Attached files

| file | filename |

|---|---|

| EX-32.2 - FORLINK SOFTWARE CORP INC | v215862_ex32-2.htm |

| EX-32.1 - FORLINK SOFTWARE CORP INC | v215862_ex32-1.htm |

| EX-31.1 - FORLINK SOFTWARE CORP INC | v215862_ex31-1.htm |

| EX-31.2 - FORLINK SOFTWARE CORP INC | v215862_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to ______________

Commission File Number 0-18731

FORLINK SOFTWARE CORPORATION, INC.

(Exact name of Registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of

incorporation or organization)

|

98-0398666

(I.R.S. Employer Identification No.)

|

|

9F Shenzhou Mansion, No. 31

ZhongGuanCun South Road

Haidian District, Beijing, P.R. China

(Address of principal executive offices)

|

N/A

(Zip Code)

|

|

(0086) 10 6811 8866

(Issuer's telephone number, including area code)

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class

None

|

Name of each exchange on which registered

None

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

Title of Class

Common Stock, $.001 par value

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2010 was approximately $1,627,911 The per share stock price for computational purposes was $0.35, based on the closing sale price per share for the registrant's common stock as reported on the OTC Bulletin Board on such date. This value is not intended to be a representation as to the value or worth of the registrant's common stock. The number of non-affiliates of the registrant has been calculated by subtracting the number of shares held by persons affiliated with the registrant from the number of outstanding shares.

The number of shares of the registrant's common stock, $.001 par value, outstanding on March 25, 2011 was 4,651,173 shares.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED DECEMBER 31, 2010

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

5

|

|

Item 1A.

|

Risk Factors

|

12

|

|

Item 1B.

|

Unresolved Staff Comments

|

13

|

|

Item 2.

|

Properties

|

13

|

|

Item 3.

|

Legal Proceedings

|

14

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

15

|

|

Item 6.

|

Selected Financial Data

|

15

|

|

Item 7.

|

Management’s Discussion and Analysis or Plan of Operation

|

16

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

23

|

|

Item 8.

|

Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

23

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

25

|

|

Item 9A(T).

|

Controls and Procedures

|

25

|

|

Item 9B.

|

Other Information

|

25

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

26

|

|

Item 11.

|

Executive Compensation

|

27

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

29

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

29

|

|

Item 14.

|

Principal Accountant Fees and Services

|

30

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

30

|

|

Signatures

|

33

|

2

CAUTIONARY NOTES REGARDING

FORWARD LOOKING INFORMATION

Readers of this Annual Report on Form 10-K (“Form 10-K”) and any document incorporated by reference herein, are advised that this document and documents incorporated by reference into this document contain both statements of historical facts and forward looking statements. Forward looking statements are subject to certain risks and uncertainties, which could cause actual results to differ materially for those indicated by the forward-looking statements. Forward-looking statements usually contain the words “estimate,” “anticipate,” “believe,” “expect,” or similar expressions, and are subject to numerous known and unknown risks and uncertainties. Examples of forward looking statements include, but are not limited to (i) projections of revenues, income or loss, earning or loss per share, capital expenditures, dividends, capital structure and other financial items, (ii) statements of the plans and objectives of the Company or its management or board of directors, including the introduction of new products, or estimates or predictions of actions by customers, suppliers, competitors or regulatory authorities, (iii) statements of future economic performance, and (iv) statements of assumptions underlying other statements and statements about the Company or its business.

This document and any documents incorporated by reference herein also identify important factors which could cause actual results to differ materially from those indicated by forward looking statements. These risks and uncertainties include price competition, the decisions of customers, the actions of competitors, the effects of government regulation, possible delays in the introduction of new products and services, customer acceptance of products and services, the Company's ability to secure debt and/or equity financing on reasonable terms, and other factors which are described herein and/or in documents incorporated by reference herein.

The cautionary statements made above and elsewhere by the Company should not be construed as exhaustive or as any admission regarding the adequacy of disclosures made by the Company. Forward looking statements are beyond the ability of the Company to control and in many cases the Company cannot predict what factors would cause results to differ materially from those indicated by the forward looking statements. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

3

PART I

Item 1. Business.

Overview

Forlink Software Corporation, Inc. (the "Company" or the "Registrant" or "Forlink" or "we" or "us") is in the business of providing e-business application solutions and IT outsourcing services in the People’s Republic of China (“PRC” or “China”). Through our subsidiaries, we offer our clients business information management consulting and planning, application software design, agency and integrated application services for the third party’s software and other online application services. We also offer the “For”-series of software products. Our clients are mainly in the telecom and logistics industries, as well as government agencies. We have also invested in companies in logistics, finance and information technology (IT) industries. The application platforms used by these companies are supported by our integrated application systems, software and IT outsourcing services. Our headquarters are located in Beijing, with branch offices in Chengdu and Shanghai. We also have a research and development (“R&D”) center located in Chengdu.

Company Organization and History

We are a Nevada corporation which was originally incorporated on January 7, 1986 as "Why Not?, Inc." under the laws of the State of Utah and subsequently reorganized under the laws of Nevada on December 30, 1993. From 1996 until 1999, the Company continued as an unfunded venture in search of a suitable business acquisition or business combination.

On November 3, 1999, we entered into a Plan of Reorganization with Beijing Forlink Software Technology Co., Ltd., (hereinafter "BFSTC"), a limited liability company organized under the laws of the PRC, under the terms of which BFSTC gained control of the Company. Pursuant to the Plan of Reorganization, we acquired 100% of the registered and fully paid-up capital of BFSTC in exchange for 20,000,000 shares of the Company's authorized, but unissued, common stock. BFSTC is engaged in the provision of computer software consultancy and engineering services and the development and sale of computer software in the PRC. As a part of its computer consultancy and engineering services, BFSTC is also engaged in the sale of computer hardware. In June 2001, BFSTC changed its name to Forlink Technologies Co. Ltd. (“FTCL”). FTCL is our major operating subsidiary in China.

In August 2001, we acquired Beijing Slait Science & Technology Development Limited Co. (“SLAIT”) pursuant to a Plan of Reorganization dated January 11, 2001. We issued 59,430,000 shares of our common stock to SLAIT’s original owners in exchange for 100% of the outstanding equity of SLAIT. As a result of the share exchange, the former owners of SLAIT own approximately 70% of the issued and outstanding shares of the Company, and SLAIT became a wholly-owned subsidiary of the Company. We also agreed to transfer 1,085,000 Renminbi (“RMB”) (approximately US$131,039) to the former owners of SLAIT. A change in control occurred in which all but one of the officers and directors of the Company resigned and two former directors (also former owners) of SLAIT became officers and directors of the Company. Prior to its dissolution in 2004, SLAIT provided application system integration technology and specializes in large volume transaction processing software for networks such as mobile phone billing and band operation. Subsequent to our acquisition, the principal activities of SLAIT were gradually shifted to those of FTCL. On February 13, 2004, SLAIT was officially dissolved in accordance with relevant PRC regulations.

On June 18, 2003, Forlink Technologies (Hong Kong) Limited (“FTHK”) was incorporated in Hong Kong Special Administrative Region as a limited liability company. In December 2003, FTHK became a wholly owned subsidiary of Forlink. FTHK is an investment holding company. Because of the favorable business environment in Hong Kong, we can simplify and speed up investment transactions through this subsidiary. Through FTHK, on December 18, 2003, we invested $760,870 in All China Logistics Online Co., Ltd. ("All China Logistics"), a privately held PRC company and a leading provider of logistic services in China, in exchange for a 17.8% equity interest. Through this investment, we have become the second largest shareholder of All China Logistics and its sole software solution provider. FTHK is also responsible for directly importing from overseas companies certain hardware needed for product integration, which allows us to improve our hardware pass-through profit margin.

