Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - STEINWAY MUSICAL INSTRUMENTS INC | a2202616zex-32_2.htm |

| EX-32.1 - EX-32.1 - STEINWAY MUSICAL INSTRUMENTS INC | a2202616zex-32_1.htm |

| EX-31.1 - EX-31.1 - STEINWAY MUSICAL INSTRUMENTS INC | a2202616zex-31_1.htm |

| EX-31.2 - EX-31.2 - STEINWAY MUSICAL INSTRUMENTS INC | a2202616zex-31_2.htm |

| EX-23.1 - EX-23.1 - STEINWAY MUSICAL INSTRUMENTS INC | a2202616zex-23_1.htm |

| EX-23.2 - EX-23.2 - STEINWAY MUSICAL INSTRUMENTS INC | a2202616zex-23_2.htm |

| EX-21.1 - EX-21.1 - STEINWAY MUSICAL INSTRUMENTS INC | a2202616zex-21_1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010 |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER 001-11911

STEINWAY MUSICAL INSTRUMENTS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 35-1910745 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

800 South Street, Suite 305, Waltham, Massachusetts (Address of Principal Executive Offices) |

02453 (Zip Code) |

|

Registrant's telephone number, including area code (781) 894-9770 |

||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered |

|

|---|---|---|

| Ordinary Common Shares, $.001 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements during the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the Common Stock held by non-affiliates of the registrant was $82,946,693 as of June 30, 2010.

Number of shares of Common Stock outstanding as of March 8, 2011: |

Class A | 477,952 | ||

|

Ordinary | 11,578,360 | ||

|

Total | 12,056,312 |

DOCUMENTS INCORPORATED BY REFERENCE

Part III – Items 10-14 – Definitive Proxy Statement of the Registrant to be filed pursuant to Regulation 14A, Parts I-IV – Final Prospectus of the Registrant dated August 1, 1996 filed pursuant to Rule 424(b).

Note Regarding Forward-Looking Statements

Certain statements contained throughout this Annual Report on Form 10-K are "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent our present expectations or beliefs concerning future events. We caution readers that such statements are necessarily based on certain assumptions that are subject to risks and uncertainties, which could cause actual results to differ materially from those indicated in this report. These risk factors include, but are not limited to, the factors discussed in Item 1A of this report. We encourage investors to read Item 1A carefully. Undue reliance should not be placed on the forward-looking statements contained in this report. These statements, like all statements contained in this report, speak only as of the date of this report (unless another date is indicated) and we undertake no obligation to update or revise the statements except as required by law.

Note Regarding Incorporation By Reference

The Securities and Exchange Commission ("SEC") allows us to disclose certain information by referring the reader to other documents we have filed with the SEC. The information to which we refer is "incorporated by reference" into this Annual Report on Form 10-K. Please read that information.

Company History

Steinway Musical Instruments, Inc., through its wholly owned subsidiaries, is a global leader in the design, manufacture, marketing and distribution of high quality musical instruments. We are the largest domestic manufacturer of musical instruments. Whenever we refer to the "Company" or to "us," or use the terms "we" or "our" in this annual report, we are referring to Steinway Musical Instruments, Inc. and its subsidiaries.

Steinway Musical Instruments, Inc., formerly Selmer Industries, Inc., was incorporated in 1993. We are a Delaware corporation with our principal executive offices located at 800 South Street, Suite 305, Waltham, Massachusetts 02453, and our telephone number is (781) 894-9770. Through our corporate website, www.steinwaymusical.com, we provide access free of charge to all of our filings with the SEC, including our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. These reports are available immediately following filing with the SEC. Information contained on or connected to our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this report or any other filing that we make with the SEC. Additionally, the SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers like us that file electronically with the SEC.

Financial Information by Segment and Geographic Location

Information on business segments and geographic areas in which we operated for the years ended December 31, 2010, 2009 and 2008 is contained in Note 17 to the Consolidated Financial Statements included in this report.

Musical Instrument Industry

We operate two reportable segments within the musical instrument industry: pianos and band & orchestral instruments.

1

Pianos – The overall piano market is comprised of two main categories: grand pianos and upright pianos. Steinway & Sons pianos compete in the high-end segment of the market, whereas our Boston and Essex lines compete in the mid-priced segment of the piano market.

From 2005 to 2009, grand piano sales declined sharply in the United States, the world's largest grand piano market. In 2010, industry sales showed some recovery, but the U.S. grand piano market remains significantly lower than historical averages. Since Steinway realizes the majority of its profit from high-end grand piano sales, our results are generally more affected by economic cycles, demographics, and the public's continued interest in music than by industry trends. As a result of the recent economic crisis, our sales in the United States and in most of our markets overseas continue to be at depressed levels.

Band & Orchestral Instruments – Historically, demand for band & orchestral instruments in the domestic market have been more significantly impacted by factors such as demographic trends than by macroeconomic cycles. However, the recent financial crisis has impaired the ability of some dealers to obtain the credit necessary to purchase inventory. In addition, in some areas of the United States, the downturn has led to cuts in state budgets which may negatively impact school music programs in the short term.

Studies have emphasized the importance of music education in a child's development and many school band directors promote band programs as social organizations rather than the first step of intensive music study. We expect this emphasis on music education and steady demographic trends to contribute to a relatively stable domestic market in the long term.

Imports into the domestic market from offshore low-cost producers have created a highly price sensitive domestic market where manufacturers have implemented aggressive pricing programs in an attempt to maintain market share positions. Imported instruments have also allowed dealers to source their own proprietary lines in an attempt to improve their margins. To remain competitive in this market, we import some student woodwind and brass instruments, primarily entry-level, made to our specifications. The impact of lower priced imported instruments has also led to consolidation within the industry, leaving Conn-Selmer, Yamaha and Jupiter as the top three remaining full line competitors.

Business and Products

Piano Segment

The Family of Steinway-Designed Pianos is a comprehensive offering of the world's finest pianos at three distinct price points to suit every buyer looking to purchase a fine quality piano. The family is comprised of our three brands: Steinway & Sons, Boston and Essex.

Steinway & Sons grand pianos, handcrafted in New York and Germany, are considered to be the highest quality pianos in the world and have one of the most widely recognized and prestigious brand names. We also offer Steinway & Sons upright pianos as well as two mid-priced lines of pianos under the Boston and Essex brand names.

Steinway & Sons Pianos – Steinway & Sons pianos differ from all others in design specifications, materials used and the assembly process. We offer two premium-priced product lines under the Steinway & Sons brand: grand pianos and upright pianos. Grand pianos historically have accounted for the majority of our production. We offer seven sizes of the grand piano ranging from the 5'1" baby grand to the largest 9' concert grand. The smaller grands are sold to both individual and institutional customers, while the concert grands are sold primarily to institutions. Steinway & Sons grand pianos are premium pianos in terms of quality and price, with retail prices for ebony pianos generally ranging from $51,400 to $130,800 in the United States. Limited edition pianos and pianos with special veneers sell for retail prices of up to $200,000. Steinway & Sons also offers art case pianos designed by either Steinway master craftsmen or renowned artisans. These unique creations often feature exteriors of

2

elaborate marquetry and intricate hand-painting. Many of these pianos are created to commemorate special events and anniversaries.

In 2010, we sold 1,836 grand pianos, of which 1,032 units were shipped from our New York facility to dealers in the Americas. The remaining 804 units were shipped from our German facility primarily to Europe and Asia.

