Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x Annual Report to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year ended December 31, 2009.

o Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _____________to______________

Commission File No. 000-27773

|

ASPIRE INTERNATIONAL, INC.

|

||

|

(Exact name of registrant as specified in its charter)

|

|

Maryland

|

91-1869317

|

|

|

(State or other jurisdiction

|

(I.R.S. Employer

|

|

|

of Incorporation)

|

Identification No.)

|

|

18 Crown Steel Drive, Unit #310, Markham, Ontario L3R 9X8

|

||

|

(Address of principal executive offices)

|

Registrant’s telephone number, including area code: (905) 943-9996

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class

|

Name of each Exchange on which Registered

|

|

|

Not Applicable

|

None

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, $0.001 Par Value

|

||

|

(Title of Class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes o No þ

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yeso No þ

Check if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this form, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Non-accelerated filer o

|

|

Accelerated filer o

|

Smaller Reporting Company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of February 18, 2011: was approximately $7,900,000

Indicate the number of shares outstanding of the Company’s classes of common stock as of February 18, 2011: 18,884,419 shares of common stock, par value $0.001 per share.

Documents incorporated by reference: None.

|

TABLE OF CONTENTS

|

|||

| Page | |||

| 1 | |||

| 2 | |||

| 2 | |||

| 2 | |||

| 4 | |||

| 6 | |||

| 7 | |||

| 7 | |||

| 8 | |||

| 8 | |||

| 11 | |||

| 12 | |||

| 13 | |||

| 13 | |||

| 14 | |||

COMPANY HISTORY AND INTRODUCTION

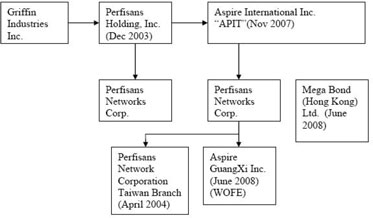

Aspire International Inc. (“Aspire” or the “Company”), a Maryland corporation, was formerly known as Perfisans Holdings Inc. (“Perfisans”) before October 25, 2007. Prior to that, the Company was known as Griffin Industries, Inc., which acquired 100% of the capital stock of Perfisans Networks Corporation (“Perfisans Networks”), an Ontario corporation, on December 19, 2003. This transaction was accounted for as a reverse acquisition. We changed our name to Perfisans in conjunction with the reverse acquisition. On October 25, 2007, Perfisans changed its name to Aspire.

In June, 2008, we set up a wholly owned subsidiary of Aspire, Mega Bond (Hong Kong) Limited (“Mega Bond”), a Hong Kong company, to develop a China trade business. Mega Bond operated as an independent business unit with its own profit and loss. Mega Bond ceased business operations in the second quarter of 2009. It is management’s intention to close the Mega Bond office in fiscal 2011.

In June, 2008 we set up a wholly owned foreign enterprise operation Aspire GuangXi Inc. (“Aspire GuangXi”) in the province of GuangXi, China, in order to operate a mine in GuangXi. Aspire GuangXi is a fully owned subsidiary of Perfisans Networks, and is focused on managing the GuangXi Manganese mining Project. Aspire GuangXi ceased business operations in the second quarter of 2009.

For the fiscal year 2009, the Company’s organizational chart was as follows:

On 14 February 2011, the Company disposed of its subsidiary Perfisans Networks Corporation, and consequently its primary mining operations, contained in its subsidiary Aspire GuangXi Inc.

1

Additionally, on 14 February 2011, the Company entered into an Asset Purchase Agreement with Candid Global Resources (Hong Kong) Ltd., which agreed to sell 100% of its assets, including the sub-entity known as “Mygos” and related trademarks and intellectual property in exchange for 10,000,000 shares of Aspire.

The Company’s primary business operations, purchased as part of this agreement, is the Mygos website (http://www.mygos.net/) which is an online business-to-consumer shopping mall, headquartered in Shenzhen, in the Guangdong province of China. Mygos operates as a platform to allow users to start their own businesses online and currently hosts over 80,000 active stores.

EMPLOYEES

As of December 31, 2009, the Company had 2 full-time employees in Canada and China.

Our headquarters are located at 18 Crown Steel Drive, Suite 310, Markham, Ontario, L3R 9X8, in 1,267 square feet of office space leased from an unrelated party. Current rentals are $958.61 per month excluding insurance and other occupancy charges. The lease expires in June 2010.

We are not a party to any material legal proceedings and there are no material legal proceedings pending with respect to our property. We are not aware of any legal proceedings contemplated by any governmental authorities involving either our property or us. None of our directors, officers or affiliates is an adverse party in any legal proceedings involving us or our subsidiaries, or has an interest in any proceeding which is adverse to us or our subsidiaries.

Our shares of common stock are quoted on the NASD’s OTC Bulletin Board under the symbol “PFNH”. The symbol was changed to “PFHD” on November 14, 2007 after the 25 to 1 reverse stock split. The symbol was again changed to “APIT” on December 18, 2007. Listed below are the high and low sale prices for the shares of our common stock during the fiscal years ended December 31, 2007, 2008, 2009 and through March 15, 2011, as adjusted to reflect the reverse split of our shares of common stock effectuated on November 14, 2007. These quotations reflect inter-dealer prices, without mark-up, mark-down or commission and may not represent actual transactions.

|

Common Stock

|

High

|

Low

|

||||||

|

Fiscal 2008

|

||||||||

|

First Quarter

|

$ | 0.51 | $ | 0.20 | ||||

|

Second Quarter

|

0.40 | 0.10 | ||||||

|

Third Quarter

|

0.40 | 0.06 | ||||||

|

Fourth Quarter

|

0.51 | 0.06 | ||||||

|

Fiscal 2009

|

||||||||

|

First Quarter

|

$ | 0.15 | $ | 0.04 | ||||

|

Second Quarter

|

0.10 | 0.02 | ||||||

|

Third Quarter

|

0.05 | 0.02 | ||||||

|

Fourth Quarter

|

0.38 | 0.02 | ||||||

|

Through February 18, 2011

|

0.42 | 0.24 | ||||||

2

On February 18, 2011 there were approximately 250 holders of record of our 18,884,419 shares of common stock issued and outstanding.

On February 18, 2011 the last sale price of the shares of our common stock as reported on the OTC Bulletin Board was $0.42.

DIVIDEND POLICY

We have never paid cash dividends and have no plans to do so in the foreseeable future. Our future dividend policy will be determined by our board of directors and will depend upon a number of factors, including our financial condition and performance, our cash needs and expansion plans, income tax consequences, and the restrictions that applicable laws and our credit arrangements then impose.

RECENT SALES of UNREGISTERED SECURITIES

There were no issuances of unregistered Securities

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY PLANS

On February 12, 2004, our board of directors adopted our 2004 Stock Option Plan (the “Option Plan”). The Option Plan provides for the grant of incentive and non-qualified stock options to selected employees, the grant of non-qualified options to selected consultants and to directors and advisory board members. The Option Plan authorizes the grant of options for 10,000,000 shares of our common stock.

During the second quarter of fiscal year 2009, the Company cancelled all outstanding stock options, when the Aspire GuangXi mining operation became inactive.

