UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

|

|

| þ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| |

|

|

| o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 |

Commission File Number 001-34803

Qlik Technologies Inc.

(Exact name of registrant as specified in its charter)

| |

|

|

| Delaware

|

|

20-1643718 |

| (State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.) |

| |

|

|

| 150 N. Radnor Chester Road, Suite E220 |

|

|

| Radnor, Pennsylvania

|

|

19087 |

| (Address of principal executive offices)

|

|

(Zip Code) |

(888) 828-9768

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

| (Title of each class)

|

|

(Name of each exchange on which registered) |

| Common Stock, $0.0001 par value

|

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None.

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule

405 of the Securities Act. Yes o No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13

or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its

corporate Web site, if any, every Interactive Date File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or

for such shorter period that the registrant was required to submit and post such files). Yes

o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Rule 405 of Regulation

S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filed, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer.” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

| |

|

|

|

|

|

|

| Large accelerated filer o

|

|

Accelerated filer o

|

|

Non-accelerated filer þ

|

|

Smaller reporting company o |

|

|

|

|

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of

the Exchange Act). Yes o No þ

As

of March 11, 2011, there were 79,013,474 shares of the

registrant’s common stock issued and outstanding. As of June 30, 2010, the last business day of the registrant’s most recently completed second

fiscal quarter, the registrant’s common stock was not listed on any exchange or over-the-counter

market. The registrant’s common stock began trading on The NASDAQ Global Market on July 16, 2010.

As of December 31, 2010, the aggregate market value of shares of common stock held by

non-affiliates of the registrant was $1.0 billion based on the number of shares held by

non-affiliates as of December 31, 2010 and based on the last reported sale price of the

registrant’s common stock on December 31, 2010. For purposes of this disclosure, shares of common

stock held by persons who hold more than 5% of the outstanding shares of common stock and shares

held by executive officers and directors of the registrant have been excluded because such persons

may be deemed to be affiliates. This determination of executive officer or affiliate status is not

necessarily a conclusive determination for other purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the definitive Proxy Statement to be used in connection with the

registrant’s 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of

this Form 10-K to the extent stated. That Proxy Statement will be filed within 120 days of

registrant’s fiscal year ended December 31, 2010.

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K, except for historical financial information contained

herein, contains forward-looking statements, including, but not limited to, statements regarding

the value and effectiveness of our products, the introduction of product enhancements or additional

products and our growth, expansion and market leadership, that involve risks, uncertainties,

assumptions, and other factors which, if they do not materialize or prove correct, could cause our

results to differ materially from those expressed or implied by such forward-looking statements.

All statements, other than statements of historical fact, are statements that could be deemed

forward-looking statements, including statements containing the words “predicts,” “plan,”

“expects,” “anticipates,” “believes,” “goal,” “target,” “estimate,” “potential,” “may,” “will”,

“might,” “could,” “anticipate,” “momentum,” and similar words. We intend all such forward-looking

statements to be covered by the safe harbor provisions for forward-looking statements contained in

Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the

Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those

projected in such statements due to various factors, including but not limited to:

| |

• |

|

risk and uncertainties inherent in our business; |

| |

• |

|

our ability to attract new customers and retain existing customers; |

| |

• |

|

our ability to effectively sell, service and support our products; |

| |

• |

|

our ability to manage our international operations; |

| |

• |

|

our ability to compete effectively; |

| |

• |

|

our ability to develop and introduce new products and add-ons or enhancements to

existing products; |

| |

• |

|

our ability to continue to promote and maintain our brand in a cost-effective

manner; |

| |

• |

|

our ability to manage growth; |

| |

• |

|

our ability to attract and retain key personnel; |

| |

• |

|

the scope and validity of intellectual property rights applicable to our products; |

| |

• |

|

adverse economic conditions in general and adverse economic conditions

specifically affecting the markets in which we operate; and |

| |

• |

|

other risks discussed in the section titled “Risk Factors,” set forth in Part I,

Item 1A of this Annual Report on Form 10-K and elsewhere in this report. |

Past performance is not necessarily indicative of future results. There can be no assurance

that the actual results or developments anticipated by us will be realized or, even if

substantially realized, that they will have the expected consequences to, or effects on, us.

Therefore, no assurance can be given that the outcomes stated in such forward-looking statements

and estimates will be achieved.

The forward-looking statements in this Annual Report on Form 10-K represent our views as of

the date of this Annual Report on Form 10-K. We anticipate that subsequent events and developments

will cause our views to change. However, while we may elect to update these forward-looking

statements at some point in the future, we undertake no intention or obligation to update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise.

You should, therefore, not rely on these forward-looking statements as representing our views as

of any date subsequent to the date of this Annual Report on Form 10-K.

1

Overview

Qlik Technologies Inc. (“We, QlikTech or the Company”) has pioneered a powerful, user-driven

business intelligence solution that enables our customers to make better and faster business

decisions. Our Business Discovery platform, QlikView, combines enterprise-class analytics and

search functionality with the simplicity and ease-of-use found in office productivity software

tools for a broad set of business users. QlikView is powered by our in-memory associative search

technology, which has utilized rapid advances in computing power to yield significant improvement

in flexibility and performance at a lower cost than traditional business intelligence solutions. We

have grown our customer base from over 4,000 active customers in 2006 to approximately 18,000

active customers as of December 31, 2010 and increased our revenue at a 50.4% compound annual growth rate during the same period.

We added an average of approximately 400 new customers per month during

fiscal year 2010. Our solution addresses the needs of a diverse range of customers from middle

market customers to large enterprises such as Autodesk, Campbell Soup Company, Colonial Life, The

Dannon Company, Inc., Heidelberger Druckmaschinen AG, ING, Kraft Foods, Lifetime Brands, Nasdaq

OMX, National Health Service (NHS), Qualcomm, Symantec and Volvo Car UK Limited. We have customers

in over 100 countries, and approximately 75% of our revenue for the year ended December 31, 2010

was derived internationally.

QlikView empowers business users to navigate data in a manner consistent with the fluid,

associative nature of human thought. Our technology platform enables users to consolidate large,

disparate data sets and discover relationships within data in real time when requested by the user.

