Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33778

NEUTRAL TANDEM, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 31-1786871 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 550 West Adams Street Suite 900 Chicago, Illinois |

60661 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code (312) 384-8000

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value Per Share |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock, $0.001 par value per share, held by non-affiliates of the registrant on June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was $358,724,655 (based on the closing sales price of the registrant’s common stock on that date). Shares of the registrant’s common stock held by each officer, director and each other person known to the registrant who beneficially owns more than 5% or more of the registrant’s outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 11, 2011, the registrant had 33,220,694 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Neutral Tandem, Inc. definitive Proxy Statement for its 2011 Annual Meeting of Stockholders to be filed with the Commission pursuant to Regulation 14A not later than 120 days after December 31, 2010 are incorporated by reference in Part III of this Form 10-K.

Table of Contents

NEUTRAL TANDEM, INC.

FORM 10-K

| Page | ||||||

| Part I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

19 | |||||

| Item 1B. |

37 | |||||

| Item 2. |

38 | |||||

| Item 3. |

39 | |||||

| Item 4. |

40 | |||||

| Part II | ||||||

| Item 5. |

41 | |||||

| Item 6. |

43 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

44 | ||||

| Item 7A. |

59 | |||||

| Item 8. |

60 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

85 | ||||

| Item 9A. |

85 | |||||

| Item 9B. |

87 | |||||

| Part III | ||||||

| Item 10. |

88 | |||||

| Item 11. |

88 | |||||

| Item 12. |

Security Ownership or Certain Beneficial Owners and Management and Related Stockholder Matters |

89 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

89 | ||||

| Item 14. |

89 | |||||

| Part IV | ||||||

| Item 15. |

Exhibits and Financial Statement Schedules | 90 | ||||

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Our Company

We provide U.S. and international voice, IP Transit, and Ethernet telecommunications services primarily on a wholesale basis. We offer these services using an all-IP network, which enables us to deliver global connectivity for a variety of media, including voice, data and video. Our solutions enable carriers and other providers to deliver telecommunications traffic or other services where they do not have their own network or elect not to use their own network. These solutions are sometimes called “off-net” services. We also provide our solutions to customers, like content providers, who also typically do not have their own network. We were incorporated in Delaware on April 19, 2001 and commenced operations in 2004.

For the year ended December 31, 2010, we increased revenue to $199.8 million, an increase of 18.3% compared to $168.9 million for the year ended December 31, 2009. Our income from operations for the year ended December 31, 2010 was $54.1 million compared to $64.0 for the year ended December 31, 2009. Net income for the year ended December 31, 2010 was approximately $32.6 million compared to net income of $41.3 million for the year ended December 31, 2009.

Voice Services

We provide voice interconnection services primarily to competitive carriers, including wireless, wireline, cable and broadband telephony companies. Competitive carriers use our tandem switches to interconnect and exchange local and long distance traffic between their networks without the need to establish direct switch-to-switch connections. Competitive carriers are carriers that are not Incumbent Local Exchange Carriers, or ILECs, such as AT&T, Verizon and Qwest.

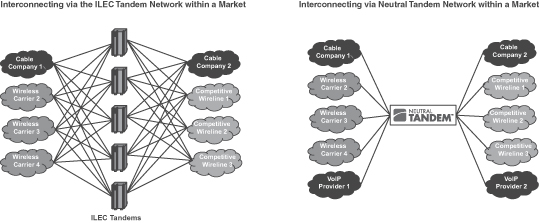

Prior to the introduction of our local voice service, competitive carriers generally had two alternatives for exchanging traffic between their networks. The two alternatives were interconnecting to the ILEC tandems or directly connecting individual switches, commonly referred to as “direct connects.” Given the cost and complexity of establishing direct connects, competitive carriers often elected to utilize the ILEC tandem as the method of exchanging traffic. The ILECs typically required competitive carriers to interconnect to multiple ILEC tandems with each tandem serving a restricted geographic area. In addition, as the competitive telecommunications market grew, the process of establishing interconnections at multiple ILEC tandems became increasingly difficult to manage and maintain, causing delays and inhibiting competitive carrier growth, and the purchase of ILEC tandem services became an increasingly significant component of a competitive carrier’s costs.

The tandem switching services offered by ILECs consist of local transit services, which are provided in connection with local calls, and switched access services, which are provided in connection with long distance calls. Under certain interpretations of the Telecommunications Act of 1996 and implementing regulations, ILECs are required to provide local transit services to competitive carriers. ILECs generally set per minute rates and other charges for tandem transit services according to rate schedules approved by state public utility commissions, although the methodology used to review these rate schedules varies from state to state. ILECs are also required to offer switched access services to competing telecommunications carriers under the Telecommunications Act of 1996 and implementing regulations. ILECs generally set per minute rates and other charges for switched access services according to mandated rate schedules set by the Federal Communications Commission, or FCC, for interstate calls and by state public utility commissions for intrastate calls. Our solution enables competitive carriers to exchange traffic between their networks without using an ILEC tandem for both local and long distance calls.

A loss of ILEC market share to competitive carriers escalated competitive tensions and resulted in an increased demand for tandem switching. Growth in intercarrier traffic switched through ILEC tandems created

1

Table of Contents

switch capacity shortages known in the industry as ILEC “tandem exhaust,” where overloaded ILEC tandems became a bottleneck for competitive carriers. This increased call blocking and gave rise to service quality issues for competitive carriers.

We founded our company to solve these interconnection problems and better facilitate the exchange of traffic among competitive carriers and non-carriers. With the introduction of our services, we believe we became the first carrier to provide alternative tandem services capable of alleviating the ILEC tandem exhaust problem. By utilizing our managed tandem service, our customers benefit from a simplified interconnection network solution that reduces costs, increases network reliability, decreases competitive tension and adds network diversity and redundancy.

According to the Local Exchange Routing Guide, an industry standard guide maintained by Telcordia that is used by carriers, there are approximately 1.52 billion telephone numbers assigned to carriers in North America. Our services are principally targeted to address the estimated 840 million, or 55% of the total 1.52 billion, telephone numbers assigned primarily to competitive carriers; that is, all carriers that are not ILECs.

We have signed voice services agreements with major competitive carriers and non-carriers and operated in 179 markets as of December 31, 2010. During the fourth quarter of 2010, our network carried 29.9 billion minutes of traffic. As of December 31, 2010, our network was capable of connecting calls to an estimated 526 million telephone numbers assigned to carriers. Telephone numbers assigned to a carrier may not necessarily be assigned to, and in use by, an end user.

Our business originally connected only local traffic among carriers within a single metropolitan market. In 2006, we installed a national IP backbone network connecting our major local markets. In 2008, we began offering terminating switched access services and originating switched access services. Switched access services are provided in connection with long distance calls. Our terminating switched access services allows interexchange carriers to send calls to us and we then terminate those calls to the appropriate terminating carrier in the local market in which we operate. Our originating switched access service allows the originating carrier in the local market in which we operate to send calls to us that we then deliver to the appropriate interexchange carrier that has been selected to carry that call. In both instances, the interexchange carrier is our customer, which means that it is financially responsible for the call. On October 1, 2010, we acquired Tinet S.p.A. (Tinet), an Italian corporation that operates a global IP backbone network. As a result of the foregoing, our service offerings now include the capability of switching and carrying local, long distance and international voice traffic.

