Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Rhino Resource Partners LP | a2202596zex-31_2.htm |

| EX-99.1 - EX-99.1 - Rhino Resource Partners LP | a2202596zex-99_1.htm |

| EX-31.1 - EX-31.1 - Rhino Resource Partners LP | a2202596zex-31_1.htm |

| EX-32.1 - EX-32.1 - Rhino Resource Partners LP | a2202596zex-32_1.htm |

| EX-21.1 - EX-21.1 - Rhino Resource Partners LP | a2202596zex-21_1.htm |

| EX-32.2 - EX-32.2 - Rhino Resource Partners LP | a2202596zex-32_2.htm |

| EX-10.25 - EX-10.25 - Rhino Resource Partners LP | a2202596zex-10_25.htm |

| EX-23.1 - EX-23.1 - Rhino Resource Partners LP | a2202596zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 001-34892

Rhino Resource Partners LP

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

27-2377517 (I.R.S. Employer Identification No.) |

|

424 Lewis Hargett Circle, Suite 250 Lexington, KY (Address of principal executive offices) |

40503 (Zip Code) |

Registrant's telephone number, including area code: (859) 389-6500

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Units representing Limited Partner Interests | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2010, the last business day of the registrant's most recently completed second fiscal quarter, the registrant's equity was not listed on any domestic exchange or over-the-counter market. The registrant's common units began trading on the New York Stock Exchange on September 30, 2010. As of March 14, 2011, the registrant had 12,406,760 common units and 12,397,000 subordinated units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Documents incorporated by reference in this report are listed in the Exhibit Index of this Form 10-K

i

ash: Inorganic material consisting of iron, alumina, sodium and other incombustible matter that are contained in coal. The composition of the ash can affect the burning characteristics of coal.

assigned reserves: Proven and probable reserves that have the permits and infrastructure necessary for mining.

as received: Represents an analysis of a sample as received at a laboratory.

Btu: British thermal unit, or Btu, is the amount of heat required to raise the temperature of one pound of water one degree Fahrenheit.

Central Appalachia: Coal producing area in eastern Kentucky, Virginia and southern West Virginia.

coal seam: Coal deposits occur in layers typically separated by layers of rock. Each layer is called a "seam." A seam can vary in thickness from inches to a hundred feet or more.

coke: A hard, dry carbon substance produced by heating coal to a very high temperature in the absence of air. Coke is used in the manufacture of iron and steel.

EIA: Energy Information Administration.

fossil fuel: A hydrocarbon such as coal, petroleum or natural gas that may be used as a fuel.

GAAP: Generally accepted accounting principles in the United States.

high-vol metallurgical coal: Metallurgical coal that has a volatility content of 32% or greater of its total weight.

Illinois Basin: Coal producing area in Illinois, Indiana and western Kentucky.

limestone: A rock predominantly composed of the mineral calcite (calcium carbonate (CaCO3)).

lignite: The lowest rank of coal. It is brownish-black with a high moisture content commonly above 35% by weight and heating value commonly less than 8,000 Btu.

low-vol metallurgical coal: Metallurgical coal that has a volatility content of 17% to 22% of its total weight.

mid-vol metallurgical coal: Metallurgical coal that has a volatility content of 23% to 31% of its total weight.

metallurgical coal: The various grades of coal suitable for carbonization to make coke for steel manufacture. Its quality depends on four important criteria: volatility, which affects coke yield; the level of impurities including sulfur and ash, which affects coke quality; composition, which affects coke strength; and basic characteristics, which affect coke oven safety. Metallurgical coal typically has a particularly high Btu but low ash and sulfur content.

non-reserve coal deposits: Non-reserve coal deposits are coal-bearing bodies that have been sufficiently sampled and analyzed in trenches, outcrops, drilling and underground workings to assume continuity between sample points, and therefore warrants further exploration stage work. However, this coal does not qualify as a commercially viable coal reserve as prescribed by standards of the SEC until a final comprehensive evaluation based on unit cost per ton, recoverability and other material factors concludes legal and economic feasibility. Non-reserve coal deposits may be classified as such by either limited property control or geologic limitations, or both.

ii

non-reserve limestone deposits: Similar to non-reserve coal deposits, non-reserve limestone deposits are limestone-bearing bodies that have been sufficiently sampled and analyzed in trenches, outcrops, drilling, and underground workings to assume continuity between sample points, and therefore warrants further exploration stage work. However, this limestone does not qualify as a commercially viable limestone reserve as prescribed by standards of the SEC until a final comprehensive evaluation based on unit cost per ton, recoverability, and other material factors concludes legal and economic feasibility. Non-reserve limestone deposits may be classified as such by either limited property control or geologic limitations, or both.

Northern Appalachia: Coal producing area in Maryland, Ohio, Pennsylvania and northern West Virginia.

overburden: Layers of earth and rock covering a coal seam. In surface mining operations, overburden is removed prior to coal extraction.

preparation plant: Usually located on a mine site, although one plant may serve several mines. A preparation plant is a facility for crushing, sizing and washing coal to prepare it for use by a particular customer. The washing process separates higher ash coal and may also remove some of the coal's sulfur content.

probable (indicated) reserves: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

proven (measured) reserves: Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

reclamation: The process of restoring land to its prior condition, productive use or other permitted condition following mining activities. The process commonly includes "recontouring" or reshaping the land to its approximate original appearance, restoring topsoil and planting native grass and shrubs. Reclamation operations are typically conducted concurrently with mining operations. Reclamation is closely regulated by both state and federal laws.

reserve: That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

steam coal: Coal used by power plants and industrial steam boilers to produce electricity, steam or both. It generally is lower in Btu heat content and higher in volatile matter than metallurgical coal.

sulfur: One of the elements present in varying quantities in coal that contributes to environmental degradation when coal is burned. Sulfur dioxide (SO2) is produced as a gaseous by-product of coal combustion.

surface mine: A mine in which the coal lies near the surface and can be extracted by removing the covering layer of soil overburden. Surface mines are also known as open-pit mines.

tons: A "short" or net ton is equal to 2,000 pounds. A "long" or British ton is 2,240 pounds. A "metric" tonne is approximately 2,205 pounds. The short ton is the unit of measure referred to in this report.

Western Bituminous region: Coal producing area located in western Colorado and eastern Utah.

iii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains "forward-looking statements". Statements included in this report that are not historical facts, that address activities, events or developments that we expect or anticipate will or may occur in the future, including things such as our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and similar matters, are forward-looking statements. These statements can be identified by the use of forward-looking terminology, including "may," "believe," "expect," "anticipate," "estimate," "continue" or similar words. These statements are made by us based on our past experience and our perception of historical trends, current conditions and expected future developments as well as other considerations we believe are appropriate under the circumstances. Whether actual results and developments in the future will conform to our expectations is subject to numerous risks and uncertainties, many of which are beyond our control or our ability to predict. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in these statements. The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

- •

- changes in governmental regulation of the mining industry or the electric utility industry;

- •

- adverse weather conditions and natural disasters;

- •

- weakness in global economic conditions;

- •

- decreases in demand for electricity and changes in demand for coal;

- •

- poor mining conditions resulting from geological conditions or the effects of prior mining;

- •

- equipment problems at mining locations;

- •

- the availability of transportation for coal shipments;

- •

- the availability and costs of key supplies and commodities such as steel, diesel fuel and explosives;

- •

- the availability and prices of competing electricity generation fuels;

- •

- our ability to secure or acquire high-quality coal reserves;

- •

- our ability to find buyers for coal under favorable supply contracts; and

- •

- certain factors discussed elsewhere in this report, including those factors listed under "Risk Factors."