QlikView visualizes data in a simple, intuitive user interface that enables users to interactively

explore and analyze information. The ease-of-use and flexibility of QlikView enables a broad set of

business users, such as sales, marketing, human resources and finance professionals; executive

management and other managers; operations, support and information technology (“IT”) staff; data

analysts and statisticians. Examples of QlikView users include:

| |

• |

|

Operations Planner — uses QlikView to prepare inventory forecasts for

a global food manufacturer resulting in significant improvement in

forecast accuracy and reduced transportation and workforce costs |

| |

• |

|

Pharmaceutical Sales Representative — uses QlikView to access current

industry sales trends and doctor prescription history while on a sales

call with a busy physician |

| |

• |

|

Chief Information Officer — uses QlikView to analyze IT spending and

budget information to identify opportunities for cost savings and

service level improvement |

| |

• |

|

Police Sergeant — uses QlikView to maintain a consolidated view of

crime levels and optimize staffing allocations to dispatch police into

high crime areas |

We have a differentiated business model designed to accelerate the adoption of our product by

reducing the time and cost to purchase and implement our software. Our low risk approach to product

sales provides a needed alternative to costly, all-or-nothing, traditional business intelligence

sales models. We initially focus on specific business users or departments within a prospective

customer’s organization and seek to solve a targeted business need. After demonstrating QlikView’s

benefits to initial adopters within an organization, we work to expand sales of our product to

other business units, geographies and use cases with the long-term goal of broad organizational

deployment. We have a diversified distribution model that consists of a direct sales force and a

partner network of resellers, original equipment manufacturers (“OEM”) relationships and systems

integrators. Additionally, our online QlikCommunity provides us with a loyal and growing network of

users who promote our software, provide support for other users and contribute valuable insights

and feedback for our product development efforts.

For the years ended December 31, 2010, 2009 and 2008, our revenue was $226.5 million, $157.4

million and $118.3 million, representing year-over-year growth of 44% in 2010 and 33% in 2009. In

addition, we generated operating income of $27.6 million, $13.2 million and $1.6 million for the

years ended December 31, 2010, 2009 and 2008. For the year ended December 31, 2010, software

license revenue and maintenance revenue comprised 90% of our total revenue and professional

services revenue comprised 10% of our total revenue.

The Company currently operates in one business segment, namely, the development,

commercialization and implementation of software products and related services. See Note 11 to our

consolidated financial statements, Business and Geographical Segment Information, for information

regarding our business and the geographies in which we operate.

2

Our Industry

Use of Business Intelligence and Data Analytics Tools

We believe that to succeed in today’s increasingly competitive markets, businesses must

accelerate the rate at which they identify and respond to changing business conditions. An

organization’s market agility and ultimate success in the global marketplace are dependent upon its

ability to enable business users across organizations to harness the power of increasing volumes of

information to make effective business decisions. In seeking to gain an information advantage, many

organizations have implemented a range of solutions, including business intelligence and data

analysis tools. We believe that traditional business intelligence tools often fail to provide

timely and critical insights to business professionals due to inflexible data architecture, lack of

broad usability and substantial implementation time and costs. As a result of the limitations of

traditional business intelligence tools, many business users have turned to spreadsheets to help

them perform data analysis. Business users have adopted spreadsheets for many applications due to

their wide availability; however, these general productivity tools were not specifically designed

to facilitate interactivity, collaboration, aggregation or analysis of data for decision making.

Trends Driving Adoption of Business Intelligence and Data Analytics Solutions

The use and importance of business intelligence and data analytics software within

organizations of all sizes has increased significantly for several reasons, including:

Exponential Growth in Data Available for Analysis. Over the last two decades, organizations

have made significant investments in automating business processes with software applications that

generate substantial amounts of data which must be manipulated, analyzed and made accessible to be

useful to decision makers. However, this data is often stored in different formats making it

challenging to efficiently analyze the data and gain insight from it without using powerful data

analytics solutions.

Disparate Data Sources. In today’s highly competitive marketplace, companies are expanding

operations through geographic diversification, acquisitions and partnerships. The frequency of

these strategic activities can result in a complex web of infrastructure and software systems

within an organization. In addition, companies are more closely integrating their systems with

those of their customers, partners and suppliers and adopting new software applications to improve

business efficiency. As a result, large amounts of data are stored in various repositories across

an extended network creating significant data aggregation challenges. Organizations often deploy a

number of tools, including sophisticated data integration software, purpose-built data warehouses

and business intelligence systems, to efficiently and reliably aggregate, synchronize and analyze

this disparate business data.

Decentralized Decision-Making. We believe that many organizations are shifting towards

decentralized decision-making in order to more efficiently respond to changing industry trends and

competitive threats. This shift has created the need for data analysis tools that support employees

at all levels of the organization as they assume more responsibility for making critical business

decisions. Additionally, we believe that increases in the power and performance of mobile networks

and devices will drive demand for mobile access to business data. The widespread use of simple yet

robust personal software applications has driven demand from business users for intuitive

analytical tools to make faster and better decisions.

The Empowered Consumer. Today’s business users are also consumers. At home they are able to

read books on an eReader, watch movies on a tablet, and chat and collaborate with friends via

social media sites. They are able to access the information they want, how they want it, when they

want it. But at work they find that web sites are blocked, their selection of devices is

restricted, and email clients groan under security overhead. As consumers, these users are

empowered, but in the corporate setting, they are not. We believe that this daily cognitive

dissonance is causing a fundamental shift in corporate computing as business users are demanding

more flexibility, and IT is evolving to become a supportive partner with these empowered users.

Traditional Software Tools are Inadequate

Although there has been increasing adoption of business intelligence and data analytics tools,

we believe that most of these traditional tools are inadequate to meet the needs of users and face

the following limitations:

Analysis Tools Don’t Serve Business Users. Most traditional business intelligence tools were

developed specifically for data analysts and other quantitative professionals and are driven and

deployed in a top-down approach. These systems require sophisticated programming skills to

construct or modify predefined, inflexible data sets, known as “data cubes.” These tools are used

to produce static reports which the business user cannot easily modify or explore in an interactive

manner. A typical business user does not possess the skills or authority needed to modify the

underlying data cube and therefore must engage their IT departments to reconfigure the analysis to

produce the requested information between each decision cycle. As a result, business users often do

not have access to critical data in a timely manner and may miss important insights and

opportunities.

Highly Inflexible Solutions are Difficult to Implement and Maintain. Traditional business

intelligence solutions require the integration of large volumes of data stored across an

organization and its partners and the development of a pre-defined summarization of the data (or

data warehouse) to support static query and reporting tools. These tasks can be time-consuming and

complex and often require significant professional services support to complete. In addition,

traditional business intelligence solutions can be difficult to update and require substantial

investments to refresh the underlying data.

