Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CINCINNATI BELL INC | d8k.htm |

Cincinnati Bell Investor Day

Houston, Texas

March 16, 2011

Exhibit 99.1 |

2

2

2

Today’s Agenda

Welcome & Introduction

Kim Sheehy, Vice President, Investor Relations and Treasurer

Company & Strategy Overview

Jack Cassidy, President & Chief Executive Officer

Financial Update

Gary Wojtaszek, Chief Financial Officer

Cincinnati Bell Communications

Ted Torbeck, President, Cincinnati Bell Communications

Data Center Strategy

Gary Wojtaszek, Chief Financial Officer

Data Center Colocation

Dave Ferdman, Chief Executive Officer, CyrusOne

Customer Perspective

Ken Braud, Chief Information Officer, Halliburton

Question & Answer

Cincinnati Bell Management Team |

3

3

3

Safe Harbor

Certain of the statements and predictions contained in this presentation constitute

forward-looking statements within the meaning of the Private Securities

Litigation Reform Act. In particular, statements, projections or

estimates that include or reference the words “believes,”

“anticipates,”

“plans,”

“intends,”

“expects,”

“will,”

or any similar expression fall within the safe harbor for forward-looking

statements contained in the Reform Act. Actual results or outcomes may

differ materially from those indicated or suggested by any such

forward-looking statement for a variety of reasons, including, but not limited to:

changing market conditions and growth rates within the telecommunications industry or

generally within the overall economy; changes in competition in markets in

which the company operates; pressures on the pricing of company products and

services; advances in telecommunications technology; the ability to generate

sufficient cash flow to fund the company’s business plan, repay the company’s debt and interest

obligations, and maintain its networks; the ability to refinance

indebtedness when required on

commercially reasonable terms; changes in the telecommunications

regulatory environment; changes in

the demand for the company’s services and products; the demand for particular

products and services within the overall mix of products sold, as the

company’s products and services have varying profit margins; the

company’s ability to introduce new service and product offerings on a timely and cost

effective basis; work stoppage caused by labor disputes; restrictions imposed under

various credit facilities and debt instruments; the company’s ability to

attract and retain highly qualified employees; the company’s ability to

access capital markets and the successful execution of restructuring

initiatives; changes in the funded status of the company’s retiree

pension and healthcare plans; disruption in operations caused by a health

pandemic, such as the H1N1 influenza virus; changes in the company’s

relationships with current large customers, a small number of whom account for a

significant portion of company revenue; disruption in the company’s

back-office information technology systems, including its billing system;

the company’s ability to integrate successfully the business of Cyrus Networks, LLC with

the company’s existing operations and to achieve the anticipated benefits

of the acquisition of Cyrus

Networks, LLC; and failure of or disruption in the operation of the company’s

data centers. More information on potential risks and uncertainties is

available in recent filings with the Securities and

Exchange Commission, including Cincinnati Bell’s Form 10-K report, Form

10-Q reports and Form 8-K reports. The forward-looking

statements included in this presentation represent company estimates as of

March 16, 2011. Cincinnati Bell anticipates that subsequent events and

developments will cause its estimates to change.

|

4

4

4

Non GAAP Financial Measures

This presentation contains information about adjusted earnings before interest,

taxes, depreciation and amortization (Adjusted EBITDA), Adjusted

EBITDA margin, free cash flow,

and net debt. These are non-GAAP financial measures used by Cincinnati Bell

management when evaluating results of operations and cash flow. Management

believes these measures also provide users of the financial statements with

additional and useful comparisons of current results of operations and cash

flows with past and future periods. Non-GAAP financial measures should

not be construed as being more important than comparable GAAP measures.

Detailed reconciliations of Adjusted EBITDA, free cash flow (including the

Company’s definition of these terms), and net debt to comparable GAAP

financial measures can be found in the appendix to this presentation.

|

Jack

Cassidy President and CEO |

6

6

6

135 year old full-service provider of data and

voice communications services over wireline

and wireless networks in the Greater Cincinnati

and Dayton areas

Provides business customers with outsourced

data center colocation operations in world

class, state-of-the-art data center facilities

Strong brand recognition and

reputation for service

Proven capabilities with track record

of delivering results

Well positioned for growth in the

Data Center industry

2010 Revenue

(1)

$1,377MM

Wireline

IT Services

and Hardware

Wireless

$502MM

Data Center

Colocation

2010 Adjusted EBITDA

(2)

Cincinnati Bell Overview

(1)

Before intercompany eliminations

(2)

Before Corporate expenses |

7

7

7

Wireline: 674K access lines

Wireless: 509K wireless subscribers

Broadband: 256K high speed internet

subscribers

Entertainment: 28K Fioptics

subscribers

Regional market leader

offering full bundle

of integrated telecommunications services

Successfully

defending

market

share

in

the face of intense competition

Expanding fiber network

to offer digital

television and faster Internet

2010 Communications Revenue Mix

Voice –Business

Data

Long Distance and VoIP

Other

Voice –Consumer

Cincinnati Bell Communications

23%

19%

14%

6%

38% |

8

8

8

Locations: Cincinnati, Houston, Dallas,

Austin, Chicago, South Bend and London

Square footage: 639K square feet

Utilization: 88% (as of Dec. 31, 2010)

Activity: Signed 45K square feet of DC

space in Q4 2010

Five years of organic data center growth

enhanced by CyrusOne

acquisition in June

2010

Premier regional facilities with growing

national presence

Path forward to become preferred global

provider

of

data

center

colocation

to

Fortune 1000

Cincinnati Bell Data Center Colocation |

9

9

9

Net Debt / Adjusted EBITDA

4.2x

4.0x

4.1x

4.9x

3.0

4.0

5.0

6.0

Dec-07

Dec-08

Dec-09

Dec-10

(x)

$1,349

$1,403

$1,336

$1,377

1,150

1,300

1,450

2007

2008

2009

2010

Revenue

($MM)

Adjusted EBITDA

$473

$480

$470

$502

400

450

500

550

2007

2008

2009

2010

($MM)

