Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cooper-Standard Holdings Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - Cooper-Standard Holdings Inc. | dex991.htm |

Cooper Standard

Fourth

Quarter

and

Full

Year

Earnings

Call

March 21, 2011

Exhibit 99.2 |

cooperstandard

Introduction & Agenda

•

Introduction:

Glenn

Dong,

Treasurer

•

Executive

Overview:

Jim

McElya,

CEO

•

Business

Highlights:

Keith

Stephenson,

COO

•

Financial

Review

&

2011

Guidance:

Allen

Campbell,

CFO

•

Questions & Answers

2 |

cooperstandard

Safe Harbor

3

In addition to historical information, certain statements contained herein are

forward-looking statements within the meaning of federal securities

laws, and Cooper Standard Automotive (Cooper Standard) intends that such

forward-looking statements be subject to the safe-harbor created thereby.

These forward-looking statements include statements concerning the

company’s plans, objectives, goals, strategies, future events, future

revenue or performance, capital expenditures, financing needs, plans or

intentions

relating

to

acquisitions,

business

trends,

the

impact

of

“fresh-start”

accounting,

the

impact

of

the

company’s

bankruptcy

on

its

future

performance

and

other

information

that

is

not

historical

information.

When

used

herein,

the

words

“estimates,”

“expects,”

“anticipates,”

“projects,”

“plans,”

“intends,”

“believes,”

“forecasts,”

or

future

or

conditional

verbs,

such

as

“will,”

“should,”

“could,”

or

“may,”

and

variations

of

such

words or similar expressions are intended to identify forward-looking

statements. All forward-looking statements, including, without

limitation, management’s examination of historical operating trends and data,

are based upon Cooper Standard’s current expectations and various

assumptions. Cooper Standard’s expectations, beliefs and projections

are expressed in good faith and Cooper Standard believes there is a

reasonable basis for them. However, no assurances can be made that these

expectations, beliefs and projections will be achieved. Forward-looking

statements are not guarantees of future performance and are subject to

significant risks and uncertainties that may cause actual results or achievements to be materially

different from the future results or achievements expressed or implied by the

forward-looking statements. |

Safe

Harbor 4

This presentation includes forward-looking statements, reflecting current

analysis and expectations, based on what are believed to be reasonable

assumptions. Forward-looking statements may involve known and unknown

risks, uncertainties and other factors, which may cause the actual results to

differ materially from those projected, stated

or

implied,

depending

on

many

factors,

including,

without

limitation: the inability to compare the company’s

financial condition or results historically due to fresh start accounting; the

company’s emergence from bankruptcy will reduce or eliminate certain

tax benefits; the company’s emergence from bankruptcy may adversely effect its

operations going forward; the company’s dependence on the automotive industry;

the company’s dependence on certain major customers; the company's

ability to generate cash to service its indebtedness and dividend

obligations

of

preferred

shares;

availability

and

cost

of

raw

materials;

the uncertainty of the company’s ability to

meet significant increases in demand; competition in the industry; sovereign and

other risks related to the company conducting operations outside the United

States; the uncertainty of the company’s ability to achieve expected

cost reduction savings; the company’s exposure to product liability and warranty claims; labor

conditions;

escalating

pricing

pressures

from

our

customers;

the

company’s

ability

to

meet

customers’

needs for

new

and

improved

products

in

a

timely

manner;

potential

conflicts

of

interests

between

certain

shareholders

and

the company; the company’s legal rights to its intellectual property

portfolio; the company’s underfunded pension plans; the actual return

on pension assets, environmental and other regulations; the possibility that the company’s

acquisition

strategy

will

not

be

successful;

and

the

possibility

of impairment charges relating to goodwill and long-

lived assets. There may be other factors that may cause the company’s actual

results to differ materially from the forward-looking statement.