CONTRACTUAL OBLIGATIONS AND COMMERCIAL COMMITMENTS:

Contractual obligations as of December 31, 2009 are as follows:

|

Contractual Obligations

|

Total

|

Less than 1

year

|

After 1-3

years

|

3-5

years

|

Thereafter

|

|||||||||||||||

|

Building leases

|

$ | 3,900 | $ | 3,900 | $ | — | $ | — | $ | — | ||||||||||

|

Land use payments

|

122,756 | — | 3,645 | 45,811 | 73,300 | |||||||||||||||

|

Promissory note

|

2,017,478 | 2,017,478 | — | — | — | |||||||||||||||

|

Total

|

$ | 2,144,134 | $ | 2,021,378 | $ | 3,645 | $ | 45,811 | $ | 73,300 | ||||||||||

3

RECENT ACCOUNTING PRONOUNCEMENTS:

None.

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. We regularly evaluate our estimates and assumptions based upon historical experience and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are notreadily apparent from other sources. To the extent actual results differ from those estimates, our future results of operations may be affected. We believe the following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements.

REVENUE RECOGNITION

Mega Bond – This subsidiary’s primary business operations involve sourcing electronic components for importing into China. Its policy is to recognize revenue earned on a gross vs net basis in accordance with ASC No. 605-45, “RevenueRecognition: Principal Agent Considerations” whereby it evaluates inventory and credit risk and whether there is a transfer of the risks and rewards of ownership. As a result of the fact that the Company takes possession of the goods prior to import, the Company records revenue on a gross basis. At this time, persuasive evidence of an arrangement exists, delivery has occurred, the selling price is fixed, and collectibility is reasonably assured. The impact on Operating Income is the same whether the Company records revenue on a gross or net basis.

Aspire GuangXi – The Company currently has no revenue related to the mining operations and does not expect to generate revenue until such time that the Company acquires control of the mine in accordance with the earn-in agreement.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

We maintain allowances for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. If the financial condition of our customers were to deteriorate, our actual losses may exceed our estimates, and additional allowances would be required.

FORWARD-LOOKING STATEMENTS

The following discussion and analysis should be read in conjunction with the financial statements and notes appearing elsewhere in this Annual Report on Form 10-K.

This filing contains forward-looking statements. The words “anticipated,” “believe,” “expect, “plan,” “intend,” “seek,” “estimate,” “project,” “could,” “may,” and similar expressions are intended to identify forward-looking statements. These statements include, among others, information regarding future operations, future capital expenditures, and future net cash flow. Such statements reflect our management’s current views with respect to future events and financial performance and involve risks and uncertainties, including, without limitation, general economic and business conditions, changes in foreign, political, social, and economic conditions, regulatory initiatives and compliance with governmental regulations, the ability to achieve further market penetration and additional customers, and various other matters, many of which are beyond our control. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove to be incorrect, actual results may vary materially and adversely from those anticipated, believed, estimated or otherwise indicated. Consequently, all of the forward-looking statements made in this filing are qualified by these cautionary statements and there can be no assurance of the actual results or developments, nor

4

OVERVIEW

Aspire International Inc. (“Aspire” or the “Company”), a Maryland corporation, was formerly known as Perfisans Holdings Inc. (“Perfisans”) before October 25,2007. Prior to that, Perfisans was known as Griffin Industries, Inc. (“Griffin”), which acquired 100% of the capital stock of Perfisans Networks Corporation (“Perfisans Networks”), an Ontario corporation, on December 19, 2003. This transaction was accounted for as a reverse acquisition. We changed our name to Perfisans in conjunction with the reverse acquisition. On October 25, 2007, Perfisans changed its name to Aspire.

Because we have not generated sufficient revenue to date, we have prepared our financial statements with the assumption that there is substantial doubt that we can continue as a going concern. Our ability to continue as a going concern is dependent on our ability to affect our Plan of Operations.

PLAN OF OPERATIONS

Aspire International Inc. is a U.S. company, incorporated in October 14, 1997 in the state of Maryland.

On 14 February 2011, the Company disposed of its subsidiary Perfisans Networks Corporation, and consequently its primary mining operations, contained in its subsidiary Aspire GuangXi Inc.

Additionally, on 14 February 2011, the Company entered into an Asset Purchase Agreement with Candid Global Resources (Hong Kong) Ltd., which agreed to sell 100% of its assets, including the sub-entity known as “Mygos” and related trademarks and intellectual property in exchange for 10,000,000 shares of Aspire.

The Company’s primary business operations, purchased as part of this agreement, is the Mygos website (http://www.mygos.net/) which is an online business-to-consumer shopping mall, headquartered in Shenzhen, in the Guangdong province of China. Mygos operates as a platform to allow users to start their own businesses online and currently hosts over 80,000 active stores.

The Company’s plans during fiscal 2011 are as follows:

During Q1 and Q2 of 2011, the Company will focus on expanding Mygos’s business in the China and South East Asia (including the Hong Kong, Macao, and Taiwan markets).

In Q3 of 2011, the Company intends to begin promoting Mygos in India, Japan, South Korea, and North America.

In Q4 of 2011, the Company intends to begin promoting Mygos in Australia, New Zealand, and Africa.

FISCAL YEAR ENDED DECEMBER 31, 2009 COMPARED TO DECEMBER 31, 2008

The sales and cost of sales for both 2008 and 2009 related solely to the Mega Bond division. The reduction in sales of $99,246 was due to the decision of management to cease operations at the end of the first quarter of 2009, until they determined whether it wished to continue in this line of business. In 2011 management made the decision that it would not discontinue the operations of the division. There were no significant assets or liabilities remaining in the division at the end of 2009.

Interest increased to the continued accrued interest on debt and further advances by shareholders. General and administration decreased due to the fact the company was mostly inactive during the last three quarters of 2009.

5

LIQUIDITY AND CAPITAL RESOURCES

At December 31, 2009, we had an accumulated deficit of $23,697,626 and a working capital deficit of $7,332,154. For the year ended December 31, 2009, net cash used in operating activities amounted to $63,228, as compared to $92,780 for the year ended December 31, 2008.

In March 2004, we borrowed $250,000 from an unaffiliated lender. The loan bears interest at 2% per month and is payable on July 3, 2004 or upon our receipt of at least $4,000,000 of proceeds from the sale of stock. In October 30, 2004 we increased the borrowed amount from the same lender to $392,208 which bears interest at 3% per month. The total amount of the loan with principal and interest was $2,017,478 as at December 31, 2009.

We are now in the process of extending the loan period. We intend to repay such loans out of proceeds from future additional funding raised by sale of stock.

We currently have a balance of $335,209.11 owed to General Resources Company, a corporation which is a shareholder of Aspire. We intend to repay such loans out of proceeds from future additional funding which may be raised by sale of stock.

There was a director loan of $90,000 which bears an interest at 2% per month that we received during the year of 2005. Interest is accruing on this loan at $5,400 per quarter.

We have a promissory note in the amount of $2,017,478 that bears interest at 3% per month, with principal and interest payable at December 31, 2005. Management is in default of the payment on maturity and is currently in discussions with the lender to revise the terms. The new terms have not been finalized or agreed to by either side and the lender has not demanded repayment.

At December 31, 2009, we had no material commitments for capital expenditures other than for those expenditures incurred for the mining operations.

It is not anticipated that further financing will need to be raised to carry out our business plans for Mygos for fiscal 2011.