Net Debt

$2,443

$1,942

$1,932

$1,981

0

1,000

2,000

3,000

Dec-07

Dec-08

Dec-09

Dec-10

($MM)

Proven Performance Track Record |

10

10

10

Consumer

Business

Voice -

Business

Other Wireline

Voice -

Consumer

Wireless

Q4 2010 Customer Channel Mix

Q4 2010 Product Mix by Revenues*

* Before intercompany eliminations

IT Services and

Hardware

Revenue Diversification Strategy

Wireline

Data

Data Center

Colocation

34%

66%

10%

10%

19%

10%

19%

21%

11% |

11

11

11

Maintain profitability and

cash flow of Communications

through defending core

business and aggressive

cost reduction initiatives

Create Sustainable Shareholder Value

Invest to establish national

then global footprint to

become preferred global

provider to Fortune 1000

customers

Implement fully financed,

disciplined data center

expansion plan and

optimize capital structure

Generate Strong

Operating Cash Flows

Grow Data Center

Colocation

Maintain Financial

Discipline

Clear Strategic Focus |

Gary Wojtaszek

Chief Financial Officer |

13

13

13

2010 Highlights –

Solid Performance, Positive Outlook

Adjusted EBITDA

of $502 million is

highest since 2003

CyrusOne

acquisition

generated

62

percent Adjusted EBITDA Margin;

$45 million of revenue; and $28

million of Adjusted EBITDA

(reflects 6 months of operation)

Free

Cash

Flow

of

$149

million

equates to 27 percent yield

Repurchased

4 million shares for

$10 million in Q4 using excess free

cash flow

•

Growth in Revenue and Adjusted

EBITDA; solid contributions from

CyrusOne acquisition in June 2010

•

Revenue, Adjusted EBITDA and

Free Cash Flow exceeded financial

guidance

•

Completed refinancing to

strengthen balance sheet; no

maturities until 2015; 90 percent of

maturities are 2017 and beyond |

14

14

14

Wireline

•

Solid Adjusted EBITDA margin at 47

percent

•

Fioptics entertainment customers

totaled 28,000 at year-end

•

Fioptics homes passed increased to

79,000 with approximately 30 percent

penetration of homes passed after one

year

Wireless

•

Adjusted EBITDA of $91 million;

highest since 2003

•

Q4 net adds included 2,400

postpaid, 5,500 prepaid, 9,000

postpaid smartphones

•

Full-year postpaid data ARPU up 17

percent

IT Services & Hardware

•

Q4 Revenue up 12 percent to $78 million

•

Q4 Adjusted EBITDA up 16 percent

Data Center Colocation

•

2010 Adjusted EBITDA of $70 million,

up 119 percent year-over-year driven by

CyrusOne acquisition

•

CyrusOne Adjusted EBITDA margin of 62

percent

•

Q4 utilization rate at 88 percent; 45,000 sq ft

of new space contracted in Q4

2010 Segment Highlights |

15

15

15

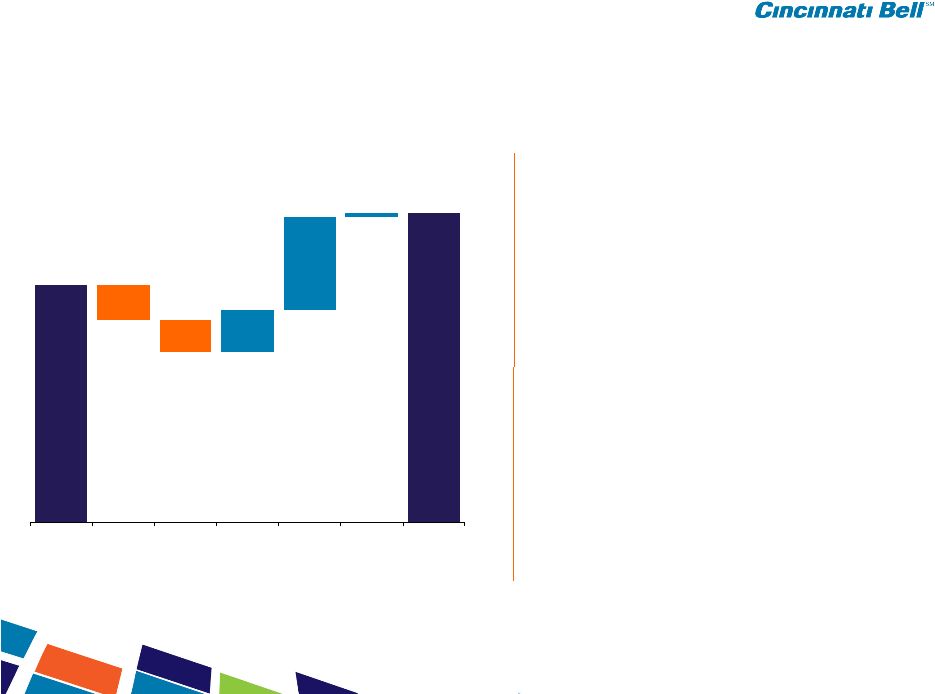

2010 Revenue

$54M increase in Data Center Colocation

•

including $45M from CyrusOne acquisition

$23M increase in IT Services and Hardware

•

$14M / 9% increase in Telecom

and IT equipment

•

$9M increase from Managed &

Professional Services

($18M) decrease in Wireless

•

($14M) decrease in postpaid service

revenue due to fewer subscribers

($21M) decrease in Wireline

•

Access line loss was 7% driving

revenue decline

•

8% LD and VoIP growth

•

Added 13K fiber entertainment subs and

9K high-speed internet subs in 2010

$1,336

($21)

($18)

