Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION OF CEO/CFO PURSUANT TO SECTION 906 - Qumu Corp | rimage111514_ex32.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - Qumu Corp | rimage111514_ex31-2.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - Qumu Corp | rimage111514_ex31-1.htm |

|

|

|

FORM 10-K/A |

|

(AMENDMENT NO. 1) |

|

|

|

U.S. SECURITIES AND EXCHANGE COMMISSION |

|

WASHINGTON, DC 20549 |

|

|

|

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE |

|

SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010 |

|

OR |

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE |

|

SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

COMMISSION FILE NO. 000-20728 |

|

|

|

RIMAGE CORPORATION |

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

Minnesota |

|

41-1577970 |

|

State or other jurisdiction of incorporation or organization |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

7725 Washington Avenue South, Minneapolis, Minnesota |

|

55439 |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

|

Registrant’s telephone number: |

|

(952) 944 - 8144 |

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

Common Stock, $.01 par value |

|

|

|

|

|

Preferred Stock Purchase Rights |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: |

None |

|

|

|

|

|

|

|

|

|

Yes o No x

Indicate

by checkmark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

Large Accelerated Filer o Accelerated Filer x

Non-Accelerated Filer o Smaller Reporting Company o

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes o No x

The aggregate market value of common stock held by non-affiliates of the registrant, computed by reference to the last quoted price at which such stock was sold on such date as reported by the Nasdaq Stock Market as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $126,600,000.

As of February 28, 2011, 9,484,272 shares of the registrant’s common stock were outstanding.

1

EXPLANATORY NOTE

This Amendment No. 1 (“Amendment No. 1”) to the Annual Report on Form 10-K/A for Rimage Corporation (“Rimage” or the “Company”) amends the Company’s Annual Report on Form 10-K for the year ended December 31, 2010 initially filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2011 (the “Original Filing”).

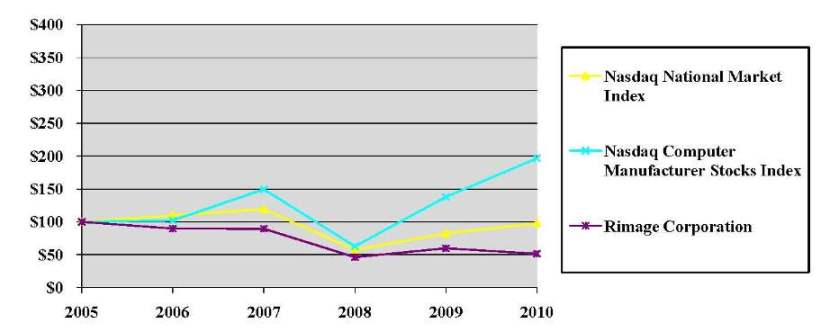

This Amendment No. 1 is being filed to amend the Performance Graph information in Item 5 of the Original Filing to accurately reflect the correct measurement period. The Original Filing included a performance table comparing the cumulative total return of the Company’s common stock during the period from December 29, 2006 to December 31, 2010. The Original Filing also included a performance graph comparing performance during the period from December 30, 2005 to December 31, 2009. Due to an inadvertent processing error immediately prior to submission of the Original Filing with the SEC, the measurement period used in the performance graph did not match the data in the performance table. Additionally, the performance table and graph in the Original Filing incorrectly used a measurement period of only four fiscal years instead of five fiscal years as required by Regulation S-K. Item 201(e)(2) of Regulation S-K states that the measurement period for the performance graph shall be the period beginning on the last trading day before the beginning of the registrant’s fifth preceding fiscal year through the end of the registrant’s last completed fiscal year. The performance graph and table in this Amendment No. 1 correctly set forth a comparison of the cumulative total return of the Company’s common stock over the last five fiscal years during the period from December 30, 2005 to December 31, 2010.

We have also included an updated signature page and currently dated certifications from the Company’s Chief Executive Officer and Chief Financial Officer, as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, and attached as Exhibits 31.1, 31.2 and 32 to this Amendment No. 1.

Except as set forth above, the Original Filing has not been amended, updated or otherwise modified.

