Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to .

Commission File Number: 0-26820

CRAY INC.

(Exact Name of Registrant as Specified in Its Charter)

| Washington | 93-0962605 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 901 Fifth Avenue, Suite 1000 Seattle, Washington |

98164 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(206) 701-2000

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $.01 par value | Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the Common Stock held by non-affiliates of the registrant as of June 30, 2010, was approximately $189,223,899 based upon the closing price of $5.58 per share reported on June 30, 2010, on the Nasdaq Global Market.

As of March 1, 2011, there were 36,150,618 shares of Common Stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference from the registrant’s definitive proxy statement relating to the annual meeting of shareholders to be held in 2011, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

EXPLANATORY NOTE

The purpose of this Amendment No. 1 to our Annual Report on Form 10-K for the year ended December 31, 2010, as filed with the Securities and Exchange Commission on March 4, 2011, is to:

| • | amend and restate the performance graph included in Item 5 to Part II to properly reflect the one-for-four reverse split of the registrant’s common stock effected on June 8, 2006; and |

| • | to amend and restate the Exhibit Index incorporated by reference in Item 15 and to re-file Exhibit 10.28 in order to attach the correct version of the registrant’s Amended and Restated 2001 Employee Stock Purchase Plan. |

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, the registrant is filing the following additional exhibits herewith:

| • | 31.3 Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002; and |

| • | 31.4 Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

Except as described above, no other amendments are being made to the registrant’s Form 10-K filed on March 4, 2011 and this Amendment No. 1 to the Annual Report on Form 10-K does not reflect the occurrence of any events thereafter.

| Item 5. | Market for the Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

Price Range of Common Stock and Dividend Policy

Our common stock is traded on the Nasdaq Global Market under the symbol CRAY. On March 1, 2011, we had 36,150,618 shares of common stock outstanding that were held by 390 holders of record.

The quarterly high and low sales prices of our common stock for the periods indicated are as follows:

| High | Low | |||||||

| Year Ended December 31, 2010: |

||||||||

| First Quarter |

$ | 6.85 | $ | 4.52 | ||||

| Second Quarter |

$ | 7.45 | $ | 4.51 | ||||

| Third Quarter |

$ | 6.90 | $ | 4.95 | ||||

2

| High | Low | |||||||

| Fourth Quarter |

$ | 7.70 | $ | 5.39 | ||||

| Year Ended December 31, 2009: |

||||||||

| First Quarter |

$ | 3.55 | $ | 1.83 | ||||

| Second Quarter |

$ | 8.10 | $ | 3.34 | ||||

| Third Quarter |

$ | 9.49 | $ | 6.55 | ||||

| Fourth Quarter |

$ | 8.55 | $ | 5.65 | ||||

We have not paid cash dividends on our common stock and we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Equity Compensation Plan Information

The following table provides information as of December 31, 2010, with respect to compensation plans under which shares of our common stock are authorized for issuance, including plans previously approved by our shareholders and plans not previously approved by our shareholders.

| Plan Category |

Number of Shares of Common Stock to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Shares of Common Stock Available for Future Issuance Under Equity Compensation Plans (excluding shares reflected in 1st column) |

|||||||||

| Equity compensation plans approved by shareholders(1) |

2,836,705 | 6.31 | 3,256,667 | |||||||||

| Equity compensation plans not approved by shareholders(2) |

609,005 | 5.72 | — | |||||||||

| Total |

3,445,710 | 6.20 | 3,256,667 | |||||||||

| (1) | The shareholders approved our 1995, 1999 and 2003 stock option plans, our 2004, 2006 and 2009 long-term equity compensation plans and our 2001 employee stock purchase plan (including as amended); the 1995 and 1999 stock option plans have terminated and no more options may be granted under those plans. Pursuant to these stock option plans, incentive options may be granted to employees (including officers) and nonqualified options may be granted to employees, officers, directors, agents and consultants with exercise prices at least equal to the fair market value of the underlying common stock at the time of grant. While the Board may grant options with varying vesting periods under these plans, most options granted to employees vest over four years, with 25% of the options vesting after one year and the remaining options vesting monthly over the next three years, and most option grants to non-employee directors vesting monthly over the twelve months after grant. Under the 2004, 2006 and 2009 long-term equity compensation plans, the Board may grant restricted and performance stock grants in addition to incentive and nonqualified stock options. As of December 31, 2010, under the option and equity compensation plans approved by shareholders under which we may grant stock options, an aggregate of 3,256,667 shares remained available for grant as options and, under the option and equity compensation plans approved by shareholders under which we may grant restricted and bonus awards, an aggregate of 1,699,108 shares were available for such awards. |