$23

$54

$3

$1,377

2009

Wireline

Wireless

IT Services &

Hardware

DC

Colocation

Eliminations

2010

($’s in millions) |

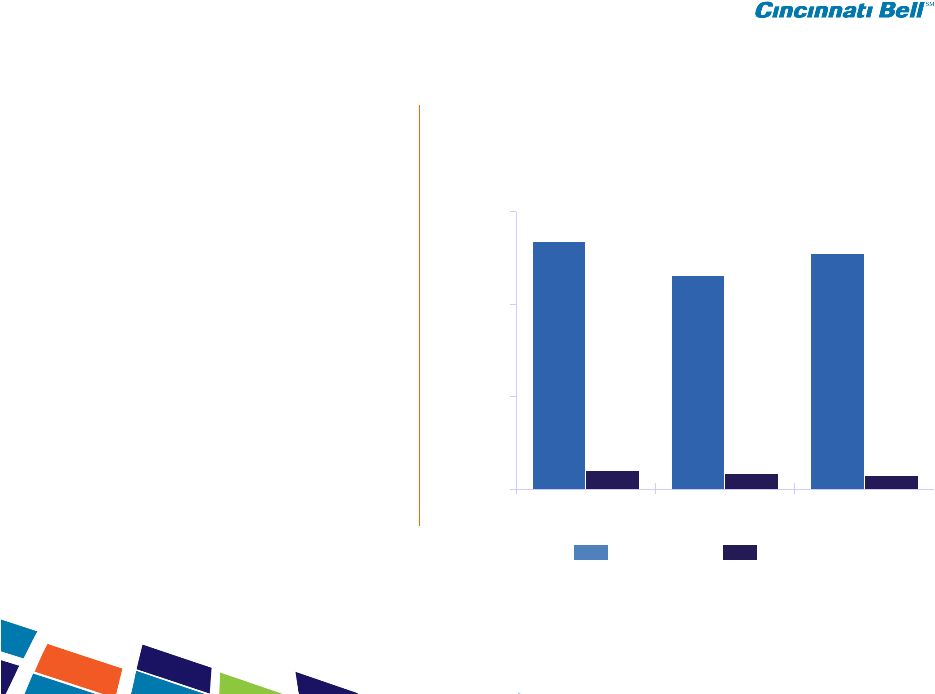

16

16

16

$470

$1

$502

($19)

$14

($3)

$38

2009

Wireline

Wireless

IT Services &

Hardware

DC

Colocation

Corporate

2010

2010 Adjusted EBITDA

$38M increase in Data Center Colocation

•

$28M from CyrusOne acquisition

•

$10M from Cincinnati-based operations

$14M increase in Wireless

•

$10M for renegotiated roaming contracts

•

$3M lower bad debts

•

$7M for lower contract services due to

outsourcing and cost reduction initiatives

•

$9M for reduction in subsidies and handset

costs

•

Partially offset by $15M lower service

revenue

($19M) decrease in Wireline

•

Access line loss was 7% driving Adjusted

EBITDA decline

•

Adjusted EBITDA margin of 47% down

slightly

($3M) decrease in IT Services and Hardware

•

Primarily payroll costs

($’s in millions)

Note: May not foot due to rounding |

17

17

17

2010 Free Cash Flow

2010 FCF of $149M, decrease of $15M

from 2009

•

$45M lower capital spending

•

$31M increase in Adjusted EBITDA

•

($53M) from higher interest & swap

term payments in 09

•

($23M) sale of wireless towers in 2009

net of pension prepayment

•

($15M) working capital

Free Cash flow yield 27%

$149

($15)

$83

($106)

($53)

$31

$45

$164

YTD 09

Capex

EBITDA

Int Pmts/

09 Swaps

Wireless

Towers Sale

Pension

Post-

Retirement

& other

WC/Other

YTD 10

($’s in millions) |

18

18

18

Disciplined Investment of Cash Flow

Cash Flow From Operations

2006

$335M

2007

$309M

2008

$404M

2009

$266M

2010

$300M

Fioptics &

Maintenance Capex

Data Center

Expansion

Acquisitions

Debt Buyback/

Share Repurchase |

19

19

19

2011 Earnings Guidance and Focus

•

Generating strong operating cash flows

•

Growing Data Center Colocation

•

Maintaining financial discipline

2011 Guidance

Revenue

$ 1.4 billion

Adjusted EBITDA*

Approx. $530 million

Free Cash Flow

Approx. $5 million

* Plus or minus 2 percent; reflects 2011 definition of Adjusted EBITDA

|

Ted

Torbeck President, Cincinnati Bell Communications

|

21

21

21

Focused on maintaining margin stability in

declining business through aggressive cost

reductions

•

Sourcing initiatives to save more than $10M

•

Other cost-out plans implemented

Access line loss is stable, 6.8% for 2010

Fioptics product suite represents growth area,

28K entertainment subs

•

Up 85% vs. 2009

•

Penetration of homes passed is strong at

approximately 30%

•

Consumer ARPU of $115 in Q4 2010

Positive high-speed Internet net adds in

saturated market

Wireline Performance

($MM)

Access Lines & High-speed Internet Subscribers

(000s)

780

724

674

238

248

256

0

500

1,000

2008

2009

2010

$796

$763

$743

$378

$365

$346

48%

48%

47%

0

500

1,000

2008

2009

2010

Revenue

Adj. EBITDA

Adj. EBITDA Margin

Access Lines

High-Speed Internet

Wireline Overview |

22

22

22

Disciplined Expense Management

Annualized Cost Reductions ($MM)

Sourcing initiatives

$10 -

$13

Payroll and

employee-related

$10 -

$12

Other cost-out programs

$5 -

$10

Total Cost Reductions

$25 -

$35

Wireline Adjusted EBITDA

margins ranged between 47%

and 48% (2008 –

2010)

•

Annual revenue decline of 3-

4% due to access line loss

•

Wireline headcount reduced

from 2,144 in 2008 to 1,863 in

2010

Margins will be maintained with:

•

Sourcing initiatives

•

Additional headcount

reductions

•

Other cost-out programs |

23

23

23

Sourcing Initiative

Reducing vendor

count; leveraging

largest suppliers

Renegotiating

supplier agreements

to achieve better

pricing

Adding cost

deflation factors

for multi-year

agreements

Leveraging

suppliers with better

market intelligence

and competition

Structured Sourcing Process

2011 Savings Target: $10 -

13 million

•

$10 million already locked in from

numerous suppliers

•

Focused on further reductions

through multi-year contract negotiations |

24

24

24

Wireline Cost Discipline

($MM)

