Attached files

Exhibit 10.2

LOAN AGREEMENT

for a loan in the amount of

$30,000,000

MADE BY AND BETWEEN

WELLS VAF-330 COMMERCE STREET, LLC

WELLS VAF-PARKWAY AT OAK HILL, LLC, and

WELLS VAF-6000 NATHAN LANE, LLC

each a Delaware limited liability company

Collectively, as “Borrowers”

and

Individually, a “Borrower”

AND

NXT CAPITAL, LLC,

a Delaware limited liability company

As “Lender”

Wells VAF Portfolio

Dated as of December 17, 2010

TABLE OF CONTENTS

| ARTICLE 1 PARTIES, BASIC LOAN TERMS AND DEFINITIONS | 1 | |||||||

| 1.1 | Parties and Basic Terms | 1 | ||||||

| 1.2 | Incorporation of Exhibits and Schedule | 4 | ||||||

| 1.3 | Definitional Provisions | 4 | ||||||

| ARTICLE 2 LOAN AND LOAN DOCUMENTS | 4 | |||||||

| 2.1 | Conditions Precedent to Initial Funding | 4 | ||||||

| 2.2 | Disbursements | 5 | ||||||

| 2.3 | Interest | 7 | ||||||

| 2.4 | Term of the Loan | 7 | ||||||

| 2.5 | Monthly Payments | 8 | ||||||

| 2.6 | Prepayments | 9 | ||||||

| 2.7 | Exit Fee | 9 | ||||||

| 2.8 | Late Charge | 10 | ||||||

| 2.9 | Application of Payments and Blocked Accounts | 10 | ||||||

| 2.10 | Project Partial Prepayments, Partial Releases | 11 | ||||||

| ARTICLE 3 FINANCIAL REPORTING COVENANTS | 11 | |||||||

| 3.1 | Financial Information Reporting | 11 | ||||||

| 3.2 | Other Information; Financial Information Form and Examination | 12 | ||||||

| ARTICLE 4 OPERATIONAL AND OTHER COVENANTS | 13 | |||||||

| 4.1 | Leasing and Operational Covenants | 13 | ||||||

| 4.2 | Other Borrower Covenants | 16 | ||||||

| 4.3 | Authorized Representative | 31 | ||||||

| ARTICLE 5 BORROWERS’ REPRESENTATIONS AND WARRANTIES | 32 | |||||||

| 5.1 | Borrowers’ Representations and Warranties | 32 | ||||||

| ARTICLE 6 ENVIRONMENTAL MATTERS | 40 | |||||||

| 6.1 | Environmental Representations and Warranties | 40 | ||||||

| 6.2 | Environmental Covenants | 41 | ||||||

| 6.3 | Right of Entry and Disclosure of Environmental Reports | 42 | ||||||

| 6.4 | Environmental Indemnitor’s Remedial Work | 43 | ||||||

| 6.5 | Environmental Indemnity | 44 | ||||||

| 6.6 | Remedies Upon an Environmental Default | 46 | ||||||

| 6.7 | Unconditional Environmental Obligations | 47 | ||||||

| 6.8 | Assignment of Environmental Obligations Prohibited | 47 | ||||||

| 6.9 | Indemnification Separate from the Loan | 47 | ||||||

| ARTICLE 7 CASUALTIES AND CONDEMNATION | 48 | |||||||

| 7.1 | Lender’s Election to Apply Insurance Proceeds on Indebtedness | 48 | ||||||

-i-

| 7.2 | Borrowers’ Obligation to Rebuild and Use of Insurance Proceeds Therefor | 50 | ||||||

| ARTICLE 8 EVENTS OF DEFAULT AND REMEDIES | 50 | |||||||

| 8.1 | Events of Default | 50 | ||||||

| 8.2 | Remedies Conferred Upon Lender | 53 | ||||||

| ARTICLE 9 LOAN EXPENSE, COSTS AND ADVANCES | 54 | |||||||

| 9.1 | Loan and Administration Expenses | 54 | ||||||

| 9.2 | Right of Lender to Make Advances to Cure Borrowers’ Defaults | 55 | ||||||

| 9.3 | Increased Costs | 55 | ||||||

| 9.4 | Borrower Withholding | 56 | ||||||

| 9.5 | Document and Recording Tax Indemnification | 57 | ||||||

| ARTICLE 10 ASSIGNMENTS BY LENDER AND DISCLOSURE | 57 | |||||||

| 10.1 | Assignments and Participations | 57 | ||||||

| 10.2 | Disclosure of Information and Confidentiality | 59 | ||||||

| 10.3 | Dissemination of Information | 60 | ||||||

| ARTICLE 11 GENERAL PROVISIONS | 60 | |||||||

| 11.1 | Captions | 60 | ||||||

| 11.2 | Waiver of Jury Trial; Waiver of Counterclaims | 60 | ||||||

| 11.3 | Jurisdiction | 61 | ||||||

| 11.4 | Governing Law | 61 | ||||||

| 11.5 | Lawful Rate of Interest | 62 | ||||||

| 11.6 | Modification; Consent | 62 | ||||||

| 11.7 | Waivers; Acquiescence or Forbearance Not to Constitute Waiver of Lender’s Requirements | 62 | ||||||

| 11.8 | Disclaimer by Lender; No Third Party Beneficiaries | 63 | ||||||

| 11.9 | Partial Invalidity; Severability | 64 | ||||||

| 11.10 | Definitions Include Amendments | 64 | ||||||

| 11.11 | Execution in Counterparts | 64 | ||||||

| 11.12 | Entire Agreement | 64 | ||||||

| 11.13 | Waiver of Damages | 64 | ||||||

| 11.14 | Claims Against Lender | 65 | ||||||

| 11.15 | Set-Offs | 65 | ||||||

| 11.16 | Relationship | 65 | ||||||

| 11.17 | Agents | 65 | ||||||

| 11.18 | Interpretation | 65 | ||||||

| 11.19 | Successors and Assigns | 66 | ||||||

| 11.20 | Time is of the Essence | 66 | ||||||

| 11.21 | Notices | 66 | ||||||

| 11.22 | Advertisement | 68 | ||||||

| 11.23 | Joint and Several Liability/Contribution | 68 | ||||||

-ii-

LIST OF EXHIBITS AND SCHEDULES TO LOAN AGREEMENT

[REVISE AS APPROPRIATE]

| Joinder | Guarantor’s Limited Joinder | |

| Exhibit A-1 | Legal Description of Land (Commerce Project) | |

| Exhibit A-2 | Legal Description of Land (Parkway Project) | |

| Exhibit A-3 | Legal Description of Land (Nathan Project) | |

| Exhibit B | Reserved | |

| Exhibit C | Reserved | |

| Exhibit D | Rent Roll | |

| Exhibit E | Insurance Requirements | |

| Exhibit F | Environmental Documents | |

| Exhibit G | Litigation | |

| Exhibit H | Reserved | |

| Exhibit I | Form of Owner’s Statement | |

| Exhibit J | Form of Disbursement & Requisition | |

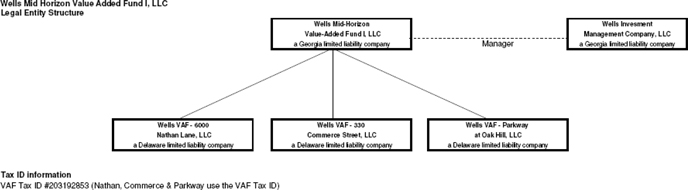

| Exhibit K | Organizational Chart | |

| Exhibit L | Minimum Release Prices | |

| Schedule I | Definitions | |

| Schedule II | Minimum Effective Rent | |

| Schedule III | Capital Improvements | |

| Schedule IV | Form of IDB Recognition Agreements | |

| Schedule V | Non-Disturbance Agreements | |

LOAN AGREEMENT

THIS LOAN AGREEMENT (as amended, modified, restated, extended, waived, supplemented or replaced from time to time, this “Agreement”) is dated as of December 17, 2010, is by and between Borrowers and Lender (defined below). In consideration of the mutual covenants, conditions and agreements herein contained, Borrowers and Lender agree as follows:

ARTICLE 1

PARTIES, BASIC LOAN TERMS AND DEFINITIONS

1.1 Parties and Basic Terms.

The terms set forth below, as used in this Agreement, shall have the meanings given them in this Section. Schedule I and the text of this Agreement also contain defined terms.

(a) Borrowers and Guarantor.

(i) Collectively, jointly and severally, Borrowers, and individually, a Borrower: Wells VAF-330 Commerce Street, LLC, Wells VAF-Parkway at Oak Hill, LLC, and Wells VAF-6000 Nathan Lane, LLC, each a Delaware limited liability company, together with its successors and permitted assigns.