Our upright pianos are intended to satisfy the needs of institutions and other customers who are constrained by space limitations. We also provide services such as repair, replacement part sales, tuning and regulation of pianos, and restoration. Restoration services range from repairs of minor damage to complete restorations of vintage pianos.

Boston and Essex Pianos – Our Boston and Essex lines allow us to compete in the mid-priced category. In 2009, we significantly enhanced the Boston piano with the introduction of the Boston Performance Edition. The improvements in materials, specifications and performance put Boston at the top of the mid-priced range, just below Steinway & Sons.

With certain limited exceptions, we allow only Steinway & Sons dealers to carry Boston and Essex pianos, thereby ensuring that these pianos will be marketed as complementary product lines to the Steinway & Sons line. These pianos, which were designed by us and are produced for us in Asia, provide our dealers with an opportunity to realize better margins in this price range while capturing sales that would have otherwise gone to a competitor. Also, since our research indicates that the vast majority of Steinway customers have previously owned another piano, Boston and Essex pianos provide future Steinway piano customers with the opportunity to join the Steinway family of owners sooner. The Family of Steinway-Designed Pianos increases our business with our dealers, making us their primary supplier in many instances. Retail prices for Boston upright and grand pianos generally range from $7,100 to $49,100 in the United States. Retail prices for Essex pianos range from $4,600 to $18,500 in the United States. Sales of Boston and Essex pianos accounted for 25% of our piano division revenue and 76% of piano unit sales in 2010.

Band Segment

We are the largest domestic producer of band & orchestral instruments and offer a complete line of brass, woodwind, percussion and string instruments with well-known brand names. We have complemented our domestic manufacturing strategy with a sourcing strategy from Asia to remain competitive in the marketplace. We have established relationships with several overseas manufacturers to produce entry-level student instruments to our design specifications. To ensure that our imported instruments meet our expectations, we have our own quality assurance staff in China to monitor and evaluate our instrument suppliers.

In 2010, sales of sourced products accounted for approximately 40% of our band division revenue. In addition to entry-level student woodwind and brass instruments from Asia, which comprise approximately 10% of our total band sales, we also import other products such as saxophones, outfit drums and accessories from sources worldwide.

Woodwind and Brass Instruments – We manufacture piccolos, flutes, clarinets, oboes, bassoons, trumpets, French horns, tubas, and trombones in our manufacturing facilities in Indiana and Ohio. We sell student level instruments in three distinct product groupings: "good" entry-level imported instruments, "better" mid-priced instruments, which are either imported or manufactured by us, and "best" instruments, which are primarily manufactured by us. In addition, we also manufacture intermediate and professional level woodwind and brass instruments. Sales of woodwind and brass instruments accounted for 63% of our band division revenue in 2010.

We sell our woodwind and brass products under the brand names Bach, Selmer, Selmer Paris, C.G. Conn, Leblanc, King, Armstrong, Holton, Yanagisawa, Vito, Emerson, Avanti, Noblet, Artley, and Benge.

3

Suggested retail prices generally range from $300 to $2,500 for student instruments and from $1,100 to $14,000 for intermediate and professional instruments. We often customize the products that we sell to professional musicians so that the product meets requested design specifications or has certain sound characteristics. We believe that specialization of products helps maintain a competitive edge in quality and product design. Our specialized woodwind and brass instruments sell for up to $34,000.

We are the exclusive U.S. distributor for Yanagisawa saxophones and Selmer Paris saxophones and clarinets. The Selmer Paris saxophone is one of the best selling professional saxophones in the world. Selmer Paris, in turn, has exclusive distribution rights to some of our brass instruments in France.

Percussion Instruments – We manufacture, source, and distribute acoustical and tuned percussion instruments, including outfit drums, marching drums, concert drums, marimbas, xylophones, vibraphones, orchestra bells, and chimes. We manufacture percussion products in North Carolina and Illinois under the Ludwig and Musser brand names. Ludwig is considered a leading brand name in acoustical drums and timpani and Musser has a strong market position in tuned percussion products. Suggested retail prices range from $500 to $5,600 for acoustical drum outfits and from $1,000 to $17,700 for tuned percussion instruments, with specialized tuned instruments purchased by symphonies and orchestras selling for up to $23,000. Sales of percussion instruments accounted for 16% of our band division revenue in 2010.

String Instruments – We distribute violins, violas, cellos, and basses. Products are sold under the brand names Glaesel, Scherl & Roth, and William Lewis & Son. Suggested retail prices generally range from $400 to $3,000 for student instruments and from $1,400 to $5,300 for intermediate and advanced instruments, with specialized instruments selling for up to $16,000. Components are primarily imported from Europe and Asia and adjusted at our factory in Ohio. Sales of string instruments accounted for 2% of our band division revenue in 2010.

Accessories – We manufacture mouthpieces and distribute accessories such as music stands, batons, mallets, straps, mutes, reeds, pads, chin rests, strings, bows, cases and instrument care products. Sales of accessories accounted for 19% of our band division revenue in 2010.

Customers

Piano Segment

Most of our piano sales are to individuals, both professional artists and amateur pianists. A majority of our Boston and Essex customers are between 40 and 50 years old and have an intermediate level of musical skill. They hold graduate degrees and report annual household income over $100,000. A majority of our Steinway & Sons customers are over 50 years old, and have a more advanced level of musical skill. They also hold graduate degrees and report income over $300,000.

The institutional segment of the piano market is less sensitive to economic cycles than the consumer segment. Over the past several years, we have increased our marketing and sales focus on the institutional market, particularly in the United States. We sell pianos to institutions such as concert halls, universities, music schools, houses of worship, hotels, and retirement homes. Approximately 17% of pianos sold in 2010 were to institutional customers. The All-Steinway School program targets music schools, conservatories and universities and encourages them to obtain the All-Steinway designation in order to attract the best music students to their programs. This prestigious list grew 9% in 2010, to 123 institutions worldwide.

Market size and volume trends are difficult to quantify for international piano markets, as there is no single source for worldwide sales data. Outside the United States, our strongest market shares are in Germany, Austria, Switzerland, the United Kingdom, and France. We believe that we hold an average grand piano market share of approximately 18% in these countries.

4

China is currently the second largest grand piano market in the world and our unit sales in China grew nearly 50% in 2010. With our three piano lines, we believe our market share of grand piano units is currently 6% in China. In recent years, we also began penetrating former Eastern Bloc countries and our unit sales in this region grew 34% in 2010. Similarly, we will be expanding our presence in Brazil in 2011 as our marketing research indicates a strong interest in music in general and pianos in particular. We expect a large portion of our long-term growth to come from these regions.

In 2010, our piano sales had the following geographic breakdown based on customer location: approximately 35% in the United States, 34% in Europe, 11% in China, 10% in Japan, and the remaining 10% primarily in other Asian countries. Our largest piano dealer accounted for approximately 3% of piano sales in 2010, while the top 15 accounts represented 25% of piano sales.

Band Segment

Band & orchestral instruments are sold to students, amateur and professional musicians, and institutions. The majority of our instruments are purchased or rented from dealers by students enrolled in music education programs in the United States. Traditionally, students join school bands or orchestras at age 10 or 11 and learn on beginner level instruments, progressing to intermediate or professional level instruments in high school or college. We estimate that approximately 80% of our domestic band sales are generated through educational programs. The remaining domestic band sales are to amateur or professional musicians or performing groups, including orchestras and symphonies. Student level instruments accounted for approximately 58% of band & orchestral unit sales and approximately 33% of instrument revenues in 2010, with intermediate and professional instruments representing the balance.