OFF-BALANCE SHEET ARRANGEMENTS

None.

6

ASPIRE INTERNATIONAL INC. AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Aspire International, Inc.

We have audited the accompanying consolidated balance sheets of Aspire International, Inc. and Subsidiaries as of 31 December 2009 and 2008, and the related consolidated statement of operations, stockholders’ equity, and cash flows for the years ended 31 December 2009 and 2008. Aspire International, Inc.’s management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstance, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Aspire International, Inc. and Subsidiaries as of 31 December 2009 and 2008 and the results of its consolidated operations and comprehensive income, stockholders' equity, and its cash flows for the years ended 31 December 2009 and 2008, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company’s significant cumulative operating losses raise substantial doubt about its ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ DNTW Chartered Accountants, LLP

Licensed Public Accountants

Markham, Canada

8 March 2011

F-2

ASPIRE INTERNATIONAL INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

AS OF 31 DECEMBER 2009 AND 2008

| 2009 | 2008 | |||||||

| ASSETS | ||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 51,888 | $ | 24,227 | ||||

|

Prepayment and other receivables

|

6,236 | 31,799 | ||||||

|

Advances receivable

|

517,474 | 517,121 | ||||||

|

Total Current Assets

|

575,598 | 573,147 | ||||||

|

Capital and Other Assets

|

||||||||

|

Deferred charges

|

54,391 | 70,114 | ||||||

|

Property and equipment, net

|

460,644 | 661,569 | ||||||

|

Intellectual property

|

1 | 1 | ||||||

|

Total Capital and Other Assets

|

515,036 | 731,684 | ||||||

|

Total Assets

|

$ | 1,090,634 | $ | 1,304,831 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 4,111,672 | $ | 3,645,243 | ||||

|

Customer advances

|

746,703 | 746,194 | ||||||

|

Advances from stockholders

|

743,463 | 657,255 | ||||||

|

Loans payable

|

288,436 | 210,769 | ||||||

|

Promissory note payable

|

2,017,478 | 1,429,232 | ||||||

|

Total Current Liabilities

|

7,907,752 | 6,688,693 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders' Deficit | ||||||||

|

Preferred stock, par value of $0.001 per share; 5,000,000 authorized; Nil issued and outstanding

|

- | - | ||||||

|

Common stock,par value of $0.001 per share; 150,000,000 authorized; 14,899,419 issued and outstanding (31 December 2008 - 12,192,752)

|

14,899 | 12,192 | ||||||

|

Additional paid-in capital

|

17,838,954 | 17,518,419 | ||||||

|

Stock subscriptions receivable

|

(617,750 | ) | (600,000 | ) | ||||

|

Deferred stock-based compensation

|

(81,187 | ) | (161,333 | ) | ||||

|

Accumulated other comprehensive loss

|

(274,408 | ) | (152,638 | ) | ||||

|

Accumulated deficit

|

(23,697,626 | ) | (22,000,502 | ) | ||||

|

Total Stockholders' Deficit

|

(6,817,118 | ) | (5,383,862 | ) | ||||

|

Total Liabilities and Stockholders' Deficit

|

$ | 1,090,634 | $ | 1,304,831 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

F-3

ASPIRE INTERNATIONAL INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED 31DECEMBER 2009 AND 2008

|

2009

|

2008

|

|||||||

|

SALES

|

71,169 | 170,415 | ||||||

|

COST OF SALES

|

63,198 | 158,420 | ||||||

|

GROSS PROFIT

|

7,971 | 12,525 | ||||||

|

OPERATING EXPENSES

|

||||||||

|

Interest

|

637,688 | 487,407 | ||||||

|

General and administrative

|

423,824 | 958,844 | ||||||

|

Management salaries

|

400,000 | 400,000 | ||||||

|

Depreciation

|

116,244 | 31,676 | ||||||

|

TOTAL OPERATING EXPENSES

|

1,577,756 | 1,877,927 | ||||||

|

NET LOSS FROM OPERATIONS

|

(1,569,785 | ) | (1,865,402 | ) | ||||

|

Writedown of assets

|

(127,339 | ) | - | |||||

|

Interest income

|

- | 223 | ||||||

|

NET LOSS

|

$ | (1,697,124 |

)

|

$ | (1,865,179 | ) | ||

|

OTHER COMPREHENSIVE (LOSS) INCOME

|

||||||||

|

Foreign currency translation

|

(121,770 | ) | 530,983 | |||||

|

COMPREHENSIVE LOSS

|

$ | (1,818,894 | ) | $ | (1,334,196 | ) | ||

|

LOSS PER WEIGHTED NUMBER OF SHARES OUTSTANDING – BASIC AND DILUTED

|

$ | (0.13 | ) | $ | (0.22 | ) | ||

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING –BASIC AND DILUTED

|

12,743,260 | 8,424,115 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

F-4

ASPIRE INTERNATIONAL INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCK HOLDERS’ DEFICIT

FOR THE YEARS ENDED 31DECEMBER 2009 AND 2008

|

Shares

|

Capital Stock

|

Additional Paid-in Capital

|

Stock Subscriptions Receivable

|

Deferred Stock-Based Compensation

|

Accumulated Other Comprehensive Loss

|

Accumulated Deficit

|

Total Stockholders’ Deficit

|

|||||||||||||||||||||||||

|

Balance at 31 December 2007

|

5,584,905 | 5,585 | 15,849,124 | - | - | (683,621 | ) | (20,135,323 | ) | (7,601,132 | ) | |||||||||||||||||||||

|

Stock issued as deposit

|

1,333,332 | 1,333 | 598,667 | (600,000 | ) | - | - | - | - | |||||||||||||||||||||||

|

Stock issued for cash

|

4,264,515 | 4,264 | 457,762 | - | - | - | - | 462,026 | ||||||||||||||||||||||||

|

Stock issued for services

|

950,000 | 950 | 351,050 | - | (161,333 | ) | - | - | 190,667 | |||||||||||||||||||||||

|

Stock issued to settle liabilities

|

- | - | 20,940 | - | - | - | - | 20,940 | ||||||||||||||||||||||||

|

Stock-based compensation

|

- | - | 213,280 | - | - | - | - | 213,280 | ||||||||||||||||||||||||

|

Fair value of interest on interest-free advances from stockholders

|

- | - | 27,596 | - | - | - | - | 27,596 | ||||||||||||||||||||||||

|

Foreign currency translation

|

- | - | - | - | - | - | (1,865,179 | ) | (1,865,179 | ) | ||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | 530,983 | - | 530,983 | ||||||||||||||||||||||||

|

Balance at 31 December 2008

|

12,192,752 | 12,192 | 17,518,419 | (600,000 | ) | (161,333 | ) | (152,638 | ) | (22,000,502 | ) | (5,383,862 | ) | |||||||||||||||||||

|

Stock issued for cash

|

666,667 | 667 | 49,333 | - | - | - | - | 50,000 | ||||||||||||||||||||||||

|

Stock issued for services

|

2,040,000 | 2,040 | 81,460 | (17,750 | ) | (50,750 | ) | - | - | 15,000 | ||||||||||||||||||||||

|

Warrants issued for services

|

- | - | 57,500 | - | (57,500 | ) | - | - | - | |||||||||||||||||||||||

|

Stock-based compensation

|

- | - | 106,640 | - | 188,396 | - | - | 295,036 | ||||||||||||||||||||||||

|

Fair value of interest on interest-free advances from stockholders

|

- | - | 25,602 | - | - | - | - | 25,602 | ||||||||||||||||||||||||

|

Foreign currency translation

|

- | - | - | - | - | (121,770 | ) | - | (121,770 | ) | ||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | (1,697,124 | ) | (1,671,522 | ) | ||||||||||||||||||||||

|

Balance at 31 December 2009

|

14,899,419 | 14,899 | 17,838,954 | (617,750 | ) | (81,187 | ) | (274,408 | ) | (23,697,626 | ) | (6,817,118 | ) | |||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