Slow Time-to-Value. Traditional business intelligence solutions have become complex product

“stacks” weaving together multiple disparate products into a single “solution.” But due to the

inherent complexities and overhead of these complex stacks, we believe that the typical business

intelligence implementation takes twelve to eighteen months, or more, to implement. By that time

the business, and the business user requirements, may have evolved or changed, resulting in an

extensive queue of user requests to update and revise reports or dashboards. Even simple changes

can take weeks or months to implement, resulting in a solution which we believe is always a few

steps behind the business and never fully addresses the business user’s requirements.

3

Substantial Total-Cost-of-Ownership. Organizations incur significant hardware, software and

professional services costs to deploy and maintain traditional business intelligence solutions. We

estimate that the cost of development for business intelligence and data warehouse applications is

about three to five times the cost of the software. These initial and ongoing costs result in a

substantial total-cost-of-ownership for many traditional business intelligence applications. Most

providers of traditional business intelligence tools rely upon professional services revenue for a

large portion of their total revenue, and thus have little incentive to migrate to a more customer

friendly license-based model or to solutions that are simple to install and easy-to-use.

Spreadsheets Not Suited for Data Analysis and Lack Reliability. Spreadsheets have been

widely adopted by business users for data analysis because they are readily available. However,

spreadsheets are general purpose business productivity tools designed for data input and

calculation. The performance of spreadsheets declines when analyzing large data sets or performing

real-time, dynamic calculations. Spreadsheets are often shared and edited by numerous parties,

resulting in multiple versions of similar material. This lack of version control causes

inconsistencies in analysis, an inability to audit workflows and significant data reliability

challenges. Furthermore, spreadsheets lack sophisticated data security features and can cause a

number of data security challenges given they can be easily shared via email or detachable storage

drives.

Our Solution

QlikView is leading a shift in the business intelligence market towards user-driven solutions.

We call this solution Business Discovery, and we believe it is the next generation of business

intelligence, bridging the gap between traditional business intelligence solutions and standalone

office productivity solutions. The QlikView Business Discovery platform is designed to enable

business users across organizations of all sizes to make faster and better decisions. The key

differentiators of our solution include:

All Business Users. Instead of just a few people involved in insight creation, QlikView

empowers all business users with sophisticated analytic capabilities delivered through an

easy-to-use, intuitive user interface. Unlike traditional business intelligence tools, which

typically require advanced programming by IT professionals to create static data reports, QlikView

allows the business user to search associatively and define visual charts through simple

point-and-click technology. Our user interface extends insight creation to edges of the

organization user and drives QlikView usage and adoption.

Zero Wait Analysis. QlikView provides customers with the tools to make faster, better

decisions that help improve business performance. Our deployment time significantly shortens

time-to-value for our customers. In addition, after the initial installation the customer’s

analysis can be rapidly updated as underlying data evolves and analytic requirements change.

Furthermore, QlikView’s in-memory associative search technology makes calculations in real time

enabling business users to intuitively interrogate and analyze data, which reduces decision cycles.

Mobility. We were one of the first business intelligence vendors with a mobile offering, and

we aim to continue to be on the forefront of the mobile business intelligence market. Tablets and

other large-form-factor mobile devices are now driving significant growth in mobile business

intelligence, expanding the use cases and user communities. Unlike traditional business

intelligence solutions, QlikView provides an intuitive user-driven interface and an application

infrastructure that is tailor-made to take advantage of the opportunity of a truly mobile,

well-informed workforce.

Lower Total-Cost-of-Ownership Yields Higher ROI. We believe that QlikView has a lower total

cost of ownership than traditional business intelligence tools. These savings are driven by reduced

expenditures across hardware, software and services from implementation through ongoing maintenance

and support. Traditional business intelligence tools are typically comprised of a number of

disparate software components. QlikView is a single, cohesive product that facilitates many types

of analysis, whether dashboards, analytic applications or

reports, in a single user interface with a common look and feel. QlikView can be implemented

in a self-service manner and runs independently with limited IT support and without extensive

infrastructure.

Highly Scalable In-Memory Architecture Leverages Hardware Advances. QlikView’s in-memory

associative technology benefits from two important computer hardware trends: 64-bit computing,

which increases the amount of memory available on computers, and multi-core central processing

units, or CPUs, which allow for parallel processing of complex calculations. Because of these

capabilities, QlikView is able to store data in memory and perform real-time calculations on a

massive volume of data from disparate sources. It is our expectation that the amount of available

memory and number of CPU cores and processing speed will continue to increase in the future. These

expected improvements will drive QlikView’s future performance with minimal incremental investment

because we perform calculations in memory and on multiple cores in parallel. Our platform

integrates with nearly all data sources and can scale from a single user to enterprise deployments

without requiring significant additional infrastructure.

4

An App-Like Model. QlikView is designed to be the easiest and fastest business intelligence

platform on which business users can develop analytic applications. We provide a powerful,

easy-to-use business intelligence platform that does not include any purpose-specific applications

when installed out-of-the-box. We believe that each of our customers’ business challenges are

highly unique and change rapidly. Therefore, our customers are best positioned to create analytical

applications that meet their individual needs, and they require a flexible platform that empowers

them to address their challenges. Additionally, we license our platform to partners, such as

independent software vendors and systems integrators, to create a wide variety of applications. We

have aligned with partners who have domain specific knowledge and who will use such knowledge to

build and support purpose-specific analytic applications that they can license directly to a user.

Remixability and Reassembly. Traditional business intelligence solutions require IT or

specialized users to get involved whenever new questions arise. In contrast, QlikView makes it easy

for business users to remix and reassemble data in new views and create new visualizations for

deeper understanding.

Our Business Model

To complement QlikView, we have developed a differentiated business model that has the

following attributes:

Broad User Focus. We seek to market and sell directly to the business user by providing an

intuitive software platform that can be installed and used with minimal training. We believe that

the ease by which business users can evaluate and benefit from our platform substantially expands

our addressable market by allowing us to target a wide range of users, generate incremental

business from existing customers and expand our footprint within their organizations. Unlike most

existing business intelligence tools, QlikView is purpose-built for business users and does not

require substantial IT support to install, integrate and maintain.

Low Risk Rapid Product Adoption. To facilitate adoption of our platform, we offer a

downloadable, easy-to-install, full-featured version of QlikView for individual use free-of-charge.

We allow our customers to purchase licenses in the way that best meets their needs, including on an

individual, workgroup, departmental or enterprise wide basis. This provides the flexibility

organizations desire when evaluating software purchases. When a customer decides to make a

purchase, we offer a 30-day, money-back guarantee to further encourage rapid adoption of QlikView.

These measures significantly reduce customer trial risk and provide a needed alternative to costly,

all-or-nothing, enterprise-wide deployment requirements.