Accordingly, there can be no assurance that Cooper Standard will meet future results,

performance or achievements expressed or implied by such forward-looking

statements. This paragraph is included to provide a safe harbor for

forward-looking statements, which are not generally required to be publicly

revised as circumstances change and which Cooper Standard does not intend to

update. There may be other factors that may cause the company’s actual

results to differ materially from the forward- looking statements. Cooper

Standard undertakes no obligation to update or revise forward-looking statements to

reflect events or circumstances that arise after the date made or to reflect the

occurrence of unanticipated events. cooperstandard

|

Jim

McElya Chairman & CEO

Executive Overview

4Q & Full Year 2010 |

Executive Overview

•

Innovative, global solutions provider for broad and

diverse customer base

•

Advantageous business model, proven record of

profitable operating performance

•

Five lanes for revenue growth

–

Industry recovery

–

Emerging markets

–

Global platforms

–

Green technology trends

–

Opportunistic acquisitions

•

Strong balance sheet

6

Ready to Thrive in the New Competitive Landscape

and Drive Shareholder Value

cooperstandard |

Executive Overview: Year and Quarter Review

•

2010:

–

Solid financial performance

–

Increased gross profit margin

–

Annual Gross business awards of $613 million*

–

Strong cash flow

–

Strong balance sheet

•

4

th

Quarter:

–

Strong adjusted EBITDA margin run-rate

–

43% of total 2010 launch

7

* Based on currently estimated production volumes for the future

periods pertaining to the

awards; includes new, replacement and conquest business.