Historically, over 80% of our band sales have been in the United States. In recent years, Asian and European markets have presented significant opportunities for growth due to the quality of our instruments and the strength of our brand names. Through collaborative efforts with our overseas distributors, we expect these markets to be a source of revenue growth in the coming years.

In 2010, approximately 75% of band sales were in the United States, 10% in Europe and the remaining 15% primarily in Japan and Canada. Our largest group of band dealers under common control accounted for approximately 11% of band sales in 2010, while the top 15 accounts represented approximately 39% of band sales.

Sales and Marketing

Piano Segment

We distribute our pianos worldwide through nearly 200 independent dealers who operate approximately 300 showrooms. We also have company operated selection centers in Tokyo and Shanghai which serve our dealers in Japan and China. In addition, we sell our pianos through eleven company operated retail showrooms: six in the United States and five in Europe. Sales to dealers accounted for approximately 75% of piano segment revenue in 2010. The remaining 25% was generated from sales made directly by us at one of our company operated retail showrooms.

We continually refine our sales and marketing programs for the consumer and institutional markets and, over recent years, have devoted significant resources to web-based marketing and sales lead generation. We employ district sales managers whose responsibilities include developing close working relationships with piano dealers. These highly experienced professionals provide dealers with sales training and technical support, and develop sales and marketing programs for the consumer and institutional markets. These sales managers are also responsible for promoting the Steinway Artist Program.

5

Steinway Artist Program – Steinway Artists are world-class pianists who voluntarily endorse Steinway & Sons by selecting the Steinway piano. Our Steinway Artist program is unique in that we do not pay artists to endorse our instruments. To become a Steinway Artist, a pianist must not only meet certain performance and professional criteria, he or she must also own a Steinway piano. We use these renowned artists in our marketing programs to help reinforce recognition of the Steinway brand name and its association with quality. The Steinway Artist Program currently includes over 1,600 of the world's finest pianists who perform on Steinway pianos.

Young Steinway Artist Program – Often a formal affiliation with Steinway & Sons has not been possible for an emerging artist since all Steinway Artists must personally own a Steinway piano. The financial realities of developing a career can often make that requirement difficult for many otherwise deserving young musicians. In an effort to reach out to young pianists at an early point in their burgeoning careers, we recently developed the Young Steinway Artist Program. This program allows us to consider pianists between 16 and 35 years of age who own either a Boston or an Essex piano. The select group of talented musicians chosen for the Young Steinway Artist Program has the distinction of an affiliation with the Steinway Artist family as well as access to the worldwide resources of Steinway & Sons.

Concert and Artist Piano Bank – To ensure that all pianists, especially Steinway Artists, have a broad selection of instruments to meet their individual touch and tonal preferences, we maintain the Concert and Artist Piano Bank. The Piano Bank includes approximately 435 instruments worldwide. Of these instruments, approximately 300 are located in the United States. In New York City alone, the Piano Bank includes approximately 115 instruments. Approximately 50% of these pianos are housed at local concert venues and the remaining instruments are at our flagship showroom in New York City where they are made available for various occasions. The remaining domestic-based pianos are leased to dealers around the country who actively support the Steinway Artist program. The Piano Bank promotes our instruments in the music industry and provides management with continual feedback on the quality and performance of recently produced instruments from our most critical customer, the professional pianist. The Piano Bank instruments are generally sold after four to five years and replaced with new pianos.

Band Segment

Our band & orchestral, string and percussion instruments and related accessories are distributed worldwide through nearly 1,500 independent musical instrument dealers and distributors.

In North America, we market our products through district sales managers and telemarketing representatives who are responsible for sales within assigned geographic territories. Each district sales manager is also responsible for developing relationships with band & orchestral directors. These directors represent all levels of music educators, from those who teach elementary school children through those involved at the college and professional levels. These individuals are the primary influencers in the choice of an instrument brand as they will generally refer students to designated dealers for the purchase of instruments.

We believe that our well-established, long-standing relationships with influential music educators are an important component of our distribution strategy. As part of our band director outreach and support, we recently launched a Division of Education to provide an educational forum that supports the day-to-day realities of music classroom management. Led by our Vice President of Education, our educational clinicians travel extensively throughout the United States, lecturing and motivating students, educators and parents on the value of music in a child's development. Within our Education Division, we continue to operate Conn-Selmer Institute ("CSI"), a program which assists graduating music education majors transition into teaching careers. CSI also offers refresher courses to experienced music educators, further enhancing our relationships with these key influencers.

6

To reach international markets, we primarily sell our instruments through distributors. Our international sales staff includes regional sales directors who have direct contact with our customers in Europe, Latin America and Asia.

We support our dealers and distributors through advertising and promotional activities. We reach our customers through trade shows, educator conferences, print media, direct mail, telemarketing, the Internet and personal sales calls. We also actively advertise in educator and trade publications and provide educational materials, catalogs and product specifications to students, educators, dealers and distributors.

Competition

Piano Segment

Steinway & Sons Pianos – The level of competition our pianos face depends on the market definition. Steinway & Sons pianos hold a unique position at the top of the grand piano market, both in terms of quality and price. While there are many makers of pianos, only a few compete directly with our Steinway brand. Other manufacturers of primarily higher priced pianos include Bösendorfer and Fazioli.

Because Steinway pianos are built to last for generations, a relatively large market exists for used Steinways. It is difficult to estimate the significance of used piano sales because most are conducted in the private aftermarket. However, we believe that used Steinway pianos provide the most significant competition in the high end piano market.

Boston and Essex Pianos – Our mid-priced pianos compete with brands such as Bechstein, Schimmel, Kawai, and Yamaha. By working with manufacturers in Asia, we have been able to enjoy labor costs and manufacturing efficiencies similar to those of some of our primary competitors while offering consumers the added benefit of pianos designed by Steinway & Sons.

Band Segment

We are the largest domestic producer of band & orchestral instruments and we have leading market shares with many of our professional level instruments. Yamaha, a Japanese corporation, is our largest competitor. New entrants into the domestic market generally experience difficulty competing due to the need for both brand recognition and an effective distribution system.

Due to the growth of offshore manufacturers and the ease of international trade, competition for sales of student level instruments in the United States has intensified in recent years. These producers benefit from low labor costs, enabling them to offer instruments at highly competitive prices. Imported instruments have also allowed dealers to source their own proprietary lines in an attempt to improve their margins. It is difficult to quantify the impact of imported musical instruments since the majority of offshore manufacturers do not report data through industry channels.

Patents and Trademarks

Steinway & Sons pioneered the development of the modern piano with over 150 patents granted since our founding. While we have several patents effective and pending in the United States and in several foreign countries, we do not believe our business is materially dependent upon any single patent.

We also have some of the most well-known brand names in the music industry. Our piano trademarks include Steinway, Steinway & Sons, the Lyre design, Boston, Heirloom Collection, Crown Jewel Collection and Essex. Our band & orchestral trademarks include Bach, Selmer, C.G. Conn, Leblanc, King, Armstrong, Ludwig, Musser, Holton, Vito, Glaesel, Scherl & Roth, Emerson, William

7

Lewis & Son, and Benge. We consider our trademarks to be important and valuable assets. It is possible that the termination, expiration or infringement of one or more of our trademarks may have an adverse effect on our business, depending on the trademark and the jurisdiction. Accordingly, we maintain trademark registrations in appropriate jurisdictions on an ongoing basis and vigorously pursue any infringement by competitors or other third parties.

