Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - CADIZ INC | exhibi_32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - CADIZ INC | exhibit_31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - CADIZ INC | exhibit_31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - CADIZ INC | exhibit_23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - CADIZ INC | exhibit_21-1.htm |

| EX-32.1 - EXHIBIT 32.1 - CADIZ INC | exhibit_32-1.htm |

| EX-10.25 - EXHIBIT 10.25 - CADIZ INC | exhibit_10-25.htm |

| EX-10.24 - EXHIBIT 10.24 - CADIZ INC | exhibit_10-24.htm |

united states

Securities and Exchange Commission

Washington, D. C. 20549

FORM 10-K

[√] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the fiscal year ended December 31, 2010

OR

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from ..... to .....

Commission File Number 0-12114

Cadiz Inc.

(Exact name of registrant specified in its charter)

|

DELAWARE

|

77-0313235

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

550 S. Hope Street, Suite 2850

|

|

|

Los Angeles, CA

|

90071

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(213) 271-1600

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

Common Stock, par value $0.01 per share

|

The NASDAQ Global Market

|

|

(Title of Each Class)

|

(Name of Each Exchange on Which Registered)

|

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in rule 405 under the Securities Act of 1933.

Yes ___ No √

Indicate by a check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ___ No √

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes √ No ___

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ___ No ___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§220.405 of this chapter) is not contained herein, and will not be contained to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. [√]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Exchange Act Rule 12b-2).

Large accelerated filer ___ Accelerated filer √ Non-accelerated filer ___ Smaller Reporting Company ___

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2).

Yes ___ No √

The aggregate market value of the common stock held by nonaffiliates as of June 30, 2010 was approximately $150,503,630 based on 12,469,232 shares of common stock outstanding held by nonaffiliates and the closing price on that date. Shares of common stock held by each executive officer and director and by each entity that owns more than 5% of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 7, 2011, the Registrant had 13,827,354 shares of common stock outstanding.

Documents Incorporated by Reference

Portions of the Registrant's definitive Proxy Statement to be filed for its 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report. The Registrant is not incorporating by reference any other documents within this Annual Report on Form 10-K except those footnoted in Part IV under the heading “Item 15. Exhibits, Financial Statement Schedules.

Cadiz Inc.

Table of Contents

|

Part I

|

||

|

Item 1.

|

1

|

|

|

Item 1A.

|

9

|

|

|

Item 1B.

|

12

|

|

|

Item 2.

|

12

|

|

|

Item 3.

|

13

|

|

|

Item 4.

|

13

|

|

|

Part II

|

||

|

Item 5.

|

14

|

|

|

Item 6.

|

16

|

|

|

Item 7.

|

17

|

|

|

Item 7A.

|

30

|

|

|

Item 8.

|

30

|

|

|

Item 9.

|

30

|

|

|

Item 9A.

|

30

|

|

|

Item 9B.

|

31

|

|

|

Part III

|

||

|

Item 10.

|

32

|

|

|

Item 11.

|

32

|

|

|

Item 12.

|

32

|

|

|

Item 13.

|

32

|

|

|

Item 14.

|

32

|

|

|

Part IV

|

||

|

Item 15.

|

33

|

Cadiz Inc.

PART I

This Form 10-K presents forward-looking statements with regard to financial projections, proposed transactions such as those concerning the further development of our land and water assets, information or expectations about our business strategies, results of operations, products or markets, or otherwise makes statements about future events. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from these forward-looking statements. These include, among others, the cautionary statements under the caption “Risk Factors”, as well as other cautionary language contained in this Form 10-K. These cautionary statements identify important factors that could cause actual results to differ materially from those described in the forward-looking statements. When considering forward-looking statements in this Form 10-K, you should keep in mind the cautionary statements described above.

Overview

Our primary asset consists of 45,000 acres of land in three areas of eastern San Bernardino County, California. Virtually all of this land is underlain by high-quality, naturally recharging groundwater resources, and is situated in proximity to the Colorado River and the Colorado River Aqueduct, the major source of imported water for Southern California. Our main objective is to realize the highest and best use of these land and water resources in an environmentally responsible way.

In 1993, we secured permits for up to 9,600 acres of agricultural development at our 35,000-acre property in the Cadiz Valley and the withdrawal of more than one million acre-feet of groundwater from the underlying aquifer system. Since that time, we have maintained various levels of agricultural development at the property and this development has provided our principal source of revenue. Although sustainable agricultural development is an important and enduring component of our business, we believe that the long-term value of our assets can best be derived through the development of a combination of water supply, water storage, and solar energy projects at our properties.

The primary factors that drive the value of water supply projects are continued population growth and increasing pressure on water supplies throughout California. Southern California in particular now faces the prospect of long-term and systematic water supply shortages resulting from restrictions on each of its three imported water sources: the State Water Project, the Colorado River and the Owens Valley. As a result of these restrictions, water agencies must overcome significant projected supply deficiencies to meet existing and projected demands. For example, despite experiencing above-average rainfall in each of the last two years, ongoing environmental and regulatory restrictions affecting California’s water supplies and infrastructure have forced many water providers to limit water deliveries to their customers. Given that the present imbalance in annual supply and demand is projected to continue for many years into the future, water providers are now evaluating new sources of supply as a method to off-set their existing shortages.

1

Opportunities in the solar energy production market are being driven by a series of policy initiatives issued by the State of California and the United States government. This includes California’s mandate to acquire 33% of the state’s electricity from renewable sources by 2020 and federal efforts to accelerate renewable energy and transmission project development in the Mojave Desert. Energy companies, government agencies and environmental organizations are actively working to identify suitable locations for solar energy development to meet future energy needs and have encouraged development on private lands.

As a result of these developments in the water and energy sectors, we plan to continue to pursue water supply, water storage and solar energy projects at our properties. At present, our development efforts are primarily focused on the Cadiz Valley Water Conservation, Recovery and Storage Project (“Water Project”), which involves the capture, delivery and storage of groundwater that is otherwise lost to evaporation. We believe that the ultimate implementation of this Water Project will create the primary source of our future cash flow and, accordingly, our working capital requirements relate largely to the development activities associated with this Water Project.

(a) General Development of Business

We are a Delaware corporation formed in 1992 to act as the surviving corporation in a Delaware reincorporation merger with Pacific Agricultural Holdings, Inc., a California corporation formed in 1983.

As part of our historical business strategy, we have conducted our land acquisition, water development activities, agricultural operations, and real estate development initiatives to maximize the long-term value of our properties and future prospects. See “Narrative Description of Business” below.

Our initial focus was on the acquisition of land and the assembly of contiguous land holdings through property exchanges to prove the quantity and quality of water resources in the Mojave Desert region of eastern San Bernardino County. We subsequently established agricultural operations on our properties in the Cadiz Valley and sought to develop the water resources underlying that site.

In 1993, we secured permits for up to 9,600 acres of agricultural development in the Cadiz Valley and the withdrawal of more than one million acre-feet of groundwater from the underlying aquifer system. Once the agricultural development was underway, we also identified that the location, geology, and hydrology of this property is uniquely suited for both agricultural development and the development of an aquifer storage, recovery, and dry-year supply project to augment the water supplies available to Southern California.