Under the 2001 employee stock purchase plan, as amended, all employees are eligible to participate and purchase shares of our common stock at a purchase price equal to 95% of the fair market value of our common stock on the fourth business day after the end of each offering period. The employee stock purchase plan covers a total of 1,000,000 shares; at December 31, 2010, we had issued a total of 894,667 shares under the plan and had a total of 105,333 shares available for future issuance. The first two columns do not include the shares to be issued under the employee stock purchase plan for the offering period that began on December 16, 2010 and will end on March 15, 2011, as neither the number of shares to be issued in that offering period nor the offering price is now determinable.

| (2) | The shareholders did not approve the 2000 non-executive employee stock option plan. Under the 2000 non-executive employee stock option plan approved by the Board of Directors on March 30, 2000, an aggregate of 1,500,000 shares pursuant to non-qualified options could be issued to employees, agents and consultants but not to officers or directors. Otherwise, the 2000 non-executive employee stock option plan is similar to the stock |

2

| option plans described in footnote (1) above. On March 30, 2010, the 2000 non-executive employee stock option plan was terminated, which ended future grants but did not affect then outstanding options. At December 31, 2010, under the 2000 non-executive employee stock plan we had options for 579,915 shares outstanding. |

On April 1, 2004, in connection with the acquisition of OctigaBay Systems Corporation, subsequently renamed Cray Canada Inc., we assumed that company’s key employee stock option plan, including existing options. Options could be granted to Cray Canada employees, directors and consultants. Otherwise the Cray Canada key employee stock option plan is similar to the stock option plans described in footnote (1) above. On March 8, 2006, the Cray Canada plan was terminated, which ended future grants but did not affect then outstanding options. Under the Cray Canada key employee stock option plan, we had 29,090 options outstanding as of December 31, 2010.

From time to time we have issued warrants as compensation to consultants and others for services without shareholder approval. As of December 31, 2010, we had no such warrants outstanding.

Unregistered Sales of Securities

We had no unregistered sales of our securities in 2010 not previously reported.

Issuer Repurchases

We did not repurchase any of our common stock in 2010.

3

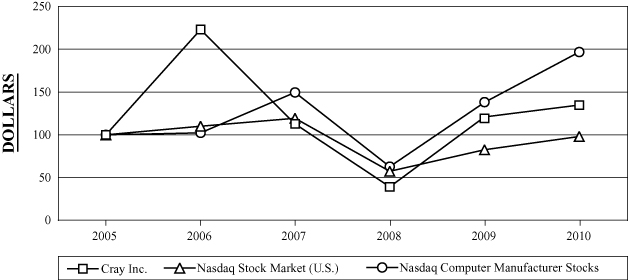

STOCK PERFORMANCE GRAPH

The graph below compares the cumulative total return to shareholders for our common stock with the comparable return of the Nasdaq Stock Market (U.S. companies) Index and the Nasdaq Computer Manufacturer Stocks Index.

The graph assumes that a shareholder invested $100 in our common stock on December 31, 2005, and that all dividends were reinvested. We have never paid cash dividends on our common stock. All return information is historical and is not necessarily indicative of future performance.