Readers are cautioned not to place undue reliance on forward-looking statements. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

iv

Unless the context clearly indicates otherwise, references in this report to "Rhino Predecessor," "we," "our," "us" or similar terms when used in a historical context refer to Rhino Energy LLC and its subsidiaries, which were contributed to Rhino Resource Partners LP in connection with its initial public offering, which was completed on October 5, 2010 (the "IPO"). When used in the present tense or prospectively, those terms refer to Rhino Resource Partners LP and its subsidiaries. References to our "general partner" refer to Rhino GP LLC, the general partner of Rhino Resource Partners LP.

We are a growth-oriented Delaware limited partnership formed to control and operate coal properties and related assets. We produce, process and sell high quality coal of various steam and metallurgical grades. We market our steam coal primarily to electric utility companies as fuel for their steam-powered generators. Customers for our metallurgical coal are primarily steel and coke producers who use our coal to produce coke, which is used as a raw material in the steel manufacturing process.

We have a geographically diverse asset base with coal reserves located in Central Appalachia, Northern Appalachia, the Illinois Basin and the Western Bituminous region. As of December 31, 2010, we controlled an estimated 309.0 million tons of proven and probable coal reserves, consisting of an estimated 297.0 million tons of steam coal and an estimated 12.0 million tons of metallurgical coal. In addition, as of December 31, 2010, we controlled an estimated 271.8 million tons of non-reserve coal deposits. As of December 31, 2010, Rhino Eastern LLC, a joint venture in which we own a 51% membership interest and for which we serve as manager, controlled an estimated 22.2 million tons of proven and probable coal reserves at the Rhino Eastern mining complex located in Central Appalachia, consisting entirely of premium mid-vol and low-vol metallurgical coal, and an estimated 34.3 million tons of non-reserve coal deposits. As of December 31, 2010, we operated ten mines, including five underground and five surface mines, located in Kentucky, Ohio and West Virginia. In addition, our joint venture operates one underground mine in West Virginia. During 2010, we operated one underground mine in Colorado, but we temporarily idled this mine at year end due to the expiration of our sole customer contract at this location. We are currently planning to restart production at this location in late 2011. Additionally, we began production and customer shipments in January 2011 at one underground mine located in Emery and Carbon Counties in Utah that we had acquired out of bankruptcy in August of 2010. The number of mines that we operate may vary from time to time depending on a number of factors, including the existing demand for and price of coal, depletion of economically recoverable reserves and availability of experienced labor. Excluding results from the joint venture, for the year ended December 31, 2010, we produced approximately 4.0 million tons of coal, purchased approximately 0.3 million tons of coal and sold approximately 4.3 million tons of coal. Additionally, the joint venture produced and sold approximately 0.3 million tons of premium mid-vol metallurgical coal for the year ended December 31, 2010.

Our principal business strategy is to safely, efficiently and profitably produce and sell both steam and metallurgical coal from our diverse asset base in order to maintain, and, over time, increase our quarterly cash distributions. In addition, we intend to expand our operations through strategic acquisitions, including the acquisition of stable, cash generating non-coal natural resource assets. We believe that such assets would allow us to grow our cash available for distribution and enhance stability of our cash flow by, for example, serving as a natural hedge to help mitigate our exposure to certain operating costs, such as diesel fuel, steel products and other commodities consumed in the mining process.

History

Our predecessor was formed in April 2003 by Wexford Capital LP ("Wexford Capital", and together with its affiliates and principals, "Wexford"). Wexford Capital is an SEC registered investment advisor which was formed in 1994 and manages a series of investment funds and has over $6.0 billion of assets under management. Since the formation of our predecessor, we have significantly grown our

coal reserves. Since April 2003, we have completed numerous coal asset acquisitions with a total purchase price of approximately $223.3 million, including our acquisition in August 2010 of certain mining assets of C.W. Mining Company out of bankruptcy. The assets acquired in August 2010 are located in Emery and Carbon Counties, Utah and include coal reserves and non-reserve coal deposits, underground mining equipment and infrastructure, an overland belt conveyor system, a loading facility and support facilities. Through these acquisitions and coal lease transactions, we have substantially increased our proven and probable coal reserves and non-reserve coal deposits. In addition, we have successfully grown our production through internal development projects.

On October 5, 2010, we completed our IPO, in which we sold an aggregate of 3,730,600 common units to the public. Our common units are listed on the New York Stock Exchange under the symbol "RNO". In connection with the IPO, Wexford contributed their membership interests in Rhino Energy LLC to us, and we issued 12,397,000 subordinated units representing limited partner interests in us and 8,666,400 common units to an affiliate of Wexford Capital and issued incentive distribution rights to our general partner. Principals of Wexford, including certain directors of our general partner, own the majority of the membership interests in our general partner.

We are managed by the board of directors and executive officers of our general partner. Our operations are conducted through, and our operating assets are owned by, our wholly owned subsidiary, Rhino Energy LLC, and its subsidiaries.

Coal Operations

Mining Operations

As of December 31, 2010, we operated four mining complexes located in Central Appalachia (Tug River, Rob Fork, Deane and Rhino Eastern (owned by the joint venture with an affiliate of Patriot Coal Corporation, or "Patriot")) and two mining complexes located in Northern Appalachia (Hopedale and Sands Hill). During 2010, we operated one mine located in the Western Bituminous region in Colorado (McClane Canyon). The McClane Canyon mine was temporarily idled at year end due to the expiration of our sole customer contract at this location. With production temporarily idled, we are in the process of building and permitting a rail loadout at this location and we are currently planning to restart production at the McClane Canyon mine in late 2011. In August 2010, we completed the acquisition of certain mining assets of C.W. Mining Company out of bankruptcy. The assets acquired are located in Emery and Carbon Counties, Utah and include coal reserves and non-reserve coal deposits, underground mining equipment and infrastructure, an overland belt conveyor system, a loading facility and support facilities. We began production from these assets at one underground mine in January 2011.

We define a mining complex as a central location for processing raw coal and loading coal into railroad cars or trucks for shipment to customers. These mining complexes include six active preparation plants and/or loadouts (including one owned by our joint venture partner), each of which receive, blend, process and ship coal that is produced from one or more of our active surface and underground mines. All of the preparation plants are modern plants that have both coarse and fine coal cleaning circuits.