cooperstandard |

8

Executive Overview: Industry Conditions

•

Capacity and raw materials concerns

•

Suppliers adding back growth-related costs

•

Continued growth in emerging markets

•

Increased demand for new technology

•

Industry consolidation creating opportunities, as

global automotive production improves

cooperstandard |

Five

Lanes for Revenue Growth •

Industry recovery

•

Emerging markets

•

Global

platforms

•

Green technology trends

•

Opportunistic acquisitions |

2011

Priorities •

Continue expansion in Asia & South America

•

Aggressively pursue business on global platforms

•

Leverage global alliance with Nishikawa

•

Successfully launch new technologies

•

Manage raw material costs and supply

cooperstandard

10 |

Business

Highlights 4Q & Full Year 2010

Keith Stephenson

Chief Operating Officer |

cooperstandard

12

Business Highlights 4

th

Quarter 2010

•

Solid revenue growth in all regions

•

Recognized by customers for quality excellence

•

Q4 launched $183 million in annualized sales,

across multiple product lines

•

Launched new generation of pump technology to

support introduction of electric vehicles

•

Continued focus on operational excellence |

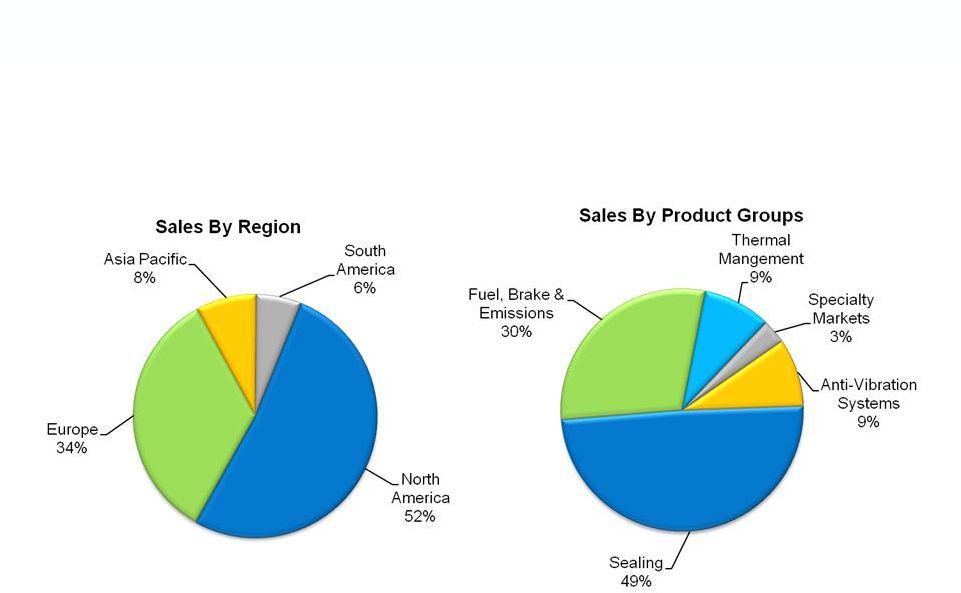

Sales

By Region & Product Groups Full Year 2010 = $2.4 Billion

Note: Inclusion of JV sales would increase Asia Pacific share to

15%

cooperstandard

13 |

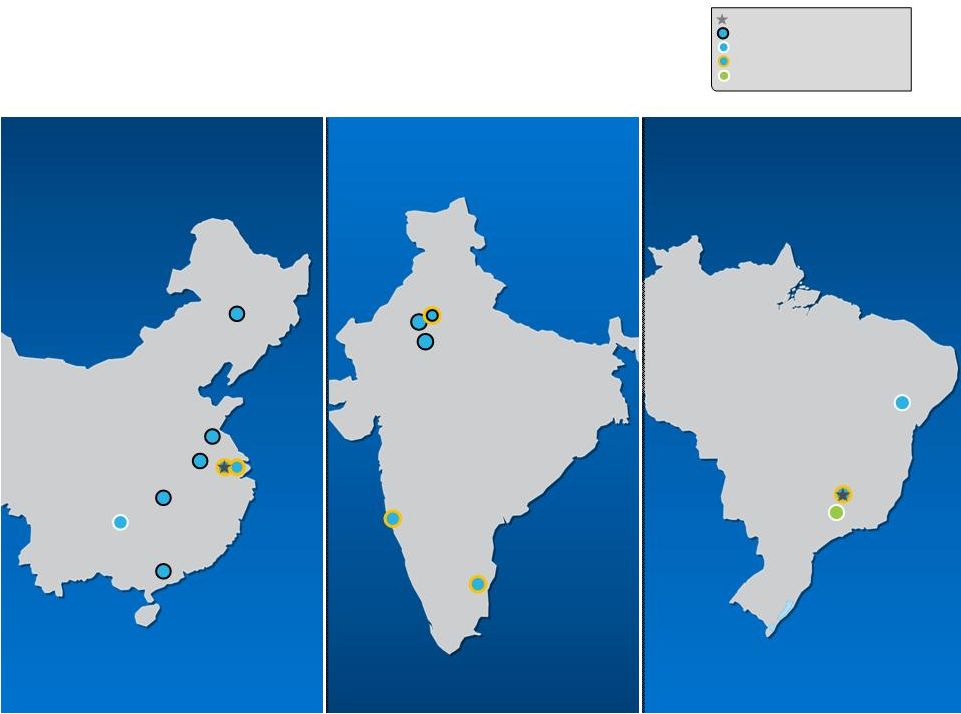

Headquarters

Joint Venture Operation

Manufacturing

Manufacturing / Technical Center

Sales / Manufacturing

Presence in Emerging Markets

Huayan

Kunshan

Panyu

