Attached files

Table of Contents

As filed with the Securities and Exchange Commission on March 28, 2011

Registration No. 333-172635

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

Form S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

INPHI CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 3674 | 77-0557980 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

3945 Freedom Circle, Suite 1100

Santa Clara, California 95054

(408) 217-7300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Young K. Sohn

Chief Executive Officer and President

3945 Freedom Circle, Suite 1100

Santa Clara, California 95054

(408) 217-7300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jorge del Calvo, Esq. Allison Leopold Tilley, Esq. Davina K. Kaile, Esq. Noelle Matteson, Esq. Pillsbury Winthrop Shaw Pittman LLP 2475 Hanover Street Palo Alto, CA 94304 (650) 233-4500 (650) 233-4545 facsimile |

Bruce K. Dallas, Esq. Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, CA 94025 (650) 752-2000 (650) 752-2111 facsimile |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and smaller reporting company in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer | ¨ | Accelerated | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

| Title of Securities Being Registered | Number of Shares Being Registered(1) |

Proposed Maximum Offering Price per Share(2) |

Proposed Maximum Offering Price |

Amount of Registration Fee(3) | ||||

| Common Stock, $0.001 par value per share |

4,351,340 | $21.51 | $93,597,323 | $10,867 | ||||

| (1) | Includes 449,366 shares of common stock issuable pursuant to an option granted to the underwriters to cover over-allotments, if any. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) based upon the average of the high and low prices of the Company’s Common Stock on the New York Stock Exchange on March 25, 2011. |

| (3) | A registration fee of $16,369 was previously paid. The excess fee of $5,502 should be credited to registrant’s account. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued March 28, 2011

3,901,974 Shares

COMMON STOCK

Inphi Corporation is offering 100,000 shares of its common stock and the selling stockholders identified in this prospectus are offering 3,801,974 shares of our common stock. We will not receive any proceeds from the sale of the shares by the selling stockholders.

Our common stock is listed on The New York Stock Exchange under the symbol “IPHI.” The closing price of our common stock as reported on The New York Stock Exchange on March 25, 2011, was $21.51 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 9.

PRICE $ A SHARE

| Price to |

Underwriting |

Proceeds to |

Proceeds to | |||||

| Per Share |

$ | $ | $ | $ | ||||

| Total |

$ | $ | $ | $ |

Certain selling stockholders have granted the underwriters the right to purchase up to an additional 449,366 shares of our common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2011.

| MORGAN STANLEY |

DEUTSCHE BANK SECURITIES |

| RBC CAPITAL MARKETS |

||||||

| STIFEL NICOLAUS WEISEL |

||||||

| NEEDHAM & COMPANY, LLC | ||||||

| OPPENHEIMER & CO. | ||||||

, 2011

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 9 | ||||

| 29 | ||||

| 30 | ||||

| Price Range of Our Common Stock |

30 | |||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 37 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 | |||

| 56 | ||||

| 74 | ||||

| 82 | ||||

| 98 | ||||

| 100 | ||||

| 106 | ||||

| Material U.S. Federal Income and Estate Tax Consequences to Non-U.S. Holders |

110 | |||

| 113 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| F-1 | ||||

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we, the selling stockholders nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

i

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information you should consider before investing in our common stock. Before making an investment decision, you should carefully read the entire prospectus, especially the risks set forth under the heading “Risk Factors” and our financial statements and related notes included elsewhere in this prospectus. References in this prospectus to “our company,” “we,” “us” and “our” refer to Inphi Corporation and its subsidiaries and predecessors during the period presented unless the context requires otherwise.

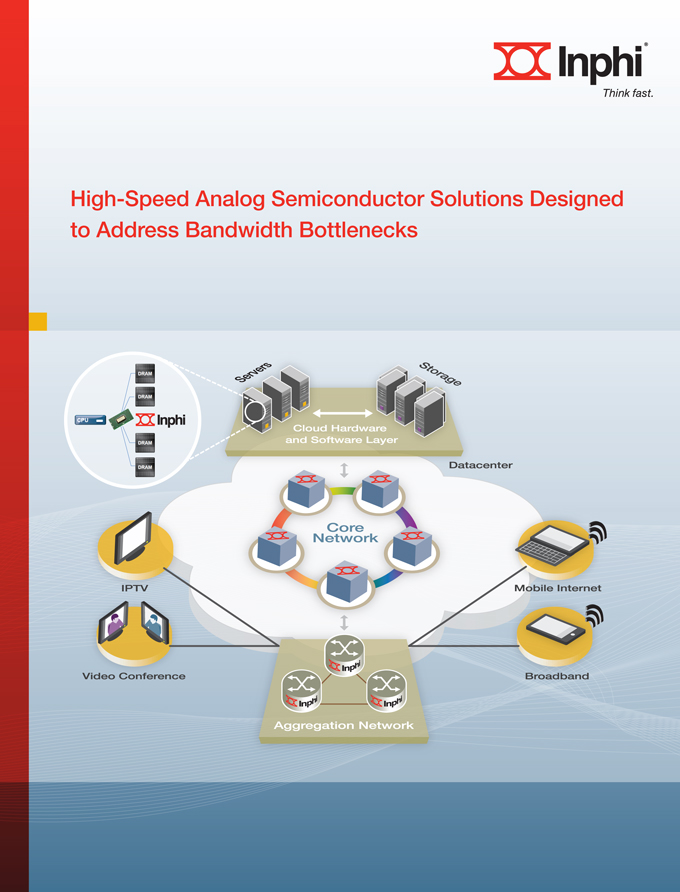

INPHI CORPORATION

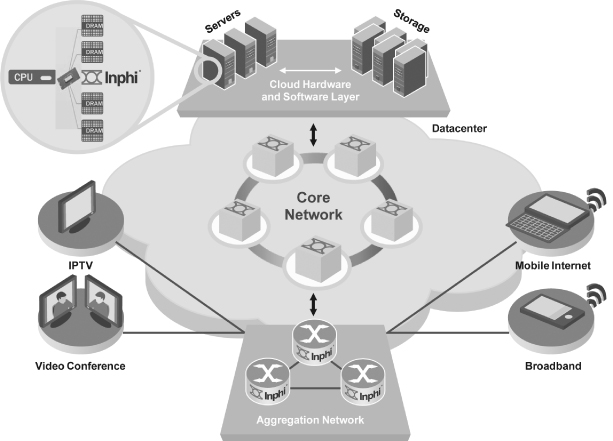

We are a fabless provider of high-speed analog semiconductor solutions for the communications and computing markets. Our analog semiconductor solutions provide high signal integrity at leading-edge data speeds while reducing system power consumption. Our semiconductor solutions are designed to address bandwidth bottlenecks in networks, maximize throughput and minimize latency in computing environments and enable the rollout of next generation communications and computing infrastructures. Our solutions provide a vital high-speed interface between analog signals and digital information in high-performance systems such as telecommunications transport systems, enterprise networking equipment, datacenter and enterprise servers, storage platforms, test and measurement equipment and military systems. We provide 40G, or 40 gigabits per second, and 100G, or 100 gigabits per second, high-speed analog semiconductor solutions for the communications market and high-speed memory interface solutions for the computing market. We have a broad product portfolio with 17 product lines and over 170 products as of December 31, 2010. For the years ended December 31, 2010 and 2009, our total revenue was $83.2 million and $58.9 million, respectively, and our net income was $26.1 million and $7.3 million, respectively.