2

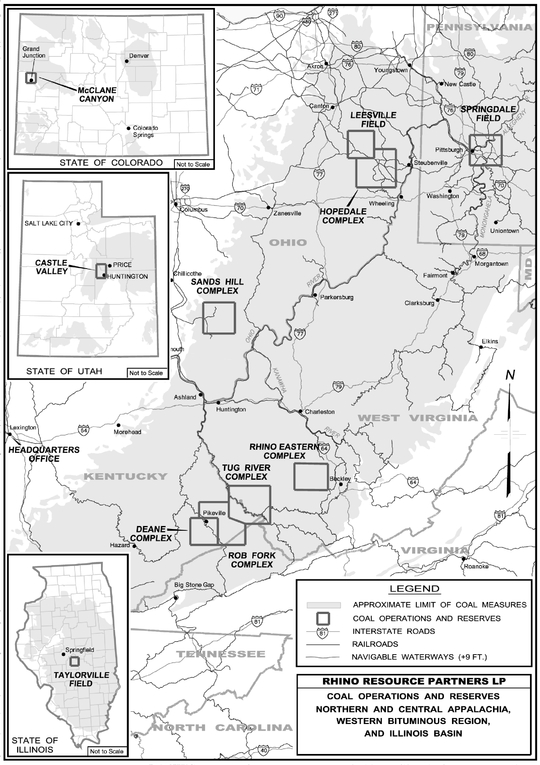

The following map shows the location of our mining operations as of December 31, 2010:

3

Our surface mines include area mining and contour mining. These operations use truck and wheel loader equipment fleets along with large production tractors and shovels. Our underground mines utilize the room and pillar mining method. These operations generally consist of one or more single or dual continuous miner sections which are made up of the continuous miner, shuttle cars, roof bolters, feeder and other support equipment. We currently own most of the equipment utilized in our mining operations. We employ preventive maintenance and rebuild programs to ensure that our equipment is modern and well-maintained. The rebuild programs are performed either by an on-site shop or by third-party manufacturers. The mobile equipment utilized at our mining operations is scheduled for replacement on an on-going basis with new, more efficient units according to a predetermined schedule.

The following table summarizes our and the joint venture's mining complexes and production by region as of December 31, 2010:

| |

|

|

Number and Type of Active Mines(2) |

|

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Tons Produced for the Year Ended December 31, 2010(3) |

||||||||||||||||

Region

|

Preparation Plants and Loadouts |

Transportation to Customers(1) |

Company Operated Mines |

Contractor Operated Mines |

Total Mines |

||||||||||||||

| |

|

|

|

|

|

(in million tons) |

|||||||||||||

Central Appalachia |

|||||||||||||||||||

Tug River Complex (KY, WV) |

Jamboree(4) | Truck, Barge, Rail (NS) | 1S | — | 1S | 0.2 | |||||||||||||

Rob Fork Complex (KY) |

Rob Fork | Truck, Barge, Rail (CSX) | 2U, 2S | — | 2U, 2S | 1.3 | |||||||||||||

Deane Complex (KY) |

Rapid Loader | Rail (CSX) | 1U | 1U | 2U | 0.4 | |||||||||||||

Northern Appalachia |

|||||||||||||||||||

Hopedale Complex (OH) |

Nelms | Truck, Rail (OHC, WLE) | 1U | — | 1U | 1.4 | |||||||||||||

Sands Hill Complex (OH) |

Sands Hill(5) | Truck, Barge | 2S | — | 2S | 0.6 | |||||||||||||

Illinois Basin |

|||||||||||||||||||

Taylorville Field (IL) |

n/a | Rail (NS) | — | — | — | — | |||||||||||||

Western Bituminous |

|||||||||||||||||||

Castle Valley Complex (UT)(6) |

Truck loadout | Truck | — | — | — | ||||||||||||||

McClane Canyon Mine (CO)(6) |

n/a | Truck | — | — | — | 0.2 | |||||||||||||

Total |

4U,5S | 1U | 5U,5S | 4.0 | |||||||||||||||

Central Appalachia |

|||||||||||||||||||

Rhino Eastern Complex (WV)(7) |

Rocklick | Truck, Rail (NS, CSX) | 1U | — | 1U | 0.3 | |||||||||||||

- (1)

- NS = Norfolk Southern Railroad; CSX = CSX Railroad; OHC = Ohio Central Railroad; WLE =

Wheeling & Lake Erie Railroad.

- (2)

- Numbers

indicate the number of active mines. U = underground; S = surface.

- (3)

- Total

production based on actual amounts and not rounded amounts shown in this table.

- (4)

- Includes

only a loadout facility.

- (5)

- Includes

only a preparation plant.

- (6)

- The

Castle Valley mine began production in early 2011, while the McClane Canyon mine was temporarily idled as of December 31, 2010.

- (7)

- Owned by a joint venture in which we have a 51% membership interest and for which we serve as manager. Amounts shown include 100% of the production. The Rocklick preparation plant is owned and operated by our joint venture partner with whom the joint venture has a transloading agreement for use of the facility.

Central Appalachia. As of December 31, 2010, we operated four mining complexes located in Central Appalachia consisting of five active underground mines, four of which are company-operated and one that is contractor-operated. In addition, we operated three company-operated surface mines. For the year ended December 31, 2010, the mines at our Tug River, Rob Fork and Deane mining complexes produced an aggregate of approximately 1.2 million tons of steam coal and an estimated 0.7 million tons of metallurgical coal, and the underground mine at the Rhino Eastern mining complex, owned by the joint venture in which we have a 51% membership interest and for which we serve as manager, produced approximately 0.3 million tons of metallurgical coal.

4

Tug River Mining Complex. Our Tug River mining complex consists of property in Kentucky and West Virginia that borders the Tug River. Our Tug River mining complex produces coal from one company-operated surface mine. Coal production from this mine is delivered by truck to the Jamboree loadout for blending and loading or to the Rob Fork facilities for processing, blending and loading. The Jamboree loadout is located on the Norfolk Southern Railroad and is a modern unit train loadout with batch weighing equipment. The Jamboree loadout is used primarily to process surface mined coal which is sold as steam coal to electric utilities. This mining complex produced approximately 0.2 million tons of steam coal for the year ended December 31, 2010.

Rob Fork Mining Complex. Our Rob Fork mining complex is located in eastern Kentucky and currently produces coal from two company-operated surface mines and two company-operated underground mines. The Rob Fork mining complex is located on the CSX Railroad and consists of a modern preparation plant utilizing heavy media circuitry that is capable of cleaning coarse and fine coal size fractions and a unit train loadout with batch weighing equipment. The mining complex has significant blending capabilities allowing the blending of raw coals with washed coals to meet a wide variety of customers' needs. The Rob Fork mining complex produced approximately 0.6 million tons of steam coal and 0.7 million tons of metallurgical coal for the year ended December 31, 2010.

Deane Mining Complex. Our Deane mining complex is located in eastern Kentucky and produces steam coal from one company-operated underground mine and one contractor-operated underground mine. The infrastructure consists of a preparation plant utilizing heavy media circuitry capable of cleaning coarse and fine coal size fractions, as well as a unit train loadout facility with batch weighing equipment capable of loading in excess of 10,000 tons into railcars in approximately four hours. The facility has significant blending capabilities allowing the blending of raw coals with washed coals to meet a wide variety of customers' needs. The Deane complex produced approximately 0.4 million tons of steam coal for the year ended December 31, 2010.

Rhino Eastern Mining Complex. The Rhino Eastern mining complex is located in Raleigh and Wyoming Counties, West Virginia. We have a 51% membership interest in, and serve as manager for, the joint venture that owns the Rhino Eastern mining complex. Pursuant to the terms of a coal purchase agreement entered into under the joint venture agreement, an affiliate of our joint venture partner, Patriot, controls the amount and terms of sales of the coal produced from the Rhino Eastern mining complex.

The Rhino Eastern mining complex produces premium metallurgical coal from one company-operated underground mine. The joint venture acquired the Rhino Eastern complex in May 2008 and commenced production in August 2008. Raw coal is trucked from the mine to a facility owned by our joint venture partner to be sized, washed and shipped by truck or via one of two rail loadouts, located on the CSX Railroad and the Norfolk Southern Railroad. The Rhino Eastern mining complex produced approximately 0.3 million tons of premium mid-vol metallurgical coal for the year ended December 31, 2010.