In 1997, we entered into the first of a series of agreements with the Metropolitan Water District of Southern California (“Metropolitan”) to jointly design, permit, and build such a project (the “Cadiz Project” or “Project”). Between 1997 and 2002, we and Metropolitan received substantially all of the state and federal approvals required for the permits necessary to construct and operate the Project, including a Record of Decision (“ROD”) from the U.S. Department of the Interior, which endorsed the Project and offered a right-of-way for construction of Project facilities. In October 2002, Metropolitan’s staff brought the right-of-way matter before the Metropolitan Board of Directors. By a very narrow margin, the Metropolitan Board voted not to accept the right-of-way grant and not to proceed with the Project. Following Metropolitan’s decision, Cadiz began to pursue new partnerships and redesign the Project to meet the changing needs of Southern California’s water providers.

2

In September 2008, we secured a new right-of-way for the Project’s water conveyance pipeline by entering into a lease agreement with the Arizona & California Railroad Company. The agreement allows Cadiz to utilize a portion of the railroad’s right-of-way for the Project water conveyance pipeline for a period up to 99 years.

In May 2009, we entered into a Memorandum of Understanding with the Natural Heritage Institute (“NHI”), a leading global environmental organization committed to protecting aquatic ecosystems, to assist with our efforts to sustainably manage the development of our Cadiz/Fenner property. As part of this “Green Compact”, we will follow stringent plans for groundwater management and habitat conservation, and create a groundwater monitoring program for the Project.

In February 2010, we released new details of a comprehensive year-long study measuring the vast scale and recharge rate of the Cadiz aquifer system. The study was conducted by internationally recognized environmental consulting firm CH2M HILL at the Project area utilizing new models produced by the U.S. Geological Survey in 2006 and 2008. The work also included a series of new wells that were drilled to further understand the hydrology of the basin. CH2M HILL and additional hydrology experts that have peer-reviewed the work confirmed the aquifer system can sustainably support the Water Project. This body of additional science indicated that water that was not currently being put to beneficial use in the agricultural operations was being lost to evaporation on dry lakes and the system could be actively managed to provide a sustainable annual supply of water without harm to the environment.

In June 2010, we entered into environmental cost-sharing and option agreements with the Santa Margarita Water District (“SMWD”). Later that month, Three Valleys Municipal Water District (“TVMWD”) and Golden State Water Company (“Golden State”) signed similar agreements followed by Suburban Water Systems (“Suburban”) in October 2010. As part of the agreements, the four water providers committed funds to an environmental review of the Project and also were granted the right to acquire a firm annual supply of water at a predetermined formula competitive with their incremental cost of new water. Additionally, the providers acquired options to storage rights in the Project that will allow them to manage their supplies to complement their other water resources

The environmental review and permitting process for the Water Project is now underway. As the first agency with a discretionary decision on the Project, SMWD has agreed to serve as the lead agency for this process. ESA Associates, a leading environmental consulting firm, was retained to prepare the Water Project’s formal CEQA documentation. The initial documentation providing Notice of Preparation of a Draft EIR has been released by SMWD for public review and comment.

(b) Financial Information about Industry Segments

Our primary business is to acquire and develop land and water resources. Our agricultural operations are confined to limited farming activities at the Cadiz Valley property. As a result, our financial results are reported in a single segment. See Consolidated Financial Statements. See also Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

3

(c) Narrative Description of Business

Our business strategy is the development of our landholdings for their highest and best uses. At present, our development activities include water resource, agricultural and solar energy development.

Water Resource Development

Our portfolio of water resources is located in proximity to the Colorado River and the Colorado River Aqueduct (“CRA”), the principal source of imported water for Southern California, and provides us with the opportunity to participate in a variety of water supply, water storage, and conservation programs with public agencies and other partners.

The Cadiz Valley Water Conservation, Recovery and Storage Project

We own approximately 35,000 acres of land and the subsurface strata, inclusive of the unsaturated soils and appurtenant water rights in the Cadiz and Fenner valleys of eastern San Bernardino County (the “Cadiz/Fenner Property”). The aquifer system underlying this property is naturally recharged by precipitation (both rain and snow) within a watershed of approximately 1,300 square miles. See Item 2, “Properties – The Cadiz/Fenner Valley Property”.

The Cadiz Valley Water Conservation, Recovery and Storage Project (the “Water Project”) is designed to supply, capture and conserve billions of gallons of renewable native groundwater currently being lost annually to evaporation from the aquifer system underlying our Cadiz/Fenner property. By implementing established groundwater management practices, the Water Project will create a new, sustainable water supply for Project participants without adversely impacting the aquifer system or the desert environment. The total quantity of groundwater to be recovered and conveyed to Project participants will not exceed a long-term annual average of approximately 50,000 acre-feet per year. The Project also offers participants the ability to carry-over their annual supply and store it in the groundwater basin from year to year, as well as approximately one million acre-feet of storage capacity that can be used to store imported water.

Water Project facilities would include, among other things:

|

·

|

High yield wells designed to efficiently recover available native groundwater from beneath the Cadiz Project area;

|

|

·

|

A 44-mile conveyance pipeline to connect the well field to the CRA;

|

|

·

|

A pumping plant to pump water through the conveyance pipeline from the CRA to the Project well-field;

|

|

·

|

An energy source to provide power to the well-field, pipeline and pumping plant; and

|

4

|

·

|

Spreading basins, which are shallow settling ponds that will be configured to efficiently percolate water from the ground surface down to the water table using subsurface storage capacity for the storage of water, if an imported water storage component of the project is ultimately implemented.

|

In general, several elements are needed to implement such a project: (1) a pipeline right-of-way from the Colorado River Aqueduct to the Water Project area; (2) storage and supply agreements with one or more public water agencies or private water utilities; (3) environmental permits; and (4) construction and working capital financing. As described below, the first three elements have been progressed on a concurrent basis. The fourth is dependent on actions arising from the completion of the first three.

|

(1)

|

A Pipeline Right-of-Way from the Colorado River Aqueduct to the Water Project Area

|

In September 2008, we secured a right-of-way for the Water Project’s water conveyance pipeline by entering into a lease agreement with the Arizona & California Railroad Company. The agreement allows for the use of a portion of the railroad’s right-of-way for a period up to 99 years to construct and operate the Water Project’s water conveyance pipeline. The pipeline would be used to convey water between our Cadiz/Fenner property and the Colorado River Aqueduct.

|

(2)

|

Storage and Supply Agreements with One or More Public Water Agencies or Private Water Utilities

|

In June 2010, we entered into option and environmental cost sharing agreements with three water providers: Santa Margarita Water District (“SMWD”), Golden State Water Company (a wholly-owned subsidiary of American States Water [NYSE: AWR]), and Three Valleys Municipal Water District. The three water providers serve more than one million customers in cities throughout California’s San Bernardino, Riverside, Los Angeles, Orange and Ventura Counties.

In September 2010, we also entered into option and environmental cost sharing agreements with Suburban Water Systems, a wholly-owned subsidiary of SouthWest Water Company. Suburban Water Systems provides water to a population of approximately 300,000 people in a 42-square-mile service area in California's Los Angeles and Orange counties.