Shanghai

Wuhu

Changchun

Chongqing

Jingzhou

Varginha

Camaçari

São Bernardo

Dharuhera

Manesar

Chennai

Pune

Sahibabad

Brazil

Brazil

China

China

India

India |

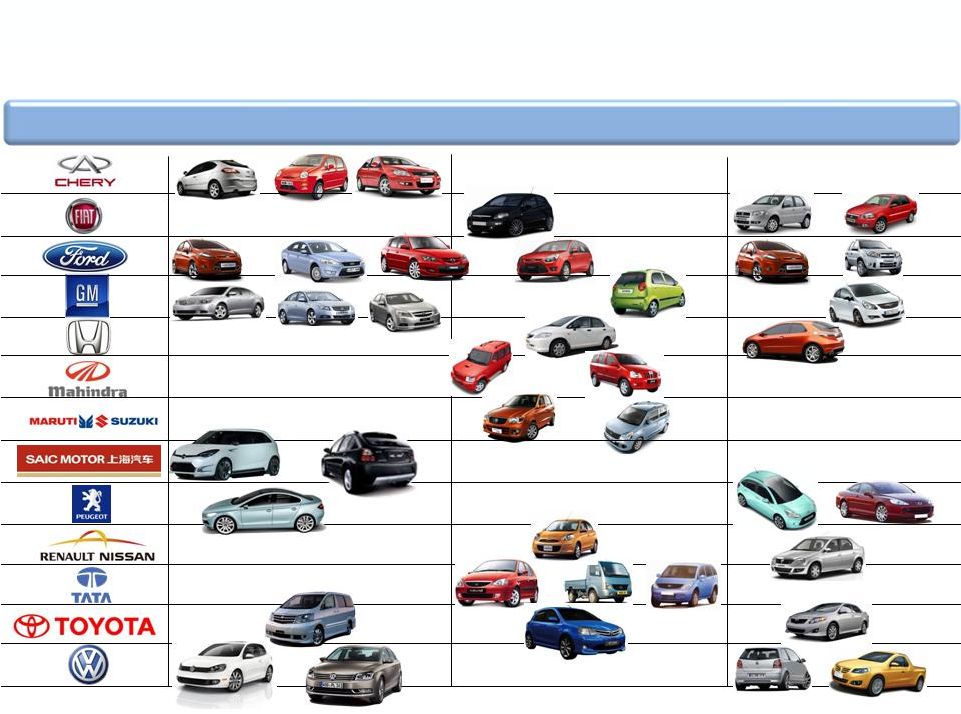

2011

Emerging Markets Vehicle Launches 15

QQ3

A3

M-11

Fiesta

Mondeo

Mazda 3

Golf

Palio

Siena

Fiesta

EcoSport

Corsa

Civic

C-3

C-4

Logan

Polo

Saveiro

Corolla

Indigo

March

Figo

Scorpio

Xylo

Wagon

R

Alto

City

Punto

Spark

Etios

LaCrosse

Lacetti

Epica

China

India

Brazil

Automaker

Ace

Indicruz

408

MG3

S100

Passat

MPV

cooperstandard |

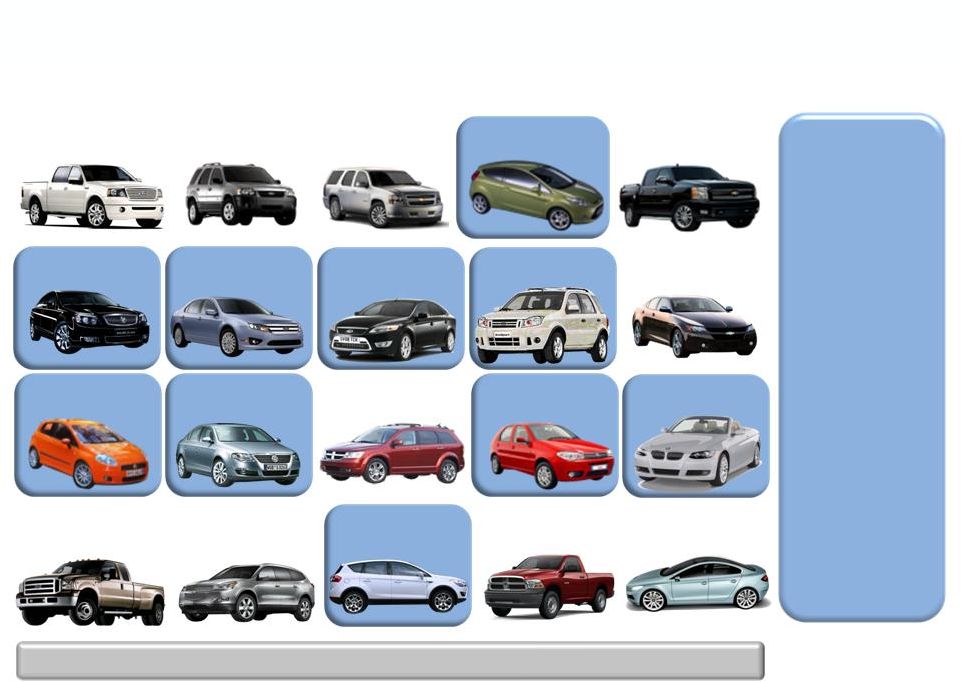

Cooper Standard’s Top 20 Platforms 4Q 2010

16

#5 GM

Silverado/Sierra

#2 Ford

Tribute/Escape

#20 Peugeot

308/408

#1 Ford

F-150

#7 Ford

Fusion / Edge

#9 Ford

Ecosport/Fiesta

#13 Chrysler

Journey

#8 Ford

Mondeo/Freelander/

V50/V70

#14 Fiat

Palio/Strada/Doblo

#3 GM

Tahoe/Yukon/

Escalade

#4 Ford

Fiesta/Fusion

#10 GM

Impala

#6 GM

Lacrosse/Insignia

#11 Fiat

Linea/Punto

#12 VW -Audi

Passat/Beduin

#19 Chrysler / Nissan

Ram / Titan

#15 BMW

3-Series

#18 Ford

Focus/Kuga/Axela

#17 GM

Chevy Traverse /

Acadia / Enclave

#16 Ford

F-Series Super Duty

Cooper

Standard

products are

consistently

on the top

selling

global

platforms

Broad customer mix across multiple vehicle segments

cooperstandard |

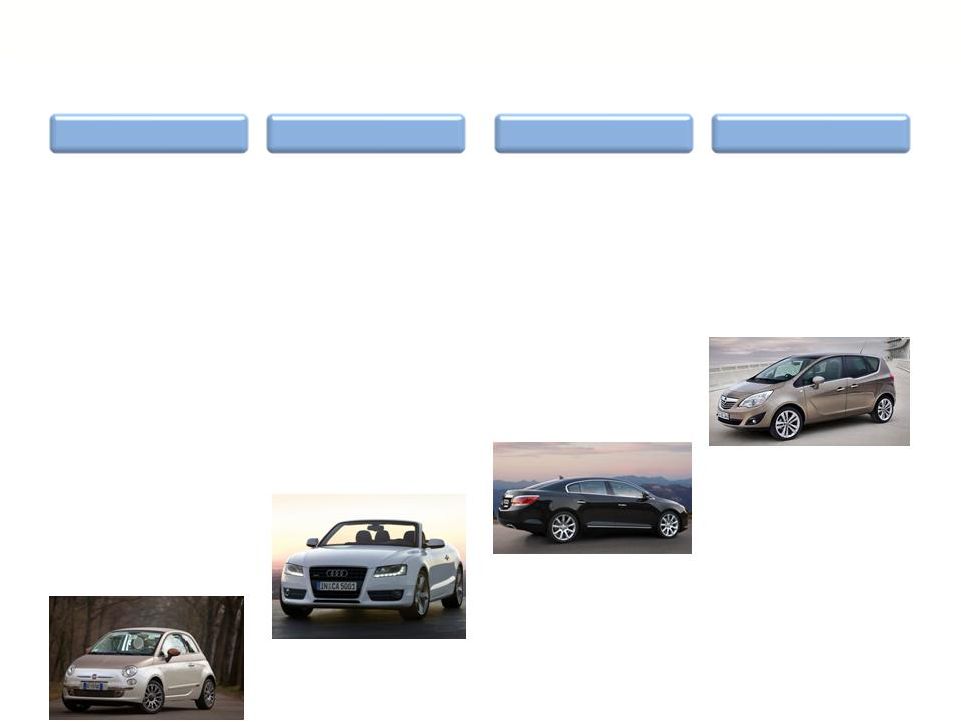

Vehicle Launches 4Q 2010

North America

Europe

Asia Pacific

South America

–

Chrysler 300

Thermal

Management

–

Fiat 500

Sealing, Thermal

Management

–

Ford Explorer

Sealing; Liftgate

Obstacle Detection

