Attached files

| file | filename |

|---|---|

| EX-31.2 - JEFFERSONVILLE BANCORP | v214979_ex31-2.htm |

| EX-32.2 - JEFFERSONVILLE BANCORP | v214979_ex32-2.htm |

| EX-21.1 - JEFFERSONVILLE BANCORP | v214979_ex21-1.htm |

| EX-32.1 - JEFFERSONVILLE BANCORP | v214979_ex32-1.htm |

| EX-31.1 - JEFFERSONVILLE BANCORP | v214979_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

OR

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to____________

Commission file number: 0-19212

JEFFERSONVILLE BANCORP

(Exact name of registrant as specified in its charter)

|

New York

|

22-2385448

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

4866 State Rte. 52, Jeffersonville, New York

|

12748

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(845) 482-4000

|

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(g) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

NONE

|

|

NONE

|

Securities registered pursuant to Section 12(g) of the Act:

Title of Class: Common Stock, $0.50 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes ¨

|

No x

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes ¨

|

No x

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes x

|

No o

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes ¨

|

No o

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes ¨

|

No x

|

As of June 30, 2010 the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $44,636,000 based on the closing price of $11.50 as reported on the National Association of Securities Dealers Automated Quotation System National Market System.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

Class

|

Outstanding at March 24, 2011

|

|

|

Common Stock, $0.50 par value per share

|

|

4,234,505 shares

|

DOCUMENTS INCORPORATED BY REFERENCE

|

Document

|

Parts Into Which Incorporated

|

|

|

Proxy Statement for the Annual Meeting of Stockholders to be held

|

Part III Items 10, 11, 12, 13 and 14

|

|

|

April 26, 2011 (Proxy Statement)

|

|

JEFFERSONVILLE BANCORP INDEX TO FORM 10-K

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

8

|

|

Item 1B.

|

Unresolved Staff Comments

|

12

|

|

Item 2.

|

Properties

|

12

|

|

Item 3.

|

Legal Proceedings

|

12

|

|

Item 4.

|

(Removed and Reserved)

|

|

|

PART II

|

||

|

Item 5.

|

Market for the Registrant’s Common Equity,

|

|

|

Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

|

|

Item 6.

|

Selected Financial Data

|

14

|

|

Item 7.

|

Management’s Discussion and Analysis of

|

|

|

Financial Condition and Results of Operations

|

15

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

29

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

30

|

|

Item 9.

|

Changes in and Disagreements with Accountants

|

|

|

on Accounting and Financial Disclosure

|

66

|

|

|

Item 9A.

|

Controls and Procedures

|

66

|

|

Item 9B.

|

Other Information

|

66

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

67

|

|

Item 11.

|

Executive Compensation

|

67

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners

|

|

|

and Management, and Related Stockholder Matters

|

67

|

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

67

|

|

Item 14.

|

Principal Accountant and Fees and Services

|

67

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

68

|

|

Signatures

|

69

|

2

ITEM 1. BUSINESS

GENERAL

Jeffersonville Bancorp (the “Company”) was organized as a New York corporation on January 12, 1982, for the purpose of becoming a registered bank holding company under the Bank Holding Company Act of 1956, as amended (the “BHC Act”). Effective June 30, 1982, the Company became the registered bank holding company for The First National Bank of Jeffersonville, a bank chartered in 1913 and organized under the national banking laws of the United States (the “Bank”). The Company is engaged in the business of managing or controlling its subsidiary bank and such other business related to banking as may be authorized under the BHC Act.

At December 31, 2010 and 2009, the Company had total assets of $430.8 million and $422.7 million, securities available for sale of $104.7 million and $91.3 million, securities held to maturity of $6.0 million and $8.2 million, and net loans receivable of $277.8 million and $275.4 million, respectively. At December 31, 2010 and 2009, total deposits were $350.9 million and $352.2 million, respectively. At December 31, 2010 and 2009, stockholders’ equity was $47.5 million and $44.7 million, respectively.

The Bank is based in Sullivan County, New York. In addition to its main office and operations center in Jeffersonville, the Bank had eleven additional branch office locations in Bloomingburg, Eldred, Liberty, Loch Sheldrake, Monticello, Livingston Manor, Narrowsburg, Callicoon, Wurtsboro, White Lake and one in a Wal*Mart store in Monticello. The Bank is a full service banking institution employing approximately 131 people and serving all of Sullivan County, New York as well as some areas of adjacent counties in New York and Pennsylvania.

NARRATIVE DESCRIPTION OF BUSINESS

Through its community bank subsidiary, The First National Bank of Jeffersonville, the Company provides traditional banking related services, which constitute the Company’s only business segment. Banking services consist primarily of attracting deposits from the areas served by its banking offices and using those deposits to originate a variety of commercial, consumer, and real estate loans. The Company’s primary sources of liquidity are its deposit base; Federal Home Loan Bank (“FHLB”) borrowings; repayments and maturities on loans; short-term assets such as federal funds and short-term interest bearing deposits in banks; and maturities and sales of securities available for sale.

The Bank has three subsidiaries, FNBJ Holding Corporation, which is a Real Estate Investment Trust (REIT) and is wholly-owned by the Bank and two other wholly-owned subsidiaries which hold, and thereby limit the liability on, selected foreclosed properties of the Bank.

The Company’s filings with the Securities and Exchange Commission, including this Annual Report on Form 10-K, are available on the Company’s website, www.jeffbank.com or upon request submitted to John A. Russell, P.O. Box 398, Jeffersonville, New York 12748.

DEPOSIT AND LOAN PRODUCTS

Deposit Products. The Bank offers a variety of deposit products typical of commercial banks and has designed product offerings responsive to the needs of both individuals and businesses. Traditional demand deposit accounts, interest-bearing transaction accounts (NOW accounts) and savings accounts are offered on a competitive basis to meet customers’ basic banking needs. Money market accounts, time deposits in the form of certificates of deposit and IRA accounts provide customers with price competitive and flexible investment alternatives. The Bank does not have a single depositor or a small group of related depositors whose loss would have a material adverse effect upon the business of the Bank. See item 7, Distribution of Assets,

Liabilities & Stockholders’ Equity for average balances of deposit products at December 31, 2010, 2009 and 2008.

Loan Products. The Company originates residential and commercial real estate loans, as well as commercial, consumer and agricultural loans, to borrowers primarily in Sullivan County, New York, designed to meet the banking needs of individual customers, businesses and municipalities. A substantial portion of the loan portfolio is secured by real estate properties located in that area. The ability of the Company’s borrowers to make principal and interest payments is dependent upon, among other things, the level of overall economic activity and the real estate market conditions prevailing within the Company’s concentrated lending area. Periodically, the Company purchases loans from other financial institutions that are in markets

outside of Sullivan County.

Please see item 7, Results of Operations 2010 versus 2009 for a description of the loan portfolio and recent loan loss experience. Additional information is set forth below relating to the Bank’s loan products, including major loan categories, general loan terms, credit underwriting criteria, and risks particular to each category of loans. The Bank does not have a major loan concentration in any individual industry.

3

Commercial Loans and Commercial Real Estate Loans. The Bank offers a variety of commercial credit products and services to its customers. These include secured and unsecured loan products specifically tailored to the credit needs of the customers, underwritten with terms and conditions reflective of risk profile objectives and corporate earnings requirements. These products are offered at all branch locations. All commercial and commercial real estate loans are governed by a commercial loan policy which was developed to provide a clear framework for determining acceptable levels of credit risk, underwriting criteria, monitoring existing credits, and managing problem credit relationships. Credit risk control mechanisms have been

established and are monitored closely for compliance by the internal auditor and an external loan review company.