The following diagrams illustrate interconnecting in a local market via the ILEC tandem networks and an example of interconnecting via our managed tandem network.

2

Table of Contents

Following the introduction of our services, we began to face competition from other non-ILEC carriers, including Level 3, Hypercube and Peerless Network. Over the past several years, competition has intensified causing us to lose some traffic as well as significantly reduce certain rates we charge our customers in various markets, including with respect to our major customers. For a further discussion see “Risk Factors—Our tandem services business faces competition from the traditional ILECs and increasing competition from certain other providers such as Level 3 Communications, Peerless Network and Hypercube, and we expect to compete with new entrants to the tandem services market…” in Item 1A below.

The second alternative for exchanging traffic, prior to our commencement of operations, was by directly connecting competitive carrier switches to each other. Implementing direct switch-to-switch network connections between all competitive switches in a market can be challenging. For example, in order to completely bypass the ILEC tandem network, a market with 100 competitive switches would require 9,900 direct one-way switch-to-switch connections. The capital and operating expense requirements, complexity and management challenges of establishing and maintaining direct connections generally makes them economical only for higher traffic switch combinations. However, where sufficient traffic between switches does exist, carriers often do establish direct connections. We believe that our customers are currently frequently establishing direct connections between their networks, even for what might be considered by historical standards to be lower traffic switch pair combinations, for various reasons, including in order to avoid paying a transit fee. For a further discussion see “Risk Factors—The market for our services is competitive and increased adoption of IP switching technologies could increase the competition we face from direct connections” in item 1A below. When our customers implement a direct connection, it reduces the traffic we carry and the revenue we earn.

Our solutions potentially help minimize these network failures and interconnection problems by offering physically diverse tandem switching facilities and transmission paths that increase network reliability. We also simplify the ordering, provisioning and capacity management requirements of our customers, and seek to leverage our extensive interconnection network to capitalize on the growth of intercarrier traffic.

Data and International Services

As part of our long-term growth strategy, on October 1, 2010, we acquired Tinet, an Italian corporation. Tinet was founded in Cagliari, Italy in 2002. Tinet provides IP Transit and Ethernet services primarily to carriers, service providers and content providers worldwide.

With this acquisition, we evolved from a primarily U.S. voice interconnection company into a global IP-based network services company focused on delivering global connectivity for a variety of media, including voice, data and video. The acquisition expanded our IP-based network internationally, enabling global end-to-end delivery of wholesale voice, IP Transit and Ethernet solutions.

We have IP Transit and Ethernet service agreements with over 650 customers in over 70 countries. In 2010, we carried over 1 Terebit of customer IP traffic. We have over 100 points of presence (POPs) where we operate our equipment in carrier neutral facilities. Our core IP Transit network uses all Juniper equipment, which reduces complexity and allows for faster service deployment, easier customer support and spare management flexibility.

We believe overall internet traffic has grown exponentially over the previous years due to factors that include:

| • | Increased broadband penetration in many countries in Asia and Eastern Europe; |

| • | Increase in user generated content (UGC) shared via multiple platforms such as YouTube, Facebook, etc.; |

| • | Multimedia mobile devices capable of taking pictures and videos; |

| • | Video streaming and internet-based video communications; and |

| • | The use of file sharing portals. |

3

Table of Contents

We believe that a similar trend will continue over the next several years due to the above factors plus:

| • | Further growth in broadband subscribers in Asia and Latin America; |

| • | Growth in mobile phone use in Latin America and Africa adding to a global increase in mobile data; and |

| • | Expected increase in the use of multiple forms of video communication, such as video conferencing, internet movies, live TV, etc., due in large part to the emergence of high-definition video capability. |

We believe that Ethernet services will be one of the fastest growing strategic data products for service providers throughout the world. Enterprise customer demand for business Ethernet services is expected to be the primary driver for service providers’ rapid transition to providing Ethernet transport. Many major service providers are beginning to provide carrier-grade Ethernet network services, offering private line, virtual private line and multi-point virtual LAN products. Additionally, wireless carriers are expected to have significant needs for Ethernet transport, as they upgrade their backhaul networks to handle the increase in bandwidth demand in order to carry mobile data services. The adoption of mobile smartphones and similar devices using data applications, such as video, is expected to contribute to this increased global demand.

Our Services

Voice Services

Our voice services in the United States allow competitive carriers to exchange local and long distance traffic between their networks without using an ILEC tandem or establishing direct connections. Each competitive carrier that connects to our network generally gains access to all other competitive carriers’ switches connected to our network. Once connected to our network, carriers can route their traffic to other destinations (telephone numbers) that are addressable by our network. We charge on a per-minute basis for traffic switched by our network.

As a core component of our service offering, we actively manage network capacity between our tandem switches and customers’ switches, which results in improved network quality and reduced call blocking. By monitoring traffic levels and projecting anticipated growth in traffic, we are generally able to provide on a timely basis additional circuits between customer switches and our network to meet increased demand. This feature saves competitive carriers substantial time and effort in managing their interconnection network, improves their customers’ experience, reduces trouble tickets and allows them to focus more on their core business. We also provide our customers with invoices, management reports and call detail records in paper and electronic formats along with monthly savings summary reports.

Our managed service offering includes technologically advanced IP switching platforms manufactured by Sonus Networks, Inc. linked together by an IP backbone. Our network is capable of automatically switching IP-originated or conventional Time Division Multiplexing, or TDM, traffic to terminating carriers using either protocol. We support IP-to-IP, IP-to-TDM, TDM-to-IP and TDM-to-TDM traffic with appropriate protocol conversion and gateway functionality. We also support both conventional Signaling System #7 and Session Initiation Protocol call routing. Session Initiation Protocol is an application-layer control (signaling) protocol for creating, modifying and terminating realtime IP communications sessions with one or more participants. These sessions include internet telephone calls, multimedia distribution and multimedia conferences. Signaling System #7 is a set of telephony signaling protocols which is used to set up the majority of the world’s Public Switched Telephone Network calls.

In addition, patent-pending proprietary software tools help us to manage the complicated routing scenarios required to terminate traffic to hundreds of millions of telephone numbers and support our network. The software allows us to quickly identify new routing opportunities between carriers and to help optimize our customers’ interconnection costs, which leads to improved customer service. We believe the adaptability and flexibility of

4

Table of Contents

our technology enables us to provide a robust service offering to interconnect a wide range of traffic types and to adapt our service offerings more efficiently than the ILECs, which predominantly employ legacy Class 4 TDM-only circuit switching technology for tandem switching.

