTNG Gel |

| Psoriasis |

| Non-exclusive Distribution Rights |

Shuanghuanglian Oral Liquid |

| Influenza |

| Non-exclusive Distribution Rights |

The fifteen prescription drugs produced by third parties and distributed through our wholesale distribution channel are covered under National Health Insurance Program.

In addition to the commercialized products mentioned above, we have an innovative pipeline of drugs which are under development and focused on the treatment of chronic diseases. The innovative pipeline of drugs is summarized below:

Product candidate | Indication | Expected launch |

R-Bambuterol-Class 1 new drug (1) | Asthma | 2013-2014 |

Gliclazide-Controlled Release Tablets (2) | Diabetes | 2014 |

Isosorbide Mononitrate-Tablets (3) | Cardiovascular-(coronary artery) | 2013-2014 |

Lovastatin-Tablets | Cardiovascular-Hyperlipemia | In development |

Verapamil Hydrochloride-Tablets | Cardiovascular-Irregular Angina | In development |

Valsartan-Controlled Release Tablets | Cardiovascular-Hypertension | In development |

Hawthorn Flavonoids-Tablets (TCM) | Cardiovascular-Hyperlipemia | In development |

(1) It is subject to SFDA approval and currently in Phase I clinical trial. Its patent term is from 2002 to 2022.

(2) It is subject to SFDA approval and currently awaiting for approval to initiate clinical trials. The patent covers the composition and preparation methods for the drug through 2028.

(3) It is subject to SFDA approval and currently awaiting for approval to initiate clinical trials.

RETAILING BUSINESS

Lotus East owns and operates 10 drug stores throughout many different districts of Beijing, including:

| · | Xin Zhong Tai Drugstore |

| · | Nan Gong Drugstore |

| · | Wan Shou Road Drugstore |

| · | He Ping Li Drugstore |

| · | Feng Lin Lv Zhou Drugstore |

| · | Youth Lake Drugstore |

| · | Capital Airport Drugstore |

9

| · | Yong An Zhong Sheng Drugstore |

| · | Cheng Zhuang Road Drugstore |

| · | Feng Tai Drugstore |

These 10 drug stores all offer in excess of 8,000 types of western and traditional Chinese medicines, and medical treatment items. The drug stores attempt to compete based on lower pricing and more efficient distribution and management practices.

Through its retail operations, Lotus East also generates revenue by the leasing of space to licensed physicians, the lease of store front areas to various merchants in the retail pharmacies.

At the end of fiscal 2009, we engaged a general manager for our Over-the-Counter Drug Division that manages our own ten drug stores’ sales, and the newly created direct sales to other Over-the-Counter drug stores in Beijing. The general manager has strong management skills in medical sales and marketing and logistics and is an expert in delivery of services to drug stores in Beijing. In the fiscal 2010, we served more than 1,000 other Over-the-Counter drug stores in Beijing. Due to the growth and success of our OTC Drug Division’s sales force, our retail revenue for fiscal 2010 was substantially increased as compared to our retail revenue for fiscal 2009. We expect our retail revenue from our direct sales to other drug stores in Beijing will continue to increase in the fiscal 2011.

Net revenues from our retail business account for approximately 29.3% and 20.6% of our total net revenues in fiscal 2010 and fiscal 2009, respectively.

RESEARCH AND DEVELOPMENT

Lotus East places great emphasis on product research and development and it has established a research and development center. Lotus East's research and development team is comprised of seven individuals who are focused on developing new drugs and generic drugs, as well as monitoring and improving Lotus East’s drugs sold in the market based on their market research. Lotus East maintains strategic relationships with several research institutions in PRC developing new drugs, such as China Academy of Science and Military Medical Science Academy. Lotus East also cooperates with top research institutions, such as the Third Hospital of Peking University School of Medicine, to perform some testing and clinical trials. We spent $86,545 and $0 on research and development during the years ended December 31, 2010 and 2009, respectively.