“Land and Expand” Customer Penetration. We seek to initially “land” within the organization

of a new customer by solving a business need of specific business users or departments. After

demonstrating the value of our solution to those initial adopters, we work to “expand” the use of

our solution across the organization by targeting other business units, geographies and use cases.

Our customer penetration strategy is focused on creating a loyal user base that promotes adoption

through tangible results and powerful, word-of-mouth marketing which facilitate incremental sales.

Globally Diversified Distribution Model. We seek to maximize the reach of the QlikView

platform by employing a multi-pronged sales approach that leverages a direct sales force and

partner network which includes resellers, OEM relationships and systems integrators. We typically

enter new markets through partnerships and reseller agreements to minimize cost and risk while we

assess demand in the new market. For example, we successfully grew our initial sales in France and

the United Kingdom without maintaining a local direct sales office and plan to use this strategy to

target additional international regions. As of December 31, 2010, we had distribution capabilities

in over 100 countries and a network of over 1,200 channel partners worldwide to help generate

demand for QlikView.

Community-Based Marketing and Support. We have established QlikCommunity, our user

community, to augment our development, marketing and support efforts. This community of over 43,000

registered users as of December 31, 2010 promotes the use of our software within their

organizations as well as to other organizations. We utilize the QlikCommunity extensively to

provide low-cost user and developer support and valuable insights used by our research and

development team for product development. This passionate, user-driven

culture and collaboration begins within our company and extends out to broader communities

within our customers’ organizations, further driving the QlikView brand and quality.

Our Growth Strategy

We intend to make QlikView the primary platform on which business users, in companies of all

sizes, make critical business decisions. The key elements of our growth strategy include:

Increase Our Global Market Penetration. We intend to expand our presence in targeted

geographies by growing our direct sales force and global partner network. We began our operations

in Sweden, have established a substantial foothold in Western Europe and continue to expand

globally. We intend to increase our presence in North America by expanding our direct sales force

and growing our indirect channel in the region. We also seek to enter new international markets by

establishing distribution partnerships to drive sales. We are leveraging our prior experience in

Europe with distribution partners and master resellers to further penetrate international regions,

such as the U.S., Japan, Australia, China, Russia and Brazil.

Further Penetrate Our Existing Customer Base. We intend to increase penetration of existing

customers by capitalizing on current users’ satisfaction to promote QlikView to other users and

departments within their organizations. Of our approximately 18,000 customers as of December 31,

2010, approximately 25% have been working with the QlikView platform for less than 12 months. We

believe a substantial opportunity exists to increase our sales to these customers. Historically, we

have migrated new customers from single project and departmental deployments to multi-department

deployments by building on the satisfaction and benefits that our customers experience using our

platform.

5

Extend Our Software Platform to Provide New Business Solutions. We plan to enhance our

current platform by adding new functionality that extends our analytics, visualization and search

capabilities to broader use cases. Today, business intelligence is primarily used to solve

internally focused decision-making by data analysts and other quantitative professionals. We

believe that due to our unique capabilities, QlikView can be extended to adjacent areas where

data-driven decisions are critical, including website navigation, content search and information

management, external data communication, product configuration and e-commerce applications. Over

time, we believe a variety of data-intensive functions within organizations could be enhanced and

made more efficient by utilizing QlikView.

Expand Our OEM Alliances and Strategic Relationships. We believe we have a significant

opportunity to expand the use of QlikView through our OEM relationships, which accounted for

approximately 8% of our sales in 2010, as well as through other distribution relationships. We have

an ongoing effort to increase our number of OEM alliances with other independent software vendors

that license our technology to embed within and enhance their solutions. In addition, we seek to

expand our strategic reseller agreements and relationships with systems integrators and consultants

and to use this channel to generate additional inbound customer prospects.

Enhance Adoption of QlikView through our Robust Mobile Offering. In addition to traditional

desktop usage, we enable customers’ use of QlikView from any location via a number of mobile

devices. In May 2009, we began offering a native iOS version of QlikView for

the Apple iPhone and in April 2010, we began offering the same for the iPad. In late 2010, we began

to develop a HTML5 based client that runs on webkit based mobile web browsers and supports full

touch-based interactivity. Our initial version, which supports Apple’s iPad shipped in March 2011,

and we believe this strategy will allow us to support all mobile devices that offer webkit based

mobile browser support. We believe the interactive capabilities of QlikView mobile client will help

establish us as a market leader in the emerging mobile business intelligence space and enhance

adoption of QlikView on the desktop as additional users experience the capabilities and benefits of

our solution.

Our Products

Our QlikView product is designed to allow deployments to scale from the single user to

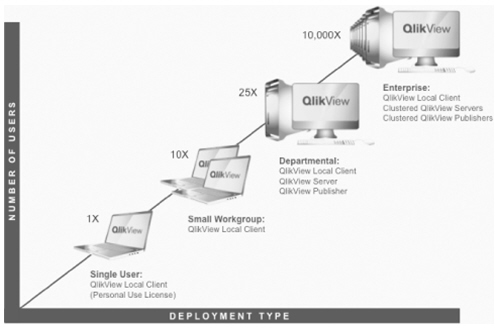

thousands of users. The following diagram shows the deployment progression for QlikView:

Single User Deployment

QlikView Local Client is designed to provide business users with a simple and efficient way to

build analytic applications to solve critical business challenges. QlikView Local Client is a

Windows application that is installed on the user’s computer. QlikView Local Client allows the user

to load disparate data sources such as databases, flat files or web services into memory. Users can

create a full array of user

interface objects such as charts, graphs, tables and listboxes and analyze and visualize the

data that is stored in memory. In addition, any user interface elements can be grouped together

into a static report suitable for printing or emailing. These analytic applications are valuable on

a standalone basis but gain their real value when shared with others in the organization.

We offer QlikView Local Client as a free download with full capabilities to develop analyses,

but with the restriction that users can only use analyses they have built themselves. This is

referred to as a Personal Use License and allows users to connect to any underlying data source,

load data, build user interfaces and conduct interactive analyses of their data. The Personal Use

License limits the use of the QlikView files to the person who created it. To share the analysis

with another user, each user must have a QlikView license, rather than a Personal Use License. The

Personal Use License provides a way for individuals to learn and gain value from QlikView and also

generates leads for our sales organization.

6

Small Workgroup Deployment

A small workgroup deployment involves the use of multiple QlikView Local Clients on standalone

client machines without a central server. In order to share QlikView data and analysis created by

others in the workgroup, each user must have an individual license. Because all data and analysis

is contained within a QlikView file, each licensed user may share, whether by email, on a portal or

on a shared drive, the QlikView file. This deployment approach is typically favored by

organizations with small user populations and/or poor network connectivity.