$796

$763

$743

23.7%

22.5%

22.8%

0

200

400

600

800

1,000

2008

2009

2010

Wireline Revenue

Payroll/Benefits as

percent of revenue

2011

Savings

Target:

$10

-

12 million

•

Achieved $5 million savings in 2011

from second half of 2010 headcount

reductions

•

Completed majority of 2011

reductions in January and February

providing additional

$5 million savings

•

Started negotiations for union

contract

–

Strong skill sets in union

workforce

–

Compensation plans are above

market

Payroll Initiative |

25

25

25

Entertainment, high-speed Internet and

voice via fiber to the home and IPTV

•

325 channel line up, including 66 HD

channels, music, local programming

•

Majority of subscribers opt for

bundle of 2 or 3 services

30% penetration of households passed

•

79,000 units passed, more than 10%

of ILEC households

•

28,000 entertainment subs

•

27,000 high-speed Internet subs

•

Consumer monthly ARPU of

approximately $115 in Q4 2010

Consumer

Fioptics

Product

Bundling

Consumer Subscriber Attach Rates

Fioptics Growth

15%

43%

42%

1 Product

2 Products

3 Products

0%

20%

40%

60%

80%

100%

Video

Internet

Voice

81%

88%

58% |

26

26

26

Unbeatable Bundles

Bundles include DirecTV in areas not

served by Fioptics

•

Churn in a bundle with entertainment

product is reduced by 50 basis points

Fioptics 2011 capital spend of $40

million; will reach 70,000 more homes

•

Construction includes DSL upgrade for

bandwidth to allow IPTV product under

Fioptics brand name |

27

27

27

2010 Adjusted EBITDA Margin of 31%

•

Highest since 2003

•

Cost reduction initiatives in 2010 were

permanent

•

Expect similar margins for 2011

Postpaid subscribers have decreased

•

Churn consistent at 2.1%

•

Results reflect impact of significant spending

by national carriers to market network and

maintain exclusivity contracts for premium

handsets

Prepaid subscribers have increased

•

Churn improved to 6%

•

Stronger network than competitors

•

Competitive rate plans

Wireless Performance

($MM)

Wireless Customers

(in 000s)

$316

$307

$289

$83

$77

$91

26%

25%

31%

0

100

200

300

400

2008

2009

2010

404

379

351

147

154

158

2008

2009

2010

Revenue

Adj. EBITDA

Adj. EBITDA Margin

Postpaid

Prepaid

Wireless Overview |

28

28

28

Smartphone subscribers up 24% from

2009 and 144% from 2008

•

Smartphones now represent 27% of all

postpaid phones

•

Consumer smartphones are up to 24%

of postpaid consumers

•

Expect continued increases in

smartphones

Data ARPU up 17% from 2009 and 46%

from 2008 driven by smartphone

penetration gains

Postpaid ARPU

Smartphones and ARPU

Smartphone Customers

(in 000s)

43

83

96

9

2

2008

2009

2010

$40.67

$38.56

$38.10

$8.02

$10.00

$11.69

2008

2009

2010

Postpaid

Prepaid

Voice

Data

$48.69

$48.56

$49.79 |

29

29

29

Blaze

9100

Motorola

Milestone

Alcatel 981

Samsung

Behold 2

Android

Windows Mobile

HTC Maple

BlackBerry

Huawei 8100

9700/9780

Pharos

Traveler

137

9300

Growing Smartphone Line Up

Blaze 2.1

Commtiva Tablet |

30

30

30

Superior Network Speeds |

31

31

31

Investments made in IT workforce

bench strength

Economy still recovering from 2008

Integration of processes between IT

Services & Hardware with Wireline is

underway

•

Sales teams

•

Technical support

Capital spend focused on data

centers and Fioptics, so IT Services

& Hardware growth will be limited

($MM)

$267

$231

$255

$20

$17

$14

$-

$100

$200

$300

2008

2009

2010

Revenue & Adjusted EBITDA

Revenue

Adjusted EBITDA

IT Services and Hardware |

Gary Wojtaszek

Chief Financial Officer |

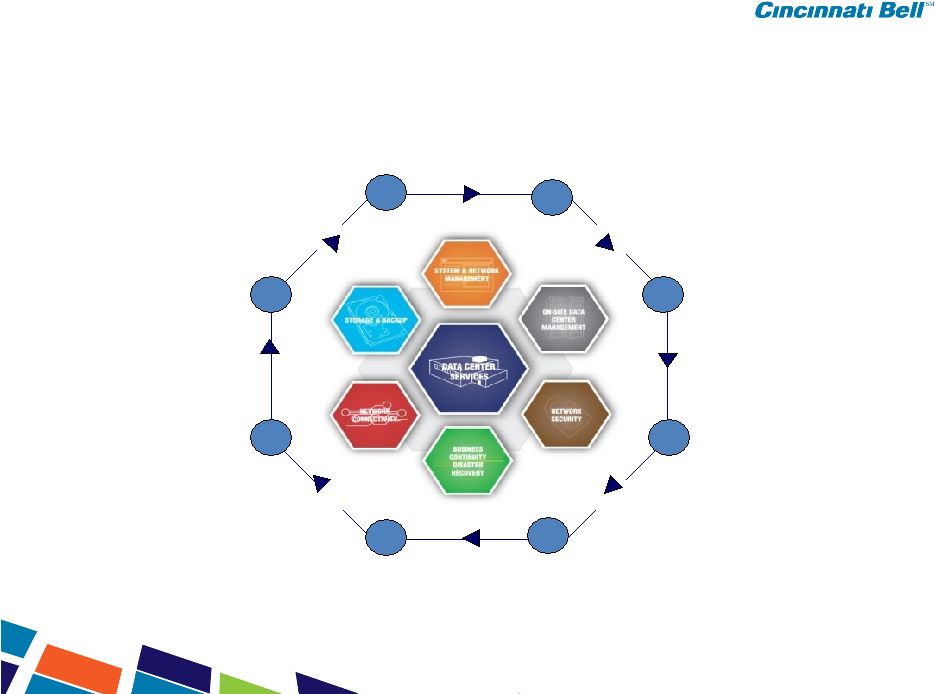

33

33

Evolution of Data Center Landscape

CIO’s need to re-engineer the information grid

Enterprise demand for information is accelerating

Demand for “digital energy”

is growing exponentially

Demand for data centers

Data Centers are purchased as a service |

34

34

34

Enterprise Demand for Information

2008

2013

39x

5x

4x

3x

Accelerating demand for

information across all

enterprises:

–

Corporate/

Enterprise/Internet

–

Media &

Entertainment

–

Healthcare &

Financial Services

–

Government/

Defense

Growth drivers*…

•

Mobile platform usage up 39x

•

Video, real-time apps up 5x

•

IP traffic up 4x

•

Shift to cloud up 3x**

Source: *CISCO VNI, June 2010

**Gartner, 2009 |

35

35

Re-engineering the Information Grid –

Reconfiguration

Reconfiguring of information –

digitization

Accessibility, speed, timeliness

Migration to network-centric

computing

Demand for “always on”

power

Corporate data storage and

disaster recovery requirements

Fortune 500 CIO’s have multiple locations

globally, with thousands of applications

running in them, and all are currently being

confronted with the same challenges in

terms of how to manage them. |

36

36

Email

Collaboration

Re-Engineering the Information Grid –

Accessibility, Speed, Timeliness

Latency Sensitivity

Best Effort

> 100ms

> 2000km

Priority

< 100ms

< 2000km

Real-Time

< 100ms;

< 2000km

Procurement

Analytics

HR/

Finance/

CRM/ERP/

BI

Voice

Virtual

Desktop

Proximity

< 5ms;

< 50km

Cincinnati Bell Data Center Focus

Main Frame

Archive/

DR Apps

Web/HTTP

Collaboration

Video

Trading

Desk

Imaging

Apps

Transactional

Apps

Document

Management |

37

37

West Coast

CyrusOne

East

Coast

CBB

Product offering must meet

quality standards and

geography

that

customers

require

Four locations around the

country will put CBB within

10 milliseconds or less of

over 90% of the

population of the US

These locations will also

be sufficient to cover over

90% of the applications

run by Fortune 500

companies

Re-Engineering the Information Grid –

Accessibility, Speed, Timeliness |

38

38

Processor speed

doubling approximately

every two years

Internet network hosts and gross

capacity

of

disk

drives

imply

exponential

relationship

between processing power,

network connectivity, and data creation

Computing

consumes

9

percent

of

total

electric in the U.S.

Demand for “Digital Energy”

Source: Energy

per Instruction

Trends in Intel®

Microprocessors,

Microarchitecture

Research Lab,

Intel Corporation

Power versus Performance

Data is not virtual; requires a physical location

with

“always

on”

power

to

exist

Enterprise data center demand is at inflection

point;

beginning

to

grow

at

increasing

rate

Enterprise users require significant “always

on”

processing & storage capacity

for data

Enterprise

shift

to

digital

grade

power

Data Centers

45

1.2%

PCs & Monitors

235

6.4%

Modems, Routers, etc.

67

1.8%

Phone Network

0.4

0%

Total

347.4

9.4%

Total U.S. Power

(billions, kWh)

3,691

Internet/Computing Infrastructure Power

Billons kWh

% of Total

Source: Lawrence Livermore labs and

Stanford University, 2007 |

39

39

Data Center is…

large computing warehouse

Electric Utilities

generate electricity

and deliver to the

Data Center

Power is cleaned up

and converted into

“computing”

products

Which is consumed

by people and

businesses

Digital Energy

SAN |

40

40

Demand for Data Centers

73%

79%

84%

92%

97%

70%

75%

80%

85%

90%

95%

100%

2009

2010

2011

2012

2013

Multi-Tenant Data Center Utilization –

Global

6%

5%

5%

5%

7%

14%

13%

15%

16%

17%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

2009A

2009P

2010P

2011P

2012P

Supply Growth

Demand Growth

Supply / Demand Imbalance

Imbalance equates to expected

global data center utilization

increasing from 65% in 2008 to

93% in 2012

Source: Tier 1 Research

Source: Tier 1 Research |

41

41

Source: Gartner –

Jan 2009

How do you Obtain DC Space?

What is Your Expected Need?

How much Space will you Need?