Our network, as of December 31, 2010, connects 2,050 unique competitive carrier switches (a 14% increase over December 31, 2009), creating up to 4.2 million unique switch-to-switch routes serving an estimated 526 million telephone numbers assigned to these carriers. Telephone numbers assigned to a carrier may not necessarily be assigned to, and in use by, an end user. In the quarter ended December 31, 2010, our network carried approximately 8.9 billion minutes of traffic per month.

We recently began to operate end-office switches in order to carry traffic from non-carriers to other carriers. Also, in 2010, we began to carry voice traffic from international carriers seeking to terminate traffic in the United States to the carriers with which we are directly connected. In addition, in the future, we may seek to carry outbound voice traffic from the United States to non-United States jurisdictions and between non-United States jurisdictions.

IP Transit Service

We operate a Tier 1 internet network. We received the Tier 1 designation from the Renesys Corporation in May 2010 . As a Tier 1 provider, we largely connect to every other Tier 1 internet provider without the need to purchase IP Transit services from a third party. Our IP transit network is ranked as one of the top 10 IPv4 backbones worldwide and one of the best connected IPv6 network. Using our Tier 1 network, we provide IP Transit service primarily to carriers, service providers and content providers worldwide.

Our IP Transit service allows internet traffic to cross or “transit” between our customer to the larger internet. IP Transit traffic is carried on either an “upsteam” or “downstream” basis, as follows:

| • | From other internet networks to us, and then inbound to reach our customer. |

| • | From our customer to us, and then outbound to reach other internet networks. |

Our IP Transit service is typically priced on a per megabit basis, and customers are often required to commit to a minimum term of service as well.

We offer our services through different interfaces with bandwidth up to 10 gigabytes per second.

Ethernet Services

We provide our Ethernet service on a wholesale basis so that our customers can fulfill their global Ethernet requirements and deliver international connectivity services to their corporate or other customers. We provide this service between different POPs, which are physical locations where we interconnect our network with our customer’s network. We also offer this service in some locations on an end-to-end basis, where we provide service all the way to the end-user building. Providing service to the end-user building is also referred to as “last-mile” connectivity.

We are able to provide an end-to-end service in certain locations by using our global network footprint and through a number of Ethernet Network to Network Interconnection (NNI) agreements that we have entered into with numerous providers worldwide. These third-party service providers have last-mile connectivity to the end-user building. We purchase this last-mile connectivity from the party with whom we have an NNI interconnection and then combine that with our POP-to-POP service to provide an end-to-end solution. We believe that one of our strengths is developing NNI agreements with metro-Ethernet providers. Ethernet service

5

Table of Contents

includes both point-to-point and multipoint connectivity configurations. Our service supports Virtual Private LAN Service (VPLS) technology for multipoint connectivity. Our Ethernet service is well suited for those regional service providers that compete for VPLS service, as such providers face significant challenges related to the speed and cost at which they can procure last-mile connectivity for their customers.

Our Network

A telecommunications network is generally comprised of various types of equipment that routes telecommunications traffic, such as routers and switches, and various transport equipment that carry the telecommunications traffic, such as DWDM, fiber optic terminals and cables or “circuits.” We typically own the equipment in our network and locate it in POPs specially designed for this purpose, such as telecom “hotels” or collocation facilities. We generally obtain the circuits we use for our network backbone from third parties under a contract where we pay a monthly recurring charge for the circuit. Alternatively, we may pay a third party a larger non-recurring up-front fee to acquire the right to use the circuit on a long term basis under what is called an indefeasible right of use, or IRU. The monthly recurring charges to use circuits charged by third party providers has decreased significantly over the past several years. Accordingly, in order to try and take advantage of this price trend, we have generally entered into contracts that have monthly recurring charges for the use of the circuits instead of acquiring IRUs. We still do, however, obtain IRUs when we believe a longer term arrangement is economically justified.

We operate a Multiprotocol Label Switching (MPLS)/IP based global network backbone. We have over 100 POPs located worldwide in our network, including in North America, Europe and Asia. Our network is highly scalable and can carry voice, data and video.

Our Strategy

Our strategy is focused on expanding our business by increasing the amount of telecommunications traffic that our network carries both in the United States and internationally. Expanding our share of telecommunications traffic increases the value of our network to our customers and enables us to capture a larger share of total telecommunications revenue. Key elements of our expansion strategy include:

| • | Increase the types of traffic we carry. Our business originally connected only local voice traffic among carriers within a single metropolitan market. In 2006, we installed a national IP backbone network connecting our major local markets. In 2010 we acquired Tinet, allowing us to integrate our IP backbone network with Tinet’s global IP network. As a result, our service offerings now include the capability of switching and carrying voice and data traffic between multiple domestic and international markets and among different types of customers. |

| • | Expand our customer base. As we expand our network and the types of services we offer, our market opportunities will include selling new services to new and existing customers. For example, we can now offer IP Transit or Ethernet services to an existing voice customer in the United States, or offer voice or Ethernet services to an existing carrier customer that currently purchases only IP Transit service. We will also offer our voice and data services to new customers. |

Our Customers

In connection with our voice service, we principally serve carriers in the United States. These carriers accounted for approximately 96.4% of our revenues in 2010, with non-carriers accounting for the remaining 3.6%. As of December 31, 2010, we have 148 carriers originating traffic and 153 carriers connected to our network. Our contracts with our top five voice customers represented approximately 61% of our total revenue through December 31, 2010. Our two largest customers, AT&T and Sprint Nextel, accounted for 22% and 18%, respectively, of our total revenues for the year ended December 31, 2010. Our contracts with customers for voice services do not contain volume commitments, are not exclusive, and could be terminated or modified in ways

6

Table of Contents

that are not favorable to us. However, while we have lost customers’ traffic in specific markets, since initiating service we have not had any significant customer cease using our services completely. We primarily generate revenue for our voice services by charging fees on a minute of use basis. For the year ended December 31, 2010, wireless and cable companies accounted for approximately 49.9% of our revenue.

In connection with our voice service, our expected market expansion plan in the United States during the 12-month period following December 31, 2010 is limited, as we now cover most of the major and mid-size markets. As a result, we are now marketing voice services internationally. Our current international service offering includes carrying traffic that originates outside of the United States and terminates in the United States to the telephone numbers that we serve. We also plan to market services to carry traffic that originates in the United States and terminates outside of the United States or is carried between non-United States jurisdictions.

In connection with our IP Transit and Ethernet services, we primarily serve carriers, service providers and content providers worldwide. We have IP Transit and Ethernet service agreements with over 650 customers in over 70 countries. Our contracts with customers for IP Transit and Ethernet services typically contain minimum term commitments. At the expiration of the relevant commitment period, the customer can terminate the agreement or require modifications to the agreement that are not favorable to us. Historically, in order to renew the period for an additional committed term following the end of the relevant commitment period, we have agreed to reduce the rates we charge the customer, sometimes significantly.