System; Fuel, Brake

& Emissions;

Thermal

Management

–

Ford Eco-Engine

Thermal

Management

–

Nissan Leaf

Thermal

Management

–

Audi A6

Sealing

–

Daimler

Mercedes SLK

Sealing

–

Ford Focus

Sealing

–

Volvo S60/C70

Fuel, Brake &

Emissions

–

GM

Celta/Prisma

Sealing

–

GM Meriva

Sealing

–

GM Alpheon

(LaCrosse)

Sealing, Fuel, Brake

& Emissions

–

Tata Indicruz

Sealing

–

Toyota Etios

Sealing

–

VW Passat

Sealing

Audi A6

GM Alpheon/LaCrosse

GM Meriva

Fiat 500

cooperstandard

17 |

Advanced Products for Emerging Trends

Bright Trim Sealing

Direct Injection

Fuel Rails

Exhaust Gas

Recirculation (EGR)

Module

Coolant Pump

Thermal Management

Key customer benefits:

•

Increases fuel economy

•

Lighter weight

•

Increased efficiency

•

Optimizes coolant flow

Opportunity:

•

Increasing need for

cooling as engines

become smaller and

more complex

•

Increase content vs.

current auxiliary pump

Fuel, Brake & Emissions

Key customer benefits:

•

Increases fuel economy

through improved burn

•

Reduced emissions

Opportunity:

•

Increased global

adoption of direct

injection engines

•

Proprietary design &

engineering

•

Few competitors

Fuel, Brake & Emissions

Key customer benefits:

•

Reduce emissions

•

Improves fuel economy

•

Integrated solution,

reduced footprint

Opportunity:

•

Increasing need due to

regulation

•

Increasing adoption of

diesel

•

Few competitors offer

integrated solution

Sealing

Key customer benefits:

•

Functionally integrates

sealing and trim

•

Multiple innovative options

(stainless, aluminum, film)

