Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - Magyar Bancorp, Inc. | form8k-113091_mgyr.htm |

2011 Annual Shareholders Meeting

March 16, 2011

1

Forward Looking Statements

This presentation contains statements about future events that constitute forward-

looking statements within the meaning of the Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-

looking statements may be identified by reference to a future period or periods, or

by the use of forward- looking terminology, such as “may,” “will,” “believe,”

“expect,” or similar terms or variations on those terms, or the negative of those

terms. Forward-looking statements are subject to numerous risks and

uncertainties, including, but not limited to, those risks previously disclosed in the

Company’s filings with the SEC, general economic conditions, changes in interest

rates, regulatory considerations, competition, technological developments,

retention and recruitment of qualified personnel, and market acceptance of the

Company’s pricing, products and services, and with respect to the loans extended

by the Bank and real estate owned, the following: risks related to the economic

environment in the market areas in which the Bank operates, particularly with

respect to the real estate market in New Jersey; the risk that the value of the real

estate securing these loans may decline in value; and the risk that significant

expense may be incurred by the Company in connection with the resolution of

these loans. The Company wishes to caution readers not to place undue reliance

on any such forward-looking statements, which speak only as of the date made.

The Company does not undertake and specifically declines any obligation to

publicly release the result of any revisions that may be made to any forward-

looking statements to reflect events or circumstances after the date of such

statements or to reflect the occurrence of anticipated or unanticipated events.

looking statements within the meaning of the Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-

looking statements may be identified by reference to a future period or periods, or

by the use of forward- looking terminology, such as “may,” “will,” “believe,”

“expect,” or similar terms or variations on those terms, or the negative of those

terms. Forward-looking statements are subject to numerous risks and

uncertainties, including, but not limited to, those risks previously disclosed in the

Company’s filings with the SEC, general economic conditions, changes in interest

rates, regulatory considerations, competition, technological developments,

retention and recruitment of qualified personnel, and market acceptance of the

Company’s pricing, products and services, and with respect to the loans extended

by the Bank and real estate owned, the following: risks related to the economic

environment in the market areas in which the Bank operates, particularly with

respect to the real estate market in New Jersey; the risk that the value of the real

estate securing these loans may decline in value; and the risk that significant

expense may be incurred by the Company in connection with the resolution of

these loans. The Company wishes to caution readers not to place undue reliance

on any such forward-looking statements, which speak only as of the date made.

The Company does not undertake and specifically declines any obligation to

publicly release the result of any revisions that may be made to any forward-

looking statements to reflect events or circumstances after the date of such

statements or to reflect the occurrence of anticipated or unanticipated events.

2

Magyar Background

} Magyar Bank established in 1922

} Magyar Bancorp completed its reorganization

into the Mutual Holding Company structure

and public offering in 2006

into the Mutual Holding Company structure

and public offering in 2006

} 6 branches in Middlesex and Somerset

Counties

Counties

} Trades on NASDAQ under symbol MGYR

} Main business lines/strategy:

} Full-service Community Bank

} Commercial/Residential lending & deposits

} Community Banking is our business strategy

3

Magyar Bank Branch Locations

4

Branchburg

1000 Route 202 South

New Brunswick

(Corporate Headquarters)

(Corporate Headquarters)

400 Somerset Street

North Brunswick

582 Milltown Road

South Brunswick

3050 Highway 27

Existing Locations

New Brunswick

(Inside Child Health Institute)

93 French Street

Coming June 2011

Bridgewater

(opened June 2010)

475 North Bridge Street

Edison

1167 Inman Avenue

1167 Inman Avenue

Deposits by Branch

5

As of 9/30/10

Fiscal Year 2010 Highlights

} Positive earnings in all four quarters (six

consecutive)

consecutive)

} FY 2010 Net Income - $3.9 million, compared to net

loss of $6.1 million in FY 2009

loss of $6.1 million in FY 2009

} Increased net interest margin by 38bps

} Checking deposits increased 4.8% of total deposits

} Reduced high cost CDs to 43.9% of total deposits

6

Fiscal Year 2010 Highlights

} Increased capital $4.2 million, (10%) year over

year

year

} Positive earnings

} Managed reduction of higher risk-weighted assets

} Expense control program

} Reduced non-performing loans year over year

} Bridgewater office - Opened June 28, 2010

} CRA - “Outstanding”