We help define industry conventions and standards within the markets we target by collaborating with technology leaders, original equipment manufacturers, or OEMs, systems manufacturers and standards bodies. Our products are designed into systems sold by OEMs, including Agilent Technologies, Inc., Alcatel-Lucent, Cisco Systems, Inc., Danaher Corporation, Dell Inc., EMC Corporation, Hewlett-Packard Company, Huawei, International Business Machines Corporation and Oracle Corporation. We believe we are one of a limited number of suppliers to these OEMs, and in some cases we may be the sole supplier for certain applications. We sell our semiconductor solutions both directly to these OEMs and to other intermediary systems or module manufacturers that, in turn, sell to these OEMs. As a result, while we cannot verify each OEM to which our products may ultimately be sold, the entities listed above represent those OEMs that we have been able to verify as end customers. During the year ended December 31, 2010, we sold our semiconductor products to more than 160 customers. Sales directly to Samsung accounted for 34% and 36% of our total revenue and sales directly and through distributors to Micron accounted for 11% and 17% of our total revenue for the years ended December 31, 2010 and 2009, respectively. Our sales to Samsung and Micron are made on a purchase order basis and we do not have long-term purchase commitments from any of our customers, including Samsung and Micron. Since 2006, we have shipped more than 100 million high-speed analog semiconductors. In 2009, we successfully introduced and began to ship a new product in production which we identify as product number INSSTE32882-GS04, or the GS04 product, and which consists of an integrated phase lock loop, or PLL, and register buffer. In a computing or storage system, in order to access the data stored in memory, a central processing unit, or CPU, is required to send command and address signals to the memory circuits. Each memory circuit connected to a CPU places a certain load, or burden, on the CPU. Therefore, there is a limit to how many memory circuits can be connected to a CPU, resulting in a limit on the memory capacity of the computing or storage system. To overcome this limit, an integrated phase lock loop, or PLL, and register buffer can be used to provide an interface between the CPU and memory to increase the memory capacity. A PLL is an electronic circuit used to synchronize a clock on an integrated circuit with an external clock source, to minimize any timing mismatches. A register buffer is an electronic circuit that allows a memory circuit to be connected to a CPU, with a reduced load on the CPU. Together, an integrated PLL and register buffer provides

1

Table of Contents

an interface between the CPU and memory to enable the installation of sufficient memory in computing and storage platforms. Sales of the GS04 product comprised 18% and 43% of our total revenue in 2010 and 2009, respectively. In 2010, we also began to ship in production volume a new “low voltage” version of our integrated PLL and register buffer, which is shipping in the form of product number INSSTE32882LV-GS02, or the GS02 product. Sales of the GS02 product comprised 32% of our total revenue in 2010. There were no other products that generated more than 10% of our total revenue in 2010, 2009 or 2008. Our total revenue increased to $83.2 million for the year ended December 31, 2010 from $58.9 million for the year ended December 31, 2009. As of December 31, 2010, our accumulated deficit was $34.6 million. Our net income increased to $26.1 million for the year ended December 31, 2010 from $7.3 million for the year ended December 31, 2009. We operate an outsourced manufacturing business model. As a result, we rely on third parties to manufacture, assemble and test our products. We also perform testing in our Westlake Village, California, facility.

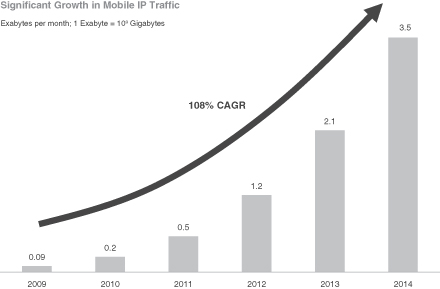

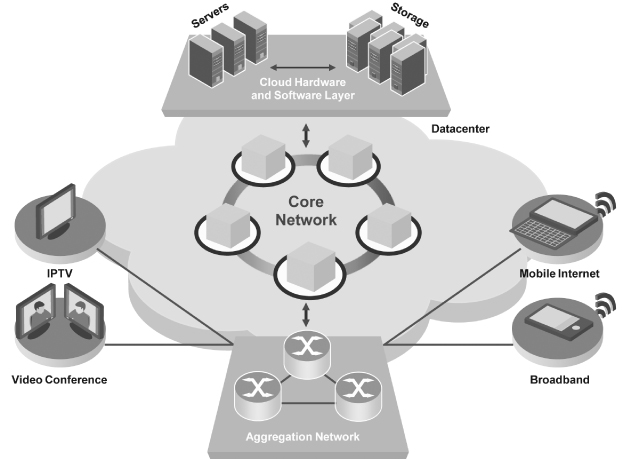

The proliferation of mobile devices and wireless connectivity is driving growth in demand for network bandwidth as users seek faster access to high-definition video and multimedia content and applications. According to the Cisco Visual Networking Index, global Internet protocol, or IP, traffic is projected to increase more than four-fold from 2009 to 2014, reaching 63.9 exabytes per month in 2014. Global mobile IP traffic is a key driver of this growth, and is projected to increase at a compound annual growth rate of 108% from 2009 to 2014. In addition, the emergence of cloud computing, which allows multiple users to simultaneously execute applications and access data at high speeds, is creating additional demand for network bandwidth and computing resources. According to the IDC eXchange, New IT Cloud Services Forecast: 2009-2013, October 2009, spending on public cloud-based server and storage services is expected to grow from $3.7 billion in 2009 to $12.8 billion in 2013, representing a compound annual growth rate of 37%.

In order to handle growing network bandwidth and faster computing speeds, communications and computing systems require greater processing resources and higher access speeds. As processing power and access speeds continue to increase, it becomes more difficult for systems to achieve high signal integrity and reliable data transmission and recovery using traditional semiconductor solutions. Moreover, in many networks and computing systems, bandwidth bottlenecks arise where the physical media and traditional semiconductor solutions are incapable of supporting the increased data transfer rates and cause signal deterioration. These signal deterioration issues are typically addressed with high-speed analog semiconductors that maintain or improve signal integrity at every point of the physical interface by employing sophisticated analog signal processing techniques to accurately generate, amplify, reshape, retime and receive the transmitted data.