(ii) Borrowers’ Address: is 6200 The Corners Parkway, Norcross, Georgia 30092, Attention: Christopher Daniels. Facsimile No. (770) 243-8594. Borrowers’ principal place of business address is 6200 The Corners Parkway, Norcross, Georgia 30092.

(iii) Borrowers’ Counsel: James M. Phipps, Esq.

(iv) Borrowers’ Counsel’s Address: DLA Piper LLP (US), 203 N. LaSalle Street, Suite 1900, Chicago, Illinois 60601-1293 Facsimile No. (312) 251-5736.

(v) Collectively, jointly and severally, “Environmental Indemnitors, and individually, “Environmental Indemnitor: Each Borrower and Guarantor.

(vi) Guarantor: Wells Mid-Horizon Value-Added Fund I, LLC, a Georgia limited liability company, together with its heirs, successors and permitted assigns.

(b) Lender.

(i) Lender: NXT Capital, LLC, a Delaware limited liability company, together with its successors and assigns.

(ii) Lender’s Address: 191 North Wacker Drive, Suite 1200, Chicago, Illinois 60606-1615. Facsimile No. (312) 450-8100.

(iii) Lender’s Counsel: Adam M. Laser, Esq.

(iv) Lender’s Counsel’s Address: Goldberg Kohn Ltd., 55 East Monroe Street, Suite 3300, Chicago, Illinois 60603. Facsimile No. (312) 332-2196.

(c) The Projects.

(i) Improvements: All improvements currently located on or under the Land or subsequently constructed on or under the Land generally consisting of improvements containing in the aggregate approximately 445,844 net square feet of rentable space. The general purpose and use of each Project is as an office project.

(ii) Land: Collectively, (i) that certain air rights parcel located in Nashville, Tennessee and legally described on Exhibit A-1 attached hereto (together with all improvements located thereon, the “Commerce Project”), (ii) that certain parcel of land located in Austin, Texas and legally described on Exhibit A-2 attached hereto (together with all improvements located therein, the “Parkway Project”), and (iii) that certain parcel of land located in Plymouth, Minnesota which is legally described on Exhibit A-3 attached hereto (together with all improvements located thereon, the “Nathan Project”).

(d) The Loan.

(i) Authorized Representative: Kevin A. Hoover

(ii) Base Rate: For each calendar month in the Loan term, the rate of interest per annum (rounded upwards, if necessary, to the nearest 1/100 of 1%) equal to the rate of interest per annum which is identified and normally published as the “One Month London Interbank Offered Rate” in the Money Rates page of the Market Data section of The Wall Street Journal online (http://online.wsj.com) (“LIBOR”) for the Business Day which is two Business Days prior to the first calendar day of such month. If The Wall Street Journal does not publish the LIBOR, or Lender determines in good faith that the rate published in the Money Rates section of The Wall Street Journal for a one month or thirty (30) day period does not accurately reflect the “London Interbank Offered Rate” available to Lender for a one month or thirty (30) day period, or if such rate no longer exists, Lender may select a replacement rate or replacement source, in its reasonable discretion.

(iii) Exit Fee: an exit fee equal to one percent (1%) of the outstanding Loan Amount.

Holdback: A portion of the Loan Amount equal to Ten Million and No/100ths ($10,000,000.00) retained by Lender for the costs and expenses incurred in

-2-

connection with certain Tenant Improvements and Leasing Commissions approved by Lender.

(iv) Initial Funding Amount: an amount equal to $19,000,000.

(v) Interest Rate: A rate equal to three and three-fourths percent (3.75%) plus the Base Rate, but in no event shall the Interest Rate be lower than seven and one-fourth percent (7.25%). Interest shall be calculated based on 360 day year and charged for the actual number of days elapsed.

(vi) Interest Reserve: A portion of the Loan Amount equal to One Million and No/100ths Dollars ($1,000,000.00).

(vii) Loan Amount: Thirty Million and No/100ths Dollars ($30,000,000.00).

(viii) Loan Application: That certain Loan Application accepted by Kevin A. Hoover on October 15, 2010.

(ix) Loan Fee: An amount equal to Three Hundred thousand and No/100ths Dollars ($300,000.00).

(x) Wells Manager: Wells Investment Management Company, LLC, a Georgia limited liability company.

(xi) Maturity Date: December 16, 2013, subject to acceleration pursuant to Section 8.2 or extension pursuant to Section 2.4. Borrowers have the right to extend the Maturity Date for two twelve (12) month periods on the terms and conditions set forth in Section 2.4.

(xii) Minimum Interest Recovery: The amount, if any, by which One Million Three Hundred Seventy-Seven Thousand Five Hundred and No/100ths Dollars ($1,377,500.00) exceeds the amount of interest actually paid by Borrowers to Lender prior to repayment of the Loan in full or acceleration of the Loan.

(xiii) Payment Commencement Date: The first day of February, 2011.

(e) Third Parties.

(i) Mortgage Broker: Holiday Fenoglio Fowler, L.P.

(ii) Property Manager: For the Commerce Project and Parkway Project, Wells Real Estate Services, LLC and for the Nathan Project, Piedmont Office Management LLC, and any successor manager of the Projects approved by Lender in writing pursuant to Section 4.1(c).

-3-

(iii) Leasing Broker: For the Commerce Project, Colliers Turley Martin Tucker, for the Nathan Project, CB Richard Ellis, Inc., and for the Parkway Project, Stream Realty Partners-Austin, L.P., and any successor leasing broker of the Projects approved by Lender in writing pursuant to Section 4.1(c).

(iv) Title Insurer: Fidelity National Title Insurance Company, or such other title insurance company licensed in the States of Texas, Tennessee and Minnesota, as may be approved in writing by Lender in Lender’s sole and absolute discretion.

1.2 Incorporation of Exhibits and Schedule.

Exhibits A through L, the Limited Joinder, Schedules I-V to this Agreement, attached hereto are incorporated in this Agreement and expressly made a part hereof by this reference.

1.3 Definitional Provisions.

All terms defined in Schedule I of this Agreement or otherwise in this Agreement shall, unless otherwise defined therein, have the same meanings when used in the Note, Security Instruments, any other Loan Documents, or any certificate or other document made or delivered pursuant hereto. The words “hereof”, “herein” and “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement. All article, section or subsection references when used in this Agreement shall, unless otherwise described, refer to the applicable article, section or subsection of this Agreement. The word “include(s)” when used in this Agreement and the other Loan Documents means “include(s), without limitation,” and the word “including” means “including, but not limited to.” Unless otherwise expressly modified in the Loan Documents, the term “days” refers to calendar days.

ARTICLE 2

LOAN AND LOAN DOCUMENTS

2.1 Conditions Precedent to Initial Funding.

(a) Borrowers agree that Lender’s obligation to close the Loan is conditioned upon Borrowers’ delivery, performance and satisfaction, as applicable, all in Lender’s sole and absolute discretion, of (i) all items set forth in the Loan Application, including Borrowers’ payment to Lender of the Loan Fee, (ii) this Agreement and the other Loan Documents, (iii) a legal opinion for the benefit of Lender and satisfactory to Lender issued by counsel for Borrowers and Guarantor in Illinois, Texas, Tennessee, Minnesota and Delaware, (iv) all other items on that certain Closing Checklist issued with respect to such Loan Application, and (v) such other documents, instruments or certificates as Lender and its counsel may require, including such documents as Lender deems necessary or appropriate to effectuate the terms and conditions of this Agreement and the other Loan Documents, and to comply with the Laws of the states of Illinois, Tennessee, Texas and Minnesota.

-4-

(b) The underwritten in-place net income for the Projects is equal to or greater than $1,478,000 at Closing, calculated by Lender based on a forward looking 12 month rent roll (assuming no rent abatement under the Wells Fargo Lease and otherwise adjusted by Lender in its discretion) and trailing 12 month operating expenses.

(c) Borrowers shall have provided Lender with copies of invoices, lien, waivers, applications for payments, cancelled checks and other evidence of payments reasonably requested by Lender related to costs of Tenant Improvements and Leasing Commissions for which Borrowers are reimbursed at Closing.

2.2 Disbursements.

(a) Initial Funding Amount. Subject to the terms, provisions and conditions of this Agreement and the other Loan Documents, on the Closing Date, Borrowers agree to borrow from Lender and Lender shall disburse to Borrowers from the proceeds of the Loan the Initial Funding Amount.