Gartner DC Customer Poll

Shows Compelling Statistics

Only 10% of market is

outsourced and most will run

out of space in three years

10% of companies have

outsource relationship

84% currently do not

70% of companies

will need at least 1k

Sq Ft of Space –

Mid

Range Companies

30% will need

greater than 3k –

Enterprise Range

Data Center Demand Outlook

67% of companies will

need space within 36

months |

42

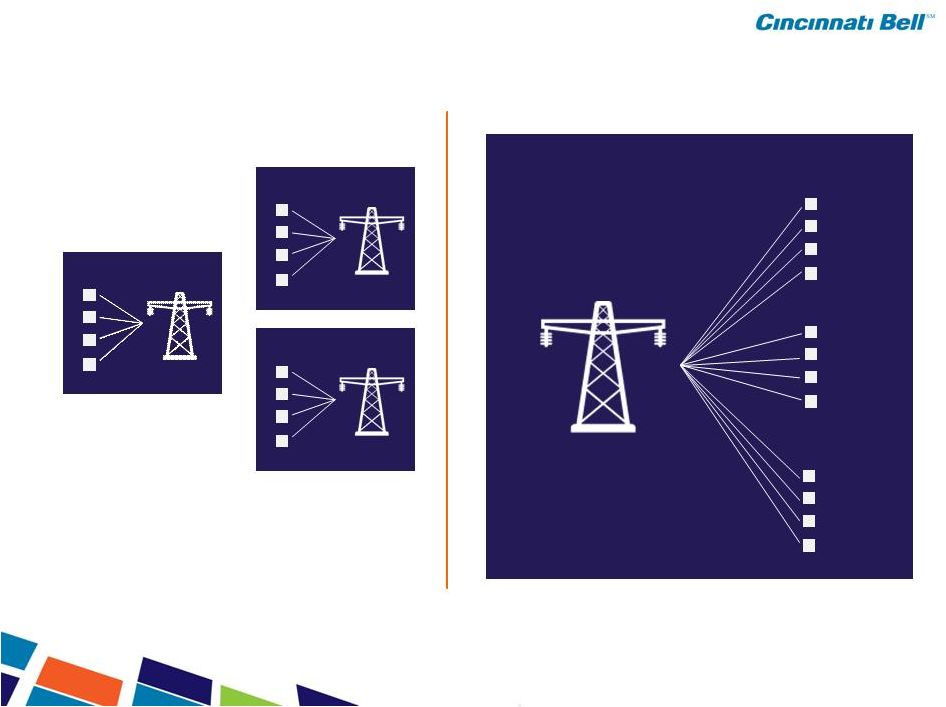

42

Company A

Company B

Company C

Data Centers are Consumed as a Utility

Situation 1905

Situation 1910

Company A

Company B

Company C

Each company has a “VP of

Electricity”, which is similar to

today’s scenario where each

company has its own data center

In a few years, companies eliminate “VP of

Electricity”

and begin purchasing power

from the utility company, which we believe

will happen in data centers |

43

43

Data Center Colocation:

Key Financial Highlights

Fundamentally Strong Model

–

Proven Growth

–

Revenue Visibility

–

Diverse Customer Base

–

High Operating Margins

–

Low Cost of Capital

–

Targeted Execution

Creates Sound & Reliable Results

33% Revenue CAGR since 2008;

19% growth in 2010

58% Adjusted EBITDA CAGR since

2008; 36% growth in 2010

LQA Q4 2010 margins are 18 pts

higher than 2008

•

Scale, experience yielding greater

efficiencies

Strong cash Return on Assets |

44

44

44

Consolidated Pro Forma Results –

Data Center Colocation

MM

$87

$130

$154

$162

$35

$64

$87

$94

40%

49%

56%

58%

30%

35%

40%

45%

50%

55%

60%

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

2008(*)

2009(*)

2010(**)

LQA Q4 2010

Revenues

Adj. EBITDA

Adj. EBITDA Margin

* CyrusOne results derived from unaudited financial statements and do not include

purchase accounting adjustments ** Prior to June 30, 2010, CyrusOne results derived from proforma unaudited financials and do

not include purchase accounting adjustments. After June

30, 2010, amounts include purchase accounting adjustments |

45

45

Majority of data center capacity located in the

Top 25 Metropolitan Statistical Areas

Approximately 13,000 firms with more than

500 employees

Space utilization of 88%; 563k sq ft utilized at Q410

versus 389K sq ft utilized at Q409

Sizable Footprint with Significant

Upside Opportunities

Data Center Capacity

Entity

Market

Facilities (#)

Data

Center

Capacity

CBTS

Cincinnati, OH

6

425,000

CyrusOne

Houston, TX

3

118,000

CyrusOne

Dallas, TX

3

57,000

CyrusOne

Austin, TX

1

12,000

CBTS

Chicago, IL

1

14,000

CBTS

Other Markets

3

13,000

17

639,000

387

389

563

25

57

76

0

100

200

300

400

500

600

700

2008

2009

2010

Utilized

Available

Markets Served

94%

88%

87% |

46

46

46

Return on Data Center Colocation Assets

LQA Q410 Adj. EBITDA of $51M

Opening PP&E of $154M

Cyrus One

Opening

Balance Sheet

Current assets

11

$

Property, Plant, and Equipment

154

Goodwill and Intangibles

407

Total Assets

572

$

Liabilities

46

$

Net Assets Acquired

526

$

MM

Cyrus is generating an approximate 33%

cash return on its investment |

47

47

($MM)

500

625

775

248

248

0

100

200

300

400

500

600

700

800

900

1000

1100

1200

Bonds

90% of our maturities are

2017 and beyond

Note: Excludes capital lease obligations and unamortized call premiums on

terminated interest rate swaps. No Significant Debt Maturities Until 2017

|

48

48

48

Implied

Segment

Valuation

Multiples

–

2010

2010A Trading Multiples

Residual

Value

10.0x 2010A

Trading Multiple

67% Implied Discount

CBB

Consol.

Wireline

Wireless

IT Services

and

Hardware

Data Center

Colocation

2010A Adj. EBITDA

520.5

345.6

90.7

14.4

86.6

Trading Multiples

6.0x

6.5x

5.5x

5.0x

3.5x

Valuation

3,123.0

2,246.4

498.9

72.0

305.8

6.0x

6.5x

5.5x

5.0x

3.5x

CBB Consol.

Wireline

Wireless

IT Services and

Hardware

Data Center

Colocation |

49

49

Considerable Accretion to Equity Investors

Assumes $25M of annual Adj. EBITDA growth in Data Center business at 10x

multiple and 5% annual Adj. EBITDA decline in Legacy CBB at 5x multiple

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

2010

2011

2012

2013

2014

2015

2016

2017

2018

Value of Legacy CBB

Value of Data Center

Debt Balance |

50

50

50

Facing Challenges with Solutions

Challenge

Enterprise class customers are

beginning to embark on an outsourcing

wave

driven by a rationalization of their

existing data centers

Enterprise class companies want to

simplify their supply chains

Enterprise class customers want

suppliers to innovate and make their

lives easier

Solution

Create best-in-class data centers

globally

that will offer our data centers

as an infrastructure or service

Establish global presence with common

processes and procedures

Establish enhanced reporting and

other features

that Fortune 1000

customers want |

Dave Ferdman

Chief Executive Officer, CyrusOne |

52

52

“Data

Center

As

A

Service”

–

our

terminology for our offering

Utilized square feet of ~162K

•

Utilization rate of 87%

2010 Adjusted EBITDA up 38% y/y

CyrusOne has performed right on plan

•

Q4 annualized EBITDA implies a

10x purchase price multiple vs.