Sales and Marketing

In the United States, our sales organization primarily divides voice accounts by customer type, such as wireless, cable, wireline and non-carrier customers, and data accounts by customer location. Outside of the United States, our sales organization primarily divides accounts by customer location. Our sales team works closely with our customers to identify and address their needs. In addition to a base salary, the compensation package for the members of our sales team includes share-based compensation and incentive arrangements, including target incentives based on our performance and the individual’s performance, tiered payment structures. The members of our sales organization have significant sales experience and in-depth knowledge of the telecommunications industry.

Our marketing team works closely with the sales team to deliver comprehensive services, develop a clear and consistent corporate image and offer a full range of product offerings. Our marketing efforts are designed to drive awareness of our service offerings. Our marketing activities include direct sales programs, social media, targeted public relations and participation in industry trade shows. We are also engaged in an ongoing effort to maintain relationships with key communications industry analysts.

Our Customer Support

Our ordering and provisioning groups form the core of our customer support team. Each group works closely with the different vendor and customer organizations responsible for establishing service. We assign an implementation manager to each account that is responsible for the delivery of our services. These managers stay in close contact with their customer and help coordinate our local operations teams during implementation. This process helps to improve customer satisfaction, increase customer implementation and promote our revenue realization.

Our network operations centers located in Cagliari, Italy and Chicago, Illinois, respectively, monitor and support our network 24 hours a day, 365 days a year. The network operations centers are responsible for troubleshooting and resolving any potential network problems.

7

Table of Contents

Competition

With respect to voice services, our primary competitors today are the traditional ILECs (primarily AT&T, Verizon and Qwest), other competitive carriers that provide tandem or similar services (primarily Level 3, Hypercube and Peerless Network), and direct connections between carriers.

The tandem switching services offered by ILECs consist of transit services, which are provided in connection with local calls, and access services, which are provided in connection with long distance calls. ILECs generally set per minute rates and other charges for tandem transit services according to rate schedules approved by state public utility commissions, although the methodology used to review these rate schedules varies from state to state. ILECs generally set per minute rates and other charges for access services according to mandated rate schedules set by the Federal Communications Commission, or FCC, for interstate calls and by state public utility commissions for intrastate calls. Our solution enables competitive carriers to exchange traffic between their networks without using an ILEC tandem for both local and long distance calls.

Over the past several years, we have faced increasing direct competition from other competitive providers of voice services, including Level 3, Hypercube and, most specifically, Peerless Network. As more specifically described below under “Item 3. Legal Proceedings,” in 2008 we commenced a patent infringement action against Peerless Network and Peerless Network asserted several counterclaims against us generally alleging that (i) our patent is invalid and unenforceable under a variety of theories, (ii) assertion of the patent amounts to patent misuse and violates certain monopolization laws, and (iii) certain conduct surrounding the litigation gave rise to a tortious interference claim. On September 2, 2010, the court hearing the case granted Peerless Network’s motion for summary judgment. The court found that our patent was invalid in light of a prior patent. Each party plans to appeal various rulings made against it in the litigation.

We also face indirect competition from carriers that directly connect their voice switches. When there is a significant amount of voice traffic between two switches, carriers have an economic incentive to establish direct connections to remove intermediate switching. We believe that our customers are currently frequently establishing direct connections between their networks for various reasons, including in order to avoid paying a transit fee. As our customers grow, the amount of traffic exchanged between them grows, thus leading to the risk that they will increase the number of direct connections between their switches and remove traffic from our tandems. The risk of direct connections will increase as more carriers move to an IP-based interface, because direct connecting between two IP-based carriers is less complex, thus enabling more direct connections. See “Risk Factors—The market for our services is competitive and increased adoption of IP switching technologies could increase the competition we face from direct connections” in Item 1A below. Also, market consolidation can significantly reduce our potential traffic since there are fewer total carriers needing to exchange traffic with each other.

We are unable to provide accurate market share information, since no regulatory body or industry association requires carriers to identify amounts of voice traffic to other carrier types. Traffic in most instances is reported on aggregate levels.

Our IP Transit and Ethernet service businesses face competition from many companies, including Level 3, Verizon, AT&T, Global Crossing, Equinix, CENX, Telx, TeliaSonera and Cogent.

Many of our competitors have significantly more employees and greater financial, technical, marketing and other resources than we have. Our ability to compete successfully with them depends on numerous factors, both inside and outside our control, including:

| • | our competitor’s ability to offer lower rates; |

| • | our competitors’ ability to bundle service offerings that we cannot match; |

| • | our responsiveness to customer needs; |

8

Table of Contents

| • | our ability to support existing and new industry standards and protocols; |

| • | our ability to raise capital; |

| • | our ability to retain and attract key employees; |

| • | interpretations of or changes to regulatory law; |

| • | our ability to continue development of technical innovations; and |

| • | the quality, reliability, security and price-competitiveness of our services. |

As a result of competitive pressures over the last several years, the average rates charged for voice services in certain markets in the United States and IP Transit services globally have decreased significantly. We believe that this trend is likely to continue. For a further discussion see “Risk Factors—Our failure to achieve or sustain market acceptance at desired pricing levels could impact our ability to maintain profitability or positive cash flow.” in Item 1A below.

Regulation

Overview

In the United States, our voice communications services business is subject to varying degrees of federal and state regulation. We operate as a common carrier and therefore are subject to the jurisdiction of both federal and state regulatory agencies, which have the authority to review our prices, terms and conditions of service. We operate as a facilities-based carrier in most states and have received all necessary state and FCC authorizations to do so. The regulatory agencies exercise control over our prices and services to varying degrees, and also impose various obligations such as reporting, payment of fees and compliance with consumer protection and public safety requirements.

By operating as a common carrier, we benefit from certain legal rights established by federal and state legislation, especially the federal Telecommunications Act of 1996, which gives us and other competitive entrants the right to interconnect to the networks of incumbent telephone companies and access to their networks. We have used these rights to gain interconnection with the incumbent telephone companies and to purchase selected services at wholesale prices that complement our ability to terminate traffic. We have also used these rights to request interconnection with competitive carriers for the termination of transit traffic to carriers when such carriers decide for whatever reason not to utilize our transit service. While our experience has been that competitive carriers usually accommodate such requests, and indeed frequently become users of our transit service as well, we have participated in federal and state regulatory proceedings involving our right to establish or maintain existing direct connections with other carriers. As previously disclosed, we subsequently resolved these proceedings amicably.