4

On June 14, 2004, Forlink Technologies (Chengdu) Limited ("FTCD") was established as a limited liability company in Chengdu, PRC and subsequently became a wholly owned subsidiary of FTHK in September 2004. FTCD is in the business of providing software outsourcing services and software development. The registered capital of FTCD is $5,000,000 and the fully paid up capital was $750,000 as of December 31, 2005. In April 2006, FTHK further invested $130,000 in FTCD. FTCD commenced operations in late 2005. The registered capital of FTCD was reduced to $200,000 in December 2007.

In compliance with China’s foreign investment restrictions on telecom value-added services and other laws and regulations, we conduct our telecom value-added services and application integration services for government organizations in China via Beijing Forlink Hua Xin Technology Co. Ltd. ("BFHX"). BFHX was established in the PRC on September 19, 2003 as a limited liability company. The registered capital of BFHX is $120,733 (RMB 1,000,000) and was fully paid up as of March 31, 2005. Mr. Yi He and Mr. Wei Li have been entrusted as nominee owners of BFHX to hold 70% and 30%, respectively, of the fully paid up capital of BFHX on behalf of Forlink as the primary beneficiary. BFHX is considered a Variable Interest Entity ("VIE"), and because we are the primary beneficiary, our consolidated financial statements include BFHX. Upon the request of the Company, Mr. Yi He and Mr. Wei Li are required to transfer their ownership in BFHX to us or our designee at any time for the amount of the fully paid registered capital of BFHX. Mr. Yi He is the Chief Executive Officer, a director and a major stockholder of the Company. Mr. Wei Li is the administration manager of FTCL.

On October 24, 2005, we entered into a definitive agreement to acquire a 17.5% equity interest from China Liquid Chemical Exchange Company Limited (“CLCE”), a PRC limited liability company. Under the terms of the agreement, Forlink deployed the “For-online Electronic Trading System”, a proprietary, integrated software solution, to support CLCE’s operations, including, but not limited to, online trading, online billing and payment, user authentication and customer care, in exchange for the 17.5% equity interest. In early 2007, CLCE increased its share capital to $1,708,526 (RMB 13,000,000). As we did not subscribe for the new shares, our shareholding of CLCE was diluted and as of December 31 2008 was 13.46%. CLCE commenced operations fully in early 2007.

On October 3, 2006, we entered into a Transfer of Right to Invest and Project Cooperation Agreement (“Statelink Agreement”) with Statelink International Group, Ltd., a British Virgin Islands company (“Statelink”), pursuant to which we acquired 22.73% registered capital in Guangxi Caexpo International Trade and Logistics Co., Ltd. (“Guangxi Caexpo”), a PRC limited liability company in the businesses of real estate development, advertising and computer distribution, for cash consideration of $2,557,545 (RMB 20,000,000) from BFHX and stock consideration of 13,000,000 shares of our restricted common stock. Thereafter, we also won a contract from Guangxi Caexpo to build an “Electronic Trade and Logistics Information Platform and Call Center” (the “Project”). On October 26, 2006, BFHX established Forlink Technologies (Guangxi) Limited (“FTGX”), a PRC limited liability company and wholly owned subsidiary, to carry out this contract. At the time of incorporation, BFHX injected RMB 20,000,000 (approximately US$2,557,545) as registered capital to FTGX. The Project was completed in the fourth quarter of 2007, and with the successful deployment of the relevant software, the client signed the final inspection report in January 2009. On August 20, 2010, the Company transferred all its ownership interests in Guangxi Caexpo to Guangxi Sanqi Investment Co., Ltd for the amount of Guangxi Caexpo’s 22.73% fully paid up capital. The Company got cash payment of $3,024,355 (RMB 20,000,000).

On October 12, 2006, we invested $31,969 (RMB 250,000) in Wuxi Stainless Steel Exchange Co., Ltd. (“Wuxi Exchange”), a PRC limited liability company, for a 12.5% equity interest. In addition, we agreed to deploy a proprietary, integrated software solution, estimated at RMB 1,000,000, to support Wuxi Exchange’s operations. The software was deployed in February 2007. On January 14, 2007, the Company entered into an agreement with a major shareholder of Wuxi Exchange pursuant to which the Company transferred 2.5% of the Company’s interest in Wuxi Exchange to this major shareholder for a cash payment of RMB 500,000.

On January 25, 2007, our board of directors and the majority holders of the Company’s common stock jointly approved an amendment to our Articles of Incorporation by written consent, to increase the number of authorized shares of common stock from 100,000,000 to 200,000,000. The Certificate of Amendment to our Articles of Incorporation to effect the increase of the number of our authorized common shares was filed with Nevada’s Secretary of State on April 4, 2007.

On April 29, 2007, we invested, through BFHX, $138,158 (RMB 1,050,000) in Beijing GuoXin Forlink Internet Technologies Limited (“BGXF”), a privately held PRC company that operates a finance study website, for a 35% equity interest. The investment in BGXF is accounted for under the equity method of accounting due to the Company’s significant influence over the operational and financial policies of BGXF. BGXF commenced operations on March 9 2008. On October 14, 2008, BGXF increased its registered capital to RMB 4,285,700, and since we did not invest additional funds into BGXF, the ratio of our holding was diluted to a 24.5% equity interest.

5

On July 12, 2007, we invested through FTGX, $1,063,830 (RMB 8,000,000) in Nanning Bulk Commodities Exchange Corporation Limited (“NNBCE”), a privately held PRC company, for an 80% equity interest. NNBCE became a subsidiary of FTGX. NNBCE, established on April 29, 2007, commenced operations on March 28, 2008, and provides logistical e-commerce service.

On September 5, 2007, we invested through NNBCE, $465,425 (RMB 3,500,000) in Guangxi Bulk Sugar & Ethanol Exchange Corporation Limited (“GBSEE”), a PRC limited liability company established on September 12, 2007, for a 35% equity interest. On the same date, All China Logistics was entrusted to hold 20% of the fully paid up capital of GBSEE on behalf of NNBCE as the primary beneficiary. Upon the request of NNBCE, All China Logistics is required to transfer its ownership interests in GBSEE to NNBCE or its designees at any time for the amount of the 20% fully paid up capital. In accordance with Financial Accounting Standards Board (“FASB”) Interpretation No. 46R “Consolidation of Variable Interest Entities - An Interpretation of ARB No. 51” (“FIN 46R”), NNBCE is deemed to hold the primary beneficial interest of the 55% equity interest in GBSEE. GBSEE was established to provide logistical e-commerce service, but it was dissolved on December 16, 2007 before it commenced any operations, and NNBCE received payments back of its investment in GBSEE of $410,397 (RMB 3,000,000) in December 2007; $66,211 (RMB 484,000) in February 2008, and $2,189 (RMB 16,000) in September 2008.

On December 24, 2007, our board of directors and the majority holders of the Company’s common stock jointly approved an amendment to our Articles of Incorporation by written consent, to effect a 1-for-20 reverse stock split. The Certificate of Amendment to our Articles of Incorporation to effect the reverse split was filed with Nevada’s Secretary of State on February 21, 2008.