Raw Materials, Component Parts, and Sourced Products

Our raw materials consist primarily of metals and woods. The majority of these materials is sourced from the Americas, with the balance coming from Europe, Asia and Africa. We manufacture our own piano plates and keys to ensure quality and availability of these component parts. Component parts for string and percussion instruments are imported from Europe and Asia. We have had adequate supplies of raw materials and component parts in the past and do not expect any disruption to the supply of these items during 2011 or in the future.

Our Boston piano line and our Essex piano line are each sole sourced from Asia. Our Selmer Paris instruments, certain component parts and some of our entry-level band instruments are also sourced from single manufacturers. We continually scrutinize these suppliers and the quality of products that they manufacture for us and we believe that we have a sufficient number of qualified band instrument suppliers to ensure availability of all offered products in the upcoming year.

Labor

As of December 31, 2010, we employed 1,680 people, consisting of 1,121 hourly production workers and 559 salaried employees. Of the 1,680 employees, 1,212 were employed in the United States and the remaining 468 were employed primarily in Europe.

Approximately 46% of our workforce in the United States is represented by labor unions. In February 2011, employees at our mallet instrument manufacturing facility in LaGrange, Illinois, who are represented by the Local 1027 of the United Brotherhood of Carpenters and Joiners of America, informed the Company that they would not present a proposal that may have allowed us to keep the facility in operation. We plan to transfer production to our percussion facility in Monroe, North Carolina by the end of 2011. Members of Local 1027 are not included in our workforce statistics below.

On February 15, 2011, our labor contract with employees at our brass instrument manufacturing facility in Eastlake, Ohio expired. While we continue to negotiate with the union's representatives, we cannot predict when we will be able to reach an agreement.

The following table indicates the union representation and the current status of our collective bargaining agreements in the United States:

| Location |

Union affiliation |

Type of manufacturing |

Number of employees |

Agreement expiration |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Eastlake, OH | United Auto Workers | Band instruments | 245 | February 15, 2011 | |||||

| Elkhart, IN | United Auto Workers | Band instrument warehouse | 7 | March 31, 2012 | |||||

| New York, NY | United Furniture Workers | Pianos | 271 | December 31, 2012 | |||||

| Springfield, OH | Glass, Molders, Pottery, Plastics & Allied Workers | Piano Plates | 16 | September 30, 2013 | |||||

In Germany, the workers' council represents all employees other than management. Nevertheless, most employment contract conditions are settled in collective bargaining agreements made between various trade unions and the employer organizations to which we belong. Our agreement with employees at our piano facility in Hamburg, Germany expires on January 31, 2012. We believe that relations with our employees and these unions are generally good.

8

An investment in our Company involves risk. In addition to the other information in this report, prospective investors should carefully consider the following risks before making an investment. The risks described below are not the only risks we face. There may be additional risks and uncertainties that we do not presently know of or that we currently consider immaterial. All of these risks could adversely affect our business, financial condition, or results of operations.

We operate in competitive markets

Our success depends upon our ability to maintain our share of the musical instrument market by providing the best instruments at prices equal to or below our competitors providing instruments of comparable quality. Increased competition could lead to price reductions, fewer large sales to institutions, reduced operating margins and loss of market share.

Our Steinway pianos currently compete with brands sold by Bösendorfer and Fazioli, which primarily produce and market pianos at the high end of the market. Because of the potential savings associated with buying a used instrument, as well as the durability of the Steinway piano, a relatively large market exists for used Steinway pianos. It is difficult to estimate the significance of used piano sales, because most are conducted in the private aftermarket. However, we believe that used Steinway pianos provide the most significant competition in the high end piano market.

Our mid-priced pianos compete with brands such as Bechstein, Schimmel, Kawai, and Yamaha. By working with manufacturers in Asia, we have been able to enjoy labor costs and manufacturing efficiencies similar to those of our primary competitors. Also, with certain limited exceptions, we allow only Steinway dealers to carry the Boston and Essex piano lines, thereby ensuring that these pianos will be marketed as complementary product lines to the Steinway line.

Our band & orchestral division competes with a number of domestic and Asian manufacturers of musical instruments, including Jupiter and Yamaha. Any of our competitors may concentrate their resources upon efforts to compete in our markets. In addition, Asian musical instrument manufacturers have made significant strides in recent years to improve their product quality. They now offer a broad range of quality products at highly competitive prices and represent a significant competitive challenge for us. Our failure to compete effectively could have a negative impact on our results of operations.

Economic downturns and changes in consumer preferences could adversely affect our business

Our business is subject to a number of general economic factors, many of which are out of our control, that may, among other things, result in a decrease in sales and net income. Sales of musical instruments are dependent in part upon discretionary consumer spending, which may be affected by general economic conditions. For example, Steinway, which represents more than half of our net sales, sells a relatively small number of Steinway & Sons grand pianos each year (1,836 in 2010). Given the small number of pianos we sell, even a slight decrease in sales could adversely affect our profitability. Band & orchestral sales are also dependent upon the continued interest of school-aged children in playing musical instruments. Any decrease in consumer spending, reduction in school budgets or decrease in school-aged children's interest in music could result in decreased sales, which could adversely affect our business and operating results.

We generate most of our sales through independent dealers and distributors

We depend on a network of independent dealers and distributors to distribute all of our band instruments and a majority of our pianos. If our dealers are unsuccessful, they will reduce their purchases from us. This would negatively impact our sales and production rates. In addition, a significant number of our U.S. dealers finance their inventory purchases through third parties. One of

9

the largest firms closed its financing operation in 2009. With the reduced number of financing options available to our dealers, a prolonged worldwide financial crisis could also result in decreased purchases, which would adversely affect our business and operating results.

We could be subject to work stoppages or other business interruptions as a result of our unionized work force

A significant portion of our hourly employees are represented by various union locals and covered by collective bargaining agreements. These agreements contain various expiration dates and must be renegotiated upon expiration. If we are unable to negotiate any of our collective bargaining agreements on satisfactory terms prior to expiration, we could experience disruptions in our operations which could have a material adverse effect on our operations.

Any significant disruption in our supply from key suppliers could delay production and adversely affect our sales

Our Boston piano line and our Essex piano line are each sole sourced from Asia. Our Selmer Paris instruments, certain component parts and some of our entry-level band instruments are also sourced from single manufacturers. We are highly dependent on the availability of essential materials and purchased components from our suppliers, some of which may be available only from limited resources. Moreover, we are dependent upon the availability of our suppliers to provide material that meets specifications, quality standards and delivery schedules. Our suppliers' failure to provide expected raw materials or component parts would adversely affect production schedules and profitability.

Although we have had adequate supplies of raw materials and component parts in the past, there is no assurance that we may not experience serious interruptions in the future. Our continued supply of materials is subject to a number of risks including: 1) the destruction of our suppliers' facilities or their distribution infrastructure; 2) work stoppages or strikes by our suppliers' employees; 3) the failure of our suppliers to provide materials of the requisite quality; 4) the failure of essential equipment at our suppliers' plants; 5) the failure or shortage of supply of raw materials to our suppliers; and 6) contractual amendments and disputes with our suppliers.