original 12.8x at acquisition

Executed turn-key data center solution

in London to meet customer demand

•

Space will be ready

for customers in Q2

Data Center Colocation Performance

($MM)

(%)

Data Center Sq. Ft. Growth

Sq. Ft. (000’s)

* Derived from the audited financial statements of CyrusOne

and does not include purchase accounting adjustments

** Prior to June 30, 2010, derived from proforma unaudited

financials and does not include purchase accounting

adjustments. After June 30, 2010, amounts include purchase

accounting adjustments

CyrusOne Colocation Overview

$21

$31

$58

$74

$9

$15

$32

$44

43%

48%

55%

59%

0%

10%

20%

30%

40%

50%

60%

70%

$-

$10

$20

$30

$40

$50

$60

$70

$80

2007 (*)

2008 (*)

2009 (*)

2010 (**)

Revenue

Adj. EBITDA

Adj. EBITDA Margin

53

85

164

187

–

20

40

60

80

100

120

140

160

180

200

2007

2008

2009

2010

Houston

Dallas

Austin |

53

53

High Touch, High Service Based Model

•

Four Seasons vs. Apartment Tenant

Fortune 1000 Enterprise customers

•

Great logos and top tier credit quality

•

Long-term, contracted recurring

revenue –

over 98% recurring

revenue

•

High operating leverage

Tier III data center campuses

•

Existing customer requirements can

be met

CyrusOne Distinctive Qualities

Superior sales force empowered and

able to own customer relationships

•

Highly structured sales process that

focuses on deep relationship selling

•

Current customers are best sales tool

and also generate over half of

incremental future revenue

Straightforward, simple business model

•

Do one thing (Data Center As A

Service) and do it better than anyone

in the industry

•

Predictable, high growth, great

visibility |

54

54

Worldwide

customer

base

currently

utilizing

Texas Data Centers As A Service

Premium

Quality

Assets

designed

to

attract

world’s largest companies

Current Space utilization of 87%

Sizable Footprint –

Significant Upside Opportunities

Houston

Dallas

Austin

London

Total

%

Sold Space

106,000

62,000

10,000

-

178,000

44%

Built-out Space (ready for sale)

12,000

14,000

3,000

-

29,000

7%

Space under construction

11,000

47,000

3,500

5,000

66,500

17%

Available for Future Space *

60,000

-

54,000

15,000

129,000

32%

Total Data Center Space

189,000

123,000

70,500

20,000

402,500

100%

* Includes executed build-to-suit leases which are under construction in Austin and Houston;

but excludes all ROFR space Data Center Space (Sq. ft.) as of March 1, 2011

|

55

55

Recurring revenue with contracted installed base

98% of revenue base is recurring with annual

churn of less than 1%

Large diversification of current industries:

55

Enterprise businesses in the Fortune 1000

Customers looking for highest levels of

quality and service

Top 5 target sub-segments include:

•

Manufacturing

•

Healthcare

•

Oil and Gas

•

Financial services

•

Technology

Current Customer Distribution

Target Customers

Current and Target Customer Profile |

56

56

Customer Base and Contract Terms

56

Take-or-pay contracts with 3 to 7 year

average contract life and renewal periods

•

High renewal rates with annual

churn of less than 1%

Blue chip customer base

•

Five of the top 10 global companies

High average monthly recurring revenues

per customer.

•

Top 50 customers average

MRR of approximately $120K

Customers are nearly 100% multi-

application, Production Enterprise

Customers

Representative Customers of

Cincinnati Bell’s Colocation business |

57

57

What Customers Have to Say…

“Working with CyrusOne was the obvious choice.”

“We are now going on two years after making the decision and one year of

being at CyrusOne and to be honest we have to pinch ourselves every now and

then to make sure we are not dreaming.”

“My staff would rate CyrusOne extremely high. It would be our expectation to

renew with them at the end of our agreement.”

57

Highest Levels of Customer Service |

58

58

58

% of Revenue

Strong revenue growth and

operating leverage have

produced growing EBITDA

margins (69% CAGR ‘07-’10)

Once a data center is established,

rental and most staff costs are

fixed/semi-fixed leading to an

increase in incremental profit

Operating Leverage Leads

to Profitable Growth

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2007

2008

2009

2010

Personnel

Property

Other

Power

Adj. EBITDA |

59

59

Rapid growth in digital

information traffic

•

Worldwide internet IP traffic

grew by an estimated 63% last

year

Increased regulatory &

compliance requirements

•

Sarbanes Oxley, HIPAA, etc.

Cost control and budget

constraints

•

Outsourcing represents an

attractive alternative to capital

intensive in-house solutions

Market Drivers for Data Center as a Service

Prohibitive customer

switching costs

•

Hard and soft switching costs

fuel continued growth by existing

customers

Supply-demand imbalance

•

Global demand continues to

significant outweigh supply |

60

60

Supply -

Demand Imbalance

6%

5%

5%

7%

14%

13%

15%

16%

17%

5%

–

5%

10%

15%

20%

2008A

2009P

2010P

2011P

2012P

Supply Growth

Demand Growth

65%

70%

77%

93%

84%

–

25%

50%

75%

100%

2008A

2009P

2010P

2011P

2012P

Global Data Center Utilization

Global demand growth over the next four years is expected

to be 16% on average, while average supply growth is

expected to be 6% over the same time period

This imbalance equates to expected global data center

utilization increasing from 65% in 2008 to 93% by 2012

Source: Tier 1 Research |

61

61

Value Proposition of “Data Center As A Service”