We leverage our proprietary high-speed analog signal processing expertise and our deep understanding of system architectures to address data bottlenecks in current and emerging communications, enterprise network, computing and storage architectures. We use our core technology and strength in high-speed analog design to enable our customers to deploy next generation communications and computing systems that operate with high performance at high speeds. We believe we are at the forefront of developing semiconductor solutions that deliver 100G speeds throughout the network infrastructure, including core, metro and the datacenter. Furthermore, our analog signal processing expertise enables us to improve throughput in computing systems. Our core competitive strengths include:

| • | System-Level Simulation Capabilities. In order to understand and solve system problems, we work closely with systems vendors to develop proprietary component, channel and system simulation models. We use these proprietary simulation and validation tools to accurately predict system performance prior to fabricating the semiconductor or alternately to identify and optimize critical semiconductor parameters to satisfy customer system requirements. |

| • | Analog Design Expertise. High-speed analog circuit design is extremely challenging at high frequencies. We believe that we are a leader in developing broadband analog semiconductors operating at frequencies of up to 100 gigahertz, or GHz. Our analog design expertise has enabled us to design and commercially ship |

2

Table of Contents

| the first 18 GHz track-and-hold amplifier, 28 GHz linear transimpedance amplifier, 40 GHz transimpedance amplifier and 50 GHz multiplexer, or MUX, and demultiplexer, or DEMUX, components. |

| • | Strong Relationships with Industry Leaders. We develop many of our high-speed analog semiconductor solutions for applications and systems that are driven by the industry leaders in the communications and computing markets. As a result of our demonstrated ability to address our customers’ technological challenges, our products have been selected to be incorporated, or “designed”, into several of their current systems and we believe we are well-positioned to continue to develop high-speed analog semiconductor solutions for their emerging architectures. For instance, our high-speed memory interface designs have been validated for Intel’s Xeon® Core i7® and next generation platforms. We also work with communication companies such as Alcatel-Lucent, Cisco and Huawei to address their next generation 100G efforts. |

| • | Broad Process Technology. We employ process technology experts, device technologists and circuit designers who have extensive experience in many process technologies including complementary metal oxide semiconductor, or CMOS, silicon germanium, or SiGe, and III-V technologies such as gallium arsenide, or GaAs, and indium phosphide, or InP. We believe that our ability to design high-speed analog semiconductors in a wide range of materials and process technologies allows us to provide superior performance, power, cost and reliability for a specific set of market requirements. |

| • | High-Speed Package Modeling and Design. We have developed deep expertise in high-speed package modeling and design, since introducing the first high-speed 50 gigahertz multiplexer and demultiplexer, or 50 GHz MUX and DEMUX, product in 2001. Our current packaging and modeling techniques enable us to deliver semiconductors that are energy efficient, offer high-speed processing and enable advanced signal integrity, all in a small footprint. |

We believe that our system-level simulation capabilities, our analog design and broad process technology design capabilities as well as our strengths in packaging enable us to differentiate ourselves by delivering advanced high-speed analog signal processing solutions. For example, we believe we have successfully demonstrated the feasibility of our next generation 100G Ethernet architecture well ahead of our competitors. Within the server market, we have applied our analog signal processing expertise to develop our isolation memory buffer, or iMB™ technology, which is designed to expand the memory capacity in existing server and computing platforms. We believe the key benefits that our solutions provide to our customers are as follows:

| • | High Performance. Our high-speed analog semiconductor solutions are designed to meet the specific technical requirements of our customers in their respective end markets. For instance, in the broadband communications market, we believe our products achieve the highest signal integrity and attain superior signal transmission distance at required error-free or low-error rates. In the computing market, we believe our products achieve industry-leading data transfer rates at the smallest die size. |

| • | Low Power and Small Footprint. In each of the end markets that we serve, the power budget of the overall system is a key consideration for the systems designers. We believe that our high-speed analog signal processing solutions enable our customers to implement system architectures that reduce overall system power consumption. We also believe that at high frequencies, our high-speed analog semiconductor devices typically consume less power than our competitors’ standard designs. In many of our applications, we are able to design and deliver semiconductors that have a smaller footprint and therefore reduce the overall system size. |

| • | Faster Time to Market. Our customers compete in markets that require high-speed, reliable semiconductors that can be integrated into their systems as soon as new market opportunities develop. To meet our customers’ time-to-market requirements, we work closely with them early in their design cycles and are actively involved in their development processes. |

3

Table of Contents

Our mission is to enable faster communications and computing infrastructure with high-speed analog semiconductor solutions that reliably capture critical analog signals, convert them to useful data, and transport the data at high speeds. Key elements of our strategy include:

| • | Focus on Markets that Require High Signal Integrity at High Speeds. We believe our target markets are driven by expected growth trends in video applications, mobile Internet and cloud computing, causing a greater demand for network bandwidth and computing speeds. We intend to continue to focus our efforts in markets where high signal integrity at high speeds is imperative. |

| • | Extend Technology Leadership in High-Speed Analog Semiconductors. We believe we employ best-in-class technology and design capabilities in our high-speed analog semiconductor solutions. We intend to continue to invest in research and development to extend our leadership in existing markets and enable the widespread deployment of our next generation technology into newer markets. |

| • | Expand Global Presence. We believe that a global presence is critical to securing design wins from both new and existing customers given the continued globalization of supply chains, particularly with respect to design and manufacturing. We plan to continue the expansion of our sales, design and technical support organization to broaden our customer reach in new markets, primarily in Asia and Europe. |

| • | Continue to Build Deep Relationships with Customers. We intend to continue to develop long-term, collaborative relationships with customers who are regarded as leaders in their respective markets. In addition, we plan to continue to work closely with customers to enable them to develop innovative solutions that address both existing and new performance challenges. |

| • | Attract and Retain Top Talent. We believe one of our key differentiators resides in the design of solutions that address complex, real world problems for our customers. In this respect, our team of analog engineers and systems designers is critical to our success. We intend to continue to aggressively recruit and seek to retain talented engineering and design personnel. |

Risk Related to Our Business

Investing in our common stock involves substantial risks, including, but not limited to, the following:

| • | Fluctuations in our Revenue and Operating Results. Our revenue and operating results can fluctuate, which could cause our stock price to decline. Factors that may contribute to these fluctuations include, but are not limited to, the reduction or cancellation of customer orders, fluctuations in the levels of component inventories held by our customers, the gain or loss of significant customers, our ability to develop and market new products and technologies on a timely basis and the timing and extent of product development costs. |

| • | History of Losses and Accumulated Deficit. As of December 31, 2010, we had an accumulated deficit of $34.6 million and have incurred net losses in each year through 2008, and we may incur net losses in the future. |

| • | Dependence on a Limited Number of Customers. We depend on a limited number of customers and products for a substantial portion of our revenue. For example, sales directly to Samsung accounted for 34% and 36% of our total revenue and sales directly and through distributors to Micron accounted for 11% and 17% of our total revenue for the years ended December 31, 2010 and 2009, respectively. Some of our customers, including Samsung and Micron, use our products primarily in high-speed memory devices. |

| • | Lack of Long-Term Purchase Commitments. Substantially all of our sales are made on a purchase order basis and we do not have long-term purchase commitments with any of our customers. The loss of, or reduction in sales to, a key customer will materially and adversely affect our operating results. |