On March 20, 2008, Forlink invested $71,124 (RMB 500,000), through BFHX, in Shandong LongDong Internet Technologies Limited (“SDLD”), a PRC limited liability company, established on October 24, 2007, for a 5% equity interest. SDLD, which commenced operations in December 2007, is in the business of providing of providing primary products e-commerce services. The purpose of the investment is to gain cash dividends from SDLD.

On February 8, 2010, the Company transferred all its ownership interests in FTCL to BFHX for the amount of FTCL’s 100% fully paid up capital.

On October 8, 2010, the Company invested $151,213 (RMB 1,000,000), through BFHX, in Shanghai Shipping Freight Exchange Co., LTD (“SSFE”), a PRC limited liability company, established on October 8, 2010, for a 5% equity interest. SSFE will not commence its operations until March 25, 2011.

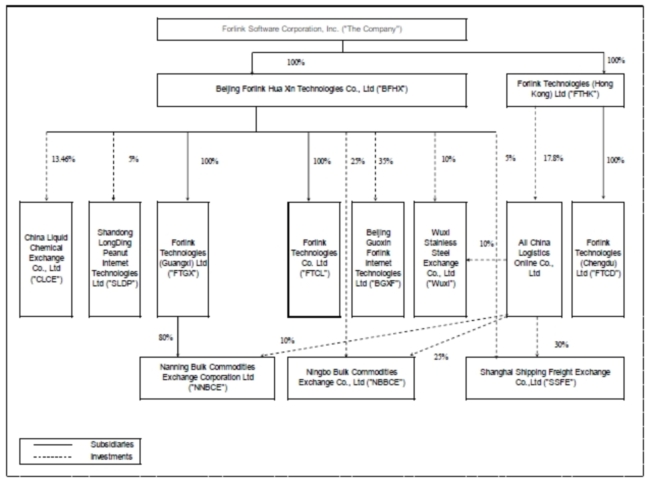

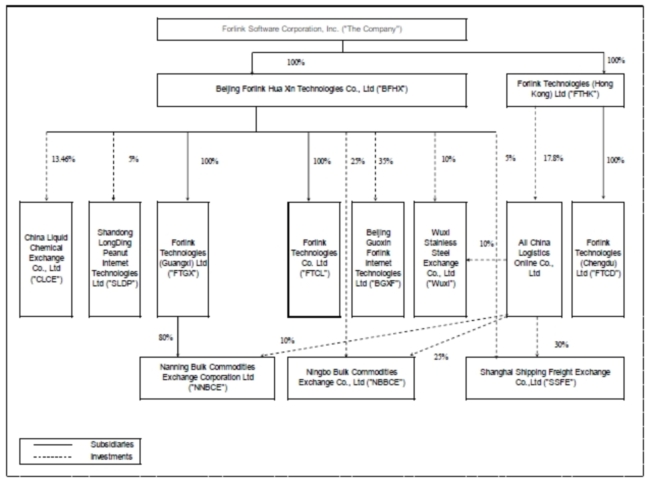

Forlink and its subsidiaries are all operating companies, and during the reporting period, none of the companies’ operations were discontinued or dissolved. Set forth below is a diagram illustrating our corporate structure as of December 31, 2010:

6

7

Employees

As of December 31, 2010, we had 194 employees, all of which are full-time. Approximately 146 of our full-time employees are software and information technology specialists engaged in research and development, maintenance and support activities. The remaining employees are sales, marketing and administrative personnel. As an incentive, we have created employee stock option plans that include vesting provisions designed to encourage long-term employment.

Products and Solutions

Our application solutions are developed on Enterprise Application Integration (EAI) platforms. Our current product offerings include:

|

·

|

For-EAI: For-EAI is an e-business application integration platform based on SOA, including basic components (SSO, workflow, etc.) and product components (For-Mail, ForCRM, ForOA, etc.) and mobile-commerce application technologies. Now all of our industry application solutions are developed on For-EAI.

|

|

·

|

For-Online: For-Online is a SaaS operating platform designed to deliver application services over the internet. The applications that can be delivered over the internet include many of our flagship products such as ForOA and ForCRM.

|

|

·

|

For-eMarket: Forlink bulk stock electronic transaction system is an online exchange system designed to facilitate the matching of vendors and sellers on electronic trading market.

|

|

·

|

ForOSS: Forlink Operation Support System is our solution for Business & Operation Support Systems (BSS/OSS) for e-business carriers and telecom carriers, and is consist of software products designed to support existing and expanding business operations of these companies. ForOSS supports billing, customer care, customer relation management, accounting, decision support and other internal functionalities.

|

Distribution Methods of the Products and Services

We mainly sell our products and services directly to our customers. We also utilize distribution partners to sell our products and services.

Research and Development

We are committed to continually research, design and develop information technology solutions and software products that meet the needs of our customers. Our Chengdu R&D center was established in February 1998. As of December 31, 2010, we had 52 employees at the Chengdu R&D Center. Our R&D expenses in 2010 and 2009 were $743,845 and $1,039,742, respectively.

Status of New Product or Service

We released For-EAI 5.0 and For-Online 5.0 in June 2009. The strengths of For-EAI 5.0 include function integration, data integration and business integration. We have also added more co-operating products and cell phone terminal components on For-EAI 5.0. We plan to develop more product components and application solutions based on For-EAI 5.0 and For-Online 5.0 in 2011.

Market Opportunities

Based on our extensive market research and industry insights, we believe that the major market opportunities for our business include the following: industry application integration; industry SaaS (software-as-a-Service); and mobile-commerce applications.

8

Our Strategy

As a professional software-solutions and technology service company, our business objective is to become a leading e-business application solutions and online application services provider in China. Our operating strategy is to use shared core technologies and management systems to identify potential clients, and through consistent long-term technology supports, build tight strategic partnerships with our clients.

The key aspects of our strategy include the following:

|

·

|

Establish a unified and standard software engineering and project management system to provide assurance for designing high-quality software products and services. As an important milestone, we have achieved Level 3 (Managed Level of Software Process Maturity) of Capability Maturity Model® Integration (CMMI), which was certified by the Software Engineering Institution.

|

|

·

|

Establish a unified e-business application platform and online services platform. We provide support for e-business application technologies and platforms in different industries, and strive to make available to our clients’ high-quality IT outsourcing services that are cost-effective. To that end, we have made gradual improvements to the power and reliability of our For-Online platform since 2004, culminating with the launch in August 2007 of For-Online 4.0.

|

|

·

|

Participate in our clients’ e-business application operations to become their strategic partner. We have invested in several companies in logistics, finance, IT industries, whose application platforms are supported by our integrated application systems, software and IT outsourcing services. These companies include NNBCE, CLCE, BGXF, NBBCE, and Wuxi Stainless Steel Exchange Co., Ltd.

|

Our Competitive Strengths

|

·

|

Professional Software Development and Services System.

|

Our professional software development and services system has substantially strengthened our competitive advantages by ensuring that we are in compliance with all relevant international standards and regulations for business. We have passed the ISO9001:2000 international quality assurance system certification and the CMMI Level 3 certification, certifying that our software development and services system is in compliance with international standards. We have passed system integration Level 2 certification.

|

·

|

Eighteen Years of Experience in Industry Applications with Proven Solutions and Products.

|

Forlink has developed core application software products such as For-eMarket, ForCRM, ForOSS and ForROA based on standardized application integration technologies. Our customers, strategic partners and suppliers recognize our company as a dependable provider of high quality services, solutions and products, and frequently recommend us to their business contacts.

|

·

|

Established Customer Relationships.

|

Because of our successful track record, we have established relationships with leading companies in telecom, logistic, finance, government, and other industry verticals in China. Our in-depth understanding of their requirements allows us to successfully deliver customized solutions. Moreover, we have strong customer service and research and development teams based in China, which allow us to respond quickly and efficiently to the needs of our clients.

|

·

|

A Strong and Stable Management Team.

|

The current management team has been with Forlink since we commenced business, and includes pioneers of enterprise application integration (EAI) technologies in China. The backgrounds of the individuals in our management team offer a breadth of knowledge and experience that covers all aspects relating to the control and development of EAI systems. Beyond expertise in the field, their close working relationships with major long-term clients demonstrate a proven ability to sustain and cultivate a successful business.