The FCC and state regulators are considering a variety of issues that may result in changes in the regulatory environment in which we operate our voice business. Most importantly, many state and federal proceedings have considered issues related to the ILECs’ pricing of services that compete with our service. To the extent that the regulatory commissions maintain or impose pricing restrictions on the transit or access rates charged by the ILEC, then the price we compete with is likely to be lower than it would be in an unregulated market. In addition, the FCC is conducting a proceeding to consider reform of its intercarrier compensation rules. This proceeding may affect the pricing and regulation of ILEC tandem services against which we compete. To the extent that any state or the FCC mandates reductions in the rates the ILECs charge for tandem services, including transit or access rates, it could have a material and adverse effect on our business, financial condition, operating results or growth opportunities. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

Although the nature and effects of governmental regulation are not predictable with certainty, we believe that the FCC is unlikely to enact rules that extinguish our basic right or ability to compete in telecommunications

9

Table of Contents

markets. However, even though many possible regulatory developments might not directly affect our operations, to the extent that they limit our customers’ ability to compete effectively against the ILEC or limit or reduce the rates at which an ILEC may provide the same services we provide, we are indirectly impacted. The following sections describe in more detail the regulatory developments described above and other regulatory matters that may affect our business.

Our United States-based IP Transit and Ethernet services are generally considered to be interstate services and generally are not regulated any state public utility commission. The FCC imposes limited obligations on carriers that provide IP Transit and Ethernet services, although in the context of “net neutrality,” the FCC is contemplating increasing the regulations that apply to internet services and peering relationships. Likewise, IP Transit and Ethernet services are not heavily regulated outside of the United States. However, in the future, we may become subject to regulation in the United States at the federal and state levels and in other countries. These regulations change from time to time in ways that are difficult for us to predict.

We are currently contemplating providing international voice services between foreign countries. These services would be provided between countries, as opposed to the entire call remaining within the same country. Calls between countries are generally less regulated than calls that are carried within a country. However, even where voice services are provided between countries, the service will still be subject to varying degrees of regulation. For example, some countries may merely require that a carrier provide notice of its operation in order to provide service, while other countries may require that the carrier comply with specific requirements that may be difficult for us to meet in order obtain a license, including a requirement that a minimum percentage of the carrier be owned by a local resident(s).

Regulatory Framework

The Telecommunications Act of 1996

The Telecommunications Act of 1996, which substantially revised the Communications Act of 1934, established the regulatory framework for the introduction of competition for local telephone services throughout the United States by new competitive entrants such as us. Before the passage of the Telecommunications Act, states typically granted an exclusive franchise in each local service area to a single dominant carrier, often a former subsidiary of AT&T known as a Regional Bell Operating Company, or RBOC, which owned the entire local exchange network and operated as a virtual monopoly in the provision of most local exchange services in most locations in the United States. The RBOCs now consist of Verizon, Qwest Communications and AT&T. These three carriers are also referred to as ILECs, along with many other smaller incumbent local exchange carriers that were not former subsidiaries of AT&T.

Among other things, the Telecommunications Act preempts state and local governments from prohibiting any entity from providing local telephone service, which has the effect of eliminating prohibitions on entry that existed in almost half of the states at the time the Telecommunications Act was enacted. Nonetheless, the Telecommunications Act preserved state and local jurisdiction over many aspects of local telephone service and, as a result, we are subject to varying degrees of federal, state and local regulation.

We believe that the Telecommunications Act provided the opportunity to accelerate the development of local telephone competition at the local level by, among other things, requiring the incumbent carriers to cooperate with competitors’ entry into the local exchange market. To that end, incumbent local exchange carriers are required to allow interconnection of their network with competitive networks. Incumbent local exchange carriers are further required by the Telecommunications Act to provide access to certain elements of their network to competitive local exchange carriers. These rules have helped the development of competitive telecommunications carriers, many of which have become our customers.

We have developed our U.S. voice business, including our decision to operate in most instances as a common carrier, and designed and constructed our networks to take advantage of the features of the

10

Table of Contents

Telecommunications Act. There have been numerous attempts to revise or eliminate the basic framework for competition in the local exchange services market through a combination of federal legislation, adoption of new rules by the FCC, and challenges to existing and proposed regulations by the incumbent carriers. We anticipate that Congress will consider a range of proposals to modify the Telecommunications Act over the next few years, including some proposals that could restrict or eliminate our access to elements of the incumbent local exchange carriers’ network. Although we consider it unlikely, based on statements of both telecommunications analysts and Congressional leaders, that Congress would reverse the fundamental policy of encouraging competition in communications markets, we cannot predict whether future legislation may adversely affect our business in any way.

Federal Regulation

The FCC regulates interstate and international communications services of common carriers, including access to local communications networks for the origination and termination of these services. We typically provide our U.S. voice services on a common carrier basis and the FCC has jurisdiction over our access services to the extent they are used as part of the origination or termination of interstate or international calls. Under certain interpretations of the Telecommunications Act, the FCC may also have the authority to regulate our provision of local transit services and intrastate access services, including setting the methodology by which state regulators determine local or intrastate pricing. To date, the FCC has not determined whether to accept this interpretation of the Telecommunications Act with respect to local transit services, although some states have proceeded as if local transit services are subject to that law. For a further discussion of the states’ rights to determine the pricing of our services under the Telecommunications Act, see “Regulatory Framework-State Regulation” below.

The FCC imposes extensive economic regulations on incumbent local exchange carriers due to their ability to exercise market power. The FCC imposes less regulation on common carriers without market power including, to date, competitive local exchange carriers. Unlike incumbent carriers, we are not currently subject to price cap or rate of return regulation, but we are subject to the general federal requirement that our charges for interstate and international services must be just, reasonable and non-discriminatory. The rates we can charge for interstate access services are limited by FCC rules, and may not exceed the rates charged by the incumbent carrier for comparable services. Apart from this limitation, the FCC currently has no rules concerning our rates for local transit or access services. We are also required to file periodic reports, to pay regulatory fees based on our interstate revenues, and to comply with FCC regulations concerning the content and format of our bills, the process for changing a customer’s subscribed carrier, and other consumer protection matters. Because we do not directly serve consumers, many of these regulations have no practical effect on our business. The FCC has authority to impose monetary forfeitures and to condition or revoke a carrier’s operating authority for violations of its requirements. Our operating costs are increased by the need to assure compliance with regulatory obligations.

We are also affected indirectly by FCC regulations that alter the competitive landscape for customers or potential customers of our services. As discussed above, the Telecommunications Act requires the incumbent local exchange carriers to provide competitors access to elements of their local network on an unbundled basis, known as UNEs. Several FCC decisions in 2003 through 2005 significantly altered the terms on which competitive carriers can obtain access to these network elements. Among other things, these decisions eliminated the obligation of incumbent carriers to offer a network element “platform” known as UNE-P that allowed competitors to offer services without any facilities of their own. It also limited the availability of some high- capacity loop and transport network elements that are typically used by competitors who do have some of their own facilities.

These changes in the FCC rules have had several effects on the competitive telecommunications carriers who are our prospective customers. First, the elimination of UNE-P has reduced the market share of resellers and led some former resellers to convert to facilities-based service. This development is positive for us because

11

Table of Contents

resellers generally are not potential users of our transit services. Second, the restrictions on the availability of loop and transport UNEs may have contributed to accelerated consolidation among competitive carriers, which may have a negative impact on us because our business model is based on the existence of many independent carriers who need to exchange traffic with each other. It is difficult to predict the overall effect of these countervailing trends on our future business opportunities.