We cannot assure investors that our suppliers will continue to provide products to us at attractive prices or at all, or that we will be able to obtain such products in the future from these or other providers on the scale and within the time periods we require. Furthermore, we cannot assure investors that substitute raw materials or component parts will meet the strict specification and quality standards we impose. If we are not able to obtain key materials, supplies, components or sourced instruments on a timely basis and at affordable costs, or we experience significant delays or interruptions of their supply, it could have a material adverse effect on our business, financial condition and results of operations.

We experience inherent concentration of credit risk in our accounts receivable

Historically, a large portion of our sales have been generated by our top 15 customers. As a result, we experience some inherent concentration of credit risk in our accounts receivable due to its composition and the relative proportion of large customer receivables to the total. This is especially true at our band division, which characteristically has the majority of our consolidated accounts receivable balance. We consider the credit health and solvency of our customers when extending credit and when we develop our receivable allowance estimates. If our customers fail to pay a significant portion of outstanding receivable balances, it would have a negative impact on our results of operations.

10

We may be unable to successfully integrate acquisitions of related companies into our business

We have historically acquired other businesses whose operations or product lines complement our existing business. We continually explore new opportunities to enter into business combinations with other companies in order to maintain and grow our revenues and market presence. These potential transactions with other companies create risks such as difficulty in assimilating the personnel, customers, technology, products and operations with our personnel, customers, technology, products and operations; disruption of our ongoing business, including loss of management focus on existing businesses; and impairment of relationships with existing executives, employees, customers and business partners. In addition, we may not be able to identify suitable candidates for these transactions or obtain financing or otherwise make these transactions on acceptable terms. Furthermore, the benefits that we anticipate from these potential transactions may not develop as expected and we cannot be sure that we will recover our investment in any such strategic transaction.

Shifts in our product mix may result in declines in our gross margins and profit levels

Our gross margins vary among our product groups and have fluctuated from quarter to quarter as a result of shifts in product mix (that is, how much of each product type we sell in any particular quarter). The introduction of new band instruments, decreases in average selling prices, and shifts in the proportion of student level instruments to professional level instruments may cause variances in our gross margins. We also experience variances in our gross margins as a result of shifts in the proportion of our piano retail sales to wholesale sales, as well as changes in amounts of piano sales to territories where we realize more favorable pricing.

Failure of our new products to gain market acceptance may adversely affect our operating results

New products may not achieve significant market acceptance or generate sufficient sales to permit us to recover development, manufacturing and marketing costs associated with these products. Achieving market acceptance for new products may also require substantial marketing efforts and expenditures to expand consumer demand. These requirements could strain our management, financial and operational resources. Furthermore, failure of our new products to achieve market acceptance could prevent us from maintaining our existing customer base, gaining new customers or expanding our markets and could have a material adverse effect on our business, financial condition and results of operations.

Since we have a limited number of facilities, any loss of use of any of our facilities could adversely affect our operations

Our operations with respect to specific products are concentrated in a limited number of manufacturing facilities. Because we are heavily dependent on each of these facilities, our operations may be adversely affected if we experience a disruption in business at any particular facility for a prolonged period of time because we may not have adequate substitute facilities available to us.

We may face difficulties or delays renewing leases or re-leasing space in our office building

We derive rental income from our building on West 57th Street in New York City. The master lease that was in effect for ten years expired at the end of 2008; therefore, we no longer have guaranteed rental income. Changes in local market conditions, such as an oversupply of properties, including space available by sublease, may make it more difficult for us to lease space at attractive rental rates or at all. If we are unable to lease a significant amount of space in our building on economically favorable lease terms, including the cost of required renovations or concessions to tenants, our cash flow would decrease which would adversely affect our business and operating results.

11

Our operations may subject us to liabilities for environmental matters, the costs of which could be material

Our manufacturing operations involve the use, handling, storage, treatment and disposal of materials and waste products that may be toxic or hazardous. Consequently, we are subject to numerous federal, state and local environmental laws and regulations, specifically those relating to discharges to air, water and land, the handling and disposal of solid and hazardous waste, and the cleanup of properties contaminated by hazardous substances. Many environmental laws impose strict, retroactive, joint and several liability broadly upon owners and operators of properties, including with respect to environmental matters that occurred prior to the time the party became an owner or operator. In addition, we may have liability with respect to third-party sites to which we sent wastes for disposal in the past. Our potential liability at any of these sites is affected by many factors including, but not limited to, the method of remediation, our portion of the hazardous substances at the site relative to that of other responsible parties, the number of responsible parties, the financial capabilities of other parties, and contractual rights and obligations.

We have obligations and liabilities with respect to the remediation of current and former properties and third-party waste disposal sites. The liabilities and obligations in some cases are covered by an indemnification agreement and we have accrued liabilities for sites where the liability is probable and can be estimated. We cannot guarantee the indemnitor will continue to fund the cleanup liability or that the actual costs of cleanup will not exceed our present accruals. Furthermore, we may be required to fund additional remedial programs in connection with other current, former or future facilities.

Future events, such as the discovery of additional contamination or other information concerning past releases of hazardous substances at our manufacturing sites (or at sites to which we sent wastes for disposal), changes in existing environmental laws or their interpretation, and more rigorous efforts by regulatory authorities, may require additional expenditures by us to modify operations, install pollution control equipment, clean contaminated sites or curtail our operations. These expenditures could have a material negative impact on our operations.

In addition, we could be affected by future laws or regulations imposed in response to climate change concerns. Because it is uncertain what laws will be enacted, we cannot predict whether or not these laws or regulations could have a material adverse effect on our business, financial condition and results of operations.

We may not be able to protect our proprietary information

We rely in part on patent, trade secret, unfair competition, trade dress and trademark laws to protect our rights to aspects of our business and products, including product designs, proprietary manufacturing processes and technologies. The laws of many foreign countries do not protect proprietary rights to the same extent as laws in the United States. In addition, although we may have rights to a particular trademark in a given country, we may not have similar rights to that trademark in other countries.

Changes in our effective tax rates could affect future results

As an international company, we are subject to taxation in the United States and various other foreign jurisdictions in which we do business. One of these foreign jurisdictions has higher statutory rates than those in the United States, and certain of our international earnings are also taxable in the United States. Accordingly, our effective tax rates will vary depending on the relative proportion of foreign to U.S. income and absorption of foreign tax credits, changes in the valuation of our deferred tax assets and liabilities, and changes in tax laws. In addition, we are subject to examination of our income tax returns by the U.S. Internal Revenue Service and other tax authorities. We regularly assess

12

the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of our income tax reserves and expense. Should actual events or results differ from our current expectations, charges or credits to our income tax expense reserves and income tax expense may become necessary. Any such adjustments could have a significant impact on our results of operations.

Our foreign operations are exposed to risks associated with foreign regulations, exchange rate fluctuations, trade restrictions and political, economic and social instability

We manufacture, market and distribute our products worldwide. As a result, we are subject to the risks normally associated with foreign operations. For example, foreign regulations may limit our ability to produce and sell some of our products or repatriate profits to the United States. In addition, a foreign government may impose trade or foreign exchange restrictions or increased tariffs, which could adversely affect our operations. Our operations may also be negatively impacted by political, economic and social instability in foreign countries in which we operate. We are also exposed to risks associated with foreign currency fluctuations. A change in the exchange rates of the U.S. dollar, the Japanese yen, the British pound, the Chinese yuan and renminbi or the euro relative to each other or other foreign currencies could have a negative impact on us. Although we sometimes engage in transactions to protect against risks associated with foreign currency fluctuations, we cannot be sure that these fluctuations will not have an adverse effect on us. Sales outside the United States accounted for 49% of our net sales in 2010.