F-5

ASPIRE INTERNATIONAL INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED 31DECEMBER 2009 AND 2008

|

2009

|

2008

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||

|

Net loss

|

$ | (1,697,124 | ) | $ | (1,865,179 | ) | ||

|

Adjustments for non-cash items:

|

||||||||

|

Depreciation

|

116,244 | 31,676 | ||||||

|

Writedown of assets

|

127,339 | - | ||||||

|

Stock-based compensation

|

295,036 | 213,280 | ||||||

|

Stock issued for services

|

15,000 | 190,667 | ||||||

|

Interest accrued on loans

|

613,848 | 483,787 | ||||||

|

Adjustments for changes in working capital:

|

||||||||

|

Prepayments and other receivables

|

- | 77,241 | ||||||

|

Advances receivable

|

- | (517,121 | ) | |||||

|

Accounts payable and accrued liabilities

|

466,429 | 1,362,983 | ||||||

|

Deferred charges

|

- | (70,114 | ) | |||||

|

CASH USED IN OPERATING ACTIVITIES

|

(63,228 | ) | (92,780 | ) | ||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||

|

Purchase of property and equipment

|

- | (668,615 | ) | |||||

|

CASH USED IN INVESTING ACTIVITIES

|

- | (668,615 | ) | |||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||

|

Advances from stockholders

|

86,208 | 15,260 | ||||||

|

Proceeds from loans payable

|

77,667 | 206,892 | ||||||

|

Proceeds from issuance of common stock

|

50,000 | 462,027 | ||||||

|

CASH PROVIDED BY FINANCING ACTIVITIES

|

213,875 | 684,179 | ||||||

|

EFFECT OF FOREIGN CURRENCY TRANSLATION

|

(122,986 | ) | 76,239 | |||||

|

NET INCREASE(DECREASE) IN CASH

|

27,661 | (977 | ) | |||||

|

CASH, BEGINNING OF YEAR

|

24,227 | 25,204 | ||||||

|

CASH, END OF YEAR

|

$ | 51,888 | $ | 24,227 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

F-6

ASPIRE INTERNATIONAL INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED 31DECEMBER2009 AND 2008

1. NATURE OF OPERATIONS

The consolidated financial statements include the accounts of Aspire International, Inc. (the “Company” or “Aspire”, formerly Perfisans Holdings, Inc.) and its wholly-owned subsidiaries, Perfisans Networks Corporation (“Perfisans”) and Mega Bond Group (Hong Kong) Limited (“Mega Bond”). Perfisans Networks Corporation includes the accounts of its wholly-owned subsidiaries, Perfisans Networks (Taiwan) Corporation (“Perfisans Taiwan”) and Aspire (GuangXi) Inc (“Aspire GuangXi”). All material inter-company balances and transactions have been eliminated. The Company has funded its operations to date mainly through the issuance of shares.

Mega Bond’s business activity involved the sale of electronic components up to the end of 31 March 2009. Mega Bond ceased business operations in the second quarter of 2009. It is management’s intention to close the Mega Bond office in fiscal 2011.

The Company ceased business operations at Perfisans Taiwan effective the second quarter of 2009. It is management’s intention to close the Taiwan branch in fiscal 2011.

2. GOING CONCERN

Certain principal conditions and events are prevalent which indicate that there could be substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. These include:

|

1)

|

Recurring operating losses

|

|

2)

|

Stockholders’ deficiency

|

|

3)

|

Working capital deficiency

|

|

4)

|

Adverse key financial ratios

|

The continuation of the Company as a going concern is dependent upon its ability to raise additional financing and ultimately attain and maintain profitable operations from commercialization of its intellectual property.

The consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed in the preparation of these consolidated financial statements.

Revenue Recognition

Mega Bond – This subsidiary’s primary business operations involve sourcing electronic components for importing into China. Its policy is to recognize revenue earned on a gross vs net basis in accordance with Accounting Standards Codification (“ASC”) No. 605-45, Revenue Recognition: Principal Agent Considerations whereby it evaluates inventory and credit risk and whether there is a transfer of the risks and rewards of ownership. As a result of the fact that the Company takes possession of the goods prior to import, the Company records revenue on a gross basis. At that time, persuasive evidence of an arrangement exists, delivery has occurred, the selling price is fixed, and collectability is reasonably assured. The impact on Operating Income is the same whether the Company records revenue on a gross or net basis.

Aspire GuangXi – The Company currently has no revenue related to the mining operations and does not expect to generate revenue until such time that the Company acquires control of the mine in accordance with the earn-in agreement.

F-7

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, amounts due to banks, and any other highly liquid investments with a maturity of three months or less. The carrying amounts approximate fair values because of the short-term maturity of those instruments.

Fair Value of Financial Instruments

The Company’s financial instruments include advances receivable, accounts payable, customer advances, advances from stockholders, loans payable, promissory notes payable, and stock subscriptions receivable.

The estimated fair values of financial instruments have been determined by the Company using available market information and valuation methodologies. Considerable judgment is required in estimating fair values. Accordingly, the estimates may not be indicative of the amounts the Company could realize in a current market exchange. As of 31 December 2009 and 2008 the carrying values of financial instruments approximate their fair values due to the short-term maturity of these instruments.

Long Term Financial Instruments

The fair value of each of the Company’s long-term financial assets and debt instruments is based on the amount of future cash flows associated with each instrument discounted using an estimate of what the Company’s current borrowing rate for similar instruments of comparable maturity would be.

Property and Equipment

Property and equipment are recorded at cost less accumulated amortization. Amortization is provided using the following annual rates and methods:

|

Furniture and fixtures

|

20%declining balance

|

|

Office equipment

|

20% declining balance

|

|

Computer equipment

|

30% declining balance

|

|

Plant and equipment

|

30% declining balance

|

|

Vehicles

|

30% declining balance

|

|

Leasehold Improvement

|

Straight-line over the term of the lease

|

Impairment of Long-Lived Assets

In accordance with ASC No. 360 Property, Plant, and Equipment, long-lived assets to be held and used are analyzed for impairment whenever events or changes in circumstances indicated that the related carrying amounts may not be recoverable. The Company evaluates at each balance sheet date whether events and circumstances have occurred that indicate possible impairment. If there are indications of impairment, the Company uses future undiscounted cash flows of the related asset or asset grouping over the remaining life in measuring whether the assets are recoverable. In the event such cash flows are not expected to be sufficient to recover the recorded asset values, the assets are written down to their estimated fair value. Long-lived assets to be disposed of are reported at the lower of carrying amount or fair value of the asset less costs to sell. For the year-ended 31 December 2009, management has assessed an impairment writedown of $101,773 (2008 - $Nil) on its capital assets.