Risks particular to commercial loans include borrowers’ capacities to perform according to contractual terms of loan agreements during periods of unfavorable economic conditions and changing competitive environments. Management expertise and competency are critical factors affecting the customers’ performance and ultimate ability to repay their debt obligations. Commercial real estate loans and other secured commercial loans are exposed to fluctuations in collateral value.

Consumer Loans. The Bank also offers a variety of consumer loan products. These products include both open-end credit (home equity lines of credit, unsecured revolving lines of credit) and closed-end credit secured and unsecured installment loans. Most of these loans are originated at the branch level. This delivery mechanism is supported by an automated loan platform delivery system. The lending process is designed to ensure not only the efficient delivery of credit products, but also compliance with applicable consumer regulations while minimizing credit risk exposure.

Credit decisions are made under the guidance of a standard consumer loan policy, with the assistance of senior credit managers. The loan policy was developed to provide definitive guidance encompassing credit underwriting, monitoring and management. Under the policy, unsecured consumer loans are granted to customers of good character who have an assured income, with a guideline of at least one year’s steady employment, a satisfactory credit record, and a guideline debt to income ratio of 40%. The quality and condition of the consumer loan portfolio, as well as compliance with established standards, is also monitored closely.

A borrower’s ability to repay consumer debt is generally dependent upon the stability of the income stream necessary to service the debt. Adverse changes in economic conditions resulting in higher levels of unemployment increase the risk of consumer defaults. Risk of default is also affected by a customer’s total debt obligation. While the Bank can analyze a borrower’s capacity to repay at the time a credit decision is made, subsequent extensions of credit by other financial institutions may cause the customer to become over-extended, thereby increasing the risk of default.

Residential Real Estate Loans. The Company originates a variety of mortgage loan products including fixed rate mortgages and adjustable rate mortgages. All mortgage loans originated are held in the Bank’s portfolio. The Bank’s residential real estate loan policy is designed to originate a diversified mix of 15-30 year fixed and variable rate, single and multi-family home loans with loan-to-value rates ranging from 60-80%. Residential real estate loans possess risk characteristics much the same as consumer loans. Stability of the borrower’s employment is a critical factor in determining the likelihood of repayment. Mortgage loans are also subject to the risk that the value of the underlying collateral will decline due to

economic conditions or other factors.

SUPERVISION AND REGULATION

The Company is a bank holding company, registered with the Board of Governors of the Federal Reserve System (“Federal Reserve”) under the Bank Holding Company Act (“BHC Act”). As such, the Federal Reserve is the Company’s primary federal regulator, and the Company is subject to extensive regulation, examination, and supervision by the Federal Reserve. The Bank is a national banking association, chartered by the Office of the Comptroller of the Currency (“OCC”). The OCC is the Bank’s primary federal regulator, and the Bank is subject to extensive regulation, examination, and supervision by the OCC. In addition, the Federal Deposit Insurance Corporation (“FDIC”) has authority to conduct special examinations of insured depository institutions, such as the

Bank, as deposit insurer.

Each of the federal banking agencies, including the Federal Reserve and the OCC, has issued substantially similar risk-based and leverage capital guidelines applicable to the banking organizations they supervise. The guidelines apply on a consolidated basis and require bank holding companies (on a consolidated basis) and banks to maintain a minimum ratio of Tier 1 capital to total average assets (or “leverage ratio”) of 3%. For those banks that do not have the highest regulatory ratings, the minimum Tier 1 leverage ratio is 4%. The capital adequacy guidelines also require bank holding companies and banks to maintain a minimum ratio of Tier 1 capital to risk-weighted assets of 4% and a minimum ratio of qualifying total capital to risk-weighted assets of 8%. Under the Federal Reserve guidelines, certain

small bank holding companies with pro forma consolidated assets of less than $500 million, such as the Company, are not required to follow the risk-based and leverage capital guidelines. As of December 31, 2010, the Bank’s leverage ratio was 10.4%, its ratio of Tier 1 capital to risk-weighted assets was 15.7%, and its ratio of qualifying total capital to risk-weighted assets was 17.0%. The federal banking agencies may set higher minimum capital requirements for bank holding companies and banks whose circumstances warrant it, such as companies or banks anticipating significant growth or facing unusual risks. The Federal Reserve has not advised the Bank of any special capital requirement applicable to it.

4

The Federal Reserve has indicated that it will consider a bank holding company’s capital ratios and other indications of its capital strength in evaluating any proposal to expand its banking or non-banking activities. Any bank holding company whose capital does not meet the minimum capital adequacy guidelines is considered to be undercapitalized and is required to submit an acceptable plan to the Federal Reserve for achieving capital adequacy. An acceptable capital plan would likely include, among other actions, a restriction on the Company’s ability to pay dividends to its stockholders.

Any bank that is less than adequately-capitalized is subject to certain mandatory prompt corrective actions by its primary federal regulatory agency, as well as other discretionary actions, to resolve its capital deficiencies. The severity of the actions required to be taken increases as the bank’s capital position deteriorates. Among the actions that may be imposed on an undercapitalized bank is the implementation of a capital restoration plan. A bank holding company must guarantee that a subsidiary bank will meet its capital restoration plan, up to an amount equal to 5% of the subsidiary bank’s assets at the time the bank became undercapitalized or the amount required to meet regulatory capital requirements, whichever is less. In addition, under Federal Reserve policy, a bank holding company is

expected to serve as a source of financial and managerial strength, and to commit financial resources to support its subsidiary banks in times of financial stress. Any capital loans made by a bank holding company to a subsidiary bank are subordinate to the claims of the bank’s depositors and to certain other indebtedness of the subsidiary bank. In the event of the bankruptcy of a bank holding company, any commitment by the bank holding company to a federal banking regulatory agency to maintain the capital of a subsidiary bank would be assumed by the bankruptcy trustee and would be entitled to priority of payment.

The Bank also is subject to regulatory limits on its ability to pay dividends to the Company. By statue, the Bank may not pay a dividend, without prior OCC approval, if the total amount of all dividends declared during the calendar year, including the proposed dividend, exceeds the sum of its retained net income to date during the calendar year and its retained net income over the preceding two years. As of December 31, 2010, the Bank had approximately $2.2 million available for the payment of dividends without prior OCC approval. The Bank’s ability to pay dividends also is subject to the Bank being in compliance with the regulatory capital requirements described above. The Bank is currently in compliance with these requirements.

The deposits of the Bank are insured up to regulatory limits by the FDIC. The Wall Street Reform Act amended the Federal Deposit Insurance Act (the “FDIA”), effective December 31, 2010, to temporarily provide unlimited deposit insurance coverage for funds held in noninterest-bearing transaction accounts through December 31, 2012. This coverage is separate from, and in addition to, the $250,000 coverage provided to depositors with other accounts held with the Bank. While similar to the FDIC’s Transaction Account Guarantee Program, which expired December 31, 2010, low-interest Negotiable Order of Withdrawal (NOW) accounts and Interest on Lawyer Trust Accounts (IOLTAs) do not qualify for unlimited coverage.

The deposits of the Bank are subject to the deposit insurance premium assessments of the Deposit Insurance Fund (“DIF”). The FDIC currently maintains a risk-based assessment system under which assessment rates vary based on the level of risk posed by the institution to the DIF. The assessment rate may, therefore, change when that level of risk changes.