•

Ease of assembly

Opportunity:

•

Consumer preference

•

Ability to integrate into

modules

cooperstandard

18 |

Focus

on Operational Excellence •

Disciplined approach to restructuring and Lean

–

Target annual cost savings 4% of sales

•

Manufacturing design and process expertise

–

Won 2 Honda Brazil awards in 4Q

•

Disciplined model for acquisition integration

cooperstandard

19 |

Financial Overview

4Q & Full Year 2010

Allen Campbell

Chief Financial Officer

Due to Cooper Standard’s adoption of fresh start reporting on May 31, 2010, in

some of its financial reports, the company’s

financial

information

for

periods

ended

on

or

prior

to

May

31,

2010

is

described

as

relating

to

Predecessor

periods, and financial information for periods ended after May 31, 2010 is

described as relating to Successor periods. For purposes of this financial

overview, the company is presenting financial information for Predecessor and

Successor periods on a combined basis so that results of operations for the three

and nine months ended September 30, 2010 can be more readily compared with

the corresponding periods in the prior year. The company believes that

presenting this financial information on a combined basis provides management and

investors with a more meaningful perspective on ongoing financial and

operational performance and trends. For a presentation of results of

operations and other financial information on an uncombined basis, please refer to

Cooper Standard’s Quarterly Report

on

Form

10-Q

for

the

quarter

ended

September

30,

2010,

which

was

filed

with

the

SEC

on

November

12,

2010. |

4Q

and Full Year 2010 Performance $ Millions

Q4 2009

Q4 2010

Net Sales

$577.6

$603.7

Operating Profit (Loss)

$ 37.2

$ 25.7

Gross Profit

$ 91.1

$ 96.8

FY 2009

FY 2010

$1,945.3

$2,414.1

$ (344.1)

$ 142.2

$ 266.3

$ 409.6

Net Income (Loss)

$ 37.4

$ 14.8

$ (356.1)

$ 676.9

Adjusted EBITDA

$ 61.7

$ 176.5

$ 276.5

$ 70.8

% Margin

10.2%

9.1%

12.3%

11.5%

SGA

$ 53.3

$ 67.9

$ 199.6

$ 251.7

cooperstandard

21 |

EBITDA and Adjusted EBITDA Reconciliation

22

$ USD Millions

2009

2010

Net Income (Loss)

$(356.1)

$ 676.9

Provision for income tax expense (benefit)

(55.7)

EBITDA

$(233.7)

$ 893.8

Restructuring

32.4

6.4

Adjusted EBITDA

$ 176.5

$ 276.5

45.0

12 Months Ended December 31st

Net Interest expense

64.3

69.5

Depreciation and amortization

113.8

102.4

Bond repurchase

(9.1)

Foreign exchange (gains)/losses

(4.0)

--

17.1

EDITDA and Adjusted EBITDA are Non-GAAP measures. Reference comments on slide

26 Reorganization / Fresh Start/ Impairment

(660.0)

Inventory write-up

--

8.1

EBITDA excl. Reorg & Impairment

233.8

147.2

380.9

Reorganization related fees

7.7

0.4

Other

0.9

(1.7)

Right sizing of German facilities

--

5.8

Stock based compensation

1.4

6.6

cooperstandard |

Cash

Flow 4Q 2010 Cash Balance as of September 30

232.3

$

Cash generated

62.2

Cash Balance as of December 31

294.5

$

($ in Millions)

Q4 - 2010

Cash from Operations

37.9

$

Changes in operating assets & liabilities

52.4

Cash from Operations

90.3

$

Capital Expenditures

(30.9)

Cash from Operations less CAPEX

59.4

$

Proceeds from sale of fixed assets

2.5

Financing Activities

(1.6)

