Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Virolab, Inc. | aax8kex991_3172011.htm |

| EX-10.1 - EXHIBIT 10.1 - Virolab, Inc. | aax8kex101_3172011.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES AND EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 18, 2011

ACCELERATED ACQUISITIONS X, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-54059

|

27-2787170

|

||

|

(State or Other Jurisdiction of

Incorporation)

|

(Commission File

No.)

|

(I.R.S. Employer

Identification No.)

|

|

1840 Gateway Drive, Suite 200, Foster City, CA

|

94404

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (650) 283-2653

N/A

(Former name or former address, if changed since last report)

(Address of Principal Offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

r

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR.425)

|

|

r

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

r

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

r

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

- 1 -

TABLE OF CONTENTS

|

Item 1.01 Entry into a Material Definitive Agreement

|

3

|

|

|

Item 5.06 Change in Shell Company Status

|

3

|

|

|

Item 9.01 Financial Statements and Exhibits

|

37

|

|

|

SIGNATURES

|

38

|

|

|

EXHIBIT INDEX

|

39

|

- 2 -

Item 1.01 Entry into a Material Definitive Agreement

On March 8, 2011, the Company entered into a Licensing Agreement (“Licensing Agreement”) with Virolab Nevada, LLC. (“Licensor”) pursuant to which the Company was granted an exclusive, non-transferrable worldwide license for certain intellectual property developed by Licensor, principally comprising the technology, patents, intellectual property, know-how, trade secret information, clinical trial protocols and data, and all commercial rights regarding the therapeutic vaccine for HPV and HPV-related cancers and specific blood test for HPV (the “Technology”).

Except for the rights granted under the License Agreement, Licensor retains all rights, title and interest to the Technology and any improvements thereto—although the License includes the Company’s right to utilize such improvements.

The term of the License commences the date of the Licensing Agreement and continues for thirty (30) years, provided that the Licensee is not in breach or default of any of the terms or conditions contained in this Agreement. In addition to other requirements, the continuation of the License is conditioned on the Company generating net revenues in the normal course of operations or the funding by the Company of specified amounts for qualifying research, development and commercialization expenses related to the Technology. In addition, the Company is required to fund certain specified expenses related to the commercialization of the Technology as specified in detail in the License Agreement. The license is terminated upon the occurrence of events of default specified in the License Agreement.

A copy of the License Agreement is attached as Exhibit 10.1.

Item 5.06 Change in Shell Company Status.

Prior to the Company’s entry into the business of research, development and commercialization of therapeutic vaccines and specific blood tests for various serious diseases such as HPV-related cancers, through the execution of the License Agreement and the development of sales channels in connection therewith as described in Item 1.01 above, the Company was a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). As a result of entering into these agreements and undertaking efforts to begin financial consulting services and product distribution operations, we ceased to be a shell company. There has not, however, been a change of control of our company.

OTHER PERTINENT INFORMATION

Unless specifically set forth to the contrary, when used herein, the terms “Accelerated Acquisitions X, Inc.”, "we", "our", the "Company" and similar terms refer to Accelerated Acquisitions X, Inc., a Delaware corporation.

FORM 10 DISCLOSURE

Item 2.01(f) of Form 8-K states that if the registrant was a shell company, like our company, the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10.

- 3 -

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to our ability to develop our operations, our ability to satisfy our obligations, our ability to consummate the acquisition of additional assets, our ability to generate revenues and pay our operating expenses, our ability to raise capital as necessary, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in "Risk Factors" and the risk factors described in our other filings with the Securities and Exchange Commission. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

From inception May 4, 2010, Accelerated Acquisitions X, Inc. was organized as a vehicle to investigate and, if such investigation warrants, acquire a target company or business seeking the perceived advantages of being a publicly held corporation. Our principal business objectives were to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. The Company has not restricted our potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business.

On May 4, 2010, the Registrant sold 5,000,000 shares of Common Stock to Accelerated Venture Partners, LLC for an aggregate investment of $2,000.00. The Registrant sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act.

On February 22, 2011, Virolab S de RL de CV (“Purchaser”) agreed to acquire 22,350,000 shares of the Company’s common stock par value $0.0001 for a price of $0.0001 per share. At the same time, Accelerated Venture Partners, LLC agreed to tender 3,500,000 of their 5,000,000 shares of the Company’s common stock par value $0.0001 for cancellation. Following these transactions, Virolab S de RL de CV., owned 94% of the Company’s 25,350,000, issued and outstanding shares of common stock par value $0.0001 and the interest of Accelerated Venture Partners, LLC was reduced to approximately 6% of the total issued and outstanding shares. Simultaneously with the share purchase, Ricardo Rosales, PhD was appointed to the Company’s Board of Directors. Such action represents a change of control of the Company.

Prior to the purchase of the shares, the Purchasers were not affiliated with the Company. However, the Purchasers will be deemed affiliates of the Company after the share purchase as a result of their stock ownership interest in the Company. The purchase of the shares by the Purchasers was completed pursuant to written Subscription Agreements with the Company. The purchase was not subject to any other terms and conditions other than the sale of the shares in exchange for the cash payment. The Company intends to file a Certificate of Amendment to its Certificate of Incorporation with the Secretary of State of Delaware in order to change its name to “Virolab, Inc.”.

- 4 -

On February, 2011, the Company entered into a Consulting Services Agreement with Accelerated Venture Partners LLC (“AVP”), a company controlled by Timothy J. Neher. The agreement requires AVP to provide the Company with certain advisory services that include reviewing the Company’s business plan, identifying and introducing prospective financial and business partners, and providing general business advice regarding the Company’s operations and business strategy in consideration of (a) an option granted by the Company to AVP to purchase 1,500,000 shares of the Company’s common stock at a price of $0.0001 per share (the “AVP Option”) (which was immediately exercised by the holder) subject to a repurchase option granted to the Company to repurchase the shares at a price of $0.0001 per share in the event the Company fails to complete funding as detailed in the agreement subject to the following milestones:

| ● |

Milestone 1 –

|

Company’s right of repurchase will lapse with respect to 60% of the shares upon securing

|

|

|

|

$5 million in available cash from funding;

|

|

|

| ● |

Milestone 2 –

|

Company’s right of repurchase will lapse with respect to 40% of the Shares upon securing

|

|

|

|

$10 million in available cash (inclusive of any amounts attributable to Milestone 1);

|

and (b) cash compensation at a rate of $66,667 per month. The payment of such compensation is subject to Company’s achievement of certain designated milestones, specifically, cash compensation of $400,000 is due consultant upon the achievement of Milestone 1, $400,000 and $400,000 upon the achievement of Milestone 2. Upon achieving each Milestone, the cash compensation is to be paid to consultant in the amount then due at the rate of $66,667 per month. The total cash compensation to be received by the consultant is not to exceed $800,000 unless AAV receives an amount of funding in excess of the amount specified in Milestone 2. If the Company receives equity or debt financing that is an amount less than Milestone 1, in between any of the above Milestones or greater than the above Milestones, the cash compensation earned by the Consultant under this Agreement will be prorated according to the above Milestones.