THE CHINESE MARKET FOR DRUGS

According to 2009 PRC National Bureau of Statistics and PRC National Population & Family Planning Commission statistics, currently, the Chinese market trends which support Louts East’s future growth include:

| · | Strong demand for pharmaceuticals due to growing affluence, larger middle class, and aging population; |

| · | Elderly population (60+) has grown from 130 million (10.5% of population) in 2000 to 144 million (11% of population) in 2005; |

| · | Cardio-cerebrovascular disease has been on the rise in the PRC due to changing diet habits and moving to a younger age profile; |

| · | Growing government support for Chinese healthcare industry; |

| · | Government’s Universal Health Plan package of $125 billion delivered by next three years; and |

China government’s healthcare reform has begun to take into effect which includes: (i) promoting separation of prescribing and dispensing functions; (ii) encouraging development of pharmacies; and (iii) limiting over-prescription and reducing exorbitant hospital mark-ups and abating corruption. Therefore, many Chinese domestic companies have begun to build chain drug store networks through acquisition. Further, there is a trend to consolidate China’s fragmented pharmaceutical industry in China based on the following factors:

| · | There are approximately 4,000 pharmaceutical manufacturers in China. The average revenue of each pharmaceutical manufacturer is approximately $7 million and the average R&D of each pharmaceutical manufacture is approximately 5% of average revenue of each pharmaceutical manufacturer. Hence, it is hard to form a leadership in China pharmaceutical industry due to the lack of innovation; |

| · | Since GMP certification compliance announced that, the number of drug manufactures was reduced from 6,000 to less than 4,000 in 2009 and we expect that this number will continue to decrease; |

| · | Market-driven competition may eliminate smaller companies. |

10

As a result, the characteristics of future market leaders may be: (i) well-established nationwide sales and distribution network; (ii) strong product development capabilities; and (iii) access to capital. Lotus East believes it is well-positioned to emerge as a leader in the industry.

DISTRIBUTION METHODS OF THE PRODUCTS OR SERVICES AND LOTUS EAST'S CUSTOMERS

Currently, Lotus East’s national sales network includes:

| · | Direct sales of prescription drugs to over 40 hospitals; and |

| · | 10 regional centers use 100+ third party independent distributors to reach hospitals, clinics in 1st, 2nd, 3rd tier cities, and remote villages. A regional sales director for each regional center teamed with 3-10 salespeople. |

Lotus East’s ten regional centers include:

| · | Mongolia Regional Center |

| · | Anhui Regional Center |

| · | Guangdong Regional Center |

| · | Central Regional Center |

| · | Northern Regional Center |

| · | Eastern Regional Center |

| · | South Western Regional Center |

| · | North Eastern Regional Center |

| · | Guangxi Regional Center |

| · | North Western Regional Center |

Lotus East’s sales force will be expanded to increase direct sales of pharmaceuticals to hospitals and third-party OTC drug stores. Lotus East plans to add distributors to national sales network.

Lotus East sells four branded prescription drugs produced and packaged by En Ze Jia Shi (brand name: Maixin, Junxin, Muxin, Ni Mai Jiao Lin) and one branded prescription drug produced and packaged by Si Huan Pharmaceutical Co., Ltd. (brand name: Yipubishan) by its direct sales channel. Lotus East owns the intellectual property rights for the five prescription drugs. Lotus East’s drug products are also sold through its retail drug stores. Lotus East sells over 8,000 kinds of drugs through its 10 drugstores in Beijing.

Lotus East recognizes the importance of branding as well as packaging. All of its products bear a uniform brand but it also brands and packages its products with specialized designs to differentiate the different categories of its products. Lotus East relies on a combination of trademark, copyright and trade secret protection laws in PRC and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect its intellectual property and its brand. Lotus East intends to apply for patent protection of certain of its special technologies to protect its core technologies. There are no assurances, however, that if such applications are made that the patents will be granted. Lotus East also enters into confidentiality, non-compete and invention assignment agreements with its employees and consultants and nondisclosure agreements with third parties. "Maixin", “Muxin”, “En Ze Jia Shi” and "Liang Fang" are its registered trademarks in the PRC.

Lotus East conducts promotional marketing activities to publicize and enhance the company's image as well as to reinforce the recognition of its brand name, including:

| · | publishing advertisements and articles in national as well as specialized and provincial pharmaceutics and Biotech newspapers and magazines, and in other media, including the Internet; |

| · | participation in national meetings, seminars, symposiums, exhibitions for bio-pharmaceutical and other related industries; |

| · | organizing cooperative promotional activities with distributors; |

| · | Educational and seminar training sessions to physicians and pharmacists to introduce and explain its drugs; and |

| · | Establishment of direct sales to resell various retail pharmaceutical products to other third party pharmacies. |

Excluding customers in its retail operations, Lotus East currently has over 200 customers, including over 30 direct customers in Beijing, Shanghai, Chongqing, Guangdong, Inner Mongolia, Ningxia, Henan, Hubei, Liaoning, Heilongjiang, Guangxi, Jiangsu, Hebei, Anhui, Yunnan, Sichuan, Shanxi provinces in the PRC. We did not have any customer that accounted for over 10% of our revenues for fiscal 2010 and 2009, respectively. In fiscal 2010, Lotus East spent $0 on advertising expenses as compared to $46,450 in fiscal 2009.