Departmental and Enterprise Deployments

Departmental and enterprise deployments utilize a server to provide a central repository for

all QlikView analysis. The QlikView Server component supports authentication and security models to

ensure appropriate user access and simultaneous access to analyses by large user groups. We

designed QlikView Server to maximize the use of the processing power of standard multi-core servers

by spreading calculations over all available CPU cores. The QlikView Server can be grouped across

more than one physical server into clusters to provide fault tolerance and additional scale.

Server based deployments scale from small user groups (less than 25) to enterprise-wide use

(tens of thousands of users). We offer the QlikView Server at two license levels: Small Business

Edition and Enterprise Edition. Small Business Edition is limited to 25 users and is suitable only

for small and midsize deployments. The Enterprise Edition has no user limits and includes

capabilities designed for larger and more technically complex implementations.

To manage large deployments of QlikView, we offer our QlikView Publisher component which is an

administrative interface for maintaining QlikView analyses. QlikView Publisher allows users to

reload data in a QlikView analysis on a periodic basis to ensure that the most current data is

available. QlikView Publisher also connects to directory servers within organizations and applies

user security rules to a QlikView analysis to ensure appropriate user access. Finally, QlikView

Publisher can alert end users to changes to a QlikView file and facilitate distribution via email

or a web based interface called AccessPoint. The QlikView Publisher can be deployed across one or

more physical servers to provide the scale needed for large QlikView deployments. QlikView

Publisher is licensed on a per server basis and includes a separately licensable option for PDF

report distribution capabilities. For large enterprise deployments, multiple QlikView Servers and

QlikView Publishers can be clustered to provide load balancing and fail over capabilities.

Access to the QlikView Server is governed by a Client Access License (“CAL”) licensing model.

The most common QlikView Server license type is a Named User CAL. In addition to access to the

QlikView Server there are separately licensable options for real-time data streaming capabilities

and test and development servers. QlikView also offers separately licensable options for a

connector to SAP and Salesforce.com.

Our Technology

QlikView’s primary architectural principles are to provide end user simplicity and rapid

deployment. In developing our solution, we endeavor to obscure the underlying technical complexity

from the user while providing powerful easy-to-use functionality.

Superior End User Experience

QlikView is designed to mirror the fluid, associative nature of human thought. We believe

people process information in non-hierarchical ways when making decisions. Faced with a decision,

each person uses a different path to reach a conclusion. We designed QlikView to support this type

of decision-making by allowing users to explore data according to their own thought processes,

seeing updated calculations and relationships with each QlikView interaction.

We call this flexible model of interaction “associative search.” Associative search is a

non-hierarchical model of interacting with interrelated data elements. It allows users to select

arbitrary groups of data elements and see how these selections affect the remaining data

elements. In QlikView, the user’s selections are shown in green, data elements related to

these selections are shown in white, and data elements not related to these selections are shown in

gray. The user’s current selections apply to all the data in QlikView and affect every calculated

value. Thus, with every interaction, users see the relationship between data and also the effect

their selection has on calculations that they are tracking. Importantly, information is never

hidden from the user. All data is always shown to the user, including information not related to

the user selection. This can lead a user to see unexpected insights from otherwise excluded data.

Finally, all user interactions and data calculations are performed in real time. Because of the

rapid response time and ease of use, users can click frequently through data and analysis. Users

take advantage of this speed to “surf” the data and identify relationships that they may otherwise

miss in competing products.

Traditional business intelligence query tools filter data that is not part of the current

query, hiding data from the user and potentially omitting valuable information which did not meet

the initial parameters of the question. Typically, the queries that underlie these tools take many

minutes or even hours to run. This creates a high cost of investigation and may cause users to

avoid running multiple queries. In addition, to improve performance, traditional tools often

require reports to be run in batches and thus be pre-defined ahead of time.

7

Fast Deployment

QlikView’s architecture reduces the cycle time between data collection and deployment of

analysis to the end user to a few weeks and sometimes to as little as a few days. By moving all

data in-memory, QlikView does not require the use of data warehouses for high performance analyses

which shortens the time to access data. QlikView does not require disk-based cubes since it

performs all calculations in real time as the user explores a data set. This approach allows the

user to interactively analyze a data set and easily modify the scope of an analysis. In addition,

in many cases, end users can build the required analyses themselves. The QlikView architecture

facilitates the development of all types of analysis, including dashboards, analytic applications

or reports, on a single platform with a common user interface. QlikView is often deployed with

limited IT intervention enabling IT staff to focus on data integration and data quality challenges

which is where they can be most valuable.

Traditional business intelligence tools typically require long and complicated deployments for

several reasons. In traditional deployments, large volumes of data used for decision-making must be

moved into query-only data repositories such as data warehouses to accommodate the heavy query

loads that traditional tools make on operational systems. Traditional tools store analyses on disk

in pre-calculated cubes to improve perceived metric calculation performance. These disk-based cubes

are difficult and time-consuming to build and maintain and require the scope of analysis to be

decided ahead of time. Thus, typical deployments of traditional business intelligence tools require

an extended requirements gathering phase during which IT staff work with business users in an

attempt to document and lock-down the scope of analysis in advance. Traditional business

intelligence tools have many end user tools for viewing analyses. Once the data is organized, there

is a long process of selecting and deploying the appropriate end user tool. Finally, due to product

complexity, traditional tools must be managed and governed by resource constrained IT departments,

rather than by business users. Most traditional deployments require over a year to implement fully,

with changes to the scope of a project extending the time to value.

Technology Foundations

Associative search has two key technological foundations: all data is held in computer memory

(RAM), and all calculations are performed in real time. Two important computing trends have

supported these architectural decisions. The first trend is the shift from 32-bit computing to

64-bit computing, which has exponentially raised the amount of available RAM per computer. It is

currently possible to purchase servers with as much as 512 gigabytes of RAM, whereas as recently as

2005, most servers had four gigabytes of RAM. This increase in available memory has made it

practical to move data storage from disk directly into RAM. The second trend is the increasing

pervasiveness of multi-core CPUs. In 2005, most servers had single-core CPUs. Today, commonly

available servers can have as many as 48 cores across eight CPUs. For applications that have been

designed to run calculations in parallel, this shift has provided a large increase in processing

power. These high capacity servers are readily available for purchase, even online via credit card,

for less than $50,000. Even quite recently this level of computing power would require a custom

built machine costing hundreds of thousands or even millions of dollars.