(b) Holdback and Interest Reserve. The Holdback shall be retained by Lender for the costs and expenses incurred in connection with the Tenant Improvements and Leasing Commissions. In addition, the Interest Reserve shall be retained by Lender and applied to the payment of monthly interest in accordance with the provisions of Section 2.5. Once the maximum stated amount for any category is disbursed, no further disbursements for that category will be made. The Holdback and Interest Reserve shall not bear interest until the funds are disbursed in accordance with the terms hereof.

(c) All Requests for Disbursement. At Lender’s option, disbursements shall be made by Lender to Borrowers, or directly to the architect, contractor, supplier, broker or other third party entitled to payment, or through an escrow pursuant to an agreement with the Title Insurer (for payments with respect to work or services for which any third party has a statutory right to file a lien against any Project which may be superior in priority to the lien of any Security Instrument). Any and all disbursements made in connection with hard costs for Tenant Improvements shall be subject to retainage of ten percent (10%) of the value of work performed, as reasonably determined by Lender. Holdback funds allocated to one category may not be reallocated to another category without Lender’s prior written consent. Absent a default hereunder or under any of the other Loan Documents, Lender shall make disbursements of portions of the Holdback subject to each of the following conditions (except to the extent waived in writing by Lender and any such condition waived by Lender as to any particular disbursement may be re-imposed as a condition of subsequent disbursements):

(i) All disbursements from the Holdback to be made pursuant to this Section 2.2 shall be made by Lender not more frequently than once during any calendar month pursuant to a single monthly disbursement request from Borrowers covering all amounts to be disbursed. Each monthly disbursement shall be in a minimum amount of $250,000 or, if less, the remaining undisbursed amount of the Holdback. At least 10 Business Days prior to the date of any such disbursement,

-5-

Borrowers shall provide Lender with a written request for payment, including a certification executed by Borrowers and acceptable to Lender as to the validity and accuracy of the information contained in such request in the form of the Disbursement Requisition attached hereto as Exhibit J, together with a completed and executed Owner’s Statement in the form attached hereto as Exhibit I, with copies of invoices, lien waivers, applications for payments, canceled checks, or other evidence of payment of amounts incurred and/or due and payable by Borrowers in connection with the Tenant Improvements and Leasing Commissions. It shall be a condition of the final disbursement with respect to any Tenant Improvements Project which includes disbursement of the retainage for such project, that Lender shall have received full and final waivers of lien from the general contractor and all subcontractors who have performed work on or supplied materials to such Tenant Improvements Project, and Lender shall have received an estoppel statement from the Tenant that the Tenant has accepted the Tenant Improvements without qualification.

(ii) Lender shall have approved, in its reasonable discretion, the Tenant Improvements, Leasing Commissions and with respect to each Tenant Improvements Project a schedule for completion of such Tenant Improvements Project (each, a “Tenant Improvements Completion Schedule”) and a construction budget (each, a “Tenant Improvements Budget”).

(iii) Lender’s Consultant shall have inspected and approved the portion of the Tenant Improvements Project completed.

(iv) Lender shall have received, at Borrowers’ expense, an endorsement to the Title Policies insuring the priority of the Security Instruments with respect to such disbursement and indicating that no intervening liens exist against the Projects.

(v) Such disbursement shall be utilized to pay the actual costs of the Tenant Improvements and Leasing Commissions as portions of the same are completed.

(vi) Borrowers shall have paid the Disbursement Processing Fee and, upon demand, any and all reasonable out-of-pocket fees due Lender and any and all costs incurred by Lender up to the date of such disbursement (and Borrowers hereby authorize Lender to increase the disbursement request by such amounts to effectuate payment to Lender via a disbursement of the Loan).

(vii) Lender shall have approved or deemed approved the applicable Lease (if required hereunder) to which the requested disbursement relates and such Lease shall be in full force and effect. If such disbursement is for Leasing Commissions and all or a portion of the Leasing Commissions is due upon occupancy, Lender shall have received an estoppel statement from the Tenant stating that Tenant has accepted possession and taken occupancy of the applicable Project.

-6-

(viii) The Project Yield must be equal to or greater than twelve percent (12.0%).

(ix) If, as a result of one or more Partial Releases, the sole remaining Project is the Commerce Project, the funds available for disbursement from the Holdback shall equal the lesser of (i) the funds then remaining in the Holdback and (ii) $4,000,000.

2.3 Interest.

Until (a) the occurrence of an Event of Default or (b) February 11, 2011 if the Borrowers have failed to deliver to Lender the fully executed IDB Recognition Agreements on or before February 10, 2011, the principal amount of the Loan outstanding from time to time shall bear interest at the Interest Rate. If an Event of Default exists or from and after February 11, 2011 if the fully executed IDB Recognition Agreements have not been received by Lender on or before February 10, 2011, interest shall accrue on the outstanding principal amount of the Loan at the Default Rate and all references to “Interest Rate” herein and in the other Loan Documents shall mean the Default Rate in either case. Notwithstanding the foregoing, if the fully executed IDB Recognition Agreements are received by Lender after February 10, 2011 and prior to the occurrence of an Event of Default hereunder, the interest rate payable on the principal amount of the Loan outstanding thereafter shall be the original Interest Rate and not the Default Rate.

2.4 Term of the Loan.

(a) Unless due and payable sooner pursuant to Section 2.5 or Article 8, all Indebtedness shall be due and payable in full on the Maturity Date, provided that Borrower shall have the right to extend the Maturity Date (each a “Extension Option”) for two additional 12-month terms (each 12 month period is hereinafter referred to as an “Extension Term”), thereby extending the Maturity Date to the last day of the applicable Extension Term.

(b) Borrower may only exercise an Extension Option upon satisfying the following conditions:

(i) Borrower shall have delivered to Lender written notice of such election no earlier than 120 days and no later than 90 days prior to the then current Maturity Date;

(ii) Such notice is accompanied by a non-refundable extension fee equal to $150,000;

(iii) Lender shall have received Borrowers’ and Guarantor’s most recent financial statements required pursuant to Article 3 and there must be no Material Adverse Change in any Borrower’s or Guarantor’s financial condition, as reflected in such financial statements;

-7-

(iv) The Capital Improvements have been Completed in accordance with all requirements of this Loan Agreement;

(v) No Default exists and no Event of Default previously occurred or exists under the Loan Documents;

(vi) For the first Extension Term Project Yield must be equal to or greater than 10.5%; and

(vii) For the first Extension Term, the Debt Service Coverage Ratio is not less than 1.45: 1.00; and

(viii) For the second Extension Term, the Project Yield must be equal to or greater than 11.0%; and

(ix) For the second Extension Term, the Debt Service Coverage Ratio is not less than 1.50: 1.00.

2.5 Monthly Payments.

Commencing on the Payment Commencement Date and continuing on the first day of each month thereafter, Borrowers shall pay to Lender a Monthly Net Cash Flow Payment which shall be applied toward payment of Accrued Interest for the previous month. In the event the Monthly Net Cash Flow Payment exceeds Accrued Interest, then such excess shall be retained by Borrowers. To the extent the Monthly Net Cash Flow Payment is less than Accrued Interest, absent a Default hereunder or under any of the other Loan Documents, funds remaining in the Interest Reserve, if any, shall be disbursed by Lender to pay such unpaid Accrued Interest. Upon each disbursement of funds from the Interest Reserve, such funds shall be added to principal outstanding on the Loan, shall bear interest at the Interest Rate and the Interest Reserve shall be concurrently reduced by the amount disbursed by Lender to pay such Accrued Interest. Commencing on the date upon which no undisbursed funds remain in the Interest Reserve, no further draws from the Interest Reserve shall be permitted. If the Interest Reserve is exhausted or an Event of Default has occurred and is continuing, Borrowers shall immediately commence making monthly payments of Accrued Interest from its own funds, whether or not the Monthly Net Cash Flow payment is sufficient therefor.

Borrowers shall pay Lender, in advance, on the date hereof, interest only on the outstanding principal balance of the Loan at the Interest Rate from the date hereof through and including the last day of the calendar month in which this Agreement is executed.

At Lender’s option, all monthly and quarterly (if any) payments due to Lender shall be paid to Lender by Automated Clearing House debit of immediately available funds from the financial institution account designated by Borrowers in the Automated Clearing House debit authorization executed by Borrowers in connection with this Agreement; and shall be effective upon receipt. Borrowers shall execute any and all forms and documentation

-8-

necessary from time to time to effectuate such automatic debiting. In no event shall any such payments be refunded to Borrowers.