7

Fiscal Year 2010 Summary

8

Total Assets

9

Total Assets declined 5% in FY10

$325,602

$368,777

$375,560

10

$427,932

CDs as percentage of deposits decreased to 43.9% in FY10

Checking Deposit Growth

11

$51,010

$53,672

$84,677

$88,771

CAGR: Compound Annual Growth Rate

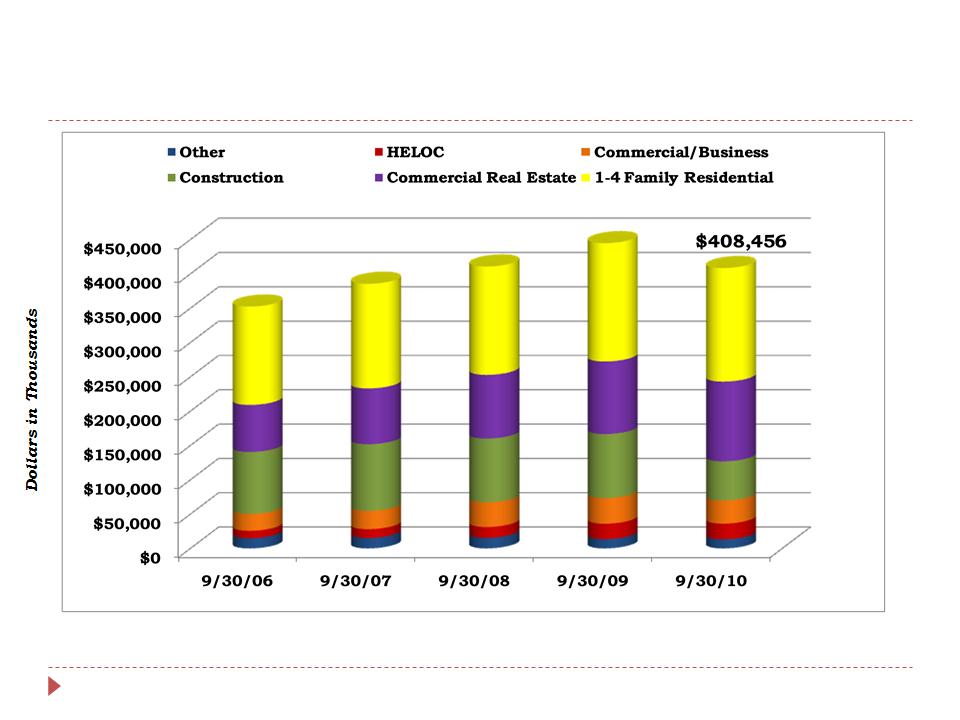

Loan Composition

$352,353

$385,582

$410,728

12

$444,780

Construction loans as percentage of loans declined from

20.9% on 9/30/09 to 14.0% on 9/30/10

20.9% on 9/30/09 to 14.0% on 9/30/10

13

Available lines declined 65% from $23M to $8M.

Construction Loans declined 38.7% in FY10

Non-Performing Loans

14

$20,068

$7,400

$8,048

$33,484

$27,417

Other Real Estate Owned

$0

$2,238

$4,666

$5,562

$12,655

Non-Performing Assets

16

Source: SNL Financial

Peer Group: MHCs with total assets $400MM- $750MM

Peer Group: MHCs with total assets $400MM- $750MM

Sale of Real Estate Owned (REO)

} Magyar Bank sold four REO properties in FY

2010 totaling $3.6 million for a net gain of

$62,000.

2010 totaling $3.6 million for a net gain of

$62,000.

} Currently have contracts of sale on four

properties with a carrying value of $7.3 million

(56% of REO at 12/31/2010). No additional

loss is expected from these sales.

properties with a carrying value of $7.3 million

(56% of REO at 12/31/2010). No additional

loss is expected from these sales.

17

18

10-year Treasury/Fed Funds

19

Net Interest Margin

Source: SNL Financial

Peer Group: MHCs with total assets $400MM- $750MM

Peer Group: MHCs with total assets $400MM- $750MM

Quarterly Net Income (Loss)

20

12/31/08 3/31/09 6/30/09 9/30/09 12/31/09 3/31/10 6/30/10 9/30/10 12/31/10

(Includes

$3.4 million

$3.4 million

Income Tax

Benefit)

Benefit)

FY09: Net Loss $6.1 Million

FY10: Net Income $3.9 million

Non-interest Expense

} Total non-interest expense increased only

$92,000 (1%) in FY 2010.

$92,000 (1%) in FY 2010.

} Non-performing asset expense increased $436,000 (+78%)

} FDIC Insurance Assessments increased $200,000 (+19%)

} Occupancy expenses increased $145,000 (+6%)

} However, compensation and benefit expense

decreased $582,000 (7%).

decreased $582,000 (7%).

} Restructuring in FYs 2009 and 2010 reduced employee

count and benefits.

count and benefits.

} Board cash compensation decreased $111,000, or 25%

21

Core Earnings Enhancements

} Net interest margin

} Resolution of non-performing assets

} Residential mortgage business returning

} Retail operations

} Expense control

} Reap benefits of restructuring

} Resolution of non-performing assets

} New FDIC insurance assessment base

22

Magyar Bank Capital Ratios

23

As of December 31, 2010

*”Well-Capitalized” threshold as defined by Sec. 38 of the Federal Deposit Insurance Act.

Stock Price Performance

24

MGYR Stock Price & Volume Chart

25

Price on

3/15/11

$4.25

Price on

2/23/10

$3.27

MGYR Stock Performance

From 2/23/10 - 3/15/11

MGYR: +29.97%

MHC Peer Group: -7.13%

SNL Thrift MHCs: -6.29%

Source: SNL Financial

Peer Group: MHCs with total

assets $400MM-$750MM

assets $400MM-$750MM

Fiscal Year 2011

27

Fiscal Year 2011

} Reduce non-performing assets

} Increase core earnings

} Growth in residential and commercial lending

} FDIC Assessment decrease April 1

} New method of calculating FDIC insurance

premium favors community banks

premium favors community banks

} Dodd-Frank Impact

} Edison Branch Grand Opening

28

Community Banking IS our Business

Strategy

Strategy

} Relationships key driver to growth

} Residential Mortgages coming back to

community banks

community banks

} Commercial Lending

} Non-Profit Organizations

} Over $2.7 million in deposits

} Great referral sources

} CRA - “Outstanding” rating

} Employees volunteer and serve on boards of local

organizations

organizations

29

Questions?

30