4

Table of Contents

| • | Lengthy Sales Cycle. We must win competitive bid processes, such wins known as “design wins,” to enable us to sell our semiconductor products for use in our customers’ products. The design win process is lengthy and we may not secure the design win or generate any revenue despite incurring significant design and development expenditures. Even after securing a design win, we may experience delays in generating revenue. |

| • | Lengthy and Expensive Qualification Process. Our customers require our products and our third-party contractors to undergo lengthy, expensive and extensive qualification processes. In addition, a successful qualification does not assure any sales of the product to that customer and it can take several months or more before a customer takes volume production of components or systems that incorporate our products, if at all. |

| • | Need to Continually Develop and Introduce New Products. Our future success depends on our ability to continually develop and introduce new products to meet the changing technology and performance requirements of our customers, diversify our revenue base and generate new revenue to replace, or build upon, the success of previously introduced products which may be rapidly maturing. For example, in 2009, we successfully introduced and began to ship a new product in production which we identify as product number INSSTE32882-GS04, or the GS04 product, and which consists of an integrated PLL and register buffer. Sales of the GS04 product comprised 18% and 43% of our total revenue in 2010 and 2009, respectively. This product has now matured and, as a result, sales of this product are now declining in volume. In 2010, we also began to ship in production volume a new “low voltage” version of our integrated PLL and register buffer, which is shipping in the form of product number INSSTE32882LV-GS02, or the GS02 product. Sales of the GS02 product comprised 32% of our total revenue in 2010. |

| • | Market Development of and Demand for 100G Solutions. We are currently investing significant resources to develop semiconductor solutions supporting 100G data transmission rates. If sufficient market demand for 100G solutions does not develop or develops more slowly than expected, or if we fail to accurately predict market requirements or demand for 100G solutions, our business, competitive position and operating results would suffer. |

Before you invest in our common stock, you should carefully consider all the information in this prospectus including matters set forth under the heading “Risk Factors.”

Corporate Information

We were incorporated in Delaware in November 2000 as TCom Communications, Inc. and changed our name to Inphi Corporation in February 2001. Our principal executive offices are located at 3945 Freedom Circle, Suite 1100, Santa Clara, California 95054. Our telephone number at that location is (408) 217-7300. Our website address is www.inphi.com. Information on our website is not part of this prospectus and should not be relied upon in determining whether to make an investment decision. Substantially all of our long-lived tangible assets are located in the United States. As of December 31, 2010, the net book value of our long-lived tangible assets located outside the United States was approximately $1.3 million, which consists mainly of manufacturing fixtures used by our third-party contractors in Taiwan. In addition, we recently established our international headquarters in Singapore, from which we plan to conduct our international operations.

Inphi®, iMB™, the Inphi logo and Think Fast logo are trademarks or service marks owned by Inphi. All other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners.

5

Table of Contents

THE OFFERING

| Common stock offered by us |

100,000 shares | |

| Common stock offered by selling stockholders |

3,801,974 shares | |

| Common stock to be outstanding immediately after this offering |

26,041,014 shares (26,041,014 if the underwriters exercise their over-allotment in full) | |

| Over-allotment option |

449,366 shares | |

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes, including working capital. See “Use of Proceeds.” | |

| New York Stock Exchange symbol |

“IPHI” | |

The number of shares of common stock to be outstanding immediately after this offering is based on 25,088,122 shares outstanding as of December 31, 2010, and excludes:

| • | 6,672,249 shares of common stock issuable upon the exercise of options outstanding as of December 31, 2010, at a weighted average exercise price of $3.85 per share; |

| • | 40,713 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $1.64 per share; and |

| • | 2,032,192 shares of common stock reserved for future issuance under our 2010 Stock Incentive Plan, as well as up to 396,379 shares subject to outstanding options under our 2000 Stock Option/Stock Issuance Plan, or 2000 Stock Plan. Our 2010 Stock Incentive Plan contains provisions that will automatically increase its share reserve each year, as more fully described in “Executive Compensation—Employee Benefit Plans.” |

Unless otherwise stated, all information in this prospectus assumes:

| • | no exercise of options or warrants outstanding as of December 31, 2010, except for 852,892 shares to be issued and sold in this offering upon the exercise of vested stock options, at a weighted average exercise price of $1.67 per share; and |

| • | no exercise by the underwriters of their option to purchase additional shares. |

6

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The information set forth below should be read together with “Capitalization,” “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

The summary statements of operations data for the years ended December 31, 2010, 2009 and 2008 have been derived from our audited financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results to be expected in the future, and results of interim periods are not necessarily indicative of results for the entire year.

| Year Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| (in thousands, except share and per share data) |

||||||||||||

| Statements of Operations Data: |

||||||||||||

| Revenue |

$ | 55,253 | $ | 37,617 | $ | 32,727 | ||||||

| Revenue from related party(1) |

27,940 | 21,235 | 10,227 | |||||||||

| Total revenue |

83,193 | 58,852 | 42,954 | |||||||||

| Cost of revenue |

29,438 | 21,269 | 19,249 | |||||||||

| Gross profit |

53,755 | 37,583 | 23,705 | |||||||||

| Total operating expense(2) |

41,816 | 29,498 | 27,009 | |||||||||

| Income (loss) from operations |

11,939 | 8,085 | (3,304 | ) | ||||||||

| Other income (expense) |

(50 | ) | 73 | (124 | ) | |||||||

| Income (loss) before income taxes |

11,889 | 8,158 | (3,428 | ) | ||||||||

| Provision (benefit) for income taxes(3) |

(14,242 | ) | 829 | — | ||||||||

| Net income (loss) |

$ | 26,131 | $ | 7,329 | $ | (3,428 | ) | |||||

| Net income (loss) allocable to common stockholders |

$ | 5,240 | $ | 130 | $ | (3,428 | ) | |||||

| Net income (loss) per share: |

||||||||||||

| Basic |

$ | 1.03 | $ | 0.08 | $ | (2.66 | ) | |||||

| Diluted |

$ | 0.61 | $ | 0.05 | $ | (2.66 | ) | |||||

| Weighted-average shares used in computing net income (loss) per share: |

||||||||||||

| Basic |

5,086,169 | 1,668,876 | 1,289,431 | |||||||||

| Diluted |

8,546,537 | 2,785,277 | 1,289,431 | |||||||||

| (1) | Revenue from related party consists of revenue from Samsung, which, together with associated entities, held over 13% of our outstanding shares of common stock before our initial public offering. After our initial public offering in November 2010, Samsung, together with associated entities, holds less than 10% of our outstanding shares of common stock. Revenue from Samsung for the entire year of 2010 was presented as revenue from related party. |

Footnotes continued on the following page.

7

Table of Contents

| As of December 31, 2010 | ||||||||

| Actual | As Adjusted | |||||||

| (in thousands) | ||||||||

| Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 110,172 | $ | 112,979 | ||||

| Working capital |

116,887 | 119,694 | ||||||

| Total assets |

158,957 | 161,764 | ||||||

| Total liabilities |

16,271 | 16,271 | ||||||

| Total stockholders’ equity |

142,686 | 145,493 | ||||||

The preceding table presents a summary of our balance sheet data as of December 31, 2010:

| • | on an actual basis; and |

| • | on an adjusted basis to give effect to the sale by stockholders of 852,892 shares of common stock to be issued upon exercise of vested stock options immediately prior to completion of this offering with net proceeds to us of $1.4 million and the sale of 100,000 shares of common stock in this offering at an assumed public offering price of $21.51 per share (the closing price of our common stock as reported on the New York Stock Exchange on March 25, 2011), after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

A $1.00 increase (decrease) in the assumed public offering price of $21.51 per share would increase (decrease), on an as adjusted basis, each of cash and cash equivalents, total assets and total stockholders’ equity by approximately $95,750, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

Footnotes continued from the prior page.

| (2) | Stock-based compensation expense is included in our results of operations as follows: |

| Year Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| (in thousands) | ||||||||||||

| Operating expense: |

||||||||||||

| Cost of revenue |

$ | 107 | $ | 31 | $ | 119 | ||||||

| Research and development |

1,381 | 475 | 358 | |||||||||

| Sales and marketing |

526 | 238 | 101 | |||||||||

| General and administrative |

691 | 421 | 417 | |||||||||

| (3) | The provision (benefit) for income taxes for the years ended December 31, 2010 and 2009 included the releases and reversals of valuation allowances against deferred tax assets provided in prior periods. Please see note 7 to the notes to our consolidated financial statements. |

8

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below before making a decision to buy our common stock. The risks and uncertainties described below are not the only ones we face. If any of the following risks actually occurs, our business, financial condition, results of operations or growth prospects could be harmed. In that case, the trading price of our common stock could decline and you might lose all or part of your investment in our common stock. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair our business operations. You should also refer to the other information set forth in this prospectus, including our financial statements and the related notes.