9

Our Strategic Partners

Strategic partnerships are essential elements of our business model. At this time, we have three types of partners that contribute to the continuing success of our business.

|

·

|

Technology Development Partners. These partners provide technology (through licensing or other arrangements) for our solutions or for joint development. Our major technology development partners include HP, Oracle, BEA, IONA, Redhat and Redflag-linux.

|

|

·

|

Marketing and Product Partners. These partners provide products and/or technology that are bundled with our solutions and products for marketing purposes. Our marketing and product partners include HP, Intel, IBM, Oracle, Lenovo and Digital China.

|

|

·

|

Distribution Partners. These partners distribute our solutions and products to our customers. Our current distribution partner is Beijing Federal.

|

Competitive Conditions

The market for information technology services in China is rapidly growing and changing. We compete with many domestic companies. Our principal competitors in application integration services include AsiaInfo and Digital China. Our principal competitors in the SaaS field include UFSOFT and MYCRM. All of these companies are leading companies in the Chinese IT industry.

Government Regulations

The Chinese government has generally encouraged the development of the information technology industry, and the products and services we offer are currently subject to PRC government regulations.

The State Council of the PRC (the “State Council”) promulgated the Regulations on the Protection of Computer Software (the “Software Protection Regulations”) in December 2001, which became effective in January 2002. The Software Protection Regulations were promulgated, among other things, to protect the copyright of computer software in China. According to the Software Protection Regulations, computer software that is independently developed and exists in a physical form or is attached to physical goods will be protected. However, such protection does not apply to any ideas, mathematical concepts, processing and operation methods used in the development of software solutions.

Under the Software Protection Regulations, PRC citizens, legal persons and organizations enjoy copyright protection over computer software they have developed, regardless of whether the software has been published. Other developers may enjoy PRC copyright protection over computer software they have developed if such computer software was first distributed in China, or in accordance with a bilateral agreement between China and the developer’s country of citizenship or residence, or in accordance with an international treaty to which China is a party.

Under the Software Protection Regulations, owners of software copyright protection enjoy rights of publication, authorship, modification, duplication, issuance, lease, transmission on the information network, translation, licensing and transfer. Software copyright protection takes effect on the day of completion of the software’s development.

For software developed by legal persons and other organizations, software protection extends until December 31st of the 15th year from the date the software solution was first published. However, the Software Protection Regulations will not protect the software unless it is published within 50 years of the completion of its development. Licensing agreements may allow others to exploit the software copyright, but exclusive licenses must be in writing. A written contract is also required to transfer any software copyright.

Civil remedies available under the Software Protection Regulations against infringements of copyright include cessation of the infringement and elimination of its effects, an apology and compensation for losses. The administrative department of copyright may order the infringer of a software copyright to stop all infringing acts, confiscate illegal gains, confiscate and destroy infringing copies, and impose a fine on the infringer under certain circumstances. Disputes regarding infringements of software copyright may be settled through mediation, arbitration, or the PRC courts directly.

10

Dependence on Major Customers

For the year ended December 31, 2010, approximately 55% of the Company's total net revenues were generated by two customers, Beijing Mobile Communication Company (“Beijing Mobile”) and Guangxi Caexpo International Trade and Logistics Co., Ltd (“Guangxi Caexpo”). The loss of any or both of these customers could have a material adverse effect on our business.

Our largest customer has been Guangxi Caexpo. We won the contract in 2006 to build the Electronic Trade and Logistics Information Platform and Call Center. The revenue from hardware integration sales was recognized in 2009.

During the year ended December 31, 2010, sales to Guangxi Caexpo totaled $1,683,246, which accounted for 33% of our total revenue for the period.

Although we are an important strategic IT partner of Guangxi Caexpo, we do not have long-term contracts with Guangxi Caexpo. All of our agreements with Guangxi Caexpo are for short-term projects or sales of third-party hardware. While we feel that our significant relationships with Guangxi Caexpo will likely provide additional sales agreements in the future, Guangxi Caexpo is not contractually bound to purchase any products or services from us. The loss of this customer could hurt our business by reducing our revenues and profitability.

Our second largest customer in 2010 was Beijing Mobile. Since 1998, we have been developing and maintaining the carrier’s BOSS. BOSS is an integrated software platform and it is developed in stages to accommodate the carrier’s increasing subscribers and service offerings. We completed phase one in 2002, phrase two in 2006 and phrase three in 2007. We are currently continuing to maintain phases one, two and three.

Patents, Intellectual Property, and Licensing

We rely on a combination of patents, copyrights, trademarks, trade secrets, confidentiality agreements, and other contractual restrictions with employees and third parties to establish and protect our proprietary rights. Despite these precautions, the measures we undertake may not prevent misappropriation or infringement of our proprietary technology. These measures may not preclude competitors from independently developing products with functionality or features similar to our products.

As of December 31, 2010, we have been issued 62 patents in the PRC that are currently in force. We also have 2 patent applications submitted for review and approval. The normal expiration dates of our issued patents in the PRC range from 2026 to 2030. It is possible that we will not receive patents for applications that we have submitted and those that we plan to file in the future. Furthermore, our issued patents may not adequately protect our technology from infringement or prevent others from claiming that our products infringe the patents of those third parties. Our failure to protect our intellectual property could materially harm our business. In addition, our competitors may independently develop similar or superior technology, duplicate our products, or design around our patents. It is possible that litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others. Litigation could result in substantial costs and diversion of resources and could materially harm our business.

Some of our products are designed to include software or other intellectual property licensed from third parties. While it may be necessary in the future to seek or renew licenses relating to various aspects of our products, we believe that such licenses generally could be obtained on commercially reasonable terms. However, failure to obtain such licenses on commercially reasonable terms could materially harm our business.

Environmental Matters

None.

11

Item 1A. Risk Factors.

In addition to the other information in this Form 10-K, the following factors should be considered in evaluating our business and our future prospects:

POLITICAL AND ECONOMIC POLICIES OF THE CHINESE GOVERNMENT COULD AFFECT OUR INDUSTRY IN GENERAL AND OUR COMPETITIVE POSITION IN PARTICULAR

Since the establishment of the People's Republic of China in 1949, the Communist Party has been the governing political party in the PRC. The highest bodies of leadership are the Politburo of the Communist Party, the Central Committee and the National People's Congress. The State Council, which is the highest institution of government administration, reports to the National People's Congress and has under its supervision various commissions, agencies and ministries, including The Ministry of Information Industry and the telecommunications regulatory body of the Chinese government. Since the late 1970s, the Chinese government has been reforming the Chinese economic system. Although we believe that economic reforms and the macroeconomic measures adopted by the Chinese government have had and will continue to have a positive effect on economic development in China, there can be no assurance that the economic reform strategy will not from time to time be modified or revised. Such modifications or revisions, if any, could have a material adverse effect on the overall economic growth of China and investment in the Internet and the telecommunications industry in China. Such developments could reduce, perhaps significantly, the demand for our products and services. There is no guarantee that the Chinese government will not impose other economic or regulatory controls that would have a material adverse effect on our business. Furthermore, changes in political, economic and social conditions in China, adjustments in policies of the Chinese government or changes in laws and regulations could affect our industry in general and our competitive position in particular.