Under the terms of the agreements with the four water providers, upon completion of the Water Project’s California Environmental Quality Act (“CEQA”) review, each agency will have the right to acquire an annual supply of 5,000 acre-feet of water at a pre-determined formula competitive with their incremental cost of new water. SMWD also was given the option to purchase an additional 10,000 acre-feet of water per year. In addition, the agencies have options to acquire storage rights in the Water Project to allow them to manage their supplies to complement their other water resources.

5

We continue to work with additional water providers interested in acquiring rights to the remaining annual supply expected to be conserved by the Water Project and are in discussions with third parties regarding the imported storage aspect of this Project. We have also begun to develop an operating plan for the Water Project that will manage the delivery of conserved water to the Project’s subscribers.

|

(3)

|

Environmental Permits

|

In order to properly develop and quantify the sustainability of the Water Project, and prior to initiating the formal permitting process for the Water Project, we commissioned internationally recognized environmental consulting firm CH2M HILL to complete a comprehensive study of the water resources at the Project area. Following a year of analysis, CH2M HILL released its study of the aquifer system in February 2010. Utilizing new models produced by the U.S. Geological Survey in 2006 and 2008, the study estimated the total groundwater in storage in the aquifer system to be between 17 and 34 million acre-feet, a quantity on par with Lake Mead, the nation’s largest surface reservoir. The study also identified a renewable annual supply of native groundwater in the aquifer system currently being lost to evaporation. CH2M HILL’s findings, which were peer reviewed by leading groundwater experts, confirmed that the aquifer system could sustainably support the Water Project.

Further, and also prior to beginning the formal environmental permitting process, we entered into a Memorandum of Understanding with the Natural Heritage Institute (“NHI”), a leading global environmental organization committed to protecting aquatic ecosystems, to assist with our efforts to sustainably manage the development of our Cadiz/Fenner property. As part of this “Green Compact,” we will follow stringent plans for groundwater management and habitat conservation, and create a groundwater management plan for the Water Project.

In June 2010, as discussed in (2), above, we entered into environmental cost sharing agreements with all participating water providers. The environmental cost sharing agreements created a framework for funds to be committed by each participant to share in the costs associated with the ongoing CEQA review work. SMWD has agreed to serve as the lead agency for the review process. In July 2010, ESA Associates, a leading environmental consulting firm, was retained to prepare the formal CEQA documentation. In February 2011, SMWD issued a Notice of Preparation of a Draft Environmental Impact Report (DEIR) formally commencing the public portion of the CEQA permitting process for the Water Project.

|

(4)

|

Construction and Working Capital

|

Once the environmental review is concluded, we expect that we will complete economic agreements with the Water Project participants and make arrangements for the construction phase of the Water Project. Construction would consist of well-field facilities at the Water Project site and a conveyance pipeline extending approximately 44 miles along the right-of-way described in (1), above, from the well-field to the Colorado River Aqueduct.

Other Eastern Mojave Properties

Our second largest landholding is approximately 9,000 acres in the Piute Valley of eastern San Bernardino County. This landholding is located approximately 15 miles from the resort community of Laughlin, Nevada, and about 12 miles from the Colorado River town of Needles, California. Extensive hydrological studies, including the drilling and testing of a full-scale production well, have demonstrated that this landholding is underlain by high-quality groundwater. The aquifer system underlying this property is naturally recharged by precipitation (both rain and snow) within a watershed of approximately 975 square miles. Discussions with potential partners with the objective of developing our Piute Valley assets are ongoing.

6

Additionally, we own acreage located near Danby Dry Lake, approximately 30 miles southeast of our landholdings in the Cadiz and Fenner valleys. The Danby Lake property is located approximately 10 miles north of the CRA. Initial hydrological studies indicate that it has excellent potential for a water supply project.

Agricultural Development

Within the Cadiz/Fenner property, 9,600 acres have been zoned for agriculture. The infrastructure includes seven wells that are interconnected within this acreage, with total annual production capacity of approximately 13,000 acre feet of water. Additionally, there are housing and kitchen facilities that support up to 300 employees. The underlying groundwater, fertile soil, and desert temperatures are well suited for a wide variety of fruits and vegetables.

Permanent crops currently in commercial production include 160 acres of vineyards of certified organic, dried-on-the-vine raisins and 260 acres of lemons. Both of these crops are farmed using sustainable agricultural practices.

Seasonal vegetable crops in 2010 included squash and beans. All seasonal vegetable crops are grown organically.

We currently derive our agricultural revenues through the sale of our products in bulk or through independent packing facilities. We incur all of the costs necessary to produce and harvest our organic raisin crop. These raisins are then sold in bulk to a raisin processing facility. We also incur all of the costs necessary to produce our lemon crop. Once harvested, the lemons are shipped in bulk to a packing and sales facility. In recent periods, our agricultural revenues have declined largely due to the removal of 640 acres of vineyard during the years 2004 through 2007 as the vineyard reached the end of its commercial life. In 2009, we entered into a lease agreement with a third party to replace the acreage that was taken out of production by developing up to an additional 500 acres of lemon orchards. We expect to receive lease income once the new lemon orchards reach commercial production through a profit sharing agreement within the lease. The first 40 acres of this new orchard were planted in March 2010.

Although we plan to maintain our agricultural development, revenues will continue to vary from year to year based on acres in development, crop yields, and prices. Further, we do not believe that our agricultural revenues are likely to be material to our overall results of operations once we begin to receive revenues from the Water Project.

Renewable Energy and Other Development Opportunities

In addition to the projects described above, we believe that our landholdings are suitable for other types of development, including solar energy production. Located in an area with strong solar irradiation, proximity to existing utility corridors, appropriate topography, and access to water supplies, our properties could provide an ideal setting for solar energy generation. Moreover, state, federal and local government entities, along with environmental organizations, have issued compelling calls to increase the production of renewable energy to reduce greenhouse gas emissions and the consumption of imported fossil fuels. Solar energy development on private land, particularly in the Mojave Desert region where our properties are located, is being encouraged as an alternative to the use of federal desert lands.

7

We believe that we can ease the demand for the use of federal lands for siting solar facilities in the Mojave Desert by providing solar development opportunities on our significant, contiguous private landholdings. Up to 20,000 acres at our Cadiz/Fenner property could potentially be made available for solar energy projects. We are presently in discussions with energy companies interested in utilizing our landholdings for various types of solar energy development.

In addition to solar energy development, we believe that over the longer-term, the population of Southern California, Nevada, and Arizona will continue to grow, and that, in time, the economics of commercial and residential development of our properties will become attractive.

We remain committed to the ongoing sustainable use of our land and water assets, and will continue to explore all opportunities for environmentally-responsible development of these assets. We cannot predict with certainty which of these various opportunities will ultimately be utilized.

Seasonality

Our water resource development activities are not seasonal in nature.

Our farming operations are limited to the cultivation of lemons and grapes/raisins and spring and fall plantings of vegetables on the Cadiz Valley properties. These operations are subject to the general seasonal trends that are characteristic of the agricultural industry.

Competition

We face competition for the acquisition, development and sale of our properties from a number of competitors. We may also face competition in the development of water resources and siting of renewable energy facilities associated with our properties. Since California has scarce water resources and an increasing demand for available water, we believe that location, price and reliability of delivery are the principal competitive factors affecting transfers of water in California.