Superior customer experience

Premium facilities and technical

expertise

High availability & power density

Secure “worry free”

environment

Customer flexibility

Financial predictability

Attractive alternative to capital

intensive in-house solutions

(CapEx to OpEx) |

62

62

62

1

2

3

4

5

6

7

8

Initial

Qualification

Scoping,

Proposal &

Engineering

Negotiations/

Order Creation

Implementations

Accounting

Operations

Account and

Service Delivery

Management

Marketing/

Lead Generation

Go to Market Strategy –

Eight Stage Process |

63

63

Expanding Distribution Model

Local Sales Model

–

Original Focus

Direct Sales Force

Local Contacts

Specific Advertising in Local Market

63

National Campaign

–

Future Focus

Add Sales Force around the world

–Hire with focus on Enterprise

Market

Web Presence

Email

Social Networking

National Advertising

Trade Shows/Analyst Coverage

–

Gartner

–

IDC

–

Forresters |

Question & Answer

Management Team |

Thank you! |

Appendix |

Kim Sheehy

VP, Investor Relations & Treasurer

kim.sheehy@cinbell.com

513-397-7862

Contact Information |

68

68

Adjusted EBITDA Definition

Cincinnati Bell

Reconciliation of Adjusted EBITDA

2010

2011

Adjusted EBITDA, as reported

$502

$510

Pension and OPEB expenses:

Interest cost

32

28

Expected return on assets

(28)

(25)

Amortization of loss

13

17

Adjusted EBITDA, new definition

$519

$530

(in millions) |

69

69

Non-GAAP Reconciliations

$ in millions

Wireline

Wireless

Data Center

Colocation

IT Services &

Hardware

Corporate

Total

Company

Operating Income (GAAP)

233.5

$

56.3

$

34.2

$

4.3

$

(29.0)

$

299.3

$

Add:

Depreciation and amortization

103.9

33.4

34.6

7.3

0.3

179.5

Restructuring charges

8.2

1.0

1.4

2.8

0.3

13.7

Acquisition costs

-

-

-

-

9.1

9.1

Adjusted EBITDA (Non-GAAP)

345.6

$

90.7

$

70.2

$

14.4

$

(19.3)

$

501.6

$

Wireline

Wireless

Data Center

Colocation*

IT Services &

Hardware*

Corporate

Total

Company

Operating Income (GAAP)

255.6

$

33.0

$

17.0

$

10.7

$

(20.8)

$

295.5

$

Add:

Depreciation and amortization

103.9

39.4

15.0

6.2

0.4

164.9

Restructuring charges and loss on sale of asset

5.0

4.8

-

-

-

9.8

Adjusted EBITDA (Non-GAAP)

364.5

$

77.2

$

32.0

$

16.9

$

(20.4)

$

470.2

$

Wireline

Wireless

Data Center

Colocation*

IT Services &

Hardware*

Corporate

Total

Company

Operating Income (GAAP)

258.4

$

46.8

$

8.0

$

13.4

$

(21.4)

$

305.2

$

Add:

Depreciation and amortization

101.2

35.5

11.2

5.8

0.2

153.9

Restructuring, asset impairment, patent lawsuit

and operating tax settlements

18.1

0.5

-

0.7

1.8

21.1

Adjusted EBITDA (Non-GAAP)

377.7

$

82.8

$

19.2

$

19.9

$

(19.4)

$

480.2

$

*

2008 and 2009 amounts have been revised to split the Technology Solutions

segment into the Data Center Colocation and IT Services and Hardware

segments Twelve Months Ended December 31, 2010

Twelve Months Ended December 31, 2009

Twelve Months Ended December 31, 2008 |

70

70

Non-GAAP Reconciliations

Twelve Months Ended

December 31, 2007

Total

Company

Operating Income (GAAP)

282.4

$

Add:

Depreciation and amortization

150.8

Restructuring charges

39.8

Adjusted EBITDA (Non-GAAP)

473.0

$

Wireline

Wireless

Data Center

Colocation

IT Services &

Hardware

Corporate

Total

Company

Operating Income (GAAP)

52.5

$

4.1

$

9.2

$

4.0

$

(5.3)

$

64.5

$

Add:

Depreciation and amortization

26.7

8.0

13.0

2.1

-

49.8

Restructuring charges

4.9

1.0

1.4

1.0

0.2

8.5

Adjusted EBITDA (Non-GAAP)

84.1

$

13.1

$

23.6

$

7.1

$

(5.1)

$

122.8

$

Three Months Ended December 31, 2010

$ in millions |

71

71

Non-GAAP Reconciliations

$ in millions

Twelve Months

Twelve Months

Ended December 31,

Ended December 31,

2010

2009

Reconciliation of GAAP Cash Flow to

Free Cash Flow (as defined by the company)

Net increase (decrease) in cash and cash equivalents

54.3

$

16.3

$

Less adjustments:

Issuance of long-term debt

(2,134.3)

(492.8)

Net change in credit and receivables

facilities with initial maturities less than 90 days

85.9

42.1

Repayment of debt

1,554.5

506.5

Debt issuance costs

42.6

15.3

Common stock

repurchase 10.0

73.2

Acquisitions of businesses

526.7

3.4

Acquisition

costs 9.1

-

Free cash flow (as defined by the company)

148.8

$

164.0

$

|

72

72

Non-GAAP Reconciliations

2007

2008

2009

2010

Total debt

2,009.7

1,960.7

1,979.1

2,523.6

Less: Interest rate swap adjustment

(2.9)

(22.4)

(14.6)

(3.8)

Less: Cash and cash equivalents

(26.1)

(6.7)

(23.0)

(77.3)

Net debt (as defined by the company)

1,980.7

$

1,931.6

$

1,941.5

$

2,442.5

$

December 31,

2007

2008

2009

2010

CyrusOne Operating Income (GAAP)

4.5

$

8.1

$

24.3

$

22.6

$

Depreciation and amortization

4.0

7.3

7.7

21.5

CyrusOne Adjusted EBITDA (Non-GAAP)

8.5

$

15.4

$

32.0

$

44.1

$

*

2007-2009 amounts were derived from unaudited financial statements and do not

include purchase accounting adjustments. Prior to June 30, 2010, amounts were derived from

proforma unaudited financials and do not include purchase accounting adjustments. After June 30, 2010, amounts

include purchase accounting adjustments.

Twelve Months Ended December 31,

Three Months Ended

December 31, 2010

CyrusOne

CyrusOne Operating Income (GAAP)

4.8

$

Depreciation and amortization

8.0

CyrusOne Adjusted EBITDA (Non-GAAP)

12.8

$

$ in millions |