2

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

4 |

||

|

|

|

4 |

|

|

|

|

|

|

|

5 |

|||

|

|

|

|

|

|

6 |

|||

3

|

|

|

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s common stock is quoted on The Nasdaq Global Market. The graph and table below set forth a comparison of the cumulative total return of the Company’s common stock over the last five fiscal years with a broad market index and either a nationally-recognized industry standard or an index of peer companies selected by the Company. Rimage has chosen to use the Nasdaq National Market Index (U.S.) as its broad market index and the Nasdaq Computer Manufacturer Stocks Index as its index of peer companies.

The following graph shows changes during the period from December 30, 2005 to December 31, 2010 in the value of $100 invested in: (1) the Nasdaq National Market Index (U.S.); (2) the Nasdaq Computer Manufacturer Stocks Index; and (3) Rimage’s common stock. The values of each investment as of the dates indicated are based on share prices plus any dividends paid in cash, with the dividends reinvested on the date they were paid. The calculations exclude trading commissions and taxes. The table and graph are not necessarily indicative of future investment performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12/30/05 |

|

12/29/06 |

|

12/31/07 |

|

12/31/08 |

|

12/31/09 |

|

12/31/10 |

|

||||||

|

|

|||||||||||||||||||

|

Nasdaq National Market Index |

|

$ |

100.00 |

|

$ |

109.84 |

|

$ |

119.14 |

|

$ |

57.41 |

|

$ |

82.53 |

|

$ |

97.95 |

|

|

|

|||||||||||||||||||

|

Nasdaq Computer Manufacturer Stocks Index |

|

$ |

100.00 |

|

$ |

102.13 |

|

$ |

149.41 |

|

$ |

62.76 |

|

$ |

137.84 |

|

$ |

196.73 |

|

|

|

|||||||||||||||||||

|

Rimage Corporation |

|

$ |

100.00 |

|

$ |

89.72 |

|

$ |

89.54 |

|

$ |

46.27 |

|

$ |

59.83 |

|

$ |

51.45 |

|

4

Pursuant to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

Dated: March 24, 2011 |

RIMAGE CORPORATION |

|

|

|

|

|

|

|

By: |

/s/ Sherman L. Black |

|

|

|

Sherman L. Black |

|

|

|

Chief Executive Officer |

|

|

|

|

|

|

By: |

/s/ James R. Stewart |

|

|

|

James R. Stewart |

|

|

|

Chief Financial Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. Each person whose signature appears below constitutes and appoints Sherman L. Black and James R. Stewart as his true and lawful attorneys-in-fact and agents, each acting alone, with full power of substitution and re-substitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments to this Annual Report on Form 10-K and to file the same, with all exhibits thereto, and other documents in connection therewith, with the U.S. Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, each acting alone, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all said attorneys-in-fact and agents, each acting alone, or his substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

|

|

|

|

|

|

|

|

|

|

Signature |

|

Title |

|

Date |

|||

|

|

|

|

|

|

|||

|

/s/ Sherman L. Black |

|

Chief Executive Officer and President |

|

March 24, 2011 |

|||

|

Sherman L. Black |

|

(Principal Executive Officer), Director |

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

/s/ James R. Stewart |

|

Chief Financial Officer (Principal |

|

March 24, 2011 |

|||

|

James R. Stewart |

|

Financial and Accounting Officer) |

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

/s/ James L. Reissner |

|

Director |

|

March 24, 2011 |

|||

|

James L. Reissner |

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

/s/ Thomas F. Madison |

|

Director |

|

March 24, 2011 |

|||

|

Thomas F. Madison |

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

/s/ Steven M. Quist |

|

Director |

|

March 24, 2011 |

|||

|

Steven M. Quist |

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

/s/ Lawrence M. Benveniste |

|

Director |

|

March 24, 2011 |

|||

|

Lawrence M. Benveniste |

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

/s/ Philip D. Hotchkiss |

|

Director |

|

March 24, 2011 |

|||

|

Philip D. Hotchkiss |

|

|

|

|

|||

5

|

|

|

|

Exhibit |

|

|

No. |

Description |

|

31.1 |

Certificate of Chief Executive Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Exchange Act. |

|

|

|

|

31.2 |

Certificate of Chief Financial Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Exchange Act. |

|

|

|

|

32 |

Certification pursuant to 18 U.S.C. §1350. |

6