Northern Appalachia. We operate two mining complexes located in Northern Appalachia consisting of one company-operated underground mine and two company-operated surface mines. For the year ended December 31, 2010, these mines produced an aggregate of approximately 2.0 million tons of steam coal.

Hopedale Mining Complex. The Hopedale mining complex includes an underground mine located in Hopedale, Ohio approximately five miles northeast of Cadiz, Ohio. Coal produced from the Hopedale mine is first cleaned at our Nelms preparation plant located on the Ohio Central Railroad and the Wheeling & Lake Erie Railroad in Cadiz, Ohio and then shipped by train or truck to the customer. The infrastructure includes a full-service loadout facility. This underground mining operation produced approximately 1.4 million tons of steam coal for the year ended December 31, 2010.

5

Sands Hill Mining Complex. We operate two surface mines at our Sands Hill mining complex, located near Hamden, Ohio. In 2009, we completed construction of a river-front barge and dock facility on the Ohio River. The infrastructure also includes a preparation plant. The Sands Hill mining complex produced approximately 0.6 million tons of steam coal and approximately 0.4 million tons of limestone aggregate for the year ended December 31, 2010.

Western Bituminous Region. During 2010, we operated an underground mine in the Western Bituminous region of Colorado, which has been temporarily idled. In January 2011, we began production at an underground mine in Emery and Carbon Counties, Utah.

McClane Canyon Mine. The McClane Canyon mine is located near Loma, Colorado and is on property leased from the Bureau of Land Management ("BLM"). The mine produced approximately 0.2 million tons of steam coal for the year ended December 31, 2010, all of which was sold to Xcel's Cameo power plant, located east of Grand Junction, Colorado pursuant to a contract with Xcel which expired on December 31, 2010. We have temporarily idled production at the McClane Canyon mine as we build and permit a rail loadout. We believe access to a rail loadout will enable us to expand our customer base. We are currently planning to restart production at the McClane Canyon mine in late 2011.

In addition to the McClane Canyon mine, we currently control three nearby federal leases consisting of approximately 7,600 acres, two of which have the potential to support a future underground coal mining operation with procurement of an adjacent federal leasehold. We began the permitting process and leasehold procurement in 2005 and expect the process to last approximately one to three more years. We are currently in an exploration process to define the volume, quality, and mineability of the coal reserves.

Castle Valley Mining Complex. In August 2010, we completed the acquisition of certain mining assets of C.W. Mining Company out of bankruptcy. The assets acquired are located in Emery and Carbon Counties, Utah and include coal reserves and non-reserve coal deposits, underground mining equipment and infrastructure, an overland belt conveyor system, a loading facility and support facilities. In January 2011, we began production from these assets at one underground mine. The coal we produce and sell from these mining assets is sold as steam coal in the Western Bituminous region.

Other Non-Mining Operations

In addition to our mining operations, we operate several subsidiaries which provide auxiliary services for our coal mining operations. Rhino Trucking provides our Kentucky coal operations with dependable, safe coal hauling to our preparation plants and loadout facilities and our southeastern Ohio coal operations with reliable transportation to our customers where rail is not available. Rhino Services is responsible for mine-related construction, site and roadway maintenance and post-mining reclamation. We have been able to efficiently supply internally the majority of these services, which were previously outsourced. Through Rhino Services, we plan and monitor each phase of our mining projects as well as the post-mining reclamation efforts. We also perform the majority of our drilling and blasting activities at our company-operated surface mines in-house rather than contracting to a third party. Our Triad Roof Support Systems subsidiary manufactures roof control products used in underground coal mining.

Other Natural Resource Assets

Incidental to our coal mining process, we mine limestone from reserves located at our Sands Hill mining complex and sell it as aggregate to various construction companies and road builders that are located in close proximity to the mining complex when market conditions are favorable. We believe that

6

our production of limestone provides us with an additional source of revenues at low incremental capital cost.

Customers

General

Our primary customers for our steam coal are electric utilities, and the metallurgical coal we produce is sold primarily to domestic and international steel producers. Excluding results from the joint venture, for the year ended December 31, 2010, approximately 84% of our coal sales tons consisted of steam coal and approximately 16% consisted of metallurgical coal. For the year ended December 31, 2010, 100% of the joint venture's coal sales tons consisted of metallurgical coal. For the year ended December 31, 2010, excluding results from the joint venture, approximately 74% of our coal sales tons that we produced were sold to electric utilities. In addition, for the year ended December 31, 2010, excluding results from the joint venture, approximately 3% of our total coal sales tons were sold through the OTC market, a portion of which were ultimately supplied to electric utilities. The majority of our electric utility customers purchase coal for terms of one to three years, but we also supply coal on a spot basis for some of our customers. Excluding the results from the joint venture, for the year ended December 31, 2010, we derived approximately 82.5% of our total coal revenues from sales to our ten largest customers, with affiliates of our top three customers accounting for approximately 43.0% of our coal revenues for that period: Indiana Harbor Coke Company, L.P., a subsidiary of Sunoco, Inc. (17.7%); GenOn Energy, Inc. (fka Mirant Corporation) (12.9%); and American Electric Power Company, Inc. (12.4%). Additionally, pursuant to the terms of a coal purchase agreement entered into under the joint venture agreement, we sell 100% of the joint venture's production to an affiliate of our joint venture partner, Patriot, which controls the amount and terms of sales of the coal produced from the joint venture. Incidental to our coal mining process, we mine limestone and sell it as aggregate to various construction companies and road builders that are located in close proximity to our Sands Hill mining complex.

Coal Supply Contracts

For the years ended December 31, 2010 and 2009, approximately 96% and 99%, respectively, of our aggregate coal tons sold were sold through supply contracts. We expect to continue selling a significant portion of our coal under supply contracts.

Quality and volumes for the coal are stipulated in coal supply contracts, and in some instances buyers have the option to vary annual or monthly volumes. Most of our coal supply contracts contain provisions requiring us to deliver coal within certain ranges for specific coal characteristics such as heat content, sulfur, ash, hardness and ash fusion temperature. Failure to meet these specifications can result in economic penalties, suspension or cancellation of shipments or termination of the contracts. Some of our contracts specify approved locations from which coal may be sourced. Some of our contracts set out mechanisms for temporary reductions or delays in coal volumes in the event of a force majeure, including events such as strikes, adverse mining conditions, mine closures, or serious transportation problems that affect us or unanticipated plant outages that may affect the buyers.

The terms of our coal supply contracts result from competitive bidding procedures and extensive negotiations with customers. As a result, the terms of these contracts, including price adjustment features, price re-opener terms, coal quality requirements, quantity parameters, permitted sources of supply, future regulatory changes, extension options, force majeure, termination and assignment provisions, vary significantly by customer.

7

Transportation

We ship coal to our customers by rail, truck or barge. For the year ended December 31, 2010, the majority of our coal sales tonnage was shipped by rail. The majority of our coal is transported to customers by either the CSX Railroad or the Norfolk Southern Railroad in eastern Kentucky and by the Ohio Central Railroad or the Wheeling & Lake Erie Railroad in Ohio. In addition, in southeastern Ohio, we use our own trucking operations to transport coal to our customers where rail is not available. We used third-party trucking to transport coal to our customer in Colorado. With the expiration at December 31, 2010 of our sole customer contract in Colorado, we temporarily idled the McClane Canyon mine, and are in the process of permitting a rail loadout at this location. In addition, coal from certain of our mines is located within economical trucking distance to the Big Sandy River and/or the Ohio River and can be transported by barge. It is customary for customers to pay the transportation costs to their location.