QlikView’s in-memory architecture allows it to manipulate large amounts of data, while giving

users a high level of interactivity. QlikView compresses data as it is brought into memory, and

this enables it to store data in-memory more efficiently than it would be stored on disk in a

traditional relational database. As data is brought into memory, QlikView also maps the linkages

between data elements to help facilitate visualization of data element associations. In more recent

versions of QlikView, data can be streamed directly into memory from source applications, providing

a mechanism for updating the data in-memory without reloading.

QlikView’s ability to perform real-time calculations allows it to handle the calculation of

complex measures and metrics quickly. QlikView is designed to spread the calculation load across

all available CPU cores and to manage this workload across many concurrent users. In addition, our

platform can cache results across users so that the most commonly used calculations are performed

the least number of times.

QlikCommunity

We have a loyal base of users on our online community website, QlikCommunity, which is

comprised of over 43,000 registered users as of December 31, 2010. Our QlikCommunity website was

relaunched in May 2009, and during the year ended December 31, 2010, we

averaged approximately 60 new user registrations each day. QlikCommunity provides our

registered users with a low-cost, user-friendly product support resource, which includes:

| |

• |

|

discussion forums to share their QlikView experiences and to find answers to

questions about the product and its features |

| |

• |

|

user groups based on location, industry and job function |

| |

• |

|

blogs written by our employees |

| |

• |

|

user-generated content, including best practices, how-to’s, documentation and

other material. |

In addition, QlikCommunity provides us with a loyal network of practitioners who promote the

usage of our software and provide support to users trying to solve technical problems.

QlikCommunity also serves as a valuable feedback loop through which our product development team

gains insights about new features and functionalities that help guide our future product

development. QlikCommunity users also provide us with their contact information when they register

as a member, and we effectively target these users as a pool of self-selecting, low-cost, qualified

sales leads.

8

Research and Development

Our research and development (“R&D”) organization is responsible for the design, development,

testing and support of our software. Our current research and development efforts are focused on

new releases of existing products as well as new products and modules.

As of December 31, 2010, we had 96 people in our R&D organization. Our entire R&D organization

is located in Lund, Sweden. The core members of our R&D team have been with our company since as

early as 1996. We believe that the tenure of our core development organization provide us with a

competitive advantage. We use an agile philosophy in our development process which encourages broad

participation in design and testing and rapid prototyping. Our development, testing and quality

assurance processes use automated testing extensively and are designed in alignment with Capability

Maturity Model Integration (“CMMI”), an industry R&D process improvement approach.

We aim to release major feature releases of QlikView every 12 to 18 months, with service

releases every two to four months between major releases. Some new product capabilities such as

mobile technologies and data connectors that can be developed independently are released more

frequently.

We work closely with our customers in developing our products and have designed a flexible

product development process that is responsive to customer feedback that we receive throughout the

process. Planning for each major release begins with a requirements gathering meeting called a

Reference Group which gathers input from our customer-facing implementation consultants in each of

our markets. As the product is developed, specific customers and partners are identified to provide

detailed feedback on product design. Then, a broad set of customers and partners are involved in

beta testing major releases of QlikView, which typically occurs for several months prior to general

availability. In addition to local requirements, we gather all direct customer input from

QlikCommunity, our community website. From the Reference Group we consolidate and prioritize all

customer requirements. These requirements form the input for the Design Group which comprises core

members from R&D and our Product Marketing team. The Design Group segments requirements into the

product release cycle and assesses the technical feasibility of all requests.

Within our operations, we are extensive users of our own product. We install, upgrade and use

our product internally in a pre-release and beta state before allowing it to be made generally

available. Consequently, this process allows us to identify and resolve many deployment issues

prior to making the product available to customers.

Innovation is a critical factor in the success of QlikView, and identifying and incubating

innovation is built into our R&D process. We have recently added a QlikView Labs department to

consolidate and manage innovative uses of QlikView and new core technologies. We invest time and

money in identifying and nurturing new product concepts with the intention of incorporating

successful ideas into the product as new product modules or as entirely new products.

Marketing and Sales

We market and sell our products and services through our direct sales force and an indirect

sales channel comprised of a global partner network. Our direct sales force consists of

professional sales people who typically have several years of experience selling enterprise

software. Our global partner network brings key technological and industry expertise that we

utilize to help us reach customer organizations around the world. These indirect sales channels

often aid us in shortening the sales cycles we typically face with prospective customers.

Our global partner network includes master resellers, elite resellers and resellers. These

partners are authorized to sell licenses and to implement and provide first line support for our

products. A master reseller is generally appointed to extend geographic sales into a territory

where we have no direct sales presence. Designation of elite reseller versus reseller is driven by

the amount of sales volume that they derive from the sale of our product. Additionally we work with

system integrators and other technological consulting firms who provide complementary skills and

expertise in a certain industry or region.

Our global partner network also includes OEM partners who use QlikView technology as a bundled

or add-on feature in their products and services. Typically OEM partners include software

companies, SaaS vendors and information providers. More broadly, this category applies to any

organization seeking to leverage QlikView to power the analytics in an existing or new product or

in a service offering.

We support our global partner network through a program that provides a structured framework

to effectively recruit, enable and support partners who sell and deliver complementary QlikView

solutions. Our team provides a complete lifecycle of support to partners, based on three

fundamental principles:

| |

• |

|

enable partners through technical support, education, training and certification |

| |

• |

|

market with and for partners through branding, awareness, customer marketing and

lead generation programs |

| |

• |

|

sell QlikView and “Powered by QlikView” products with effective sales tools and

sales support. |

9

As of December 31, 2010, our global partner network was comprised of more than 1,200 partners

in over 100 countries. No individual partner represented more than 3% of our revenues in the fiscal

years ended December 31, 2010, 2009 or 2008.

We focus our marketing efforts on increasing brand awareness, communicating product advantages

and generating qualified leads for our sales force and channel partners. We rely on a variety of

marketing vehicles, including trade shows, advertising, public relations, industry research, our

website and collaborative relationships with technology vendors. In addition, we work closely with

a number of our global partners on co-marketing and lead-generation activities in an effort to

broaden our marketing reach.

Maintenance and Services

Maintenance and Support. Our customers generally receive one year of software maintenance

and support as part of their initial purchase of our products and have the option annually to renew

their maintenance agreements. These annual maintenance agreements provide customers the right to

receive unspecified software updates, maintenance releases and patches, and unlimited access to our

support services. We engage third parties to provide first-line support for our product. We work

closely with these third parties to help ensure that they have the necessary skills and product

knowledge to assist our customers with installation, maintenance and other requirements. Our

internal support personnel are based in our offices in Lund, Sweden; Raleigh, North Carolina;

Dusseldorf, Germany; and Sydney, Australia; and they work with our third party partners to handle

support issues that may arise.