In February 2011, the FDIC adopted a final rule making certain changes to the deposit insurance assessment system, many of which were made as a result of provisions of the Wall Street Reform Act. The final rule also revises the assessment rate schedule effective April 1, 2011, and adopts additional rate schedules that will go into effect when the Deposit Insurance Fund (DIF) reserve ratio reaches various milestones. The final rule changes the deposit insurance assessment system from one that is based on domestic deposits to one that is based on average consolidated total assets minus average tangible equity. In addition, the rule suspends FDIC dividend payments if the DIF reserve ratio exceeds 1.5 percent, but provides for decreasing assessment rates when the DIF reserve ratio reaches certain thresholds.

In calculating assessment rates, the rule adopts a new “scorecard” assessment scheme for insured depository institutions with $10 billion or more in assets. It retains the risk category system for insured depository institutions with less than $10 billion in assets, such as the Bank, assigning each institution to one of four risk categories based upon the institution’s capital evaluation and supervisory evaluation, as defined by the rule. Depending on the DIF reserve ratio, the total base assessment rates for each risk category will be as follows:

| Basis Points | ||||||||||||||||

|

DIF Reserve Ratio

|

Risk Category I

|

Risk Category II

|

Risk Category III

|

Risk Category IV

|

||||||||||||

|

< 1.15%

|

2.5 – 9 | 9 – 24 | 18 – 33 | 30 – 45 | ||||||||||||

|

1.15 – 2%

|

1.5 – 7 | 7 – 22 | 14 – 29 | 25 – 40 | ||||||||||||

|

2 – 2.5%

|

1 – 6 | 5 – 20 | 12 – 27 | 23 – 38 | ||||||||||||

|

> 2.5%

|

0.5 – 5 | 4.5 – 19 | 10 – 25 | 20 – 35 | ||||||||||||

5

The rule will take effect for the quarter beginning April 1, 2011, and will be reflected in the invoices for assessments due September 30, 2011.

The FDIA provides for additional assessments to be imposed on insured depository institutions to pay for the cost of Financing Corporation (“FICO”) funding. The FICO assessments are adjusted quarterly to reflect changes in the assessment base of the DIF and do not vary depending upon a depository institution’s capitalization or supervisory evaluation. During 2010, FDIC assessments for purposes of funding FICO bond obligations ranged from an annualized $0.0106 per $100 of deposits for the first quarter of 2009 to $0.0104 per $100 of deposits for the fourth quarter of 2009. The Bank paid $33,000 of FICO assessments in 2009. For the first quarter of 2011, the FICO assessment rate is $0.0102 per $100 of deposits. The Bank paid a total of $38,000 in special and regular assessments during

2010.

As a member of the Federal Home Loan Bank of New York, the Bank is required to hold a minimum amount of the capital stock thereof. As of December 31, 2010, the Bank satisfied this requirement.

Transactions between the Bank and any affiliate, which includes the Company, are governed by sections 23A and 23B of the Federal Reserve Act. Generally, sections 23A and 23B are intended to protect insured depository institutions from suffering losses arising from transactions with non-insured affiliates by placing quantitative and qualitative limitations on covered transactions between a bank and any one affiliate as well as all affiliates of the bank in the aggregate, and requiring that such transactions be on market terms as well as terms that are consistent with safe and sound banking practices.

Under the Gramm-Leach-Bliley Act (“GLB Act”), all financial institutions, including the Company and the Bank, are required to adopt privacy policies to restrict the sharing of nonpublic customer data with nonaffiliated parties at the customer’s request, and establish procedures and practices to protect customer data from unauthorized access. The Company has developed such policies and procedures for itself and the Bank, and believes it is in compliance with all privacy provisions of the GLB Act. In addition the Fair and Accurate Credit Transactions Act (“FACT Act”) includes many provisions concerning national credit reporting standards, and permits consumers, including customers of the Company and the Bank, to opt out of information sharing among affiliated companies for marketing

purposes. The FACT Act also requires banks and other financial institutions to notify their customers if they report negative information about them to a credit bureau or if they are granted credit on terms less favorable than those generally available. The Federal Reserve and the Federal Trade Commission (“FTC”) have extensive rulemaking authority under the FACT Act, and the Company and the Bank are subject to the rules that have been promulgated by the Federal Reserve and FTC, including recent rules regarding limitations of affiliate marketing and implementation of programs to identify, detect and mitigate certain identity theft red flags.

In response to periodic disclosures by companies in various industries of the loss or theft of computer-based nonpublic customer information, several members of Congress have called for the adoption of national standards for the safeguarding of such information and the disclosure of security breaches. Several committees of both houses of Congress have conducted hearings on data security and related issues, and have legislation pending before them regarding this issue.

Under Title III of the USA PATRIOT Act, also known as the International Money Laundering Abatement and Anti-Terrorism Financing Act of 2001, all financial institutions, including the Company and the Bank, are required to take certain measures to identify their customers, prevent money laundering, monitor certain customer transactions and report suspicious activity to U.S. law enforcement agencies, and scrutinize or prohibit altogether certain transactions of special concern. Financial institutions also are required to respond to requests for information from federal banking regulatory agencies and law enforcement agencies concerning their customers and their transactions. Information-sharing among financial institutions concerning terrorist or money laundering activities is encouraged by an exemption provided

from the privacy provisions of the GLB Act and other laws. Financial institutions that hold correspondent accounts for foreign banks or provide private banking services to foreign individuals are required to take measures to avoid dealing with certain foreign individuals or entities, including foreign banks with profiles that raise money laundering concerns, and are prohibited altogether from dealing with foreign “shell banks” and persons from jurisdictions of particular concern. All financial institutions also are required to adopt internal anti-money laundering programs. The effectiveness of a financial institution in combating money laundering activities is a factor to be considered in any application submitted by the financial institution under the Bank Merger Act, which applies to the Bank, or the BHC Act, which applies to the Company. The Company and the Bank have in place a Bank Secrecy Act and USA PATRIOT Act compliance program, and they engage in very few

transactions of any kind with foreign financial institutions or foreign persons.

The Sarbanes-Oxley Act (“SOA”) implemented a broad range of measures to increase corporate responsibility, enhance penalties for accounting and auditing improprieties at publicly traded companies, and protect investors by improving the accuracy and reliability of corporate disclosures pursuant to federal securities laws. SOA applies generally to companies that have securities registered under the Securities Exchange Act of 1934, including publicly-held bank holding companies such as the Company. SOA includes very specific disclosure requirements and corporate governance rules, and the SEC and securities exchanges have adopted extensive additional disclosure, corporate governance, and other related rules pursuant to SOA’s mandate. SOA represents significant federal involvement in matters

traditionally left to state regulatory systems, such as the regulation of the accounting profession, and to state corporate law, such as the relationship between a board of directors and management and between a board of directors and its committees. In addition, the federal banking regulators have adopted generally similar requirements concerning the certification of financial statements by bank officials.

6

Home mortgage lenders, including banks, are required under the Home Mortgage Disclosure Act (“HMDA”) to make available to the public expanded information regarding the pricing of home mortgage loans, including the “rate spread” between the interest rate on loans and certain Treasury securities and other benchmarks. The availability of this information has led to increased scrutiny of higher-priced loans at all financial institutions to detect illegal discriminatory practices and to the initiation of a limited number of investigations by federal banking agencies and the U.S. Department of Justice. The Company has no information that it or its affiliates are the subject of any HMDA investigation.

Over the past several years, declining housing values have resulted in deteriorating economic conditions across the U.S., resulting in significant write-downs in the values of mortgage-backed securities and derivative securities by financial institutions, government sponsored entities, and major commercial and investment banks. This has led to decreased confidence in financial markets among borrowers, lenders, and depositors as well as extreme volatility in the capital and credit markets and the failure of some entities in the financial sector. The Company is fortunate that the markets it serves have been impacted to a lesser extent than many areas around the country.

The Wall Street Reform Act, passed into law on July 21, 2010, represents a significant overhaul of many aspects of the regulation of the financial-services industry. Among other things, the Wall Street Reform Act creates a new federal Consumer Financial Protection Bureau (CFPB), tightens capital standards, imposes clearing and margining requirements on many derivatives activities, and generally increases oversight and regulation of financial institutions and financial activities.

The CFPB will begin operations on July 21, 2011. It will have broad authority to write regulations regarding consumer financial products and services. These regulations will apply to numerous types of entities, including insured depository institutions such as the Bank. Such regulations will not be proposed until the CFPB begins operations. It is impossible to predict at this time the content or number of such regulations.

In addition to the self-implementing provisions of the statute, the Wall Street Reform Act calls for over 200 administrative rulemakings by various federal agencies to implement various parts of the legislation. While some rules have been finalized and/or issued in proposed form, many have yet to be proposed. It is impossible to predict when all such additional rules will be issued or finalized, and what the content of such rules will be. We will have to apply resources to ensure that we are in compliance with all applicable provisions of the Wall Street Reform Act and any implementing rules, which may increase our costs of operations and adversely impact our earnings.

7

TAXATION

The Company files a calendar year consolidated federal income tax return on behalf of itself and its subsidiaries. The Company reports its income and deductions using the accrual method of accounting. The components of income taxes are as follows for the years ended December 31 (in thousands):

|

Tax Expense (Benefit)

|

2010

|

2009

|

2008

|

|||||||||

|

Federal

|

$ | 559 | $ | (791 | ) | $ | 1,135 | |||||

|

State

|

60 | 57 | 57 | |||||||||

|

Deferred tax (benefit)

|

(337 | ) | 1,417 | (2,053 | ) | |||||||

|

Total income taxes

|

$ | 282 | $ | 683 | $ | (861 | ) | |||||

For a detailed discussion of income taxes please refer to note 10 in the Notes to Consolidated Financial Statements.

MONETARY POLICY AND ECONOMIC CONDITIONS

The earnings of the Company and the Bank are affected by the policies of regulatory authorities, including the Federal Reserve System. Federal Reserve System monetary policies have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future. Because of the changing conditions in the national economy and in the money markets, as a result of actions by monetary and fiscal authorities, interest rates, credit availability and deposit levels may change due to circumstances beyond the control of the Company and the Bank.

COMPETITION

The Bank faces strong competition for local business in the communities it serves from other financial institutions. Throughout Sullivan County there are 42 branches of commercial banks, savings banks, savings and loan associations and other financial organizations.

With respect to most of the services that the Bank offers, there is competition from financial institutions other than commercial banks. Money market funds and internet banks actively compete with banks for deposits. Savings banks, savings and loan associations and credit institutions, as well as consumer finance companies, insurance companies and pension trusts are important competitors. The Bank’s ability to maintain profitability is also affected by competition for loans.

NUMBER OF PERSONNEL

At December 31, 2010, there were 131 persons employed by the Bank.

ITEM 1A. RISK FACTORS

Although our common stock is traded on the NASDAQ Small Cap Market, the volume of trading in our common stock has been light. As a result, shareholders may not be able to quickly and easily sell their common stock.

Although our common stock is traded on the NASDAQ Small Cap Market, and a number of brokers offer to make a market in the common stock on a regular basis, trading volume is limited. As a result, you may find it difficult to sell shares at or above the price at which you purchased them and you may lose part of your investment.

Our common stock is not FDIC-insured.

Shares of our common stock are not securities or savings or deposit accounts or other obligations of our subsidiary bank. Our common stock is not insured by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency and is subject to investment risk, including the possible loss of your entire investment.

8

Applicable laws and regulations restrict both the ability of the Bank to pay dividends to the Company, and the ability of the Company to pay dividends to you.

Our principal source of income consists of dividends, if any, from the Bank. Payment of dividends by the Bank to us is subject to regulatory limitations imposed by the Office of the Comptroller of the Currency (“OCC”) and the Bank must meet OCC capital requirements before and after the payment of any dividends. In addition, the Bank cannot pay a dividend, without prior OCC approval, if the total amount of all dividends declared during a calendar year, including the proposed dividend, exceeds the sum of its retained net income to date during the calendar year plus the previous two years. The OCC has discretion to prohibit any otherwise permitted capital distribution on general safety and soundness grounds. As of December 31, 2010, approximately $2.2 million was available for the payment of dividends

without prior OCC approval.

Moreover, the laws of the State of New York, where the Company is incorporated, require that dividends be paid only from capital surplus so that the net assets of the Company remaining after such dividend payments are at least equal to the amounts of the Company’s stated capital.

Any payment of dividends in the future will continue to be at the sole discretion of our board of directors and will depend on a variety of factors deemed relevant by our board of directors, including, but not limited to, earnings, capital requirements and financial condition.

We operate in a highly regulated environment and may be adversely affected by changes in laws and regulations.

We are subject to extensive regulation, supervision and examination by the Board of Governors of the Federal Reserve System (“Federal Reserve”). The OCC is the Bank’s primary regulator and the Bank is subject to extensive regulation, examination, and supervision by the OCC. The Federal Deposit Insurance Corporation (“FDIC”) also has authority to conduct special examinations of insured depository institutions, such as the Bank, a deposit insurer. Such regulation and supervision govern the activities in which a financial institution and its holding company may engage and are intended primarily for the protection of the insurance fund and depositors and are not intended for the protection of investors in our common stock. Regulatory authorities have extensive discretion in connection

with their supervisory and enforcement activities, including the imposition of restrictions on the operation of an institution, the classification of assets by the institution and the adequacy of an institution’s allowance for loan losses. Any change in such regulation and oversight, whether in the form of regulatory policy, regulations, or legislation, may have a material impact on our operations.

In addition to the tightened capital standards to be imposed as a result of the Dodd-Frank Act, the Basel Committee on Bank Supervision recently announced higher global minimum capital standards (Basel III). Basel III has not been formally adopted and, at this time, it is unclear what the effect on the Bank will be.

Compliance with the recently enacted Dodd-Frank Reform Act may adversely impact our earnings.

On July 21, 2010, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Reform Act”) into law. The Dodd-Frank Reform Act represents a significant overhaul of many aspects of the regulation of the financial-services industry. Major elements in the Dodd-Frank Reform Act include the following:

|

|

·

|

The establishment of the Financial Stability Oversight Counsel, which will be responsible for identifying and monitoring systemic risks posed by financial firms, activities, and practices.

|

|

|

·

|

Enhanced supervision of large bank holding companies (i.e., those with over $50 billion in total consolidated assets), with more stringent supervisory standards to be applied to them.

|

|

|

·

|

The creation of a special regime to allow for the orderly liquidation of systemically important financial companies, including the establishment of an orderly liquidation fund.

|

|

|

·

|

The development of regulations to address derivatives markets, including clearing and exchange trading requirements and a framework for regulating derivatives-market participants.

|

|

|

·

|

Enhanced supervision of credit-rating agencies through the Office of Credit Ratings within the SEC.

|

|

|

·

|

Increased regulation of asset-backed securities, including a requirement that issuers of asset-backed securities retain at least 5% of the risk of the asset-backed securities.

|

|

|

·

|

The establishment of a Bureau of Consumer Financial Protection, within the Federal Reserve, to serve as a dedicated consumer-protection regulatory body.

|

|

|

·

|

Amendments to the Truth in Lending Act aimed at improving consumer protections with respect to mortgage originations, including originator compensation, minimum repayment standards, and prepayment considerations.

|

9

The majority of the provisions in the Dodd-Frank Reform Act are aimed at financial institutions that are significantly larger than the Company or the Bank. Nonetheless, there are provisions with which we will have to comply with. As rules and regulations are promulgated by the federal agencies responsible for implementing and enforcing the provisions in the Dodd-Frank Reform Act, we will have to work to apply resources to ensure that we are in compliance with all applicable provisions, which may adversely impact the Company’s results of operations, financial condition or liquidity, any of which may impact the market price of the Company’s common stock.

The Company’s profitability depends significantly on local and national economic conditions.

We make loans and most of our assets are located in Sullivan County, New York as well as some adjacent areas in New York and Pennsylvania. Adverse changes in economic conditions in these markets could compromise our ability to collect loans, could reduce the demand for loans, and otherwise could negatively affect our performance and financial condition. A significant decline in general economic conditions, caused by inflation, recession, acts of terrorism, outbreak of hostilities or other international or domestic occurrences, unemployment, changes in securities markets or other factors could impact these local economic conditions and, in turn, have a material adverse effect on the Company’s financial condition and results of operations.

While the stability of the financial and capital marketplaces in the United States improved in 2010, global economic troubles and weak domestic growth indicators, especially stubbornly high unemployment, continued to create uncertainty of economic recovery in the near term. Passage of the sweeping Dodd-Frank Financial Reform Act has broad implications for lenders and details of many of its provisions have yet to be fully implemented by regulatory agencies. As a consumer driven legislative initiative, the end result is expected to be negative for the banking industry as a whole.

As a lender, we may be adversely affected by general economic weaknesses, and, in particular, a sharp downturn in the housing industry in the states of New York and Pennsylvania. A depressed economy has led to higher foreclosure rates increased charges to the allowance for loan losses and the reduction in real estate values in Sullivan County. No assurance can be given that these conditions will improve or will not worsen or that such conditions will not result in an increase in delinquencies, causing a decrease in our interest income, or continue to have an adverse impact on our loan loss experience, causing an increase in our allowance for loan losses.

There can be no assurance that recent government action will help stabilize the U.S. financial system and will not have unintended adverse consequences.

In recent periods, the U.S. government and various federal agencies and bank regulators have taken steps to stabilize and stimulate the financial services industry. Changes also have been made in tax policy for financial institutions. The Emergency Economic Stabilization Act of 2008 (the “EESA”), was an initial legislative response to the financial crises affecting the banking system and financial markets and going concern threats to financial institutions. Pursuant to the EESA, the Federal Reserve was given the authority to, among other things, purchase up to $700 billion of mortgages, mortgage-backed securities and certain other financial instruments from financial institutions for the purpose of stabilizing and providing liquidity to the U.S. financial markets. The Federal Reserve’s first

efforts to maintain low long-term interest rates by purchasing mortgage backed securities ended in the spring of 2010 and was largely successful in holding those rates in check. As a European solvency crisis emerged in April, rates sank lower as investors sought the safety of the treasury market. However, a second initiative by the Federal Reserve in the fall of 2010 involving the purchase of long term U.S. Treasury bonds had the opposite of the desired effect, driving rates up nearly 100 basis points in the span of two months leading into the end of the year. Also late in 2010, Congress passed and the President signed into law an extension of current tax cuts which were set to expire at the end of the year, with an additional stimulus of a 2% reduction in Social Security payroll taxes for nearly all wage earners in 2011.

Other government action, such as the Homeowner Affordability and Stability Plan which was intended to prevent mortgage defaults and foreclosures, which may provide benefits to the economy as a whole, but may also reduce the value of certain mortgage loans or other mortgage-related securities which investors, such as the Company, may hold. There can be no assurance as to the actual impact that these or other government actions will have on the financial markets, including the extreme levels of volatility and limited credit availability currently being experienced. The failure of measures to help stabilize the financial markets and a continuation or worsening of current financial market conditions could materially and adversely affect the Company’s business, financial condition, results of operations, access

to credit or the trading price of its common stock.

Declining residential and commercial real estate values could threaten the soundness and collectability of the real estate loans in the Bank’s portfolio.

At December 31, 2010, 64.5% of the total assets of the Company, or $277,812,000, consisted of net loans. Of that amount, $247,647,000 or 89.1% of net total loans were secured by residential or commercial real estate. Based on information from the National Association of Realtors, the average residential real estate sales price in its primary market area for the quarter ended December 31, 2010 has fallen approximately 13% from the average residential real estate sales price for the comparable quarter in 2009. See Management’s Discussion and Analysis – Nonaccrual and Past Due Loans.

10

There is no assurance that we will be able to successfully compete with others for business.

We compete for loans, deposits, and investment dollars with other insured depository institutions and enterprises, such as securities firms, insurance companies, savings associations, credit unions, mortgage brokers, and private lenders, many of which have substantially greater resources. The differences in resources and regulations may make it harder for us to compete profitably, reduce the rates that we can earn on loans and investments, increase the rates we must offer on deposits and other funds, and adversely affect our overall financial condition and earnings.

Declining tax revenues could threaten the soundness of the Bank’s investments in certain securities.

The Bank owns local non-rated municipal securities which are intended to be held until maturity. At December 31, 2010 the carrying value of these investment securities was $6,021,000. If declining economic activity and real estate values result in significant reduced tax revenues to the municipal entities which issued these securities, the entities could be forced to default on repayment of the securities, having an adverse effect on the Bank’s financial condition.

Our profitability depends on maintaining our projected interest rate differentials.

Our operating income and net income depend to a great extent on ‘‘rate differentials,’’ i.e., the difference between the interest yields we receive on loans, securities and other interest bearing assets and the interest rates we pay on interest bearing deposits and other liabilities. These rates are highly sensitive to many factors which are beyond our control, including general economic conditions and the policies of various governmental and regulatory authorities, including the Federal Reserve.

Our growth and expansion may be limited by many factors.

We have pursued and intend to continue to pursue an internal growth strategy, the success of which will depend primarily on generating an increasing level of loans and deposits at acceptable risk and interest rate levels without corresponding increases in non-interest expenses. We cannot assure you that we will be successful in continuing our growth strategies, due, in part, to delays and other impediments inherent in our highly regulated industry, limited availability of qualified personnel or unavailability of suitable branch sites. The Company is committed to maintaining loan credit quality and sacrificing growth in the loan portfolio if necessary. In addition, the success of our growth strategy will depend, in part, on continued favorable economic conditions in our market area.

11

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

ITEM 2. PROPERTIES

In addition to the main office of the Company and the Bank in Jeffersonville, New York, the Bank has eleven branch locations and an operations center all within Sullivan County. Our branches are located in Bloomingburg, Callicoon, Eldred, Liberty, Livingston Manor, Loch Sheldrake, Monticello (two), Narrowsburg, White Lake and Wurtsboro. The Bank owns the main office and operations center along with seven branches: Bloomingburg, Eldred, Liberty, Livingston Manor, Loch Sheldrake, Narrowsburg and one location in Monticello. We occupy four branch locations pursuant with a lease arrangement in Callicoon, White Lake, Wurtsboro and one located in a Wal*Mart store in Monticello.

The Company’s leases for Callicoon, Wal*Mart, Wurtsboro and White Lake expire in 2012, 2014, 2020, and 2030 respectively. A renewal options exists for Callicoon for an additional 15 years. Future minimum lease payments are disclosed under the title Contractual Obligations.

The major classifications of premises and equipment and the book value thereof were as follows at December 31, 2010 (in thousands):

|

Premises and Equipment

|

2010

|

|||

|

Land

|

$ | 1,057 | ||

|

Buildings and improvements

|

6,563 | |||

|

Furniture and fixtures

|

337 | |||

|

Equipment

|

4,191 | |||

| 12,148 | ||||

|

Less accumulated depreciation and amortization

|

6,864 | |||

|

Total premises and equipment, net

|

$ | 5,284 | ||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

The Company and the Bank are not parties to any material legal proceedings other than ordinary routine litigation incidental to business.

12

PART II

|

ITEM 5.

|

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

The Company’s common stock is traded on the NASDAQ Small Cap Market under the symbol JFBC. There are currently no market makers for the stock but the following investment firms are known to handle Jeffersonville Bancorp stock transactions: E*TRADE Securities LLC, TD Ameritrade, Inc. and Stifel, Nicolaus & Company, Inc. The following table shows the range of high and low sale prices for the Company’s stock and cash dividends paid for the quarters indicated.

|

Cash

|

||||||||||||

|

Sales

|

Sales

|

dividends

|

||||||||||

|

For the Quarter Ended:

|

low

|

high

|

paid

|

|||||||||

|

December 31, 2010

|

$ | 10.04 | $ | 11.25 | $ | 0.13 | ||||||

|

September 30, 2010

|

$ | 10.00 | $ | 11.25 | $ | 0.13 | ||||||

|

June 30, 2010

|

$ | 11.00 | $ | 12.45 | $ | 0.13 | ||||||

|

March 31, 2010

|

$ | 9.50 | $ | 12.60 | $ | 0.13 | ||||||

|

December 31, 2009

|

$ | 9.00 | $ | 10.03 | $ | 0.13 | ||||||

|

September 30, 2009

|

$ | 8.62 | $ | 9.75 | $ | 0.13 | ||||||

|

June 30, 2009

|

$ | 8.56 | $ | 9.75 | $ | 0.13 | ||||||

|

March 31, 2009

|

$ | 8.52 | $ | 9.78 | $ | 0.13 | ||||||

Number of Holders of Record. At the close of business on February 28, 2011, the Company had 1,393 stockholders of record of the 4,234,505 shares of common stock then outstanding.

Securities Authorized for Issuance Under Equity Compensation Plan. The Company has no equity compensation plans under which its securities may be issued.

Payment of Dividends. Applicable laws and regulations restrict the ability of the Bank to pay dividends to the Company, and the ability of the Company to pay dividends to stockholders. Payment of dividends in the future will be at the sole discretion of the Company’s board of directors and will depend on a variety of factors deemed relevant by the board of directors, including, but not limited to, earnings, capital requirements and financial condition. See Item 1. Business — Supervision and Regulation.

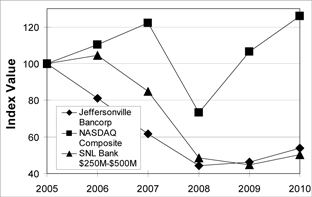

COMPARATIVE STOCK PERFORMANCE GRAPH

The following graph sets forth the cumulative total shareholder return on the Company’s Common Stock for the last five fiscal years. Total shareholder return is measured by dividing total dividends (assuming dividend reinvestment) for the measurement period plus share price change for a period by the share price at the beginning of the measurement period. The Company’s cumulative shareholder return over a five-year period is based on an investment of $100 on December 31, 2005 and the reinvestment of all dividends since that date to December 31, 2010 and is compared to the cumulative total return of the NASDAQ - Composite Index and the SNL Bank $250m - $500m Index. The data used was obtained from published sources and is believed to be accurate.

13

COMPARISON OF FIVE-YEAR CUMULATIVE RETURN FISCAL YEAR ENDED DECEMBER 31, 2010

|

Period Ending December 31,

|

||||||||||||||||||||||||

|

Index:

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||||||||||||

|

Jeffersonville Bancorp

|

100.00 | 80.99 | 61.58 | 44.22 | 46.32 | 53.74 | ||||||||||||||||||

|

NASDAQ Composite Index

|

100.00 | 110.39 | 122.15 | 73.32 | 106.57 | 125.91 | ||||||||||||||||||

|

SNL Bank $250M-$500M Index

|

100.00 | 104.48 | 84.92 | 48.50 | 44.89 | 50.24 | ||||||||||||||||||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

FIVE-YEAR SUMMARY

(In thousands, except share and per share data)

|

December 31,

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Results of Operations

|

||||||||||||||||||||

|

Interest income

|

$ | 21,838 | $ | 21,827 | $ | 22,953 | $ | 23,479 | $ | 23,881 | ||||||||||

|

Interest expense

|

4,365 | 5,847 | 7,228 | 8,615 | 8,211 | |||||||||||||||

|

Net interest income

|

17,473 | 15,980 | 15,725 | 14,864 | 15,670 | |||||||||||||||

|

Provision (credit) for loan losses

|

2,300 | 1,300 | 265 | (370 | ) | 90 | ||||||||||||||

|

Net income

|

3,129 | 3,084 | 2,702 | 4,275 | 4,943 | |||||||||||||||

|

Financial Condition

|

||||||||||||||||||||

|

Total assets

|

$ | 430,787 | $ | 422,684 | $ | 398,567 | $ | 387,430 | $ | 397,291 | ||||||||||

|

Total deposits

|

350,906 | 352,205 | 296,724 | 299,242 | 325,073 | |||||||||||||||

|

Gross loans

|

282,147 | 279,407 | 267,563 | 252,985 | 250,760 | |||||||||||||||

|

Stockholders’ equity

|

47,498 | 44,663 | 42,662 | 43,958 | 41,275 | |||||||||||||||

|

Average Balances

|

||||||||||||||||||||

|

Total assets

|

$ | 439,150 | $ | 415,678 | $ | 393,964 | $ | 389,384 | $ | 400,535 | ||||||||||

|

Total deposits

|

366,486 | 327,257 | 300,984 | 315,941 | 326,136 | |||||||||||||||

|

Gross loans

|

279,174 | 270,361 | 259,713 | 250,277 | 246,890 | |||||||||||||||

|

Stockholders’ equity

|

46,605 | 43,755 | 43,929 | 42,249 | 42,272 | |||||||||||||||

|

Financial Ratios

|

||||||||||||||||||||

|

Net income to average total assets

|

0.71 | % | 0.74 | % | 0.69 | % | 1.10 | % | 1.23 | % | ||||||||||

|

Net income to average stockholders’ equity

|

6.71 | % | 7.05 | % | 6.15 | % | 10.12 | % | 11.69 | % | ||||||||||

|

Average stockholders’ equity to average total assets

|

10.61 | % | 10.53 | % | 11.15 | % | 10.85 | % | 10.55 | % | ||||||||||

|

Share and Per Share Data

|

||||||||||||||||||||

|

Basic earnings per share

|

$ | 0.74 | $ | 0.73 | $ | 0.64 | $ | 1.00 | $ | 1.13 | ||||||||||

|

Dividends per share

|

$ | 0.52 | $ | 0.52 | $ | 0.52 | $ | 0.50 | $ | 0.48 | ||||||||||

|

Dividend payout ratio

|

70.4 | % | 71.4 | % | 81.5 | % | 49.9 | % | 42.4 | % | ||||||||||

|

Book value at year end

|

$ | 11.22 | $ | 10.55 | $ | 10.08 | $ | 10.38 | $ | 9.59 | ||||||||||

|

Total dividends paid

|

$ | 2,202,000 | $ | 2,202,000 | $ | 2,202,000 | $ | 2,134,000 | $ | 2,098,000 | ||||||||||

|

Average number of shares outstanding

|

4,234,459 | 4,234,321 | 4,234,321 | 4,266,397 | 4,376,494 | |||||||||||||||

|

Shares outstanding at year end

|

4,234,505 | 4,234,321 | 4,234,321 | 4,234,321 | 4,305,348 | |||||||||||||||

14

SUMMARY OF QUARTERLY RESULTS OF OPERATIONS

(Dollars in thousands, except per share data)

|

December 31,

|

September 30,

|

June 30,

|

March 31,

|

December 31,

|

September 30,

|

June 30,

|

March 31,

|

|||||||||||||||||||||||||

|

2010

|

2010

|

2010

|

2010

|

2009

|

2009

|

2009

|

2009

|

|||||||||||||||||||||||||

|

Interest income

|

$ | 5,389 | $ | 5,484 | $ | 5,572 | $ | 5,393 | $ | 5,482 | $ | 5,565 | $ | 5,407 | $ | 5,373 | ||||||||||||||||

|

Interest expense

|

(958 | ) | (1,110 | ) | (1,153 | ) | (1,144 | ) | (1,277 | ) | (1,438 | ) | (1,539 | ) | (1,593 | ) | ||||||||||||||||

|

Net interest income

|

4,431 | 4,374 | 4,419 | 4,249 | 4,205 | 4,127 | 3,868 | 3,780 | ||||||||||||||||||||||||

|

Provision for loan losses

|

(650 | ) | (650 | ) | (800 | ) | (200 | ) | (800 | ) | (350 | ) | — | (150 | ) | |||||||||||||||||

|

Non-interest income

|

844 | 673 | 654 | 786 | 993 | 890 | 854 | 891 | ||||||||||||||||||||||||

|

Non-interest expenses

|

(3,542 | ) | (3,540 | ) | (3,676 | ) | (3,961 | ) | (3,671 | ) | (3,570 | ) | (3,645 | ) | (3,655 | ) | ||||||||||||||||

|

Income before income taxes

|

1,083 | 857 | 597 | 874 | 727 | 1,097 | 1,077 | 866 | ||||||||||||||||||||||||

|

Income tax (expense) benefit

|

(142 | ) | (89 | ) | 32 | (83 | ) | (91 | ) | (281 | ) | (199 | ) | (112 | ) | |||||||||||||||||

|

Net income

|

$ | 941 | $ | 768 | $ | 629 | $ | 791 | $ | 636 | $ | 816 | $ | 878 | $ | 754 | ||||||||||||||||

|

Basic earnings per share

|

$ | 0.22 | $ | 0.18 | $ | 0.15 | $ | 0.19 | $ | 0.15 | $ | 0.19 | $ | 0.21 | $ | 0.18 | ||||||||||||||||

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following is a discussion of the factors which significantly affected the consolidated results of operations and financial condition of Jeffersonville Bancorp (“Parent Company”) and its wholly-owned subsidiary, The First National Bank of Jeffersonville (“Bank”). For purposes of this discussion, references to the Company include both the Bank and the Parent Company, as the Bank is the Parent Company’s only subsidiary. This discussion should be read in conjunction with the consolidated financial statements and notes thereto, and the other financial information appearing elsewhere in this annual report.

This document contains forward-looking statements, which are based on assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar words. The Company’s ability to predict results and the actual effect of future plans or strategies is uncertain. Factors which could have a material adverse effect on operations include, but are not limited to, changes in interest rates, general economic conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and Federal Reserve Board, the quality or

composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market areas and accounting principles and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements. Actual results could differ materially from forward-looking statements.

GENERAL

The Parent Company is a bank holding company founded in 1982 and headquartered in Jeffersonville, New York. The Parent Company owns 100% of the outstanding shares of the Bank’s common stock and derives substantially all of its income from the Bank’s operations in the form of dividends paid to the Parent Company. The Bank is a national bank chartered in 1913 serving Sullivan County, New York with branch offices in Jeffersonville, Bloomingburg, Eldred, Liberty, Loch Sheldrake, Monticello (two), Livingston Manor, Narrowsburg, Callicoon, White Lake and Wurtsboro. The Bank’s administrative offices are located in Jeffersonville, New York.

The Company’s mission is to serve the community banking needs of its borrowers and depositors, who predominantly are individuals, small businesses and local municipal governments. The Company believes it understands its local customer needs and provides quality service with a personal touch.

The financial results of the Company are influenced by economic events that affect the communities we serve as well as national economic conditions, primarily interest rates trend, affecting the entire banking industry. Changes in net interest income and provisions for loan losses have the greatest impact on the Company’s profits. As high unemployment lingers and economic activity remains stagnant, loan delinquencies have increased. Real estate values in the nation, and particularly Sullivan County, remain depressed and a large segment of the Company’s assets are in real estate secured loans. As a result, provisions for loan losses increased by $1.0 million in 2010 as compared to 2009. This trend is not likely to reverse in the short term and similar results are expected in 2011. While long term

interest rates rose in the latter part of 2010, short term rates have remained at historic lows. This benefited the Company’s net interest margin as most of the Company’s liabilities are short term. This trend is likely to continue in 2011 as the Federal Reserve continues to indicate their intention to keep short term rates low for an extended period.

The Company has a long history of profitable operations and a strong capital base that have been the foundation of the Company since its inception. Management believes this trend will continue and the Company will be well positioned to take advantage of business opportunities when the current economic downturn reverses course.

15

CRITICAL ACCOUNTING POLICIES

Management of the Company considers the accounting policy relating to the allowance for loan losses to be a critical accounting policy given the inherent uncertainty in evaluating the levels of the allowance required to cover credit losses in the portfolio and the material effect that such judgments can have on the results of operations. The allowance for loan losses is maintained at a level deemed adequate by management based on an evaluation of such factors as economic conditions in the Company’s market area, past loan loss experience, the financial condition of individual borrowers, and underlying collateral values based on independent appraisals. While management uses available information to recognize losses on loans, future additions to the allowance for loan losses may be necessary based on changes

in economic conditions and values of real estate particularly in Sullivan County. Collateral underlying certain real estate loans could lose value which could lead to future additions to the allowance for loan losses. See Item 7 Management’s Discussion and Analysis/ Allowance for Loan Losses for further discussion. In addition, Federal regulatory agencies, as an integral part of their examination process, periodically review the Company’s allowance for loan losses and may require the Company to recognize additions to the allowance based on their judgments about information available to them at the time of their examination, which may not be currently available to management.

Foreclosed real estate consists of properties acquired through foreclosure or by acceptance of a deed in lieu of foreclosure. At the time of initial foreclosure, or when foreclosure occurs in-substance, these assets are recorded at fair value less estimated costs to sell and the excess, if any, of the loan over the fair market value of the assets received, less estimated selling costs, is charged to the allowance for loan and lease losses. Any subsequent valuation adjustments are charged or credited to other non-interest income. Operating costs associated with the properties are charged to expense as incurred. Gains on the sale of foreclosed real estate are included in income when title has passed and the sale has met all the requirements prescribed by GAAP.

Impaired securities are evaluated on at least a quarterly basis, and more frequently when market conditions warrant such an evaluation, to determine whether the impairment is other-than-temporary. To determine whether an impairment is other-than-temporary, management utilizes criteria such as the reasons underlying the impairment, the magnitude and duration of the impairment and the intent and ability of the Company to retain its investment in the security for a period of time sufficient to allow for an anticipated recovery in the fair value. The term “other-than-temporary” is not intended to indicate that the decline is permanent, but indicates that the prospects for a near-term recovery of value is not necessarily favorable, or that there is a lack of evidence to support a realizable value equal to

or greater than the carrying value of the security. In addition, the total impairment is separated into the amount of the impairment related to (a) credit loss and (b) the amount of the impairment related to all other factors, such as interest rate changes. The difference between the present value of the cash flows expected to be collected and the amortized cost basis of a security is considered to be the credit loss. Once an impairment is determined to be other-than-temporary, the impairment related to credit loss, if any, is charged to income and the amount of the impairment related to all other factors is recognized in other comprehensive income (loss).

The Company has evaluated subsequent events and transactions occurring through the date of issuance of the financial data included herein.

RECENT ACCOUNTING PRONOUNCEMENTS

For recent accounting pronouncements, turn to page 39.

FINANCIAL CONDITION

Total assets increased by $8.1 million or 1.9% to $430.8 million at December 31, 2010 from $422.7 million at December 31, 2009. The increase was primarily due to a $13.3 million or 14.6% increase in securities available for sale to $104.7 million at December 31, 2010 from $91.3 million at December 31, 2009, a $2.4 million or 0.9% increase in loans, net of allowance, from $275.4 million at December 31, 2009 to $277.8 million at December 31, 2010, and an increase in Bank owned life insurance of $971,000 to $15.6 million at December 31, 2010. Partially reducing these increases was a decrease of $5.8 million or 43.6% in cash and cash equivalents from $13.3 million at December 31, 2009 to $7.5 million at December 31, 2010, a decrease in held to maturity securities of $2.2 million or 26.7% to $6.0 million at December

31, 2010 from $8.2 million at December 31, 2009 and a decrease in other assets of $1.8 million primarily due to retirement plan amendments. Overnight borrowings were used to fund short term liquidity needs. Deposits decreased $1.3 million to $350.9 million or 0.4% at December 31, 2010. Time deposits decreased $19.9 million or 11.4% to $154.6 million at December 31, 2010 from $174.5 million at December 31, 2009. Demand deposits decreased $1.4 million or 2.2% to $62.9 million at December 31, 2010. Partially offsetting this, savings and insured money market accounts increased $19.0 million or 23.8% from $79.9 million at December 31, 2009 to $99.0 million at December 31, 2010. NOW and Super NOW deposits increased $1.0 million or 3.0% to $34.5 million at December 31, 2010. Non-deposit liabilities increased $6.6 million or 25.4% in 2010 from $25.8 million at December 31, 2009 to $32.4 million at December 31, 2010. The increase in non-deposit liabilities was primarily due to an overnight

borrowing from the Federal Home Loan Bank of New York of $9.1 million at December 31, 2010. Partially offsetting this increase was a $2.7 million decrease in other liabilities to $7.9 million at December 31, 2010 as a result of retirement plan amendments.

16

In 2010, total gross loans increased $2.7 million or 1.0% from $279.4 million at December 31, 2009 to $282.1 million at December 31, 2010. Within the loan portfolio, residential mortgages increased $4.6 million or 4.5% and commercial real estate increased by $1.0 million or 1.0%. Home equity, farmland and construction real estate loans decreased, in total, $2.7 million from prior year, and other loans for commercial and consumer purposes decreased $0.6 million or 1.6%. The growth in residential and commercial real estate loans reflects the Company’s strategy to conservatively grow the real estate portfolio. The overall loan portfolio is structured in accordance with management’s belief that loans secured by residential and commercial real estate generally result in lower loan loss levels compared to

other types of loans because of the value of the underlying collateral. The Company remains committed to maintaining loan credit quality and sacrificing growth in the loan portfolio, if necessary.

There was a $419,000 increase in foreclosed real estate at December 31, 2010 to $1.8 million, up from $1.4 million at December 31, 2009. The balance in both years consisted primarily of commercial property. This commercial property was under a lease agreement, with lease payments being recorded in income. Total nonperforming loans decreased $0.8 million from $13.3 million at December 31, 2009 to $12.5 million at December 31, 2010 primarily due to a decrease in nonperforming commercial mortgages. Net loan charge-offs increased from $482,000 in 2009 to $1,953,000 in 2010 due to increased write-offs as a result of lower property values. At December 31, 2010, the allowance for loan losses equaled $4.3 million representing 1.54% of total gross loans outstanding and 34.7% of total nonperforming loans.

Total stockholders’ equity was $47.5 million at December 31, 2010, an increase of $2.8 million over December 31, 2009 at $44.7 million. This increase was the result of $3.1 million of net income and a $1.9 million change in accumulated other comprehensive income (loss) from a loss of $1.5 million to income of $0.4 million partially offset by cash dividends of $2.2 million.

RESULTS OF OPERATIONS 2010 VERSUS 2009

Net Income

Net income for 2010 of $3.1 million increased 1.5% or $45,000 from 2009. Net interest income after provision for loan losses increased $493,000 or 3.4% to $15.2 million for the year ended December 31, 2010. This increase was comprised of a decrease in interest expense of $1.5 million or 25.3%, from $5.8 million for the year ended December 31, 2009 to $4.4 million for the same period ended December 31, 2010, partially offset by an increase in the provision for loan losses of $1.0 million to $2.3 million for the year ended December 31, 2010. A further discussion of the provision follows in the “Summary of Loan Loss Experience” below. Interest and dividend income increased $11,000 year over year. This was the net effect of an increase in interest earned on tax-exempt securities of $366,000 partially

offset by lower earnings on taxable securities in the amount of $287,000. The change in interest income was due to an increase in the amount of higher yielding tax-exempt securities and a decrease in the amount of taxable security holdings. The decrease in interest expense was primarily due to a decrease in interest expense on deposits of $0.8 million or 17.6% due to the lower interest rate environment and $0.7 million or 52.9% of interest expense on Federal Home Loan Bank borrowings due to reduced borrowing levels during 2010. Non-interest income decreased a decrease of $0.7 million or 18.5% from $3.6 million in 2009 to $3.0 million in 2010 due to a $446,000 decrease in net security gains and a $143,000 decrease in service charge income. Non-interest expense increased $178,000 primarily due to a $225,000 increase in other non-interest expense. See “Non-Interest Income and Non-Interest Expense” below for further

discussion.

Tax Equivalent Interest Income and Interest Expense

Throughout the following discussion, net interest income and its components are expressed on a tax equivalent basis which means that, where appropriate, tax exempt income is shown as if it were earned on a fully taxable basis.

The largest source of income for the Company is net interest income, which represents interest earned on loans, securities and short-term investments, less interest paid on deposits and other interest bearing liabilities. Tax equivalent net interest income of $18.7 million for 2010 represented an increase of 9.9% over 2009. Net interest margin increased 22 basis points to 4.73% in 2010 compared to 4.51% in 2009 due to reduced interest rates on interest bearing assets combined with a relatively fixed interest rate on long-term debt. The total of tax equivalent interest earning assets and interest bearing liabilities increased a net of $1.7 million as a result of a $0.2 million increase in total interest bearing assets and decrease in interest bearing liabilities of $1.5 million.

Total tax equivalent interest income for 2010 was $23.0 million, compared to $22.8 million in 2009 with the average yield on assets decreasing from 6.06% in 2009 to 5.83% in 2010. The net increase of $196,000 or 4.7% in 2010 is largely the result of a $551,000 increase in tax equivalent interest income on tax-exempt securities due primarily to an increase of $12.1 million in average balance of tax-exempt securities. This increase was partially offset by a $287,000 decrease in interest on taxable securities, as a result of a 54 basis point reduction in yield as higher-yielding securities were called or matured and replaced with lower-yielding securities, and a $58,000 decrease in interest on loans. Despite average loan balances increasing in all but the installment loan category for a net increase of $8.8 million