We believe that we have good relationships with rail carriers and truck companies due, in part, to our modern coal-loading facilities at our loadouts and the working relationships and experience of our transportation and distribution employees.

Suppliers

Principal supplies used in our business include diesel fuel, explosives, maintenance and repair parts and services, roof control and support items, tires, conveyance structures, ventilation supplies and lubricants. We use third-party suppliers for a significant portion of our equipment rebuilds and repairs, drilling services and construction.

We have a centralized sourcing group for major supplier contract negotiation and administration, for the negotiation and purchase of major capital goods and to support the mining and coal preparation plants. We are not dependent on any one supplier in any region. We promote competition between suppliers and seek to develop relationships with those suppliers whose focus is on lowering our costs. We seek suppliers who identify and concentrate on implementing continuous improvement opportunities within their area of expertise.

Competition

The coal industry is highly competitive. There are numerous large and small producers in all coal producing regions of the United States and we compete with many of these producers. Our main competitors include Alliance Resource Partners LP, Alpha Natural Resources, Inc., Arch Coal, Inc., Booth Energy Group, CONSOL Energy Inc., International Coal Group, Inc., James River Coal Company, Massey Energy Company, Murray Energy Corporation, Oxford Resource Partners, LP, Patriot and TECO Energy, Inc.

The most important factors on which we compete are coal price, coal quality and characteristics, transportation costs and the reliability of supply. Demand for coal and the prices that we will be able to obtain for our coal are closely linked to coal consumption patterns of the domestic electric generation industry and international consumers. These coal consumption patterns are influenced by factors beyond our control, including demand for electricity, which is significantly dependent upon economic activity and summer and winter temperatures in the United States, government regulation, technological developments and the location, availability, quality and price of competing sources of fuel such as natural gas, oil and nuclear, and alternative energy sources such as hydroelectric power.

8

Regulation and Laws

The coal mining industry is subject to regulation by federal, state and local authorities on matters such as:

- •

- employee health and safety;

- •

- mine permits and other licensing requirements;

- •

- air quality standards;

- •

- water quality standards;

- •

- storage, use and disposal of petroleum products and other hazardous substances;

- •

- plant and wildlife protection;

- •

- reclamation and restoration of mining properties after mining is completed;

- •

- the discharge of materials into the environment, including waterways or wetlands;

- •

- storage and handling of explosives;

- •

- wetlands protection;

- •

- surface subsidence from underground mining;

- •

- the effects, if any, that mining has on groundwater quality and availability; and

- •

- legislatively mandated benefits for current and retired coal miners.

In addition, many of our customers are subject to extensive regulation regarding the environmental impacts associated with the combustion or other use of coal, which could affect demand for our coal. The possibility exists that new laws or regulations, or new interpretations of existing laws or regulations, may be adopted that may have a significant impact on our mining operations or our customers' ability to use coal.

We are committed to conducting mining operations in compliance with applicable federal, state and local laws and regulations. However, because of extensive and comprehensive regulatory requirements, violations during mining operations occur from time to time. Violations, including violations of any permit or approval, can result in substantial civil and criminal fines and penalties, including revocation or suspension of mining permits. None of the violations to date have had a material impact on our operations or financial condition.

While it is not possible to quantify the costs of compliance with applicable federal and state laws and regulations, those costs have been and are expected to continue to be significant. Nonetheless, capital expenditures for environmental matters have not been material in recent years. We have accrued for the present value of estimated cost of reclamation and mine closings, including the cost of treating mine water discharge when necessary. The accruals for reclamation and mine closing costs are based upon permit requirements and the costs and timing of reclamation and mine closing procedures. Although management believes it has made adequate provisions for all expected reclamation and other costs associated with mine closures, future operating results would be adversely affected if we later determined these accruals to be insufficient. Compliance with these laws and regulations has substantially increased the cost of coal mining for all domestic coal producers.

Mining Permits and Approvals

Numerous governmental permits or approvals are required for coal mining operations. When we apply for these permits and approvals, we are often required to assess the effect or impact that any proposed production of coal may have upon the environment. The permit application requirements

9

may be costly and time consuming, and may delay or prevent commencement or continuation of mining operations in certain locations. Future laws and regulations may emphasize more heavily the protection of the environment and, as a consequence, our activities may be more closely regulated. Laws and regulations, as well as future interpretations or enforcement of existing laws and regulations, may require substantial increases in equipment and operating costs, or delays, interruptions or terminations of operations, the extent of any of which cannot be predicted. The permitting process for certain mining operations can extend over several years, and can be subject to judicial challenge, including by the public. Some required mining permits are becoming increasingly difficult to obtain in a timely manner, or at all. We cannot assure you that we will not experience difficulty and/or delay in obtaining mining permits in the future.

Regulations provide that a mining permit can be refused or revoked if the permit applicant or permittee owns or controls, directly or indirectly through other entities, mining operations which have outstanding environmental violations. Although, like other coal companies, we have been cited for violations in the ordinary course of business, we have never had a permit suspended or revoked because of any violation, and the penalties assessed for these violations have not been material.

Before commencing mining on a particular property, we must obtain mining permits and approvals by state regulatory authorities of a reclamation plan for restoring, upon the completion of mining, the mined property to its approximate prior condition, productive use or other permitted condition.

Mine Health and Safety Laws

Stringent safety and health standards have been in effect since the adoption of the Coal Mine Health and Safety Act of 1969. The Federal Mine Safety and Health Act of 1977 (the "Mine Act"), and regulations adopted pursuant thereto, significantly expanded the enforcement of health and safety standards and imposed comprehensive safety and health standards on numerous aspects of mining operations, including training of mine personnel, mining procedures, blasting, the equipment used in mining operations and other matters. The Mine Safety and Health Administration ("MSHA") monitors compliance with these laws and regulations. In addition, the states where we operate also have state programs for mine safety and health regulation and enforcement. Federal and state safety and health regulations affecting the coal industry are complex, rigorous and comprehensive, and have a significant effect on our operating costs.

The Mine Act is a strict liability statute that requires mandatory inspections of surface and underground coal mines and requires the issuance of enforcement action when it is believed that a standard has been violated. A penalty is required to be imposed for each cited violation. Negligence and gravity assessments result in a cumulative enforcement scheme that may result in the issuance of withdrawal orders. The Mine Act contains criminal liability provisions. For example, criminal liability may be imposed for corporate operators who knowingly or willfully authorize, order or carry out violations. The Mine Act also provides that civil and criminal penalties may be assessed against individual agents, officers and directors who knowingly authorize, order or carry out violations. Violations of mandatory health and safety standards that are labeled as "serious" may result in the issuance of an order requiring the immediate withdrawal of miners from the mine or shutting down a mine or any section of a mine or any piece of mine equipment.