Employees

As of December 31, 2010, we employed 10 full-time employees (i.e. those individuals working more than 1,000 hours per year). We believe that our employee relations are good.

8

Regulation

Our operations are subject to varying degrees of federal, state and local laws and regulations. As we proceed with the development of our properties, including the Water Project, we will be required to satisfy various regulatory authorities that we are in compliance with the laws, regulations and policies enforced by such authorities. Groundwater development, and the export of surplus groundwater for sale to entities such as public water agencies, is subject to regulation by specific existing statutes, in addition to general environmental statutes applicable to all development projects. Additionally, we must obtain a variety of approvals and permits from state and federal governments with respect to issues that may include environmental issues, issues related to special status species, issues related to the public trust, and others. Because of the discretionary nature of these approvals and concerns which may be raised by various governmental officials, public interest groups and other interested parties during both the development and the approval process, our ability to develop properties and realize income from our projects, including the Water Project, could be delayed, reduced or eliminated.

Access To Our Information

Our annual, quarterly and current reports, proxy statements and other information are filed with the Securities and Exchange Commission (“SEC”) and are available free of charge through our web site, www.cadizinc.com, as soon as reasonably practical after electronic filing of such material with the SEC.

Our SEC filings are also available to the public at the SEC website at www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room located at 100 F Street N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room.

Our business is subject to a number of risks, including those described below.

Our Development Activities Have Not Generated Significant Revenues

At present, our development activities include water resource, agricultural and solar energy development at our San Bernardino County properties. We have not received significant revenues from our development activities to date and we do not know when, if ever, we will receive operating revenues sufficient to offset the costs of our development activities. As a result, we continue to incur a net loss from operations.

We May Never Generate Significant Revenues or Become Profitable Unless We Are Able To Successfully Implement Programs To Develop Our Land Assets and Related Water Resources

We do not know the terms, if any, upon which we may be able to proceed with our water and other development programs. Regardless of the form of our water development programs, the circumstances under which supplies or storage of water can be developed and the profitability of any supply or storage project are subject to significant uncertainties, including the risk of variable water supplies and changing water allocation priorities. Additional risks include our ability to obtain all necessary regulatory approvals and permits, possible litigation by environmental or other groups, unforeseen technical difficulties, general market conditions for water supplies, and the time needed to generate significant operating revenues from such programs after operations commence.

9

The Development of Our Properties Is Heavily Regulated, Requires Governmental Approvals and Permits That Could Be Denied, and May Have Competing Governmental Interests and Objectives

In developing our land assets and related water resources, we are subject to local, state, and federal statutes, ordinances, rules and regulations concerning zoning, resource protection, environmental impacts, infrastructure design, subdivision of land, construction and similar matters. Our development activities are subject to the risk of adverse interpretations or changes to U.S. federal, state and local laws, regulations and policies. Further, our development activities require governmental approvals and permits. If such permits were to be denied or granted subject to unfavorable conditions or restrictions, our ability to successfully implement our development programs would be adversely impacted.

The opposition of government officials may adversely affect our ability to obtain needed government approvals and permits upon satisfactory terms in a timely manner. In this regard, federal government appropriations currently preclude spending for any proposal to store water for the purpose of export or for any activities associated with the approval of rights-of-way on lands managed by the Needles Field Office of the Bureau of Land Management. As a result of our right-of-way with the Arizona & California Railroad Company, we do not believe federal approval will be required to implement the Project; however, even this may be subject to challenges.

A significant portion of our Cadiz/Fenner property is included in a study area as part of an ongoing Environmental Impact Statement (“EIS”) process for the expansion of the Marine Corp Air Ground Combat Center in Twentynine Palms, California. There are currently six different alternatives being considered for base expansion and our property, including portions of the Project area and agricultural operations, are included in one of the six different alternatives being studied. This alternative, however, was not selected as the "Preferred Alternative" in the base expansion project's Draft Environmental Impact Statement ("DEIS") issued by the U.S. Department of the Navy in February 2011. As a result, we do not believe that our property will ultimately be impacted by expansion of the base. In the event any of the Cadiz/Fenner Valley landholdings are included in the final expansion area, then we would be entitled to full fair market value compensation for any property taken.

Additionally, the statutes, regulations and ordinances governing the approval processes provide third parties the opportunity to challenge proposed plans and approvals. In California, third parties have the ability to file litigation challenging the approval of a project, which they usually do by alleging inadequate disclosure and mitigation of the environmental impacts of the project. Opposition from environmental groups could cause delays and increase the costs of our development efforts or preclude such development entirely. While we have worked with representatives of various environmental interests and agencies to minimize and mitigate the impacts of our planned projects, certain groups may remain opposed to our development plans.

10

Our Failure To Make Timely Payments of Principal and Interest on Our Indebtedness May Result in a Foreclosure on Our Assets

As of December 31, 2010, we had indebtedness outstanding to our senior secured lenders of approximately $51.412 million. Our assets have been put up as collateral for this debt. If we cannot generate sufficient cash flow to make principal and interest payments on this indebtedness when due, or if we otherwise fail to comply with the terms of agreements governing our indebtedness, we may default on our obligations. If we default on our obligations, our lenders may sell off the assets that we have put up as collateral. This, in turn, would result in a cessation or sale of our operations.

The Conversion of Our Outstanding Senior Indebtedness into Common Stock Would Dilute the Percentage of Our Common Stock Held by Current Stockholders

Our senior indebtedness is convertible into common stock at the election of our lenders. As of December 31, 2010, our senior indebtedness was convertible into 1,765,773 shares of our common stock, an amount equal to approximately 11% of the number of fully-diluted shares of our common stock outstanding as of that date. An election by our lenders to convert all or a portion of our senior secured indebtedness into common stock will dilute the percentage of our common stock held by current stockholders.

We May Not Be Able To Obtain the Financing We Need To Implement Our Asset Development Programs

Based upon our current and anticipated usage of cash resources, we have sufficient funds to meet our expected working capital needs through fiscal year 2011. We will continue to require additional working capital to meet our cash resource needs from that point forward and to continue to finance our operations until such time as our asset development programs produce revenues. If we cannot raise needed funds, we might be forced to make substantial reductions in our operating expenses, which could adversely affect our ability to implement our current business plan and ultimately our viability as a company. We cannot assure you that our current lenders, or any other lenders, will give us additional credit should we seek it. If we are unable to obtain additional credit, we may engage in further equity financings. Our ability to obtain equity financing will depend, among other things, on the status of our asset development programs and general conditions in the capital markets at the time funding is sought. Although we currently expect our capital sources to be sufficient to meet our near term liquidity needs, there can be no assurance that our liquidity requirements will continue to be satisfied. Any further equity financings would result in the dilution of ownership interests of our current stockholders.

The Issuance of Equity Securities Under Management Equity Incentive Plans Will Impact Earnings

Our compensation programs for management emphasize long-term incentives, primarily through the issuance of equity securities and options to purchase equity securities. It is expected that plans involving the issuance of shares, options, or both will be submitted from time to time to our stockholders for approval. In the event that any such plans are approved and implemented, the issuance of shares and options under such plans may result in the dilution of the ownership interest of other stockholders and will, under currently applicable accounting rules, result in a charge to earnings based on the value of our common stock at the time of issue and the fair value of options at the time of their award. The expense would be recorded over the vesting period of each stock and option grant.

11

Not applicable at this time.

Following is a description of our significant properties.

The Cadiz/Fenner Valley Property

Since 1983, we have acquired approximately 35,000 acres of largely contiguous land in the Cadiz and Fenner Valleys of eastern San Bernardino County, California. This area is located approximately 30 miles north of the Colorado River Aqueduct (“CRA”). In 1984, we conducted investigations of the feasibility of agricultural development of this land. These investigations confirmed the availability of high-quality groundwater in quantities appropriate for agricultural development.

Additional independent geotechnical and engineering studies conducted since 1985 have confirmed that the Cadiz/Fenner property overlies an aquifer system that is ideally suited for the conservation, recovery and delivery of indigenous groundwater as well as the storage of conserved or imported water, as contemplated by the Water Project. See Item 1, “Business – Narrative Description of Business – Water Resource Development”.

In November 1993, the San Bernardino County Board of Supervisors unanimously approved a General Plan Amendment establishing an agricultural land use designation for 9,600 acres of the property. This action also allows for the withdrawal of more than 1,000,000 acre-feet of groundwater from the aquifer system underlying the property.

In February 2010, we released new details of a comprehensive year-long study measuring the vast scale and recharge rate of the Cadiz/Fenner aquifer system. The study was conducted by internationally recognized environmental consulting firm CH2M HILL at the Project area utilizing new models produced by the U.S. Geological Survey in 2006 and 2008. CH2M HILL and additional hydrology experts that have peer-reviewed the work confirmed the aquifer system can sustainably support the Water Project.

Other Eastern Mojave Properties

We also own approximately 10,800 additional acres in the eastern Mojave Desert, including the Piute and Danby Dry Lake properties.

12

Our second largest property consists of approximately 9,000 acres in the Piute Valley of eastern San Bernardino County. This landholding is located approximately 15 miles from the resort community of Laughlin, Nevada, and about 12 miles from the Colorado River town of Needles, California. Extensive hydrological studies, including the drilling and testing of a full-scale production well, have demonstrated that this landholding is underlain by high-quality groundwater. The aquifer system underlying this property is naturally recharged by precipitation (both rain and snow) within a watershed of approximately 975 square miles. Discussions with potential partners have commenced with the objective of developing our Piute Valley assets.

Additionally, we own acreage located near Danby Dry Lake, approximately 30 miles southeast of our Cadiz/Fenner landholdings. Our Danby Dry Lake property is located approximately 10 miles north of the Colorado River Aqueduct. Initial hydrological studies indicate that it has excellent potential for water supply.

Executive Offices

We lease approximately 7,200 square feet of office space in Los Angeles, California for our executive offices. The lease terminates in October 2012. Current base rent under the lease is approximately $14,500 per month.

Cadiz Real Estate

In December 2003, we transferred substantially all of our assets (with the exception of our office sublease, certain office furniture and equipment and any Sun World related assets) to Cadiz Real Estate LLC, a Delaware limited liability company (“Cadiz Real Estate”). We hold 100% of the equity interests of Cadiz Real Estate, and therefore we continue to hold 100% beneficial ownership of the properties that we transferred to Cadiz Real Estate. The Board of Managers of Cadiz Real Estate currently consists of two managers appointed by us.

Cadiz Real Estate is a co-obligor under our senior secured convertible term loan, for which assets of Cadiz Real Estate have been pledged as security.

Because the transfer of our properties to Cadiz Real Estate has no effect on our ultimate beneficial ownership of these properties, we refer throughout this Report to properties owned of record either by Cadiz Real Estate or by us as “our” properties.

Debt Secured by Properties

Our assets have been pledged as collateral for $51.412 million of debt outstanding on December 31, 2010. Information regarding interest rates and principal maturities is provided in Note 6 to the Consolidated Financial Statements.

There are no material pending legal proceedings to which we are a party or of which any of our property is the subject.

13

PART II

Our common stock is currently traded on The NASDAQ Global Market ("NASDAQ") under the symbol "CDZI." The following table reflects actual sales transactions for the dates that we were trading on NASDAQ, as reported by Bloomberg LP.

|

High

|

Low

|

|||||||

|

Quarter Ended

|

Sales Price

|

Sales Price

|

||||||

|

2009:

|

||||||||

|

March 31

|

$

|

8.20

|

$

|

7.51

|

||||

|

June 30

|

$

|

9.98

|

$

|

9.37

|

||||

|

September 30

|

$

|

11.86

|

$

|

11.44

|

||||

|

December 31

|

$

|

12.13

|

|

$

|

11.92

|

|||

|

2010:

|

||||||||

|

March 31

|

$

|

12.80

|

$

|

12.50

|

||||

|

June 30

|

$

|

12.45

|

$

|

11.41

|

||||

|

September 30

|

$

|

10.27

|

$

|

9.71

|

||||

|

December 31

|

$

|

12.50

|

|

$

|

12.14

|

|||

On March 7, 2011, the high, low and last sales prices for the shares, as reported by Bloomberg, were $12.14, $11.50, and $11.57, respectively.

As of March 7, 2011, the number of stockholders of record of our common stock was 134.

To date, we have not paid a cash dividend on our common stock and do not anticipate paying any cash dividends in the foreseeable future. Our senior secured convertible term loan has covenants that prohibit the payment of dividends.

All securities sold by us during the three years ended December 31, 2010, which were not registered under the Securities Act of 1933, as amended, have been previously reported in accordance with the requirements of Rule 12b-2 of the Securities Exchange Act of 1934, as amended.

14

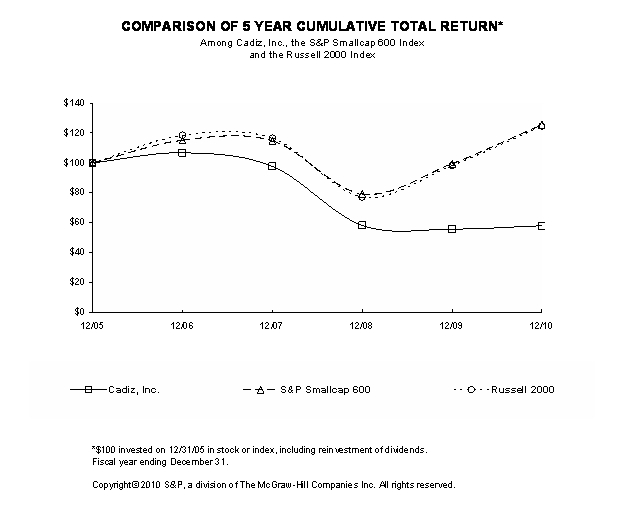

STOCK PRICE PERFORMANCE

The stock price performance graph below compares the cumulative total return of Cadiz common stock against the cumulative total return of the Standard & Poor’s Small Cap 600 NASDAQ U.S. index and the Russell 2000® index for the past five fiscal years. The graph indicates a measurement point of December 31, 2005, and assumes a $100 investment on such date in Cadiz common stock, the Standard & Poor’s Small Cap 600 and the Russell 2000® indices. With respect to the payment of dividends, Cadiz has not paid any dividends on its common stock, but the Standard & Poor’s Small Cap 600 and the Russell 2000® indices assume that all dividends were reinvested. The stock price performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this annual report on Form 10-K into any filing under the Securities Act of 1933, as amended, except to the extent that Cadiz specifically incorporates this graph by reference, and shall not otherwise be deemed filed under such acts.

15

The following selected financial data insofar as it relates to the years ended December 31, 2010, 2009, 2008, 2007, and 2006, has been derived from our audited financial statements. The information that follows should be read in conjunction with the audited consolidated financial statements and notes thereto for the period ended December 31, 2010 included in Part IV of this Form 10-K. See also Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations".

($ in thousands, except for per share data)

|

Year Ended December 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Statement of Operations Data:

|

|||||||||||||||||||

|

Total revenues

|

$

|

1,023

|

$

|

808

|

$

|

992

|

$

|

426

|

$

|

614

|

|||||||||

|

Net loss

|

(15,899

|

)

|

(14,399

|

)

|

(15,909

|

)

|

(13,633

|

)

|

(13,825

|

)

|

|||||||||

|

Net loss applicable to common stock

|

$

|

(15,899

|

)

|

$

|

(14,399

|

)

|

$

|

(15,909

|

)

|

$

|

(13,633

|

)

|

$

|

(13,825

|

)

|

||||

|

Per share:

|

|||||||||||||||||||

|

Net loss (basic and diluted)

|

$

|

(1.16

|

)

|

$

|

(1.13

|

)

|

$

|

(1.32

|

)

|

$

|

(1.15

|

)

|

$

|

(1.21

|

)

|

||||

|

Weighted-average common shares outstanding

|

13,672

|

12,722

|

12,014

|

11,845

|

11,381

|

||||||||||||||

|

December 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Balance Sheet Data:

|

|||||||||||||||||||

|

Total assets

|

$

|

48,936

|

$

|

50,319

|

$

|

47,412

|

$

|

49,572

|

$

|

50,326

|

|||||||||

|

Long-term debt

|

$

|

44,403

|

$

|

36,665

|

$

|

33,975

|

$

|

29,652

|

$

|

25,881

|

|||||||||

|

Preferred stock, common stock and additional paid-in capital

|

$

|

282,496

|

$

|

276,884

|

$

|

263,658

|

$

|

254,102

|

$

|

245,322

|

|||||||||

|

Accumulated deficit

|

$

|

(281,550

|

)

|

$

|

(265,651

|

) |

|

$

|

(251,252

|

)

|

$

|

(235,343

|

)

|

$

|

(221,710

|

)

|

|||

|

Stockholders' equity

|

$

|

946

|

$

|

11,233

|

$

|

12,406

|

$

|

18,759

|

$

|

23,612

|

|||||||||

Common shares issued and outstanding have increased from 11,330,463 in 2005 to 13,677,772 in 2010. The increase is primarily due to the issuance of shares to investors in private placements, the issuance of shares to investors upon the conversion of preferred stock and warrant exercises, and the issuance of shares to employees, vendors and lenders.

16

In connection with the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, the following discussion contains trend analysis and other forward-looking statements. Forward-looking statements can be identified by the use of words such as "intends", "anticipates", "believes", "estimates", "projects", "forecasts", "expects", "plans" and "proposes". Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from these forward-looking statements. These include, among others, our ability to maximize value from our land and water resources and our ability to obtain new financings as needed to meet our ongoing working capital needs. See additional discussion under the heading "Risk Factors” above.

Overview

Our primary asset consists of 45,000 acres of land in three areas of eastern San Bernardino County, California. Virtually all of this land is underlain by high-quality, naturally recharging groundwater resources, and is situated in proximity to the Colorado River and the Colorado River Aqueduct, the major source of imported water for Southern California. Our main objective is to realize the highest and best use of these land and water resources in an environmentally responsible way.

In 1993, we secured permits for up to 9,600 acres of agricultural development at our 35,000-acre property in the Cadiz Valley and the withdrawal of more than one million acre-feet of groundwater from the underlying aquifer system. Since that time, we have maintained various levels of agricultural development at the property and this development has provided our principal source of revenue. Although sustainable agricultural development is an important and enduring component of our business, we believe that the long-term value of our assets can best be derived through the development of a combination of water supply, water storage, and solar energy projects at our properties.

The primary factors that drive the value of water supply projects are continued population growth and increasing pressure on water supplies throughout California. Southern California in particular now faces the prospect of long-term and systematic water supply shortages resulting from restrictions on each of its three imported water sources: the State Water Project, the Colorado River and the Owens Valley. As a result of these restrictions, water agencies must overcome significant projected supply deficiencies to meet existing and projected demands. For example, despite experiencing above-average rainfall in each of the last two years, ongoing environmental and regulatory restrictions affecting California’s water supplies and infrastructure have forced many water providers to limit water deliveries to their customers. Given that the present imbalance in annual supply and demand is projected to continue for many years into the future, water providers are now evaluating new sources of supply as a method to off-set their existing shortages.

Opportunities in the solar energy production market are being driven by a series of policy initiatives issued by the State of California and the United States government. This includes California’s mandate to acquire 33% of the state’s electricity from renewable sources by 2020 and federal efforts to accelerate renewable energy and transmission project development in the Mojave Desert. Energy companies, government agencies and environmental organizations are actively working to identify suitable locations for solar energy development to meet future energy needs and have encouraged development on private lands.

17

As a result of these developments in the water and energy sectors, we plan to continue to pursue water supply, water storage and solar energy projects at our properties. At present, our development efforts are primarily focused on the Cadiz Valley Water Conservation, Recovery and Storage Project (“Water Project”), which involves the capture, delivery and storage of groundwater that is otherwise lost to evaporation. We believe that the ultimate implementation of this Water Project will create the primary source of our future cash flow and, accordingly, our working capital requirements relate largely to the development activities associated with this Water Project.

Water Resource Development

The Water Project involves the capture, delivery and storage of groundwater that would otherwise be lost to evaporation. The Water Project would be designed, constructed and operated in accordance with prudent groundwater management principles so as to maximize the reasonable and beneficial use of groundwater, and avoid waste and harm to the environment or other consumptive users.

In general, several elements are needed to implement such a project: (1) a pipeline right-of-way from the Colorado River Aqueduct to the Water Project area; (2) storage and supply agreements with one or more public water agencies or private water utilities; (3) environmental permits; and (4) construction and working capital financing. As described below, the first three elements have been progressed on a concurrent basis. The fourth is dependent on actions arising from the completion of the first three.

|

(1)

|

A Pipeline Right-of-Way from the Colorado River Aqueduct to the Water Project Area

|

In September 2008, we secured a right-of-way for the Water Project’s water conveyance pipeline by entering into a lease agreement with the Arizona & California Railroad Company. The agreement allows for the use of a portion of the railroad’s right-of-way for a period up to 99 years to construct and operate the Water Project’s water conveyance pipeline. The pipeline would be used to convey water between our Cadiz/Fenner property and the Colorado River Aqueduct.

|

(2)

|

Storage and Supply Agreements with One or More Public Water Agencies or Private Water Utilities

|

In June 2010, we entered into option and environmental cost sharing agreements with three water providers: Santa Margarita Water District (“SMWD”), Golden State Water Company (a wholly-owned subsidiary of American States Water [NYSE: AWR]) and Three Valleys Municipal Water District. The three water providers serve more than one million customers in cities throughout California’s San Bernardino, Riverside, Los Angeles, Orange and Ventura Counties.

18

In September 2010, we also entered into option and environmental cost sharing agreements with Suburban Water Systems, a wholly-owned subsidiary of SouthWest Water Company. Suburban Water Systems provides water to a population of approximately 300,000 people in a 42-square-mile service area in California's Los Angeles and Orange counties.

Under the terms of the agreements with the four water providers, upon completion of the Water Project’s California Environmental Quality Act (“CEQA”) review, each agency will have the right to acquire an annual supply of 5,000 acre-feet of water at a pre-determined formula competitive with their incremental cost of new water. SMWD also was given the option to purchase an additional 10,000 acre-feet of water per year. In addition, the agencies have options to acquire storage rights in the Water Project to allow them to manage their supplies to complement their other water resources. The option agreements had no impact on our operations, financial position, or cash flows for the year-ended December 31, 2010.

We continue to work with additional water providers interested in acquiring rights to the remaining annual supply expected to be conserved by the Water Project and are in discussions with third parties regarding the imported storage aspect of this Project. We have also begun to develop an operating plan for the Water Project that will manage the delivery of conserved water to the Project’s subscribers.

|

(3)

|

Environmental Permits

|

In order to properly develop and quantify the sustainability of the Water Project, and prior to initiating the formal permitting process for the Water Project, we commissioned internationally recognized environmental consulting firm CH2M HILL to complete a comprehensive study of the water resources at the Project area. Following a year of analysis, CH2M HILL released its study of the aquifer system in February 2010. Utilizing new models produced by the U.S. Geological Survey in 2006 and 2008, the study estimated the total groundwater in storage in the aquifer system to be between 17 and 34 million acre-feet, a quantity on par with Lake Mead, the nation’s largest surface reservoir. The study also identified a renewable annual supply of native groundwater in the aquifer system currently being lost to evaporation. CH2M HILL’s findings, which were peer reviewed by leading groundwater experts, confirmed that the aquifer system could sustainably support the Water Project.

Further, and also prior to beginning the formal environmental permitting process, we entered into a Memorandum of Understanding with the Natural Heritage Institute (“NHI”), a leading global environmental organization committed to protecting aquatic ecosystems, to assist with our efforts to sustainably manage the development of our Cadiz/Fenner property. As part of this “Green Compact,” we will follow stringent plans for groundwater management and habitat conservation, and create a groundwater management plan for the Water Project.

In June 2010, as discussed in (2), above, we entered into environmental cost sharing agreements with all participating water providers. The environmental cost sharing agreements created a framework for funds to be committed by each participant to share in the costs associated with the ongoing CEQA review work. SMWD has agreed to serve as the lead agency for the review process. In July 2010, ESA Associates, a leading environmental consulting firm, was retained to prepare the formal CEQA documentation. In February 2011, SMWD issued a Notice of Preparation of a Draft Environmental Impact Report (DEIR) formally commencing the public portion of the CEQA permitting process for the Water Project.

19

|

(4)

|

Construction and Working Capital

|

Once the environmental review is concluded, we expect that we will complete economic agreements with the Water Project participants and make arrangements for the construction phase of the Water Project. Construction would consist of well-field facilities at the Water Project site and a conveyance pipeline extending approximately 44 miles along the right-of-way described in (1), above, from the well-field to the Colorado River Aqueduct.

Agricultural Development

Within the Cadiz/Fenner property, 9,600 acres have been zoned for agriculture. The infrastructure includes seven wells that are interconnected within this acreage, with total annual production capacity of approximately 13,000 acre feet of water. Additionally, there are housing and kitchen facilities that support up to 300 employees. The underlying groundwater, fertile soil, and desert temperatures are well suited for a wide variety of fruits and vegetables.

Permanent crops currently in commercial production include 160 acres of vineyards of certified organic, dried-on-the-vine raisins and 260 acres of lemons. Both of these crops are farmed using sustainable agricultural practices.

Seasonal vegetable crops in 2010 included squash and beans. All seasonal vegetable crops are grown organically.

We currently derive our agricultural revenues through the sale of our products in bulk or through independent packing facilities. We incur all of the costs necessary to produce and harvest our organic raisin crop. These raisins are then sold in bulk to a raisin processing facility. We also incur all of the costs necessary to produce our lemon crop. Once harvested, the lemons are shipped in bulk to a packing and sales facility. In recent periods, our agricultural revenues have declined largely due to the removal of 640 acres of vineyard during the years 2004 through 2007 as the vineyard reached the end of its commercial life. In 2009, we entered into a lease agreement with a third party to replace the acreage that was taken out of production by developing up to an additional 500 acres of lemon orchards. We expect to receive lease income once the new lemon orchards reach commercial production through a profit sharing agreement within the lease. The first 40 acres of this new orchard were planted in March 2010.

Although we plan to maintain our agricultural development, revenues will continue to vary from year to year based on acres in development, crop yields, and prices. Further, we do not believe that our agricultural revenues are likely to be material to our overall results of operations once we begin to receive revenues from the Water Project.

Renewable Energy and Other Development Opportunities

In addition to the projects described above, we believe that our landholdings are suitable for other types of development, including solar energy production. Located in an area with strong solar irradiation, proximity to existing utility corridors, appropriate topography, and access to water supplies, our properties could provide an ideal setting for solar energy generation. Moreover, state, federal and local government entities, along with environmental organizations, have issued compelling calls to increase the production of renewable energy to reduce greenhouse gas emissions and the consumption of imported fossil fuels. Solar energy development on private land, particularly in the Mojave Desert region where our properties are located, is being encouraged as an alternative to the use of federal desert lands.

20

We believe that we can ease the demand for the use of federal lands for siting solar facilities in the Mojave Desert by providing solar development opportunities on our significant, contiguous private landholdings. Up to 20,000 acres at our Cadiz/Fenner property could potentially be made available for solar energy projects. We are presently in discussions with energy companies interested in utilizing our landholdings for various types of solar energy development.

In addition to solar energy development, we believe that over the longer-term, the population of Southern California, Nevada, and Arizona will continue to grow, and that, in time, the economics of commercial and residential development of our properties will become attractive.

We remain committed to the ongoing sustainable use of our land and water assets, and will continue to explore all opportunities for environmentally-responsible development of these assets. We cannot predict with certainty which of these various opportunities will ultimately be utilized.

Results of Operations

(a) Year Ended December 31, 2010 Compared to Year Ended December 31, 2009

We have not received significant revenues from our water resource and real estate development activity to date. Our revenues have been limited to our agricultural operations. As a result, we continue to incur a net loss from operations. We had revenues of $1.0 million for the year ended December 31, 2010, and $0.8 million for the year ended December 31, 2009. The increase in revenue is primarily due to a larger raisin and lemon harvest in 2010 in comparison to 2009. The net loss totaled $15.9 million for the year ended December 31, 2010, compared with a net loss of $14.4 million for the year ended December 31, 2009. The higher 2010 loss was primarily due to higher stock based non-cash compensation costs related to shares and options issued under the 2009 Equity Incentive Plan.