THE GROWTH OF OUR BUSINESS IS DEPENDENT ON GOVERNMENT TELECOMMUNICATIONS INFRASTRUCTURE AND BUDGETARY POLICY, PARTICULARLY THE ALLOCATION OF FUNDS TO SUSTAIN THE GROWTH OF THE TELECOMMUNICATIONS INDUSTRY IN CHINA

Virtually all of our large customers are directly or indirectly owned or controlled by the government of China. Accordingly, their business strategies, capital expenditure budgets and spending plans are largely decided in accordance with government policies, which, in turn, are determined on a centralized basis at the highest level by the National Development and Reform Commission of China. As a result, the growth of our business is heavily dependent on government policies for telecommunications and internet infrastructure. Insufficient government allocation of funds to sustain the growth of China's telecommunications industries in the future could reduce the demand for our products and services and have a material adverse effect on our ability to grow our business.

CURRENCY EXCHANGE RATE RISK DUE TO FLUCTUATIONS IN THE EXCHANGE RATE BETWEEN U.S. DOLLARS AND RENMINBI

The functional currency of our operations is Renminbi (“RMB”) and our financial statements are expressed in U.S. dollars (“USD”). As a result, we are subject to the effects of exchange rate fluctuations between these currencies. In July 2005, the Chinese government announced that it would no longer peg its currency exclusively to USD but instead would switch to a managed floating exchange rate based on market supply and demand with reference to a basket of currencies determined by the People’s Bank of China. The exchange rate of RMB to USD changed from RMB 8.28 to RMB 7.82 in late December 2006. Any future devaluation of the RMB against the USD may have an adverse effect on our reported net income. As our operations are conducted in the PRC, substantially all our revenues, expenses, assets and liabilities are denominated in RMB. In general, our exposure to foreign exchange risks should be limited. However, the value in our shares may be affected by the foreign exchange rate between the USD and the RMB because the value of our business is effectively denominated in RMB, while our shares are traded in USD. Furthermore, a decline in the value of RMB could reduce the USD equivalent of the value of the earnings from, and our investment in, our subsidiaries in the PRC; while an increase in the value of the RMB may require us to exchange more USD into RMB to meet the working capital requirements of our subsidiaries in China. Depreciation of the value of the USD will also reduce the value of the cash we hold in USD, which we may use for purposes of future acquisitions or other business expansion. We actively monitor our exposure to these risks and adjust our cash position in RMB and USD when we believe such adjustments will reduce risks.

12

GENERAL RISK OF FINANCING

In order for the Company to meet its continuing cash requirements and to successfully implement its growth strategy, the Company will need to rely on increased future revenues and/or will require additional financing. In the event additional financing is required, no assurances can be given that such financing will be available in the amount required or, if available, that it can be on terms satisfactory to the Company.

RISK OF CHINESE ECONOMIC SLOW DOWN

The Chinese economy has recently experienced a slowing of its growth rate. The slow-down has been exacerbated by the recent global crisis in the financial services and credit markets, which has resulted in significant volatility and dislocation in the global capital markets. It is still uncertain how long the global crisis in the financial services and credit markets will continue and how much adverse impact it will have on the global economy in general or the Chinese economy in particular. Slowing economic growth in China could result in slowing growth for China’s major telecommunications carriers, which are our major customers, as well as slowing growth for enterprises and government entities that buy our IT software products and services. Any such adverse conditions for our customers could reduce their demand for our software and services and therefore reduce our revenues.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Description of Property.

We have an office in Chengdu, PRC, which houses FTCD. The building is located at B-16B, Wangfujing Business Mansion, No.5 Huaxingzheng Street, Chengdu, Sichuan Province, PRC, and was purchased on behalf of the Company by Mr. Yi He, our Chief Executive Officer. By a stockholders’ resolution passed on March 8, 1999, it was ratified that the title to the building belongs to the Company. In 2005, the title to the building was transferred to FTCD.

We currently rent office space of approximately 2,027 square meters that serves as our headquarters at 9/F Shenzhou Mansion, No. 31 Zhongguancun Street, Haidian District, Beijing, China. We have a renewable lease agreement for these premises until March 29, 2011. The total rent from March 30, 2009 to March 29, 2011 is $770,457 (RMB 5,326,944).

In addition, we currently have two regional field support offices in the PRC, namely, in Shanghai and Chengdu. The lease terms for these offices are as follows:

|

Name

|

Rent Period

|

Size (in m2)

|

Annual Rent

|

|||

|

Shanghai Office

|

3/23/2010 – 3/22/2011*

|

75.53

|

$5,022(RMB33,600)

|

|||

|

Chengdu R&D Center

|

|

11/22/2010 – 11/21/2011

|

|

602.59

|

|

$35,927 (RMB 248,400)

|

* At the expiration of the lease, we will continue to lease the premises on a month-to-month basis for $585 (RMB 4,000) per month.

We believe that the current facilities occupied by the Company and its subsidiaries will be able to meet the Company’s operational needs for the coming year.

Item 3. Legal Proceedings.

The Company is not a party to any legal proceedings and to the best of the Company's knowledge, no such proceedings are threatened or contemplated. At this time, the Company has no bankruptcy, receivership, or similar proceedings pending.

13

PART II

|

Item 5.

|

Market for Registrant’s Common Equity Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

Market Information

Our common stock, par value $0.001 per share, is currently trading on the Over the Counter Bulletin Board system under the symbol "FLSW". There is no assurance that our common stock will continue to be quoted or that any liquidity exists for the Company’s shareholders.

The following table sets forth the range of high and low bid prices for the Company's common stock for each quarterly period indicated, as reported by the “Businessweek Companies” website. Quotations reflect inter-dealer prices without retail markup, markdown or commissions and may not represent actual trades.

Common Stock

|

Quarter Ended

|

High Bid

|

Low Bid

|

||||||

|

December 31, 2010

|

$ | 0.30 | $ | 0.15 | ||||

|

September 30, 2010

|

$ | 0.95 | $ | 0.12 | ||||

|

June 30, 2010

|

$ | 0.70 | $ | 0.20 | ||||

|

March 31, 2010

|

$ | 0.30 | $ | 0.13 | ||||

|

December 31, 2009

|

$ | 0.30 | $ | 0.13 | ||||

|

September 30, 2009

|

$ | 0.36 | $ | 0.12 | ||||

|

June 30, 2009

|

$ | 0.80 | $ | 0.22 | ||||

|

March 31, 2009

|

$ | 0.90 | $ | 0.85 | ||||

Holders

As of March 25, 2011, there were 4,651,173 shares of the Company's common stock outstanding held of record by approximately 548 stockholders (not including beneficial owners who hold shares at broker/dealers in “street name”).

Dividends

The Company has never paid cash dividends on its common stock and does not intend to do so in the foreseeable future. The Company currently intends to retain its earnings for the operation and expansion of its business.