10

We have developed a health and safety management system that, among other things, educates our employees about health and safety requirements including those arising under federal and state laws that apply to our mines. In addition, our health and safety management system tracks the performance of each operational facility in meeting the requirements of safety laws and company safety policies. As an example of the resources we allocate to health and safety matters, our safety management system includes a company-wide safety director and local safety directors who oversee safety and compliance at operations on a day-to-day basis. We continually monitor the performance of our safety management system and from time-to-time modify that system to address findings or reflect new requirements or for other reasons. We have even integrated safety matters into our compensation and retention decisions. For instance, our bonus program includes a meaningful evaluation of each eligible employee's role in complying with, fostering and furthering our safety policies.

We evaluate a variety of safety-related metrics to assess the adequacy and performance of our safety management system. For example, we monitor and track performance in areas such as "accidents, reportable accidents, lost time accidents and the lost-time accident frequency rate" and a number of others. Each of these metrics provides insights and perspectives into various aspects of our safety systems and performance at particular locations or mines generally and, among other things, can indicate where improvements are needed or further evaluation is warranted with regard to the system or its implementation. An important part of this evaluation is to assess our performance relative to certain national benchmarks.

Our non-fatal days lost incidence rate was 39.3% below the industry average for the year ended December 31, 2010. Non-fatal days lost incidence rate is an industry standard used to describe occupational injuries that result in loss of one or more days from an employee's scheduled work. Our non-fatal days lost time incidence rate for all operations for the year ended December 31, 2010 was 1.53 as compared to the national average of 2.52 through the nine months ended September 30, 2010, as reported by MSHA.

In addition, for the year ended December 31, 2010 our average MSHA violations per inspection day was 0.70 as compared to the full year 2009 national average of 0.82 violations per inspection day, 14.6% below the 2009 national average.

In 2006, the Mine Improvement and New Emergency Response Act of 2006, or MINER Act, was enacted. The MINER Act significantly amended the Mine Act, requiring improvements in mine safety practices, increasing criminal penalties and establishing a maximum civil penalty for non-compliance, and expanding the scope of federal oversight, inspection and enforcement activities. Since passage of the MINER Act, enforcement scrutiny has increased, including more inspection hours at mine sites, increased numbers of inspections and increased issuance of the number and the severity of enforcement actions and related penalties. Various states also have enacted their own new laws and regulations addressing many of these same subjects. MSHA continues to interpret and implement various provisions of the MINER Act, along with introducing new proposed regulations and standards. Among these new proposed regulations is MSHA's proposed rule titled "Lowering Miner's Exposure to Respirable Coal Mine Dust, Including Continuous Personal Dust Monitors." The rule, which is currently in the public hearing and comment phase, would require a 50% reduction in the allowable respirable coal mine dust exposure limits and require each operation to significantly increase the number of respirable coal mine dust samples taken. The rule would also increase oversight by MSHA regarding coal mine dust and ventilation issues at each mine, including the approval process for ventilation plans at each mine. MSHA also introduced an Emergency Temporary Standard in 2010 that required the application and continued maintenance of a significantly increased amount of rock dust throughout underground coal mines.

Mining accidents in the last several years in West Virginia, Kentucky and Utah have received national attention and instigated responses at the state and national levels that have resulted in

11

increased scrutiny of current safety practices and procedures at all mining operations, particularly underground mining operations. More stringent mine safety laws and regulations promulgated by these states and the federal government have included increased sanctions for non-compliance. Other states have proposed or passed similar bills, resolutions or regulations addressing mine safety practices. Moreover, workplace accidents, such as the April 5, 2010, Upper Big Branch Mine incident, are likely to result in more stringent enforcement and possibly the passage of new laws and regulations.

Following the April 5, 2010 Upper Big Branch mine incident, public scrutiny of large mining operations has increased among government officials as well as regulatory agencies. On April 14, 2010, U.S. Representative George Miller publicly released a list of mining operations which would have faced "pattern of violation" sanctions were it not for contested notices of violation. This list included our Mine 28 in Pike County, Kentucky. After additional inspections on April 20, 2010, MSHA issued various citations related to Mine 28. Although we took steps to immediately abate certain of these citations, we may incur various penalties or sanctions.

From time to time, certain portions of individual mines have been required to suspend or shut down operations temporarily in order to address a compliance requirement or because of an accident. For instance, MSHA issues orders pursuant to Section 103(k) that, among other things, call for operations in the area of the mine at issue to suspend operations until compliance is restored. Likewise, if an accident occurs within a mine, the MSHA requirements call for all operations in that area to be suspended until the circumstance leading to the accident has been resolved. During the fiscal year ended December 31, 2010 (as in earlier years), we received such orders from government agencies and have experienced accidents within our mines requiring the suspension or shutdown of operations in those particular areas until the circumstances leading to the accident have been resolved. While the violations or other circumstances that caused such an accident were being addressed, other areas of the mine could and did remain operational. These circumstances did not require us to suspend operations on a mine-wide level or otherwise entail material financial or operational consequences for us. We cannot assure you that any suspension of operations at any one of our locations that may occur in the future will not have material financial or operational consequences for us.

It is our practice to contest notices of violations in cases in which we believe we have a good faith defense to the alleged violation or the proposed penalty and/or other legitimate grounds to challenge the alleged violation or the proposed penalty. In December 2008 and March 2009, MSHA assessed proposed penalties in excess of $100,000 with regard to three separate notices of violation, all of which relate to our operations at Mine 28. Each of these notices of violation alleged an "unwarrantable failure" under the Mine Act with specific regard to the accumulation of combustible materials. The combustible materials typically underlying such citations are coal, loose coal, and float coal dust. We have contested these violations on grounds that the underlying circumstances did not support the issuance of a notice of violation and/or the gravity of the proposed penalty. These contests are pending. These alleged violations were abated at the time or immediately after the notices of violation were issued, and we have not been issued any notices of violation from MSHA proposing a penalty in excess of $100,000 since March 2009. We cannot predict the outcome of our challenges or assure you that we will not be assessed significant fines, penalties, or sanctions in the future with respect to alleged instances of non-compliance.

On November 19, 2010, Rhino Eastern LLC, a joint venture in which we own a 51% membership interest and serves as manager, received an MSHA notification of a potential pattern of violations under Section 104(e) of the Mine Act for Rhino Eastern's Eagle #1 Mine located in Bolt, West Virginia, based on MSHA's initial screening of compliance records for the twelve months ended August 31, 2010 and of accident and employment records for the twelve months ended June 30, 2010. On December 7, 2010, we submitted a Corrective Action Plan to MSHA and this plan became effective on December 31, 2010.

12

On February 4, 2011, CAM Mining LLC ("CAM Mining"), a subsidiary of us, received an imminent danger order under Section 107(a) of the Mine Act which stated that two carpenters in the employ of an independent, third-party contractor were working 10 feet above ground on the roof of a structure at CAM Mining's Mine 28 without tie off lines. The carpenters were immediately instructed to safely climb down to the ground level where they received further safety training. These actions terminated the order.

We exercise substantial efforts toward achieving compliance at our mines. In light of the recent citations issued with respect to Mine 28 and Eagle #1 Mine, we have further increased our focus with regard to health and safety at all of our mines and at Mine 28 and Eagle #1 Mine in particular. These efforts include hiring additional skilled personnel, providing training programs, hosting quarterly safety meetings with MSHA personnel and making capital expenditures in consultation with MSHA aimed at increasing mine safety. We believe that these efforts have contributed, and continue to contribute, positively to safety and compliance at Mine 28 and Eagle #1 Mine.