F-8

Intellectual Property

Intellectual property is recorded at cost less impairment write down. Intellectual property is not amortized as it has an indefinite life. Impairment tests are performed at least once a year and when conditions indicating possible impairment exist. Intellectual property is written down if the carrying amount exceeds the fair value or if significant doubt exists with respect to recoverability.

Income Taxes

The Company accounts for income taxes in accordance with ASC No. 740 Income Taxes which prescribes use of the asset and liability method, whereby deferred tax asset and liability account balances are determined based on differences between the financial reporting and tax bases of assets and liabilities and are measured using enacted tax rates. The effects of future changes in tax laws or rates are not anticipated.

Income taxes are recognized for the following a) the amount of tax payable for the current year, and b) deferred tax assets and liabilities for future tax consequences of events that have been recognized differently in the financial statements than for tax purposes.

Stock-BasedCompensation

All stock awards granted to employees and non-employees are valued at fair value by using the Black-Scholes option pricing model and are recognized on a straight line basis over the service periods of each award. The Company accounts for equity instruments issued in exchange for the receipt of goods or services from other than employees whereby costs are measured at the estimated fair market value of the consideration received or the estimated fair value of the equity instruments issued, whichever is more reliably measurable. The value of equity instruments issued for consideration of non-employee services is determined on the earlier of the date a performance commitment is received or the date on which performance is completed.

Earnings or Loss Per Share

Basic earnings or loss per share is computed by dividing net earnings or loss by the weighted average number of common shares outstanding for the year. Diluted earnings or loss per share is computed by dividing net earnings or loss by the weighted average number of common shares outstanding plus common stock equivalents (if dilutive) related to stock options and warrants for each year. At 31 December 2009, there were Niloptions (2008 – 134,204) and 1,775,000 warrants (2008 – 30,000) exercisable. There were no common equivalent shares outstanding at December 31, 2008 and 2007 that have been included in dilutive loss per share calculation as the effects would have been anti-dilutive.

Foreign Currency Translation

The Company's accounts have been translated into U.S. dollars in accordance with the provisions of ASC No. 830 Foreign Currency Matters. The Company’s subsidiaries are established in Canada, Hong Kong, China, and Taiwan and each maintains its books and records in local currencies. The Company uses the current rate method to translate the financial information of its various subsidiaries from the local currencies into its reporting currency, which is the US dollar. Under the current rate method, all assets and liabilities are translated at the current rate, stockholder’s equity accounts are translated at historical rates, and revenues and expenses are translated at average rates for the year.

F-9

Due to the fact that items in the financial statements are being translated at different rates according to their nature, a translation adjustment is created. This translation adjustment has been included in accumulated other comprehensive income (loss).

Comprehensive Income

The Company adopted ASC No. 220 Comprehensive Income, which establishes standards for reporting and presentation of comprehensive income and its components in a full set of financial statements. Comprehensive income is presented in the statements of changes in stockholders' equity, and consists of foreign currency translation adjustments. ASC No. 220 requires only additional disclosures in the financial statements and does not affect the Company's financial position or results of operations.

Use of Estimates

Preparation of financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the financial statements and related notes to the financial statements. These estimates are based on management’s best knowledge of current events and actions the Company may undertake in the future. Actual results may ultimately differ from such estimates. Significant estimates include accrued liabilities, valuation allowance for income taxes, fair value of stock issued for services and estimates for calculation for stock-based compensation.

4. ADVANCES RECEIVABLE

The Company’s subsidiary Aspire GuangXi executed a manganese ore mining distribution and management agreement in China with the mine owner and a management company. From the proceeds of the mining operation, Aspire GuangXi is required to distribute 30% to the management company who is responsible to incur all operating expenses. As of31 December 2009, Aspire GuangXi has a receivable of $517,474, as a result of paying for certain expenses on behalf of the management company and to enable it to commence mining operations. Once the mine commences operations the Company is expected to receive repayment of these advances.

5. DEFERRED CHARGES

During the year ended 31 December 2008, Aspire GuangXi executed a distribution and management agreement with the owner of a manganese ore mine in China. To facilitate access to the mine, the Company made payments to the property owners in the outskirts of the mining property. This cost is being amortized over the period of the agreement.

|

Cost

|

Accumulated Amortization

|

Net

2009

|

Net

2008

|

|||||||||||||

|

Deferred charges

|

$ | 77,410 | $ | 23,019 | $ | 54,391 | $ | 70,144 | ||||||||

6. PROPERTY AND EQUIPMENT

|

Cost

|

Accumulated Amortization

|

Net

2009

|

Net

2008

|

|||||||||||||

|

Furniture and fixtures

|

$ | 60,437 | $ | 59,302 | $ | 1,135 | $ | 16,316 | ||||||||

|

Office equipment

|

33,156 | 32,813 | 343 | 368 | ||||||||||||

|

Computer equipment

|

251,026 | 247,857 | 3,169 | 2,863 | ||||||||||||

|

Plant and equipment

|

344,817 | 116,832 | 227,985 | 325,470 | ||||||||||||

|

Vehicles

|

- | - | - | 20,950 | ||||||||||||

|

Leasehold improvements

|

- | - | - | 67,744 | ||||||||||||

|

Construction in progress

|

228,012 | - | 228,012 | 227,858 | ||||||||||||

| $ | 917,448 | $ | 456,804 | $ | 460,644 | $ | 661,569 | |||||||||

F-10

7. INTELLECTUAL PROPERTY

Intellectual property represents licenses to use, modify and prepare derivative works of licensors’ source material. Licenses may be subject to annual and usage fees. The terms of the licenses continue indefinitely unless breached by the terms of the agreements. As at 31 December 2009 and 2008, the Company had three licensing agreements, which it entered into between April 2002 and July 2002. These licenses are non-transferable, non-sub licensable and royalty-free. The Company must pay annual support and maintenance fees to the licensors to maintain the terms of the agreements. These licenses give the Company the right to incorporate licensor software into the Company’s internally-developed software and the products it is developing.

Annual support and maintenance fees are expensed as they become due. For 2009 and 2008, the Company is in breach of payment of its annual support and maintenance fees, and in default of such fee payment, the licensors may not maintain the terms of the agreements.

The Company evaluates the recoverability of the intellectual property and reviews the impairment on an annual basis and at any other time if events occur or circumstances change that would more likely than not reduce the fair value below its carrying amount. Several factors are used to evaluate the intellectual property, including but not limited to, management’s plans for future operations, recent operating results and projected undiscounted cash flows. The Intellectual property was written-down to a nominal value of $1 in 2002.

8. BANK INDEBTEDNESS

The Company has overdraft protection available up to a maximum of $10,000 CAD or $9,532 USD (2008 - $8,210 USD).

9. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

|

2009

|

2008

|

|||||||

|

Accounts payable

|

$ | 296,404 | $ | 352,269 | ||||

|

Accrued liabilities – management salaries

|

2,199,000 | 1,799,000 | ||||||

|

Accrued liabilities – payroll

|

399,348 | 303,770 | ||||||

|

Accrued liabilities – interest

|

251,935 | 241,219 | ||||||

|

Accrued liabilities – consulting

|

194,424 | 504,424 | ||||||

|

Accrued liabilities – professional

|

35,018 | 54,333 | ||||||

|

Accrued liabilities – others

|

735,543 | 390,243 | ||||||

| $ | 4,111,672 | $ | 3,645,243 | |||||

10. INCOME TAXES

For the year ended 31 December 2009, the Company had a net loss of $1,697,124 (2008 - $1,865,179) and as a result was not obligated to pay any income taxes.