The requirements of complying with various federal regulations may strain our resources

As a public company, we are subject to various federal regulations, including the reporting requirements of the Sarbanes-Oxley Act. Sarbanes-Oxley requires that we maintain effective disclosure controls and procedures, corporate governance standards, and internal controls over financial reporting. Although we devote significant time and resources to ensure ongoing compliance with the reporting requirements of Sarbanes-Oxley, we can give no assurance that we will continue to meet these requirements in the future or that reportable conditions or material weakness in our internal controls and procedures may not arise despite our best efforts to prevent them. While we have taken and continue to take all steps necessary to comply with Sarbanes-Oxley, including maintaining effective internal controls, our failure to meet the requirements of Sarbanes-Oxley or other federal regulations could negatively impact our business, financial condition and results of operations.

Further issuances of equity securities may be dilutive to current shareholders

Our ability to execute our business strategy depends on our access to an appropriate blend of debt financing and equity financing. The interests of our existing shareholders could be diluted if additional equity securities are issued to finance future developments, acquisitions, or repay indebtedness.

Messrs. Kirkland and Messina exercise significant control over us, which could adversely affect investors

Mr. Kyle R. Kirkland, Chairman of the Board, and Mr. Dana D. Messina, Chief Executive Officer, hold in the aggregate 100% of our Class A common stock, representing approximately 80% of the voting power of our Company's capital stock. So long as Messrs. Kirkland and Messina continue to hold a majority of the voting power, they will be able, acting together, to exercise a controlling influence over our Company, including with respect to the composition of our board of directors and, through it, the direction and policies of the Company. We cannot assure that Messrs. Kirkland and Messina will not pursue other business interests that will conflict with investors' interests.

Item 1B. Unresolved Staff Comments

None.

13

We own most of our manufacturing and warehousing facilities, as well as the building that includes Steinway Hall in New York City. The remaining Steinway retail stores are leased. Substantially all of the domestic real estate has been pledged to secure our debt. The following table lists our significant owned and leased facilities:

| Location |

Owned/ Leased |

Approximate Floor Space (Square Feet) |

Type of Facility and Activity Performed |

||||

|---|---|---|---|---|---|---|---|

| Long Island City, NY | Owned | 450,000 | Piano manufacturing and restoration; administrative offices; training | ||||

| New York, NY | Owned | 217,000 | Piano retail store/showroom; office rental property | ||||

| Melville, NY | Leased | 9,200 | Piano retail store/showroom | ||||

| Westport, CT | Leased | 11,000 | Piano retail store/showroom | ||||

| Coral Gables, FL | Leased | 6,000 | Piano retail store/showroom | ||||

| Paramus, NJ | Leased | 4,000 | Piano retail store/showroom | ||||

| West Hollywood, CA | Leased | 3,800 | Piano retail store/showroom | ||||

| Springfield, OH | Owned | 110,000 | Piano plate manufacturing | ||||

| Hamburg, Germany | Owned | 221,000 | Piano manufacturing; executive offices; training | ||||

| Leased | 6,000 | Piano retail store/showroom | |||||

| Munich, Germany | Leased | 15,000 | Piano retail store/showroom | ||||

| Düsseldorf, Germany | Leased | 6,200 | Piano retail store/showroom | ||||

| Berlin, Germany | Leased | 7,000 | Piano retail store/showroom/service workshop | ||||

| Remscheid, Germany | Leased | 25,000 | Piano key manufacturing | ||||

| Wilkow, Poland | Owned | 10,000 | Piano key manufacturing | ||||

| Shanghai, China | Leased | 22,000 | Piano warehouse/showroom/workshop | ||||

| London, England | Leased | 10,000 | Piano retail store/showroom | ||||

| Tokyo, Japan | Leased | 9,000 | Piano selection center; warehouse | ||||

| Leased | 2,000 | Administrative offices | |||||

| Eastlake, OH | Owned | 160,000 | Brass instrument manufacturing | ||||

| Elkhart, IN | Owned | 150,000 | Brass instrument manufacturing | ||||

| Owned | 88,000 | Woodwind manufacturing; warehouse; office | |||||

| Owned | 81,000 | Warehouse | |||||

| Owned | 25,000 | Administrative offices | |||||

| Elkhorn, WI | Owned | 58,000 | Former brass instrument manufacturing; held for sale | ||||

| Kenosha, WI | Owned | 95,000 | Former woodwind manufacturing and warehouse; held for sale | ||||

| LaGrange, IL | Owned | 35,000 | Percussion instrument manufacturing | ||||

| Monroe, NC | Leased | 114,000 | Percussion instrument manufacturing; warehouse | ||||

| Cleveland, OH | Leased | 35,000 | String instrument manufacturing | ||||

| London, England | Leased | 8,000 | Band instrument office; warehouse | ||||

We spent $3.7 million for capital improvements in 2010 consisting primarily of tooling, machinery, software and system upgrades, and plant and facility improvements. We expect capital spending in 2011 to be in the range of $4.0 to $6.0 million, relating to similar items, along with $1.0 to $2.0 million for improvements and renovations at our building in New York City.

14

General

We are involved in certain legal proceedings regarding environmental matters, which are described below. Further, in the ordinary course of business, we are party to various legal actions that management believes are routine in nature and incidental to the operation of the business. While the outcome of such actions cannot be predicted with certainty, we believe that, based on our experience in dealing with these matters, their ultimate resolution will not have a material adverse impact on our business, financial condition, or results of operations or prospects.

Environmental Matters

We are required to comply with various federal, state, local and foreign environmental laws, including those relating to discharges to air, water and land, the handling and disposal of solid and hazardous waste and the cleanup of properties contaminated by hazardous substances, including chlorinated solvents. Our operations are subject to environmental laws and regulations that require us to obtain and maintain permits from regulatory authorities. Non-compliance with environmental laws and regulations or the permits we have been issued could give rise to significant fines, penalties and other costs. We currently do not expect to incur material expenditures relating to environmental compliance in 2011.

Certain environmental laws, such as the Comprehensive Environmental Response, Compensation, and Liability Act, as amended ("CERCLA"), impose strict, retroactive, joint and several liability upon persons responsible for releases of hazardous substances, which liability is broadly construed. Under CERCLA and other laws, we may have liability for investigation and cleanup costs and other damages relating to our current or former properties, or third-party sites to which we sent wastes for disposal. Our potential liability at any of these sites is affected by many factors including, but not limited to, the method of remediation, our portion of the hazardous substances at the site relative to that of other parties, the number of responsible parties, the financial capabilities of other parties, and contractual rights and obligations.

We are continuing an existing environmental remediation plan at a facility we acquired in 2000. We expect to pay these costs, which approximate $0.6 million, over a 10-year period. We have accrued approximately $0.5 million for the estimated remaining cost of this remediation program, which represents the present value total cost using a discount rate of 4.54%.