Implementing and complying with these state and federal safety laws and regulations could adversely affect our results of operations and financial position. Some safety measures may decrease our production rates or cause us not to pursue certain reserves due to safety concerns, adversely affecting our revenues. For instance, we incurred approximately $3.1 million for the eighteen months ended June 30, 2010 in capital expenditures to comply with the requirements of the MINER Act. We project capital expenditures of approximately $2.8 million on compliance with mine safety laws over the next five years. These figures are subject to change, however, as new requirements come into effect.

Black Lung Laws

Under federal black lung benefits laws, businesses that conduct current mining operations must make payments of black lung benefits to coal miners with black lung disease and to some survivors of a miner who dies from this disease. To help fund these benefits, a tax is levied on production of $1.10 per ton for underground-mined coal and $0.55 per ton for surface-mined coal, but not to exceed 4.4% of the applicable sales price, in order to compensate miners who are totally disabled due to black lung disease and some survivors of miners who died from this disease, and who were last employed as miners prior to 1970 or subsequently where no responsible coal mine operator has been identified for claims. In addition, some claims for which coal operators had previously been responsible will be obligations of the government trust funded by the tax. The Revenue Act of 1987 extended the termination date of this tax from January 1, 1996, to the earlier of January 1, 2014, or the date on which the government trust becomes solvent. In 2010, we recorded approximately $3.5 million of expense related to this excise tax.

On March 23, 2010, President Obama signed into law health care reform legislation, known as the Affordable Health Choices Act, which includes significant changes to the federal black lung program. Among other things, these changes include provisions, retroactive to 2005, which would (1) provide an automatic survivor benefit paid upon the death of a miner with an awarded black lung claim, without requiring proof that the death was due to pneumoconiosis and (2) establish a rebuttable presumption with regard to pneumoconiosis among miners with 15 or more years of coal mine employment that are totally disabled by a respiratory condition. These changes could have a material impact on our costs expended in association with the federal black lung program.

For miners last employed as miners after 1969 and who are determined to have contracted black lung, we maintain insurance coverage sufficient to cover the cost of present and future claims or we participate in state programs that provide this coverage. We may also be liable under state laws for black lung claims and are covered through either insurance policies or state programs. Congress and state legislatures regularly consider various items of black lung legislation, which, if enacted, could adversely affect our business, results of operations and financial position.

13

Workers' Compensation

We are required to compensate employees for work-related injuries under various state workers' compensation laws. The states in which we operate consider changes in workers' compensation laws from time to time. Our costs will vary based on the number of accidents that occur at our mines and other facilities, and our costs of addressing these claims. We are insured under the Ohio State Workers Compensation Program for our operations in Ohio. Our remaining operations, including Central Appalachia and the Western Bituminous region, are insured through Rockwood Casualty Insurance Company.

Surface Mining Control and Reclamation Act

SMCRA establishes operational, reclamation and closure standards for all aspects of surface mining, including the surface effects of underground coal mining. SMCRA requires that comprehensive environmental protection and reclamation standards be met during the course of and upon completion of mining activities. In conjunction with mining the property, we reclaim and restore the mined areas by grading, shaping and preparing the soil for seeding. Upon completion of mining, reclamation generally is completed by seeding with grasses or planting trees for a variety of uses, as specified in the approved reclamation plan. We believe we are in compliance in all material respects with applicable regulations relating to reclamation.

SMCRA and similar state statutes require, among other things, that mined property be restored in accordance with specified standards and approved reclamation plans. The act requires that we restore the surface to approximate the original contours as soon as practicable upon the completion of surface mining operations. The mine operator must submit a bond or otherwise secure the performance of these reclamation obligations. Mine operators can also be responsible for replacing certain water supplies damaged by mining operations and repairing or compensating for damage to certain structures occurring on the surface as a result of mine subsidence, a consequence of long-wall mining and possibly other mining operations. In addition, the Abandoned Mine Lands Program, which is part of SMCRA, imposes a tax on all current mining operations, the proceeds of which are used to restore mines closed prior to SMCRA's adoption in 1977. The maximum tax is 31.5 cents per ton on surface-mined coal and 13.5 cents per ton on underground-mined coal. As of December 31, 2010, we had accrued approximately $35.7 million for the estimated costs of reclamation and mine closing, including the cost of treating mine water discharge when necessary. In addition, states from time to time have increased and may continue to increase their fees and taxes to fund reclamation of orphaned mine sites and abandoned mine drainage control on a statewide basis.

After the application is submitted, public notice or advertisement of the proposed permit action is required, which is followed by a public comment period. It is not uncommon for a SMCRA mine permit application to take over two years to prepare and review, depending on the size and complexity of the mine, and another two years or even longer for the permit to be issued. The variability in time frame required to prepare the application and issue the permit can be attributed primarily to the various regulatory authorities' discretion in the handling of comments and objections relating to the project received from the general public and other agencies. Also, it is not uncommon for a permit to be delayed as a result of judicial challenges related to the specific permit or another related company's permit.

Federal laws and regulations also provide that a mining permit or modification can be delayed, refused or revoked if owners of specific percentages of ownership interests or controllers (i.e., officers and directors or other entities) of the applicant have, or are affiliated with another entity that has outstanding violations of SMCRA or state or tribal programs authorized by SMCRA. This condition is often referred to as being "permit blocked" under the federal Applicant Violator Systems, or AVS. Thus, non-compliance with SMCRA can provide the bases to deny the issuance of new mining permits

14

or modifications of existing mining permits, although we know of no basis by which we would be (and we are not now) permit-blocked.

In addition, on November 30, 2009, the Office of Surface Mining Reclamation and Enforcement ("OSM") published an advanced notice of proposed rulemaking to revise the "stream buffer zone rule," or SBZ Rule, that prohibits mining disturbances within 100 feet of streams if there would be a negative effect on water quality. OSM intends to propose a series of Stream Protection Rules in 2011 and will finalize those rules in 2012. We are unable to predict the impact, if any, of these actions by the OSM, although the actions potentially could result in additional delays and costs associated with obtaining permits, prohibitions or restrictions relating to mining activities near streams, and additional enforcement actions. In addition, Congress has proposed, and may in the future propose, legislation to restrict the placement of mining material in streams. The requirements of the revised SBZ Rule or future legislation, when adopted, will likely be stricter than the prior SBZ Rule to further protect streams from the impact of surface mining, and may adversely affect our business and operations.

Surety Bonds

A mine operator must secure the performance of its reclamation obligations required under SMCRA through the use of surety bonds or other approved forms of performance security to cover the costs the state would incur if the mine operator were unable to fulfill its obligations. It has become increasingly difficult for mining companies to secure new surety bonds without the posting of partial collateral. In addition, surety bond costs have increased while the market terms of surety bonds have generally become less favorable. It is possible that surety bonds issuers may refuse to renew bonds or may demand additional collateral upon those renewals. Our failure to maintain, or inability to acquire, surety bonds that are required by state and federal laws would have a material adverse effect on our ability to produce coal, which could affect our profitability and cash flow.

As of December 31, 2010, we had approximately $76.1 million in surety bonds outstanding to secure the performance of our reclamation obligations.