Future FCC rulings may further affect the market for our services. For example, the FCC has been asked in several cases to forbear from requiring incumbent carriers to continue offering loop and transport UNEs in particular markets. The FCC has granted such petitions in portions of two metropolitan areas (Omaha, Nebraska, and Anchorage, Alaska), and denied them in several others (Boston, Providence, New York, Pittsburgh, Philadelphia, and Virginia Beach-Norfolk, Seattle, Minneapolis-St. Paul, Denver, and Phoenix). The most recent petition that the FCC denied (for Phoenix) currently is being reviewed by a federal court of appeals. If the FCC approves additional forbearance petitions, or is required to do so by the court, it could force some competitive carriers to reduce or eliminate their operations in affected metropolitan areas, which may negatively affect our business opportunities. The FCC is also considering a number of other proposals that may affect competitive carriers’ access to UNEs as well as the prices for such access. We cannot predict the results of future regulatory or court rulings, or any changes in the availability of UNEs as the result of future legislative changes.

Intercarrier Compensation

In 2001, the FCC initiated a proceeding to address rules that require one carrier to make payment to another carrier for access to the other’s network, or intercarrier compensation. In its notice of proposed rulemaking, or NPRM, the FCC sought comment on some possible advantages of moving from the current rules to a bill and keep structure for all traffic types in which carriers would recover costs primarily from their own customers, not from other carriers. To date, the FCC has taken no action on these proposed rules. More recently, on February 8, 2011, the FCC adopted a NPRM, that addresses reforming the Universal Service Fund high-cost program as the program transitions to cover broadband service, as well as changes to intercarrier compensation rules. In the NPRM, the FCC states that the record indicates that local transit service is competitive, but also requests public comment as to whether the FCC should make any changes to the rules that govern local transit service. The FCC is likely to publish proposed rules for further public comment in the near future, though it is not yet known whether or when any final rules may be adopted. If the FCC does make any changes to intercarrier compensation, such changes could affect our business. For example, the FCC could change the pricing of local transit traffic, including lowering the rates, freezing the rates or establishing uniform rates, any of which could have a material adverse effect on our business, financial condition and operating results; or it could clarify that local transit rates are intended to be unregulated, which could improve our opportunities in some markets where the current pricing is regulated at a very low level, which discourages competition. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

Additionally, we recently began providing access service, which is part of the origination and termination of long distance calls. The FCC generally regulates interstate access services and the states regulate intrastate access services. The FCC, as part of the intercarrier compensation NPRM discussed above, has proposed to reduce significantly both interstate and intrastate access charges, though it has not yet proposed specific rules to accomplish this reduction. The FCC is likely to publish proposed rules for further public comment in the near future though it is not yet known whether or when final rules may be adopted. If the FCC or any state does lower or eliminate any access charges, whether independent of or as part of the intercarrier compensation docket described above, such a change could have a material and adverse effect on our business, financial condition, operating results or growth opportunities. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

We generally have no revenue exposure associated with reciprocal compensation for local traffic because our customers are primarily carrier customers, who are responsible for any compensation. However, certain FCC proposals discussed above, if adopted, would make us and other tandem service providers liable for the

12

Table of Contents

intercarrier compensation charges imposed by the terminating carrier in certain instances, which we would then have an opportunity to recover from the carrier who delivered the traffic to us. Even if we do have a legal right to recover these charges, we would bear risk if this occurs, including but not limited to disputes over the amount due and credit risk. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

Regulatory Treatment of VoIP

In February 2004, the FCC initiated a proceeding to address the appropriate regulatory framework for Voice over internet Protocol, or VoIP, providers. In a series of orders since that time, the FCC has imposed on VoIP providers most of the same requirements that would apply if they were regulated as common carriers, other than the payment of access charges. These include duties to provide access to 911 emergency services, to permit duly authorized law enforcement officials to monitor communications, to contribute to the cost of the FCC’s universal service program, to pay certain regulatory fees, and to comply with the same customer privacy rules as telecommunications carriers. These obligations are likely to increase the cost of providing VoIP service and slow the growth of VoIP providers. Because VoIP providers are users of our services, this trend may negatively affect demand for our services.

Currently, the status of VoIP providers with respect to access charges is not clear, although a report issued by the FCC in 1998 suggests that some forms of VoIP may constitute “telecommunications services” that are subject to regulation as common carriers, and therefore subject to payment of access charges under federal law. The 1998 report also suggested, however, that this regulatory treatment would not apply until after the FCC determined which specific services were subject to regulation. A 2004 FCC order determined that telephone services that both originate and terminate on conventional telephone lines are common carrier services that are subject to access charges even if they are carried in VoIP form for some portion of the service. The 2004 FCC order did not address the treatment of VoIP in other situations. The intercarrier compensation NPRM described above seeks comments regarding whether VoIP providers will be required to pay access charges. It is unclear whether or when any final rules on this matter will be issued.

State Regulation

State agencies exercise jurisdiction over intrastate telecommunications services, including local telephone service and in-state toll calls. To date, we are authorized or have the right to provide intrastate local telephone and long-distance telephone services in forty-seven states, Puerto Rico and the District of Columbia. As a condition to providing intrastate telecommunications services as a common carrier, we are required, among other things, to:

| • | file and maintain intrastate tariffs or price lists in most states describing the rates, terms and conditions of our services; |

| • | comply with state regulatory reporting, tax and fee obligations, including contributions to intrastate universal service funds; and |

| • | comply with, and to submit to, state regulatory jurisdiction over consumer protection policies (including regulations governing customer privacy, changing of service providers and content of customer bills), complaints, quality of service, transfers of control and certain financing transactions. |

Generally, state regulatory authorities can condition, modify, cancel, terminate or revoke certificates of authority to operate in a state for failure to comply with state laws or the rules, regulations and policies of the state regulatory authority. Fines and other penalties may also be imposed for such violations.

In addition, states have authority under the Telecommunications Act to approve or (in limited circumstances) reject agreements for the interconnection of telecommunications carriers’ facilities with those of the incumbent local exchange carrier, to arbitrate disputes arising in negotiations for interconnection and to

13

Table of Contents

interpret and enforce interconnection agreements. In exercising this authority, the states determine the rates, terms and conditions under which we can obtain collocation in ILEC central offices and interconnection trunks for termination of local traffic to ILEC customers, under the FCC rules. The states may re-examine these rates, terms and conditions from time to time.