As of 31 December 2009, the Company had non-capital losses of approximately $15,421,808 available to be carried forward and to offset future taxable income. These losses expire as follows:

F-11

|

2010

|

$ | 37,214 | ||

|

2014

|

2,822,191 | |||

|

2015

|

4,311,769 | |||

|

2026

|

2,396,581 | |||

|

2027

|

2,964,271 | |||

|

2028

|

1,501,030 | |||

|

2029

|

1,388,752 | |||

| $ | 15,421,808 | |||

The Company has deferred income tax assets as follows:

|

2009

|

2008

|

|||||||

|

Net operating loss carried forward

|

$ | 15,421,808 | $ | 13,360,571 | ||||

|

Effective income tax rate

|

32.5 | % | 32.5 | % | ||||

|

Deferred income tax on loss carried forward

|

5,012,088 | 4,342,185 | ||||||

|

Valuation allowance for deferred income tax assets

|

(5,012,088 | ) | (4,342,185 | ) | ||||

| $ | - | $ | - | |||||

It has been determined that realization of a deferred income tax asset is not likely to occur and therefore a valuation allowance has been recorded against these non-capital losses.

11. ADVANCES FROM STOCKHOLDERS

Advances from stockholders include the following:

A loan of $90,000 from a director of the corporation, which is unsecured, bears interest at 2% per month, and is due on demand. The Company has accrued interest of $21,600 (2008 - $21,600) as interest on this loan from a director for the year.

Other loans from shareholders and directors which are unsecured, non-interest bearing, and are due on demand. The Company calculated the fair value of interest on these interest free loans from shareholders at the rate of 5% (2008 – 5%) per annum and recorded it as a component of additional paid in capital.

12. LOANS PAYABLE

The Company’s subsidiary Mega Bond obtained a loan of US $85,788 (CAD $90,000) on 5 June 2008 which is unsecured, repayable in 12 months, and carries a rate of interest of 18% payable semi annually. As of 31 December 2009, the Company was in default with respect to this loan and the balance remains outstanding.

The Company obtained a loan of $154,418 (CAD $162,000) on 26 November 2008 which is unsecured, non-interest bearing, and repayable on demand.

F-12

13. PROMISSORY NOTE PAYABLE

Promissory note in the amount of $2,017,478 (2008 - $1,429,232) bears interest at 3% per month, with principal and interest payable on 31 December 2005. As of 31 December 2009, the Company was in default with respect to this loan and the balance remains outstanding.

14. CAPITAL STOCK

Authorized

5,000,000 non-voting preferred shares with a par value of $0.001 per share

150,000,000 voting common shares with a par value of $0.001 per share

Issued and Outstanding

14,899,419 common shares (2008 - 12,192,752)

Stock Issuances

On 13 March 2008, the Company issued 60,000 common shares to Whalehaven valued at $0.35 per common share, being payment of interest accrued on convertible notes for $21,000.

On 26 May 2008, the Company issued 1,333,332 common shares valued at $600,000 in lieu of security for $600,000 (RMB 4.2 million) to Liao, Dong Shang (mine owner) in accordance with the Management Agreement with Liuzhou Yi Sheng Da Trading Co., Ltd. (“Liuzhou”), dated 26 May 2008. The management of the Manganese Ore at Guangxi Fong Sheng has been assigned to the Company for a period of ten years, commencing on 1 June 2008 and terminating on 31 May 2018.

On 22 July 2008, the Company received share subscriptions from Million Financial Corporation to purchase 3,184,687 restricted shares at $0.105 for a total consideration of $334,392. The Company issued 3,184,687 restricted shares to Million Financial Corporation. The Company also issued an additional 318,469 shares (being 10% of 3,184,687 restricted shares issued) as commission to Million Financial Corporation.

On 18 September 2008, the Company received share subscriptions from Million Financial Corporation to purchase 620,155 restricted shares at $0.16 for a total consideration of $100,000. The Company issued 620,155 restricted shares to Million Financial Corporation. The Company also issued an additional 62,016 shares (being 10% of 620,155 restricted shares issued) as commission to Million Financial Corporation.

On 18 September 2008, the Company issued 100,000 restricted common shares and another 200,000 restricted common shares to two consultants, being a total of 300,000 restricted common shares for consulting services.

On 3 November 2008, the Company issued 2,000,000 common shares which were intended to be used as collateral in secured financing of $1.2 million for the Company’s wholly-owned subsidiary Aspire GuangXi Inc. The shares remained in the possession of the Company during the negotiations and were subsequently cancelled on 5 March 2009 when the financing did not materialize.

On 4 November 2008, the Company issued 250,000 restricted common shares to a consultant for services to be provided over 6 months at a price of $0.44 per share for total consideration of $110,000. The shares will be amortized over 6 months.

On 4 November 2008, the Company issued 400,000 restricted common shares to a consultant for services to be provided over 6 months at a price of $0.44 per share for total consideration of $176,000. The shares will be amortized over 6 months.

F-13

On 4 November 2008, the Company issued 40,000 shares to a private investor as part of a private placement for cash at $0.25 per common share for total consideration of $10,000.

On 6 November 2008, the Company issued 39,188 shares to a private investor as part of a private placement for cash at $0.45 per share as per an agreement as of 25 May 2008 for total consideration of $17,634.

On 15 September 2009, the Company issued 675,000 shares and share purchase warrants to a consultant in exchange for $0.01 per share and for services to be provided over 12 months. Each warrant entitles the consultant to purchase one share of the Company at a price of $0.012 and is exercisable at any time within 12 months after the signing date. The value of the services from the issuance of these shares and warrants will be amortized over 12 months.

On 9 October 2009, the Company issued 1,100,000 shares and share purchase warrants to consultants in exchange for $0.01 per share and for services to be provided over 12 months. Each warrant entitles the consultant to purchase 1 share of the Company at a price of $0.012 and is exercisable at any time within 12 months after the signing date.The value of the services from the issuance of these shares and warrants will be amortized over 12 months..

On 15 December 2009, the Company issued 200,000 shares and paid $5,000 cash in exchange for services provided by consultants during the year. The shares were provided at a price of $0.075 per share for total consideration of $20,000.

Stock Options

The Company has adopted a Stock Option Plan (the “Plan”), pursuant to which common shares not exceeding 25% of the total issued and outstanding shares are reserved for issuance. Options may be granted to officers, directors, consultants and full-time employees of the Company. Options granted under the Plan may be exercisable for a period not exceeding ten years, may require vesting, and shall be at an exercise price, all as determined by the Board. Options will be non-transferable and are exercisable only by the participant during his or her lifetime. If a participant ceases affiliation with the Company by reason of death or permanent disability, the option remains exercisable for 180 days following death or 30 days following permanent disability but not beyond the options expiration date. Other termination gives the participant 30 days to exercise, except for termination for cause, which results in immediate cancellation of the option. Options granted under the Plan must be exercised with cash. Any unexercised options that expire or that are cancelled upon an employee ceasing to be employed by the Company become available again for issuance under the Plan. The Plan may be terminated or amended at any time by the Board of Directors.