Foreign Exchange/Other

1.9

Net Cash Generated in Q4

62.2

$

cooperstandard

23 |

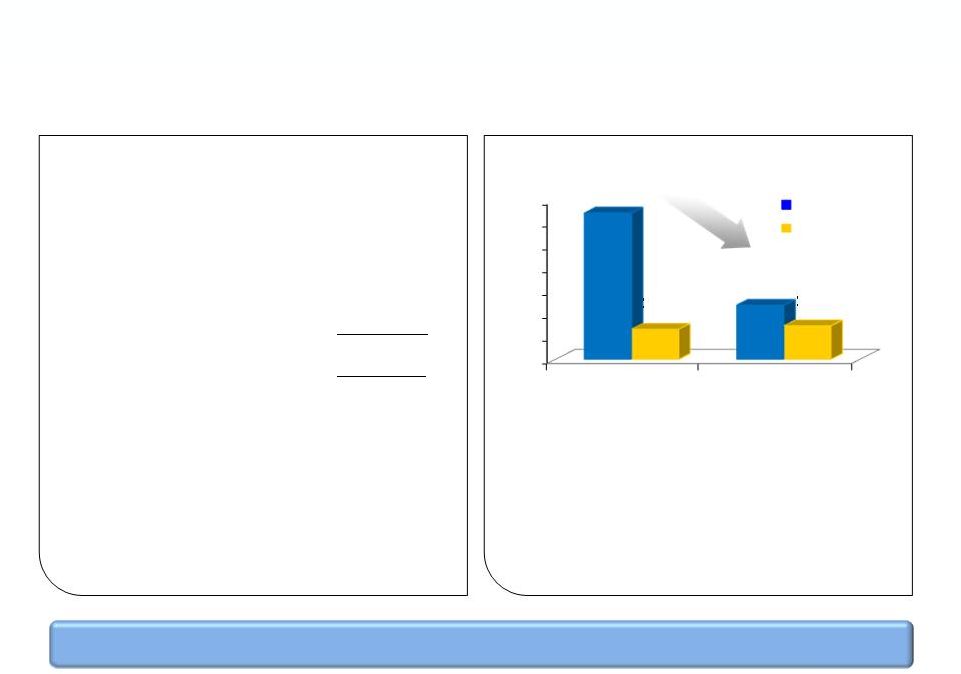

Liquidity as of December 31, 2010

Cash on Balance Sheet

$294.5M

ABL Revolver

125.0M

Letters of Credit

(33.2)M

Total Liquidity

$386.3 M

Flexible capital structure allows for future growth opportunities

•

27% increase in cash from the prior

quarter

•

ABL Revolver undrawn

•

Net leverage = $182 million

•

Net leverage ratio = 0.7x

•

No major debt maturity until 2018

cooperstandard

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

$1,291

Q1-10

Q4-10

Debt

Cash

$265

$477

$295

24 |

2011

Guidance* •

Sales: $2.5 billion -

$2.6 billion

•

Capital expenditures: $90 million -

$100 million

•

Cash restructuring: $10 million -

$20 million

•

Cash taxes: $25 million -

$30 million

*

Guidance is based on IHS December North American production of 12.9

million, and Europe (including Russia) production of 18.6 million.

cooperstandard

25 |

Non-GAAP Financial Measures

26

EBITDA and adjusted EBITDA are measures not recognized under Generally

Accepted Accounting Principles (GAAP) which exclude certain non-cash and

non- recurring items.

When analyzing the company’s operating performance, investors should use

EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net

income (loss), operating income, or any other performance measure derived in

accordance with GAAP, or as an alternative to cash flow from operating

activities as a measure of the company’s performance. EBITDA and

adjusted EBITDA have limitations as analytical

tools

and

should

not

be

considered

in

isolation

or

as

substitutes for

analysis of the company’s results of operations as reported under GAAP. Other

companies may report EBITDA and adjusted EBITDA differently and therefore

Cooper Standard’s results may not be comparable to other similarly

titled measures of other companies.

cooperstandard |

Questions & Answers |

2011

Summary •

Continue expansion in Asia & South America

•

Aggressively pursue business on global platforms

•

Leverage global alliance with Nishikawa

•

Successfully launch new technologies

•

Manage raw material costs and supply

28

Ready to Thrive in the New Competitive Landscape

and Drive Shareholder Value

cooperstandard |

Appendix |

cooperstandard

30

Three Months Ended

December 31, 2010

Net income

14.8

$

Provision for income tax benefit

(0.3)

Interest expense, net of interest income

10.8

Depreciation and amortization

29.8

EBITDA

55.1

$

Restructuring

(1)

(0.7)

Stock-based compensation

(2)

2.8

Severance

(3)

5.8

Other

(1.3)

Adjusted EBITDA

61.7

$

(1)

Includes non-cash restructuring.

(2)

Non-cash stock amortization expense and non-cash stock option expense.

(3)

Severance costs associated with the right sizing of our German facilities.

4

th

Quarter 2010 Adjusted EBITDA |