Some state regulatory authorities assert jurisdiction over the provision of transit services in connection with local calls, particularly the ILECs’ provision of the service. Several state regulatory authorities have initiated proceedings to examine the regulatory status of transit services. Some states have taken the position that transit service is an element of the “transport and termination of traffic” services that incumbent ILECs are required to provide at rates based on incremental cost analysis under the Telecommunications Act, while other states have ruled that the Telecommunications Act does not apply to these services. For example, a declaratory action was commenced in 2008 with the Connecticut Department of Public Utility Control, or the DPUC, pursuant to which a competitive carrier requested that the DPUC order the ILEC to reduce its transit rate to a cost-based rate similar to a rate offered by that ILEC in a different state or to a rate justified in a separate cost proceeding. In 2010, the DPUC ordered the ILEC to lower its rate to a cost-based rate that was significantly lower than the existing rate. Although the ILEC has filed an appeal of that order to the appropriate federal court, we have in some cases lowered the rate we charge our customers as a result of the DPUC’s ruling. Additionally, in December 2008, the United States District Court for the District of Nebraska held that the ILEC must provide local transit service under the Telecommunications Act and that the Nebraska Public Service Commission did not err in using TELRIC, an incremental cost-based methodology, to determine the applicable rate. Similarly, the Public Service Commission of Georgia and the Public Utilities Commission of Ohio each have open rulemaking proceedings addressing, among other items, applying incremental cost-based pricing for local transit services. While we cannot predict whether or how such pricing rules may finally be adopted or implemented, the rulemaking in Ohio allows for waivers of pricing rules based on the existence of competition. We would pursue this waiver if necessary. If, as a result of any state proceeding, an ILEC is required to reduce or limit the rate it charges for transit service, we would likely be forced to reduce our rate, which could have a material and adverse affect on our business, financial condition and operating results. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

To date, the FCC has not resolved this dispute over interpretation of the Telecommunications Act, resulting in disparate pricing of these services among the states. Many states also have asserted that they have jurisdiction over interconnections between competitive carriers. Our success in securing interconnections with competitive carriers may be affected by the degree of jurisdiction states exert over such interconnections. If a state takes the position that it does not have jurisdiction over such interconnection or over the regulation of competitive local transit services generally, we may be unable to assert successfully a legal right to terminate transit traffic to a carrier that refuses to accept terminating traffic from us on reasonable or any terms. Such an inability may have a material adverse effect on our business, financial condition and operating results. See “Risk Factors—Carriers may refuse to directly interconnect with us and consequently, we would be unable to terminate our customers’ traffic to them” in Item 1A below.

Additionally, we recently began providing access services, which is part of the origination and termination of long distance calls, using our tandem switches. Under the Telecommunications Act, state governments currently exercise jurisdiction over intrastate access services. In some but not all states, intrastate access charges are considerably higher than interstate access charges, creating a significant revenue opportunity for us. Some states have imposed limits on the access charges that competitive carriers may impose, and some are currently considering whether to mandate a decrease in existing intrastate access charges. Also, as noted above, the FCC has asked for comments on the issue of intercarrier compensation and, as a result of any proceeding, could require states to reduce their intrastate access charges. If intrastate access charges are eliminated or lowered for any reason, such change could have a material and adverse effect on our business, financial condition, operating results or growth opportunities. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

14

Table of Contents

Intellectual Property

Our success is dependent in part upon our proprietary technology. We rely principally upon trade secret and copyright law to protect our technology, including our software, network design, and subject matter expertise. We enter into confidentiality or license agreements with our employees, distributors, customers and potential customers and limit access to and distribution of our software, documentation and other proprietary information. We believe, however, that because of the rapid pace of technological change in the communications industry, the legal protections for our services are less significant factors in our success than the knowledge, ability and experience of our employees and the timeliness and quality of our services.

We have been granted one patent and have three additional patent applications pending with the U.S. Patent and Trademark Office.

The granted patent addresses our core business, the operation of a managed tandem network. In June 2008, we commenced an action generally alleging that Peerless Network was infringing on the granted patent. Peerless Network asserted several counterclaims against us, generally alleging that (i) our patent was invalid and unenforceable under a variety of theories, (ii) that assertion of the patent amounted to patent misuse and violated certain monopolization laws, and (iii) certain conduct surrounding the litigation gave rise to a tortious interference claim. On September 2, 2010, the court hearing the case granted Peerless Network’s motion for summary judgment. The court found that the ’708 Patent was invalid in light of a prior patent. Each party plans to appeal various rulings made against it in the litigation. See “Item 3. Legal Proceedings.”

One of the pending patent applications addresses a series of traffic routing designs developed by us to assist our customers in reducing their internal network operating costs. The second pending patent application covers a set of proprietary operating systems and software developed by us to manage our network. The third pending patent application relates to systems designed to facilitate the efficient treatment of inter-network communications transmissions, such as a telecommunications transmission between an international service provider network and a domestic service provider network. There can be no assurance regarding how, whether or when these additional patent applications may be granted as issued patents.

OTHER MATTERS

Employees

At December 31, 2010, we had 230 full-time employees, including 176 in Operations, 22 in Sales and Marketing and 32 in General and Administrative functions. The number of employees increased by 56.5%, up from 147 on December 31, 2009. Of this increase, 75 or 51% was due to the acquisition of Tinet on October 1, 2010. We expect to further increase our headcount in 2011 as we continue to expand both existing and new markets. Of our employees, 103 were located at our corporate office in Chicago, Illinois. The remaining 127 employees are located in our offices in Italy and Germany and throughout the world at our switch locations. No labor union represents our employees located in the United States. Certain of our employees located in Italy and Germany are members of industry trade unions. We have not experienced any work stoppages and consider our relations with our employees to be good. In addition, we have 35 sales agents that work throughout the areas in which Tinet operates.

Information Available on the Internet

Our internet address is www.neutraltandem.com. The information contained on or connected to our web site is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this or any other report filed with the Securities and Exchange Commission (the “SEC”). Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to those reports, are available free of charge through our web site as soon as reasonably practicable after we file them with, or furnish them to, the SEC. These reports may also be obtained at the SEC’s public reference room at 100 F Street, N.E., Washington, DC 20549. The SEC also maintains a web site at www.sec.gov that contains reports, proxy statements and other information regarding SEC registrants, including Neutral Tandem.

15

Table of Contents

Corporate Information

Neutral Tandem’s principal executive offices are located at 550 West Adams Street, Suite 900, Chicago, Illinois, 60661.