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG OUR COMMON STOCK,

THE NASDAQ STOCK MARKET (U.S. COMPANIES) INDEX AND THE NASDAQ

COMPUTER MANUFACTURER STOCKS INDEX THROUGH DECEMBER 31, 2010

| 12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | |||||||||||||||||||

| Cray Inc. |

100.0 | 223.3 | 112.6 | 39.1 | 120.7 | 134.8 | ||||||||||||||||||

| Nasdaq Stock Market (U.S.) |

100.0 | 109.8 | 119.1 | 57.4 | 82.5 | 97.9 | ||||||||||||||||||

| Nasdaq Computer Manufacturer Stocks |

100.0 | 102.1 | 149.4 | 62.8 | 137.8 | 196.7 | ||||||||||||||||||

| Item 15. | Exhibits and Financial Statement Schedules |

(a)(1) Financial Statements

| Consolidated Balance Sheets at December 31, 2010 and December 31, 2009 |

| Consolidated Statements of Operations for the years ended December 31, 2010, 2009 and 2008 |

| Consolidated Statements of Shareholders’ Equity and Comprehensive Income (Loss) for the years ended December 31, 2010, 2009 and 2008 |

| Consolidated Statements of Cash Flows for the years ended December 31, 2010, 2009 and 2008 |

| Notes to Consolidated Financial Statements |

| Report of Independent Registered Public Accounting Firm |

(a)(2) Financial Statement Schedules

Schedule II — Valuation and Qualifying Accounts — The financial statement schedule for the years ended December 31, 2010, 2009 and 2008 should be read in conjunction with the consolidated financial statements of Cray Inc. filed as part of this annual report on Form 10-K.

Schedules other than that listed above have been omitted since they are either not required, not applicable, or because the information required is included in the consolidated financial statements or the notes thereto.

(a)(3) Exhibits

The Exhibits listed in the Exhibit Index, which appears immediately following the signature page and is incorporated herein by reference, are filed as part of this annual report on Form 10-K. Each management contract or compensatory plan or agreement listed on the Exhibit Index is identified by an asterisk.

4

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Company has duly caused this Amendment No.1 to the Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Seattle, State of Washington, on March 18, 2011.

| CRAY INC. | ||

| By | /S/ PETER J. UNGARO | |

| Peter J. Ungaro | ||

| Chief Executive Officer and President | ||

5

EXHIBIT INDEX

| Exhibit Number |

Description | |

| 3.1 | Restated Articles of Incorporation(1) | |

| 3.2 | Amended and Restated Bylaws(7) | |

| 4.1 | Form of Common Stock Purchase Warrants due June 21, 2009(13) | |

| 10.0* | 1999 Stock Option Plan(29) | |

| 10.1* | 2000 Non-Executive Employee Stock Option Plan(5) | |

| 10.2* | 2001 Employee Stock Purchase Plan, as Amended(10) | |

| 10.3* | 2003 Stock Option Plan(2) | |

| 10.4* | 2004 Long-Term Equity Compensation Plan(12) | |

| 10.5* | 2005 Executive Bonus Plan(16) | |

| 10.6* | Cray Canada Inc. Amended and Restated Key Employee Stock Option Plan(17) | |

| 10.7* | 2006 Long-Term Equity Compensation Plan(28) | |

| 10.8* | 2009 Long-Term Equity Compensation Plan(35) | |

| 10.9* | Form of Officer Non-Qualified Stock Option Agreement(18) | |

| 10.10* | Form of Officer Incentive Stock Option Agreement(18) | |

| 10.11* | Form of Director Stock Option Agreement(18) | |

| 10.12* | Form of Director Stock Option Agreement, immediate vesting(18) | |

| 10.13* | Form of Employee Restricted Stock Agreement, current form(32) | |

| 10.14* | Form of Director Restricted Stock Agreement(1) | |

| 10.15* | 2007 Cash Incentive Plan(7) | |

| 10.16* | Senior Officer Cash Incentive Plan for annual cash incentive awards(8) | |

| 10.17* | Letter Agreement between the Company and Peter J. Ungaro, effective March 7, 2005(15) | |

| 10.18* | Offer Letter between the Company and Margaret A. Williams, dated April 14, 2005(21) | |

| 10.19* | Offer Letter between the Company and Brian C. Henry, dated May 16, 2005(22) | |

| 10.20* | Form of Management Continuation Agreement between the Company and its Executive Officers and certain other Employees, as in effect prior to December 19, 2008(9) | |