Services. Our revenue model is license driven with minimal professional services required to

install and configure our software. We believe that this enables our customers to achieve rapid

time-to-value. While the vast majority of implementation projects are conducted by our partners, we

have also established an expert services department to support customers and partners with more

in-depth technical know-how and best practices about our product including implementation,

scripting, user interface design, application development and security management. Training is

given either in-person or online. Typically, in-person training courses are billed on a per-person,

per-class basis. We have both standard packages as well as customized trainings. We also utilize

and promote QlikCommunity as a supplement support resource for our customers.

Customers

As of December 31, 2010, we had approximately 18,000 active customers in over 100 countries.

Our customers conduct their respective businesses in numerous industry verticals, including

consumer packaged goods, financial services, pharmaceuticals, retail, manufacturing, technology and

healthcare. We do not believe our business is substantially dependent on any particular customer as

no customer represented more than 2% of our revenue in 2010, 2009 or 2008. Our target markets are

not confined to certain industries and geographies as we are focused on providing a solution that

generally meets the needs of business users.

Brand and Intellectual Property

Our intellectual property is an essential element of our business. We own registered

trademarks for the “Qlik” and “QlikView” name. We rely on a combination of copyright, patent,

trademark, trade dress and trade secrecy laws, as well as confidentiality procedures and

contractual restrictions, to establish and protect our proprietary rights both domestically and

abroad. These laws, procedures and restrictions provide only limited protection. As of December 31,

2010, we had three issued U.S. patents and had a pending application for a fourth U.S. patent. In

addition, we had 19 issued and six pending foreign patents. Any future patents issued to us may

be challenged, invalidated or circumvented. Any patents that might be issued in the future, with

respect to pending or future patent applications, may not provide sufficiently broad protection or

may not prove to be enforceable in actions against alleged infringers. We endeavor to enter into

agreements with our employees and contractors and with parties with whom we do business in order to

limit access to and disclosure of our proprietary information.

We cannot be certain that the steps we have taken will prevent unauthorized use or reverse

engineering of our technology. Moreover, others may independently develop technologies that are

competitive with ours or that infringe our intellectual property. The enforcement of our

intellectual property rights also depends on any legal actions against these infringers being

successful, but these actions may not be successful, even when our rights have been infringed.

Furthermore, effective patent, trademark, trade dress, copyright and trade secret protection

may not be available in every country in which our products are offered. In addition, the legal

standards relating to the validity, enforceability and scope of protection of intellectual property

rights are uncertain and still evolving.

From time to time, we may encounter disputes over rights and obligations concerning

intellectual property. Although we believe that our product offerings do not infringe the

intellectual property rights of any third party, we cannot be certain that we will prevail in any

intellectual property dispute. If we do not prevail in these disputes, we may lose some or all of

our intellectual property protection, be enjoined from further sales of products determined to

infringe the rights of others and/or be forced to pay substantial royalties to a third party, any

of which could harm our business, financial condition and results of operations.

10

Competition

Our technology platform and differentiated business model help us to compete in the highly

competitive business intelligence market. We face competition from many companies that are

offering, or may soon offer, products that compete with our products.

To date, we have primarily faced competitors in several broad categories, including business

intelligence software, analytical processes, query tools, web-based reporting tools and report

delivery technology. Independent competitors that are primarily focused on business intelligence

products include, among others, MicroStrategy and the SAS Institute. We also compete with large

software corporations, including suppliers of enterprise resource planning software, that provide

one or more capabilities competitive with our products, such as IBM, Microsoft, Oracle and SAP AG.

We believe we generally compete favorably with respect to these competitors; however, some of our

competitors and potential competitors have advantages over us, such as:

| |

• |

|

longer operating histories |

| |

• |

|

significantly greater financial, technical, marketing or other resources |

| |

• |

|

stronger brand and business user recognition |

| |

• |

|

broader global distribution and presence. |

Current and future competitors may also have greater resources to make strategic acquisitions.

By doing so, these competitors may increase their ability to meet the needs of our potential

customers. Our current or prospective indirect channel partners may establish cooperative

relationships with our current or future competitors. These relationships may limit our ability to

sell our products through specific distribution channels. Accordingly, new competitors or alliances

among current and future competitors may emerge and rapidly gain significant market share. These

developments could limit our ability to obtain revenues from new customers and to maintain

technical support revenues from our installed customer base.

See Item 1A of this Annual Report on Form 10-K entitled “Risk Factors” for further discussion

regarding our competition.

Culture and Employees

As a global company, we have 780 employees as of December 31, 2010, of which 199 were employed

in the U.S. and 581 were employed outside the U.S. We believe that having a strong company culture

and set of values is critical to our success. Our corporate culture provides us with a competitive

advantage by supporting our ability to keep our market offering consistent despite a globally

diverse employee

base. To communicate and reinforce our culture, we have a set of corporate values which

provide a framework for guiding employees in implementation of our business model without direct

managerial control. Our values are:

| |

• |

|

challenge the conventional |

| |

• |

|

be thorough but keep it simple |

| |

• |

|

open and straightforward |

| |

• |

|

teamwork yields the best results. |

Our values are taught and reinforced from the moment new employees join our company. Shortly

after being hired, all employees attend QlikAcademy, a week-long training session in Lund, Sweden,

to learn about our product, our sales model and our cultural values. Our values form the fabric of

our work ethic, and we believe that they enable us to quickly recruit and properly manage our

highly talented employees. Our culture encourages the iteration of ideas to address complex

technical challenges. In addition, we embrace individual thinking and creativity. Despite our

growth, we constantly seek to maintain a small-company feel that promotes interaction and the

exchange of ideas among employees. We try to minimize company hierarchy to facilitate meaningful

communication among employees at all levels and across all departments. This openness extends to

our partners and customers, as well as allowing us to establish strong relationships that

contribute to our growth.

11

Every year since 2000 we have hosted an annual QlikTech summit where we bring together all our

employees in one location to build cross-border relationships and to facilitate communications.

During the summit we update employees on our progress, provide training around new initiatives,

host presentations by industry speakers and key customers and allow open interaction between

employees from around the world. Our summit is a critical mechanism for promoting consistent and

efficient execution of the year’s strategic plan. Having the summit at a single time and in a

single location provides our globally distributed organization with an opportunity to share ideas

and best practices. We believe that the summit is one of the key elements in maintaining a strong

company culture among our employees.