EXECUTIVE OFFICERS AND DIRECTORS

The names, ages and positions of our executive officers and directors, as of December 31, 2010, are set forth below:

| Name |

Age | Position(s) | ||||

| Rian J. Wren |

54 | Chief Executive Officer and Director | ||||

| Robert Junkroski |

46 | Chief Financial Officer and Executive Vice President | ||||

| Surendra Saboo |

51 | President and Chief Operating Officer | ||||

| Richard Monto |

46 | General Counsel, Secretary and Senior Vice President, External Affairs | ||||

| David Lopez |

46 | Senior Vice President of Sales | ||||

| James P. Hynes |

63 | Director, Chairman | ||||

| Peter J. Barris |

59 | Director | ||||

| G. Edward Evans |

49 | Director | ||||

| Robert C. Hawk |

71 | Director | ||||

| Lawrence M. Ingeneri |

52 | Director | ||||

Rian J. Wren. Mr. Wren joined us in February 2006 and has served as our Chief Executive Officer and a Director since that time. On February 16, 2011, Mr. Wren announced that Mr. Wren was retiring as our Chief Executive Officer effective April 1, 2011, but would continue to serve as a Director. Mr. Wren also served as our President from February 2006 until November 2010. Prior to joining us, Mr. Wren was Senior Vice President and General Manager of Telephony for Comcast Cable from November 1999 to August 2005. Mr. Wren joined Comcast in 1999 and was named CEO of Broadnet, Comcast’s international wireless company located in Brussels, Belgium in 2000. After returning to the United States, he served as the Senior Vice President and General Manager of Telephony for Comcast Cable Division. Prior to joining Comcast, Mr. Wren held several senior management positions at AT&T from 1978 to 1999, including President of the Southwest Region, and worked in the Consumer, Business, Network Services, and Network Systems Manufacturing divisions for more than 20 years. Mr. Wren holds a B.S. degree in Electrical Engineering from the New Jersey Institute of Technology and an M.S. in Management from Stanford University, which he attended as a Sloan Fellow.

Robert Junkroski. Mr. Junkroski has been with the Company since it commenced services, and has served as our Chief Financial Officer and Executive Vice President since that time. Prior to joining us, Mr. Junkroski held the position of Vice President of Finance with Focal Communications Corporation, or Focal (now part of Level 3 Communications Inc.), from 1999 to 2002. Mr. Junkroski previously served as Focal’s Treasurer and Controller from 1997 to 2001. Focal filed for bankruptcy protection in December 2002. Before joining Focal, Mr. Junkroski was Controller for Brambles Equipment Services, Inc. and Focus Leasing Corporation. Mr. Junkroski holds a B.B.A. degree in Accounting and Economics from University of Dubuque and an M.B.A. concentrating in Finance and Accounting from Roosevelt University, and is a Certified Public Accountant in Illinois.

Surendra Saboo. Dr. Saboo joined us in May 2006 as our Chief Operating Officer, and in 2010, was appointed President of Neutral Tandem. Prior to joining us, Dr. Saboo was the Vice President of Product Development and Operations for Voice Services at Comcast Corporation from January 2002 to March 2006. From June 2000 to December 2001, Dr. Saboo served as Executive Vice President and Chief Operating Officer of Broadnet Europe, SPRL, a pan-European subsidiary of Comcast Corporation. Prior to joining Comcast Corporation, Dr. Saboo was the Chairman, Chief Executive Officer and founder of Teledigm, an e-CRM software product company in Dallas, Texas. Prior to starting Teledigm, Dr. Saboo spent 14 years at AT&T in a

16

Table of Contents

variety of operating areas including research and development, engineering, product management, strategy, systems development and operations. Dr. Saboo began his career with AT&T in 1986 as a Member of Technical Staff at Bell Laboratories in Holmdel, NJ. Dr. Saboo holds a B.S.M.E. degree from Birla Institute of Technology, India as well as M.S. and Ph.D. degrees in Operations Research from Ohio State University.

Richard Monto. Mr. Monto joined us in 2007, and has served as our General Counsel and Corporate Secretary since February 2008. Mr. Monto has 15 years of diversified telecommunications experience. From 2001 to 2005, Mr. Monto held senior positions, including Chief Legal Officer, with Universal Access Global Holdings Inc. From 1995 and 2000, Mr. Monto held various legal positions with MCI Telecommunications. Prior to MCI, Mr. Monto practiced for several years at private law firms, including the law firm of Sonnenschein, Nath and Rosenthal. Mr. Monto holds a B.A. degree from the University of Michigan in Russian and Eastern European Studies and a J.D. from the Boston University School of Law.

David Lopez. Mr. Lopez joined us in 2003 and has served as our Senior Vice President of Sales since that time. As Senior Vice President of Sales, Mr. Lopez oversees the management and growth of all Neutral Tandem carrier accounts. Mr. Lopez brings a wealth of sales management experience to Neutral Tandem and has more than 20 years experience in the telecommunications industry. He has been with Neutral Tandem since its inception and has secured agreements with nearly every national wireless carrier and several dozen other competitive landline and cable providers. For nearly 20 years, Mr. Lopez has provided account management responsibilities at Centel, Sprint, and Focal Communications Corporation. In his most recent position, Mr. Lopez provided sales management for Focal’s largest and most successful market from 1997 to 2003. During his tenures at Centel and Sprint from 1992 to 1997, Mr. Lopez held national account positions with responsibility for local service, Centrex, and PBX equipment to Fortune 500 companies. Lopez holds a B.S. in Marketing from Illinois State University.

James P. Hynes. Mr. Hynes co-founded Neutral Tandem in 2001, and served as Chief Executive Officer until February 2006, after which he became Executive Chairman. In December 2006 Mr. Hynes stepped down as Executive Chairman and assumed the title of Chairman of the Board, a position he holds today. Active in the industry for over 30 years, Mr. Hynes personally directed the establishment of COLT Telecommunications in Europe as their first CEO in 1992. As Chairman of the Board, he led COLT’s initial public offering in 1996. Mr. Hynes established MetroRED Telecom in South America and Mexico, as well as KVH Telecom in Tokyo. Concurrent with taking on these operating roles, he was Group Managing Director at Fidelity Capital for 10 years. His career has included senior positions with Chase Manhattan, Continental Corporation, Bache & Co. and New York Telephone. Mr. Hynes is Chairman of the Board of Trustees of Iona College and is also on the North American Board of the SMURFIT Graduate School of Business, University College Dublin in Ireland.

Peter J. Barris. Mr. Barris has served as a Director since 2003. Mr. Barris is currently the Managing General Partner of New Enterprise Associates, Inc. (NEA) where he specializes in information technology investing. Mr. Barris has been with NEA since 1992, and he serves as a general partner or other officer of various entities affiliated with NEA. From 1988 to 1990, Mr. Barris was President and Chief Operating Officer at LEGENT Corporation. Mr. Barris held various management positions at UCCEL Corporation from 1985 to 1988. Prior to that, Mr. Barris also held various management positions between 1977 and 1985 at the General Electric Company, including Vice President and General Manager at GE Information Services, Inc. Mr. Barris also serves as a member of the Boards of Directors of InnerWorkings, Inc. (NASDAQ: INWK), where he also serves as a member of the audit, compensation and nominating and corporate governance committees, Vonage Holdings Corp. (NASDAQ: VG), where he also serves as a member of the compensation and nominating and corporate governance committees, Echo Global Logistics, Inc. (NASDAQ: ECHO), where he also serves as a member of the nominating and corporate governance committee and chairman of the compensation committee, Broadview Network Holdings, Inc., Cyren Call Communications Corporation, Groupon, Inc., Jobfox, Inc., MBXG Holdings, Inc., SnagFilms, Inc. and Hillcrest Laboratories, Inc. Mr. Barris is a member of the Board of Trustees of In-Q-Tel, Northwestern University and the University of Virginia, College Foundation.

17

Table of Contents