Risks Related to Our Business

Our revenue and operating results can fluctuate from period to period, which could cause our share price to fluctuate.

Our revenue and operating results have fluctuated in the past and may fluctuate from period to period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following factors, as well as other factors described elsewhere in this prospectus:

| • | the receipt, reduction or cancellation of orders by customers; |

| • | fluctuations in the levels of component inventories held by our customers; |

| • | the gain or loss of significant customers; |

| • | market acceptance of our products and our customers’ products; |

| • | our ability to develop, introduce and market new products and technologies on a timely basis; |

| • | the timing and extent of product development costs; |

| • | new product announcements and introductions by us or our competitors; |

| • | incurrence of research and development and related new product expenditures; |

| • | fluctuations in sales by module manufacturers who incorporate our semiconductor solutions in their products, such as memory modules; |

| • | cyclical fluctuations in our markets; |

| • | fluctuations in our manufacturing yields; |

| • | significant warranty claims, including those not covered by our suppliers; |

| • | changes in our product mix or customer mix; |

| • | intellectual property disputes; and |

| • | loss of key personnel or the inability to attract qualified engineers. |

As a result of these and other factors, the results of any prior quarterly or annual periods should not be relied upon as indications of our future revenue or operating performance. Fluctuations in our revenue and operating results could cause our share price to decline.

We have an accumulated deficit and have incurred net losses in the past. We may incur net losses in the future.

As of December 31, 2010, we had an accumulated deficit of $34.6 million. We have incurred net losses in each year through 2008. We generated net income (loss) of $26.1 million, $7.3 million and $(3.4) million for the years ended December 31, 2010, 2009 and 2008, respectively. We may incur net losses in the future.

9

Table of Contents

We depend on a limited number of customers for a substantial portion of our revenue, and the loss of, or a significant reduction in orders from, one or more of our major customers could negatively impact our revenue and operating results. In addition, if we offer more favorable prices to attract or retain customers, our average selling prices and gross margins would decline.

For the year ended December 31, 2010, our 10 largest customers collectively accounted for 76% of our total revenue. Sales directly to Samsung accounted for 34% and 36% of our total revenue and sales directly and through distributors to Micron accounted for 11% and 17% of our total revenue for the years ended December 31, 2010 and 2009, respectively. Some of our customers, including Samsung and Micron, use our products primarily in high-speed memory devices. We believe our operating results for the foreseeable future will continue to depend on sales to a relatively small number of customers. In the future, these customers may decide not to purchase our products at all, may purchase fewer products than they did in the past or may alter their purchasing patterns.

In addition, our relationships with some customers may deter other potential customers who compete with these customers from buying our products. To attract new customers or retain existing customers, we may offer these customers favorable prices on our products. In that event, our average selling prices and gross margins would decline. The loss of a key customer, a reduction in sales to any key customer or our inability to attract new significant customers could negatively impact our revenue and materially and adversely affect our results of operations.

We do not have long-term purchase commitments from our customers and if our customers cancel or change their purchase commitments, our revenue and operating results could suffer.

Substantially all of our sales to date, including sales to Samsung and Micron, have been made on a purchase order basis. We do not have any long-term commitments with any of our customers. As a result, our customers may cancel, change or delay product purchase commitments with little or no notice to us and without penalty. This in turn could cause our revenue to decline and materially and adversely affect our results of operations.

We may face claims of intellectual property infringement, which could be time-consuming, costly to defend or settle and result in the loss of significant rights and which could harm our relationships with our customers and distributors.

The semiconductor industry is characterized by companies that hold patents and other intellectual property rights and that vigorously pursue, protect and enforce intellectual property rights. From time to time, third parties may assert against us and our customers and distributors their patent and other intellectual property rights to technologies that are important to our business.

Claims that our products, processes or technology infringe third-party intellectual property rights, regardless of their merit or resolution, could be costly to defend or settle and could divert the efforts and attention of our management and technical personnel. For example, Netlist, Inc. filed suit against us in the United States District Court, Central District of California, in September 2009, alleging that our iMB™ and certain other memory module components infringe three of Netlist’s patents. For more details, see “Business—Legal Proceedings.”

Infringement claims also could harm our relationships with our customers or distributors and might deter future customers from doing business with us. We do not know whether we will prevail in these proceedings given the complex technical issues and inherent uncertainties in intellectual property litigation. If any pending or future proceedings result in an adverse outcome, we could be required to:

| • | cease the manufacture, use or sale of the infringing products, processes or technology; |

| • | pay substantial damages for infringement; |

| • | expend significant resources to develop non-infringing products, processes or technology, which may not be successful; |

10

Table of Contents

| • | license technology from the third-party claiming infringement, which license may not be available on commercially reasonable terms, or at all; |

| • | cross-license our technology to a competitor to resolve an infringement claim, which could weaken our ability to compete with that competitor; or |

| • | pay substantial damages to our customers or end users to discontinue their use of or to replace infringing technology sold to them with non-infringing technology, if available. |

Any of the foregoing results could have a material adverse effect on our business, financial condition and results of operations.

Winning business is subject to lengthy competitive selection processes that require us to incur significant expenditures prior to generating any revenue or without any guarantee of any revenue related to this business. Even if we begin a product design, a customer may decide to cancel or change its product plans, which could cause us to generate no revenue from a product. If we fail to generate revenue after incurring substantial expenses to develop our products, our business and operating results would suffer.

We are focused on winning more competitive bid processes, known as “design wins,” that enable us to sell our high-speed analog semiconductor solutions for use in our customers’ products. These selection processes typically are lengthy and can require us to incur significant design and development expenditures and dedicate scarce engineering resources in pursuit of a single customer opportunity. We may not win the competitive selection process and may never generate any revenue despite incurring significant design and development expenditures. Failure to obtain a design win could prevent us from offering an entire generation of a product. This could cause us to lose revenue and require us to write off obsolete inventory, and could weaken our position in future competitive selection processes. Even after securing a design win, we may experience delays in generating revenue from our products as a result of the lengthy development cycle typically required. Our customers generally take a considerable amount of time to evaluate our products. Our design cycle from initial engagement to volume shipment is typically two to three years.