The Company also has the option to make a lump sum payment to AVP in lieu of all amounts payable thereunder.

On March 8, 2011, the Company entered into a Licensing Agreement (“Licensing Agreement”) with Virolab Nevada LLC. (“Licensor”) pursuant to which the Company was granted an exclusive, non-transferrable worldwide license for certain intellectual property developed by Licensor, principally comprising the technology, patents, intellectual property, know-how, trade secret information, clinical trial protocols and data, and all commercial rights regarding the therapeutic vaccine for HPV and HPV-related cancers and s specific blood test for HPV (the “Technology”). (see Item 1.01, above).

Accelerated Acquisitions, X, Inc. has licensed technology that has been in development since 1998 with a focus in the fields of in Biotechnology and Molecular Biology. The main focus has been in the developing and in the testing of human vaccines and in immunological diagnostic testing.

The technology developed is first curative vaccine for pre-cancerous and cancerous lesions of the Cervix along with a specific immune-reactive test to diagnose oncogenic human papillomavirus (HPV) from blood serum. Over 3,000 patients have treated to date, and Phase IV trials are ongoing. The patent and intellectual rights of these biotechnology products now belong to the company. The technology is now entering the second phase of its development - that is to start industrial production and commercialization of products. The company plans contract out the commercial manufacture of the diagnostic and therapeutic products, and also build and operate a Biotechnology laboratory and will initially use this location as its research lab for the HPV diagnostic testing. In addition, the company will initially work with Women’s Health Clinics in major population centers of Mexico, in order to administer its products under supervised and controlled conditions. These for-profit centers will also feed a clinical trial patient database to be used for further research.

For the therapeutic vaccine, the company will develop both the Mexican and International markets. The company is also talking to many clinics and hospitals throughout Mexico who will be able to administer the treatment in 2011. The company has reached an agreement with the first clinic in the City of Tijuana, Baja California, who will administer the therapy to overseas patients coming to Mexico to get the treatment. Patients from around the world, including the U.S., have already been successfully treated. The company currently has enough inventory to treat approximately 7,000 patients, which it is allowed to sell immediately under the current protocols.

- 5 -

The technology involves the key process of developing production of MEL-1. MEL-1 is derived from the Virus Vaccine MVA, the smallpox vaccine developed in Munich during the 1940´s. The World Health Organization approved MVA for use in other human vaccines in the early 1990´s. Genes that produce the protein E2 from Bovine Papillomavirus were inserted into MVA. E2 is an anti-tumoral protein that self-regulates the activity of HVP´s tumor-generating proteins. The modified vaccine is injected directly into infected cells. This then produces an overdose of anti-tumor E2 protein delivered directly into the HPV-infected tumor cells of the host. The immunological system of the patient reacts and destroys weakened HPV infected cells. As a result, the patient develops antibodies against HPV and against anything foreign that may be contained in those cells. The modified vaccine and its method of application are part of, and included in the MEL-1 patent.

The MEL-1 vaccine eliminates HPV from patients and regresses and heals pre-cancerous or cancerous lesions. The standard treatments include weekly injections of MEL-1 for a period of six weeks.

The HPV diagnostic test, EDIVPH, uses a standard ELISA procedure to test for HPV antibodies in the blood serum. The advantage is the quick and easy access to blood samples, and requiring no gynecological examination, like the other tests for HPV. The Mexican health infrastructure is grossly insufficient to handle this health issue. Less than 12% of women have access to this procedure and health service. Mexico, like most nations, realizes that the only hope for healthy living for many women infected is the early detection of HPV related lesions. However, large capital investments are needed for both the medical equipment and in the training of gynecologists, and money for this early detection is not always available. Take for example, in Mexico one woman dies of Cervical Cancer every two hours, an overwhelming statistic. EDIVPH testing can be done rapidly and efficiently, and Virolab can process blood samples taken from thousands of women daily at its facilities and can diagnose and typify oncogenic HPV strains.

Background

Cervical Cancer and Breast Cancer are two of the leading causes of women´s death in the world. The World Health Organization (WHO) reports that theses sad facts are true also for most developing countries around the world. These types of cancer are caused by Human Papillomavirus (HPV), acquired through sexual contact. HPV is extremely contagious and women can be infected even when their partners use condoms.

In general HPV infected men do not show symptoms, but genital warts and codylomata may appear. On the contrary, infected women commonly develop pre-cancerous lesions of increasing seriousness known as CIN I, CIN II, and CIN III, which could become cervical cancer quickly and cause death. Since the virus might foster the growth of tumoral cells anytime from six months to 15 years after infection women have to undergo gynecological test and pap-smears for early detection of carcinoma at least once a year.

When a lesion is detected doctors perform outpatient surgery to remove it. The HPV infection however, is never cured and once a lesion develops in the uterus, the lesion is likely to recur sometime after removal surgery. The recommended check up is then twice a year. If precancerous or cancerous lesions develop in Mexican women the Official Mexican Norm mandates treatment with Radiotherapy and Chemotherapy. Waiting period for these therapies could be as much as several months.

Worldwide, the numbers of HPV infection are staggering. Worldwide, about 300 million women are infected with HPV and likely at least 300 million men as well. Of the women, about 10%, or 30 million women, will develop mild pre-cancerous lesions, about a third of those, or 10 million women, will develop serious pre-cancerous lesions, and about 500,000 will develop cervical cancer, of whom 270,000 will die.

The two approved vaccines (Gardasil, marketed by Merck and Cervarix, marketed by GlaxoSmithKline) provide little benefit to women who have already been infected with HPV types 16 and 18 - which includes most sexually active females. For this reason the vaccine is recommended primarily for those women who have not yet been exposed to HPV during sex. Both are delivered in three shots over six months. In most countries they are approved only for female use, but are approved for male use in relevant countries like USA and UK. The vaccine does not have any therapeutic effect on existing HPV infections or cervical lesions.

- 6 -

Effect of the Therapeutic Vaccine

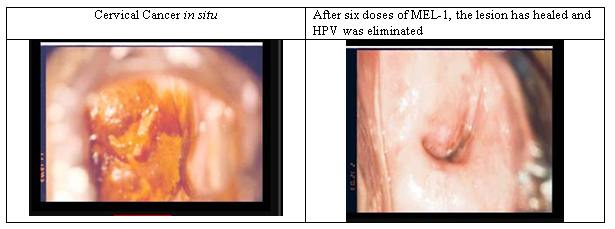

Below is an example of a Cervical Cancer in the before and after stage. This illustration was taken from a patient treated with MEL-1, one of more than 3000 women treated with MEL-1 so far.

A distinctive advantage of MEL-1 is that it eliminates HPV from the patient, whether female or male. This means that for the first time HPV can be cleared from both women and men and the spread of the virus can be stopped. This makes it possible to eliminate one of the leading causes of women´s death in the world.

Clinical Protocols

Vaccines used for treatments in humans, must undergo extensive Medical Protocols before they can be released as cures for public health benefits. Medical protocols were reviewed by the Health Ministry at the State and Governmental levels. The application of the vaccine and results from its’ use were reviewed by the Hospital Ethics Committees.

The following institutions participated in the Medical protocols for MEL-1: IMSS General Hospital zone 2A, IMSS Gyneco-Obstetrics Hospital, Mexico City, Department of Gynecology, Juarez Hospital, Mexico City, Women´s Hospital, Zamora, Michoacan, FES Zaragoza, UNAM; the departments of Immunology, Molecular Biology, Biophysics and Biomathematics, and Cell Biology of the Institute for Biomedical Research, UNAM, both in Mexico City, and Institute of Virology, Neuherberg-Muenchen, Germany.

The technology has completed Phase I, II, and III of the Medical Protocols, and Phase IV is ongoing. The results show a regression and elimination of pre-cancerous lesions at a greater than 95% success rate. The Mexican Health regulations mandate that women with carcinoma of the cervix undergo extreme radiotherapy or chemotherapy. Because this is so, the protocol cannot be applied to completion in women with cervical cancer. Application of MEL-1 to these patients showed the same impressive results for cervical carcinoma up to the point in which the protocol had to stop and the patient was subject to the treatments mandated by law.

The results of the 13 years of Medical Protocols are summarized below:

Pre-clinical Phase (test on animals) - 5 years. Human carcinoma implanted in rats and rabbits were successfully eliminated with MEL-1. HPV was eliminated as well.

Phase I (test on humans) - 2 years. HPV was eliminated without showing secondary or adverse effects to MEL-1.

Phase II (test on humans with pre-cancerous lesions and carcinoma) - 3 years. Test of healing effectiveness. Elimination and regression (CIN III to CIN I) of lesions showed a 94% success rate during the trial. The remaining 6% of the subjects were healed several months after the trial ended.

- 7 -

Phase IIB (testing on humans with pre-cancerous lesions and carcinoma). Elimination and regression (CIN III to CIN I) of lesions showed a 98% success rate during the trial.

Phase III (testing on humans with pre-cancerous lesions and carcinoma of 1176 patients). Elimination of lesions in 97% of patients, and regression in most others.

The results are published (or in draft) in international journals.

Phase IV: Ongoing. Presently, the application of MEL-1 now to more than 3,000 patients yields the same results.

Other: MEL-1 has also been tested in 30 men with intraurethral condyloma with a 93% success, and several men with bladder or prostate lesions, with 100% success.

Patents

The company has licensed all rights and know how that includes the patent pending to the vaccine MEL-1; and the method of application of MEL-1 directly to carcinomas. Information regarding the specific blood test, and the process is trade secret to date, and patent applications will be filed as soon as the company acquires sufficient financing.

Market

According to the World Health Organization (WHO), an estimated 300 million women are infected with HPV worldwide and an estimated 300 million men as well. Of the women, about 10%, or 30 million women, will develop mild pre-cancerous lesions, about a third of those, or 10 million women, will develop serious pre-cancerous lesions, and about 500,000 will develop cervical cancer, of whom 270,000 will die.

In North America, the U.S. has about 16 million cases of HPV infection in women, Brazil has 11.7 million and Mexico has 4.2 million. The top 7 countries in North America account for 41 million cases. In Asia, China has 69 million cases of HPV infection in women and India has 24 million. The top 5 countries in Asia account for over 100 million cases. In Europe and Russia, Russia has 19 million cases of HPV infection in women, Ukraine has 6 million and France has over 5 million. The top 8 countries in Europe and Russia account for over 45 million cases. This is likely greatly underestimated, as there is no current way to diagnose the majority of the population that has HPV and what type of strain they carry. Add the male counterparts and the proportion of the adult population that has some type of HPV strain doubles. The fact that teenagers are starting sexual activity at an earlier age than in past decades indicates that the epidemic will only expand.

The first market the product will be launched in will be Mexico, Central and South America. According to the WHO, in this region, over 31,000 women die of cervical cancer each year, with over 68,000 new cases every year, and 200 million women are at risk of developing cervical cancer, primarily from HPV (http://apps.who.int/hpvcentre/statistics/dynamic/ico/country_pdf/MEX.pdf), the biological agent that causes this type of cancer. HPV is also associated with Breast Cancer, Bladder Cancer, and Prostate Cancer.

Cervical Cancer and Breast cancer are two of the top leading causes of women’s deaths in the World. In Mexico, The capacity of the gynecological infrastructure can only accommodate less than 12% of the female population per year. Most of the population does not have access to prevent these terrible and totally preventable diseases. Unfortunately, Mexico is not an exception and most countries around the world share these sad statistics. Worst of all, all known procedures are only palliatives, directed to the control but not the cure of the HPV infection. We face an epidemic of global proportions. .

Two vaccines are available to prevent infection by some HPV types, Gardasil, marketed by Merck and Cervarix, marketed by GlaxoSmithKline. Both protect against initial infection with HPV types 16 and 18, which cause most of the HPV associated cancer cases. Gardasil also protects against HPV types 6 and 11, which cause 90% of genital warts.

The vaccines provide little benefit to women who have already been infected with HPV types 16 and 18 - which includes most sexually active females. For this reason the vaccine is recommended primarily for those women who have not yet been exposed to HPV during sex. Both are delivered in three shots over six months. In most countries they are approved only for female use, but are approved for male use in relevant countries like USA and UK. The vaccine does not have any therapeutic effect on existing HPV infections or cervical lesions.

- 8 -

It is estimated that over 12 million women less than 13 years of age and with no previous sex contact could be vaccinated with Gardasil™ preventive treatment. The idea is to immunize the population beforehand and the Mexican government has a program to vaccinate 250,000 women, or 2% of eligible women. There are serious concerns at FDA about the claims placed on Gardasil™ about its immunizing properties. Regardless of whether the preventive vaccine actually works and those 12.5 million women might be spared of HPV infection, and thus of the cervical cancer, the only scientific cure for the other women at risk is the company’s MEL-1- vaccine.

Competition for the Therapeutic Vaccine

We are aware of several development-stage and established enterprises, including major pharmaceutical and biotechnology firms, which are actively engaged in infectious disease and cancer vaccine research and development. These include Crucell, Sanofi-Aventis, Novartis, GlaxoSmithKline plc, MedImmune, Inc., a wholly owned subsidiary of AstraZeneca, Merck and Pfizer Inc. The company may also experience competition from companies that have acquired or may acquire technologies from companies, universities and other research institutions. As these companies develop their technologies, they may develop proprietary technologies which may materially and adversely affect our business. We should note that while most of these companies are working on preventative vaccines, our product is used as a treatment and cure for pre-cancerous and cancerous lesions, as well as eliminating HPV.

In addition, a number of companies are developing products to address the same diseases that we are targeting. For example, Merck and GlaxoSmithKline have products on the market for cervical cancer in the therapeutic setting; Transgene/Roche have a cervical cancer product in Phase II trials, although Roche terminated the relationship in February, 2011.

There are seven main approaches companies are using: Live vector based, peptide based, protein based, DNA-based, RNA replicon based, dendritic cell based and tumor cell based. (See Ma, et al., HPV and Therapeutic Vaccines: Where are we in 2010? Current Cancer Therapy Reviews, 2010, 6, 81-103, for a thorough review). Of the live vector based approaches more similar to ours, ours is the only one using the E2 protein, with the others using constructs that express the E6 and/or E7 proteins. While Advaxis’ product uses the Listeria bacterium as a vector, both Celtic Pharma’s and Transgene also use a Vaccinia vector.

If any of our competitors develop products with efficacy or safety profiles significantly better than our products, we may not be able to commercialize our products, and sales of any of our commercialized products could be harmed. Some of our competitors and potential competitors have substantially greater product development capabilities and financial, scientific, marketing and human resources than we do. Competitors may develop products earlier, obtain FDA approvals for products more rapidly, or develop products that are more effective than those under development by us. We will seek to expand our technological capabilities to remain competitive, however, research and development by others may render our technologies or products obsolete or noncompetitive, or result in treatments or cures superior to ours.

Our competitive position will be affected by the disease indications addressed by our product candidates and those of our competitors, the timing of market introduction for these products and the stage of development of other technologies to address these disease indications. For us and our competitors, proprietary technologies, the ability to complete clinical trials on a timely basis and with the desired results, and the ability to obtain timely regulatory approvals to market these product candidates are likely to be significant competitive factors. Other important competitive factors will include the efficacy, safety, ease of use, reliability, availability and price of products and the ability to fund operations during the period between technological conception and commercial sales.

The FDA and other regulatory agencies may expand current requirements for public disclosure of virus-based product development data, which may harm our competitive position with foreign and U.S. companies developing virus-based products for similar indications.

- 9 -

Competition for the Blood Test

The company’s licensed EDIVPH blood test is the only method that does not involve colposcopic examination or biopsy/smears from the cervix. The test is done as an immunological reaction in a sample of blood serum. Since a specialist does not need to examine the patient and technicians to take blood samples are quick and plentiful, the method allows for the examination of thousands of patients by a single technician at the company. Tens of thousands of samples require automation of the process and results can be obtained overnight.

The Hybrid Capture method involves colposcopic examination and taking a biopsy or smear from the cervix with a scrub. The method determines oncogenic and non-onocgenic viruses but does not typify the HPV.

The Liquid Cytology method involves colposcopic examination and also taking a biopsy or smear from the cervix. The method identifies normal and abnormal cells, but does not detect or typify the presence of HPV.

The PCR method also requires a biopsy or smear sample. This method involves colposcopic examination and taking a frozen biopsy or sample from the cervix. This method typifies HPV.

The Thin Prep DNA determination method involves a colposcopic examination and taking a biopsy or smear from the cervix. This method detects abnormal cells and typifies HPV DNA.

The Light Sensitive Device method, involves the insertion of the device in the vagina and taking the sample to a lab with a spectrometer to measure light absorptions. It is still an experimental method.

RISK FACTORS

Before you invest in our securities, you should be aware that there are various risks. You should consider carefully these risk factors, together with all of the other information included in this annual report before you decide to purchase our securities. If any of the following risks and uncertainties develop into actual events, our business, financial condition or results of operations could be materially adversely affected.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to continue as a going concern and our ability to obtain future financing.

In their report dated June 30, 2010 our independent auditors stated that our financial statements for the period from inception May 4, 2010 through June 30, 2010 were prepared assuming that we would continue as a going concern. Our ability to continue as a going concern is an issue raised as a result of recurring losses from operations and cash flow deficiencies since our inception. We continue to experience net losses. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loans and grants from various financial institutions where possible. If we are unable to continue as a going concern, you may lose your entire investment.

We were formed in May, 2010 and have a limited operating history and, accordingly, you will not have any basis on which to evaluate our ability to achieve our business objectives.

We are a development stage company with limited operating results to date. Since we do not have an established operating history or regular sales yet, you will have no basis upon which to evaluate our ability to achieve our business objectives.

- 10 -

The absence of any significant operating history for us makes forecasting our revenue and expenses difficult, and we may be unable to adjust our spending in a timely manner to compensate for unexpected revenue shortfalls or unexpected expenses.

As a result of the absence of any operating history for us, it is difficult to accurately forecast our future revenue. In addition, we have limited meaningful historical financial data upon which to base planned operating expenses. Current and future expense levels are based on our operating plans and estimates of future revenue. Revenue and operating results are difficult to forecast because they generally depend on our ability to promote and sell our services. As a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected revenue shortfall, which would result in further substantial losses. We may also be unable to expand our operations in a timely manner to adequately meet demand to the extent it exceeds expectations.

Our limited operating history does not afford investors a sufficient history on which to base an investment decision.

We are currently in the early stages of developing our business. There can be no assurance that at this time that we will operate profitably or that we will have adequate working capital to meet our obligations as they become due.

Investors must consider the risks and difficulties frequently encountered by early stage companies, particularly in rapidly evolving markets. Such risks include the following:

|

●

|

Competition

|

|

●

|

ability to anticipate and adapt to a competitive market

|

|

●

|

ability to effectively manage expanding operations; amount and timing of operating costs and capital expenditures relating to expansion of our business, operations, and infrastructure; and

|

|

●

|

dependence upon key personnel to market and sell our services and the loss of one of our key managers may adversely affect the marketing of our products and services.

|

We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition, and results of operations could be materially and adversely affected and we may not have the resources to continue or expand our business operations.

We are a development stage company and are substantially dependent on a third party

The Company is a development stage Company and is currently substantially dependent upon technology licensed from Virolab Nevada, LLC. Moreover, since demand for therapeutic vaccine for HPV and HPV-related cancers has not, to the Company’s knowledge, been effectively addressed by others on a global basis, Management believes, but cannot assure, that it has an opportunity and both the capability and experience to be successful in its endeavor to generate savings for purchasers of custom building materials in its target markets.

We have no profitable operating history and May Never Achieve Profitability

From inception (May 4, 2010) through December 31, 2010, the Company has an accumulated deficiency during the development stage of $1,800 notwithstanding the fact that the principals of the Company have worked without salary and the Company has operated with minimal overhead. We are an early stage company and have a limited history of operations and have not generated revenues from operations since our inception. We are faced with all of the risks associated with a company in the early stages of development. Our business is subject to numerous risks associated with a relatively new, low-capitalized company engaged in our business sector. Such risks include, but are not limited to, competition from well-established and well-capitalized companies, and unanticipated difficulties regarding the marketing and sale of our services. There can be no assurance that we will ever generate significant commercial sales or achieve profitability. Should this be the case, our common stock could become worthless and investors in our common stock or other securities could lose their entire investment.

- 11 -

We have a need to raise additional capital

The Company will require significant additional financing in order to meet the milestones and requirements of its Business Plan and avoid discontinuation of the License. Funding would be required for staffing, marketing, public relations and the necessary research precedent to expanding the scope of its offering to include the global market. The Company intends to seek an aggregate of $10,000,000 in 2011 and 2012; however there is no guarantee that the Company will be able to raise this or any amount of additional capital and a failure to do so would have a significant adverse effect on the Company’s ability, or would cause significant delays in its ability to address the market for purchases of building materials and homes by commercial enterprises and achieve its Business Plan. Notwithstanding, the License is not subject to immediate discontinuation if the initial milestone (net revenues in excess of expenses in the normal course of operations or receive funding of at least $500,000 by one year from March 10, 2011) is not achieved. The three milestones detailed in the License are cumulative and provide that the conditions are satisfied if any one of the three milestones is achieved. In other words, if Milestone #1 (raising $500,000 or generating revenues in the amount of $500,000) is not met, the requirement can be met by achieving Milestone #2 by the second anniversary of the License Agreement (raising $500,000 or generating $500,000 in revenues) and if neither is met, then the requirements can be satisfied by achieving Milestone #3 by the end of the third year (raising $1 million or generating $1 million in revenues). Neither the Company nor any of its advisors or consultants has significant experience in raising funds similar to the $1,000,000 estimated to be required.

The Company’s Management and its advisors lack meaningful experience in the marketing of the Licensed building material products

In view of the fact that the marketing of the Company’s licensed therapeutic vaccine products is a new business and there are no known comparable models in the market, the Company lacks the specific experience to implement its business plan. While the Company will seek to obtain resources which will support its marketing activities, there is no assurance that this lack of experience will not negatively affect the Company’s implementation of its business plan and prospects for growth and ultimate success.

Dependence on the Management, without whose services Company business operations could cease.

At this time, our management are wholly responsible for the development and execution of our business plan. Our founders are under no contractual obligation to remain employed by us, although they have no present intent to leave. If our management should choose to leave us for any reason before we have hired additional personnel our operations may fail. Even if we are able to find additional personnel, it is uncertain whether we could find qualified management who could develop our business along the lines described herein or would be willing to work for compensation the Company could afford. Without such management, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our officers and directors devote limited time to the Company’s business and are engaged in other business activities

At this time, one officers and directors devotes their full-time attention to the Company’s business. Based upon the growth of the business, we would intend to employ additional management and staff. The limited time devoted to the Company’s business could adversely affect the Company’s business operations and prospects for the future. Without full-time devoted management, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

- 12 -

Concentrated control risks; shareholders could be unable to control or influence key corporate actions or effect changes in the Company’s board of directors or management.

Our current officers and directors currently own 25,350,000 shares of our common stock, representing approximately 100% of the voting control of the Company. Our current officers and directors therefore has the power to make all major decisions regarding our affairs, including decisions regarding whether or not to issue stock and for what consideration, whether or not to sell all or substantially all of our assets and for what consideration and whether or not to authorize more stock for issuance or otherwise amend our charter or bylaws.

Lack of employment agreements with key management risking potential of the loss of the Company’s top management

We do not currently have an employment agreement with any of our key management or key man insurance on their lives. Our future success will depend in significant part on our ability to retain and hire key management personnel. Competition for such personnel is intense and there can be no assurance that we will be successful in attracting and retaining such personnel. Without such management, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Lack of additional working capital may cause curtailment of any expansion plans while raising of capital through sale of equity securities would dilute existing shareholders’ percentage of ownership

Our available capital resources will not be adequate to fund our working capital requirements based upon our present level of operations for the 12-month period subsequent to December 31, 2010. A shortage of capital would affect our ability to fund our working capital requirements. If we require additional capital, funds may not be available on acceptable terms, if at all. In addition, if we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could dilute existing shareholders. If funds are not available, we could be placed in the position of having to cease all operations.

We do not presently have a traditional credit facility with a financial institution. This absence may adversely affect our operations

We do not presently have a traditional credit facility with a financial institution. The absence of a traditional credit facility with a financial institution could adversely impact our operations. If adequate funds are not otherwise available, we may be required to delay, scale back or eliminate portions of our operations and product development efforts. Without such credit facilities, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our inability to successfully achieve a critical mass of sales could adversely affect our financial condition

No assurance can be given that we will be able to successfully achieve a critical mass of sales in order to cover our operating expenses and achieve sustainable profitability. Without such critical mass of sales, the Company could be forced to cease operations.

Our success is substantially dependent on general economic conditions and business trends, a downturn of which could adversely affect our operations

The success of our operations depends to a significant extent upon a number of factors relating to business spending. These factors include economic conditions, activity in the financial markets, general business conditions, personnel cost, inflation, interest rates and taxation. Our business is affected by the general condition and economic stability of our customers and their continued willingness to work with us in the future. An overall decline in the demand for services could cause a reduction in our sales and the Company could face a situation where it never achieves a critical mass of sales and thereby be forced to cease operations.

- 13 -

Changes in generally accepted accounting principles could have an adverse effect on our business financial condition, cash flows, revenue and results of operations

We are subject to changes in and interpretations of financial accounting matters that govern the measurement of our performance. Based on our reading and interpretations of relevant guidance, principles or concepts issued by, among other authorities, the American Institute of Certified Public Accountants, the Financial Accounting Standards Board, and the United States Securities and Exchange Commission, our management believes that our current contract terms and business arrangements have been properly reported. However, there continue to be issued interpretations and guidance for applying the relevant standards to a wide range of contract terms and business arrangements that are prevalent in the industries in which we operate. Future interpretations or changes by the regulators of existing accounting standards or changes in our business practices could result in future changes in our revenue recognition and/or other accounting policies and practices that could have a material adverse effect on our business, financial condition, cash flows, revenue and results of operations.

We will need to increase the size of our organization, and may experience difficulties in managing growth.

We are a small company with three full-time employees. We expect to experience a period of significant expansion in headcount, facilities, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate managers. Our future financial performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We have offered and sold our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information provided by investors themselves.

If any prior offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

We incur costs associated with SEC reporting compliance.

The Company made the decision to become an SEC “reporting company” in order to comply with applicable laws and regulations. We incur certain costs of compliance with applicable SEC reporting rules and regulations including, but not limited to attorneys fees, accounting and auditing fees, other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately $25,000 per year. On balance, the Company determined that the incurrence of such costs and expenses was preferable to the Company being in a position where it had very limited access to additional capital funding.

- 14 -

The availability of a large number of authorized but unissued shares of common stock may, upon their issuance, lead to dilution of existing stockholders.

We are authorized to issue 100,000,000 shares of common stock, $0.0001 par value per share, of which, as of March 10, 2011, 25,350,000 shares of common stock were issued and outstanding. We are also authorized to issue 10,000,000 shares of preferred stock, $0.0001 par value, none of which are issued and outstanding. These shares may be issued by our board of directors without further stockholder approval. The issuance of large numbers of shares, possibly at below prior investment valuations, is likely to result in substantial dilution to the interests of other stockholders. In addition, issuances of large numbers of shares may adversely affect the value of our common stock.

We may need additional capital that could dilute the ownership interest of investors.

We require substantial working capital to fund our business. If we raise additional funds through the issuance of equity, equity-related or convertible debt securities, these securities may have rights, preferences or privileges senior to those of the rights of holders of our common stock and they may experience additional dilution. We cannot predict whether additional financing will be available to us on favorable terms when required, or at all. Since our inception, we have experienced negative cash flow from operations and expect to experience significant negative cash flow from operations in the future. The issuance of additional common stock by the Company may have the effect of further diluting the proportionate equity interest and voting power of holders of our common stock.

We may not have adequate internal accounting controls. While we have certain internal procedures in our budgeting, forecasting and in the management and allocation of funds, our internal controls may not be adequate.

We are constantly striving to improve our internal accounting controls. While we believe that our internal controls are adequate for our current level of operations, we believe that we may need to employ accounting additional staff as our operations ramp up. We do not have a dedicated full time Chief Financial Officer, which we intend to employ within the next twelve months. Additionally, our board of directors has not designated an Audit Committee and we do not presently have any outside directors. We intend to attract outside directors once the Company commences full operations, and to designate an Audit Committee from such outside directors. There is no guarantee that such projected actions will be adequate or successful or that such improvements will be carried out on a timely basis. If, in the future, we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws.

We do not have adequate insurance coverage

At this time, we do not have adequate insurance coverage and therefore have the risk of loss or damages to our business and assets. We cannot assure you that we would not face liability upon the occurrence of any event which could result in any loss or damages being assessed against the Company. Moreover, any insurance we may ultimately acquire may not be adequate to cover any loss or liability we may incur.

We are subject to numerous laws and regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to extensive federal, state and local laws and regulations relating to the financial markets. Future laws or regulations, any adverse change in the interpretation of existing laws and regulations or our failure to comply with existing legal requirements may result in substantial penalties and harm to our business, results of operations and financial condition. We may be required to make large and unanticipated capital expenditures to comply with governmental regulations. Our operations could be significantly delayed or curtailed and our cost of operations could significantly increase as a result of regulatory requirements or restrictions. We are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

- 15 -

We do not intend to pay cash dividends in the foreseeable future

We currently intend to retain all future earnings for use in the operation and expansion of our business. We do not intend to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

There is currently no market for our securities and there can be no assurance that any market will ever develop or that our common stock will be listed for trading.

There has not been any established trading market for our common stock and there is currently no market for our securities. While we have been approved for trading on the OTC Bulletin Board (“OTCBB”), there can be no assurance as the prices at which our common stock will trade if a trading market develops, of which there can be no assurance. Until our common stock is fully distributed and an orderly market develops, (if ever) in our common stock, the price at which it trades is likely to fluctuate significantly.

Our common stock is subject to the Penny Stock Regulations

Once it commences trading (if ever) our common stock will likely be subject to the SEC's “penny stock” rules to the extent that the price remains less than $5.00. Those rules, which require delivery of a schedule explaining the penny stock market and the associated risks before any sale, may further limit your ability to sell your shares.

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our common stock currently has no “market price” and when and if a trading market develops, may fall within the definition of penny stock and subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the `penny stock` rules may restrict the ability of broker-dealers to sell our common stock and may affect the ability of investors to sell their common stock in the secondary market.

Our common stock is illiquid and may in the future be subject to price volatility unrelated to our operations

Our common stock has no market price and, if and when a market price is established, could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock. Sales of substantial amounts of common stock, or the perception that such sales could occur, could adversely affect the market price of our common stock (if and when a market price is established) and could impair our ability to raise capital through the sale of our equity securities.

- 16 -

We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the Nasdaq Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors' independence, audit committee oversight, and the adoption of a code of ethics. We have not yet adopted any of these corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We have incurred losses since inception, expect to incur significant net losses in the foreseeable future and may never become profitable.

We have experienced operating losses to date; as of June 30, 2010 our accumulated deficit was approximately $1,800 . We have generated no revenues. We expect to continue to incur substantial additional operating losses for at least the next year as we advance to gain commercial approval for sales in Mexico and Central and South America, and pursue cross-over-approval clinical trials in Europe, the U.S. and Asia and continued research and development activities. We may never successfully commercialize our vaccine product candidates and thus may never have any significant future revenues or achieve and sustain profitability.

We have limited sources of revenue and our success is dependent on our ability to develop our vaccine and other product candidates.

We are able to sell the current products at minimal cost under a Phase IV clinical protocol in Mexico, and may not have any other products commercially available for several years, if at all. Our ability to generate future revenues depends heavily on our success in:

|

●

|

securing Mexican regulatory approvals for our product candidates;

|

|

●

|

developing and securing U.S. and/or foreign regulatory approvals for our product candidates, including securing regulatory approval for conducting clinical trials with product candidates;

|

|

●

|

commercializing any products for which we receive approval from the FDA and foreign regulatory authorities; and

|

None of our human vaccine product candidates has been approved for sale, and we may not develop commercially successful vaccine products.

Our human vaccine programs are in the early to late stages of research and development, and currently include vaccine product candidates in discovery, pre-clinical studies to Phase IV clinical studies. The success of our efforts to develop and commercialize our vaccine product candidates could fail for a number of reasons. For example, we could experience delays in product development, clinical trials, manufacturing and regulatory approval. Our vaccine product candidates could be found to be ineffective or unsafe, or otherwise fail to receive necessary regulatory clearances. The products, if safe and effective, could be difficult to manufacture on a large scale or uneconomical to market, or our competitors could develop superior vaccine products more quickly and efficiently or more effectively market their competing products.

- 17 -

In addition, adverse events, or the perception of adverse events, relating to vaccines and vaccine delivery technologies may negatively impact our ability to develop commercially successful vaccine products. For example, pharmaceutical companies have been subject to claims that the use of some pediatric vaccines has caused personal injuries, including brain damage, central nervous system damage and autism. These and other claims may influence public perception of the use of vaccine products and could result in greater governmental regulation, stricter labeling requirements and potential regulatory delays in the testing or approval of our potential products.

We will need substantial additional capital to develop our vaccine and other product candidates and for our future operations.

Conducting the costly and time consuming research, pre-clinical and clinical testing necessary to obtain regulatory approvals and bring our vaccine technology and product candidates to market will require a commitment of substantial funds in excess of our current capital. Our future capital requirements will depend on many factors, including, among others: the progress of our current and new product development programs; the progress, scope and results of our pre-clinical and clinical testing; the time and cost involved in obtaining regulatory approvals; the cost of manufacturing our products and product candidates; the cost of prosecuting, enforcing and defending against patent infringement claims and other intellectual property rights; competing technological and market developments; and our ability and costs to establish and maintain collaborative and other arrangements with third parties to assist in potentially bringing our products to market.

Additional financing may not be available on acceptable terms, or at all. Domestic and international capital markets have been experiencing heightened volatility and turmoil, making it more difficult to raise capital through the issuance of equity securities. Furthermore, as a result of the recent volatility in the capital markets, the cost and availability of credit has been and may continue to be adversely affected by illiquid credit markets and wider credit spreads. Concern about the stability of the markets generally and the strength of counterparties specifically has led many lenders and institutional investors to reduce, and in some cases cease to provide, funding to borrowers. To the extent we are able to raise additional capital through the sale of equity securities or we issue securities in connection with another transaction, the ownership position of existing stockholders could be substantially diluted. If additional funds are raised through the issuance of preferred stock or debt securities, these securities are likely to have rights, preferences and privileges senior to our common stock and may involve significant fees, interest expense, restrictive covenants and the granting of security interests in our assets. Fluctuating interest rates could also increase the costs of any debt financing we may obtain. Raising capital through a licensing or other transaction involving our intellectual property could require us to relinquish valuable intellectual property rights and thereby sacrifice long term value for short-term liquidity.

Our failure to successfully address ongoing liquidity requirements would have a substantially negative impact on our business. If we are unable to obtain additional capital on acceptable terms when needed, we may need to take actions that adversely affect our business, our stock price and our ability to achieve cash flow in the future, including possibly surrendering our rights to some technologies or product opportunities, delaying our clinical trials or curtailing or ceasing operations.

If we are unable to attract and retain key personnel and advisors, it may adversely affect our ability to obtain financing, pursue collaborations or develop or market our product candidates.

To pursue our business strategy, we will need to attract and retain qualified scientific personnel and managers, including personnel with expertise in clinical trials, government regulation, manufacturing, marketing and other areas. Competition for qualified personnel is intense among companies, academic institutions and other organizations. If we are unable to attract and retain key personnel and advisors, it may negatively affect our ability to successfully develop, test, commercialize and market our products and product candidates.

- 18 -

We face intense and increasing competition and many of our competitors have significantly greater resources and experience.

Many other companies are pursuing other forms of treatment or prevention for diseases that we target. For example, many of our competitors are working on developing and testing HPV vaccines for the treatment of cervical and other cancers. Several HPV vaccines developed by our competitors have been approved for human use. Our competitors and potential competitors include large pharmaceutical. These companies have significantly greater financial and other resources and greater expertise than us in research and development, securing government contracts and grants to support research and development efforts, manufacturing, pre-clinical and clinical testing, obtaining regulatory approvals and marketing. This may make it easier for them to respond more quickly than us to new or changing opportunities, technologies or market needs. Many of these competitors operate large, well-funded research and development programs and have significant products approved or in development. Small companies may also prove to be significant competitors, particularly through collaborative arrangements with large pharmaceutical companies or through acquisition or development of intellectual property rights. Our potential competitors also include academic institutions, governmental agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for product and clinical development and marketing. Research and development by others may seek to render our technologies or products obsolete or noncompetitive.

If we lose or are unable to secure collaborators or partners, or if our collaborators or partners do not apply adequate resources to their relationships with us, our product development and potential for profitability will suffer.

We have entered into, or may enter into, distribution, co-promotion, partnership, sponsored research and other arrangements for development, manufacturing, sales, marketing and other commercialization activities relating to our products. The amount and timing of resources applied by our collaborators are largely outside of our control.

If any of our other current or future collaborators breaches or terminates our agreements, or fails to conduct our collaborative activities in a timely manner, our commercialization of products could be diminished or blocked completely. It is possible that collaborators will change their strategic focus, pursue alternative technologies or develop alternative products, either on their own or in collaboration with others. Further, we may be forced to fund programs that were previously funded by our collaborators, and we may not have, or be able to access, the necessary funding. The effectiveness of our partners, if any, in marketing our products will also affect our revenues and earnings.

We desire to enter into new collaborative agreements. However, we may not be able to successfully negotiate any additional collaborative arrangements and, if established, these relationships may not be scientifically or commercially successful. Our success in the future depends in part on our ability to enter into agreements with other highly-regarded organizations. This can be difficult due to internal and external constraints placed on these organizations. Some organizations may have insufficient administrative and related infrastructure to enable collaborations with many companies at once, which can extend the time it takes to develop, negotiate and implement a collaboration. Once news of discussions regarding possible collaborations are known in the medical community, regardless of whether the news is accurate, failure to announce a collaborative agreement or the entity's announcement of a collaboration with another entity may result in adverse speculation about us, resulting in harm to our reputation and our business.

Disputes could also arise between us and our existing or future collaborators, as to a variety of matters, including financial and intellectual property matters or other obligations under our agreements. These disputes could be both expensive and time-consuming and may result in delays in the development and commercialization of our products or could damage our relationship with a collaborator.

- 19 -

A small number of partners and government contracts account for a substantial portion of our revenue.

We currently derive, and in the past we have derived, a significant portion of our revenue from a limited number of partners and government grants and contracts. If we fail to sign additional future contracts with major licensing partners and the government, if a contract is delayed or deferred, or if an existing contract expires or is cancelled and we fail to replace the contract with new business, our revenue would be adversely affected.

We have agreements with government agencies, which are subject to termination and uncertain future funding.

We have entered into agreements with government agencies, and we intend to continue entering into these agreements in the future. Our business is partially dependent on the continued performance by these government agencies of their responsibilities under these agreements, including adequate continued funding of the agencies and their programs. We have no control over the resources and funding that government agencies may devote to these agreements, which may be subject to annual renewal and which generally may be terminated by the government agencies at any time.

Government agencies may fail to perform their responsibilities under these agreements, which may cause them to be terminated by the government agencies. In addition, we may fail to perform our responsibilities under these agreements. Many of our government agreements are subject to audits which may occur several years after the period to which the audit relates. If an audit identifies significant unallowable costs, we could incur a material charge to our earnings or reduction in our cash position. As a result, we may be unsuccessful entering or ineligible to enter into future government agreements.

Our quarterly operating results may fluctuate significantly.

We expect our operating results to be subject to quarterly fluctuations. Our net loss and other operating results will be affected by numerous factors, including:

• variations in the level of expenses related to product candidates or future development programs;

• merger integration expenses;

• addition or termination of clinical trials or funding support;

• any intellectual property infringement lawsuit in which we may become involved;

• any legal claims that may be asserted against us or any of our officers;

• regulatory developments affecting product candidates or those of our competitors;

• our execution of any collaborative, licensing or similar arrangements, and the timing of payments we may make or receive under these arrangements; and

• if any of our products receives regulatory approval, the levels of underlying demand for our products.

If our quarterly operating results fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. Furthermore, any quarterly fluctuations in our operating results may, in turn, cause the price of our stock to fluctuate substantially. We believe that quarterly comparisons of our financial results are not necessarily meaningful and should not be relied upon as an indication of our future performance.

If we are unable to obtain government approval of our products, we will not be able to commercialize them in the United States.

We need FDA approval prior to marketing our products in the United States. If we fail to obtain FDA approval to market our product candidates, we will be unable to sell our products in the United States, which will significantly impair our ability to generate revenues.

- 20 -

This regulatory review and approval process, which includes evaluation of pre-clinical studies and clinical trials of our products as well as the evaluation of our manufacturing processes and our third-party contract manufacturers' facilities, is lengthy, expensive and uncertain. To receive approval, we must, among other things, demonstrate with substantial evidence from well-controlled clinical trials that our product candidates are both safe and effective for each indication for which approval is sought. Satisfaction of the approval requirements typically takes several years and the time needed to satisfy them may vary substantially, based on the type, complexity and novelty of the product. We do not know if or when we might receive regulatory approvals for any of our product candidates currently under development. Moreover, any approvals that we obtain may not cover all of the clinical indications for which we are seeking approval, or could contain significant limitations in the form of narrow indications, warnings, precautions or contra-indications with respect to conditions of use. In such event, our ability to generate revenues from such products would be greatly reduced and our business would be harmed.