| 10.21* | Form of Management Retention Agreement, dated as of December 19, 2008, including Annex A-1 and Annex A-2 applicable to Peter J. Ungaro and Brian C. Henry, respectively(26) | |

| 10.22* | Executive Severance Policy, as in effect on December 19, 2008(26) | |

| 10.23* | Executive Severance Policy, as adopted on December 13, 2010(37) | |

| 10.24* | Retention Agreement between the Company and Peter J. Ungaro, dated December 20, 2005(24) | |

| 10.25* | Retention Agreement between the Company and Brian C. Henry, dated December 20, 2005(24) | |

| 10.26* | Retention Agreement between the Company and Margaret A. Williams, dated December 20, 2005(24) | |

| 10.27* | Summary sheet setting forth amended compensation arrangements for non-employee Directors(25) | |

| 10.28* | Amended and Restated 2001 Employee Stock Purchase Plan (pending shareholder approval) | |

| 10.29 | Form of Indemnification Agreement(11) | |

| 10.30 | Lease Agreement between 900 Fourth Avenue Property LLC and the Company, dated as of August 11, 2008(19) | |

| 10.31 | FAB I Building Lease Agreement between Union Semiconductor Technology Corporation and the Company, dated June 30, 2000(6) | |

| 10.32 | Amendment No. 1 to the FAB Building Lease Agreement between Union Semiconductor Technology Corporation and the Company, dated as of August 19, 2002(3) | |

| 10.33 | Conference Center Lease Agreement between Union Semiconductor Technology Corporation and the Company, dated June 30, 2000(6) | |

| 10.34 | Amendment No. 1 to the Conference Center Lease Agreement between Union Semiconductor Technology Corporation and the Company, dated as of August 19, 2002(3) | |

| 10.35 | Development Building and Conference Center Lease Agreement between Northern Lights Semiconductor Corporation and the Company, dated as of February 1, 2008(30) | |

| 10.36 | Lease between NEA Galtier, LLC and the Company, dated as of July 2, 2009(34) | |

| 10.37 | Technology Agreement between Silicon Graphics, Inc. and the Company, effective as of March 31, 2000(4) | |

| 10.38 | Amendment No. 2 to the Technology Agreement between Silicon Graphics, Inc. and the Company, dated as of March 30, 2007(31) | |

| 10.39 | Amendment No. 3 to the Technology Agreement between Silicon Graphics, Inc. and the Company, dated | |

6

| Exhibit Number |

Description | |

| as of March, 28, 2008(14) | ||

| 10.40 | Credit Agreement between Wells Fargo Bank, National Association and the Company, dated December 29, 2006(27) | |

| 10.41 | First Amendment to Credit Agreement between Wells Fargo Bank, National Association and the Company, dated January 31, 2007(32) | |

| 10.42 | Second Amendment to Credit Agreement between Wells Fargo Bank, National Association and the Company, effective as of December 31, 2007(23) | |

| 10.43 | Third Amendment to Credit Agreement between Wells Fargo Bank, National Association and the Company, dated August 22, 2008(19) | |

| 10.44 | Fourth Amendment to Credit Agreement between Wells Fargo Bank, National Association and the Company, dated April 20, 2009(20) | |

| 10.45 | Fifth Amendment to Credit Agreement between Wells Fargo Bank, National Association and the Company, dated June 1, 2009(33) | |

| 10.46 | Loan and Security Agreement between Silicon Valley Bank and the Company, dated September 13, 2010(36) | |

| 21.1 | Subsidiaries of the Company** | |

| 23.1 | Consent of Peterson Sullivan LLP, Independent Registered Public Accounting Firm** | |

| 24.1 | Power of Attorney for directors and officers (included on the signature page of this report)** | |

| 31.1 | Rule 13a-14(a)/15d-14(a) Certification of Mr. Ungaro, Chief Executive Officer** | |

| 31.2 | Rule 13a-14(a)/15d-14(a) Certification of Mr. Henry, Chief Financial Officer** | |

| 31.3 | Rule 13a-14(a)/15d-14(a) Certification of Mr. Ungaro, Chief Executive Officer | |