Our primary expenses are our ongoing overhead costs (i.e. general and administrative expense) and our interest expense. We will continue to incur non-cash expenses in connection with our management and director equity incentive compensation plans.

Revenues. Revenue totaled $1.0 million during the year ended December 31, 2010, compared to $0.8 million during the year ended December 31, 2009. The increase in revenue was primarily due to a larger raisin and lemon harvest in 2010 in comparison to 2009. 2010 revenues included $0.7 million of revenues related to citrus crop sales, which were up $0.1 million from the prior year, and $0.3 million of revenues related to raisin sales, which were up $0.1 million from the prior year.

Cost of Sales. Cost of Sales totaled $0.9 million during the year ended December 31, 2010, compared with $1.1 million during the year ended December 31, 2009. The higher cost of sales for the year ended December 31, 2009, related largely to a reduction in carrying costs of the 2008 raisin inventory resulting in a write-down of inventory in 2009.

21

General and Administrative Expenses. General and administrative expenses during the year ended December 31, 2010, totaled $10.8 million compared with $9.4 million for the year ended December 31, 2009. Non-cash compensation costs related to stock and option awards are included in general and administrative expenses.

Compensation costs from stock and option awards for the year ended December 31, 2010 totaled $4.0 million compared with $2.3 million for the year ended December 31, 2009. The higher 2010 expense related largely to the issuance of restricted shares and the vesting of options that were issued under our 2009 Equity Incentive Plan.

Other general and administrative expenses, exclusive of stock based compensation costs, totaled $6.8 million in the year ended December 31, 2010, compared with $7.1 million for the year ended December 31, 2009. The higher 2009 expenses were primarily due to new hydrological studies and an incentive fee earned for certain legal and advisory services upon completion of milestones associated with the Water Project.

Depreciation. Depreciation expenses totaled $0.3 million for the year ended December 31, 2010, compared to $0.3 million for 2009.

Interest Expense, net. Net interest expense totaled $4.7 million during the year ended December 31, 2010, compared to $4.3 million during 2009. The following table summarizes the components of net interest expense for the two periods (in thousands):

|

Year Ended

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Interest on outstanding debt

|

$

|

2,782

|

$

|

2,356

|

||||

|

Amortization of debt discount

|

1,918

|

1,937

|

||||||

|

Amortization of deferred loan costs

|

42

|

56

|

||||||

|

Interest income

|

(8

|

)

|

(35

|

)

|

||||

|

$

|

4,734

|

$

|

4,314

|

|||||

The interest on outstanding debt increased from $2.4 million to $2.8 million due to the increase in interest rate from 5% to 6% per annum on the senior secured convertible term loan and the increase in debt outstanding under the new working capital facility, while the amortization of debt discount decreased slightly due to extension of the accretion schedule related to the conversion option embedded in the term loan. 2010 interest income decreased to $8 thousand from $35 thousand in the prior year due to lower short-term interest rates and a more conservative investment policy.

22

Debt Refinancing. Deferred loan costs, which are primarily legal fees, are amortized over the life of each loan agreement. In June 2006, we refinanced our term loan with ING Capital LLC (“ING”) with a new senior secured convertible term loan with a different lender. As a result, $408,000 of legal fees were capitalized and will be amortized over the 7 year life of the loan agreement. An additional $105,000 of lender fees were capitalized when the term loan was modified in October 2010. These fees will be amortized over the remaining life of the term loan. In June 2009 and October 2010, the term loan was modified as to certain of its conversion features. As a result of the of these convertible debt arrangements, the change in conversion value between the original and modified instrument totaled approximately $3.2 million, which was recorded as additional debt discount with an offsetting amount recorded as additional paid-in capital. Such debt discount is accreted to the redemption value of the instrument over the remaining term of the loan as additional interest expense. In connection with the modification transaction in October 2010, a derivative liability related to the conversion option was recorded. This derivative liability had a fair value of $451 thousand at December 31, 2010, and will be marked-to-market at the end of each reporting period and recorded as other income (expense).

(b) Year Ended December 31, 2009 Compared to Year Ended December 31, 2008

We had revenues of $0.8 million for the year ended December 31, 2009, and $1.0 million for the year ended December 31, 2008. The decrease in revenue is primarily due to a smaller raisin and lemon harvest in 2009 in comparison to 2008. The net loss totaled $14.4 million for the year ended December 31, 2009, compared with a net loss of $15.9 million for the year ended December 31, 2008. The larger loss in 2008 resulted primarily from higher non-cash expenses related to stock and option awards, and expenses related to our lawsuit against the Metropolitan Water District of Southern California that was settled in the first quarter of 2009.

Revenues. Revenue totaled $0.8 million during the year ended December 31, 2009, compared to $1.0 million during the year ended December 31, 2008. The decrease in revenue is primarily due to a smaller raisin and lemon harvest in 2009 in comparison to 2008. 2009 revenues included $0.6 million of revenues related to citrus crop sales, which were down $0.1 million from the prior year, and $0.2 million of revenues related to raisin sales, which were down $0.1 million from the prior year.

Cost of Sales. Cost of Sales totaled $1.1 million during the year ended December 31, 2009, compared with $1.1 million during the year ended December 31, 2008.

General and Administrative Expenses. General and administrative expenses during the year ended December 31, 2009, totaled $9.4 million compared with $11.2 million for the year ended December 31, 2008. Non-cash compensation costs related to stock and option awards are included in general and administrative expenses.

Compensation costs from stock and option awards for the year ended December 31, 2009 totaled $2.3 million compared with $4.4 million for the year ended December 31, 2008. The expense reflects the vesting schedule of the 2007 Management Equity Incentive Plan stock awards that became effective in July 2007. Of these amounts, $1.2 million in 2009 and $3.1 million in 2008 relate to Milestone Based Deferred Stock, none of which were ultimately issued. Shares and options issued under the Plans vested over varying periods from the date of issue to January 2011.

Other general and administrative expenses, exclusive of stock based compensation costs, totaled $7.2 million in the year ended December 31, 2009, compared with $6.8 million for the year ended December 31, 2008. Higher 2009 expenses were primarily due to additional legal and consulting fees related to water development efforts.

23

Depreciation. Depreciation expenses totaled $0.3 million for the year ended December 31, 2009, compared to $0.3 million for 2008.

Interest Expense, net. Net interest expense totaled $4.3 million during the year ended December 31, 2009, compared to $4.3 million during 2008. The following table summarizes the components of net interest expense for the two periods (in thousands):

|

Year Ended

December 31,

|

||||||||

|

2009

|

2008

|

|||||||

|

Interest on outstanding debt

|

$

|

2,356

|

$

|

2,033

|

||||

|

Amortization of debt discount

|

1,937

|

2,299

|

||||||

|

Amortization of deferred loan costs

|

56

|

77

|

||||||

|

Interest income

|

(35

|

)

|

(107

|

)

|

||||

|

$

|

4,314

|

$

|

4,302

|

|||||