We consider our current relationship with our employees to be good. We are not a party to a

collective bargaining agreement with any of our employees.

Company Information and Website

We file annual, quarterly and current reports, proxy statements and other documents with the

Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934. The public

may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at

Station Place, 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the

operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet

website that contains reports, proxy and information statements and other information regarding

issuers, including us, that file electronically with the SEC. The public can obtain any documents

that we file with the SEC at http://www.sec.gov.

In addition, our company website can be found on the internet at http://www.qlikview.com. The

website contains information about us and our operations. Copies of each of our filings with the

SEC on Form 10-K, Form 10-Q and Form 8-K and all amendments to those reports, can be viewed and

downloaded free of charge as soon as reasonably practicable after the reports and amendments are

electronically filed with or furnished to the SEC. To view the reports, access

http://investor.qlikview.com and click on “Financial Information.” References to our company

website address in this report are intended to be inactive textual references only, and none of the

information contained on our website is part of this report or incorporated in this report by

reference.

12

Our business is subject to numerous risks. You should carefully consider the risks described below

together with the other information set forth in this Annual Report on Form 10-K and other

documents we file with the SEC, which could materially affect our business, financial condition,

and future results. The risks described below are not the only risks facing our company. Risks and

uncertainties not currently known to us or that we currently deem to be immaterial also may

materially adversely affect our business, financial condition, and operating results.

We have limited experience in targeting a global marketplace and compete in a rapidly evolving

industry which makes our future operating results difficult to predict.

We have limited experience in targeting the global business intelligence marketplace. In

addition, we have a limited operating history in an industry characterized by rapid technological

innovation, changing customer needs, evolving industry standards and frequent introductions of new

products, enhancements and services. Any of these factors can render our existing software platform

and services obsolete or unmarketable. We believe that our future success will depend in large part

on our ability:

| |

• |

|

to support current and future releases of popular hardware, operating

systems, computer programming languages, databases and software applications |

| |

• |

|

to develop new products that achieve market acceptance in a timely manner |

| |

• |

|

to meet an expanding range of customer requirements. |

As we encounter increasing competitive pressures, we will likely be required to modify,

enhance, reposition or introduce new products and service offerings. We may not be successful in

doing so in a timely, cost-effective and appropriately responsive manner, or at all. All of these

factors make it difficult to predict our future operating results which may impair our ability to

manage our business.

We may experience quarterly fluctuations in our operating results due to a number of factors which

make our future results difficult to predict and could cause our operating results to fall below

expectations or our guidance.

Our operating results may fluctuate due to a variety of factors, many of which are outside of

our control. As a result, comparing our operating results on a period-to-period basis may not be

meaningful. Our past results should not be relied on as an indication of our future performance. If

our revenue or operating results fall below the expectations of investors or securities analysts or

below any guidance we may provide to the market, the price of our common stock could decline

substantially.

Our operating results have varied in the past. In addition to other risk factors listed in

this “Risk Factors” section, factors that may affect our quarterly operating results, business and

financial condition include the following:

| |

• |

|

demand for our software platform and services and the size and timing of orders |

| |

• |

|

market acceptance of our current and future products |

| |

• |

|

a slowdown in spending on information technology and software by our current and/or prospective customers |

| |

• |

|

sales cycles and performance of our indirect channel partners and original equipment manufacturers (known as OEMs) |

| |

• |

|

budgeting cycles of our customers |

| |

• |

|

the management, performance and expansion of our international operations |

| |

• |

|

the rate of renewals of our maintenance agreements |

| |

• |

|

changes in the competitive dynamics of our markets |

| |

• |

|

our ability to control costs, including our operating expenses |

| |

• |

|

customers delaying purchasing decisions in anticipation of new products or product enhancements by us or our competitors |

| |

• |

|

the outcome or publicity surrounding any pending or threatened lawsuits |

| |

• |

|

the timing of recognizing revenue in any given quarter as a result of revenue recognition rules |

13

| |

• |

|

an increase in the rate of product returns |

| |

• |

|

foreign currency exchange rate fluctuations |

| |

• |

|

failure to successfully manage any acquisitions |

| |

• |

|

general economic and political conditions in our domestic and international markets. |

In addition, we may in the future experience fluctuations in our gross and operating margins

due to changes in the mix of our direct and indirect sales, domestic and international revenues,

and license and professional services revenues.

We may implement changes to our license pricing structure for all of our products including

increased prices and modified licensing parameters. If these changes are not accepted by our

current or future customers, our business, operating results and financial condition could be

harmed.

Based upon all of the factors described above, we have a limited ability to forecast the

amount and mix of future revenues and expenses, and it is likely that at some time our operating

results will fall below our estimates or the expectations of public market analysts and investors.

We depend on revenue from a single product platform.

We are dependent on a single product platform, QlikView. Our business would be harmed by a

decline in demand for, or in the price of, our software platform as a result of, among other

factors:

| |

• |

|

any change in our pricing model |

| |

• |

|

support, research and development or other expenditures undertaken in

attempts, whether or not successful, to develop new products |

| |

• |

|

maturation in the markets for our products. |

Our financial results would suffer if the market for business intelligence software does not

continue to grow or if we are unable to further penetrate this market.

Nearly all of our revenues to date have come from sales of business intelligence software and

related maintenance services. We expect these sales to account for substantially all of our

revenues for the foreseeable future. Although demand for business intelligence software has grown

in recent years, the market for business intelligence software applications is still evolving. We

cannot be sure that this market will continue to grow or, even if it does grow, that customers will

purchase our software platform or services. We have spent, and intend to keep spending,

considerable resources to educate potential customers about business intelligence software in

general and our software platform in particular. However, we cannot be sure that these expenditures

will help our software platform achieve any additional market acceptance or enable us to attract

new customers or new users at existing customers. A reduction in the demand for our services and

software platform could be caused by, among other things, lack of customer acceptance, weakening

economic conditions, competing technologies and services or decreases in software spending. If the

market and our market share fail to grow or grow more slowly than we currently expect, our

business, operating results and financial condition would be harmed.

We use indirect channel partners and if we are unable to maintain successful relationships

with them, our business, operating results and financial condition could be harmed.

In addition to our direct sales force, we use strategic indirect channel partners, such as

distribution partners, value-added resellers, system integrators and OEMs to license and support

our software platform. For the year ended December 31, 2010, transactions by indirect channel

partners accounted for more than 50% of our total product licenses and first year maintenance

billings.

Our channel partners may offer customers the products of several different companies,

including products that compete with ours. Our channel partners generally do not have an exclusive

relationship with us; thus, we cannot be certain that they will prioritize or provide adequate