11

GROWTH STRATEGIES

Lotus East’s growth strategies include, but not limited to, the following areas:

| · | Expansion in sales network: Lotus East plans to add more distributors to its nation-wide sales channels. Lotus East attends substantially every major drug expos in China. Lotus East’s sales representatives are experienced with medical education backgrounds, and are located in ten regional sales centers providing sales and post-sales services to its customers. Regional distributors come into contact with Lotus East through words of mouth and public information. Further, government hospitals are Lotus East’s important direct sales channels. Although Lotus East believes it will encounter high entry barriers to increase new additional hospitals direct sales channels, Lotus East attempts to add new hospital channels in the future; |

|

|

|

| · | Increase in quality drugs offerings: Lotus East’s brand quality stems from its commitment to quality and efficacy of products. Lotus East plans to increase the kinds of prescription drugs and sell them through its national wholesale channel and sales network. In addition, developing drugs to treat cardio-cerebrovascular, asthma and diabetes diseases remain the strategic focus in Lotus East’s pipeline development; |

|

|

|

| · | Building strong brands; |

|

|

|

| · | Leverage economies of scale and cost reduction to gain market share; |

|

|

|

| · | Bringing new drugs into the market, such as: cooperation with top R&D institutions; focus on intellectual property acquisition and sponsoring SFDA application and clinical trial testing; |

AGREEMENT WITH WU LAN CHA BU EMERGENCY HOSPITAL

In October 2006, Lotus East entered into a five-year loan agreement and contract with Wu Lan Cha Bu Emergency Hospital whereby Lotus East agreed to lend to Wu Lan Cha Bu Emergency Hospital approximately $4.5 million (RMB 30 million) for the construction of a hospital ward in Inner Mongolia, China. In exchange for the loan, Wu Lan Cha Bu Emergency Hospital agreed that Lotus East would be the exclusive provider for all medicines and disposable medical treatment apparatus to it for a period of 20 years. In October 2006, Dr. Zhongyi Liu, our Chief Executive Officer and the Chairman and principal stockholder of Lotus East, loaned these funds to Wu Lan Cha Bu Emergency Hospital on behalf of Lotus East. Accordingly, in October 2006 Lotus East entered into an assignment agreement whereby it assigned all of its rights, obligations, and receipts under the loan agreement to Dr. Liu, except for the rights to revenues from the sale of medical and disposable medical treatment apparatus which will remain with Lotus East. As compensation to Dr. Liu for accepting the assignment under the loan agreement including all of the risks and obligations and for Dr. Liu not accepting the rights to revenues from the sale of medical and disposable medical treatment apparatus which will remain with Lotus East, Lotus East agreed to pay Dr. Liu an aggregate of approximately $1.3 million (RMB 9 million) to be paid in five equal annual installments of approximately $272,000 (RMB 1.8 million). The construction project of Wu Lan Cha Bu Emergency Hospital is slowly keeping going down and it is beyond Lotus East’s control. Currently, we estimate the hospital construction project will be completed by 2012 and we anticipate that Lotus East will begin generating revenue from the hospital in 2013.

COMPETITION

Vertically integrated pharmaceutical operations are still at an early stage of development in China due to heavy state involvement in the past and Lotus East believes that the industry is fragmented. Lotus East faces competition from domestic drug research and development companies and drug manufacturing companies which are growing rapidly. Its direct competitors are domestic pharmaceutical companies and new drug research and development institutes that have fairly strong research and development capabilities in new drugs such as Beijing Venture Biopharma Technology Co., Ltd., Fosun Group Co., Ltd., Zhuhai Lizhu and Beijing Nohua. Lotus East also faces competition of foreign companies who have strong proprietary pipeline and strong financial resources. These companies have significantly greater assets than Lotus East has and have a larger current market share than Lotus East has. Lotus East believes the following are its competitive advantage:

| · | Lotus East is one of the first facilities that have been GMP certified by SFDA; |

| · | Lotus East has established products and brand name that are familiar to doctors and pharmacists; |

| · | Good product quality and reputation and generally has not experienced any quality control issue; and |

| · | Extensive distribution network and lower prices. |

Lotus East believes that it is able to compete as a result of its advantages mentioned above.

12

SOURCES AND AVAILABILITY OF RAW MATERIALS, THIRD PARTY MANUFACTURED FINISHED GOODS AND PRINCIPAL SUPPLIERS

Lotus East designs, creates prototypes and manufactures its products at its manufacturing facilities located at Beijing, PRC. Its principal raw materials include Brimonidine Tartrate, Levofloxacin Lactate, Nicergoline and Valsartan. Lotus East requires a supply of quality raw materials to manufacture its products. Historically, Lotus East has not had difficulty in obtaining raw materials from suppliers. Currently, Lotus East relies on numerous suppliers to deliver its required raw materials. The prices for these raw materials are subject to market forces largely beyond Lotus East's control, including energy costs, organic chemical prices, market demand, and freight costs. The prices for these raw materials have varied significantly in the past and may vary significantly in the future.

Third party manufactured finished goods needed to Lotus East’s wholesale distribution channel and retail drugstores are relatively easy to purchase from a number of suppliers. While Lotus East does not have long-term contracts with these suppliers, Lotus East has long-term and good business relationship with them and these companies have generally met Lotus East’s supply requirements. Generally, the factors that affect third party manufactured finished goods price are market demand and freight costs, etc… The price of drugs in China, while unstable and beyond Lotus East’s control, historically did not affect Lotus East’s business significantly, because Lotus East pass along any significant change in drugs price to its customers. However, Lotus East cannot guarantee that the present conditions of the drugs market will continue. Any significant rise in the price of or demand for drugs could have an adverse affect on our results of operations.

INTELLECTUAL PROPERTY

Lotus East relies on a combination of trademark, copyright and trade secret protection laws in PRC and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect its intellectual property and brand. Lotus East intends to apply for patent protection of certain of its special technologies to protect its core technologies. There are no assurances, however, that if such applications are made that the patents will be granted. Lotus East also enters into confidentiality, non-compete and invention assignment agreements with its employees and consultants and nondisclosure agreements with third parties. "Maixin", “Muxin”, “En Ze Jia Shi” and "Liang Fang" are its registered trademarks in the PRC.

GOVERNMENT REGULATION

(A). General regulations related to the pharmaceutical industry in the PRC

The Drug Administration Law of the PRC governs Lotus East and its products. The State Food & Drug Administration of the PRC regulates and implements PRC drug laws. As a developer, producer and distributor of medicinal products, we are subject to regulation and oversight by the SFDA and its provincial and local branches. The Law of the PRC on the Administration of Pharmaceuticals provides the basic legal framework for the administration of the production and sale of pharmaceuticals in China and covers the manufacturing, distributing, packaging, pricing and advertising of pharmaceutical products. Its implementing regulations set forth detailed rules with respect to the administration of pharmaceuticals in China. The quality and production control standards must be in compliance with PRC’s GMP requirements. We are also subject to other PRC laws and regulations that are applicable to business operators, manufacturers and distributors in general.

| · | Registration and approval of medicine: A medicine must be registered and approved by the SFDA before it can be manufactured. The registration and approval process requires the manufacturer to submit to the SFDA a registration application containing detailed information concerning the efficacy and quality of the medicine and the manufacturing process and the production facilities the manufacturer expects to use. To obtain the SFDA registration and approval necessary for commencing production, the manufacturer is also required to conduct pre-clinical trials, apply to the SFDA for permission to conduct clinical trials, and, after clinical trials are completed, file clinical data with the SFDA for approval. The SFDA has granted Lotus East six government permits for it to produce the following products: Valsartan capsules; the material of Valsartan; Levofloxacin Lactate for Injection; the material of Levofloxacin Lactate; Brimonidine Tartrate Eyes Drops with a density of 0.1; and Brimonidine Tartrate Eyes Drops with the density of 0.3. |

|

|

|

| · | New medicine: If a medicine is approved by the SFDA as a new medicine, the SFDA will issue a new medicine certificate to the manufacturer and impose a monitoring period which shall be calculated starting from the day of approval for manufacturing of the new medicine and may not exceed five years. The length of the monitoring period is specified in the new medicine certificate. During the monitoring period, the SFDA will monitor the safety of the new medicine, and will neither accept new medicine certificate applications for an identical medicine by another pharmaceutical company, nor approve the production or import of an identical medicine by other pharmaceutical companies. For new medicines approved prior to September 2002, the monitoring period could be longer than five years. As a result of these regulations, the holder of a new medicine certificate effectively has the exclusive right to manufacture the new medicine during the monitoring period. |

13

| · | Provisional national production standard: In connection with the SFDA’s approval of a new medicine, the SFDA will normally direct the manufacturer to produce the medicine according to a provisional national production standard, or a provisional standard. A provisional standard is valid for two years, during which the SFDA closely monitors the production process and quality consistency of the medicine to develop a national final production standard for the medicine, or a final standard. Three months before the expiration of the two-year period, the manufacturer is required to apply to the SFDA to convert the provisional standard to a final standard. Upon approval, the SFDA will publish the final standard for the production of this medicine. In practice, the approval for conversion to a final standard is a time-consuming process. However, during the SFDA’s review period, the manufacturer may continue to produce the medicine according to the provisional standard. |

|

|

|

| · | Transitional period: Prior to the latter of (1) the expiration of a new medicine’s monitoring period or (2) the date when the SFDA grants a final standard for a new medicine after the expiration of the provisional standard, the SFDA will not accept applications for an identical medicine nor will it approve the production of an identical medicine by other pharmaceutical companies. Accordingly, the manufacturer will continue to have an exclusive production right for the new medicine during this transitional period. |

|

|

|

| · | Continuing SFDA regulation: Pharmaceutical manufacturers in China are subject to continuing regulation by the SFDA. If the labeling or manufacturing process of an approved medicine is significantly modified, a new pre-market approval or pre-market approval supplement will be required by the SFDA. A pharmaceutical manufacturer is subject to periodic inspection and safety monitoring by the SFDA to determine compliance with regulatory requirements. The SFDA has a variety of enforcement actions available to enforce its regulations and rules, including fines and injunctions, recall or seizure of products, the imposition of operating restrictions, partial suspension or complete shutdown of production and criminal prosecution. |

(B). Pharmaceutical product manufacturing

| · | Permits and licenses for pharmaceutical manufactures: A pharmaceutical manufacturer must obtain a pharmaceutical manufacturing permit from the SFDA’s relevant branch. This permit is valid for five years and is renewable upon its expiration. Lotus East has the requisite approval and licenses from the Beijing SFDA in order to operate its production facilities. Lotus East does not anticipate any difficulty in renewing its pharmaceutical manufacturing permits upon expiration. |

|

|

|

| · | Good manufacturing practice: A pharmaceutical manufacturer must meet Good Manufacturing Practice standards, or GMP standards, for each of its production facilities in China in respect of each form of pharmaceutical products it produces. GMP standards include staff qualifications, production premises and facilities, equipment, raw materials, environmental hygiene, production management, quality control and customer complaint administration. If a manufacturer meets the GMP standards, the SFDA will issue to the manufacturer a Good Manufacturing Practice certificate, or a GMP certificate, with a five-year validity period. However, for a newly established pharmaceutical manufacturer that meets the GMP standards, the SFDA will issue a GMP certificate with only a one-year validity period. Lotus East is one of the first enterprises to be authenticated by the National China Good Manufacturing Practices (GMP). |

|

|

|

| · | Pharmaceutical distribution: A distributor of pharmaceutical products in China must obtain a pharmaceutical operating permit from the relevant provincial or local SFDA branches. After the operating permit is obtained, the distributor must follow the Good Supply Practice (“GSP”) requirements to establish a complete quality assurance system included product management, personnel, equipments, purchasing, storage and sales processes. Distributors will have to apply for accreditation to the provincial FDA. The provincial FDA will engage experts to conduct on-site inspection in accordance with the standards of pharmaceutical quality management specifications. The GSP certification will be granted to the distributor after it passes the inspections and the GSP certificate is valid for 5 years. Pharmaceutical distributors must obtain Drug dealers must obtain operating permits and GSP certificate of drugs prior to starting the distribution. Otherwise, it is a violation of the Drug Administration Law and the distributor will be prosecuted accordingly. |

|

|

|

| · | Good supply practice standards: The SFDA applies Good Supply Practice standards, or GSP standards, to all pharmaceutical wholesale and retail distributors to ensure the quality of distribution in China. The currently applicable GSP standards require pharmaceutical distributors to implement controls on the distribution of medicine, including standards regarding staff qualifications, distribution premises, warehouses, inspection equipment and facilities, management and quality control. A certificate for GSP standards, or GSP certificate, is valid for five years, except for a newly established pharmaceutical distribution company, for which the GSP certificate is valid for only one year. |

14

| · | Price controls: The retail prices of prescription and over-the-counter medicines sold in China, primarily those included in the national and provincial medical insurance catalogs and those pharmaceutical products whose production or distribution are deemed to constitute monopolies, are subject to price controls in the form of fixed prices or price ceilings administered by the Price Control Office under the National Development and Reform Commission, or the NDRC, and provincial price control authorities. The controls over the retail price of a medicine effectively set the limits for the wholesale price of that medicine. From time to time, the NDRC publishes and updates a national list of medicines that are subject to price control. Fixed prices and price ceilings on medicines are determined based on profit margins that the NDRC deems reasonable, the type and quality of the medicine, its production costs, the prices of substitute medicines and the extent of the manufacturer’s compliance with the applicable GMP standards. The NDRC directly regulates the price of some of the medicines on the list, and delegates the power to provincial price control authorities to regulate the remainder on the list. For those medicines under the authority of provincial price control authorities, each provincial price control authority regulates medicines manufactured by manufacturers registered in that province. Provincial price control authorities have the discretion to authorize price adjustments based on the local conditions and the level of local economic development. Only the manufacturer of a medicine may apply for an increase in the retail price of the medicine and it must apply either to the NDRC, if the price of the medicine is nationally regulated, or to the provincial price control authorities in the province where it is registered, if the price of the medicine is provincially regulated. For a provincially regulated medicine, when provincial price control authorities approve an application, they will file the new approved price with the NDRC for confirmation and thereafter the newly approved price will become binding and enforceable across China. |

|

|

|

| · | Tendering requirement for hospital purchases of medicines: Provincial and municipal government agencies such as provincial or municipal health departments also operate a mandatory tendering process for purchases by state-owned hospitals of a medicine included in provincial medicine catalogs. These government agencies organize a tendering process once every year in their province or city and typically invite manufacturers of provincial catalog medicines that are on the hospitals’ formularies and are in demand by these hospitals to participate in the tendering process. A government-approved committee consisting of physicians, experts and officials is delegated by these government agencies the power to review bids and select one or more medicines for the treatment of a particular medical condition. The selection is based on a number of factors, including bid price, quality and manufacturer’s reputation and service. The bidding price of a winning medicine will become the price required for purchases of that medicine by all state-owned hospitals in that province or city. The tendering requirement was first introduced in 2001 and has since been implemented across China. We understand that the level of present implementation of the tendering requirement varies among different provinces in China. |

|

|

|

| · | Reimbursement under the national medical insurance program: As of March 2011, approximately 402 million people were enrolled into the National Medical Insurance Program. The Ministry of Labor and Social Security, together with other government authorities, determines which medicines are to be included in or removed from the national medicine catalog for the National Medical Insurance Program, and under which tier a medicine should fall, both of which affect the amounts reimbursable to program participants for their purchases of those medicines. These determinations are based on a number of factors, including price and efficacy. A National Medical Insurance Program participant can be reimbursed for the full cost of a Tier 1 medicine and 80 to 90% of the cost of a Tier 2 medicine. Although it is designated as a national program, the implementation of the National Medical Insurance Program is delegated to various provincial governments, each of which has established its own medicine catalog. A provincial government must include all Tier 1 medicines listed in the national medicine catalog in its provincial medicine catalog, but may use its discretion based on its own selection criteria to add other medicines to, or exclude Tier 2 medicines listed in the national medicine catalog from, its provincial medicine catalog, so long as the combined numbers of the medicines added and excluded do not exceed 15% of the number of the Tier 2 medicines listed in the national catalog. In addition, provincial governments may use their discretion to upgrade a nationally classified Tier 2 medicine to Tier 1 in their provincial medicine catalogs, but may not downgrade a nationally classified Tier 1 medicine to Tier 2. The total amount of reimbursement for the cost of prescription and over-the-counter medicines, in addition to other medical expenses, for an individual program participant in a calendar year is capped at the amount in that participant’s individual account. The amount in a participant’s account varies, depending upon the amount of contributions from the participant and his or her employer. Generally, program participants who are from relatively wealthier eastern parts of China and relatively wealthier metropolitan centers have greater amounts in their individual accounts than those from less developed provinces. |

15

COMPLIANCE WITH ENVIRONMENTAL LAW

Lotus East complies with the Environmental Protection Law of China as well as the applicable local regulations. In addition to statutory and regulatory compliance, we actively ensure the environmental sustainability of our operations. The costs for PRC environmental regulation compliance in the past two fiscal years has been immaterial and mainly for the waste discharge processing, industrial exhaust treatment and dust cleaning in connection with our production facilities. Penalties would be levied upon us if we fail to adhere to and maintain certain standards. Such failure has not occurred in the past, and we generally do not anticipate that it will occur in the future, but no assurance can be given in this regard.

EMPLOYEES

As of the report filing date, Lotus East has about 533 employees (355 exclusive sales representatives, 111 retail store staff, 35 administrative staff, 25 factory workers and 7 research and development staff), including 233 full time employees and 300 part time employees. Majority of our employees are organized into a union under the labor laws of China and can bargain collectively with Lotus East. Lotus East has not experienced a work stoppage since inception and does not anticipate any work stoppage in the foreseeable future. Management believes that its relations with its employees and union are good.

HISTORY OF OUR COMPANY

Lotus Pharmaceuticals, Inc. (“Lotus” or “the Company”), formerly S.E. Asia Trading Company, Inc. (“S.E.”), was incorporated on January 28, 2004 to sell jewelry and home accessories under the laws of the State of Nevada. S.E. operated as a retailer of jewelry, framed art and home accessories.

Lotus International was incorporated under the laws the State of Nevada on August 28, 2006 to develop and market pharmaceutical products in China. On September 6, 2006, S.E. entered into a definitive Share Exchange Agreement with Lotus International, whereby S.E. would acquire all of the outstanding common stock of Lotus International in exchange for newly-issued shares of S.E.’s stock to Lotus International's stockholders. On September 28, 2006, Lotus International became S.E.’s wholly-owned subsidiary and Lotus International's stockholders own the majority of S.E.’s voting stock. The acquisition of Lotus International by S.E. was accounted for as a reverse merger because on a post-merger basis, the former stockholders of Lotus International held a majority of S.E.’s outstanding common stock on a voting and fully-diluted basis. As a result, Lotus International is deemed to be the acquirer for accounting purposes.

We changed S.E.’s name to Lotus Pharmaceuticals, Inc. on December 6, 2006.

On May 25, 2007, Lotus Century Pharmaceutical (Beijing) Technology Co., Ltd. (“Lotus Century”), a wholly foreign-owned enterprise (“WFOE”), was incorporated in Beijing, China. Lotus Century is a Chinese limited liability company and a wholly-owned subsidiary of Lotus International. On August 20, 2007, an assignment agreement was signed between Lotus International and Lotus Century. Lotus Century obtained assignment of Lotus International’s Contractual Agreements to control the management and voting and to take all the profits and bear all the losses of Lotus East.

ITEM 1A. RISK FACTORS

Investing in our securities involves a great deal of risk. Careful consideration should be made of the following factors as well as other information included in this report before deciding to purchase our common stock. You should pay particular attention to the fact that we conduct all of our operations in China and are governed by a legal and regulatory environment that in some respects differs significantly from the environment that may prevail in other countries. Our business, financial condition or results of operations could be affected materially and adversely by any or all of these risks.

Risks relating to Our Business

We may need additional financing to execute our business plan.

The revenues from the production and sale of pharmaceutical products and the projected revenues from these products may not be adequate to support our expansion and product development programs. We may need substantial additional funds to build our new production facilities, pursue further research and development, obtain regulatory approvals, market our products, and file, prosecute, defend and enforce our intellectual property rights. We will seek additional funds through public or private equity or debt financing, strategic transactions and/or from other sources. We could enter into collaborative arrangements for the development of particular products that would lead to our relinquishing some or all rights to the related technology or products.

16

There are no assurances that future funding will be available on favorable terms or at all. If additional funding is not obtained, we will need to reduce, defer or cancel development programs, planned initiatives or overhead expenditures, to the extent necessary. The failure to fund our capital requirements would have a material adverse effect on our business, financial condition and results of operations.

Our success depends on collaborative partners, licensees and other third parties over whom we have limited control.

Due to the complexity of the process of developing pharmaceuticals, our core business depends on arrangements with pharmaceutical institutes, corporate and hospital collaborators, licensors, licensees and others for the research, development, clinical testing, technology rights, manufacturing, marketing and commercialization of our products. We have several research collaborations. Our license agreements could obligate us to diligently bring potential products to market, make milestone payments and royalties that, in some instances, could be substantial, and incur the costs of filing and prosecuting patent applications. There are no assurances that we will be able to establish or maintain collaborations that are important to our business on favorable terms, or at all.