Air Emissions

The Federal Clean Air Act, or the CAA, and similar state and local laws and regulations, which regulate emissions into the air, affect coal mining operations both directly and indirectly. The CAA directly impacts our coal mining and processing operations by imposing permitting requirements and, in some cases, requirements to install certain emissions control equipment, on sources that emit various hazardous and non-hazardous air pollutants. The CAA also indirectly affects coal mining operations by extensively regulating the air emissions of coal-fired electric power generating plants and other industrial consumers of coal, including air emissions of sulfur dioxide, nitrogen oxides, particulates, mercury and other compounds. There have been a series of recent federal rulemakings that are focused on emissions from coal-fired electric generating facilities. Installation of additional emissions control technology and additional measures required under laws and regulations related to air emissions will make it more costly to operate coal-fired power plants and possibly other facilities that consume coal and, depending on the requirements of individual state implementation plans, or SIPs, could make coal a less attractive fuel alternative in the planning and building of power plants in the future. Stricter air emission regulation would impact the operation of existing power plants and the construction of new power plants and may lead to changes in our customers' cost structure and purchasing patterns. Coal-fired power plants without up-to-date pollution controls may have to continue to install pollution control technology and upgrades, and might not be able to recover costs for these upgrades in the prices they charge for power due, in part, to the control exercised by state public utility commissions over such rate matters. As a result, the regulation of emissions under the CAA may impact our operations due to any resulting change in the use and demand for coal by our steam coal customers,

15

which could have a material adverse effect on our business, financial condition and results of operations.

EPA's Acid Rain Program, provided in Title IV of the CAA, regulates emissions of sulfur dioxide from electric generating facilities. Sulfur dioxide is a by-product of coal combustion. Affected facilities purchase or are otherwise allocated sulfur dioxide emissions allowances, which must be surrendered annually in an amount equal to a facility's sulfur dioxide emissions in that year. Affected facilities may sell or trade excess allowances to other facilities that require additional allowances to offset their sulfur dioxide emissions. In addition to purchasing or trading for additional sulfur dioxide allowances, affected power facilities can satisfy the requirements of the EPA's Acid Rain Program by switching to lower sulfur fuels, installing pollution control devices such as flue gas desulfurization systems, or "scrubbers," or by reducing electricity generating levels.

EPA has promulgated rules, referred to as the "NOx SIP Call," that require coal-fired power plants in 21 eastern states and Washington D.C. to make substantial reductions in nitrogen oxide emissions in an effort to reduce the impacts of ozone transport between states. As a result of the program, many power plants have been or will be required to install additional emission control measures, such as selective catalytic reduction devices. Installation of additional emission control measures will make it more costly to operate coal-fired power plants, potentially making coal a less attractive fuel.

Additionally, in March 2005, EPA issued the final Clean Air Interstate Rule, or CAIR, which would have permanently capped nitrogen oxide and sulfur dioxide emissions in 28 eastern states and Washington, D.C. CAIR required those states to achieve the required emission reductions by requiring power plants to either participate in an EPA-administered "cap-and-trade" program that caps emission in two phases, or by meeting an individual state emissions budget through measures established by the state. The stringency of the caps under CAIR may have required many coal-fired sources to install additional pollution control equipment, such as wet scrubbers, to comply. This increased sulfur emission removal capability required by the rule could have resulted in decreased demand for lower sulfur coal, which may have potentially driven down prices for lower sulfur coal. On July 11, 2008, the United States Court of Appeals for the D.C. Circuit vacated CAIR. The EPA subsequently filed a petition for rehearing or, in the alternative, for a remand of the case without vacatur. On December 23, 2008, the Court issued an opinion to remand without vacating CAIR. Therefore, CAIR will remain in effect while the EPA conducts rulemaking to modify CAIR to comply with the Court's July 2008 opinion. The Court declined to impose a schedule by which the EPA must complete the rulemaking, but reminded the EPA that the Court does "...not intend to grant an indefinite stay of the effectiveness of this Court's decision." The EPA is considering its options on how to proceed.

In March 2005, EPA finalized the Clean Air Mercury Rule, or CAMR, which established a two-part nationwide cap on mercury emissions from coal-fired power plants beginning in 2010. The CAMR has been the subject of ongoing litigation, and on February 8, 2008, the United States Court of Appeals for the D.C. Circuit vacated the rule for further consideration by the EPA. As a result of the decision to vacate the CAMR, in February 2009 the EPA announced that it would regulate mercury emissions by issuing Maximum Achievable Control Technology standards, or MACT, which are likely to impose stricter limitations on mercury emissions from power plants than the vacated CAMR. The EPA is under a court deadline to issue a final rule requiring MACT for power plants by November 2011. In conjunction with these efforts, on December 24, 2009, EPA approved an Information Collection Request (ICR) requiring all US power plants with coal-or oil-fired electric generating units to submit emissions information for use in developing air toxics emissions standards. The EPA has stated that it intends to propose air toxics standards for coal- and oil-fired electric generating units by March 10, 2011. In addition, on April 30, 2010, EPA proposed new MACT for several classes of boilers and process heaters, including large coal-fired boilers and process heaters, which would require significant reductions in the emission of particulate matter, carbon monoxide, hydrogen chloride, dioxins and

16

mercury. While the future of mercury emission regulation is uncertain, certain states have adopted or proposed mercury control regulations that are more stringent than the federal requirements, which could reduce the demand for coal in those states.

The EPA has adopted new, more stringent national air quality standards, or NAAQS, for ozone and fine particulate matter. As a result, some states will be required to amend their existing SIPs to attain and maintain compliance with the new air quality standards. For example, in December 2004, the EPA designated specific areas in the United States as in "non-attainment" with the new NAAQS for fine particulate matter. In March 2007, the EPA published final rules addressing how states would implement plans to bring applicable non-attainment regions into compliance with the new air quality standard. Because coal mining operations and coal-fired electric generating facilities emit particulate matter, our mining operations and customers could be affected when the standards are implemented by the applicable states.

In June 2005, the EPA amended its regional haze program to improve visibility in national parks and wilderness areas. Affected states were required to develop SIPs by December 2007 that, among other things, identify facilities that will have to reduce emissions and comply with stricter emission limitations. This program may restrict construction of new coal-fired power plants where emissions are projected to reduce visibility in protected areas. In addition, this program may require certain existing coal-fired power plants to install emissions control equipment to reduce haze-causing emissions such as sulfur dioxide, nitrogen oxide, and particulate matter. Demand for our steam coal could be affected when these standards are implemented by the applicable states.

On June 3, 2010, EPA issued a final rule setting forth a more stringent primary NAAQS applicable to sulfur dioxide. The rule also modifies the monitoring increment for the sulfur dioxide standard, establishing a 1-hour standard, and expands the sulfur dioxide monitoring network. Attainment designations will be made pursuant to the modified standards by June 2012. States with non-attainment areas will have until 2014 to submit SIP revisions which must meet the modified standard by August 1, 2017; for all other areas, states will be required to submit "maintenance" SIPs by 2013. EPA also plans to address the secondary sulfur dioxide standard, which is currently under review. As a result, coal-fired power plants, which are the largest end users of our coal, may be required to install additional emissions control equipment or take other steps to lower sulfur emissions.

The Department of Justice, on behalf of the EPA, has filed lawsuits against a number of coal-fired electric generating facilities alleging violations of the new source review provisions of the CAA. The EPA has alleged that certain modifications have been made to these facilities without first obtaining certain permits issued under the new source review program. Several of these lawsuits have settled, but others remain pending. Depending on the ultimate resolution of these cases, demand for our coal could be affected.