2.6 Prepayments.

Except as expressly permitted pursuant to Section 2.10 herein in connection with a Partial Release, Borrowers shall have the right to make prepayments of the Loan, in full, but not in part, at any time provided Borrowers (i) give Lender at least five (5) days’ prior written notice, (ii) pay the Exit Fee due hereunder based upon the amount of the Loan prepaid at such time, and (iii) pay the Minimum Interest Recovery, if any. Any prepayment received hereunder shall be applied to the Indebtedness in the manner set forth in Section 2.9. All amounts applied to reduce the outstanding principal balance of the Loan shall result in a permanent principal reduction of the Loan and Borrower shall not have any right to reborrow any such amounts.

In the event Borrowers receive any payment or deposit proceeds with respect to a purchase contract, other agreement, or a Lease of the Project (other than rental payments and expense reimbursements) including lease termination, retention of deposits, cancellation or similar fees, such payment shall be deposited into the Guarantor Level Blocked Account and used by Borrowers exclusively for Eligible Expenses and the costs and expenses of Tenant Improvements, Leasing Commissions and other capital improvements actually incurred by Borrowers in connection with the Projects. Insurance Proceeds applied to the principal balance of the Loan in accordance with Article 7 herein, shall be applied partly in reduction of the principal balance of the Loan and partly to pay a portion of the Exit Fee in proportion to the amount of the principal reduction.

2.7 Exit Fee.

Upon any repayment of the Loan in full, whether on the Maturity Date or on any other date (including upon the acceleration of the Loan by Lender as provided herein), Borrowers will pay to Lender the Exit Fee, PLUS, the Minimum Interest Recovery. Upon any repayment of the Loan in part pursuant to a Partial Release expressly permitted under Section 2.10 herein or as otherwise expressly permitted hereunder, Borrowers will pay to Lender the Exit Fee in proportion to the amount being repaid, and upon final payment the Exit Fee due Lender shall be reduced by any amounts received by Lender and applied toward the Exit Fee as a result of any previous repayment. The Exit Fee and Minimum Interest Recovery shall be deemed earned upon the execution of this Agreement, and Borrowers hereby acknowledge and agree that the Exit Fee and Minimum Interest Recovery is each a bargained for consideration and a material inducement to Lender’s making the Loan and is not a penalty. No Exit Fee or Minimum Interest Recovery shall be due or payable in connection with the application by Lender of Insurance Proceeds to the Loan in accordance with Article 7 herein.

-9-

2.8 Late Charge.

If any payment of principal (other than the final payment of principal due at maturity, whether by acceleration or otherwise), interest due on the Loan, or any other amounts due hereunder or per the Note or the other Loan Documents is not timely received by Lender within five (5) days of the due date therefor, Borrowers, without notice or demand by Lender, promptly shall pay an amount equal to five percent (5%) of each delinquent payment (“Late Charge”).

2.9 Application of Payments and Blocked Accounts.

(a) Application of Payments. Except as otherwise provided in this Agreement, (i) provided that no Event of Default exists, payments made on the Loan will be applied, at Lender’s option, first to any Expenses or other costs Borrowers are obligated to pay under this Agreement or the other Loan Documents, second to interest due on the Note, third to the outstanding principal balance of the Note in the inverse order of maturity, fourth to the Minimum Interest Recovery payable to Lender, fifth to the Exit Fee payable to Lender and sixth to all other Indebtedness due under the Loan Documents, and (ii) so long as an Event of Default remains outstanding, payments made on the Loan shall be applied to the Indebtedness in such order, priority and manner as Lender may elect.

(b) Blocked Accounts:

(i) Borrowers will cause all Gross Revenues to be deposited to the Property Level Blocked Accounts and shall give irrevocable notices to tenants and other account debtors of Borrowers or the Projects to make all payments made by wire transfer, directly to the applicable Property Level Blocked Account or if by check to the applicable Lockbox.

(ii) At Closing, Borrower shall deposit into the Guarantor Level Blocked Account from the proceeds of the Initial Funding Amount the amount of $3,875,000 (the “Project Improvement Funds”), which funds shall be held and disbursed in accordance with the terms of this Agreement. Provided no Default or Event of Default has occurred and is continuing hereunder or under any of the other Loan Documents, Borrower may withdraw funds from the Guarantor Level Blocked Account for the sole purpose of paying or reimbursing Borrowers for the payment of costs and expenses of Tenant Improvements, Capital Improvements and Leasing Commissions actually incurred by Borrowers. The Project Improvement Funds shall be allocated as follows: (i) $634,250 for Capital Improvements, (ii) $431,792 for the costs and expenses of Tenant Improvements and Leasing Commissions actually incurred by Borrower prior to the Closing Date and (iii) $2,808,958 for Tenant Improvements and Leasing Commissions in connection with Leases and/or Lease renewals entered into by any of the Borrowers following the Closing Date, capital improvements deemed necessary by Borrowers to lease the Projects or working capital costs and expenses in connection with the operation of the Projects . Funds allocated to one category may not be reallocated to another category without Lender’s

-10-

prior written consent. Either prior to or promptly after disbursing any Project Improvement Funds from the Guarantor Level Blocked Account, Borrowers shall provide Lender with copies of invoices, lien waivers, applications for payments, cancelled checks, or other evidence of payment of amounts incurred and/or due and payable by Borrowers in connection with any such disbursement. Project Improvement Funds shall be only be disbursed in accordance with this Section 2.9(b)(ii) and any failure to comply with the terms hereof shall constitute an immediate Event of Default under this Agreement.

2.10 Project Partial Prepayments, Partial Releases.

Borrowers shall have the right to obtain a release (a “Partial Release”) of Lender’s liens against a Project in connection with a partial prepayment of the Loan provided that each of the following conditions are satisfied: (a) the partial prepayment is in an amount equal to or greater than the sum of the Release Price for such Project or such lesser amount as Lender agrees to accept as a partial prepayment, in its sole and absolute discretion (which Release Price payable hereunder shall not exceed the then outstanding principal balance of the Loan), plus that portion of the Exit Fee payable under Section 2.6 in connection therewith, (b) no Default under the Loan Documents has occurred and is then continuing, (c) at least one of the Projects will remain as collateral for Borrowers’ obligations under the Loan Documents, (d) Project Yield for the Project(s) remaining as collateral will be equal to or greater than twelve percent (12%), and (e) such release Project is refinanced with or sold, in an arms-length transaction, to an unrelated third party who or which is not an Affiliate of any Borrower, Guarantor or Wells Manager. Upon any such permitted prepayment and the satisfaction of the conditions set forth in this Section 2.10 Lender will release its liens encumbering such Project and, except for all obligations accruing prior to such prepayment and those obligations which under the terms hereof or under any other Loan Document would otherwise expressly survive the repayment of the Loan, such Project and the Borrower owning such Project shall be released and shall no longer be subject to the Loan Documents.

ARTICLE 3

FINANCIAL REPORTING COVENANTS

3.1 Financial Information Reporting.

(a) Monthly Information. Within 15 days following the end of each calendar month, Borrowers shall deliver to Lender: (i) monthly unaudited operating statements for the Projects, showing actual sources and uses of cash during such month, (ii) a current rent roll (including monthly delinquency reports and a monthly schedule of delinquency receipts and payments), (iii) a summary of all leasing activity then taking place with respect to the Projects, particularly describing the status of all pending non-residential lease negotiations, if any, (iv) for any period in which Borrowers are obligated to pay Lender all or a portion of Net Cash Flow (or at other times as requested by Lender), a Net Cash Flow Statement for such month, and (v) monthly bank statements for the Projects in the aggregate, including for the Property Level Blocked Accounts and the Guarantor Level Blocked Account.

-11-

(b) Quarterly Information. Within 45 days following the end of each calendar quarter, Borrowers shall deliver to Lender quarterly unaudited financial statements (including a balance sheet, an income statement and a statement of cash flows) of Borrowers.

(c) Annual Information. Within 45 days following the end of each fiscal year, Borrowers shall deliver to Lender the Projects’ updated annual operating budgets for the following fiscal year. Within 90 days following the end of each fiscal year, Borrowers shall deliver to Lender its annual unaudited financial statements (including, balance sheet, an income statement and a statement of cash flows). Borrowers shall further cause each Guarantor to deliver the annual guarantor information set forth in Section 3.1(d).

(d) Guarantor Information. Unless otherwise requested more frequently by Lender, within 60 days after each calendar quarter, Borrowers shall cause each Guarantor to deliver to Lender its quarterly financial statements showing all contingent liabilities of such Guarantor (including a balance sheet, an income statement and a statement of cash flows showing results for both the quarter and year to date) and within 120 days after its fiscal year, its annual audited financial statements).

(e) Promptly upon their becoming available and to the extent not otherwise readily publicly available, Borrower shall cause Guarantor to deliver copies of all regular and periodic reports and all registration statements and prospectuses, if any, filed by Guarantor with any securities exchange or with the Securities and Exchange Commission or any governmental or private regulatory authority.