A number of risks arise from our dependence on collaborative agreements with third parties. Product development and commercialization efforts could be adversely affected if any collaborative partner:

| · | terminates or suspends its agreement with us; |

| · | causes delays; |

| · | fails to timely develop or manufacture in adequate quantities a substance needed in order to conduct clinical trials; |

| · | fails to adequately perform clinical trials; |

| · | determines not to develop, manufacture or commercialize a product to which it has rights; or |

| · | otherwise fails to meet its contractual obligations. |

Our collaborative partners could pursue other technologies or develop alternative products that could compete with the products we are developing.

The profitability of our products will depend in part on our ability to protect proprietary rights and operate without infringing the proprietary rights of others.

The profitability of our products will depend in part on our ability to obtain and maintain patents and licenses and preserve trade secrets, and the period our intellectual property remains exclusive. We must also operate without infringing the proprietary rights of third parties and without third parties circumventing its rights. The patent positions of pharmaceutical enterprises, including ours, are uncertain and involve complex legal and factual questions for which important legal principles are largely unresolved. The biotechnology patent situation outside the US is uncertain, is currently undergoing review and revision in many countries, and may not protect our intellectual property rights to the same extent as the laws of the US. Because patent applications are maintained in secrecy in some cases, we cannot be certain that we or our licensors are the first creators of inventions described in our pending patent applications or patents or the first to file patent applications for such inventions.

Other companies may independently develop similar products and design around any patented products we develop. We cannot assure you that:

| · | any of our patent applications will result in the issuance of patents; |

| · | we will develop additional patentable products; |

| · | the patents of others will not impede our ability to do business; or |

| · | third parties will not be able to circumvent our patents. |

A number of pharmaceutical, research, and academic companies and institutions have developed technologies, filed patent applications or received patents on technologies that may relate to our business. If these technologies, applications or patents conflict with ours, the scope of our current or future patents could be limited or our patent applications could be denied. Our business may be adversely affected if competitors independently develop competing technologies, especially if we do not obtain, or obtain only narrow, patent protection. If patents that cover our activities are issued to other companies, we may not be able to obtain licenses at a reasonable cost, or at all; develop our technology; or introduce, manufacture or sell the products we have planned.

17

Patent litigation is becoming widespread in the pharmaceutical industry. Such litigation may affect our efforts to form collaborations, to conduct research or development, to conduct clinical testing or to manufacture or market any products under development. There are no assurances that our patents would be held valid or enforceable by a court or that a competitor's technology or product would be found to infringe our patents in the event of patent litigation. Our business could be materially affected by an adverse outcome to such litigation. Similarly, we may need to participate in interference proceedings declared by the U.S. Patent and Trademark Office or equivalent international authorities to determine priority of invention. We could incur substantial costs and devote significant management resources to defend our patent position or to seek a declaration that another company's patents are invalid.

Much of our know-how and technology may not be patentable, though it may constitute trade secrets. There are no assurances that we will be able to meaningfully protect our trade secrets. We cannot assure you that any of our existing confidentiality agreements with employees, consultants, advisors or collaborators will provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure. Collaborators, advisors or consultants may dispute the ownership of proprietary rights to our technology, for example by asserting that they developed the technology independently.

We may encounter difficulties in manufacturing our products

Before our products can be profitable, they must be produced in commercial quantities in a cost-effective manufacturing process that complies with regulatory requirements, including GMP, production and quality control regulations. If we cannot arrange for or maintain commercial-scale manufacturing on acceptable terms, or if there are delays or difficulties in the manufacturing process, we may not be able to conduct clinical trials, obtain regulatory approval or meet demand for our products. Production of our products could require raw materials which are scarce or which can be obtained only from a limited number of sources. If we are unable to obtain adequate supplies of such raw materials, the development, regulatory approval and marketing of our products could be delayed.

We could need more clinical trials or take more time to complete our clinical trials than we have planned.

Clinical trials vary in design by factors including dosage, end points, length, and controls. We may need to conduct a series of trials to demonstrate the safety and efficacy of our products. The results of these trials may not demonstrate safety or efficacy sufficiently for regulatory authorities to approve our products. Further, the actual schedules for our clinical trials could vary dramatically from the forecasted schedules due to factors including changes in trial design, conflicts with the schedules of participating clinicians and clinical institutions, and changes affecting product supplies for clinical trials.