The delays inherent in these lengthy sales cycles increase the risk that a customer will decide to cancel, curtail, reduce or delay its product plans or adopt a competing design from one of our competitors, causing us to lose anticipated revenue. In addition, any delay or cancellation of a customer’s plans could materially and adversely affect our financial results, as we may have incurred significant expense without generating any revenue. Finally, our customers’ failure to successfully market and sell their products could reduce demand for our products and materially and adversely affect our business, financial condition and results of operations. If we were unable to generate revenue after incurring substantial expenses to develop any of our products, our business would suffer.

Our customers require our products and our third-party contractors to undergo a lengthy and expensive qualification process which does not assure product sales. If we are unsuccessful in or delayed in qualifying any of our products with a customer, our business and operating results would suffer.

Prior to purchasing our products, our customers require that both our products and our third-party contractors undergo extensive qualification processes, which involve testing of our products in the customers’ systems, as well as testing for reliability. This qualification process may continue for several months. However, qualification of a product by a customer does not assure any sales of the product to that customer. Even after successful qualification and sales of a product to a customer, a subsequent revision in our third party contractors’ manufacturing process or our selection of a new supplier may require a new qualification process with our customers, which may result in delays and in our holding excess or obsolete inventory. After our products are qualified, it can take several months or more before the customer commences volume production of components or systems that incorporate our products. Despite these uncertainties, we devote substantial resources, including design, engineering, sales, marketing and management efforts, to qualifying our products with customers in anticipation of sales. If we are unsuccessful or delayed in qualifying any of our products with a customer, sales of those products to the customer may be precluded or delayed, which may impede our growth and cause our business to suffer.

11

Table of Contents

The complexity of our products could result in undetected defects and we may be subject to warranty claims and product liability, which could result in a decrease in customers and revenue, unexpected expenses and loss of market share. In addition, our product liability insurance may not adequately cover our costs arising from products defects or otherwise.

Our products are sold as components or as modules for use in larger electronic equipment sold by our customers. A product usually goes through an intense qualification and testing period performed by our customers before being used in production. We primarily outsource our product testing to third parties and also perform some testing in our Westlake Village, California, facility. We inspect and test parts, or have them inspected and tested in order to screen out parts that may be weak or potentially suffer a defect incurred through the manufacturing process. From time to time, we are subject to warranty or product liability claims that may require us to make significant expenditures to defend these claims or pay damage awards. For example, in September 2010, we were informed of a claim related to repair and replacement costs in connection with shipments of over 4,000 integrated circuits made by us during the summer and fall of 2009. Of these shipments, approximately 4% were later confirmed or suspected to have random manufacturing process anomalies in the wafer die in the product. Based on our standard warranty provisions, we provided replacement parts to the customer for the known and suspected failures that had occurred. In addition, and without informing us, in the fall of 2009, the customer instituted its own larger scale replacement program that covered the replacement of entire subassemblies in which our product was only one component. In September 2010, the customer made an initial claim for approximately $18 million against us for the costs incurred relative to that program. We believe the amount of the claim is without merit as our warranty liability is contractually limited to the repair or replacement of the affected Inphi products, which, to the extent the customer has requested replacement, has already been completed. A formal claim has yet to be made and discussions with the customer are ongoing. However, claims of this nature are subject to various risks and uncertainties and there can be no assurance that this matter will be resolved without further significant costs to us, including the potential for arbitration or litigation.

Generally, our agreements seek to limit our liability to the replacement of the part or to the revenue received for the product, but these limitations on liability may not be effective or sufficient in scope in all cases. If a customer’s equipment fails in use, the customer may incur significant monetary damages including an equipment recall or associated replacement expenses, as well as lost revenue. The customer may claim that a defect in our product caused the equipment failure and assert a claim against us to recover monetary damages. The process of identifying a defective or potentially defective product in systems that have been widely distributed may be lengthy and require significant resources, and we may incur significant replacement costs and contract damage claims from our customers as well as harm to our reputation. In certain situations, circumstances might warrant that we consider incurring the costs or expense related to a recall of one of our products in order to avoid the potential claims that may be raised should the customer reasonably rely upon our product only to suffer a failure due to a design or manufacturing process defect. Defects in our products could harm our relationships with our customers and damage our reputation. Customers may be reluctant to buy our products, which could harm our ability to retain existing customers and attract new customers and our financial results. In addition, the cost of defending these claims and satisfying any arbitration award or judicial judgment with respect to these claims could harm our business prospects and financial condition. Although we carry product liability insurance, this insurance may not adequately cover our costs arising from defects in our products or otherwise.

We rely on our relationships with industry and technology leaders to enhance our product offerings and our inability to continue to develop or maintain such relationships in the future would harm our ability to remain competitive.

We develop many of our semiconductor products for applications in systems that are driven by industry and technology leaders in the communications and computing markets. We also work with OEMs, system manufacturers and standards bodies to define industry conventions and standards within our target markets. We believe these relationships enhance our ability to achieve market acceptance and widespread adoption of our products. If we are unable to continue to develop or maintain these relationships, our semiconductor solutions would become less desirable to our customers, our sales would suffer and our competitive position could be harmed.

12

Table of Contents

If we fail to accurately anticipate and respond to market trends or fail to develop and introduce new or enhanced products to address these trends on a timely basis, our ability to attract and retain customers could be impaired and our competitive position could be harmed.

We operate in industries characterized by rapidly changing technologies and industry standards as well as technological obsolescence. We have developed products that may have long product life cycles of 10 years or more, as well as other products in more volatile high growth or rapidly changing areas, which may have shorter life cycles of only two to three years. We believe that our future success depends on our ability to develop and introduce new technologies and products that generate new sources of revenue to replace, or build upon, existing product revenue streams that may be dependent upon limited product life cycles. If we are not able to repeatedly introduce, in successive years, new products that ship in volume, our revenue will likely not grow and may decline significantly and rapidly. In 2009, we successfully introduced and began to ship a new product in production which we identify as product number INSSTE32882-GS04, or the GS04 product, and which consists of an integrated phase lock loop, or PLL, and register buffer. Sales of the GS04 product comprised 18% and 43% of our total revenue in 2010 and 2009, respectively. In 2010, we also began to ship in production volume a new “low voltage” version of our integrated PLL and register buffer, which is shipping in the form of product number INSSTE32882LV-GS02, or the GS02 product. Sales of the GS02 product comprised 32% of our total revenue in 2010. There were no other products that generated more than 10% of our total revenue in 2010, 2009 or 2008. As we continued to grow our business in 2010, the GS04 product matured. As a result, sales of the GS04 product are now declining in volume. We currently expect that by 2011 the GS04 product will no longer be material to our total revenue. This underscores the importance of the need for us to continually develop and introduce new products to diversify our revenue base as well as generate new revenue to replace and build upon the success of previously introduced products which may be rapidly maturing.