| 31.4 | Rule 13a-14(a)/15d-14(a) Certification of Mr. Henry, Chief Financial Officer | |

| 32.1 | Certification pursuant to 18 U.S.C. Section 1350 by the Chief Executive Officer and the Chief Financial Officer** | |

| (1) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on June 8, 2006. |

| (2) | Incorporated by reference to the Company’s definitive Proxy Statement for the 2003 Annual Meeting, as filed with the Commission on March 31, 2003. |

| (3) | Incorporated by reference to the Company’s Annual Report on Form 10-K, as filed with the Commission for the fiscal year ended December 31, 2002 on March 28, 2003. |

| (4) | Incorporated by reference to the Company’s Quarterly Report on Form 10-Q, as filed with the Commission on May 15, 2000. |

| (5) | Incorporated by reference to the Company’s Registration Statement on Form S-8 (SEC No. 333-57970), as filed with the Commission on March 30, 2001. |

| (6) | Incorporated by reference to the Company’s Annual Report on Form 10-K, as filed with the Commission for the fiscal year ended December 31, 2000 on April 2, 2001. |

| (7) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on February 12, 2007. |

| (8) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on May 14, 2008. |

| (9) | Incorporated by reference to the Company’s Quarterly Report on Form 10-Q, as filed with the Commission on May 17, 1999. |

| (10) | Incorporated by reference to the Company’s definitive Proxy Statement for the 2005 Annual Meeting, as filed with the Commission on April 14, 2005. |

| (11) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on February 8, 2011. |

| (12) | Incorporated by reference to the Company’s definitive Proxy Statement for the 2004 Annual Meeting, as filed with the Commission on March 24, 2004. |

| (13) | Incorporated by reference to the Company’s Registration Statement on Form S-3 (SEC No. 333-57972), as filed with the Commission on March 30, 2001. |

7

| (14) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on April 8, 2008. |

| (15) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on March 8, 2005. |

| (16) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on March 25, 2005. |

| (17) | Incorporated by reference to the Company’s Registration Statement on Form S-8 (SEC No. 333-114243), as filed with the Commission on April 6, 2004. |

| (18) | Incorporated by reference to the Company’s Annual Report on Form 10-K, as filed with the Commission for the fiscal year ended December 31, 2004 on April 1, 2005. |

| (19) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on August 29, 2008. |

| (20) | Incorporated by reference to the Company’s Annual Report on Form 10-K, as filed with the Commission for the fiscal year ended December 31, 2009 on March 16, 2010. |

| (21) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on May 9, 2005. |

| (22) | Incorporated by reference to the Company’s Quarterly Report on Form 10-Q, as filed with the Commission on November 9, 2005. |

| (23) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on January 4, 2008. |

| (24) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on December 22, 2005. |

| (25) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on February 21, 2006. |

| (26) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on December 22, 2008. |

| (27) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on January 4, 2007. |

| (28) | Incorporated by reference to the Company’s definitive Proxy Statement for the 2006 Annual Meeting, as filed with the Commission on April 28, 2006. |

| (29) | Incorporated by reference to the Company’s Registration Statement on Form S-8, (SEC No. 333-57970), as filed with the Commission on March 30, 2001. |

| (30) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on February 1, 2008. |

| (31) | Incorporated by reference to the Company’s Quarterly Report on Form 10-Q, as filed with the Commission on August 7, 2007. |

| (32) | Incorporated by reference to the Company’s Annual Report on Form 10-K, as filed with the Commission for the fiscal year ended December 31, 2006 on March 9, 2007. |

| (33) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on July 13, 2009. |

| (34) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on July 16, 2009. |

| (35) | Incorporated by reference to the Company’s definitive Proxy Statement for the 2009 Annual Meeting, as filed with the Commission on March 31, 2009. |

| (36) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on September 17, 2010. |

| (37) | Incorporated by reference to the Company’s Current Report on Form 8-K, as filed with the Commission on December 17, 2010. |

| * | Management contract or compensatory plan or arrangement. |

| ** | Previously filed. |

8