F-14

Activity under the Plan was follows:

|

Number of Warrants

|

Weighted Average Exercise Price

|

|||||||

|

Outstanding at 31 December 2007

|

152,204 | $ | 5.07 | |||||

|

Granted

|

- | - | ||||||

|

Cancelled

|

- | - | ||||||

|

Outstanding at 31 December 2008

|

152,204 | $ | 5.07 | |||||

|

Granted

|

- | - | ||||||

|

Cancelled

|

(152,204 | ) | $ | 5.07 | ||||

|

Exercisable at 31 December 2009

|

- | - | ||||||

No options were granted in 2008 or 2009. As of 31 December 2009 there were Nil options exercisable (31 December 2008 - 134,204 options exercisable) at a weighted average exercise price of $Nil (31 December 2008 - $5.10).

As of 31 December 2009, there was $Nil (31 December 2008 - $106,640) of unrecognized expenses related to non-vested stock-based compensation arrangements. The stock-based compensation expense for the year related to options was $106,640 (2008 - $213,280).

Stock Purchase Warrants

During the year, the following activity occurred in respect of warrants outstanding:

|

Number of Warrants

|

Weighted Average Exercise Price

|

|||||||

|

Outstanding at 31 December 2007

|

255,333 | $ | 33.11 | |||||

|

Granted

|

- | - | ||||||

|

Expired

|

(225,333 | ) | $ | 33.11 | ||||

|

Outstanding at 31 December 2008

|

30,000 | $ | 1.50 | |||||

|

Granted

|

1,775,000 | $ | 0.012 | |||||

|

Expired

|

(30,000 | ) | $ | 1.50 | ||||

|

Exercisable at 31 December 2009

|

1,775,000 | $ | 0.012 | |||||

As of 31 December 2009, 675,000 of the warrants outstanding are due to expire on 15 September 2010 and 1,100,000 of the warrants outstanding are due to expire on 9 October 2010.

As of 31 December 2009, there was $43,125 (31 December 2008 - $Nil) of unamortized deferred stock-based compensation related to warrants outstanding. The stock-based compensation expense for the year related to warrants was $14,375 (2008 - $Nil).

Common Stock Subscribed

The Company has an agreement with SBI and Westmoreland wherein they have committed to purchase 80,000 common shares of the Company at $50 per share for $4 million of funding. Net proceeds of $695,000 have been received by the Company and Westmoreland to date for the purchase of 15,000 common shares. SBI and Westmoreland have signed promissory notes for the balance that has not yet been received.

On 15 September 2009, the Company issued 675,000 common shares at a price of $0.01 for total proceeds of $6,750 which is receivable at year-end.

On 9 October 2009, the Company issued 1,100,000 common shares at a price of $0.01 for total proceeds of $11,000 which is receivable at year-end.

F-15

15. DEFERRED STOCK-BASED COMPENSATION

Activity in deferred stock-based compensation for the years ended 31 December 2009 and 2008 was as follows:

|

Balance at 31 December 2007

|

$ | - | ||

|

Stock issued for services (650,000 shares)

|

286,000 | |||

|

Stock-based compensation expense

|

(124,667 | ) | ||

|

Balance at 31 December 2008

|

161,333 | |||

|

Stock issued for services (1,775,000 shares)

|

50,750 | |||

|

Warrants issued for services (1,775,000 warrants)

|

57,500 | |||

|

Stock-based compensation expense

|

(188,396 | ) | ||

|

Balance at 31 December 2009

|

$ | 81,187 |

16. COMMITMENTS AND CONTINGENCIES

The Company has been served with a Notice dated July 21, 2006 from a former employee and Investor of Griffin Industries (Prior to name change to Perfisans Holdings Inc.) for specific performance of the March 24, 1999 Rescission Agreement. The former employee is asking for replacement warrants equivalent in value to the price of stock on October 19, 1998 calculated at 6,000 shares priced at $75 per share for a total consideration of $450,000. There has been no development or communication regarding this claim since July 21, 2006 and no expense has been accrued in the financial statements.

On May 26, 2008, Perfisans Networks Corporation (“Perfisans”), a wholly-owned subsidiary of Aspire International Inc. (the “Company”) entered into a Management Agreement with Liuzhou Yi Sheng Da Trading Co., Ltd. (“Liuzhou”), dated May 26, 2008, whereby the parties agreed that the management of the Manganese Ore at Guangxi Fong Sheng shall be assigned to the Company for a period of ten years, commencing on June 1, 2008 and terminating on May 31, 2018. The Company will be paid a management fee of 21% of the total sales revenue of the Ore.

The Company leases premises in Canada under an operating lease with a three years term expiring on May 31, 2010. Minimum lease commitments exclusive of insurance and other occupancy charges under the lease atyear-end were:

|

2010 (5 months)

|

$

|

3,900

|

||

|

Total

|

$

|

3,900

|

The Company’s subsidiary Aspire Guangxi executed a distribution and management agreement with the owner of a manganese ore mine in China. To facilitate access to the mine, the Company has committed payments to the property owners in the outskirts of the mining property to facilitate access to the mining property. The Company is committed to the following payments:

|

2010

|

-

|

|||

|

2011

|

3,645

|

|||

|

2012

|

13,804

|

|||

|

2013 and thereafter

|

105,307

|

|||

|

Total

|

$

|

122,756

|

F-16

17. SEGEMENTED DISCLOSURES

Revenue and assets by geographic regions and business segment are as follows for 2009:

|

China

(Mine Management)

|

Hong Kong (Import / Export)

|

|||||||

|

Sales

|

- | 71,169 | ||||||

|

Cost of Sales

|

- | (63,198 | ) | |||||

|

Operating Expenses

|

(1,605,299 | ) | (83,854 | ) | ||||

|

Net Loss

|

(1,605,299 | ) | (91,825 | ) | ||||

|

Total Assets

|

1,085,794 | 4,840 | ||||||

Revenue and assets by geographic regions and business segment are as follows for 2008:

|

China

(Mine Management)

|

Hong Kong (Import / Export)

|

|||||||

|

Sales

|

- | 169,795 | ||||||

|

Cost of Sales

|

- | (158,420 | ) | |||||

|

Operating Expenses

|

(1,800,675 | ) | (75,879 | ) | ||||

|

Net Loss

|

(1,800,675 | ) | (64,504 | ) | ||||

|

Total Assets

|

1,271,356 | 33,475 | ||||||

18. SUBSEQUENT EVENTS

On 14 February 2011, the Company entered into an Acquisition Agreement with its directors Bok Wong and To Hon Lam and the Company’s wholly owned subsidiary Perfisans Networks Corporation. Pursuant to this agreement, Bok Wong and To Hon Lam acquired 100% of the common stock of Perfisans for consideration of $10.

On 14 February 2011, the Company and Candid Global Resources Hong Kong Ltd entered into an Asset Purchase Agreement whereby Candid Global Resources Hong Kong Ltd agreed to sell to Aspire, 100% of their assets, including the sub-entity known as “Mygos” and related trademarks and intellectual property for 10,000,000 common shares of Aspire.