To compete successfully, we must design, develop, market and sell new or enhanced products that provide increasingly higher levels of performance and reliability while meeting the cost expectations of our customers. The introduction of new products by our competitors, the delay or cancellation of a platform for which any of our semiconductor solutions are designed, the market acceptance of products based on new or alternative technologies or the emergence of new industry standards could render our existing or future products uncompetitive from a pricing standpoint, obsolete and otherwise unmarketable. Our failure to anticipate or timely develop new or enhanced products or technologies in response to technological shifts could result in decreased revenue and our competitors winning design wins. In particular, we may experience difficulties with product design, manufacturing, marketing or certification that could delay or prevent our development, introduction or marketing of new or enhanced products. Although we believe our products are fully compliant with applicable industry standards, proprietary enhancements may not in the future result in full conformance with existing industry standards under all circumstances. Due to the interdependence of various components in the systems within which our products and the products of our competitors operate, customers are unlikely to change to another design, once adopted, until the next generation of a technology. As a result, if we fail to introduce new or enhanced products that meet the needs of our customers or penetrate new markets in a timely fashion, and our designs do not gain acceptance, we will lose market share and our competitive position, very likely on an extended basis, and operating results will be adversely affected.

If sufficient market demand for 100G solutions does not develop or develops more slowly than expected, or if we fail to accurately predict market requirements or market demand for 100G solutions, our business, competitive position and operating results would suffer.

We are currently investing significant resources to develop semiconductor solutions supporting 100G data transmission rates in order to increase the number of such solutions in our product line. If we fail to accurately predict market requirements or market demand for 100G semiconductor solutions, or if our 100G semiconductor solutions are not successfully developed or competitive in the industry, our business will suffer. If 100G networks are deployed to a lesser extent or more slowly than we currently anticipate, we may not realize any benefits from our investment. As a result, our business, competitive position, market share and operating results would suffer.

13

Table of Contents

Our target markets may not grow or develop as we currently expect and are subject to market risks, any of which could materially harm our business, revenue and operating results.

To date, a substantial portion of our revenue has been attributable to demand for our products in the communications and computing markets and the growth of these overall markets. These markets have fluctuated in size and growth in recent times. Our operating results are impacted by various trends in these markets. These trends include the deployment and broader market adoption of next generation technologies, such as 40 gigabits per second, or Gbps or G, and 100G, in communications and enterprise networks, timing of next generation network upgrades, the introduction and broader market adoption of next generation server platforms, timing of enterprise upgrades and the introduction and deployment of high-speed memory interfaces in computing platforms. We are unable to predict the timing or direction of the development of these markets with any accuracy. For example, we expect that the deployment of different types of memory devices for which our iMB™ product is designed will be substantially dependent on the development of next generation server platforms. We have not generated any significant revenue from our iMB™ product to date, and if the development or adoption of next generation server platforms is delayed, or if these server platforms do not interoperate with memory devices for which our iMB™ product is designed, we may not realize revenue from our iMB™ product. In addition, because some of our products are not limited in the systems or geographic areas in which they may be deployed, we cannot always determine with accuracy how, where or into which applications our products are being deployed. If our target markets do not grow or develop in ways that we currently expect, demand for our semiconductor products may decrease and our business and operating results could suffer.

We rely on a limited number of third parties to manufacture, assemble and test our products, and the failure to manage our relationships with our third-party contractors successfully could adversely affect our ability to market and sell our products and our reputation. Our revenue and operating results would suffer if these third parties fail to deliver products or components in a timely manner and at reasonable cost or if manufacturing capacity is reduced or eliminated as we may be unable to obtain alternative manufacturing capacity.

We operate an outsourced manufacturing business model. As a result, we rely on third-party foundry wafer fabrication and assembly and test capacity. We also perform testing in our Westlake Village, California, facility. We generally use a single foundry for the production of each of our various semiconductors. Currently, our principal foundries are Global Communications Semiconductors, Inc., or GCS, Sumitomo Electric Device Innovations Inc., Taiwan Semiconductor Manufacturing Company Ltd., or TSMC, TowerJazz Semiconductor Ltd., United Monolithic Semiconductors S.A.S., or UMS, and WIN Semiconductors Corp. We also use third-party contract manufacturers for a significant majority of our assembly and test operations, including Kyocera Corporation, Natel Engineering Co., Inc., Orient Semiconductor Electronics Ltd., or OSE, Presto Engineering, Signetics Korea Co., Ltd. and STATS ChipPAC Ltd.

Relying on third-party manufacturing, assembly and testing presents significant risks to us, including the following:

| • | failure by us, our customers or their end customers to qualify a selected supplier; |

| • | capacity shortages during periods of high demand; |

| • | reduced control over delivery schedules and quality; |

| • | shortages of materials; |

| • | misappropriation of our intellectual property; |

| • | limited warranties on wafers or products supplied to us; and |

| • | potential increases in prices. |

The ability and willingness of our third-party contractors to perform is largely outside our control. If one or more of our contract manufacturers or other outsourcers fails to perform its obligations in a timely manner or at

14

Table of Contents

satisfactory quality levels, our ability to bring products to market and our reputation could suffer. For example, if that manufacturing capacity is reduced or eliminated at one or more facilities, including as a response to the recent worldwide decline in the semiconductor industry, or any of those facilities are unable to keep pace with the growth of our business, we could have difficulties fulfilling our customer orders and our revenue could decline. In addition, if these third parties fail to deliver quality products and components on time and at reasonable prices, we could have difficulties fulfilling our customer orders, our revenue could decline and our business, financial condition and results of operations would be adversely affected.

Additionally, as many of our fabrication and assembly and test contractors are located in the Pacific Rim region, principally in Taiwan, our manufacturing capacity may be similarly reduced or eliminated due to natural disasters, political unrest, war, labor strikes, work stoppages or public health crises, such as outbreaks of H1N1 flu. This could cause significant delays in shipments of our products until we are able to shift our manufacturing, assembly or test from the affected contractor to another third-party vendor. There can be no assurance that alternative capacity could be obtained on favorable terms, if at all.

Our costs may increase substantially if the wafer foundries that supply our products do not achieve satisfactory product yields or quality.

The wafer fabrication process is an extremely complicated process where the slightest changes in the design, specifications or materials can result in material decreases in manufacturing yields or even the suspension of production. From time to time, our third-party wafer foundries have experienced, and are likely to experience manufacturing defects and reduced manufacturing yields related to errors or problems in their manufacturing processes or the interrelationship of their processes with our designs. In some cases, our third-party wafer foundries may not be able to detect these defects early in the fabrication process or determine the cause of such defects in a timely manner. We may incur substantial research and development expense for prototype or development stage products as we qualify the products for production.

Generally, in pricing our semiconductors, we assume that manufacturing yields will continue to increase, even as the complexity of our semiconductors increases. Once our semiconductors are initially qualified with our third-party wafer foundries, minimum acceptable yields are established. We are responsible for the costs of the wafers if the actual yield is above the minimum. If actual yields are below the minimum we are not required to purchase the wafers. The minimum acceptable yields for our new products are generally lower at first and increase as we achieve full production. Unacceptably low product yields or other product manufacturing problems could substantially increase the overall production time and costs and adversely impact our operating results on sales of our products. Product yield losses will increase our costs and reduce our gross margin. In addition to significantly harming our operating results and cash flow, poor yields may delay shipment of our products and harm our relationships with existing and potential customers.

We do not have any long-term supply contracts with our contract manufacturers or suppliers, and any disruption in our supply of products or materials could have a material adverse affect on our business, revenue and operating results.