Securities Authorized for Issuance under Equity Compensation Plans

Please see the discussion in Item 12 titled “Equity Compensation Plan Information” below.

Item 6. Selected Financial Data

Not applicable.

14

Item 7. Management’s Discussion and Analysis or Plan of Operation

General

Statements contained herein that are not historical facts are forward-looking statements as that term is defined by the Private Securities Litigation Reform Act of 1995. Although we believe that the expectations reflected in such forward looking statements are reasonable, the forward looking statements are subject to risks and uncertainties that could cause actual results to differ from those projected. We caution investors that any forward looking statements made by us are not guarantees of future performance and those actual results may differ materially from those in the forward-looking statements. Such risks and uncertainties include, without limitation: well-established competitors who have substantially greater financial resources and longer operating histories, regulatory delays or denials, ability to compete as a start-up company in a highly competitive market, and access to sources of capital.

The following discussion and analysis should be read in conjunction with our financial statements and notes thereto included elsewhere in this Form 10-K. Except for the historical information contained herein, the discussion in this Form 10-K contains certain forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. The cautionary statements made in this Form 10-K should be read as being applicable to all related forward looking statements wherever they appear in this Form 10-K. The Company's actual results could differ materially from those discussed here. We undertake no obligation to update publicly any forward-looking statements for any reason even if new information becomes available or other events occur in the future.

Overview

We are a professional software development and technology service company. We are also a leading provider of industry e-business application solutions in China. Our main business is providing application development and maintenance services for companies in the telecom, logistics and government industries. We are inputting our efforts to develop our new products and services on on-line trading platform, SaaS platform (For-Online), the internet of things (“IOT”) application solutions and mobile business application solutions. We anticipate making profits from these products and services in the foreseeable future

In addition to our core business, we believe that there are opportunities for us to expand into new areas and to grow our business not only internally but through acquisitions and investments. For a description of all of our investments and other business activities since 1999, please refer to the section titled “Company History and Recent Developments” under Item 1 (Description of Business) in Part I of this Form 10-K.

Revenues

Our business includes Forlink brand "For-"series software system sales such as ForOSS, ForRMS, For-Mail and their copyright licensing, and For-series related system integration, which consists of hardware sales and other related services rendered to customers. The following table shows our revenue breakdown by business line:

|

Year Ended December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Sales of For-series software

|

$ | 4,499,719 | $ | 3,473,568 | ||||

|

as a percentage of net sales

|

92 | % | 55 | % | ||||

|

For-series related system integration

|

$ | 402,789 | $ | 2,815,396 | ||||

|

as a percentage of net sales

|

8 | % | 45 | % | ||||

As indicated in the foregoing table, sales of For-series software as a percentage of net sales increased from 55% in 2009 to 92% in 2010 while sales of For-series related system integration as a percentage of net sales decreased from 45% in 2009 to 8% in 2010. The main reason was that our third and last sale for the system integration project for Guangxi Caexpo was recognized in 2009. The decrease in our sales of system integration was also attributable to a decrease in customer sales contracts due to lower customer demand. However, the Company’s strategy is to increase software sales which carry higher profit margins.

Generally, we offer our products and services to our customers on a total-solutions basis. Most of the contracts we undertake for our customers include revenue from hardware and software sales and professional services.

15

Sources of Revenue

|

·

|

Hardware Revenue: Revenues from sales of products are mainly derived from sales of hardware. Normally, the hardware that we procure is in connection with total-solutions basis system integration contracts.

|

|

·

|

Service Revenue: Service revenue consists of revenue for the professional services we provide to our customers for network planning, design and systems integration, software development, modification and installation, and related training services.

|

|

·

|

Software License Revenue: We generate revenue in the form of fees received from customers to whom we issue licenses for the use of our software products over an agreed period of time.

|

Costs of Revenue

Our costs of revenue include hardware costs, software-related costs and compensation and travel expenses for the professionals involved in the relevant projects. Hardware costs consist primarily of third party hardware costs. We recognize hardware costs in full upon delivery of the hardware to our customers. Software-related costs consist primarily of packaging and written manual expenses for our proprietary software products and software license fees paid to third-party software providers for the right to sublicense their products to our customers as part of our solutions offerings. The costs associated with designing and modifying our proprietary software are classified as research and development expenses as such costs are incurred.

Operating Expenses

Operating expenses are comprised of selling expenses, research and development expenses and general and administrative expenses.

Selling expenses include compensation expenses for employees in our sales and marketing departments, third party advertising expenses, as well as sales commissions and sales agency fees.

Research and development expenses relate to the development of new software and the modification of existing software. We expense such costs as they are incurred.

Taxes

According to the relevant PRC tax rules and regulations, FTCL and BFHX, both of which are recognized as New Technology Enterprises operating within a New and High Technology Development Zone, are entitled to an Enterprise Income Tax (“EIT”) rate of 15%.

Pursuant to approval documents dated September 23, 1999 and August 2, 2000 issued by the Beijing Tax Bureau and the State Tax Bureau respectively, FTCL received full exemption from EIT for fiscal years 1999 through 2002, and a 50% EIT reduction at the rate of 7.5% for fiscal years 2003 through 2005. As of December, 31, 2008, FTCL was entitled to an EIT rate of 25%.

Pursuant to an approval document dated January 19, 2004 issued by the State Tax Bureau, BFHX received full exemption from EIT for fiscal years 2004 through 2006. As of December 31, 2008, BFHX was entitled to an EIT rate of 7.5%.

Hong Kong profits tax is calculated at 16.5% on the estimated assessable profits of FTHK for the period. The EIT rates for FTCD and NNBCE are 25%. No provision for EIT and Hong Kong profits tax were made for FTCL, BFHX, FTCD, FTGX, NNBCE and FTHK as they have not gained taxable income for the periods.

Revenue from the sale of hardware procured in China together with the related system integration is subject to a 17% value added tax (“VAT”). However, companies that develop their own software and have the software registered are generally entitled to a VAT refund. If the net amount of the VAT payable exceeds 3% of software sales, the excess portion of the VAT is refundable upon our application to the tax authority. This policy is effective until 2011. Changes in Chinese tax laws may adversely affect our future operations.

16

Foreign Exchange

Our functional currency is United States Dollars (“USD”) and our financial records are maintained and the financial statements prepared in USD. The functional currency of FTHK is Hong Kong Dollars (“HKD”) and the financial records are maintained and the financial statements prepared in HKD. The functional currency of FTCL, BFHX, FTGX and FTCD is Renminbi (“RMB”) and the financial records are maintained and the financial statements are prepared in RMB.

Foreign currency transactions during the year are translated into each company’s denominated currency at the exchange rates ruling at the transaction dates. Gains and losses resulting from foreign currency transactions are included in the consolidated statement of operations. Assets and liabilities denominated in foreign currencies at the balance sheet date are translated into each company’s denominated currency at year-end exchange rates. All exchange differences are dealt with in the consolidated statements of operations.

The financial statements of the Company’s operations based outside of the United States have been translated into USD in accordance with ASC 830. Management has determined that the functional currency for each of the Company’s foreign operations is its applicable local currency. When translating functional currency financial statements into USD, year-end exchange rates are applied to the consolidated balance sheets, while average period rates are applied to consolidated statements of operations. Translation gains and losses are recorded in translation reserve as a component of stockholders’ equity.

The value of the RMB is subject to changes in China’s central government policies and to international economic and political developments affecting supply and demand in the China Foreign Exchange Trading System market. Since 1994, the conversion of RMB into foreign currencies, including USD, has been based on rates set by the People’s Bank of China, which are set daily based on the previous day’s interbank foreign exchange market rates and current exchange rates on the world financial markets. Since 1994, the official exchange rate generally has been stable. In July 2005, the Chinese government announced that it will no longer peg its currency exclusively to USD but will switch to a managed floating exchange rate based on market supply and demand with reference to a basket of currencies yet to be named by the People’s Bank of China, which will likely increase the volatility of RMB as compared to USD. The exchange rate of RMB to USD changed from RMB 8.28 to 8.11 in late July 2005.

The following table shows the exchange rates and the weighted average rates for the years ended December 31, 2010 and 2009:

|

USD

|

HKD

|

RMB

|

||||||

|

Exchange rate as of December 31,

|

2010

|

1

|

7.82

|

6.61

|

||||

|

2009

|

1

|

7.79

|

6.84

|

|||||

|

Weighted average rates ruling for

|

2010

|

1

|

7.80

|

6.69

|

||||

|

|

2009

|

|

1

|

|

7.78

|

|

6.84

|

Critical Accounting Policies and Estimates

We prepare our consolidated financial statements in accordance with generally accepted accounting principles in the United States of America. The preparation of those financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. On an on-going basis, we evaluate our estimates and judgments, including those related to revenues and cost of revenues under customer contracts, bad debts, income taxes, investment in affiliate, long-lived assets and goodwill. We base our estimates and judgments on historical experience and on various other factors that we believe are reasonable. Actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition

We generally provide services under multiple element arrangements, which include software license fees, hardware and software sales, provision of system integration services including consulting, implementation, and software maintenance. We evaluate revenue recognition on a contract-by-contract basis as the terms of each arrangement vary. The evaluation of the contractual arrangements often requires judgments and estimates that affect the timing of revenue recognized in the statements of operations. Specifically, we may be required to make judgments about:

17

|

|

·

|

whether the fees associated with our products and services are fixed or determinable;

|

|

|

·

|

whether collection of our fees is reasonably assured;

|

|

|

·

|

whether professional services are essential to the functionality of the related software product;

|

|

·

|

whether we have the ability to make reasonably dependable estimates in the application of the percentage-of-completion method; and

|

|

·

|

whether we have verifiable objective evidence of fair value for our products and services.

|

The Company recognizes revenues in accordance with the provisions of ASC 985, “Software Revenue Recognition.” ASC 985 requires among other matters, that there be a signed contract evidencing an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectability is probable.

Software license revenue is recognized over the accounting periods contained in the terms of the relevant agreements, commencing upon the delivery of the software provided that (1) there is evidence of an arrangement, (2) the fee is fixed or determinable, and (3) collection of the fee is considered probable.

Revenue from non-software, multiple-element arrangements is recognized in accordance with ASC 605-25, “Revenue Arrangements with Multiple Deliverables”. Under ASC 605-25, the Company recognizes revenue from the multiple-deliverables which has value to the customer on a stand-alone basis. Deliverables in an arrangement that do not meet the separation criteria in ASC 605-25 are treated as one unit of accounting for purposes of revenue recognition.

In the case of maintenance revenues, vendor-specific objective evidence, or VSOE, of fair value is based on substantive renewal prices, and the revenues are recognized ratably over the maintenance period.

In the case of consulting and implementation services revenues, where VSOE is based on prices from stand-alone sale transactions, the revenues are recognized as services that are performed pursuant to ASC 985-605-25.

For hardware transactions where software is incidental, the Company does not apply separate accounting guidance to the hardware and software elements. The Company applies the provisions of ASC 985-605-15. Per ASC 985-605-15, if the software is considered not essential to the functionality of the hardware, then the hardware is not considered “software related” and is excluded from the scope of ASC 985-605-15. Such sale of computer hardware is recognized as revenue on the transfer of risks and rewards of ownership, which generally coincides with the time when the goods are delivered to customers and title has passed.

Remote hosting services, where VSOE is based upon consistent pricing charged to customers based on volumes and performance requirements on a stand-alone basis and substantive renewal terms, are recognized ratably over the contract term as the services are performed. The remote hosting arrangements generally require the Company to perform one-time set-up activities and include a one-time set-up fee. This one-time set-up fee is generally paid by the customer at contract execution. The Company has determined that these set-up activities do not constitute a separate unit of accounting, and accordingly, the related set-up fees are recognized protractedly over the term of the contract.

The Company is considering the applicability of ASC 985-605-55, “Application of AICPA Statement of SOP 97-2 to Arrangements That Include the Right to Use Software Stored on Another Entity’s Hardware,” to the hosting services arrangements on a contract-by-contract basis. If the Company determines that the customer does not have the contractual right to take possession of the Company’s software at any time during the hosting period without significant penalty, ASC 985-605 would not apply to these contracts in accordance with ASC 985-605-55.

Income Taxes

The Company accounts for income taxes in accordance with ASC 740 “Accounting for Income Taxes.” Under ASC 740, deferred tax liabilities or assets at the end of each period are determined using the tax rate expected to be in effect when taxes are actually paid or recovered. Valuation allowances are established when it is more likely than not that some or all of the deferred tax assets not be realized.

18

In July, 2006, the FASB ASC 740-10-25, “Accounting for Uncertainty in Income Taxes-an interpretation of FASB Statement No. 109”. This Interpretation provides guidance for recognizing and measuring uncertain tax positions, as defined in ASC 740, “Accounting for Income Taxes.” ASC 740-10-25 prescribes a threshold condition that a tax position must meet for any of the benefit of the uncertain tax position to be recognized in the financial statements. Guidance is also provided regarding derecognition, classification and disclosure of these uncertain tax positions.

Allowance for Doubtful Accounts

We record an allowance for doubtful accounts based on specifically identified amounts that the Company believes to be uncollectible. We have a limited number of customers with individually large amounts due at any given balance sheet date. Any unanticipated change in one of those customers’ credit worthiness or other matters affecting the collectability of amounts due from such customers could have a material effect on the results of operations in the period in which such changes or events occur. After all attempts to collect a receivable have failed, the receivable is written off against the allowance.

Recent Accounting Pronouncements

On October 27, 2010, the FASB clarified that the disclosures proposed as part of its project on disclosures of certain loss contingencies will not be effective for the 2010 annual financial statements of public calendar-year-end entities as originally proposed. The Board will discuss a revised effective date during redeliberations on the project.

On October 19, 2010, the FASB and IASB issued a DP to obtain feedback from the FASB’s and IASB’s stakeholders on (1) the time and effort they would need to adopt several new and significant accounting and reporting standards and (2) the dates on which those new standards should be effective. On the basis of the responses, the FASB and IASB plan to develop an implementation plan whose main objective will be to help stakeholders properly manage the cost and pace of these changes. Comments on the DP are due by January 31, 2011.

On August 17, 2010, the FASB and IASB issued an ED on lease accounting. The ED, released by the FASB as a proposed ASU, creates a new accounting model for both lessees and lessors and eliminates the concept of operating leases. The proposed ASU, if finalized, would converge the FASB’s and IASB’s accounting for lease contracts in most significant areas.

In January 2010, the FASB issued guidance to amend the disclosure requirements related to recurring and nonrecurring fair value measurements. The guidance requires new disclosures on the transfers of assets and liabilities between Level 1 (quoted prices in active market for identical assets or liabilities) and Level 2 (significant other observable inputs) of the fair value measurement hierarchy, including the reasons and the timing of the transfers. Additionally, the guidance requires a roll forward of activities on purchases, sales, issuance, and settlements of the assets and liabilities measured using significant unobservable inputs (Level 3 fair value measurements). The guidance became effective for us with the reporting period beginning January 1, 2010, except for the disclosure on the roll forward activities for Level 3 fair value measurements, which will become effective for us with the reporting period beginning July 1, 2011. Other than requiring additional disclosures, adoption of this new guidance did not have a material impact on our financial statements.

In September 2009, FASB introduced new guidance addressing the accounting for revenue arrangements with multiple elements and certain revenue arrangements that include software. The guidance allows companies to allocate consideration in a multiple element arrangement in a way that better reflects the economics of the transaction and eliminates the residual method. In addition, tangible products that have software components that are “essential to the functionality” of the tangible product will be scoped out of the software revenue guidance. The new guidance became effective on January 1, 2011 and it is not expected to have a material impact on our financial statements.

19

Consolidated Results of Operations

Year Ended December 31, 2010 Compared to Year Ended December 31, 2009

The following table sets forth the results of our operations for the periods indicated:

|

|

Year Ended

|

Year Ended

|

||||||

|

|

December 31,

|

December 31,

|

||||||

|

|

2010

|

2009

|

||||||

|

Net Sales

|

$ | 5,027,707 | $ | 6,288,964 | ||||

|

Cost of Sales

|

(2,038,463 | ) | (2,592,005 | ) | ||||

|

Gross Profit

|

2,989,244 | 3,696,959 | ||||||

|

Selling Expenses

|

(1,050,740 | ) | (1,199,800 | ) | ||||

|

Research and Development Expenses

|

(743,845 | ) | (1,039,742 | ) | ||||

|

General and Administrative Expenses

|

(1,626,102 | ) | (1,199,494 | ) | ||||

|

Operating Profit (Loss)

|

(431,443 | ) | 257,923 | |||||

|

Other Income

|

728,107 | 298,254 | ||||||

|

Net Profit (Loss)

|

(330,428 | ) | 625,040 | |||||

|

Gain/Loss Per Share

|

(0.07 | ) | 0.13 | |||||

|

Basic Weighted Average Shares Outstanding

|

4,651,173 | 4,651,173 | ||||||

|

Diluted Weighted Average Shares Outstanding

|

4,651,173 | 4,651,173 | ||||||

Net Sales.

Our net sales decreased 20% from $6,288,964 in 2009 to $5,027,707 in 2010. Sales of For-series software increased 33.% from $3,473,568 in 2009 to $4,624,918 in 2010. The decrease in net sales was mainly attributable to a significant decrease in system integration sales, from $2,815,396 in 2009 to $402,789 in 2010, a decrease of 86%. We did not enter into any sales contracts with significant system integration providers in 2010 as we did in 2009. It is the Company’s strategy to focus on sales for its For-series software because software sales carry higher profit margins.

Cost of Sales.

Our cost of sales decreased 21% from $2,592,005 in 2009 to $2,038,463 in 2010. This decrease was in line with our decrease in sales for 2010. Cost of sales, as a percentage of net sales, remained at approximately 41% in 2009 and 2010.

Gross Profit.

Gross profit decreased 19% from $3,696,959 in 2009 to $2,989,244 in 2010. This decrease was attributable to the decrease in overall net sales. However, the gross profit margin remained at approximately 59% in both 2009 and 2010.

Operating Expenses.

Total operating expenses year-over-year was maintained at comparable levels, at $3,420,687 in 2010 and $3,440,061 in 2009. This situation was the principal result of the offset from an increase in general and administrative expenses against a decrease in research and development expenses.

Selling expenses decreased 12% from $1,199,800 in 2009 to $1,050,740 in 2010, as a result of the dissolution of one of our sales agency located in Hangzhou, China on September 28, 2009.

Research and development expenses decreased 28% from $1,039,742 in 2009, to $743,845 in 2010, stemming from our decreased number of employees in our research and development department from 61 in 2009 to 51 in 2010. We started several new internal projects in 2009 which required additional research and development. These projects have been finished and integrated into our new products in 2009.

General and administrative expenses increased 36% from $1,199,494 in 2009 to $1,626,102 in 2010. The increase was primarily due to the increase in communication fees, such as the internet trusteeship management fee for telecom providers and an increase in rent for Forlink Technologies Co. Ltd. (“FTCL”) and Beijing Forlink Hua Xin Technology Co. Ltd. (“BFHX”). Pursuant to our prior lease agreements for FTCL and BFHX, we were able to obtain a month of rent free during February 2009. Under the current lease agreements for FTCL and BFHX, the free rent provision was eliminated, and we instead pay standard rent on a monthly basis pursuant to the terms of the lease agreements. The increase in general and administration expenses was also due to the reclassification of expenses for the Chengdu office of FTCL. The function of FTCL’s Chengdu office has been changed from a sales office to a management platform since January 2010. Therefore, the expenses of FTCL’s Chengdu office, including employee wages and communication fees, have been reclassified from selling expenses in 2009 to general and administrative expenses in 2010.

20

Operating Profit (Loss).

We recorded an operating loss of $330,428 in 2010 as compared to an operating profit of $625,040 in 2009, a decrease of 153%. The decrease was largely due to the decrease in net sales of 20% from $6,288,964 in 2009 to $5,027,707 in 2010.

Other Income.

Our other income increased 144% from $298,254 in 2009 to $728,107 in 2010, as a result of an increase in our VAT refund. Our other income is derived entirely from VAT refund associated with our software sales.

Net Profit (Loss).

We recorded a net loss of $303,632 in 2010, or basic and diluted loss of $0.07 per share, as compared to a net profit of $625,040 in 2009, or basic and diluted profit of $0.13 per share.

Liquidity and Capital Resources

Our capital requirements are primarily working capital requirements related to costs of hardware for network solution projects and costs associated with the expansion of our business. In order to minimize our working capital requirements, we generally obtain from our hardware vendors payment terms that are timed to permit us to receive payment from our customers for the hardware before our payments to our hardware vendors are due. However, we sometimes obtain less favorable payment terms from our customers, thereby increasing our working capital requirements. We have historically financed our working capital and other financing requirements through careful management of our billing cycle and, to a limited extent, bank loans. The net cash used in operating activities was $2,045,634 in 2010 as compared to $685,985 in 2009. The decrease in net cash used was mainly due to the decreased balance of other taxes payable in 2010. The cash flow from investing activities was $2,974,215 in 2010, compared to $340,862 in 2009. The huge increase in cash flow from investing activities resulted from the increase in funds when we received $3,024,255 by transferring the long-term investment in Guangxi Caexpo. The decrease in cash flow from financing activities resulted from the decrease in the balance of short term borrowings.

Our accounts receivable balance at December 31, 2010 was $3,914,923, as compared to $2,434,557 at the end of 2009. The increase is mainly attributable to one customer Guangxi Caexpo. The balance of Guangxi Caexpo’s accounts receivable increased to $3,543,155 on December 31, 2010 from $0 on December 31, 2009. Our inventory position at the end of 2010 was $760,655, as compared to $935,566 at the beginning of the year. At the end of 2010, we had several inventory items in the process of delivery to two of our major customers.

We ended the year with a cash position of $3,580,269. We had positive operating cash flow of $1,339,406, primarily due to the disposal of long term investments in 2010.