A summary of expected payments associated with this project is as follows:

| |

Environmental Payments |

|||

|---|---|---|---|---|

2011 |

$ | 77 | ||

2012 |

61 | |||

2013 |

61 | |||

2014 |

61 | |||

2015 |

61 | |||

Thereafter |

302 | |||

Total |

$ | 623 | ||

In 2004, we acquired two manufacturing facilities from G. Leblanc Corporation, now Grenadilla, Inc. ("Grenadilla"), for which environmental remediation plans had already been established. In connection with the acquisition, we assumed the existing accrued liability of approximately $0.8 million for the cost of these remediation activities. Based on a review of past and

15

ongoing investigatory and remedial work by our environmental consultants, and discussions with state regulatory officials, as well as recent sampling, we estimate the remaining costs of such remedial plans to be $2.4 million. Pursuant to the purchase and sale agreement, we have sought indemnification from Grenadilla for anticipated costs above the original estimate. We filed a claim against the escrow and recorded a corresponding receivable for this amount in other assets in our consolidated balance sheet. Based on the current estimated costs of remediation, this receivable totaled $2.1 million as of December 31, 2010 and 2009. We reached an agreement with Grenadilla whereby current environmental costs are paid directly out of the escrow. Currently, the escrow balance exceeds our receivable balance. Accordingly, Grenadilla has recently expressed an interest in engaging in non-binding mediation in order to close out the escrow arrangement so that the cash can be distributed to the respective parties in accordance with the purchase agreement. Due to the nature of mediation, the impact, if any, on our financial condition or results of operations cannot be determined at this time.

Based on our past experience and currently available information, the matters described above, as well as our other liabilities and compliance costs arising under environmental laws, are not expected to have a material impact on our capital expenditures, earnings or competitive position in an individual year. However, some risk of environmental liability is inherent in the nature of our current and former business and we may, in the future, incur material costs to meet current or more stringent compliance, cleanup, or other obligations pursuant to environmental laws.

16

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our Ordinary common stock is traded on the New York Stock Exchange ("NYSE") under the "LVB" symbol. On May 27, 2010, we submitted an unqualified certification to the NYSE regarding our compliance with NYSE corporate governance listing standards as of the date of certification. The following table sets forth, for the periods indicated, the high and low share prices of our Ordinary common stock as reported on the NYSE.

| Year Ended December 31, 2010 |

High |

Low |

|||||

|---|---|---|---|---|---|---|---|

First Quarter |

$ | 20.48 | $ | 15.10 | |||

Second Quarter |

20.76 | 16.37 | |||||

Third Quarter |

19.86 | 14.31 | |||||

Fourth Quarter |

20.00 | 16.25 | |||||

| Year Ended December 31, 2009 |

High |

Low |

|||||

|---|---|---|---|---|---|---|---|

First Quarter |

$ | 18.46 | $ | 6.83 | |||

Second Quarter |

14.40 | 10.11 | |||||

Third Quarter |

12.83 | 9.81 | |||||

Fourth Quarter |

16.09 | 11.16 | |||||

We have two classes of common stock: Class A and Ordinary. With the exception of disparate voting power, both classes are substantially identical. Each share of Class A common stock entitles the holder to 98 votes. Holders of Ordinary common stock are entitled to one vote per share. Class A common stock shall automatically convert to Ordinary common stock if, at any time, the Class A common stock is not owned by an original Class A holder.

Holders of Record – As of March 1, 2011, there were 2,891 beneficial shareholders of our Ordinary common stock and two holders of record of the Class A common stock.

Dividends – Under our domestic credit facility agreement and the indenture for our senior note debt, we are permitted, within certain limitations, to pay cash dividends on our common stock. Although the limits under our indenture agreement increase as we accumulate earnings over time, we do not anticipate paying additional cash dividends on our common stock in the foreseeable future.

The payment of any future dividends will be determined by the Board of Directors in light of conditions then existing, including our results of operations, financial condition, cash requirements, limitations or restrictions in debt agreements, tax treatment of dividends, business conditions and other factors.

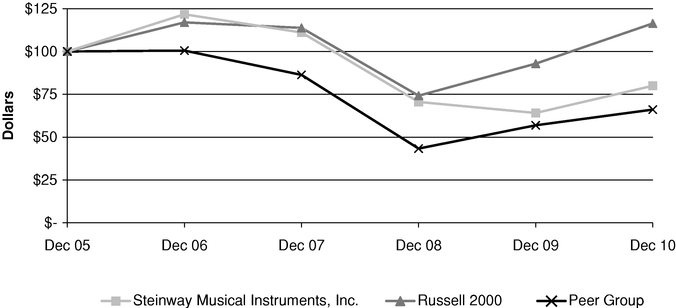

Performance Graph – The following line graph compares the yearly percentage change in our cumulative total shareholder return on our Ordinary common stock for the period from December 31, 2005 to December 31, 2010 to the cumulative total return for the Russell 2000 Stock Index ("Russell 2000") and the cumulative total return for a peer group consisting of La-Z-Boy, Inc., Harley-Davidson, Inc., Callaway Golf Company, and Marine Products Corp ("Peer Group").

The Peer Group was selected by management based on the status of each as a manufacturer and/or distributor of consumer goods in the luxury, leisure, or furniture categories. The performance graph assumes a $100 investment on December 31, 2005 in each of our Ordinary common stock, the Russell 2000, and the common stock of the Peer Group. Steinway Musical Instruments, Inc. is included in the Russell 2000. Total shareholder return for Steinway Musical Instruments, Inc., as well as the Russell 2000 and the Peer Group, is based on the cumulative amount of dividends for a period

17

(assuming dividend reinvestment) and the difference between the share price at the beginning and at the end of the period.

Cumulative Total Returns

| |

December 31, | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||

Steinway Musical Instruments, Inc. |

$ | 100.00 | $ | 121.72 | $ | 111.08 | $ | 70.55 | $ | 64.10 | $ | 79.97 | |||||||

Russell 2000 |

100.00 | 117.00 | 113.79 | 74.19 | 92.90 | 116.40 | |||||||||||||

Peer Group |

100.00 | 110.54 | 86.33 | 43.32 | 56.91 | 66.08 | |||||||||||||

Purchases of Equity Securities by the Issuer

| Period | (a) Total Number of Shares (or Units) Purchased |

(b) Average Price Paid per Share (or Unit) |

(c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs |

(d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

August 1 – August 31, 2010 |

1,627 | $ | 15.59 | 1,627 | $ | 22,843,680 | |||||||

September 1 – September 30, 2010 |

20,200 | 16.03 | 20,200 | 22,519,840 | |||||||||

Total |

21,827 | $ | 16.00 | 21,827 | $ | 22,519,840 | |||||||

In May 2008 we announced a share repurchase program, which permits us to make discretionary purchases of up to $25.0 million of our Ordinary common stock. To date, we have purchased 102,127 shares under this program.

18

Equity Compensation Plans

The following table sets forth the equity compensation plan information for our Employee Stock Purchase Plan and our Stock Plans, which are described in Note 12:

| |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted- average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Plan Category | (a) | (b) | (c) | |||||||

| Equity compensation plans approved by security holders: | ||||||||||

1996 Stock Plan |

337,876 |

$ |

20.95 |

– |

||||||

| 2006 Stock Plan | 749,010 | 20.45 | 249,740 | |||||||

| 2006 Purchase Plan | 15,709 | 16.58 | 209,330 | |||||||

| Total | 1,102,595 | $ | 20.55 | 459,070 | ||||||

19

Item 6. Selected Financial Data

The following table sets forth our selected consolidated financial data as of and for each of the five years in the period ended December 31, 2010, as derived from our audited financial statements. The table should be read in conjunction with our Consolidated Financial Statements, including the footnotes, and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this report, as well as previously filed Annual Reports on Form 10-K.