F-17

None

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this report, we conducted an evaluation, under the supervision and with the participation of our chief executive officer and principal accounting officer of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives and management necessarily is required to apply its judgment in evaluating the cost-benefit relationship of o possible controls and procedures.

Based on this evaluation, our chief executive officer and principal accounting officer have concluded that our disclosure controls and procedures were not effective as of December 31, 2009 at the reasonable assurance level for the reasons discussed below related to identified material weaknesses in our internal controls over financial reporting.

To address the material weakness, we performed additional analysis and other post-closing procedures in an effort to ensure our consolidated financial statement included in this annual report have been prepared in accordance with accounting principles generally accepted in the United States of America. Accordingly, management believes that the financial statements included in this report fairly present all material respects of our financial condition, results of operations and cash flows for the periods presented.

We recognize the importance of internal controls and management is making an effort to mitigate this material weakness to the fullest extent possible. At any time, if it appears that any control can be implemented to continue to mitigate such weakness, it will be immediately implemented.

Management’s Report on Internal Control Over Financial Reporting

Under Section 404 of the Sarbanes-Oxley Act of 2002, management is required to assess the effectiveness of the Company’s internal control over financial reporting as of the end of each fiscal year and report, based on that assessment, whether the Company’s internal control over financial reporting is effective.

The management of Aspire International, Inc. is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Securities Exchange Act of 1934 as a process designed by, or under the supervision of, the company’s principal executive and principal financial officers and effected by the Company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

* Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company;

* Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and

* Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements.

7

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2009. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in “Internal Control-Integrated Framework.” These criteria are in the areas of control environment, risk assessment, control activities, information and communication, and monitoring. The Company’s assessment included extensive documenting, evaluating and testing the design and operating effectiveness of its internal controls over financial reporting.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be presented or detected on a timely basis.

Based on management’s assessment, we have concluded that, as of December 31, 2009, the Company’s internal control over financial reporting was not effective due to the material weaknesses identified below:

Inherent in small business is the pervasive problem of segregation of duties. Given that the Company only employs two executive officers, one of which is a director, segregation of duties is not possible at this stage in the corporate lifecycle. We are planning to mitigate this risk by hiring an adequate amount of staff in the future in order to segregate incompatible duties. We do not presently possess the necessary funds to hire such staff. Until this time that we have adequate funds to hire additional staff, the board will be actively involved in reviewing all significant transactions which are subject to this weakness. This weakness was identified by our auditors during the audit of the December 31, 2009 fiscal year. This weakness has existed since inception of the Company.

This Annual Report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation requirements by the Company’s independent registered public account firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report.

Changes in Internal Controls Over Financial Reporting

There have been no changes in our internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Not Applicable

|

NAME

|

AGE

|

POSITION

|

||

|

Bok Wong

|

46

|

CEO, President, Principle Accounting Officer & Chairman

|

||

|

To-Hon Lam

|

50

|

Director

|

||

|

Eric Wang

|

43

|

Director

|

8

Each of the above officers and directors shall hold office until the next annual meeting of our shareholders or until a successor is elected and qualified.

BOK WONG. Bok Wong co-founded Perfisans Networks in February 2001 and has acted as its Vice President of Operations and Business since inception. Mr. Wong became the President and CEO in November 2005. Previously he co-founded Intervis Corporation, a System On Chip design consulting company. Intervis is a multi million dollar company, which designs complex network ASICchips and network processors for companies such as 3COM, Nortel, and Cabletron. He was the principal consultant of Intervis from 1998 to 2000 and Trebia Director of ASIC Technology from 2000 to February 2001. Mr. Wong has also worked with ATI Technologies, Genesis Microchip, and Philips in Hong Kong.

TO-HON LAM. To-Hon Lam co-founded Perfisans Networks in February 2001 and has served as our Director since 2001. Prior to Perfisans, he successfully launched Matrox Toronto Design Center specializing in multi-million gate graphics and video processors. Mr. Lam has managed over 100 software and hardware projects. He was the co-founder and Director of Engineering with SiconVideo where he has employed from 1999 through February 2001. He also worked with ATI Technologies, where he designed several state of the art application specific integrated circuits (ASIC). ATI is currently a leader in the graphic chip design industry. Mr. Lam has over 21 years of engineering and design management experience with ASIC technologies.

ERIC WANG has served as our Director since 2005. A 13–year veteran of General Resources where he served as Vice President & CFO. As Vice President and CFO, he had overall responsibility for Financial Controls & Planning. Prior to that he was the deputy manager of Shang-Ching United C.P.A. Firm

Except as set forth herein, no officer or director of the Company has, during the last five years: (i) been convicted in or is currently subject to a pending a criminal proceeding; (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to any Federal or state securities or banking laws including, without limitation, in any way limiting involvement in any business activity, or finding any violation with respect to such law, nor (iii) has any bankruptcy petition been filed by or against the business of which such person was an executive officer or a general partner, whether at the time of the bankruptcy of for the two years prior thereto.

CODE OF ETHICS

Our board of directors adopted a Code of Ethics which covers all executive officers of our company and its subsidiaries. The Code of Ethics requires that senior management avoid conflicts of interest; maintain the confidentiality of information relating to our company; engage in transactions in shares of our common stock only in compliance with applicable laws and regulations and the requirements set forth in the Code of Ethics; and comply with other requirements which are intended to ensure that such officers conduct business in an honest and ethical manner and otherwise act with integrity and in the best interest of our company.

All of our executive officers are required to affirm in writing that they have reviewed and understand the Code of Ethics.

AUDIT COMMITTEE FINANCIAL EXPERT

We do not have an audit committee financial expert.

COMPENSATION OF THE BOARD OF DIRECTORS

Directors who are also our employees do not receive additional compensation for serving on the Board or its committees. Non-employee directors are not paid any annual cash fee. Directors are entitled to receive options under our Stock Option Plan. All directors are reimbursed for their reasonable expenses incurred in attending Board meetings. We intend to procure directors and officers liability insurance.

9

LIMITATION ON LIABILITY AND INDEMNIFICATION OF DIRECTORS AND OFFICERS

Under Maryland state law, a director or officer is generally not individually liable to the corporation or its shareholders for any damages as a result of any act or failure to act in his capacity as a director or officer, unless it is proven that:

1. his act or failure to act constituted a breach of his fiduciary duties as a director or officer; and

2. his breach of those duties involved intentional misconduct, fraud or a knowing violation of law.

This provision is intended to afford directors and officers protection against and to limit their potential liability for monetary damages resulting from suits alleging a breach of the duty of care by a director or officer. As a consequence of this provision, our stockholders will be unable to recover monetary damages against directors or officers for action taken by them that may constitute negligence or gross negligence in performance of their duties unless such conduct falls within one of the foregoing exceptions. The provision, however, does not alter the applicable standards governing a director’s or officer’s fiduciary duty and does not eliminate or limit our right or the right of any stockholder to obtain an injunction or any other type of non-monetary relief in the event of a breach of fiduciary duty.

As permitted by Maryland law, our By-Laws include a provision which provides for indemnification of a director or officer by us against expenses, judgments, fines and amounts paid in settlement of claims against the director or officer arising from the fact that he was an officer or director, provided that the director or officer acted in good faith and in a manner he or she believed to be in or not opposed to our best interests.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons pursuant to the foregoingprovisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT