Attached files

Table of Contents

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

FOR THE FISCAL YEAR ENDED JANUARY 1, 2011

Commission file number 0-14800

X-RITE, INCORPORATED

(Name of registrant as specified in charter)

| Michigan | 38-1737300 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

4300 44th Street S.E., Grand Rapids, Michigan 49512

(Address of principal executive offices)

616-803-2100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.10 par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section15 (d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

On March 3, 2011, the number of outstanding shares of the registrant’s common stock, par value $.10 per share, was 85,912,620.

The aggregate market value of the common stock held by non-affiliates of the registrant (i.e., excluding shares held by executive officers, directors and control persons as defined in Rule 405, 17 CFR 230.405) as of July 2, 2010, the last business day of the second quarter of the Company’s fiscal year, was $313,929,903 computed at the closing price on that date.

Portions of the Company’s Proxy Statement for the 2011 Annual Meeting of Shareholders are incorporated by reference into Part III. Exhibit Index is located at Page 82.

Table of Contents

FORM 10-K

X-Rite, Incorporated

For The Year Ended January 1, 2011

| Part |

Topic |

Page |

||||

| Part I |

||||||

| Item 1 |

1 | |||||

| Item 1A |

7 | |||||

| Item 1B |

12 | |||||

| Item 2 |

13 | |||||

| Item 3 |

13 | |||||

| Item 4 |

14 | |||||

| 14 | ||||||

| Part II |

||||||

| Item 5 |

15 | |||||

| Item 6 |

17 | |||||

| Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 | ||||

| Item 7A |

36 | |||||

| Item 8 |

37 | |||||

| Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures |

76 | ||||

| Item 9A |

76 | |||||

| Item 9B |

76 | |||||

| Part III |

||||||

| Item 10 |

Directors, Executive Officers of the Registrant, and Corporate Governance |

77 | ||||

| Item 11 |

77 | |||||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

77 | ||||

| Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

78 | ||||

| Item 14 |

78 | |||||

| Part IV |

||||||

| Item 15 |

79 | |||||

| 80 | ||||||

| 82 | ||||||

Table of Contents

PART I

| ITEM 1. | BUSINESS |

X-Rite, Incorporated (X-Rite, the Company, our, we, or us) is a global leader in color science and color technology. The Company develops, manufactures, markets and supports innovative color solutions through measurement instrumentation systems, software, color standards and services, as described below in the product overview section. X-Rite’s expertise in inspiring, selecting, measuring, formulating, communicating and matching color helps users get color right the first time and every time, which translates to better quality and reduced costs. X-Rite serves a range of markets including printing, packaging, photography, graphic design, video, automotive, paints, plastics, textiles, dental and medical. We serve these markets through our core product lines of Imaging and Media, Industrial, Standards, Support, Retail and Other. A more detailed discussion of our major markets and product line offerings appears below.

Products are sold worldwide through the Company’s own sales personnel and through independent sales representatives and dealers. The Company is headquartered in Grand Rapids, Michigan and has other domestic operations in New Jersey, North Carolina, and Massachusetts. In addition, the Company has locations in Switzerland, Germany, England, France, Italy, Spain, the Czech Republic, Russia, China, Hong Kong, and Japan. Manufacturing facilities are located in the United States, Switzerland, and Germany.

X-Rite was organized in 1958 as a Michigan corporation and completed its initial public offering of common stock in April of 1986. The Company has historically grown organically through investment in new products and our existing business and in more recent years our growth has been driven by investing in international expansion and strategic acquisitions.

| • | Product Innovation |

Product innovation is a key success factor to our ability to remain competitive in the color management industry. In 2010, we introduced nine new products and six major product upgrades. We also devoted resources to developing customer-specific solutions for eight of our customers. In 2010, we spent approximately eleven percent of our revenues on engineering, research, and development. Our focus continues to center on color management solutions that incorporate software, hardware, standards, and services.

| • | International Growth |

With offices in eleven countries outside the U.S. and service centers across Europe, Asia, and the Americas, we continue to expand our ability to conduct business with customers around the world. The Company began to accelerate its global presence in 1993 with the establishment of sales and service subsidiaries in several locations throughout Europe and Asia. In 2006 and 2007, we expanded our global presence even further through the acquisitions of Amazys Holding AG and Pantone Inc., respectively. In 2010, 2009, and 2008 international sales represented 66.9, 64.7, and 67.2 percent of total revenue, respectively.

| • | Amazys Holding AG Acquisition |

We completed the acquisition of Amazys Holding AG (Amazys) on July 5, 2006 for $306.7 million. With significant international operations, Amazys was based in Switzerland and developed, marketed, and supported hardware, software, and services to measure and communicate color for the imaging and media, photography, digital imaging, plastics, apparel, textiles, and automotive industries. Prior to the acquisition, Amazys was X-Rite’s largest direct competitor. Subsequent to the acquisition of Amazys, X-Rite became the leader in the color management industry, and we established our European headquarters in Regensdorf, Switzerland.

1

Table of Contents

| • | Pantone, Inc. Acquisition |

We completed the acquisition of Pantone, Inc. (Pantone) on October 24, 2007 for $175.9 million. The Pantone product offerings were and continue to be a leader in color inspiration, communication and specification standards in the creative design industries. The PANTONE® products represent a key color standard in the graphic arts, printing, publishing and advertising industries. Pantone also provides color standards and design tools for the fashion, home furnishings, architecture, paint, industrial design and interior design industries. With the addition of the Pantone business, X-Rite was able to expand the global reach and breadth of our product offerings into new industries and established significant international recognition by incorporating the PANTONE® trade name into the X-Rite corporate brand.

In connection with the completion of the aforementioned acquisitions, the Company identified a series of operational and organizational restructuring necessary to realign the Company, realize operational synergies of the acquisitions, and continue to remain competitive across all facets of the color management industry. While the need for these initiatives was clearly identified, the timing became critical in lieu of the global economic downturn that ensued in 2008. From the onset of the restructuring activities in 2006 through the end of 2010 the Company incurred approximately $28.7 million in restructuring charges. These charges relate to the synergies realized as part of our acquisition and integration, cost containment actions taken as a result of the global economic recession, and other actions to align our global entity and tax structure.

The debt load incurred as a result of the acquisitions coupled with the economic recession resulted in the Company experiencing covenant defaults on its credit facilities and it was required to complete a Corporate Recapitalization Plan in 2008. Under this plan, the Company was able to raise $155 million in capital through the issuance of additional shares of its common stock. Subsequently, in the fall of 2009, the Company entered into an exchange agreement to effectively convert $41.6 million of the outstanding second lien term loan for 41,561 newly issued Series A Preferred Stock (mandatorily redeemable preferred stock or MRPS) with a stated value of $1,000. The MRPS entitled the holders to dividends at a fixed annual rate of 14.375 percent and included the issuance of warrants to acquire 7.5 million shares of common stock at an exercise price of $0.01 per share. Furthermore, in the fall of 2010, the Company extinguished the second lien credit agreement with cash on hand of $9.9 million and borrowings under the first lien revolving credit facility of $16.5 million. As the condition of the global economy began to improve in 2009 and 2010, the Company has since been able to start realizing the benefits of the restructuring activities discussed above and have seen significant growth in sales in 2010 across all significant markets. With this improved operations performance the Company was able to meet all financial covenants at the 2010 and 2009 year ends.

PRODUCT OVERVIEW

Measurement Instrumentation

| • | Colorimeters measure light much like the human eye using red, green and blue receptors and are utilized to measure printed colors on packages, labels, textiles and other materials where a product’s appearance is critical for buyer acceptance. |

| • | Spectrophotometers offer more precision than colorimeters; they measure light at more points over the entire visible spectrum. The increased precision of spectrophotometers make them useful in predicting color formulation for many types of materials such as plastics, paints, inks, ceramics and metals. The Company offers different optical geometries of spectrophotometers as well as application types from bench-top models, to portables to non-contact versions. Each variation provides specific benefits for the wide variety of markets served, whether it is a portable multi-angle for an automotive paint or a bench-top sphere geometry for a textile application or a non-contact single angle spectrophotometer for cosmetics, the specific device and accompanying software provide solutions for management of color and appearance in almost any application where color is found. |

2

Table of Contents

| • | Densitometers are instruments that measure optical or photographic density, compare such measurement to a reference standard, and signal the result to the operator of the instrument. Some models are designed for use in controlling variables in the processing of x-ray film in medical and non-destructive testing applications. Other models are designed to be used to control process variables in the production of photo-transparencies, such as photographic film and microfilm, or measure the amount of light that is reflected from a surface, such as ink on paper. |

| • | Spectrodensitometers combine the function of a densitometer with the functions of a colorimeter and a spectrophotometer to provide measurements for monitoring color reproduction used for controlling the color of printed inks in graphic arts applications. |

| • | Sensitometers are used to expose various types of photographic film in a very precise manner for comparison to a reference standard. The exposed film is processed and then “read” with a densitometer to determine the extent of variation from the standard. |

Software

The Company provides software and databases that interface with its color measurement instruments and other process equipment. These software packages allow the user to collect and store color measurement data, compare that data to established standards and databases, communicate color results and formulate colors from a database.

Standards Products

The Standards product line embodies products for the accurate communication and reproduction of color, digitally or in print. These products establish color standardization and are used by customers worldwide in a variety of industries including imaging and media, textiles, digital technology, plastics, paint, medical, and food.

Services

Support Services provides customers access to color professional specialists, training, and technical support worldwide through color seminars, classroom workshops, on-site consulting, and interactive media development. Support Services additionally provides service repair operations that specialize in repairing all X-Rite equipment.

MAJOR MARKETS AND PRODUCT LINES

As noted above, the Company operates across a broad spectrum of markets including printing, packaging, photography, graphic design, video, automotive, paints, plastics, textiles and medical. These markets are generally categorized to align with our six core product line offerings as outlined below. A key to the Company’s success is our ability to integrate our products and solutions across the various industries of a product life cycle to improve the color management process from the inception of a design, through the manufacturing process, and end user experience.

Imaging and Media

The Imaging and Media product line consists of Digital Imaging and Printing.

The Digital Imaging product line consists of solutions for graphic designers, photo processing, photography, graphic design, pre-press service bureaus, and a myriad of calibration tools for image setters, raster image processors, and other digital applications. Our color management systems give designers control of scanned artwork, images captured with a digital camera, desktop printers, high-end proofers and commercial presses that translate color from one device to the next. These solutions work to create value at key stages of the workflow by reducing waste, increasing productivity and enhancing quality.

3

Table of Contents

The Printing product line supports both digital and traditional printing. X-Rite’s color-calibrated instruments, digital palettes, and output measurement devices support color communication for the entire printing and preprinting process, reducing set up time and eliminating the opportunity for costly mistakes. Our handheld products are straightforward, self-contained solutions that keep color on-target in the pre-press process, ink lab and pressroom. X-Rite’s automated scanning systems support the need for faster and more frequent color data collection.

Industrial

Our Industrial product line is concentrated in the quality and process control markets. We design, develop, and manufacture precision instrumentation, software, and systems for global manufacturers, fulfilling a need to measure color for formulation, quality, and process control for paint, plastics, and textiles. Accurate color reproduction and global supply chain management offer these manufacturers and businesses a competitive advantage, and are important factors when products are assembled from parts made around the world. X-Rite’s industrial product solutions are designed to reduce waste, increase production uptime, improve process management, and enable global color communication.

Standards

The Standards product line provides for the accurate communication and reproduction of color. The PANTONE® products represent a key color standard in the home fashion and design industries, serving the graphic arts, printing, publishing, advertising, paint, and textiles markets. The Standards product line also embodies the Munsell Color System, which is a scientifically based color order system that is used to define color based on the three attributes of color: hue, value, and chroma.

Support Services

Our Support Services market provides customers access to color professional specialists, training, and technical support worldwide through color seminars, classroom workshops, on-site consulting, and interactive media development. Our Support Services business provides both major manufacturers and end users with comprehensive solutions for their color and workflow problems. Support Services additionally operates and manages the Company’s service repair operation with facilities around the world and specializes in repairing all X-Rite equipment. The products repaired by the service department include products currently covered by our warranty program as well as those products which are out of warranty.

Retail

X-Rite’s Retail product line consists of paint matching. The paint matching market is conducted under the name of MatchRite. X-Rite is a leading supplier of retail paint matching systems for home centers, mass merchants, hardware stores and paint retailers in North America, and has established a strong presence in Europe and other regions of the world. X-Rite’s Retail customers rely on its strength in color measurement instrumentation, database creation and management, custom software development, and large scale account servicing. These solution-based products reduce paint inventory for the retailer and provide a user-friendly environment for sophisticated shade matching capabilities to the consumer.

Other

Medical and Dental—X-Rite serves the medical x-ray market’s imaging needs and provides instrumentation designed for use in controlling variables in the processing of x-ray film. Additionally, we manufacture restorative tooth shade matching instruments and complementary software packages that are designed for use in cosmetic dental practices.

4

Table of Contents

OTHER INFORMATION

Manufacturing, Sourcing and Service

We manufacture the majority of our products at our facilities in Michigan, New Jersey, and Switzerland. We generally have multiple sources for raw materials, supplies and components but also have some materials that are single sourced. These consist primarily of electrical and molded plastic components which are generally widely available in the market. We rely on a number of strategic supply chain partners to produce key components or sub-assemblies that support our final assembly, calibration, and test process as well as our finished products. Product repair and service is provided at eleven locations throughout the world.

Competition

Our business is competitive and subject to technological change, evolving customer requirements, and changing business models. We face strong competition in many areas of our current business activities. The rapid pace of technological change creates new opportunities for both our existing competitors as well as start-ups. Moreover, the rise of new industry alliances, and mergers and acquisitions can dramatically change our competitive landscape and can result in competitors with significant resources in research and development, marketing and sales. Customer requirements change quickly as a result of new and more cost efficient technologies. We face direct competition from approximately ten firms which are producing competing products in the Imaging and Media category, approximately eight manufacturers of competing products in the Retail and Industrial markets, and approximately four distributors in the Standards industry; some of whom have significant access to resources. The primary base of competition for all the Company’s products is technology and intellectual property, design, service, and price. Our competitive position may be adversely affected in the future by one or more of the factors described in this section.

Employees

As of January 1, 2011 and January 2, 2010, the Company employed 746 and 753 people on a full time basis, of which 481 and 484, respectively, were in the United States. We believe we have generally good relationships with our employees.

Patents

As of January 1, 2011, X-Rite owned 174 patents and had 80 patent applications on file. While the Company follows a policy of obtaining patent protection for its products where appropriate, it does not believe that the loss of any existing patent, or failure to obtain any new patents, would have a material adverse impact on its current operations. We expect to protect our products and technology by asserting our intellectual property rights where appropriate and prudent.

Distribution Networks

The Company’s products are sold by its own sales personnel and through independent manufacturer’s representatives. Certain products not sold directly to end-users are distributed through a network of independent dealers throughout Europe, Asia Pacific and the Americas.

Seasonality

The Company’s business is generally not subject to seasonal variations that significantly impact sales, production, or net income.

5

Table of Contents

Significant Customers

In 2010 and 2009, the Company did not have any customers which accounted for greater than 10 percent of consolidated net sales. One significant customer, Heidelberger Druckmaschinen AG, accounted for $32.0 million or 12.2 percent, of total net sales in 2008.

Backlog

The Company’s estimated backlog of scheduled but unshipped orders was $20.9 million as of January 29, 2011 and $17.3 million as of January 30, 2010. This backlog is expected to be utilized during the current fiscal year.

Research, Development and Engineering

During 2010, 2009, and 2008, the Company expensed $23.7, $22.6, and $29.4 million, respectively, on research, development, and engineering.

In addition to the research, development, and engineering costs reported as operating expenses, certain costs to develop new software products were capitalized in each of the last three years. Software development costs capitalized totaled $6.5, $4.4, and $4.0 million in 2010, 2009, and 2008, respectively. The related amortization expense was included in cost of sales (see Note 1 to the Consolidated Financial Statements).

Financial Information About Segments and Geographic Areas

We operate and generate revenue as one segment in the color management industry. For further discussion of our segment reporting, see Note 2 to the Consolidated Financial Statements accompanying this Report.

We operate in the geographic areas described above under Item 1, “Business.” For additional information regarding our revenue and long-lived assets by geographic area, see Note 2 to the Consolidated Financial Statements accompanying this Report. For information regarding risks relating to our foreign operations, see Item 1A, “Risk Factors” in this Report.

Regulatory and Environmental Matters

We are subject to federal, state, local and foreign laws, rules and regulations that govern activities that may have adverse environmental effects and which impose liability for compliance and clean-up costs resulting for the discharge, handling, storage and disposal of hazardous wastes and substances. Compliance with these laws, rules and regulations has not had, and is not expected to have, a material effect on our business, results of operations or financial condition.

Availability of Information

X-Rite’s internet website is www.xrite.com. X-Rite’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Exchange Act are available free of charge through our website as soon as reasonably practicable after we electronically file with or furnish them to the Securities and Exchange Commission.

6

Table of Contents

| ITEM 1A | RISK FACTORS |

There are many risk factors that may adversely affect the Company’s operating results, including the following significant risks. See also the Notes to the Consolidated Financial Statements located herein at Item 8 for additional risks that may affect the Company.

Our future results could be harmed by economic, political, geographic, regulatory and other specific risks associated with international operations.

During fiscal 2010, we derived approximately 66.9 percent of our total revenues from sales of our products outside of the United States, compared with 64.7 percent during fiscal 2009 and 67.2 percent during fiscal 2008. Substantially all of our foreign generated revenues were denominated in Swiss Francs, Euros, British Pound Sterling, or Chinese Yuan. The United States dollar value of our foreign generated revenues varies with currency exchange rate fluctuations. Significant increases in the value of the United States dollar relative to other currencies could have a material adverse effect on our results of operations. We address currency risk management through regular operating and financing activities. We currently have no hedging or similar foreign currency contracts to mitigate the risk of exchange rate fluctuations. Fluctuations in the value of foreign currencies could adversely impact the profitability of our foreign operations. We intend to continue to pursue growth opportunities in sales internationally, which could expose us to greater risks associated with international sales and operations. There can be no assurance that we will maintain or expand our international sales. If the revenues generated from international activities, especially in emerging markets, are inadequate to offset the expense of maintaining such international operations, our business, financial condition and results of operations could be materially and adversely affected. The increasingly international reach of our businesses could also subject us and our results of operations to unexpected, uncontrollable and rapidly changing economic and political conditions. Specifically, international sales and operations are subject to inherent risks, including:

| • | lack of experience in a particular geographic market; |

| • | tariffs and other barriers, including import and export requirements, taxes on subsidiary operations and investment restrictions or requirements; |

| • | different and changing regulatory requirements in various countries and regions; |

| • | fluctuating exchange rates and currency controls; |

| • | difficulties in staffing and managing foreign sales and support operations; |

| • | longer accounts receivable payment cycles; |

| • | potentially adverse tax consequences, including repatriation of earnings; |

| • | diminished protection of intellectual property in some countries outside the U.S.; |

| • | development and support of localized and translated products; |

| • | lack of acceptance of localized products or X-Rite in foreign countries; |

| • | differing local product preferences and product requirements; |

| • | labor force instability, including possible shortages of skilled personnel required for local operations; |

| • | exposure to local economic conditions; and |

| • | political, economic, and civil instability, such as perceived or actual public health, terrorist risks, violence, civil unrest, or outbreaks of war which impact a geographic region and business operations therein. |

As we expand our international operations, we may encounter new risks. For example, as we focus on building our international sales and distribution networks in new geographic regions, we must continue to develop relationships with qualified local distributors and trading companies. If we are not successful in developing these relationships, we may not be able to grow sales in these geographic regions.

7

Table of Contents

Our debt level and the inability to access capital markets could adversely affect our operating flexibility and put us at a competitive disadvantage.

As of January 1, 2011, the Company had $136.6 million of first lien and revolving debt and $36.4 million of mandatorily redeemable preferred stock, net of warrant discount of $10.6 million. This amount of debt and payment obligations with respect to our preferred stock will require significant interest and principal payments. Our level of debt and the limitations imposed on us by our credit agreements and the terms of our preferred stock could adversely affect our operating flexibility and put us at a competitive disadvantage. Our debt level and the terms of our preferred stock may adversely affect our future performance, because, among other things:

| • | We may be placed at a competitive disadvantage relative to our competitors, some of which have lower fixed payment obligations and greater financial resources than we do; |

| • | Our ability to complete future acquisitions may be limited; |

| • | We will have to use a portion of our cash flow for debt service and satisfying our payment obligations with respect to our preferred stock rather than for investment in research and development and capital expenditures; |

| • | We may not be able to obtain further debt financing and/or we may have to pay more for such additional financing as we are able to obtain; |

| • | We may not be able to take advantage of business opportunities; and |

| • | We will be more vulnerable to adverse economic conditions. |

The senior credit facilities contain certain covenants applicable to us and our subsidiaries that may adversely affect our ability to create liens, incur indebtedness, make certain investments or acquisitions, pay dividends, repurchase shares, enter into certain transactions with affiliates, incur capital expenditures beyond prescribed limits and that require us to deliver certain reports and information, and meet certain financial ratios. In addition, the terms of our preferred stock contain certain covenants applicable to us and our subsidiaries that may adversely affect our ability to create new classes of equity securities, incur indebtedness, pay dividends, or repurchase shares.

Our ability to make scheduled payments of principal of, to pay interest on, or to refinance our indebtedness and to satisfy our payment obligations with respect to our preferred stock will depend upon our future operating performance and cash flows, which may be affected by factors beyond our control. In addition, there can be no assurance that we will be able to access the capital markets to obtain future debt or equity financing on commercially reasonable terms or at all in connection with the repayment or refinancing of our indebtedness. If we are unable to service our indebtedness or satisfy our payment obligations with respect to our preferred stock, these obligations could be accelerated, thereby causing our business, financial condition and results of operations to be materially adversely affected. Additionally, if one or more rating agencies downgrade our credit rating, we may have difficulty obtaining additional financing, refinancing existing indebtedness and/or our cost of obtaining additional financing or refinancing existing indebtedness may be increased significantly.

If we fail to attract, hire and retain qualified personnel, we may not be able to design, develop, market or sell our products or successfully manage our business.

Our operations and the development of new products require expertise. In addition, our ability to attract new customers, retain existing customers and pursue our strategic objectives depends on the continued services of our current management, sales, product development and technical personnel and our ability to identify, attract, train and retain similar personnel. Competition for top management personnel is intense and we may not be able to recruit and retain the personnel we need if we are unable to offer competitive compensation and benefits. The loss of any one of our management personnel, or our inability to identify, attract, train, retain and integrate additional qualified management personnel, could make it difficult for us to manage our business successfully and pursue our strategic objectives. We do not carry key person life insurance on any of our employees. Similarly, competition for skilled sales, product development and technical personnel is intense and we may not

8

Table of Contents

be able to recruit and retain the personnel we need. The loss of the services of key sales, product development and technical personnel, or our inability to hire new personnel with the requisite skills, could restrict our ability to develop new products or enhance existing products in a timely manner, sell products to our customers or manage our business effectively.

If we are unable to protect our intellectual property rights, our business and prospects may be harmed.

We have made significant expenditures to develop and acquire technology and intellectual property rights. We actively patent and trademark these properties when deemed appropriate and will vigorously defend them against infringement. Our failure to protect our intellectual property could seriously harm our business and prospects because developing new products and technologies is critical to our success. We will incur substantial costs in obtaining patents and, if necessary, defending our intellectual propriety rights. We do not know whether we will obtain the patent protection we seek, or that the protection we do obtain will be found valid and enforceable if challenged. Our efforts to protect our intellectual property through patents, trademarks, service marks, domain names, trade secrets, copyrights, confidentiality and nondisclosure agreements and other measures may not be adequate to protect our proprietary rights. Patent filings by third parties could render our intellectual property less valuable. Disputes may arise as to ownership of our intellectual property or as to whether products designed by our competitors infringe our intellectual property rights. Employees, consultants and others who participate in developing our products may breach their agreements with us regarding our intellectual property, and we may not have adequate remedies for the breach. In addition, intellectual property rights may be unavailable or limited in some foreign countries, which could make it easier for competitors to capture market position. Competitors may also capture market share from us by designing products that mirror the capabilities of our products or technology without infringing on our intellectual property rights. In addition, as sales of our products continue to grow internationally, our exposure to intellectual property infringements in countries where intellectual property rights protections are less stringent will increase. If we do not obtain sufficient international protection for our intellectual property, our competitiveness in international markets could be impaired, which would limit our growth and future revenue.

We may be subject to intellectual property litigation and infringement claims, which could cause us to incur significant expenses or prevent us from selling our products.

A successful claim of patent or other intellectual property infringement against us could adversely affect our growth and profitability, in some cases materially. We cannot assure you that others will not claim that our proprietary or licensed products are infringing on their intellectual property rights or that we do not in fact infringe on those intellectual property rights. From time to time, we receive notices from third parties of potential infringement and receive claims of potential infringement. We may be unaware of intellectual property rights of others that may cover some of our technology. If someone claims that our products infringed on their intellectual property rights, any resulting litigation could be costly and time consuming and would divert the attention of management and key personnel from other business issues. The complexity of the technology involved and the uncertainty of intellectual property litigation increase these risks. Claims of intellectual property infringement also might require us to enter into costly royalty or license agreements or to modify our products. We also may be subject to significant damages or an injunction preventing us from manufacturing, selling or using some of our products in the event of a successful claim of patent or other intellectual property infringement. Any of these adverse consequences could have a material adverse effect on our business, financial condition and results of operations.

The markets for our products and services are highly competitive. If we are unable to compete effectively with existing or new competitors, our business could be negatively impacted.

The markets in which we compete are very competitive and subject to technological change, evolving standards, frequent product enhancements and introductions and changing customer requirements. A number of companies offer products and services that are similar to those offered by us and that target the same markets. In

9

Table of Contents

addition, any of these competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements, and to devote greater resources to the development, promotion and sale of their products than us. Our competitors may develop products and services that compete with those offered by us or may acquire companies, businesses and product lines that compete with us. It also is possible that competitors may create alliances and rapidly acquire significant market share, including in new and emerging markets. If we are not able to differentiate our products and services in the market, competitive pressures may potentially impact our sales volumes, pricing structure, gross margin, operating expenses and operating income.

Accordingly, there can be no assurance that current or potential competitors of X-Rite will not develop or acquire products or services comparable or superior to those that we develop, combine or merge to form significant competitors, or adapt more quickly than us to new technologies, evolving industry trends and changing customer requirements. Competition could cause price reductions, reduced margins or loss of market share for our products and services, any of which could materially and adversely affect our business, operating results and financial condition. There can be no assurance that we will be able to compete successfully against current and future competitors or that the competitive pressures that the company may face will not materially adversely affect our business, operating results, cash flows and financial condition.

We may be affected by environmental laws and regulations.

We are subject to a variety of laws, rules and regulations relating to discharges of substances into the air, water and land, the handling, storage and disposal of wastes and the cleanup of properties necessitated by pollutants. Any of those regulations could require us to acquire expensive equipment or to incur substantial other expenses to comply with them. If we incur substantial additional expenses, product costs could significantly increase. Also, if we fail to comply with present or future environmental laws, rules and regulations, such failure could result in fines, suspension of production or cessation of operations.

Our reliance on outsourced manufacturing presents risks to our fulfillment process.

We rely on a number of strategic supply chain partners to produce key components or sub-assemblies that support our final assembly, calibration, and test process. Some of these suppliers are small companies, single sourced which may experience adverse financial conditions and therefore present risks to our fulfillment process.

We depend on new product development to compete effectively.

We have made large investments in new products and services. There are no assurances as to when future revenues from these products will be received, or that the ultimate profit margins received will be adequate to justify the investment.

Continual development of new products, technologies, and enhancements to existing products is a core component of our long-term growth plans. Our future business, financial condition and results of operations will depend to a significant extent on our ability to develop new products and services that address these market opportunities. As a result, we believe that significant expenditures for research, development and engineering will continue to be required in the future. Product development requires a time-consuming and costly research and development process. Unexpected delays in this process may significantly affect the timing of future revenues and increase costs. We must anticipate the features and functionality that customers will demand, incorporate those features and functionality into products, price our products competitively and introduce new products to the market on a timely basis. We cannot assure you that the products we expect to introduce will incorporate the features and functionality demanded by our customers, will be successfully developed, or will be introduced within the appropriate window of market demand. If there are delays in production of current or new products, our potential future business, financial condition, and results of operations could be adversely affected. In addition, the time required for competitors to develop and introduce competing products may be shorter, their manufacturing yields may be better, and their production costs may be lower than those experienced by us.

10

Table of Contents

Adverse general economic and industry conditions could adversely affect our revenues and profitability.

Adverse general economic and industry conditions could lead to declines in the use of our products by our customers and a decline in sales. Many of our products are used for quality control purposes within a larger manufacturing or production process by customers who have been or may be impacted by adverse economic and market conditions. As such, our sales in some instances are linked to capital goods spending. Another economic slowdown or adverse global economic or industry conditions generally could result in a decrease in capital goods spending, sales and thereby adversely affect our revenues and profitability. In addition, accounts receivable and past due accounts could increase due to a decline in our customers’ ability to pay as a result of adverse economic and market conditions which also could adversely affect our financial performance.

We may face potential tax liabilities.

We are subject to taxation in many jurisdictions in the United States, Europe, Asia and elsewhere. In the ordinary course of business, there are transactions and calculations where the ultimate tax liability cannot be determined with certainty at the time the transaction is entered into. Preparation of our income tax provision requires the use of judgments as to how these transactions will ultimately be taxed. We believe our tax accruals are accurate though the ultimate determination of these issues may be different from that which is reflected in our historical provision and accruals. Should these determinations be different from what is previously recorded and additional tax is assessed, those assessments would be recorded in the period in which they occur.

The Company’s reliance on a small number of primary manufacturing centers may affect timely production and profitability.

Manufacturing and service of much of our core color products are performed at our headquarters facility in Grand Rapids, Michigan, and in our Regensdorf, Switzerland and Carlstadt, New Jersey facilities. Should a catastrophic event occur at any of these facilities, our ability to manufacture products, complete existing orders, and provide other services could be adversely impacted for an undetermined period of time. Although we have purchased business interruption insurance to cover the costs of certain catastrophic events, there is no assurance that such insurance could be adequate to cover the losses we may incur from any such disruption or event. In addition, our inability to conduct normal business operations for a period of time could have an adverse impact on the short-term and long-term operating results.

Impairment charges relating to our goodwill, indefinite lived intangibles, and long-lived assets could adversely affect our financial performance.

We regularly monitor our goodwill, indefinite lived intangibles, and long-lived assets for impairment indicators using the fair value of our reporting unit and the undiscounted cash flows expected to be generated from the long-lived assets. Changes in economic or operating conditions impacting our estimates and assumptions could result in the impairment of our goodwill, indefinite lived intangibles, or long-lived assets. In the event that we determine that our goodwill, indefinite lived intangibles, or long-lived assets are impaired, we may be required to record a significant charge to earnings that could adversely affect our financial condition and operating results.

We are involved from time to time in various legal and regulatory proceedings and claims, which could adversely affect our financial performance.

We are involved in various legal and regulatory proceedings and claims from time to time that could be significant. These are typically claims that arise in the normal course of business including, without limitation, commercial or contractual disputes, including disputes with our customers, suppliers or competitors, intellectual property matters, personal injury claims, tax matters and employment matters. No assurance can be given that such proceedings and claims will not adversely affect our financial condition, operating results and cash flows.

11

Table of Contents

New laws or regulations or changes in existing laws or regulations could adversely affect our financial performance.

We are subject to a variety of federal, state, local and foreign laws, rules and regulations, including those related to health, safety and environmental matters. Governmental regulations also affect taxes and levies, capital markets, healthcare costs, energy usage, international trade, and immigration and other labor issues, all of which may have a direct or indirect effect on our businesses and our customers’ and suppliers’ businesses. We cannot predict the substance or impact of pending or future legislation or regulations, or the application thereof. Changes in these laws or regulations, the interpretation thereof or the introduction of new laws or regulations could increase the costs of doing business for us or our customers or suppliers or restrict our actions and adversely affect our financial condition, operating results and cash flows.

| ITEM 1B | UNRESOLVED STAFF COMMENTS—None |

12

Table of Contents

| ITEM 2. | PROPERTIES |

The Company and its subsidiaries own or lease properties throughout the world. Listed below are the principal properties owned or leased as of January 1, 2011:

| Location |

Principal Uses |

Owned/Leased | ||

| Grand Rapids, MI |

Company headquarters, manufacturing, RD&E, sales, customer service, warehouse, and administration | Owned | ||

| Tewksbury, MA |

RD&E, sales, customer service, and administration | Leased | ||

| Greensboro, NC |

Sales and customer service | Leased | ||

| Carlstadt, NJ |

Manufacturing, RD&E, sales, customer service, warehouse, and administration | Leased | ||

| Regensdorf, Switzerland |

Manufacturing, RD&E, sales, customer service, warehouse and administration | Leased | ||

| Poynton, England |

Sales, customer service, and administration | Leased | ||

| Berlin, Germany |

Sales and customer service | Leased | ||

| Neu-Isenburg, Germany |

Sales and customer service | Leased | ||

| Martinsried, Germany |

Manufacturing, RD&E, sales, customer service, and training | Leased | ||

| Stuttgart, Germany |

Sales and customer service | Leased | ||

| Luxembourg, Grand Duchy of Luxembourg |

Administration | Leased | ||

| Massy, France |

Sales, customer service, and administration | Leased | ||

| Prato, Italy |

Sales and customer service | Leased | ||

| Barcelona, Spain |

Sales and customer service | Leased | ||

| Moscow, Russia |

Sales | Leased | ||

| Vyskov, Czech Republic |

Sales and customer service | Leased | ||

| Quarry Bay, Hong Kong |

Sales, customer service, warehouse and administration | Leased | ||

| Tokyo, Japan |

Sales, customer service, and administration | Leased | ||

| Beijing, China |

Sales and customer service | Leased | ||

| Guangzhou, China |

Sales and customer service | Leased | ||

| Shanghai, China (4 sites) |

Sales, customer service, and administration | Leased | ||

As of January 1, 2011, X-Rite and its subsidiaries collectively owned approximately 375,000 square feet of space and leased approximately 247,000 square feet.

Management considers all the Company’s properties and equipment to be suitable and adequate for its current and reasonably anticipated development, production, distribution, and selling requirements.

| ITEM 3. | LEGAL PROCEEDINGS |

The Company is periodically involved in legal proceedings, legal actions, and claims arising in the normal course of business, including proceedings related to product, labor, and other matters. Such matters are subject to many uncertainties, and outcomes are not predictable. The Company records amounts for losses that are deemed probable and subject to reasonable estimates. Although the results of the proceedings, actions, and claims described in this report cannot be predicted with certainty the Company does not believe that the ultimate resolution of any of these matters will have a material adverse effect on its financial condition or results of operations.

13

Table of Contents

| ITEM 4. | REMOVED AND RESERVED |

SUPPLEMENTARY ITEM—EXECUTIVE OFFICERS OF THE COMPANY

The following table lists the names, ages, and positions of all of the Company’s executive officers. Executive officers are appointed annually by our Board of Directors and serve at the pleasure of the Board of Directors.

| Name |

Age | Position | ||||

| Thomas J. Vacchiano Jr. |

58 | President, Chief Executive Officer | ||||

| Rajesh K. Shah |

59 | Executive Vice President, Chief Financial Officer and Secretary | ||||

| Francis Lamy |

52 | Executive Vice President, Chief Technology Officer | ||||

Thomas J. Vacchiano, Jr. is the President and Chief Executive Officer of the Company and has held that position since October 1, 2006. Mr. Vacchiano also serves as a director of the Company. He joined X-Rite as its President in July 2006 as part of the Amazys acquisition. Prior to the Amazys acquisition, he served as Amazys’ President and Chief Executive Officer. Amazys was a color technology company headquartered in Switzerland and was publicly traded on the Swiss Stock Exchange.

Rajesh K. Shah is the Executive Vice President, Chief Financial Officer and Secretary of the Company and has held that position since October 2009. Prior to joining X-Rite, Mr. Shah served as Executive Vice President and Chief Financial Officer of Cadence Innovation, LLC, a global manufacturer of automotive interior systems from 2007 to March 2009. Prior to his service at Cadence Innovation, Mr. Shah was Executive Vice President and Chief Financial Officer of Remy International, Inc., a manufacturer of automotive and commercial products from 2002 to 2006.

Francis Lamy is the Executive Vice President and Chief Technology Officer of the Company and has held that positions since July 2006, when he joined the Company in connection with its acquisition of Amazys. Prior to joining X-Rite, Mr. Lamy served as the Executive Vice President and Chief Technology Officer of GretagMacbeth AG, the primary subsidiary of Amazys, since 1999.

14

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s common stock is listed on the NASDAQ—Global Select Market under the symbol “XRIT”. As of March 3, 2011, there were approximately 830 shareholders of record. Ranges of high and low sales prices reported by the NASDAQ for the past two fiscal years appear in the following table.

| High | Low | |||||||

| Year Ended January 1, 2011: |

||||||||

| Fourth Quarter |

$ | 4.75 | $ | 3.61 | ||||

| Third Quarter |

3.84 | 3.19 | ||||||

| Second Quarter |

3.98 | 3.05 | ||||||

| First Quarter |

3.50 | 2.04 | ||||||

| Year Ended January 2, 2010: |

||||||||

| Fourth Quarter |

$ | 2.20 | $ | 1.80 | ||||

| Third Quarter |

2.10 | 1.36 | ||||||

| Second Quarter |

2.78 | 1.03 | ||||||

| First Quarter |

1.63 | 0.95 | ||||||

In 2007, the Company’s Board of Directors voted to suspend payment of its dividend on common stock. This decision was made in order to accelerate the repayment of debt and to invest in future product development initiatives. Although the Board does not currently anticipate reinstating the dividend payment in the foreseeable future, it will continue to reevaluate this matter periodically. Any determination to pay cash dividends will be at the discretion of the Board and will be dependent upon the Company’s results of operations, financial condition, terms of financing arrangements, and such other factors as the Board may deem relevant.

15

Table of Contents

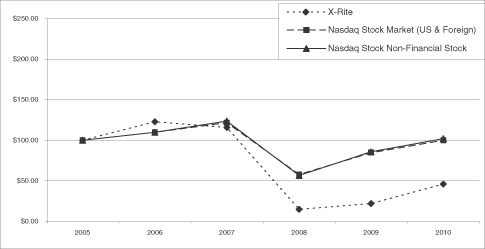

Shareholder Return Performance Graph

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareholder return on the Company’s common stock with that of the cumulative total return of the NASDAQ Stock Index (US & foreign) and NASDAQ Non-Financial Stock Index for the five-year period ended January 1, 2011 (fiscal 2010). The graph assumes an investment of $100 on January 1, 2006 (beginning of fiscal 2006) in the Company’s common stock, the NASDAQ Stock Index (US & foreign) and the NASDAQ Non-Financial Index, with dividends reinvested.

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||

| X-Rite, Inc. |

$ | 100 | $ | 123 | $ | 116 | $ | 15 | $ | 22 | $ | 46 | ||||||||||||

| NASDAQ US & foreign |

$ | 100 | $ | 110 | $ | 122 | $ | 58 | $ | 85 | $ | 100 | ||||||||||||

| NASDAQ Non-Financial |

$ | 100 | $ | 110 | $ | 124 | $ | 57 | $ | 86 | $ | 102 | ||||||||||||

16

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

Selected financial data for the five most recently completed fiscal years is summarized below. Such data should be read in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements and notes thereto and information included elsewhere in this Annual Report on Form 10-K.

(in thousands, except per share data)

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Net sales |

$ | 222,740 | $ | 191,667 | $ | 261,491 | $ | 248,710 | $ | 167,641 | ||||||||||

| Operating income (loss) |

28,929 | 3,821 | (54,864 | ) | 16,643 | (25,660 | ) | |||||||||||||

| Net income (loss) |

3,641 | (25,242 | ) | (117,824 | ) | (20,822 | ) | (27,144 | ) | |||||||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic |

0.04 | (0.33 | ) | (3.12 | ) | (0.72 | ) | (1.09 | ) | |||||||||||

| Diluted |

0.04 | (0.33 | ) | (3.12 | ) | (0.72 | ) | (1.09 | ) | |||||||||||

| Dividends per share |

— | — | — | — | 0.10 | |||||||||||||||

| Total assets |

$ | 439,095 | $ | 472,715 | $ | 545,657 | $ | 654,824 | $ | 462,259 | ||||||||||

| Mandatorily redeemable preferred stock, net of warrant discount of $10,615 and $14,065, in 2010 and 2009 respectively |

36,402 | 29,764 | — | — | — | |||||||||||||||

| Long-term debt, less current portion |

135,248 | 176,400 | 264,017 | 378,300 | 190,200 | |||||||||||||||

| Weighted-average common shares outstanding: |

||||||||||||||||||||

| Basic |

84,414 | 77,500 | 37,753 | 28,866 | 24,865 | |||||||||||||||

| Diluted |

85,799 | 77,500 | 37,753 | 28,866 | 24,865 | |||||||||||||||

Assets acquired and liabilities assumed in the Amazys Holding AG and Pantone, Inc. acquisitions were recorded on the Company’s Consolidated Balance Sheets based on their estimated fair values as of the date of acquisition—July 5, 2006 and October 24, 2007, respectively. The results of operations of Amazys Holding AG and Pantone, Inc. have been included in the Company’s Consolidated Statements of Operations since the dates of acquisition. During the fourth quarter of 2008, an impairment charge of $58.1 million was recognized in relation to the acquired goodwill and indefinite-lived intangibles. See Note 4 to the Consolidated Financial Statements for further discussion of this impairment.

17

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

FORWARD-LOOKING STATEMENTS:

This discussion and analysis of financial condition and results of operations, as well as other sections of the Company’s Form 10-K, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended, that are based on management’s beliefs, assumptions, current expectations, estimates and projections about the industries it serves, the economy, and about the Company itself. Words such as “anticipates,” “believes,” “estimates,” “expects,” “likely,” “plans,” “projects,” “should,” and variations of such words and similar expressions are intended to identify such forward looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence including those listed in Item 1A—Risk Factors. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. Furthermore, X-Rite, Incorporated undertakes no obligation to update, amend or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Forward-looking statements include, but are not limited to, statements concerning liquidity, capital resources needs, tax rates, dividends, and potential new markets.

The following management’s discussion and analysis describes the principal factors affecting the results of operations, liquidity and capital resources, as well as the critical accounting policies of X-Rite, Incorporated (also referred to as X-Rite or the Company). For purposes of this discussion, amounts from the accompanying Consolidated Financial Statements and related notes have been rounded to millions of dollars, except where separately disclosed, for convenience of the reader. These rounded amounts are the basis for calculations of comparative changes and percentages used in this discussion. This discussion should be read in conjunction with the accompanying Consolidated Financial Statements, which include additional information about the Company’s significant accounting policies, practices and transactions that underlie its financial results.

OVERVIEW OF THE COMPANY

X-Rite, Incorporated is a global leader in color science and color technology. The Company develops, manufactures, markets and supports innovative color solutions through measurement instrumentation systems, software, color standards and services, as described below in the product overview section. X-Rite’s expertise in inspiring, selecting, measuring, formulating, communicating and matching color helps users get color right the first time and every time, which translates to better quality and reduced costs. X-Rite serves a range of markets including printing, packaging, photography, graphic design, video, automotive, paints, plastics, textiles, dental and medical. We serve these markets through our core product lines of Imaging and Media, Industrial, Standards, Support, Retail and Other. A more detailed discussion of our major markets and product line offerings appears below.

Products are sold worldwide through the Company’s own sales personnel and through independent sales representatives and dealers. The Company is headquartered in Grand Rapids, Michigan and has other domestic operations in New Jersey, North Carolina, and Massachusetts. In addition, the Company has locations in Switzerland, Germany, England, France, Italy, Spain, the Czech Republic, Russia, China, Hong Kong, and Japan. Manufacturing facilities are located in the United States, Switzerland, and Germany.

Overview of 2010

| • | 2010 net sales of $222.7 million up 16.2 percent from 2009 |

| • | 2010 operating income of $29.0 million up $25.2 million from 2009 |

| • | 2010 fully diluted earnings per share of $0.04 per share, compared to $(0.33) loss per share for 2009 |

| • | Strong year to date cash flow before financing of $31.4 million or 14.1 percent of sales |

| • | Reduced debt by $47.0 million year to date, including the pay off of the Second Lien Credit Facility in September 2010 |

18

Table of Contents

RESULTS OF OPERATIONS

The following table summarizes the results of the Company’s operations for the 2010, 2009 and 2008 fiscal years and includes amounts expressed as a percentage of net sales (in millions):

| 2010 | 2009 | 2008 | ||||||||||||||||||||||

| Net sales |

$ | 222.7 | 100.0 | % | $ | 191.7 | 100.0 | % | $ | 261.5 | 100.0 | % | ||||||||||||

| Cost of sales: |

||||||||||||||||||||||||

| Products sold |

89.6 | 40.2 | 80.9 | 42.2 | 109.7 | 41.9 | ||||||||||||||||||

| Inventory valuation adjustment |

— | — | — | — | 12.8 | 4.9 | ||||||||||||||||||

| Restructuring and other related charges |

— | — | 0.2 | 0.1 | 0.4 | 0.2 | ||||||||||||||||||

| Gross profit |

133.1 | 59.8 | 110.6 | 57.7 | 138.6 | 53.0 | ||||||||||||||||||

| Operating expenses |

104.1 | 46.8 | 106.8 | 55.7 | 135.4 | 51.8 | ||||||||||||||||||

| Goodwill and indefinite-lived intangibles impairment |

— | — | — | — | 58.1 | 22.2 | ||||||||||||||||||

| Operating income (loss) |

29.0 | 13.0 | 3.8 | 2.0 | (54.9 | ) | (21.0 | ) | ||||||||||||||||

| Interest expense |

(28.0 | ) | (12.6 | ) | (33.5 | ) | (17.5 | ) | (46.3 | ) | (17.7 | ) | ||||||||||||

| Write-off of deferred financing costs |

(1.1 | ) | (0.5 | ) | (2.3 | ) | (1.2 | ) | (3.8 | ) | (1.5 | ) | ||||||||||||

| Other income (expense) |

1.5 | 0.7 | 2.1 | 1.1 | (1.1 | ) | (0.4 | ) | ||||||||||||||||

| Loss before income taxes |

1.4 | 0.6 | (29.9 | ) | (15.6 | ) | (106.1 | ) | (40.6 | ) | ||||||||||||||

| Income taxes (benefit) |

(2.2 | ) | (1.0 | ) | (4.7 | ) | (2.5 | ) | 11.7 | 4.5 | ||||||||||||||

| Net income (loss) |

$ | 3.6 | 1.6 | % | $ | (25.2 | ) | (13.1 | )% | $ | (117.8 | ) | (45.1 | )% | ||||||||||

The following table summarizes net sales from continuing operations by product line (in millions):

Net Sales

| (in millions) | 2010 | 2009 | 2008 | |||||||||||||||||||||

| Imaging and Media |

$ | 87.6 | 39.3 | % | $ | 74.1 | 38.6 | % | $ | 114.8 | 43.9 | % | ||||||||||||

| Industrial |

51.6 | 23.2 | 42.0 | 21.9 | 51.0 | 19.5 | ||||||||||||||||||

| Standards |

37.7 | 16.9 | 32.5 | 17.0 | 42.1 | 16.1 | ||||||||||||||||||

| Support Services |

26.5 | 11.9 | 23.3 | 12.2 | 28.9 | 11.1 | ||||||||||||||||||

| Retail |

15.3 | 6.9 | 14.3 | 7.4 | 18.3 | 7.0 | ||||||||||||||||||

| Other |

4.0 | 1.8 | 5.5 | 2.9 | 6.4 | 2.4 | ||||||||||||||||||

| Total Net Sales |

$ | 222.7 | 100.0 | % | $ | 191.7 | 100.0 | % | $ | 261.5 | 100.0 | % | ||||||||||||

For 2010, net sales increased $31.0 million, or 16.2 percent compared to 2009. All of the Company’s core product lines realized year to date net sales increases. The Company’s strong sales growth was the result of recently launched product and marketing initiatives in combination with the global market recovery. For 2009, net sales decreased $69.8 million, or 26.7 percent compared to 2008. Lower sales volumes were experienced across all business units with the most significant declines occurring within the Imaging and Media business unit. These declines primarily were a result of the global economic recession and its related effect on the Company.

The Company experienced net sales increases in 2010 in all the major geographic regions of the world where it conducts business:

Americas—Net sales were up by $9.0 million, or 11.7 percent versus the prior year. Strong sales in the Industrial and Standards lines are leading America’s sales growth, with Imaging and Media channel sales contributing. The Home Depot rollout of several hundred paint matching systems in the first half of 2009 is dampening the overall sales growth results for the region. In 2009, net sales in the Americas were down $19.3 million, or 20.1 percent over 2008.

19

Table of Contents

Europe—In 2010, net sales were up $13.0 million, or 18.1 percent, versus the prior year. Increasing success across multiple product lines is contributing to sales performance. Improving conditions in the print market is a significant driver of improved sales, complemented by sales gains in both the Retail and Standards lines. The Industrial line is a positive contributor as well. In 2009, net sales in Europe were down $43.3 million, or 37.5 percent over 2008.

Asia Pacific—Net sales were up $9.0 million, or 21.1 percent, in 2010 over the prior year. This represents strong economic growth in the overall region with the exception of Japan. The Imaging and Media line reported strong sales growth supported by a number of new sales and marketing motions. The Industrial and Support Services lines were also strong contributors to sales growth. In 2009, Asia Pacific net sales were down by $7.2 million, or 14.4 percent.

The Company’s primary foreign exchange exposures are from the Euro and the Swiss Franc. The impact of fluctuations in these currencies was reflected mainly in the Company’s European operations. Foreign currency fluctuations, primarily the weakening of the Euro over the U.S. dollar, had a $1.6 million unfavorable effect on 2010 net sales as compared to 2009. In 2009, the impact of translating foreign denominated net sales to U.S. dollars had an unfavorable effect on net sales of $3.1 million. The impact of translating foreign denominated net sales to U.S. dollars improved net sales by $7.1 million in 2008 compared to 2007. In 2010, both domestic and international revenue increased, with international revenue accounting for 66.9 percent of net sales. In 2009 and 2008, both domestic and international revenue decreased, with international revenue accounting for 64.7 and 67.2 percent of net sales, respectively.

The Imaging and Media product lines provide solutions for commercial and package printing applications, digital printing and photo processing, photographic, graphic design and pre-press service bureaus in the imaging industries. Imaging and Media net sales were up $13.5 million, or 18.3 percent over 2009. A strong performance in global sales is being driven by large customers with increasing demand associated with a number of new sales and marketing initiatives. This sales growth was complemented by an improving sales performance in Asia where Imaging and Media sales efforts are experiencing increasing success with a range of graphic arts products that serve a growing print market. As the market conditions for press manufacturers improve, demand from press manufacturers has rebounded contributing favorably to our product line results.

The Imaging and Media market reported a decrease of 2009 revenue of $40.7 million, or 35.4 percent, as compared to 2008. The decline in the Imaging and Media product line was driven by the pressroom and printing markets where demand from end user consumers has not recovered from economic recession conditions initially experienced at the end of 2008. Leading the decline in the Imaging and Media product line was a year over year decline in European sales of 42.5 percent.

The Industrial group product line provides color measurement solutions for the automotive quality control, process control and global supply chain markets. The Company’s products are an integral part of the manufacturing process for automotive interiors and exteriors, as well as textiles, plastics, and dyes. Industrial 2010 net sales were up $9.6 million, or 22.8 percent over 2009. Multiple products in all geographies reported strong sales growth year over year. The economic recovery has provided a strong boost to sales in this product line. New products such as our non-contact instruments and the MA9X series of products, along with a number of sales and marketing initiatives in the industrial market yielded positive results.

The Industrial market’s 2009 net sales decreased by $9.0 million, or 17.6 percent compared to the prior year. The Industrial market’s decline has been the result of the declines in the global automotive channel and related supply chain. As the U.S. economy weakened in 2008 and continued into 2009 a number of these supply chain projects were delayed into 2010. The largest area of decline for the Industrial product line was experienced in North America where year over year sales were down 29.5 percent. These declines were partially offset by strong Asia Pacific sales, particularly strong towards the second half of 2009, accounting for a 4.7 percent year over year increase. The Industrial product line experienced the smallest decline in year over year sales compared to other product lines, due to improving market conditions, new products, and new sales and marketing initiatives.

20

Table of Contents

The Standards product line includes products for the accurate communication and reproduction of color, servicing worldwide customers in a variety of industries including imaging and media, textiles, digital technology, plastics and paint. In 2010, Standards net sales were up $5.2 million, or 16.0 percent over 2009. The growth was lead by the new Pantone Matching System® Plus Series and supported by growth in the licensing business, and ongoing sales of the cotton product line serving the Home and Fashion sectors.

In 2009, Standards reported a decrease in net sales of $9.6 million, or 22.8 percent, compared to 2008. Decreases in the net sales of the Standards product line were driven by declining sales in the graphics and textile markets. Products serving the fashion and textile markets saw improving results as the year progressed compared to the graphic arts sector.

The Support Services product line provides professional color training and support worldwide through seminar training, classroom workshops, on-site consulting, technical support and interactive media development. This group also manages the Company’s global service repair departments. In 2010, Support Services net sales were up $3.2 million, or 14.0 percent over 2009. The Company is seeing healthy demand for repair and professional services as the economy is improving and instrument use is increasing. New service programs providing training and various support offers are also gaining traction.

In 2009, the Support Services group recorded a decrease in net sales of $5.6 million, or 19.6 percent compared to 2008. As customers closed their plants or stopped production lines in 2009, instruments were not being returned for certifications and repairs causing a slowdown in demand for key revenue sources in the Support Services sector. The improvement in general market conditions towards the end of 2009 yielded an increase in instrument certifications and repairs during this period.

The Retail product line markets its paint matching products under the Match-Rite name to home improvement centers, mass merchants, paint retailers, and paint manufacturers. In 2010, Retail net sales were up $1.0 million, or 7.2 percent versus 2009. In 2009, the Company was involved in a major program with Home Depot to upgrade several hundred stores with new paint matching systems. In 2010, this was not the case. The Company’s new non-contact retail paint matching solution and new Capsure™ solution for in front of the counter use by paint contractors and decorators are the main drivers for the strong sales performance as they are both being well received in the marketplace.

The Retail market experienced a sales decrease of $4.0 million, or 22.0 percent, for 2009 compared with 2008. Continuing success in North America with the new iVue® (a next generation retail paint matching system) solution for Retail customers was partially offset by the decline in year over year demand of the Matchstick product family in Europe and the general reduction in capital expenditures by the industry. In 2009 the Retail product line was negatively impacted by the challenging economic environment in the European retail markets. While sales in North America were down 13.8 percent year over year, our European sales experienced a much deeper decline of 56.5 percent for the same period. The declining European sales in 2009 were related to the economic recession in Europe. The Matchstick product line was supplemented with a new product platform leveraging state of the art technology and features in the second quarter of 2010.

The Company’s products denoted as Other primarily serve the Medical and Dental markets. The Medical product line provides instrumentation designed for use in controlling variables in the processing of x-ray film and other applications. The Dental product line provides shade matching technology to the cosmetic dental industry through X-Rite’s ShadeVision and Shade-X systems. Other product sales decreased in both 2010 and 2009 compared to each prior year by 27.0 and 13.7 percent, respectively, due to weaker demand for products in 2010 and the economic conditions in 2009.

Cost of Sales and Gross Profit

X-Rite’s cost of sales consists primarily of materials, labor, and overhead associated with manufacturing its products. Manufacturing activities are primarily conducted at facilities in Michigan, New Jersey, and

21

Table of Contents

Switzerland, with smaller operations located in Germany. Software development is also conducted at these facilities, as well as at a facility in Massachusetts. The Company’s gross profit historically has fluctuated within a narrow range. Principal drivers of gross profit include production volumes, product mix, labor, facilities, materials costs, and exchange rates.

Gross profit benefited for 2010 from increased operating efficiencies, cost control initiatives, and higher sales volume. These benefits were slightly impacted by unfavorable foreign exchange, product and sales mix, and suspension of furloughs and employee benefits implemented in 2009. Gross profit for 2010 was $133.1 million, or 59.8 percent of net sales, compared with $110.6 million, or 57.7 percent of net sales, for 2009.

Gross profit for 2009 was $110.6 million, or 57.7 percent, compared to $138.6 million, or 53.0 percent of sales, for 2008. The 2008 gross profit results include a $12.8 million adjustment or 4.9 percent of sales, related to the fair value valuation of Pantone’s inventory. Adjusted for this item, the Company’s 2009 gross margins were comparable to 2008 results. The Company was successful in offsetting the unfavorable absorption impacts resulting from the year over year decline in sales through cost reductions including but not limited to employee furloughs, headcount reductions, and reduced employee benefits including vacation.

Operating Expenses