(In thousands except share and per share data)

| Years Ended December 31, | 2010 | 2009(1) | 2008(2) | 2007 | 2006(3) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Statement of operations data: |

|||||||||||||||||

Net sales |

$ | 318,121 | $ | 306,436 | $ | 387,413 | $ | 406,314 | $ | 384,620 | |||||||

Gross profit |

95,950 | 84,913 | 115,290 | 123,486 | 107,407 | ||||||||||||

Income from operations |

22,813 | 13,271 | 21,193 | 35,202 | 18,378 | ||||||||||||

Net income (loss) |

7,900 | 5,336 | 8,186 | 15,410 | (668 | ) | |||||||||||

Earnings (loss) per share |

|||||||||||||||||

Basic |

$ | 0.68 | $ | 0.60 | $ | 0.96 | $ | 1.81 | $ | (0.08 | ) | ||||||

Diluted |

$ | 0.68 | $ | 0.60 | $ | 0.95 | $ | 1.78 | $ | (0.08 | ) | ||||||

Weighted average shares: |

|||||||||||||||||

Basic |

11,640,955 | 8,855,138 | 8,557,761 | 8,521,700 | 8,303,770 | ||||||||||||

Diluted |

11,695,086 | 8,859,554 | 8,629,647 | 8,647,300 | 8,303,770 | ||||||||||||

Balance sheet data (at December 31): |

|||||||||||||||||

Cash |

$ | 119,811 | $ | 65,873 | $ | 44,380 | $ | 37,304 | $ | 30,409 | |||||||

Current assets |

328,628 | 293,906 | 297,267 | 285,729 | 282,678 | ||||||||||||

Total assets |

485,094 | 449,790 | 453,318 | 457,678 | 447,175 | ||||||||||||

Current liabilities |

53,784 | 46,696 | 62,554 | 66,986 | 66,048 | ||||||||||||

Total debt |

154,510 | 158,240 | 186,750 | 176,266 | 178,411 | ||||||||||||

Stockholders' equity |

228,624 | 196,496 | 157,081 | 163,779 | 158,001 | ||||||||||||

Other financial data: |

|||||||||||||||||

Capital expenditures |

$ | 3,732 | $ | 4,552 | $ | 5,338 | $ | 4,967 | $ | 5,549 | |||||||

Cash dividends declared per common share |

$ | – | $ | – | $ | – | $ | 3.00 | $ | – | |||||||

Margins: |

|||||||||||||||||

Gross profit |

30.2% | 27.7% | 29.8% | 30.4% | 27.9% | ||||||||||||

Operating |

7.2% | 4.3% | 5.5% | 8.7% | 4.8% | ||||||||||||

- (1)

- In

2009, our results were beneficially impacted by a gain on extinguishment of debt of $3.4 million. This was partially offset by the

$1.0 million impairment of trademarks associated with our online music business. Earnings per share was diluted by the issuance of 1,700,000 shares of our Ordinary common stock in November

2009. These items are described more fully in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

- (2)

- In

2008, our results were adversely impacted by the impairment of our band division goodwill of $8.6 million and facility

rationalization charges, including property impairment and severance costs totaling $1.3 million. This was partially offset by a gain on extinguishment of debt of $0.6 million. These

items are described more fully in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

- (3)

- In 2006, our results were adversely affected by a significant increase in our provision for doubtful accounts, which resulted from the bankruptcy filings of two large band division customers; the loss on extinguishment of debt of $9.7 million; and the strike at our Elkhart, Indiana brass instrument manufacturing facility. These items are described more fully in our Annual Report on Form 10-K for the period ended December 31, 2006.

20

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations (Tabular Amounts in Thousands)

Introduction

The following discussion provides an assessment of the results of our operations and liquidity and capital resources together with a brief description of certain accounting policies. Accordingly, the following discussion should be read in conjunction with our Consolidated Financial Statements and the Notes to Consolidated Financial Statements included within this report.

Overview

Through our operating subsidiaries, we are one of the world's leading manufacturers of musical instruments. Our strategy is to capitalize on our strong brand names, leading market positions, strong distribution networks, and quality products.

Piano Segment – Sales of our pianos are influenced by general economic conditions, demographic trends and general interest in music and the arts. The operating results of our piano segment are primarily affected by Steinway & Sons grand piano sales. Given the total number of these pianos that we sell in any year (1,836 sold in 2010), a slight change in units sold can have a material impact on our business and operating results. Our results are also influenced by sales of Boston and Essex pianos, which together represented 76% of total piano units sold but only 25% of total piano division revenues in 2010. Our Boston piano line and our Essex piano line are each sole sourced from Asia. The ability of these manufacturers to produce and ship products to us could impact our business and operating results. A breakdown of sales by our divisions and their geographic location can be found in Note 17 to the financial statements. In 2010, our piano sales had the following geographic breakdown based on customer location: approximately 35% in the United States, 34% in Europe, 11% in China, 10% in Japan, and the remaining 10% primarily in other Asian countries. For the year ended December 31, 2010, our piano segment sales were $190.5 million, representing 60% of our total revenues.

Piano Outlook for 2011 – We expect a challenging year for our overseas piano division with respect to sales and gross profit due to lingering economic problems in many of the markets to which that division sells. However, our domestic dealers are experiencing fewer credit restrictions, so we anticipate the improvement shown in the domestic piano results to continue during 2011. We will continue to manage production levels to minimize factory inefficiency and not build excess inventory and we have sufficient manufacturing capacity to meet anticipated or increased demand.

Band Segment – Our student band instrument sales are influenced by trends in school enrollment, general attitudes toward music and the arts, and our ability to provide competitively priced products to our dealer network. Management estimates that 80% of our domestic band sales are generated through educational programs; the remainder is to amateur or professional musicians or performing groups, including symphonies and orchestras.

Our offerings of sourced products include quality, competitively priced instruments that have our brand names and are built to our specifications. Our product offerings are tailored to the needs of traditional school music dealers who provide full-service rental programs to beginning band students, as well as music retailers and e-commerce dealers selling directly to end consumers from their stores or through the Internet. We believe our product offerings have helped us remain competitive at various price points and will continue to do so in the future.

In 2010, student level instruments accounted for approximately 58% of band & orchestral unit shipments and approximately 33% of band instrument revenues, with intermediate and professional instruments representing the balance. In 2010, approximately 75% of band sales were in the United

21

States, 10% in Europe and the remaining 15% primarily in Japan and Canada. For the year ended December 31, 2010, our band sales were $127.6 million, representing 40% of our total revenues.

Band Outlook for 2011 – Instrument orders to date are higher than in 2010, so we expect sales to improve and margins to remain consistent in 2011. We will continue to manage production so as to minimize factory inefficiencies. We currently have sufficient manufacturing capacity to meet anticipated or increased demand.

Inflation and Foreign Currency Impact – Although we cannot accurately predict the precise effect of inflation on our operations, we do not believe that inflation has had a material effect on sales or results of operations in recent years.