3.2 Other Information; Financial Information Form and Examination.

In addition to the foregoing required information, Borrowers shall provide to Lender any Other Information as Lender may from time to time reasonably request relating to the Borrowers, Guarantor or the Projects. Except as otherwise specified herein or agreed to in writing by Lender, all financial statements to be provided to Lender shall be prepared in accordance with sound accounting practices applied on a consistent basis, fairly presenting the financial condition as of the date indicated, and shall be certified as true, complete and correct by the party who has prepared such information. Lender may request that either Borrowers’ or Guarantor’s annual financial statement be audited by an independent certified public accountant reasonably acceptable to Lender, at Borrowers’ sole cost and expense, at any time after an Event of Default has occurred or after Lender asserts any claim under the Limited Joinder attached hereto. Borrowers shall during regular business hours upon reasonable notice (except during the existence of an Event of Default) permit or cause to permit Lender or any of Lender’s representatives (including an independent firm of certified public accountants) to have access to and examine all books and records of Borrowers and Guarantor. Unless otherwise approved by Lender in writing, all books and records will be located at Borrowers’ or Guarantor’s, as applicable, primary place of business.

-12-

ARTICLE 4

OPERATIONAL AND OTHER COVENANTS

4.1 Leasing and Operational Covenants.

(a) Leasing Restrictions. Without the prior written consent of Lender, Borrowers shall not (i) enter into any leases, (ii) modify the form of lease previously approved by Lender, (iii) modify, amend or terminate any Lease, (iv) accept any rental payment more than 30 days in advance of its due date or (v) enter into any ground lease of the Project. Borrowers shall provide Lender not less than 10 Business Days to review any proposed leases and any proposed modifications or amendments to any Lease. All Leases must contain an automatic attornment provision whereby in the event of a foreclosure, the tenant automatically shall recognize the successor owner as landlord and such tenant shall have no right to terminate its Lease in the event of such foreclosure. If Borrowers enter into any new Lease or any modification or renewal of any existing Lease, at Lender’s request, Borrowers shall cause the Tenant thereunder to execute a subordination, non-disturbance and attornment agreement in form and substance reasonably satisfactory to Lender. Borrowers shall provide Lender with a copy of the fully executed original of all Leases promptly following their execution. Within 10 Business Days after written request from Borrower, Lender shall execute and deliver a subordination, non-disturbance and attornment agreement substantially in the form reasonably approved by Lender (with such modifications thereto requested by the tenant as may be reasonably acceptable to Lender) to any tenant under any Lease and shall negotiate in good faith the terms of such subordination, non-disturbance and attornment agreements with proposed tenants under proposed Leases (or existing tenants under proposed extensions or renewals of existing Leases).

Notwithstanding the foregoing, so long as no Event of Default exists Borrowers may, without Lender’s prior written consent, enter into any Lease for 10,000 net rentable square feet of space or less in any Project so long as: (A) such Lease is on the form previously approved by Lender without material modifications; (B) the term of such Lease is at least five (5) years; (C) the rent for such Lease is not less than 95% of the market rent and the rent for any renewal option is not less than 95% of the market rent at the time of renewal; (D) the tenant improvement costs and leasing commissions relating to such Lease to be paid by Borrowers are “market” and otherwise comparable to improvements and commissions for other tenants engaged in a similar business; and (E) the aggregate rentable square feet leased pursuant to all Leases entered into without Lender’s consent pursuant to this sentence during the term of the Loan at any Project does not exceed, in the aggregate, 15% of the net rentable square feet at any such Project.

If Lender fails to approve or disapprove any matter for which Borrowers have requested consent or approval pursuant to this Section 4.1(a) within seven (7) Business Days after Lender’s receipt of Borrowers’ written request therefor, Borrowers shall send a second written request for consent to Lender which the first page thereof states, in bold type and all capital letters:

-13-

“YOUR FAILURE TO RESPOND TO THIS SECOND REQUEST WITHIN FIVE (5) BUSINESS DAYS OF YOUR RECEIPT HEREOF SHALL BE DEEMED, PURSUANT TO THE TERMS OF THE LOAN AGREEMENT BETWEEN YOU AND THE UNDERSIGNED, TO BE YOUR GRANTING OF CONSENT FOR THE MATTER FOR WHICH CONSENT WAS REQUESTED.”

Lender’s failure to respond to such second request within such five (5) Business Day period shall be deemed Lender’s approval of the matter for which approval was requested pursuant to this Section 4.1.(a).

(b) Defaults Under Leases. Borrowers will not suffer or permit (i) any breach or default to occur in any of Borrowers’ or landlord’s obligations under any of the Leases, or (ii) any Lease termination by reason of any failure of any Borrower or landlord to meet any requirement of any Lease, including those with respect to any time limitation within which any of Borrowers’ work is to be done or the space is to be available for occupancy by the lessee. Borrowers shall notify Lender in writing in the event a Tenant commits a material default under a Lease, promptly after any Borrower becomes aware of any such material default.

(c) Project Management/Leasing. Borrowers shall not change the Property Manager or Leasing Broker or enter into, terminate or cancel any management or leasing contracts, or modify or amend any existing management or leasing contract to increase the fees or other obligations thereunder, without the prior written approval of Lender, which approval shall not be unreasonably withheld, conditioned or delayed.

(d) Furnishing Notices. Borrowers shall provide Lender with copies of all material notices pertaining to any Borrower, Guarantor or Wells Manager or any Project received by any Borrower from any Tenant, Guarantor, Wells Manager, Governmental Authority or insurance company within seven (7) days after such notice is received, but with respect to Wells Manager and Guarantor, only to extent such notice relates to the Project. In addition, Borrowers shall promptly provide Lender with written notice of any litigation, arbitration, or other proceeding or governmental investigation pending or, to any Borrower’s or Guarantor’s knowledge, threatened against any Borrower, or Guarantor or Wells Manager relating to any Project. Notwithstanding the foregoing, Borrowers shall not be obligated to provide Lender with such written notice in respect of uninsured personal injury litigation against any Borrower or any Project if the amount claimed is less than $100,000.00, as long as the maximum liability under such cases is covered in its entirety by liability insurance maintained by Borrowers and the insurance carrier has not refused the tender of defense or coverage.

(e) Alterations. Without the prior written consent of Lender, Borrowers shall not make any material alterations to any Project, except for tenant improvements required by the terms of Leases approved or deemed approved by Lender or for which no approval is required.

-14-

(f) Cash Distributions. Borrowers shall not make any distributions to its partners, members or shareholders while the Loan is outstanding, except that so long as no Default or Event of Default exists and all payments then owing to Lender have been paid, Borrowers may, distribute monthly Excess Cash Flow.

(g) Reserved.

(h) Compliance With Laws. Borrowers shall comply with all applicable Laws and requirements of any Governmental Authority having jurisdiction over Borrowers or the Projects including all building, zoning, density, land use, covenants, conditions and restrictions, and subdivision requirements (including parcel maps and environmental impact and other environmental requirements), whether now existing or later to be enacted and whether foreseen or unforeseen.

(i) Use of Projects. Unless required by applicable Law, Borrowers shall not, without Lender’s prior written consent, permit changes in the use of the Projects from that of the time this Agreement was executed other than as consistent with such provisions set forth in Section 2.2. Without Lender’s prior written consent, Borrowers shall not (i) initiate or acquiesce in a change in the plat of subdivision, or zoning classification or use of the Projects, or (ii) grant any encumbrances or easements burdening the Projects, except such encumbrances or easements that do not adversely affect the current or anticipated use of the Projects.

(j) No Commingling of Funds. Borrowers shall not commingle the funds related to the Projects with funds from any other property.

(k) Maintenance and Preservation of the Projects. Borrowers shall keep the Projects in good condition and repair (normal wear and tear excepted) and if all or part of any Project becomes damaged or destroyed, Borrowers shall promptly and completely repair and/or restore such Project in a good and workmanlike manner in accordance with sound building practices. Borrowers shall not commit or allow waste or permit impairment or deterioration of the Projects. Borrowers shall not abandon the Projects.

(l) Construction. Each Tenant Improvements Project shall be Completed in substantial accordance with the Tenant Improvements Construction Documents and in compliance with all applicable Laws, regulations, ordinances, codes, permits, licenses, declarations, covenants, or restrictions of record or other agreements relating to the Projects or any part thereof.

(m) Completion. Borrowers shall cause Completion of construction of the Capital Improvements in accordance with the terms of this Agreement and the timeframes set forth in Schedule III. “Complete” or “Completed” or “Completion” means one hundred percent (100%) completion of the Capital Improvements and/or Tenant Improvements, in a good and workmanlike manner and in compliance with all applicable Laws and private restrictions included in the Permitted Exceptions, and with respect to each Tenant Improvements Projects in substantial accordance with Tenant Improvement Construction

-15-

Documents, in all cases free and clear of all liens, claims, encumbrances and rights of others (other than those created by liens for taxes and assessments that are not delinquent and those liens which Borrowers are contesting in accordance with the terms of this Agreement), as evidenced by the issuance of certificates of completion by Lender or its consultant and a final certificate of occupancy and as applicable, acceptance of completion by the applicable Tenant.

(n) Replacement Reserve. In addition to any other construction, renovation and maintenance requirements set forth in this Agreement, commencing with the first Loan Year, Borrowers shall expend at least $0.20 per square foot of net rentable space (exclusive of Insurance Proceeds and proceeds from the Holdback) on maintenance of the Projects. To the extent Borrowers do not provide evidence, reasonably satisfactory to Lender, that Borrowers have spent such sum on an annual basis, Borrowers shall deposit with Lender such amount not spent. Lender shall hold such sum in reserve (the “Replacement Reserve”) for Borrowers’ use to fund future maintenance expenses incurred by Borrowers in any Loan Year after Borrowers have spent in the aggregate at least $0.20 per square foot of net rentable space on maintenance of the Projects during the then current Loan Year. Such amounts shall be disbursed from the Replacement Reserve upon satisfaction of the same conditions applicable to the Holdback (other than obtaining a date down endorsement to the Title Policies). Borrowers hereby grant Lender a first priority security interest in the Replacement Reserve, all funds contained therein and all products and proceeds thereof and all such funds are pledged as additional collateral for the Loan and Borrowers shall execute any other documents and take any other actions necessary to provide Lender with such a perfected security interest in such funds. Upon the Maturity Date or at any time following an Event of Default, the moneys then remaining in the Replacement Reserve shall, at Lender’s option, be applied against the Indebtedness. All sums held in the Replacement Reserve may be commingled with other borrower reserves held by Lender and shall not be deemed to be held in trust for the benefit of Borrowers. The Replacement Reserve shall be maintained at a financial institution designated by Lender from time to time, in its sole and absolute discretion (so long as such institution’s deposits are insured by the Federal Deposit Insurance Corporation), and shall be under the sole dominion and control of Lender, and Borrowers shall have no right to control or direct the investment of funds therein. Sums held by Lender in the Replacement Reserve shall accrue interest at rates determined by Lender to be equivalent to any interest received by Lender on its own general funds, and any interest accruing and paid on such amounts shall be deemed to be part of the Replacement Reserve and absent an Event of Default hereunder, shall be applied in accordance with this Section 4.1(n).

4.2 Other Borrower Covenants.

Borrowers further covenant and agree as follows:

(a) Loan Closing. If the conditions precedent to the closing of the Loan are not complied with as of the Closing Date, Lender may terminate Lender’s obligation to fund the Loan by written notice to Borrowers.

-16-

(b) Prohibition of Assignments and Transfers by Borrowers.

(i) Generally. Borrowers shall not assign or attempt to assign its rights under this Agreement or any of the other Loan Documents or the Loan or delegate or attempt to delegate any of its duties or obligations under this Agreement or any of the other Loan Documents or the Loan and any purported assignment or delegation shall be void. Without the prior written consent of Lender, which consent may be withheld in Lender’s sole and absolute discretion, Borrowers shall not suffer or permit any Transfer. In addition, Wells Manager (in its capacity as sole Manager of Guarantor the sole member of each Borrower), shall at all times Control the day-to-day management and operation of Borrowers’ business and all material business decisions (including a sale or refinance) for Borrowers until the Indebtedness is repaid in full. Notwithstanding any provision of this Agreement or the other Loan Documents to the contrary, the issuance, conveyance, sale, assignment, transfer, pledge, encumbrance or other disposition of any direct or indirect interest in the Guarantor shall be permitted without any consent, notice (unless expressly provided below), fees or costs and shall not constitute a Default or Event of Default hereunder; provided that:

(A) no such Transfer shall be to a Blocked Person or would result in the breach by Borrowers of this Loan Agreement or the other Loan Documents, and following such Transfer, Wells Manager shall continue to Control the day-to-day management and operation of Borrowers’ business and all material business decisions (including a sale or refinance) for Borrowers, and

(B) in the event that any such Transfer results in any Person, together with any other Person Controlling, Controlled by or Under Common Control with such Person, owning or encumbering more than 20% of the direct or indirect interests in Guarantor:

(1) Borrowers shall give Lender at least thirty (30) days prior written notice of such Transfer, and

(2) Lender shall have the right to conduct its customary background and internal compliance checks as to such Person or Persons.

(ii) Transfers Prohibited by ERISA. In addition to the prohibitions set forth in Section 4.2(b)(i), above, Borrowers shall not engage in or permit a Transfer that would constitute or result in the occurrence of one or more non-exempt prohibited transactions under ERISA or the Internal Revenue Code. Borrowers agree to unwind any such Transfer upon notice from Lender or, at Lender’s option, to assist Lender in obtaining such prohibited transaction exemption(s) from the Employee Benefits Security Administration with respect to such Transfer as are necessary to remedy such prohibited transactions. In addition to its general obligation to

-17-

indemnify Lender under Section 4.2(l), Borrowers shall reimburse Lender for any Expenses incurred by Lender to obtain any such prohibited transaction exemptions. Borrowers’ obligations under this Section 4.2(b)(ii) shall survive the expiration or termination of the Loan Documents, Borrowers shall not engage in any transaction which would cause any obligation, or action taken or to be taken, hereunder (or the exercise by Lender of any of its rights under any of the Loan Documents) to be a non-exempt (under a statutory or administrative class exemption) prohibited transaction under ERISA. Borrowers further covenant and agree to deliver to Lender such certifications or other evidence from time to time throughout the term of the Loan Documents, as reasonably requested by Lender, that (i) Borrowers are not an “employee benefit plan” as defined in Section 3(3) of ERISA, which is subject to Title I of ERISA, or a “governmental plan” within the meaning of Section 3(32) of ERISA; (ii) Borrowers are not subject to Federal or state statutes regulating investments and fiduciary obligations with respect to governmental plans; and (iii) one or more of the following circumstances is true:

(1) Equity interests in Borrowers are publicly offered securities within the meaning of 29 C.F.R. Section 2510.3-101(b)(2);

(2) Less than 25 percent of each outstanding class of equity interests in Borrowers are held by “benefit plan investors” within the meaning of 29 C.F.R. Section 2510.3-101(f)(2); or

(3) Each Borrower qualifies as an “operating company” within the meaning of 29 C.F.R. Section 2510.3-101 or an investment company registered under the Investment Company Act of 1940.

Borrowers shall indemnify Lender and defend and hold Lender harmless from and against all civil penalties, excise taxes, or other loss, cost damage and expense (including, without limitation, reasonable attorneys’ fees and disbursements and costs incurred in the investigation, defense and settlement of claims and losses incurred in correcting any prohibited transaction or in the sale of a prohibited loan, and in obtaining any individual prohibited transaction exemption under ERISA that may be required, in Lender’s reasonable discretion) that Lender may incur, directly or indirectly, as a result of a Default under this Section 4.2(b)(ii). This indemnity shall survive any termination of the Loan Documents or, satisfaction or foreclosure of the Security Instruments.

(c) Mechanics’ Liens and Contest Thereof. Borrowers will not suffer or permit any mechanics’ lien claims to be filed or otherwise asserted against the Projects and will promptly discharge the same in case of the filing of any claims for lien or proceedings for the enforcement thereof, provided, however, that Borrowers shall have the right to contest in good faith and with reasonable diligence the validity of any such lien or claim provided that Borrowers notify Lender of their desire to do so in writing and, within 20 days of the earlier of written notice by Borrowers to Lender of the existence of such lien or written notice by Lender to Borrowers of the existence of the lien, either (i) post a statutory lien bond

-18-

that removes such lien from title to the applicable Project, (ii) provide a letter of credit (in a form reasonably acceptable to Lender) or cash deposit in an amount sufficient to pay one hundred twenty-five percent (125%) of such lien claim or other security reasonably satisfactory to Lender to protect Lender’s interest and security should the contest be unsuccessful or (iii) cause such lien claim to be fully insured to the reasonable satisfaction of Lender by the Title Company that issued the Title Policy. Lender will not be required to make any further disbursements of the proceeds of the Loan until either (i) such mechanic’s lien claim has been completely removed, bonded over, insured or as to which a letter of credit or cash sufficient to pay one hundred twenty-five percent (125%) of such claim has been deposited with Lender or, (ii) at Borrowers’ sole option, Borrower elects to restrict disbursements from the Holdback to amounts in excess of one hundred twenty-five percent (125%) of such lien claim (or all such lien claims being contested for which Borrowers have elected to proceed under this Section 4.2(c)). In the event Borrowers shall fail to discharge any such lien or prosecute such contest as set forth above, or such lien is not otherwise fully reserved for or bonded over as set forth above, Lender may, at its election in its sole and absolute discretion, cause such lien to be satisfied and released or otherwise provide security to the Title Insurer to indemnify over such lien. Any amounts so expended by Lender, including premiums paid or security furnished in connection with the issuance of any surety company bonds, shall be deemed to constitute disbursement of the proceeds of the Loan hereunder owing to Lender by Borrowers. In settling, compromising or discharging any claims for lien, Lender shall not be required to inquire into the validity or amount of any such claim.

(d) Maintenance of Insurance. Borrowers shall not bring or keep any article on the Projects or cause or allow any condition to exist if that could invalidate or would be prohibited by any insurance coverage required to be maintained by Borrowers on the Projects. When any insurance policies expire, Borrowers shall furnish to Lender any additional and renewal insurance policies (along with evidence of the prepaid premiums) or certificates thereof acceptable to Lender, satisfying the Minimum Insurance Requirements. Unless Borrowers provide Lender with appropriate evidence of the insurance coverage required by this Agreement, Lender may purchase insurance at Borrowers’ expense to protect Lender’s interests in the Projects and to maintain the insurance required by this Agreement. Prior to purchasing any such insurance, Lender will use its good faith efforts to provide notice to Borrowers of its intention to do so, provided, however, that Lender’s failure to provide such notice shall not affect Borrowers’ responsibility for the expense of such insurance purchased by Lender. This insurance may, but need not, protect Borrowers’ interests. The coverage purchased by Lender may not pay any claim made by any Borrower or any claim that is made against any Borrower in connection with the Projects or any required insurance policy. Borrowers may later cancel any insurance purchased by Lender, but only after providing Lender with appropriate evidence that Borrowers have obtained insurance as required by this Agreement. If Lender purchases insurance for the Projects or insurance otherwise required by this Agreement, Borrowers will be responsible for the costs of that insurance and other charges reasonably imposed by Lender in connection with the placement of the insurance until the effective date of the cancellation or expiration of the insurance. The costs of the insurance may be added to the Indebtedness effective as of the

-19-

date Lender purchases such insurance and such costs may be more than the cost of insurance Borrowers are able to obtain on their own. The effective date of coverage may be the date the prior coverage lapsed or the date on which Borrowers failed to provide Lender proof of coverage.

(e) Payment of Insurance. Borrowers shall timely pay all premiums on all insurance policies to assure that at all times Borrowers have in effect insurance as required pursuant to the Minimum Insurance Requirements attached hereto as Exhibit E. In order to effectuate the timely payment of all premiums, Borrowers shall pay to Lender, at the time of and in addition to the monthly installments of principal and/or interest due under the Note, a sum equal to 1/12 of the amount estimated by Lender to be sufficient to enable Lender to pay at least 60 days before they become due and payable, all insurance premiums relating to Borrowers and the Projects as determined by Lender (the “Insurance Escrow”). Notwithstanding the foregoing to the contrary, so long as (i) Lender has provided written approval of the blanket insurance policy covering the Projects, including with respect to carrier and coverage (and such coverage shall comply in all respects with the form of insurance required by the Minimum Insurance Requirements), (ii) the protection afforded Borrowers under any blanket insurance approved hereunder shall be no less than that which would have been afforded under a separate policy or policies relating to the Projects, (iii) such carrier has agreed to provide Lender with written notice of cancellation of such policy 30 days prior thereto, (iv) Borrowers at all times during the term of the Loan provide evidence of timely payment of all insurance premiums in respect of such policy prior to the due date thereof, and (v) no Event of Default exists hereunder, Borrowers’ obligation to impound funds in the Insurance Escrow pursuant to this Section 4.2(e) shall be suspended.

(f) Payment of Taxes. Borrowers shall pay all real estate taxes and assessments and charges of every kind upon the Projects (the “Property Taxes”) before the same become delinquent, and, unless Lender has paid such taxes directly on Borrowers’ behalf, furnish to Lender evidence that the Property Taxes are paid at least five (5) Business Days prior to the last date for payment of such taxes and before imposition of any penalty or accrual of interest. In order to effectuate the timely payment of all Property Taxes, Borrowers shall pay to Lender, at the time of and in addition to the monthly installments of principal and/or interest due under the Note, a sum equal to 1/12 of the amount estimated by Lender to be sufficient to enable Lender to pay at least 60 days before they become due and payable, all Property Taxes as determined by Lender (the “Property Tax Escrow”). Borrowers shall have the right to pay Property Taxes under protest or to otherwise contest any such tax or assessment, but only if (i) such contest has the effect of preventing the collection of such taxes so contested and also of preventing the sale or forfeiture of the Projects or any part thereof or any interest therein, (ii) Borrowers have notified Lender of Borrowers’ intent to contest such taxes, and (iii) if the Property Tax Escrow is determined to be insufficient to pay such Property Taxes which are being protested, Borrowers have deposited security in form and amount reasonably satisfactory to Lender, which shall be added to the Property Tax Escrow. If Borrowers fail to commence such contest or, having commenced to contest the same, shall thereafter fail to prosecute such contest in good faith or with due diligence (as determined by Lender), or, upon adverse conclusion of any such contest, shall fail to pay

-20-

such Property Taxes, Lender shall apply the sums held in the Property Tax Escrow to pay such Property Taxes, and if such sums are insufficient, Lender may, at its election (but shall not be required to), pay and discharge any such Property Taxes and any interest or penalty thereon, and any amounts so expended by Lender shall be deemed to constitute disbursements of the Loan proceeds hereunder (even if the total amount of disbursements would exceed the face amount of the Note).

(g) Property Tax Escrow and Insurance Escrow. So long as no Event of Default exists hereunder and provided that Borrowers shall have delivered to Lender a copy of the insurance premium bill or Property Tax bill, as the case may be, and the Insurance Escrow or Property Tax Escrow is sufficient for the purpose of paying such insurance premium or Property Tax, respectively, then Lender shall apply the sums in the Insurance Escrow to pay such insurance premiums and the sums in the Property Tax Escrow to pay such Property Taxes. If the amount held in the applicable escrow with Lender is insufficient to fully pay such amounts, Borrowers shall, within the earlier of (i) 10 days following notice at any time from Lender or (ii) five (5) days prior to when such payment is due, remit such additional sum as may be required for the full payment of such insurance premiums or Property Taxes, and if Borrowers fail to do so, Lender may disburse such amounts from the Loan (even if the total amount of disbursements would exceed the face amount of the Note). All sums reserved or held in the Property Tax Escrow and the Insurance Escrow may be commingled with the general funds of Lender, and shall not be deemed to be held in trust for the benefit of Borrowers. The Property Tax Escrow and Insurance Escrow shall be maintained at a financial institution designated by Lender from time to time in its sole and absolute discretion (so long as such institution’s deposits are insured by the Federal Deposit Insurance Corporation). Borrowers hereby grant Lender a first priority security interest in funds held in the Property Tax Escrow and the Insurance Escrow, including all interest accruing thereon, and all such funds are pledged as additional collateral for the Loan and Borrowers shall execute any other documents and take any other actions necessary to provide Lender with such a perfected security interest in such funds. Sums held by Lender in the Property Tax Escrow and Insurance Escrow shall accrue interest at rates determined by Lender to be equivalent to any interest received by Lender on its own general funds, and any interest accruing and paid on such amounts shall be deemed to be part of the Property Tax Escrow or Insurance Escrow, as applicable, and absent an Event of Default hereunder, shall be applied in accordance with this Section 4.2(g). Upon the Maturity Date or at any time following an Event of Default, the moneys then remaining in escrow with Lender or its agent shall, at Lender’s option, be applied against the Indebtedness. The obligation of Borrowers to pay Property Taxes and insurance premiums is not affected or modified by the provisions of this paragraph.

(h) Personal Property. All of Borrowers’ personal property, fixtures, attachments and equipment delivered upon, attached to, used or required to be used in connection with the operation of the Projects (collectively, the “Personal Property”) shall always be located at the Projects and shall be kept free and clear of all liens, encumbrances and security interests. Borrowers shall not (nor shall it knowingly permit any Tenant to), without the prior written consent of Lender, sell, assign, transfer, encumber, remove or

-21-

permit to be removed from the Projects any of the Personal Property. So long as no Event of Default has occurred and is continuing, Borrowers may sell or otherwise dispose of the Personal Property when obsolete, worn out, inadequate, unserviceable or unnecessary for use in the operation of the Projects, but, if material to the operation of the Projects, only upon replacing the same with other Personal Property at least equal in value and utility to the Personal Property that is disposed.

(i) Appraisals. Lender shall have the right to obtain a new or updated Appraisal of the Projects from time to time, and Borrowers shall cooperate with Lender in this regard. The Borrowers shall pay for any such Appraisal if (a) an Event of Default exists, (b) the Appraisal is the first Appraisal obtained by Lender during any Loan Year (except for the first Loan Year), or (c) if the Appraisal is obtained to comply with any Laws or regulatory requests, or Lender policy promulgated to comply therewith.

(j) Loss of Note or other Loan Documents. Upon notice from Lender of the loss, theft, or destruction of the Note and upon receipt of an affidavit of lost note and an indemnity reasonably satisfactory to Borrowers from Lender, or in the case of mutilation of the Note, upon surrender of the mutilated Note, Borrowers shall make and deliver a new note of like tenor in lieu of the then to be superseded Note. If any of the other Loan Documents were lost or mutilated, Borrowers agree to execute and deliver replacement Loan Documents in the same form of such Loan Document(s) that were lost or mutilated.

(k) Publicity. With the prior written approval of Guarantor, which shall not be unreasonably withheld, delayed or denied, Lender may publicize the making of the Loan and, in such publicity, may include a brief description of the Projects and the Loan, including the amounts and the identities of the parties involved.

(l) Indemnification. Borrowers shall indemnify Lender, including each party owning an interest in the Loan and their respective successors, assigns, officers, directors, employees and consultants (each, an “Indemnified Party”) and defend and hold each Indemnified Party harmless from and against all claims, suits, actions, losses, injuries, damages, liabilities, criminal and civil penalties, excise taxes, costs and Expenses (including attorneys fees and costs) of any and every kind to any Persons or property by reason of or in any way related to or arising out of (i) the operation or maintenance of the Projects; (ii) any claims made by any third party against Lender in any manner relating to or arising out of any breach of representation or warranty, Default or Event of Default under any of the Loan Documents; (iii) any Indemnified Party’s response to a subpoena or involvement in discovery, litigation, or similar matters that would not have occurred but for the Loan; (iv) any and all claims for brokerage, leasing, finders or similar fees which may be made relating to the Projects, the Loan, the Indebtedness or the Loan Documents, or (v) any claims made by any third party against Lender in any manner relating to or arising out of any other matter arising in connection with the Loan, any Borrower, Guarantor, any Environmental Indemnitor, any Lease, any Tenant, any Project or any Person claiming by or through any of the foregoing which may be asserted against, imposed on or incurred by an Indemnified Party in connection with the Indebtedness, the Loan, the Loan Documents, the Projects or any portion of any of the foregoing or the exercise by an Indemnified Party of rights or

-22-

remedies granted to it under the Loan Documents or applicable Law. Notwithstanding the immediately preceding sentence, no Indemnified Party shall be entitled to be indemnified against the gross negligence or willful misconduct of any Indemnified Party. Upon written request by an Indemnified Party, Borrowers will undertake, at their own costs and expense, on behalf of such Indemnified Party, using counsel reasonably satisfactory to the Indemnified Party, the defense of any legal action or proceeding whether or not such Indemnified Party shall be a party and for which such Indemnified Party is entitled to be indemnified pursuant to this Section 4.2(l). At Lender’s option, Lender may, at Borrowers’ expense, prosecute or defend any action involving the priority, validity or enforceability of any of the Loan Documents.

If any Indemnified Party is made a party defendant to any litigation or any claim is threatened or brought against any Indemnified Party concerning the Indebtedness, the Loan Documents, the Projects or any part thereof, or any interest therein, or the construction, maintenance, operation or occupancy or use thereof, then Borrowers shall indemnify, defend and hold the Indemnified Parties harmless from and against all liability by reason of said litigation or claims, including attorneys’ fees and expenses incurred by the Indemnified Parties in any such litigation or claim, whether or not any such litigation or claim is prosecuted to judgment. If Lender commences an action against Borrowers to enforce any of the terms hereof or to prosecute any breach by Borrowers of any of the terms hereof or to recover any sum secured hereby, Borrowers shall pay to Lender its reasonable attorneys’ fees and expenses. The right to such attorneys’ fees and expenses shall be deemed to have accrued on the commencement of such action, and shall be enforceable whether or not such action is prosecuted to judgment. If Borrowers breach any term of the Loan Documents, Lender may engage the services of an attorney or attorneys to protect its rights hereunder, and in the event of such engagement following any breach by Borrowers, Borrowers shall pay Lender reasonable attorneys’ fees and expenses incurred by Lender, whether or not an action is actually commenced against Borrowers by reason of such breach. All references to “attorneys” in this Subsection and elsewhere in the Loan Documents shall include, without limitation, any attorney or law firm engaged by Lender and Lender’s in-house counsel, and all references to “fees and expenses” in this Subsection and elsewhere in the Loan Documents shall include, without limitation, any fees of such attorney or law firm, any appellate counsel fees, if applicable, and any allocation charges and allocation costs of Lender’s in-house counsel.

A waiver of subrogation shall be obtained by Borrowers from its insurance carrier and, consequently, Borrowers waive any and all right to claim or recover against Lender, its officers, employees, agents and representatives, for loss of or damage to Borrowers, the Projects, Borrowers’ property or the property of others under Borrowers’ control from any cause insured against or required to be insured against by the provisions of the Loan Documents.

The indemnification obligations hereunder shall survive the repayment of the Loan and any foreclosure, deed-in-lieu or transfer in lieu of foreclosure or similar proceeding or any transfer of title to the Projects or any portion thereof or a transfer of the ownership interest in Borrowers.

-23-

(m) Reserved.

(n) Reserved.

(o) Single Purpose Entity. Each Borrower at all times shall remain a Single Purpose Entity until after the Indebtedness has been repaid in full. Specifically, Borrowers represent, warrant and covenant as follows:

(i) Each Borrower has not and will not:

(A) engage in any business or activity other than the ownership, leasing, operation and maintenance, financing and sale of the Project owned by each such Borrower, and activities incidental thereto;

(B) acquire or own any assets other than (i) the applicable Project owned by such Borrower, and (ii) such incidental Personal Property as may be necessary for the operation of the Projects;

(C) merge into or consolidate with any Person, or dissolve, terminate, liquidate in whole or in part, transfer or otherwise dispose of all or substantially all of its assets (except in accordance with Section 2.10 herein) or change its legal structure;

(D) fail to observe all organizational formalities, or fail to preserve its existence as an entity duly organized, validly existing and in good standing (if applicable) under the applicable Laws of the jurisdiction of its organization or formation, or terminate or fail to comply with the provisions of its organizational documents or modify or amend any provision of its organizational documents relating to its status as a Single Purpose Entity without the prior written consent of Lender;

(E) own any subsidiary, or make any investment in, any Person;

(F) commingle its assets with the assets of any other Person, or permit any Affiliate or constituent party independent access to its bank accounts;

(G) incur any debt, secured or unsecured, direct or contingent (including guaranteeing any obligation), other than (i) the Indebtedness, (ii) trade and operational indebtedness incurred in the ordinary course of business with trade creditors, provided such indebtedness is (1) unsecured, (2) not evidenced by a note, (3) on commercially reasonable terms and conditions, and (4) unless being contested in good faith, not more than sixty (60) days past due, and/or (iii) financing leases and purchase money indebtedness incurred in the ordinary course of business relating to Personal Property on commercially reasonable terms and conditions; provided,

-24-

however, the aggregate amount of the indebtedness of the Borrowers, described in (ii) and (iii) shall not exceed at any time three percent (3%) of the outstanding principal amount of the Note and, provided, further, that for purposes of this subsection (G)(x) tenant improvement, construction allowance or similar obligations of Borrower under Leases shall not be considered “debt” or “trade and operational indebtedness” and (y) the satisfaction of the requirements of this subsection (G) shall not require any holder of any direct or indirect interest in Borrower to make additional capital contributions;

(H) fail to maintain its records, books of account, bank accounts, financial statements, accounting records and other entity documents separate and apart from those of any other Person; except that Borrower’ financial position, assets, liabilities, net worth and operating results may be included in the consolidated financial statements of an Affiliate, provided that such consolidated financial statements contain a footnote indicating that Borrowers are a separate legal entity and that it maintains separate books and records;