We currently do not have long-term supply contracts with any of our third-party contract manufacturers. We make substantially all of our purchases on a purchase order basis, and our contract manufacturers are not required to supply us products for any specific period or in any specific quantity. We expect that it would take approximately nine to 12 months to transition from our current foundry or assembly services to new providers. Such a transition would likely require a qualification process by our customers or their end customers. We generally place orders for products with some of our suppliers several months prior to the anticipated delivery date, with order volumes based on our forecasts of demand from our customers. Accordingly, if we inaccurately forecast demand for our products, we may be unable to obtain adequate and cost-effective foundry or assembly capacity from our third-party contractors to meet our customers’ delivery requirements, or we may accumulate excess inventories. On occasion, we have been unable to adequately respond to unexpected increases in customer

15

Table of Contents

purchase orders and therefore were unable to benefit from this incremental demand. None of our third-party contract manufacturers have provided any assurance to us that adequate capacity will be available to us within the time required to meet additional demand for our products.

Our foundry vendors and assembly and test vendors may allocate capacity to the production of other companies’ products while reducing deliveries to us on short notice. In particular, other customers that are larger and better financed than us or that have long-term agreements with our foundry vendor or assembly and test vendors may cause our foundry vendor or assembly and test vendors to reallocate capacity to those customers, decreasing the capacity available to us. We do not have long-term supply contracts with our third-party contract manufacturers and if we enter into costly arrangements with suppliers that include nonrefundable deposits or loans in exchange for capacity commitments, commitments to purchase specified quantities over extended periods or investment in a foundry, our operating results could be harmed. We may not be able to make any such arrangement in a timely fashion or at all, and any arrangements may be costly, reduce our financial flexibility, and not be on terms favorable to us. Moreover, if we are able to secure foundry capacity, we may be obligated to use all of that capacity or incur penalties. These penalties may be expensive and could harm our financial results. To date, we have not entered into such arrangements with our suppliers. If we need another foundry or assembly and test subcontractor because of increased demand, or if we are unable to obtain timely and adequate deliveries from our providers, we might not be able to cost effectively and quickly retain other vendors to satisfy our requirements.

Many of our customers depend on us as the sole source for a number of our products. If we are unable to deliver these products as the sole supplier or as one of a limited number of suppliers, our relationships with these customers and our business would suffer.

A number of our customers do not have alternative sources for our semiconductor solutions and depend on us as the sole supplier or as one of a limited number of suppliers for these products. Since we outsource our manufacturing to third-party contractors, our ability to deliver our products is substantially dependent on the ability and willingness of our third-party contractors to perform, which is largely outside our control. A failure to deliver our products in sufficient quantities or at all to our customers that depend on us as a sole supplier or as one of a limited number of suppliers may be detrimental to their business and, as a result, our relationship with the customer would be negatively impacted. If we are unable to maintain our relationships with these customers after such failure, our business and financial results may be harmed.

If we are unable to attract, train and retain qualified personnel, particularly our design and technical personnel, we may not be able to execute our business strategy effectively.

Our future success depends on our ability to attract and retain qualified personnel, including our management, sales and marketing, and finance, and particularly our design and technical personnel. We do not know whether we will be able to retain all of these personnel as we continue to pursue our business strategy. Historically, we have encountered difficulties in hiring qualified engineers because there is a limited pool of engineers with the expertise required in our field. Competition for these personnel is intense in the semiconductor industry. As the source of our technological and product innovations, our design and technical personnel represent a significant asset. The loss of the services of one or more of our key employees, especially our key design and technical personnel, or our inability to attract and retain qualified design and technical personnel, could harm our business, financial condition and results of operations.

We may not be able to effectively manage our growth, and we may need to incur significant expenditures to address the additional operational and control requirements of our growth, either of which could harm our business and operating results.

To effectively manage our growth, we must continue to expand our operational, engineering and financial systems, procedures and controls and to improve our accounting and other internal management systems. This

16

Table of Contents

may require substantial managerial and financial resources, and our efforts in this regard may not be successful. Our current systems, procedures and controls may not be adequate to support our future operations. If we fail to adequately manage our growth, or to improve our operational, financial and management information systems, or fail to effectively motivate or manage our new and future employees, the quality of our products and the management of our operations could suffer, which could adversely affect our operating results.

We face intense competition and expect competition to increase in the future. If we fail to compete effectively, it could have an adverse effect on our revenue, revenue growth rate, if any, and market share.

The global semiconductor market in general, and the communications and computing markets in particular, are highly competitive. We compete or plan to compete in different target markets to various degrees on the basis of a number of principal competitive factors, including product performance, power budget, features and functionality, customer relationships, size, ease of system design, product roadmap, reputation and reliability, customer support and price. We expect competition to increase and intensify as more and larger semiconductor companies enter our markets. Increased competition could result in price pressure, reduced profitability and loss of market share, any of which could materially and adversely affect our business, revenue and operating results.

Currently, our competitors range from large, international companies offering a wide range of semiconductor products to smaller companies specializing in narrow markets. Our primary competitors include Broadcom Corporation, Hittite Microwave Corporation, Integrated Device Technology, Inc. and Texas Instruments Incorporated, as well as other analog signal processing companies. We expect competition in the markets in which we participate to increase in the future as existing competitors improve or expand their product offerings. In addition, as we develop our 100G semiconductor solution, we may face competition from companies such as Broadcom and NetLogic Microsystems, Inc.

Our ability to compete successfully depends on elements both within and outside of our control, including industry and general economic trends. During past periods of downturns in our industry, competition in the markets in which we operate intensified as our customers reduced their purchase orders. Many of our competitors have substantially greater financial and other resources with which to withstand similar adverse economic or market conditions in the future. These developments may materially and adversely affect our current and future target markets and our ability to compete successfully in those markets.

We use a significant amount of intellectual property in our business. Monitoring unauthorized use of our intellectual property can be difficult and costly and if we are unable to protect our intellectual property, our business could be adversely affected.

Our success depends in part upon our ability to protect our intellectual property. To accomplish this, we rely on a combination of intellectual property rights, including patents, copyrights, trademarks and trade secrets in the United States and in selected foreign countries where we believe filing for such protection is appropriate. Effective protection of our intellectual property rights may be unavailable, limited or not applied for in some countries. Some of our products and technologies are not covered by any patent or patent application, as we do not believe patent protection of these products and technologies is critical to our business strategy at this time. A failure to timely seek patent protection on products or technologies generally precludes us from seeking future patent protection on these products or technologies. We cannot guarantee that:

| • | any of our present or future patents or patent claims will not lapse or be invalidated, circumvented, challenged or abandoned; |

| • | our intellectual property rights will provide competitive advantages to us; |

| • | our ability to assert our intellectual property rights against potential competitors or to settle current or future disputes will not be limited by our agreements with third parties; |

| • | any of our pending or future patent applications will be issued or have the coverage originally sought; |

17

Table of Contents

| • | our intellectual property rights will be enforced in jurisdictions where competition may be intense or where legal protection may be weak; |

| • | any of the trademarks, copyrights, trade secrets or other intellectual property rights that we presently employ in our business will not lapse or be invalidated, circumvented, challenged or abandoned; or |

| • | we will not lose the ability to assert our intellectual property rights against or to license our technology to others and collect royalties or other payments. |